Form DFAN14A TICC Capital Corp. Filed by: TPG Specialty Lending, Inc.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant ¨ Filed by a Party other than the Registrant x

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| x | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

TICC CAPITAL CORP.

(Name of Registrant as Specified In Its Charter)

TPG Specialty Lending, Inc.

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | Fee not required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

On July 19, 2016, TPG Specialty Lending, Inc. issued the following press release:

TPG Specialty Lending, Inc. Corrects Misleading Statements from TICC Capital Corp. in Letter to Stockholders

Outlines TICC’s Long History of Underperformance, Questionable Governance and Misalignment with TICC Stockholders

Demonstrates That There is Significant Interest in Managing TICC and That Terminating the Existing External Adviser Will Give TICC Stockholders the Opportunity to Achieve Improved Returns

Reminds TICC Stockholders That They Have the Right to Terminate the External Adviser’s Contract AT NO COST To Stockholders

Urges TICC Stockholders to Vote the GOLD Proxy Card to Terminate TICC’s External Adviser Contract and Elect T. Kelley Millet to the TICC Board

NEW YORK—(BUSINESS WIRE)—TPG Specialty Lending, Inc. (“TSLX”; NYSE: TSLX), a specialty finance company focused on lending to middle-market companies, today issued a letter to TICC Capital Corp. (“TICC”) stockholders outlining TICC’s long history of underperformance, questionable governance and misalignment with TICC stockholders. TSLX notes that there is already significant interest in managing TICC’s assets to generate value for stockholders, as at least three independent advisers have already expressed such an interest, and that terminating the existing external adviser will give TICC stockholders the opportunity to achieve improved returns.

The letter also urges stockholders to protect their investment in TICC and vote by signing and returning the GOLD proxy card FOR the termination of the investment advisory agreement between TICC and its external adviser and the election of TSLX’s highly-qualified and independent nominee, T. Kelley Millet, to TICC’s Board of Directors at TICC’s 2016 Annual Meeting, which is scheduled for September 2, 2016.

Please click here to view the full letter: http://www.changeticcnow.com/content/uploads/2016/07/Second-TSLX-Letter-to-TICC-Stockholders.pdf

TSLX’s proxy materials are also available through the SEC’s website and at www.changeTICCnow.com.

About TPG Specialty Lending

TPG Specialty Lending, Inc. (“TSLX” or the “Company”) is a specialty finance company focused on lending to middle-market companies. The Company seeks to generate current income primarily in U.S.-domiciled middle-market companies through direct originations of senior secured loans and, to a lesser extent, originations of mezzanine loans and investments in corporate bonds and equity securities. The Company has elected to be regulated as a business development company, or BDC, under the Investment Company Act of 1940 and the rules and regulations promulgated thereunder. TSLX is externally managed by TSL Advisers, LLC, a Securities and Exchange Commission registered investment adviser. TSLX leverages the deep investment, sector, and operating resources of TPG Special Situations Partners, the dedicated special situations and credit platform of TPG, with approximately $16 billion of assets under management as of March 31, 2016, and the broader TPG platform, a global private investment firm with approximately $74 billion of assets under management as of March 31, 2016. For more information, visit the Company’s website at www.tpgspecialtylending.com.

Forward-Looking Statements

Information set forth herein may contain forward-looking statements, including, but not limited to, statements with regard to the expected future financial position, results of operations, cash flows, dividends, portfolio, financing plans, business strategy, budgets, capital expenditures, competitive positions, growth opportunities, plans and objectives of management of TICC Capital Corp. (“TICC”), statements with regard to the expected future financial position, results of operations, cash flows, dividends, portfolio, financing plans, business strategy, budgets, capital expenditures, competitive positions, growth opportunities, plans and objectives of management of TPG Specialty Lending, Inc. (“TSLX”), and statements with regard to TSLX’s proposed business combination transaction with TICC (including any financing required in connection with a possible transaction and the benefits, results, effects and timing of a possible transaction). Statements set forth herein concerning the business outlook or future economic performance, anticipated profitability, revenues, expenses, dividends or other financial items, and product or services line growth of TSLX, TICC and/or the combined businesses of TSLX and TICC, including, but not limited to, statements containing words such as “anticipate,” “approximate,” “believe,” “plan,” “estimate,” “expect,” “project,” “could,” “would,” “should,” “will,” “intend,” “may,” “potential,” “upside” and other similar expressions, together with other statements that are not historical facts, are forward-looking statements that are estimates reflecting the best judgment of TSLX based upon currently available information.

Such forward-looking statements are inherently uncertain, and stockholders and other potential investors must recognize that actual results may differ materially from TSLX’s expectations as a result of a variety of factors including, without limitation, those discussed below. Such forward-looking statements are based upon TSLX’s current expectations and include known and unknown risks, uncertainties and other factors, many of which TSLX is unable to predict or control, that may cause TSLX’s plans with respect to TICC or the actual results or performance of TICC, TSLX or TICC and TSLX on a combined basis to differ materially from any plans, future results or

performance expressed or implied by such forward-looking statements. These statements involve risks, uncertainties and other factors discussed below and detailed from time to time in TSLX’s filings with the Securities and Exchange Commission (“SEC”).

Risks and uncertainties related to a possible transaction include, among others, uncertainty as to whether TSLX will further pursue, enter into or consummate a transaction on the terms set forth in its proposal or on other terms, uncertainty as to whether TICC’s board of directors will engage in good faith, substantive discussions or negotiations with TSLX concerning its proposal or any other possible transaction, potential adverse reactions or changes to business relationships resulting from the announcement or completion of a transaction, uncertainties as to the timing of a transaction, adverse effects on TSLX’s stock price resulting from the announcement or consummation of a transaction or any failure to complete a transaction, competitive responses to the announcement or consummation of a transaction, the risk that regulatory or other approvals and any financing required in connection with the consummation of a transaction are not obtained or are obtained subject to terms and conditions that are not anticipated, costs and difficulties related to a potential integration of TICC’s businesses and operations with TSLX’s businesses and operations, the inability to obtain, or delays in obtaining, cost savings and synergies from a transaction, unexpected costs, liabilities, charges or expenses resulting from a transaction, litigation relating to a transaction, the inability to retain key personnel, and any changes in general economic and/or industry specific conditions.

In addition to these factors, other factors that may affect TSLX’s plans, results or stock price are set forth in TSLX’s Annual Report on Form 10-K and in its reports on Forms 10-Q and 8-K.

Many of these factors are beyond TSLX’s control. TSLX cautions investors that any forward-looking statements made by TSLX are not guarantees of future performance. TSLX disclaims any obligation to update any such factors or to announce publicly the results of any revisions to any of the forward-looking statements to reflect future events or developments.

Third Party-Sourced Statements and Information

Certain statements and information included herein have been sourced from third parties. TSLX does not make any representations regarding the accuracy, completeness or timeliness of such third party statements or information. Except as expressly set forth herein, permission to cite such statements or information has neither been sought nor obtained from such third parties. Any such statements or information should not be viewed as an indication of support from such third parties for the views expressed herein. All information in this communication regarding TICC, including its businesses, operations and financial results, was obtained from public sources. While TSLX has no knowledge that any such information is inaccurate or incomplete, TSLX has not verified any of that information. TSLX reserves the right to change any of its opinions expressed herein at any time as it deems appropriate. TSLX disclaims any obligation to update the data, information or opinions contained herein.

Proxy Solicitation Information

In connection with TSLX’s solicitation of proxies for the 2016 annual meeting of TICC stockholders in favor of (a) the election of TSLX’s nominee to serve as a director of TICC and (b) TSLX’s proposal to terminate the Investment Advisory Agreement, dated as of July 1, 2011, by and between TICC and TICC Management, LLC, as contemplated by Section 15(a) of the Investment Company Act of 1940, as amended, TSLX filed an amended definitive proxy statement in connection therewith on Schedule 14A with the SEC on July 14, 2016 (the “TSLX Proxy Statement”). TSLX has commenced mailing the TSLX Proxy Statement and accompanying GOLD proxy card to stockholders of TICC. This communication is not a substitute for the TSLX Proxy Statement.

TSLX STRONGLY ADVISES ALL STOCKHOLDERS OF TICC TO READ THE TSLX PROXY STATEMENT AND THE OTHER PROXY MATERIALS AS THEY BECOME AVAILABLE BECAUSE THEY CONTAIN IMPORTANT INFORMATION. SUCH TSLX PROXY MATERIALS ARE AND WILL BECOME AVAILABLE AT NO CHARGE ON THE SEC’S WEB SITE AT HTTP://WWW.SEC.GOV AND ON TSLX’S WEBSITE AT HTTP://WWW.TPGSPECIALTYLENDING.COM. IN ADDITION, TSLX WILL PROVIDE COPIES OF THE TSLX PROXY STATEMENT WITHOUT CHARGE UPON REQUEST. REQUESTS FOR COPIES SHOULD BE DIRECTED TO TSLX’S PROXY SOLICITOR AT [email protected].

The participants in the solicitation are TSLX and T. Kelley Millet, and certain of TSLX’s directors and executive officers may also be deemed to be participants in the solicitation. As of the date hereof, TSLX beneficially owned 1,633,719 shares of common stock of TICC. As of the date hereof, Mr. Millet did not directly or indirectly beneficially own any shares of common stock of TICC.

Security holders may obtain information regarding the names, affiliations and interests of TSLX’s directors and executive officers in TSLX’s Annual Report on Form 10-K for the year ended December 31, 2015, which was filed with the SEC on February 24, 2016, its proxy statement for the 2016 annual meeting of TSLX stockholders, which was filed with the SEC on April 8, 2016, and certain of its Current Reports on Form 8-K. These documents can be obtained free of charge from the sources indicated above. Additional information regarding the interests of these participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, is available in the TSLX Proxy Statement and other relevant materials to be filed with the SEC (if and when available).

This document shall not constitute an offer to sell, buy or exchange or the solicitation of an offer to sell, buy or exchange any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Contacts

TPG Specialty Lending, Inc.

Investors

Lucy Lu

212-601-4753

or

Charlie Koons

MacKenzie Partners, Inc.

800-322-2885

or

Media

Luke Barrett

212-601-4752

or

Tom Johnson or Pat Tucker

Abernathy MacGregor

212-371-5999

[email protected] / [email protected]

TPG

SPECIALTY

LENDING

July 19, 2016

Fellow TICC Stockholders:

TICC Capital Corp. (“TICC” or the “Company”) has

a long history of underperformance, questionable governance and misalignment with the true owners of TICC – you, the stockholders.

It is likely you have

received, or will soon receive, phone calls from TICC’s management or their representatives trying to convince you to vote against our nominee and our proposal to terminate the existing adviser. Unfortunately, under Maryland law, TICC is not

obligated to provide us with stockholder data and so we cannot make similar calls. But, as TICC’s single largest stockholder, we would welcome the opportunity to speak directly with you. You can reach us by calling our proxy solicitor,

MacKenzie Partners, Inc., toll-free at (800) 322-2885 or by email at

[email protected]. Simply put, TICC’s management team has failed you, and now,

with our nominee and proposal being put before you, they are trying desperately to keep their jobs.

The time for change is now.

On behalf of TPG Specialty Lending, Inc. (“TSLX”), we urge you to vote today to terminate the investment advisory agreement between TICC and its external adviser and to

elect our highly qualified and independent nominee, T. Kelley Millet, to TICC’s Board of Directors.

It is your right as a stockholder to enact change at TICC.

VOTE THE ENCLOSED GOLD CARD NOW to protect your investment and end more than a decade of failure at TICC.

Stockholders have the right, under the Investment Company

Act of 1940, as amended, to terminate the external adviser’s contract at no cost to stockholders. DO NOT DELAY! Vote the enclosed GOLD CARD TODAY.

The status

quo is unacceptable and will only result in further deterioration in the value of your investment, so make your voice heard at the TICC Annual Meeting on September 2, 2016 by SIGNING AND RETURNING THE GOLD CARD TODAY.

Sincerely,

TPG Specialty Lending, Inc.

Joshua Easterly

Chairman and Co-Chief Executive Officer

Michael Fishman Co-Chief Executive Officer

PROTECT YOUR INVESTMENT. VOTE THE GOLD CARD TODAY

TO END A DECADE OF FAILURE AT TICC. YOUR VOTE COUNTS. VOTING INFORMATION CAN BE FOUND AT WWW.CHANGETICCNOW.COM

TPG

SPECIALTY

LENDING

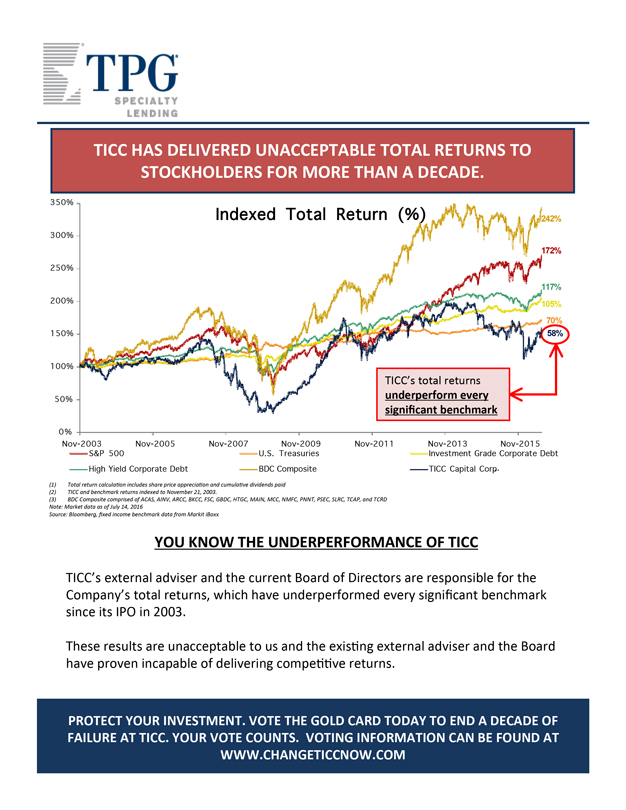

TICC HAS DELIVERED UNACCEPTABLE TOTAL RETURNS TO STOCKHOLDERS FOR MORE THAN A DECADE.

Indexed Total Return (%)

242%

172%

117%

105%

70%

58%

TICC’s total returns underperform every significant benchmark

350%

300%

250%

200%

150%

100%

50%

0%

Nov-2003 Nov-2005 Nov-2007 Nov-2009 Nov-2011 Nov-2013 Nov-2015

S&P 500

High Yield Corporate Debt

U.S. Treasuries

BDC Composite

Investment Grade Corporate Debt

TICC Capital Corp.

(1) Total return calculation includes share price appreciation and

cumulative dividends paid

(2) TICC and benchmark returns indexed to November 21, 2003.

(3) BDC Composite comprised of ACAS, AINV, ARCC, BKCC, FSC, GBDC, HTGC, MAIN, MCC, NMFC, PNNT, PSEC, SLRC, TCAP, and TCRD Note: Market data as of July 14, 2016

Source: Bloomberg, fixed income benchmark data from Markit iBoxx

YOU KNOW THE UNDERPERFORMANCE

OF TICC

TICC’s external adviser and the current Board of Directors are responsible for the Company’s total returns, which have underperformed every

significant benchmark since its IPO in 2003.

These results are unacceptable to us and the existing external adviser and the Board have proven incapable of

delivering competitive returns.

PROTECT YOUR INVESTMENT. VOTE THE GOLD CARD TODAY TO END A DECADE OF FAILURE AT TICC. YOUR VOTE COUNTS. VOTING INFORMATION CAN BE

FOUND AT WWW.CHANGETICCNOW.COM

TPG

SPECIALTY

LENDING

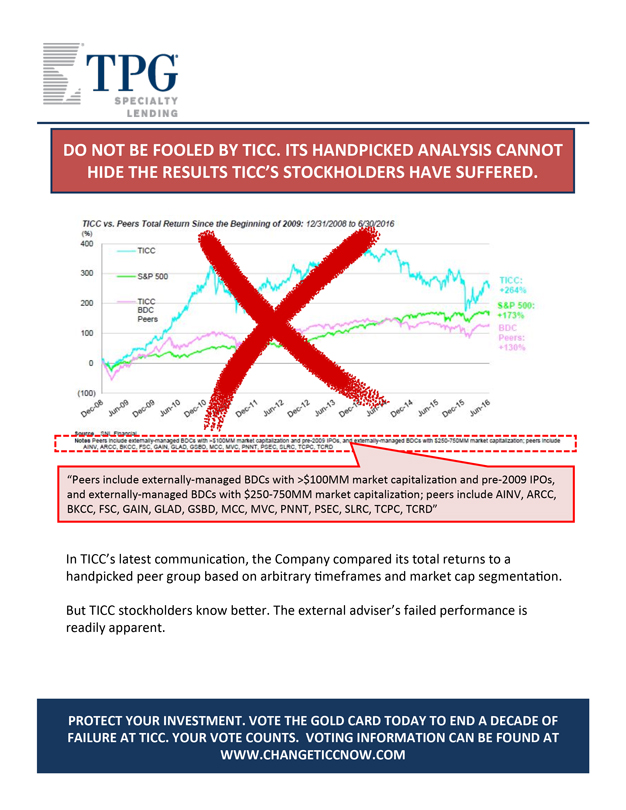

DO NOT BE FOOLED BY TICC. ITS HANDPICKED ANALYSIS CANNOT HIDE THE RESULTS TICC’S

STOCKHOLDERS HAVE SUFFERED.

TICC vs. Peers Total Return Since the Beginning of 2009: 12/31/2008 to 6/30/2016

TICC

S&P 500

TICC

BDC

Peers

TICC:

+264%

S&P 500: +173%

BDC

Peers:

+130%

(%)

400

300

200

100

0

(100)

Dec-08 Jun-09 Dec-09 Jun-10 Dec-10 Dec-11 Jun-12 Dec-12 Jun-13 Dec-13 Jun-14 Dec-14 Jun-15 Dec-15 Jun-16

Source SNI Financial

Notes Peers includes externally-managed BDCs with >$100MM market

capitalization and pre-2009 IPOs, and externally-managed BDCs with $250-750MM market capitalization; peers include AINV, ARCC, BKCC, FSC, GAIN, GLAD, GSBD, MCC, MVC, PNNT, PSEC, SLRC, TCPC, TCRD

“Peers include externally-managed BDCs with >$100MM market capitalization and pre-2009 IPOs, and externally-managed BDCs with $250-750MM market capitalization; peers

include AINV, ARCC, BKCC, FSC, GAIN, GLAD, GSBD, MCC, MVC, PNNT, PSEC, SLRC, TCPC, TCRD”

In TICC’s latest communication, the Company compared its total

returns to a handpicked peer group based on arbitrary timeframes and market cap segmentation.

But TICC stockholders know better. The external adviser’s failed

performance is readily apparent.

PROTECT YOUR INVESTMENT. VOTE THE GOLD CARD TODAY TO END A DECADE OF

FAILURE AT TICC. YOUR VOTE COUNTS. VOTING INFORMATION CAN BE FOUND AT

WWW.CHANGETICCNOW.COM

TPG

SPECIALTY

LENDING

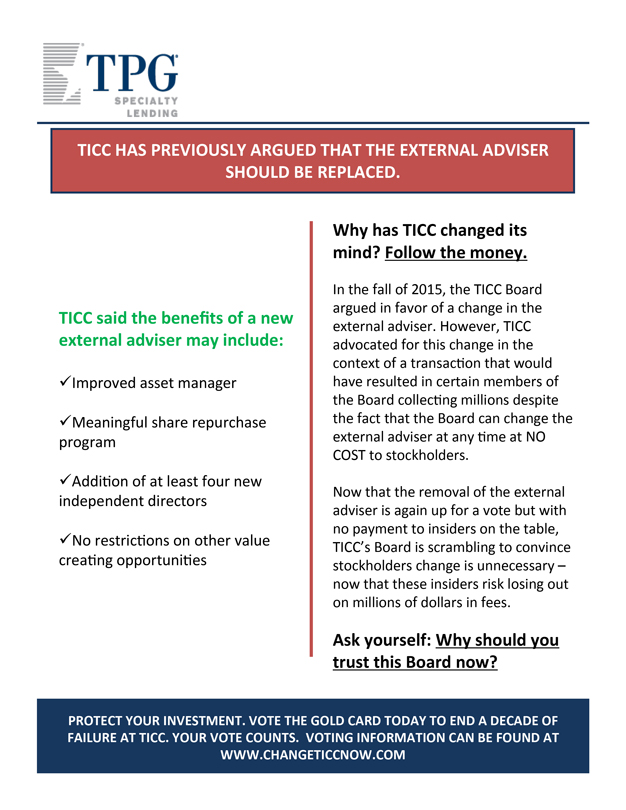

TICC HAS PREVIOUSLY ARGUED THAT THE EXTERNAL ADVISER SHOULD BE REPLACED.

TICC said the benefits of a new external adviser may include:

Improved asset manager

Meaningful share repurchase program

Addition of at least four new independent

directors

No restrictions on other value creating opportunities

Why has TICC

changed its mind? Follow the money.

In the fall of 2015, the TICC Board argued in favor of a change in the external adviser. However, TICC advocated for this

change in the context of a transaction that would have resulted in certain members of the Board collecting millions despite the fact that the Board can change the external adviser at any time at NO COST to stockholders.

Now that the removal of the external adviser is again up for a vote but with no payment to insiders on the table, TICC’s Board is scrambling to convince stockholders change is

unnecessary – now that these insiders risk losing out on millions of dollars in fees.

Ask yourself: Why should you trust this Board now?

PROTECT YOUR INVESTMENT. VOTE THE GOLD CARD TODAY TO END A DECADE OF FAILURE AT TICC. YOUR VOTE COUNTS. VOTING INFORMATION CAN BE FOUND AT WWW.CHANGETICCNOW.COM

TPG

SPECIALTY

LENDING

TICC’s BOARD IS SHOULD NOT BE TRUSTED; IT IS ONLY FOCUSED ON SELF PRESERVATION.

AT YOUR EXPENSE!

TICC Board’s questionable governance actions include:

X

Delaying the setting of its 2016 Annual Meeting beyond June for the first time in its history at a time when, for the first time in four years, insiders bought more than 1.8 million shares that can be voted to protect their personal interests

X Paying $141.4 million in management and incentive fees to its external adviser despite more than a decade of failed performance and notwithstanding its mandated

ANNUAL review process

X Not approving a share buyback program that would benefit all TICC stockholders despite a majority of the Board PERSONALLY buying TICC

shares

X Refusing to meaningfully engage with TSLX regarding its highly compelling offer to acquire TICC

X Likely violating federal securities law and intentionally misleading stockholders, as TICC and its management were found to have done by a federal judge

PROTECT YOUR INVESTMENT. VOTE THE GOLD CARD TODAY TO END A DECADE OF

FAILURE AT TICC. YOUR

VOTE COUNTS. VOTING INFORMATION CAN BE FOUND AT

WWW.CHANGETICCNOW.COM

TPG

SPECIALTY

LENDING

TERMINATING THE EXTERNAL ADVISER WILL GIVE STOCKHOLDERS THE OPPORTUNITY TO ACHIEVE

IMPROVED RETURNS.

THERE IS SIGNIFICANT INTEREST IN MANAGING TICC - At least three independent advisers have already expressed a willingness to manage TICC’s

assets to generate value for stockholders.

The TICC Board can mitigate any supposed risk it sees by:

1. Acting now to replace the external adviser; or

2. Liquidating the Company’s assets and

returning stockholders’ money

DO NOT allow TICC’s management to scare you into inaction - there are clear, viable options for TICC once the external

adviser contract has been terminated.

The status quo is not the solution.

PROTECT YOUR INVESTMENT. VOTE THE GOLD CARD TODAY TO END A DECADE OF FAILURE AT TICC. YOUR VOTE COUNTS. VOTING INFORMATION CAN BE FOUND AT WWW.CHANGETICCNOW.COM

TPG

SPECIALTY

LENDING

If you have any questions concerning this letter OR HOW TO VOTE, please call MacKenzie

Partners, Inc. at one of the phone numbers listed below.

105 Madison Avenue

New York, NY 10016

(212) 929-5500 (call collect) or

TOLL-FREE (800) 322-2885

[email protected]

About TPG Specialty Lending

TPG Specialty Lending, Inc. (“TSLX” or the

“Company”) is a specialty finance company focused on lending to middle-market companies. The Company seeks to generate current income primarily in U.S.-domiciled middle-market companies through direct originations of senior secured loans

and, to a lesser extent, originations of mezzanine loans and investments in corporate bonds and equity securities. The Company has elected to be regulated as a business development company, or BDC, under the Investment Company Act of 1940 and the

rules and regulations promulgated thereunder. TSLX is externally managed by TSL Advisers, LLC, a Securities and Exchange Commission registered investment adviser. TSLX leverages the deep investment, sector, and operating resources of TPG Special

Situations Partners, the dedicated special situations and credit platform of TPG, with approximately $16 billion of assets under management as of March 31, 2016, and the broader TPG platform, a global private investment firm with approximately $74

billion of assets under management as of March 31, 2016. For more information, visit the Company’s website at www.tpgspecialtylending.com.

Forward-Looking

Statements

Information set forth herein may contain forward-looking statements, including, but not limited to, statements with regard to the expected future

financial position, results of operations, cash flows, dividends, portfolio, financing plans, business strategy, budgets, capital expenditures, competitive positions, growth opportunities, plans and objectives of management of TICC Capital Corp.

(“TICC”), statements with regard to the expected future financial position, results of operations, cash flows, dividends, portfolio, financing plans, business strategy, budgets, capital expenditures, competitive positions, growth

opportunities, plans and objectives of management of TPG Specialty Lending, Inc. (“TSLX”), and statements with regard to TSLX’s proposed business combination transaction with TICC (including any

PROTECT YOUR INVESTMENT. VOTE THE GOLD CARD TODAY TO END A DECADE OF FAILURE AT TICC. YOUR VOTE COUNTS. VOTING INFORMATION CAN BE FOUND AT WWW.CHANGETICCNOW.COM

TPG

SPECIALTY

LENDING

financing required in connection with a possible transaction and the benefits,

results, effects and timing of a possible transaction). Statements set forth herein concerning the business outlook or future economic performance, anticipated profitability, revenues, expenses, dividends or other financial items, and product or

services line growth of TSLX, TICC and/or the combined businesses of TSLX and TICC, including, but not limited to, statements containing words such as anticipate,” “approximate,” “believe,” “plan,”

“estimate,” “expect,” “project,” “could,” “would,” “should,” “will,” “intend,” “may,” “potential,” “upside” and other similar expressions,

together with other statements that are not historical facts, are forward-looking statements that are estimates reflecting the best judgment of TSLX based upon currently available information.

Such forward-looking statements are inherently uncertain, and stockholders and other potential investors must recognize that actual results may differ materially from TSLX’s

expectations as a result of a variety of factors including, without limitation, those discussed below. Such forward-looking statements are based upon TSLX’s current expectations and include known and unknown risks, uncertainties and other

factors, many of which TSLX is unable to predict or control, that may cause TSLX’s plans with respect to TICC or the actual results or performance of TICC, TSLX or TICC and TSLX on a combined basis to differ materially from any plans, future

results or performance expressed or implied by such forward-looking statements. These statements involve risks, uncertainties and other factors discussed below and detailed from time to time in TSLX’s filings with the Securities and Exchange

Commission (“SEC”).

Risks and uncertainties related to a possible transaction include, among others, uncertainty as to whether TSLX will further pursue,

enter into or consummate a transaction on the terms set forth in its proposal or on other terms, uncertainty as to whether TICC’s board of directors will engage in good faith, substantive discussions or negotiations with TSLX concerning its

proposal or any other possible transaction, potential adverse reactions or changes to business relationships resulting from the announcement or completion of a transaction, uncertainties as to the timing of a transaction, adverse effects on

TSLX’s stock price resulting from the announcement or consummation of a transaction or any failure to complete a transaction, competitive responses to the announcement or consummation of a transaction, the risk that regulatory or other

approvals and any financing required in connection with the consummation of a transaction are not obtained or are obtained subject to terms and conditions that are not anticipated, costs and difficulties related to a potential integration of

TICC’s businesses and operations with TSLX’s businesses and operations, the inability to obtain, or delays in obtaining, cost savings and synergies from a transaction, unexpected costs, liabilities, charges or expenses resulting from a

transaction, litigation relating to a transaction, the inability to retain key personnel, and any changes in general economic and/or industry specific conditions.

In addition to these factors, other factors that may affect TSLX’s plans, results or stock price are set forth in TSLX’s Annual Report on Form 10-K and

in its reports on Forms 10-Q and 8-K.

Many of these factors are beyond TSLX’s control. TSLX cautions investors that any forward-looking statements made by

TSLX are not guarantees of future performance. TSLX disclaims any obligation to update any such factors or to announce publicly the results of any revisions to any of the forward-looking statements to reflect future events or developments.

Third Party-Sourced Statements and Information

Certain statements and

information included herein have been sourced from third parties. TSLX does not make any representations regarding the accuracy, completeness or timeliness of such third party statements or information. Except as expressly set forth herein,

permission to cite such statements or information has neither been sought nor obtained from such third parties. Any such statements or information should not be viewed as an indication of support from such third parties for the views expressed

herein.

PROTECT YOUR INVESTMENT. VOTE THE GOLD CARD TODAY TO END A DECADE OF FAILURE AT TICC. YOUR VOTE COUNTS. VOTING INFORMATION CAN BE FOUND AT

WWW.CHANGETICCNOW.COM

TPG

SPECIALTY

LENDING

All information in this communication regarding TICC, including its businesses,

operations and financial results, was obtained from public sources. While TSLX has no knowledge that any such information is inaccurate or incomplete, TSLX has not verified any of that information. TSLX reserves the right to change any of its

opinions expressed herein at any time as it deems appropriate. TSLX disclaims any obligation to update the data, information or opinions contained herein.

Proxy

Solicitation Information

In connection with TSLX’s solicitation of proxies for the 2016 annual meeting of TICC stockholders in favor of (a) the election

of TSLX’s nominee to serve as a director of TICC and (b) TSLX’s proposal to terminate the Investment Advisory Agreement, dated as of July 1, 2011, by and between TICC and TICC Management, LLC, as contemplated by

Section 15(a) of the Investment Company Act of 1940, as amended, TSLX filed an amended definitive proxy statement in connection therewith on Schedule 14A with the SEC on July 14, 2016 (the “TSLX Proxy Statement”). TSLX has

commenced mailing the TSLX Proxy Statement and accompanying GOLD proxy card to stockholders of TICC. This communication is not a substitute for the TSLX Proxy Statement.

TSLX STRONGLY ADVISES ALL STOCKHOLDERS OF TICC TO READ THE TSLX PROXY STATEMENT AND THE OTHER PROXY MATERIALS AS THEY BECOME AVAILABLE BECAUSE THEY CONTAIN IMPORTANT INFORMATION.

SUCH TSLX PROXY MATERIALS ARE AND WILL BECOME AVAILABLE AT NO CHARGE ON THE SEC’S WEB SITE AT HTTP://WWW.SEC.GOV AND ON TSLX’S WEBSITE AT HTTP://WWW.TPGSPECIALTYLENDING.COM. IN ADDITION, TSLX WILL PROVIDE COPIES OF THE TSLX PROXY STATEMENT

WITHOUT CHARGE UPON REQUEST. REQUESTS FOR COPIES SHOULD BE DIRECTED TO TSLX’S PROXY SOLICITOR AT [email protected].

The participants in the

solicitation are TSLX and T. Kelley Millet, and certain of TSLX’s directors and executive officers may also be deemed to be participants in the solicitation. As of the date hereof, TSLX beneficially owned 1,633,719 shares of common stock of

TICC. As of the date hereof, Mr. Millet did not directly or indirectly beneficially own any shares of common stock of TICC.

Security holders may obtain

information regarding the names, affiliations and interests of TSLX’s directors and executive officers in TSLX’s Annual Report on Form 10-K for the year ended December 31, 2015, which was filed with the SEC on February 24, 2016,

its proxy statement for the 2016 annual meeting of TSLX stockholders, which was filed with the SEC on April 8, 2016, and certain of its Current Reports on Form 8-K. These documents can be obtained free of charge from the sources indicated

above. Additional information regarding the interests of these participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, is available in the TSLX Proxy Statement and other

relevant materials to be filed with the SEC (if and when available).

This document shall not constitute an offer to sell, buy or exchange or the solicitation of an

offer to sell, buy or exchange any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such

jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

PROTECT YOUR INVESTMENT. VOTE THE GOLD CARD TODAY TO END A DECADE OF FAILURE AT TICC. YOUR VOTE COUNTS. VOTING INFORMATION CAN BE FOUND AT

WWW.CHANGETICCNOW.COM

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Åsa Vilsson new CFO at Elanders

- BitFuFu Files 2023 Annual Report on Form 20-F

- CTT Systems AB (publ.) - Interim Report First Quarter 2024

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share