Form 1-A Mad Science Group, Inc.

1-A LIVE 0001834997 XXXXXXXX true Mad Science Group, Inc. A8 1993 0001834997 8200 00-0000000 30 0 8360 BOUGAINVILLE STREET SUITE 201 MONTREAL A8 H4P 2G1 514-344-4181 Shafik Mina Other 167599.00 0.00 1719792.00 119009.00 2662838.00 183734.00 396865.00 1724355.00 938483.00 2662838.00 1441341.00 127351.00 5178.00 454202.00 0.07 0.07 Martindale, Keysor & Co., PLLC Class A Common Stock 6055045 000000000 None None 0 000000000 None None 0 000000000 None true true Tier2 Audited Equity (common or preferred stock) Y N N Y N N 1834862 6055045 8.2500 19999999.00 0.00 0.00 0.00 19999999.00 Dalmore Group, LLC 100000.00 Martindale, Keysor & Co, PLLC 45000.00 Ulmer & Berne LLP 60000.00 136352 19794999.00 true AL AK AZ AR CA CO CT DE FL GA HI ID IL IN IA KS KY LA ME MD MA MI MN MS MO MT NE NV NH NJ NM NY NC ND OH OK OR PA RI SC SD TN TX UT VT VA WA WV WI WY DC PR AL AK AZ AR CA CO CT DE FL GA HI ID IL IN IA KS KY LA ME MD MA MI MN MS MO MT NE NV NH NJ NM NY NC ND OH OK OR PA RI SC SD TN TX UT VT VA WA WV WI WY DC PR true

AN OFFERING STATEMENT PURSUANT TO REGULATION A RELATING TO THESE SECURITIES HAS BEEN FILED WITH THE SECURITIES AND EXCHANGE COMMISSION. INFORMATION CONTAINED IN THIS PRELIMINARY OFFERING CIRCULAR IS SUBJECT TO COMPLETION OR AMENDMENT. THESE SECURITIES MAY NOT BE SOLD NOR MAY OFFERS TO BUY BE ACCEPTED BEFORE THE OFFERING STATEMENT FILED WITH THE COMMISSION IS QUALIFIED. THIS PRELIMINARY OFFERING CIRCULAR SHALL NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY NOR MAY THERE BE ANY SALES OF THESE SECURITIES IN ANY STATE IN WHICH SUCH OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL BEFORE REGISTRATION OR QUALIFICATION UNDER THE LAWS OF SUCH STATE. THE COMPANY MAY ELECT TO SATISFY ITS OBLIGATION TO DELIVER A FINAL OFFERING CIRCULAR BY SENDING YOU A NOTICE WITHIN TWO BUSINESS DAYS AFTER THE COMPLETION OF THE COMPANY’S SALE TO YOU THAT CONTAINS THE URL WHERE THE FINAL OFFERING CIRCULAR OR THE OFFERING STATEMENT IN WHICH SUCH FINAL OFFERING CIRCULAR WAS FILED MAY BE OBTAINED.

PART II - OFFERING CIRCULAR

PURSUANT TO REGULATION A UNDER THE SECURITIES ACT OF 1933

MAD SCIENCE GROUP INC.

8360 Bougainville St.

Suite

201

Montreal, Quebec H4P 2G1

514-344-4181

www.madscience.org

UP TO 2,424,242 SHARES OF CLASS A COMMON STOCK

PRICE: $8.25 PER SHARE

MINIMUM INVESTMENT: ONE HUNDRED SHARES ($825.00)

We are offering a minimum of 181,818 shares of our Class A Common Stock and a maximum of 2,424,242 shares of Class A Common Stock on a “best efforts” basis. The offering will begin as soon as practicable after this Offering Circular has been qualified by the Securities and Exchange Commission (the “Commission”) and the relevant state regulators, as necessary. If $1,500,000 in subscriptions for the shares (the “Minimum Offering”) is not deposited in escrow on or before [●] (which date may be extended at our option) (the “Termination Date”), all subscriptions will be refunded to subscribers without deduction or interest. Subscribers have no right to a return of their funds until the Termination Date. If the Minimum Offering has been achieved by [●], the Offering may continue until the earlier of [●] (which date may be extended at our option) or the date when all shares have been sold. See “Plan of Distribution” and “Securities Being Offered” for a description of our capital stock.

The Company has engaged North Capital Private Securities Corporation (“NCPS”), a registered broker-dealer and member FINRA/SIPC, as escrow agent to hold any funds that are tendered by investors. The Company may hold one or more closings on a rolling basis, after the Minimum Offering is achieved, at which point the Company receives the funds from the escrow agent and issues shares to investors.

| Price to Public | Underwriting discounts and Commissions (1) | Proceeds to issuer (2) | ||||||||||

| Per share | $ | 8.25 | $ | 0.0825 | $ | 8.1675 | ||||||

| Total Minimum | $ | 1,500,000 | $ | 15,000 | $ | 1,485,000 | ||||||

| Total Maximum | $ | 20,000,000 | $ | 200,000 | $ | 19,800,000 | ||||||

| (1) | Mad Science Group Inc., a Quebec corporation (“Mad Science Group,” “MSG,” “we,” “us,” “our” or “Company”) has engaged Dalmore Group, LLC member FINRA/SIPC (“Dalmore”) to perform administrative and technology-related functions in connection with the Offering, but not for underwriting or placement agent services. This amount includes a payment of one percent (1%) of the aggregate gross proceeds raised in the Offering but does not include a one-time due diligence fee of $5,000 and one-time consulting fee of $20,000. See “Plan of Distribution” for details regarding the compensation payable to Dalmore and other third-parties in connection with this Offering. | |

| (2) | Does not include expenses of the Offering (other than the fees paid to Dalmore under “Plan of Distribution –Commissions and Discounts” for the administrative and technology-related services provided in connection with the Offering), including, but not limited to, fees and expenses for marketing and advertising of the Offering, media expenses, fees for escrow fees, accounting, audit and legal services, fees for EDGAR document conversion and filing, and website posting fees. |

THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OR GIVE ITS APPROVAL OF ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

GENERALLY NO SALE MAY BE MADE TO YOU IN THIS OFFERING IF THE AGGREGATE PURCHASE PRICE YOU PAY IS MORE THAN 10% OF THE GREATER OF YOUR ANNUAL INCOME OR NET WORTH. DIFFERENT RULES APPLY TO ACCREDITED INVESTORS AND NON-NATURAL PERSONS. BEFORE MAKING ANY REPRESENTATION THAT YOUR INVESTMENT DOES NOT EXCEED APPLICABLE THRESHOLDS, WE ENCOURAGE YOU TO REVIEW RULE 251(d)(2)(i)(C) OF REGULATION A. FOR GENERAL INFORMATION ON INVESTING, WE ENCOURAGE YOU TO REFER TO www.investor.gov.

NOTICE TO FOREIGN INVESTORS

IF A PURCHASER OF SHARES IN THIS OFFERING LIVES OUTSIDE THE UNITED STATES, IT IS THE PURCHASER’S RESPONSIBILITY TO FULLY OBSERVE THE LAWS OF ANY RELEVANT TERRITORY OR JURISDICTION OUTSIDE THE UNITED STATES IN CONNECTION WITH THE PURCHASE OF SUCH SHARES, INCLUDING OBTAINING REQUIRED GOVERNMENTAL OR OTHER CONSENTS OR OBSERVING ANY OTHER REQUIRED LEGAL OR OTHER FORMALITIES. THE COMPANY RESERVES THE RIGHT TO DENY THE PURCHASE OF SHARES IN THIS OFFERING BY ANY FOREIGN PURCHASER.

About This Form 1-A and Offering Circular

In making an investment decision, you should rely only on the information contained in the Form 1-A and this Offering Circular. We have not authorized anyone to provide you with information different from that contained in this Form 1-A and Offering Circular. We are offering to sell and seeking offers to buy the Shares only in jurisdictions where offers and sales are permitted. You should assume that the information contained in this Form 1-A and Offering Circular is accurate only as of the date of this Form 1-A and Offering Circular, regardless of the time of delivery of the Form 1-A and the Offering Circular. Our business, financial condition, results of operations, and prospects may have changed since that date. Statements contained herein as to the content of any agreements or other documents are summaries and, therefore, are necessarily selective and incomplete and are qualified in their entirety by the actual agreements or other documents.

Continuous Offering

Under Rule 251(d)(3) to Regulation A, the following types of continuous or delayed Offerings are permitted, among others: (1) securities offered or sold by or on behalf of a person other than the issuer or its subsidiary or a person of which the issuer is a subsidiary; (2) securities issued upon conversion of other outstanding securities; or (3) securities that are part of an Offering which commences within two calendar days after the qualification date. These may be offered on a continuous basis and may continue to be offered for a period in excess of 30 days from the date of initial qualification. They may be offered in an amount that, at the time the Offering statement is qualified, is reasonably expected to be offered and sold within one year from the initial qualification date. No securities will be offered or sold “at the market.” The supplement will not, in the aggregate, represent any change from the maximum aggregate Offering price calculable using the information in the qualified Offering statement. This information will be filed no later than two business days following the earlier of the date of determination of such pricing information or the date of first use of the Offering circular after qualification.

Sale of our shares in this Offering will commence within two calendar days of the qualification date and it will be a continuous Offering pursuant to Rule 251(d)(3)(i)(F).

THIS OFFERING IS INHERENTLY RISKY AND PROSPECTIVE INVESTORS SHOULD BE PREPARED TO SUSTAIN A LOSS OF THEIR ENTIRE INVESTMENT. SEE “RISK FACTORS” STARTING ON PAGE 3 OF THIS OFFERING CIRCULAR.

THE COMPANY IS FOLLOWING THE “OFFERING CIRCULAR” FORMAT OF DISCLOSURE UNDER REGULATION A.

THE DATE OF THIS OFFERING CIRCULAR IS JANUARY 24, 2022

INVESTMENT IN SMALL BUSINESSES INVOLVES A HIGH DEGREE OF RISK, AND INVESTORS SHOULD NOT INVEST ANY FUNDS IN THIS OFFERING UNLESS THEY CAN AFFORD TO LOSE THEIR ENTIRE INVESTMENT. IN MAKING AN INVESTMENT DECISION, INVESTORS MUST RELY ON THEIR OWN EXAMINATION OF THE ISSUER AND THE TERMS OF THE OFFERING, INCLUDING THE MERITS AND RISKS INVOLVED.

THIS OFFERING CIRCULAR DOES NOT CONSTITUTE AN OFFER TO SELL OR SOLICITATION OF AN OFFER TO BUY IN ANY JURISDICTION IN WHICH SUCH OFFER OR SOLICITATION WOULD BE UNLAWFUL OR ANY PERSON TO WHO IT IS UNLAWFUL TO MAKE SUCH OFFER OR SOLICITATION. THESE SECURITIES MAY NOT BE SOLD NOR MAY OFFERS TO BUY BE ACCEPTED PRIOR TO THE TIME AN OFFERING CIRCULAR WHICH IS NOT DESIGNATED AS A PRELIMINARY OFFERING CIRCULAR IS DELIVERED AND THE OFFERING STATEMENT FILED WITH THE COMMISSION BECOMES QUALIFIED.

NEITHER THE DELIVERY OF THIS OFFERING CIRCULAR NOR ANY SALE MADE HEREUNDER SHALL, UNDER ANY CIRCUMSTANCES, CREATE AN IMPLICATION THAT THERE AS HAS BEEN NO CHANGE IN THE AFFAIRS OF OUR COMPANY SINCE THE DATE HEREOF. INFORMATION CONTAINED IN THE PRELIMINARY OFFERING CIRCULAR IS SUBJECT TO COMPLETION OR AMENDMENT.

THE OFFERING PRICE OF THE SECURITIES IN WHICH THIS OFFERING CIRCULAR RELATES HAS BEEN DETERMINED BY THE COMPANY AND DOES NOT NECESSARILY BEAR ANY SPECIFIC RELATION TO THE ASSETS, BOOK VALUE OR POTENTIAL EARNINGS OF THE COMPANY OR ANY OTHER RECOGNIZED CRITERIA OF VALUE.

NASAA UNIFORM LEGEND:

IN MAKING AN INVESTMENT DECISION INVESTORS MUST RELY ON THEIR OWN EXAMINATION OF THE ISSUER AND THE TERMS OF THE OFFERING, INCLUDING THE MERITS AND RISKS INVOLVED. THESE SECURITIES HAVE NOT BEEN RECOMMENDED BY THE FEDERAL OR STATE SECURITIES COMMISSION OR REGULATORY AUTHORITY. FURTHERMORE, THE FOREGOING AUTHORITIES HAVE NOT CONFIRMED THE ACCURACY OR DETERMINED THE ADEQUACY OF THIS DOCUMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE. THESE SECURITIES ARE SUBJECT TO RESTRICTIONS ON TRANSFERABILITY AND RESALE AND MAY NOT BE TRANSFERRED OR RESOLD EXCEPT AS PERMITTED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, AND THE APPLICABLE STATE SECURITIES LAWS, PURSUANT TO REGISTRATION OR EXEMPTION THEREFROM. INVESTORS SHOULD BE AWARE THAT THEY WILL BE REQUIRED TO BEAR THE FINANCIAL RISKS OF THIS INVESTMENT FOR AN INDEFINITE PERIOD OF TIME.

THIS OFFERING CIRCULAR MAY CONTAIN FORWARD-LOOKING STATEMENTS AND INFORMATION RELATING TO, AMONG OTHER THINGS, THE COMPANY, ITS BUSINESS PLAN AND STRATEGY, AND ITS INDUSTRY. THESE FORWARD-LOOKING STATEMENTS ARE BASED ON THE BELIEFS OF, ASSUMPTIONS MADE BY, AND INFORMATION CURRENTLY AVAILABLE TO THE COMPANY’S MANAGEMENT. WHEN USED IN THE OFFERING MATERIALS, THE WORDS “ESTIMATE,” “PROJECT,” “BELIEVE,” “ANTICIPATE,” “INTEND,” “EXPECT” AND SIMILAR EXPRESSIONS ARE INTENDED TO IDENTIFY FORWARD-LOOKING STATEMENTS AND CONSTITUTE FORWARD LOOKING STATEMENTS. THESE STATEMENTS REFLECT MANAGEMENT’S CURRENT VIEWS WITH RESPECT TO FUTURE EVENTS AND ARE SUBJECT TO RISKS AND UNCERTAINTIES THAT COULD CAUSE THE COMPANY’S ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE CONTAINED IN THE FORWARD-LOOKING STATEMENTS. INVESTORS ARE CAUTIONED NOT TO PLACE UNDUE RELIANCE ON THESE FORWARD-LOOKING STATEMENTS, WHICH SPEAK ONLY AS OF THE DATE ON WHICH THEY ARE MADE. THE COMPANY DOES NOT UNDERTAKE ANY OBLIGATION TO REVISE OR UPDATE THESE FORWARD-LOOKING STATEMENTS TO REFLECT EVENTS OR CIRCUMSTANCES AFTER SUCH DATE OR TO REFLECT THE OCCURRENCE OF UNANTICIPATED EVENTS.

| ii |

table of contents

| iii |

The Company

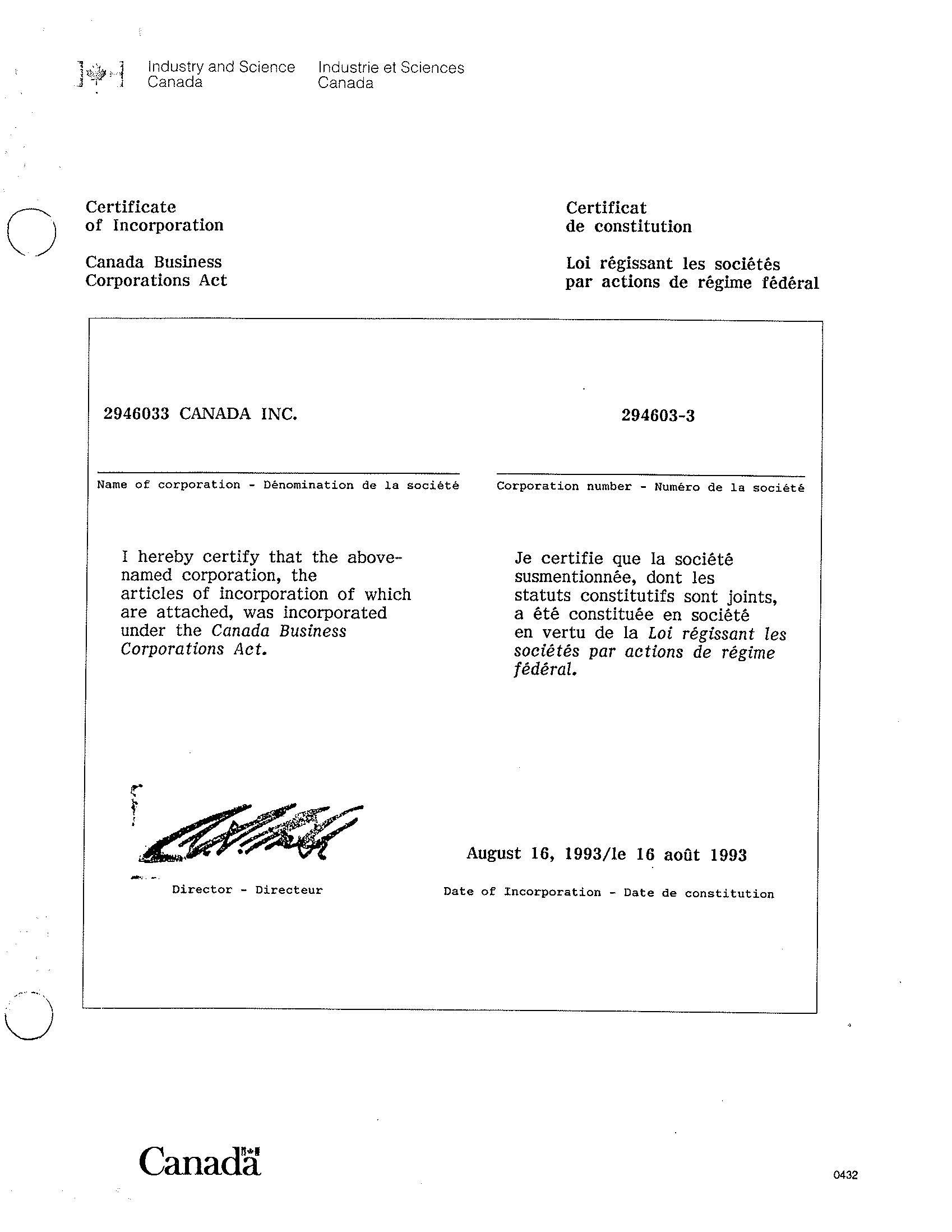

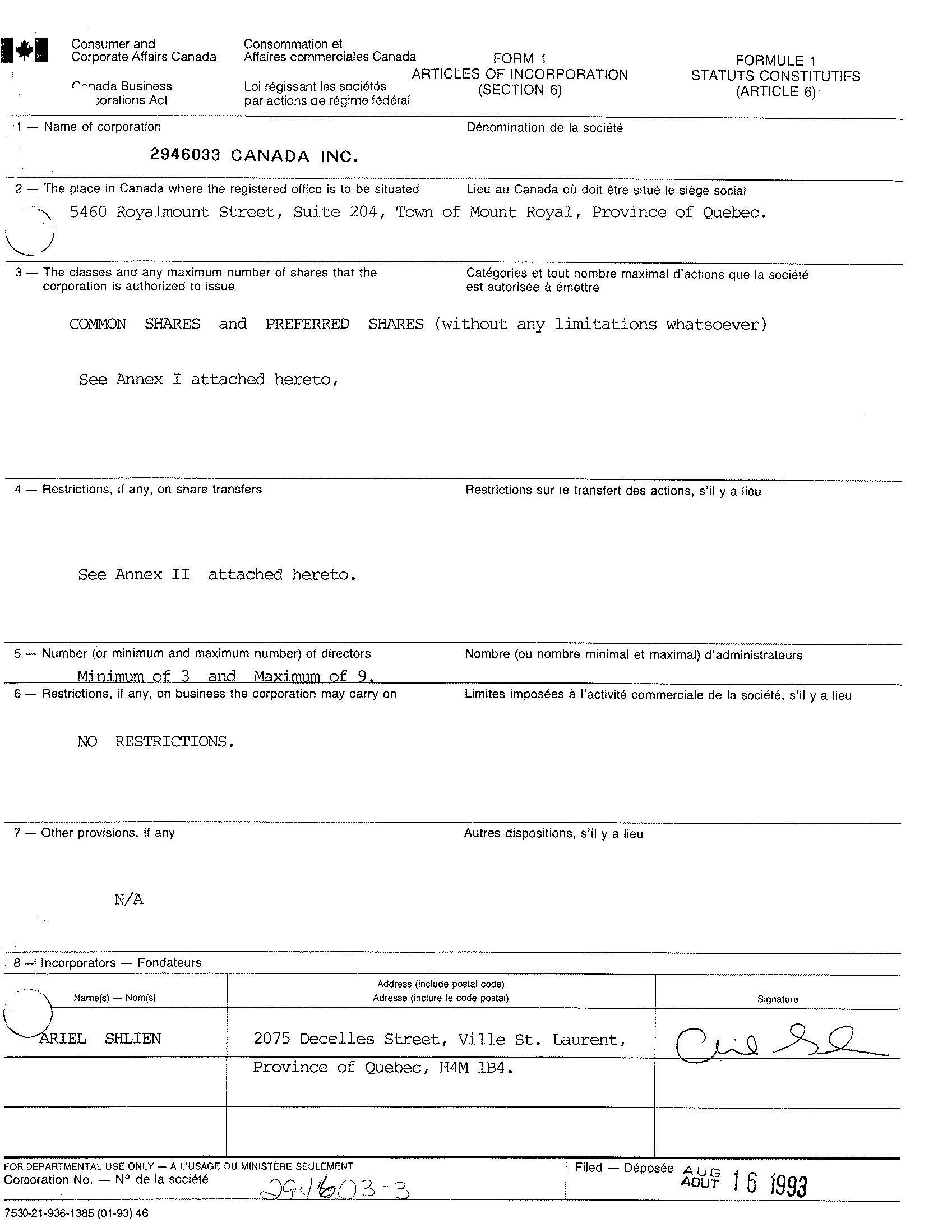

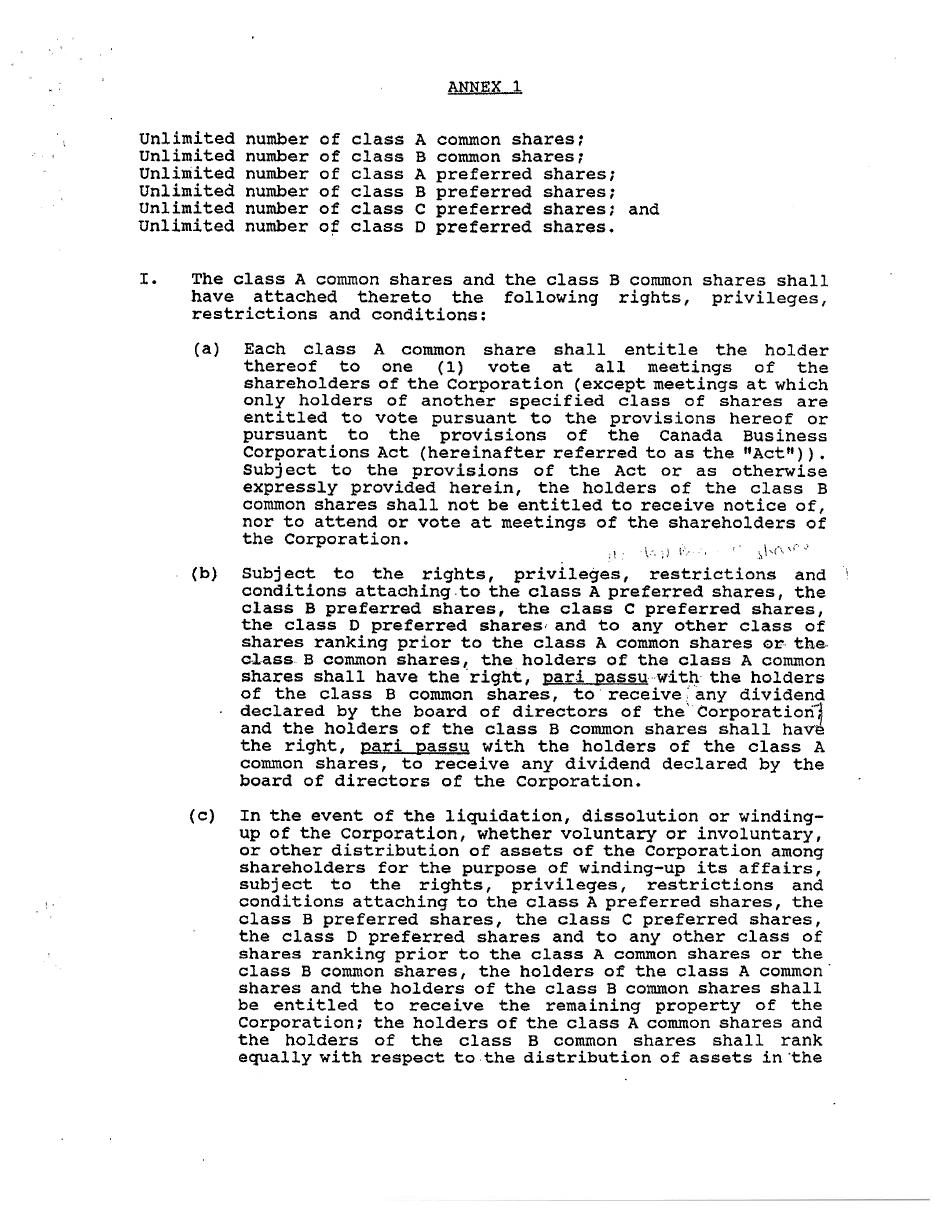

Mad Science Group Inc. was incorporated on August 16, 1993 as a Canadian corporation. With headquarters in Montreal, Quebec, we are a global leader in the business of granting and supporting franchises worldwide operating children’s science education and entertainment programs serving after-school programs, pre-school programs, workshops, birthday parties, camps and other special events. These programs are targeted for children ages 3-12. We also offer a NASA-branded enrichment program in after-school, summer camp and birthday party settings, and programs we refer to as Schoolhouse Chess and Brixology. All franchisees operate under the “MAD SCIENCE” and “MAD SCIENCE & DESIGN” brand and associated trademarks, service marks and logos. We currently have 140 franchisees worldwide. As part of our effort to broaden and deepen our penetration into the child enrichment ecosystem, in 2020, we launched two (2) new lines of business in addition to our franchise system by offering the following science-education related products directly to our target markets: (i) an online digital science platform, known as “The Kids Club,” offering various STEM activities, including experiment videos, for children ages 5-12 and (ii) a home-delivery subscription-based “science box” program, known as “Loop Lab,” targeting children ages 8 and up, delivering boxes with various hands-on STEM activities directly to the home. While these new lines of business have only just begun, we are hopeful that they will be meaningful contributors to our growth in the future. In 2021, we expanded our business development focus to include offering government-funded programs and, in January 2022, we entered into a two-year contract with the Chicago Board of Education to provide STEM workshops to 520 elementary schools through one of our corporate-owned franchisee subsidiaries.

The Offering

| Securities offered: | Class A Common Shares | |

| Offering price per share: | $8.25 per share | |

Maximum number of shares to be sold in this Offering

Minimum number of shares to be sold in this Offering: |

2,424,242 Class A Common Shares

181,818 Class A Common Shares | |

| Number of Shares outstanding before this Offering | 6,055,045 | |

| Market for these securities: | There is currently no public market for these securities. | |

| Use of proceeds: | The net proceeds of the offering will be used primarily for acquisition of complementary franchise businesses, expansion of our existing franchisee network, and other working capital purposes. | |

| Termination of this Offering: | This Offering will close upon the earlier of (1) the sale of the maximum number of Shares offered hereby, (2) one year from the date this Offering begins, or (3) a date prior to one year from the date this Offering begins that is so determined by our Board of Directors. |

| 1 |

Selected Risks Associated with Our Business

Our business is subject to a number of risks and uncertainties, including those highlighted in the section titled “Risk Factors” immediately following this summary. These risks include, but are not limited to, the following:

| ● | Our financial results are affected by the operating and financial results of our franchisees. Since the COVID-19 outbreak, the royalties we receive from our franchisees have fallen dramatically due, to among other things, the closure of a substantial portion of the schools in our markets and public health measures warning against congregating in public areas. Until such time as our franchisees are able to resume pre-pandemic levels of operations, we expect to continue to incur operating losses and cannot assure you that we will achieve or maintain profitable operations. | |

| ● | Our sales of franchises, from which we receive an initial franchise fee, have failed to increase at the same rate as they did prior to the onset of the COVID-19 pandemic. If the primary users of our franchisees’ services and products do not believe they can participate in the programs offered by our franchisees, our sales of new franchises, and the amount of royalties received from existing franchises, will decrease. Indeed, it is possible that a substantial number of our franchisees will fail as a consequence of the effects of the COVID-19 pandemic and resulting public health measures put in place in an effort to combat it. | |

| ● | Our success depends on our ability and the ability of our franchisees to uphold the reputation of our brand, which will depend on the effectiveness of our and our franchisees’ marketing, our and their program quality, and our franchisees’ customer experience. | |

| ● | If we are unable to anticipate consumer preferences and successfully develop and introduce new, innovative and updated programs or if our franchisees are not successful in operating their franchised operations, we may not be able to maintain or increase our sales or achieve profitability. | |

| ● | An economic downturn or economic uncertainty in the United States, where most of our franchisees operate, may adversely affect consumer discretionary spending and demand for our franchisees’ programs. | |

| ● | We intend to use a substantial portion of the net proceeds raised in this Offering to develop new geographic markets for our programs, develop new programs to offer prospective franchisees, and acquire companies engaged in similar or related activities. If we fail to raise the necessary funds in this Offering to carry out these objectives or are otherwise unsuccessful in meeting these objectives, our operations and financial results may suffer. | |

| ● | Our results of operations could be materially harmed if we are unable to accurately forecast demand for our programs. | |

| ● | The impact of the COVID-19 pandemic or any other pandemic could affect our supply chain and/or consumer behavior. | |

| ● | If we are unable to protect our intellectual property rights, our financial results may be negatively impacted. | |

| ● | We may be subject to liability if we or our franchisees infringe upon the intellectual property rights of third parties. | |

| ● | We will likely need to raise additional capital to grow our business. We may not be able to raise such capital on terms acceptable to us or at all. | |

| ● | Our future success depends on our key executive officers and our ability to attract, retain, and motivate qualified personnel and franchisees. | |

| ● | Security breaches and other disruptions could compromise our information and expose us to liability, which would cause our business and reputation to suffer. | |

| ● | The offering price of the Shares in this Offering has been arbitrarily established by our current management, considering such matters as the current state of our business, prospects for our future growth, our intellectual property, and the markets and industry in which we operate. The offering price bears little relationship to our assets, net worth, or any other objective criteria. | |

| ● | No application is currently being prepared for the Shares to be listed on an exchange or quoted on any OTC Markets tier. There can be no assurance that a liquid market for the Shares will develop or, if it does develop, that it will continue. If a market does develop, it may not be liquid. |

| 2 |

The SEC requires us to identify risks that are specific to our business and financial condition. The Company is still subject to all the same risks that all companies in our business, and all companies in the economy, are exposed to. These include risks relating to economic downturns, political and economic events and technological developments. You should consider general risks as well as specific risks when deciding whether to invest.

Risks Related to Our Business

The Coronavirus pandemic has adversely affected and continues to adversely affect our business operations, financial condition, liquidity and cash flow, and the length of such impacts are uncertain.

The Coronavirus (“COVID-19”) pandemic has, and continues to, adversely affect our business operations, financial condition, liquidity and cash flow, and the length of such impacts are uncertain. While COVID-19 vaccination programs have recently commenced in many of the geographic markets where our franchisees operate, there can be no certainty that these vaccination programs will be successful, and if so, for how long, in slowing or resolving the pandemic and/or ameliorating the conditions which have led to a reduced demand for our programs. Since the circumstances surrounding the pandemic and the vaccination programs are still evolving, we are unable to reasonably foresee the future effect and ultimate impact of the COVID-19 pandemic on our business and the business of our franchisees. The spread of COVID-19 has caused public health officials to recommend precautions to mitigate the spread of the virus, including warning against congregating in heavily populated areas, such as malls and community centers. Among the precautions has been the closure of a substantial portion of the schools in the United States and Canada and other geographic markets where our franchisees operate, which has adversely impacted our royalty revenue from franchisees and may continue to do so. There is significant uncertainty around the breadth and duration of these school closures and other business disruptions related to COVID-19, as well as its long-term impact on the U.S. and global economy. The extent to which COVID-19 impacts our results will depend on future developments, which remain uncertain and cannot be predicted, including new information that may emerge concerning the severity of COVID-19, the effectiveness of the vaccination programs, the appearance and prevalence of mutated strains of the Coronavirus, and the actions taken to contain it or treat its impact. We have asked our corporate employees whose jobs allow them to work remotely to do so for the foreseeable future. Such precautionary measures could create operational challenges as we adjust to a remote workforce, which could adversely impact our business.

While our revenues for the first six months of the fiscal year ending March 31, 2022 have rebounded from the level in the comparable period for the prior year during the fiscal year ended March 31, 2021, the Company experienced a significant decline in revenues compared to fiscal 2020 due primarily to reduced royalty fees received from our franchisees who experienced a dramatic decrease in demand for their programs. This decline in demand for our programs was due to community-wide measures taken in response to the COVID-19 pandemic, including indefinite school closings, a decline in use of public transportation, a virtual workforce, and restrictions on social gatherings. The COVID-19 pandemic also negatively impacted the growth rate in the number of new franchises sold over the past 18 months resulting in a decrease in initial franchise fees we received. While efforts were taken to reduce our expenses during fiscal 2021 and the first six months of fiscal 2022 in light of these developments, including, but not limited to, the deferral of a substantial percentage of our executive officers’ salaries, our loss from operations widened significantly from fiscal 2020 to fiscal 2021.

If we fail to successfully implement our growth strategy, our ability to increase our revenues and net income could be adversely affected.

Our growth strategy is based primarily on (i) acquiring other franchisors offering compatible or synergistic products or programs, (ii) the development of existing and new franchisees, and (iii) developing new product offerings, including, but not limited to, government-funded STEM enrichment programs. We may pursue acquisitions to increase our market penetration, enter new geographic markets and expand the scope of services we provide. We cannot guarantee that we will identify suitable acquisition candidates, that acquisitions will be completed on acceptable terms, or that we will be able to integrate successfully the operations of any acquired business into our existing business. Furthermore, there is a risk that we will misjudge the compatibility of the programs offered by those franchisors with our own franchised programs and the quality of the franchisees. The acquisitions could be of significant size and involve operations in multiple jurisdictions. The acquisition and integration of another business would divert management attention from other business activities. This diversion, together with other difficulties we may incur in integrating an acquired business, could have a material adverse effect on our business, financial condition and results of operations. In addition, we may borrow money or issue capital stock to finance acquisitions or enter into new markets, such as government-funded STEM enrichment programs. Such borrowings might not be available on terms as favorable to us as our current borrowing terms and may increase our leverage, and the issuance of capital stock could dilute the interests of our stockholders.

| 3 |

In addition to acquiring other franchisors, our growth strategy will include the development of our existing and new franchisees. Our franchisees face many challenges in growing their businesses, including:

| ● | availability and cost of financing; | |

| ● | securing required domestic or foreign governmental permits and approvals; | |

| ● | anticipating trends in new geographic regions and acceptance of our products and services; | |

| ● | competition with competing franchise systems; and | |

| ● | employing, training and retaining qualified personnel. |

Since part of our business development is funded by franchisee investment, our growth strategy is dependent on our franchisees’ (or prospective franchisees’) ability to access funds to finance such development. If our franchisees (or prospective franchisees) are not able to obtain financing at commercially reasonable rates, or at all, they may be unwilling or unable to invest in business development, and our future growth could be adversely affected.

Our growth strategy also relies on our ability to identify, recruit and enter into franchise agreements with a sufficient number of qualified franchisees. In addition, our ability and the ability of our franchisees to successfully expand into new markets may be adversely affected by a lack of awareness or acceptance of our brand as well as a lack of existing marketing efforts and operational execution in these new markets. To the extent that we are unable to implement effective marketing and promotional programs and foster recognition and affinity for our brand in new markets, our franchisees may not perform as expected and our growth may be significantly delayed or impaired. In addition, franchisees may have difficulty securing adequate financing, particularly in new markets, where there may be a lack of adequate history and brand familiarity. Our franchisees’ business development efforts may not be successful, which could materially and adversely affect our business, results of operations and financial condition.

Our success depends on our ability to uphold the reputation of our brand, which will depend on the effectiveness of our marketing, our product quality, and our franchisees’ customer experience.

We believe that our brand image and brand awareness is vital to the success of our business. The “Mad Science” name is integral to our business as well as to the implementation of our strategies for expanding our business. We also believe that maintaining and enhancing our brand image, particularly in new markets where we have limited brand recognition, is important to maintaining and expanding our customer base. As we execute our growth strategy, our ability to successfully expand into new markets or to maintain the strength and distinctiveness of our brand image in our existing markets will be adversely impacted if we fail to connect with our target customer. Among other things, we rely on social media platforms, such as Instagram, Facebook and Twitter, to help implement our marketing strategies and promote our brand. Our brand and reputation may be adversely affected if we fail to achieve these objectives, if our public image was to be tarnished by negative publicity, or if we fail to deliver innovative and high-quality programs our franchisees’ targeted clientele desire. Negative publicity regarding one or more of our franchisees or strategic partners, such as Crayola, Lego Brands or NASA, could adversely affect our reputation. Additionally, while we devote considerable efforts and resources to protecting our intellectual property, if these efforts are not successful the value of our brand may be harmed. Any harm to our brand and reputation could have a material adverse effect on our financial condition.

Brand value also can be severely damaged even by isolated incidents, particularly if the incidents receive considerable negative publicity or result in litigation. Some of these incidents may relate to the way we manage our relationships with our franchisees, our growth strategies, our development efforts or the ordinary course of our, or our franchisees’, businesses. Other incidents that could be damaging to our brand may arise from events that are or may be beyond our ability to control, such as:

| ● | actions taken (or not taken) by one or more franchisees or their employees relating to the health, safety, and welfare of the participants in their programs; | |

| ● | data security breaches or fraudulent activities associated with our and our franchisees’ electronic payment systems; | |

| ● | third-party misappropriation, dilution or infringement of our intellectual property; and | |

| ● | illegal activity targeted at us or our franchisees. |

| 4 |

Consumer demand for our products and services and our brand’s value could diminish significantly if any such incidents or other matters erode consumer confidence in us or in our products or services, which would likely result in fewer sales of franchises and other products and, ultimately, lower royalty revenue, which in turn could materially and adversely affect our results of operations and financial condition.

If we are unable to anticipate consumer preferences and successfully develop and introduce new, innovative and updated programs and products, we may not be able to maintain or increase our sales or achieve profitability.

Our success depends on our ability to timely identify and originate program and product trends as well as to anticipate and react to changing consumer demands. All of our products are subject to changing consumer preferences and we cannot predict such changes with any certainty, nor are such consumer preferences and trends uniform throughout the various geographic markets in which our franchisees operate. We will need to anticipate, identify and respond quickly to changing consumer demands and trends in order to provide programs and products our customers seek and maintain our brand image. If we cannot identify changing trends in advance, fail to react to changing trends or misjudge the market for a trend, the operations of our franchisees may suffer which, in turn, would cause our royalties to decline, negatively impacting our financial condition and results of operations.

Even if we are successful in anticipating consumer demands, our ability to adequately react to and execute on those demands will in part depend upon our continued ability to develop or acquire and introduce high-quality and attractive programs and products. If we fail to provide products and programs that consumers want, our brand image could be negatively impacted. Our failure to effectively introduce new products and programs and enter into new product and program categories that are accepted by consumers could result in a decrease in net revenues, which could have a material adverse effect on our financial condition.

Our franchisees could take actions that harm us.

Our franchisees are independent third party business owners who are contractually obligated to operate in accordance with the operational and other standards set forth in our franchise agreement. Although we engage in a thorough screening process when reviewing potential franchisee candidates, we cannot be certain that our franchisees will have the business acumen or financial resources necessary to operate successful franchises in their approved territories. In addition, certain state or foreign franchise laws may limit our ability to terminate, not renew or modify these franchise agreements. As independent business owners, the franchisees oversee their own daily operations. As a result, the ultimate success and quality of any franchise rests with the franchisee. If franchisees do not successfully operate in a manner consistent with required standards and comply with local laws and regulations, franchise fees and royalties paid to us may be adversely affected and our brand image and reputation could be harmed, which in turn could adversely affect our results of operations and financial condition.

Moreover, although we believe we generally maintain positive working relationships with our franchisees, disputes with franchisees could damage our brand image and reputation and our relationships with our franchisees, generally.

Our future growth could place strains on our management, employees, information systems and internal controls, which may adversely impact our business.

Our future growth may place significant demands on our administrative, operational, financial and other resources. Any failure to manage growth effectively could seriously harm our business. To be successful, we will need to continue to implement management information systems and improve our operating, administrative, financial and accounting systems and controls. We will also need to train new employees and maintain close coordination among our executive, accounting, finance, human resources, marketing, technology, sales and operations functions. These processes are time-consuming and expensive, increase management responsibilities and divert management attention, and we may not realize a return on our investment in these processes. Our failure to successfully execute on our planned expansion could materially and adversely affect our results of operations and financial condition.

Changing economic conditions, including unemployment rates, may reduce demand for our products and services.

Our revenues and other financial results are subject to general economic conditions. Our revenues depend, in part, on the number of dual-income families and working single parents who desire child development or educational services. A deterioration of general economic conditions, including a soft housing market and/or rising unemployment, may adversely impact us because of the tendency of out-of-work parents to diminish or discontinue utilization of these services. Finally, there can be no assurance that demographic trends, including the number of dual-income families in the workforce, will continue to lead to increased demand for our products and services.

| 5 |

We may require additional financing to execute our business plan and fund our other liquidity needs.

We currently have a revolving bank credit facility of up to $100,000. Should we be subject to a materially adverse economic or financial effect, and we are unable to increase our revenues or decrease our operating expenses from recent historical run-rate levels, we expect that we would need to obtain additional capital to fund our operations. Should our cash flows from operations not meet or exceed our projections, we may need to pursue one or more alternatives, such as to:

| ● | reduce or delay planned capital expenditures or investments in our business; | |

| ● | seek additional financing or restructure or refinance all or a portion of our indebtedness at or before maturity; | |

| ● | sell assets or businesses; | |

| ● | sell additional equity; or | |

| ● | curtail our operations. |

Any such actions may materially and adversely affect our future prospects. In addition, we cannot ensure that we will be able to raise additional equity capital, restructure or refinance any of our indebtedness or obtain additional financing on commercially reasonable terms or at all.

Any long-term indebtedness we may incur could adversely affect our business and limit our ability to expand our business or respond to changes, and we may be unable to generate sufficient cash flow to satisfy our debt service obligations.

We may incur additional indebtedness in the future. Any long-term indebtedness we may incur and the fact that a substantial portion of our cash flow from operating activities could be needed to make payments on this indebtedness could have adverse consequences, including the following:

| ● | reducing the availability of our cash flow for our operations, capital expenditures, future business opportunities, and other purposes; | |

| ● | limiting our flexibility in planning for, or reacting to, changes in our business and the industries in which we operate, which would place us at a competitive disadvantage compared to our competitors that may have less debt; | |

| ● | limiting our ability to borrow additional funds; | |

| ● | increasing our vulnerability to general adverse economic and industry conditions; and | |

| ● | failing to comply with the covenants in our debt agreements could result in all of our indebtedness becoming immediately due and payable. |

Our ability to borrow any funds needed to operate and expand our business will depend in part on our ability to generate cash. Our ability to generate cash is subject to the performance of our business as well as general economic, financial, competitive, legislative, regulatory, and other factors that are beyond our control. If our business does not generate sufficient cash flow from operating activities or if future borrowings are not available to us in amounts sufficient to enable us to fund our liquidity needs, our operating results, financial condition, and ability to expand our business may be adversely affected. Moreover, our inability to make scheduled payments on our debt obligations in the future would require us to refinance all or a portion of our indebtedness on or before maturity, sell assets, delay capital expenditures or seek additional equity.

| 6 |

We are subject to a variety of additional risks associated with our franchisees.

Our franchise business model subjects us to a number of risks, any one of which may impact our royalty revenues collected from our franchisees, harm the goodwill associated with our brand, and materially and adversely impact our business and results of operations.

Bankruptcy of franchisees. A franchisee bankruptcy could have a substantial negative impact on our ability to collect payments due under such franchisee’s franchise agreement(s). In a franchisee bankruptcy, the bankruptcy trustee may reject its franchise agreement(s) pursuant to Section 365 under the U.S. bankruptcy code, in which case there would be no further royalty payments from such franchisee, and we may not ultimately recover those payments in a bankruptcy proceeding of such franchisee in connection with a damage claim resulting from such rejection.

Franchisee changes in control. Our franchises are operated by independent business owners. Although we have the right to approve franchise owners, and any transferee owners, it can be difficult to predict in advance whether a particular franchise owner will be successful. If an individual franchise owner is unable to successfully establish, manage and operate its business, the performance and quality of its service could be adversely affected, which could reduce its sales and negatively affect our royalty revenues and brand image. Although our franchise agreements prohibit “changes in control” of a franchisee without our prior consent as the franchisor, a franchise owner may desire to transfer a franchise. In addition, in any transfer situation, the transferee may not be able to successfully operate the business. In such a case, the performance and quality of service could be adversely affected, which could also reduce its sales and negatively affect our royalty revenues and brand image.

Franchisee insurance. Our franchise agreements require each franchisee to maintain certain insurance types and levels. Losses arising from certain extraordinary hazards, however, may not be covered, and insurance may not be available (or may be available only at prohibitively expensive rates) with respect to many other risks. Moreover, any loss incurred could exceed policy limits and policy payments made to franchisees may not be made on a timely basis. Any such loss or delay in payment could have a material adverse effect on a franchisee’s ability to satisfy its obligations under its franchise agreement or other contractual obligations, which could cause a franchisee to terminate its franchise agreement and, in turn, negatively affect our operating and financial results.

Some of our franchisees are operating entities. Franchisees may be natural persons or legal entities. Our franchisees that are operating companies with operations outside of running the franchised business are subject to business, credit, financial and other risks, which may be unrelated to the operation of their franchise businesses. These unrelated risks could materially and adversely affect a franchisee that is an operating company and its ability to service its customers and maintain its operations while making royalty payments, which in turn may materially and adversely affect our business and operating results.

Franchise agreement termination; nonrenewal. Each franchise agreement is subject to termination by us as the franchisor in the event of a default, generally after expiration of applicable cure periods, although under certain circumstances a franchise agreement may be terminated by us upon notice without an opportunity to cure. Our right to terminate franchise agreements may be subject to certain limitations under any applicable state relationship laws that may require specific notice or cure periods despite the provisions in the franchise agreement. The default provisions under our franchise agreements are drafted broadly and include, among other things, any failure to meet operating standards and actions that may threaten the licensed intellectual property. Moreover, a franchisee may have a right to terminate its franchise agreement in certain circumstances.

In addition, each franchise agreement has an expiration date. Upon the expiration of a franchise agreement, we or the franchisee may, or may not, elect to renew the franchise agreement. If the franchise agreement is renewed, the franchisee will receive a “successor” franchise agreement for an additional term. Such option, however, is contingent on the franchisee’s execution of our then-current form of franchise agreement (which may include increased royalty revenues, marketing fees and other fees and costs), the satisfaction of certain conditions and the payment of a renewal fee. If a franchisee is unable or unwilling to satisfy any of the foregoing conditions, the expiring franchise agreement will terminate upon expiration of its term. Our right to elect to not renew a franchise agreement may be subject to certain limitations under any applicable state relationship laws that may require specific notice periods or “good cause” for non-renewal despite the provisions in the franchise agreement.

Franchisee litigation; effects of regulatory efforts. We and our franchisees are subject to a variety of litigation risks, including, but not limited to, customer claims, personal injury claims, litigation with or involving our relationship with franchisees, litigation alleging that the franchisees are our employees or that we are the co-employer of our franchisees’ employees, employee allegations against the franchisee or us of improper termination and discrimination, landlord/tenant disputes and intellectual property claims, among others. Each of these claims may increase costs, reduce the execution of new franchise agreements and affect the scope and terms of insurance or indemnifications we and our franchisees may have. For example, in June 2020, a former franchisee filed an arbitration proceeding against us and six (6) of our franchisees in The Netherlands alleging, among other things, that our termination of the former franchisee’s franchise agreement constituted a breach of its franchise agreements causing damages in excess of $4.5 million. A legal action has been brought in the French courts against us by a purported competitor claiming damages of approximately $6.0 million for the loss of earnings, reputational damages and lost investment opportunities. While we believe the allegations made against us in both these proceedings are without any basis or merit, and have retained legal counsel to vigorously defend them, there can be no assurance regarding any resolution or the outcome of these proceedings. Judgments against us in the amounts sought by these parties would have a materially adverse effect on our business and financial condition.

In addition, we and our franchisees are subject to various regulatory enforcement actions regarding, among other things, franchise and employment laws, such as: failure to comply with franchise registration and disclosure requirements; the provision to prospective franchisees of business projections; efforts to categorize franchisors as the co-employers of their franchisees’ employees; legislation to categorize individual franchised businesses as large employers for the purposes of various employment benefits; and other legislation or regulations that may have a disproportionate impact on franchisors and/or franchised businesses. These changes may impose greater costs and regulatory burdens on franchising, and negatively affect our ability to sell new franchises.

| 7 |

Franchise agreements and franchisee relationships. Our franchisees develop and operate their business under terms set forth in our franchise agreements. These agreements give rise to long-term relationships that involve a complex set of mutual obligations and mutual cooperation. We have a standard set of franchise agreements that we typically use with our franchisees, but various franchisees have negotiated specific terms in these agreements. Furthermore, we may from time to time negotiate terms of our franchise agreements with individual franchisees. We seek to have positive relationships with our franchisees, based in part on our common understanding of our mutual rights and obligations under our agreements, to enable both the franchisees’ business and our business to be successful. However, we and our franchisees may not always maintain a positive relationship or always interpret our agreements in the same way. Our failure to have positive relationships with our franchisees could individually or in the aggregate cause us to change or limit our business practices, which may make our business model less attractive to our franchisees.

While our franchisee revenues are not concentrated among one or a small number of parties, the success of our business is significantly affected by our ability to maintain contractual relationships with profitable franchisees. A typical franchise agreement has a ten-year term. If we fail to maintain or renew our contractual relationships on acceptable terms, or if one or more significant franchisees were to become insolvent or otherwise were unwilling to pay amounts due to us, our business, reputation, financial condition and results of operations could be materially adversely affected.

Our business is subject to various laws and regulations, and changes in such laws and regulations, or failure to comply with existing or future laws and regulations, could adversely affect our business.

We are subject to the FTC Franchise Rule promulgated by the U.S. Federal Trade Commission (“FTC”) that regulates the offer and sale of franchises in the United States and that requires us to provide to all prospective franchisees certain mandatory disclosure in a Franchise Disclosure Document (“FDD”). In addition, we are subject to state franchise sales laws in 14 states that regulate the offer and sale of franchises by requiring us to make a franchise filing and, in some instances, obtain approval by the state franchise agency of that filing prior to our making any offer or sale of a franchise in those states and to provide a FDD to prospective franchisees in accordance with such laws. We are also subject to franchise laws in certain provinces in Canada, which, like the FTC Franchise Rule, require presale disclosure to prospective franchisees prior to the sale of a franchise. We must also comply with international laws, including franchise laws, in the countries where we have franchise operations or conduct franchise offer and sales activities. Failure to comply with such laws may result in a franchisee’s right to rescind its franchise agreement and to seek damages, and may result in investigations or actions from federal or state franchise authorities, civil fines or penalties, and stop orders, among other remedies. We are also subject to franchise relationship laws in many states that regulate many aspects of the franchisor-franchisee relationship, including renewals and terminations of franchise agreements, franchise transfers, the applicable law and venue in which franchise disputes must be resolved, discrimination and franchisees’ right to associate, among others. Our failure to comply with such franchise relationship laws could result in fines, damages, restitution and our inability to enforce franchise agreements where we have violated such laws. Our non-compliance with federal and state franchise laws could result in liability to franchisees and regulatory authorities (as described above), inability to enforce our franchise agreements, required rescission of franchise agreements and a reduction in our anticipated royalty revenue, which in turn may materially and adversely affect our business and results of operating.

We and our franchisees are also subject to the Fair Labor Standards Act of 1938, as amended, and various other laws in the United States and foreign countries governing such matters as minimum-wage requirements, overtime and other working conditions. A significant number of our and our franchisees’ employees are paid at rates related to the U.S. federal minimum wage, and past increases in the U.S. federal minimum wage have increased labor costs, as would future increases. Such increases in labor costs and other changes in labor laws could affect franchisee performance and quality of service, decrease royalty revenues and adversely affect our brand.

The markets for our services are competitive, and we may be unable to compete successfully.

The markets for our products and services are competitive, and we may be subject to increased competition in our markets in the future. We expect existing competitors and new entrants into the markets where we do business to constantly revise and improve their business models in light of challenges from us or other companies in the industry. If we cannot respond effectively to advances by our competitors, our business and financial performance may be adversely affected. Increased competition may result in new products and services that fundamentally change our markets, reduce franchise prices, reduce margins or decrease our market share. We may be unable to compete successfully against current or future competitors, some of whom may have significantly greater financial, technical, marketing, sales and other resources than we do.

| 8 |

We rely upon trademark, copyright and trade secret laws and contractual restrictions to protect our proprietary rights, and if these rights are not sufficiently protected, our ability to compete and generate revenues could be harmed.

We rely on a combination of trademark, copyright and trade secret laws, and contractual restrictions, such as confidentiality agreements and licenses, to establish and protect our proprietary rights. The steps taken by us to protect our proprietary information may not be adequate to prevent misappropriation of our intellectual property. Our proprietary rights may not be adequately protected because:

| ● | laws and contractual restrictions may not prevent misappropriation of our intellectual property or deter others from developing similar intellectual property; and | |

| ● | policing unauthorized use of our products and trademarks is difficult, expensive and time-consuming, and we may be unable to determine the extent of any unauthorized use. |

The laws of certain foreign countries may not protect the use of unregistered trademarks or other proprietary rights to the same extent as do the laws of the United States. As a result, international protection of our intellectual property rights may be limited and our right to use our trademarks and other proprietary rights outside the United States could be impaired. Other persons or entities may have rights to trademarks that contain portions of our marks or may have registered similar or competing marks for digital signage in foreign countries. There may also be other prior registrations of trademarks identical or similar to our trademarks in other foreign countries. Our inability to register our trademarks or other proprietary rights or purchase or license the right to use the relevant trademarks or other proprietary rights in these jurisdictions could limit our ability to penetrate new markets in jurisdictions outside the United States.

Litigation may be necessary to protect our trademarks and other intellectual property rights, to enforce these rights or to defend against claims by third parties alleging that we infringe, dilute or otherwise violate third-party trademark or other intellectual property rights. Any litigation or claims brought by or against us, whether with or without merit, or whether successful or not, could result in substantial costs and diversion of our resources, which could have a material adverse effect on our business, financial condition, results of operations or cash flows. Any intellectual property litigation or claims against us could result in the loss or compromise of our intellectual property rights, could subject us to significant liabilities, require us to seek licenses on unfavorable terms, if available at all or prevent us from manufacturing or selling certain products, any of which could have a material adverse effect on our business, financial condition, results of operations or cash flows.

We may face intellectual property infringement claims that could be time-consuming, costly to defend and result in its loss of significant rights.

Other parties may assert intellectual property infringement claims against us, and our products and services may infringe the intellectual property rights of third parties. We may also initiate claims against third parties to defend our intellectual property. Intellectual property litigation is expensive and time-consuming and could divert management’s attention from our core business. If there is a successful claim of infringement against us, we may be required to pay substantial damages to the party claiming infringement, develop non-infringing intellectual property or enter into royalty or license agreements that may not be available on acceptable terms, if at all. Our failure to develop non-infringing intellectual property or license the proprietary rights on a timely basis could harm our business. Also, we may be unaware of filed patent applications that relate to our products. Parties making infringement claims may be able to obtain an injunction, which could prevent us from operating portions of our business or use the allegedly infringing intellectual property. Any intellectual property litigation could adversely affect our business, financial condition or results of operations.

We depend on key executive management and other key personnel, and may not be able to retain or replace these individuals or recruit additional personnel, which could harm our business.

Our growth and success depend in large part on the managerial and leadership skills of our senior management team. All of our key employees are employed on an “at will” basis and we do not have key-man life insurance covering any of our employees. We may be unable to retain our management team and other key personnel and may be unable to find qualified replacements. The loss of the services of any of our executive management members or other key personnel could have a material adverse effect on our business and prospects, as we may not be able to find suitable individuals to replace such personnel on a timely basis or without incurring increased costs, or at all.

| 9 |

Management Discretion as to Use of Proceeds

While the Company’s management intends to use the net proceeds from this Offering for the general purposes described under “Use of Proceeds,” we reserve the right to use the funds obtained from this Offering for other purposes not presently contemplated which we deem to be in the best interests of the Company and its shareholders or in order to address changed circumstances or opportunities. Because of the foregoing, the success of the Company will be substantially dependent upon the discretion and judgment of the Company’s management with respect to application and allocation of the net proceeds of this Offering. Investors for the Shares offered hereby will be entrusting their funds to the Company’s management, upon whose judgment and discretion the investors must depend.

Inadequacy of Funds

We may be unable to realize the maximum gross offering proceeds of $20.0 million, and even if we do, it may be insufficient to allow for the implementation of the Company’s business plan. Assuming the minimum offering amount is reached ($1.5 million), all investor funds will be transferred from the escrow account to the Company immediately upon the Company’s request, and at regular intervals (e.g., weekly or monthly) thereafter. If more than the minimum but less than the maximum number of Shares offered in this Offering are sold, or if certain assumptions contained in management’s business plans prove to be incorrect, the Company may have inadequate funds to develop and expand its business as intended. The Company’s ability to meet its financial obligations, cash needs, and to achieve its objectives, will be adversely affected if the maximum number of Shares offered hereby are not sold.

We do not have an independent board of directors which could create a conflict of interests and pose a risk from a corporate governance perspective.

Our Board of Directors consists entirely of our current executive officers, which means that we do not have any outside or independent directors. The lack of independent directors:

| ● | May prevent the Board from being independent from management in its judgments and decisions and its ability to pursue the Board responsibilities without undue influence. |

| ● | May present us from providing a check on management, which can limit management taking unnecessary risks. |

| ● | Create potential for conflicts between management and the diligent independent decision-making process of the Board. |

| ● | Present the risk that our executive officers on the Board may have influence over their personal compensation and benefits levels that may not be commensurate with our financial performance. |

| ● | Deprive us of the benefits of various viewpoints and experience when confronting challenges that we face. |

Because officers serve on our Board of Directors, it will be difficult for the Board to fulfill its traditional role as overseeing management.

Because we do not have a nominating or compensation committee, shareholders will have to rely on the entire board of directors, no members of which are independent, to perform these functions.

We do not have a nominating or compensation committee, or any such committee comprised of independent directors. The board of directors performs these functions. No members of the board of directors are independent directors. Thus, there is a potential conflict in that board members who are also part of management will participate in discussions concerning management compensation and audit issues that may affect management decisions.

The Company Has Engaged In Certain Transactions With Related Persons.

Please see the section of this Offering Circular entitled “Interest of Management and Others in Certain Transactions.”

Computer, Website or Information System Breakdown Could Affect the Company’s Business

Computer, website and/or information system breakdowns as well as cyber security attacks could impair the Company’s ability to service its franchisees and customers leading to reduced revenue from sales and/or reputational damage, which could have a material adverse effect on the Company’s consolidated financial results as well as your investment.

Limitation on Director Liability

The Company may provide for the indemnification of its directors to the fullest extent permitted by law and, to the extent permitted by such law, eliminate or limit the personal liability of directors to the Company and its shareholders for monetary damages for certain breaches of fiduciary duty. Such indemnification may be available for liabilities arising in connection with this Offering. Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers or persons controlling the Company pursuant to the foregoing provisions, the Company has been informed that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act and is therefore unenforceable.

The Company Is Not Subject To Sarbanes-Oxley Regulations And Lack The Financial Controls And Safeguards Required Of Public Companies.

The Company does not have the internal infrastructure necessary, and is not required, to complete an attestation about our financial controls that would be required under Section 404 of the Sarbanes - Oxley Act of 2002. There can be no assurances that there are no significant deficiencies or material weaknesses in the quality of our financial controls. The Company expects to incur additional expenses and diversion of management’s time if and when it becomes necessary to perform the system and process evaluation, testing and remediation required in order to comply with the management certification and auditor attestation requirements.

Risks Related to Our Common Shares and the Offering

The Company May Undertake Additional Equity or Debt Financing That May Dilute the Shares in This Offering

The Company may undertake further equity or debt financing which may be dilutive to existing shareholders, including you, or result in an issuance of securities whose rights, preferences and privileges are senior to those of existing shareholders, including you, and also reducing the value of Shares subscribed for under this Offering.

| 10 |

An Investment in the Shares Is Speculative and There Can Be No Assurance of Any Return on Any Such Investment

An investment in the Company’s Shares is speculative and there is no assurance that investors will obtain any return on their investment. Investors will be subject to substantial risks involved in an investment in the Company, including the risk of losing their entire investment.

The concentration of our capital stock ownership with insiders will likely limit your ability to influence corporate matters.

Prior to commencement of the Offering, our executive officers and directors beneficially own all of our outstanding common stock. Even assuming that the maximum number of Shares are sold in this Offering, our directors and executive officers will continue to own in excess of 71% of the Company’s voting securities. As a result, these persons have the ability to exercise control over most matters that require approval by our stockholders, including the election of directors and approval of significant corporate transactions. Corporate action might be taken even if other stockholders oppose them. This concentration of ownership might also have the effect of delaying or preventing a change in control of our company that other stockholders may view as beneficial.

Failure to Satisfy the Minimum Offering Amount

We must raise gross proceeds of at least $1.5 million in this Offering in order for the Company to access any of the subscription funds. The Company cannot assure you that subscriptions to meet the minimum offering amount will be obtained. The Company has the right to terminate this Offering at any time, regardless of the number of Shares that have sold.

We currently have no plans to pay cash dividends for the foreseeable future.

We plan to retain earnings to finance future growth and have no current plans to pay cash dividends to shareholders. Any indebtedness that we incur in the future may also limit our ability to pay dividends. Because we may not pay cash dividends for the foreseeable future, holders of our securities will experience a gain on their investment in our Shares only in the case of an appreciation of value of our securities, which may or may not be readily realizable if our Shares are not readily marketable. You should neither expect to receive dividend income from investing in our Shares nor an appreciation in value.

This is not a Firm Underwritten Offering.

The Shares are being offered on a “best efforts” basis by the management of the Company. Accordingly, there is no assurance that we will sell the maximum number of Shares offered in the Offering, or any lesser amount.

If The Maximum Offering Is Not Raised, It May Increase the Amount of Long-Term Debt or the Amount of Additional Equity It Needs To Raise

There is no assurance that the maximum number of Shares in this Offering will be sold. If the maximum Offering amount is not sold, we may need to incur additional debt or raise additional equity in order to finance our operations. Increasing the amount of debt will increase our debt service obligations and make less cash available for distribution to our shareholders. Increasing the amount of additional equity that we will have to seek in the future will further dilute those investors participating in this Offering.

Investor Funds Will Not Accrue Interest While In Escrow Prior To Closing

All funds delivered in connection with subscriptions for the securities will be held in a non-interest-bearing escrow account until a closing of the Offering, if any. If we fail to hold a closing prior to [●] (which date may be extended at our option) (the “Termination Date”), investor subscriptions will be returned without interest or deduction. Investors in the securities offered hereby may not have the use of such funds or receive interest thereon pending the completion of the Offering.

There is No Public Trading Market for the Company’s Shares

At present, there is no active trading market for the Company’s securities and the Company cannot assure you that a trading market will ever develop for the Shares being offered hereby. If the Company’s securities ever publicly trade, they may be relegated to an OTC market that provides significantly less liquidity than the NASDAQ markets or stock exchanges. Prices for securities traded solely on the OTC market may be difficult to obtain and holders of the Shares may be unable to resell their securities at or near their original price or at any price. In any event, except to the extent that investors’ Shares may be registered on a Form S-1 Registration Statement with the Securities and Exchange Commission in the future, there is absolutely no assurance that Shares could be sold under Rule 144 or otherwise until the Company becomes a current public reporting company with the Securities and Exchange Commission and otherwise is current in the Company’s business, financial and management information reporting, and applicable holding periods have been satisfied.

| 11 |

Any market that develops in our Shares will be subject to the “penny stock” regulations and restrictions pertaining to low priced stocks that would create a lack of liquidity and make trading difficult or impossible.

If the Shares do become eligible for trading, they may be traded in the over-the-counter market, which is commonly referred to as the OTC Pink as maintained by FINRA. As a result, an investor may find it difficult to dispose of, or to obtain accurate quotations as to the price of our securities.

Rule 3a51-1 of the Exchange Act establishes the definition of a “penny stock,” for purposes relevant to us, as any equity security that has a minimum bid price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to a limited number of exceptions that are not available to us. While we are offering the Shares in this Offering at an offering price greater than $5.00, it is possible that our Shares will be considered a penny stock. This classification severely and adversely affects any market liquidity for our Shares.

For any transaction involving a penny stock, unless exempt, the penny stock rules require that a broker or dealer approve a person’s account for transactions in penny stocks and the broker or dealer receive from the investor a written agreement to the transaction setting forth the identity and quantity of the penny stock to be purchased. In order to approve a person’s account for transactions in penny stocks, the broker or dealer must obtain financial information and investment experience and objectives of the person and make a reasonable determination that the transactions in penny stocks are suitable for that person and that that person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks.

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prepared by the SEC relating to the penny stock market, which, in highlight form, sets forth the basis on which the broker or dealer made the suitability determination and that the broker or dealer received a signed, written agreement from the investor prior to the transaction. Disclosure also must be made about the risks of investing in penny stocks in public offerings and in secondary trading and commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Additionally, monthly statements must be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

Because of these regulations, broker-dealers may not wish to engage in the above-referenced necessary paperwork and disclosures and/or may encounter difficulties in their attempt to sell the Shares being offered in this Offering Circular, which may affect your ability to sell our Shares in any secondary market and have the effect of reducing the level of trading activity in any secondary market, with a corresponding decrease in the price of our Shares.

Should Our Securities Become Quoted On a Public Market, Sales of a Substantial Number of Shares of Our Stock May Cause the Price of Our Stock to Decline

Should a market develop and our shareholders sell substantial amounts of our Shares in the public market, shares sold may cause the price to decrease below the current offering price. These sales may also make it more difficult for us to sell equity or equity-related securities at a time and price that we deem reasonable or appropriate.

The Offering Price for the Shares Offered Has Been Determined By the Company

The price at which the Shares are being offered has been arbitrarily determined by the Company. There is no relationship between the offering price and our assets, book value, net worth, or any other economic or recognized criteria of value. Rather, the price of the Shares was derived as a result of internal decisions based upon various factors including prevailing market conditions, our future prospects and our capital structure. These prices do not necessarily accurately reflect the actual value of the Shares or the price that may be realized upon disposition of the Shares.

You Should Be Aware Of the Long-Term Nature of This Investment

There is not now, and likely will not be, a public market, for the Shares. Because the Shares have not been registered under the Securities Act or under the securities laws of any state or non-United States jurisdiction, the Shares may have certain transfer restrictions. It is not currently contemplated that registration under the Securities Act or other securities laws will be affected. Limitations on the transfer of the Shares may also adversely affect the price that you might be able to obtain for the Shares in a private sale. You should be aware of the long-term nature of your investment in the Company.

The Shares In This Offering Have No Protective Provisions.

The Shares in this Offering have no protective provisions. As such, you will not be afforded protection, by any provision of the Shares or as a Shareholder in the event of a transaction that may adversely affect you, including a reorganization, restructuring, merger or other similar transaction involving the Company. If there is a “liquidation event” or “change of control” the Shares being offered do not provide you with any protection. In addition, there are no provisions attached to the Shares in the Offering that would permit you to require the Company to repurchase the Shares in the event of a takeover, recapitalization or similar transaction.

Compliance with the Sarbanes-Oxley Act of 2002 will require substantial financial and management resources.

Section 404 of the Sarbanes-Oxley Act of 2002 requires certain SEC-reporting companies to evaluate and report on its system of internal controls and, if and when we are no longer a “smaller reporting company,” will require that we have such a system of internal controls audited. If we fail to maintain the adequacy of our internal controls, we could be subject to regulatory scrutiny, civil or criminal penalties and/or stockholder litigation. Any inability to provide reliable financial reports could harm our business. Furthermore, any failure to implement required new or improved controls, or difficulties encountered in the implementation of adequate controls over our financial processes and reporting in the future, could harm our operating results or cause us to fail to meet our reporting obligations. Inferior internal controls could also cause investors to lose confidence in our reported financial information, which could have a negative effect on the trading price of our securities.

Because we are a Canadian company, it may be difficult to serve legal process or enforce judgments against us.

We are incorporated and have our corporate headquarters in Canada. In addition, all of our officers and directors reside outside of the United States. Accordingly, service of process upon us may be difficult to obtain within the United States. Furthermore, because substantially all of our assets are located outside the United States, any judgment obtained in the United States against us, including one predicated on the civil liability provisions of the U.S. federal securities laws, may not be collectible within the United States. Therefore, it may not be possible to enforce those actions against us.

| 12 |

In addition, it may be difficult to assert U.S. securities law claims in original actions instituted in Canada. Canadian courts may refuse to hear a claim based on an alleged violation of U.S. securities laws against us or these persons on the grounds that Canada is not the most appropriate forum in which to bring such a claim. Even if a Canadian court agrees to hear a claim, it may determine that Canadian law and not U.S. law is applicable to the claim. If U.S. law is found to be applicable, the content of applicable U.S. law must be proved as a fact, which can be a time-consuming and costly process. Certain matters of procedure will also be governed by Canadian law. Furthermore, it may not be possible to subject foreign persons or entities to the jurisdiction of the courts in Canada. Similarly, to the extent that our assets are located in Canada, investors may have difficulty collecting from us any judgments obtained in the U.S. courts and predicated on the civil liability provisions of U.S. securities provisions.

We are governed by the corporate laws of Québec, which in some cases have a different effect on shareholders than the corporate laws of Delaware.