Apple (AAPL) Will Rally Through iPad 3 Announcement, Here's Why....

Get Alerts AAPL Hot Sheet

Price: $169.89 +0.51%

Rating Summary:

39 Buy, 25 Hold, 7 Sell

Rating Trend: = Flat

Today's Overall Ratings:

Up: 11 | Down: 12 | New: 13

Rating Summary:

39 Buy, 25 Hold, 7 Sell

Rating Trend: = Flat

Today's Overall Ratings:

Up: 11 | Down: 12 | New: 13

Join SI Premium – FREE

Do you think Apple (Nasdaq: AAPL) will see a "sell the news" reaction to the March 7 iPad 3 announcement? Think again.

Analysts at Deutsche Bank said despite growing concerns that shares will sell-off after the highly-anticipated iPad refresh they recommend (and history shows) that Apple should be owned through any product announcement-related price volatility.

The firm notes: "First, our analysis shows that product announcements in themselves don’t have a meaningful, lasting impact on Apple's stock price, on average. Second, earnings revisions tend to follow 30+ days after launch, after the new product has demonstrated traction in the marketplace and as analysts tend to initially under-estimate the impact of new products on Apple's results as it takes time to assess consumers' reception. Finally, we believe Apple's strong move YTD (+34% vs. +9% for S&P500) reflects a laundry list of other positive developments in the Apple story (see list of 10 factors below); rather than extreme expectations around iPad 3."

Below is the 10 reasons the firm is giving as to why Apple continues to rally.

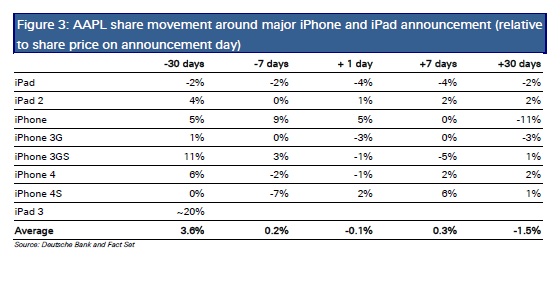

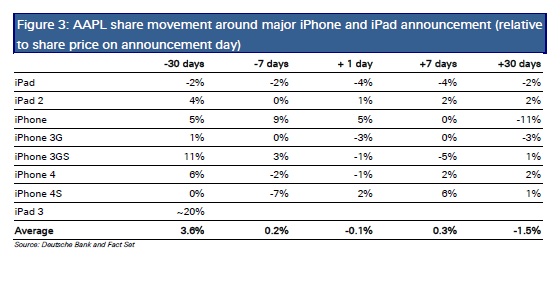

Below is a chart from Deutsche Bank that shows AAPL share movement around major iPhone and iPad announcement.

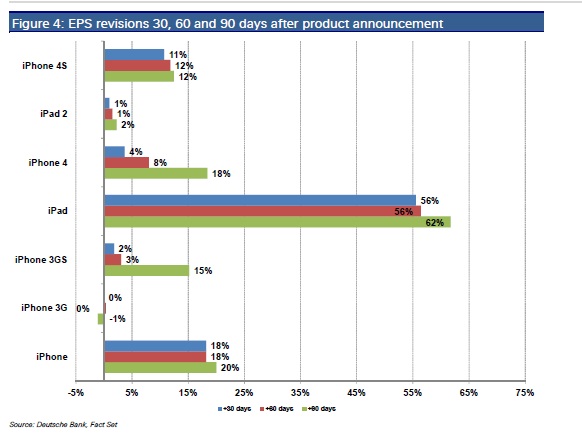

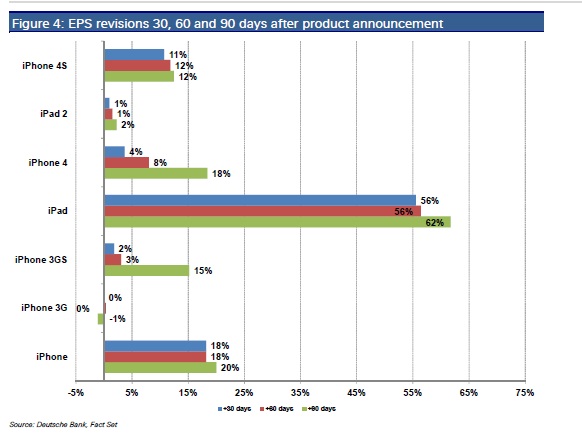

Here is a chart from Deutsche Bank that shows EPS revisions 30, 60 and 90 days after product announcement.

The firm is maintaining their Buy rating and $600 price target on Apple.

For an analyst ratings summary and ratings history on Apple click here.

Analysts at Deutsche Bank said despite growing concerns that shares will sell-off after the highly-anticipated iPad refresh they recommend (and history shows) that Apple should be owned through any product announcement-related price volatility.

The firm notes: "First, our analysis shows that product announcements in themselves don’t have a meaningful, lasting impact on Apple's stock price, on average. Second, earnings revisions tend to follow 30+ days after launch, after the new product has demonstrated traction in the marketplace and as analysts tend to initially under-estimate the impact of new products on Apple's results as it takes time to assess consumers' reception. Finally, we believe Apple's strong move YTD (+34% vs. +9% for S&P500) reflects a laundry list of other positive developments in the Apple story (see list of 10 factors below); rather than extreme expectations around iPad 3."

Below is the 10 reasons the firm is giving as to why Apple continues to rally.

- 1) Increased China iPhone distribution following deal with China Telecom and ongoing iPhone momentum.

- Positive developments in Apple's litigation / patent situation including: successful verdicts vs. Motorola in Germany (FRAND), major new patent touch awards (which we view as a large ‘hidden asset’) and a positive ruling on the Proview case.

- A relatively quiet Mobile World Congress and lack of a new 'iPhone killer'

- Additional details emerged around Win8 tablets that suggest some inter operability issues.

- Increased evidence of competitor stumbles including weak results from HPQ and disappointing new product announcement from Nokia, etc.

- Management's apparent willingness to begin paying a dividend or returning cash to shareholders in the medium term. Tim Cook specifically indicated that ‘use of cash

discussions are intensifying,

- Recently published third party data that indicates iPhone and iPad momentum in the enterprise is growing,

- Apple previewed its next generation Mac OS, Mountain lion, and expectations of new Macbook Pro and Air upgrades are growing,

- Increasing evidence that Apple is negotiating with content providers to product streaming media content, feeding expectations of Apple’s foray into the TV market.

- Strong and growing iOS developer ecosystem; 500K+ apps in the App Store (140K apps are iPad specific) and 25B downloads (vs. ~340K Android and ~10B downloads)

Below is a chart from Deutsche Bank that shows AAPL share movement around major iPhone and iPad announcement.

Here is a chart from Deutsche Bank that shows EPS revisions 30, 60 and 90 days after product announcement.

The firm is maintaining their Buy rating and $600 price target on Apple.

For an analyst ratings summary and ratings history on Apple click here.

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Gilead Sciences (GILD) Misses Q1 EPS by 288c

- USCB Financial Holdings, Inc. (USCB) Tops Q1 EPS by 2c

- Alphabet (GOOGL) soars 16% on Q1 results beat, first-ever dividend

Create E-mail Alert Related Categories

Analyst Comments, Insiders' BlogRelated Entities

Deutsche Bank, Standard & Poor's, Dividend, EarningsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share