Form PRE 14A SINCLAIR BROADCAST GROUP For: Dec 31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ý | ||

Filed by a Party other than the Registrant o | ||

Check the appropriate box: | ||

ý | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

o | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material under §240.14a-12 | |

SINCLAIR BROADCAST GROUP, INC. | |||

(Name of Registrant as Specified In Its Charter) | |||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | |||

Payment of Filing Fee (Check the appropriate box): | |||

ý | No fee required. | ||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||

(1) | Title of each class of securities to which transaction applies: | ||

N/A | |||

(2) | Aggregate number of securities to which transaction applies: | ||

N/A | |||

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||

N/A | |||

(4) | Proposed maximum aggregate value of transaction: | ||

N/A | |||

(5) | Total fee paid: | ||

N/A | |||

o | Fee paid previously with preliminary materials. | ||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||

(1) | Amount Previously Paid: | ||

N/A | |||

(2) | Form, Schedule or Registration Statement No.: | ||

N/A | |||

(3) | Filing Party: | ||

N/A | |||

(4) | Date Filed: | ||

N/A | |||

April 29, 2016

Dear Shareholder:

You are cordially invited to attend the annual meeting of shareholders of Sinclair Broadcast Group, Inc. The annual meeting on June 2, 2016 will be held at Sinclair’s corporate office, 10706 Beaver Dam Road, Hunt Valley, Maryland 21030 at 10:00 a.m. local time.

Enclosed with this letter is a notice of the annual meeting of shareholders, a proxy statement, a proxy card and a return envelope. Also enclosed with this letter is Sinclair Broadcast Group, Inc.'s Annual Report to shareholders for the year ended December 31, 2015.

Your vote on these matters is very important. We urge you to review carefully the enclosed materials and to return your proxy promptly. The proxy materials are also available at

http://www.astproxyportal.com/ast/26141.

You are cordially invited to attend the annual meeting and you may vote in person even though you have returned your proxy card. Whether or not you plan to attend the annual meeting, please sign and promptly return your proxy card in the enclosed postage paid envelope.

Sincerely,

David D. Smith

Chairman of the Board

and Chief Executive Officer

IF YOU PLAN TO ATTEND:

Please note that space limitations make it necessary to limit attendance at the meeting to our shareholders of record as of March 14, 2016. Registration will begin at 9:30 a.m. and seating will begin at 9:45 a.m. Each shareholder may be asked to present valid picture identification, such as a driver’s license or passport. Shareholders holding stock in brokerage accounts (“street name” holders) will need to bring a copy of a brokerage statement reflecting stock ownership as of March 14, 2016 (record date). Cameras (including the use of cellular/smart phones with photographic capabilities), recording devices and other electronic devices will not be permitted at the meeting.

YOUR VOTE IS IMPORTANT—Please execute and return the enclosed proxy card

promptly, whether or not you plan to attend the

Sinclair Broadcast Group, Inc. annual meeting.

SINCLAIR BROADCAST GROUP, INC.

10706 Beaver Dam Road

Hunt Valley, Maryland 21030

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

Important notice regarding the availability of proxy materials

for the shareholder meeting to be held on June 2, 2016.

The proxy statement and 2015 annual report to shareholders are available at

http://www.astproxyportal.com/ast/26141.

Dear Shareholders:

The annual meeting of Sinclair Broadcast Group, Inc. will be held on June 2, 2016 at our corporate office, 10706 Beaver Dam Road, Hunt Valley, Maryland 21030 at 10:00 a.m. local time for the following purposes:

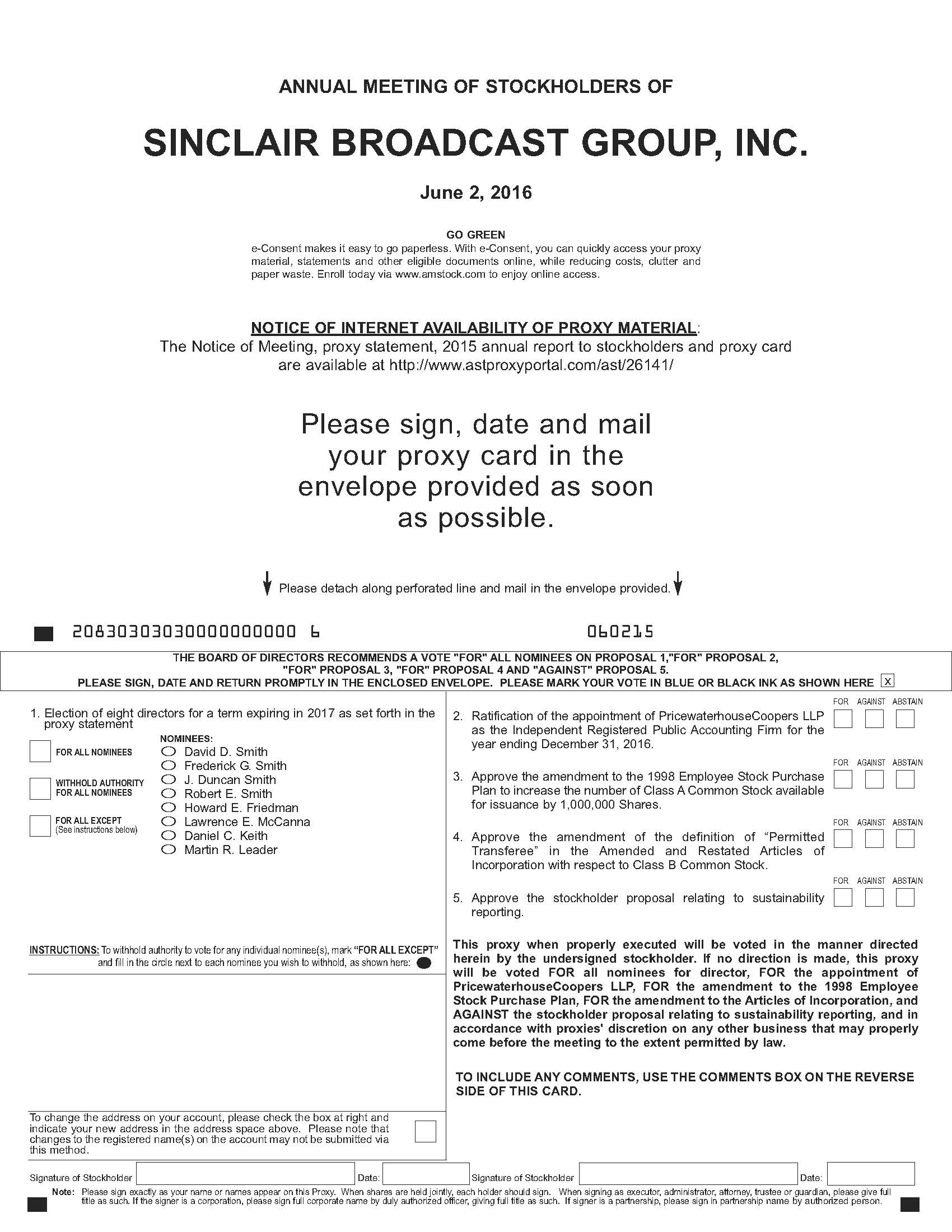

1. | The election of eight directors, each for a one-year term; |

2. | The ratification of the appointment of PricewaterhouseCoopers, LLP as our independent registered public accounting firm for the year ending December 31, 2016; |

3. | To amend our 1998 Employee Stock Purchase Plan to increase the number of shares of Class A Common Stock available for issuance by 1,000,000 shares; |

4. | To amend the definition of "Permitted Transferee" in our Amended and Restated Articles of Incorporation with respect to Class B Common Stock; |

5. | To consider a stockholder proposal relating to sustainability reporting, if properly presented; and |

6. | The consideration of any other matters as may properly come before the annual meeting. |

You will be able to vote your shares at the annual meeting if you were a shareholder of record at the close of business on March 14, 2016. Your vote at the annual meeting is very important to us.

BY ORDER OF THE BOARD OF DIRECTORS

J. Duncan Smith, Secretary

Baltimore, Maryland

April 29, 2016

TABLE OF CONTENTS

Page | |

INFORMATION ABOUT THE 2015 ANNUAL MEETING AND VOTING

The Annual Meeting

The annual meeting will be held on June 2, 2016 at our corporate office, 10706 Beaver Dam Road, Hunt Valley, Maryland 21030 at 10:00 a.m. local time.

This Proxy Solicitation

On or about April 29, 2016, we began mailing this proxy statement to people who, according to our records, owned common shares of beneficial interests in us as of the close of business on March 14, 2016. We are sending you this proxy statement because our Board of Directors is seeking a proxy to vote your shares at the annual meeting. This proxy statement is intended to assist you in deciding how to vote your shares. Proxy materials are also available at http://www.astproxyportal.com/ast/26141.

We are paying the cost of soliciting these proxies. Our directors, officers and employees may request proxies in person or by telephone, mail, or letter. We will reimburse brokers and other nominees for their reasonable out-of-pocket expenses for forwarding proxy materials to beneficial owners of our common shares.

Voting Your Shares

Shareholders of Record. You may vote your shares at the annual meeting either in person or by proxy. To vote in person, you must attend the annual meeting and obtain and submit a ballot. Ballots for registered shareholders to vote in person will be available at the annual meeting. If your shares are registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, LLC, you are considered the registered holder of those shares. As the registered stockholder, you can ensure your shares are voted at the meeting by submitting your instructions by completing, signing, dating and returning the enclosed proxy card in the envelope provided.

If you complete the proxy card, except for the voting instructions, then your shares will be voted FOR each of the director nominees identified on the proxy card, FOR ratification of the selection of PricewaterhouseCoopers, LLP as our independent registered public accounting firm for 2016, FOR the approval of the amendment to the 1998 Employee Stock Purchase Plan, FOR the amendment to our Amended and Restated Articles of Incorporation ("Charter"), and AGAINST the shareholder proposal related to sustainability reporting.

We have described in this proxy statement all the proposals that we expect will be made at the annual meeting. If a shareholder or we properly present any other proposal at the meeting, we will use your proxy to vote your shares on the proposal in our best judgment.

Your proxy card will be valid only if you sign, date and return it in time for it to be received by us before the annual meeting scheduled to be held on June 2, 2016.

Beneficial Owners. Most of our stockholders hold their shares through a broker, bank, trustee or another nominee, rather than registered directly in their name (which is often referred to as “street name”). In that case, you are considered the beneficial owner of shares held in street name, and the proxy materials, including a notice enabling you to receive proxy material through the mail, are being forwarded to you by your broker, bank, trustee or nominee. As the beneficial owner, you are entitled to direct the voting of your shares by your intermediary. Brokers, banks and nominees typically offer telephonic or electronic means by which the beneficial owners of shares held by them can submit voting instructions, in addition to the traditional mailed voting instruction cards. If you are a beneficial owner of shares, you cannot vote in person at the annual meeting unless you have a proper power of attorney from your broker. Votes directed through a broker must be received by us before the annual meeting.

If you hold your shares in street name with a broker and you do not tell your broker how to vote or provide the broker with a voting instruction form, your broker cannot vote on your behalf for the election of director nominees (Proposal 1), for the approval of the amendment to the 1998 Employee Stock Purchase Plan (Proposal 3), for the amendment to the Charter (Proposal 4), or for the shareholder proposal related to sustainability reporting (Proposal 5).

1

Revoking Your Proxy

If you decide to change your vote, you may revoke your proxy at any time before it is voted at the annual meeting. You may revoke your proxy by any one of three ways:

• | you may notify our Secretary in writing that you wish to revoke your proxy, at the following address: Sinclair Broadcast Group, Inc., 10706 Beaver Dam Road, Hunt Valley, Maryland, 21030, Attention: J. Duncan Smith, Vice President and Secretary. We must receive your notice before the time of the annual meeting; |

• | you may submit a proxy dated later than your original proxy; or |

• | you may attend the annual meeting and vote. Merely attending the annual meeting will not by itself revoke a proxy; you must obtain a ballot and vote your shares to revoke the proxy and in the case of shares held in street name you must obtain a proper power of attorney from your broker to vote your shares. |

Vote Required for Approval

Shares Entitled to Vote. On March 14, 2016 (the record date), the following shares were issued and outstanding and had the votes indicated:

• | 69,070,726 shares of Class A Common Stock, each of which is entitled to one vote on each of the proposals, and |

• | 25,928,357 shares of Class B Common Stock, each of which is entitled to ten votes on each of the proposals |

Quorum. A majority of the outstanding shares of common stock entitled to vote, or a “quorum,” must be present at the annual meeting in order to transact business. A quorum will be present if 164,177,149 votes are represented at the annual meeting, either in person (by the shareholders) or by proxy. If a quorum is not present, a vote cannot occur. In deciding whether a quorum is present, abstentions and broker non-votes (where a broker or nominee is not permitted to vote on a matter and has not received voting instructions from the beneficial owner) will be counted as shares that are represented at the annual meeting.

Votes Required. The votes required on each of the proposals are as follows:

Proposal 1: Election of Eight Directors | The eight nominees for director who receive the most votes will be elected. This is called a “plurality.” If you indicate “withhold authority to vote” for a particular nominee on your proxy card, your vote will not count either for or against the nominee. Broker non-votes are not counted as votes cast for nominees for director and will not affect the outcome of the proposal. |

Proposal 2: Ratification of Selection of Independent Registered Public Accounting Firm | The affirmative vote of a majority of the votes cast at the annual meeting is required to ratify the Audit Committee’s selection of the independent registered public accounting firm. If you abstain from voting, your abstention will not count as a vote cast for or against the proposal. |

Proposal 3: Approval of the Amendment to the 1998 Employee Stock Purchase Plan | The affirmative vote of a majority of the votes cast at the annual meeting is required to ratify the approval of the amendment to the 1998 Employee Stock Purchase Plan. If you abstain from voting, your abstention will not count as a vote cast for or against the proposal. |

Proposal 4: Amendment to the Company's Charter | The affirmative vote of two thirds of all of the votes entitled to be cast at the annual meeting is required to ratify the amendment. If you abstain from voting, your abstention will not count as a vote cast for or against the amendment. |

Proposal 5: Shareholder Proposal Relating to Sustainability Reporting | The affirmative vote of a majority of the votes cast at the annual meeting is required to ratify the shareholder proposal. If you abstain from voting, your abstention will not count as a vote cast for or against the proposal. |

Additional Information

We are mailing our annual report to registered shareholders for the year ended December 31, 2015, including consolidated financial statements, to all shareholders entitled to vote at the annual meeting together with this proxy statement. The annual report includes details on how to get additional information about us. The annual report does not constitute a part of the proxy solicitation material. Proxy materials are also available to registered shareholders and to beneficial owners at http://www.astproxyportal.com/ast/26141.

2

PROPOSAL 1: ELECTION OF DIRECTORS

Nominees for election to the Board of Directors are:

David D. Smith

Frederick G. Smith

J. Duncan Smith

Robert E. Smith

Howard E. Friedman

Daniel C. Keith

Martin R. Leader

Lawrence E. McCanna

Each director will be elected to serve for a one-year term, unless he resigns or is removed before his term expires, or until his replacement is elected and qualified. Each of the nominees listed above is currently a member of the Board of Directors and each of them has consented to serve as a director if elected. More detailed information about each of the nominees is available in the section of this proxy statement titled Directors, Executive Officers and Key Employees.

If any of the nominees cannot serve for any reason (which is not anticipated), the Board of Directors may designate a substitute nominee or nominees. If a substitute is nominated, we will vote all valid proxies for the election of the substitute nominee or nominees. Alternatively, the Board of Directors may also decide to leave the board seat or seats open until a suitable candidate or candidates are located, or it may decide to reduce the size of the Board.

The Amended and Restated Certificate of Incorporation provides that our business shall be managed by a Board of Directors of not less than three and not more than thirteen directors with the number of directors to be fixed by the Board of Directors from time to time. The Board of Directors has presently established the size of the Board at eight members. Proxies for the annual meeting may not be voted for more than eight nominees.

Messrs. David, Duncan and Robert Smith and Dr. Frederick Smith (collectively, the "Controlling Shareholders") are brothers and have entered into a shareholders agreement pursuant to which they have agreed to vote for each other as candidates for election to the Board of Directors until December 31, 2025. The Controlling Shareholders own collectively 76.8% of the total voting power.

The Board of Directors recommends a vote FOR each of the nominees to the Board of Directors.

PROPOSAL 2: RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board of Directors has sole responsibility for the selection of our independent registered public accounting firm and has appointed PricewaterhouseCoopers, LLP (PricewaterhouseCoopers) as our independent registered public accounting firm for the fiscal year ending December 31, 2016. The Board of Directors recommends ratification of this appointment by the shareholders. If the shareholders do not ratify the appointment of PricewaterhouseCoopers, the Audit Committee will reevaluate the engagement of the independent registered public accounting firm. Even if the appointment is ratified, the Audit Committee, in its discretion, may nevertheless appoint another independent registered public accounting firm at any time during the year if the Audit Committee determines that such a change would be in the best interests of the shareholders. PricewaterhouseCoopers audited the Company’s financial statements for the fiscal year ended December 31, 2015.

A representative of PricewaterhouseCoopers is expected to attend the annual meeting. The PricewaterhouseCoopers representative will have the opportunity to make a statement if he or she desires to do so and will be able to respond to appropriate questions from shareholders.

The Board of Directors recommends a vote FOR ratification of the appointment of PricewaterhouseCoopers, LLP.

3

PROPOSAL 3: AMENDMENT TO THE 1998 EMPLOYEE STOCK PURCHASE PLAN

As of February 1, 2016, our 1998 Employee Stock Purchase Plan (the “ESPP”) had remaining reserved shares of 100,253 of the authorized two million two hundred thousand (2,200,000) shares of common stock reserved for issuance under the ESPP. The Compensation Committee (in this proposal, the "Committee") of the Board of Directors concluded that it would be in our best interests to increase the number of shares of our Class A Common Stock available for issuance under the ESPP. The Committee determined that an increase of 1,000,000 shares would be appropriate based on the historical annual volume of share purchases under the ESPP and the Board of Directors on February 8, 2016 approved an amendment, subject to stockholder approval, to increase the number of available shares by this amount and caused a registration statement to be filed with respect to that increase.

Summary of the ESPP

The ESPP provides our employees with an opportunity to become owners of Sinclair through a convenient arrangement for purchasing shares of common stock. The following is a summary of the ESPP.

General

Purpose. The ESPP offers eligible employees the opportunity to purchase shares of our common stock through after-tax payroll withholding. The ESPP is intended to permit our employees to acquire an equity interest in Sinclair thereby providing them with an incentive to work for the growth and success of Sinclair. We may use the funds we receive under the ESPP for any general corporate purpose.

Eligibility. All of our employees are eligible to participate in the ESPP, except (1) employees who have not been employed for at least one full year of service and (2) employees who hold more than 5% of our common stock. Employees’ benefits will vary depending upon their election as to level of participation. No non-employee directors are eligible to participate in the ESPP. As of March 14, 2016, there were approximately 6,228 employees eligible to participate in the ESPP. The number of shares from this additional pool that will be purchased by executive officers cannot be determined in advance because participation is voluntary.

Shares available under the ESPP. If the amendment is approved, the ESPP would authorize us to issue up to an additional 1,000,000 shares of common stock from authorized but unissued shares or from stock owned by Sinclair, including stock purchased on the market. The number of shares we may issue under the ESPP automatically adjusts for stock dividends, stock splits, reclassifications and other changes affecting the common stock.

Administration. The Committee of our Board of Directors administers the ESPP. The Committee may delegate this authority. The Committee has the authority and discretion to specify the terms and conditions of stock purchases by employees under the ESPP (within the limitations of the ESPP) and to otherwise interpret and construe the terms of the ESPP and any related agreements. Under the ESPP, the Committee (or the Board of Directors) can lengthen or shorten the payroll deduction periods, increase the purchase price for shares, or make other administrative adjustments. The ESPP also specifically provides for indemnification of the Committee, other directors, and agents for actions taken with respect to the ESPP.

Options Granted Under the ESPP

How options are granted. On the first day of each payroll deduction period, a participating employee will automatically receive options to purchase a number of shares of our common stock with money that is withheld from his or her paycheck. The number of shares available to the participating employee will be determined at the end of the payroll deduction period by dividing (1) the total amount of money withheld during the payroll deduction period by (2) the exercise price of the options (as described below). Options granted under the ESPP to employees will be automatically exercised to purchase shares on the last day of the payroll deduction period, unless the participating employee has, at least thirty days earlier or by such other deadline as the Committee sets, requested that his or her payroll contributions stop. The Committee will determine the treatment of fractional shares. Any cash accumulated in an employee’s account for a period in which an employee elects not to participate will be distributed to the employee.

Exercise price. The initial exercise price for options under the ESPP will be 85% of the lesser of the fair market value of the common stock as of the first day of the payroll deduction period and as of the last day of that period. The Committee may increase the exercise price before a payroll deduction period begins. No participant can purchase more than $25,000 worth of our common stock in all payroll deduction periods ending during the same calendar year.

4

Election to participate. Participating employees must elect before the beginning of a given payroll deduction period to participate, although a prior election will carry over until revoked.

Termination of service. If an employee’s employment ends for any reason, including death, any cash accumulated in the employee’s account will be distributed, and the employee will immediately cease to participate in the ESPP, unless the Committee specifies some other treatment.

Other information. All options granted under the ESPP will be evidenced by participation agreements or other approved documentation. The Committee has broad discretion to determine the timing, amount, exercisability, and other terms and conditions of options granted to employees. No options granted or funds accumulated under the ESPP are assignable or transferable other than by will or in accordance with the laws of descent and distribution. The Committee may impose restrictions on sale of the stock or require the stock to be held at a particular broker.

Amendment or Termination of the ESPP

The Board of Directors may amend or terminate the ESPP at any time and from time to time. Stockholder approval is required for any changes if such approval is required to preserve the ESPP’s status as a plan under section 423 of the Internal Revenue Code. Absent extension by the Board with stockholder approval, no payroll deduction period will begin after October 1, 2007.

Tax Consequences

The following generally summarizes the United States federal income tax consequences that will arise with respect to participation in the plan and with respect to the sale of common stock acquired under the plan. This summary is based on the tax laws in effect as of the date of this proxy statement. Changes to these laws could alter the tax consequences described below.

Tax Consequences to Participants. A participant will not have income upon enrolling in the plan or upon purchasing stock at the end of an offering. A participant may have both compensation income and a capital gain or loss upon the sale of stock that was acquired under the plan. The amount of each type of income and loss will depend on when the participant sells the stock. If the participant sells the stock more than two years after the commencement of the offering during which the stock was purchased and more than one year after the date that the participant purchased the stock, at a profit (the sales proceeds exceed the purchase price), then the participant will have compensation income equal to the lesser of:

• 15% of the value of the stock on the day the offering commenced; and

• the participant’s profit.

Any excess profit will be long-term capital gain. If the participant sells the stock at a loss (if sales proceeds are less than the purchase price) after satisfying these waiting periods, then the loss will be a long-term capital loss. If the participant sells the stock prior to satisfying these waiting periods, then he or she will have engaged in a disqualifying disposition. Upon a disqualifying disposition, the participant will have compensation income equal to the value of the stock on the day he or she purchased the stock less the purchase price. The participant also will have a capital gain or loss equal to the difference between the sales proceeds and the value of the stock on the day he or she purchased the stock. This capital gain or loss will be long-term if the participant has held the stock for more than one year and otherwise will be short-term.

Tax Consequences to the Company. There will be no tax consequences to the Company except that we will be entitled to a deduction when a participant has compensation income upon a disqualifying disposition. Any such deduction will be subject to the limitations of Section 162(m) of the Code.

INCORPORATION BY REFERENCE

The foregoing is only a summary of the ESPP and is qualified in its entirety by reference to its full text, a copy of which is attached as Appendix B.

The Board of Directors recommends a vote FOR the approval of the amendment to the 1998 Employee Stock Purchase Plan.

5

PROPOSAL 4: AMENDMENT TO THE COMPANY'S CHARTER

After due consideration, the Board of Directors concluded that the proposed amendment to the Charter is consistent with the originally intended objectives in creating Class B Common Shares and in defining a Permitted Transferee in Article FIFTH of the Amended and Restated Charter. As such, the Board of Directors recommends for approved by the Shareholders an amendment to the Amended and Restated Charter by inserting at the end of Article FIFTH, Section (b)(i) the following:

The Board of Directors has recommended and directed that there be submitted to the stockholders for their approval an amendment (the "Amendment") to the Charter by inserting at the end of Article FIFTH, Section (b)(i) the following:

“or (G) any “Private Foundation” (as described in Internal Revenue Code Sections 501(c)(3) and Section 509) or any “Supporting Organization” (as described in Internal Revenue Code Section 509(a)(3)) that: (i) has been formed by (or at the direction of) any one or more Controlling Stockholder and/or by any one or more Permitted Transferee and/or any combination of any one or more Controlling Stockholder and/or Permitted Transferee; or (ii) the management, distributions, decision making, or investment strategy of which is controlled in whole or in part by any one or more Controlling Stockholder and/or any one or more Permitted Transferee.”

Purpose and Effect of the Amendment

The purpose of the Amendment is to provide the holders of our Class B Common Stock with greater flexibility for estate planning purposes. The Amendment would not have any direct effect on shares of our Class A Common Stock.

Under the Charter, shares of Class B Common Stock automatically convert into an equal number of shares of Class A Common Stock upon the holder’s transfer of the shares to a person or entity other than a “Permitted Transferee.” The Amendment would expand the definition of Permitted Transferee by including the language above. Please see Appendix A for a complete, redlined copy of the Charter showing the Amendment in context.

The Smith brothers (David, Frederick, J. Duncan and Robert Smith) hold substantially all of the Class B Common Stock and some of our Class A Common Stock. See Security Ownership of Certain Beneficial Owners and Management below. Holders of Class A Common Stock are entitled to one vote per share, and holders of Class B Common Stock are entitled to ten votes per share except for votes relating to “going private” and certain other transactions. The Class A Common Stock and the Class B Common Stock vote together as a single class except as otherwise may be required by Maryland law on all matters presented for a vote. Thus the Controlling Shareholders own collectively 76.6% of the total voting power. Holders of Class B Common Stock may at any time convert their shares into the same number of shares of Class A Common Stock.

The primary effect of the Amendment will be to permit the Smith brothers to transfer shares of Class B Common Stock to certain types of charitable organizations. To qualify as a Permitted Transferee, the charitable organization must have been formed by or at the direction of one of the Smith brothers or one of their Permitted Transferees, or the charitable organization must be controlled in whole or in part by one or more of the Smith brothers or any of their Permitted Transferees. The purpose of these limitations is to ensure that the Smith brothers retain control over the voting of any shares of Class B Common Stock that are transferred to such a Permitted Transferee.

The Board of Directors recommends a vote FOR the Amendment to the Charter.

6

PROPOSAL 5: SHAREHOLDER PROPOSAL RELATING TO SUSTAINABILITY REPORTING

The Company has been advised that Calvert Investment Management, Inc. ("Calvert"), 4550 Montgomery Avenue, Suite 1000N, Bethesda, MD 20814, a beneficial owner of at least $2,000 in market value of the Company’s common stock, intends to present the following resolution for approval at the Annual Meeting:

“RESOLVED: Shareholders request that Sinclair Broadcast Group, Inc. prepare a sustainability report describing the company's environmental, social and governance (ESG) risks and opportunities including diversity, workplace policies and programs as well as product quality and responsibility disclosure. The report, prepared at reasonable cost and omitting proprietary information, should be published by October 31, 2016.

Supporting Statement by Calvert:

We believe tracking and reporting on ESG business practices make a company more responsive to a transforming business environment characterized by finite natural resources, changing legislation, concerns over healthcare and safety, and heightened public expectations for corporate accountability. Reporting also helps companies better integrate and gain strategic value from existing sustainability efforts, identify gaps and opportunities in products and processes, develop company-wide communications, publicize innovative practices and receive feedback.

Mainstream financial companies are continuing to recognize the links between environmental, social and governance ("ESG") performance and shareholder value. As such, the availability of ESG performance data is growing through a wide range of data providers, such as Bloomberg. Also, investment firms like Goldman Sachs and Deutsche Asset Management are increasingly incorporating corporate social and environmental practices into their investment decisions.

The United Nations' Principles for Responsible Investment has nearly 1,400 signatories who seek the integration of ESG factors in investment decision making. They collectively hold $59 trillion assets under management and require information on ESG factors to analyze fully the risks and opportunities associated with existing and potential investments.

We believe that disclosure of sustainability policies, programs and performance can help a company address and manage sustainability opportunities and risks and that such disclosure is increasingly becoming a competitive advantage. Disclosure on key topics can help the company and its stakeholders understand where issues are managed well and where there are opportunities for better practice. Disclosure on topics such as energy and waste management, employee retention and training programs, employee diversity programs, and programming, could help management identify opportunities for innovation, risk reduction, and cost savings.

The report should include a company-wide review of policies, practices and metrics related to ESG performance using the GRI Index and checklist as a reference.”

Board Statement and Recommendation of the Board Regarding the Shareholder Proposal

We conduct our business in compliance with applicable environmental, health and safety regulations and have a strong corporate culture of supporting these practices, including with respect to ESG related matters. However, we do not believe that separate reporting on these practices represents an efficient or prudent use of our corporate resources. Accordingly and for the reasons set forth below, the Board of Directors unanimously recommends that you vote AGAINST this shareholder proposal.

We believe that to prepare and issue a formal report of the type sought by the proponents, which they recommend be prepared with reference to the Global Reporting Initiative (GRI) Sustainability Reporting Guidelines, would require significant time and expense and produce little added benefit to our shareholders. GRI is an international organization, based in Europe, with offices in the United States and several other countries around the globe. The GRI Guidelines consist of over 90 pages of Reporting Principles and Standard Disclosures as well as an Implementation Manual of over 260 pages. We believe the GRI Guidelines are primarily relevant to multinational corporations, especially those with significant operations in developing countries and a large shareholder base outside the United States.

Although we disagree with the specific proposal at issue, we agree that ESG related matters are an important and worthwhile area of focus for the Company. In opposing the proposal, we are merely resisting the requirement to devote company resources to comprehensively gathering data and publishing an ESG report pursuant to the GRI Guidelines. This should not be interpreted as a lack of concern by the Board of Directors or the Company about ESG topics or implementing ESG related practices, procedures or policies.

7

Our Code of Business Conduct and Ethics, posted on our website, reflects our commitment to conduct business in accordance with the letter and spirit of all applicable laws, rules, and regulations, and to avoid even the appearance of impropriety. The Company already recognizes the importance, as both an ethical and a business responsibility, of addressing the environmental and social impacts of our business, and ensuring the Company’s impact on its employees and the communities they serve is a positive one. For example:

• | Sinclair complies with related laws on enhancing the safety, health and security of our employees, specifically Workers’ Compensation (WC) and OSHA. We follow the guidelines of these related laws and this is evidenced by these key performance indicators. Sinclair’s experience rating (a comparison of the amount of loss that an insured party experiences compared to the amount of loss that similar insureds experience) has decreased below the national experience rating of 1.0 since 2014. In 2014, the experience rating decreased from 1.03 to 0.9. In 2015, the experience rating decreased to 0.74. Sinclair conducts training to educate managers and employees on safety practices. Sinclair designates a key individual, typically the television station's Director of Engineering, as the point of contact for all safety matters. |

• | Through its Broadcast Diversity Scholarship Fund, which Sinclair recently increased, Sinclair helps minority students fund their undergraduate studies related to broadcast journalism. |

• | Sinclair promotes internal promotions and lateral moves for its employees. Sinclair recognizes the benefit of developmental experiences and encourages employees to talk with their supervisors about their career plans. Supervisors are encouraged to support employees' efforts to gain experience and advance within the organization. Upward mobility provides growth for employees and qualified personnel for the Company. Sinclair provides formal leadership and/or development training to managers and other employees, such programs to include web-based leadership courses, Dale Carnegie, Sinclair University, certification programs, tuition reimbursement and attendance at industry conferences and seminars. |

• | Sinclair has a No Harassment Policy and does not tolerate harassment of our job applicants, employees, clients or visitors. Sinclair also has policies in place in regards to Conflict of Interests and Employee Conduct contained in the Employee Handbook. We encourage feedback from employees at all levels through our Open Door Policy Submission Form and Upward Feedback program. |

• | Sinclair’s local television stations and their employees are often leaders in their communities with respect to fundraising, awareness raising for issues of importance, and supporting voluntary organizations. Our newscasts routinely provide coverage of leaders in our stations’ communities and spotlight important community initiatives. A number of our stations also raise funds for local charities through station-sponsored events. |

• | Our stations regularly broadcast public service announcements in programming, and local broadcast stations regularly create, participate in or report on community service projects that help the viewers and organizations in their respective markets. |

The proponents’ resolution, if implemented, will, in the Board of Director’s opinion, require an excessive amount of Company time, effort, and money when compared with any incremental benefit. The Company has a long history of dedication to good corporate citizenship, and the Company’s existing practices are sound. Preparing the requested report would, in the Board of Director’s estimation, deplete human and financial resources without providing any meaningful or demonstrable benefit to our shareholders, our employees, or the communities in which we operate. We do not believe it is in the best interests of our shareholders for the Company to add staff and spend additional time and money to develop a report that lacks an immediate and tangible return for our shareholders. The Board believes that it is far more important to the majority of the Company’s shareholders that management continues to focus on improving areas of the Company that can provide tangible results to our shareholders.

Again, and for all of the above reasons, the Board of Directors unanimously recommends that you vote AGAINST this shareholder proposal.

8

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

There were 94,999,083 shares of our common stock issued and outstanding on March 14, 2016, consisting of 69,070,726 shares of Class A Common Stock and 25,928,357 shares of Class B Common Stock. The following table shows how many shares were owned by the following categories of persons as of that date:

• | persons known to us who beneficially own more than 5% of the shares; |

• | each director and each executive officer described on the “Summary Compensation Table”; and |

• | directors and all executive officers as a group. |

Shares of Class B Common Stock Beneficially Owned (a) | Shares of Class A Common Stock Beneficially Owned | Percent of Total Voting | ||||||||

Name | Number | Percent | Number | Percent (b) | Power (c) | |||||

David D. Smith † | 7,411,072 | 28.6 | % | 10,238,169 (d) | 13.0 | % | 23.3 | % | ||

J. Duncan Smith † | 7,073,466 | 27.3 | % | 7,185,494 (e) | 9.4 | % | 21.4 | % | ||

Robert E. Smith † | 6,474,806 | 25.0 | % | 6,479,431 (f) | 8.5 | % | 19.6 | % | ||

Frederick G. Smith † | 4,057,673 | 15.6 | % | 4,085,947 (g) | 5.6 | % | 12.3 | % | ||

Christopher S. Ripley † | — | — | 250,164 (h) | * | * | |||||

David B. Amy † | — | — | 228,566 | * | * | |||||

Steven M. Marks † | — | — | 93,406 | * | * | |||||

Martin R. Leader † | — | — | 62,794 | * | * | |||||

Daniel C. Keith † | — | — | 47,250 | * | * | |||||

Lawrence E. McCanna † | — | — | 28,775 | * | * | |||||

Barry M. Faber † | — | — | 11,676 | * | * | |||||

Howard E. Friedman † | — | — | 4,000 | * | * | |||||

Manning & Napier Advisors | ||||||||||

290 Woodcliff Drive | ||||||||||

Fairport, NY 14450 | — | — | 6,637,864 (i) | 9.6 | % | 2.0 | % | |||

FMR LLC | ||||||||||

245 Summer Street | ||||||||||

Boston, MA 02210 | — | — | 5,931,786 (j) | 8.6 | % | 1.8 | % | |||

The Vanguard Group, Inc. | ||||||||||

100 Vanguard Boulevard | ||||||||||

Malvern, PA 19355 | — | — | 4,602,989 (k) | 6.7 | % | 1.4 | % | |||

Blackrock, Inc. | ||||||||||

40 East 52nd Street | ||||||||||

New York, NY 10022 | — | — | 4,063,000 (l) | 5.9 | % | 1.2 | % | |||

The Bank of New York Mellon Corporation | ||||||||||

225 Liberty Street | ||||||||||

New York, NY 10286 | — | — | 3,609,964 (m) | 5.2 | % | 1.1 | % | |||

All directors and executive officers as a group | ||||||||||

(16 persons) | 25,017,017 | 96.5 | % | 28,753,361 (n) | 29.7 | % | 76.8 | % | ||

* Less than 1%

† The address for such beneficial owner is 10706 Beaver Dam Road, Hunt Valley, Maryland 21030.

9

(a) | By virtue of a stockholders’ agreement by and among David D. Smith, Frederick G. Smith, J. Duncan Smith and Robert E. Smith, each of the Smith brothers is required to vote all of his Class A and Class B Common Stock in favor of the other Smith brothers to cause their election as directors. Consequently, each of the Smith brothers may be deemed to beneficially own the shares of common stock individually owned by the other Smith brothers. Nevertheless, each of the Smith brothers disclaims beneficial ownership of the shares owned by the other Smith brothers. |

(b) | Percent of Class A Common Stock beneficially owned is the number of shares of Class A Common Stock beneficially owned divided by the sum of (i) number of shares of Class A Common Stock outstanding plus (ii) any Class B Common Stock individually held plus (iii) any options and stock-settled stock appreciation rights (SARs). The percentage of beneficial ownership assumes Class B Common Stock individually held plus any options and SARs are outstanding for the respective party, but not any other party. |

(c) | Holders of Class A Common Stock are entitled to one vote per share and holders of Class B Common Stock are entitled to ten votes per share except for votes relating to “going private” and certain other transactions. The Class A Common Stock and the Class B Common Stock vote together as a single class except as otherwise may be required by Maryland law on all matters presented for a vote. Holders of Class B Common Stock may at any time convert their shares into the same number of shares of Class A Common Stock. The percentage of voting power assumes conversion of Class B Common Stock individually held plus any options and SARs are outstanding for the respective party, but not any other party. |

(d) | Includes 7,411,072 shares of Class B Common Stock beneficially owned, each of which is convertible into one share of Class A Common Stock, 10,084 shares of Class A Common Stock held in the 401(k) Plan, and 507,013 shares of Class A Common Stock held in irrevocable trusts established by David D. Smith for the benefit of family members, of which he is a co-trustee. Also includes 2,310,000 outstanding Stock Appreciation Rights (SARs) with exercises prices ranging from $11.68 to $31.40. The number of shares of Class A Common Stock issuable is determined by dividing (i) the amount of the difference between the aggregate market value of the shares underlying the SARs and the aggregate exercise price of the SARs by (ii) the closing market price per share on the date of exercise. There would have been 943,840 shares of Class A Common Stock issued, assuming that all of the outstanding SARs were exercised on March 14, 2016 based on the closing value of Class A Common Stock on this date and the underlying exercise prices of the SARs. |

(e) | Includes 7,073,466 shares of Class B Common Stock beneficially owned, each of which is convertible into one share of Class A Common Stock, 80,185 shares of Class A Common Stock, 9,263 shares of Class A Common Stock held in the 401(k) Plan, and 22,580 shares of Class A Common Stock held in custodial accounts established by J. Duncan Smith for the benefit of family members, of which he is a ctrustee. The shares of Class B Common Stock include 137,154 shares held in an irrevocable trust established by J. Duncan Smith for the benefit of family members, of which he is the trustee. |

(f) | Includes 6,474,806 shares of Class B Common Stock beneficially owned, each of which is convertible into one share of Class A Common Stock, 4,000 shares of Class A Common Stock, and 625 shares of Class A Common Stock held in the 401(k) Plan. The shares of Class B Common Stock include 145,000 shares held in an irrevocable trust established by Robert E. Smith for the benefit of family members, of which he is the trustee. |

(g) | Includes 4,057,673 shares of Class B Common Stock beneficially owned, each of which is convertible into one share of Class A Common Stock, 18,900 shares of Class A Common Stock, and 9,374 shares of Class A Common Stock in the 401(k) Plan. |

(h) | Includes 250,000 of outstanding stock options with exercise prices ranging from $27.36 to $32.54 and 164 shares of Class A Common Stock held in the 401(k) Plan. See Compensation Discussion and Analysis, Employment Agreements, for more information. |

(i) | As set forth in the Schedule 13G filed by Manning & Napier Advisors with the SEC on January 12, 2016, Manning & Napier Advisors is deemed to be the beneficial owner of 6,637,864 shares and has sole voting power with respect to 5,792,564 of those shares and sole dispositive power with respect to all 6,637,864 shares. |

(j) | As set forth in the Schedule 13G/A filed by FMR, LLC with the SEC on February 12, 2016, FMR, LLC is deemed to be the beneficial owner of 5,931,786 shares and has sole voting power with respect to 82,700 of those shares and sole dispositive power with respect to all 5,931,786 shares. |

10

(k) | As set forth in the Schedule 13G/A filed by The Vanguard Group, Inc. with the SEC on February 10, 2016, The Vanguard Group, Inc. is deemed to be the beneficial owner of 4,602,989 shares and has sole voting power with respect to 147,182 of those shares, shared dispositive power with respect to 146,782 of those shares and sole dispositive power with respect to 4,456,207 of those shares. |

(l) | As set forth in the Schedule 13G/A filed by Blackrock, Inc. with the SEC on January 22, 2016, Blackrock, Inc. is deemed to be the beneficial owner of 4,063,000 shares and has sole voting power with respect to 3,913,795 of those shares and sole dispositive power with respect to all 4,063,000 shares. |

(m) | As set forth in the Schedule 13G filed by The Bank of New York Mellon Corporation with the SEC on January 26, 2016, The Bank of New York Mellon Corporation is deemed to be the beneficial owner of 3,609,964 shares and has sole voting power with respect to 3,500,006 of those shares and has shared voting power and shared dispositive power with respect to all 3,609,964 of those shares. |

(n) | Includes shares of Class A Common Stock that may be acquired upon the exercise of options and SARs. |

11

DIRECTORS, EXECUTIVE OFFICERS AND KEY EMPLOYEES

Set forth below is certain information relating to our named directors and nominees, executive officers and certain key employees.

Name | Age | Title |

Directors | ||

David D. Smith | 65 | President, Chief Executive Officer, Chairman of the Board and Director |

Frederick G. Smith | 66 | Vice President and Director |

J. Duncan Smith | 62 | Vice President, Secretary and Director |

Robert E. Smith | 52 | Director |

Howard E. Friedman | 50 | Director |

Daniel C. Keith | 61 | Director |

Martin R. Leader | 75 | Director |

Lawrence E. McCanna | 72 | Director |

Executive Officers | ||

David B. Amy | 63 | Executive Vice President / Chief Operating Officer of Sinclair |

Barry M. Faber | 54 | Executive Vice President / General Counsel |

Steven M. Marks | 59 | Co-Chief Operating Officer of Sinclair Television Group, Inc. |

Steven J. Pruett | 61 | Co-Chief Operating Officer of Sinclair Television Group, Inc. |

Christopher S. Ripley | 39 | Chief Financial Officer |

David R. Bochenek | 53 | Senior Vice President / Chief Accounting Officer |

M. William Butler | 63 | Senior Vice President / Promotion and Corporate Marketing |

Rebecca J. Hanson | 51 | Senior Vice President / Strategy and Policy |

Robert F. Malandra | 53 | Senior Vice President / Finance / Television |

Delbert R. Parks, III | 63 | Senior Vice President / Chief Technology Officer |

Lucy A. Rutishauser | 51 | Senior Vice President / Corporate Finance / Treasurer |

Donald H. Thompson | 49 | Senior Vice President / Human Resources |

Robert D. Weisbord | 53 | Chief Operating Officer / Sinclair Digital |

Members of the Board of Directors are elected for one-year terms and serve until their successors are duly elected and qualified. Executive officers are appointed by the Board of Directors annually to serve for one-year terms and serve until their successors are duly appointed and qualified.

Messrs. David, Duncan and Robert Smith and Dr. Frederick Smith are brothers and have entered into a stockholders' agreement pursuant to which they have agreed to vote for each other as candidates for election to the Board of Directors until December 31, 2025.

12

Profiles

David D. Smith has served as President and Chief Executive Officer since 1988 and as Chairman of the Board of Sinclair Broadcast Group, Inc. since September 1990. Mr. Smith founded Comark Communications, Inc., a company engaged in the manufacture of high power transmitters for UHF television stations, and was an officer and director of Comark until 1986. He also was a principal in other television stations prior to serving as a General Manager of WPMY (formerly WCWB-TV) from 1984 until 1986. In 1986, Mr. Smith was instrumental in the formation of Sinclair Broadcast Group, Inc. Mr. Smith serves as a member of the Board of Directors of Atlantic Automotive Corporation, The Triscari Group, Inc., The Sinclair Relief Fund, The American Flag Foundation, Inc., Cunningham Communications Inc., Gerstell Development, LP, Keyser Investment Group, Inc. and is a member of the Board of Managers of Alarm Funding Associates, LLC.

Based on Mr. Smith’s (i) more than twenty years of experience and expertise in the television broadcast industry, (ii) extensive industry knowledge and innovative thinking, (iii) understanding of the challenges, opportunities and risks faced by us and the industry, and (iv) valuable, significant shareholder perspective, the Board believes Mr. Smith has acquired the experience, qualifications, attributes and skills necessary to act in the best interests of the Company and its stockholders, and thus, the Board has concluded that Mr. Smith should continue to serve as a director for the Company.

Frederick G. Smith has served as Vice President of Sinclair since 1990 and Director since 1986. Prior to joining Sinclair in 1990, Dr. Smith was an oral and maxillofacial surgeon engaged in private practice and was employed by Frederick G. Smith, M.S., D.D.S., P.A., a professional corporation of which Dr. Smith was the sole officer, director and stockholder. Dr. Smith serves as a member of the Board of Directors or Trustees of the Freven Foundation, Gerstell Academy, University of Maryland at Baltimore Foundation, St. Joseph’s Hospital, The Sinclair Relief Fund, Cunningham Communications Inc., Gerstell Development, LP, Keyser Investment Group, Inc. and Beaver Dam, LLC.

Based on Dr. Smith’s (i) more than twenty years of experience in the television broadcast industry, and (ii) valuable, significant shareholder perspective, the Board believes Dr. Smith has acquired the experience, qualifications, attributes and skills necessary to act in the best interests of the Company and its stockholders, and thus, the Board has concluded that Dr. Smith should continue to serve as a director for the Company.

J. Duncan Smith has served as Vice President, Secretary and as a Director of Sinclair since 1986. Prior to that, he built and operated the following television stations: WPMY (formerly WCWB-TV) in Pittsburgh, Pennsylvania; WTTE-TV in Columbus, Ohio; WIIB-TV in Bloomington, Indiana and WTTA-TV in Tampa/St. Petersburg, Florida. In addition, Mr. Smith worked for Comark Communications, Inc., a company engaged in the manufacture of high power transmitters for UHF television stations. Mr. Smith serves as a member of the Board of Directors of The High Rock Foundation, Cunningham Communications Inc., Gerstell Development, LP, Keyser Investment Group, Inc., Beaver Dam, LLC, and The Sinclair Relief Fund.

Based on Mr. Smith’s (i) more than twenty years of experience in the television broadcast industry, and (ii) valuable, significant shareholder perspective, the Board believes Mr. Smith has acquired the experience, qualifications, attributes and skills necessary to act in the best interests of the Company and its stockholders, and thus, the Board has concluded that Mr. Smith should continue to serve as a director for the Company.

Robert E. Smith has served as a Director since 1986. He served as Vice President and Treasurer of Sinclair from 1988 to June 1998, at which time he resigned from his position as Vice President and Treasurer. In March 1997, Mr. Smith started RSMK LLC, a commercial real estate investment company. Prior to 1986, he assisted in the construction of several television stations including WTTE-TV in Columbus, Ohio and also worked for Comark Communications, Inc., a company engaged in the manufacture of high power transmitters for UHF television stations. Mr. Smith serves as a member of the Board of Directors of Nextgen Foundation Charitable Trust, Gerstell Academy, Keyser Investment Group, Inc., Cunningham Communications, Inc., Gerstell Development LP, Beaver Dam LLC, and Laker Partners, LLC.

Based on Mr. Smith’s (i) more than twenty years of experience in the television broadcast industry, and (ii) valuable, significant shareholder perspective, the Board believes Mr. Smith has acquired the experience, qualifications, attributes and skills necessary to act in the best interests of the Company and its stockholders, and thus, the Board has concluded that Mr. Smith should continue to serve as a director for the Company.

Howard E. Friedman has served as Director since January 6, 2015. He is the founding Partner of Lanx Management LLC, a hedge “fund of funds” as well as the Co-Founder, Publisher & CEO of Watermark Press, Inc. From 2006-2010, Mr. Friedman served as President and then Chairman of the Board of the American Israel Public Affairs Committee (AIPAC). In 2007 and in 2009, Washington Life Magazine listed Mr. Friedman as one of the 100 most powerful people in Washington D.C. From 2010-2012, he served as the President of the American Israel Educational Foundation, the charitable arm of

13

AIPAC. He is the immediate past Chair of the Board of The Associated: Jewish Community Federation of Baltimore. Mr. Friedman has served as President of the Baltimore Jewish Council, and as President of JTA-The Global News Service of the Jewish People. He currently serves as the Chairman of the Board of the Union of Orthodox Jewish Congregations of America. In addition, Mr. Friedman serves on the boards of the Johns Hopkins University Bloomberg School of Public Health, Touro College and University System, Talmudical Academy and the Simon Wiesenthal Center.

Based on Mr. Friedman’s extensive skills in finance, management and investment matters, the Board believes Mr. Friedman has acquired the experience, qualifications, attributes and skills necessary to act in the best interests of the Company and its stockholders, and thus, the Board has concluded that Mr. Friedman should continue to serve as a director for the Company.

Daniel C. Keith has served as a Director since May 2001. Mr. Keith is the President and Founder of the Cavanaugh Group, Inc., a Baltimore-based investment advisory firm founded in October 1995. Prior to establishing the Cavanaugh Group, Inc., Mr. Keith was Vice President, Senior Portfolio Manager, and Director of the Investment Management division of a local financial services company since 1985. During this time, he served as Chairman of the Investment Advisory Committee and was a member of the Board of Directors. Mr. Keith has been advising clients since 1979. He serves as a member of the Boards of Trustees of The High Rock Foundation.

Based on Mr. Keith’s extensive skills in finance, management and investment matters, the Board believes Mr. Keith has acquired the experience, qualifications, attributes and skills necessary to act in the best interests of the Company and its stockholders, and thus, the Board has concluded that Mr. Keith should continue to serve as a director for the Company.

Martin R. Leader has served as a Director since May 2002. Mr. Leader is a retired partner of the law firm ShawPittman (now known as Pillsbury Winthrop Shaw Pittman LLP) in Washington, D.C. where he specialized in communications law matters. Prior to his service at ShawPittman, Mr. Leader was a senior partner with the law firm of Fisher Wayland Cooper Leader & Zaragoza in Washington, D.C. from 1973 to 1999. Mr. Leader was a member of the Board of Directors of Atlantic Automotive Corporation until February 2006. Mr. Leader has served on the staff of the Office of Opinions and Review of the Federal Communications Commission. He is a member of the District of Columbia Bar. Mr. Leader graduated from Tufts University and Vanderbilt University Law School.

Based on Mr. Leader’s (i) prior experience in communications law and (ii) insight on government relations particularly with the Federal Communications Commission, the Board believes Mr. Leader has acquired the experience, qualifications, attributes and skills necessary to act in the best interests of the Company and its stockholders, and thus, the Board has concluded that Mr. Leader should continue to serve as a director for the Company.

Lawrence E. McCanna has served as a Director since July 1995. Mr. McCanna was a shareholder of the accounting firm of Gross, Mendelsohn & Associates, P.A. from 1972 and served as its managing director through June 30, 2009. On July 1, 2009, Mr. McCanna retired from full-time employment with the firm, liquidating his entire interest in Gross, Mendelson & Associates on that date. Mr. McCanna provides substantial value to the Board of Directors through his extensive accounting, finance and management experience. He is an audit committee financial expert as defined by the SEC. Mr. McCanna has served on various committees of the Maryland Association of Certified Public Accountants and was Chairman of the Management of the Accounting Practice Committee. He is also a former member of the Management of an Accounting Practice Committee of the American Institute of Certified Public Accountants and a former member of the Board of Directors of Maryland Special Olympics and Mount St. Joseph High School.

Based on Mr. McCanna’s (i) extensive accounting, finance and management experience and (ii) ability to serve as an audit committee financial expert as defined by the SEC, the Board believes Mr. McCanna has acquired the experience, qualifications, attributes and skills necessary to act in the best interests of the Company and its stockholders, and thus, the Board has concluded that Mr. McCanna should continue to serve as a director for the Company.

14

David B. Amy has served as Executive Vice President and Chief Operating Officer of Sinclair Broadcast Group, Inc. since April 1, 2014. Prior to that, he served as Executive Vice President / Chief Financial Officer (CFO) of Sinclair since March 2001. From September 1999 to March 2001 he served as Executive Vice President and as Vice President and CFO from September 1998 to September 1999. Beginning in 1994, he served as CFO until September 1998. In addition, he serves as Secretary of Sinclair Television Group, Inc., and its wholly-owned subsidiaries that owns and operates our broadcasting operations. Mr. Amy has over 30 years of broadcast experience, having joined the predecessor of Sinclair as a Business Manager for WPNT-TV (formerly WPMY-TV and prior to that WPTT-TV) in Pittsburgh, Pennsylvania. Mr. Amy received his MBA degree from the University of Pittsburgh in 1981. Mr. Amy serves as a member of the Board of Directors of KDSM, LLC, The Maryland Science Center and Television Music License Committee. He is also a member of the Board of Managers of Triangle Sign & Service, LLC and Chairman of the Board of Managers of Alarm Funding Associates, LLC. He served as a member of the Board of Directors of Acrodyne Communications, Inc., and G1440 Holdings, Inc. until 2009; Visionair, Inc. until 2008 and Jadoo Power Systems, Inc. until 2007. Mr. Amy also served as the Audit Committee Chairman of Acrodyne Communications, Inc. until 2009.

Barry M. Faber has served as Executive Vice President / General Counsel since May 2008, as Vice President / General Counsel from August 1999 to May 2008 and prior to that as Associate General Counsel from 1996 to 1999. Prior to that time, he was associated with the law firm of Fried, Frank, Harris, Shriver, & Jacobson in Washington, D.C. Barry M. Faber is a graduate of the University of Virginia and the University of Virginia School of Law. Mr. Faber is also a member of the Board of Directors of The Sinclair Relief Fund.

Steven M. Marks has served as Co-Chief Operating Officer within our broadcast segment since May 2007. Prior to that, he served as Chief Operating Officer / Television Group from February 2003 to May 2007. Mr. Marks is responsible for the operations of a certain number of our television stations. Prior to that, he served as Vice President / Regional Director from March 2002 to February 2003. As a Vice President / Regional Director, Mr. Marks was responsible for the Baltimore, Columbus, Pittsburgh, Flint, Tallahassee, Charleston, West Virginia, Portland, Springfield, Minneapolis, Tampa, Syracuse, Norfolk, Richmond, Buffalo and Rochester markets. Prior to his appointment as Vice President / Regional Director, Mr. Marks served as Regional Director since October 1994. Mr. Marks served as General Manager for Sinclair’s flagship station, WBFF-TV in Baltimore, Maryland from July 1991 until October 1994. From 1986 until joining WBFF-TV in 1991, Mr. Marks served as General Sales Manager at WTTE-TV in Columbus, Ohio. Prior to that time, he was National Sales Manager for WFLX-TV in West Palm Beach, Florida.

Steven J. Pruett joined Sinclair as Co-Chief Operating Officer within our broadcast segment in April 2013, overseeing the operations of a certain number of our television stations. Prior to that, he was with Communications Corporation of America, first as Chief Financial Officer, then becoming its President in 2006 and President and Chief Executive Officer, as well as a member of the Board, in 2007. Mr. Pruett served as special strategic advisor to DirecTV and Thomson Consumer Electronics from 1998 to 2002. From 1995 to 1999, he was a Managing Director at Communications Equity Associates. During his career, he has helped found several broadcast groups as an initial investor, financier, managing partner or board member including Spanish Radio Group Excel Communications, ACME Television, USBG, and UPI Media, where he served as President. Mr. Pruett attended Southern Illinois University at Edwardsville where he majored in Radio and Television. He later earned a Masters in Management from the JL Kellogg Graduate School of Business at Northwestern University. Beginning 2008, Mr. Pruett was a key member of the Fox Affiliate Board of Governors where he served as Treasurer until 2011 when he was elected Chairman, a position he held until 2014.

Christopher S. Ripley has served as Chief Financial Officer since April 1, 2014. Prior to that, Mr. Ripley served as Managing Partner of Canor LLC, a boutique media/entertainment advisory firm since 2013. From 2001 to 2013, he was a Managing Director at UBS Investment Bank’s Global Media Group and served as head of the Los Angeles office where he managed, advised and/or structured various financings and merger and acquisition transactions, managed bankers and support staff, and oversaw regulatory and compliance matters for the office. From 2000 to 2001, he was a Principal at Prime Ventures LLC, a venture capital firm where he was involved in capital investment decisions, business development, M&A, and organizational structuring. Prior to that and from 1998, Mr. Ripley worked in the investment banking division of Donaldson, Lufkin & Jenrette Securities Corporation. Mr. Ripley graduated from the University of Western Ontario, Richard Ivey School of Business, with a Bachelor of Arts in Honors Business Administration.

15

David R. Bochenek has served as Senior Vice President / Chief Accounting Officer since December 2013. Prior to that, he served as Vice President / Chief Accounting Officer since May 2005. Prior to that, he served as Chief Accounting Officer from November 2002 to April 2005. Mr. Bochenek joined Sinclair in March 2000 as the Corporate Controller. Prior to joining Sinclair, Mr. Bochenek was Vice President, Corporate Controller for Prime Retail, Inc. from 1993 until 2000. From 1990 to 1993, Mr. Bochenek served as Assistant Vice President for MNC Financial, Inc. and prior to that held various positions in the audit department of Ernst & Young, LLP. Mr. Bochenek received his Bachelor of Business Administration in Accounting and Master of Science in Finance from Loyola University, Maryland. Mr. Bochenek is a Certified Public Accountant and is a member of the board for Media Financial Management Association (MFM).

M. William Butler has served as Senior Vice President / Promotion and Corporate Marketing since October 2015. Prior to that, he served as Vice President / Programming and Promotion of Sinclair Television Group, Inc. since 1997. Prior to that, he served as Director of Programming at KCAL-TV in Los Angeles, California. Prior to that, he Director of Marketing and Programming at WTXF-TV in Philadelphia, Pennsylvania and prior to that he was the Program Director at WLVI in Boston, Massachusetts. Mr. Butler attended the Graduate Business School of University of Cincinnati from 1975 to 1976.

Rebecca J. Hanson has served as Senior Vice President / Strategy and Policy since January 2013. Prior to that, she was a Senior Advisor, Broadcast Spectrum with the Media Bureau of the Federal Communications Commission, and served on the Incentive Auction Task Force as the point person for broadcaster participation and issues affecting nonparticipating broadcasters. Prior to joining the FCC from 2007 to 2009, she was the Vice President, Strategic Initiatives at Sprint Nextel, where she was responsible for the launch and long-term growth strategy for the WiMAX network and a member of the deal team leading the financing and merger with Clearwire for a national spectrum footprint. From 2006 to 2007 she was a consultant focusing on business planning and deal execution for various digital media companies. Prior to that and from 2000, she held the positions of Senior Vice President, Business Development, and Vice President and Deputy General Counsel at XM Satellite Radio, Inc., where she was the lead negotiator for key strategic alliances and partnerships in the areas of programming, marketing, distribution, acquisitions/joint ventures and product development. She began her career as an attorney with Brownstein and Zeidman from 1993 to 1996 and then ShawPittman (now Pillsbury Winthrop Shaw Pittman) from 1996 to 2000, where she specialized in the areas of technology, commercial finance, and venture capital.

Robert F. Malandra has served as Senior Vice President / Finance and Television since June 2015. Prior to that, he served as Vice President / Finance and Television of Sinclair Television Group, Inc. since 2008 and has been with the company since 2006. Prior to joining Sinclair he worked for Madison Square Garden as an Executive Consultant covering their Radio City, MSG Network, and Arena properties. Prior to that, he was with Rainbow Media (now AMC Networks) where he served as Vice President Planning, Advertising for their network of regional sports channels. Prior to that, he was Vice President for Rainbow’s PRISM/SportsChannel Philadelphia. He holds an MBA in Media Strategy from Manchester Business School in Manchester England.

Delbert R. Parks, III has served as Senior Vice President / Chief Technology Officer of Sinclair Television Group, Inc. since November 2014. Prior to that, he served as Senior Vice President / Operations and Engineering, since December 2013. Prior to that, he served as Vice President / Engineering and Operations of Sinclair Television Group, Inc. since 1996. From 1985 to 1996, he was Director of Operations and Engineering for WBFF-TV in Baltimore, Maryland and Sinclair. He has held various operations and engineering positions with us for the last 40 years. He is responsible for planning, organizing and implementing operational and engineering policies and strategies as they relate to television operations, internet activity, information management systems, and infrastructure. Mr. Parks is a SMPTE (Society of Motion Picture and Television Engineers) Fellow and is a member of the Society of Broadcast Engineers. He is on the Board of Directors of the Baltimore Area Council of the Boy Scouts of America and has been active in the scouting program with his sons. Mr. Parks is also a retired Army Lieutenant Colonel who has held various commands during his 26-year reserve career.

Lucy A. Rutishauser has served as Senior Vice President / Corporate Finance / Treasurer since December 2013. Prior to that, she was Vice President / Corporate Finance / Treasurer since November 2002. From March 2001 until November 2002, she served as Treasurer and, from 1998 until March 2001, she served as Assistant Treasurer. From 1996 to 1997, Ms. Rutishauser was the Assistant Treasurer for Treasure Chest Advertising Company. From 1992 to 1996, Ms. Rutishauser served as Assistant Treasurer and Director of Treasury for Integrated Health Services, Inc. From 1988 to 1992, Ms. Rutishauser held various treasury positions with Laura Ashley, Inc. and the Black and Decker Corporation. Ms. Rutishauser graduated magna cum laude from Towson University with a Bachelor of Science degree in Economics and Finance and received her M.B.A., with honors from the University of Baltimore. Ms. Rutishauser is a member of the National Institute of Investor Relations and the Association of Finance Professionals.

16

Donald H. Thompson has served as Senior Vice President / Human Resources since December 2013. Prior to that, he served as Vice President / Human Resources since November 1999 and prior to that as Director of Human Resources from September 1996. Prior to joining us, Mr. Thompson was a Human Resources Manager for NASA at the Goddard Space Flight Center near Washington, D.C. Mr. Thompson holds a Bachelor’s Degree in Psychology and a Certificate in Personnel and Industrial Relations from University of Maryland, and an MS in Business / Human Resource & Behavioral Management and an MBA from Johns Hopkins University. Mr. Thompson is a member of the Society for Human Resource Management.

Robert D. Weisbord has served as Chief Operating Officer of Sinclair Digital Group, a newly created Digital Interactive Business Unit for Sinclair Broadcasting Group since January 2014. Mr. Weisbord is responsible for all web/mobile app/social media creation, interaction of the unit with news and television station platforms, revenue generation, and exploring strategic partnerships and potential related acquisitions. He served as Vice President / New Media from June 2010 to January 2014. From 2008 to June 2010, he served as Director of Digital Interactive Marketing for Sinclair. From 1997, he served in various management positions for the Company including Regional Group Manager, General Manager for the Company’s Las Vegas duopoly of KVMY-TV and KVCW-TV, and Director of Sales. Prior to that and from 1993, he was National Sales Manager for WTVT-TV in Tampa, Florida. Mr. Weisbord began his broadcasting career in the radio industry with Family Group Broadcasting in 1985. Mr. Weisbord holds a Bachelor of Science degree in Business Management and a Masters in Business Administration from the University of Tampa.

CORPORATE GOVERNANCE

Board of Directors and Committees. In 2015, the Board of Directors held a total of six meetings. All directors attended all of the meetings of the Board of Directors and all committees of the Board of Directors on which he served. All directors attended the Annual Meeting held on June 4, 2015. It is the Board’s policy that the directors should attend our annual meeting of shareholders, absent exceptional cause.

The committees of the Board of Directors include an Audit Committee and a Compensation Committee and from time to time special committees formed by the Board of Directors as may be necessary.

Board Leadership Structure and Risk Oversight. David D. Smith serves as both the Chairman of the Board of Directors and the President and Chief Executive Officer. The Chief Executive Officer’s performance is reviewed annually by the Compensation Committee, which reports results to the Board of Directors. The Compensation Committee consists of four directors, all of whom are independent pursuant to the Nasdaq Stock Market rules (the Nasdaq listing requirements). The Board of Directors appoints an independent director to preside over special committee meetings; however, no lead independent director of the Board of Directors exists. The Company deems this leadership structure appropriate for our Controlled Company (see Controlled Company Determination below) as it promotes efficient communication between the Chief Executive Officer and the Board of Directors as well as between the various board committees and the Board of Directors while monitoring effective independent board oversight over the Chief Executive Officer and the Company’s risks. While the Company’s management is charged with managing the Company’s day-to-day risks, the Company’s financial risk oversight is primarily conducted by the Audit Committee, which consists entirely of independent directors for purposes of Nasdaq listing requirements and Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the Exchange Act). The Audit Committee reports financial risk oversight matters to the Board of Directors based on committee assessments and periodic reports from management. The Compensation Committee provides risk oversight concerning our compensation policies and practices. The Board of Directors with the assistance of management is responsible for all other risk oversight measures.

Risk Assessment of Compensation Policies and Practices. The Company’s primary source of revenue is advertising which it sells to a large variety of customers. The Company does not pay a significant amount of incentive compensation to employees with the ability to take significant risks which could have a material adverse effect on the Company. Incentive compensation is primarily paid to sales personnel who are not executive officers of the Company and do not have the ability or authority to engage in significant risk taking activity. While we pay incentive compensation to certain of our executive officers, it is not significant to the Company as a whole and we believe it is designed to minimize unnecessary risk taking by aligning each executive’s interests with those of our shareholders and by emphasizing long-term performance rather than promoting short-term risk taking at the expense of long-term returns. Our sales personnel and executive officers are incentivized to generate revenues and cannot participate in material speculative transactions or put material amounts of capital at risk without Board approval. As a result, the Company’s management, in consultation with the Company’s Compensation Committee, determined that the Company’s compensation policies and practices are not reasonably likely to have a material adverse effect.

17