Form 425 Western Refining, Inc. Filed by: TESORO CORP /NEW/

| Filed by Tesoro Corporation (Commission File No. 001-03473) Pursuant to Rule 425 under the Securities Act of 1933, as amended Subject Company: Western Refining, Inc. (Commission File No. 001-32721) |

TESORO WTM Western Refining

Tesoro to Acquire Western Refining

Creates a Premier, Highly Integrated and

Geographically Diversified Refining, Marketing and Logistics Company

November 17, 2016

Forward Looking Statements

This communication contains certain statements that are “forward-looking” statements within the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934. Words such as “may,” “will,” “could,” “anticipate,” “estimate,” “expect,” “predict,” “project,” “future,”

“potential,” “intend,” “plan,” “assume,” “believe,” “forecast,” “look,” “build,” “focus,” “create,” “work” “continue” or the

negative of such terms or other variations thereof and words and terms of similar substance used in connection with any discussion of future plans, actions, or events identify forward-looking statements. These forward-looking statements include, but

are not limited to, statements regarding the proposed merger, integration and transition plans, synergies, opportunities, anticipated future performance, expected share buyback program and expected dividends. There are a number of risks and

uncertainties that could cause actual results to differ materially from the forward-looking statements included in this communication. For example, the expected timing and likelihood of completion of the proposed merger, including the timing,

receipt and terms and conditions of any required governmental and regulatory approvals of the proposed merger that could reduce anticipated benefits or cause the parties to abandon the transaction, the ability to successfully integrate the

businesses, the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement, the possibility that stockholders of Tesoro Corporation (“Tesoro”) may not approve the issuance of new

shares of common stock in the merger or that stockholders of Western Refining, Inc. (“Western”) may not approve the merger agreement, the risk that the parties may not be able to satisfy the conditions to the proposed transaction in a

timely manner or at all, risks related to disruption of management time from ongoing business operations due to the proposed transaction, the risk that any announcements relating to the proposed transaction could have adverse effects on the market

price of Tesoro’s common stock or Western’s common stock, the risk that the proposed transaction and its announcement could have an adverse effect on the ability of Tesoro and Western to retain customers and retain and hire key personnel

and maintain relationships with their suppliers and customers and on their operating results and businesses generally, the risk that problems may arise in successfully integrating the businesses of the companies, which may result in the combined

company not operating as effectively and efficiently as expected, the risk that the combined company may be unable to achieve cost-cutting synergies or it may take longer than expected to achieve those synergies, the risk that the combined company

may not buy back shares, the risk of the amount of any future dividend Tesoro may pay, and other factors. All such factors are difficult to predict and are beyond our control, including those detailed in Tesoro’s annual reports on Form 10-K,

quarterly reports on Form 10-Q and Current Reports on Form 8-K that are available on Tesoro’s website at http://www.tsocorp.com and on the SEC website at http://www.sec.gov, and those detailed in Western’s annual reports on Form 10-K,

quarterly reports on Form 10-Q and Current Reports on Form 8-K that are available on Western’s website at http://www.wnr.com and on the SEC website at http://www.sec.gov. Western’s forward-looking statements are based on assumptions

that Western believes to be reasonable but that may not prove to be accurate. We undertake no obligation to publicly release the result of any revisions to any such forward-looking statements that may be made to reflect events or circumstances that

occur, or which we become aware of, except as required by applicable law or regulation. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof.

2 | Tesoro Western Refining

Delivering Significant Shareholder Value

Creates a premier, highly integrated and geographically diversified refining, marketing and logistics company

Committed to delivering $350 to $425 million in annual synergies; run rate to be achieved within the first two years

Expect to achieve 10% to 13% EPS1 accretion in 2018, the first full year of combined operations; represents 5.8x EBITDA multiple with run-rate synergies2

Well positioned, highly reliable and advantaged refining system with access to wide array of advantaged crude oil

Creates strong, multi-brand marketing and convenience store portfolio in growing regions

Expands opportunities for logistics growth in crude oil production basins and product regions

1) Based on 2018 I/B/E/S consensus EPS estimate

2) Based on 2017 I/B/E/S consensus EBITDA

estimate for Western plus $350 million of synergies

3 | Tesoro Western Refining

Transaction Aligns with Strategic Priorities

Operational efficiency and effectiveness

- Safety and reliability

- Cost leadership

- System improvements

Value chain optimization

Financial discipline

Value-driven growth

High performing culture

Enduring commitment to execution

4 | Tesoro Western Refining

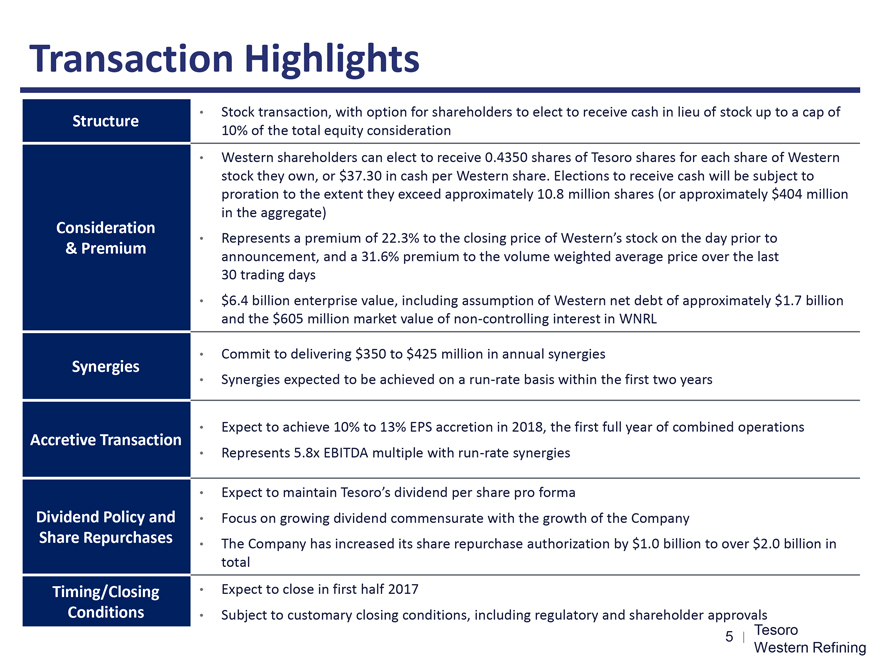

Transaction Highlights

Structure Stock transaction, with option for shareholders to elect to receive cash in lieu of stock up to a cap of 10% of the total equity consideration

Consideration & Premium Western shareholders can elect to receive 0.4350 shares of Tesoro shares for each share of Western stock they own, or $37.30 in cash

per Western share. Elections to receive cash will be subject to proration to the extent they exceed approximately 10.8 million shares (or approximately $404 million in the aggregate)

Represents a premium of 22.3% to the closing price of Western’s stock on the day prior to announcement, and a 31.6% premium to the volume weighted average price over the last

30 trading days

$6.4 billion enterprise value, including assumption of Western net debt of approximately $1.7 billion and the $605 million market value of

non-controlling interest in WNRL

Synergies Commit to delivering $350 to $425 million in annual synergies

Synergies expected to be achieved on a run-rate basis within the first two years

Accretive

Transaction Expect to achieve 10% to 13% EPS accretion in 2018, the first full year of combined operations

Represents 5.8x EBITDA multiple with run-rate synergies

Dividend Policy and Share Repurchases Expect to maintain Tesoro’s dividend per share pro forma

Focus on growing dividend commensurate with the growth of the Company

The Company has

increased its share repurchase authorization by $1.0 billion to over $2.0 billion in total

Timing/Closing Conditions Expect to close in first half 2017

Subject to customary closing conditions, including regulatory and shareholder approvals

5 |

Tesoro Western Refining

Western Overview

Attractive refining locations

- Three refineries with 254 thousand barrels

per day crude oil capacity

- Pipeline access to advantaged crude oil

Permian,

San Juan, Bakken and Western Canada

- Historically strong refined product regions

Integrated distribution network

- Fully integrated crude oil pipeline system to serve

refineries and 3rd parties, including 17% interest in Minnesota pipeline

- Refined product distribution to retail and wholesale customers

- Approximately 545 convenience stores in Arizona, Colorado, New Mexico, Texas, Minnesota and Wisconsin

Growth opportunities

- Three growth platforms: refining, marketing and logistics

- Expand logistics footprint and utilization in Permian, San Juan and Bakken

Significant

ownership in Western Refining Logistics, a high-quality logistics business

- Owns 52.6% of WNRL, LP units and 100% of incentive distribution rights

WTM Western Refining

6 | Tesoro Western Refining

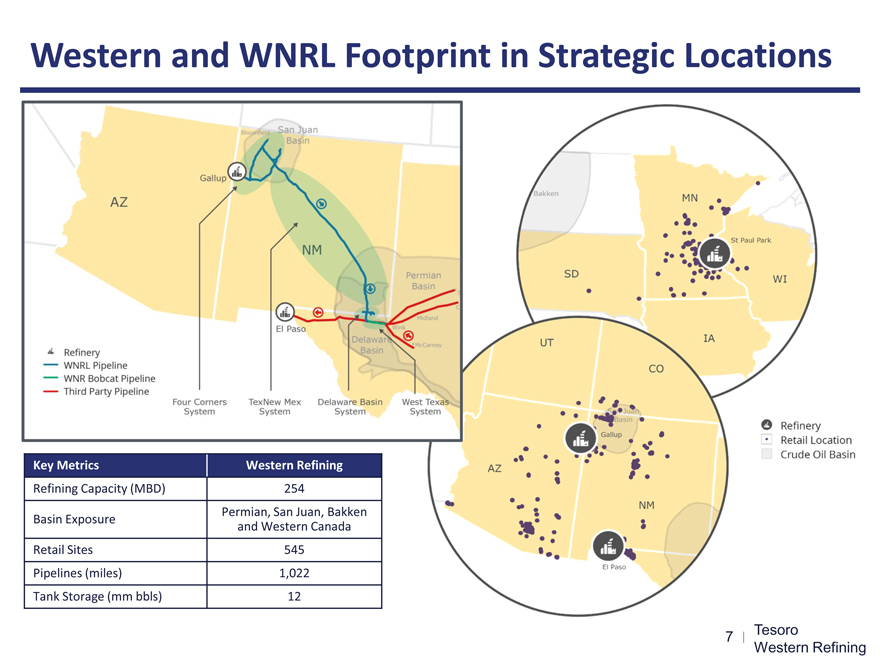

Western and WNRL Footprint in Strategic Locations

Bloomfield San Juan Basin

Gallup

AZ

Refinery

WNRL Pipeline

WNR Bobcat Pipeline

Third Party Pipeline

Four Corners System

NM

El Paso

TextNew Mex System

Permian Basin

Delaware Basin Wink Midland McCarney

Delaware Basin System

West Texas System

Key Metrics Western Refining

Refining Capacity (MBD) 254

Basin Exposure Permian, San Juan, Bakken and Western Canada

Retail Sites 545

Pipelines (miles) 1,022

Tank Storage (mm bbls) 12

Bakken MN

SD St Paul Park

WI IA

UT CO San Juan Basin Gallup

AZ NM

El Paso

Refinery

Retail Location

Crude Oil Basin

7 | Tesoro Western Refining

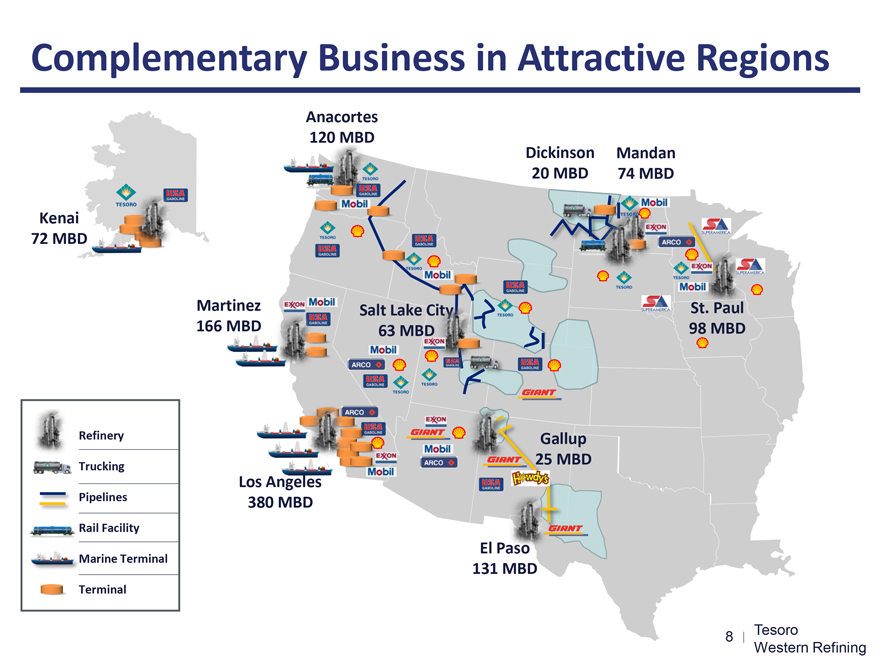

Complementary Business in Attractive Regions

Kenai 72 MBD

Anacortes 120 MBD

Dickinson 20 MBD

Mandan 74 MBD

Martinez 166 MBD

Salt Lake City 63 MBD

St. Paul 98 MBD

Los Angeles 380 MBD

Gallup 25 MBD

El Paso 131 MBD

Refinery

Trucking

Pipelines

Rail Facility

Marine Terminal

Terminal

8 | Tesoro Western Refining

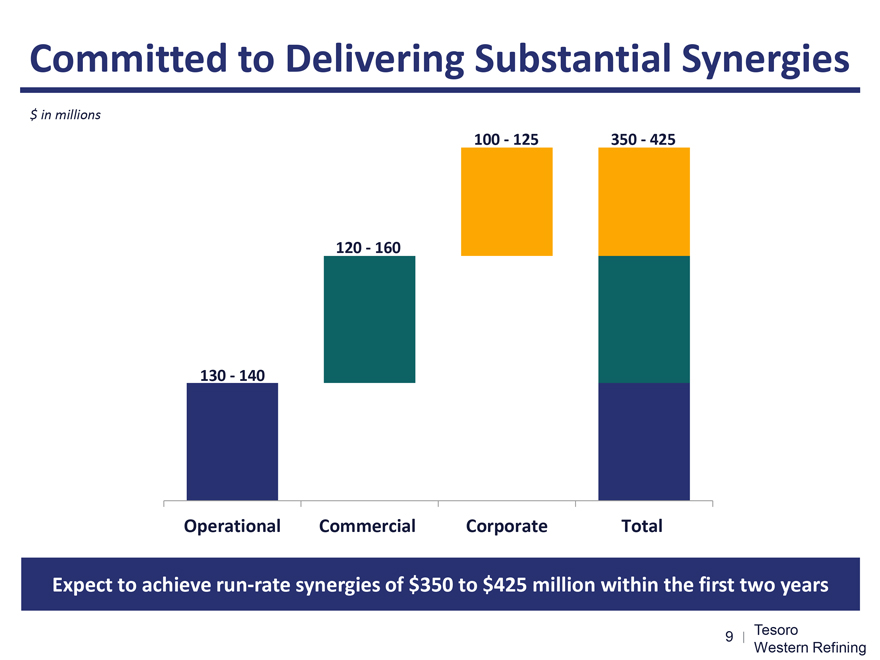

Committed to Delivering Substantial Synergies

$ in millions

130 - 140 120 - 160 100 - 125 350 - 425

Operational Commercial Corporate Total

Expect to achieve run-rate synergies of $350 to $425

million within the first two years

9 | Tesoro Western Refining

Synergies Strengthen Competitive Position

Implement Operations Excellence Management System to improve reliability and reduce costs

Consolidate corporate services and G&A

Optimize logistics operational

efficiencies and growth

Enhance retail integration

Improve working

capital efficiency

Increase procurement efficiency

Reduce

supply and distribution costs across value chain

Commercial integration and higher refining utilization

10 | Tesoro Western Refining

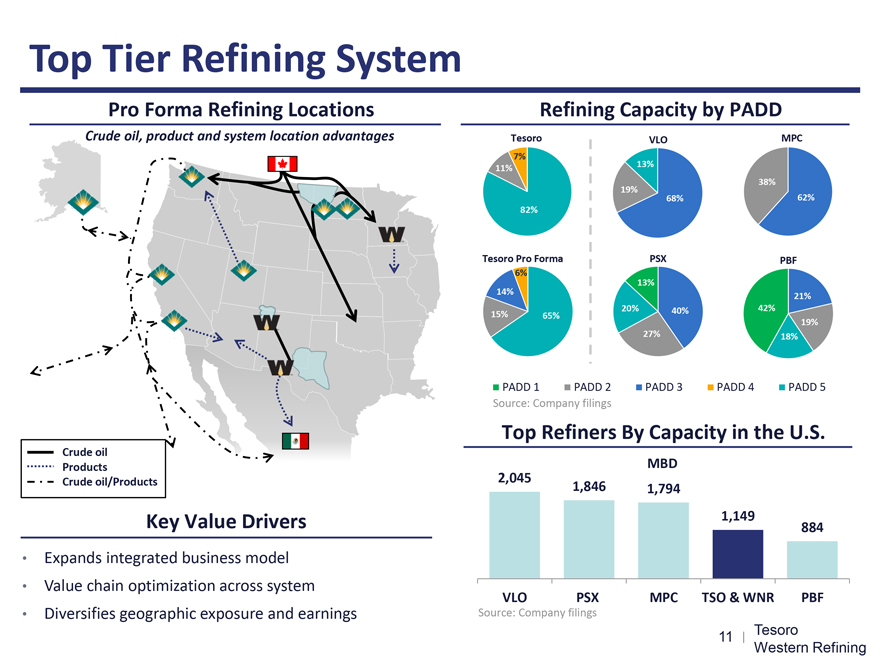

Top Tier Refining System

Pro Forma Refining Locations

Crude oil, product and system location

advantages

Crude oil

Products

Crude oil/Products

Key Value Drivers

Expands integrated business model

Value chain optimization across system

Diversifies geographic exposure and earnings

Refining Capacity by PADD

Tesoro

7%

11%

82%

Tesoro Pro Forma

6%

14%

15% 65%

VLO

13%

19%

68%

PSX

13%

20% 40%

27%

MPC

38%

62%

PBF

21%

42%

19%

18%

PADD 1 PADD 2 PADD 3 PADD 4 PADD 5

Source: Company filings

Top Refiners By Capacity in the U.S.

2,045 1,846 MBD 1,794 1,149 884

VLO PSX MPC TSO & WNR PBF

Source: Company filings

11 | Tesoro

Western Refining

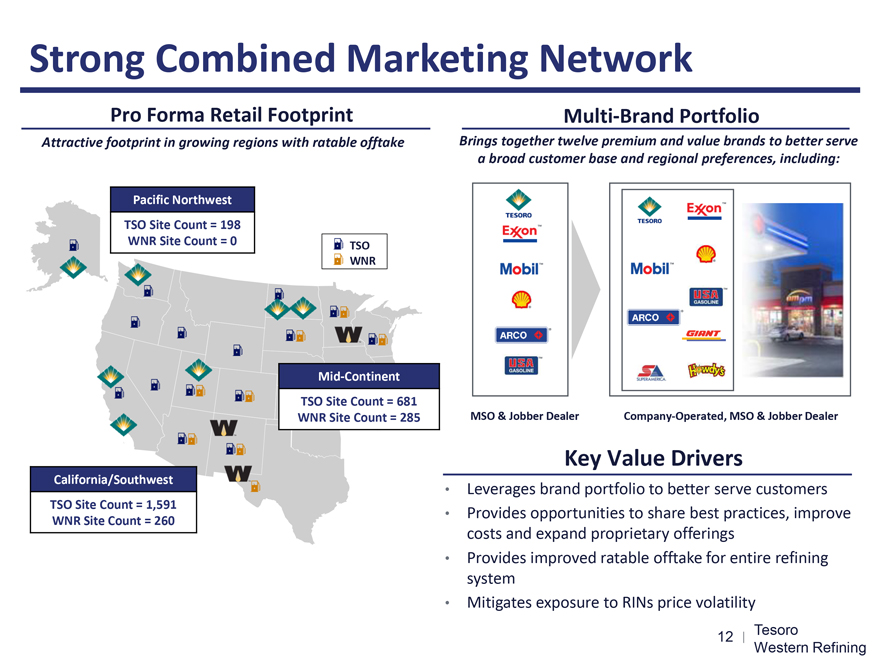

Strong Combined Marketing Network

Pro Forma Retail Footprint

Attractive footprint in growing regions with ratable offtake

Pacific Northwest

TSO Site Count = 198

WNR Site Count = 0

TSO

WNR

Mid-Continent

TSO Site Count = 681

WNR Site Count = 285

California/Southwest

TSO Site Count = 1,591

WNR Site Count = 260

Multi-Brand Portfolio

Brings together twelve premium and value brands to better serve a broad customer base and regional preferences, including:

MSO & Jobber Dealer Company-Operated, MSO & Jobber Dealer

Key Value Drivers

Leverages brand portfolio to better serve customers

Provides opportunities to

share best practices, improve costs and expand proprietary offerings

Provides improved ratable offtake for entire refining system

Mitigates exposure to RINs price volatility

12 | Tesoro

Western Refining

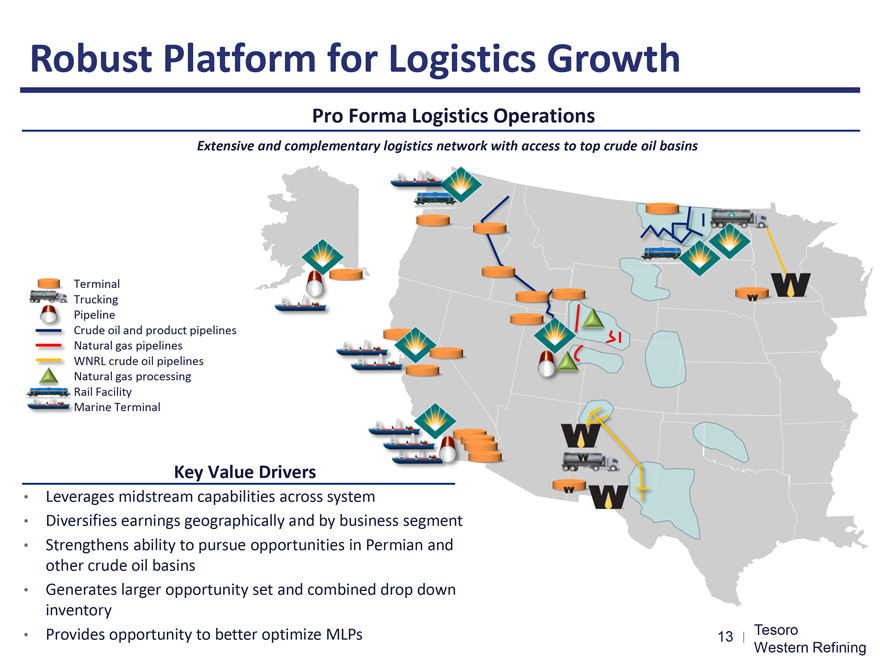

Robust Platform for Logistics Growth

Pro Forma Logistics Operations

Extensive and complementary logistics network with access to

top crude oil basins

Terminal

Trucking

Pipeline

Crude oil and product pipelines

Natural gas pipelines

WNRL crude oil pipelines

Natural gas processing

Rail Facility

Marine Terminal

Key Value Drivers

Leverages midstream capabilities across system

Diversifies earnings geographically and by

business segment

Strengthens ability to pursue opportunities in Permian and other crude oil basins

Generates larger opportunity set and combined drop down inventory

Provides opportunity to

better optimize MLPs

13 | Tesoro

Western Refining

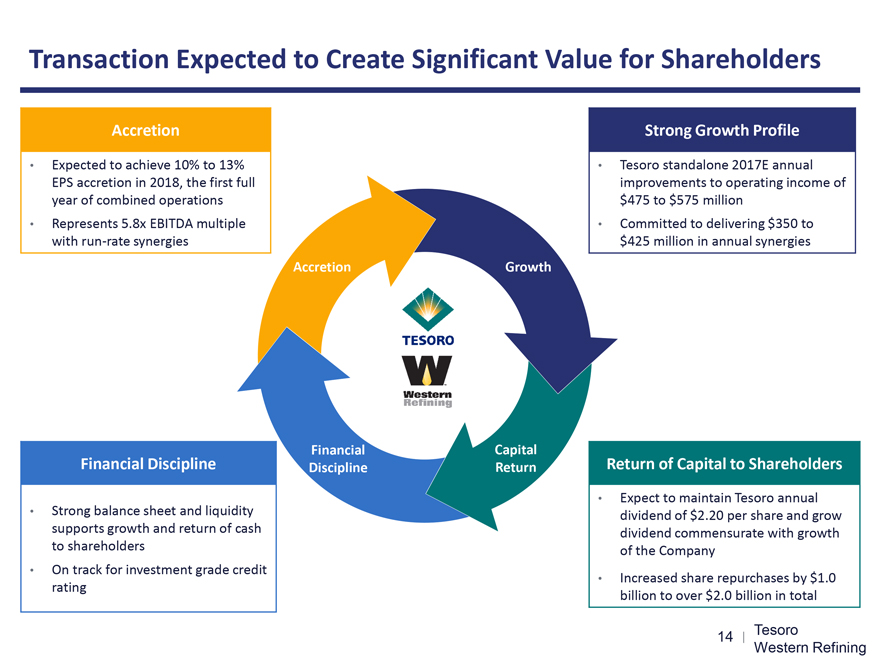

Transaction Expected to Create Significant Value for Shareholders

Accretion

Expected to achieve 10% to 13% EPS accretion in 2018, the first full year of

combined operations

Represents 5.8x EBITDA multiple with run-rate synergies

Financial Discipline

Strong balance sheet and liquidity supports growth and

return of cash to shareholders

On track for investment grade credit rating

Accretion

Growth

Capital Return

Financial Discipline

TESORO

W™ Western Refining

Strong Growth Profile

Tesoro standalone 2017E annual improvements to operating income of $475

to $575 million

Committed to delivering $350 to $425 million in annual synergies

Return of Capital to Shareholders

Expect to maintain Tesoro annual dividend of $2.20 per share

and grow dividend commensurate with growth of the Company

Increased share repurchases by $1.0 billion to over $2.0 billion in total

14 | Tesoro

Western Refining

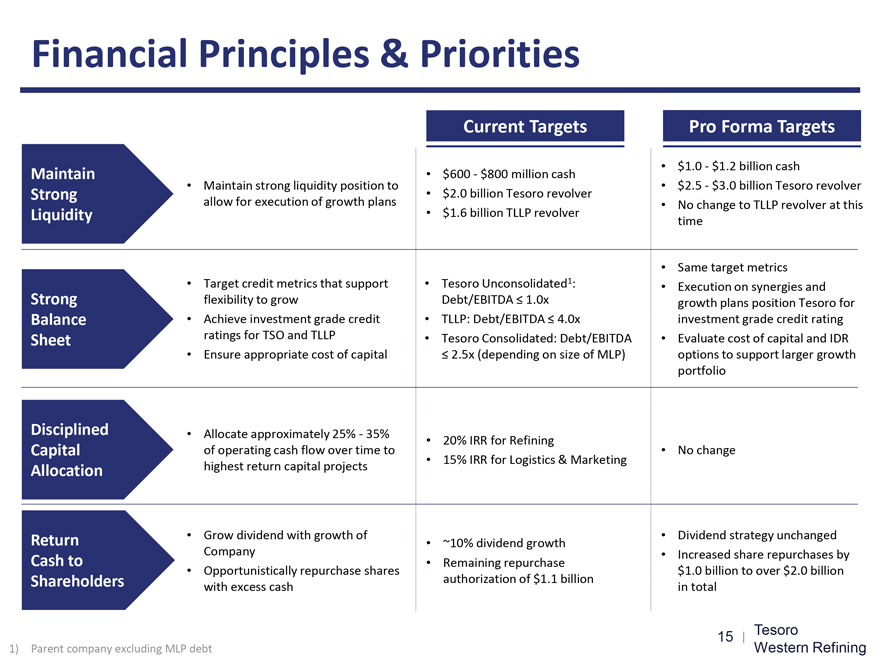

Financial Principles & Priorities

Maintain Strong Liquidity

Strong Balance Sheet

Disciplined Capital Allocation

Return Cash to Shareholders

Maintain strong liquidity position to allow for execution of growth plans

Target credit

metrics that support flexibility to grow

Achieve investment grade credit ratings for TSO and TLLP

Ensure appropriate cost of capital

Allocate approximately 25% - 35% of operating cash flow

over time to highest return capital projects

Grow dividend with growth of Company

Opportunistically repurchase shares with excess cash

Current Targets

$600 - $800 million cash

$2.0 billion Tesoro revolver

$1.6 billion TLLP revolver

Tesoro Unconsolidated1: Debt/EBITDA

£ 1.0x

TLLP: Debt/EBITDA £ 4.0x

Tesoro Consolidated: Debt/EBITDA £ 2.5x (depending on size of MLP)

20% IRR for Refining

15% IRR for Logistics & Marketing

~10% dividend growth

Remaining repurchase authorization of $1.1 billion

Pro Forma Targets

$1.0 - $1.2 billion cash

$2.5 - $3.0 billion Tesoro revolver

No change to TLLP revolver at this time

Same target metrics

Execution on synergies and growth plans position Tesoro for investment

grade credit rating

Evaluate cost of capital and IDR options to support larger growth portfolio

No change

Dividend strategy unchanged

Increased share repurchases by $1.0 billion to over $2.0 billion in total

1) Parent company

excluding MLP debt

15 | Tesoro

Western Refining

Tesoro 2017E Stand-Alone Outlook

2017E Business Assumptions

Tesoro Index (dollars per barrel) 12 – 14

Marketing Fuel Margins (cents per gallon) 11 – 14

Annual Improvements to Operating Income

($ in Millions) 475 - 575

2017E Capital Outlook (in millions)

Income $ 325

Regulatory 90

Maintenance 455

Total Tesoro Capital Expenditures $ 870

Turnaround Expenditures $ 360

Growth $ 230

Maintenance 95

Total TLLP Capital Expenditures1 $ 325

1) TLLP capital principally funded through sources

independent of Tesoro (MLP cash flows, unit issuances, debt)

16 | Tesoro

Western Refining

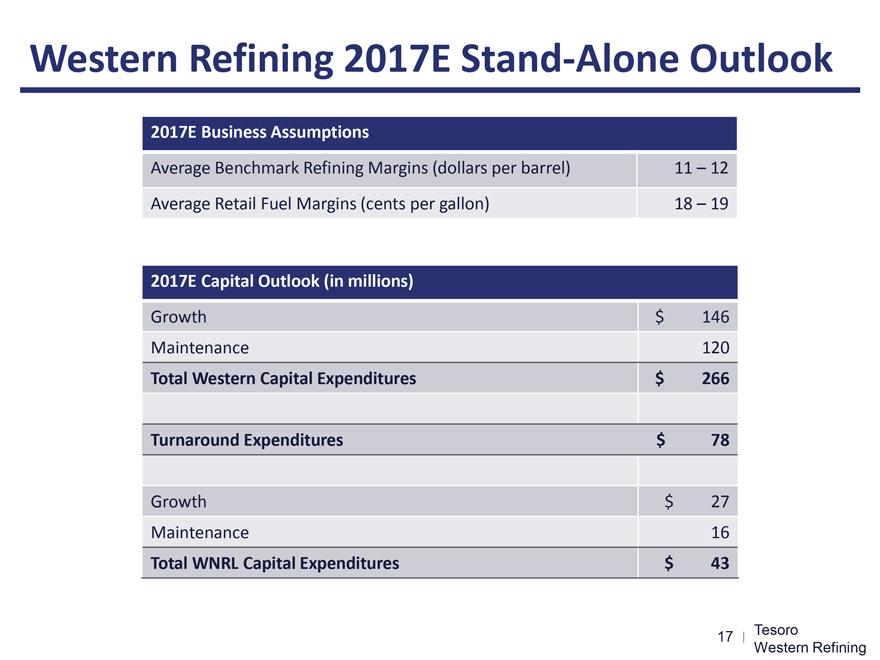

Western Refining 2017E Stand-Alone Outlook

2017E Business Assumptions

Average Benchmark Refining Margins (dollars per barrel) 11 –

12

Average Retail Fuel Margins (cents per gallon) 18 – 19

2017E Capital

Outlook (in millions)

Growth $ 146

Maintenance 120

Total Western Capital Expenditures $ 266

Turnaround Expenditures $ 78

Growth $ 27

Maintenance 16

Total WNRL Capital Expenditures $ 43

17 | Tesoro

Western Refining

Delivering Significant Shareholder Value

Substantial synergies

Significant earnings accretion

Top tier refining system

Leading multi-brand marketing portfolio in growing geographies

Robust platform for logistics growth

Strong balance sheet and capacity for

further growth

TESORO

TESORO LOGISTICS

Western Refining Logistics

Western Refining

Premier, highly integrated and geographically diversified refining, marketing and logistics company

18 | Tesoro

Western Refining

TESORO W™ Western Refining

Appendix

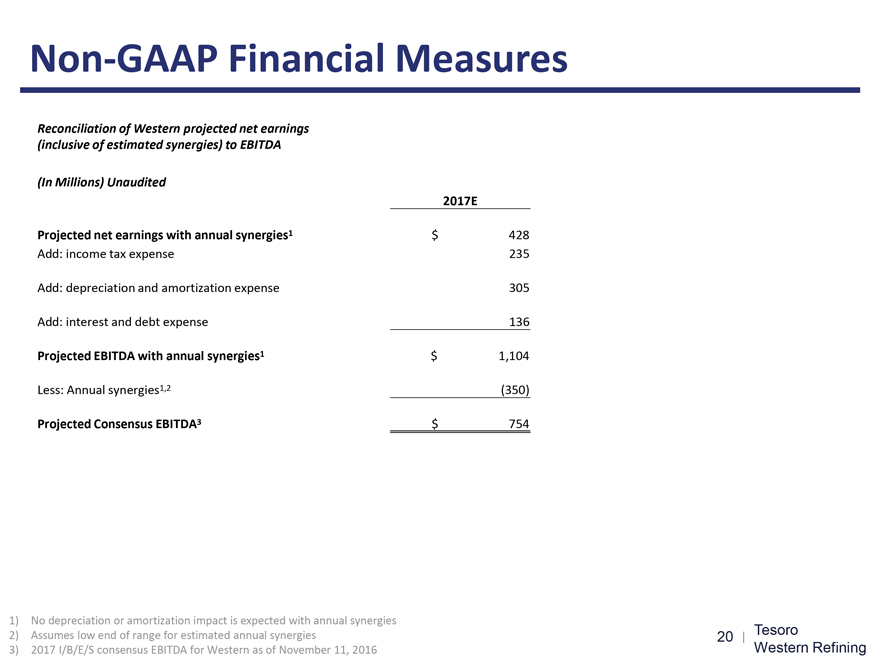

Non-GAAP Financial Measures

Reconciliation of Western projected net earnings

(inclusive of estimated

synergies) to EBITDA

(In Millions) Unaudited

2017E

Projected net earnings with annual synergies1 $ 428

Add: income tax expense 235

Add: depreciation and amortization expense 305

Add: interest and debt expense 136

Projected EBITDA with annual synergies1 $ 1,104

Less: Annual synergies1,2 (350)

Projected Consensus EBITDA3 $ 754

1) No depreciation or amortization impact is expected with

annual synergies

2) Assumes low end of range for estimated annual synergies

3) 2017 I/B/E/S consensus EBITDA for Western as of November 11, 2016

20 |

Tesoro

Western Refining

Important Information

No

Offer or Solicitation:

This communication relates to a proposed business combination between Western and Tesoro. This announcement is for informational purposes

only and is neither an offer to purchase, nor a solicitation of an offer to sell, any securities or the solicitation of any vote in any jurisdiction pursuant to the proposed transactions or otherwise, nor shall there be any sale, issuance or

transfer or securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Additional Information and Where to Find It:

This communication may be deemed to be

solicitation material in respect of the proposed transaction between Tesoro and Western. In connection with the proposed transaction, Western and/or Tesoro may file one or more proxy statements, registration statements, proxy statement/prospectus or

other documents with the SEC. This communication is not a substitute for the proxy statement, registration statement, proxy statement/prospectus or any other documents that Tesoro or Western may file with the SEC or send to stockholders in

connection with the proposed transaction. STOCKHOLDERS OF TESORO AND WESTERN ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE PROXY STATEMENT(S), REGISTRATION STATEMENT(S) AND/OR PROXY STATEMENT/PROSPECTUS, BECAUSE THEY

WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION.

Any definitive proxy statement(s) (if and when available) will be mailed to stockholders of

Western and/or Tesoro, as applicable. Investors and security holders will be able to obtain copies of these documents, including the proxy statement/prospectus, and other documents filed with the SEC (when available) free of charge at the SEC’s

website, http://www.sec.gov. Copies of documents filed with the SEC by Tesoro will be made available free of charge on Tesoro’s website at http://www.tsocorp.com or by contacting Tesoro’s Investor Relations Department by phone at

210-626-6000. Copies of documents filed with the SEC by Western will be made available free of charge on Western’s website at http://www.wnr.com or by contacting Western’s Investor Relations Department by phone at 602-286-1530 or

602-286-1533.

Participants in the Solicitation:

Tesoro and its directors and

executive officers, and Western and its directors and executive officers, may be deemed to be participants in the solicitation of proxies from the holders of Tesoro common stock and Western common stock in respect of the proposed transaction.

Information about the directors and executive officers of Tesoro is set forth in the proxy statement for Tesoro’s 2016 Annual Meeting of Stockholders, which was filed with the SEC on March 22, 2016, and in the other documents filed after the

date thereof by Tesoro with the SEC. Information about the directors and executive officers of Western is set forth in the proxy statement for Western’s 2016 Annual Meeting of Shareholders, which was filed with the SEC on April 22, 2016, and in

the other documents filed after the date thereof by Western with the SEC. Investors may obtain additional information regarding the interests of such participants by reading the proxy statement/prospectus regarding the proposed transaction when it

becomes available. You may obtain free copies of these documents as described in the preceding paragraph.

21 | Tesoro

Western Refining

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Valstybės investicinis kapitalas UAB audited Annual information for the year 2023

- ROSEN, A LEADING AND TOP RANKED LAW FIRM, Encourages Lifecore Biomedical Inc. f/k/a Landec Corporation Investors to Inquire About Securities Class Action Investigation – LFCR, LNDC

- ROSEN, NATIONAL TRIAL LAWYERS, Encourages Northern Genesis Acquisition Corp. n/k/a The Lion Electric Company Investors to Secure Counsel Before Important Deadline in Securities Class Action – NGA

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share