Form 8-K Delek US Holdings, Inc. For: Nov 27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 27, 2017

DELEK US HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

Delaware | 001-38142 | 35-2581557 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

7102 Commerce Way Brentwood, Tennessee | 37027 |

(Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (615) 771-6701

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

x Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 8.01 Other Events.

Effective November 27, 2017, senior management of Delek US Holdings, Inc. (the “Company”) will begin using the materials included in Exhibit 99.1 to this report (the “Investor Presentation”) in connection with presentations to existing and prospective investors. The Investor Presentation is incorporated into this Item 8.01 by this reference and will also be available on the Company's website at www.delekus.com.

Important Information:

The Company’s and Alon USA Partners, LP’s (“ALDW”) security holders are urged to read the consent statement/prospectus regarding the proposed transaction when it becomes available because it will contain important information. Investors will be able to obtain a free copy of the consent statement/prospectus, as well as other filings containing information about the proposed transaction, without charge, at the SEC’s internet site (http://www.sec.gov). Copies of the consent statement/prospectus and the filings with the SEC that will be incorporated by reference in the consent statement/prospectus can also be obtained, without charge, by directing a request either to Delek US Holdings, Inc., 7102 Commerce Way, Brentwood, Tennessee, 37027, Attention: Investor Relations or to Alon USA Partners, LP, 12700 Park Central Drive, Suite 1600, Dallas, Texas 75251, Attention: Investor Relations.

The respective directors and executive officers of Alon USA Partners GP, LLC (the “General Partner”) and the Company may be deemed to be “participants” (as defined in Schedule 14A under the Securities and Exchange Act of 1934, as amended (the “Exchange Act”)) in respect of the proposed transaction. Information about the General Partner’s directors and executive officers is available in ALDW’s annual report on Form 10-K for the fiscal year ended December 31, 2016 filed with the SEC on February 27, 2017, and subsequent filings with the SEC. Information about the Company s directors and executive officers is available in Old Delek’s (as defined below) annual report on Form 10-K for the fiscal year ended December 31, 2016, filed with the SEC on February 28, 2017, and in its proxy statement for its 2017 annual meeting of stockholders, filed with the SEC on April 6, 2017, and in Old Delek’s and the Company’s subsequent filings with the SEC. Other information regarding the participants in the solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the consent statement/prospectus and other relevant materials to be filed with the SEC when they become available.

On January 2, 2017, Delek US Energy, Inc. (formerly known as Delek US Holdings, Inc.), Delaware corporation (“Old Delek”), entered into an Agreement and Plan of Merger with Alon USA Energy, Inc., a Delaware corporation (“Alon USA”), the Company (formerly known as Delek Holdco, Inc.), a Delaware corporation (also referred to as “New Delek” herein), Dione Mergeco, Inc., a Delaware corporation and wholly owned subsidiary of the Registrant (“Delek Merger Sub”), and Astro Mergeco, Inc., a Delaware corporation and wholly owned subsidiary of the Registrant (“Astro Merger Sub”), as amended by the First Amendment to Agreement and Plan of Merger, dated as of February 27, 2017, and the Second Amendment to Agreement and Plan of Merger, dated as of April 21, 2017 (collectively, the “Delek-Alon Merger Agreement”). Pursuant to the Delek-Alon Merger Agreement, Certificates of Amendment and Certificates of Merger filed with the Secretary of State of the State of Delaware on June 30, 2017, (i) Old Delek was renamed “Delek US Energy, Inc.” and the Company was renamed “Delek US Holdings, Inc.”; (ii) Delek Merger Sub merged with and into Old Delek (the “Delek Merger”), with Old Delek surviving as a wholly owned subsidiary of the Registrant; and (iii) Astro Merger Sub merged with and into Alon USA (the “Alon Merger” and together with the Delek Merger, the “Delek-Alon Mergers”), with Alon USA surviving as a direct and indirect wholly owned subsidiary of the Registrant. The Delek-Alon Mergers were effective as of July 1, 2017 (the “Delek-Alon Effective Time”). By reason of the Delek-Alon Mergers, at the Delek-Alon Effective Time, New Delek became the parent public reporting company. On July 3, 2017, New Delek filed a Current Report on Form 8-K filed for the purpose of establishing the Company as the successor issuer to Old Delek and Alon USA pursuant to Rule 12g-3(c) under the Exchange Act. In addition, as a result of the Delek-Alon Mergers, the shares of common stock of Old Delek and Alon USA were delisted from the New York Stock Exchange in July 2017, and their respective reporting obligations under the Exchange Act were terminated.

This document shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended (the “Securities Act”).

Item 9.01 Financial Statements and Exhibits.

(a) | Financial statements of businesses acquired. |

Not applicable.

(b) | Pro forma financial information. |

Not applicable.

(c) | Shell company transactions. |

Not applicable.

(d) | Exhibits. |

99.1Investor presentation materials to be used beginning November 27, 2017.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: November 27, 2017 | DELEK US HOLDINGS, INC. |

/s/ Kevin Kremke | |

Name: Kevin Kremke | |

Title: Executive Vice President / Chief Financial Officer | |

November 2017

Delek US Holdings, Inc.

Investor Presentation

Disclaimers

2

Forward Looking Statements:

Delek US Holdings, Inc. (“Delek US”) and Delek Logistics Partners, LP (“Delek Logistics”; collectively with Delek US, defined as “we”, “our”) and Alon USA Partners, LP (“Alon

Partners”) are traded on the New York Stock Exchange in the United States under the symbols “DK”, ”DKL” and “ALDW” respectively, and, as such, are governed by the rules and

regulations of the United States Securities and Exchange Commission. These slides and any accompanying oral and written presentations contain forward-looking statements that

are based upon current expectations and involve a number of risks and uncertainties. Statements concerning current estimates, expectations and projections about future results,

performance, prospects, opportunities, plans, actions and events and other statements, concerns, or matters that are not historical facts are “forward-looking statements,” as that

term is defined under the federal securities laws. These forward-looking statements include, but are not limited to, statements regarding crude oil markets, production, quality,

pricing, imports, exports, cuts and growth; differentials including increases, trends and the impact of thereof on crack spreads; the post-merger integration and transition plan with

Alon USA Energy Inc. (“ALJ”), including the timing, closing and success thereof; improvements in global markets; pipeline utilization, expansions and rates; Permian Basin

production, activity, facilities, rig counts and takeaway capacity and any benefits therefrom to our Logistics assets or wholesale business; refinery complexity, configurations,

utilization, crude oil slate flexibility, capacities, equipment limits, margins, bottlenecks and capital investments; advantages of U.S. refineries to global peers including world

distillation capacity and transportation and energy advantages; crack spread cycles and trends; the potential transaction with Alon Partners including the costs, exchange ratio,

benefits and synergies thereof and our ability to complete the transaction timely or at all; future crude oil supply at the Company's refineries including link to WTI, differentials,

cash flow, EBITDA; our ability to complete the Alkylation project at Krotz Springs successfully or at all and the benefits, flexibility, returns and EBITDA therefrom; our ability to

identify and complete California initiatives successfully or at all and costs, cash flow and benefits thereof; capacity increases on our Paline pipeline and impacts or benefits thereof;

distribution growth at DKL; coverage and leverage; future investments in, projects at and growth of our retail, logistics and refining assets and the value and impact thereof;

financial strength and flexibility; integration of assets and operations; light product pricing including the relationship of such pricing to the Gulf Coast; future initiatives, valuations,

balance sheet, cash, dropdown inventory, cash flow and self help projects including the profitability thereof; cost of capital and capital allocation and value creation relating

thereto; our ability to create sustainable value; synergies and efficiencies relating to the ALJ acquisition; future ability to return value to shareholders, future dropdowns and the

success thereof; continued safe and reliable operations; opportunities, anticipated future performance and financial position, and other factors. Investors are cautioned that the

following important factors, among others, may affect these forward-looking statements. These factors include, but are not limited to: risks and uncertainties related to the ability

to successfully integrate the businesses of Delek US and ALJ; the risk that the combined company may be unable to achieve cost-cutting synergies, or it may take longer than

expected to achieve those synergies; uncertainty related to timing and amount of value returned to shareholders; risks and uncertainties with respect to the quantities and costs

of crude oil we are able to obtain and the price of the refined petroleum products we ultimately sell; gains and losses from derivative instruments; management's ability to

execute its strategy of growth through acquisitions and the transactional risks associated with acquisitions and dispositions; acquired assets may suffer a diminishment in fair value

as a result of which we may need to record a write-down or impairment in carrying value of the asset; changes in the scope, costs, and/or timing of capital and maintenance

projects; operating hazards inherent in transporting, storing and processing crude oil and intermediate and finished petroleum products; our competitive position and the effects

of competition; the projected growth of the industries in which we operate; general economic and business conditions affecting the geographic areas in which we operate; and

other risks contained in Delek US’, Delek Logistics’ and Alon Partners’ filings with the United States Securities and Exchange Commission. Forward-looking statements should not

be read as a guarantee of future performance or results, and will not be accurate indications of the times at, or by which such performance or results will be achieved. Forward-

looking information is based on information available at the time and/or management’s good faith belief with respect to future events, and is subject to risks and uncertainties

that could cause actual performance or results to differ materially from those expressed in the statements. Neither Delek US, Delek Logistics Partners nor Alon Partners undertakes

any obligation to update or revise any such forward-looking statements.

Non-GAAP Disclosures:

Delek US and Delek Logistics believe that the presentation of EBITDA, distributable cash flow and distribution coverage ratio provides useful information to investors in assessing

their financial condition, results of operations and cash flow their business is generating. EBITDA, distributable cash flow and distribution coverage ratio should not be considered

as alternatives to net income, operating income, cash from operations or any other measure of financial performance or liquidity presented in accordance with U.S. GAAP. EBITDA,

distributable cash flow and distribution coverage ratio have important limitations as analytical tools because they exclude some, but not all, items that affect net income.

Additionally, because EBITDA, distributable cash flow and distribution coverage ratio may be defined differently by other companies in its industry, Delek US' and Delek Logistics’

definitions may not be comparable to similarly titled measures of other companies, thereby diminishing their utility. Please see reconciliations of EBITDA and distributable cash

flow to their most directly comparable financial measures calculated and presented in accordance with U.S. GAAP in the appendix.

Current Refining Market Environment

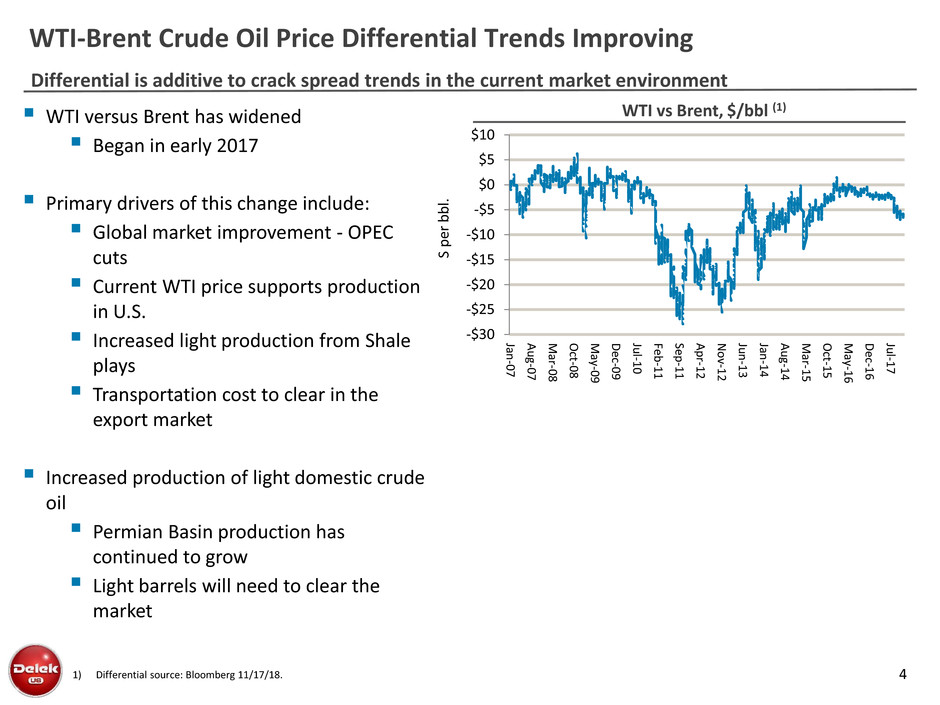

Differential is additive to crack spread trends in the current market environment

WTI-Brent Crude Oil Price Differential Trends Improving

4 1) Differential source: Bloomberg 11/17/18.

-$30

-$25

-$20

-$15

-$10

-$5

$0

$5

$10

Jan

-0

7

A

u

g-0

7

M

ar-0

8

Oct

-0

8

M

ay-0

9

D

e

c-0

9

Ju

l-1

0

Fe

b

-1

1

Se

p

-1

1

A

p

r-1

2

N

o

v-1

2

Ju

n

-1

3

Jan

-1

4

A

u

g-1

4

M

ar-1

5

Oct

-1

5

M

ay-1

6

D

e

c-1

6

Ju

l-1

7

S

p

er

b

b

l.

WTI vs Brent, $/bbl (1) WTI versus Brent has widened

Began in early 2017

Primary drivers of this change include:

Global market improvement - OPEC

cuts

Current WTI price supports production

in U.S.

Increased light production from Shale

plays

Transportation cost to clear in the

export market

Increased production of light domestic crude

oil

Permian Basin production has

continued to grow

Light barrels will need to clear the

market

WTI versus Mars and Maya differentials favor light crude oil refineries

Light-Heavy Crude Oil Price Differential Trends Improving

5 1) Differential source: Argus – November 20, 2017; NYMEX futures prices.

-$6.00

-$4.00

-$2.00

$0.00

$2.00

$4.00

$6.00

Jan

-1

5

M

ar-1

5

M

ay-1

5

Ju

l-1

5

Se

p

-1

5

N

o

v-1

5

Jan

-1

6

M

ar-1

6

M

ay-1

6

Ju

l-1

6

Se

p

-1

6

N

o

v-1

6

Jan

-1

7

M

ar-1

7

M

ay-1

7

Ju

l-1

7

Se

p

-1

7

N

o

v-1

7

S

p

er

b

b

l.

WTI vs Mars, $/bbl (1)

-$2.00

$0.00

$2.00

$4.00

$6.00

$8.00

$10.00

Jan

-1

5

M

ar-1

5

M

ay-1

5

Ju

l-1

5

Se

p

-1

5

N

o

v-1

5

Jan

-1

6

M

ar-1

6

M

ay-1

6

Ju

l-1

6

Se

p

-1

6

N

o

v-1

6

Jan

-1

7

M

ar-1

7

M

ay-1

7

Ju

l-1

7

Se

p

-1

7

N

o

v-1

7

S

p

er

b

b

l.

WTI vs Maya, $/bbl (1) Light – Heavy crude oil differential has narrowed

during 2017

OPEC cuts have primarily been medium

sour barrels

Heavy sour production declines in Mexico

and Venezuela

Majority of barrels from the U.S. shale

production are light sweet

This change in differentials affects the Gulf Coast

refining complex economics

Most US Gulf Coast refineries are

configured to run medium/heavy

Significant impact on effective refinery

capacity as light crude oil is increased

Capital investment can be significant to

overcome bottlenecks

Crack Spread Cycle Turning Up

Crack spread at highest since 2015 and expected to continue upward trend

6

-$30

-$20

-$10

$0

$10

$20

$30

$40

$50

1

0

-J

a

n

-1

0

1

0

-Ma

r-

1

0

1

0

-Ma

y

-1

0

1

0

-J

u

l-

1

0

1

0

-S

e

p

-1

0

1

0

-N

o

v

-1

0

1

0

-J

a

n

-1

1

1

0

-Ma

r-

1

1

1

0

-Ma

y

-1

1

1

0

-J

u

l-

1

1

1

0

-S

e

p

-1

1

1

0

-N

o

v

-1

1

1

0

-J

a

n

-1

2

1

0

-Ma

r-

1

2

1

-Ma

y

-1

2

1

-J

u

l-

1

2

1

-S

e

p

-1

2

1

-N

o

v

-1

2

2

-J

a

n

-1

3

2

-Ma

r-

1

3

2

-Ma

y

-1

3

2

-J

u

l-

1

3

2

-S

e

p

-1

3

2

-N

o

v

-1

3

2

-J

a

n

-1

4

2

-Ma

r-

1

4

2

-Ma

y

-1

4

2

-J

u

l-

1

4

2

-S

e

p

-1

4

2

-N

o

v

-1

4

2

-J

a

n

-1

5

2

-Ma

r-

1

5

2

-Ma

y

-1

5

2

-J

u

l-

1

5

2

-S

e

p

-1

5

2

-N

o

v

-1

5

2

-J

a

n

-1

6

2

-Ma

r-

1

6

2

-Ma

y

-1

6

2

-J

u

l-

1

6

2

-S

e

p

-1

6

2

-N

o

v

-1

6

2

-J

a

n

-1

7

2

-Ma

r-

1

7

2

-Ma

y

-1

7

2

-J

u

l-

1

7

2

-S

e

p

-1

7

2

-N

o

v

-1

7

2

-J

a

n

-1

8

2

-Ma

r-

1

8

2

-Ma

y

-1

8

Q

3

2

0

1

8

2

0

1

9

Brent-WTI Cushing Spread Per Barrel WTI 5-3-2 Gulf Coast Crack Spread Per Barrel

(1) Source: Platts as of November 20, 2017; 5-3-2 crack spread based on HSD. Mitsui Forward Curve as of November 13, 2017

(2) Crack Spreads: (+/-) Contango/Backwardation

2010

Avg:

$9.08

2011

Avg:

$23.78

2012

Avg:

$26.91

2013

Avg:

$18.08

2014

Avg:

$12.60

2015

Avg:

$15.67

2016

Avg:

$10.36

2017

Avg:

$14.04

2018F

Avg:

$17.66

2010 Brent-

WTI Diff:

$(0.67)

2011 Brent-

WTI Diff:

$(15.81)

2012 Brent-

WTI Diff:

$(17.57)

2013 Brent-

WTI Diff:

$(10.77)

2014 Brent-

WTI Diff:

$(6.48)

2015 Brent-

WTI Diff:

$(4.86)

2016 Brent-

WTI Diff:

$(1.71)

2017 Brent-

WTI Diff:

$(4.01)

2018F Brent-

WTI Diff:

$(5.58)

Investment Highlights

(1) Based on price per common share as of close of trading on November 20, 2017.

(2) Currently 5.4% of the ownership interest in the general partner is owned by three members of senior management of Delek US (who are also directors of the general partner). The

remaining ownership interest is held by a subsidiary of Delek US.

(3) Please see page 33 for reconciliation of GAAP to non GAAP amounts 7

•Current Price: $29.99/share (1)

•Market Capitalization: $2.5 billion (1)

•NYSE: DKL: (Market cap $694 mm) Own 63.5%, including 2% GP(2)

•NYSE: ALDW (Market cap $932 mm) Own 81.6% of LP units and 100%

of GP. DK has a definitive agreement to acquire remaining LP units,

subject to customary closing conditions

Overview (NYSE: DK)

•Net income of $1.29 per share

• Adjusted net income of $0.81 per share

• Adjusted EBITDA of $195.9 million

Strong Third Quarter 2017

Performance (3)

•Closed on July 1, 2017

•Purchased the remaining 53% ownership that DK did not already own

in an all stock transaction; exchange ratio 0.5040 share of DK for each

share for ALJ

•Reached definitive agreement to purchase remaining ALDW units on

November 8, 2017

Alon Acquisition

Opportunities to Unlock Value

•September 30, 2017 balance sheet:

•Delek US: $831.7 million of cash; $1,427.8 million of debt

•Includes $5.3 million cash and $401.3 million debt of DKL

Flexible Financial Position to

Support Growth

Integrated Company with Asset Diversity and Scale

Strategically Located Assets with Permian Basin Exposure

8

Retail

• Approximately 300

stores

• Southwest US locations

• Largest licensee of 7-

Eleven stores in the US

• West Texas wholesale

marketing business

Asphalt

• 14 asphalt terminals

located in TN, OK, TX,

WA, CA, AZ and NV

• Largest asphalt supplier

in CA and second

largest asphalt supplier

in TX

Refining (1)

• 7th largest independent

refiner

• 302,000 bpd in total

• El Dorado, AR

• Tyler, TX

• Big Spring, TX

• Krotz Springs, LA

• Own 81.6% of LP/100%

of GP of ALDW, which

owns Big Spring

Logistics

• 9 terminals

• Approximately 1,290

miles of pipeline

• 8.5 million bbls of

storage capacity

• West Texas wholesale

• Joint venture crude oil

pipelines: RIO / Caddo

• Own 63.5%, incl. 2% GP,

of DKL

1) California refineries have not operated since 2012.

Renewables

Approx. 61m gallons

Biodiesel:

• Crossett, AR

• Cleburne, TX

Renewable Diesel/Jet:

• California

Transaction completed on July 1; Initiatives underway across the asset base

Acquisition of Alon Provides Opportunities to Unlock Value

9

Simplify Corporate Structure:

• ALDW Transaction –Announced agreement to purchase

remaining 18.4% of ALDW LP units that Delek US does not

own, subject to customary closing conditions.

Synergy Capture:

• Target - $85 million to $105 million annual synergies by

2018

• Captured - $53 million on annualized basis through

September 2017

Improve Operations:

• Krotz Springs Refinery – Reduce cost and add flexibility

• California Assets – Derive Value from asset base; reduce

cost

Unlock Logistics Value:

• Potential Growth for DKL - $78 million of EBITDA for

potential future dropdowns

• Dropdowns provides cash flow back to Delek US

Should simplify corporate structure of Delek US

Acquisition of the remaining Alon USA Partners LP Units

10

1) Please see page 31 for additional information related to this transaction.

• On November 8, 2017, Delek announced definitive agreement to acquire remaining limited

partner units of Alon USA Partners (ALDW)

• Delek US currently owns 81.6% of the outstanding common units

• All stock for unit transaction for remaining 18.4% of the outstanding common units

• Exchange ratio of 0.49 shares of Delek US for each ALDW common unit not already owned

by Delek US

• Expected benefits

• Simplified corporate structure

• Ability to reallocate cash flow from distributions to investment

• Enables ability to more efficiently drop down logistic assets to DKL in the future

• Ability to use the balance sheet strength of Delek US to refinance high cost debt at ALDW

• Reduces number of public companies to 2 (DK and DKL) lowering public company costs

• Timing/Approvals

• Transaction expected to close in the first quarter 2018

• Subject to customary closing conditions

• Delek US owns and has committed to vote a sufficient number of ALDW common units to

approve the merger

Robust Synergy Opportunity from DK/ALJ Combination

11

Expect to achieve run-rate synergies of approximately $85 - $105 million in 2018;

$53.0 million of annualized synergies captured as of Sept. 30, 2017

Type Description Estimate

Commercial

• Logistics, purchase and

trading benefits from a

larger platform

• $20-$35 m

Operational

• Sharing of resources

across the platform;

improved insurance and

procurement

efficiencies

• $13-$15 m

Cost of

Capital

• Benefit from Delek US’

financial position to

reduce interest expense

through refinancing

efforts

• $19-$20 m

Corporate

• Reducing the number of

public companies;

consolidating functions

to improve efficiencies

• $33-$35 m

Corporate

Cost of

Capital

Operational

Commercial

Target

$85-$105

($ in millions)

On track to capture targeted synergies from transaction

To Date 9/30/17

$53.0

Areas of focus to add flexibility and increase margin potential from refinery

Krotz Springs Improvement Initiatives

12

Improve Units to Add Product Flexibility

• Alkylation Project – under construction - provides

ability to upgrade low value production into higher

value gasoline

Crude – Transportation and Flexibility

• Transportation – focus on reducing the cost of crude

oil delivered into Krotz Springs

• Flexibility – Working with DKL to explore ways to

increase ability to access lower cost crude oil

• Create ability to adjust crude slate between

LLS and Midland based on market conditions

and refinery runs

Product Netback Improvement

• Build out wholesale business along the Colonial

Pipeline system

Expected annual EBITDA $35-$40 million; Target completion in 1Q19

Krotz Springs Alkylation Project

13

• Alkylation unit with 6,000 bpd capacity

• Approx. $103.0 estimated capital costs with

$20.0 million spent as of Sept. 30, 2017

• Improves refinery flexibility

• Converts lower priced iso-butane into higher

value alkylate

• Enables multiple summer grades of gasoline to

be produced

• Increases octane to produce premium gasoline

• Ability to access local markets

• Estimated project returns

• Estimated annual EBITDA (1) $35-$40 million

• Driven by the conversion/Reduces

dependency on crack spread environment for

project return

• Economics based on 67 cents/gallon spread

between CBOB 7.8 and iso-butane

• Sensitivity: each 10 cents/gallon change equals

$3.2 million EBITDA change

0.69

0.97

1.23 1.21

0.90

0.61

0.65

0.00

0.20

0.40

0.60

0.80

1.00

1.20

1.40

Sp

re

ad

, CP

G

Gulf Coast CBOB 7.8 – Isobutane Spread

38.4 44.0

22.2

22.2

8.0

8.0

11.1 8.7

Base Alky

Change in Yields, in 000 bpd

Gasoline Diesel/Jet Heavy Oils Other

1) Please see page 34 for a reconciliation of forecasted EBITDA to forecasted net income.

Assets are non core to Delek US geographic footprint; Exploring ways to derive value and reduce costs

California Initiatives

14

• Assets primarily consist of three locations – Paramount, Long Beach and Bakersfield

• Refining assets have been idled since 2012

• Alt Air renewable fuels facility operates at the Paramount location

• Target to exit J Aron financing agreement for California mid 2018 that should reduce

interest and fees

• Paramount and Long Beach (1)

• Evaluating options to divest assets

• Bakersfield (1)

• Evaluating options to lower carrying cost of this location

• Goal to divest assets to strategic buyers, returning cash to Delek US and reducing costs

related to these assets over time.

• $40.0-$45.0 million potential cost savings by divesting all California assets; cash flow to

Delek from asset sales

1) At Sept. 30, 2017 Paramount and Long Beach were moved to discontinued operations per accounting requirements due to efforts to divest the operations. Bakersfield

remains as part of continuing operations.

Increased Drop Down Inventory Creates Platform to Support Logistics

Growth

15

Potential Growth for DKL

• Delek Logistics Partners provides

platform to unlock logistics value

• Increased access to Permian and

Delaware basin through presence of

Big Spring refinery

• Improves ability to develop

crude oil gathering and

terminalling assets

1) Information for illustrative purposes only to show potential based on estimated dropdown assets listed. Actual amounts will vary based on market conditions, which assets

are dropped, timing of dropdowns, timing of Paline Pipeline 7,000 bpd capacity expansion, actual performance of the assets and Delek Logistics in the future.

2) Based on 7x multiple. Assumed for illustrative purposes. Will vary based on market conditions and valuations at the time of the dropdown of each asset.

3) Please see page 35 for a reconciliation of EBITDA.

Strong EBITDA Growth Profile Supporting Distribution Growth (1)

$108

$12 $8 $34

$32

$194

$-

$50.0

$100.0

$150.0

$200.0

$250.0

LTM DKL

EBITDA

9/30/2017

Asphalt Drop

down

Inventory

Annualized

EBITDA -

Paline

expansion

Big Spring

Drop Down

Inventory

Krotz Springs

Drop Down

Inventory

Total EBITDA

Potential

• Drop downs, excluding Krotz Springs, could create significant cash flow to Delek

• $42-$50m EBITDA equates to ~$300-350m cash proceeds to DK (2)

• Provides visibility for continued DKL LP double digit distribution growth

• Significant GP benefits

Potential Dropdown Items from

Alon Acquisition

Estimated EBITDA

($ million / year)

Asphalt Terminals $11-13

Big Spring Asphalt Terminal $9-11

Big Spring assets $8-10

Big Spring Wholesale Marketing $14-16

Total Excluding Krotz Springs $42-50

Krotz Springs assets $30-34

Total $72-84 (3)

($ in millions)

Note: based on DKL LTM EBITDA + potential

dropdowns + Paline expansion

Potential Timing

4Q17 1H18 2019 1Q18

WTI-Linked Crude Oil Refining System

System with Over 300,000 bpd of Crude Oil Throughput Capacity (~69% Permian Basin Based)

WTI-Linked Refining System with Permian Based Crude Oil Slate

17

Tyler, Texas

• 75,000 bpd crude

throughput

• 8.7 complexity

• Light crude refinery

• Permian Basin and

east Texas sourced

crude

El Dorado, Arkansas

• 80,000 bpd crude

throughput

• 10.2 complexity

• Flexibility to process

medium and light

crude

• Permian Basin, local

Arkansas, east Texas

and Gulf Coast crudes

Big Spring, Texas

• 73,000 bpd crude

throughput

• 10.5 complexity

• Process WTI and WTS

crude

• Located in the Permian

Basin

Krotz Springs, Louisiana

• 74,000 bpd crude

throughput

• 8.4 complexity

• Permian Basin, local

and Gulf Coast crude

sources

Crude Oil Supply is Primarily WTI Linked barrels - Currently approximately 262,000 barrels per day/95.6

million barrels per year; $1/bbl. change in WTI-Brent differential is approximately $96 million of EBITDA

Big Spring

73 kbpd

26.6 m bbls

100% WTI

linked

Tyler

75 kbpd

27.4 m bbls

100% WTI

linked

El Dorado

80 kbpd

29.2 m bbls

100% WTI

linked

Krotz

74 kbpd

27.0 m bbls

46% WTI

linked

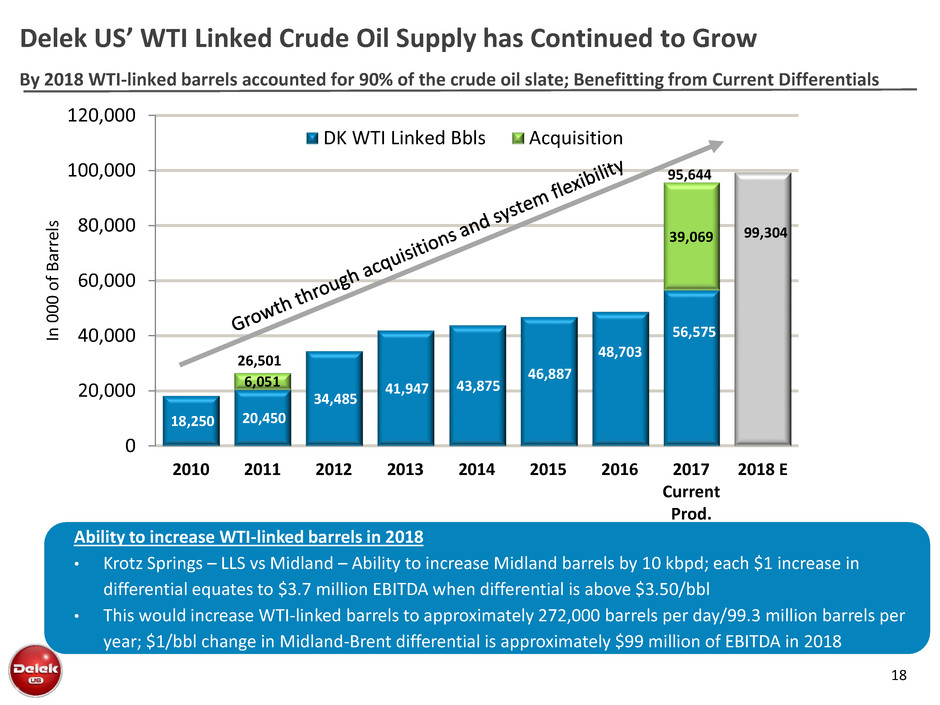

By 2018 WTI-linked barrels accounted for 90% of the crude oil slate; Benefitting from Current Differentials

Delek US’ WTI Linked Crude Oil Supply has Continued to Grow

18

Ability to increase WTI-linked barrels in 2018

• Krotz Springs – LLS vs Midland – Ability to increase Midland barrels by 10 kbpd; each $1 increase in

differential equates to $3.7 million EBITDA when differential is above $3.50/bbl

• This would increase WTI-linked barrels to approximately 272,000 barrels per day/99.3 million barrels per

year; $1/bbl change in Midland-Brent differential is approximately $99 million of EBITDA in 2018

18,250 20,450

34,485

41,947 43,875

46,887

48,703

56,575

99,304

6,051

39,069

0

20,000

40,000

60,000

80,000

100,000

120,000

2010 2011 2012 2013 2014 2015 2016 2017

Current

Prod.

2018 E

In

0

0

0

o

f

B

ar

rel

s

DK WTI Linked Bbls Acquisition

26,501

95,644

Logistics Assets Positioned for

Growth

NY008LRP - 912119_1.wor -L r - r- rLL P 912119_1.wo

San Angelo

Fort Worth Dallas

Waco

Tyler

Shreveport

Monroe

El Dorado

Beaumont New Orleans

Little Rock Memphis

Brentwood

Nashville

Knoxville

Abilene

Big Spring

Krotz Springs

NY008LRP - 912119_1.wor - rL 1.P 912119_

SALA GATHERING SYSTEM

AR

LA

Magnolia El Dorado

~805 miles (1) of crude and

product transportation

pipelines, including the 195

mile crude oil pipeline from

Longview to Nederland, TX

~ 600 mile crude oil gathering

system in AR

Storage facilities with 7.3

million barrels of active shell

capacity

Rail Offloading Facility

Pipelines/Transportation Segment

Wholesale and marketing

business in Texas

9 light product terminals: TX,

TN, AR

Approx. 1.2 million barrels of

active shell capacity

Wholesale/Terminalling Segment

20

Logistics Assets Positioned to Benefit from Permian Basin Activity

Growing logistics assets support crude sourcing and product marketing for customers

(NY008LRP) 912119_1.wor1. r) 912119 rr) 912119 1.1.) 912119(NY008LRP _ o

EAST TEXAS LOGISTICS SYSTEM

Mt. Pleasant

Big Sandy

Longview

Kilgore

Henderson

Tyler

DELEK THIRD-PARTY ASSETS

Enterprise Pipeline (Product)

Delek US Refinery

DELEK LOGISTICS (DKL)

Product Terminal

Product Tank Farm

Product Pipeline

Corporate Headquarters

Crude Tank Farm

Crude Pipeline Third Party Terminal

West Coast Asphalt Terminals (2)

Mojave, Phoenix, Elk Grove and Bakersfield

NY008LRP - 912119_1.wor - .P rL - .- .P rP r008L 912119_1LY R - . o - .

Paramount/

Long Beach

Mojave

CA

Bakersfield

Elk Grove

Flagstaff

Phoenix

NV

AZ

(1) Includes approximately 240 miles of leased pipeline capacity.

(2) DK assets acquired through the ALJ acquisition which creates potential for drop-down assets to DKL. Drop-down subject to Delek Logistics' conflicts committee review and approval.

Product Terminal

Asphalt Terminal

21

West Texas Wholesale Business Benefiting from Permian Activity

West Texas Wholesale and Marketing Gross Margin

13,377

Bbl/d

14,353

Bbl/d

15,493

Bbl/d

16,523

Bbl/d 18,156

Bbl/d

16,707

Bbl/d

16,357

Bbl/d

13.482

Bbl/d

• Operates in an area around the Permian Basin;

Complementary to Delek US refining/retail in

region:

• Purchases refined products from third parties

for resale at owned and third party terminals

in west Texas

• Includes ethanol blending activity

• Positioned to benefit from positive industry

dynamics:

• Drilling rig count has increased since May 2016,

there are currently 380 rigs operating in the

Permian Basin(2)

• Improved efficiencies in the Permian Basin

have benefitted rig production levels

• Forecast for continued production growth

• Current takeaway pipeline capacity is

adequate

• Potential for tight production/takeaway

capacity in future

(1) (1) (1) (1)

($ in millions)

Substantial Increase in Permian Production Expected(3)

13.942

Bbl/d 13,257

Bbl/d

(1) (1)

$7.2 $7.6

$8.5

$15.5

$14.0

$28.2

$8.0

$6.9

$4.4

$13.5

$0.0

$5.0

$10.0

$15.0

$20.0

$25.0

$30.0

2009 2010 2011 2012 2013 2014 2015 2016 Q3'16

YTD

Q3'17

YTD

1) RINs gross margin benefit included in the 2013 west Texas gross margin per barrel was approximately $6.4 million, or $0.99/Bbl, 2014 gross margin included $4.6 million, or

$0.75/Bbl, 2015 gross margin included $5.3 million, or $0.89/Bbl, 2016 gross margin included $6.7 million, or $1.39/Bbl, 3Q16 YTD gross margin included $4.6 million, or

$1.29/Bbl, and 3Q17 YTD gross margin included $3.9 million, or $1.05/Bbl.

2) Source: Baker Hughes Drilling Rig report through Nov 3, 2017.

3) Simmons & Co. research report, “Global Macro Oil Update: Contemplating a Wide Range of Potential Outcomes”, Drillinginfo, RigData, Company Reports/Filings, EIA, -

August 22, 2017.

13,377

Bbl/d

14,353

Bbl/d

15,493

Bbl/d

16,523

Bbl/d 18,156

Bbl/d

16,707

Bbl/d

16,357

Bbl/d 13.039

Bbl/d

13.647

Bbl/d ,

l/

0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

4,500

5,000

2

0

0

9

2

0

1

0

2

0

1

1

2

0

1

2

2

0

1

3

2

0

1

4

2

0

1

5

2

0

1

6

2

0

17

E

2

0

18

E

2

0

19

E

2

0

20

E

In

000

b

p

d

• Approximately 195 mile 35 kbpd crude oil pipeline –

Longview, TX south to Beaumont

• Allows shippers ability to ship Midland or

Cushing crude barrels to the Gulf Coast

• Increased demand for space on pipeline, as

crude oil differentials have widened

• Increasing temporary incentive tariff based on

demand

• Base FERC rate at $1.50/bbl

• Effective Nov 1, temporary incentive tariff of

$1.25/bbl at 8,500 bbl/d or greater; $1.50/bbl at

8,499 bbl/d or lower

• Previous incentive tariff was $$0.75/bbl at 8,500

bbl/d or greater; $1.50/bbl at 8,499 bbl/d or

lower

• Adding capacity in 1Q 2018

• Adding pump capacity to achieve 42,000 bpd

• Evaluating potential for additional capacity

Note: The previous contract that expired on June 30, 2016 had 35,000 Bbl/d of mainline capacity reserved for third parties to use exclusively during a term that began on January 1, 2015.

Delek Logistics elected to extend the contract at 10,000 Bbl/d from July 1, 2016 to December 31, 2016. Following the December 31, 2016 expiration, volume shipped is subject to the FERC

tariff and incentive rates that are currently in place.

22

Paline Pipeline Benefitting from Crude Oil Price Differentials

Environment Supports Increased Incentive Tariff

23

Delek US GP and IDR Ownership is in DKL in the high splits

Future Potential Dropdowns to DKL Benefit Delek US Cash Flow

Supports Long Term Distribution Growth at Delek Logistics

Total Quarterly Distribution Per Unit

Target Amount

Unitholders General Partner

Minimum Quarterly Distribution below $0.37500 98.0% 2.0%

First Target Distribution $0.37500 to $0.43125 98.0% 2.0%

Second Target Distribution $0.43125 to $0.46875 85.0% 15.0%

Third Target Distribution $0.46875 to $0.56250 75.0% 25.0%

Thereafter above $0.56250 50.0% 50.0%

• DKL Distribution was

$0.715/unit for 3Q 2017

• DKL distribution growth

target per LP unit of at least

10% annually through 2019

• Delek US Ownership:

• 61.5% of LP Units

• 2% GP Interest

(1) Based on no change in number of units and assumes all units are paid distribution, including IDRs to Delek US and its affiliates. Targeted annual growth rate in distribution

based on 10% through 2019 per Delek Logistics guidance in 4Q16 earnings release. Growth based on declared amounts. Growth from 2019 to 2020 based on 10% per year.

Delek US and affiliates own approximately 61% of limited partner units and 100% of the general partner units. Information for illustrative purposes only, actual amounts will

be determined by Delek Logistics based on future performance and pursuant to its partnership agreement.

Assumed Annual Distribution (LP and GP) to Delek US if Delek Logistics were to have a long term distribution

growth of 10% per year.(1) Combination of all Alon logistic assets, including asphalt, could potentially support

growth to 2020

$28.1 $33.1

$38.3 $42.7 $47.0

$51.7 $56.8

$1.9 $5.0

$12.4

$18.8

$25.7

$33.2

$41.6

$-

$20.0

$40.0

$60.0

$80.0

$100.0

$120.0

2014 2015 2016 2017E 2018E 2019E 2020E

Distribution - LP Distribution - GP

$ in millions 2016 – 2020E GP distribution CAGR +35%

24

(1) MQD = minimum quarterly distribution set pursuant to the Partnership Agreement.

(2) Distribution coverage based on distributable cash flow divided by distribution amount in each period. Please see page 40 for reconciliation.

(3) 3Q17 based on total distributions paid on November 14, 2017.

(4) Leverage ratio based on LTM EBITDA as defined by credit facility covenants for respective periods.

1.70x 1.58x

2.28x 2.40x

3.21x 2.69x 2.55x 2.56x 3.00x

3.14x 3.11x 3.49x 3.48x 3.47x 3.70x 3.85x 3.83x

3.88x 3.72x

1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17

DKL: Increased Distribution with Conservative Coverage and Leverage

Distribution per unit has been increased nineteenth consecutive time since the IPO

Distributable Cash Flow Coverage Ratio (2)(3)

Leverage Ratio (4)

$0.375 $0.385 $0.395 $0.405 $0.415 $0.425

$0.475 $0.490 $0.510 $0.530 $0.550

$0.570 $0.590 $0.610 $0.630 $0.655

$0.680 $0.690 $0.705 $0.715

MQD (1)1Q 13 2Q 13 3Q 13 4Q 13 1Q 14 2Q 14 3Q 14 4Q 14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17

Increased 90.7% through 3Q 2017 distribution

1.39x 1.32x 1.35x 1.30x

1.61x 2.02x 1.42x 1.67x

1.23x 1.47x 1.50x 1.17x 1.19x 1.31x 0.99x 0.90x 0.98x

1.07x

0.97x

1Q 13 2Q 13 3Q 13 4Q 13 1Q 14 2Q 14 3Q 14 4Q 14 1Q 15 2Q 15 3Q 15 4Q 15 1Q 16 2Q 16 3Q 16 4Q16 1Q17 2Q17 3Q17

Avg. 1.35x in 2013

Avg. 1.68x in 2014

Avg. 1.37x in 2015 Avg. 1.09x in 2016

Avg. 1.01x in 2017

Opportunities for Retail

Integrated wholesale marketing and retail network at Big Spring; complementary to DKL west Texas

25

Current Retail Operations

• Approximately 300 store retail system in

Central/west Texas and New Mexico

• Supplies ~635 branded sites,

including substantially all of Alon’s

retail sites

• Opportunity to invest in business to

improves store base and grow over time

to increase retail system value

Refineries

Legend:

Big Spring

Krotz

Springs

Branded license agreement and payment card location

Branded company-operated and distributor location

Unbranded supply available

Phoenix

Tucson

El Paso

Abilene

Wichita

Falls

Albuquerque

DKL served terminals

El Dorado

Tyl

er

Prior Retail Experience

• Built Southeast U.S. retail system

with 348 stores

• In November 2016 sold the network

for $535.0 million, net cash proceeds

of $377.3 million before tax

• Deal value of approximately 12.7x

EBITDA multiple

13.6x

16.4x

6.9x 7.9x

19.3x

7.8x

10.4x

12.7x

Susser

(2014)

Hess

(2014)

Pioneer

(2014)

Aloha

(2014)

Warren

(2014)

Pantry

(2014)

CST

Brands

(2016)

DK

Retail

(2016)

Comparative Retail Transaction EBITDA Multiples

Median: 10.4x

Solid Financial Position

Financial Strength and Flexibility to Support Initiatives

At September 30, 2017 approximately $832 million of cash

27

• Focused on growing business, while maintaining

financial flexibility

• Sold retail assets in Nov. 2016 for $535

million

• Closed Alon transaction on July 1, 2017

• At September 30 cash balance of $832 million and

net debt of $596 million

• Net debt of $200 million excluding DKL

related cash/debt

• Current balance sheet should have financial

flexibility to support:

• Opportunity for cost of capital benefits from

combination estimated to be approximately

$20 million

• Capital allocation program focused on

investment, return to shareholders and

growth over cycle

1) Amounts prior to 4Q16 have been adjusted to remove cash associated the retail operations that were sold in November 2016.

2) Based on company filings as of 9/30/17.

Capitalization as of September 30, 2017 (2)

Cash Balance ($MM) (1)

$40

$219

$590

$383

$430

$287

$689 $832

2010 2011 2012 2013 2014 2015 2016 3Q17

($ in millions)

Current Debt $351.0

Long-Term Debt 1,076.8

Total Debt $1,427.8

Cash ($831.7)

Net Debt Delek US Consolidated $596.1

Delek Logistics

Total Debt $401.3

Cash ($5.3)

Net Debt Delek Logistics $396.0

Net Debt Delek US excluding DKL $200.1

Invest in the business

Forecast 2017 capex includes spending on Alon assets

for six months

Commenced Alky unit project at Krotz Springs

2018 El Dorado Turnaround planning underway

Consent decree spending at Big Spring

Programs in place allow different options to return cash to

shareholders

Regular dividend

$150 million DK share repurchase plan(1)

$30 million DKL limited partner unit repurchase plan(1)

Capital Allocation Focused on Long-Term Value Creation

28

Dividends Declared ($/share)

$0.15 $0.15 $0.15 $0.21

$0.55 $0.60 $0.60 $0.60 $0.60 $0.18

$0.39

$0.40

$0.40

$0.15 $0.15

$0.33

$0.60

$0.95 $1.00

$0.60 $0.60 $0.60

2009 2010 2011 2012 2013 2014 2015 2016 LTM 3Q17

Regular Special

$37 $75

$42

$6

$150

2013 2014 2015 2016 Current

Authorization

DK Share Repurchases ($MM)

1) These plans do not have expiration dates.

$88.6

$157.1

$213.6

$191.0

$46.3

$161.6

2012A 2013A 2014A 2015A 2016A 2017E

Historical Capital Spending

($ in millions)

(1)

Initiatives Underway to Create Sustainable Value

Current Valuation Below Peer EV to EBITDA

29 (1) Based on NASDAQ IR Insights/Factset as of 11/20/17.

Balance sheet with $832 million of cash

supports company initiatives

Permian focused refining system

Margins benefiting from wider discount

between Midland WTI and Brent crude oil

Initiatives underway to unlock value

$95 million of annualized synergy capture

expected to be achieved in 2018

$35 to $40 million of annual EBITDA expected

from alky project at Krotz Springs to be

completed in 1Q19

$78 million of potential logistics EBITDA in

dropdown inventory can create cash flow to

Delek US

ALDW Transaction would simplify corporate

structure and allow reallocation of ALDW

distribution to business investments

$8.0 million of potential EBITDA from

increased capacity on the Paline Pipeline

$40.0-$45.0 million potential cost savings by

divesting all California assets; cash flow to

Delek from asset sales

Current valuation for Delek US below peer group

may create attractive opportunity

0.0x

1.0x

2.0x

3.0x

4.0x

5.0x

6.0x

7.0x

8.0x

9.0x

10.0x

EV/EBITDA

2018 2019 18 avg 19 avg

30

Complementary

Logistics Systems

Significant Organic

Growth / Margin

Improvement

Opportunities

Focus on Long Term

Shareholder Returns

Financial Flexibility

Permian Focused

Refining System

Questions and Answers

An Integrated and

Diversified Refining,

Logistics and Marketing

Company

31

Additional Information

No Offer or Solicitation

This communication relates to a proposed business combination between Delek US and Alon Partners. This announcement is for informational

purposes only, and is neither an offer to purchase, nor a solicitation of an offer to sell, any securities, or the solicitation of any vote in any jurisdiction

pursuant to the proposed transactions or otherwise, nor shall there be any sale, issuance or transfer or securities in any jurisdiction in contravention

of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act

of 1933, as amended.

Additional Information and Where to Find It

This press release does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval.

In connection with the proposed acquisition transaction, a registration statement on Form S-4 will be filed with the SEC that will include a consent

statement of Alon Partners. Delek US also plans to file other relevant materials with the SEC. UNITHOLDERS OF ALON PARTNERS ARE

ENCOURAGED TO READ THE REGISTRATION STATEMENT AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING

THE CONSENT STATEMENT/PROSPECTUS THAT WILL BE PART OF THE REGISTRATION STATEMENT, BECAUSE THEY WILL CONTAIN

IMPORTANT INFORMATION ABOUT THE PROPOSED ACQUISITION. The final consent solicitation /prospectus will be mailed to unitholders of

Alon Partners. Investors and security holders will be able to obtain the documents, and any other documents that Delek US has filed with the SEC,

free of charge at the SEC's website, www.sec.gov. In addition, documents filed with the SEC by Delek US will be available free of charge by (1)

accessing Delek US’ website at www.delekus.com under the "Investor Relations" link and then under the heading "SEC Filings"; (2) writing Delek US

at 7102 Commerce Way, Brentwood, TN 37027, Attention: Investor Relations; or (3) writing Alon Partners at 7102 Commerce Way, Brentwood, TN

37027, Attention: Investor Relations.

Participants in the Solicitation

Delek US, Alon Partners and their respective directors and executive officers may be deemed to be participants in the solicitation of consents in favor

of the acquisition from the unitholders of Alon Partners. Additional information regarding the interests of those participants and other persons who

may be deemed participants in the transaction may be obtained by reading the consent statement/prospectus regarding the proposed acquisition

when it becomes available. Free copies of this document may be obtained as described in the preceding paragraph.

Appendix

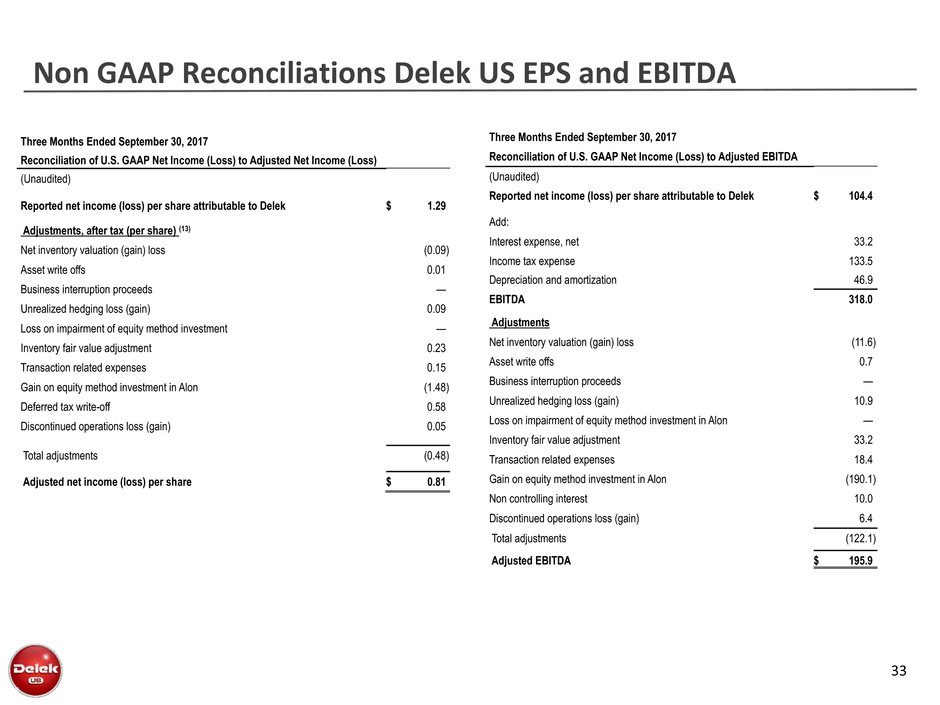

Non GAAP Reconciliations Delek US EPS and EBITDA

33

Three Months Ended September 30, 2017

Reconciliation of U.S. GAAP Net Income (Loss) to Adjusted EBITDA

(Unaudited)

Reported net income (loss) per share attributable to Delek $ 104.4

Add:

Interest expense, net 33.2

Income tax expense 133.5

Depreciation and amortization 46.9

EBITDA 318.0

Adjustments

Net inventory valuation (gain) loss (11.6 )

Asset write offs 0.7

Business interruption proceeds —

Unrealized hedging loss (gain) 10.9

Loss on impairment of equity method investment in Alon —

Inventory fair value adjustment 33.2

Transaction related expenses 18.4

Gain on equity method investment in Alon (190.1 )

Non controlling interest 10.0

Discontinued operations loss (gain) 6.4

Total adjustments (122.1 )

Adjusted EBITDA $ 195.9

Three Months Ended September 30, 2017

Reconciliation of U.S. GAAP Net Income (Loss) to Adjusted Net Income (Loss)

(Unaudited)

Reported net income (loss) per share attributable to Delek $ 1.29

Adjustments, after tax (per share) (13)

Net inventory valuation (gain) loss (0.09 )

Asset write offs 0.01

Business interruption proceeds —

Unrealized hedging loss (gain) 0.09

Loss on impairment of equity method investment —

Inventory fair value adjustment 0.23

Transaction related expenses 0.15

Gain on equity method investment in Alon (1.48 )

Deferred tax write-off 0.58

Discontinued operations loss (gain) 0.05

Total adjustments (0.48 )

Adjusted net income (loss) per share $ 0.81

Non GAAP Reconciliations of Potential Alky Unit EBITDA (1)

34

(1) Based on projected range of potential future performance from the alkylation unit project at Krotz Springs. Amounts of EBITDA, net income and timing will vary. Actual

amounts will be based on timing of completion, performance of the project and market conditions.

Reconciliation of Forecast U.S. GAAP Net Income (Loss) to Forecast

EBITDA for Alkylation Project

Forecasted

Range

Forecasted Net Income $ 17.8 $ 21.0

Add:

Interest Expense, net — —

Income tax expense 10.3 12.1

Depreciation and amortization 6.9 6.9

Forecasted EBITDA $ 35.0 $ 40.0

Non GAAP Reconciliations of Potential Dropdown EBITDA (1)

35

(1) Based on projected range of potential future logistics assets that could be dropped to Delek Logistics from Delek US in the future. Amounts of EBITDA, net income and timing

will vary, which will affect the potential future EBITDA and associated deprecation and interest at DKL. Actual amounts will be based on timing, performance of the assets,

DKL’s growth plans and valuation multiples for such assets at the time of any transaction.

Reconciliation of Forecasted Logistics Dropdown EBITDA to Forecasted Amounts under US GAAP

Delek Logistics Partners LP

($ in millions)

Forecasted Net Income Range 13.6$ 15.9$

Add: Depreciation and amortization expenses 33.6$ 39.2$

Add: Interest and financing costs, net 24.8$ 28.9$

Forecasted EBITDA Range 72.0$ 84.0$

Potential Dropdown Range

Delek US Focused on Growth through Acquisitions

(1) Includes logistic assets in purchase price. Purchase price includes working capital for refineries.

(2) Mt. Pleasant includes $1.1 million of inventory.

2006

Abilene & San Angelo

terminals

$55.1 mm

2012

Nettleton

Pipeline

$12.3 mm

2011

Paline Pipeline

$50 mm

Acquisition Completed

171 retail fuel &

convenience stores

& related assets

$157.3 mm

2005 to 2007 2011 to 2012 2013 to Current

Crude

Gathering

2013

Biodiesel

Facility

$5.3 mm

2011

Lion refinery &

related pipeline & terminals

$228.7 mm(1)

2005

Tyler refinery &

related assets

$68.1 mm(1)

2011 - 2014

Building new large format convenience stores

2013

Tyler-Big Sandy

Pipeline

$5.7 mm

2014

Biodiesel

Facility

$11.1 mm

Logistics Segment Retail Segment Refinery Segment

Crude

Logistics

Refining

Product

Logistics

Retail

2012

Big Sandy

terminal & pipeline

$11.0 mm

2013

North Little Rock

Product Terminal

$5.0 mm

2011

SALA Gathering

Lion Oil acquisition

Assets

P

u

rc

h

as

e

d

Increased Gathering

East and West Texas

36

2014

Mt. Pleasant

System

$11.1 mm (2)

2014

Frank

Thompson

Transport

$11.9 mm

DKL Joint Ventures

RIO Pipeline

Caddo Pipeline

Exp. Inv.: ~$104 mm

2015

47%

ownership

in Alon USA

2015

47%

ownership

in Alon USA

2016

Sold MAPCO

for $535mm

2017

Acquired rest of

Alon USA

2017

Acquired rest

of Alon USA

37

Current Delek US Corporate Structure

(1) As of September 30, 2017, a 5.4% interest in the Delek US ownership interest in the general partner is held by three members of senior management of Delek US. The

remaining ownership interest is indirectly held by Delek US.

(2) Market cap based on share and unit prices on November 20, 2017.

94.6%

ownership interest (1)

2.0% interest

General partner interest

Incentive distribution

rights Delek Logistics Partners, LP

NYSE: DKL

Market Cap: $694 million

Delek Logistics GP, LLC

(the General Partner)

Delek US Holdings, Inc.

NYSE: DK

Market Cap: $2.5 billion

61.5% interest in

LP units

Alon USA Partners, LP

NYSE: ALDW

Market Cap: $932 million

81.6% interest

Focused on simplifying the structure

• On Nov. 8, 2017 a definitive agreement was reached to acquire the remaining limited partner units of ALDW

that Delek US does not already own in an all stock transaction.

• Exchange ratio of 0.49 shares of Delek US for each ALDW common unit not already owned by Delek US,

subject to customary closing conditions

-$30

-$20

-$10

$0

$10

$20

$30

$40

$50

J

a

n

-1

0

Fe

b

-1

0

Ma

r-

1

0

A

p

r-

1

0

Ma

y

-1

0

J

u

n

-1

0

J

u

l-

1

0

A

u

g

-1

0

S

e

p

-1

0

O

c

t-

1

0

N

o

v

-1

0

D

e

c

-1

0

J

a

n

-1

1

Fe

b

-1

1

Ma

r-

1

1

A

p

r-

1

1

Ma

y

-1

1

J

u

n

-1

1

J

u

l-

1

1

A

u

g

-1

1

S

e

p

-1

1

O

c

t-

1

1

N

o

v

-1

1

D

e

c

-1

1

J

a

n

-1

2

Fe

b

-1

2

Ma

r-

1

2

A

p

r-

1

2

Ma

y

-1

2

J

u

n

-1

2

J

u

l-

1

2

A

u

g

-1

2

S

e

p

-1

2

O

c

t-

1

2

N

o

v

-1

2

D

e

c

-1

2

J

a

n

-1

3

Fe

b

-1

3

Ma

r-

1

3

A

p

r-

1

3

Ma

y

-1

3

J

u

n

-1

3

J

u

l-

1

3

A

u

g

-1

3

S

e

p

-1

3

O

c

t-

1

3

N

o

v

-1

3

D

e

c

-1

3

J

a

n

-1

4

Fe

b

-1

4

Ma

r-

1

4

A

p

r-

1

4

Ma

y

-1

4

J

u

n

-1

4

J

u

l-

1

4

A

u

g

-1

4

S

e

p

-1

4

O

c

t-

1

4

N

o

v

-1

4

D

e

c

-1

4

J

a

n

-1

5

Fe

b

-1

5

Ma

r-

1

5

A

p

r-

1

5

Ma

y

-1

5

J

u

n

-1

5

J

u

l-

1

5

A

u

g

-1

5

S

e

p

-1

5

O

c

t-

1

5

N

o

v

-1

5

D

e

c

-1

5

J

a

n

-1

6

Fe

b

-1

6

Ma

r-

1

6

A

p

r-

1

6

Ma

y

-1

6

J

u

n

-1

6

J

u

l-

1

6

A

u

g

-1

6

S

e

p

-1

6

O

c

t-

1

6

N

o

v

-1

6

D

e

c

-1

6

J

a

n

-1

7

Fe

b

-1

7

Ma

r-

1

7

A

p

r-

1

7

Ma

y

-1

7

J

u

n

-1

7

J

u

l-

1

7

A

u

g

-1

7

S

e

p

-1

7

O

c

t-

1

7

N

o

v

-1

7

Brent-WTI Cushing Spread Per Barrel WTI 5-3-2 Gulf Coast Crack Spread Per Barrel LLS 5-3-2 Gulf Coast Crack Spread Per Barrel

U.S. Refining Environment Trends

Refined Product Margins and WTI-Linked Feedstock Favor Delek US

(1) Source: Platts as of November 20, 2017; 5-3-2 crack spread based on HSD

(2) Crack Spreads: (+/-) Contango/Backwardation

(1) (2) (2)

38

($14.00)

($12.00)

($10.00)

($8.00)

($6.00)

($4.00)

($2.00)

$0.00

$2.00

Ja

n

-1

1

Fe

b

-1

1

M

ar

-1

1

A

p

r-

11

M

ay

-1

1

Ju

n

-1

1

Ju

l-1

1

A

u

g-

1

1

Se

p

-1

1

O

ct-1

1

N

o

v-

1

1

De

c-

1

1

Ja

n

-1

2

Fe

b

-1

2

M

ar

-1

2

A

p

r-

12

M

ay

-1

2

Ju

n

-1

2

Ju

l-1

2

A

u

g-

1

2

Se

p

-1

2

O

ct-1

2

N

o

v-

1

2

De

c-

1

2

Ja

n

-1

3

Fe

b

-1

3

M

ar

-1

3

A

p

r-

13

M

ay

-1

3

Ju

n

-1

3

Ju

l-1

3

A

u

g-

1

3

Se

p

-1

3

O

ct-1

3

N

o

v-

1

3

De

c-

1

3

Ja

n

-1

4

Fe

b

-1

4

M

ar

-1

4

A

p

r-

14

M

ay

-1

4

Ju

n

-1

4

Ju

l-1

4

A

u

g-

1

4

Se

p

-1

4

O

ct-1

4

N

o

v-

1

4

De

c-

1

4

Ja

n

-1

5

Fe

b

-1

5

M

ar

-1

5

A

p

r-

15

M

ay

-1

5

Ju

n

-1

5

Ju

l-1

5

A

u

g-

1

5

Se

p

-1

5

O

ct-1

5

N

o

v-

1

5

De

c-

1

5

Ja

n

-1

6

Fe

b

-1

6

M

ar

-1

6

A

p

r-

16

M

ay

-1

6

Ju

n

-1

6

Ju

l-1

6

A

u

g-

1

6

Se

p

-1

6

O

ct-1

6

N

o

v-

1

6

De

c-

1

6

Ja

n

-1

7

Fe

b

-1

7

M

ar

-1

7

A

p

r-

17

M

ay

-1

7

Ju

n

-1

7

Ju

l-1

7

A

u

g-

1

7

Se

p

-1

7

O

ct-1

7

N

o

v-

1

7

WTI Midland vs. WTI Cushing Crude Oil Pricing

Access to Midland Crude Oil Benefits Margins

($ per barrel)

Approx. 207,000

bpd of Midland

crude oil in DK

system

39

Source: Argus – as of November 20, 2017

DKL: Reconciliation of Cash Available for Distribution

40

(1) Distribution based on actual amounts distributed during the periods; does not include a LTIP accrual. Coverage is defined as cash available for distribution divided by total distribution.

(2) Results in 2013, 2014 and 2015 are as reported excluding predecessor costs related to the drop down of the tank farms and product terminals at both Tyler and El Dorado during the

respective periods.

Note: May not foot due to rounding and annual adjustments that occurred in year end reporting.

(dollars in millions, except coverage) 1Q13 (2) 2Q13(2) 3Q13(2) 4Q13(2) 2013 (2) 1Q14 (2) 2Q14(2) 3Q14(2) 4Q14(2) 2014 (2) 1Q15(2) 12Q15(2 3Q15(2) 4Q15(2) 2015 (2) 1Q16 2Q16 3Q16 4Q16 2016 1Q17 2Q17 3Q17

Reconciliation of Distributable Cash Flow to net cash from operating activities

Net cash provided by operating activities $2.0 $18.7 $19.9 $8.9 $49.4 $14.4 $31.2 $20.1 $20.8 $86.6 $15.9 $30.8 $20.2 $1.3 $68.2 $26.4 $31.2 $29.2 $13.9 $100.7 $23.5 $23.9 $30.5

Accretion of asset retirement obligations (0.0) (0.1) (0.0) (0.1) (0.2) (0.1) (0.1) (0.1) 0.0 (0.2) (0.1) (0.1) (0.1) (0.1) (0.3) (0.1) (0.1) (0.1) (0.1) (0.3) (0.1) (0.1) (8.4)

Deferred income taxes 0.0 0.0 (0.1) (0.3) (0.3) 0.0 (0.1) (0.0) 0.2 0.1 (0.2) 0.2 0.0 0.0 (0.0) - - - 0.2 0.2 - (0.1) (0.7)

Gain (Loss) on asset disposals - - - (0.2) (0.2) - (0.1) - (0.0) (0.1) (0.0) 0.0 - (0.1) (0.1) 0.0 - (0.0) - 0.0 (0.0) 0.0 0.4

Changes in assets and liabilities 12.1 (4.9) (5.1) 6.3 8.3 3.4 (6.0) (1.6) 3.0 (1.2) 3.3 (7.3) 3.6 20.5 20.1 (5.4) (7.1) (10.0) 7.7 (14.9) (3.6) 0.9 (0.1)

Maint. & Reg. Capital Expenditures (1.3) (1.1) (1.3) (1.8) (5.1) (0.8) (1.0) (0.8) (3.9) (6.5) (3.3) (3.9) (3.5) (2.7) (11.8) (0.7) (0.9) (0.7) (3.6) (5.9) (2.2) (2.1) (0.1)

Reimbursement for Capital Expenditures 0.3 0.2 - 0.4 0.8 - - - 1.6 1.6 1.2 1.4 2.3 0.0 5.2 0.2 0.6 0.7 0.4 1.9 3.1 0.8 0.0

Distributable Cash Flow $13.1 $12.8 $13.4 $13.3 $52.9 $17.0 $24.0 $17.7 $21.8 $80.3 $16.8 $21.1 $22.6 $18.9 $81.3 $20.4 $23.7 $19.1 $18.5 $81.7 $20.6 $23.4 $21.6

Coverage (1) 1.39x 1.32x 1.35x 1.30x 1.35x 1.61x 2.02x 1.42x 1.67x 1.68x 1.23x 1.47x 1.50x 1.17x 1.37x 1.19x 1.31x 0.99x 0.90x 1.09x 0.98x 1.07x 0.97x

Total Distribution (1) $9.4 $9.7 $9.9 $10.2 $39.3 $10.5 $11.9 $12.4 $13.1 $47.9 $13.7 $14.4 $15.1 $16.1 $59.3 $17.1 $18.1 $19.3 $20.5 $75.0 $21.0 $21.8 $22.3

DKL: Income Statement and Non-GAAP EBITDA Reconciliation

41

(1) Includes approximately $2.0 million of estimated annual incremental general and administrative expenses expected to incur as a result of being a separate publicly traded partnership.

(2) Interest expense and cash interest both include commitment fees and interest expense that would have been paid by the predecessor had the revolving credit facility been in place during the 12

months ended 9/30/13 period presented and Delek Logistics had borrowed $90.0 million under the facility at the beginning of the period. Interest expense also includes the amortization of debt

issuance costs incurred in connection with our revolving credit facility.

(3) Forecast provided in the IPO prospectus on Nov. 1, 2012.

(4) Results in 2013 and 2014 are as reported excluding predecessor costs related to the drop down of the tank farms and product terminals at both Tyler and El Dorado during the respective periods.

(5) Results for 1Q15 are as reported excluding predecessor costs related to the 1Q15 drop downs.

Note: May not foot due to rounding.

Forecast12 Months

9/30/13

(1)(2)(3) 1Q13 (4) 2Q13(4) 3Q13(4) 4Q13(4) 2013(4) 1Q14(4) 2Q14 3Q14 4Q14 2014 (4) 1Q15(5) 2Q15 3Q15 4Q15 2015 1Q16 2Q16 3Q16 4Q16 2016 1Q17 2Q17 3Q17

Total Net Sales $797.1 $210.9 $230.1 $243.3 $223.1 $907.4 $203.5 $236.3 $228.0 $173.3 $841.2 $143.5 $172.1 $165.1 $108.9 $589.7 $104.1 $111.9 $107.5 $124.7 $448.1 $129.5 $126.8 $130.6

Cost of Goods Sold (721.8) (187.9) (208.0) (218.2) (197.3) (811.4) (172.2) (196.6) (194.1) (134.3) (697.2) (108.4) (132.5) (124.4) (71.0) (436.3) (66.8) (73.1) ($73.5) ($88.8) (302.2) (92.6) (85.0) ($89.1)

Operating Expenses (18.7) (5.9) (6.1) (6.6) (7.2) (25.8) (8.5) (9.5) (10.2) (9.7) (38.0) (10.6) (10.8) (11.6) (11.7) (44.8) (10.5) (8.7) ($9.3) ($8.8) (37.2) (10.4) (10.0) ($10.7)

Contribution Margin $56.6 $17.2 $16.1 $18.4 $18.6 $70.3 $22.8 $30.2 $23.7 $29.3 $106.0 $24.5 $28.8 $29.1 $26.2 $108.6 $26.8 $30.0 $24.7 $27.2 $108.7 $26.5 $31.8 $30.8

Depreciation and Amortization (9.3) (2.4) (2.4) (2.6) (3.4) (10.7) (3.4) (3.5) (3.7) (3.9) (14.6) (4.0) (4.7) (4.5) (5.9) (19.2) (5.0) (4.8) ($5.4) ($5.6) (20.8) (5.2) (5.7) ($5.5)

General and Administration Expense (7.7) (1.7) (1.1) (1.8) (1.7) (6.3) (2.6) (2.2) (2.5) (3.3) (10.6) (3.4) (3.0) (2.7) (2.3) (11.4) (2.9) (2.7) ($2.3) ($2.3) (10.3) (2.8) (2.7) ($2.8)

Gain (Loss) on Asset Disposal - - - - (0.2) (0.2) - (0.1) - - (0.1) - - - (0.1) (0.1) 0.0 - ($0.0) $0.0 0.0 (0.0) 0.0 ($0.0)

Operating Income $39.6 $13.1 $12.6 $14.0 $13.3 $53.2 $16.8 $24.4 $17.5 $22.1 $80.8 $17.1 $21.1 $21.8 $17.9 $77.9 $19.0 $22.5 $17.0 $19.2 $77.7 $18.5 $23.4 $22.6

Interest Expense, net (3.6) (0.8) (0.8) (1.2) (1.8) (4.6) (2.0) (2.3) (2.2) (2.1) (8.7) (2.2) (2.6) (2.8) (3.0) (10.7) (3.2) (3.3) ($3.4) ($3.7) (13.6) (4.1) (5.5) ($7.1)

(Loss) Income from Equity Method Invesments (0.1) (0.3) (0.1) (0.6) (0.2) (0.2) ($0.3) ($0.4) (1.2) 0.2 1.2 $1.6

Income Taxes - (0.1) (0.1) (0.3) (0.2) (0.8) (0.1) (0.3) (0.2) 0.5 (0.1) (0.3) (0.1) (0.1) 0.6 0.2 (0.1) (0.129) ($0.1) $0.3 (0.1) (0.1) (0.1) ($0.2)

Net Income $36.0 $12.2 $11.8 $12.5 $11.3 $47.8 $14.7 $21.8 $15.1 $20.5 $72.0 $14.6 $18.3 $18.6 $15.3 $66.8 $15.4 $18.9 $13.2 $15.3 $62.8 $14.6 $19.0 $16.9

EBITDA:

Net Income $36.0 $12.2 $11.8 $12.5 $11.3 $47.8 $14.7 $21.8 $15.1 $20.5 $72.0 $14.6 $18.3 $18.6 $15.3 $66.8 $15.4 $18.9 $13.2 $15.3 $62.8 $14.6 $19.0 $16.9

Income Taxes - 0.1 0.1 0.3 0.2 0.8 0.1 0.3 0.2 (0.5) 0.1 0.3 0.1 0.1 (0.6) (0.2) 0.1 0.1 $0.1 ($0.3) 0.1 0.1 0.1 0.2

Depreciation and Amortization 9.3 2.4 2.4 2.6 3.4 10.7 3.4 3.5 3.7 3.9 14.6 4.0 4.7 4.5 5.9 19.2 5.0 4.8 $5.4 $5.6 20.8 5.2 5.7 5.5

Interest Expense, net 3.6 0.8 0.8 1.2 1.8 4.6 2.0 2.3 2.2 2.1 8.7 2.2 2.6 2.8 3.0 10.7 3.2 3.3 $3.4 $3.7 13.6 4.1 5.5 7.1

EBITDA $48.9 $15.5 $15.0 $16.6 $16.7 $63.8 $20.2 $27.9 $21.2 $26.1 $95.4 $21.1 $25.7 $26.1 $23.6 $96.5 $23.7 $27.1 $22.0 $24.4 $97.3 $23.9 $30.3 $29.7

Investor Relations Contact:

Kevin Kremke Keith Johnson

Executive Vice President, CFO Vice President of Investor Relations

615-224-1323 615-435-1366

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- LINCOLN ALERT: Bragar Eagel & Squire, P.C. Announces that a Class Action Lawsuit Has Been Filed Against Lincoln National Corporation and Encourages Investors to Contact the Firm

- ADSK INVESTOR ALERT: ROSEN, TOP RANKED INVESTOR COUNSEL, Encourages Autodesk, Inc. Investors to Secure Counsel Before Important Deadline in Securities Class Action First Filed by the Firm – ADSK

- International Horticultural Exhibition 2024 Chengdu Opens

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share