Form S-4 SCHULMAN A INC Filed by: ICO P&O, Inc.

Table of Contents

As filed with the Securities and Exchange Commission on October 27, 2016

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

A. Schulman, Inc.*

(Exact name of registrant as specified in its charter)

| Delaware (State of Incorporation) |

2821 (Primary Standard Industrial Classification Code Number) |

34-0514850 (I.R.S. Employer Identification No.) |

3637 Ridgewood Road,

Fairlawn, Ohio 44333

(330) 666-3751

(Address, including zip code, and telephone number, including area code, of registrants’ principal executive offices)

Andrean R. Horton

Executive Vice President and Chief Legal Officer

3637 Ridgewood Road,

Fairlawn, Ohio 44333

(330) 666-3751

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With a copy to:

Kimberly J. Pustulka

Jones Day

901 Lakeside Avenue

Cleveland, Ohio 44114

(216) 586-3939

Approximate date of commencement of proposed exchange offer: As soon as practicable after this Registration Statement is declared effective.

If the securities being registered on this form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, please check the following box. ☐

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a small reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “small reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☒ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☐ (Do not check if a smaller reporting company) | Small reporting company | ☐ |

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) ☐

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) ☐

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of Each Class of Securities to be Registered |

Amount to be |

Proposed Maximum Offering Price per Note |

Proposed Offering Price |

Amount of Registration Fee(1) | ||||

| 6.875% Senior Notes due 2023 |

$375,000,000 | 100% | $375,000,000 | $43,462.50 | ||||

| Guarantees of 6.875% Senior Notes due 2023(2) |

N/A | N/A | N/A | N/A(3) | ||||

|

| ||||||||

|

| ||||||||

| (1) | Calculated in accordance with Rule 457(f) of the Securities Act of 1933 (the “Securities Act”). |

| (2) | See inside facing page for additional registrant guarantors. |

| (3) | Pursuant to Rule 457(n) under the Securities Act, no separate filing fee is required for the guarantees. |

The Registrants hereby amend this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrants shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act, or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

| * | See table of additional registrants |

Table of Contents

Table of Additional Registrants*

| Exact Name of Registrant as Specified in its Charter |

State of Incorporation or Organization |

IRS Employer Identification Number |

Primary Standard Industrial Classification Number | |||

| Bayshore Industrial, L.L.C. |

Texas | 75-0554850 | 325211 | |||

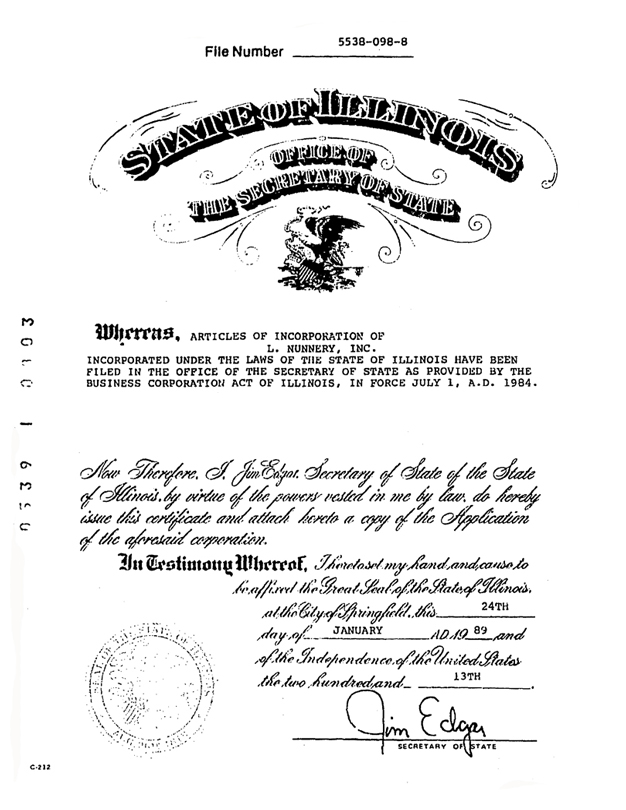

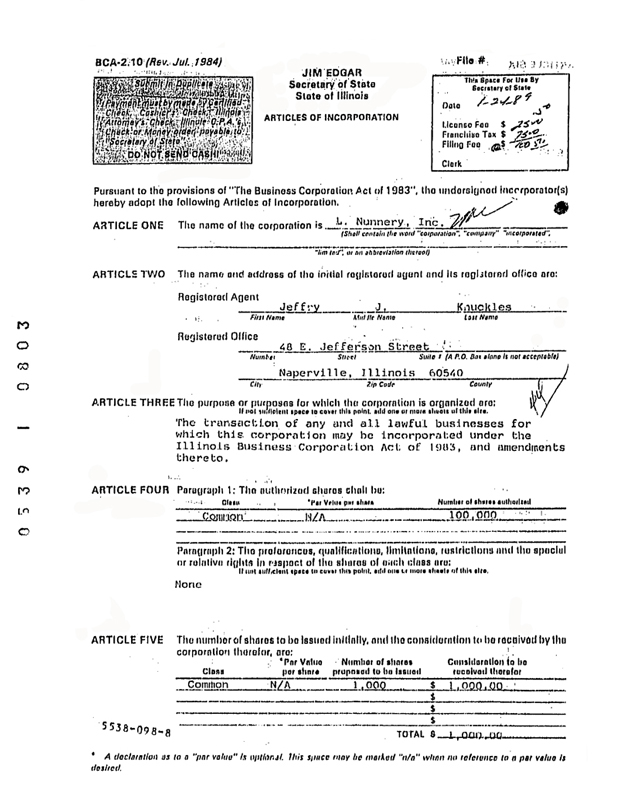

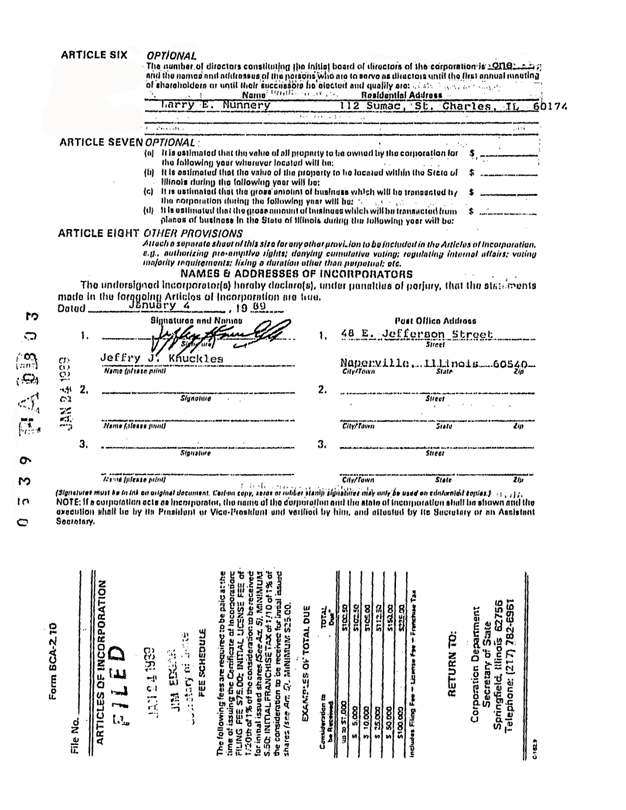

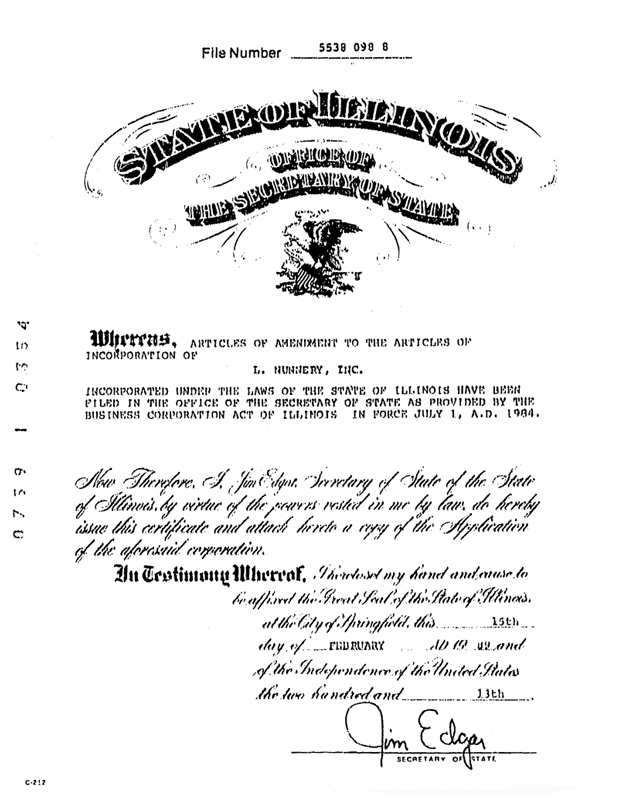

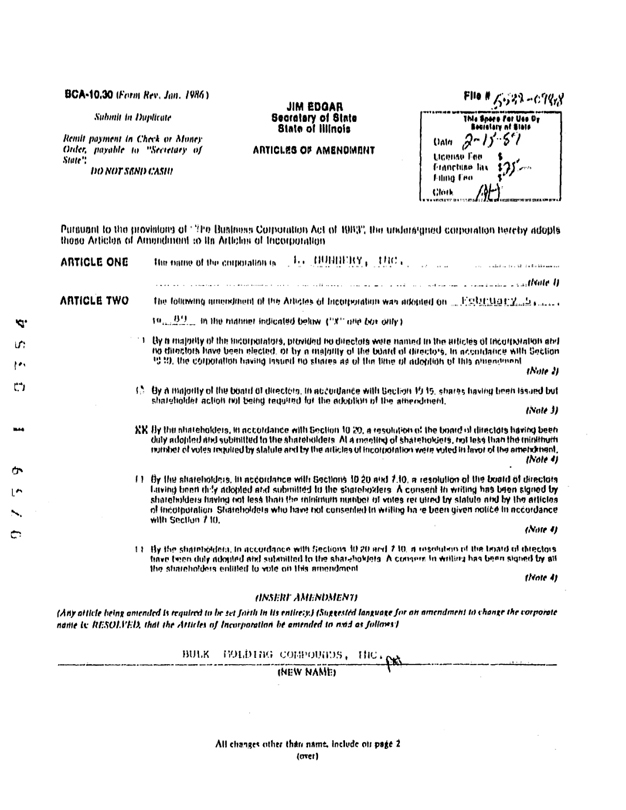

| Bulk Molding Compounds, Inc. |

Illinois | 36-3635448 | 325211 | |||

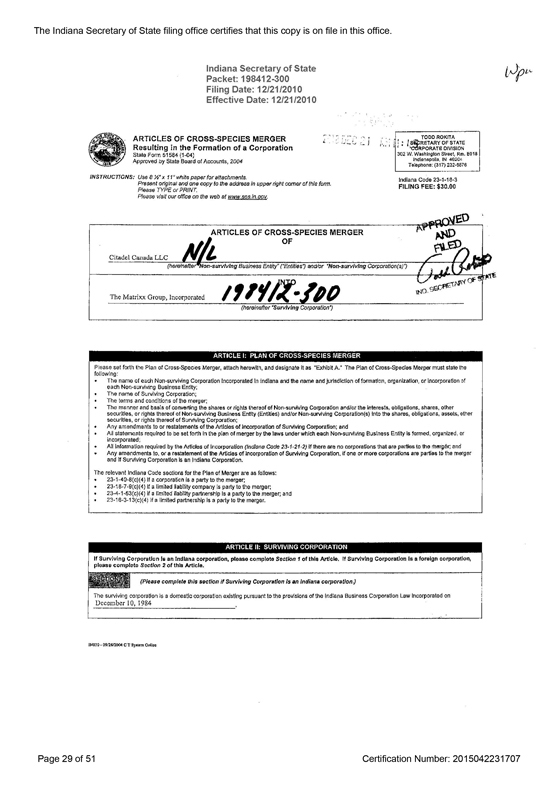

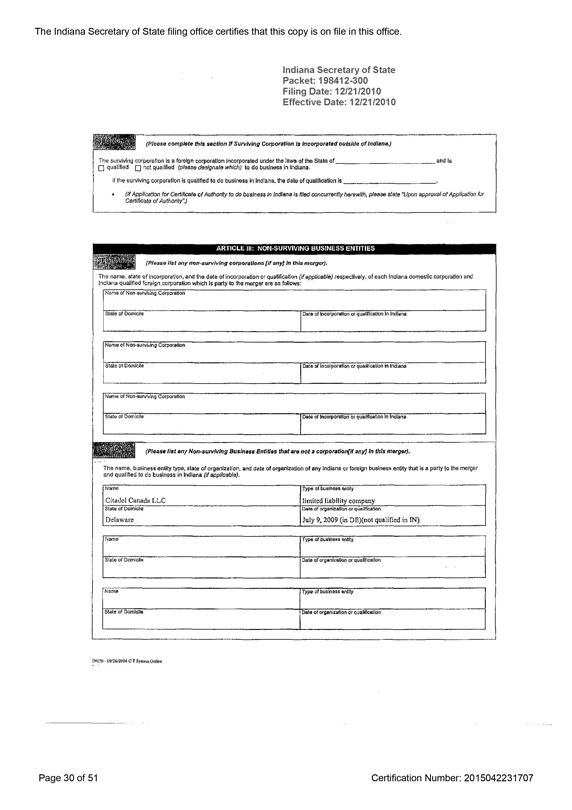

| Citadel Intermediate Holdings, LLC |

Delaware | 26-2495369 | 551112 | |||

| Citadel Plastics Holdings, Inc. |

Delaware | 20-8502342 | 551112 | |||

| HGGC Citadel Plastics Holdings, Inc. |

Delaware | 45-4472141 | 551112 | |||

| HGGC Citadel Plastics Intermediate Holdings, Inc. |

Delaware | 45-4472265 | 551112 | |||

| HPC Holdings, LLC |

Delaware | 26-2526837 | 551112 | |||

| ICO-Schulman, LLC |

Texas | 37-1601870 | 551112 | |||

| ICO Global Services, Inc. |

Delaware | 51-0380029 | 551112 | |||

| ICO P&O, Inc. |

Delaware | 75-0567360 | 551112 | |||

| ICO Polymers, Inc. |

Delaware | 74-2869009 | 551112 | |||

| ICO Polymers North America, Inc. |

New Jersey | 22-2548114 | 325211 | |||

| ICO Technology, Inc. |

Delaware | 74-2868642 | 551112 | |||

| LPI Holding Company |

Delaware | 20-3275636 | 551112 | |||

| Lucent Polymers Inc. |

Delaware | 20-3275702 | 325211 | |||

| Premix, Inc. |

Ohio | 34-0845290 | 325211 | |||

| Premix Holding Company |

Delaware | 39-1961790 | 551112 | |||

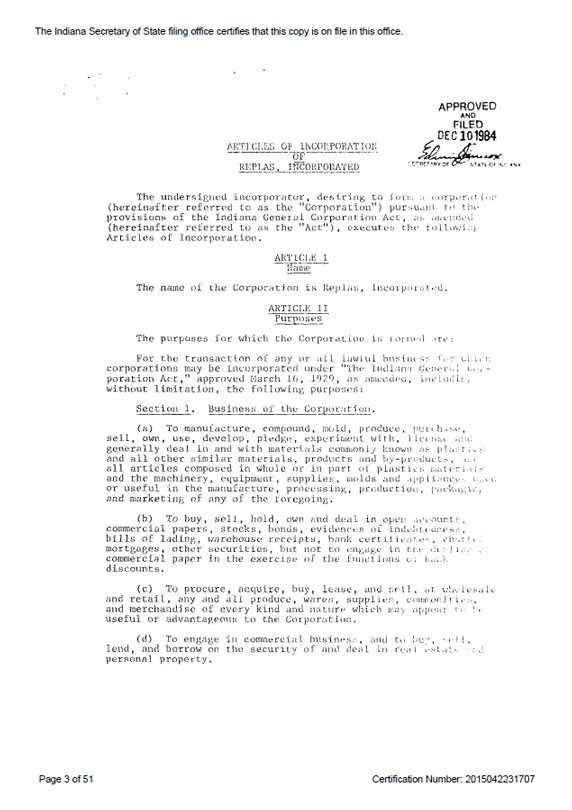

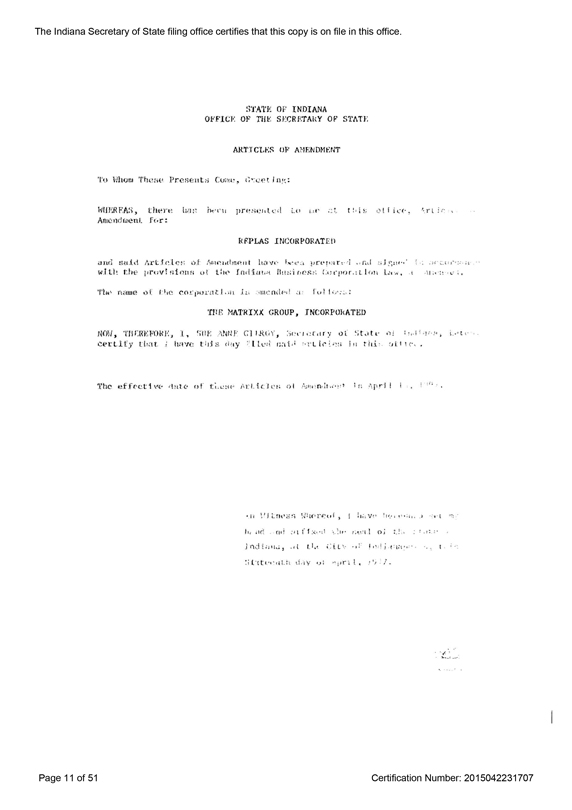

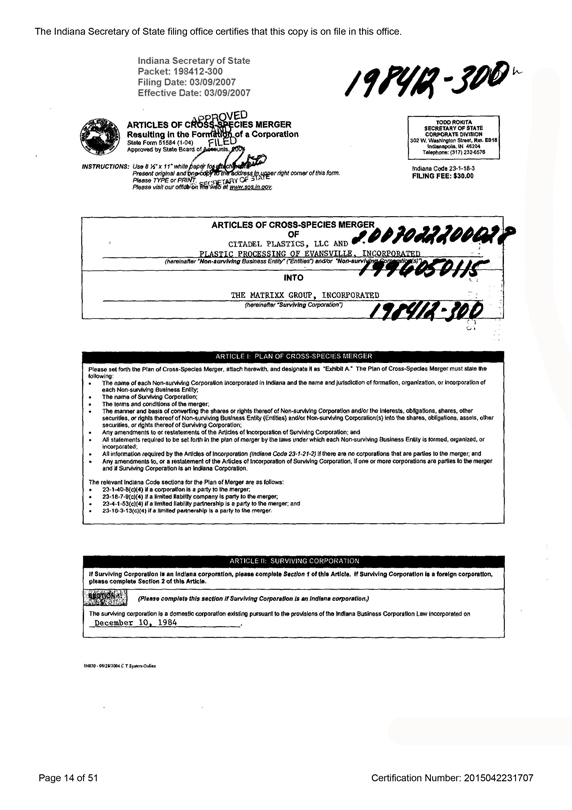

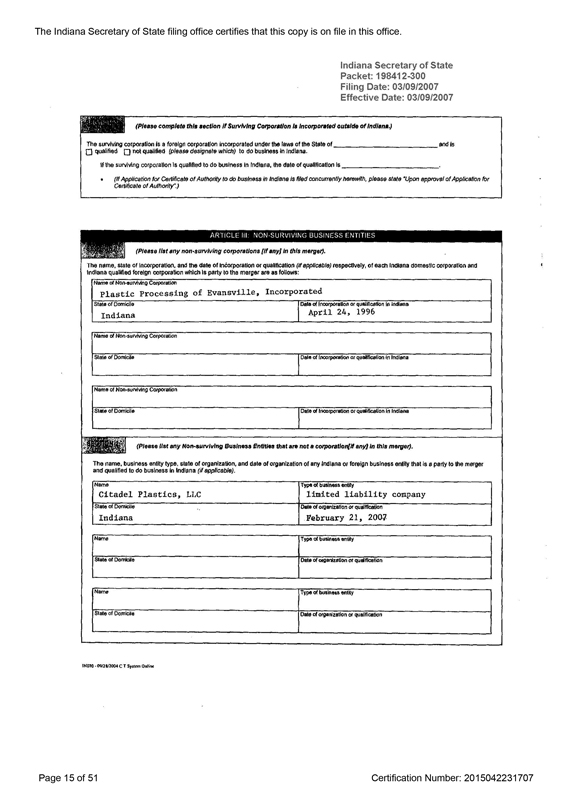

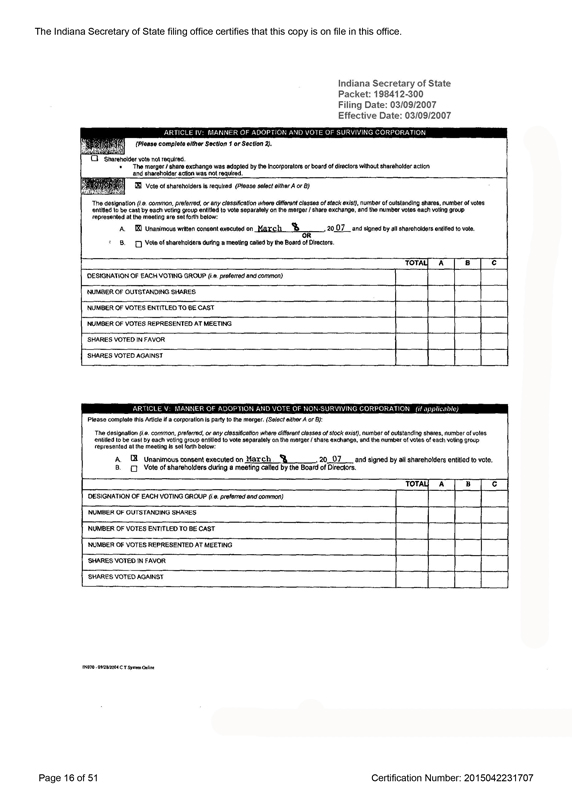

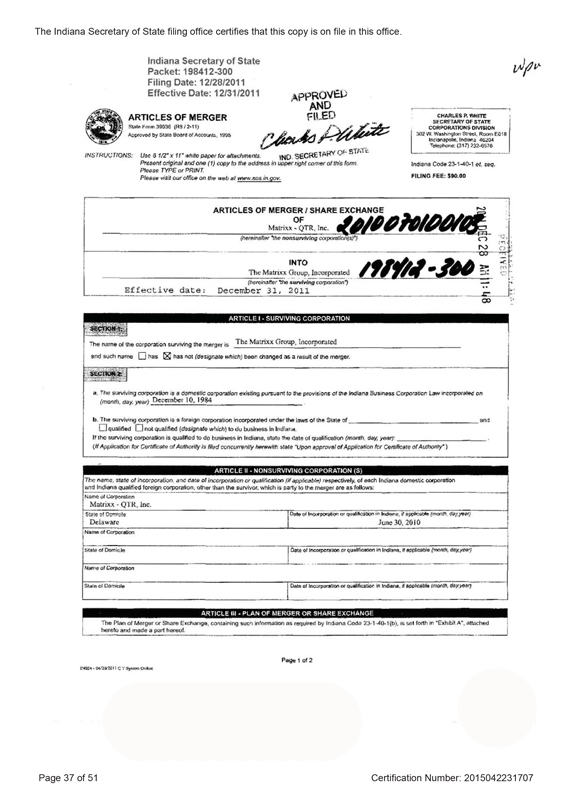

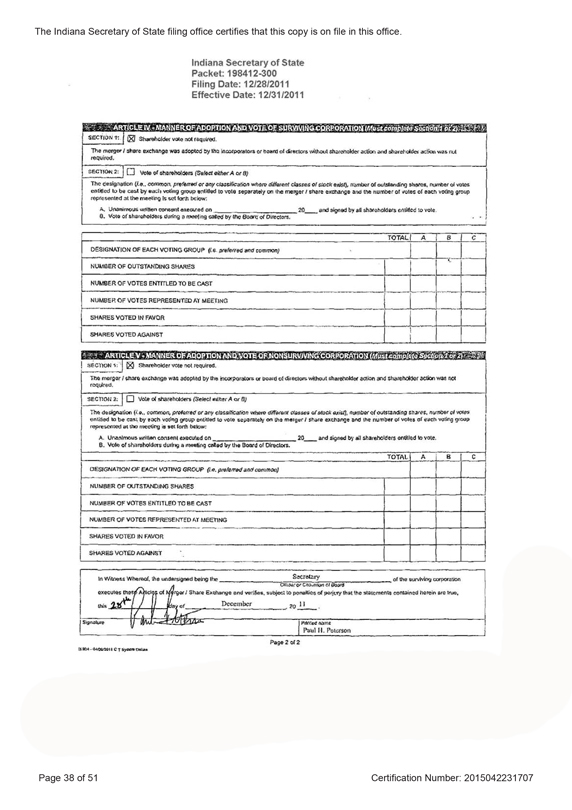

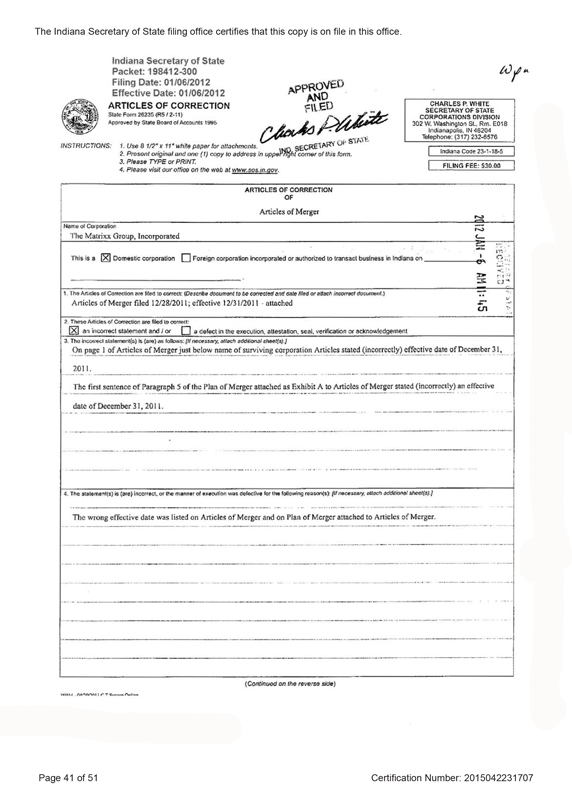

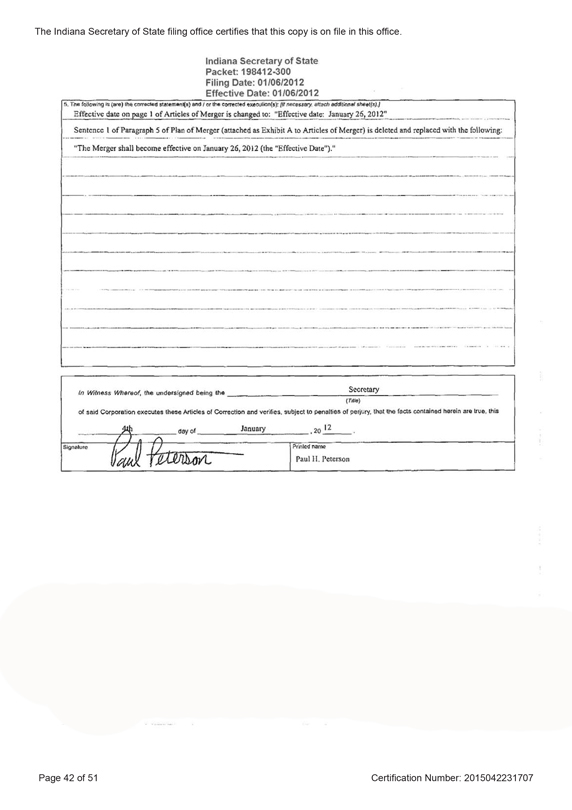

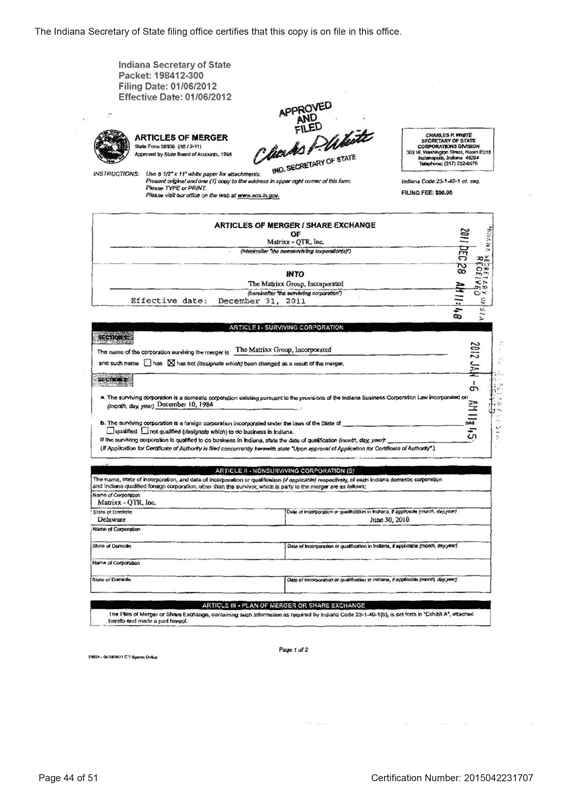

| The Matrixx Group, Incorporated |

Indiana | 35-1622701 | 325211 | |||

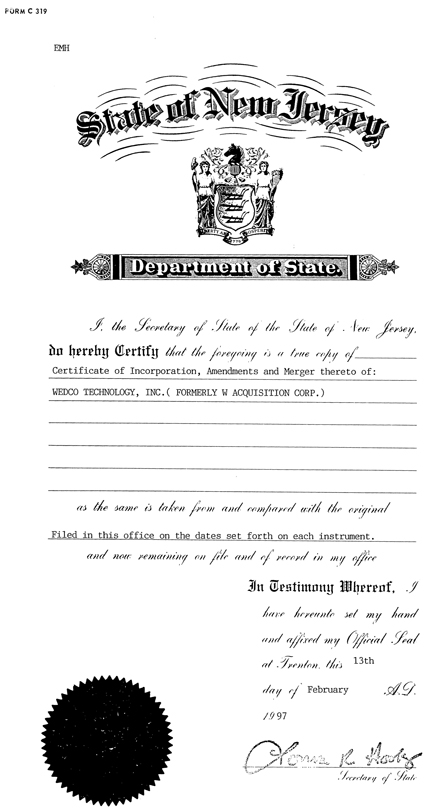

| Wedco Technology, Inc. |

New Jersey | 22-3439360 | 551112 | |||

*The address and telephone number of the principal executive offices of each additional registrant is 3637 Ridgewood Road, Fairlawn, Ohio 44333, (330) 666-3751. The name, address and telephone number of the agent for service of each additional registrant is Andrean R. Horton, Executive Vice President and Chief Legal Officer at 3637 Ridgewood Road, Fairlawn, Ohio 44333, (330) 666-3751.

Table of Contents

Information contained herein is subject to completion or amendment. A registration statement relating to these securities has been filed with the Securities and Exchange Commission. These securities may not be sold nor may offers to buy be accepted prior to the time the registration statement becomes effective. This prospectus shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of these securities in any state in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such state.

SUBJECT TO COMPLETION, DATED OCTOBER 27, 2016

PROSPECTUS

OFFER TO EXCHANGE

Up to $375,000,000 aggregate principal amount of 6.875% Senior Notes due 2023

For any and all outstanding 6.875% Senior Notes due 2023

On May 26, 2015, we issued $375,000,000 aggregate principal amount of restricted 6.875% Senior Notes due 2023 in a private placement. We refer to these notes as the “Original Notes.”

We are offering to exchange up to $375,000,000 aggregate principal amount of new 6.875% Senior Notes due 2023, which we refer to as the “Exchange Notes,” for the Original Notes. We refer to this offer to exchange as the “Exchange Offer.” The terms of the Exchange Notes are substantially identical to the terms of the Original Notes, except that the Exchange Notes will be registered under the Securities Act of 1933, or the “Securities Act,” and the transfer restrictions and registration rights and related special interest provisions applicable to the Original Notes will not apply to the Exchange Notes. The Exchange Notes will be part of the same series of Original Notes and issued under the same base indenture and applicable supplemental indentures, which we refer to collectively as the “Indenture.” The Exchange Notes will be exchanged for Original Notes in minimum denominations of $2,000 and integral multiples of $1,000 in excess thereof. We will not receive any proceeds from the issuance of Exchange Notes in the Exchange Offer.

You may withdraw tenders of Original Notes at any time prior to the expiration of the Exchange Offer.

The Exchange Offer expires at 9:00 a.m. New York City time on , 2016, unless extended, which we refer to as the “Expiration Date.”

We do not intend to list the Exchange Notes on any securities exchange or to seek approval through any automated quotation system, and no active public market for the Exchange Notes is anticipated.

You should consider carefully the risk factors beginning on page 7 of this prospectus before deciding whether to participate in the Exchange Offer.

Neither the Securities and Exchange Commission, or the “SEC,” nor any state securities commission has approved or disapproved of these Exchange Notes or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2016.

Table of Contents

| ii | ||||

| ii | ||||

| iii | ||||

| 1 | ||||

| 7 | ||||

| 13 | ||||

| 20 | ||||

| 20 | ||||

| 21 | ||||

| 74 | ||||

| 77 | ||||

| 78 | ||||

| 78 | ||||

| 78 |

This prospectus may only be used where it is legal to make the Exchange Offer and by a broker-dealer for resales of Exchange Notes acquired in the Exchange Offer where it is legal to do so.

Rather than repeat certain information in this prospectus that we have already included in reports filed with the SEC, this prospectus incorporates important business and financial information about us that is not included in or delivered with this prospectus. We will provide this information to you at no charge upon written or oral request directed to: A. Schulman, Inc., 3637 Ridgewood Road, Fairlawn, Ohio 44333, Attention: Corporate Secretary, telephone: (330) 666-3751. In order to receive timely delivery of any requested documents in advance of the Expiration Date, you should make your request no later than , 2016, which is five full business days before you must make a decision regarding the Exchange Offer.

In making a decision regarding the Exchange Offer, you should rely only on the information contained in or incorporated by reference into this prospectus. We have not authorized anyone to provide you with any other information. If you receive any other information, you should not rely on it.

You should not assume that the information contained in this prospectus is accurate as of any date other than the date of the front cover of this prospectus or that the information incorporated by reference into this prospectus is accurate as of any date other than the date of the incorporated document. Neither the delivery of this prospectus nor any exchange made hereunder shall under any circumstances imply that the information herein is correct as of any date subsequent to the date on the cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

In this prospectus, unless otherwise indicated, including as set forth under the heading “Description of the Exchange Notes,” the terms “Company,” “issuer,” “A. Schulman,” “us,” “we” and “our” refer to A. Schulman, Inc. and its consolidated subsidiaries.

Each broker-dealer that receives Exchange Notes for its own account pursuant to the Exchange Offer must acknowledge that it will deliver a prospectus in connection with any resale of Exchange Notes. The letter of transmittal accompanying this prospectus, which we refer to as the “Letter of Transmittal,” states that by so acknowledging and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an “underwriter” within the meaning of the Securities Act. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of Exchange Notes received in exchange for Original Notes where the Original Notes were acquired by such broker-dealer as a result of market-making activities or other trading activities. We have agreed that, for a period ending on the date that is 20 business days after the date of this prospectus, we will make this prospectus available to any broker-dealer for use in connection with these resales. See “Plan of Distribution.”

Table of Contents

WHERE YOU CAN FIND ADDITIONAL INFORMATION

We are subject to the informational reporting requirements of the Securities Exchange Act of 1934, which we refer to as the “Exchange Act.” We file annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings are available over the Internet at the SEC’s website at www.sec.gov. You may read and copy any reports, statements and other information filed by us at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Please call 1-800-SEC-0330 for further information about the Public Reference Room. You may also inspect our SEC reports and other information on our website at www.aschulman.com. The information contained on or accessible through our website is not part of this prospectus, other than the documents that we file with the SEC that are specifically incorporated by reference in this prospectus.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

We file periodic reports and other information with the SEC. In this prospectus, we “incorporate by reference” certain information we have filed with the SEC, which means that important information is being disclosed to you by referring to those documents. Those documents that are filed prior to the date of this prospectus are considered part of this prospectus, and those documents that are filed after the date of this prospectus and prior to the completion of the Exchange Offer will be considered a part of this prospectus from the date of the filing of such documents. Any statement contained in a document incorporated or deemed to be incorporated herein by reference, or contained in this prospectus, shall be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained herein or in any other subsequently dated or filed document which also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. The documents listed below are incorporated by reference in this prospectus:

| • | our Annual Report on Form 10-K for the year ended August 31, 2016; and |

| • | our Current Reports on Form 8-K filed on September 22, 2016, September 28, 2016, October 3, 2016 (amended October 7, 2016), October 17, 2016 and October 24, 2016. |

We also incorporate by reference any future filings we make with the SEC under Section 13(a), 13(c), 14 or 15(d) of the Exchange Act on or after the date of this prospectus and prior to the termination of the Exchange Offer. We do not and will not, however, incorporate by reference in this prospectus any documents or portions thereof that are not deemed “filed” with the SEC, including any information furnished pursuant to Item 2.02 or Item 7.01 of our Current Reports on Form 8-K after the date of this prospectus unless, and except to the extent, specified in such Current Reports.

We will provide you with a copy of any of these filings (other than an exhibit to these filings, unless the exhibit is specifically incorporated by reference into the filing requested) at no cost, if you submit a request to us by writing or telephoning us at the following address or telephone number:

A. Schulman, Inc.

3637 Ridgewood Road

Fairlawn, Ohio 44333

Attn: Corporate Secretary

(330) 666-3751

ii

Table of Contents

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

A number of the matters discussed in this prospectus that are not historical or current facts deal with potential future circumstances and developments and may constitute “forward-looking statements” within the meaning of the federal securities laws. Forward-looking statements can be identified by the fact that they do not relate strictly to historic or current facts and relate to future events and expectations. Forward-looking statements contain such words as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” and other words and terms of similar meaning in connection with any discussion of future operating or financial performance. Forward-looking statements are based on management’s current expectations and include known and unknown risks, uncertainties and other factors, many of which management is unable to predict or control, that may cause actual results, performance or achievements to differ materially from those expressed or implied in the forward-looking statements. Any forward-looking statement speaks only as of the date on which such statement is made, and we undertake no obligation, and specifically decline any obligation, other than that imposed by law, to publicly update or revise any forward-looking statements whether as a result of new information, future events or otherwise.

Risk factors and uncertainties that could cause actual results to differ materially from those suggested by these forward-looking statements, and could adversely affect the Company’s future financial performance, include, but are not limited to, the following:

| • | worldwide and regional economic, business and political conditions, including continuing economic uncertainties in some or all of the Company’s major product markets or countries where the Company has operations; |

| • | the effectiveness of the Company’s efforts to improve operating margins through sales growth, price increases, productivity gains, and improved purchasing techniques; |

| • | competitive factors, including intense price competition; |

| • | fluctuations in the value of currencies in areas where the Company operates; |

| • | volatility of prices and availability of the supply of energy and raw materials that are critical to the manufacture of the Company’s products, particularly plastic resins derived from oil and natural gas; |

| • | changes in customer demand and requirements; |

| • | effectiveness of the Company to achieve the level of cost savings, productivity improvements, growth and other benefits anticipated from acquisitions and the integration thereof, joint ventures and restructuring initiatives; |

| • | escalation in the cost of providing employee health care; |

| • | uncertainties regarding the resolution of pending and future litigation and other claims; |

| • | the performance of the global automotive market as well as other markets served; |

| • | further adverse changes in economic or industry conditions, including global supply and demand conditions and prices for products; |

| • | operating problems with our information systems as a result of system security failures such as viruses, cyber-attacks or other causes; |

| • | our current debt position could adversely affect our financial health and prevent us from fulfilling our financial obligations; |

iii

Table of Contents

| • | integration of acquisitions, including most recently HGGC Citadel Plastic Holdings, Inc., which we refer to as “Citadel,” with our existing business, including the risk that the integration will be more costly or more time consuming and complex or simply less effective than anticipated; |

| • | our ability to achieve the anticipated synergies, cost savings and other benefits from the Citadel acquisition; |

| • | substantial time devoted by management to the integration of the Citadel acquisition; and |

| • | failure of counterparties to perform under the terms and conditions of contractual arrangements, including suppliers, customers, buyers and sellers of a business and other third parties with which the Company contracts. |

You should refer to the section entitled “Risk Factors” for a discussion of certain risks and uncertainties that may cause our actual results to differ from expected results. These factors and the other risk factors described in this prospectus are not necessarily all of the important factors that could cause actual results to differ materially from those expressed in any of our forward-looking statements. Other unknown or unpredictable factors also could adversely affect our results. Consequently, there can be no assurance that the actual results or developments anticipated by us will be realized or, even if substantially realized, that they will have the expected consequences to or effects on us. Given these uncertainties, prospective investors are cautioned not to place undue reliance on such forward-looking statements.

iv

Table of Contents

This summary highlights selected information about us and the Exchange Offer. This summary may not contain all of the information that may be important to you. For a more complete understanding of our business, you should read carefully this entire prospectus, including the section entitled “Risk Factors” in this prospectus and in our Annual Report on Form 10-K for the fiscal year ended August 31, 2016 incorporated by reference herein, and in the other documents that we refer to and that are incorporated by reference in this prospectus, for a complete understanding of us and the Exchange Offer. In particular, we incorporate by reference important business and financial information into this prospectus. This summary contains forward-looking statements that involve risks and uncertainties.

Overview

A. Schulman, Inc. is an international supplier of high-performance plastic formulations, resins, and services headquartered in Fairlawn, Ohio. The Company’s customers span a wide range of markets such as packaging, mobility, building & construction, electronics & electrical, agriculture, personal care & hygiene, custom services, and sports, home & leisure.

On June 1, 2015, the Company acquired Citadel, a specialty engineered plastics company that produces thermoset composites and thermoplastic compounds for specialty product applications. The Company used the net proceeds from the private sale of the Original Notes to finance a portion of the cash consideration that was paid in the Citadel acquisition, to refinance certain existing debt and for general corporate purposes, including fees and expenses related to the Citadel acquisition.

Corporate Information

A. Schulman, Inc. was founded as an Ohio corporation in 1928 by Alex Schulman in Akron, Ohio. In 1969, we changed our state of incorporation to Delaware, and went public in 1972. Our principal executive office is located at 3637 Ridgewood Road, Fairlawn, Ohio 44333 and our telephone number is (330) 666-3751. Our common stock is listed on the NASDAQ Stock Market under the symbol “SHLM.” Our website address is www.aschulman.com. The information contained on or accessible through our website is not a part of this prospectus, other than the documents that we file with the SEC that are incorporated by reference into this prospectus.

1

Table of Contents

The Exchange Offer

The following summary is provided solely for your convenience. This summary is not intended to be complete. You should read the full text and more specific details contained elsewhere in this prospectus. For a more detailed description of the Exchange Offer, see “The Exchange Offer.”

| Exchange Offer |

We are offering to exchange up to $375,000,000 aggregate principal amount of our registered 6.875% Senior Notes due 2023 for an equal principal amount of our outstanding restricted 6.875% Senior Notes due 2023 that were issued on May 26, 2015. The terms of the Exchange Notes are identical in all material respects to those of the Original Notes, except for transfer restrictions and registration rights and related special interest provisions relating to the Original Notes. Holders of Original Notes do not have any appraisal or dissenters’ rights in connection with the Exchange Offer. |

| Purpose of Exchange Offer |

The Exchange Notes are being offered to satisfy our obligations under the registration rights agreement entered into at the time we issued and sold the Original Notes, which we refer to as the “Registration Rights Agreement.” |

| Expiration Date; withdrawal of tenders; return of Original Notes not accepted for exchange |

The Exchange Offer will expire at 9:00 a.m., New York City time, on , 2016, or on a later date and time to which we extend it. Tenders of Original Notes in the Exchange Offer may be withdrawn at any time prior to the Expiration Date. We will exchange the Exchange Notes for validly tendered Original Notes promptly following the Expiration Date. Any Original Notes that are not accepted for exchange for any reason will be returned by us, at our expense, to the tendering holder promptly after the expiration or termination of the Exchange Offer. |

| Procedures for tendering Original Notes |

Each holder of Original Notes wishing to participate in the Exchange Offer must follow procedures of the Depository Trust Company’s, which we refer to as “DTC,” Automated Tender Offer Program, or “ATOP,” subject to the terms and procedures of that program. The ATOP procedures require that the Exchange Agent, as defined below, receive, prior to the Expiration Date, a computer-generated message known as an “agent’s message” that is transmitted through ATOP and that DTC confirm that: |

| • | DTC has received instructions to exchange your Original Notes; and |

| • | you agree to be bound by the terms of the Letter of Transmittal. |

| See “The Exchange Offer—Procedures for tendering Original Notes.” |

| Consequences of failure to exchange the Original Notes |

You will continue to hold Original Notes, which will remain subject to their existing transfer restrictions, if you do not validly tender your |

2

Table of Contents

| Original Notes or you tender your Original Notes and they are not accepted for exchange. With some limited exceptions, we will have no obligation to register the Original Notes after we consummate the Exchange Offer. See “The Exchange Offer—Terms of the Exchange Offer” and “The Exchange Offer—Consequences of failure to exchange.” |

| Conditions to the Exchange Offer |

The Exchange Offer is not conditioned upon any minimum aggregate principal amount of Original Notes being tendered or accepted for exchange. The Exchange Offer is subject to customary conditions, which may be waived by us in our discretion. We currently expect that all of the conditions will be satisfied and that no waivers will be necessary. |

| Exchange Agent |

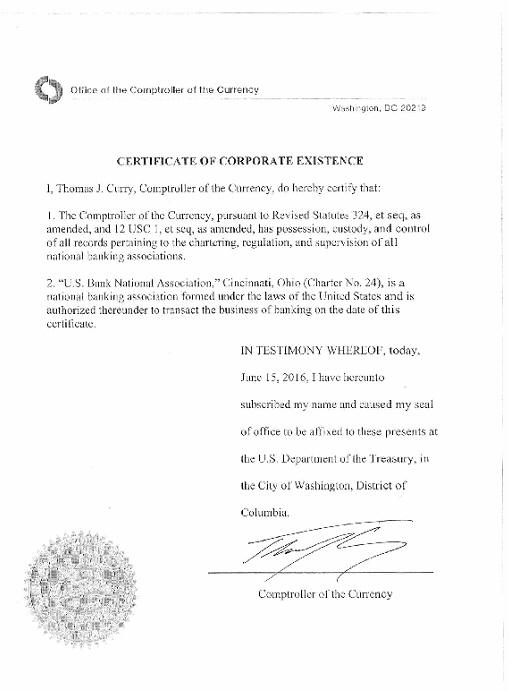

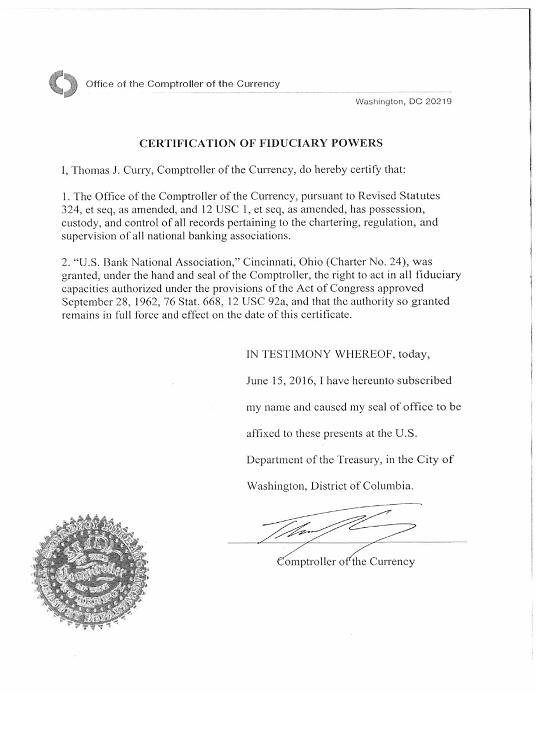

U.S. Bank National Association, which we refer to as the “Exchange Agent.” |

| Certain United States federal income tax considerations |

Your exchange of an Original Note for an Exchange Note will not constitute a taxable exchange. The exchange will not result in taxable income, gain or loss being recognized by you or by us for United States federal income tax purposes. Immediately after the exchange, you will have the same adjusted basis and holding period in each Exchange Note received as you had immediately prior to the exchange in the corresponding Original Note surrendered. See “Certain United States Federal Income Tax Considerations.” |

| Risk Factors |

You should consider carefully the risk factors beginning on page 7 of this prospectus before deciding whether to participate in the Exchange Offer. |

3

Table of Contents

The Exchange Notes

The following summary is provided solely for your convenience. This summary is not intended to be complete. You should read the full text and more specific details contained elsewhere in this prospectus. For a more detailed description of the Exchange Notes, see “Description of the Exchange Notes.” With respect to the discussion of the terms of the Exchange Notes on the cover page, in this summary of the offering and under the caption “Description of the Exchange Notes,” the terms “we,” “us,” “our,” “A. Schulman” or the “Company” refer only to A. Schulman, Inc., and not to any of its subsidiaries.

| Issuer |

A. Schulman, Inc., a Delaware corporation. |

| Notes Offered |

$375,000,000 aggregate principal amount of 6.875% Senior Notes due 2023. |

| Maturity |

The Exchange Notes will mature on June 1, 2023. |

| Interest |

Interest on the Exchange Notes will accrue at a rate of 6.875% per annum. Interest on the Exchange Notes will be payable semi-annually in cash in arrears on June 1 and December 1 of each year, commencing June 1, 2017. |

| Guarantees |

The Exchange Notes will be guaranteed on a senior unsecured basis, which we refer to as the “Guarantees,” by each of the Company’s domestic restricted subsidiaries that is a borrower or guarantor under its senior secured credit facilities, which we refer to as the “Senior Secured Credit Facilities” and include (a) a $300.0 million senior secured revolving credit facility due 2020, which we refer to as the “Revolving Credit Facility,” (b) $200.0 million senior secured term loan A facility due 2020, which we refer to as the “Term Loan A Facility,” and (c) approximately $500.0 million of senior secured term loan B facilities due 2022 consisting of a $350.0 million tranche and a €145.0 million tranche. We refer to the subsidiaries of the Company that issue Guarantees of the Exchange Notes as the “Guarantors.” |

| Ranking |

The Exchange Notes and the Guarantees will be our and the Guarantors’ senior unsecured obligations and will be equal in right of payment with all of our and the Guarantors’ existing and future senior debt and senior to any of our and the Guarantors’ future subordinated debt. The Exchange Notes and the Guarantees will rank junior to all of our and the Guarantors’ existing and future secured debt, including the Senior Secured Credit Facilities, to the extent of the value of the collateral securing such debt, including the obligations under the Senior Secured Credit Facilities. The Exchange Notes will also be structurally subordinated to all of the liabilities of our existing and future subsidiaries that do not guarantee the Exchange Notes. |

| We and our subsidiaries had approximately $955.0 million of indebtedness (excluding intercompany indebtedness) outstanding as of August 31, 2016, of which approximately $580.0 million was secured obligations, and we had an additional $279.1 million of |

4

Table of Contents

| availability under the Revolving Credit Facility (after giving effect to outstanding letters of credit), all of which would be secured debt if drawn, ranking effectively senior to the Exchange Notes to the extent of the value of the collateral securing such indebtedness. |

| For the year ended August 31, 2016, our non-Guarantor subsidiaries accounted for 70.5% of our net sales. Included in our non-Guarantor subsidiaries net sales are $5.1 million of intercompany sales. |

| Optional Redemption |

The Exchange Notes will be redeemable on or after June 1, 2018 at the redemption prices specified under “Description of the Exchange Notes—Optional Redemption.” Prior to June 1, 2018, we may redeem some or all of the Exchange Notes at a redemption price of 100% of the principal amount, plus accrued and unpaid interest, if any, to the redemption date, plus a “make whole” premium. Also, we may redeem up to 35% of the Exchange Notes before June 1, 2018 with the net cash proceeds from certain equity offerings at the redemption prices set forth elsewhere herein. See “Description of the Exchange Notes—Optional Redemption.” |

| Change of Control Offer |

If we experience specific kinds of changes of control, we must offer to repurchase all of the Exchange Notes at 101% of their principal amount, plus accrued and unpaid interest, if any, to the repurchase date. See “Description of the Exchange Notes—Change of Control.” |

| Asset Sale Offer |

If we or our restricted subsidiaries sell certain assets and do not repay certain debt or reinvest the proceeds of such sales within certain time periods, we must offer to repurchase a portion of the Exchange Notes as described under “Description of the Exchange Notes—Certain Covenants—Limitation on Asset Sales.” |

| Certain Covenants |

The Indenture contains covenants that limit, among other things, our ability and the ability of some of our subsidiaries to: |

| • | incur additional indebtedness; |

| • | pay dividends, make other distributions or repurchase or redeem our capital stock; |

| • | prepay, redeem or repurchase certain debt; |

| • | make loans and investments; |

| • | sell, transfer or otherwise dispose of assets; |

| • | incur or permit to exist certain liens; |

| • | enter into certain types of transactions with affiliates; |

| • | enter into agreements restricting our subsidiaries’ ability to pay dividends; and |

| • | consolidate, amalgamate, merge or sell all or substantially all of our assets. |

5

Table of Contents

| No Established Trading Market |

The Exchange Notes will be a new class of securities for which there is currently no market. Although the initial purchasers of the Original Notes have informed us that they intend to make a market in the Exchange Notes, the initial purchasers are not obligated to do so, and may discontinue market-making activities at any time without notice. Accordingly, we cannot assure you that a liquid market for the Exchange Notes will develop or be maintained. |

| Use of Proceeds |

We will not receive any cash proceeds from the issuance of the Exchange Notes. See “Use of Proceeds.” |

| Trustee |

U.S. Bank National Association, which we refer to as the “Trustee.” |

6

Table of Contents

An investment in the Exchange Notes involves a significant degree of risk, including the risks described in this prospectus. You should carefully consider the risk factors set forth below as well as the other information contained under “Disclosure Regarding Forward-Looking Statements” and in the documents incorporated by reference in this prospectus, before making a decision regarding the Exchange Offer. Any of the following risks, as well as other risks and uncertainties, could materially and adversely affect our business, results of operations, cash flows and/or financial condition and thus cause the value of the Exchange Notes to decline. The risks and uncertainties described below are not the only risks facing our company. Additional risks and uncertainties not currently known to us or those we currently view to be immaterial may also materially and adversely affect our business, financial condition or results of operations. In such a case, you may lose all or part of your investment in the Exchange Notes.

Risks Relating to the Exchange Offer

If you choose not to exchange your Original Notes in the Exchange Offer, the transfer restrictions currently applicable to your Original Notes will remain in force and the market price of your Original Notes could decline.

If you do not exchange your Original Notes for Exchange Notes in the Exchange Offer, then you will continue to be subject to the transfer restrictions that apply to the Original Notes as set forth in the offering memorandum related to the private sale of the Original Notes. In general, the Original Notes may not be sold unless the sale is registered or exempt from registration under the Securities Act. Except as required by the Registration Rights Agreement, we do not intend to register resales of the Original Notes under the Securities Act. You should refer to “The Exchange Offer” for information about how to tender your Original Notes.

The tender of Original Notes pursuant to the Exchange Offer will reduce the outstanding principal amount of the Original Notes, which may have an adverse effect upon, and increase the volatility of, the market price of the Original Notes due to reduction in liquidity.

Certain persons who participate in the Exchange Offer must deliver a prospectus in connection with resales of the Exchange Notes.

Based on interpretations of the staff of the SEC contained in Exxon Capital Holdings Corp., SEC no-action letter (April 13, 1988), Morgan Stanley & Co. Inc., SEC no-action letter (June 5, 1991) and Shearman & Sterling, SEC no-action letter (July 2, 1983), we believe that you may offer for resale, resell or otherwise transfer the Exchange Notes without compliance with the registration and prospectus delivery requirements of the Securities Act. However, in some instances described in this prospectus under “Plan of Distribution,” certain holders of Exchange Notes will remain obligated to comply with the prospectus delivery requirements of the Securities Act in order to transfer the Exchange Notes. If such a holder transfers any Exchange Notes without delivering a prospectus meeting the requirements of the Securities Act or without an applicable exemption from registration under the Securities Act, such a holder may incur liability under the Securities Act. We do not, and will not, assume or indemnify such a holder against this liability.

Risks Relating to the Exchange Notes and Our Debt

Our substantial debt could adversely affect our financial health and prevent us from fulfilling our obligations under the Exchange Notes.

We have significant debt service obligations. As of August 31, 2016, we had outstanding debt of approximately $955.0 million and had an additional $279.1 million of availability under our Revolving Credit Facility (after giving effect to outstanding letters of credit), all of which would be secured debt if drawn, which

7

Table of Contents

would have effectively ranked senior to the Exchange Notes to the extent of the value of the collateral securing such indebtedness. Our substantial debt could have important consequences to you. For example, it could:

| • | make it more difficult for us to satisfy our obligations with respect to the Exchange Notes and the Senior Secured Credit Facilities; |

| • | increase our vulnerability to general adverse economic and industry conditions, including interest rate fluctuations, because a portion of our borrowings, including those under the Senior Secured Credit Facilities, will be at variable rates of interest; |

| • | require us to dedicate a substantial portion of our cash flow from operations to payments on our debt, thereby reducing the availability of our cash flow to fund working capital, capital expenditures, acquisitions, joint ventures and investments and other general corporate purposes; |

| • | limit our flexibility in planning for, or reacting to, changes in our business and the product categories in which we participate; |

| • | limit our ability to obtain additional debt or equity financing due to applicable financial and restrictive covenants in our debt agreements; |

| • | place us at a competitive disadvantage compared to our competitors that have less debt; and |

| • | limit our ability to borrow additional funds. |

We expect to pay expenses and to pay principal and interest on current and future debt from cash provided by operating activities. Therefore, our ability to meet these payment obligations will depend on future financial performance and regional cash availability, which is subject in part to numerous economic, business and financial factors beyond our control. If our cash flow and capital resources are insufficient to fund our debt obligations, we may be forced to reduce or delay expansion plans and capital expenditures, limit payment of dividends, sell material assets or operations, obtain additional capital or restructure our debt.

Despite our anticipated debt levels, we and our subsidiaries may still incur significant additional debt. Incurring more debt could increase the risks associated with our substantial debt.

We and our subsidiaries may be able to incur substantial additional debt, including additional secured debt, in the future. The terms of the Indenture and our Revolving Credit Facility restrict, but do not completely prohibit, us from doing so. As of August 31, 2016, we had approximately $20.9 million outstanding under our Revolving Credit Facility and approximately $279.1 million of undrawn availability under our Revolving Credit Facility (after giving effect to outstanding letters of credit), all of which would be secured debt. In addition, the Indenture allows us to issue additional notes under certain circumstances, which will also be guaranteed by the Guarantors. The Indenture also allows us to incur certain other additional secured debt. The Indenture allows our non-Guarantor subsidiaries, which include our foreign subsidiaries, to incur additional debt, which debt (as well as other liabilities at any such subsidiary) would be structurally senior to the Exchange Notes. In addition, the Indenture does not prevent us from incurring certain other liabilities that do not constitute indebtedness (as defined in the Indenture). If new debt or other liabilities are added to our current debt levels, the related risks that we and our subsidiaries now face could intensify.

If we default under the Senior Secured Credit Facilities, we may not be able to service our debt obligations.

In the event of a default under the Senior Secured Credit Facilities, the lenders under the facilities could elect to declare all amounts borrowed, together with accrued and unpaid interest and other fees, to be due and payable. If such acceleration occurs, thereby permitting an acceleration of amounts outstanding under the Exchange Notes, we may not be able to repay the amounts due under the Senior Secured Credit Facilities, or the Exchange Notes. This could have serious consequences to the holders of the Exchange Notes and to our financial condition and results of operations, and could cause us to become bankrupt or insolvent.

8

Table of Contents

We may not be able to generate sufficient cash to service all of our debt, including the Exchange Notes, and may be forced to take other actions to satisfy our obligations under our debt, which may not be successful.

As of August 31, 2016, we had cash and cash equivalents of $35.3 million. In addition, we had access to a Revolving Credit Facility of $300.0 million, with approximately $279.1 million available as of August 31, 2016 (after giving effect to outstanding letters of credit). Our ability to make scheduled payments on or to refinance our debt obligations, including the Exchange Notes, and to fund working capital, planned capital expenditures and expansion efforts and any strategic alliances or acquisitions we may make in the future depends on our ability to generate cash in the future and our financial condition and operating performance, which are subject to prevailing economic and competitive conditions and to certain financial, business and other factors beyond our control. We cannot assure you that we will maintain a level of cash flows from operating activities sufficient to permit us to pay the principal, premium, if any, and interest on our debt, including the Exchange Notes.

If our cash flows and capital resources are insufficient to fund our debt service obligations, we may be forced to reduce or delay investments and capital expenditures, or to sell assets, seek additional capital or restructure or refinance our debt, including the Exchange Notes. These alternative measures may not be successful and may not permit us to meet our scheduled debt service obligations. If our operating results and available cash are insufficient to meet our debt service obligations, we could face substantial liquidity problems and might be required to dispose of material assets or operations to meet our debt service and other obligations. We may not be able to consummate those dispositions or to obtain the proceeds sought from them, and these proceeds may not be adequate to meet any debt service obligations then due. Additionally, the Indenture and the agreements governing the Senior Secured Credit Facilities limit the use of the proceeds from any disposition; as a result, we may not be allowed, under these documents, to use proceeds from such dispositions to satisfy our debt service obligations. Further, we may need to refinance all or a portion of our debt on or before maturity, and we cannot assure you that we will be able to refinance any of our debt on commercially reasonable terms or at all.

Debt under the Senior Secured Credit Facilities is effectively senior to the Exchange Notes and the Guarantees to the extent of the value of the collateral securing the Senior Secured Credit Facilities.

As of August 31, 2016, the Company and the Guarantors had approximately $543.0 million outstanding under the Senior Secured Credit Facilities and approximately $279.1 million of undrawn availability under our Revolving Credit Facility (after giving effect to outstanding letters of credit), all of which was secured debt. Obligations under the Senior Secured Credit Facilities are effectively senior in right of payment to all of the Company’s and the Guarantors’ obligations under the Exchange Notes and the Guarantees to the extent of the value of the collateral securing the Senior Secured Credit Facilities. In the event of a bankruptcy, claims by the holders of the Exchange Notes will, therefore, be effectively junior to claims by our creditors under the Senior Secured Credit Facilities to the extent of the realizable value of the collateral securing the Senior Secured Credit Facilities. In the same manner, the Exchange Notes and the Guarantees will also be effectively junior in right of payment to any other debt secured by a lien on our and the Guarantors’ assets, to the extent of the realizable value of such collateral.

The Indenture and the agreements governing the Senior Secured Credit Facilities impose significant operating and financial restrictions on us and our subsidiaries, which may prevent us from capitalizing on business opportunities.

The Indenture and the agreements governing the Senior Secured Credit Facilities impose significant operating and financial restrictions on us. These restrictions limit our ability, among other things, to:

| • | incur additional debt or issue certain disqualified stock and preferred stock; |

| • | pay dividends, repurchase our capital stock, or make other restricted payments or investments; |

| • | place restrictions on the ability of our restricted subsidiaries to pay dividends or make other payments to us; |

9

Table of Contents

| • | engage in transactions with affiliates; |

| • | sell certain assets or merge with or into other companies; |

| • | create liens; and |

| • | enter into unrelated businesses. |

Our Revolving Credit Facility and our Term Loan A Facility require us to meet financial covenants, including covenants relating to an interest coverage ratio and a maximum net debt leverage ratio.

As a result of these covenants and restrictions, we are limited in how we conduct our business and we may be unable to raise additional debt or equity financing to compete effectively or to take advantage of new business opportunities. The terms of any future debt we may incur could include more restrictive covenants. We cannot assure you that we will be able to maintain compliance with these covenants in the future and, if we fail to do so, that we will be able to obtain waivers from the lenders and/or amend the covenants.

Federal and state statutes allow courts, under specific circumstances, to void guarantees and require note holders to return payments received from guarantors.

The Exchange Notes will be guaranteed by our domestic subsidiaries that guarantee the Senior Secured Credit Facilities. Under the federal bankruptcy law and comparable provisions of state fraudulent transfer laws, a Guarantee could be voided, or claims in respect of a Guarantee could be subordinated to all other debts of that Guarantor if, among other things, the Guarantor, at the time it incurred the indebtedness evidenced by its Guarantee:

| • | incurred this debt with the intent of hindering, delaying or defrauding current or future creditors; |

| • | received less than reasonably equivalent value or fair consideration for the incurrence of the Guarantee; |

| • | was insolvent or rendered insolvent by reason of the incurrence of the Guarantee; |

| • | was engaged in a business or transaction for which the Guarantor’s remaining assets constituted unreasonably small capital; or |

| • | intended to incur, or believed that it would incur, debts beyond its ability to pay those debts as they mature. |

In addition, any payment by that Guarantor pursuant to its Guarantee could be voided and required to be returned to the Guarantor, or to a fund for the benefit of the creditors of the Guarantor.

The measures of insolvency for purposes of these fraudulent transfer laws will vary depending upon the law applied in any proceeding to determine whether a fraudulent transfer has occurred. Generally, however, a Guarantor would be considered insolvent if:

| • | the sum of its debts, including contingent liabilities, was greater than the fair saleable value of all of its assets; |

| • | the present fair saleable value of its assets was less than the amount that would be required to pay its probable liability on its existing debts, including contingent liabilities, as they become absolute and mature; or |

| • | it could not pay its debts as they become due. |

10

Table of Contents

The Indenture contains a provision intended to limit each Guarantor’s liability to the maximum amount that it could incur without causing the incurrence of obligations under its Guarantee to be a fraudulent transfer. This provision may not be effective to protect the Guarantees from being voided under fraudulent transfer law, or may eliminate the Guarantor’s obligations or reduce the Guarantor’s obligations to an amount that effectively makes the Guarantee worthless.

Not all of our subsidiaries will guarantee the Exchange Notes, and the assets of our non-Guarantor subsidiaries may not be available to make payments on the Exchange Notes.

Not all of our subsidiaries are required to guarantee the Exchange Notes. Our subsidiaries that do not guarantee the Exchange Notes generated approximately $1,759.4 million of net sales for the year ended August 31, 2016. Included in our non-Guarantor subsidiaries net sales are $5.1 million of intercompany sales. In the event that any non-Guarantor subsidiary becomes insolvent, liquidates, reorganizes, dissolves or otherwise winds up, holders of its debt and other liabilities (including its trade creditors) generally will be entitled to payment on their claims from the assets of that subsidiary before any of those assets are made available to us. Our subsidiaries that do not guarantee the Exchange Notes are separate and distinct legal entities and have no obligation, contingent or otherwise, to pay any amounts due pursuant to the Exchange Notes, or to make any funds available therefor, whether by dividends, loans, distributions or other payments. Consequently, your claims in respect of the Exchange Notes will be structurally subordinated to all of the liabilities of our non-Guarantor subsidiaries, including trade payables, and any claims of third party holders of preferred equity interests, if any, in our non-Guarantor subsidiaries.

Our non-Guarantor subsidiaries may incur obligations that will constrain the ability of our subsidiaries to provide us with cash, which may affect our ability to make payments on our indebtedness, including the Exchange Notes offered hereby.

Our cash flows and our ability to service our debt, including our ability to pay the interest on and principal of the Exchange Notes when due, will be dependent upon cash dividends and other distributions or other transfers from our subsidiaries. Dividends, loans and advances to us from our non-Guarantor subsidiaries may be restricted by covenants in certain debt agreements. If our non-Guarantor subsidiaries incur obligations with these restrictive covenants, it will constrain the ability of our non-Guarantor subsidiaries to provide us with cash, which may affect our ability to make payments on the Exchange Notes.

The Guarantors may be released from their Guarantees under certain circumstances.

The Guarantors may be released from the Guarantees in a variety of circumstances. So long as any obligations under certain of the Senior Secured Credit Facilities remain outstanding, any Guarantee of the Exchange Notes may be released without action by, or consent of, any holder of Exchange Notes or the Trustee if, at the discretion of lenders under the Senior Secured Credit Facilities, the related Guarantor is no longer a Guarantor of obligations under the Senior Secured Credit Facilities. You will not have a claim as a creditor against any subsidiary that is no longer a Guarantor, and the indebtedness and other liabilities, including trade payables, whether secured or unsecured, of those subsidiaries will effectively be senior to your claims as a holder of the Exchange Notes.

We may not be able to repurchase the Exchange Notes upon a change of control or pursuant to an asset sale offer, which would result in a default under the Indenture and would adversely affect our business and financial condition.

Upon a change of control, as defined under the Indenture, the holders of Exchange Notes will have the right to require us to offer to purchase all of the Exchange Notes then outstanding at a price equal to 101% of their principal amount plus accrued and unpaid interest, if any. The source of funds for any such purchase of the Exchange Notes will be our available cash or cash generated from operations or other sources, including borrowings, sales of assets or sales of equity. We may not be able to repurchase the Exchange Notes upon a change

11

Table of Contents

of control because we may not have sufficient financial resources, including the ability to arrange necessary financing on acceptable terms or at all, to purchase all of the Exchange Notes that are tendered upon a change of control. Our failure to offer to purchase all outstanding Exchange Notes or to purchase all validly tendered Exchange Notes would be an event of default under the Indenture. Such an event of default may cause the acceleration of our other debt. Our other debt also may contain restrictions on repayment requirements with respect to specified events or transactions that constitute a change of control under the Indenture.

In addition, in certain circumstances specified in the Indenture, we will be required to commence an Offer to Purchase, as defined in the Indenture, pursuant to which we must repay senior debt or make an offer to purchase a principal amount of the Exchange Notes equal to the Excess Proceeds, as defined in the Indenture. The purchase price of the Exchange Notes will be 100% of their principal amount, plus accrued and unpaid interest.

Our other debt may contain restrictions that would limit or prohibit us from completing any such Offer to Purchase. Our failure to purchase any such Exchange Notes when required under the Indenture would be an event of default under the Indenture.

An active trading market may not develop for the Exchange Notes.

We have been informed by the initial purchasers of the Original Notes that they intend to make a market in the Exchange Notes. However, the initial purchasers are not obligated to make a market in the Exchange Notes and may cease their market-making activities at any time. The liquidity of any trading market in the Exchange Notes, and the market price quoted for the Exchange Notes, may be adversely affected by changes in the overall market for these types of securities and by changes in our financial performance or prospects or in the prospects for companies in our industries generally. As a result, you cannot be sure that an active trading market will develop for the Exchange Notes.

Many of the covenants in the Indenture will not apply if the Exchange Notes are rated investment grade by both Moody’s and Standard & Poor’s.

Many of the covenants in the Indenture will not apply to us during any period in which the Exchange Notes are rated investment grade by both Moody’s and Standard & Poor’s (each as defined herein), provided at such time no default or event of default has occurred and is continuing. Such covenants restrict, among other things, our ability to pay distributions, incur debt and enter into certain other transactions. There can be no assurance that the Exchange Notes will ever be rated investment grade, or that if they are rated investment grade, that the Exchange Notes will maintain these ratings. However, suspension of these covenants would allow us to engage in certain transactions that would not be permitted while these covenants were in force. To the extent the covenants are subsequently reinstated, any such actions taken while the covenants were suspended would not result in an event of default under the Indenture. See “Description of the Exchange Notes—Certain Covenants—Changes in Covenants when Notes Rated Investment Grade.”

12

Table of Contents

Purpose of the Exchange Offer

In connection with the offer and sale of the Original Notes, we entered into the Registration Rights Agreement with the initial purchasers of the Original Notes. We are making the Exchange Offer to satisfy our obligations under the Registration Rights Agreement.

Terms of the Exchange Offer

We are offering to exchange, upon the terms and subject to the conditions set forth in this prospectus and in the Letter of Transmittal, Exchange Notes for an equal principal amount of Original Notes. The terms of the Exchange Notes are identical in all material respects to those of the Original Notes, except for the transfer restrictions and registration rights and related special interest provisions relating to the Original Notes that will not apply to the Exchange Notes. The Exchange Notes will be of the same class as the Original Notes. The Exchange Notes will be entitled to the benefits of Indenture. See “Description of the Exchange Notes.”

The Exchange Offer is not conditioned upon any minimum aggregate principal amount of Original Notes being tendered or accepted for exchange. As of the date of this prospectus, $375,000,000 aggregate principal amount of the Original Notes was outstanding. Original Notes tendered in the Exchange Offer must be in minimum denominations of $2,000 and integral multiples of $1,000 in excess thereof.

Based on certain interpretive letters issued by the staff of the SEC to third parties in unrelated transactions, holders of Original Notes, except any holder who is an “affiliate” of ours within the meaning of Rule 405 under the Securities Act, who exchange their Original Notes for Exchange Notes pursuant to the Exchange Offer generally may offer the Exchange Notes for resale, resell the Exchange Notes and otherwise transfer the Exchange Notes without compliance with the registration and prospectus delivery provisions of the Securities Act, provided that the Exchange Notes are acquired in the ordinary course of the holders’ business and such holders are not participating in, and have no arrangement or understanding with any person to participate in, a distribution of the Exchange Notes.

Each broker-dealer that receives Exchange Notes for its own account in exchange for Original Notes, where the Original Notes were acquired by the broker-dealer as a result of market-making activities or other trading activities, must acknowledge that it will deliver a prospectus in connection with any resale of the Exchange Notes as described in “Plan of Distribution.” In addition, to comply with the securities laws of individual jurisdictions, if applicable, the Exchange Notes may not be offered or sold unless they have been registered or qualified for sale in the jurisdiction or an exemption from registration or qualification is available and complied with. We have agreed, pursuant to the Registration Rights Agreement, to file with the SEC a registration statement (of which this prospectus forms a part) with respect to the Exchange Notes. If you do not exchange Original Notes for Exchange Notes pursuant to the Exchange Offer, your Original Notes will continue to be subject to restrictions on transfer.

If any holder of the Original Notes is an affiliate of ours, is engaged in or intends to engage in or has any arrangement or understanding with any person to participate in the distribution of the Exchange Notes to be acquired in the Exchange Offer, the holder would not be able to rely on the applicable interpretations of the SEC and would be required to comply with the registration requirements of the Securities Act, except for resales made pursuant to an exemption from, or in a transaction not subject to, the registration requirement of the Securities Act and applicable state securities laws.

Expiration Date; extensions; termination; amendments

The Exchange Offer expires on the Expiration Date, which is 9:00 a.m., New York City time, on , 2016 unless we, in our sole discretion, extend the period during which the Exchange Offer is open.

13

Table of Contents

We reserve the right to extend the Exchange Offer at any time and from time to time prior to the Expiration Date by giving written notice to the Exchange Agent and by public announcement communicated by no later than 9:00 a.m., New York City time, on the next business day following the previously scheduled Expiration Date, unless otherwise required by applicable law or regulation, by making a release to PR Newswire or other wire service. During any extension of the Exchange Offer, all Original Notes previously tendered will remain subject to the Exchange Offer and may be accepted for exchange by us.

The exchange date will promptly follow the Expiration Date. We expressly reserve the right to:

| • | terminate the Exchange Offer and not accept for exchange any Original Notes for any reason, including if any of the events set forth below under “—Conditions to the Exchange Offer” shall have occurred and shall not have been waived by us; and |

| • | amend the terms of the Exchange Offer in any manner, whether before or after any tender of the Original Notes. |

If any termination or material amendment occurs, we will notify the Exchange Agent in writing and will either issue a press release or give written notice to the holders of the Original Notes as promptly as practicable. Additionally, in the event of a material amendment or change in the Exchange Offer, which would include any waiver of a material condition hereof, we will extend the offer period, if necessary, so that at least five business days remain in the Exchange Offer following notice of the material amendment or change, as applicable.

Unless we terminate the Exchange Offer prior to 9:00 a.m., New York City time, on the Expiration Date, we will exchange the Exchange Notes for the tendered Original Notes promptly after the Expiration Date, and will issue to the Exchange Agent Exchange Notes for Original Notes validly tendered, not withdrawn and accepted for exchange. Any Original Notes not accepted for exchange for any reason will be returned without expense to the tendering holder promptly after expiration or termination of the Exchange Offer. See “—Acceptance of Original Notes for exchange; delivery of Exchange Notes.”

This prospectus and the Letter of Transmittal and other relevant materials will be mailed by us to record holders of Original Notes and will be furnished to brokers, banks and similar persons whose names, or the names of whose nominees, appear on the lists of holders for subsequent transmittal to beneficial owners of Original Notes.

Procedures for tendering Original Notes

To participate in the Exchange Offer, you must properly tender your Original Notes to the Exchange Agent as described below. We will only issue the Exchange Notes in exchange for the Original Notes that you timely and properly tender. Therefore, you should allow sufficient time to ensure timely delivery of the Original Notes, and you should follow carefully the instructions on how to tender your Original Notes. It is your responsibility to properly tender your Original Notes. No Letter of Transmittal or other document should be sent to us. Beneficial owners may request their respective brokers, dealers, commercial banks, trust companies or nominees to effect the above transactions for them.

If you have any questions or need help in exchanging your Original Notes, please contact the Exchange Agent at the address or telephone numbers set forth below.

All of the Original Notes were issued in book-entry form, and all of the Original Notes are currently represented by global certificates registered in the name of Cede & Co., the nominee of DTC. You may tender your Original Notes using ATOP. The Exchange Agent will make a request to establish an account with respect to the Original Notes at DTC for purposes of the Exchange Offer within two business days after this prospectus is sent to holders of Original Notes, and any financial institution that is a participant in DTC may make book-entry delivery of Original Notes by causing DTC to transfer the Original Notes into the Exchange Agent’s account at DTC in accordance with DTC’s procedures for transfer. In connection with the transfer, DTC will send an

14

Table of Contents

“agent’s message” to the Exchange Agent. The agent’s message will state that DTC has received instructions from the participant to tender the Original Notes and that the participant agrees to be bound by the terms of the Letter of Transmittal.

By using the ATOP procedures to exchange the Original Notes, you will not be required to deliver a Letter of Transmittal to the Exchange Agent. However, you will be bound by its terms just as if you had signed it. The tender of Original Notes by you pursuant to the procedures set forth in this prospectus will constitute an agreement between you and us in accordance with the terms and subject to the conditions set forth in this prospectus and in the Letter of Transmittal.

All questions as to the validity, form, eligibility, including time of receipt, and acceptance for exchange of any tender of Original Notes will be determined by us and will be final and binding. We reserve the absolute right to reject any or all tenders not in proper form or the acceptances for exchange of which may, upon advice of our counsel, be unlawful. We also reserve the right to waive any defect, irregularities or conditions of tender as to particular Original Notes. Our interpretation of the terms and conditions of the Exchange Offer, including the instructions in the Letter of Transmittal, will be final and binding on all parties. Unless waived, all defects or irregularities in connection with tenders of the Original Notes must be cured within such time as we shall determine. Although we intend to notify holders of defects or irregularities with respect to tenders of the Original Notes, neither we, the Exchange Agent nor any other person will incur any liability for failure to give such notification. Tenders of the Original Notes will not be deemed made until such defects or irregularities have been cured or waived. Any Original Notes received by the Exchange Agent that are not properly tendered and as to which the defects or irregularities have not been cured or waived will be returned to the tendering holder as soon as practicable after the Expiration Date.

In all cases, we will issue the Exchange Notes for the Original Notes that we have accepted for exchange under the Exchange Offer only after the Exchange Agent receives, prior to the Expiration Date: a book-entry confirmation of such number of the Original Notes into the Exchange Agent’s account at DTC and a properly transmitted agent’s message.

If we do not accept any tendered Original Notes for exchange or if the Original Notes are submitted for a greater principal amount than the holder desires to exchange, the unaccepted or non-exchanged Original Notes will be returned without expense to their tendering holder. Such non-exchanged Original Notes will be credited to an account maintained with DTC. These actions will occur as promptly as practicable after the expiration or termination of the Exchange Offer.

Each broker-dealer that receives the Exchange Notes for its own account in exchange for the Original Notes, where those Original Notes were acquired by such broker-dealer as a result of market-making activities or other trading activities, must acknowledge that it will deliver a prospectus in connection with any resale of those Exchange Notes. See “Plan of Distribution.”

Terms and conditions contained in the Letter of Transmittal

The Letter of Transmittal contains, among other things, the following terms and conditions, which are part of the Exchange Offer.

The transferring party tendering Original Notes for exchange will be deemed to have exchanged, assigned and transferred the Original Notes to us and irrevocably constituted and appointed the Exchange Agent as the transferor’s agent and attorney-in-fact to cause the Original Notes to be assigned, transferred and exchanged. The transferor will be required to represent and warrant that it has full power and authority to tender, exchange, assign and transfer the Original Notes and to acquire Exchange Notes issuable upon the exchange of the tendered Original Notes and that, when the same are accepted for exchange, we will acquire good and unencumbered title to the tendered Original Notes, free and clear of all liens, restrictions (other than restrictions on transfer), charges

15

Table of Contents

and encumbrances and that the tendered Original Notes are not and will not be subject to any adverse claim. The transferor will be required to also agree that it will, upon request, execute and deliver any additional documents deemed by the Exchange Agent or us to be necessary or desirable to complete the exchange, assignment and transfer of tendered Original Notes. The transferor will be required to agree that acceptance of any tendered Original Notes by us and the issuance of Exchange Notes in exchange for tendered Original Notes will constitute performance in full by us of our obligations under the Registration Rights Agreement and that we will have no further obligations or liabilities under the Registration Rights Agreement, except in certain limited circumstances. All authority conferred by the transferor will survive the death, bankruptcy or incapacity of the transferor and every obligation of the transferor will be binding upon the heirs, legal representatives, successors, assigns, executors, administrators and trustees in bankruptcy of the transferor.

Upon agreement to the terms of the Letter of Transmittal pursuant to an agent’s message, a holder, or beneficial holder of the Original Notes on behalf of which the holder has tendered, will, subject to that holder’s ability to withdraw its tender, and subject to the terms and conditions of the Exchange Offer generally, thereby certify that:

| • | it is not an affiliate of ours or our subsidiaries or, if the transferor is an affiliate of ours or our subsidiaries, it will comply with the registration and prospectus delivery requirements of the Securities Act to the extent applicable; |

| • | the Exchange Notes are being acquired in the ordinary course of business of the person receiving the Exchange Notes, whether or not the person is the registered holder; |

| • | the transferor has not entered into, engaged in, does not intend to engage in, and has no arrangement or understanding with any other person to engage in a distribution of the Exchange Notes issued to the transferor; |

| • | the transferor is not a broker-dealer who purchased the Original Notes for resale pursuant to an exemption under the Securities Act tendering Original Notes acquired directly from the Company for the transferor’s own account; and |

| • | the transferor is not restricted by any law or policy of the SEC from trading the Exchange Notes acquired in the Exchange Offer. |

Each broker-dealer that receives Exchange Notes for its own account in exchange for Original Notes where such Original Notes were acquired by such broker-dealer as a result of market-making activities or other trading activities must acknowledge that it will deliver a prospectus in connection with any resale of such Exchange Notes. See “Plan of Distribution.”

Withdrawal rights

Original Notes tendered pursuant to the Exchange Offer may be withdrawn at any time prior to the Expiration Date.

For a withdrawal to be effective, a written letter or facsimile transmission notice of withdrawal must be received by the Exchange Agent at its address set forth in the Letter of Transmittal not later than 9:00 a.m., New York City time, on the Expiration Date. Any notice of withdrawal must specify the name and number of the account at DTC to be credited with withdrawn Original Notes and otherwise comply with the ATOP procedures. The Exchange Agent will return properly withdrawn Original Notes promptly following receipt of notice of withdrawal. Properly withdrawn Original Notes may be retendered by following the procedures described under “—Procedures for tendering Original Notes” above at any time on or prior to 9:00 a.m., New York City time, on the Expiration Date. All questions as to the validity of notices of withdrawals, including time of receipt, will be determined by us, and will be final and binding on all parties.

16

Table of Contents

Acceptance of Original Notes for exchange; delivery of Exchange Notes

Upon the terms and subject to the conditions of the Exchange Offer, the acceptance for exchange of Original Notes validly tendered and not withdrawn and the issuance of the Exchange Notes will be made on the exchange date. For purposes of the Exchange Offer, we will be deemed to have accepted for exchange validly tendered Original Notes when and if we have given written notice to the Exchange Agent. The Original Notes surrendered in exchange for the Exchange Notes will be retired and cannot be reissued.

The Exchange Agent will act as agent for the tendering holders of Original Notes for the purposes of receiving Exchange Notes from us and causing the Original Notes to be assigned, transferred and exchanged. Original Notes tendered by book-entry transfer into the Exchange Agent’s account at DTC pursuant to the procedures described above will be credited to an account maintained by the holder with DTC for the Original Notes, promptly after withdrawal, rejection of tender or termination of the Exchange Offer.

Conditions to the Exchange Offer

Notwithstanding any other provision of the Exchange Offer, or any extension of the Exchange Offer, we will not be required to issue Exchange Notes in exchange for any properly tendered Original Notes not previously accepted and may terminate the Exchange Offer by oral or written notice to the Exchange Agent and by timely public announcement communicated, unless otherwise required by applicable law or regulation, to PR Newswire or other wire service, or, at our option, modify or otherwise amend the Exchange Offer, if, in our reasonable determination:

| • | there is threatened, instituted or pending any action or proceeding before, or any injunction, order or decree shall have been issued by, any court or governmental agency or other governmental regulatory or administrative agency or of the SEC: |

| • | seeking to restrain or prohibit the making or consummation of the Exchange Offer; |

| • | assessing or seeking any damages as a result thereof; or |

| • | resulting in a material delay in our ability to accept for exchange or exchange some or all of the Original Notes pursuant to the Exchange Offer; or |

| • | the Exchange Offer violates any applicable law or any applicable interpretation of the staff of the SEC. |

These conditions are for our sole benefit and may be asserted by us with respect to all or any portion of the Exchange Offer regardless of the circumstances, including any action or inaction by us, giving rise to the condition or may be waived by us in whole or in part at any time or from time to time in our sole discretion. The failure by us at any time to exercise any of the foregoing rights will not be deemed a waiver of any right, and each right will be deemed an ongoing right that may be asserted at any time or from time to time. We reserve the right, notwithstanding the satisfaction of these conditions, to terminate or amend the Exchange Offer.

Any determination by us concerning the fulfillment or non-fulfillment of any conditions will be final and binding upon all parties.

In addition, we will not accept for exchange any Original Notes tendered, and no Exchange Notes will be issued in exchange for any Original Notes, if at such time, any stop order has been issued or is threatened with respect to the registration statement of which this prospectus forms a part, or with respect to the qualification of the indenture under which the Original Notes were issued under the Trust Indenture Act of 1939.

17

Table of Contents

Exchange Agent

U.S. Bank National Association, has been appointed as the Exchange Agent. Questions relating to the procedure for tendering, as well as requests for additional copies of this prospectus or the Letter of Transmittal, should be directed to the Exchange Agent addressed as follows:

By Registered Certified or Regular Mail or Overnight Courier or Hand Delivery:

U.S. Bank National Association

111 Filmore Avenue

St. Paul, Minnesota 55107-1402

Attn: Corporate Actions

By Facsimile Transmission:

651-466-7367

For Information:

800-934-6802

Originals of all documents sent by facsimile should be promptly sent to the Exchange Agent by mail, by hand or by overnight delivery service.

Solicitation of tenders; expenses