Form 497K TIGERSHARES TRUST

| UP Fintech China-U.S. Internet Titans ETF Trading Symbol: TTTN The Nasdaq Market Summary Prospectus January 25, 2020 www.upfintech.com |

Before you invest, you may want to review the Fund’s prospectus and statement of additional information (“SAI”), which contain more information about the Fund and its risks. The current prospectus and SAI dated January 25, 2020, are incorporated by reference into this summary prospectus. You can find the Fund’s prospectus, reports to shareholders, and other information about the Fund online at https://www.upfintecham.com/documents. You can also get this information at no cost by calling 1-800-617-0004.

IMPORTANT NOTE: Beginning on January 1, 2021, paper copies of the Fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the shareholder reports from your financial intermediary, such as a broker-dealer or bank. Instead, the shareholder reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

You may elect to receive all future Fund shareholder reports in paper, free of charge. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. Please contact your financial intermediary to inform them that you wish to continue receiving paper copies of Fund shareholder reports and for details about whether your election to receive reports in paper will apply to all funds held with your financial intermediary.

Investment Objective

The UP Fintech China-U.S. Internet Titans ETF (the “Fund”) seeks to provide investment results that closely correspond, before fees and expenses, to the performance of a specific equity securities index. The Fund’s current index is the Nasdaq China US Internet Tiger Index (the “Underlying Index”).

Fees and Expenses

This table describes the fees and expenses that you may pay if you buy and hold Shares. You may also pay brokerage commissions on the purchase and sale of Shares.

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment):

Management Fee | 0.59% |

Distribution and/or Service (12b-1) Fees (1) | 0.00% |

Other Expenses | 0.00% |

Total Annual Fund Operating Expenses | 0.59% |

(1) | Pursuant to a Rule 12b-1 Distribution and Service Plan (the “Plan”), the Fund may bear a Rule 12b-1 fee not to exceed 0.25% per year of the Fund’s average daily net assets. However, no such fee is currently paid by the Fund, and the Board of Trustees has not currently approved the commencement of any payments under the Plan. |

Example

The following example is intended to help you compare the cost of investing in the Fund with the cost of investing in other funds. The example assumes that you invest $10,000 for the time periods indicated. The example also assumes that the Fund provides a return of 5% a year and that operating expenses remain the same. The example does not reflect any brokerage commissions that you may pay on purchases and sales of Shares. Although your actual costs may be higher or lower, based on these assumptions, whether you do or do not redeem your Shares, your costs would be:

One Year | Three Years | Five Years | Ten Years |

$60 | $189 | $329 | $738 |

Portfolio Turnover

The Fund may pay transaction costs, including commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Shares are held in a taxable account. These costs, which are not reflected in the annual fund operating expenses or in the example, affect the Fund’s performance. For the period from the Fund’s commencement of operations on November 6, 2018 through September 30, 2019, the Fund’s portfolio turnover rate was 33% of the average value of its portfolio. This rate excludes the value of portfolio securities received or delivered as a result of in-kind creations or redemptions of the Fund’s shares.

Principal Investment Strategies

Under normal circumstances, the Fund will invest at least 80% of its assets, exclusive of any collateral held from securities lending, in the components of the Underlying Index, depositary receipts representing such components and securities underlying depositary receipts in the Underlying Index. The Underlying Index is designed to track the performance of the 10 largest publicly-traded Chinese Internet companies and the 10 largest publicly-traded U.S. Internet companies. The constituents of the Underlying Index are weighted according to their market capitalization, but their weights are modified so that, as of each rebalance: (1) the maximum weight of any constituent does not exceed 8% of the Underlying Index and no more than five constituents are 8% of the Underlying Index; (2) any remaining constituents whose weight exceeds 4% are capped at 4% of the Underlying Index; and (3) any excess weight is redistributed proportionally across the remainder of the Underlying Index constituents. As of the inception date of the Underlying Index, this resulted in the largest five constituents each constituting 8% of the Underlying Index and 15 constituents each constituting 4% of the Underlying Index.

The U.S. components of the Underlying Index are the 10 largest companies by market capitalization included in the NASDAQ Internet Index that are incorporated in the U.S. The Chinese components of the Underlying Index are the 10 largest companies by market capitalization whose primary business includes the provision of internet-related services, as determined by Nasdaq, Inc., the provider of the Underlying Index, and that are: (1) incorporated or domiciled in China; and (2) either members of the NASDAQ Global Index or listed in the U.S.

The Fund may invest up to 20% of its assets in instruments that are not included in the Underlying Index, but that Wealthn LLC, the Fund’s investment adviser (‘‘Wealthn’’), or the Fund’s Sub-Adviser (as defined below), Vident Investment Advisory, LLC (“VIA”), believe will help the Fund track the Underlying Index. These investments may include equity securities and depositary receipts of issuers whose securities are not components of the Underlying Index, other investment companies (including ETFs) and cash or cash equivalents (including money market funds). The other investment companies in which the Fund may invest may be advised, sponsored or otherwise serviced by Wealthn, VIA and/or their affiliates.

Although the Fund reserves the right to “representative sample” the Underlying Index, the Fund expects to use a replication methodology to seek to track the Underlying Index.

As of September 30, 2019, the Underlying Index was comprised of 20 securities of companies with a market capitalization range of $6.42 billion to $858.68 billion and an average market capitalization of $179.90 billion. The Underlying Indexed is rebalanced and reconstituted quarterly.

The Fund is non-diversified. To the extent the Underlying Index is concentrated in a particular industry, the Fund is expected to be concentrated in that industry. As of September 30, 2019, issuers in the technology sector represented a significant portion (52.72%) of the Underlying Index. The Fund’s investments may appreciate or depreciate significantly in value over short periods of time.

Principal Risks

An investment in the Fund involves risk, including those described below. The principal risks of investing in the Fund listed below are presented in alphabetical order, and not in order of importance or potential exposure, to facilitate your ability to find particular risks and compare them with the risks of other funds. Each risk summarized below is considered a "principal risk" of investing in the Fund, regardless of the order in which it appears. There is no assurance that the Fund will achieve its investment objective. An investor may lose money by investing in the Fund.

China Risk. The value of the Fund’s investments in Chinese securities will be impacted by the economic, political, diplomatic, and social conditions within China and to be more volatile than the performance of more geographically diversified funds. China is generally considered an emerging market country and investments in Chinese securities carry the risks associated with emerging markets, as well as risks particular to the region. China may be subject to considerable degrees of economic, political and social instability. The economies, industries, and securities and currency markets of China may be adversely affected by slow economic activity worldwide, protectionist trade policies, dependence on exports and international trade, currency devaluations and other currency exchange rate fluctuations, restrictions on monetary repatriation, increasing competition from Asia’s low-cost emerging economies, environmental events and natural disasters that may occur in China, and military conflicts either in response to social unrest or with other countries. In addition, the tax laws and regulations in mainland China are subject to change, possibly with retroactive effect.

Over the last few decades, the Chinese government has undertaken reform of economic and market practices and has expanded the sphere of private ownership of property in China. However, Chinese markets generally continue to experience inefficiency, volatility and pricing anomalies resulting from governmental influence, a lack of publicly available information and/or political and social instability. Investments in Chinese issuers may be subject to the risk of expropriation and nationalization. The Chinese government may also impose capital controls, which could adversely affect the Fund, its ability to repatriate its investments and the value of the Fund’s investments. In additiosn, the Chinese government may intervene in currency markets, which could cause its currency, and therefore the value of the Fund’s investments in China, to depreciate. The Chinese economy is heavily reliant upon trade and export growth. Reduction in spending on Chinese products and services; further increases in trade restrictions, such as those resulting from the US-China trade dispute, or even the threat thereof; or a downturn in any of the economies of China’s key trading partners may negatively affect the Chinese economy and its issuers.

Concentration Risk. To the extent that the Fund’s investments are concentrated on a particular industry or group of industries, the Fund is subject to loss due to adverse occurrences that may affect that industry, group of industries or sector. Focusing on a particular industry or group of industries could increase the Fund’s volatility over the short term.

Communication Services Sector Risk. Companies in the communications sector may be affected by industry competition, substantial capital requirements, government regulation, cyclicality of revenues and earnings, obsolescence of communications products and services due to technological advancement, a potential decrease in the discretionary income of targeted individuals and changing consumer tastes and interests.

Consumer Discretionary Sector Risk. The consumer discretionary sector may be affected by changes in domestic and international economies, exchange and interest rates, competition, consumers’ disposable income, consumer preferences, consumer confidence, social trends and marketing campaigns. Success depends heavily on disposable

household income and consumer spending. Changes in demographics and consumer tastes can affect the demand for consumer products.

Technology Sector Risk. The value of stocks of technology companies and companies that rely heavily on technology is particularly vulnerable to rapid changes in technology product cycles, rapid product obsolescence, government regulation and competition, both domestically and internationally, including competition from competitors with lower production costs. Technology companies and companies that rely heavily on technology, especially those of smaller, less-seasoned companies, tend to be more volatile than the overall market.

Currency Risk and Exchange Risk. Securities in which the Fund invests, or to which it obtains exposure, may be denominated or quoted in currencies other than the U.S. dollar. Changes in foreign currency exchange rates will affect the value of these securities. Generally, when the U.S. dollar rises in value against a foreign currency, an investment in a security denominated in that currency loses value because the currency is worth fewer U.S. dollars. Foreign currencies also involve the risk that they will be devalued or replaced, adversely affecting the value of the Fund’s investments. Changes in currency exchange rates may also affect the profitability of issuers included in the Underlying Index.

Depositary Receipts Risk. The risks of investments in depositary receipts include those described in Foreign Investment Risk and Currency Risk. In addition, depositary receipts may not track the price of the underlying foreign securities, and their value may change materially at times when the U.S. markets are not open for trading.

Emerging Markets Risk. Investments in countries that are in the early stages of their industrial development involve exposure to economic structures that generally are less economically diverse and mature than those in the United States and to political systems that may be less stable. Investments in emerging markets may be subject to the risk of abrupt and severe price declines and their financial markets often lack liquidity. In addition, emerging market countries may be more likely than developed countries to experience rapid and significant adverse developments in their political or economic structures. Emerging market economies also may be overly reliant on particular industries, and more vulnerable to shifts in international trade, trade barriers, and other protectionist or retaliatory measures. Governments in many emerging market countries participate to a significant degree in their economies and securities markets. Some emerging market countries restrict foreign investments, impose high withholding or other taxes on foreign investments, impose restrictive exchange control regulations, or may nationalize or expropriate the assets of private companies. Emerging market countries also may be subject to high inflation and rapid currency devaluations and currency-hedging techniques may be unavailable in certain emerging market countries.

Equity Investing Risk. An investment in the Fund involves the risks involved with investing in equity securities, such as market fluctuations, changes in interest rates and perceived trends in stock prices. The values of equity securities could decline generally or could underperform other investments. In addition, securities may decline in value due to factors affecting a specific issuer, market or securities markets generally. In the event of liquidation, equity securities are generally subordinate in rank to debt and other securities of the same issuer.

ETF Risk. As an ETF, the Fund is subject to the following risks:

Authorized Participants Concentration Risk. The Fund may have a limited number of financial institutions that may act as Authorized Participants (“APs”). To the extent that those APs exit the business or are unable to process creation and/or redemption orders, Shares may trade at a discount to net asset value (or “NAV”) like closed-end fund shares and may face delisting from the Exchange.

Flash Crash Risk. Sharp price declines in securities owned by the Fund may trigger trading halts, which may result in the Fund’s shares trading in the market at an increasingly large discount to NAV during part (or all) of a trading day or cause the Fund itself to halt trading.

International Closed Market Trading Risk. Because certain of the Fund’s investments trade in markets that are closed when the Fund and Exchange are open, there are likely to be deviations between the current prices of such

investments and the prices at which such investments are marked for purposes of the Fund’s Intraday Indicative Value (“IIV”). As a result, Shares may appear to trade at a significant discount or premium to NAV.

Large Shareholder Risk. Certain shareholders may own a substantial amount of the Fund’s Shares. Redemptions by large shareholders could have a significant negative impact on the Fund. In addition, transactions by large shareholders may account for a large percentage of the trading volume on the Exchange and may, therefore, have a material upward or downward effect on the market price of the Shares.

Premium-Discount Risk. Shares may trade above or below their NAV. Accordingly, investors may pay more than NAV when purchasing Shares or receive less than NAV when selling Shares. The market prices of Shares will generally fluctuate in accordance with changes in NAV, changes in the relative supply of, and demand for, Shares, and changes in the liquidity, or the perceived liquidity, of the Fund’s holdings.

Secondary Market Trading Risk. Investors buying or selling Shares in the secondary market may pay brokerage commissions or other charges, which may be a significant proportional cost for investors seeking to buy or sell Shares. Although the Shares are listed on the Exchange, there can be no assurance that an active or liquid trading market for them will develop or be maintained or that the Shares will continue to be listed. In addition, trading in Shares on the Exchange may be halted.

Foreign Investment Risk. Returns on investments in foreign securities could be more volatile than, or trail the returns on, investments in U.S. securities. Exposures to foreign securities entail special risks, including due to: differences in information available about foreign issuers; differences in investor protection standards in other jurisdictions; capital controls risks, including the risk of a foreign jurisdiction imposing restrictions on the ability to repatriate or transfer currency or other assets; political, diplomatic and economic risks; regulatory risks; and foreign market and trading risks, including the costs of trading and risks of settlement in foreign jurisdictions. In addition, the Fund’s investments in securities denominated in other currencies could decline due to changes in local currency relative to the value of the U.S. dollar, which may affect the Fund’s returns.

Geographic Risk. The Fund expects to invest a significant portion of its assets in a few countries or geographic regions. Thus, there is a greater risk that economic, political, regulatory, diplomatic, social and environmental conditions in that particular country or geographic region may have a significant impact on the Fund’s performance and that the Fund’s performance will be more volatile than the performance of more geographically diversified funds. A natural or other disaster could occur in a geographic region in which the Fund invests, which could affect the economy or particular business operations of companies in the specific geographic region, causing an adverse impact on the Fund’s investments.

Internet Companies Risk. Investments in Internet companies may be volatile. Internet companies are subject to intense competition, the risk of product obsolescence, changes in consumer preferences and legal, regulatory and political changes. They are also especially at risk of hacking and other cybersecurity events. In addition, it can be difficult to adequately capture what qualifies as an Internet company.

Investment Risk. An investment in the Fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. When you sell your Shares, they could be worth less than what you paid for them.

Large Capitalization Company Risk. The Fund’s investments in large capitalization companies may underperform other segments of the market because they may be less responsive to competitive challenges and opportunities and unable to attain high growth rates during periods of economic expansion.

Liquidity Risk. Certain securities held by the Fund may be or become more difficult (or impossible) to buy or sell at the time and at the price the Fund would like due to a variety of factors. Liquidity events could potentially impact any security, but funds that invest in foreign or emerging market securities generally are subject to greater liquidity risk than funds that do not invest in these types of securities.

Management Risk. If the Fund uses a representative sampling strategy to invest in what it believes to be a representative sample of the component securities of the Underlying Index, it may not track the Underlying Index with the same degree of accuracy as would an investment vehicle replicating the entire Underlying Index. The Fund is subject to the risk that VIA’s security selection process may not produce the intended results.

Market Events Risk. Turbulence in the financial markets and reduced liquidity in the equity markets may negatively affect issuers, which could have an adverse effect on the Fund. In addition, there is a risk that policy changes by the U.S. Government and/or Federal Reserve, such as increasing interest rates, could cause increased volatility in financial markets and higher levels of Fund redemptions, which could have a negative impact on the Fund.

Non-Diversified Fund Risk. Because the Fund is non-diversified and may invest a greater portion of its assets in fewer issuers than a diversified fund, changes in the market value of a single portfolio holding could cause greater fluctuations in the Fund’s share price than would occur in a diversified fund. This may increase the Fund’s volatility and cause the performance of a single portfolio holding or a relatively small number of portfolio holdings to have a greater impact on the Fund’s performance.

Operational and Cybersecurity Risk. The Fund, Wealthn, VIA, the Fund’s service providers and your ability to transact with the Fund may be prone to operational and information security risks resulting from cybersecurity incidents. Cybersecurity incidents may adversely impact the Fund’s business operations by subjecting the Fund to regulatory fines or financial losses. Cybersecurity incidents could also affect issuers of securities in which the Fund invests, leading to a significant loss of value.

Other Investment Company Risks. Investing in another investment company exposes the Fund to all the risks of that investment company and, in general, subjects it to a pro rata portion of the other investment company’s fees and expenses. As a result, an investment by the Fund in an ETF or investment company could cause the Fund’s operating expenses to be higher and, in turn, performance to be lower than if the Fund were to invest directly in the securities underlying the ETF or investment company.

Passive Investment Risk. The Fund is not actively managed, does not seek to “beat” the Underlying Index and does not take temporary defensive positions when markets decline. Therefore, the Fund may not sell a security due to current or projected underperformance of a security, industry or sector. There is no guarantee that the Underlying Index will create the desired exposure. The Underlying Index may not contain an appropriate mix of securities, but the Fund’s investment objective and principal investment strategies impose limits on the Fund’s ability to invest in securities not included in the Underlying Index.

Small Fund Risk. The Fund is small and does not yet have a significant number of shares outstanding. Small funds are at greater risk than larger funds of wider bid-ask spreads for its shares, trading at a greater premium or discount to NAV, liquidation and/or a stop to trading.

Tax Risk. In order to qualify for the favorable tax treatment generally available to regulated investment companies, the Fund must satisfy certain income, asset diversification and distribution requirements each year. If the Fund were to fail to qualify as a regulated investment company, it would be taxed in the same manner as an ordinary corporation, and distributions to its shareholders would not be deductible by the Fund in computing its taxable income, which would adversely affect the Fund’s performance.

Tracking Error Risk. Tracking error is the divergence of the Fund’s performance from that of the Underlying Index. The performance of the Fund may diverge from that of its Underlying Index because of a number of reasons, such as the use of representative sampling, transaction costs, the Fund’s holding of cash, differences in accrual of dividends, changes to the Underlying Index, tax considerations, rebalancing, or the need to meet new or existing regulatory requirements. Unlike the Fund, the returns of the Underlying Index are not reduced by investment and other operating expenses, including the trading costs associated with implementing changes to its portfolio of investments. Tracking error risk may be heightened during times of market volatility or other unusual market conditions. To the extent that the Fund calculates its NAV based on fair value prices and the value of the Underlying Index is based on securities’

closing prices (i.e., the value of the Underlying Index is not based on fair value prices), the Fund’s ability to track the Underlying Index may be adversely affected. For tax efficiency purposes, the Fund may sell certain securities to realize losses, which will result in a deviation from the Underlying Index.

Valuation Risk. The sale price the Fund could receive for a security may differ from the Fund’s valuation of the security and may differ from the value used by the Underlying Index, particularly for securities that trade in low volume or volatile markets or that are valued using a fair value methodology. The Fund relies on various sources to calculate its NAV. The information may be provided by third parties that are believed to be reliable, but the information may not be accurate due to errors by such pricing sources, technological issues, or otherwise.

Volatility Risk. Volatility is the characteristic of a security, an index or a market to fluctuate significantly in price within a short time period. The Fund may have investments that appreciate or depreciate significantly in value over short periods of time. This may cause the Fund’s net asset value per share to experience significant increases or declines in value over short periods of time, however, all investments long- or short-term are subject to risk of loss.

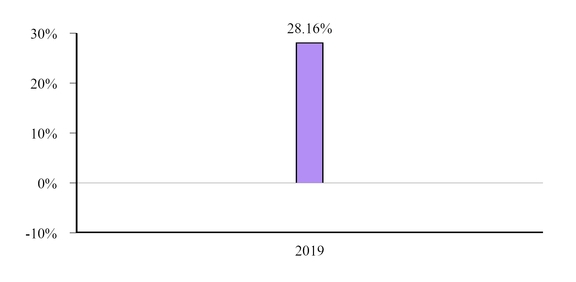

Performance

The bar chart and performance table below illustrate the variability of the Fund’s returns and the risks of an investment in the Fund by showing the performance of the Fund for the past calendar year and by showing how the Fund’s average annual returns compare with those of a broad measure of market performance as well as the Fund’s Underlying Index. Past performance (before and after taxes) does not necessarily indicate how the Fund will perform in the future. Updated performance information is available at www.upfintecham.com.

Calendar Year Returns as of December 31

During the period of time shown in the bar chart, the highest return for a calendar quarter was 22.78% for the quarter ended March 31, 2019, and the lowest return for a calendar quarter was -4.35% for the quarter ended September 30, 2019.

Average Annual Total Returns

(For the periods ended December 31, 2019)

1 Year | Since Inception (11/6/2018) | |||

Return Before Taxes | 28.16 | % | 14.72 | % |

Return After Taxes on Distributions | 28.16 | % | 14.72 | % |

Return After Taxes on Distributions and Sale of Fund Shares | 16.67 | % | 11.24 | % |

Nasdaq 100 Total Return Index (reflects no deduction for fees, expenses, or taxes) | 39.46 | % | 22.76 | % |

Nasdaq China US Internet Tiger Index (reflects no deduction for fees, expenses, or taxes) | 28.95 | % | 15.37 | % |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown, and after-tax returns shown are not relevant to investors who are exempt from tax or hold their Fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts.

Investment Adviser

Wealthn LLC serves as the investment adviser of the Fund (“Adviser”).

Investment Sub-Adviser

Vident Investment Advisory, LLC (“Sub-Adviser”) serves as the investment Sub-Adviser of the Fund.

Portfolio Managers

Denise Krisko, CFA, President of the Sub-Adviser, has served as the lead portfolio manager of the Fund since inception in November 2018. Habib Moudachirou and Rafael Zayas, CFA, Senior Portfolio Managers at the Sub-Adviser, have also served as portfolio managers of the Fund since inception in November 2018.

Purchase and Sale of Shares

The Fund issues and redeems Shares on a continuous basis only in large blocks of Shares, typically 50,000 Shares each, called “Creation Units.” Creation Units are issued and redeemed in-kind for securities and/or for cash. Individual Shares may only be purchased and sold in secondary market transactions through brokers. Once created, individual Shares generally trade in the secondary market at market prices that change throughout the day. Market prices of Shares may be greater or less than their NAV.

Tax Information

Distributions you receive from the Fund are generally taxable to you as ordinary income for federal income tax purposes, except that distributions reported by the Fund as “capital gain dividends” are taxed to you as long-term capital gains, and distributions may also be subject to state and/or local taxes. Fund distributions generally are not taxable to you if you are investing through a tax-advantaged retirement plan account or are a tax-exempt investor, although you may be taxed on withdrawals from your tax-advantaged account.

Purchases Through Broker-Dealers and Other Financial Intermediaries

If you purchase Shares through a broker-dealer or other financial intermediary, the Fund and its related companies may pay the intermediary for the sale of Shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend Shares over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- CIDARA Therapeutics ALERT: Bragar Eagel & Squire, P.C. is Investigating Cidara Therapeutics, Inc. on Behalf of Cidara Therapeutics Stockholders and Encourages Investors to Contact the Firm

- NorthStar Gaming Announces Extension of Strategic Marketing Agreement and Short-Term Financing from Playtech

- International Horticultural Exhibition 2024 Chengdu Opens

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share