Form 424B2 CITIGROUP INC

|

The information in this preliminary pricing supplement is not complete and may be changed. A registration statement relating to these securities has been filed with the Securities and Exchange Commission. This preliminary pricing supplement and the accompanying prospectus supplement and prospectus are not an offer to sell these securities, nor are they soliciting an offer to buy these securities, in any state where the offer or sale is not permitted. SUBJECT TO COMPLETION, DATED MAY 20, 2022 |

| Citigroup Inc. |

May----, 2022 Medium-Term Senior Notes, Series G Pricing Supplement No. 2022-CMTNG1283 Filed Pursuant to Rule 424(b)(2) Registration Statement No. 333-255302 |

Fixed to Floating Rate Notes Linked to the Consumer Price Index Due May 27, 2027

| · | The notes will bear interest during each monthly interest period (i) during the first year: at a fixed rate of 5.00% per annum and (ii) after the first year until maturity: at a floating rate based on the lagging year-over-year percentage change in the Consumer Price Index (“CPI,” as described below under “Key Terms—CPI percent change”), subject to the minimum interest rate specified below for any monthly interest period. Because the CPI is one measure of price inflation in the United States, the return on your notes will depend on U.S. inflation levels, as measured by the CPI. The CPI for purposes of the notes is the non-seasonally adjusted U.S. City Average All Items Consumer Price Index for All Urban Consumers, as published on Bloomberg Page “CPURNSA” (or any successor page). The notes are designed for investors who seek fixed interest payments for the first year of the term of the notes and floating interest payments linked to the CPI thereafter. |

| · | The notes are senior unsecured debt obligations of Citigroup Inc. All payments due on the notes are subject to the credit risk of Citigroup Inc. |

| KEY TERMS | |

| Issuer: | Citigroup Inc. Upon at least 15 business days’ notice, any wholly owned subsidiary of Citigroup Inc. may, without the consent of any holder of the notes, assume Citigroup Inc.’s obligations under the notes, and in such event Citigroup Inc. shall be released from its obligations under the notes, subject to certain conditions, including the condition that Citigroup Inc. fully and unconditionally guarantee all payments under the notes. See “Additional Terms of the Notes” in this pricing supplement. |

| Stated principal amount: | $1,000 per note |

| Pricing date: | May 25, 2022 |

| Issue date: | May 27, 2022 |

| Maturity date: | May 27, 2027. If the maturity date is not a business day, then the payment required to be made on the maturity date will be made on the next succeeding business day with the same force and effect as if it had been made on the maturity date. No additional interest will accrue as a result of delayed payment. |

| Payment at maturity: | $1,000 per note plus accrued and unpaid interest |

| Interest: |

· During each interest period from and including the issue date to but excluding May 27, 2023, the notes will bear interest at a fixed rate of 5.00% per annum. · During each interest period commencing on or after May 27, 2023, the notes will bear interest at a floating rate equal to the CPI percent change, as determined on the interest determination date for that interest period, subject to a minimum interest rate of 2.50% per annum. The amount of interest you receive on each interest payment date for each note you hold will be equal to (i) $1,000 times the applicable interest rate per annum divided by (ii) 12. After the first year of the term of the notes, interest payments will vary based on fluctuations in the CPI percent change, subject to the minimum interest rate specified above. After the first year, the notes may pay a below-market rate for an extended period of time, or even throughout the entire remaining term. |

| CPI or Consumer Price Index: | The non-seasonally adjusted U.S. City Average All Items Consumer Price Index for All Urban Consumers, as published on Bloomberg page “CPURNSA” (or any successor page). See “Determination of the Level of the Consumer Price Index” in this pricing supplement for more information. |

| CPI percent change: | (final CPI level – initial CPI level) / initial CPI level |

| Initial CPI level: | For each monthly interest period, the CPI level for the calendar month that is fifteen calendar months prior to the month of the interest payment date that begins such interest period |

| Final CPI level: | For each monthly interest period, the CPI level for the calendar month that is three calendar months prior to the month of the interest payment date that begins such interest period |

| Interest determination date: | For any interest period commencing on or after May 27, 2023, the second business day preceding the date that begins such interest period |

| Business day: | Any day that is not a Saturday or Sunday and that, in New York City, is not a day on which banking institutions are authorized or obligated by law or executive order to close |

| Interest period: | Each one-month period from and including an interest payment date (or the issue date, in the case of the first interest period) to but excluding the next interest payment date |

| Interest payment dates: | Interest on the notes is payable monthly on the 27th day of each month commencing on June 27, 2022 and ending on the maturity date. If any interest payment date is not a business day, then the payment required to be made on that interest payment date will be made on the next succeeding business day with the same force and effect as if it had been made on that interest payment date. No additional interest will accrue as a result of delayed payment. |

| Day count convention: | 30/360 Unadjusted |

| CUSIP / ISIN: | 17290A6V7 / US17290A6V71 |

| Listing: | The notes will not be listed on any securities exchange and accordingly, may have limited or no liquidity. You should not invest in the notes unless you are willing to hold them to maturity. |

| Underwriter: | Citigroup Global Markets Inc. (“CGMI”), an affiliate of the issuer, acting as principal. See “General Information—Supplemental information regarding plan of distribution; conflicts of interest” in this pricing supplement. |

| Underwriting fee and issue price: | Issue price(1) | Underwriting fee(2) | Proceeds to issuer(3) |

| Per note: | $1,000.00 | $15.00 | $985.00 |

| Total: | $ | $ | $ |

(1) Citigroup Inc. currently expects that the estimated value of the notes on the pricing date will be between $970 and $990 per note, which will be less than the issue price. The estimated value of the notes is based on CGMI’s proprietary pricing models and our internal funding rate. It is not an indication of actual profit to CGMI or other of our affiliates, nor is it an indication of the price, if any, at which CGMI or any other person may be willing to buy the notes from you at any time after issuance. See “Valuation of the Notes” in this pricing supplement.

(2) CGMI will receive an underwriting fee of up to $15.00 for each note sold in this offering. For more information on the distribution of the notes, see “Supplemental Plan of Distribution” in this pricing supplement. The total underwriting fee and proceeds to issuer in the table above give effect to the actual total underwriting fee. In addition to the underwriting fee, CGMI and its affiliates may profit from expected hedging activity related to this offering, even if the value of the notes declines. See “Use of Proceeds and Hedging” in the accompanying prospectus.

(3) The per note proceeds to issuer indicated above represent the minimum per note proceeds to issuer for any note, assuming the maximum per note underwriting fee. As noted above, the underwriting fee is variable.

Investing in the notes involves risks not associated with an investment in conventional fixed-rate debt securities. See “Risk Factors” beginning on page PS-2.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the notes or determined that this pricing supplement and the accompanying prospectus supplement and prospectus are truthful or complete. Any representation to the contrary is a criminal offense.

You should read this pricing supplement together with the accompanying prospectus supplement and prospectus, which can be accessed via the hyperlink below:

Prospectus Supplement and Prospectus each dated May 11, 2021

The notes are not bank deposits and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency, nor are they obligations of, or guaranteed by, a bank.

| Citigroup Inc. |

Risk Factors

The following is a non-exhaustive list of certain key risk factors for investors in the notes. You should read the risk factors below together with the risk factors included in the accompanying prospectus supplement and in the documents incorporated by reference in the accompanying prospectus, including Citigroup Inc.’s most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q, which describe risks relating to the business of Citigroup Inc. more generally. We also urge you to consult your investment, legal, tax, accounting and other advisers before you invest in the notes.

| · | After the first year, the notes will pay interest at a floating rate that may be as low as the minimum interest rate on one or more interest payment dates. The rate at which the notes will bear interest during each monthly interest period after the first year will be based on the lagging year-over-year percentage change in the CPI, which we refer to as the CPI percent change (as defined above in “Key Terms—CPI percent change”), on the interest determination date for that interest period. As a result, the interest payable on the notes will vary with fluctuations in the CPI, subject to the minimum interest rate. It is impossible to predict whether the CPI percent change will rise or fall or the amount of interest payable on the notes. The per annum interest rate determined for each monthly interest period after the first year is applicable only to that period; interest payments for any other monthly interest period after the first year will vary. |

| · | After the first year, variations in the interest rate on the notes from one month to the next may be significant. After the first year, the interest rate applicable to any monthly interest period will be based on the percentage change in the level of the CPI measured over the one-year period ending three months prior to the month of the interest payment date that begins that interest period. This method of measuring the CPI percent change may be more volatile than alternative methods that could have been used, such as a comparison of the average level of the CPI in one year to the average level of the CPI in another year. Moreover, unlike the measure of inflation used by the Federal Reserve in setting monetary policy, the CPI includes particularly volatile elements such as food and energy items. If the prices of these items fluctuate dramatically year-over-year, they may also cause the CPI to experience significant fluctuations. For example, if the price of gasoline falls dramatically from one July to the next, the level of the CPI may similarly decline. |

| · | After the first year, the yield on the notes may be lower than the yield on a standard debt security of comparable maturity. After the first year, the interest rate on the notes will vary depending on changes in the level of the CPI and may be as low as the minimum interest rate for any interest period. Accordingly, the rate applicable to any interest period after the first year may be less than that which would be payable on a conventional fixed-rate, non-callable debt security of ours of comparable maturity. |

| · | Many factors, including United States monetary policy, may influence U.S. inflation rates, and could materially and adversely affect the value of the notes. The Federal Reserve uses the tools of monetary policy, including conducting open market operations, imposing reserve requirements, permitting depository institutions to hold contractual clearing balances and extending credit through its discount window facility, to alter the federal funds rate, which in turn affects the U.S. money supply, interest rates and rates of inflation. One way that the Federal Reserve might foster price stability and reduce inflation is to raise the target federal funds rate. If the Federal Reserve employs monetary policy to reduce inflation, the level of the CPI may decrease or experience a lower rate of change, which would adversely affect the amount of one or more interest payments to you. |

Although we expect U.S. monetary policy to influence the rate of inflation and, accordingly, the level of the CPI, inflation is influenced by a number of unpredictable factors and there can be no assurance that the Federal Reserve’s policies or actions will be effective. For example, in 2009, despite multiple measures taken by the Federal Reserve to provide liquidity to the economy, inflation rates remained extremely low. Other factors that influence interest rates or inflation rates generally may include sentiment regarding underlying strength in the U.S., European and global economies, expectations regarding the level of price inflation, sentiment regarding credit quality in U.S., European and global credit markets, supply and demand of various consumer goods, services and energy resources and the performance of capital markets generally.

| · | The CPI percent change may not reflect the actual levels of inflation affecting holders of the notes. The CPI is just one measure of price inflation in the United States and, therefore, may not reflect the actual levels of inflation affecting holders of the notes. Further, your per annum interest rate for each monthly interest period after the first year is based on the lagging year-over-year percentage change in the level of the CPI for the one-year period ending three months prior to the month of the interest payment date that begins that interest period. Accordingly, an investment in the notes should not be expected to fully offset any costs of inflation actually experienced by investors during the term of the notes. |

| · | The notes are subject to the credit risk of Citigroup Inc., and any actual or anticipated changes to its credit ratings or credit spreads may adversely affect the value of the notes. You are subject to the credit risk of Citigroup Inc. If Citigroup Inc. defaults on its obligations under the notes, your investment would be at risk and you could lose some or all of your investment. As a result, the value of the notes will be affected by changes in the market’s view of Citigroup Inc.’s creditworthiness. Any decline, or anticipated decline, in Citigroup Inc.’s credit ratings or increase, or anticipated increase, in the credit spreads charged by the market for taking Citigroup Inc. credit risk is likely to adversely affect the value of the notes. |

| · | You will be entitled to receive the full principal amount of your notes, subject to the credit risk of Citigroup Inc., only if you hold the notes to maturity. Because the value of the notes may fluctuate, if you are able to sell your notes in the secondary market prior to maturity, you may receive less than the stated principal amount. |

| PS-2 |

| Citigroup Inc. |

| · | The notes will not be listed on any securities exchange and you may not be able to sell them prior to maturity. The notes will not be listed on any securities exchange. Therefore, there may be little or no secondary market for the notes. CGMI currently intends to make a secondary market in relation to the notes and to provide an indicative bid price for the notes on a daily basis. Any indicative bid price for the notes provided by CGMI will be determined in CGMI’s sole discretion, taking into account prevailing market conditions and other relevant factors, and will not be a representation by CGMI that the notes can be sold at that price or at all. CGMI may suspend or terminate making a market and providing indicative bid prices without notice, at any time and for any reason. If CGMI suspends or terminates making a market, there may be no secondary market at all for the notes because it is likely that CGMI will be the only broker-dealer that is willing to buy your notes prior to maturity. Accordingly, an investor must be prepared to hold the notes until maturity. |

| · | The estimated value of the notes on the pricing date, based on CGMI’s proprietary pricing models and our internal funding rate, will be less than the issue price. The difference is attributable to certain costs associated with selling, structuring and hedging the notes that are included in the issue price. These costs include (i) any selling concessions or other fees paid in connection with the offering of the notes, (ii) hedging and other costs incurred by us and our affiliates in connection with the offering of the notes and (iii) the expected profit (which may be more or less than actual profit) to CGMI or other of our affiliates in connection with hedging our obligations under the notes. These costs adversely affect the economic terms of the notes because, if they were lower, the economic terms of the notes would be more favorable to you. The economic terms of the notes are also likely to be adversely affected by the use of our internal funding rate, rather than our secondary market rate, to price the notes. See “The estimated value of the notes would be lower if it were calculated based on our secondary market rate” below. |

| · | The estimated value of the notes was determined for us by our affiliate using proprietary pricing models. CGMI derived the estimated value disclosed on the cover page of this pricing supplement from its proprietary pricing models. In doing so, it may have made discretionary judgments about the inputs to its models, such as the level and volatility of the CPI, interest and yield rates in the market generally, the volatility of those rates and interest rates. CGMI’s views on these inputs may differ from your or others’ views, and as an underwriter in this offering, CGMI’s interests may conflict with yours. Both the models and the inputs to the models may prove to be wrong and therefore not an accurate reflection of the value of the notes. Moreover, the estimated value of the notes set forth on the cover page of this pricing supplement may differ from the value that we or our affiliates may determine for the notes for other purposes, including for accounting purposes. You should not invest in the notes because of the estimated value of the notes. Instead, you should be willing to hold the notes to maturity irrespective of the initial estimated value. |

| · | The estimated value of the notes would be lower if it were calculated based on our secondary market rate. The estimated value of the notes included in this pricing supplement is calculated based on our internal funding rate, which is the rate at which we are willing to borrow funds through the issuance of the notes. Our internal funding rate is generally lower than our secondary market rate, which is the rate that CGMI will use in determining the value of the notes for purposes of any purchases of the notes from you in the secondary market. If the estimated value included in this pricing supplement were based on our secondary market rate, rather than our internal funding rate, it would likely be lower. We determine our internal funding rate based on factors such as the costs associated with the notes, which are generally higher than the costs associated with conventional debt securities, and our liquidity needs and preferences. Our internal funding rate is not the same as the rate at which interest is payable on the notes. |

| · | The estimated value of the notes is not an indication of the price, if any, at which CGMI or any other person may be willing to buy the notes from you in the secondary market. Any such secondary market price will fluctuate over the term of the notes based on the market and other factors described in the next risk factor. Moreover, unlike the estimated value included in this pricing supplement, any value of the notes determined for purposes of a secondary market transaction will be based on our secondary market rate, which will likely result in a lower value for the notes than if our internal funding rate were used. In addition, any secondary market price for the notes will be reduced by a bid-ask spread, which may vary depending on the aggregate stated principal amount of the notes to be purchased in the secondary market transaction, and the expected cost of unwinding related hedging transactions. As a result, it is likely that any secondary market price for the notes will be less than the issue price. |

| · | The value of the notes prior to maturity will fluctuate based on many unpredictable factors. The value of your notes prior to maturity will fluctuate based on the level and volatility of the CPI, interest and yield rates in the market generally, as well as the volatility of those rates, the time remaining to maturity of the notes, fluctuations in the prices of various consumer goods, services and energy resources, inflation and expectations concerning inflation in the United States, a variety of economic, financial, political, regulatory or judicial events affecting the CPI, inflation in the United States, the U.S. economy or debt markets generally, the time remaining to maturity and our creditworthiness, as reflected in our secondary market rate. You should understand that the value of your notes at any time prior to maturity may be significantly less than the issue price. |

| · | Immediately following issuance, any secondary market bid price provided by CGMI, and the value that will be indicated on any brokerage account statements prepared by CGMI or its affiliates, will reflect a temporary upward adjustment. The amount of this temporary upward adjustment will steadily decline to zero over the temporary adjustment period. See “Valuation of the Notes” in this pricing supplement. |

| · | Our offering of the notes does not constitute a recommendation to invest in an instrument linked to the CPI. You should not take our offering of the notes as an expression of our views about how the CPI will perform in the future or as a recommendation to invest in any instrument linked to the CPI, including the notes. As we are part of a global financial institution, our affiliates may, and often do, have positions (including short positions), and may publish research or express opinions, that in |

| PS-3 |

| Citigroup Inc. |

each case conflict with an investment in the notes. You should undertake an independent determination of whether an investment in the notes is suitable for you in light of your specific investment objectives, risk tolerance and financial resources.

| · | The CPI itself and the way the CPI is calculated may change in the future and could adversely affect the value of the notes. The CPI is calculated and published by the Bureau of Labor Statistics of the U.S. Labor Department (the “BLS”). The BLS may change the method by which it calculates the CPI. Changes in the way the CPI is calculated could reduce the level of the CPI, which could reduce the amount of one or more interest payments to you after the first year and, accordingly, the value of your notes. Further, if the CPI is discontinued or substantially altered, the calculation agent may have the sole discretion to substitute a successor index that is comparable to the CPI, which may also adversely affect the amount of one or more interest payments to you after the first year and the value of your notes. |

| · | You will have no rights against the publishers of the CPI. You will have no rights against the BLS, the publisher of the CPI, even though the amount you receive on each interest payment date after the first year will depend upon the level of the CPI. The BLS is not in any way involved in this offering and has no obligations relating to the notes or the holders of the notes. |

| · | The historical performance of the CPI is not an indication of its future performance. The historical levels of the CPI, which are included in this pricing supplement, should not be taken as an indication of the future levels of the CPI during the term of the notes. Changes in the level of the CPI will affect the value of the notes, but it is impossible to predict whether the level of the CPI will rise or fall. |

| · | The calculation agent, which is an affiliate of the issuer, will make determinations with respect to the notes. Citibank, N.A., the calculation agent for the notes, is an affiliate of ours. As calculation agent, Citibank, N.A. will determine, among other things, each initial CPI level and each final CPI level and will calculate the related CPI percent change, interest rate and payment to you on each interest payment date. Any of these determinations or calculations made by Citibank, N.A. in its capacity as calculation agent, including with respect to the calculation of the level of the CPI in the event of the unavailability of the level of the CPI, may adversely affect the amount of one or more interest payments to you. |

| · | The U.S. federal tax consequences of an assumption of the notes are unclear. The notes may be assumed by a successor issuer, as discussed in “Additional Terms of the Notes.” The law regarding whether or not such an assumption would be considered a taxable modification of the notes is not entirely clear and, if the Internal Revenue Service (the “IRS”) were to treat the assumption as a taxable modification, a U.S. Holder would generally be required to recognize gain (if any) on the notes and the timing and character of income recognized with respect to the notes after the assumption could be affected significantly. You should read carefully the discussion under “United States Federal Income Tax Considerations” in this pricing supplement. You should also consult your tax adviser regarding the U.S. federal tax consequences of an assumption of the notes. |

| PS-4 |

| Citigroup Inc. |

Additional Terms of the Notes

The notes are intended to qualify as eligible debt securities for purposes of the Federal Reserve's total loss-absorbing capacity (“TLAC”) rule. As a result, in the event of a Citigroup Inc. bankruptcy, Citigroup Inc.'s losses and any losses incurred by its subsidiaries would be imposed first on Citigroup Inc.’s shareholders and then on its unsecured creditors, including the holders of the notes. Further, in a bankruptcy proceeding of Citigroup Inc. any value realized by holders of the notes may not be sufficient to repay the amounts owed on the notes. For more information about the consequences of “TLAC” on the notes, you should refer to the “Citigroup Inc.” section beginning on page 13 of the accompanying prospectus.

Upon at least 15 business days’ notice, any wholly owned subsidiary (the “successor issuer”) of Citigroup Inc. may, without the consent of any holder of the notes, assume all of Citigroup Inc.’s obligations under the notes, and in such event Citigroup Inc. shall be released from its obligations under the notes (in each case, except as described below), subject to the following conditions:

| (a) | Citigroup Inc. shall enter into a supplemental indenture under which Citigroup Inc. fully and unconditionally guarantees all payments on the notes when due, agrees to comply with the covenants described in the section “Description of Debt Securities—Covenants—Limitations on Liens” and “—Limitations on Mergers and Sales of Assets” in the accompanying prospectus as applied to itself and retains certain reporting obligations under the indenture; |

| (b) | the successor issuer shall be organized under the laws of the United States of America, any State thereof or the District of Columbia; and |

| (c) | immediately after giving effect to such assumption of obligations, no default or event of default shall have occurred and be continuing. |

Upon any such assumption, the successor issuer shall succeed to and be substituted for, and may exercise every right and power of, Citigroup Inc. under the notes with the same effect as if such successor issuer had been named as the original issuer of the notes, and Citigroup Inc. shall be relieved from all obligations and covenants under the notes, except that Citigroup Inc. shall have the obligations described in clause (a) above. For the avoidance of doubt, the successor issuer shall not be responsible for Citigroup Inc.’s compliance with the covenants described in clause (a) above.

If a successor issuer assumes the obligations of Citigroup Inc. under the notes as described above, events of bankruptcy or insolvency or resolution proceedings relating to Citigroup Inc. will not constitute an event of default with respect to the notes, nor will any breach of a covenant by Citigroup Inc. (other than payment default). Therefore, if a successor issuer assumes the obligations of Citigroup Inc. under the notes as described above, events of bankruptcy or insolvency or resolution proceedings relating to Citigroup Inc. (in the absence of any such event occurring with respect to the successor issuer) will not give holders the right to declare the notes to be due and payable, and a breach of a covenant by Citigroup Inc. (including the covenants described in the section “Description of Debt Securities—Covenants—Limitations on Liens” and “—Limitations on Mergers and Sales of Assets” in the accompanying prospectus), other than payment default, will not give holders the right to declare the notes to be due and payable. Furthermore, if a successor issuer assumes the obligations of Citigroup Inc. under the notes as described above, it will not be an event of default under the notes if the guarantee of the notes by Citigroup Inc. ceases to be in full force and effect or if Citigroup Inc. repudiates the guarantee.

There are no restrictions on which subsidiary of Citigroup Inc. may be a successor issuer other than as specifically set forth above. The successor issuer may be less creditworthy than Citigroup Inc. and/or may have no or nominal assets. If Citigroup Inc. is resolved in bankruptcy, insolvency or other resolution proceedings and the notes are not contemporaneously declared due and payable, and if the successor issuer is subsequently resolved in later bankruptcy, insolvency or other resolution proceedings, the value you receive on the notes may be significantly less than what you would have received had the notes been declared due and payable immediately upon certain events of bankruptcy or insolvency or resolution proceedings relating to Citigroup Inc. or the breach of a covenant by Citigroup Inc.

The notes are “specified securities” for purposes of the indenture. The terms set forth above do not apply to all securities issued under the indenture, but only to the notes offered by this pricing supplement (and similar terms may apply to other securities issued by Citigroup Inc. that are identified as “specified securities” in the applicable pricing supplement).

You should read carefully the discussion of U.S. federal tax consequences of any such assumption under “General Information—U.S. federal income tax considerations” in this pricing supplement.

| PS-5 |

| Citigroup Inc. |

| General Information |

| Additional information: |

The description of the notes in this pricing supplement supplements, and, to the extent inconsistent with, replaces the general terms of the notes set forth in the accompanying prospectus supplement and prospectus. The accompanying prospectus supplement and prospectus contain important disclosures that are not repeated in this pricing supplement.

The notes are senior unsecured debt securities issued by Citigroup Inc. under the senior debt indenture described in the accompanying prospectus supplement and prospectus. The notes will constitute part of the senior debt of Citigroup Inc. and will rank equally with all other unsecured and unsubordinated debt of Citigroup Inc. |

| Business day: | Any day that is not a Saturday or Sunday and that, in New York City, is not a day on which banking institutions are authorized or obligated by law or executive order to close. |

| Regular record date: | Interest will be payable on each interest payment date to the holders of record of the notes at the close of business on the business day immediately preceding the relevant interest payment date, except that the final interest payment will be made to the persons who hold the notes on the maturity date. |

| U.S. federal income tax considerations: |

In the opinion of our tax counsel, Davis Polk & Wardwell LLP, the notes will be treated as debt for U.S. federal income tax purposes. Based on market conditions as of the pricing date, the notes will be treated either as "variable rate debt instruments" or "contingent payment debt instruments" for U.S. federal income tax purposes. The Final Pricing Supplement will give further information as to which treatment applies to the notes.

If the notes are treated as variable rate debt instruments, stated interest on the notes will be taxable to a U.S. Holder (as defined in the accompanying prospectus supplement) as ordinary interest income at the time it accrues or is received in accordance with the holder’s method of tax accounting. Upon the sale or other taxable disposition of a note, a U.S. Holder generally will recognize capital gain or loss equal to the difference between the amount realized on the disposition (other than any amount attributable to accrued interest, which will be treated as a payment of interest) and the holder’s adjusted tax basis in the note. A U.S. Holder’s adjusted tax basis in a note will generally equal the purchase price paid to acquire the note. Such gain or loss generally will be long-term capital gain or loss if the U.S. Holder held the note for more than one year at the time of disposition.

If the notes are treated as contingent payment debt instruments, (i) a U.S. Holder will be required to recognize interest income based on our “comparable yield” for a similar non-contingent debt instrument and a “projected payment schedule” in respect of the notes, adjusted each year to take account for the difference between the actual and the projected payments in that year, and (ii) gain with respect to a note will be treated as ordinary income.

Subject to the discussions in “United States Federal Tax Considerations—Tax Consequences to Non-U.S. Holders” and “—FATCA” in the accompanying prospectus supplement, if you are a Non-U.S. Holder (as defined in the accompanying prospectus supplement) of the notes, under current law you generally will not be subject to U.S. federal withholding or income tax in respect of payments on or amounts received on the sale, exchange, redemption or retirement of the notes, provided that (i) income in respect of the notes is not effectively connected with your conduct of a trade or business in the United States, and (ii) you comply with the applicable certification requirements. See “United States Federal Tax Considerations—Tax Consequences to Non-U.S. Holders” in the accompanying prospectus supplement for a more detailed discussion of the rules applicable to Non-U.S. Holders of the notes.

If withholding tax applies to the notes, we will not be required to pay any additional amounts with respect to amounts withheld.

Under their terms, the notes may be assumed by a successor issuer, in which case we will guarantee the successor issuer’s payment obligations under the notes. See “Additional Terms of the Notes.” We intend to treat such an assumption as not giving rise to a taxable modification of the notes. While our counsel believes this treatment of such an assumption is reasonable under current law and based on the expected circumstances of the assumption, it has not rendered an opinion regarding such treatment in light of the lack of clear authority addressing the consequences of such an assumption. Provided that an assumption of the notes is not a taxable modification, the U.S. federal income tax treatment of the notes would not be affected by the assumption. However, if the IRS were to treat an assumption of the notes as a taxable modification, the timing and character of income recognized with respect to the notes after the assumption could be affected significantly, depending on circumstances at the time of the assumption. Moreover, a U.S. Holder would generally be required to recognize gain (if any) with |

| PS-6 |

| Citigroup Inc. |

|

respect to the notes at the time of the assumption in the same manner as described in the accompanying prospectus supplement in respect of a sale or other taxable disposition of the notes. You should consult your tax adviser regarding the consequences of an assumption of the notes.

You should read the section entitled “United States Federal Tax Considerations” in the accompanying prospectus supplement. The preceding discussion, when read in combination with that section, constitutes the full opinion of Davis Polk & Wardwell LLP regarding the material U.S. federal tax consequences of owning and disposing of the notes.

You should also consult your tax adviser regarding all aspects of the U.S. federal tax consequences of an investment in the notes and any tax consequences arising under the laws of any state, local or non-U.S. taxing jurisdiction. | |

| Fees and selling concessions: |

CGMI, an affiliate of Citigroup Inc. and the underwriter of the sale of the notes, is acting as principal and will receive an underwriting fee of up to $15.00 for each note sold in this offering. The actual underwriting fee will be equal to $15.00 for each note sold by CGMI directly to the public and will otherwise be equal to the selling concession provided to selected dealers, as described in this paragraph. From this underwriting fee, CGMI will pay selected dealers not affiliated with CGMI a variable selling concession of up to $15.00 for each note they sell.

Additionally, it is possible that CGMI and its affiliates may profit from expected hedging activity related to this offering, even if the value of the notes declines. You should refer to “Risk Factors” above and the section “Use of Proceeds and Hedging” in the accompanying prospectus. |

| Supplemental information regarding plan of distribution; conflicts of interest: |

The terms and conditions set forth in the Amended and Restated Global Selling Agency Agreement dated April 7, 2017 among Citigroup Inc. and the agents named therein, including CGMI, govern the sale and purchase of the notes.

The notes will not be listed on any securities exchange.

In order to hedge its obligations under the notes, Citigroup Inc. expects to enter into one or more swaps or other derivatives transactions with one or more of its affiliates. You should refer to the sections “Risk Factors—The estimated value of the notes on the pricing date, based on CGMI’s proprietary pricing models and our internal funding rate, will be less than the issue price,” and the section “Use of Proceeds and Hedging” in the accompanying prospectus.

CGMI is an affiliate of Citigroup Inc. Accordingly, the offering of the notes will conform with the requirements addressing conflicts of interest when distributing the securities of an affiliate set forth in Rule 5121 of the Conduct Rules of the Financial Industry Regulatory Authority, Inc. Client accounts over which Citigroup Inc., its subsidiaries or affiliates of its subsidiaries have investment discretion are not permitted to purchase the notes, either directly or indirectly, without the prior written consent of the client.

See “Plan of Distribution; Conflicts of Interest” in the accompanying prospectus supplement for more information. |

| Calculation agent: | Citibank, N.A., an affiliate of Citigroup Inc., will serve as calculation agent for the notes. All determinations made by the calculation agent will be at the sole discretion of the calculation agent and will, in the absence of manifest error, be conclusive for all purposes and binding on Citigroup Inc. and the holders of the notes. Citibank, N.A. is obligated to carry out its duties and functions as calculation agent in good faith and using its reasonable judgment. |

| PS-7 |

| Citigroup Inc. |

How Interest Payments on the Notes Work

During the first year of the term of the notes, the notes will bear interest at a fixed rate. After the first year, the notes will bear interest during each monthly interest period at a per annum rate equal to the CPI percent change determined on the interest determination date for that interest period, subject to the minimum interest rate of 2.50% per annum.

The CPI percent change applicable to any monthly interest period will be the percentage change in the level of the CPI measured over the one-year period ending three months prior to the month of the interest payment date that begins that interest period. For example, the interest payment that you will receive on June 27, 2023 will depend on the year-over-year percentage change in the level of the CPI from February 2022 to February 2023.

During each interest period, interest payments will be calculated on the basis of a 360-day year consisting of twelve 30-day months. The amount of each interest payment will equal (i) the stated principal amount of the notes multiplied by the interest rate in effect during the applicable interest period divided by (ii) 12.

The following table sets forth hypothetical per annum interest rates based on various levels of the CPI, assuming a hypothetical initial CPI level of 100.00. The hypothetical CPI percent changes and the hypothetical per annum interest rates have been rounded for ease of analysis.

| Hypothetical Final CPI Level |

Hypothetical CPI Percent Change(1) |

Hypothetical Per Annum Interest Rate(2) |

| 97.000 | -3.00% | 2.50% |

| 98.000 | -2.00% | 2.50% |

| 98.500 | -1.50% | 2.50% |

| 99.000 | -1.00% | 2.50% |

| 100.000 | 0.00% | 2.50% |

| 101.000 | 1.00% | 2.50% |

| 102.000 | 2.00% | 2.50% |

| 103.000 | 3.00% | 3.00% |

| 104.000 | 4.00% | 4.00% |

| 105.000 | 5.00% | 5.00% |

| 106.000 | 6.00% | 6.00% |

| 107.000 | 7.00% | 7.00% |

| 108.000 | 8.00% | 8.00% |

|

_______________________________ (1) Hypothetical CPI percent change = The percentage change in the level of the CPI measured over the one-year period ending three months prior to the month of the interest payment date that begins that interest period.

(2) Hypothetical per annum interest rate = the hypothetical CPI percent change determined on the interest determination date for that interest period, subject to a minimum of 2.50% per annum for any interest period. | ||

| PS-8 |

| Citigroup Inc. |

Determination of the Level of the Consumer Price Index

The CPI refers to the non-seasonally adjusted U.S. City Average All Items Consumer Price Index for All Urban Consumers, as published on Bloomberg page “CPURNSA” (or any successor page) or any successor index as described below. The U.S. Bureau of Labor Statistics (“BLS”), an agency within the United States Department of Labor, publishes CPI data monthly.

If the CPI for any relevant month is not published on Bloomberg page “CPURNSA” (or any successor page) by 3:00 p.m. New York City time on the relevant interest determination date, but has otherwise been reported by the BLS, then the calculation agent will determine the CPI as reported by the BLS for such month using such other source as on its face, after consultation with Citigroup Inc., appears to accurately set forth the CPI as reported by the BLS.

To determine each initial CPI level and each final CPI level, the calculation agent will use the most recently available level of the CPI, determined as described above, on the relevant interest determination date, even if such level has been adjusted from a previously reported level for the relevant month. However, if an initial CPI level or final CPI level used by the calculation agent on any interest determination date to determine the applicable interest rate for the related interest period is subsequently revised by the BLS, the interest rate determined on such interest determination date will not be revised.

If the CPI is rebased to a different year or period and the 1982-1984 CPI is no longer used, the base reference period for the notes will continue to be the 1982-1984 reference period as long as the 1982-1984 CPI continues to be published.

If, while the notes are outstanding, the CPI is discontinued or is substantially altered, as determined in the sole discretion of the calculation agent, the level of the CPI will be determined by reference to (a) the substitute index chosen by the Secretary of the Treasury for the United States Department of the Treasury’s Inflation-Protected Securities, as described in Appendix B, Section I, Paragraph B.4 of Part IV of 69 Federal Register, No. 144 (July 28, 2004), or (b) if no such index is chosen, the successor index chosen by the calculation agent, in its sole discretion, acting in good faith and using its reasonable judgment. If the calculation agent determines at that time, in its sole discretion, that there is no appropriate successor index, or that the level of the CPI is not available for any other reason, the calculation agent will determine the level of the CPI by a computation methodology that the calculation agent determines will replicate the CPI as closely as reasonably possible under the circumstances.

Upon any selection of a successor index by the calculation agent, the calculation agent will cause notice to be furnished to us and to the trustee, who will provide notice of such selection to the registered holders of the notes.

| PS-9 |

| Citigroup Inc. |

Description of the Consumer Price Index

Unless otherwise stated, we have derived all information regarding the non-seasonally adjusted U.S. City Average All Items Consumer Price Index for All Urban Consumers provided in this pricing supplement, including its composition and method of calculation, from publicly available sources. Such information reflects the policies of, and is subject to change by, the BLS. The BLS is under no obligation to continue to produce, and may discontinue or suspend the production of, the CPI at any time. We have not independently verified any information relating to the CPI.

The BLS began calculating and publishing the CPI in January 1978 and publishes CPI data every month. The CPI level for any particular month is published during the following month. The CPI is a measure of the average change in consumer prices over time for a fixed market basket of goods and services, including food, clothing, shelter, fuels, transportation, charges for doctors’ and dentists’ services and drugs. In calculating the index, price changes for the various items are averaged together with weights that represent their importance in the spending of urban households in the United States. The contents of the market basket of goods and services and the weights assigned to the various items are updated periodically by the BLS to take into account changes in consumer expenditure patterns. The CPI is expressed in relative terms in relation to a time base reference period for which the level is set at 100.0. The base reference period for these notes is the 1982-1984 average.

The notes are linked to the non-seasonally adjusted CPI. Consequently, there is no elimination of the effect of changes that tend to occur at the same time and with approximately the same magnitude each year (e.g., those changes relating to holidays or climate patterns).

The notes represent obligations of Citigroup Inc. only. The notes have not been passed on by BLS. The notes are not sponsored, endorsed, sold or promoted by BLS and BLS makes no warranties and bears no liability with respect to the notes.

| PS-10 |

| Citigroup Inc. |

Historical Information on the Consumer Price Index

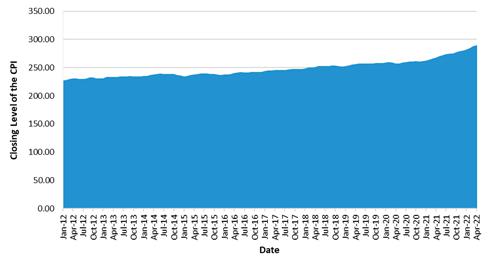

The following table sets forth the published levels of the CPI as reported by the BLS for the period from January 2012 through April 2022. We obtained the information in the table below from Bloomberg Financial Markets, without independent verification. The historical levels of the CPI should not be taken as an indication of future levels, and no assurance can be given as to the level of the CPI for any relevant month.

| Historical Levels of the CPI | ||||||||||||

| Month | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | |

| January | 226.665 | 230.28 | 233.916 | 233.707 | 236.916 | 242.839 | 247.867 | 251.712 | 257.971 | 261.582 | 281.148 | |

| February | 227.663 | 232.166 | 234.781 | 234.722 | 237.111 | 243.603 | 248.991 | 252.776 | 258.678 | 263.014 | 283.716 | |

| March | 229.392 | 232.773 | 236.293 | 236.119 | 238.132 | 243.801 | 249.554 | 254.202 | 258.115 | 264.877 | 287.504 | |

| April | 230.085 | 232.531 | 237.072 | 236.599 | 239.261 | 244.524 | 250.546 | 255.548 | 256.389 | 267.054 | 289.109 | |

| May | 229.815 | 232.945 | 237.9 | 237.805 | 240.236 | 244.733 | 251.588 | 256.092 | 256.394 | 269.195 | n/a | |

| June | 229.478 | 233.504 | 238.343 | 238.638 | 241.038 | 244.955 | 251.989 | 256.143 | 257.797 | 271.696 | n/a | |

| July | 229.104 | 233.596 | 238.25 | 238.654 | 240.647 | 244.786 | 252.006 | 256.571 | 259.101 | 273.003 | n/a | |

| August | 230.379 | 233.877 | 237.852 | 238.316 | 240.853 | 245.519 | 252.146 | 256.558 | 259.918 | 273.567 | n/a | |

| September | 231.407 | 234.149 | 238.031 | 237.945 | 241.428 | 246.819 | 252.439 | 256.759 | 260.28 | 274.31 | n/a | |

| October | 231.317 | 233.546 | 237.433 | 237.838 | 241.729 | 246.663 | 252.885 | 257.346 | 260.388 | 276.589 | n/a | |

| November | 230.221 | 233.069 | 236.151 | 237.336 | 241.353 | 246.669 | 252.038 | 257.208 | 260.229 | 277.948 | n/a | |

| December | 229.601 | 233.049 | 234.812 | 236.525 | 241.432 | 246.524 | 251.233 | 256.974 | 260.474 | 278.802 | n/a | |

The following table sets forth the year-over-year percentage change in the level of the CPI given the historical levels reported above. The historical figures below should not be taken as an indication of any future value of the CPI percent change that would apply during the term of the notes.

| Historical Year-Over-Year Percentage Change in the Level of the CPI | |||||||||||

| Month | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

| January | 2.93% | 1.59% | 1.58% | -0.09% | 1.37% | 2.50% | 2.07% | 1.55% | 2.49% | 1.40% | 7.48% |

| February | 2.87% | 1.98% | 1.13% | -0.03% | 1.02% | 2.74% | 2.21% | 1.52% | 2.33% | 1.68% | 7.87% |

| March | 2.65% | 1.47% | 1.51% | -0.07% | 0.85% | 2.38% | 2.36% | 1.86% | 1.54% | 2.62% | 8.54% |

| April | 2.30% | 1.06% | 1.95% | -0.20% | 1.13% | 2.20% | 2.46% | 2.00% | 0.33% | 4.16% | 8.26% |

| May | 1.70% | 1.36% | 2.13% | -0.04% | 1.02% | 1.87% | 2.80% | 1.79% | 0.12% | 4.99% | n/a |

| June | 1.66% | 1.75% | 2.07% | 0.12% | 1.01% | 1.63% | 2.87% | 1.65% | 0.65% | 5.39% | n/a |

| July | 1.41% | 1.96% | 1.99% | 0.17% | 0.84% | 1.72% | 2.95% | 1.81% | 0.99% | 5.37% | n/a |

| August | 1.69% | 1.52% | 1.70% | 0.20% | 1.06% | 1.94% | 2.70% | 1.75% | 1.31% | 5.25% | n/a |

| September | 1.99% | 1.18% | 1.66% | -0.04% | 1.46% | 2.23% | 2.28% | 1.71% | 1.37% | 5.39% | n/a |

| October | 2.16% | 0.96% | 1.66% | 0.17% | 1.64% | 2.04% | 2.52% | 1.76% | 1.18% | 6.22% | n/a |

| November | 1.76% | 1.24% | 1.32% | 0.50% | 1.69% | 2.20% | 2.18% | 2.05% | 1.17% | 6.81% | n/a |

| December | 1.74% | 1.50% | 0.76% | 0.73% | 2.07% | 2.11% | 1.91% | 2.29% | 1.36% | 7.04% | n/a |

The following graph shows the published levels of the CPI as reported by the BLS for the period from January 2012 through April 2022. Past movements of the CPI are not indicative of future CPI levels. Changes in the CPI will affect the value of the notes and the interest payments on the notes but it is impossible to predict whether the CPI will rise or fall.

| PS-11 |

| Citigroup Inc. |

Valuation of the Notes

CGMI calculated the estimated value of the notes set forth on the cover page of this pricing supplement based on proprietary pricing models. CGMI’s proprietary pricing models generated an estimated value for the notes by estimating the value of a hypothetical package of financial instruments that would replicate the payout on the notes, which consists of a fixed-income bond (the “bond component”) and one or more derivative instruments underlying the economic terms of the notes (the “derivative component”). CGMI calculated the estimated value of the bond component using a discount rate based on our internal funding rate. CGMI calculated the estimated value of the derivative component based on a proprietary derivative-pricing model, which generated a theoretical price for the instruments that constitute the derivative component based on various inputs, including the factors described under “Risk Factors—The value of the notes prior to maturity will fluctuate based on many unpredictable factors” in this pricing supplement, but not including our creditworthiness. These inputs may be market-observable or may be based on assumptions made by CGMI in its discretionary judgment.

The estimated value of the notes is a function of the terms of the notes and the inputs to CGMI’s proprietary pricing models. The range for the estimated value of the notes set forth on the cover page of this preliminary pricing supplement reflects uncertainty on the date of this preliminary pricing supplement about the inputs to CGMI’s proprietary pricing models on the pricing date.

For a period of approximately four months following issuance of the notes, the price, if any, at which CGMI would be willing to buy the notes from investors, and the value that will be indicated for the notes on any brokerage account statements prepared by CGMI or its affiliates (which value CGMI may also publish through one or more financial information vendors), will reflect a temporary upward adjustment from the price or value that would otherwise be determined. This temporary upward adjustment represents a portion of the hedging profit expected to be realized by CGMI or its affiliates over the term of the notes. The amount of this temporary upward adjustment will decline to zero on a straight-line basis over the four-month temporary adjustment period. However, CGMI is not obligated to buy the notes from investors at any time. See “Risk Factors—The notes will not be listed on any securities exchange and you may not be able to sell them prior to maturity.”

Certain Selling Restrictions

Prohibition of Sales to EEA Retail Investors

The notes may not be offered, sold or otherwise made available to any retail investor in the European Economic Area. For the purposes of this provision:

| (a) | the expression “retail investor” means a person who is one (or more) of the following: |

| (i) | a retail client as defined in point (11) of Article 4(1) of Directive 2014/65/EU (as amended, “MiFID II”); or |

| (ii) | a customer within the meaning of Directive 2002/92/EC, where that customer would not qualify as a professional client as defined in point (10) of Article 4(1) of MiFID II; or |

| (iii) | not a qualified investor as defined in Directive 2003/71/EC; and |

| (b) | the expression “offer” includes the communication in any form and by any means of sufficient information on the terms of the offer and the notes offered so as to enable an investor to decide to purchase or subscribe the notes. |

Additional Information

We reserve the right to withdraw, cancel or modify any offering of the notes and to reject orders in whole or in part prior to their issuance.

© 2022 Citigroup Global Markets Inc. All rights reserved. Citi and Citi and Arc Design are trademarks and service marks of Citigroup Inc. or its affiliates and are used and registered throughout the world.

| PS-12 |

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Citi Upgrades United Microelectronics Corp (2303:TT) (UMC) to Buy 'with limited downside'

- Equifax (EFX) PT Lowered to $263 at Citi

- Bilibili (BILI) PT Raised to $13.50 at Citi

Create E-mail Alert Related Categories

SEC FilingsRelated Entities

CitiSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share