Form 425 Kensington Capital Acqui Filed by: Kensington Capital Acquisition Corp. IV

Filed by Kensington Capital Acquisition Corp. IV

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Kensington Capital Acquisition Corp. IV

Commission File No. 001-41314

Date: June 29, 2022

Below is the form of presentation to be used by Amprius Technologies, Inc. on June 29, 2022 at the Cantor Fitzgerald Technology ESG Conference being held at the Four Seasons Hotel in East Palo Alto, CA.

Transforming Electric Mobility Investor Presentation June 2022

DISCLAIMER INDUSTRY AND MARKET DATA Although all information and opinions and or other information expressed in this presentation (this “Presentation”), including market data and other statistical information, were obtained from sources believed to be reliable and are included in good faith, Amprius Technologies, Inc. (“Amprius”) and Kensington Capital Acquisition Corp. IV (“Kensington”) have not independently verified the information and make no representation or warranty, express or implied, as to its accuracy or completeness. Some data is also based on the good faith estimates of Amprius and Kensington, which are derived from their respective reviews of internal sources as well as the independent sources described above. This Presentation contains preliminary information only, is subject to change at any time and is not and should not be assumed to be complete or to constitute all the information necessary to adequately make an informed decision regarding your engagement with Amprius and Kensington. FORWARD-LOOKING STATEMENTS The information in this Presentation includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), Section 21E of the Securities Exchange Act of 1934 and the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995, each as amended, including Kensington’s or Amprius’ or their management teams’ expectations, hopes, beliefs, intentions or strategies regarding the future. Forward-looking statements may be identified by the use of words such as “estimate,” “plan,” “project,” “forecast,” “intend,” “expect,” “anticipate,” “believe,” “seek” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward- looking statements include, but are not limited to, statements regarding Amprius' expected product offerings, the addressable market for Amprius’ products, Amprius' ability to produce its products at a commercial level and the capitalization of Kensington after giving effect to the proposed business combination between Amprius and Kensington (the “Proposed Business Combination”). These statements are based on various assumptions, whether or not identified in this Presentation, and on the current expectations of Amprius’ and Kensington’s management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied upon by any investors as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of Amprius and Kensington. These forward-looking statements are subject to a number of risks and uncertainties, including changes in domestic and foreign business, market, financial, political and legal conditions; the inability of the parties to successfully or timely consummate the Proposed Business Combination, including the risk that any regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the Proposed Business Combination or that the approval of the equity holders of Amprius or Kensington is not obtained; failure to realize the anticipated benefits of the Proposed Business Combination; risks related to the rollout of Amprius’ business and the timing of expected business milestones; the effects of competition on Amprius’ business; supply shortages in the materials necessary for the production of Amprius’ products; the termination of government clean energy and electric vehicle incentives or the reduction in government spending on vehicles powered by battery technology; delays in construction and operation of production facilities; the amount of redemption requests made by Kensington’s public equity holders; and the ability of Kensington or the combined company to issue equity or equity- linked securities in connection with the Proposed Business Combination or in the future. Additional information concerning these and other factors that may impact the operations and projections discussed herein can be found in Kensington’s periodic filings with the Securities and Exchange Commission (the “SEC”), including Kensington’s final prospectus for its initial public offering filed with the SEC on March 2, 2022 and the Registration Statement (as defined below) filed in connection with the Proposed Business Combination. If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that neither Amprius or Kensington presently know or that Amprius and Kensington currently believe are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect Amprius’ and Kensington’s expectations, plans or forecasts of future events and views as of the date of this Presentation. Amprius and Kensington anticipate that subsequent events and developments will cause Amprius’ and Kensington’s assessments to change. However, while Amprius and Kensington may elect to update these forward-looking statements at some point in the future, Amprius and Kensington specifically disclaim any obligation to do so. These forward-looking statements should not be relied upon as representing Amprius’ or Kensington’s assessments as of any date subsequent to the date of this Presentation. Accordingly, undue reliance should not be placed upon the forward-looking statements. Neither Amprius, Kensington, nor any of their respective affiliates have any obligation to update this Presentation other than as required by law. 2

DISCLAIMER (CONT.) IMPORTANT INFORMATION FOR INVESTORS AND SHAREHOLDERS This communication is being made in respect of the proposed transaction involving Kensington and Amprius. A full description of the terms of the transaction is provided in the registration statement on form S-4, dated June 21, 2022, (File No. 333-265740) (the “Registration Statement”) filed with the SEC by Kensington. The Registration Statement includes a prospectus with respect to the combined company’s securities to be issued in connection with the Proposed Business Combination and a preliminary proxy statement with respect to the shareholder meeting of Kensington to vote on the Proposed Business Combination. Kensington also plans to file other documents and relevant materials with the SEC regarding the Proposed Business Combination. After the Registration Statement is declared effective by the SEC, the definitive proxy statement/prospectus included in the Registration Statement will be mailed to the shareholders of Kensington as of the record date to be established for voting on the Proposed Business Combination. SECURITY HOLDERS OF AMPRIUS AND KENSINGTON ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) AND OTHER DOCUMENTS AND RELEVANT MATERIALS RELATING TO THE PROPOSED BUSINESS COMBINATION THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BEFORE MAKING ANY VOTING DECISION WITH RESPECT TO THE PROPOSED BUSINESS COMBINATION BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED BUSINESS COMBINATION AND THE PARTIES TO THE PROPOSED BUSINESS COMBINATION. Shareholders are able to obtain free copies of the proxy statement/prospectus and other documents containing important information about Amprius and Kensington once such documents are filed with the SEC through the website maintained by the SEC at http://www.sec.gov. The information contained on, or that may be accessed through the websites referenced in this Presentation is not incorporated by reference into, and is not a part of, this Presentation. PARTICIPANTS IN THE SOLICITATION Kensington and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of Kensington in connection with the Proposed Business Combination. Amprius and its officers and directors may also be deemed participants in such solicitation. Security holders may obtain more detailed information regarding the names, affiliations and interests of certain of Kensington’s executive officers and directors in the solicitation by reading Kensington’s final prospectus filed with the SEC on March 2, 2022, the definitive proxy statement/prospectus, which will become available after the Registration Statement has been declared effective by the SEC and other relevant materials filed with the SEC in connection with the Proposed Business Combination when they become available. Information concerning the interests of Kensington’s participants in the solicitation, which may, in some cases, be different from those of Kensington’s shareholders generally, is set forth in the preliminary proxy statement/prospectus included in the Registration Statement. NO OFFER OR SOLICITATION This Presentation shall not constitute an offer to sell or the solicitation of an offer to buy any securities or constitute a solicitation of any vote or approval in respect of the potential transaction and shall not constitute an offer to sell or a solicitation of an offer to buy the securities of Kensington, Amprius or the combined company, nor shall there be any sale of any such securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of the Securities Act. TRADEMARKS AND TRADE NAMES Amprius and Kensington own or have rights to various trademarks, service marks and trade names that they use in connection with the operation of their respective businesses. This Presentation also contains trademarks, service marks and trade names of third parties, which are the property of their respective owners. The use or display of third parties’ trademarks, service marks, trade names, or products in this Presentation is not intended to, and does not, imply a relationship with Amprius or Kensington, or an endorsement or sponsorship by or of Amprius or Kensington. Solely for convenience, the trademarks, service marks and trade names referred to in this Presentation may appear without the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that Amprius or Kensington will not assert, to the fullest extent under applicable law, their rights or the right of the applicable licensor to these trademarks, service marks and trade names. Contacts: For Investors [email protected] 949.574.3860 3

AMPRIUS & KENSINGTON Transaction Overview Overview • Founded in 2008, Amprius is a pioneer in the production of silicon nanowire anodes for high-energy density lithium-ion batteries • Kensington Capital Acquisition Corp. IV (NYSE: KCAC.U, “Kensington”) is a SPAC with $230 million of cash held in trust • Amprius and Kensington are combining to expand the commercial battery production capabilities of Amprius Capital Structure • Amprius shareholders are rolling 100% of their equity • Transaction proceeds will be retained in the business and used for growth capital expenditures • Pro forma for the transaction (assuming no redemptions): − Net transaction expenses, Amprius will have $390 million of pro forma cash to fund construction of its mass production manufacturing facility ($230 million Kensington cash in trust, plus $200 million additional equity capital, less $40 million in (1) estimated transaction expenses) Valuation • Pro Forma Enterprise Value of $939 million • Represents attractive entry relative to battery peer group Kensington has identified Amprius as a unique and compelling investment opportunity – Amprius has developed and is presently manufacturing a commercial silicon nanowire anode battery technology that is expected to enable the future of electric mobility (1) See Slide 23 for more information. 4

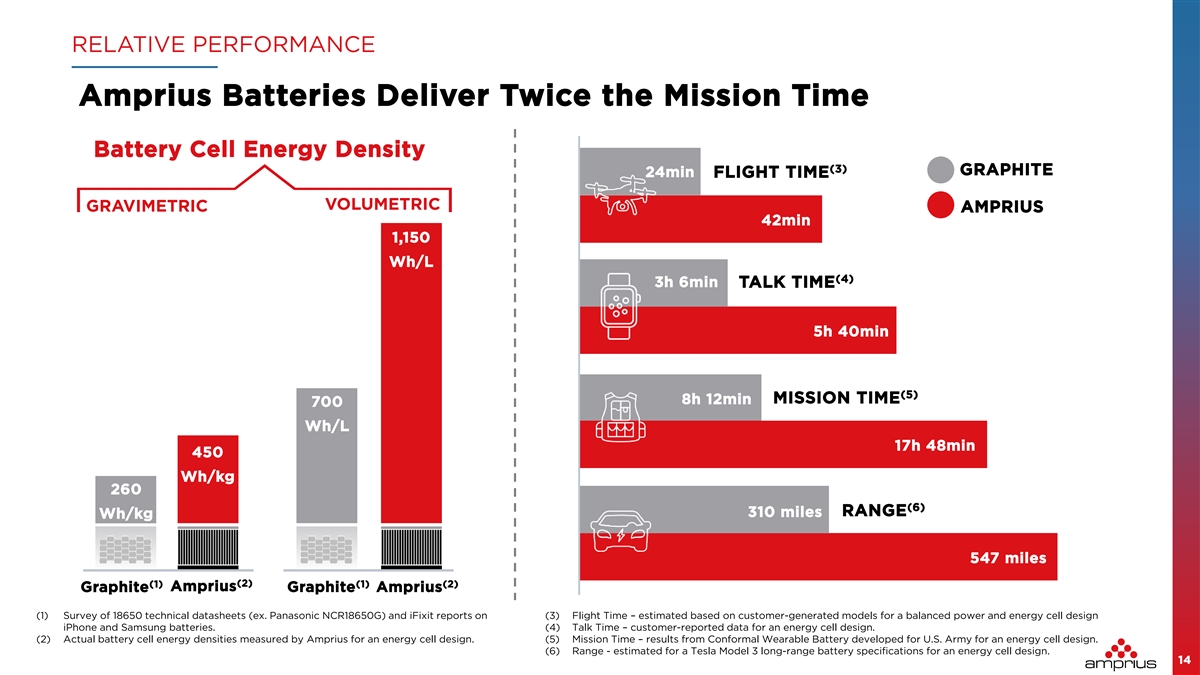

We Enable the Future of Electric Mobility Today Innovation (1) 100% silicon anode battery Superior Battery Performance § High Energy Density (2) (2)(3) Up to 450 Wh/kg and 1,150 Wh/L § High Power Density Up to 10C § Fast Charge Rate Capability 80% charge in <6 minutes § Wide Operating Temperature -30°C to 55°C Commercially Proven Tested and validated by industry leading partners Note: Certain performance metrics are based on specific Amprius products. (1) Actual percentage of silicon is 99.5-99.9% which is within the range of acceptable purity levels for materials that are considered 100%. (2) At C/10 and 23°C. (3) Volumetric energy density is calculated using body dimensions at 30% state of charge (“SoC”). 5 5

LEADERSHIP TEAM Technology Innovators and Experienced Business Operators Core Operational and Technical Team has been at Amprius for 10+ Years DR. KANG SUN SANDRA WALLACH JON BORNSTEIN DR. IONEL STEFAN DR. WEIJIE WANG RONNIE TAO AARON BAKKE Chief Executive Officer Chief Financial Officer Chief Operating Officer Chief Technical Officer Chief Scientist VP of Business Director of Quality and Director Development and Manufacturing Led two successful business Experienced public Silicon Valley veteran with Recognized expert in Pioneer of design and Industry veteran with Experienced leader in ventures in renewable company CFO. 25 years’ experience in the electrochemistry and fabrication of the silicon buyer and supply-side quality assurance, lean energy – JA Solar Co. Ltd. semiconductor industry energy storage. nanowire anode. experience, sales and manufacturing ERP (launched IPO on NASDAQ) Former CFO of Identiv leading high-volume strategic development. implementation and and RayTracker Inc. (NASDAQ: INVE); VP of manufacturing, product Leads the company’s Renowned expert in supply chain. Successfully led market (acquired by First Solar Finance at MiaSole and development and R&D. scientific research and vapor phase deposition penetration towards Inc.). Juniper Networks; CFO of development of high- technologies. Globally recognized industry leadership in General Electric’s (GE) M.S. Materials Science, energy and high-power accomplishments in Micro-Mobility, Consumer Former VP and GM at Industrial Systems, Drives Stanford University. batteries. Responsible for nanowire quality and Electronics, Smart Home Honeywell; VP and CTO at & Controls division. development and manufacturing. Robotics and Smart Océ, N.V. Ph.D. Chemistry, Case manufacturing. Home Devices. B.A. Economics and Public Western Reserve MBA, Northwestern Ph.D. Materials Science, Policy, University of University. Ph.D. Condensed Matter University – Kellogg MBA, University of Brown University. California, Berkeley. Physics, Lanzhou School of Business. Rochester – Simon University. Business School. 6

BOARD AND INVESTORS Track Record of Creating Significant Public Shareholder Value Board of Directors • Kensington Capital Acquisition Corp. IV (NYSE: KCAC.U) is a Special Purpose Acquisition Company (“SPAC”) with $230 million of cash held in trust focused DON DIXON DR. STEVEN CHU DR. WEN HSIEH DR. KANG SUN on combining with a company in the global Chairman of the Board Board Director Board Director Chief Executive Officer automotive and automotive- 1997 Nobel Prize for Physics and Board Director related sectors • Seasoned SPAC management team averaging 30 years of operational and transactional experience (1) Selected Investors • Experienced board with extensive public company capabilities and networks in the mobility and manufacturing sectors VantagePoint Capital Partners (1) Represents investors in Amprius, Inc., which owned 99.6% of Amprius as of June 1, 2022. 7

COMPANY DEVELOPMENT Turning a Transformational Technology Into a Commercial Reality GWh Scale Project Development Initiated in 2021 2021 Customer Orders & Commercial Sales in 2018 KWh Scale 2018 Manufacturing in 2016 Silicon Nanowire Design Finalized Founded in 2008 in 2014 2016 Fully Operational in 2010 2014 2008 8

AMPRIUS AT A GLANCE High Performance Battery Offerings Commercially Available Today and Validated by Blue Chip Partners Up to 80% Founded in 2008 100% Higher Energy 75 with Headquarters in Silicon Anode Density than (2) Patents (1) Technology Conventional Fremont, CA Batteries ~250 KWh 30+ 10,000+ 10 Commercial Customers Batteries Manufacturing Validated SKUs Shipped Capacity Today Performance Airbus Defence and USABC Low Cost, Fast World Changing Ideas Space 2021 Innovative Charging Silicon Nanowire 2022 Finalist Supplier of the Year Cell Technology Contract Fast Company Award Award (1) Actual percentage of silicon is 99.5-99.9% which is within the range of acceptable purity levels for materials that are considered 100%. (2) As of April 28, 2022, 62 patents had been issued (29 in the U.S. and 33 in the EU, Korea, Japan, China, Taiwan and Israel), 11 patents are pending (6 in the U.S. and 5 in the EU, Japan, Korea, Taiwan and China) and 2 issued U.S. patents are licensed from Stanford University. 9

GRAPHITE VS. SILICON (1) Why Silicon? 100% Silicon Anode Has ~10x Capacity vs. Graphite Silicon anode can swell up to ~300% causing battery damage after a few cycles Actual Anode Capacity Before Cycling After Cycling Broken silicon particles 3,400 mAh/g Silicon particles fail during cycling 355 mAh/g (2) (2) Graphite Silicon Silicon nanowire structure maintains its form (1) Actual percentage of silicon is 99.5-99.9% which is within the range of acceptable purity levels for materials that are considered 100%. (2) Based on Amprius measurements in half cells. 10 Amprius Silicon Silicon Particles Nanowire Anode Anode

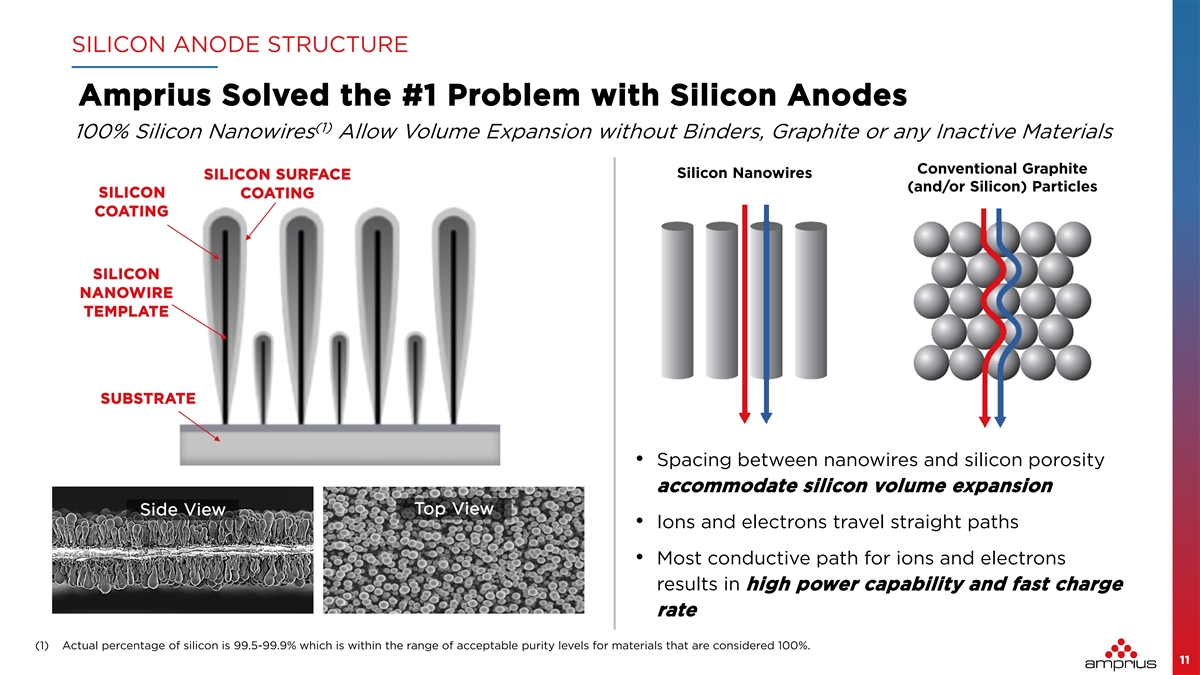

SILICON ANODE STRUCTURE Amprius Solved the #1 Problem with Silicon Anodes (1) 100% Silicon Nanowires Allow Volume Expansion without Binders, Graphite or any Inactive Materials Conventional Graphite Silicon Nanowires SILICON SURFACE (and/or Silicon) Particles SILICON COATING COATING SILICON NANOWIRE TEMPLATE SUBSTRATE • Spacing between nanowires and silicon porosity accommodate silicon volume expansion Top View Side View • Ions and electrons travel straight paths • Most conductive path for ions and electrons results in high power capability and fast charge rate (1) Actual percentage of silicon is 99.5-99.9% which is within the range of acceptable purity levels for materials that are considered 100%. 11

GRAPHITE VS. SILICON Amprius’ Anode is a Drop-in Replacement for Lithium-Ion Batteries Conventional Graphite Battery Amprius Silicon Anode Battery Current Collector Lithium Ion Graphite Current Collector Anode Silicon Anode is a Thinner, Direct Replacement Separator Separator Lithium Ion Higher Cathode Loading Enables Much Higher Cathode Energy Current Collector Current Collector 12 `

INCUMBENT TECHNOLOGY VS. AMPRIUS Amprius' Battery Cells Today Outperform Graphite Batteries Graphite Anode Performance Metric (3) (1) Battery Cells (1)(2) Anode Capacity (mAh/g) 335-355 1,500-2,500 Specific Energy (Wh/kg) ~215-285 360-500 Energy Density (Wh/L) ~530-715 890-1,400 (4) Charging Time to 80% 30 minutes <6 minutes Rate Capability/Power Up to 10C Up to 10C Cycle Life 500-1,000 cycles 200-1,200 cycles Operating Temperature -20 to 60°C -30 to 55°C (1) Other than cycle life, based on survey of 18650 technical datasheets (ex. Panasonic NCR18650G), Sony VTC6 technical datasheet, iFixit reports on iPhone and Samsung batteries and Y. Sun et al.: Li-ion Battery Reliability – A Case Study of the Apple iPhone. For cycle life, based on Shmuel De-Leon: Li-Ion NCA/NMC Cylindrical Hard Case Cells Market 2021. (2) Anode Capacity for Graphite Anode Battery (full cells) uses typical N/P ratio of 1.05 - 1.10. (3) Includes both released and unreleased products with energy and power cell designs. (4) Based on Amprius’ High Power cells. 13

RELATIVE PERFORMANCE Amprius Batteries Deliver Twice the Mission Time Battery Cell Energy Density (3) GRAPHITE 24min FLIGHT TIME VOLUMETRIC GRAVIMETRIC AMPRIUS 42min 1,150 Wh/L (4) 3h 6min TALK TIME 5h 40min (5) MISSION TIME 8h 12min 700 Wh/L 17h 48min 450 Wh/kg 260 (6) 310 miles RANGE Wh/kg 547 miles (2) (1) (1) (2) Graphite Amprius Graphite Amprius (1) Survey of 18650 technical datasheets (ex. Panasonic NCR18650G) and iFixit reports on (3) Flight Time – estimated based on customer-generated models for a balanced power and energy cell design iPhone and Samsung batteries. (4) Talk Time – customer-reported data for an energy cell design. (2) Actual battery cell energy densities measured by Amprius for an energy cell design. (5) Mission Time – results from Conformal Wearable Battery developed for U.S. Army for an energy cell design. (6) Range - estimated for a Tesla Model 3 long-range battery specifications for an energy cell design. 14

ANODE PRODUCTION Silicon Nanowire Anode in KWh-Scale Production Today (1) Metal Foil Nanowire “Template” 100% Silicon Coating Foil Substrate Load Nanowire Module Silicon Deposition Modules Finished Anode (1) Actual percentage of silicon is 99.5-99.9% which is within the range of acceptable purity levels for materials that are considered 100%. 15

MANUFACTURING PROCESS Amprius Utilizes Existing Commercial Manufacturing Processes Cathode and Assembly Processes are Unchanged; the Only Change is to the Anode Manufacturing Line SILICON NANOWIRE ANODE SILICON NANOWIRE ANODE BATTERY ASSEMBLY BATTERY CATHODE Slitting Stacking Formation SILICON NANOWIRE ANODE TRADITIONAL BATTERY MANUFACTURING LINE MANUFACTURING LINE Mixing Coating Calendaring 16

HIGH-VOLUME MANUFACTURING TOOL Equipment Designed for GWh-Scale Production Large-Scale Anode Tool Leveraging Commercially-Used Solar Production Technology • Expected to partner with (1) Centrotherm , a supplier of production solutions to the world’s leading manufacturers of semiconductors and solar cells, to be our mass production tool provider • Utilizing well-established tool provider is expected to reduce technical and schedule risk (1) https://www.centrotherm.de/ 17 17

PLANNED HIGH-VOLUME MANUFACTURING FACILITY U.S. High-Volume Manufacturing Facility Key Criteria Top Locations Identified Skilled manufacturing workforce Favorable taxes and incentive programs Utilities and access to raw materials Amprius Headquarters and Pilot (KWh) Scale Commercial Regulatory permitting Manufacturing Facility Rendering of High-Volume Manufacturing Plant Real estate costs GEORGIA Industrial construction experience TEXAS Accessibility of rail and interstate 18 18

TARGET MARKETS Uniquely Positioned to Address the Aviation and EV Markets Market Segment Amprius Advantage TAM – 2025 (1) Unmanned Aerial Systems (“UAS”) Ultra-high gravimetric and volumetric energy Drones for delivery, imaging, and military, density and extreme-fast charge $38.2B including high altitude pseudo satellites (“HAPS”) (2) Air Transportation Ultra-high gravimetric energy density and Passenger Airplanes (5-20 passengers) and extreme-fast charge $11.1B Urban Air Mobility (“UAM”) (1-4 passengers) Ultra-high gravimetric density, operational in (3) Electric Vehicles wide temperature and pressure ranges and $67.2B extreme-fast charge $116.5B Total (1) $38.2B 2025 UAS battery market estimated as total UAS market in 2025 ($63.6B, InsiderIntelligence) plus total HAPS market in 2025 ($70M, Stratistics) * Amprius estimate of battery spend per system and replacement estimates. (2) $11.1B 2025 UAM battery market estimated as total UAM Market in 2025 ($37.0B, Morgan Stanley Research) * Amprius estimate of battery spend per system and replacement estimates. (3) Electric vehicle battery market size from Markets and Markets Research February 2021 report. 19 EV Aviation

TARGET MARKETS Applications Enabled by Amprius’ Batteries Unmanned Aerial High Altitude Pseudo Air Systems (Drones) Satellites Transportation Product (1) Recon Drone Stratospheric Satellite eVTOL Application Balanced Energy/Power High Energy High Power Amprius Product 15+ Ah, 380+ Wh/kg at C/5 with Performance 1.4 Ah, 390 Wh/kg at C/5 5.8 Ah, 450 Wh/kg at C/10 6C long pulse Specification Very long endurance and eVTOL with extreme-fast charge Ultra long sustained flight at high increased capacity with no and greatly extended service End User Benefit altitude with max payload increase in weight or volume radius (1) Actively sampling with OEMs and continuing to pursue joint development agreements. 20

BLUE CHIP PARTNERS Amprius Batteries Have Been Validated by Industry Leaders Commercial shipments since 2017 Amprius has enabled Airbus to set World Nine development programs Records for HAPS endurance and flight Amprius is designed into Airbus’ HAPS platform Commercial shipments in 2022 with backlog commitments through 2023 Airbus Defence and Space 2021 Innovative Supplier of the Year Award (1) Current Amprius Strategic Investor New cell developed in H1’2022 The high specific energy of Amprius batteries enable and initial commercial shipments the Zephyr to fly uninterrupted in the stratosphere expected in H2’2022 which would not be possible with lower performance batteries. This will further extend the capability and utility of the Zephyr platform for our customers. New multi-year development — Sophie Thomas program for low cost EV batteries Airbus HAPS with the United States Advanced Program Director Battery Consortium (“USABC”) (1) Airbus is an investor in Amprius, Inc., which owned 99.6% of Amprius as of June 1, 2022. 21

USE OF PROCEEDS Expand Production Capacity to Support Customer Growth What we have What’s next Disruptive High-Volume Technology Manufacturing Commercial Meet growing demand Customer Wins Enable new customer wins Reduce costs with scale Pilot (KWh)-Scale Expand market applications Manufacturing 22

TRANSACTION OVERVIEW Transaction Overview ($ and share counts in millions, except per share data) Sources Pro Forma Valuation Pro Forma Shares Outstanding 1 32.9 KCAC Public Shares $ 800 Share Price at Closing $ 10.00 KCAC Cash Held in Trust 230 Equity Value $ 1, 329 (1) 200 Additional Equity Capital Less: Cash (390) Plus: Debt - Total Sources $ 1,230 Enterprise Value $ 9 39 Uses Illustrative Pro Forma Ownership KCAC Sponsor Equity Consideration to Amprius Existing Shareholders $ 800 Shares KCAC 7.4% Public Shares (1) Cash to Balance Sheet 390 17.3% Amprius Existing Estimated Transaction Expenses 40 Shareholders Additional 60.2% (1) Equity Capital Total Uses $ 1,230 15.1% Notes: Assumes no redemptions from Kensington’s public shareholders. Assumes equity capital is issued at $10.00 per share. Excludes the impact of Kensington’s warrants (public or private). (1) Assumes financing through a PIPE transaction (@ $10.00 / share) and / or committed equity facility. 23

OVERVIEW OF KENSINGTON CAPITAL ACQUISITION CORP. IV Kensington Overview Justin Mirro Chairman & Chief Executive Officer • 25 years of operating, M&A and financing experience in the automotive and automotive-related sectors • President of Kensington Capital Partners • NYSE-listed (KCAC.U) Special Purpose Acquisition Company (“SPAC”) with $230 million in trust for the purpose of combining with a global automotive-related company Dieter Zetsche • Management and board with extensive public company experience and operating Vice Chairman & President capabilities in the automotive and automotive-related sectors • 45 years of development, engineering and management • Relevant automotive experience to optimize program launches and capital experience within the automotive sector deployment while facilitating commercial relationships • Former CEO of Daimler • Track record of creating significant shareholder value in automotive businesses Bob Remenar Board Members Board Members Chief Operating Officer • 35 years of operational, manufacturing and management experience within the automotive sector • Former CEO of Nexteer Automotive and Chassix Mitch Quain Tom LaSorda Former Chief Executive Officer of Investor and Board Member of Chrysler Multiple Public Companies Simon Boag Chief Technology Officer • 30 years of leadership, manufacturing, operational and Nicole Nason Don Runkle technological experience with automotive supply chains Former Administrator of the Former Chairman and CEO of • Former President of Mopar and EVP of Chrysler Purchasing Multiple Automotive Businesses U.S. FHWA and NHTSA Dan Huber Chief Financial Officer Anders Pettersson Matt Simoncini • 20 years of experience in investment banking, consulting, Former Chief Executive Officer of Former Chief Executive Officer of business development and operational management Thule Group Lear Corporation • Co-Founder of The Motor Weekly newsletter 24

AMPRIUS FULFILLS KENSINGTON’S INVESTMENT OBJECTIVES Global automotive-related business with Enterprise Value >$500M Leverages high-growth mega-trends of emerging technology proliferation Validated technical, commercial and financial capabilities based upon global automotive standards World-class management team and board with expertise in leading and running public companies Business enhanced by Kensington’s mobility experience to de-risk and accelerate commercial success 25

Forward-Looking Statements

This communication includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), Section 21E of the Securities Exchange Act of 1934 and the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995, each as amended, including Kensington Capital Acquisition Corp. IV’s (“Kensington”) or Amprius Technologies, Inc.’s (“Amprius”) or their management teams’ expectations, hopes, beliefs, intentions or strategies regarding the future. Forward-looking statements may be identified by the use of words such as “estimate,” “plan,” “project,” “forecast,” “intend,” “expect,” “anticipate,” “believe,” “seek” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding the proposed business combination between Amprius and Kensington (the “Proposed Business Combination”). These statements are based on various assumptions, whether or not identified in this communication, and on the current expectations of Amprius’ and Kensington’s management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied upon by any investors as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of Amprius and Kensington. These forward-looking statements are subject to a number of risks and uncertainties, including changes in domestic and foreign business, market, financial, political and legal conditions; the inability of the parties to successfully or timely consummate the Proposed Business Combination, including the risk that any regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the Proposed Business Combination or that the approval of the equity holders of Amprius or Kensington is not obtained; failure to realize the anticipated benefits of the Proposed Business Combination; risks related to the rollout of Amprius’ business and the timing of expected business milestones; the effects of competition on Amprius’ business; supply shortages in the materials necessary for the production of Amprius’ products; the termination of government clean energy and electric vehicle incentives or the reduction in government spending on vehicles powered by battery technology; delays in construction and operation of production facilities; the amount of redemption requests made by Kensington’s public equity holders; and the ability of Kensington or the combined company to issue equity or equity-linked securities in connection with the Proposed Business Combination or in the future. Additional information concerning these and other factors that may impact the operations and projections discussed herein can be found in Kensington’s periodic filings with the Securities and Exchange Commission (the “SEC”), including Kensington’s final prospectus for its initial public offering filed with the SEC on March 2, 2022 and the Registration Statement (as defined below) filed in connection with the Proposed Business Combination. If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that neither Amprius or Kensington presently know or that Amprius and Kensington currently believe are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect Amprius’ and Kensington’s expectations, plans or forecasts of future events and views as of the date of this communication. Amprius and Kensington anticipate that subsequent events and developments will cause Amprius’ and Kensington’s assessments to change. However, while Amprius and Kensington may elect to update these forward-looking statements at some point in the future, Amprius and Kensington specifically disclaim any obligation to do so. These forward-looking statements should not be relied upon as representing Amprius’ or Kensington’s assessments as of any date subsequent to the date of this communication. Accordingly, undue reliance should not be placed upon the forward-looking statements. Neither Amprius, Kensington, nor any of their respective affiliates have any obligation to update this communication other than as required by law.

Important Information and Where to Find It

This communication is being made in respect of the proposed transaction involving Kensington and Amprius. A full description of the terms of the transaction is provided in the registration statement on form S-4, dated June 21, 2022 (File No. 333-265740) (the “Registration Statement”), filed with the SEC by Kensington. The Registration Statement includes a prospectus with respect to the combined company’s securities to be issued in connection with the Proposed Business Combination and a preliminary proxy statement with respect to the shareholder meeting of Kensington to vote on the Proposed Business Combination. Kensington also plans to file other documents and

relevant materials with the SEC regarding the Proposed Business Combination. After the Registration Statement is declared effective by the SEC, the definitive proxy statement/prospectus included in the Registration Statement will be mailed to the shareholders of Kensington as of the record date to be established for voting on the Proposed Business Combination. SECURITY HOLDERS OF AMPRIUS AND KENSINGTON ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) AND OTHER DOCUMENTS AND RELEVANT MATERIALS RELATING TO THE PROPOSED BUSINESS COMBINATION THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BEFORE MAKING ANY VOTING DECISION WITH RESPECT TO THE PROPOSED BUSINESS COMBINATION BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED BUSINESS COMBINATION AND THE PARTIES TO THE PROPOSED BUSINESS COMBINATION. Shareholders are able to obtain free copies of the proxy statement/prospectus and other documents containing important information about Amprius and Kensington once such documents are filed with the SEC through the website maintained by the SEC at http://www.sec.gov. The information contained on, or that may be accessed through the websites referenced in this communication is not incorporated by reference into, and is not a part of, this communication.

Participants in the Solicitation

Kensington and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of Kensington in connection with the Proposed Business Combination. Amprius and its officers and directors may also be deemed participants in such solicitation. Security holders may obtain more detailed information regarding the names, affiliations and interests of certain of Kensington’s executive officers and directors in the solicitation by reading Kensington’s final prospectus filed with the SEC on March 2, 2022, the definitive proxy statement/prospectus, which will become available after the Registration Statement has been declared effective by the SEC, and other relevant materials filed with the SEC in connection with the Proposed Business Combination when they become available. Information concerning the interests of Kensington’s participants in the solicitation, which may, in some cases, be different from those of Kensington’s shareholders generally, is set forth in the preliminary proxy statement/prospectus included in the Registration Statement.

No Offer or Solicitation

This communication shall not constitute an offer to sell or the solicitation of an offer to buy any securities, or constitute a solicitation of any vote or approval in respect of the potential transaction and shall not constitute an offer to sell or a solicitation of an offer to buy the securities of Kensington, Amprius or the combined company, nor shall there be any sale of any such securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of the Securities Act.

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Paramount Global (PARA) and Skydance are closer to a merger - CNBC

- VistaGen Therapeutics (VTGN) Reports Positive Results from Phase 2A Pilot Study of PH15

- Owlet (OWLT) Forges Groundbreaking Partnership with Wheel to Launch Virtual TeleHealth Services Platform

Create E-mail Alert Related Categories

SEC FilingsRelated Entities

Definitive AgreementSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share