Form 6-K UBS AG For: May 05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

Date: May 5, 2015

UBS Group AG

Commission File Number: 1-36764

UBS AG

Commission File Number: 1-15060

(Registrants’ Names)

Bahnhofstrasse 45, Zurich, Switzerland

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

This Form 6-K consists of the presentation materials related to the First Quarter 2015 Results of UBS Group AG and UBS AG, including speaker notes, which appear immediately following this page.

First quarter 2015 results May 5, 2015 |

Cautionary statement

regarding forward-looking statements 1

This presentation contains statements that constitute “forward-looking statements,”

including but not limited to management’s outlook for UBS’s financial performance and statements relating to the anticipated effect of

transactions and strategic initiatives on UBS’s business and future development. While these

forward-looking statements represent UBS’s judgments and expectations concerning the matters described, a number of risks,

uncertainties and other important factors could cause actual developments and results to differ

materially from UBS’s expectations. These factors include, but are not limited to: (i) the degree to which UBS is successful in

executing its announced strategic plans, including its cost reduction and efficiency initiatives

and its planned further reduction in its Basel III risk-weighted assets (RWA) and leverage ratio denominator (LRD), and to

maintain its stated capital return objective; (ii) developments in the markets in which UBS

operates or to which it is exposed, including movements in securities prices or liquidity, credit spreads, currency exchange rates

and interest rates and the effect of economic conditions and market developments on the

financial position or creditworthiness of UBS’s clients and counterparties, and the degree to which UBS is successful in implementing

changes to its business to meet changing market, regulatory and other conditions; (iii) changes

in the availability of capital and funding, including any changes in UBS’s credit spreads and ratings, or arising from

requirements for bail-in debt or loss-absorbing capital; (iv) changes in or the

implementation of financial legislation and regulation in Switzerland, the US, the UK and other financial centers that may impose more stringent

capital (including leverage ratio), liquidity and funding requirements, incremental tax

requirements, additional levies, limitations on permitted activities, constraints on remuneration or other measures; (v) uncertainty as to

when and to what degree the Swiss Financial Market Supervisory Authority (FINMA) will approve

reductions to the incremental RWA resulting from the supplemental operational risk capital analysis mutually agreed to by

UBS and FINMA, or will approve a limited reduction of capital requirements due to measures to

reduce resolvability risk; (vi) the degree to which UBS is successful in executing the transfer of business to UBS Switzerland

AG, a establishing a US intermediate holding company and implementing the US enhanced prudential

standards, completing the squeeze-out of minority shareholders of UBS AG, changing the operating model of UBS

Limited and other changes which UBS may make in its legal entity structure and operating model,

including the possible consequences of such changes, and the potential need to make other changes to the legal structure

or booking model of UBS Group in response to legal and regulatory requirements, including

capital requirements, resolvability requirements and proposals in Switzerland and other countries for mandatory structural reform

of banks; (vii) changes in UBS’s competitive position, including whether differences in

regulatory capital and other requirements among the major financial centers will adversely affect UBS’s ability to compete in certain

lines of business; (viii) changes in the standards of conduct applicable to our businesses that

may result from new regulation or new enforcement of existing standards, including measures to impose new or enhanced

duties when interacting with customers or in the execution and handling of customer

transactions; (ix) the liability to which UBS may be exposed, or possible constraints or sanctions that regulatory authorities might impose

on UBS, due to litigation, contractual claims and regulatory investigations; (x) the effects on

UBS’s cross-border banking business of tax or regulatory developments and of possible changes in UBS’s policies and practices

relating to this business; (xi) UBS’s ability to retain and attract the employees necessary

to generate revenues and to manage, support and control its businesses, which may be affected by competitive factors including

differences in compensation practices; (xii) changes in accounting or tax standards or policies,

and determinations or interpretations affecting the recognition of gain or loss, the valuation of goodwill, the recognition of

deferred tax assets and other matters; (xiii) limitations on the effectiveness of UBS’s

internal processes for risk management, risk control, measurement and modeling, and of financial models generally; (xiv) whether UBS

will be successful in keeping pace with competitors in updating its technology, particularly in

trading businesses; (xv) the occurrence of operational failures, such as fraud, misconduct, unauthorized trading and systems

failures; (xvi) restrictions to the ability of subsidiaries of the Group to make loans or

distributions of any kind, directly or indirectly, to UBS Group AG; and (xvii) the effect that these or other factors or unanticipated events

may have on our reputation and the additional consequences that this may have on our business

and performance. The sequence in which the factors above are presented is not indicative of their likelihood of occurrence

or the potential magnitude of their consequences. Our business and financial performance could

be affected by other factors identified in our past and future filings and reports, including those filed with the SEC. More

detailed information about those factors is set forth in documents furnished by UBS and filings

made by UBS with the SEC, including UBS’s Annual Report on Form 20-F for the year ended 31 December 2014. UBS is not

under any obligation to (and expressly disclaims any obligation to) update or alter its

forward-looking statements, whether as a result of new information, future events, or otherwise.

This presentation and the information contained herein are provided solely for information purposes, and are not to be construed as a solicitation of an offer to buy or sell any securities or other financial

instruments in Switzerland, the United States or any other jurisdiction. No investment decision

relating to securities of or relating to UBS Group AG, UBS AG or their affiliates should be made on the basis of this document.

Refer to UBS's first quarter 2015 report and its Annual report on Form 20-F for the year

ended 31 December 2014. No representation or warranty is made or implied concerning, and UBS assumes no responsibility for, the

accuracy, completeness, reliability or comparability of the information contained herein

relating to third parties, which is based solely on publicly available information. UBS undertakes no obligation to update the

information contained herein.

Disclaimer:

©

UBS

2015.

The

key

symbol

and

UBS

are

among

the

registered

and

unregistered

trademarks

of

UBS.

All

rights

reserved. |

Net profit

attributable to UBS Group AG shareholders of CHF 1,977 million Group

Net profit attributable to UBS Group AG shareholders CHF 1,977 million, diluted EPS CHF

0.53 Reported

profit

before

tax

(PBT)

CHF

2,708

million,

adjusted

PBT

CHF

2,268

million

Basel III fully applied CET1 ratio 13.7%, Swiss SRB fully applied leverage ratio 4.6%

Business divisions

1

Wealth Management:

PBT CHF 856 million and NNM CHF 14.4 billion

–

Highest PBT since 3Q08, net margin up 7 bps to 35 bps

Wealth Management Americas:

PBT USD 293 million and NNM USD 4.8 billion

–

Record PBT and record USD invested assets

Retail & Corporate:

PBT CHF 443 million

–

Highest first quarter PBT since 1Q10 and all KPIs within target ranges

Global Asset Management:

PBT CHF 186 million and NNM CHF 7.5 billion excluding money market flows

–

PBT up 50%, highest since 4Q09

Investment Bank:

–

Strong performances in both ICS and CCS

Corporate Center:

PBT of negative CHF 340 million

–

Significant PBT improvement across all three Corporate Center units

1Q15 highlights

1

Adjusted

numbers

unless

otherwise

indicated,

refer

to

slide

30

for

details

about

adjusted

numbers,

Basel

III

numbers

and

FX

rates

in

this

presentation

2

PBT CHF 844 million |

UBS Group AG results

(consolidated) Refer to slide 30 for details about adjusted numbers, Basel III numbers

and FX rates in this presentation; 1 Includes non-controlling interests in UBS AG reflecting the non-exchanged

UBS AG shares as well as non-controlling interests related to the preferred notes issued by

UBS AG; 2 In addition to net profit attributable to non-controlling interests in UBS AG

reflecting the non-exchanged UBS AG shares, we expect to attribute net profit of ~CHF 80

million to non-controlling interests related to the preferred notes issued by UBS AG in both

2015, all of which in the second quarter, and 2016 and of ~CHF 70 million in 2017

3

CHF million

FY13

FY14

1Q14

4Q14

1Q15

Total operating income

27,732

28,027

7,258

6,746

8,841

Total operating expenses

24,461

25,567

5,865

6,342

6,134

Profit before tax as reported

3,272

2,461

1,393

404

2,708

of

which:

own

credit

on

financial

liabilities

designated

at

fair

value

(283)

292

88

70

226

of which: gains on sales of real estate

288

44

23

20

378

of which: gain on disposals

65

43

0

0

141

of which: net restructuring charges

(772)

(677)

(204)

(208)

(305)

of which: net losses related to the buyback of debt in public tender offers

(167)

0

0

0

0

of which: impairment of a financial investment available-for-sale

0

(48)

0

0

0

of which: credit related to changes to retiree benefit plans in the US

0

41

0

8

0

Adjusted profit before tax

4,141

2,766

1,486

514

2,268

of which: provisions for litigation, regulatory and similar matters

(1,701)

(2,594)

(193)

(310)

(58)

Tax (expense)/benefit

110

1,180

(339)

515

(670)

Net profit attributable to preferred noteholders

204

142

0

31

0

Net

profit

attributable

non-controlling

interests

1,2

5

32

0

29

61

Net profit attributable to UBS Group AG shareholders

3,172

3,466

1,054

858

1,977

Diluted EPS (CHF)

0.83

0.91

0.27

0.23

0.53

Return on tangible equity, adjusted (%)

9.8

8.6

10.7

8.6

14.4

Total book value per share (CHF)

12.74

13.94

13.07

13.94

14.33

Tangible book value per share (CHF)

11.07

12.14

11.41

12.14

12.59 |

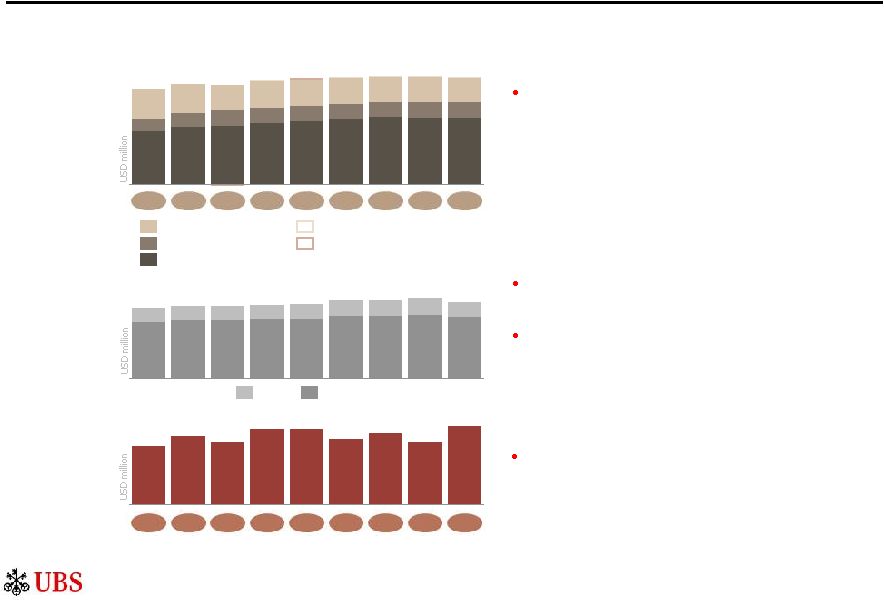

Wealth

Management Adjusted numbers unless otherwise indicated, refer to slide 30 for details

about adjusted numbers, Basel III numbers and FX rates in this presentation 1 CHF 422

million excluding CHF 291 million charges for provisions for litigation, regulatory and similar matters; 2 Profit before tax CHF 684 million excluding

CHF 291 million charges for provisions for litigation, regulatory and similar matters

4

Operating

income

Operating

expenses

Profit

before

tax

2,106

2,004

2,031

1,921

1,943

1,859

1,837

1,953

1,913

1,250

1,311

1,264

1,528

713

1

1,285

1,348

1,220

1,346

1,224

69%

66%

73%

66%

62%

C/I ratio

Personnel

Other

Operating income CHF 2,106 million

Operating expenses CHF 1,250 million

PBT CHF 856 million

64%

80%

59%

65%

3Q13

1Q14

3Q14

4Q14

1Q15

1Q13

2Q13

4Q13

2Q14

PBT CHF 856 million, highest since 3Q08

Transaction-based

Net interest

Recurring net fee

Other

Credit loss (expense)/recovery

73%

77%

77%

72%

76%

Recurring

income

71%

75%

72%

78%

856

909

891

911

897

922

978

986

949

508

523

517

513

496

518

569

583

560

554

505

406

423

542

472

479

436

589

Transaction-based income increased across all regions, most

notably in APAC

Net interest income decreased, mainly due to lower income from

loans and deposits on a stronger Swiss Franc

Recurring net fee income decreased, mainly due to lower

invested assets on a stronger Swiss Franc

G&A expenses decreased, mainly due to lower marketing and

Corporate Center costs

Personnel expenses increased, mainly due to increased variable

compensation and untaken vacation accruals

59% cost/income ratio

836

825

778

862

822

815

828

834

859

521

442

486

463

436

477

391

388

393

2

856

694

767

659

512

617

607

690 |

Wealth

Management 5

Strong growth in mandate penetration, net margin up 7 bps to 35 bps

10.1

5.0

5.8

10.9

9.8

15.0

10.7

14.4

3.0

Gross margin

1

Net margin

2

3Q13

1Q14

3Q14

4Q14

1Q15

1Q13

2Q13

4Q13

2Q14

95.1

94.9

96.8

102.2

111.7

93.2

105.3

110.8

112.7

5.8%

1.2%

4.2%

4.8%

4.9%

2.7%

2.3%

4.6%

7.3%

970

987

966

928

899

886

871

862

870

Annualized

growth rate

Invested

assets

CHF billion

Margins

bps

CHF billion

Net new

money

Loans

CHF billion

NNM CHF 14.4 billion, 5.8% growth rate

on strong inflows from APAC as well as Europe

Domestic and International

Invested assets CHF 970 billion

positive market performance, more than offset by

negative FX translation effects

Mandate penetration 25.5%

with strong net mandate sales of CHF 15.0 billion

Net margin 35 bps

Gross loans CHF 110.8 billion

translation effects, underlying trend remains positive

Adjusted numbers unless otherwise indicated, refer to slide 30 for details about adjusted

numbers, Basel III numbers and FX rates in this presentation 1

Annualized operating income before credit loss (expense) or recovery in bps of average

invested assets; 2 Annualized PBT in bps of average invested assets , down on FX

, up from 24.4%,

, strong NNM and

86

82

86

84

87

85

85

90

91

28

28

23

30

32

33

17

35

28

, up 7 bps |

Wealth

Management Adjusted numbers unless otherwise indicated, refer to slide 30 for details

about adjusted numbers, Basel III numbers and FX rates in this presentation Based on the

Wealth Management business area structure; refer to page 31 of the 1Q15 financial report

for more information Invested assets

CHF billion

1,496

776

761

Client advisors

FTE

31.3.15

1,201

773

503

349

276

178

165

Europe

Switzerland

Asia Pacific

Emerging markets

of which: UHNW

6

CHF billion

Net new

money

Annualized

growth rate

Gross

margin

bps

3.3%

1.1%

(1.7%)

(0.7%)

(2.5%)

1Q14

3Q14

4Q14

1Q15

2Q14

1Q14

3Q14

4Q14

1Q15

2Q14

1Q14

3Q14

4Q14

1Q15

2Q14

1Q14

3Q14

4Q14

1Q15

2Q14

1Q14

3Q14

4Q14

1Q15

2Q14

7.8%

9.2%

12.2%

13.1%

16.0%

3.6%

0.2%

0.9%

5.3%

11.0%

3.6%

1.8%

0.8%

8.7%

(0.5%)

8.1%

5.9%

5.1%

9.1%

7.1%

(2.2)

1.0

(1.5)

3.0

(0.6)

5.0

7.8

5.0

8.2

8.9

4.4

0.4

0.1

1.6

2.2

3.3

0.7

(0.2)

1.5

0.3

7.4

5.7

7.1

10.1

9.6

80

82

83

83

85

83

73

83

78

85

96

90

91

89

90

96

95

97

92

93

54

57

52

55

56

Strong NNM growth, positive in all regions, with APAC and Europe

as main

contributors |

1,924

1,919

1,901

1,898

1,865

1,851

1,748

1,780

1,696

Wealth Management Americas

Adjusted numbers unless otherwise indicated, refer to slide 30 for details about adjusted

numbers, Basel III numbers and FX rates in this presentation 7

Operating

income

Operating

expenses

Profit

before

tax

1,652

1,582

1,567

1,517

1,523

1,608

1,691

1,651

1,476

C/I ratio

Personnel

Other

3Q13

1Q14

3Q14

4Q14

1Q15

1Q13

2Q13

4Q13

2Q14

Record PBT USD 293 million

Transaction-based

Net interest

Recurring net fee

Other

Credit loss (expense)/recovery

71%

75%

73%

74%

77%

Recurring

income

69%

75%

77%

76%

86%

86%

84%

86%

86%

87%

87%

85%

88%

Operating income USD 1,901 million

Operating expenses USD 1,608 million

PBT USD 293 million

948

1,030

1,043

1,088

1,119

1,163

1,197

1,187

1,186

217

235

286

276

250

261

276

280

277

530

507

433

476

472

464

441

448

432

1,202

1,241

1,234

1,256

1,257

1,303

1,307

1,336

1,292

274

282

283

311

325

349

344

355

316

293

233

267

246

284

283

232

256

220

G&A expenses decreased, mainly due to lower charges for

provisions for litigation, regulatory and similar matters and

lower Corporate Center costs

Personnel expenses decreased, mainly due to lower FA

compensation, primarily reflecting lower performance-based

compensation and slightly lower compensable revenues

Operating income decreased, mainly due to lower transaction-

based income

85% cost/income ratio |

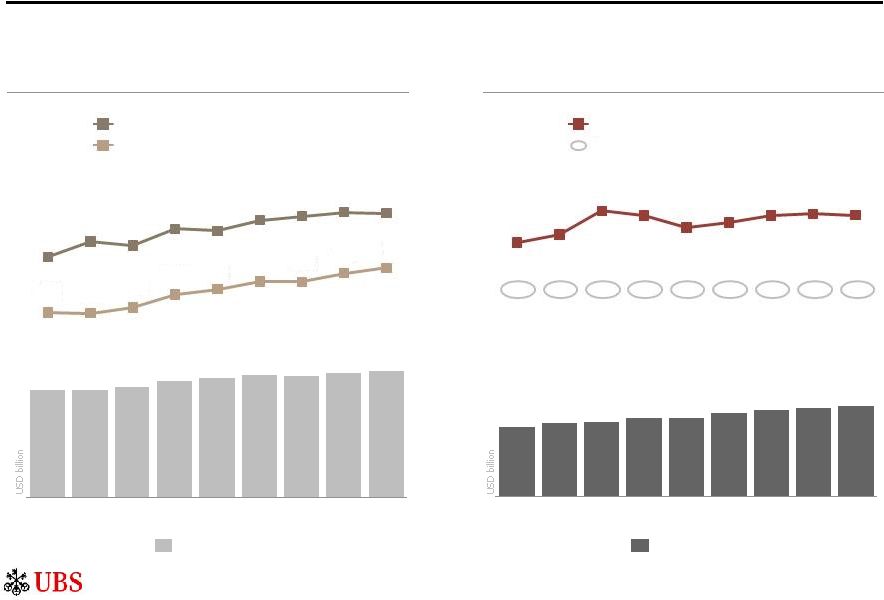

Wealth

Management Americas Adjusted numbers unless otherwise indicated, refer to slide 30 for

details about adjusted numbers, Basel III numbers and FX rates in this presentation

1

Annualized operating income before credit loss (expense) or recovery in bps of average invested

assets; 2 Annualized PBT in bps of average invested assets 8

Annualized

growth rate

78

78

73

75

76

80

76

79

76

NNM USD 4.8 billion, 1.9% growth rate

reflecting net new money inflows from financial

advisors employed more than one year

Invested assets USD 1,050 billion

positive market performance and NNM

Net margin 11 bps

Record USD invested assets and loan balances

2.8

2.1

4.9

2.1

4.9

USD billion

9.2

(2.5)

4.8

5.5

Gross margin

1

Net margin

2

Net new

money

3Q13

1Q14

3Q14

4Q14

1Q15

1Q13

2Q13

4Q13

2Q14

11

10

12

12

11

10

10

11

9

Invested

assets

USD billion

36.8

37.6

39.1

39.6

43.3

Loans

USD billion

34.5

41.7

45.5

44.6

Margins

bps

Gross loans USD 45.5 billion

credit lines and mortgages

1.9%

2.2%

1.9%

(1.0%)

0.9%

2.1%

0.9%

1.3%

4.4%

1,050

1,032

1,016

1,017

987

970

919

892

891

new

record

on

mainly on increased

up

2bps

,

, |

Wealth

Management Americas 9

Record USD invested assets and industry-leading FA productivity

Invested assets and FA productivity

Net interest income and lending

Invested assets per FA (USD million)

Annualized revenue per FA (USD k)

Credit

loss

(expense)/recovery (USD

million)

Invested assets

3Q13

1Q14

3Q14

4Q14

1Q15

1Q13

2Q13

4Q13

2Q14

Loans, gross

3Q13

1Q14

3Q14

4Q14

1Q15

1Q13

2Q13

4Q13

2Q14

Adjusted numbers unless otherwise indicated, refer to slide 30 for details about adjusted

numbers, Basel III numbers and FX rates in this presentation 961

1,005

994

1,042

1,037

1,068

1,079

1,091

1,088

1,050

1,032

1,016

1,017

987

970

919

892

891

126

126

129

136

139

143

143

147

150

217

235

286

276

250

261

276

280

277

0

(21)

(9)

19

(1)

0

(2)

0

0

45.5

44.6

43.3

41.7

39.6

39.1

37.6

36.8

34.5

Net interest income (USD million) |

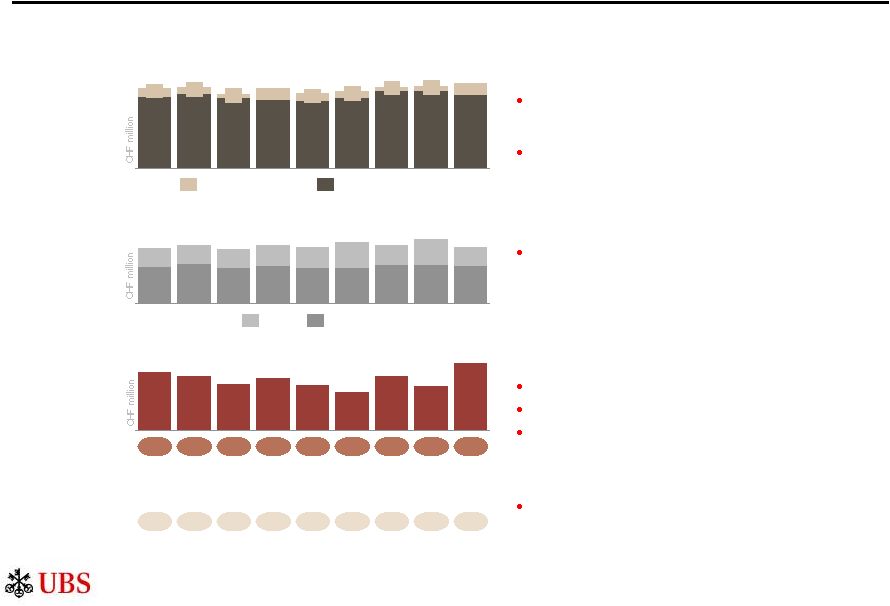

Retail

& Corporate Adjusted numbers unless otherwise indicated, refer to slide 30 for

details about adjusted numbers, Basel III numbers and FX rates in this presentation

10

Operating

income

Operating

expenses

Profit

before

tax

958

938

932

931

958

948

919

979

913

512

571

532

587

541

558

557

536

557

59%

57%

62%

58%

52%

C/I ratio

Personnel

Other

61%

60%

54%

57%

Highest first quarter PBT since 1Q10 and all KPIs within target ranges

Transaction-based

Net interest

Recurring net fee

Other

Credit loss (expense)/recovery

3Q13

1Q14

3Q14

4Q14

1Q15

1Q13

2Q13

4Q13

2Q14

Operating income CHF 979 million

Operating expenses CHF 536 million

PBT CHF 443 million

531

542

531

540

523

541

563

557

568

243

272

262

256

234

247

267

273

284

134

133

140

138

144

127

127

126

130

376

361

350

336

343

336

331

322

343

181

197

191

251

189

235

181

235

193

443

356

446

367

401

344

417

390

362

Transaction-based income increased, mainly due to

FX-trading and hedging-related income

Net interest income increased, mainly due to pricing measures,

partly offset by lower allocated revenues from Group ALM

Credit loss expenses decreased

G&A expenses decreased, mainly as 4Q14 included significant

investments in our multichannel offering; marketing expenses

and professional fees also declined

Personnel expenses increased, mainly due to higher variable

compensation accruals

54% cost/income ratio

Net interest margin 165 bps vs. 162 bps in 4Q14,

mainly reflecting higher net interest income

Annualized net new retail business volume growth 3.1% vs.

0.6% in 4Q14, following the typical seasonal pattern |

Global Asset

Management Adjusted numbers unless otherwise indicated, refer to slide 30 for details

about adjusted numbers, Basel III numbers and FX rates in this presentation 11

Operating

income

Operating

expenses

Profit

before

tax

429

449

418

410

404

427

462

463

443

68

72

511

497

34

489

27

465

38

451

47

482

447

29

489

41

483

53

213

230

206

215

205

208

222

223

218

110

108

111

124

120

149

116

150

107

325

373

338

357

325

339

317

338

323

186

151

107

126

143

130

152

160

124

69%

71%

70%

72%

69%

C/I ratio

Personnel

Other

67%

77%

64%

75%

3Q13

1Q14

3Q14

4Q14

1Q15

1Q13

2Q13

4Q13

2Q14

PBT CHF 186 million, up 50% and highest since 4Q09

Performance fees

Net management fees

(1.3)

(3.9)

(4.6)

13.0

3.8

Net new

money ex. MM

5.1

11.6

7.5

(5.8)

Net new money excluding money market flows of

CHF 7.5 billion, of which 2.5 billion from third parties and

CHF 5.1 billion from our wealth management businesses

Operating income CHF 511 million

Performance fees increased, primarily in O’Connor and

A&Q funds, partly offset by global real estate and

traditional investments

Net management fees decreased, mainly in traditional

investments, primarily due to FX

Operating expenses CHF 325 million

G&A expenses decreased, mainly as the prior quarter

included charges for provisions for litigation, regulatory

and similar matters, as well as due to lower Corporate

Center costs

PBT CHF 186 million

64% cost/income ratio

Net margin 11 bps vs. 8 bps in 4Q14

Gross margin 31 bps vs. 30 bps in 4Q14 |

(1,205)

292

844

549

386

563

335

806

928

Investment Bank

12

Operating

income

Operating

expenses

Profit

before

tax

1,087

1,078

864

832

1,011

879

932

918

1,162

645

397

338

324

409

382

315

297

701

997

771

505

706

770

986

738

712

801

2,250

2,666

1,935

1,985

2,241

2,190

1,861

1,707

2,728

1,821

1,270

551

1,643

775

868

3,190

936

1,677

1,136

541

1,641

1,109

532

1,474

848

626

1,372

869

503

1,444

966

478

1,800

1,291

509

64%

80%

79%

75%

161%

C/I ratio

Personnel

Other

66%

75%

68%

85%

Strong performances in both ICS and CCS

3Q13

1Q14

3Q14

4Q14

1Q15

1Q13

2Q13

4Q13

2Q14

Operating income CHF 2,666 million

Operating expenses CHF 1,821 million

PBT CHF 844 million

1

Corporate Client Solutions

Investor Client Services –

FX, Rates and Credit

3

Investor Client Services –

Equities

2,254

CCS increased on higher revenues in DCM, ECM and

financing solutions as well as higher risk management

revenues, partly offset by lower advisory revenues

ICS increased in FRC, on significantly higher volatility and

client activity levels, and Equities, on stronger performance

across all sectors and regions, mainly reflecting seasonally

higher client activity levels

G&A expenses decreased, mainly due to lower charges

for provisions for litigation, regulatory and similar matters

and the annual UK bank levy in 4Q14

Personnel expenses increased on higher performance

driven variable compensation expenses

68% cost/income ratio

Annualized return on attributed equity 46%

Basel III RWA CHF 64 billion

Funded assets CHF 175 billion

2

Adjusted numbers unless otherwise indicated, refer to slide 30 for details about adjusted

numbers, Basel III numbers and FX rates in this presentation 1 Operating income

including credit loss (expense) or recovery; 2 CHF 567 million excluding CHF 1,687 million charges for provisions for litigation, regulatory and similar

matters; 3 Profit before tax CHF 482 million excluding CHF 1,687 million charges for

provisions for litigation, regulatory and similar matters |

Adjusted numbers

unless otherwise indicated, refer to slide 30 for details about adjusted numbers, Basel III numbers and FX rates in this presentation

1 Operating income excluding credit loss (expense) or recovery/average management VaR, based on

unrounded figures; 2 Annualized operating income excluding credit loss (expense) or

recovery/quarter-end Basel III RWA, phase-in; 3 Phase-in Solid 1Q15 results

delivered with continued efficient resource utilization Investment Bank

Market volatility

VIX and VDAX (index value), USD/EUR and USD/CHF 90-day volatility (%)

Resource utilization and return on RWA

CHF billion, %

Revenue per unit of VaR

CHF million

Equity trading volumes

Indexed, 1.1.13 = 100

13 |

Corporate Center

PBT negative CHF 340 million Corporate Center

Adjusted numbers unless otherwise indicated, refer to slide 30 for details about adjusted

numbers, Basel III numbers and FX rates in this presentation 14

Operating expenses before allocations decreased on lower G&A and

personnel expenses, partly due to favorable currency effects

Net allocations for shared services decreased, mainly due to lower

operating expenses before allocations

Operating income increased, mainly due higher retained income related to

hedge accounting models and cross-currency basis swaps held as

economic hedges

Improved results across all three Corporate Center units

Operating income improved, mainly as 4Q14 included losses from the

termination of certain CDS contracts and greater novation and unwind

activity

Operating expenses decreased, mainly due to lower charges for provisions

for litigation, regulatory and similar matters as well as the annual UK bank

levy in 4Q14

(340)

(1,180)

(832)

(458)

(501)

Profit

before

tax

1Q14

3Q14

4Q14

1Q15

2Q14

Corporate Center results by unit (CHF million)

Corporate Center total (CHF million)

Services

Operating income

(14)

4

9

(6)

(4)

Operating expenses

233

(9)

180

255

218

o/w before allocations

2,082

1,881

2,058

2,314

2,029

o/w net allocations

(1,849)

(1,890)

(1,878)

(2,059)

(1,811)

Profit before tax

(246)

13

(171)

(261)

(222)

Group Asset and Liability Management

Operating income

(46)

(55)

(65)

(201)

118

o/w gross income

160

189

275

129

407

o/w net allocations

(206)

(243)

(341)

(330)

(289)

Operating expenses

(8)

3

(1)

6

(4)

Profit before tax

(39)

(57)

(64)

(208)

122

Non-core and Legacy Portfolio

Operating income

29

(167)

(322)

(361)

(80)

Operating expenses

245

247

273

350

160

Profit before tax

(216)

(414)

(596)

(711)

(240)

Losses reduced due to improved results in all three Corporate Center

units, mainly due to improved operating income in Non-core and Legacy

Portfolio and Group ALM, and lower operating expenses in Non-core and

Legacy Portfolio |

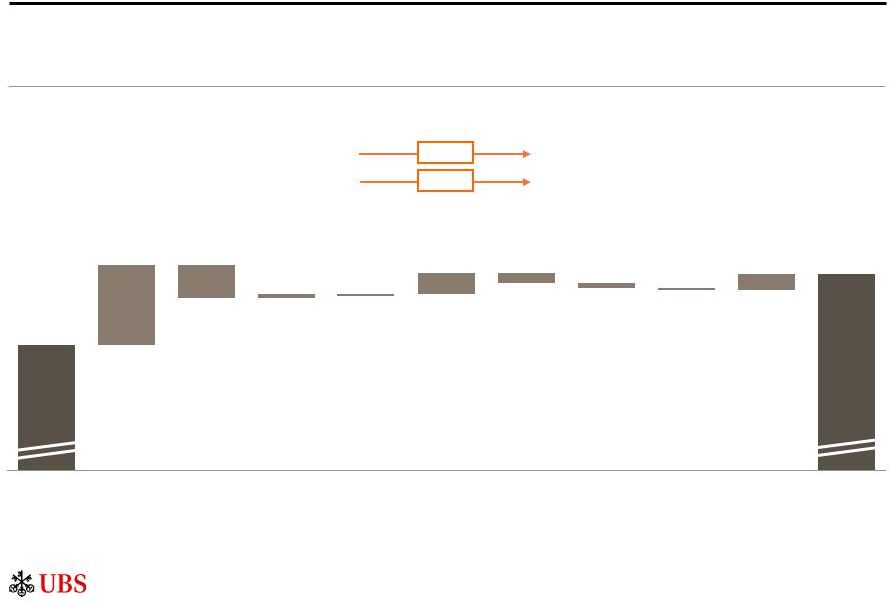

Adjusted numbers

unless otherwise indicated, refer to slide 30 for details about adjusted numbers, Basel III numbers and FX rates in this presentation

Charts illustrative only and bars not to scale; Numbers may not sum up to totals due to

rounding; 1 Refer to page 41 of the 2014 annual report for details of our cost

reduction targets; 2 Refer to slide 26 for details on net cost reduction progress as of the

end of 1Q15 ~CHF

0.8

billion

net

cost

reductions

using

March

2015

annualized

exit

rate

Corporate Center cost reductions

15

Cumulative annualized net cost reduction

CHF billion

Target CHF 1.4 billion net cost

reduction by 2015 year-end

exit rate vs. FY13

1,2

March 2015 exit rate performance

is an early positive sign of

continued cost reductions

Execution risk remains throughout

the year, we will continue to be

vigilant on costs, including

expenses driven by higher

regulatory demand

0.8

0.5

0.3

~0.05

0.8

0.5

0.3

0.6

0.3

0.2

0.1

Services and

Group ALM

Non-core and

Legacy Portfolio

FY14 vs. FY13

(as reported with

4Q14 results on 10.2.15)

1Q15 quarterly

annualized

vs. FY13

March 2015 monthly

annualized exit rate

vs. FY13

Annualized incremental

net cost reduction in 1Q15

Lower net cost reduction

due to exit-rate normalization,

e.g., to reflect seasonality |

Swiss SRB Basel III

capital and leverage ratios Adjusted numbers unless otherwise indicated, refer to slide

30 for details about adjusted numbers, Basel III numbers and FX rates in this presentation

As of 31.3.15, our post-stress fully applied Basel III CET1 capital ratio exceeded

10% 16

Basel III CET1 capital ratio (fully applied)

CHF billion

Swiss SRB leverage ratio (fully applied)

CHF billion

Fully applied Swiss SRB leverage ratio 4.6%

1Q15

4Q14

3Q14

2Q14

1Q14

CET1

capital

CET1

capital

ratio

RWA

29.9

30.6

30.0

28.9

29.6

227

227

219

216

216

1Q15

4Q14

3Q14

2Q14

1Q14

Total

capital

Leverage

ratio

LRD

38.0

41.0

41.0

40.8

44.5

988

981

981

998

977

13.4%

13.7%

13.5%

13.2%

13.7%

4.6%

4.1%

4.2%

4.2%

3.8% |

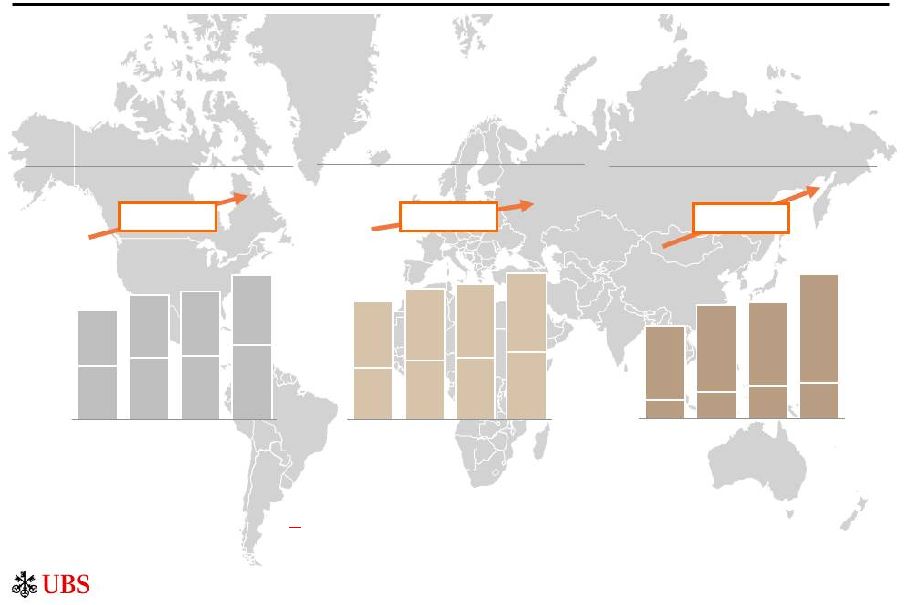

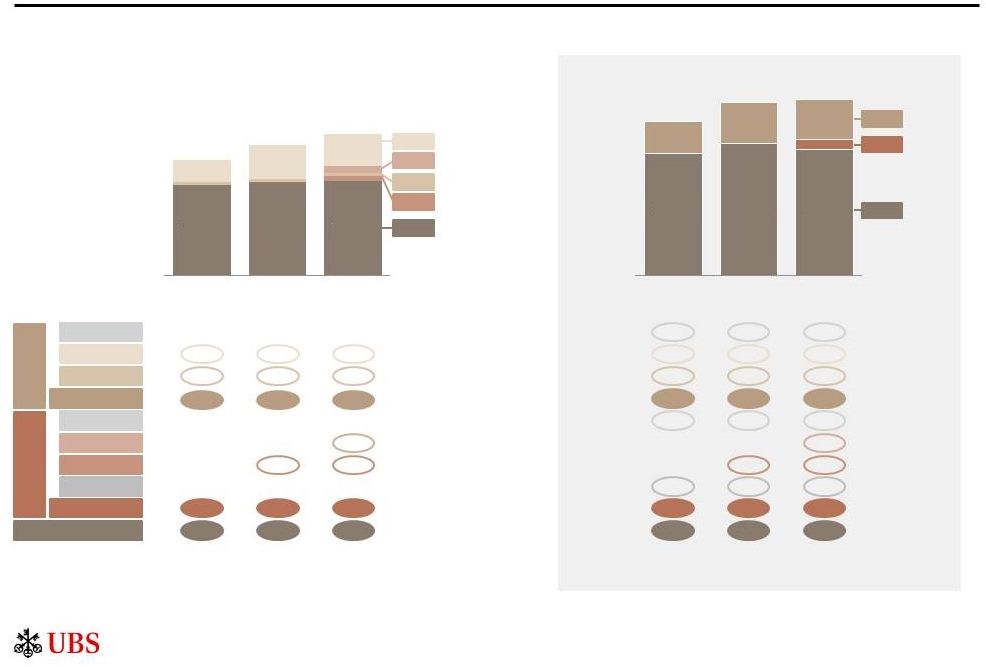

The world's leading

wealth management franchise Profit before tax

CHF billion

Invested assets

CHF trillion

WM

WMA

Adjusted numbers unless otherwise indicated, refer to slide 30 for details about adjusted

numbers, Basel III numbers and FX rates in this presentation Numbers may not sum up to

totals due to rounding 1Q12

0.7

0.1

0.6

0.3

1Q15

1Q13

0.7

0.3

0.9

0.9

1.1

1Q14

0.7

0.2

0.9

1.0

1Q15

1.0

2.0

0.9

1.8

1Q13

1Q14

1.7

0.9

0.9

0.8

0.8

0.7

1Q12

1.5

1.8

1Q14

1Q12

1.6

1.8

1Q15

1.7

1.9

3.5

1.9

1Q13

1.4

3.2

2.1

3.6

3.9

+10% CAGR

+7% CAGR

+16% CAGR

Unique global footprint

operating in the largest and fastest growing markets

Superior growth prospects and strong track record

17

Operating income

CHF billion |

The world's

leading wealth manager

UBS is the world's largest wealth manager

1

Strong capital

position

UBS capital position is strong –

and we can adapt to change

Attractive capital

returns policy

UBS is committed to an attractive capital returns policy

UBS –

a unique and attractive investment

proposition

18

1 Scorpio Partnership Global Private Banking Benchmark 2014; 2 Adjusted pre-tax profit,

refer to slide 27 for details; 3 Payout ratio of at least 50% conditional on maintaining a

fully applied Basel III CET1 capital ratio of at least 13% and post-stress fully applied

Basel III CET1 ratio of at least 10% Unique global footprint provides exposure to both

the world's largest and fastest growing global wealth pools

Leading position across the attractive HNW and UHNW client segments

Profitable in all regions including Europe, US, APAC and emerging markets

Significant benefits from scale; high and rising barriers to entry

Retail & Corporate, Global Asset Management and the Investment Bank all add to our

wealth management franchise, providing a unique proposition for clients

Highly cash generative with a very attractive risk-return profile

10-15% pre-tax profit growth target for our combined wealth management

businesses Our fully applied Basel III CET1 capital ratio is the highest among large

global banks and we already meet our expected 2019 Swiss SRB Basel III capital ratio

requirements Our highly capital accretive business model allows us to adapt to changes

in regulatory capital requirements

Our earnings capacity, capital efficiency and low-risk profile all support our objective

to deliver sustainable and growing capital returns to our shareholders

Our capital returns capacity is strengthened by our commitment to further improve

efficiency and our potential for net upward revaluations of deferred tax assets

We target to pay out at least 50% of net profits

3

, while maintaining our strong capital

position and profitably growing our businesses

2 |

Appendix

|

52,359

50,608

IFRS equity attributable to UBS Group AG shareholders

31.12.14

Foreign

currency

translation

(OCI)

31.3.15

Employee

share and

share options

plans (share

premium)

Cash flow

hedges

(OCI)

Net profit

Treasury

shares

Financial

investments

available-

for-sale

(OCI)

Defined

benefit

plans (OCI)

Other

QoQ movement

CHF million, except for per share figures in CHF

Increase in

UBS Group AG's

ownership

interest in UBS AG

Total book value per share:

Tangible book value per share:

12.14

13.94

31.12.14

12.59

14.33

31.3.15

77

14

539

(272)

(126)

376

(799)

1,977

(36)

Equity attributable to UBS Group AG shareholders CHF 52 billion as of 31.3.15

20

+2.8%

+3.7% |

1Q14

Swiss SRB Basel III capital and ratios

Refer to slide 30 for details about adjusted numbers, Basel III numbers and FX rates in this

presentation 1 Phase-out capital; 2 Hybrid capital subject to phase-out; 3

Goodwill, net of tax, offset against hybrid capital and loss-absorbing capital

21

Ratio

T2 Low-trigger

T2 High-trigger

AT1 High-trigger

CET1

13.7%

0.8%

0.4%

4.6%

CHF billion

Fully applied

Phase-in

22.7%

25.9%

25.5%

1Q15 fully applied Basel III CET1 capital ratio 13.7%

18.6%

1.4%

5.9%

T2

CET1

AT1

T2

AT1

Low-trigger

7.1

10.5

10.0

7.1

10.5

10.0

CET1

29.9

28.9

29.6

41.2

42.9

40.8

Total capital

38.0

40.8

44.5

52.2

56.3

56.8

RWA

226.8

216.5

216.4

229.9

220.9

219.4

3.0

2.1

2.0

Other¹

High-trigger

1.0

0.9

0.9

1.0

0.9

0.9

Total T2

8.1

11.4

11.0

11.0

13.4

13.0

Other²

3.1

3.2

2.9

Deductions³

(3.1)

(3.7)

(3.9)

Total AT1

-

0.5

3.9

-

-

3.0

Low-trigger

2.3

2.3

High-trigger

0.5

1.7

0.5

1.7

1.0%

AT1 Low-trigger

4Q14

1Q15

1Q14

4Q14

1Q15

18.9%

16.8%

20.6%

13.2%

13.4%

13.7%

17.9%

19.4%

18.6% |

Refer to slide 30

for details about adjusted numbers, Basel III numbers and FX rates in this presentation 1

Hybrid capital subject to phase-out; 2 Goodwill, net of tax, offset against hybrid capital and loss-absorbing capital; 3 Refer to the "BIS Basel III leverage ratio" section of the 1Q15

financial report for further detail

Ratio

Fully applied

Phase-in

T2

CET1

AT1

T2 Low-trigger

T2 High-trigger

AT1 High-trigger

CET1

AT1 Low-trigger

1Q15 fully applied Swiss SRB leverage ratio 4.6%

Total capital

38.0

40.8

44.5

49.3

54.3

54.8

Swiss SRB LRD

987.9

997.8

976.9

994.0

1,004.9

982.2

4.1%

4.6%

3.8%

Swiss SRB leverage ratio

22

CHF billion

billion

(31.3.15)

CHF 14.0

BIS Basel III leverage ratio 3.4% on a fully applied basis and 4.4% on a

phase-in basis BIS Basel III LRD CHF 991 billion on a fully applied basis and

CHF 996 billion on a phase-in basis 3

3 |

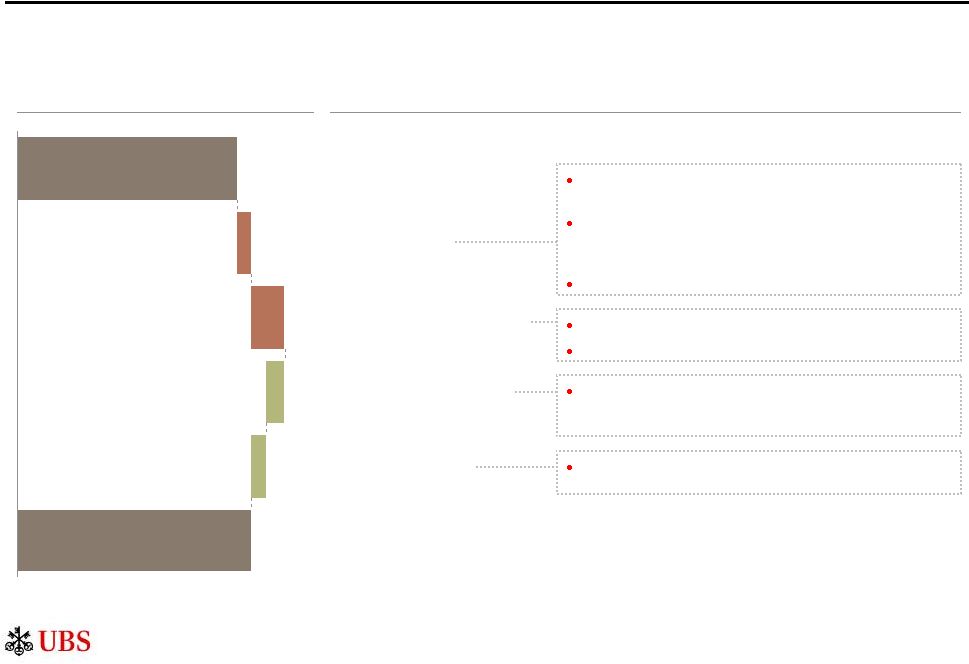

LRD: Swiss SRB vs.

BIS Basel III rules 23

We expect the net difference to decrease by year-end 2015, as we adjust our exposures to new

regulation

LRD

(CHF

billion)

Description of changes

973

991

Derivative

exposures

Securities financing

transactions

Off-balance sheet

commitments

Scope of

consolidation

BIS LRD

Fully applied

Spot, 31.3.15

Refer to slide 30 for details about adjusted and underlying numbers, Basel III numbers and FX

rates in this presentation 1 Chart based on 31.3.15 spot balances, 1Q15 average fully

applied Swiss SRB LRD was CHF 977 billion ~17

~42

(~24)

(~18)

Swiss SRB LRD

Fully applied

Spot, 31.3.15

Inclusion of net notionals for protection sold through

credit derivatives

Current exposure method (CEM) add-ons no longer

exempt for ETD and exposures to qualifying central

counterparties

Partly offset by netting with cash collateral

Addition of charge for counterparty credit risk

Stricter netting criteria

Application of credit conversion factors in line with the

Basel III framework and inclusion of forward-starting

repurchase agreements

Exclusion of assets of entities consolidated under IFRS

but not in regulatory scope of consolidation |

Breakdown of changes

in RWA 24

31.12.14

By type

CHF billion

31.12.14

By business division

CHF billion

216

216

(5)

+1

216

216

(3)

+3

31.3.15

Methodology/model-driven

Book size and other

Currency effects

Investment Bank

31.3.15

+4

All

other

businesses

2

(0)

CHF 2.0 billion increase in operational risk RWA due to

AMA model parameter changes

CHF 2.3 billion increase in credit risk RWA due to

increased multipliers on Swiss mortgages

CHF 0.7 billion increase in credit risk RWA primarily due to

higher derivative exposures partly offset by repayment of

loans and termination of loan facilities

HF 0.8 billion increase in operational risk RWA related to

AMA model parameter changes

CHF 0.9 billion decrease in RWA due to currency effects

Non-core

and

Legacy

Portfolio

1

CHF 1.0 billion decrease in credit risk RWA primarily due currency

effects and repayment of loans, termination of loan facilities partly

offset by

to higher derivative exposures

CHF 2.3 billion increase in credit risk RWA due to increased

multipliers on Swiss mortgages

CHF 0.8 billion increase in operational risk RWA due to AMA model

parameter changes

CHF 2.0 billion decrease in market risk RWA primarily due to lower

regulatory VaR, Stressed VaR and risks not in VaR and currency

effects

CHF 0.4 billion increase in operational risk RWA due to AMA model

parameter changes

Refer to slide 30 for details about adjusted numbers, Basel III numbers and FX rates in this

presentation 1 Refer to pages 55-57 of the 1Q15 financial report for more

information on Non-core and Legacy Portfolio; 2 Corporate Centre – Group ALM, Corporate Centre – Services,

Wealth Management, Wealth Management Americas, Retail & Corporate and Global Asset

Management |

Strong balance

sheet, funding and liquidity position Refer to slide 30 for details about adjusted

numbers, Basel III numbers and FX rates in this presentation 1 Refer

to

the

"Liquidity

and

funding

management"

section

of

the

1Q15

financial

report

for

further

detail;

2

Estimated

pro-forma

ratio

Other (including net replacement

values)

Loans

Cash collateral on securities borrowed

and reverse repo agreements

Trading portfolio assets

Financial investments available-

for-sale

Cash, balances with central

banks and due from banks

Due to banks (10)

Short-term debt issued (23)

Trading portfolio liabilities (30)

Cash collateral on securities lent

and repo agreements (24)

Long-term debt issued

Due to customers

Total equity

Other liabilities

Strong funding and liquidity

Asset funding

31.3.15, CHF billion

25

314

71

133

91

107

82

56

399

Liabilities

and equity

135

121

Assets

127%

coverage

•

Well diversified by market, tenor and currency

•

Limited use of short-term wholesale funding

•

Basel III LCR 122% and Basel III NSFR

2

106%

1 |

0.3

Corporate Center cost reductions

26

(<0.1)

(0.1)

7.9

7.5

0.2

0.2

(0.1)

(0.2)

7.9

7.5

0.5

(0.1)

7.2

<0.1

(<0.1)

7.8

7.2

0.6

0.5

Temporary

regulatory demand²

Litigation

provisions¹

Services &

Group ALM

CHF 1.0 billion

net cost reduction

target by 2015

year-end exit rate

vs. FY13

3

~CHF 0.8 billion net cost reduction as per March 2015 exit rate

Non-core

and Legacy

Portfolio

CHF 0.4 billion

net cost reduction

target by 2015

year-end exit rate

vs. FY13

3

Residual

operating expenses

Net cost

reduction

FX

Net cost

reduction

FX

Net cost

reduction

FX

FY13

FY14

1Q15

annualized

March 2015

annualized

exit rate

Services and

Group ALM

March 2015 exit rate

net cost reduction

Average monthly

run rate (residual

operating expenses)

~CHF 630

million

~CHF 620

million

~CHF 600

million

~CHF 600

million

0.2

(0.2)

2.4

1.1

1.3

0.7

+0.1

0.6

(0.3)

1.1

0.9

~CHF 90

million

~CHF 80

million

~CHF 50

million

~CHF 50

million

FY13

FY14

1Q15

annualized

March 2015

annualized

exit rate

Non-core and

Legacy Portfolio

March 2015 exit rate

net cost reduction

Net cost

reduction

Net cost

reduction

Net cost

(reduction)/

increase

0.6

Litigation

provisions

Residual

operating expenses

Average monthly

run rate (residual

operating expenses)

~CHF 0.8

billion

annualized

net cost

reduction

Lower allocations

from Corporate

Center –

Services

Lower direct costs

in Non-core and

Legacy Portfolio

Normalization,

incl. seasonality

Adjusted operating expenses before allocations (net of allocations to the Non-core and

Legacy Portfolio), CHF billion Adjusted operating expenses, CHF billion

Adjusted numbers unless otherwise indicated, refer to slide 30 for details about adjusted

numbers, Basel III numbers and FX rates in this presentation Charts illustrative only

and bars not to scale; Numbers may not sum up to totals due to rounding; 1 Provisions for litigation, regulatory and similar matters;

2 Regulatory demand of temporary nature; 3 Refer to page 41 of the 2014 annual report for

details on our cost reduction targets |

Services and Group

ALM Net cost reduction

CHF 1.0 billion by 2015 year-end exit rate

Non-core and

Legacy Portfolio

Net cost reduction

Basel III RWA (fully applied)

CHF 0.4 billion by 2015 year-end exit rate, additional CHF 0.7 billion after 2015

~CHF 40 billion by 31.12.15, ~CHF 25 billion by 31.12.17

Group and business division targets

27

Ranges for sustainable performance over the cycle

1

Business divisions

Corporate Center

Retail & Corporate

Net new business volume growth rate

Net interest margin

Adjusted cost/income ratio

1-4% (retail business)

140-180 bps

50-60%

Global Asset

Management

Net new money growth rate

Adjusted cost/income ratio

Adjusted annual pre-tax profit

3-5% excluding money market

60-70%

CHF 1 billion in the medium term

Investment Bank

Adjusted annual pre-tax RoAE

Adjusted cost/income ratio

Basel III RWA limit (fully applied)

Funded assets limit

>15%

70-80%

CHF 70 billion

CHF 200 billion

Refer to slide 30 for details about adjusted numbers, Basel III numbers and FX rates in this

presentation 1 Refer to page 41 of the 2014 annual report for details; 2 Based on the

rules applicable as of the announcement of the target (6.5.14); 2 Our objective is to

maintain a post-stress fully applied CET1 capital ratio of at least 10%

Wealth Management

Americas

Net new money growth rate

Adjusted cost/income ratio

2-4%

75-85%

Wealth Management

Net new money growth rate

Adjusted cost/income ratio

3-5%

55-65%

10-15% annual adjusted pre-tax profit growth for

combined businesses through the cycle

Group

Group

Adjusted cost/income ratio

Adjusted return on tangible equity

Basel III CET1 ratio (fully applied)

Basel III RWA (fully applied)

Swiss SRB LRD

60-70%

around 10% in 2015, >15% from 2016

at least 13%

2

<CHF 215 billion by 31.12.15, <CHF 200 billion by 31.12.17

CHF 900 billion by 2016

2 |

Regional

performance

–

1Q15

1

CHF billion

4Q14

1Q15

4Q14

1Q15

4Q14

1Q15

4Q14

1Q15

4Q14

1Q15

4Q14

1Q15

WM

0.1

0.1

0.5

0.6

1.0

1.0

0.4

0.4

(0.0)

-

2.0

2.1

WMA

1.9

1.8

-

-

-

-

-

-

-

-

1.9

1.8

R&C

-

-

-

-

-

-

0.9

1.0

-

-

0.9

1.0

Global AM

0.2

0.2

0.1

0.1

0.1

0.1

0.1

0.1

-

-

0.5

0.5

Investment Bank

0.6

0.8

0.6

0.7

0.5

0.8

0.2

0.4

0.0

(0.0)

1.9

2.7

Corporate Center

-

-

-

-

-

-

-

-

(0.6)

0.0

(0.6)

0.0

Group

2.8

2.9

1.1

1.4

1.7

1.9

1.7

1.9

(0.6)

0.0

6.7

8.1

WM

0.1

0.1

0.3

0.3

0.7

0.6

0.2

0.2

0.0

0.0

1.3

1.2

WMA

1.6

1.5

-

-

-

-

-

-

-

-

1.6

1.5

R&C

-

-

-

-

-

-

0.6

0.5

-

-

0.6

0.5

Global AM

0.1

0.1

0.1

0.0

0.1

0.1

0.1

0.1

0.0

(0.0)

0.4

0.3

Investment Bank

0.5

0.6

0.4

0.5

0.4

0.6

0.2

0.2

0.2

0.0

1.6

1.8

Corporate Center

-

-

-

-

-

-

-

-

0.6

0.4

0.6

0.4

Group

2.3

2.3

0.8

0.9

1.2

1.3

1.0

1.0

0.8

0.4

6.1

5.8

WM

0.0

0.0

0.1

0.2

0.4

0.4

0.2

0.2

(0.0)

(0.0)

0.7

0.9

WMA

0.2

0.3

-

-

-

-

-

-

-

-

0.2

0.3

R&C

-

-

-

-

-

-

0.4

0.4

-

-

0.4

0.4

Global AM

0.1

0.1

0.0

0.0

0.0

0.0

0.0

0.1

(0.0)

0.0

0.1

0.2

Investment Bank

0.1

0.2

0.2

0.3

0.1

0.2

0.1

0.2

(0.2)

(0.0)

0.3

0.8

Corporate Center

-

-

-

-

-

-

-

-

(1.2)

(0.3)

(1.2)

(0.3)

Group

0.4

0.6

0.3

0.5

0.5

0.6

0.7

0.9

(1.4)

(0.4)

0.5

2.3

EMEA²

Switzerland

Corporate Center

and global³

Total

Operating

income

Operating

expenses

Profit

before tax

Americas

Asia Pacific

28

Adjusted numbers unless otherwise indicated, refer to slide 30 for details about adjusted

numbers, Basel III numbers and FX rates in this presentation 1

Refer to the "Group performance" section of the 1Q15 financial report for further

detail about regional performance; 2 Europe, Middle East, and Africa excluding

Switzerland; 3 Refers to items managed globally |

Adjusted

results 29

Adjusting items

Business division / Corporate Center

1Q13

2Q13

3Q13

4Q13

1Q14

2Q14

3Q14

4Q14

1Q15

CHF million

Operating income as reported (Group)

7,775

7,389

6,261

6,307

7,258

7,147

6,876

6,746

8,841

Of which:

Gain on sale of a subsidiary

Wealth Management

141

Gain on sale of Global AM’s Canadian domestic business

Global Asset Management

34

Gain from the partial sale of our investment in Markit

Investment Bank

43

Impairment of financial investments available-for-sale

Investment Bank

(48)

Investment Bank

55

Corporate Center - Group ALM

(24)

Own credit on financial liabilities designated at FV

Corporate Center - Services

(181)

138

(147)

(94)

88

72

61

70

226

Gains on sales of real estate

Corporate Center - Services

19

207

61

23

1

20

378

Corporate Center - Group ALM

(119)

(75)

Corporate Center - Non-core and Legacy Portfolio

27

Operating income adjusted (Group)

7,983

7,232

6,201

6,415

7,147

7,031

6,863

6,656

8,096

Operating expenses as reported (Group)

6,327

6,369

5,906

5,858

5,865

5,929

7,430

6,342

6,134

Of which:

Wealth Management

26

50

62

41

40

38

60

48

46

Wealth Management Americas

10

10

13

26

10

7

15

23

24

Retail & Corporate

15

13

15

12

15

13

20

16

16

Global Asset Management

4

14

12

13

4

2

5

39

18

Investment Bank

6

31

84

89

124

27

50

60

70

Corporate Center - Services

(3)

5

(1)

(7)

2

4

16

8

119

Corporate Center - Non-core and Legacy Portfolio

188

18

5

24

9

(2)

10

14

11

Wealth Management Americas

(3)

(7)

Global Asset Management

(8)

Investment Bank

(19)

(1)

Corporate Center - Non-core and Legacy Portfolio

(3)

Operating expenses adjusted (Group)

6,081

6,229

5,718

5,660

5,661

5,840

7,287

6,142

5,829

Operating profit/(loss) before tax as reported

1,447

1,020

356

449

1,393

1,218

(554)

404

2,708

Operating profit/(loss) before tax adjusted

1,901

1,003

484

755

1,486

1,191

(424)

514

2,268

Net losses related to the buyback of debt

in public tender offer

Net restructuring charges

Credit related to changes to retiree benefit plans

in the US

Net gain on sale of remaining proprietary

trading business

Adjusted numbers unless otherwise indicated, refer to slide 30 for details about adjusted

numbers, Basel III numbers and FX rates in this presentation Refer to page 15 of the

1Q15 financial report for an overview of adjusted numbers |

30

Important information related to this

presentation

Use of adjusted numbers

If applicable for a given adjusted KPI (i.e., adjusted return on tangible equity), adjustment

items are calculated on an after-tax basis by applying indicative tax rates (i.e., 2% for own

credit, 22% for other items, and with certain large items assessed on a case-by-case

basis). Refer to page 22 of the 1Q15 financial report for more information.

Basel III RWA, Basel III capital and Basel III liquidity ratios

Basel III numbers are based on the BIS Basel III framework, as applicable for Swiss

Systemically relevant banks (SRB). Numbers in the presentation are Swiss SRB Basel III numbers

unless otherwise stated. Our fully applied and phase-in Swiss SRB Basel III and BIS Basel

III capital components have the same basis of calculation, except for differences disclosed

on page 93 of the 1Q15 financial report. Basel III

risk-weighted assets in this presentation are calculated on the basis of Basel III fully applied unless otherwise stated. Our RWA under BIS Basel III are the same as under

Swiss SRB Basel III.

Leverage ratio and leverage ratio denominator in this presentation are calculated

on the basis of fully applied Swiss SRB, unless otherwise stated.

Refer to the “Capital Management” section in the 1Q15 financial report for more

information.

Currency translation

Monthly income statement items of foreign operations with a functional currency other than

Swiss francs are translated with month-end rates into Swiss francs. Refer to “Note 19

Currency translation rates” in the 1Q15 financial report for more information. Rounding

Unless otherwise indicated, “adjusted” figures exclude the adjustment items listed on

the previous slide, to the extent applicable, on a Group and business division level. Adjusted

results are a non-GAAP financial measure as defined by SEC regulations. Refer to page 15 of

the 1Q15 financial report for an overview of adjusted numbers. Numbers presented throughout this presentation may not add up precisely to the totals

provided in the tables and text. Percentages, percent changes and absolute variances are

calculated based on rounded figures displayed in the tables and text and may not precisely reflect the percentages, percent changes and absolute variances

that would be derived based on figures that are not rounded. |

UBS First Quarter 2015 Earnings Call Remarks

May 5, 2015

Sergio P. Ermotti (Group CEO): Opening remarks

SLIDE 2 – 1Q15 highlights

While the first quarter is typically the strongest of the year, our results this quarter are exceptionally good. We reported adjusted pre-tax profit of almost 2.3 billion francs, and net profit was almost 2.0 billion francs. And the results were strong across the board, with all of our business divisions performing well. Our Basel 3 fully applied CET1 ratio also rose to 13.7%, so we remain the best capitalized bank in our peer group.

The results underline that our business model works and our approach to thinking long-term and acting early is paying off. From a macroeconomic and market point of view, the first quarter was more demanding than a typical year, but we were prepared.

So while our results for the quarter are very good and I am confident about our momentum, like we said at Q4, we wouldn’t multiply any quarterly result by four.

Turning to the business divisions -

Together our wealth management businesses delivered the highest profits since 2008 and made solid progress with their strategic initiatives to grow lending and increase mandate penetration.

Wealth Management had its best quarter since 2008 in terms of profitability. Net new money was very strong, even for a first quarter, and was achieved without compromising our profitability standards.

Page 1

Wealth Management Americas delivered another record profit before tax on its highest ever invested asset base, and attracted solid net new money.

Despite a very challenging macroeconomic environment, Retail and Corporate delivered its best first quarter in five years.

Global Asset Management also posted strong results and robust net new money.

The Investment Bank deserves applause not only for its excellent performance with pre-tax profit of 844 million francs, but also because the results were delivered without increasing our risk profile, and while remaining within allocated resource limits. This is a very important point to consider when assessing our results. Our strategy focusses on areas where we excel, and it is well-suited to the high volume and volatility environment we saw in Q1.

Our strategic cost reduction program is ambitious, and I am pleased with the progress we are making in its implementation. While improving our efficiency and effectiveness is a top priority, short-term dynamics will not change our plans, as this would impact our ability to deliver long-term sustainable growth.

Tom will now take you through the details of the quarter.

Tom Naratil (Group CFO & Group COO): Walk-through of the quarter

SLIDE 3 – UBS Group AG results (consolidated)

As usual, my commentary will reference adjusted results unless otherwise stated.

This quarter, we excluded net restructuring charges of 305 million Swiss francs, an own credit gain of 226 million, gains on sales of real estate of 378 million and a gain of 141 million on the sale of a subsidiary in Wealth Management. The net effect of these adjustment items is an accretion to capital of around 150 million in the quarter. An overview of these adjustments can be found on page 15 of our first quarter report.

Page 2

Profit before tax was 2.3 billion, up from 514 million in the prior quarter.

IFRS net profit attributable to shareholders was nearly 2 billion, and adjusted return on tangible equity was seasonally high at 14.4%, ahead of our full-year target of around 10%.

Net profit attributable to non-controlling interests was 61 million. This primarily related to net profit attributable to non-controlling interests in UBS AG reflecting the non-exchanged UBS AG shares. We also expect to attribute net profit of approximately 80 million to non-controlling interests related to the preferred notes issued by UBS AG, all of which will be booked in the second quarter of 2015.

SLIDE 4 – Wealth Management

Wealth Management delivered a strong performance, with profit before tax of 856 million, up 23% to its highest level since the third quarter of 2008.

Operating income increased 5% to 2.1 billion, as transaction-based income rose in all regions, but most notably in APAC and Switzerland. While transaction-based income was up across nearly all products, the increase was largely driven by seasonal effects, portfolio rebalancing and higher volumes in FX as a consequence of the SNB’s actions in January.

Both net interest income and recurring net fees were down due to the stronger Swiss Franc. Excluding the effect of currency movements, recurring income increased on a continued rise in recurring net fees. This underlying trend gives us even more confidence in our ability to deliver on our key initiatives, as net mandate sales were strongly positive in all regions.

Expenses decreased 5%, mainly due to lower marketing expenses and Corporate Center costs, as well as favorable currency effects. This brought the cost/income ratio to 59%, within our target range of 55 to 65%.

Page 3

SLIDE 5 – Wealth Management

Net new money was a strong 14.4 billion, the highest it’s been in eight quarters.

Mandate penetration increased 110 basis points to 25.5% of invested assets, as the business delivered 15 billion in net mandate sales.

Both gross and net margin were up on higher revenues and profit before tax, and on a lower average invested asset base. Gross margin increased 4 basis points to 86 basis points, and net margin increased 7 basis points to 35 basis points, its highest level in over five years.

Marginal transactional activity continues to cause significant swings in trading and commission revenues, resulting in large month-to-month swings in our gross margin, which was 91 basis points in January, 82 basis points in February and 92 basis points in March. What we’ve seen in two out of three months in the first quarter shows the potential upside in a more normalized environment.

SLIDE 6 – Wealth Management

Net new money was positive in all regions, with the largest net inflows in APAC, which delivered 8.2 billion of net new money. Europe delivered net new money of 3 billion, with strong inflows from our domestic business, and positive net inflows from our international business, following seasonally high offshore outflows in the fourth quarter. Net new money was 1.6 billion in Switzerland and 1.5 billion in Emerging Markets.

On a global basis, net new money continued to be strong, with 10.1 billion from our ultra-high net worth clients and a solid contribution from our high net worth clients. Of the 14.4 billion of net new money delivered in the quarter, only 1.8 billion came from increased Lombard lending.

Our net new money is one of many KPIs that we use to monitor our performance, and we don’t buy net new money. Surprisingly, we’ve seen some irrational competition for net new money as some large competitors pay premiums for deposits and these assets.

Page 4

In contrast to some of these competitors, as we highlighted in our fourth quarter earnings call, we’ll be taking action on a number of fronts to optimize our resource utilization, and to ensure that any resource constraints are appropriately priced. Some of these actions may cause affected clients to withdraw some of their cash assets, thus impacting our net new money. These exits would result in net new money outflows, which we’ll exclude from our net new money growth KPI calculation. While it’s unlikely that all assets will be withdrawn, the assets in scope approach 30 billion francs. We expect the bulk of the liquidity coverage ratio and leverage ratio denominator relief from these actions to come in the second quarter, with a slight benefit to come in the third.

Our net new money growth of 5.8% in the first quarter does not exclude any outflows associated with these assets.

Both APAC and Switzerland saw a sharp rise in revenue, as transaction-based income increased on higher client activity. In APAC, we saw strong demand for structured products, particularly related to equities. In Switzerland, the increase was largely driven by rebalancing and foreign-exchange related revenues triggered by the SNB’s actions in January. Revenues were relatively stable in Emerging Markets and down in Europe on a stronger Swiss Franc.

SLIDE 7 – Wealth Management Americas

Wealth Management Americas had a record quarter, generating a profit before tax of 293 million dollars, up 26% on lower expenses.

Operating income was 1.9 billion dollars, and decreased from the fourth quarter, mainly as there were fewer calendar and trading days. As a percentage of revenue, recurring income increased to a record 77%.

Page 5

Expenses were down 5% to 1.6 billion dollars, mainly due to lower FA compensation on lower compensable revenues, and also as charges for litigation, regulatory and similar matters declined from the prior quarter.

Our cost/income ratio was 84.6%, at the top end our target range of 75 to 85%.

SLIDE 8 – Wealth Management Americas

Wealth Management America’s trillion dollar invested asset base continued to grow to record levels, on both positive market performance and solid net new money at 4.8 billion dollars. Net inflows were driven by advisors who’ve been with the firm for more than one year. For the second quarter, we expect to see the typical trend of increased client withdrawals associated with seasonal income tax payments.

We continued to see positive trends in mandate penetration, which increased 40 basis points to 33.9%.

Net margin increased 2 basis points to 11 basis points on lower expenses, which more than offset the impact of a higher average invested asset base and lower revenues, while gross margin was down 2 basis points to 73 basis points.

SLIDE 9 – Wealth Management Americas

Invested assets per FA increased to a record 150 million dollars, while our annualized revenue per FA remained industry leading at 1.1 million dollars. The average production of recruits continued to outpace production of FAs leaving, with 77% of our recruits ranked in the first and second industry quintile, compared with 29% of FAs who left. In general, we’ve continued to see low FA attrition in the industry and at UBS.

Consistent with our strategy, we continued to grow lending balances with total loans growing 2% to 45.5 billion dollars. Average mortgage balances increased 2% to 7.8 billion dollars and securities-backed lending balances were up 3% to 32.1 billion. Although pricing on securities-based lending remains firm, mortgage spreads are under pressure as the industry targets high quality High Net Worth and Ultra High Net Worth mortgage loans.

Page 6

SLIDE 10 – Retail & Corporate

Retail and Corporate delivered its best first quarter in five years with a profit before tax of 443 million francs, up 24%. All KPIs were within their target ranges.

Operating income was up 7%, mostly reflecting lower credit loss expenses, but also higher transaction-based income and net interest income.

Transaction-based income was up 4% to 284 million, as the volatility in both interest rates and foreign-exchange after the SNB’s actions led to increased client activity in FX hedging and trading, as well as gains from macro fair-value hedge ineffectiveness. This was partly offset by a decline in credit card-related income, which was higher in the fourth quarter reflecting seasonal holiday activity.

Net interest income increased 2% to 568 million with increases in both loans and deposits, as we introduced pricing measures in response to the SNB’s policy changes, and as we saw continued benefits from pricing measures we implemented in the prior year. This more than offset the continued effect of persistently low interest rates on our replication portfolios.

On our fourth quarter earnings call, we noted that if the negative interest rate environment in Switzerland continued, our net interest margin would likely be at the lower end of our target range of 140 to 180 basis points. Considering today’s environment, in a constant rate scenario and if asset spreads hold firm despite new market entrants in the mortgage market, as we approach year-end, we would expect a net interest margin that is a bit lower than the middle of our target range.

Following a typical seasonal pattern, net new business volume growth for our retail business was solid at 3.1%, within our target range of 1 to 4%. Net new business volume for retail clients stood at 1.1 billion, and was impacted by over half a billion francs of euro-denominated cash withdrawals following the SNB’s actions.

Page 7