Form 10-Q WeTrade Group Inc. For: Jun 30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

|

|

| For the quarterly period ended: |

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

|

|

| For the transition period from ____________ to _____________ |

(Exact name of small business issuer as specified in its charter) |

|

| |

(State or other jurisdiction of incorporation or organization) |

| (I.R.S. Tax. I.D. No.) |

(Address of Principal Executive Offices) |

|

( |

(Registrant’s Telephone Number, Including Area Code) |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See definition of “large accelerated filer,” accelerated filer” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

Large accelerated filer | ☐ | Accelerated filer | ☐ |

☐ | Smaller Reporting Company | ||

Emerging growth company |

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

As of August 15, 2022, there were

TABLE OF CONTENTS

|

| 3 |

| ||

|

|

|

|

|

|

|

|

|

| ||

|

|

|

|

|

|

|

| 4 |

| ||

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

| 24 |

| |

|

| 28 |

| ||

|

| 28 |

| ||

|

|

|

|

|

|

|

|

|

| ||

|

|

|

|

|

|

|

| 29 |

| ||

|

| 29 |

| ||

|

| 29 |

| ||

|

| 29 |

| ||

|

| 29 |

| ||

|

| 29 |

| ||

|

| 30 |

| ||

|

|

|

|

|

|

|

| 31 |

| ||

| 2 |

| Table of Contents |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended, (the “Exchange Act”). These forward-looking statements are generally located in the material set forth under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations” but may be found in other locations as well. These forward-looking statements are subject to risks and uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from the results, performance or achievements expressed or implied by the forward-looking statements. You should not unduly rely on these statements.

We identify forward-looking statements by use of terms such as “may,” “will,” “expect,” “anticipate,” “estimate,” “hope,” “plan,” “believe,” “predict,” “envision,” “intend,” “will,” “continue,” “potential,” “should,” “confident,” “could” and similar words and expressions, although some forward-looking statements may be expressed differently. You should be aware that our actual results could differ materially from those contained in the forward-looking statements.

Forward-looking statements are based on information available at the time the statements are made and involve known and unknown risks, uncertainties and other factors that may cause our results, levels of activity, performance or achievements to be materially different from the information expressed or implied by the forward-looking statements in this report. These factors include, among others:

| ● | our ability to execute on our growth strategies; |

|

|

|

| ● | our ability to find manufacturing partners on favorable terms; |

|

|

|

| ● | declines in general economic conditions in the markets where we may compete; |

|

|

|

| ● | our anticipated needs for working capital; and |

Where we express an expectation or belief as to future events or results, such expectation or belief is expressed in good faith and believed to have a reasonable basis.

Forward-looking statements speak only as of the date of this report or the date of any document incorporated by reference in this report. Except to the extent required by applicable law or regulation, we do not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date of this report or to reflect the occurrence of unanticipated events.

| 3 |

| Table of Contents |

PART I – FINANCIAL INFORMATION

Item 1. Financial Statements

WETRADE GROUP INC

CONDENSED CONSOLIDATED BALANCE SHEETS

(All amounts shown in U.S. Dollars) |

| June 30, 2022 |

|

| December 31, 2021 |

| ||

|

| (Unaudited) |

|

|

|

| ||

ASSETS |

|

|

|

|

|

| ||

Current assets: |

|

|

|

|

|

| ||

Cash and cash equivalents |

| $ |

|

| $ |

| ||

Accounts receivables |

|

|

|

|

|

| ||

Account receivable- related party |

|

|

|

|

|

| ||

Note receivable |

|

|

|

|

|

| ||

Other receivables |

|

|

|

|

|

| ||

Prepayments |

|

|

|

|

|

| ||

Prepayment- related party |

|

|

|

|

|

| ||

Total current assets |

|

|

|

|

|

| ||

Non current assets: |

|

|

|

|

|

|

|

|

Property and equipment, net |

|

|

|

|

|

| ||

Right of use assets |

|

|

|

|

|

| ||

Intangible asset, net |

|

|

|

|

|

| ||

Rental deposit |

|

|

|

|

|

| ||

Total non-current assets |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

Total assets: |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

Account payables |

|

|

|

|

|

| ||

Account payables- related parties |

|

|

|

|

|

| ||

Accrued expenses |

|

|

|

|

|

| ||

Tax payables |

|

|

|

|

|

| ||

Amount due to related parties |

|

|

|

|

|

| ||

Lease liabilities, current |

|

|

|

|

|

| ||

Other payables |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

Total current liabilities |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

Lease liabilities, non-current |

|

|

|

|

|

| ||

Total liabilities |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

Stockholders’ equity: |

|

|

|

|

|

|

|

|

Common stock; $ |

|

|

|

|

|

| ||

Additional paid in capital |

|

|

|

|

|

| ||

Accumulated other comprehensive income |

|

|

|

|

|

| ||

Retained earning |

|

|

|

|

|

| ||

Total Stockholders’ equity |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

Total Liabilities and stockholders’ equity |

| $ |

|

| $ |

| ||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

| 4 |

| Table of Contents |

WETRADE GROUP INC

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

|

| For the Three Months Ended June 30, 2022 |

|

| For the Three Months Ended June 30, 2021 |

|

| For the Six Months Ended June 30, 2022 |

|

| For the Six Months Ended June 30, 2021 |

| ||||

|

| (unaudited) |

|

| (unaudited) |

|

| (unaudited) |

|

| (unaudited) |

| ||||

Revenue: |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Service revenue, related party |

| $ |

|

| $ |

|

| $ |

|

| $ |

| ||||

Service revenue |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Total service revenue |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Cost of revenue |

|

| ( | ) |

|

| ( | ) |

|

| ( | ) |

|

| ( | ) |

Gross Profit |

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative expense |

| $ |

|

| $ |

|

| $ |

|

| $ |

| ||||

Total operating expenses |

|

| ( | ) |

|

| ( | ) |

|

| ( | ) |

|

| ( | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Profit/ (loss) from operations |

|

| ( | ) |

|

|

|

|

|

|

|

|

| |||

Other revenue |

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Profit/ (loss) before provision for income taxes |

|

| ( | ) |

|

|

|

|

|

|

|

|

| |||

Income tax provision |

|

| ( | ) |

|

| ( | ) |

|

| ( | ) |

|

| ( | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income/ (loss) |

| $ | ( | ) |

| $ |

|

| $ |

|

| $ |

| |||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income/ (loss) |

| $ | ( | ) |

| $ |

|

| $ |

|

| $ |

| |||

Other comprehensive income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustment |

|

| ( | ) |

|

|

|

|

| ( | ) |

|

|

| ||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total comprehensive income/ (loss) |

| $ | ( | ) |

| $ |

|

| $ | ( | ) |

| $ |

| ||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earning per share, basic and diluted |

| $ | ( | ) |

| $ |

|

| $ |

|

| $ |

| |||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average shares outstanding, basic and diluted |

|

|

|

|

|

|

|

|

|

|

|

| ||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

| 5 |

| Table of Contents |

WETRADE GROUP INC

CONDENSED STATEMENTS OF CASH FLOWS

(UNAUDITED)

|

| For the Six months |

|

| From the Six months |

| ||

|

| June 30, 2022 |

|

| June 30, 2021 |

| ||

|

| (unaudited) |

|

| (unaudited) |

| ||

Cash flows from operating activities: |

|

|

|

|

|

| ||

Net income |

|

|

|

|

|

| ||

Amortization of intangible asset |

|

|

|

|

|

| ||

Depreciation |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

Accounts receivables |

|

|

|

|

| ( | ) | |

Account receivable- related party |

|

|

|

|

|

| ||

Other receivables |

|

| ( | ) |

|

|

| |

Prepayments |

|

| ( | ) |

|

| ( | ) |

Accounts payables |

|

| ( | ) |

|

|

| |

Accounts payable- related party |

|

|

|

|

|

| ||

Accrued expenses |

|

| ( | ) |

|

|

| |

Right of use assets |

|

|

|

|

|

| ||

Lease liabilities |

|

| ( | ) |

|

| ( | ) |

Other payables |

|

|

|

|

| ( | ) | |

Net cash flows provided by/ (used in) operating activities: |

|

|

|

|

| ( | ) | |

|

|

|

|

|

|

|

|

|

Cash flow from investing activities: |

|

|

|

|

|

|

|

|

Leasehold improvements |

|

| ( | ) |

|

| ( | ) |

Net cash used in investing activities: |

|

| ( | ) |

|

| ( | ) |

|

|

|

|

|

|

|

|

|

Cash flow from financing activities: |

|

|

|

|

|

|

|

|

Proceeds from/ (repayment) of note receivable |

|

|

|

|

| ( | ) | |

Proceeds from related parties loan |

|

|

|

|

|

| ||

Net cash flows provided by/ (used in) financing activities: |

|

|

|

|

| ( | ) | |

|

|

|

|

|

|

|

|

|

Effect of exchange rate changes on cash |

|

| ( | ) |

|

| ( | ) |

|

|

|

|

|

|

|

|

|

Change in cash and cash equivalents: |

|

|

|

|

| ( | ) | |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents, beginning of period |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

Cash and cash equivalents, end of period |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

Supplemental cash flow information: |

|

|

|

|

|

|

|

|

Cash paid for interest |

|

| |

|

|

|

| |

Cash paid for taxes |

|

|

|

|

|

| ||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

| 6 |

| Table of Contents |

WETRADE GROUP INC AND SUBSIDIARY

Condensed Consolidated Statement of Changes in Stockholders’ Equity (unaudited)

Three months ended June 30, 2022 (Unaudited)

|

| Common Stock |

|

| Additional Paid in |

|

| Retained Earnings (Accumulated |

|

| Accumulated Other comprehensive |

|

| Total Shareholder Equity |

| |||||||||

|

| Shares |

|

| Amount |

|

| Capital |

|

| Deficit) |

|

| income (loss) |

|

| (Deficit) |

| ||||||

Balance as of March 31, 2022 |

|

|

|

| $ |

|

| $ |

|

| $ |

|

| $ |

|

| $ |

| ||||||

Share cancellation |

|

| ( | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

Foreign currency translation adjustment |

|

| - |

|

|

|

|

|

|

|

|

|

|

|

| ( | ) |

|

| ( | ) | |||

Net income/ (loss) for the period |

|

| - |

|

|

|

|

|

| |

|

|

| ( | ) |

|

|

|

|

| ( | ) | ||

Balance as of June 30, 2022 |

|

|

|

| $ |

|

| $ |

|

| $ |

|

| $ |

|

| $ |

| ||||||

Six months ended June 30, 2022 (Unaudited)

|

| Common Stock |

|

| Additional Paid in |

|

| Retained Earnings (Accumulated |

|

| Accumulated Other comprehensive |

|

| Total Shareholder Equity |

| |||||||||

|

| Shares |

|

| Amount |

|

| Capital |

|

| Deficit) |

|

| income (loss) |

|

| (Deficit) |

| ||||||

Balance as of December 31, 2021 |

|

|

|

| $ |

|

| $ |

|

| $ |

|

| $ |

|

| $ |

| ||||||

Share cancellation |

|

| ( | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

Foreign currency translation adjustment |

|

| - |

|

|

|

|

|

|

|

|

|

|

|

| ( | ) |

|

| ( | ) | |||

Net income for the period |

|

| - |

|

|

|

|

|

|

|

|

| $ |

|

|

|

|

| $ |

| ||||

Balance as of June 30, 2022 |

|

|

|

| $ |

|

| $ |

|

| $ |

|

| $ |

|

| $ |

| ||||||

| 7 |

| Table of Contents |

Three months ended June 30, 2021 (Unaudited)

|

| Common Stock |

|

| Additional Paid in |

|

| Retained Earnings (Accumulated |

|

| Accumulated Other comprehensive |

|

| Total Shareholder Equity |

| |||||||||

|

| Shares |

|

| Amount |

|

| Capital |

|

| Deficit) |

|

| income (loss) |

|

| (Deficit) |

| ||||||

Balance as of March 31, 2021 |

|

|

|

| $ |

|

| $ |

|

| $ |

|

| $ |

|

| $ |

| ||||||

Foreign currency translation adjustment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||

Net income for the period |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||

Balance as of June 30, 2021 |

|

|

|

| $ |

|

| $ |

|

| $ |

|

| $ |

|

| $ |

| ||||||

Six months ended June 30, 2021 (Unaudited)

|

| Common Stock |

|

| Additional Paid in |

|

| Retained Earnings (Accumulated |

|

| Accumulated Other comprehensive |

|

| Total Shareholder Equity |

| |||||||||

|

| Shares* |

|

| Amount |

|

| Capital |

|

| Deficit) |

|

| income (loss) |

|

| (Deficit) |

| ||||||

Balance as of December 31, 2020 |

|

|

|

| $ |

|

| $ |

|

| $ |

|

| $ |

|

| $ |

| ||||||

Foreign currency translation adjustment |

|

| - |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

Net income for the period |

|

| - |

|

|

|

|

|

|

|

| $ |

|

|

|

|

| $ |

| |||||

Balance as of June 30, 2021 |

|

|

|

| $ |

|

| $ |

|

| $ |

|

| $ |

|

| $ |

| ||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

| 8 |

| Table of Contents |

Wetrade Group Inc

Notes to Condensed Consolidated Financial Statements

For the Three Months Ended June 30, 2022

(Unaudited)

NOTE 1 – NATURE OF BUSINESS

Organization

WeTrade Group, Inc was incorporated in the State of Wyoming on March 28, 2019 and is in the business of providing technical services and solutions via its social e-commerce platform. We are committed to providing an international cloud-based intelligence system and independently developed a micro-business cloud intelligence system called the “YCloud.” Our goal is to provide technical and auto-billing management services to micro-business online stores in China through big data analytics, machine learning mechanisms, social network recommendations, and multi-channel data analysis.

We provide technology services to both individual and corporate users. We provide access to “YCloud” to our customers, which are Zhuozhou Weijiafu Information Technology Limited (“Weijiafu”), a PRC technology company, which then provide “YCloud” services to individual and corporate micro-business owners, Changtongfu Technology (Hainan) Co Limited (“Changtongfu”), a PRC technology company, which then provide “YCloud” services to individual and corporate business owners in the hotel and travel industries.

The market individual micro-business owners represents a potential of 330 million users by the year of 2023. (Source: iResrarch. http://xueqiu.com/8455183447/172404679?sharetime=2,2/22/2021). YCloud serves corporate users in multiple industries, including Yuetao Group, Zhiding, Lvyue, Yuebei, Yuedian, Coke GO, and Zhongyanshangyue. We conduct business operations in mainland China and have established trial operations in Hong Kong. We expect to utilize the YCloud system to establish a global strategic cooperation with various social media platforms.

The main functions of the YCloud system are to manage users’ marketing relationships, CPS commission profit management, multi-channel data statistics, AI fission and management, and improved supply chain systems.

Currently, YCloud serves the micro business industry. We expect to expand the application of YCloud to tourism, hospitality, livestreaming and short video, medical beauty and traditional retail industries.

Recent Business Developments

In first Quarter 2022, the Company has entered YCloud system service agreements with three new customers as follows:

Beijing Yidong Linglong Cultural Media Co., Ltd. (“Beijing Yidong”), a PRC media and internet company that provides comprehensive high-quality digital contents, cultural and arts exchange activities for users.

Beijing Maitu International Travel Agency Co., Ltd (“Maitu International”), a PRC company that has been engaged in outbound tourism business since May 2008. Maitu is also a leading tourism company in South Korea, Japan and China.

Beijing Youth Travel Service Co., Ltd (“Beijing Youth Travel”) is an international travel agency approved by the National Tourism Administration and subordinate to the Beijing Municipal Tourism Administration. Beijing Youth Travel is a cross-regional comprehensive tourism enterprise group with more than 70 chain stores, and it integrates services in outbound tourism, inbound tourism, domestic tourism, tourism fleet, taxi, real estate, catering, consulting services, advertising, culture and entertainment.

| 9 |

| Table of Contents |

Our Business

We have utilized digitalization, electronic management, electronic data exchange, big data analysis, AI fission technology, revenue management and other technologies to build a strong coordination effect. We believe that our cloud technology enables us to develop a highly functional platform for micro-business users in China. We have optimized our product using the tools and platforms best suited to serve our customers and developed YCloud.

We believe that YCloud is the first global micro-business cloud intelligent internationalization system. It conducts multi-channel data analysis through the learning of big data and social recommendation relationships. It also provides users with AI fission and management systems and supply chain systems in order to reach a wider range of user groups. YCloud has four main functions and competitive advantages as follows:

Multiple integrated payment methods and payment analytics: the YCloud system provides micro-businesses and hotel owners with multiple payment methods such as Alipay, WeChat, and UnionPay. The total order amount is directly entered into the platform to collect funds in separate accounts. Using YCloud’s technology support, the micro-business owners offer multiple channels of payments to their customers, including Alipay, WeChat, and UnionPay. Meanwhile, YCloud assigns a bar code to merchandises that purchasers can then scan to pay, allowing purchasers to make payments both online and offline. This proprietary payment technology allows our customers to reduce labor costs and error rates, thus significantly improving data analysis.

| · | Single-scenario payment function: although micro-business owners are provided with a multi-method payment function for their consumers through the YCloud system, micro-business owners only have a single sales channel to display. The revenue of each sale is divided by commissions, and the cost is allocated to suppliers and the handling fee to the YCloud system. The remaining balance goes to micro-business owners. |

|

|

|

| · | Multi-scenario payment function: micro-business owners have multiple sales channels to display and numerous channels to perform revenue sharing and profit consolidation functions. After various products are sold through different channels, the cost will be allocated to suppliers and the handling fee to the YCloud system. The remaining balance will be combined and goes to micro-business owners. |

During the year 2020, due to the impact of the COVID-19 outbreak, many companies, including businesses traditionally operating offline, from a wide range of industries, such as tourism, catering, entertainment or retail, have opted for a micro-business model to build sales channels through online social platforms and expand business opportunities. As a result of the COVID-19 outbreak, consumer demand shifted, which forced business owners to expand to new markets and be present on multiple social platforms. Through continuous research on the micro-business industry, and its understanding of the relationship between people and social relationships on social platforms, YCloud develops new technology designed to meet the ever changing demand of micro-business owners across all industries

Team management: the YCloud system utilizes user marketing relationship tracking and CPS commission revenue management tools.

AI fission and management: using intelligent robots to analyze user behavior, data sharing, purchase history, and other data, the YCloud system provides tailored recommendations and displays. For example, the YCloud system connects users’ behavior across multiple apps and platforms and makes automatic recommendations based on its analysis.

Supply chain system integration: the YCloud system applies cross-platform resource integration technology. The integration allows the multi-channel output of high-quality products and creates a seamless connection between suppliers and customers. The YCloud provides a complete supply chain system integrating supply, sales, finance, and service.

| 10 |

| Table of Contents |

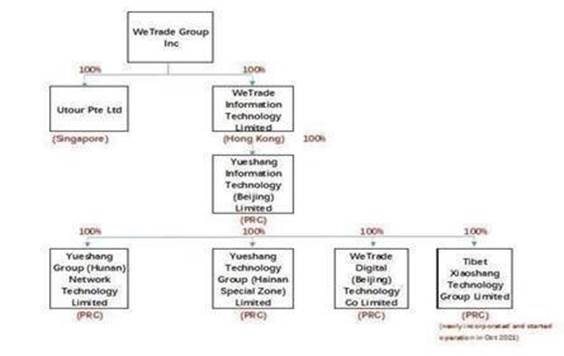

The following diagram sets forth the structure of the Company as of the date of this Current Report:

Our business and corporate address in the United States is 1621 Central Ave, Cheyenne, WY 82001 Our telephone number is +86-13795206876 and our registered agent for service of process is Wyoming Registered Agent, 1621 Central Ave, Cheyenne, WY 82001. Our fiscal year end is December 31. Our Chinese business and corporate address is No. 18, Kechuang 10th Street, Beijing Economic and Technological Development Zone, Beijing, People Republic of China. The Chinese address is where our management is located.

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of preparation of financial statements

The consolidated financial statements have been prepared in accordance with generally accepted accounting principles in the United States of America (“GAAP”). The consolidated financial statements include the financial statements of the Company and its subsidiaries. All significant inter-company transactions and balances have been eliminated in consolidation.

The condensed consolidated financial statements of the Company as of and for the six months ended June 30, 2022 and 2021 are unaudited. In the opinion of management, all adjustments (including normal recurring adjustments) that have been made are necessary to fairly present the financial position of the Company as of June 30, 2022, the results of its operations for the six months ended June 30, 2022 and 2021, and its cash flows for the six months ended June 30, 2022 and 2021. Operating results for the quarterly periods presented are not necessarily indicative of the results to be expected for a full fiscal year. Certain prior period amounts in the consolidated financial statements and accompanying notes have been reclassified to conform to the current period’s presentation. The balance sheet as of December 31, 2021 has been derived from the Company’s audited financial statements included in the Form 10-K for the year ended December 31, 2021.

| 11 |

| Table of Contents |

The statements and related notes have been prepared pursuant to the rules and regulations of the Securities and Exchange Commission (the “SEC”). Accordingly, certain information and footnote disclosures normally included in financial statements prepared in accordance with U.S. GAAP have been omitted pursuant to such rules and regulations. These financial statements should be read in conjunction with the financial statements and other information included in the Company’s Annual Report on Form 10-K as filed with the SEC for the fiscal year ended December 31, 2021.

As of June 30, 2022, the details of the consolidating subsidiaries are as follows:

|

| Place of |

| Attributable equity |

| |

Name of Company |

| incorporation |

| interest % |

| |

Utour Pte Ltd |

|

|

| % | ||

|

|

|

|

|

|

|

WeTrade Information Technology Limited (“WITL”) |

|

|

| % | ||

|

|

|

|

|

|

|

Yueshang Information Technology (Beijing) Co., Ltd. (“YITB”) |

|

|

| % | ||

Yueshang Group Network (Hunan) Co., Limited (“Yueshang Hunan”) |

|

|

| % | ||

Yueshang Technology Group (Hainan Special Economic Zone) Co. Limited (“Yueshang Hainan”) |

|

|

| % | ||

WeTrade Digital (Beijing) Technology Co Limited (f/k/a XiaoShang Technology Beijing Co Limited) |

|

|

| % | ||

Tibet Xiaoshang Technology Group Limited |

|

|

| % | ||

Nature of Operations

WeTrade Group Inc. (the “Company” or “We’ or “Us”) is a Wyoming corporation incorporated on March 28, 2019. The Company is an investment holding company that formed as a Wyoming corporation to use as a vehicle for raising equity outside the US.

As of June 30, 2022, the nature operation of its subsidiaries are as follows:

|

| Place of |

| Nature of |

|

Name of Company |

| incorporation |

| operation |

|

Utour Pte Ltd |

| Singapore |

| Investment holding company |

|

|

|

|

|

|

|

WeTrade Information Technology Limited (“WITL”) |

| Hong Kong |

| Investment holding company |

|

|

|

|

|

|

|

Yueshang Information Technology (Beijing) Co., Ltd. (“YITB”) |

| P.R.C. |

| Providing of social e-commerce services, technical system support and services |

|

Yueshang Group Network (Hunan) Co., Limited (“Yueshang Hunan”) |

| P.R.C |

| Providing of social e-commerce services, technical system support and services |

|

Yueshang Technology Group (Hainan Special Economic Zone) Co. Limited (“Yueshang Hainan”) |

| P.R.C |

| Providing of social e-commerce services, technical system support and services |

|

WeTrade Digital (Beijing) Technology Co Limited (FKA: XiaoShang Technology Beijing Co Limited) |

| P.R.C |

| Providing of social e-commerce services, technical system support and services |

|

Tibet Xiaoshang Technology Group Limited |

| P.R.C |

| Providing of social e-commerce services, technical system support and services. |

|

| 12 |

| Table of Contents |

COVID-19 outbreak

In March 2020 the World Health Organization declared coronavirus COVID-19 a global pandemic. The COVID-19 pandemic has negatively impacted the global economy, workforces, customers, and created significant volatility and disruption of financial markets. It has also disrupted the normal operations of many businesses, including ours. This outbreak could decrease spending, adversely affect demand for our services and harm our business and results of operations. It is not possible for us to predict the duration or magnitude of the adverse results of the outbreak and its effects on our business or results of operations at this time.

Revenue recognition

The Company follows the guidance of Accounting Standards Codification (ASC) 606, Revenue from Contracts. ASC 606 creates a five-step model that requires entities to exercise judgment when considering the terms of contracts, which includes (1) identifying the contracts or agreements with a customer, (2) identifying our performance obligations in the contract or agreement, (3) determining the transaction price, (4) allocating the transaction price to the separate performance obligations, and (5) recognizing revenue as each performance obligation is satisfied. The Company only applies the five-step model to contracts when it is probable that the Company will collect the consideration it is entitled to in exchange for the services it transfers to its clients.

Cash and Cash Equivalents

The Company considers all highly liquid debt instruments purchased with a maturity period of three months or less to be cash or cash equivalents. The carrying amounts reported in the accompanying unaudited condensed consolidated balance sheets for cash and cash equivalents approximate their fair value. All of the Company’s cash that is held in bank accounts in Singapore and PRC is not protected by Federal Deposit Insurance Corporation (“FDIC”) insurance or any other similar insurance in the PRC, or Singapore.

Foreign Currency

The Company’s principal country of operations is the PRC. The accompanying consolidated financial statements are presented in US$. The functional currency of the Company is US$, and the functional currency of the Company’s subsidiaries is RMB. The consolidated financial statements are translated into US$ from RMB at year-end exchange rates as to assets and liabilities and average exchange rates as to revenues and expenses. Capital accounts are translated at their historical exchange rates when the capital transactions occurred. The resulting translation adjustments are recorded as a component of shareholders’ equity included in other comprehensive income. Gains and losses from foreign currency transactions are included in profit or loss. There were no gains and losses from foreign currency transactions from the inception to June 30, 2022.

|

| June 30, 2022 |

|

| December 31, 2021 |

| ||

RMB: US$ exchange rate |

|

|

|

|

|

| ||

| 13 |

| Table of Contents |

The balance sheet amounts, with the exception of equity, June 30, 2022 and December 31, 2021 were translated at

Use of Estimate

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of expenses during the reporting periods. Actual results could differ from those estimates.

Property and Equipment

Property and equipment are stated at the historical cost, less accumulated depreciation. Depreciation on property and equipment is provided using the straight-line method over the estimated useful lives of the assets for both financial and income tax reporting purposes as follows:

Office equipment |

| |

Leasehold improvements |

|

Upon sale or disposal of an asset, the historical cost and related accumulated depreciation or amortization of such asset were removed from their respective accounts and any gain or loss is recorded in the statements of income.

The Company reviews the carrying value of property, plant, and equipment for impairment whenever events and circumstances indicate that the carrying value of an asset may not be recoverable from the estimated future cash flows expected to result from its use and eventual disposition. In cases where undiscounted expected future cash flows are less than the carrying value, an impairment loss is recognized equal to an amount by which the carrying value exceeds the fair value of assets. The factors considered by management in performing this assessment include current operating results, trends and prospects, the manner in which the property is used, and the effects of obsolescence, demand, competition and other economic factors. Based on this assessment, no impairment expenses for property, plant, and equipment were recorded in operating expenses during the six months ended June 30, 2022 and 2021.

Concentration of Risk

Financial instruments that potentially subject the Company to concentrations of credit risk consist principally of cash. Cash on hand amounted to $

Accounts receivable

Accounts receivables are presented net of allowance for doubtful accounts. The Company uses specific identification in providing for bad debts when facts and circumstances indicate that collection is doubtful and based on factors listed in the following paragraph. If the financial conditions of its customers were to deteriorate, resulting in an impairment of their ability to make payments, additional allowance may be required.

| 14 |

| Table of Contents |

The Company maintains an allowance for doubtful accounts which reflects its best estimate of amounts that potentially will not be collected. The Company determines the allowance for doubtful accounts on general basis taking into consideration various factors including but not limited to historical collection experience and credit-worthiness of the customers as well as the age of the individual receivables balance. Additionally, the Company makes specific bad debt provisions based on any specific knowledge the Company has acquired that might indicate that an account is uncollectible. The facts and circumstances of each account may require the Company to use substantial judgment in assessing its collectability.

Intangible Asset

Intangible asset is software development cost incurred by the Company, it will be amortized on a straight line basis over the estimated useful life of 5 years.

Leases

The Company adopted Accounting Standards Update No. 2016-02, Leases (Topic 842) (ASU 2016-02), as amended, which supersedes the lease accounting guidance under Topic 840, and generally requires lessees to recognize operating and financing lease liabilities and corresponding right-of-use (ROU) assets on the balance sheet and to provide enhanced disclosures surrounding the amount, timing and uncertainty of cash flows arising from leasing arrangements.

Operating leases are included in operating lease right-of-use (“ROU”) assets and short-term and long-term lease liabilities in our consolidated balance sheets. Finance leases are included in property and equipment, other current liabilities, and other long-term liabilities in our consolidated balance sheets.

ROU assets represent the Company’s right to use an underlying asset for the lease term and lease liabilities represent the Company’s obligation to make lease payments arising from the lease. Operating lease ROU assets and liabilities are recognized at commencement date based on the present value of lease payments over the lease term. As most of the leases do not provide an implicit rate, we use the industry incremental borrowing rate based on the information available at commencement date in determining the present value of lease payments. We use the implicit rate when readily determinable. The operating lease ROU asset also includes any lease payments made and excludes lease incentives. The lease terms may include options to extend or terminate the lease when it is reasonably certain that we will exercise that option. Lease expense for lease payments is recognized on a straight-line basis over the lease term.

Under ASC 840, leases were classified as either capital or operating, and the classification significantly impacted the effect the contract had on the company’s financial statements. Capital lease classification resulted in a liability that was recorded on a company’s balance sheet, whereas operating leases did not impact the balance sheet. After the new adoption, $

| 15 |

| Table of Contents |

ASU 2016-02 requires that public companies use a secured incremental browning rate for the present value of lease payments when the rate implicit in the contract is not readily determinable. We determine a secured rate on a quarterly basis and update the weighted average discount rate accordingly. Lease terms and discount rate follow:

Lease cost |

| In USD |

| |

Operating lease cost (included in general and admin in company’s statement of operations) |

| $ |

| |

|

|

|

|

|

Other information |

|

|

|

|

Cash paid for amounts included in the measurement of lease liabilities for the six months ended 6/30/2022 |

|

|

| |

Weighted average remaining lease term-operating leases (in years) |

|

|

| |

Average discount rate - operating leases |

|

| % | |

|

|

|

|

|

The supplemental balance sheet information related to leases for the period is as follows: |

|

|

|

|

Operating leases |

|

|

|

|

Long -term right-of-use assets |

|

|

| |

Total right-of-use assets |

| $ |

| |

|

|

|

|

|

Short-term operating lease liabilities |

|

|

| |

Long-term operating lease liabilities |

|

|

| |

Total operating lease liabilities |

| $ |

| |

|

|

|

|

|

Maturities of the Company’s lease liabilities are as follows: |

|

|

|

|

|

|

|

|

|

Year ending June 30, |

|

|

|

|

2023 |

|

|

| |

2024 |

|

|

| |

2025 |

|

|

| |

2026 |

|

|

| |

Total lease payments |

|

|

| |

Less: Imputed interest/present value discount |

|

| ( | ) |

Present value of lease liabilities |

| $ |

| |

Income Tax

Income taxes are determined in accordance with the provisions of ASC Topic 740, “Income Taxes” (“ASC Topic 740”). Under this method, deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax basis. Deferred tax assets and liabilities are measured using enacted income tax rates expected to apply to taxable income in the periods in which those temporary differences are expected to be recovered or settled. Any effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date.

ASC 740 prescribes a comprehensive model for how companies should recognize, measure, present, and disclose in their financial statements uncertain tax positions taken or expected to be taken on a tax return. Under ASC 740, tax positions must initially be recognized in the financial statements when it is more likely than not the position will be sustained upon examination by the tax authorities. Such tax positions must initially and subsequently be measured as the largest amount of tax benefit that has a greater than 50% likelihood of being realized upon ultimate settlement with the tax authority assuming full knowledge of the position and relevant facts.

| 16 |

| Table of Contents |

The Company has a subsidiary in Singapore and PRC. The Company is subject to tax in Singapore and PRC jurisdictions. As a result of its future business activities, the Company will be required to file tax returns that are subject to examination by the Inland Revenue Authority of Singapore and Tax Department of PRC.

Profit Per Share

Basic net income per share of common stock attributable to common stockholders is calculated by dividing net income attributable to common stockholders by the weighted-average shares of common stock outstanding for the period. Potentially dilutive shares, which are based on the weighted-average shares of common stock underlying outstanding stock-based awards, warrants, options, or convertible debt using the treasury stock method or the if-converted method, as applicable, are included when calculating diluted net income (loss) per share of common stock attributable to common stockholders when their effect is dilutive.

Potential dilutive securities are excluded from the calculation of diluted EPS in profit periods as their effect would be anti-dilutive.

As of June 30, 2022, there were no potentially dilutive shares.

|

| For the period June 30, 2022 |

|

| For the period June 30, 2021 |

| ||

Statement of Operations Summary Information: |

|

|

|

|

|

| ||

Net Profit |

| $ |

|

|

|

| ||

Weighted-average common shares outstanding - basic and diluted |

|

|

|

|

|

| ||

Net profit per share, basic and diluted |

| $ |

|

|

|

| ||

Fair Value

The Company follows guidance for accounting for fair value measurements of financial assets and financial liabilities and for fair value measurements of nonfinancial items that are recognized or disclosed at fair value in the financial statements on a recurring basis. Additionally, the Company adopted guidance for fair value measurement related to nonfinancial items that are recognized and disclosed at fair value in the financial statements on a nonrecurring basis. The guidance establishes a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value.

The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to measurements involving significant unobservable inputs (Level 3 measurements). The three levels of the fair value hierarchy are as follows:

Level 1 inputs are quoted prices (unadjusted) in active markets for identical assets or liabilities that the Company has the ability to access at the measurement date.

Level 2 inputs are inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly or indirectly.

Level 3 inputs are unobservable inputs for the asset or liability. The carrying amounts of financial assets such as cash approximate their fair values because of the short maturity of these instruments.

| 17 |

| Table of Contents |

NOTE 3 – RECENT ACCOUNTING PRONOUNCEMENTS

Recent accounting pronouncements issued by the FASB (including its Emerging Issues Task Force) and the United States Securities and Exchange Commission did not or are not believed by management to have a material impact on the Company’s present or future financial statements.

NOTE 4 – REVENUE

In the business of providing an international cloud-based intelligence system, namely “YCloud” system. We aim to provide technical and auto-billing management system services to micro-business online stores in China through big data analytics, machine learning mechanisms, social network recommendations, and multi-channel data analysis. Weijiafu and Changtongfu are our customers to take charge of the YCloud users’ profiles. Meanwhile, all YCloud users’ information is retained within YCloud system.

We derive our revenue from system service fees charged for transactions conducted through YCloud.

The system services fees are collected from five customers of YCloud system based on the GMV as follow:

Gross Merchandise Volume (“GMV”) |

| June 30, 2022 |

|

| June 30, 2021 |

| ||

|

| US$ |

|

| US$ |

| ||

Non-related parties: |

|

|

|

|

|

| ||

Weijiafu |

|

|

|

|

|

| ||

Beijing Yidong |

|

|

|

|

|

| ||

Maidu International |

|

|

|

|

|

| ||

Beijing Youth |

|

|

|

|

|

| ||

|

|

|

|

|

|

| ||

Related party: |

|

|

|

|

|

|

|

|

Changtongfu |

|

|

|

|

|

| ||

Beijing Joy Trip |

|

|

|

|

|

| ||

Total GMV: |

|

|

|

|

|

| ||

As of and for the period ended June 30, 2022, we generated revenues from the four third parties customers amounting $

NOTE 5 – CASH AT BANK

As of June 30, 2022, the Company held cash in bank in the amount of $

|

| June 30, 2022 |

|

| December 31, 2021 |

| ||

Bank Deposits-China |

| $ |

|

|

|

| ||

Bank Deposits-Singapore |

|

|

|

|

|

| ||

|

|

|

|

|

|

| ||

| 18 |

| Table of Contents |

NOTE 6 – INTANGIBLE ASSET

Intangible asset is software development cost incurred by company, it will be amortized on a straight line basis over the estimated useful life of

June 30, 2022 | ||||||||||||||||

|

| Gross Carrying Amount |

|

| Accumulated Amortization |

|

| Net Carrying Amount |

|

| Weighted Average Useful Life (Years) |

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

Intangible assets: |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Software development |

| $ |

|

| $ | ( | ) |

| $ |

|

|

| 5 |

| ||

Foreign currency translation adjustment |

|

| - |

|

|

| - |

|

|

|

|

|

|

|

| |

Intangible assets, net |

| $ |

|

| $ | ( | ) |

| $ |

|

|

|

|

| ||

Amortization expense for intangible assets was $

Expected future intangible asset amortization as of June 30, 2022 was as follows:

Fiscal years: |

|

|

| |

Remaining 2022 |

| $ |

| |

2023 |

|

|

| |

NOTE 7 – PROPERTY AND EQUIPMENT

As of June 30, 2022, property and equipment consists of the following:

June 30, 2022 | ||||||||||||||||

|

| Gross Carrying Amount |

|

| Accumulated Depreciation |

|

| Net Carrying Amount |

|

| Weighted Average Useful Life (Years) |

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

Property and equipment: |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Office equipment |

| $ |

|

| $ | ( | ) |

| $ |

|

|

|

| |||

Leasehold improvement |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Property and equipment, net |

| $ |

|

| $ | ( | ) |

| $ |

|

|

|

|

| ||

Depreciation expenses of office equipment were $

Amortization expenses of leasehold improvement is $nil for the year ended June 30, 2022 and the leasehold improvement was completed in end of June 2022.

| 19 |

| Table of Contents |

NOTE 8 – ACCOUNT RECEIVABLES

As of June 30, 2022, account receivables is related to the services fee receivables from customers as follow:

|

| June 30, 2022 |

|

| December 31, 2021 |

| ||

Account receivables |

| $ |

|

| $ |

| ||

Account receivables- related parties |

|

|

|

|

|

| ||

|

| $ |

|

| $ |

| ||

We generally receive the system service fee from customers within the first ten days of each quarter due to high volume of transaction amounts conducted through YCloud from end users.

The Company’s financial instruments that are exposed to concentrations of credit risk consist primarily of accounts receivable. The Company does not require collateral for accounts receivables. The Company maintains an allowance for its doubtful accounts receivable due to estimated credit losses. The Company records the allowance against bad debt expense through the consolidated statements of operations, included in general and administrative expense, up to the amount of revenues recognized to date. Receivables are written off and charged against the recorded allowance when the Company has exhausted collection efforts without success. As of June 30, 2022, account receivable from non-related customers are amounted to $

NOTE 9 – PREPAYMENTS

As of June 30, 2022, prepayments consist of the following:

|

| June 30, 2022 |

|

| December 31, 2021 |

| ||

Office furniture and renovation |

| $ |

|

| $ |

| ||

Office rental |

|

|

|

|

|

| ||

YCloud system marketing and promotion service |

|

|

|

|

|

| ||

Others |

|

|

|

|

|

| ||

|

| $ |

|

| $ |

| ||

As of June 30, 2022, there is a prepayment of approximate $

As of June 30, 2022, there is a prepayment of approximate $

| 20 |

| Table of Contents |

NOTE 10 – NOTE RECEIVABLES

As of June 30, 2022, Note receivables consist of the following:

|

| June 30, 2022 |

|

| December 31, 2021 |

| ||

Note receivables |

| $ |

|

|

|

| ||

|

|

|

|

|

|

| ||

Note receivable is related to the short-term loan of RMB

NOTE 11 – OTHER RECEIVABLES

As of June 30, 2022, other receivables consist of advances to staff for petty cash and staff loans as follow:

|

| June 30, 2022 |

|

| December 31, 2021 |

| ||

Advance to staff for petty cash |

| $ |

|

|

|

| ||

Staff loan |

|

|

|

|

|

| ||

|

|

|

|

|

|

| ||

NOTE 12 – RENTAL DEPOSIT

As of June 30, 2022 and December 31, 2021, rental deposit of $

NOTE 13 – AMOUNT DUE TO RELATED PARTIES

|

| As of June 30, 2022 |

|

| As of December 31, 2021 |

| ||

|

|

|

|

|

|

| ||

Related parties payable |

| $ |

|

| $ |

| ||

Director fee payable |

|

|

|

|

|

| ||

|

| $ |

|

| $ |

| ||

The related party balance of $

As of June 30, 2022, the director fee payable of $

| 21 |

| Table of Contents |

NOTE 14 – RELATED PARTY TRANSACTIONS

The following is the list of the related parties to which the Company has transactions with:

| (a) | Beijing Zhidingwang Investment Management Limited Partnership (“BZIM”), the entity in which the Group’s CEO, Liu PiJun beneficially own |

| (b) | Zhiding Network Technology (Beijing) Co Limited (“ZNTB”), the entity in which the Group’s CEO, Liu Pijun beneficially own |

| (c) | Beijing Xingke Datong Technology Co Ltd (“BXDT”), the entity in which the supervisor of a subsidiary company, Deng Liangpeng beneficially own |

| (d) | Huoerguo Zhufeng Technology Co Ltd (“HZTC”), the entity in which the supervisor of a subsidiary company, Sun Tong beneficially own |

| (e) | Global Joy Trip (HK) Limited (“Global Joy HK”), the entity in which the Group’s Chairman, Daizheng and Group’s CEO, Liu Pijun are the director, the company has been dissolved in Jan 2021. |

Related parties transactions consisted of the following as of the dates indicated.

Name of related party |

| Nature of transaction |

| For the Six months ended June 30, 2022 |

|

| For the year ended December 31, 2021 |

| ||

BZIM |

| No transaction during the year |

| NA |

|

| NA |

| ||

ZNTB |

| Office rental paid on behalf of the Group |

| $ |

|

|

|

| ||

BXDT |

| System service fee |

| $ |

|

|

|

| ||

HZTC |

| System service fee |

| $ |

|

|

|

| ||

Changtongfu |

| YCloud system fee |

| $ |

|

|

|

| ||

NOTE 15 – ACCRUED EXPENSES

Accrued expenses of $

|

| June 30, 2022 |

|

| December 31, 2021 |

| ||

Accrued payroll |

| $ |

|

| $ |

| ||

|

| $ |

|

| $ |

| ||

NOTE 16 – TAX PAYABLES

As of June 30, 2022, tax payable of $

| 22 |

| Table of Contents |

NOTE 17 – OTHER PAYABLES

Other payables of $

|

| June 30, 2022 |

|

| December 31, 2021 |

| ||

Security account set up fee-Staff |

| $ |

|

| $ |

| ||

NOTE 18 – SHAREHOLDERS’ EQUITY

The company has an unlimited number of ordinary shares authorized, and has issued

On March 29, 2019, the company has issued

In February, 2020, there are

On September 15, 2020, the Wyoming Secretary of State approved the Company’s certificate of amendment to amend its Articles of Incorporation to effectuate a

On September 21, 2020, there are

On April 13, 2022, the Company and

NOTE 19- SUBSEQUENT EVENT

On July 21, 2022, the Company has uplisted its common stock to the Nasdaq Capital Market, and the closing of its initial public offering (“IPO”) of

After deducting the underwriting discounts and estimated offering expenses payable by us, we expect to receive net proceeds of approximately $

Gross proceeds |

| $ |

| |

Underwriting discounts* |

| $ |

| |

Underwriting accountable expenses |

| $ |

| |

Company offering expenses |

| $ |

| |

Net proceeds |

| $ |

|

*

| 23 |

| Table of Contents |

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis of financial condition and results of operations should be read in conjunction with our financial statements and related notes included elsewhere in this report. This discussion contains forward-looking statements that involve risks, uncertainties and assumptions. See “Cautionary Note Regarding Forward-Looking Statements.” Our actual results could differ materially from those anticipated in the forward-looking statements as a result of certain factors discussed elsewhere in this report.

Overview

WeTrade Group, Inc was incorporated in the State of Wyoming on March 28, 2019 and is in the business of providing technical services and solutions via its social e-commerce platform. We are committed to providing an international cloud-based intelligence system and independently developed a micro-business cloud intelligence system called the “YCloud.” Our goal is to provide technical and auto-billing management services to micro-business online stores in China through big data analytics, machine learning mechanisms, social network recommendations, and multi-channel data analysis.

We provide technology services to both individual and corporate users. which then provide “YCloud” services to individual and corporate micro-business owners in the hotel, hospitality, livestreaming and travel industries.

The market individual micro-business owners represents a potential of 330 million users by the year of 2023. (Source: iResrarch. http://xueqiu.com/8455183447/172404679?sharetime=2,2/22/2021). YCloud serves corporate users in multiple industries, including Yuetao Group, Zhiding, Lvyue, Yuebei, Yuedian, Coke GO, and Zhongyanshangyue. We conduct business operations in mainland China and have established trial operations in Hong Kong. We expect to utilize the YCloud system to establish a global strategic cooperation with various social media platforms.

The main functions of the YCloud system are to manage users’ marketing relationships, CPS commission profit management, multi-channel data statistics, AI fission and management, and improved supply chain systems.

Currently, YCloud serves the micro business industry. We will further expand the application of YCloud to tourism, hospitality, livestreaming and short video, medical beauty and traditional retail industries.

| 24 |

| Table of Contents |

Results of Operations

Results of Operations for the six months period ended June 30, 2022 and 2021

The following tables provide a comparison of a summary of our results of operations for the six months period ended June 30, 2022 and 2021.

|

| For the six months ended June 30, |

| |||||

|

| 2022 |

|

| 2021 |

| ||

Revenue: |

|

|

|

|

|

| ||

Service revenue- related party |

| $ | 288,337 |

|

| $ | - |

|

Service revenue- non related party |

|

| 3,556,596 |

|

|

| 6,663,816 |

|

|

|

| 3,844,933 |

|

|

| 6,663,816 |

|

Cost of Sales |

|

| (879,839 | ) |

|

| (336,767 | ) |

Gross Profit |

|

| 2,965,094 |

|

|

| 6,327,049 |

|

Operating Expenses: |

|

|

|

|

|

|

|

|

General and Administrative |

|

| 2,787,790 |

|

|

| 3,656,646 |

|

Operations Profit |

|

| 177,304 |

|

|

| 2,670,403 |

|

Other revenue |

|

| 75,608 |

|

|

| 198,599 |

|

Net Profit before income tax |

|

| 252,912 |

|

|

| 2,869,002 |

|

Income tax expense |

|

| (134,694 | ) |

|

| (374,888 | ) |

Net income |

|

| 118,218 |

|

|

| 2,494,114 |

|

Revenue from Operations

For the six-month period ended June 30, 2022 and 2021, total revenue was $3,844,933 and $6,663,816 respectively, the decrease was mainly due to the decrease in Gross Merchandise Volume (“GMV”) in Ycloud system as a result of Covid-19 lockdown in several major cities in PRC since March 2022. The system services fees are collected from five customers of YCloud system based on the GMV as follow:

Gross Merchandise Volume (“GMV”) |

| June 30, 2022 |

|

| June 30, 2021 |

| ||

|

| US$ |

|

| US$ |

| ||

Non-related parties: |

|

|

|

|

|

| ||

Customer I |

|

| 53,496,041 |

|

|

| 150,250,147 |

|

Customer II |

|

| 20,811,155 |

|

|

| - |

|

Customer III |

|

| 14,094,841 |

|

|

| - |

|

Customer IV |

|

| 19,312,009 |

|

|

| - |

|

|

|

| 107,714,046 |

|

|

| 150,250,147 |

|

Related party: |

|

|

|

|

|

|

|

|

Customer V |

|

| 8,732,504 |

|

|

| 50,678,696 |

|

Total GMV: |

|

| 116,466,550 |

|

|

| 200,928,843 |

|

Cost of revenue

Cost of revenue is mainly consisting of staff payroll, PRC central provident fund (“CPF”), staff benefits and YCloud system related expenses, the increase is mainly due to more technical services cost were incurred for the system developments for the new customer and more YCloud system related expenses were incurred during the period.

General and Administrative Expenses

For the six months period ended June 30, 2022 and 2021, general and administrative expenses were $2,787,790 and $3,656,646 respectively, the decrease is mainly due to no advertising and exhibition expenses were incurred during the period as compare to the prior period as a result of Covid-19 lockdown in PRC during the period. Furthermore, there are no legal due diligence expenses, travelling and other administrative expenses incurred as compare to the prior period.

| 25 |

| Table of Contents |

Net Income

As a result of the factors described above, there was a net income of $118,218 and net income of $2,494,114 for the period ended June 30, 2022 and 2021, respectively, the decrease is mainly due to decrease in Gross Merchandise Volume (“GMV”) in YCloud system and services are collected from YCloud users based on GMV during the period as a result of Covid-19 lockdown in certain cities in PRC.

Results of Operations for the three months period ended June 30, 2022 and 2021

The following tables provide a comparison of a summary of our results of operations for the three months period ended June 30, 2022 and 2021.

|

| For the three months ended June 30, |

| |||||

|

| 2022 |

|

| 2021 |

| ||

Revenue: |

|

|

|

|

|

| ||

Service revenue- related party |

| $ | 129,819 |

|

| $ | - |

|

Service revenue- non related party |

|

| 1,478,261 |

|

|

| 3,882,893 |

|

|

|

| 1,608,080 |

|

|

| 3,882,893 |

|

Cost of Sales |

|

| (90,651 | ) |

|

| (190,459 | ) |

Gross Profit |

|

| 1,517,429 |

|

|

| 3,692,434 |

|

Operating Expenses: |

|

|

|

|

|

|

|

|

General and Administrative |

|

| 1,982,522 |

|

|

| 1,767,457 |

|

Operations Profit/ (Loss) |

|

| (465,093 | ) |

|

| 1,924,977 |

|

Other revenue |

|

| 27,325 |

|

|

| 115,084 |

|

Net Profit before income tax |

|

| (437,768 | ) |

|

| 2,040,061 |

|

Income tax expense |

|

| (4,869 | ) |

|

| (198,031 | ) |

Net income/ (loss) |

|

| (442,637 | ) |

|

| 1,842,030 |

|

Revenue from Operations

For the three-month period ended June 30, 2022 and 2021, total revenue was $1,608,080 and $3,882,893 respectively, the decrease was mainly due to the decrease in Gross Merchandise Volume (“GMV”) in Ycloud system as a result of Covid-19 lockdown in several major cities in PRC since March 2022.

Cost of revenue

Cost of revenue is mainly consisting of staff payroll, PRC central provident fund (“CPF”), staff benefits and YCloud system related expenses, the decrease is mainly due to decrease in technical staffs headcounts and its related expenses were incurred during the period.

General and Administrative Expenses

For the three-months period ended June 30, 2022 and 2021, general and administrative expenses were $1,982,522 and $1,767,457 respectively, the increase more marketing and promotion expenses were incurred as compare to the prior period.

Net Income/ (loss)

As a result of the factors described above, there was a net loss of $442,637 and net income of $1,842,030 for the period ended June 30, 2022 and 2021, respectively, the loss making is mainly due to decrease in Gross Merchandise Volume (“GMV”) in YCloud system and services are collected from YCloud users based on GMV during the period as a result of Covid-19 lockdown in several major cities in PRC.

| 26 |

| Table of Contents |

Liquidity and Capital Resources

As of June 30, 2022, we had cash on hand of $7,152,073 as compared to $3,210,464 in prior period. The increase is mainly due to account receivables of approximate US$8.2 million collected from customers and related party during the period. However, the increase is mitigated by the prepayment of approximate US$2.3 million for the YCloud marketing and promotion services during the period

Operating activities

As of June 30, 2022, our continuing cash flow operating activities is $6,491,363 for the period ended June 30, 2022 as compared to the cash flow used in operating activities of $541,827 in prior period, which was increased by approximately of $7 million. The increase was mainly due to increase in account receivables collected from customers during the period.

Investing activities

As of June 30, 2022, cash in investing activities is $648,389 for the period ended June 30, 2022 as compared to the $170,265 in prior period. The increase was mainly due to addition of leasehold improvement of approximate of $0.65 million during the period.

Financing activities

Cash provided by our financing activities was 842,547 for the period ended June 30, 2022 as compared to cash used in financing activities of $420,562. The increase is mainly due to partially payment received from note receivables during the period.

Inflation

Inflation does not materially affect our business or the results of our operations.

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements.

Critical Accounting Policies

We prepare our financial statements in accordance with generally accepted accounting principles of the United States (“GAAP”). GAAP represents a comprehensive set of accounting and disclosure rules and requirements. The preparation of our financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. Our actual results could differ from those estimates. We use historical data to assist in the forecast of our future results. Deviations from our projections are addressed when our financials are reviewed on a monthly basis. This allows us to be proactive in our approach to managing our business. It also allows us to rely on proven data rather than having to make assumptions regarding our estimates.

Recent Accounting Pronouncements

We have reviewed all the recently issued, but not yet effective, accounting pronouncements and we do not believe any of these pronouncements will have a material impact on the Company financial statements.

| 27 |

| Table of Contents |

ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

We are a “smaller reporting company” as defined by Item 10(f)(1) of Regulation S-K, and as such are not required to provide the information contained in this item pursuant to Item 305 of Regulation S-K.

ITEM 4. CONTROLS AND PROCEDURES

Disclosure Controls and Procedures

The management of the Company is responsible for establishing and maintaining adequate internal control over financial reporting. The Company’s internal control over financial reporting is a process designed under the supervision of the Company’s Chief Executive Officer and Chief Financial Officer to provide reasonable assurance regarding the reliability of financial reporting and the preparation of the Company’s financial statements for external purposes in accordance with U.S. generally accepted accounting principles.