Form 497K Invesco Exchange-Traded

December 20, 2019 3:24 PM EST

| Summary Prospectus | December 20, 2019 | |||

|

Invesco S&P High Income Infrastructure ETF NYSE Arca, Inc. | |||

Before you invest, you may wish to review the Fund’s prospectus, which contains more information about the Fund and its risks. You can find the Fund’s prospectus, reports to shareholders, and other information about the Fund online at www.invesco.com/etfprospectus. You can also get this information at no cost by calling Invesco Distributors, Inc. at (800) 983-0903 or by sending an e-mail request to [email protected]. The Fund’s prospectus and statement of additional information, both dated December 20, 2019 (as each may be amended or supplemented), are incorporated by reference into this Summary Prospectus.

Notification of electronic delivery of shareholder materials

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. If you hold accounts through a financial intermediary, you may contact your financial intermediary to enroll in electronic delivery. Please note that not all financial intermediaries may offer this service.

You may elect to receive all future reports in paper free of charge. If you hold accounts through a financial intermediary, you can follow the instructions included with this disclosure, if applicable, or contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. Please note that not all financial intermediaries may offer this service. Your election to receive reports in paper will apply to all funds held with your financial intermediary.

Investment Objective

The Invesco S&P High Income Infrastructure ETF (the “Fund”) seeks to track the investment results (before fees and expenses) of the S&P High Income Infrastructure Index (the “Underlying Index”).

Fund Fees and Expenses

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund (“Shares”). Investors may pay brokerage commissions on their purchases and sales of Shares, which are not reflected in the table or the example below.

| Annual Fund Operating Expenses | ||||

| (expenses that you pay each year as a percentage of the value of your investment) |

||||

| Management Fees | 0.45% | |||

| Other Expenses(1) | 0.00% | |||

| Total Annual Fund Operating Expenses | 0.45% | |||

| (1) | Other Expenses do not reflect any extraordinary expenses incurred during the most recent fiscal period, such as the costs associated with a proxy statement of the Fund. Had these expenses been included, Other Expenses would have been 0.01%. |

Example

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other funds.

This example assumes that you invest $10,000 in the Fund for the time periods indicated and then sell all of your Shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. This example does not

include the brokerage commissions that investors may pay to buy and sell Shares. Although your actual costs may be higher or lower, your costs, based on these assumptions, would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||

| $46 | $144 | $252 | $567 | |||

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it purchases and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate will cause the Fund to incur additional transaction costs and may result in higher taxes when Shares are held in a taxable account. These costs, which are not reflected in Total Annual Fund Operating Expenses or in the example, may affect the Fund’s performance. During the most recent fiscal year, the portfolio turnover rate of the Fund was 41% of the average value of the portfolio.

Principal Investment Strategies

The Fund generally will invest at least 90% of its total assets in the securities that comprise the Underlying Index, as well as American depositary receipts (“ADRs”) and global depositary receipts (“GDRs”) that represent securities in the Underlying Index.

Strictly in accordance with its guidelines and mandated procedures, S&P Dow Jones Indices LLC (“S&P DJI” or the “Index Provider”) compiles, maintains and calculates the Underlying Index, which is designed to measure the performance of 50 high-yielding global equity securities of companies that engage in various infrastructure-related sub-industries. Underlying Index

| 1 | GHII Invesco S&P High Income Infrastructure ETF | invesco.com/ETFs |

P-GHII-SUMPRO-1

constituents must be constituents of the S&P Global BMI Index and meet size, listing and liquidity requirements.

Underlying Index constituents must be equity securities of companies classified in one of the infrastructure clusters (the “Infrastructure Clusters”), as determined by the S&P Dow Jones Index Group, using the Global Industry Classification Standard (“GICS®”) sub-industry classifications as follows:

Energy Infrastructure Cluster:

Oil & Gas Storage & Transportation Sub-Industry

Transportation Infrastructure Cluster:

Airport Services Sub-Industry

Highway & Railtracks Sub-Industry

Marine Ports & Services Sub-Industry

Utilities Infrastructure Cluster:

Electric Utilities Sub-Industry

Gas Utilities Sub-Industry

Multi Utilities Sub-Industry

Water Utilities Sub-Industry

Renewable Electricity Sub-Industry

Independent Power Producer & Energy Traders Sub-Industry

Securities in the Infrastructure Clusters must have a float-adjusted market capitalization (i.e., a market capitalization that is calculated based on the number of shares that are readily available in the market rather than all shares outstanding) greater than $250 million, a three-month average daily value traded of $1 million or higher and be listed on a developed market stock exchange. The top 50 highest-yielding securities that meet these criteria (ranked by 12-month dividend yield) are selected for inclusion in the Underlying Index.

As of August 31, 2019, the Underlying Index was comprised of 50 securities with market capitalizations ranging from $164.4 million to $67.8 billion.

The Fund generally will invest in all of the securities comprising the Underlying Index in proportion to their weightings in the Underlying Index.

The Fund is “non-diversified” and, therefore, is not required to meet certain diversification requirements under the Investment Company Act of 1940, as amended (the “1940 Act”).

Concentration Policy. The Fund will concentrate its investments (i.e., invest more than 25% of the value of its net assets) in securities of issuers in any one industry or group of industries only to the extent that the Underlying Index reflects a concentration in that industry or group of industries. The Fund will not otherwise concentrate its investments in securities of issuers in any one industry or group of industries. As of August 31, 2019, the Fund had significant exposure to the energy and utilities sectors. The Fund’s portfolio holdings, and the extent to which it concentrates, are likely to change over time.

Principal Risks of Investing in the Fund

The following summarizes the principal risks of the Fund.

The Shares will change in value, and you could lose money by investing in the Fund. The Fund may not achieve its investment objective.

ADR and GDR Risk. ADRs are certificates that evidence ownership of shares of a foreign issuer and are alternatives to purchasing underlying foreign securities directly in their national markets and currencies. GDRs are certificates issued by an international bank that generally are traded and denominated in the currencies of countries other than the home country of the issuer of the underlying shares. ADRs and GDRs may be subject to certain of the risks associated with direct investments in the securities of foreign companies, such as currency, political, economic and market risks. Moreover, ADRs and GDRs may not track the price of the underlying foreign securities on which they are based, and their value may change materially at times when U.S. markets are not open for trading.

Authorized Participant Concentration Risk. Only authorized participants (“APs”) may engage in creation or redemption transactions directly with the Fund. The Fund has a limited number of institutions that may act as APs and such APs have no obligation to submit creation or redemption orders. Consequently, there is no assurance that APs will establish or maintain an active trading market for the Shares. This risk may be heightened to the extent that securities held by the Fund are traded outside a collateralized settlement system. In that case, APs may be required to post collateral on certain trades on an agency basis (i.e., on behalf of other market participants), which only a limited number of APs may be able to do. In addition, to the extent that APs exit the business or are unable to proceed with creation and/or redemption orders with respect to the Fund and no other AP is able to step forward to create or redeem Creation Units (as defined below), this may result in a significantly diminished trading market for Shares, and Shares may be more likely to trade at a premium or discount to the Fund’s net asset value (“NAV”) and to face trading halts and/or delisting. Investments in non-U.S. securities, which may have lower trading volumes, may increase this risk.

Currency Risk. Because the Fund’s NAV is determined in U.S. dollars, the Fund’s NAV could decline if the currency of a non-U.S. market in which the Fund invests depreciates against the U.S. dollar. Generally, an increase in the value of the U.S. dollar against a foreign currency will reduce the value of a security denominated in that foreign currency, thereby decreasing the Fund’s overall NAV. Exchange rates may be volatile and may change quickly and unpredictably in response to both global economic developments and economic conditions, causing an adverse impact on the Fund. As a result, investors have the potential for losses regardless of the length of time they intend to hold Shares.

Equity Risk. Equity risk is the risk that the value of equity securities, including common stocks, may fall due to both changes in general economic conditions that impact the market as a whole, as well as factors that directly relate to a specific company or its industry. Such general economic conditions include changes in interest rates, periods of market turbulence or instability, or

| 2 | GHII Invesco S&P High Income Infrastructure ETF | invesco.com/ETFs |

general and prolonged periods of economic decline and cyclical change. It is possible that a drop in the stock market may depress the price of most or all of the common stocks that the Fund holds. In addition, equity risk includes the risk that investor sentiment toward one or more industries will become negative, resulting in those investors exiting their investments in those industries, which could cause a reduction in the value of companies in those industries more broadly. The value of a company’s common stock may fall solely because of factors, such as an increase in production costs, that negatively impact other companies in the same region, industry or sector of the market. A company’s common stock also may decline significantly in price over a short period of time due to factors specific to that company, including decisions made by its management or lower demand for the company’s products or services. For example, an adverse event, such as an unfavorable earnings report or the failure to make anticipated dividend payments, may depress the value of common stock.

Foreign Investment Risk. Investments in the securities of non-U.S. issuers involve risks beyond those associated with investments in U.S. securities. Foreign securities may have relatively low market liquidity, greater market volatility, decreased publicly available information, and less reliable financial information about issuers, and inconsistent and potentially less stringent accounting, auditing and financial reporting requirements and standards of practice comparable to those applicable to domestic issuers. Foreign securities also are subject to the risks of expropriation, nationalization, political instability or other adverse political or economic developments and the difficulty of enforcing obligations in other countries. Investments in foreign securities also may be subject to dividend withholding or confiscatory taxes, currency blockage and/or transfer restrictions and higher transactional costs. The Fund may invest in securities denominated in foreign currencies, fluctuations in the value of the U.S. dollar relative to the values of other currencies may adversely affect investments in foreign securities and may negatively impact the Fund’s returns.

Geographic Concentration Risk. A natural or other disaster could occur in a geographic region in which the Fund invests, which could affect the economy or particular business operations of companies in that specific geographic region and adversely impact the Fund’s investments in the affected region.

Index Risk. Unlike many investment companies, the Fund does not utilize an investing strategy that seeks returns in excess of its Underlying Index. Therefore, the Fund would not necessarily buy or sell a security unless that security is added or removed, respectively, from its Underlying Index, even if that security generally is underperforming.

Industry Concentration Risk. In following its methodology, the Underlying Index from time to time may be concentrated to a significant degree in securities of issuers operating in a single industry or industry group. To the extent that the Underlying Index concentrates in the securities of issuers in a particular industry or industry group, the Fund will also concentrate its investments to approximately the same extent. By concentrating its investments in an industry or industry group, the Fund may face more risks than if it were diversified broadly over numerous

industries or industry groups. Such industry-based risks, any of

which may adversely affect the companies in which the Fund invests, may include, but are not limited to, legislative or regulatory changes, adverse market conditions and/or increased competition within the industry or industry group. In addition, at times, such industry or industry group may be out of favor and underperform other industries, industry groups or the market as a whole.

Energy Sector Risk. Changes in worldwide energy prices, exploration and production spending may adversely affect companies in the energy sector. In addition, changes in government regulation, world events and economic conditions can affect these companies. These companies also are at risk of civil liability from accidents resulting in injury, loss of life or property, pollution or other environmental damage claims and risk of loss from terrorism and natural disasters. Commodity price volatility, changes in exchange rates, imposition of import controls, increased competition, depletion of resources, development of alternative energy sources, technological developments and labor relations also could affect companies in this sector.

Infrastructure Risk. Companies within one of the Infrastructure Clusters that comprise the Underlying Index are subject to a variety of factors that may adversely affect their business or operations, including high interest costs in connection with capital construction and improvement programs, high leverage, costs associated with compliance with and changes in environmental and other regulations, difficulty in raising capital in adequate amounts and on reasonable terms in periods of high inflation and unsettled capital markets or government budgetary constraints that impact publicly funded projects, the effects of economic slowdown or recession and surplus capacity, increased competition from other providers of services, uncertainties concerning the availability of fuel at reasonable prices, the effects of energy conservation policies and other factors.

Utilities Sector Risk. Companies in the utilities sector are subject to a variety of factors that may adversely affect their business or operations, including high interest costs associated with capital construction and improvement programs; difficulty in raising adequate capital in periods of high inflation and unsettled capital markets; governmental regulation of rates the issuer can charge to customers; costs associated with compliance with environmental and other regulations; effects of economic slowdowns and surplus capacity; increased competition; and potential losses resulting from a developing deregulatory environment.

Issuer-Specific Changes Risk. The value of an individual security or particular type of security may be more volatile than the market as a whole and can perform differently from the value of the market as a whole.

Market Risk. Securities in the Underlying Index are subject to market fluctuations. You should anticipate that the value of the Shares will decline, more or less, in correlation with any decline in value of the securities in the Underlying Index.

Market Trading Risk. The Fund faces numerous market trading risks, including the potential lack of an active market for the

| 3 | GHII Invesco S&P High Income Infrastructure ETF | invesco.com/ETFs |

Shares, losses from trading in secondary markets, and disruption in the creation/redemption process of the Fund. Any of these factors may lead to the Shares trading at a premium or discount to the Fund’s NAV.

Non-Correlation Risk. The Fund’s return may not match the return of the Underlying Index for a number of reasons. For example, the Fund incurs operating expenses not applicable to the Underlying Index, and incurs costs in buying and selling securities, especially when rebalancing the Fund’s securities holdings to reflect changes in the composition of the Underlying Index. In addition, the performance of the Fund and the Underlying Index may vary due to asset valuation differences and differences between the Fund’s portfolio and the Underlying Index resulting from legal restrictions, costs or liquidity constraints.

Non-Diversified Fund Risk. Because the Fund is non-diversified and can invest a greater portion of its assets in securities of individual issuers than a diversified fund changes in the market value of a single investment could cause greater fluctuations in Share price than would occur in a diversified fund. This may increase the Fund’s volatility and cause the performance of a relatively small number of issuers to have a greater impact on the Fund’s performance.

Operational Risk. The Fund is exposed to operational risks arising from a number of factors, including, but not limited to, human error, processing and communication errors, errors of the Fund’s service providers, counterparties or other third-parties, failed or inadequate processes and technology or systems failures. The Fund and the investment adviser seek to reduce these operational risks through controls and procedures. However, these measures do not address every possible risk and may be inadequate to address these risks.

Small- and Mid-Capitalization Company Risk. Investing in securities of small- and mid-capitalization companies involves greater risk than customarily is associated with investing in larger, more established companies. These companies’ securities may be more volatile and less liquid than those of more established companies. These securities may have returns that vary, sometimes significantly, from the overall securities market.

Often small- and mid-capitalization companies and the industries in which they focus are still evolving and, as a result, they may be more sensitive to changing market conditions.

Valuation Risk. Financial information related to securities of non-U.S. issuers may be less reliable than information related to securities of U.S. issuers, which may make it difficult to obtain a current price for a non-U.S. security held by the Fund. In certain circumstances, market quotations may not be readily available for some Fund securities, and those securities may be fair valued. The value established for a security through fair valuation may be different from what would be produced if the security had been valued using market quotations. Fund securities that are valued using techniques other than market quotations, including “fair valued” securities, may be subject to greater fluctuation in their value from one day to the next than would be the case if market quotations were used. In addition, there is no assurance that the Fund could sell a portfolio security for the value established for it

at any time, and it is possible that the Fund would incur a loss because a security is sold at a discount to its established value.

Valuation Time Risk. The Fund will invest in common stock of foreign issuers and, because foreign exchanges may be open on days when the Fund does not price its Shares, the value of those non-U.S. securities in the Fund’s portfolio may change on days when you will not be able to purchase or sell your Shares. As a result, trading spreads and the resulting premium or discount on the Shares may widen, and, therefore, increase the difference between the market price of the Shares and the NAV of such Shares.

Performance

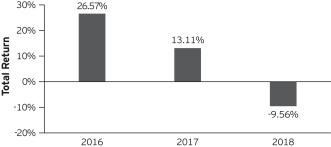

The bar chart below shows how the Fund has performed. The table below the bar chart shows the Fund’s average annual total returns (before and after taxes). The bar chart and table provide an indication of the risks of investing in the Fund by showing how the Fund’s total returns have varied from year to year and by showing how the Fund’s average annual total returns compared with a broad measure of market performance and an additional index with characteristics relevant to the Fund. Although the information shown in the bar chart and the table gives you some idea of the risks involved in investing in the Fund, the Fund’s past performance (before and after taxes) is not necessarily indicative of how the Fund will perform in the future.

The Fund is the successor to the investment performance of the Guggenheim S&P High Income Infrastructure ETF (the “Predecessor Fund”) as a result of the reorganization of the Predecessor Fund into the Fund, which was consummated after the close of business on May 18, 2018. Accordingly, the performance information shown below for periods ended on or prior to May 18, 2018 is that of the Predecessor Fund. Updated performance information is available online at www.invesco.com/ETFs.

Annual Total Returns—Calendar Years

| Best Quarter | Worst Quarter | |

| 12.02% (2nd Quarter 2016) | (8.17)% (4th Quarter 2018) |

The Fund’s year-to-date total return for the nine months ended September 30, 2019 was 19.06%.

Average Annual Total Returns for the Periods Ended December 31, 2018

After-tax returns in the table below are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from

| 4 | GHII Invesco S&P High Income Infrastructure ETF | invesco.com/ETFs |

those shown, and after-tax returns shown are not relevant to investors who hold Shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts.

| 1 Year | Since Inception (02/11/15) |

|||||||

| Return Before Taxes | (9.56 | )% | 3.87 | % | ||||

| Return After Taxes on Distributions | (10.52 | )% | 1.79 | % | ||||

| Return After Taxes on Distributions and Sale of Fund Shares | (4.73 | )% | 2.20 | % | ||||

| S&P High Income Infrastructure Index (Net) (reflects reinvested dividends net of withholding taxes but reflects no deduction for fees, expenses or taxes) |

(10.00 | )% | 3.52 | % | ||||

| S&P Global BMI Index (Net) (reflects reinvested dividends net of withholding taxes but reflects no deduction for fees, expenses or taxes) |

(10.15 | )% | 4.19 | % | ||||

Management of the Fund

Investment Adviser. Invesco Capital Management LLC (the “Adviser”).

Portfolio Managers. The following individuals are responsible jointly and primarily for the day-to-day management of the Fund’s portfolio:

| Name | Title with Adviser/Trust | Date Began Managing the Fund | ||

| Peter Hubbard | Director of Portfolio Management of the Adviser and Vice President of the Trust | May 2018 | ||

| Michael Jeanette | Senior Portfolio Manager of the Adviser | May 2018 | ||

| Tony Seisser | Portfolio Manager of the Adviser | May 2018 | ||

| Pratik Doshi | Portfolio Manager of the Adviser | December 2019 |

Purchase and Sale of Shares

The Fund issues and redeems Shares at NAV only with APs and only in large blocks of 50,000 Shares (each block of Shares is called a “Creation Unit”), or multiples thereof (“Creation Unit Aggregations”), generally in exchange for the deposit or delivery of a basket of securities. However, the Fund also reserves the right to permit or require Creation Units to be issued in exchange for cash. Except when aggregated in Creation Units, the Shares are not redeemable securities of the Fund.

Individual Shares may be purchased and sold only on a national securities exchange through brokers. Shares are listed for trading on NYSE Arca, Inc. and because the Shares will trade at market prices rather than NAV, Shares may trade at prices greater than NAV (at a premium), at NAV, or less than NAV (at a discount).

Tax Information

The Fund’s distributions generally are taxed as ordinary income, capital gains, or some combination of both, unless you are investing through a tax-advantaged arrangement, such as a 401(k) plan or an individual retirement account, in which case your distributions may be taxed as ordinary income when withdrawn from such account.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund’s distributor or its related companies may pay the intermediary for certain Fund-related activities, including those that are designed to make the intermediary more knowledgeable about exchange traded products, such as the Fund, as well as for marketing, education or other initiatives related to the sale or promotion of Fund shares. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson or financial adviser to recommend the Fund over another investment. Ask your salesperson or financial adviser or visit your financial intermediary’s web-site for more information.

| 5 | GHII Invesco S&P High Income Infrastructure ETF | invesco.com/ETFs |

P-GHII-SUMPRO-1

FREE Breaking News Alerts from StreetInsider.com!

StreetInsider.com Top Tickers, 4/19/2024

- Nasdaq, S&P tumble as Netflix, chip stocks drag; AmEx boosts Dow

- Sony/Apollo bid for Paramount could be worth as much as $29 billion - Source

- Netflix Q1 earnings top estimates on blowout subscriber growth

- Wall St indexes split, Treasuries dip amid earnings, geopolitical crosscurrents

- Gold prices rally past $2,400 on reports of Israel strikes on Iran

- Tritium DCFC Limited (DCFC): Three Australian subsidiaries were determined to be insolvent or likely to become insolvent

- Hasbro (HAS) Announces Resignation of Cynthia Williams, President of Wizards of the Coast and Hasbro Gaming

- Jabil falls after placing CEO on paid leave amid internal investigation

- Frontier Communications (FYBR) says third party had gained unauthorized access to portions of its information technology environment

- Ibotta (IBTA) Prices 6.56M Share IPO at $88/sh

- Midday movers: Netflix, Super Micro fall; Paramount Global gains

- After-hours movers: Netflix, Intuitive Surgical, Nordstrom, KB Home

- Midday movers: Tesla, Blackstone, Las Vegas Sands fall; DR Horton rises

- After-hours movers: Alcoa rises; Equifax and Las Vegas Sands fall

- Midday movers: Travelers, JB Hunt fall; United Airlines rises

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- RE Royalties Publishes Green Bond Framework and Report, Assessed as Dark Green, and Announces Investor Appreciation Day

- Athabasca Minerals Inc. Announces Court Approval of Reorganization and Delisting From TSX Venture Exchange

- Six Flags Sets Date to Announce First Quarter 2024 Earnings

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share