Form S-3ASR WYNN RESORTS LTD

As filed with the Securities and Exchange Commission on November 8, 2016 Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

WYNN RESORTS, LIMITED

(Exact name of registrant as specified in its charter)

Nevada | 46-0484987 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) | |

3131 Las Vegas Boulevard South

Las Vegas, Nevada 89109

(702) 770-7000

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Kim Sinatra

Executive Vice President, General Counsel and Secretary

Wynn Resorts, Limited

3131 Las Vegas Boulevard South

Las Vegas, Nevada 89109

(702) 770-7000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With a copy to:

Andrew L. Fabens, Esq.

Ronald O. Mueller, Esq.

Gibson, Dunn & Crutcher LLP

200 Park Avenue

New York, NY 10166

(212) 351-4000

From time to time after this registration statement becomes effective.

(Approximate date of commencement of proposed sale to the public)

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box: ¨

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box: ý

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering: ¨

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box: ý

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box: ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act:

Large accelerated filer | ý | Accelerated filer | ¨ | |||

Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

CALCULATION OF REGISTRATION FEE

Title of each class of securities to be registered(1) | Amount to be registered(2) | Proposed maximum offering price per share(2) | Proposed maximum aggregate offering price(2) | Amount of registration fee(2)(3) | ||||

Common stock, par value $0.01 per share | — | — | — | — | ||||

Preferred stock, par value $0.01 per share | — | — | — | — | ||||

Depositary shares representing preferred stock(4) | — | — | — | — | ||||

Senior debt securities, senior subordinated debt securities, subordinated debt securities and junior subordinated debt securities | — | — | — | — | ||||

(1) | Any securities registered hereunder may be sold separately or as units with other securities registered hereunder. |

(2) | An indeterminate aggregate offering price or number of securities of each identified class to be offered at indeterminate prices from time to time is being registered pursuant to this registration statement. |

(3) | In accordance with Rules 456(b) and 457(r), Wynn Resorts, Limited is deferring payment of the registration fee. |

(4) | Such indeterminate number of depositary shares to be evidenced by depositary receipts issued under a deposit agreement. If fractional interests in shares of preferred stock are issued, depositary receipts will be distributed for such fractional interests and the shares of preferred stock will be issued to the depositary under the deposit agreement. |

PROSPECTUS

Wynn Resorts, Limited

This prospectus relates to offers and sales to the public from time to time of:

• | shares of our common stock, par value $0.01 per share; |

• | shares of our preferred stock, par value $0.01; |

• | depositary shares representing preferred stock; and |

• | debt securities. |

Prospectus supplements will be filed and other offering material may be provided at later dates that will contain specific terms of each offering of our securities.

Our common stock is quoted on the NASDAQ Global Select Market under the symbol “WYNN.” Our principal executive offices are located at 3131 Las Vegas Boulevard South, Las Vegas, Nevada 89109 and the telephone number of our principal executive offices is (702) 770-7000.

We urge you to read carefully this prospectus, any accompanying prospectus supplement and any other offering materials filed or provided by us before you make your investment decision. This prospectus may not be used to sell securities unless accompanied by a prospectus supplement.

Investing in our securities involves risks. See “Risk Factors” on page 1.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities or determined if this prospectus or any accompanying prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

Neither the Nevada Gaming Commission, the Nevada State Gaming Control Board, nor any other gaming authority has passed upon the adequacy or accuracy of this prospectus or any accompanying prospectus supplement or the investment merits of the securities offered hereby. Any representation to the contrary is unlawful.

The date of this prospectus is November 8, 2016.

TABLE OF CONTENTS

Unless the context otherwise requires or unless otherwise specified, all references in this prospectus to “Wynn Resorts,” the “Company,” “we,” “us,” or “our,” or similar terms, refer to Wynn Resorts, Limited and its consolidated subsidiaries.

i

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the SEC using a “shelf” registration process. Under this shelf process, the securities described in this prospectus may be offered and sold to the public in one or more offerings. This prospectus provides you with a general description of the securities we may offer. Each time securities are offered and sold pursuant to this prospectus, we will provide a prospectus supplement that will contain specific information about the terms of that offering. The prospectus supplement may also add, update or change information contained in this prospectus. You should read both this prospectus and any prospectus supplement together with additional information described under the heading “Where You Can Find More Information.”

RISK FACTORS

Investing in our securities involves risks. You are urged to read and carefully consider the information under the heading “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2015, which is incorporated by reference into this prospectus, and in documents we file with the SEC after the date of this prospectus and which are incorporated by reference into this prospectus, as described below under the heading “Incorporation by Reference.” Before making an investment decision, you should carefully consider these risks as well as other information we incorporate by reference into this prospectus. The risks and uncertainties that we have described are not the only ones facing us. The prospectus supplement applicable to each offering of our securities will contain additional information about risks applicable to an investment in us and shares of our securities.

WHERE YOU CAN FIND MORE INFORMATION

We are subject to the informational reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and in accordance with these requirements file reports, proxy statements and other information with the SEC. The reports, proxy statements and other information that we file with the SEC may be read and copied at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains an Internet site at http://www.sec.gov that contains reports, proxy and information statements, and other information regarding issuers, like Wynn Resorts, that file electronically with the SEC. Our filings with the SEC also may be accessed through our Internet website at http://www.wynnresorts.com. Our website, and the information contained in, accessible from or connected to our website, shall not be deemed to be incorporated into, or otherwise constitute a part of, this prospectus.

INCORPORATION BY REFERENCE

We are “incorporating by reference” specified documents that we file with the SEC, which means that:

• | incorporated documents, including exhibits and other information not included in this prospectus or a prospectus supplement, are considered part of this prospectus; |

• | we are disclosing important business and financial information to you by referring you to those documents; and |

• | information that we file in the future with the SEC automatically will update and supersede earlier information contained or incorporated by reference into this prospectus. |

We are incorporating by reference into this prospectus the following documents filed with the SEC:

• | our annual report on Form 10-K for the fiscal year ended December 31, 2015; |

• | our quarterly reports on Form 10-Q for the fiscal quarters ended March 31, 2016, June 30, 2016 and September 30, 2016; |

• | our current reports on Form 8-K filed on February 11, 2016 (with respect to Item 8.01 only), April 20, 2016, May 5, 2016 (with respect to Item 8.01 only), July 6, 2016, July 28, 2016 (with respect to Item 8.01 only), August 23, 2016, and November 2, 2016 (with respect to Item 8.01 only); |

• | the description of our common stock set forth in our Registration Statement on Form 8-A, filed on October 7, 2002 (File No. 000-50028), including any amendment or reports filed for the purpose of updating the description of our common stock contained therein; and |

1

• | all other documents that we file with the SEC pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date of this prospectus and prior to termination of the offering of securities offered by this prospectus and any accompanying prospectus supplement. |

Notwithstanding the foregoing, information furnished under Items 2.02 and 7.01 of any Current Report on Form 8-K, including the related exhibits under Item 9.01, is not incorporated by reference into this prospectus.

You should rely only on the information contained or incorporated by reference into this prospectus. We have not authorized anyone to provide you with any additional information. Any statement contained in this prospectus, or a document incorporated or deemed to be incorporated by reference into this prospectus, will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus or any other subsequently filed document that is deemed to be incorporated by reference into this prospectus modifies or supersedes the statement. Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

Copies of the documents incorporated by reference into this prospectus are available from us upon request. We will provide to each person, including any beneficial owner, to whom a prospectus is delivered, a copy of any or all of the information that has been incorporated by reference into this prospectus, but not delivered with this prospectus, without charge to the requester, upon written or oral request. Exhibits to information incorporated by reference into this prospectus will not be sent, however, unless those exhibits have specifically been incorporated by reference into such information. Requests for such copies should be directed to:

Wynn Resorts, Limited

3131 Las Vegas Boulevard South

Las Vegas, Nevada 89109

(702) 770-7555

Attention: Investor Relations

Except as provided above, no other information, including information on our internet site (http://www.wynnresorts.com), is incorporated by reference into this prospectus.

FORWARD-LOOKING STATEMENTS

This prospectus, including the documents incorporated by reference into this prospectus, contains forward-looking statements, including, but not limited to, statements relating to our business strategy, development activities, competition and possible or assumed future results of operations. Any statements contained in this prospectus, including the documents incorporated by reference into this prospectus, that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting the generality of the foregoing, in some cases you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “would,” “could,” “believe,” “expect,” “anticipate,” “estimate,” “intend,” “plan,” “continue” or the negative of these terms or similar expressions. Such forward-looking information involves important risks and uncertainties that could significantly affect anticipated results in the future and, accordingly, such results may differ from those expressed in any forward-looking statements made by us. These risks and uncertainties include, but are not limited to:

• | our dependence on Stephen A. Wynn; |

• | general global political and economic conditions, particularly in China, which may impact levels of travel, leisure and consumer spending; |

• | construction risks (including disputes with and defaults by contractors and subcontractors; construction, equipment or staffing problems; shortages of materials or skilled labor; environment, health and safety issues; and unanticipated cost increases); |

• | factors affecting the development and success of new gaming and resort properties (including limited labor resources in Macau and government labor and gaming policies, unexpected cost increases, transportation infrastructure, environmental regulation and our ability to secure federal, state and local permits and approvals necessary for our construction projects); |

• | changes in the valuation of the promissory note we issued in connection with the redemption of Mr. Okada's shares; |

• | restrictions or conditions on visitation by citizens of mainland China to Macau; |

• | potential violations of law by Mr. Kazuo Okada, a former shareholder of ours; |

• | pending or future legal proceedings, regulatory or enforcement actions or probity investigations; |

• | any violations by us of the anti-money laundering laws or Foreign Corrupt Practices Act; |

2

• | competition in the casino/hotel and resort industries and actions taken by our competitors, including new development and construction activities of competitors; |

• | our dependence on a limited number of resorts and locations for all of our cash flow; |

• | our relationships with Macau gaming promoters; |

• | our ability to maintain our customer relationships and collect and enforce gaming receivables; |

• | extensive regulation of our business (including the Chinese government's ongoing anti-corruption campaign) and the cost of compliance or failure to comply with applicable laws and regulations; |

• | our ability to maintain our gaming licenses and concessions; |

• | changes in gaming laws or regulations; |

• | changes in federal, foreign, or state tax laws or the administration of such laws; |

• | cybersecurity risk including misappropriation of customer information or other breaches of information security; |

• | our current and future insurance coverage levels; |

• | conditions precedent to funding under our credit facilities; |

• | continued compliance with all provisions in our debt agreements; |

• | leverage and debt service (including sensitivity to fluctuations in interest rates); |

• | the impact on the travel and leisure industry from factors such as an outbreak of an infectious disease, extreme weather patterns or natural disasters, military conflicts and any future security alerts and/or terrorist attacks; |

• | our subsidiaries' ability to pay us dividends and distributions; |

• | our ability to protect our intellectual property rights; |

• | doing business in foreign locations such as Macau; |

• | legalization of gaming in certain jurisdictions; and |

• | changes in exchange rates. |

Further information on potential factors that could affect our financial condition, results of operations and business are included in the sections entitled “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2015, and our other filings with the SEC. You should not place undue reliance on any forward-looking statements, which are based only on information currently available to us. We undertake no obligation to publicly release any revisions to such forward-looking statements to reflect events or circumstances after the date of this prospectus.

THE COMPANY

We are a developer, owner and operator of destination casino resorts (integrated resorts). In the Macau Special Administrative Region of the People's Republic of China, the Company owns approximately 72% of Wynn Macau, Limited and the Company operates the integrated Wynn Macau and Encore at Wynn Macau resort and the integrated Wynn Palace. In Las Vegas, Nevada, the Company owns 100% of and operates the integrated Wynn Las Vegas and Encore at Wynn Las Vegas resort. We are also currently constructing Wynn Boston Harbor, an integrated resort in Everett, Massachusetts, adjacent to Boston.

Company Information

Our principal executive offices are located at 3131 Las Vegas Boulevard South, Las Vegas, Nevada 89109, telephone (702) 770-7000.

3

RATIO OF EARNINGS TO COMBINED FIXED CHARGES AND PREFERRED STOCK DIVIDENDS

The following table sets forth our historical ratios of earnings to fixed charges and our historical ratios of earnings to fixed charges and dividends on preferred stock for the periods indicated. This information should be read in conjunction with the consolidated financial statements and the accompanying notes incorporated by reference in this prospectus.

Nine months ended September 30, 2016 | Years ended December 31, | |||||||||||

2015 | 2014 | 2013 | 2012 | 2011 | ||||||||

Ratio of earnings to combined fixed charges and preferred stock dividends | 1.33x | 1.69x | 3.63x | 4.14x | 3.52x | 4.50x | ||||||

For purposes of these calculations, earnings consist of income from continuing operations before provision for income taxes and before fixed charges. Combined fixed charges include interest expense and a portion of rental expense deemed a reasonable approximation of the interest factor. We had no preferred stock issued and outstanding for any of the periods presented.

USE OF PROCEEDS

Unless otherwise stated in the applicable prospectus supplement, we intend to use the net proceeds of any securities sold by us for general corporate purposes. General corporate purposes may include repayment of debt, acquisitions, additions to working capital, capital expenditures and investments in our subsidiaries.

DESCRIPTION OF THE SECURITIES

A description of the specific terms of any common stock, preferred stock, depositary shares or debt securities that may be offered under this prospectus will be set forth in the applicable prospectus supplement relating to those securities. The terms of the offering of the securities, the initial offering price and the net proceeds to us will also be contained in any applicable prospectus supplement or other offering materials relating to such offer. Such materials may also add, update or change information contained in this prospectus.

VALIDITY OF THE SECURITIES

Unless otherwise specified in connection with the particular offering of securities, the validity of any securities issued under this prospectus will be passed upon for us by Gibson, Dunn & Crutcher LLP, New York, New York, and, with respect to matters of Nevada law, by Brownstein Hyatt Farber Schreck, LLP, Las Vegas, Nevada. Any underwriters will be represented by their own legal counsel.

EXPERTS

The consolidated financial statements of Wynn Resorts, Limited appearing in Wynn Resorts, Limited’s Annual Report (Form 10-K) for the year ended December 31, 2015 including schedules appearing therein, and the effectiveness of Wynn Resorts, Limited’s internal control over financial reporting as of December 31, 2015 have been audited by Ernst & Young LLP, independent registered public accounting firm, as set forth in their reports thereon, included therein, and incorporated herein by reference. Such consolidated financial statements are, and audited financial statements to be included in subsequently filed documents will be, incorporated herein in reliance upon the reports of Ernst & Young LLP pertaining to such financial statements and the effectiveness of our internal control over financial reporting as of the respective dates (to the extent covered by consents filed with the Securities and Exchange Commission) given on the authority of such firm as experts in accounting and auditing.

4

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. | Other Expenses of Issuance and Distribution |

The following table sets forth the fees and expenses payable by the registrant in connection with the registration and sale of the securities being registered hereby. All of such fees and expenses are estimated.

SEC registration fee | $ | * | ||

Accounting fees and expenses | + | |||

Legal fees and expenses | + | |||

Printing fees and expenses | + | |||

NASDAQ listing fee | + | |||

Miscellaneous | + | |||

Total | $ | |||

* | In accordance with Rules 456(b) and 457(r), the registrant is deferring payment of the registration fee for the securities offered by this prospectus. |

+ | These fees cannot be estimated at this time as they are calculated based on the securities offered and the number of issuances. An estimate of the aggregate expenses in connection with the sale and distribution of the securities being offered will be included in the applicable prospectus supplement. |

Item 15. | Indemnification of Directors and Officers |

The Nevada Revised Statutes provide that a corporation may indemnify its officers and directors against expenses actually and reasonably incurred in the event an officer or director is made a party or threatened to be made a party to an action (other than an action brought by or in the right of the corporation as discussed below) by reason of his or her official position with the corporation provided the director or officer (1) is not liable for the breach of any fiduciary duties as a director or officer involving intentional misconduct, fraud or a knowing violation of the law or (2) acted in good faith and in a manner he or she reasonably believed to be in the best interests of the corporation and, with respect to any criminal actions, had no reasonable cause to believe his or her conduct was unlawful. A corporation may indemnify its officers and directors against expenses, including amounts paid in settlement, actually and reasonably incurred in the event an officer or director is made a party or threatened to be made a party to an action by or in the right of the corporation by reason of his or her official position with the corporation, provided the director or officer (1) is not liable for the breach of any fiduciary duties as a director or officer involving intentional misconduct, fraud or a knowing violation of the laws or (2) acted in good faith and in a manner he or she reasonably believed to be in the best interests of the corporation. The Nevada Revised Statutes further provides that a corporation generally may not indemnify an officer or director if it is determined by a court that such officer or director is liable to the corporation or responsible for any amounts paid to the corporation in settlement, unless a court also determines that the officer or director is fairly and reasonably entitled to indemnification in light of all of the relevant facts and circumstances. The Nevada Revised Statutes require a corporation to indemnify an officer or director to the extent he or she is successful on the merits or otherwise successfully defends the action.

Wynn Resorts’ bylaws provide that it will indemnify its directors and officers to the fullest extent permitted by Nevada law, including in circumstances in which indemnification otherwise would be discretionary under Nevada law as described above. In addition, Wynn Resorts has entered into separate indemnification agreements with certain of its directors and officers that require Wynn Resorts, among other things, to indemnify such directors and officers against certain liabilities that may arise by reason of their status or service. Wynn Resorts also intends to maintain director and officer liability insurance, if available on reasonable terms.

II - 1

Item 16. | Exhibits |

Exhibit No. | Description | |

4.1 | Third Amended and Restated Articles of Incorporation of the Registrant. (Incorporated by reference from the Quarterly Report on Form 10-Q filed by the Registrant on May 8, 2015.) | |

4.2 | Eighth Amended and Restated Bylaws of the Registrant. (Incorporated by reference from the Quarterly Report on Form 10-Q filed by the Registrant on November 6, 2015.) | |

4.3 | Specimen certificate for shares of common stock, $0.01 par value per share, of the Registrant. (Incorporated by reference to Exhibit 4.1 to Amendment No. 4 to the Form S-1 filed by the registrant on October 7, 2002 (File No. 333-90600).) | |

4.4 | Indenture, dated as of March 29, 2004, between the registrant and U.S. Bank National Association, as indenture trustee. (Incorporated by reference to the Registration Statement on Form S-3 filed by the Registrant on March 30, 2004 (File No. 333-114022).) | |

4.5 | Form of Deposit Agreement. (Incorporated by reference to Exhibit 4.5 to the Registration Statement on Form S-3 filed by the Registrant on March 30, 2004 (File No. 333-114022).) | |

4.6 | Form of Depositary Share (included in Exhibit 4.5) | |

*5.1 | Opinion of Gibson, Dunn & Crutcher LLP | |

*5.2 | Opinion of Brownstein Hyatt Farber Schreck, LLP | |

*12 | Statement re: Computation of Ratio of Earnings to Combined Fixed Charges and Preferred Stock Dividends | |

*23.1 | Consent of Ernst & Young LLP, Independent Registered Public Accounting Firm | |

*23.2 | Consent of Gibson, Dunn & Crutcher LLP (included in Exhibit 5.1) | |

*23.3 | Consent of Brownstein Hyatt Farber Schreck, LLP (included in Exhibit 5.2) | |

*24 | Powers of Attorney of officers and directors of Wynn Resorts, Limited (included on signature page of this registration statement) | |

*25 | Statement of Eligibility on Form T-1 under the Trust Indenture Act of 1939, as amended, of U.S. Bank National Association, trustee under the Indenture, with respect to the Debt Securities | |

* | Filed herewith. |

Item 17. | Undertakings |

(a) The undersigned registrant hereby undertakes:

II - 2

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

(ii) To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

Provided, however, that paragraphs (a)(1)(i), (a)(1)(ii) and (a)(1)(iii) above do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to section 13 or section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(2) That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4) That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser:

(A) Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

(B) Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii) or (x) for the purpose of providing the information required by section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date; and

(5) That, for the purpose of determining liability of the registrant under the Securities Act of 1933 to any purchaser in the initial distribution of the securities:

The undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

(i) Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424;

(ii) Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant;

II - 3

(iii) The portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant or its securities provided by or on behalf of the undersigned registrant; and

(iv) Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser.

(b) The undersigned registrant hereby further undertakes that , for purposes of determining any liability under the Securities Act of 1933, each filing of the registrant’s annual report pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act of 1933 and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question of whether such indemnification by it is against public policy as expressed in the Securities Act of 1933 and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-3 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Las Vegas, State of Nevada, on this 8th day of November, 2016.

WYNN RESORTS, LIMITED | ||

By: | /s/ Stephen Cootey | |

Stephen Cootey | ||

Chief Financial Officer and Treasurer | ||

(Principal Financial and Accounting Officer) | ||

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints Stephen A. Wynn, Kim Sinatra and Matt Maddox, and each of them acting individually, with full power to act without the others, as his or her true and lawful attorney-in-fact and agent with full power of substitution and resubstitution, for him or her and in his or her name, place and stead, in any and all capacities, to sign any or all amendments to this registration statement (including post-effective amendments, or any abbreviated registration statement and any amendments thereto filed pursuant to Rule 462 under the Securities Act of 1933 and otherwise), and to file the same, with all exhibits thereto, and other documents in connection therewith, with the Securities and Exchange Commission, granting unto each said attorney-in-fact and agent full power and authority to do and perform each and every act and thing requisite and necessary to be done in and about the premises, as fully to all intents and purposes as he or she might or could do in person, hereby ratifying and confirming all that each said attorney-in-fact and agent or his or her substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities and on the dates indicated.

II - 4

Signature | Title | Date | ||

/s/ Stephen A. Wynn | Chairman of the Board and Chief Executive Officer (Principal Executive Officer) | November 8, 2016 | ||

Stephen A. Wynn | ||||

/s/ Stephen Cootey | Chief Financial Officer and Treasurer (Principal Financial and Accounting Officer) | November 8, 2016 | ||

Stephen Cootey | ||||

/s/ John J. Hagenbuch | Director | November 8, 2016 | ||

John J. Hagenbuch | ||||

/s/ Dr. Ray R. Irani | Director | November 8, 2016 | ||

Dr. Ray R. Irani | ||||

/s/ Jay L. Johnson | Director | November 8, 2016 | ||

Jay L. Johnson | ||||

/s/ Robert J. Miller | Director | November 8, 2016 | ||

Robert J. Miller | ||||

/s/ Patricia Mulroy | Director | November 8, 2016 | ||

Patricia Mulroy | ||||

/s/ Clark T. Randt, Jr. | Director | November 8, 2016 | ||

Clark T. Randt, Jr. | ||||

/s/ Alvin V. Shoemaker | Director | November 8, 2016 | ||

Alvin V. Shoemaker | ||||

/s/ J. Edward Virtue | Director | November 8, 2016 | ||

J. Edward Virtue | ||||

/s/ D. Boone Wayson | Director | November 8, 2016 | ||

D. Boone Wayson | ||||

EXHIBIT INDEX

Exhibit No. | Description | |

4.1 | Third Amended and Restated Articles of Incorporation of the Registrant. (Incorporated by reference from the Quarterly Report on Form 10-Q filed by the Registrant on May 8, 2015.) | |

4.2 | Eighth Amended and Restated Bylaws of the Registrant. (Incorporated by reference from the Quarterly Report on Form 10-Q filed by the Registrant on November 6, 2015.) | |

4.3 | Specimen certificate for shares of common stock, $0.01 par value per share, of the Registrant. (Incorporated by reference to Exhibit 4.1 to Amendment No. 4 to the Form S-1 filed by the registrant on October 7, 2002 (File No. 333-90600).) | |

4.4 | Indenture, dated as of March 29, 2004, between the registrant and U.S. Bank National Association, as indenture trustee. (Incorporated by reference to the Registration Statement on Form S-3 filed by the Registrant on March 30, 2004 (File No. 333-114022).) | |

4.5 | Form of Deposit Agreement. (Incorporated by reference to Exhibit 4.5 to the Registration Statement on Form S-3 filed by the Registrant on March 30, 2004 (File No. 333-114022).) | |

4.6 | Form of Depositary Share (included in Exhibit 4.5) | |

*5.1 | Opinion of Gibson, Dunn & Crutcher LLP | |

*5.2 | Opinion of Brownstein Hyatt Farber Schreck, LLP | |

*12 | Statement re: Computation of Ratio of Earnings to Combined Fixed Charges and Preferred Stock Dividends | |

*23.1 | Consent of Ernst & Young LLP, Independent Registered Public Accounting Firm | |

*23.2 | Consent of Gibson, Dunn & Crutcher LLP (included in Exhibit 5.1) | |

*23.3 | Consent of Brownstein Hyatt Farber Schreck, LLP (included in Exhibit 5.2) | |

*24 | Powers of Attorney of officers and directors of Wynn Resorts, Limited (included on signature page of this registration statement) | |

*25 | Statement of Eligibility on Form T-1 under the Trust Indenture Act of 1939, as amended, of U.S. Bank National Association, trustee under the Indenture, with respect to the Debt Securities | |

* | Filed herewith. |

Exhibit 5.1

November 8, 2016

Wynn Resorts, Limited 3131 Las Vegas Boulevard South Las Vegas, Nevada 89109 |

Re: | Wynn Resorts, Limited |

Registration Statement on Form S-3

Ladies and Gentlemen:

We have acted as counsel to Wynn Resorts, Limited, a Nevada corporation (the “Company”), in connection with the preparation and filing with the Securities and Exchange Commission (the “Commission”) of a Registration Statement on Form S-3 (the “Registration Statement”) under the Securities Act of 1933, as amended (the “Securities Act”), relating to the registration under the Securities Act and the proposed issuance and sale from time to time pursuant to Rule 415 under the Securities Act, together or separately and in one or more series (if applicable) of:

(i)shares of the Company’s common stock, par value $0.01 per share (the “Common Stock”);

(ii)shares of the Company’s preferred stock, par value $0.01 per share (the “Preferred Stock”);

(iii)depositary shares each representing a fraction of a share of a particular series of Preferred Stock (the “Depositary Shares”); and

(iv)the Company’s unsecured debt securities (the “Debt Securities”).

The Common Stock, Preferred Stock, Depositary Shares and Debt Securities are collectively referred to herein as the “Securities.” The Debt Securities are to be issued under an indenture dated as of March 29, 2004, between the Company and U.S. Bank National Association (the “Trust Company”), as indenture trustee (the “Base Indenture”).

In arriving at the opinions expressed below, we have examined originals, or copies certified or otherwise identified to our satisfaction as being true and complete copies of the originals, of the Base Indenture, specimen Common Stock certificate and such other documents, corporate records, certificates of officers of the Company and of public officials and other instruments as we have deemed necessary or advisable to enable us to render these opinions. In our examination, we have assumed the genuineness of all signatures, the legal capacity and competency of all natural persons, the authenticity of all documents submitted to us as originals and the conformity to original documents of all documents submitted to us as copies. As to any facts material to these opinions, we have relied to the extent we deemed appropriate and without independent investigation upon statements and representations of officers and other representatives of the Company and others.

We are not admitted or qualified to practice law in the State of Nevada. Therefore, we have relied upon the opinion of Brownstein Hyatt Farber Schreck, LLP with respect to matters governed by the laws of the State of Nevada.

We have assumed without independent investigation that:

(i) at the time any Securities are sold pursuant to the Registration Statement (the “Relevant Time”), the Registration Statement and any supplements and amendments thereto (including post-effective amendments) will be effective and will comply with all applicable laws;

(ii) at the Relevant Time, a prospectus supplement will have been prepared and filed with the Commission describing the Securities offered thereby and all related documentation and will comply with all applicable laws;

(iii) all Securities will be issued and sold in the manner stated in the Registration Statement and the applicable prospectus supplement;

(iv) at the Relevant Time, all corporate or other action required to be taken by the Company to duly authorize each proposed issuance of Securities and any related documentation (including (i) the due reservation of any shares of Common Stock or Preferred Stock for issuance upon exercise, conversion or exchange of any Securities for Common Stock or Preferred Stock (a “Convertible Security”), and (ii) the execution (in the case of certificated Securities), delivery and performance of the Securities and any related documentation referred to in paragraphs 1 and 2 below) shall have been duly completed and shall remain in full force and effect;

(v) upon issuance of any Common Stock or Preferred Stock, including upon exercise, conversion or exchange of any Convertible Security, the total number of shares of Common Stock or Preferred Stock issued and outstanding will not exceed the total number of shares of Common Stock or Preferred Stock, as applicable, that the Company is then authorized to issue under its articles of incorporation and other relevant documents; and

(vi) at the Relevant Time, a definitive purchase, underwriting or similar agreement and any other necessary agreement with respect to any Securities offered or issued will have been duly authorized by all necessary corporate or other action of the Company and duly executed and delivered by the Company and the other parties thereto.

Based on the foregoing and in reliance thereon, and subject to the assumptions, exceptions, qualifications and limitations set forth herein, we are of the opinion that:

1. With respect to Depositary Shares, when:

a. | a deposit agreement relating to such Depositary Shares (the “Deposit Agreement”) has been duly executed and delivered by the Company and the depositary appointed by the Company, |

b. | the terms of the Depositary Shares have been established in accordance with the Deposit Agreement, and |

c. | the depositary receipts representing the Depositary Shares have been duly executed and countersigned (in the case of certificated Depositary Shares), registered and |

delivered in accordance with the related Deposit Agreement and the applicable definitive purchase, underwriting or similar agreement for the consideration provided therein,

the depositary receipts evidencing the Depositary Shares will be legal, valid and binding obligations of the Company, enforceable against the Company in accordance with their terms.

2. With respect to any Debt Securities, when:

a. | the terms and conditions of such Debt Securities have been duly established by supplemental indenture or officers’ certificate in accordance with the terms and conditions of the Base Indenture, |

b. | any such supplemental indenture has been duly executed and delivered by the Company and the Trust Company (together with the Base Indenture, the “Indenture”), and |

c. | such Debt Securities have been executed (in the case of certificated Debt Securities), delivered and authenticated in accordance with the terms of the applicable Indenture and issued and sold for the consideration set forth in the applicable definitive purchase, underwriting or similar agreement, |

such Debt Securities will be legal, valid and binding obligations of the Company, enforceable against the Company in accordance with their respective terms.

The opinions expressed above are subject to the following exceptions, qualifications, limitations and assumptions:

A. We render no opinion herein as to matters involving the laws of any jurisdiction other than the State of New York. This opinion is limited to the effect of the current state of the laws of the State of New York and the facts as they currently exist. We assume no obligation to revise or supplement this opinion in the event of future changes in such laws or the interpretations thereof or such facts.

B. The opinions above are each subject to (i) the effect of any bankruptcy, insolvency, reorganization, moratorium, arrangement or similar laws affecting the rights and remedies of creditors’ generally, including without limitation the effect of statutory or other laws regarding fraudulent transfers or preferential transfers, and (ii) general principles of equity, including concepts of materiality, reasonableness, good faith and fair dealing and the possible unavailability of specific performance, injunctive relief or other equitable remedies regardless of whether enforceability is considered in a proceeding in equity or at law.

C. We express no opinion regarding the effectiveness of (i) any waiver of stay, extension or usury laws; (ii) provisions relating to indemnification, exculpation or contribution, to the extent such provisions may be held unenforceable as contrary to public policy or federal or state securities laws; or (iii) any provision to the effect that every right or remedy is cumulative and may be exercised in addition to any other right or remedy or that the election of some particular remedy does not preclude recourse to one or more others.

D. To the extent relevant to our opinion in paragraph 1, we have assumed that any securities, currencies or commodities underlying, comprising or issuable upon exercise, conversion or exchange of any Depositary Shares are validly issued, fully paid and non-assessable (in the case of an equity security) or a legal, valid and binding obligation of the issuer thereof, enforceable against such issuer in accordance with its terms.

You have informed us that you intend to issue Securities from time to time on a delayed or continuous basis, and we understand that prior to issuing any Securities pursuant to the Registration Statement (i) you will advise us in writing of the terms thereof, and (ii) you will afford us an opportunity to (x) review the operative documents pursuant to which such Securities are to be issued or sold (including the applicable offering documents), and (y) file such supplement or amendment to this opinion (if any) as we may reasonably consider necessary or appropriate.

We consent to the filing of this opinion as an exhibit to the Registration Statement, and we further consent to the use of our name under the caption “Validity of the Securities” in the Registration Statement and the prospectus that forms a part thereof. In giving these consents, we do not thereby admit that we are within the category of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations of the Commission promulgated thereunder.

Very truly yours,

/s/ Gibson, Dunn & Crutcher LLP

Exhibit 5.2

November 8, 2016

Wynn Resorts, Limited

3131 Las Vegas Boulevard South

Las Vegas, Nevada 89109

Ladies and Gentlemen:

We have acted as special Nevada counsel to Wynn Resorts, Limited, a Nevada corporation (the “Company”), in connection with the filing by the Company of a Registration Statement on Form S-3 (the “Registration Statement”) with the Securities and Exchange Commission (the “Commission”) under the Securities Act of 1933, as amended (the “Act”), relating to the registration for offering and sale from time to time by the Company of an indeterminate number of the following securities of the Company: (i) shares (the “Common Shares”) of the Company’s common stock, par value $0.01 per share (the “Common Stock”), (ii) shares (the “Preferred Shares”, and together with the Common Shares, the “Shares”) of the Company’s preferred stock, par value $0.01 per share (the “Preferred Stock”) in one or more series, (iii) depositary shares (the “Depositary Shares”) representing fractional interests in shares of Preferred Stock to be issued pursuant to a deposit agreement (each, a “Deposit Agreement”) and (iv) senior debt securities, senior subordinated debt securities, subordinated debt securities and junior subordinated debt securities (collectively, the “Debt Securities” and together with the Shares, the “Securities”) to be issued pursuant to the Indenture, dated as of March 29, 2004 (the “Indenture”), by and between the Company and U.S. Bank National Association, as trustee. This opinion letter is being furnished at your request in accordance with the requirements of Item 601(b)(5) of Regulation S-K under the Act.

In our capacity as such counsel, we are familiar with the proceedings taken and proposed to be taken by the Company in connection with the registration of the Securities, as described in the Registration Statement. For purposes of this opinion letter, and except to the extent set forth in the opinions below, we have assumed all such proceedings have been timely completed or will be timely completed in the manner presently proposed in the Registration Statement.

For purposes of rendering this opinion letter, we have made such legal and factual examinations and inquiries, including an examination of originals or copies certified or otherwise identified to our satisfaction as being true copies of (i) the Registration Statement, including the form of Deposit Agreement and the form of Receipt (as defined therein) filed as exhibits thereto, (ii) the Indenture, (iii) the articles of incorporation and bylaws of the Company (collectively, the “Governing Documents”) and (iv) such other agreements, instruments, corporate records and other documents as we have deemed necessary or appropriate for the purpose of issuing this opinion letter, and we have obtained from officers and other representatives and agents of the Company and from public officials, and have relied upon, such certificates, representations and assurances as we have deemed necessary or appropriate.

Without limiting the generality of the foregoing, in our examination and in rendering this opinion letter, we have, with your permission, assumed without independent verification, that (i) each document we have reviewed or which is referenced herein has been or will be duly executed and delivered by the parties thereto to the extent due execution and delivery are prerequisites to the effectiveness thereof; (ii) the statements of fact and representations and warranties set forth in the documents we have reviewed are, or at all relevant times will be, true and correct as to factual matters; (iii) each natural person executing a document has or will have sufficient legal capacity to do so; (iv) all documents submitted to us as originals are authentic, the signatures on all documents that we have examined are genuine, and all documents submitted to us as certified, conformed, photostatic, electronic or facsimile copies conform to the original documents; (v) all corporate records made available to us by the Company, and all public records we have reviewed, are accurate and complete; (vi) the Deposit Agreement and any and all Receipts will be executed in substantially the form filed as an exhibit to the Registration Statement or incorporated

by reference therein; (vii) any and all agreements, instruments or other documents relating to the offering, issuance or sale of any Securities, including, without limitation, the Indenture, the Deposit Agreement and any Receipts (collectively, the “Securities Documents”), have been or will be duly authorized, executed and delivered by the Company; (viii) the obligations of each party set forth in the Securities Documents are or will be its valid and binding obligations, enforceable in accordance with their respective terms; (ix) no Securities will be offered, issued or sold in violation or breach of, nor will any such offering, issuance or sale result in a default under, any agreement or instrument that is binding upon the Company or any requirement or restriction imposed by any governmental or regulatory agency, authority or body; (x) the Company has taken or will take all corporate action required in connection with the authorization, offering, issuance and sale of Securities (including, without limitation, any Shares or other securities of the Company underlying any Debt Securities or any Depositary Shares or Receipts), and all Securities will be offered, issued and sold, in compliance with all applicable laws, the Governing Documents and the relevant Securities Documents in effect at all relevant times, and any and all certificates evidencing Shares will be properly signed, registered and delivered, as necessary, in accordance with all applicable laws, the Governing Documents and the relevant Securities Documents (collectively, “Corporate Proceedings”); (xi) after any issuance of Common Shares, the total number of issued and outstanding shares of Common Stock, together with the total number of shares of Common Stock then reserved for issuance or obligated to be issued by the Company pursuant to any agreement or arrangement or otherwise, will not exceed the total number of shares of Common Stock then authorized under the Governing Documents; (xii) the voting rights, designations, preferences, limitations, restrictions, privileges and relative rights of each series of Preferred Shares will be fixed in a certificate of designation relating to such series, prepared in the form prescribed by applicable laws, duly signed by an officer of the Company and properly filed with the Nevada Secretary of State (each, a “Certificate of Designation”), and at no time will the total number of shares of Preferred Stock designated pursuant to all then-effective Certificates of Designation exceed the total number of shares of Preferred Stock then authorized under the Governing Documents; and (xiii) after any issuance of Preferred Shares, the total number of issued and outstanding shares of each series thereof, together with the total number of shares of such series then reserved for issuance or obligated to be issued by the Company pursuant to any agreement or arrangement or otherwise, will not exceed the total number of shares of such series then designated under the Certificate of Designation for such series..

We are qualified to practice law in the State of Nevada. The opinion set forth herein is expressly limited to and based exclusively on the general corporate laws of the State of Nevada, and we do not purport to be experts on, or to express any opinion with respect to the applicability or effect of, the laws of any other jurisdiction. We express no opinion concerning, and we assume no responsibility as to laws or judicial decisions related to any federal laws, rules or regulations, including any federal securities laws, rules or regulations, or any state securities or “Blue Sky” laws, rules or regulations.

Based upon the foregoing and in reliance thereon, and having regard to legal considerations and other information that we deem relevant, we are of the opinion that when all Corporate Proceedings have been taken and completed in respect of any offering, issuance or sale of Shares, and to the extent such Shares have been issued in accordance with all applicable terms and conditions set forth in the relevant Securities Documents, including payment in full of all consideration required therefor as authorized by such Corporate Proceedings and prescribed by such Securities Documents, such Shares will be duly authorized, validly issued, fully paid and non-assessable.

The opinion expressed herein is based upon the applicable laws of the State of Nevada and the facts in existence on the date hereof. In delivering this opinion letter to you, we disclaim any obligation to update or supplement the opinion set forth herein or to apprise you of any changes in such laws or facts after such time as the Registration Statement is declared effective. No opinion is offered or implied as to any matter, and no inference may be drawn, beyond the strict scope of the specific issues expressly addressed by the opinion set forth herein.

We consent to your filing this opinion letter as an exhibit to the Registration Statement and to the reference to our firm therein under the heading “Validity of the Securities”. In giving such consent, we do not admit that we are in the category of persons whose consent is required under Section 7 of the Act or the rules and regulations of the Commission promulgated thereunder.

Very truly yours,

/s/ Brownstein Hyatt Farber Schreck, LLP

Exhibit 12

WYNN RESORTS, LIMITED

COMPUTATION OF RATIO OF EARNINGS TO FIXED CHARGES

Nine months ended September 30, 2016 | Years ended December 31, | |||||||||||||||||||||||

2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||||||||||||

(in thousands, except ratios) | ||||||||||||||||||||||||

Income before income taxes, noncontrolling interest and income from equity investees | $ | 177,032 | $ | 287,424 | $ | 957,513 | $ | 985,438 | $ | 731,912 | $ | 804,095 | ||||||||||||

Add: Fixed charges | 293,719 | 363,774 | 357,214 | 316,797 | 297,874 | 236,498 | ||||||||||||||||||

Add: Amortization of capitalized interest | 11,201 | 13,924 | 15,269 | 18,976 | 20,313 | 21,382 | ||||||||||||||||||

Add: Distributed income from equity investees | 16 | 1,823 | 1,349 | 1,085 | 1,192 | 1,328 | ||||||||||||||||||

Less: Interest capitalized | 92,428 | 53,327 | 33,458 | 10,485 | 2,028 | — | ||||||||||||||||||

Earnings as adjusted | $ | 389,540 | $ | 613,618 | $ | 1,297,887 | $ | 1,311,811 | $ | 1,049,263 | $ | 1,063,303 | ||||||||||||

Interest expensed (1) | 193,698 | 300,906 | 315,062 | 299,022 | 288,759 | 229,918 | ||||||||||||||||||

Interest capitalized | 92,428 | 53,327 | 33,458 | 10,485 | 2,028 | — | ||||||||||||||||||

Interest factor of rental expense (2) | 7,593 | 9,541 | 8,694 | 7,290 | 7,087 | 6,580 | ||||||||||||||||||

Total fixed charges | $ | 293,719 | $ | 363,774 | $ | 357,214 | $ | 316,797 | $ | 297,874 | $ | 236,498 | ||||||||||||

Ratio of earnings to fixed charges (3) | 1.33 | 1.69 | 3.63 | 4.14 | 3.52 | 4.50 | ||||||||||||||||||

We had no preferred stock issued and outstanding for any of the periods presented.

(1) Interest expensed includes amortization of deferred financing costs and original issue discount and premium on debt.

(2) Interest factor of rental expense is based on an estimate which the Company considers to be a reasonable approximation.

(3) The ratio of earnings to fixed charges was computed by dividing earnings by fixed charges.

Exhibit 23.1

Consent of Independent Registered Public Accounting Firm

We consent to the reference to our firm under the caption "Experts" in the Registration Statement (Form S-3) and related Prospectus of Wynn Resorts, Limited for the registration of common stock, preferred stock, depositary shares representing preferred stock and senior debt securities, senior subordinated debt securities, subordinated debt securities and junior subordinated debt securities and to the incorporation by reference therein of our reports dated February 29, 2016, with respect to the consolidated financial statements and schedules of Wynn Resorts, Limited, and the effectiveness of internal control over financial reporting of Wynn Resorts, Limited, included in its Annual Report (Form 10-K) for the year ended December 31, 2015, filed with the Securities and Exchange Commission.

/s/ Ernst & Young LLP

Las Vegas, Nevada

November 8, 2016

Exhibit 25

_____________________________________________________________________________

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________

FORM T-1

STATEMENT OF ELIGIBILITY UNDER

THE TRUST INDENTURE ACT OF 1939 OF A

CORPORATION DESIGNATED TO ACT AS TRUSTEE

Check if an Application to Determine Eligibility of

a Trustee Pursuant to Section 305(b)(2)

_______________________________________________________

U.S. BANK NATIONAL ASSOCIATION

(Exact name of Trustee as specified in its charter)

31-0841368

I.R.S. Employer Identification No.

800 Nicollet Mall Minneapolis, Minnesota | 55402 |

(Address of principal executive offices) | (Zip Code) |

Raymond S. Haverstock

U.S. Bank National Association

60 Livingston Avenue

St. Paul, MN 55107

(651) 466-6299

(Name, address and telephone number of agent for service)

Wynn Resorts, Limited

(Issuer with respect to the Securities)

Nevada | 46-0484987 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

3131 Las Vegas Boulevard South Las Vegas, Nevada | 89109 |

(Address of Principal Executive Offices) | (Zip Code) |

Debt Securities

(Title of the Indenture Securities)

1

FORM T-1

Item 1. GENERAL INFORMATION. Furnish the following information as to the Trustee.

a) | Name and address of each examining or supervising authority to which it is subject. |

Comptroller of the Currency

Washington, D.C.

b) Whether it is authorized to exercise corporate trust powers.

Yes

Item 2. AFFILIATIONS WITH OBLIGOR. If the obligor is an affiliate of the Trustee, describe each such affiliation.

None

Items 3-15 | Items 3-15 are not applicable because to the best of the Trustee's knowledge, the obligor is not in default under any Indenture for which the Trustee acts as Trustee. |

Item 16. LIST OF EXHIBITS: List below all exhibits filed as a part of this statement of eligibility and qualification.

1. A copy of the Articles of Association of the Trustee.*

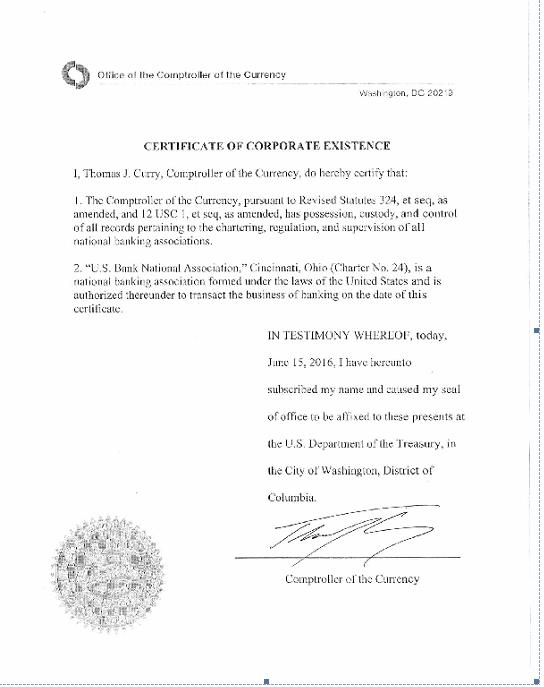

2. A copy of the certificate of authority of the Trustee to commence business, attached as Exhibit 2.

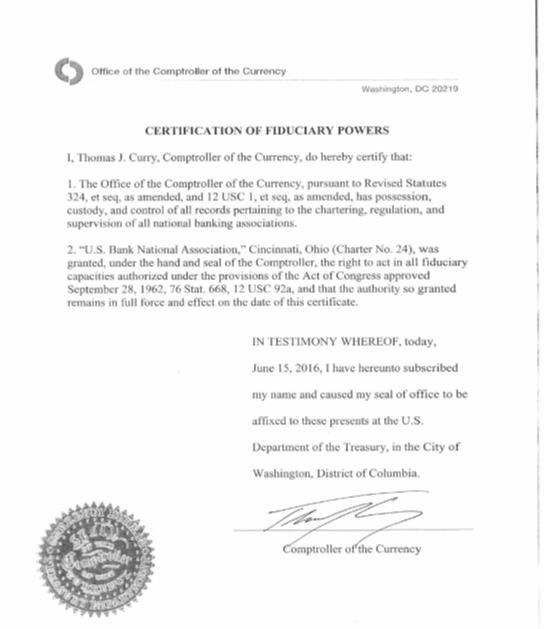

3. A copy of the certificate of authority of the Trustee to exercise corporate trust powers, attached as Exhibit 3.

4. A copy of the existing bylaws of the Trustee.**

5. A copy of each Indenture referred to in Item 4. Not applicable.

6. The consent of the Trustee required by Section 321(b) of the Trust Indenture Act of 1939, attached as Exhibit 6.

7. Report of Condition of the Trustee as of June 30, 2016 published pursuant to law or the requirements of its supervising or examining authority, attached as Exhibit 7.

* Incorporated by reference to Exhibit 25.1 to Amendment No. 2 to registration statement on S-4, Registration Number 333-128217 filed on November 15, 2005.

** Incorporated by reference to Exhibit 25.1 to registration statement on form S-3ASR, Registration Number 333-199863 filed on November 5, 2014.

2

SIGNATURE

Pursuant to the requirements of the Trust Indenture Act of 1939, as amended, the Trustee, U.S. BANK NATIONAL ASSOCIATION, a national banking association organized and existing under the laws of the United States of America, has duly caused this statement of eligibility and qualification to be signed on its behalf by the undersigned, thereunto duly authorized, all in the City of St. Paul, State of Minnesota on the 23rd of September, 2016.

By: /s/ Raymond S. Haverstock________

Raymond S. Haverstock

Vice President

3

Exhibit 2

4

Exhibit 3

5

Exhibit 6

CONSENT

In accordance with Section 321(b) of the Trust Indenture Act of 1939, the undersigned, U.S. BANK NATIONAL ASSOCIATION hereby consents that reports of examination of the undersigned by Federal, State, Territorial or District authorities may be furnished by such authorities to the Securities and Exchange Commission upon its request therefor.

Dated: September 23, 2016

By: /s/ Raymond S. Haverstock_________

Raymond S. Haverstock

Vice President

6

Exhibit 7 U.S. Bank National Association Statement of Financial Condition As of 6/30/2016 ($000's) | ||||

6/30/2016 | ||||

Assets | ||||

Cash and Balances Due From Depository Institutions | $ | 14,010,590 | ||

Securities | 108,246,267 | |||

Federal Funds | 68,244 | |||

Loans & Lease Financing Receivables | 268,104,901 | |||

Fixed Assets | 5,866,910 | |||

Intangible Assets | 12,591,165 | |||

Other Assets | 24,574,630 | |||

Total Assets | $ | 433,462,707 | ||

Liabilities | ||||

Deposits | $ | 327,848,275 | ||

Fed Funds | 1,179,456 | |||

Treasury Demand Notes | 0 | |||

Trading Liabilities | 2,172,890 | |||

Other Borrowed Money | 40,280,996 | |||

Acceptances | 0 | |||

Subordinated Notes and Debentures | 3,800,000 | |||

Other Liabilities | 13,036,463 | |||

Total Liabilities | $ | 388,318,080 | ||

Equity | ||||

Common and Preferred Stock | 18,200 | |||

Surplus | 14,266,915 | |||

Undivided Profits | 30,049,363 | |||

Minority Interest in Subsidiaries | 810,149 | |||

Total Equity Capital | $ | 45,144,627 | ||

Total Liabilities and Equity Capital | $ | 433,462,707 | ||

7

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Wynn Resorts (WYNN) PT Raised to $124 at Barclays

- Form 8.5 (EPT/RI) - Mattioli Woods

- Development of the Extraordinary General Meeting on Friday 26 April 2024

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share