Form 497K GOLDMAN SACHS TRUST

March 30, 2021 6:01 PM EDTSummary

Prospectus

March 30, 2021

Goldman Sachs MLP Energy Infrastructure Fund

Class

P: GMNPX

Before you invest, you may want to review the Goldman Sachs

MLP Energy Infrastructure Fund (the “Fund”) Prospectus, which contains more information about the Fund and its risks. You can find the Fund’s Prospectus, reports to shareholders and other information about the Fund online at https://www.gsam.com/content/gsam/us/en/individual/literature-and-forms/literature.html. You can also get this information at no cost by calling 800-621-2550 or by sending an e-mail request to

[email protected]. The Fund’s Prospectus and Statement of Additional Information (“SAI”), both dated March 30, 2021, are incorporated by reference into this Summary Prospectus.

| Investment Objective |

The Goldman

Sachs MLP Energy Infrastructure Fund (the “Fund”) seeks total return through current income and capital appreciation.

| Fees and Expenses of the Fund |

This table describes the fees and expenses that you

may pay if you buy, hold and sell shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the table and Example below.

Annual Fund Operating Expenses

(expenses that you pay each year as a

percentage of the value of your investment)

| Class P | |

| Management Fees | 0.98% |

| Other Expenses | 0.12% |

| Deferred/Current Income Tax Expenses1 | 1.15% |

| Total Annual Fund Operating Expenses | 2.25% |

| Expense Limitation2 | (0.03%) |

| Total Annual Fund Operating Expenses After Expense Limitation | 2.22% |

| 1 | The Fund accrues deferred tax liability/benefit for its future tax liability associated with the capital appreciation of its investments, distributions it receives on interests of master limited partnerships considered to be a return of capital, and for any net operating gains. The Fund’s accrued deferred tax liability, if any, is reflected each day in the Fund’s net asset value (“NAV”) per share. The Fund’s deferred tax liability/benefit will depend upon income, gains, losses, and deductions the Fund is allocated from its master limited partnership investments and on the Fund’s realized and unrealized gains and losses, and may vary greatly from year to year. Therefore, any estimate of deferred tax liability/benefit cannot be reliably predicted from year to year. |

| 2 | The Investment Adviser has agreed to reduce or limit "Other Expenses" (excluding acquired fund fees and expenses, transfer agency fees and expenses, service fees, taxes, interest, brokerage fees, expenses of shareholder meetings, litigation and indemnification, and extraordinary expenses) to 0.064% of the Fund's average daily net assets. This arrangement will remain in effect through March 30, 2022, and prior to such date the Investment Adviser may not terminate the arrangement without the approval of the Board of Trustees. |

| Expense Example |

This Example is

intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in Class

P Shares of the Fund for the time periods indicated and then redeem all of your Class P Shares at the end of those periods. The Example also assumes that your

investment has a 5% return each year and that the Fund’s

operating expenses remain the same . Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |

| Class P Shares | $225 | $700 | $1,202 | $2,583 |

2 Summary

Prospectus — Goldman Sachs MLP Energy Infrastructure Fund

| Portfolio Turnover |

The Fund pays

transaction costs when it buys and sells securities or instruments (i.e., “turns over” its portfolio). A high rate of portfolio turnover may result in increased transaction costs, including

brokerage commissions, which must be borne by the Fund and its shareholders. High portfolio turnover may result in the Fund’s recognition of gains (losses) that will increase (decrease) the Fund’s tax liability and thereby impact the

amount of the Fund’s after-tax distributions. In addition, high portfolio turnover may increase the Fund’s current and accumulated earnings and profits, resulting in a greater portion of the Fund’s distributions being treated as

taxable dividends for federal income tax purposes. These costs are not reflected in the annual fund operating expenses or in the expense example above, but are reflected in the Fund’s performance. The Fund’s portfolio turnover rate for

the fiscal year ended November 30, 2020 was 139% of the average value of its portfolio.

| Principal Strategy |

The Fund

invests, under normal circumstances, at least 80% of its net assets plus any borrowings for investment purposes (measured at the time of purchase) (“Net Assets”) in U.S. and non-U.S. equity or fixed income securities issued by energy

infrastructure companies, including master limited partnerships (“MLPs”) and “C” corporations (“C-Corps”). The Fund’s investments in MLPs will consist of at least 25% of the Fund’s total assets as

measured at the time of purchase. The Fund intends to concentrate its investments in the energy sector.

For purposes of the Fund’s 80% policy discussed

above, the Fund’s investments in energy infrastructure companies include U.S. and non-U.S. issuers that: (i) are classified by a third party as operating within the oil and gas storage and transportation sub-industries; (ii) are part of the

Fund’s stated benchmark; or (iii) have at least 50% of their assets, income, sales or profits committed to, or derived from, traditional or alternative midstream (energy infrastructure) businesses, which include businesses that are engaged in

the treatment, gathering, compression, processing, transportation, transmission, fractionation, storage, terminalling, wholesale marketing, liquefaction/regasification of natural gas, natural gas liquids, crude oil, refined products or other energy

sources as well as businesses engaged in owning, storing and transporting alternative energy sources, such as renewables (wind, solar, hydrogen, geothermal, biomass) and alternative fuels (ethanol, hydrogen, biodiesel).

The Fund’s MLP investments may include MLPs

structured as limited partnerships (“LPs”) or limited liability companies (“LLCs”); MLPs that are taxed as C-Corps; institutional units (“I-Units”) issued by MLP affiliates; private investments in public equities

(“PIPEs”) issued by MLPs; and other U.S. and non-U.S. equity and fixed income securities and derivative instruments, including pooled investment vehicles and exchange-traded notes (“ETNs”), that provide exposure to

MLPs.

The Fund may also invest up to 20% of its

Net Assets in non-energy infrastructure investments, including equity and fixed income securities of U.S. and non-U.S. companies. Such investments may include issuers in the upstream and downstream sectors of the energy value chain. Upstream energy

companies are primarily engaged in the exploration, recovery, development and production of crude oil, natural gas and natural gas liquids. Downstream energy companies are primarily engaged in the refining and retail distribution of natural gas

liquids and crude oil.

The Fund’s

investments may be of any credit quality, duration or capitalization size. The Fund may also invest in derivatives, including options, futures, forwards, swaps, options on swaps, structured

securities and other derivative instruments. While the Fund may

invest in derivatives for hedging purposes, the Fund generally does not intend to hedge its exposures. The Fund’s investments in derivatives, pooled investment vehicles, and other investments are counted towards the Fund’s 80% policy to

the extent they have economic characteristics similar to the investments included within that policy. The Fund may also invest in privately held companies and companies that only recently began to trade publicly. The Fund may invest in stock,

warrants and other securities of special purpose acquisition companies (“SPACs”).

The Fund is treated as a regular corporation, or

“C” corporation, for U.S. federal income tax purposes. Accordingly, unlike traditional open-end mutual funds, the Fund is subject to U.S. federal income tax on its taxable income at the rates applicable to corporations (at a rate of 21%)

as well as state and local income taxes.

THE

FUND IS NON-DIVERSIFIED UNDER THE INVESTMENT COMPANY ACT OF 1940, AS AMENDED (“INVESTMENT COMPANY ACT”), AND MAY INVEST A LARGER PERCENTAGE OF ITS ASSETS IN FEWER ISSUERS THAN DIVERSIFIED MUTUAL FUNDS.

The Fund’s benchmark index is the Alerian MLP

Index (Total Return, Unhedged, USD). The Alerian MLP Index (Total Return, Unhedged, USD) is the leading gauge of energy infrastructure MLPs and is a capped, float-adjusted, capitalization-weighted index, whose constituents earn the majority of their

cash flow from midstream activities involving energy commodities.

| Principal Risks of the Fund |

Loss of

money is a risk of investing in the Fund. An investment in the Fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation (“FDIC”) or any government agency. The Fund should not be relied upon

as a complete investment program. There can be no assurance that the Fund will achieve its investment objective. Investments in the Fund involve substantial risks which prospective investors should consider carefully before investing. The Fund's

principal risks are presented below in alphabetical order, and not in the order of importance or potential exposure.

Credit/Default Risk. An issuer or guarantor of fixed income securities or instruments held by the Fund (which may have low credit ratings) may default on its obligation to pay interest and repay principal or default

on any other obligation. The credit quality of the Fund’s portfolio securities or instruments may meet the Fund’s credit quality requirements at the time of purchase but then deteriorate thereafter, and such a deterioration can occur

rapidly. In certain instances, the downgrading or default of a single holding or guarantor of the Fund’s holding may impair the Fund’s liquidity and have the potential to cause significant deterioration in net asset value

(“NAV”). These risks are more pronounced in connection with the Fund’s investments in non-investment grade fixed income securities.

Derivatives Risk.

The Fund's use of options, futures, swaps, options on swaps and other derivative instruments may result in losses. These instruments, which may pose risks in addition to and greater

than those associated with investing directly in securities, currencies or other instruments, may be illiquid or less liquid, volatile, difficult to price and leveraged so that small changes in the value of the underlying instruments may produce

disproportionate losses to the Fund. Certain derivatives are also subject to counterparty risk, which is the risk that the other party in the transaction will not fulfill its contractual

3 Summary

Prospectus — Goldman Sachs MLP Energy Infrastructure Fund

obligations. The use of derivatives is a highly specialized activity

that involves investment techniques and risks different from those associated with investments in more traditional securities and instruments.

Dividend-Paying Investments Risk. The Fund’s investments in dividend-paying securities could cause the Fund to underperform other funds. Securities that pay dividends, as a group, can fall out of favor with the market, causing

such securities to underperform securities that do not pay dividends. Depending upon market conditions and political and legislative responses to such conditions, dividend-paying securities that meet the Fund’s investment criteria may not be

widely available and/or may be highly concentrated in only a few market sectors. In addition, issuers that have paid regular dividends or distributions to shareholders may not continue to do so at the same level or at all in the future. This may

limit the ability of the Fund to produce current income.

Energy Sector Risk. The Fund concentrates its investments in the energy sector, and will therefore be susceptible to adverse economic, business, social, political, environmental, regulatory or other developments

affecting that sector. The energy sector has historically experienced substantial price volatility. MLPs, energy infrastructure companies and other companies operating in the energy sector are subject to specific risks, including, among others:

fluctuations in commodity prices and/or interest rates; increased governmental or environmental regulation; reduced availability of natural gas or other commodities for transporting, processing, storing or delivering; declines in domestic or foreign

production; slowdowns in new construction; extreme weather or other natural disasters; and threats of attack by terrorists on energy assets. Energy companies can be significantly affected by the supply of, and demand for, particular energy products

(such as oil and natural gas), which may result in overproduction or underproduction. Additionally, changes in the regulatory environment for energy companies may adversely impact their profitability. Over time, depletion of natural gas reserves and

other energy reserves may also affect the profitability of energy companies.

During periods of heightened volatility, energy

producers that are burdened with debt may seek bankruptcy relief. Bankruptcy laws may permit the revocation or renegotiation of contracts between energy producers and MLPs/energy infrastructure companies, which could have a dramatic impact on the

ability of MLPs/energy infrastructure companies to pay distributions to its investors, including the Fund, which in turn could impact the ability of the Fund to pay dividends and dramatically impact the value of the Fund’s investments.

Foreign Risk. Foreign securities may be subject to risk of loss because of more or less foreign government regulation; less public information; less stringent investor protections; less stringent accounting,

corporate governance, financial reporting and disclosure standards; and less economic, political and social stability in the countries in which the Fund invests. The imposition of exchange controls, sanctions, confiscations, trade restrictions

(including tariffs) and other government restrictions by the United States and other governments, or from problems in share registration, settlement or custody, may also result in losses. Foreign risk also involves the risk of negative foreign

currency rate fluctuations, which may cause the value of securities denominated in such foreign currency (or other instruments through which the Fund has exposure to foreign currencies) to decline in value. Currency exchange rates may fluctuate

significantly over short periods of time.

Infrastructure Company Risk. Infrastructure companies are susceptible to various factors that may negatively impact their businesses or operations, including costs associated with compliance with and changes in

environmental, governmental and other regulations, rising interest costs in connection with capital construction and improvement programs, government budgetary constraints that impact publicly

funded projects, the effects of general economic conditions

throughout the world, surplus capacity and depletion concerns, increased competition from other providers of services, uncertainties regarding the availability of fuel and other natural resources at reasonable prices, the effects of energy

conservation policies, unfavorable tax laws or accounting policies and high leverage. Infrastructure companies will also be affected by innovations in technology that could render the way in which a company delivers a product or service obsolete and

natural or man-made disasters.

Interest Rate Risk. When interest rates increase, fixed income securities or instruments held by the Fund (which may include inflation protected securities) will generally decline in value. Long-term fixed income

securities or instruments will normally have more price volatility because of this risk than short-term fixed income securities or instruments. A wide variety of market factors can cause interest rates to rise, including central bank monetary

policy, rising inflation and changes in general economic conditions. The risks associated with changing interest rates may have unpredictable effects on the markets and the Fund's investments. Fluctuations in interest rates may also affect the

liquidity of fixed income securities and instruments held by the Fund.

Investment Style Risk. Different investment styles (e.g., “growth”, “value” or

“quantitative”) tend to shift in and out of favor depending upon market and economic conditions and investor sentiment. The Fund may outperform or underperform other funds that invest in similar asset classes but employ different

investment styles. The Fund intends to employ a blend of growth and value investment styles depending on market conditions, either of which may fall out of favor from time to time. Growth stocks may be more volatile than other stocks because they

are more sensitive to investor perceptions of the issuing company’s growth of earnings potential. Growth companies are often expected by investors to increase their earnings at a certain rate. When these expectations are not met, investors can

punish the stocks inordinately even if earnings showed an absolute increase. Also, since growth companies usually invest a high portion of earnings in their business, growth stocks may lack the dividends of some value stocks that can cushion stock

prices in a falling market. Growth oriented funds will typically underperform when value investing is in favor. Value stocks are those that are undervalued in comparison to their peers due to adverse business developments or other

factors.

Large Shareholder Transactions

Risk. The Fund may experience adverse effects when certain large shareholders purchase or redeem large amounts of shares of the Fund. Such large shareholder redemptions, which may occur rapidly or

unexpectedly, may cause the Fund to sell portfolio securities at times when it would not otherwise do so, which may negatively impact the Fund's NAV and liquidity. Similarly, large Fund share purchases may adversely affect the

Fund's performance to the extent that the Fund is delayed in investing new cash or otherwise maintains a larger cash position than it ordinarily would. These transactions may also accelerate the realization of taxable income to the

Fund and shareholders if such sales of investments resulted in gains, and may also increase transaction costs. In addition, a large redemption could result in the Fund's current expenses being allocated over a smaller asset base, leading

to an increase in the Fund's expense ratio.

Liquidity Risk. The Fund may make investments that are illiquid or that may become less liquid in response to market developments or adverse investor perceptions. Illiquid investments may be more difficult to

value. Liquidity risk may also refer to the risk that the Fund will not be able to pay redemption proceeds within the allowable time period because of unusual market conditions, an unusually high volume of redemption requests, or other reasons. To

meet redemption requests, the

4 Summary

Prospectus — Goldman Sachs MLP Energy Infrastructure Fund

Fund may be forced to sell securities at an unfavorable time and/or

under unfavorable conditions. Redemptions by large shareholders may have a negative impact on a Fund’s liquidity.

Market Risk. The value of the securities in which the Fund invests may go up or down in response to the prospects of individual companies, particular sectors or governments and/or general economic conditions

throughout the world due to increasingly interconnected global economies and financial markets. Events such as war, acts of terrorism, social unrest, natural disasters, the spread of infectious illness or other public health threats could also

significantly impact the Fund and its investments.

Master Limited Partnership Risk. Investments in securities of an MLP involve risks that differ from investments in common stock, including risks related to limited control and limited rights to vote on matters affecting the MLP.

Certain MLP securities may trade in lower volumes due to their smaller capitalizations, and may be subject to more abrupt or erratic price movements and lower market liquidity. MLPs are generally considered interest-rate sensitive investments that

generally rely on capital markets to finance capital expenditures and growth opportunities. During periods of interest rate volatility, limited capital markets access and/or low commodities pricing, these investments may not provide attractive

returns.

Mid-Cap and Small-Cap Risk. Investments in mid-capitalization and small-capitalization companies involve greater risks than those associated with larger, more established companies. These securities may be subject to more

abrupt or erratic price movements and may lack sufficient market liquidity, and these issuers often face greater business risks.

Non-Diversification Risk. The Fund is non-diversified, meaning that it is permitted to invest a larger percentage of its assets in fewer issuers than diversified mutual funds. Thus, the Fund may be more susceptible

to adverse developments affecting any single issuer held in its portfolio, and may be more susceptible to greater losses because of these developments.

Portfolio Turnover Rate Risk. A high rate of portfolio turnover (100% or more) involves correspondingly greater expenses which must be borne by the Fund and its shareholders.

Private Investment in Public Equities Risk. The Fund may make PIPE transactions. PIPE transactions typically involve the purchase of securities directly from a publicly traded company or its affiliates in a private placement transaction,

typically at a discount to the market price of the company’s common stock. In a PIPE transaction, the Fund may bear the price risk from the time of pricing until the time of closing. Equity issued in this manner is often subject to transfer

restrictions and is therefore less liquid than equity issued through a registered public offering. For example, the Fund may be subject to lock-up agreements that prohibit transfers for a fixed period of time. In addition, because the sale of the

securities in a PIPE transaction is not registered under the Securities Act, the securities are “restricted” and cannot be immediately resold into the public markets. The Fund may enter into a registration rights agreement with the

issuer pursuant to which the issuer commits to file a resale registration statement allowing the Fund to publicly resell its securities. However, the ability of the Fund to freely transfer the shares is conditioned upon, among other things, the

SEC’s preparedness to declare the resale registration statement effective and the issuer’s right to suspend the Fund’s use of the resale registration statement if the issuer is pursuing a transaction or some other material

non-public event is occurring. Accordingly, PIPE securities may be subject to risks associated with illiquid investments.

Special Purpose Acquisition Companies Risk. The Fund may invest in stock, warrants and other securities of SPACs. SPACs are in essence blank check companies without operating history or ongoing business

other than seeking acquisitions. The value of a SPAC’s securities is particularly dependent on the ability of its management to identify and complete a profitable acquisition. There is no guarantee that the SPACs in which the Fund invests will

complete an acquisition or that any acquisitions completed by the SPACs in which the Fund invests will be profitable. The values of investments in SPACs may be highly volatile and these investments may also have little or no liquidity.

Stock Risk. Stock prices have historically risen and fallen in periodic cycles. U.S. and foreign stock markets have experienced periods of substantial price volatility in the past and may do so again in

the future.

Strategy Risk. The Fund’s strategy of investing primarily in MLPs, resulting in its being taxed as a corporation, or a “C” corporation, rather than as a regulated investment company for U.S. federal

income tax purposes, is a relatively new investment strategy for funds. This strategy involves complicated accounting, tax and valuation issues. Volatility in the NAV may be experienced because of the use of estimates at various times during a given

year that may result in unexpected and potentially significant consequences for the Fund and its shareholders.

Tax Risk. Tax risks associated with investments in the Fund include but are not limited to the following:

MLP Tax Risk. MLPs

are generally treated as partnerships for U.S. federal income tax purposes. Partnerships do not pay U.S. federal income tax at the partnership level. Rather, each partner is allocated a share of the partnership’s income, gains, losses,

deductions and expenses. A change in current tax law or a change in the underlying business mix of a given MLP could result in an MLP being treated as a corporation for U.S. federal income tax purposes, which would result in the MLP being required

to pay U.S. federal income tax (as well as state and local income taxes) on its taxable income. This would have the effect of reducing the amount of cash available for distribution by the MLP and could result in a reduction in the value of the

Fund’s investment in the MLP and lower income to the Fund.

To the extent a distribution received by the Fund

from an MLP is treated as a return of capital, the Fund’s adjusted tax basis in the interests of the MLP may be reduced, which will result in an increase in an amount of income or gain (or decrease in the amount of loss) that will be

recognized by the Fund for tax purposes upon the sale of any such interests or upon subsequent distributions in respect of such interests. Furthermore, any return of capital distribution received from the MLP may require the Fund to restate the

character of its distributions and amend any shareholder tax reporting previously issued. Moreover, a change in current tax law, or a change in the underlying business mix of a given MLP, could result in an MLP investment being treated as a

corporation for U.S. federal income tax purposes, which could result in a reduction of the value of the Fund’s investment in the MLP and lower income to the Fund. Distributions from an MLP in excess of the Fund’s basis in the MLP will

generally be treated as capital gain. However, a portion of the gain may instead be treated as ordinary income to the extent attributable to certain assets held by the MLP the sale of which would produce ordinary income.

Investment in MLP C Corporations. As discussed above, the Fund may invest in MLPs taxed as C corporations. Such MLPs are obligated to pay federal income tax on their taxable income at the corporate tax rate and the amount of cash available for

distribution by such MLPs would generally be reduced by any such tax. Additionally, distributions received by the Fund would be taxed under federal income tax laws applicable to corporate dividends (as dividend income, potentially subject to the

corporate dividends received deduction, return of capital,

5 Summary

Prospectus — Goldman Sachs MLP Energy Infrastructure Fund

or capital gain). Thus, investment in MLPs taxed as C corporations

could result in a reduction of the value of your investment in the Fund and lower income, as compared to investments in MLPs that are classified as partnerships for tax purposes.

Fund Structure Risk.

Unlike traditional mutual funds that are structured as regulated investment companies for U.S. federal income tax purposes, the Fund will be taxable as a regular corporation, or “C” corporation, for U.S.

federal income tax purposes. This means the Fund generally will be subject to U.S. federal income tax on its taxable income at the rates applicable to corporations (at a rate of 21%), and will also be subject to state and local income

taxes.

Tax Estimation/NAV Risk. In calculating the Fund’s daily NAV, the Fund will, among other things, account for its current taxes and deferred tax liability and/or asset balances. The Fund will accrue a deferred income tax liability balance,

at the then effective statutory U.S. federal income tax rate (at a rate of 21%) plus an estimated state and local income tax rate, for its future tax liability associated with the capital appreciation of its investments and the distributions

received by the Fund on interests of MLPs considered to be return of capital and for any net operating gains. Any deferred tax liability balance will reduce the Fund’s NAV. The Fund may also accrue a deferred tax asset balance, which reflects

an estimate of the Fund’s future tax benefit associated with net operating losses and unrealized losses. Any deferred tax asset balance will increase the Fund’s NAV. To the extent the Fund has a deferred tax asset balance, consideration

is given as to whether or not a valuation allowance, which would offset the value of some or all of the deferred tax asset balance, is required. The Fund will rely to some extent on information provided by MLPs, which may not be provided to the Fund

on a timely basis, to estimate current taxes and deferred tax liability and/or asset balances for purposes of financial statement reporting and determining its NAV. The daily estimate of the Fund’s current taxes and deferred tax liability

and/or asset balances used to calculate the Fund’s NAV could vary significantly from the Fund’s actual tax liability or benefit, and, as a result, the determination of the Fund’s actual tax liability or benefit may have a material

impact on the Fund’s NAV. From time to time, the Fund may modify its estimates or assumptions regarding its current taxes and deferred tax liability and/or asset balances as new information becomes available, which modifications in estimates

or assumptions may have a material impact on the Fund’s NAV. Shareholders who redeem their shares at a NAV that is based on estimates of the Fund’s current taxes

and deferred tax liability and/or asset balances may benefit at the

expense of remaining shareholders (or remaining shareholders may benefit at the expense of redeeming shareholders) if the estimates are later revised or ultimately differ from the Fund’s actual tax liability and/or asset balances.

| Performance |

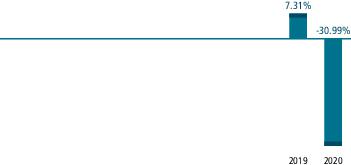

The bar chart and table

below provide an indication of the risks of investing in the Fund by showing: (a) changes in the performance of the Fund’s Class P Shares from year to year; and (b) how the average annual total returns of the Fund’s Class P Shares

compare to those of a broad-based securities market index. Through June 26, 2020, certain of the Fund’s strategies differed. Performance information set forth below reflects the Fund’s former strategies prior to that date. The

Fund’s past performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future. Updated performance information is available at no cost at

https://www.gsam.com/content/dam/gsam/pdfs/us/en/fund-resources/monthly-highlights/retail-fund-facts.pdf?sa=n&rd=n or by calling the phone number on the back cover of the Prospectus.

Performance reflects applicable fee waivers and/or

expense limitations in effect during the periods shown.

CALENDAR YEAR (CLASS P)

| During the periods shown in the chart above: | Returns | Quarter ended |

| Best Quarter Return | 35.25% | June 30, 2020 |

| Worst Quarter Return | -54.44% | March 31, 2020 |

| AVERAGE ANNUAL TOTAL RETURN |

| For the period ended December 31, 2020 | 1 Year | Since

Inception |

| Class P Shares (Inception 4/16/2018) | ||

| Returns Before Taxes | -30.99% | -14.00% |

| Returns After Taxes on Distributions | -30.99% | -14.19% |

| Returns After Taxes on Distributions and Sale of Fund Shares | -18.40% | -10.31% |

| Alerian MLP Index (Total Return, Unhedged, USD) (reflects no deduction for fees or expenses) | -28.62% | -12.47% |

After-tax

returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those

shown. In addition, the after-tax returns shown are not relevant to investors who hold Fund Shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts.

| Portfolio Management |

Goldman Sachs

Asset Management, L.P. is the investment adviser for the Fund (the “Investment Adviser” or “GSAM”).

Portfolio

Managers: Kyri Loupis, Managing Director, has managed the Fund since 2013; Ganesh V. Jois, CFA, Managing Director, has managed the Fund since 2013; and Matthew Cooper, Vice President, has managed the Fund since

2014.

| Buying and Selling Fund Shares |

The Fund does not impose minimum purchase

requirements for initial or subsequent investments in Class P Shares.

6 Summary

Prospectus — Goldman Sachs MLP Energy Infrastructure Fund

You may purchase and redeem (sell) Class P Shares of the Fund on any

business day through the Goldman Sachs Private Wealth Management business unit, The Goldman Sachs Trust Company, N.A., The Goldman Sachs Trust Company of Delaware, The Ayco Company, L.P. or with certain intermediaries that are authorized to offer

Class P Shares.

| Tax Information |

The Fund is

treated as a regular corporation, or “C” corporation, for U.S. federal, state and local income tax purposes. The Fund will make distributions that will be treated for U.S. federal income tax purposes as (i) first, taxable dividends to

the extent of your allocable share of the Fund’s earnings and profits, (ii) second, non-taxable returns of capital to the extent of your tax basis in your shares of the Fund (for the portion of those distributions that exceed the Fund’s

earnings and profits) and (iii) third, taxable gains (for the balance of those distributions). Dividend income will be treated as “qualified dividends” for federal income tax purposes, subject to favorable capital gain tax rates,

provided that certain requirements are met. Unlike a regulated

investment company, the Fund will not be able to pass-through the character of its recognized net capital gain by paying “capital gain dividends.” Although the Fund expects that a significant portion of its distributions will be treated

as nontaxable return of capital and gains, combined, no assurance can be given in this regard. Additionally, a sale of Fund shares is a taxable event for shares held in a taxable account.

| Payments

to Broker-Dealers and Other Financial Intermediaries |

If you purchase the Fund through an intermediary

that is authorized to offer Class P Shares, the Fund and/or its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the intermediary and your

salesperson to recommend the Fund over another investment. Ask your salesperson or visit your intermediary’s website for more information.

7 Summary

Prospectus — Goldman Sachs MLP Energy Infrastructure Fund

[This page intentionally left blank]

8 Summary

Prospectus — Goldman Sachs MLP Energy Infrastructure Fund

MLPEISUM1-21PV2

FREE Breaking News Alerts from StreetInsider.com!

StreetInsider.com Top Tickers, 4/26/2024

- Stocks face worst month since September, yen swings after BoJ

- Microsoft fiscal Q3 results top estimates as AI revolution spurs cloud growth

- Alphabet stock surges 11% to record high on Q1 earnings beat, first-ever dividend

- Intel slides in afterhours trading as Q1 revenue misses, Q2 outlook falls short

- Oil prices on track to snap two-week losing streak

- Rubrik (RBRK) Prices Upsized 23.5M Share IPO at $32/sh

- Union Pacific beats profit estimates on stronger pricing, resumes share buyback

- IBM tumbles on soft Q1 revenue; announces HashiCorp $6.4bn acquisition

- Hertz Global (HTZ) misses earnings expectations as fleet costs weigh

- Teladoc (TDOC) Misses Q1 EPS by 3c, offers outlook

- After-hours movers: Alphabet, Microsoft, Snap, Intel, and more

- Midday movers: Meta, IBM, Caterpillar fall; Chipotle rises

- After-hours movers: Meta, Ford, IBM, ServiceNow and more

- Midday movers: Tesla, Boeing rise; Uber, Old Dominion Freight fall

- After-hours movers: Tesla, Texas Instruments, Seagate, Visa and more

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Alphabet stock surges 11% to record high on Q1 earnings beat, first-ever dividend

- 10 analysts discuss Meta Platforms (META) stock after earnings selloff

- Rubrik, Inc. (RBRK) IPO Opens at $38.60, Priced at $32

Create E-mail Alert Related Categories

SEC FilingsRelated Entities

Goldman SachsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share