Form DEFA14A ENDURANCE SPECIALTY HOLD

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

o Preliminary Proxy Statement

o Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

o Definitive Proxy Statement

o Definitive Additional Materials

x Soliciting Materials Pursuant to Section 240.14a-12

Endurance Specialty Holdings Ltd.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

x

|

No fee required.

|

|||

|

o

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11

|

|||

|

1)

|

Title of each class of securities to which the transaction applies:

|

|||

|

2)

|

Aggregate number of securities to which transaction applies:

|

|||

|

3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|||

|

4)

|

Proposed maximum aggregate value of transaction:

|

|||

|

5)

|

Total fee paid:

|

|||

|

o

|

Fee paid previously with preliminary materials

|

|||

|

o

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|||

|

1)

|

Amount Previously Paid:

|

|||

|

2)

|

Form, Schedule or Registration Statement No.:

|

|||

|

3)

|

Filing Party:

|

|||

|

4)

|

Date Filed:

|

|||

2

October 7, 2016

Acquisition of Endurance Specialty Holdings

1

2

Transaction Highlights

n Entered into a definitive agreement to acquire 100% of the outstanding ordinary shares of

Endurance Specialty Holdings Ltd

Endurance Specialty Holdings Ltd

n Unanimously recommended by the Board of Endurance

n Total consideration: $6,304mn, US$93 per share - 1.36x book value per share (1.53x Tangible

Book value)

Book value)

n Funded through excess cash on hand and debt (no equity financing related to the transaction)

n Timeline

* Expect to close the acquisition immediately after obtaining required regulatory approvals

Transaction Summary

1. Transaction Highlights

Approval by Endurance

shareholders

Dec. 2016-Jan. 2017

Jan. 2017 or later

Feb. 2017-Mar. 2017*

3

4

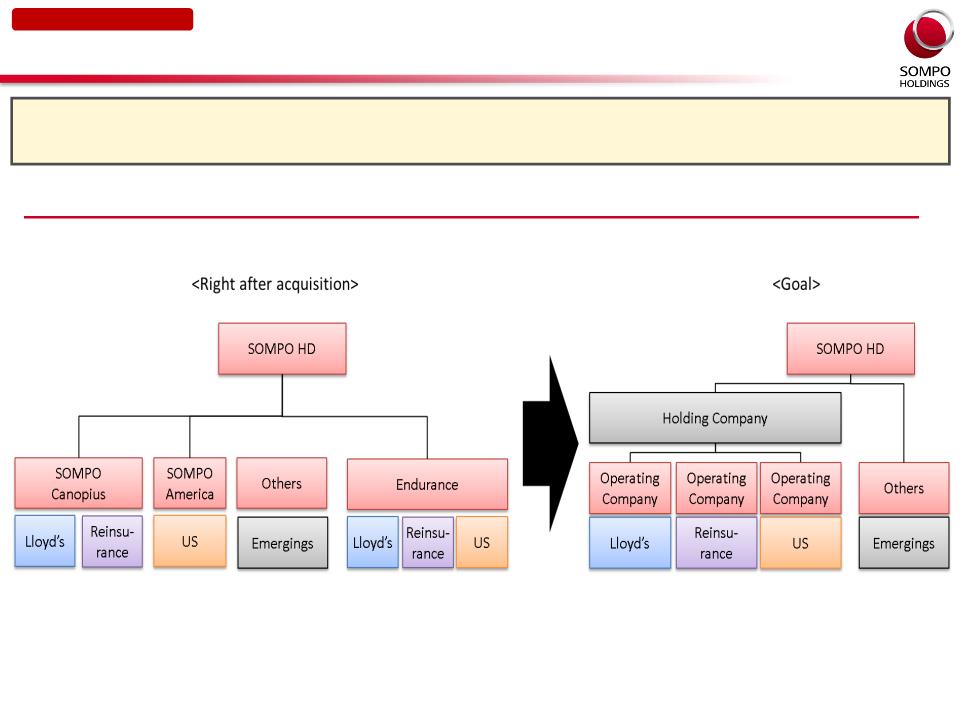

Establishing a truly integrated global insurance business platform

u By incorporating Endurance with our existing global operations, as well as considering to establish

an International Holding Company to realize further growth together as group members

an International Holding Company to realize further growth together as group members

Governance Structure for Overseas Business in the future

2. Strategic rationale

5

Global Geographical Diversification

u Expect further global geographical diversification due to the acquisition of an underwriting

business platform in North America

business platform in North America

* Premiums written are those underwritten only by the foreign subsidiaries, and therefore, don not include those underwritten abroad by Sompo Japan Nipponkoa

* Post-acquisition figure is the simple sum of Endurance’s company filings (FY2015 actual)

Premium Income by Region

JPY 78.3bn

JPY 22.0bn

JPY 219.2bn

North America

Latin America

JPY 68.6bn

JPY 131.6bn

Europe

Asia & Middle East

2. Strategic rationale

|

<Net Premiums and Net Income (Pro-forma, simple sum of SOMPO HD and Endurance for FY2015 actual)>

|

|||

|

|

SOMPO + Endurance

|

SOMPO

|

Endurance

|

|

Net Premiums

|

JPY 2,749.4 bn

|

JPY 2,552.2 bn

|

JPY 197.2 bn

|

|

(Overseas Business)

|

JPY 489.8 bn (18%)

|

JPY 292.6 bn (11%)

|

-

|

|

Adjusted consolidated profit*

|

JPY 195.8 bn

|

JPY 164.3 bn

|

JPY 31.5 bn

|

|

(Overseas Business)

|

JPY 51.9 bn (27%)

|

JPY 20.4 bn (12%)

|

-

|

|

*Endurance’s profit: available to Endurance's common shareholders, FX <USDJPY=101.12>

|

|||

6

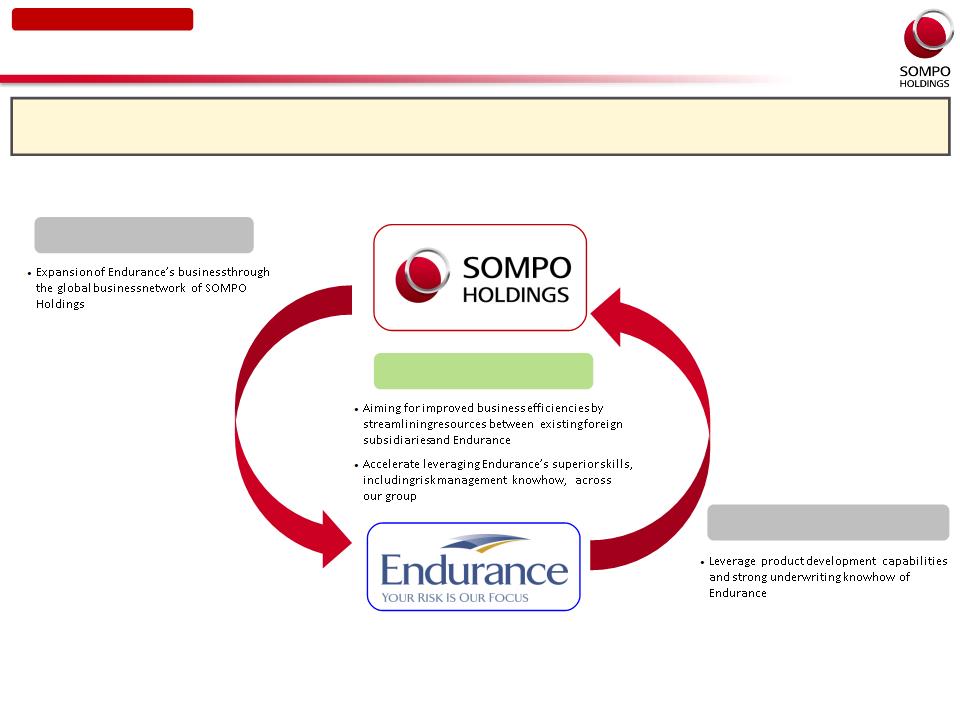

Combination of our strengths

u Mutually utilize strengths in underwriting, and pursue streamlining of resources

Leveraging underwriting

knowhow

knowhow

Utilize global network

• Offer Endurance’s products to customers of

SOMPO Holdings globally, including Japan

SOMPO Holdings globally, including Japan

Optimize resources

2. Strategic rationale

7

8

Endurance Specialty Holdings

Overview

p Founded: 2001

p Headquarters: Bermuda (listed on the NYSE)

p Representative (Chairman and CEO): John Charman

p Number of Employees*1 : 1,154

p Key Financials (US-GAAP)*1:

p Business: P&C (insurance and reinsurance)

p Credit ratings of main insurance subsidiaries:

|

Gross Premium

|

$3,321mn

|

|

|

Consolidated

Net Income |

$344mn

|

|

|

Market Cap

|

$4,263mn

|

|

|

S&P

|

A

|

|

Moody’s

|

A2

|

|

A.M. Best

|

A

|

*1 Figures disclosed by Endurance (FY2015)

3. About Endurance

9

Endurance Specialty Holdings

u Specialty insurance group with experienced management and underwriting excellence

n High growth profile and strong underwriting capabilities

• Proven high growth driven by experienced underwriters

• Strong expertise in areas such as D&O and Agriculture

n Stable profitability in reinsurance

• Development of a stable portfolio by reducing CAT risk and increasing new lines

• Acquired Montpelier*1 in 2015 and improved business efficiency through economies of scale

n Robust governance by best-in-class management

• CEO has a long and highly successful experience and track record the US and the European insurance space

• Diverse management team exemplifying sound governance

*1 Bermudian reinsurer also operating underwriting business in Lloyd’s

Strengths

3. About Endurance

10

Business Portfolio

u Business portfolio balanced in both insurance and reinsurance

u Recently focusing on specialty business in the US and primary underwriting in the UK

Breakdown of gross premiums (FY2015)

Insurance

$2.1bn (63%)

Reinsurance

$1.2bn (37%)

Agriculture 25%

• Only 17 companies are authorized by

the US government to sell the

products

the US government to sell the

products

• Compensates for the decrease of crop

yields or drop in market price, and

having relatively stable profitability

yields or drop in market price, and

having relatively stable profitability

• Ranks #5 in the US (mkt. share of c.8%)

Total $3.32 bn

(Geographical diversification)

|

US

|

64%

|

|

Bermuda

|

24%

|

|

Others

|

12%

|

Specialty (underwriting) 38%

• D&O, Cyber insurance 16%

• Professional lines 10%

• Property, Marine and Energy 12%

Specialty (reinsurance) 28%

CAT Reinsurance 9%

• Aviation, Marine and Energy 9%

• Professional lines 8%

• Liability, Workers’ Comp 5%

• Property 6%

3. About Endurance

11

Gross Premiums and Combined Ratio

u Achieved strong growth of gross premiums of 7.1%.*1 mainly in primary insurance, and kept

improving trend of combined ratio of 90.2%*1

improving trend of combined ratio of 90.2%*1

Historical Combined Ratio

Historical Gross Premiums

($mn)

CAGR:+7.1%

Expense

Ratio

Loss Ratio

Reinsurance

Insurance

Impacts of flood in Thailand, the Great East Japan

Earthquake, and earthquake in New Zealand etc.

Earthquake, and earthquake in New Zealand etc.

*1 Average figure over the last 10 years

10Y Avg.

90.2%*2

*2 Average figure excluding FY2011 is 87.7%

10Y Avg.

30.8%

10Y Avg.

59.4%

Reinsurance+0.2%

Insurance+15.3%

3. About Endurance

12

13

Key objectives

4. Summary

• To establish a truly integrated global insurance business platform with Endurance and

significantly accelerate the growth of our international business by leveraging their risk

management expertise and underwriting capabilities

significantly accelerate the growth of our international business by leveraging their risk

management expertise and underwriting capabilities

• To acquire a business platform in the US insurance market, which is the largest in the world,

and where there is stable growth, as well as achieve global diversification in our business

portfolio

and where there is stable growth, as well as achieve global diversification in our business

portfolio

• Most importantly, to welcome Endurance’s experienced management team led by Mr.

Charman to the SOMPO group, and to achieve the transformation and growth of our

international business together.

Charman to the SOMPO group, and to achieve the transformation and growth of our

international business together.

14

October 7, 2016

Acquisition of Endurance Specialty Holdings

15

Sompo Holdings, Inc.

Overview

p Founded: 1888

p Headquarters: Tokyo, Japan (listed on the TSE)

p Representative (President and Chief Executive): Kengo Sakurada

p Number of Employees: 78,000

p Key Financials:

p Business:P&C (insurance & reinsurance), Life insurance, Nursing care & Health care, Asset management

p Credit ratings of main insurance subsidiaries:

|

Gross Premium

|

JPY 2,489bil

|

( c.a. $24.1bn)

|

|

Consolidated

Net Income |

JPY 164bil

|

(c.a. $1,592m)

|

|

Market Cap

|

JPY 1,231bil

|

(c.a. $11.9bn)

|

|

S&P

|

A+

|

|

Moody’s

|

A1

|

|

A.M. Best

|

A+

|

Note Regarding Forward-looking Statements

The forecasts included in this document are based on currently available information and certain

assumptions that we believe reasonable. Accordingly, the actual results may differ materially from

those projected herein depending on various factors.

The forecasts included in this document are based on currently available information and certain

assumptions that we believe reasonable. Accordingly, the actual results may differ materially from

those projected herein depending on various factors.

Sompo Holdings, Inc.

Newgate Communications (PR adviser to Sompo)

Telephone : +44 (0) 20 7680 6500

E-Mail : [email protected]

Web : http://www.sompo-hd.com/

【Contacts】

transcription of

SOM_20161007edit_01

Transcript at 7 October 2016

Recording date unknown

Transcription carried out by Knockhundred Translations Ltd, Bearwood, Leominster HR6 9EF

Company number 06531425 VAT number 900 7855 30

|

NOTE:

|

|

[INDISCERNIBLE + time code] = when even a best guess cannot be made.

|

|

[SL + time code] = “Sounds Like” - transcriptionist’s “best guess” at what has been said.

|

|

[00:05:00] = Time code markers every 5 minutes (or closest appropriate point).

|

|

This transcription has been made in good faith as a true and accurate representation of the audio recording supplied for transcription. No liability shall be accepted for inadvertent errors made as a consequence of the original recording quality.

|

1

|

KEY

|

||

|

KS:

|

Kengo Sakurada, CEO, Sompo Holdings Inc.

|

|

|

JC:

|

John Charman, CEO and Chairman, Endurance Inc.

|

|

|

NF:

|

Nigel Frudd, Executive Officer, Sompo Holdings Inc.

|

|

|

CS:

|

Catrin Shi, Insurance Insider

|

|

|

RH:

|

Ryan Hewlett, POST

|

|

|

AM:

|

Adam McNestrie, Insurance Insider

|

|

|

MF:

|

Michael Faulkner, Insurance Day

|

|

|

OR:

|

Oliver Ralph, Financial Times

|

|

|

AL:

|

Adrian Ladbury, Commercial Risk Europe

|

|

[00:00:00]

KS: Sompo Holdings, CEO, and actually I think I could speak English a little bit better, in better conversation if there is no jet lag. Allow me to use a little bit shaky English, but I tried to explain to you as much as possible, from the bottom of my heart, and I have my great colleagues next to me, John and Nigel and I will rely upon their native English.

JC: of sorts.

KS: Anyway, joking aside, I would like to go through the points of the transaction. Let me take you through the potential highlights first, yes, Sompo Holdings has entered into an agreement to acquire 100% of Endurance Holdings Limited and this is a deal which has been unanimously agreed by the Board of Endurance. The total consideration for transaction is $6.3 billion at $93 per share which represents a multiple of 1.36 times book value per share. The acquisition will be funded through our existing cash resources and in terms of timing for this deal, we need to get approval from Endurance shareholders naturally at their shareholders meeting, to be expected by the end of this year. We also need to get relevant regulatory approvals. We hope to complete all of these processes between February and March next year.

The strategic rationale for the transaction is firstly, global diversification via a truly global integrative structure. We have the aspiration to build the first truly global integrated insurance business which will be transformational for the group and I would say that this is the first challenge for most of the global financial institutions. What do we do for this truly global integrity insurers or governance structure? I will talk about that later together with John.

Next, yes, acquiring Endurance gives us a business platform in the largest insurance market in the world. That means the US. And there is an abundance of experience and operating excellence which can benefit from across our group. This move also accelerates our ability to achieve growth from our overseas business and the acquisition of Endurance will increase our income from overseas operations from 12% to almost 30%, or to be more specific, 27% of total income.

Next, secondly, good strategic fit, a combination of our strengths. Together we will neutrally utilize our strengths and pursue streamlining of resources, we can utilize Endurance’s superior skills including underwriting and risk management knowhow across the entire group, they are particularly good at ERM.

Lastly, acquisition of the skill and talent. This is, I would say, the most important point of this succession. By welcoming Endurance’s experienced management team led by John Sherman, the CEO, as well as underwriters with sophisticated underwriting capabilities we will be able to further expand our footprint and earnings growth. We agreed with the management team of Endurance, including John of course, that they will continue to manage the business for at least five years after the acquisition.

[00:04:43]

2

I would now like to give you an overview of Endurance business what we are acquiring. Endurance was founded in 2001 as you know, and has headquarters in Bermuda and is listed on the NICE with a market cap of approximately $4.3 billion, a Chairman and CEO as mentioned is Mr Sherman who is with me today to guide me. The business has more than 110 employees and its key financial metrics are a gross premium of $3.3 billion for the fiscal year 2015 and a consolidate net income of $344 million. Endurance business operations are focused on the insurance and re-insurance in the US.

So what exactly are we acquiring in this operation? Endurance is a specialty insurance group with experience of management and underwriters excellence, and this transaction enables us to establish a truly integrated global insurance business, but the key attributes that have made this business attractive to ourselves, are many, but among many, in summary we are acquiring a business with a high growth profile and strong underwriting capabilities, a business which has demonstrated stable profitability in the regions market, a business with robust covenants in place and operated by best in class management.

Next, the business portfolio is balanced, as you can see from the pie chart, between the insurance and re-insurance markets. It has recently been focusing on specialty business in the US and primary underwriting in the UK rather than re-insurance. The insurance business accounted for £2.1 billion and the re-insurance business accounted for $1.2 billion in gross premium written in 2015 fiscal year. The geographical split of these premiums is 64% from the US, 22% from Bermuda with a remaining 12% coming from other countries, especially in the UK and Netherlands.

Next, Endurance has achieved strong growth with a CAGR of over 7% from 2006 to 2015 in growth premium. Additionally, it has managed a 10-year average combined ratio of 19.2% which is excellent and in particular, has shown steady and consistent improvement over the past four years. In conclusion, through this acquisition our aim is to 1) To establish a truly integrated global insurance business platform with Endurance and significantly accelerate the growth of our international business by utilizing their risk management expertise and underwriting capabilities. Secondly, to acquire business platforms in the US insurance market which is the largest in the world of course, and there is stable growth as well as achieve global diversification in our business portfolio, and lastly, and most importantly, it is to welcome Endurance’s experienced management team led by Mr. Sherman to the family, and to achieve the transformation and growth of our international business together, and with that, I would like to turn it over to Mr John Sherman, CEO of Endurance.

JC: Good morning ladies and gentleman. Forgive me, Nigel, can I have some water, forgive my croaky voice, we have been on aero planes far too long over the last week or so. Thank you [INDISCERNIBLE 00:09:13], I am most honored and very pleased to be here with you today. To follow on your remarks I would like to speak briefly about what this transaction means for Endurance and why we are all very excited about our future together. Sompo is a large, well capitalized and highly respected global insurance carrier. As a trading partner with Endurance for several years, we highly respect Sompo’s disciplined risk management practices and underwriting culture. Most importantly we share common values including a commitment to loyalty, integrity and exceptional client service.

[00:10:00]

This transaction marks the beginning of an exciting new chapter in our company’s journey. Endurance’s clients will benefit from our increased scale, better financial strength ratings and a larger balance sheet. While we work with Sompo to expand their geographic footprint and enhance their presence in the international markets. This expansion will present new opportunities for all of our employees, to bring their skills within a much bigger, and stronger, organization. Aligning with Sompo is a uniquely compelling opportunity to accelerate Endurance’s strategic growth trajectory while providing an immediate and highly attractive cash premium to our shareholders. Sitting here today I can say that I believe strongly in our shared vision of future

3

growth for Sompo’s international platform, and that is why I have personally committed to lead this development for the next five years alongside Endurance’s current executive leadership team. This is certainly a historic step for Endurance as a company and by working closely together with Sompo in the months and years to come. I believe we will be strongly positioned to achieve our ambitious plans for growth, and with that, I would like to turn it back to our host so we can proceed with the Q and A. Thank you.

KS: So can I welcome any questions please?

AL: Yes, thank you, hello, thank you very much for the invite here, congratulations on the deal. A very big and obvious question for you Sir, why have you decided to take your next big step of expansion, which completely makes sense obviously, why have you decided to focus on such a mature, competitive and potentially saturated market such as North America? I can understand why and how Endurance has done well over the years, with a specialty approach in that market, but why did you not decide to expand significantly further in Asia, Africa or the Middle East for example.

KS: A very good question, number wise, I would like to explain to you firstly the objective situation that is inevitable, in Japan for instance, the insurance particularly and whether you are talking about P and C or life, it’s a function of population, so if you take a look at population, movement or prospects in the next 10 years, you know that there is no robust growth in terms of numbers and market. At the same time, there are many opportunities in other industries in Japan, such as nursing and caring, and that is going to be double for the next ten years as I said the last time here. We need engine for growth, for us to grow in other markets as well, and for us to earn the fund capital to grow in the other market we need a professional and sound engine for growth outside Japan. If you take a look outside Japan there are many excellent companies of course, but as far as the market is concerned, still 70% of P and C market are occupied in the growth countries although in terms of growth speed, or speed of growth, you would say we should be in Asia, and we are in, but again in terms of the absolute size of the revenue or profit generated there in the market, it’s by far larger in the country, among which the US is the largest and for the next, I would say, 10 years, our estimate is that the US market will itself expand 1.4% for the next 10 years which is lucrative.

[00:15:00]

And as you correctly said, it does not necessarily mean we will be winning there, but what has come to specialty insurance where John’s company is very excelling and good at, there are many, many chances we can win there, but if you want to go from the B to C market, like automobile insurance, fire insurance, you can’t do that, so I won’t do that.

JC: But may I say a few words as well? I am not sure I agree with your characterization about the American market being mature, there are many mature, large insurance and re-insurance companies practicing in the US market place, what opportunity we have, as a relatively new entrant, is to be a highly efficient, extremely well focused integrated insurance and re-insurance carrier, providing modern solutions to a client base that is competing in a fiercely competitive market place. I believe we will be so much better strategically positioned at a time when many companies are facing problems in the US, one only has to look at AIG, that presents it’s not just what we do, it’s what is happening around us, and that presents enormous opportunity for us, as a fully integrated, strong, well-capitalized, well rated company.

AL: I had a recent chat with Greg O’Connor who has just taken over Berkshire Hathaway, a new operation in Europe that is very interesting, a very exciting model and one that doesn’t have any of the baggage that AIG, dare I add Zurich have, particularly in the global corporate and specialist market. So he presents a very compelling case for how that capital, and that minimal expertise at a much lower cost can be brought to bear with the complex emerging risk. How do you retain that entrepreneurial spirit ability to keep your cost level down, and make a decent return in the same way now that you are part of this huge…?

4

JC: In the same way that I have done it for 45 years. You know, we have much broader skill sets than the company you just mentioned. Those skill sets are invaluable to our clients in finding solutions for them. These are very experienced underwriters with specialist skill sets. The average experience of our underwriters in America is over 20 years, each and every one of them. And they want to be part of an underwriting business, they want to be part of a strong, vibrant growing business that is relevant to its client base. And they want to be part of a successful organization. That is why we differentiate ourselves. But we differentiate ourselves also by being a completely integrated underwriting business. Regardless of where the geographies are, we make the right decisions, in the right geographies, with the right skill sets.

SP 4: [INDISCERNIBLE 00:18:39] from the Insurance Insider, would you be able to put a figure on the kind of synergies that you will be able to achieve in this merger?

KS: Well, in the first place I don’t think we should pursue so called synergies in terms of numbers, I mean particularly in terms of costs, because as we have been discussing so long about what would be the vision, or the plan for us, and my understanding, maybe that could be shared with him, is that for us to grow we need more capital, and when I say capital I mean money capital and human capital. Of course there are different set of people skills that may be required depending on where you go, where you are, and when it comes to the US market its export. So maybe the two entire people, I would say all the staff of the entire group would be closely looked at and evaluated and will be re-deployed if there are better places to go within our group. So when I say synergy, it mostly comes from financial synergy which is say for instance, at less cost we can deploy our investment in a better place because of the size, there are the synergies I am looking at.

[00:20:30]

JC: Yes, and I think that the vision that [INDISCERNIBLE 00:20:33] and I have, is very clear in the fact that we recognized that individually our businesses were strong, but when we put them together the future is much, much better for us as a combined business with the combined skill sets that are embedded in each of the businesses.

AM: Adam McNestrie from the Insurance Insider. I wanted to ask a little bit about the opportunities that this opens for growth, both for [INDISCERNIBLE 00:21:11] and Endurance, it would be useful I suppose if you could put some, potentially some numbers around the potential organic growth for the international operations of Sompo and also talk a little bit about the opportunities that there might be for Endurance to be a vehicle for further acquisitions.

KS: As far as numbers are concerned, without Endurance our revenue and profit, in particular profit from overseas operations will be around 200 and something in 2018, that may be increased organically to 20 or something million US, but on top of that we will be able to add at least 400 million, that means eventually, and in the final year, that is the final year of the current mid-term plan, the total revenue, our total profit from overseas businesses will be around at least 700 million or something, or depending on his…

JC: Whatever you say.

SP1: One billion could not be impossible, and you are asking me how do I do that?

AM: I suppose what I am interested in, is there are pro-forma numbers essentially where you fold insurance in and you look at that, I suppose I am interested in looking forward maybe three to five years and saying what more could Endurance do as a consequence or benefit of being part of Sompo.

JC: Yes, perhaps I can answer this for you, well, we don’t give forward guidance, but what I can do is point very clearly to what we have achieved over the last three years with Endurance which is a

5

substantial expansion during the period of time I have been CEO and Chairman, of the underwriting skill sets, the products that we sell to our client base as well as the geographies that we operate within, and we have been growing our non-agricultural premium by between 30% and 40% a year. We have been investing heavily in staff and new skill sets. I can just point you Adam to Michael Chang and his group that now number over 40 senior people that we have employed in the last 7 months, that is what we call a large commercial, vertical insurance business. It supplies a range of products to major white collar businesses in the US. Chubb was very famous for its personal lines policies because as a householder, Chubb would offer property protection, liability protection, auto protection, all sorts of different coverages in one policy. They also did the same commercial business. The Head of that business joined us at the end of February and that business will become a very substantial part of our growth engine because there are very, very few people in the US that are capable of delivering that product to their clients. There are only three or four companies that have that capability. There is a perfect example of growth that is not yet within Endurance, because we have only just started, but within three to five years will be a $500 million business, just out of that very unit. So by the end of this year we will have over 100 people in that unit, that is just one example of our capability to substantially grow our presence in the US in the specialty business.

[00:25:21]

AM: And is another M&A transaction a major one potentially contemplated via Endurance as well in the next say, three to five years?

KS: Well, at this moment I think we should focus on this transaction but the reason why we should more focus on this transaction is because we want to seek better chance for father M and A, if that is possible. And we repeatedly use timing over the world as fully or truly global integrated company or group. That means for instance we will integrate in terms of capital, in terms of people, when I say people it’s not people working in the US, it’s not the people working overseas, it’s the people working all over the world. That means Japanese staff would be sent to his company, his company will send his staff to us, for better experience and larger opportunities and thirdly, as far as digital strategy is concerned, I think we have a lot of things that we could assist his company. These are the truly integrated, you can see anybody anywhere, it’s not geographical demarcation.

JC: Absolutely, and [INDISCERNIBLE 00:27:00] and I have been preaching over the last few days that whilst the international business will be independent, it will be completely integrated within Sompo.

KS: If you take a look at page four of our chart, you will see that structural concepts of how we are going to be integrated, right now we have structure like you have on the left side going to the right side, and the point is we are discussing to establish a holding company to manage control, operating company and operating lawyers and the insurance in the US and this does not necessarily mean only overseas companies. It may include Japanese subsidiaries as well, and in this holding company subject to the approval of my Board, will be controlled, managed by very, very limited people, maybe for instance three to make sure that a decision will be taken, and the right timing, and I am thinking this company will be headed by John, and the other two, among the three the other two will be sent from the Sompo side, whom I am still thinking, but two plus one will be good enough. This is very important because this company, the holding company is not one to poke their nose into the nitty gritty things of each operation, but overseas and direct, broad direction and make sure that integration is taking place, that is why there is no need for us to have more than three people when we have him.

JC: Thank you.

MF: Michael Faulkner from Insurance Day, good morning, over what sort of time frame do you envisage the integration? I know there have been some other mergers involving Japanese businesses and international businesses they have taken some years to combine for instance

6

Tokyo Marine and Kiln took a few years to integrate into the European Business of Tokyo Marine and Kiln, do you envisage something that is going to happen a lot quicker than that?

[00:29:50]

KS: I am not aware of how long they have taken for final, I mean merger or whatever, integration, but our idea is completely different. It started from the vision that we can share with him. A vision is not something you can be asked. Vision is something you have to talk, you have to show, you have to explain to your staff in a complete manner, and we decided, and it just so happened that we talked in the same way. You may think that our character may be different but unfortunately we are quite the same.

AL: That sounds like a problem.

KS: Thank you very much for the comment. But joking aside, we started from that, so what we are going to do is to send, as soon as possible, a message to our clients for their employees that we are in the same vision and philosophy and any, there could be controversial points that may arise in the future but any points that is controversial should be settled between the two of us with this lawyer. So to answer your question, it should be much sooner than that. Agility doesn’t matter.

JC: Yes, and Michael I think that we obviously for all of the reasons just mentioned, we would wish to make it as speedy an integration as possible to bring certainty for our clients and our staff, and it is, why this transaction is also unique because previous transactions by other companies have essentially had subsidiaries that have been left alone, this is a completely integrated solution that [INDISCERNIBLE 00:32:09] and I have created, and I would just like to make the point that Endurance was not for sale. Sompo has been a very valued trading partner of Endurance for many years. What happened was that in our discussions, we realized that we had a very strong common view of the future, and that we were better suited as business partners than remaining separate.

OR: Oliver Ralph from the Financial Times. Just to go back to a question someone raised earlier about your future clients, you have spoken in the past about wanting to increase the overseas exposure of Sompo which this transaction obviously does, are you happy now with the balance of Sompo as a group? Or do you see this new holding company and this acquisition as a platform for making further acquisitions outside of Japan?

KS: Well, the answer is absolutely yes, I am quite happy.

OR: You are quite happy with the balance?

KS: Yes. You are saying that, you know, in terms of the profit share, overseas share, out of all 30% is not good enough. I am going to increase it to probably 50% and that does not necessarily mean a nationality balance of the presentation. Truly globally integrated company/group does not have any quota in terms of nationality, it should be valued only on merit, and that is a very important point that I am going to bring back to Japan, to give them a good stimulus and educate them to become a truly global insurance company because you know, our Sompo Group has already 76,000 staff, and out of those 76,000 almost 7,000 are non-Japanese, but I don’t think they are sufficiently incorporated or sufficiently integrated and that has to be pushed towards the integration, this is a bi-product, I think this could be the bi-product of this transaction.

[00:35:04]

OR: Integrated in what way?

KS: Movement of people and the definition of the people by skills, not by numbers, not by age. Surprisingly you may, and there is still not sufficiently designed job description based system in

7

Japan, not yet, but that will hinder the further growth or globalization. That is something that I would like to introduce.

AL: Sorry, I don’t think I told you who I was, Adrian Ladbury from Commercial Risk Europe. Global programs, a massive growth market in the large corporate sector in particular, are you now going to be in a position to very quickly take on the likes of Zurich, AIG as they struggle a bit and offer fully integrated global programs and service all over the world? Or would you retain a more specialty focus.

JC: That is one of the great strategic benefits that comes from this transaction in the fact that the business that I just described to Adam, in that the virtualization of commercial products in the US can be very quickly expanded internationally now because we have the skill set, we just did not have the licenses globally. Sompo have licenses throughout the world that are really not used, they are used as service for Sompo’s major Japanese clients. We can over the next three to five years, rapidly expand our footprint globally, but very efficiently, in a way that the more mature businesses are currently established and you mentioned that some of those are having problems and will continue to have problems, especially in a low interest rate environment, so again it is a wonderful opportunity for us to bring our skill sets within the Sompo infrastructure and the organization and the combination of the two will create substantial opportunity.

AL: So for a corporate risk manager this is fantastic news.

KS: I can’t name the individual company but our customers include all gigantic car manufacturers operating globally and most electric companies. All of these companies are there by may not be fully staffed in terms of expertise, of better programs or whatever, that is the first thing we have to do and it’s quite promising.

JC: That is why my people are very, very excited about this transaction because of the opportunity they have to become much stronger, much more international in their outlook.

KS: And the same applies to the people in our business I think, there are many people I think and he will decide and we will decide.

CS: Thank you, I just wondered if you could explain slide 4 which shows the new company structure, a bit better, or for me to understand it a bit better, from looking at this diagram can I assume then that some of the operations of Sompo Commercial and America are going to be merged with Endurance and then I guess you are operating three different companies within that, and if so is there not any business overlaps there which are…

KS: Sorry, I missed the last part.

CS: Sorry, is there any business overlaps there when you are merging the three companies together and so them by Lloyds for instance in the US?

KS: Basically the answer is yes, but the time frame is still to be decided because that is, again, whether that is for the customer is the first criteria of course, and the second, do we have the right person, right mix of skills there? And if that is the case, we will choose to integrate through a merger or whatever, but timing still has to be considered and directions, yes.

[00:40:14]

CS: Okay, and then Mr Charman is going to be at the head of his own holding company?

KS: Yes, he may not poke his nose in details. He knows everything but…

JC: No, no, no.

8

KS: Because his role, as well as mine, is to educate and find out a good person to be a possible successor to the Executives, current Executives. If everybody relies on him they are not going to do anything, like parents to educate their children, right?

JC: Absolutely.

KS: He is a very big father.

AL: I actually just wanted to follow up on that point, so Sompo Canopius, from what I understand it employs something like 600 people, and it has well over $1 billion of business, I am trying to think about the different component pieces of that, you have got Sompo Canopius Re which is a re-insurance brand, you have also got a massive Lloyds syndicate and there is a cross over between those, do you have a strong sense of how those entities will be merged and integrated? And is that a case of folding Sompo Canopius into Endurance or is it a case of bringing those together in a way that makes sense I mean for example in London, Endurance rides what John, $300 or $400 million of business perhaps and I don’t know, Sompo Canopius’s stamp capacity maybe £900 million, so you have a bigger and more established business there, I was wondering if you could give me any more colour to try and understand how you are likely to approach that?

KS: Maybe Nigel or John would be able to answer the question in a complete manner, but my understanding is that as far as overlapping concern, overlapping of portfolio concern there is little, there is little, and we are dealing with, Sompo Canopius is dealing with the B to C business a little, automobile insurance and property, and that is something we have to think about what to do. Again, as I told you, if our transaction for this M and A causes any damage to our Sompo Canopius in terms of clients for us, secondly in terms of excellent people, let’s stop, there is no point in doing that right? And we firmly agree that we should do it carefully to make sure that the right people are protected, retained, particularly for the sake of our customers.

JC: Yeah, it would be pretty stupid of us to destroy value, and both businesses are actually quite complementary and so we will work in the months ahead to find the best and the most efficient way of creating an even stronger business out of the two businesses for the future.

NF: So the earlier question about synergies, the pricing is heavily dependent on synergies, there are some obvious synergies which are achieved in capital, in syndicates, one pot of capital rather than two pots of capital, but there is no synergy budget for putting the two Lloyds businesses together, it wasn’t predicated on that basis because of the lack of overlap and the complementary skills.

MF: A couple of questions, one, has any decision been made yet on the branding? Will Endurance become the overall international brand and the other brand such as Sompo Canopious would disappear and be subsumed under the insurance brand? And secondly, I think enterprise risk management expertise that Endurance has, I think that has been mentioned in some of the presentations that that is an area where Sompo can benefit from, I wonder if you can give any colour on that sort of area? What that might mean for the business? How you seek to use it and what sort of benefits you will obtain?

[00:44:56]

KS: Well, branding is a very sensitive and touchy issue, so I don’t think I should be so concrete or specific about that, but my thinking, my dream I would say is to use the word Sompo as long and big and wide as possible and as you know, we have Sompo in Sweden and I know one of the very senior persons there, and we have settled and reached an agreement, a rule about how to use the name of Sompo, whereas they have used Sompo, joking, let’s joke there, what happens is we got merged? This is the thing, so we exchange with them, so we are in a very good situation, there are no hostile relations between Sompo and Sampo. Now having said that, I would like to use the Sompo as long as possible. Now whether we should retain Endurance or Canopius is something

9

we have to decide, but it could be Sompo something, and that something could be different from the existing one, so we will decide.

JC: And I am very clear about the fact that on the day of closing we become employees and colleagues within Sompo.

KS: And the second question is very important, and that I think is one of the most important points. ERM is a system, a computer system created by the people and expertise, and frankly speaking, honestly speaking they are number two in terms of rating by S and P which is strong, very strong, and we are one notch below Endurance, that means there should be a lot of things that we could add and by doing that maybe we could find surplus capital that could be re-deployed to new areas, for him and for us.

MF: So does that mean utilizing the modelling expertise that Endurance may have that Sompo…

JC: Absolutely, and that is why the integration of our two businesses, the speedy integration of our two businesses is desirable from every aspect, and the skill sets that we can bring through our risk management, our analytics, our practice, with highly complex risk, but we have been dealing, and we have the expertise to do that business, and we have had that for many, many years, and through this integration, that information, that experience will be shared immediately, there will be no walls or barriers between us.

AL: Sorry, I have got a lot of questions, the re-insurance market obviously under pressure, we have just come back from Monte Carlo…

JC: I wondered where you got your tan.

AL: That was last week as well, the risk managers, they were talking about it as well, so the market is going through this big transformation, what is the future for your re-insurance business? I mean do you embrace the new world in terms of signing up obviously as you do already to an extent with the capital markets, and B, the digital revolution, the risk managers last week at the conference were talking about okay, it’s all very well telematics and all this wonderful digital technology for motor and household, but how about bringing this to the corporate market? How about delivering an insurance policy on time for once? How about actually paying the claim within hours rather than years? Do you see a huge opportunity A) in the re-insurance market, B) in the digital revolution or do you see it as…

KS: The first question will be left to you.

[00:49:38]

JC: Well firstly there are a lot of mature re-insurance companies in the world that are inefficient, have really not provided the products that their market really needs and I still strongly believe in the future of the re-insurance market place that capital ranges from traditional capital to third party capital, I was at a conference in Canada last week when I was asked the same question and the reason why traditional re-insurance is valued so much is because of the long standing relationship that there is between a re-insurer and the client, and that can be covering multiple types of business. The third party capital vehicles tend to issue re-insurance policies that are either black, or they are white, and there are no grey areas. In our industry, claims often have grey areas. Those third party capital vehicles legally are not allowed to settle within those grey areas. When you have a long standing relationship with a client over many products and over many years, that allows a set of negotiations to take place properly between the client and the re-insurer, so that is one of the great strengths that I do not see changing but what we have to do is to adapt to the ever changing global environment that we are trading in. It is highly competitive. This is the fourth business cycle in my career that I have been through. Each cycle has become more aggressive and much more challenging but we have always emerged from these cycles to become more efficient, much more focused, much more cost effective and more valuable to our clients. Just to

10

finish up on the re-insurance side is that running an insurance and re-insurance business internationally is very useful because there are some countries where we would not wish to be an insurer, there are other countries where we would not wish to be a re-insurer, but there are other countries we wish to be both. It gives us a great deal of flexibility. Think about us as portfolio risk managers being able to flex according to the market conditions in the different geographies and what our clients need us to be able to provide them with. That gives us huge flexibility, especially as an integrated business and I will let you answer the digital one.

KS: Alright, I used to be CIO so, how do I start? First of all this digital disruption is becoming kind of a thing for discussions for the last I would say two or three years to quite recently, and the first discussion, if I am not mistaken, took place in the forum, particularly where autonomous car things are being discussed, and I would say that Sompo is one of just two insurance companies that are incorporated in problems for autonomous vehicles. That means we are sending an expert to the project to come up with what would be a suitable way for a society to introduce autonomous vehicle systems. That means there is always two aspects, good and bad, and yes, by introducing autonomous vehicles the collision, the simple collision may be reduced thereby reducing the premium, is that the case? No, because the autonomous vehicles is moving or being, moving on a road, communicating with the system, traffic system. If that traffic system is hit by a cyber-attack the tragedy would be massive, not just one collision, and as far as that cyber risk is his area, so being one of the two insurance companies incorporated in that project, we would be able to come up with something good. Now, having said that, disruptors are coming from outside the market, outside the industry I would say. If you take a look at Fubar, they have company called [INDISCERNIBLE 00:54:59].

[00:55:00]

That in the US is not an insurance company, it is just a startup company and has just obtained a broker license. Now what they are doing with that, by installing an app, the driver can be protected while he is driving his car as a father, as a mother, a person and it automatically changes, the liability portfolio, the liability characterization into Uber’s when they are being called and people use their car as an Uber driver, it is seamless. The point is that they are not an insurance company, they are just a start-up company, IT, so this is the disruption, a case of disruption that is taking place. We, as a gigantic insurance group have to be prepared for that by just waiting for that, we have to go into that, that’s why our vision says we will go beyond insurance. Once we go beyond insurance we need a strong base for growth, that is Endurance.

NF: Can I just say we are very close to the end of our time so perhaps we could take one more question?

KS: Sorry, that is why we established a laboratory, and we hired a first class consultant to be our manger, to be our advisor, Dr Davenport as you may know.

AM: I think I already know the answer to this question but I just wanted to confirm, with Hurricane Matthew bearing down on Florida, maybe it has landed already, if Endurance were to lose 5% or 10% of book value which is conceivably possible, am I right in thinking the deal would proceed as it is currently designed?

NF: Yes, it would.

AM: There is no material adverse development?

NF: We have spent many, many hours looking at material adverse development sources and frankly merger agreements in the States, they really don’t exist in the same way as they would in the UK, so provided there is no disproportionate effect on Endurance versus the whole of the industry then the deal proceeds and in fact obviously we considered Hurricane Matthew, and we concluded, and rightly concluded that the insurance is all about standing by your clients and not

11

deciding to do a deal, or not do a deal, or re-negotiate a deal simply because of events that may happen and the quantum. I don’t know John whether you have got anything to add to that?

JC: That is the business we are in, or one of the businesses we are in, but you also know that it is a specialty of ours and we take great pride in the way that we underwrite that business, the way that we calculate our liability, the way that we monitor our liability and then secondly, Endurance is very different from most of our peer group in the fact that we spent a substantial amount more than our peer group on re-insurance to protect our capital base at this moment of the pricing cycle.

AM: Just one final word John, I know you have been making do on $100 a year, I hope they are going to give you a salary.

JC: Well, he is a very tough man to work for.

AM: You are a tough negotiator too though.

JC: Would you like to answer that?

KS: He wants to get it in Bitcoin.

JC: My $100 will continue.

NF: Well thank you, I think that is the end of our time, thank you very much for coming and your questions.

KS: Thank you very much.

JC: Thank you.

12

Cautionary Note Regarding Forward-Looking Statements

This material may include, and Endurance may make related oral, forward-looking statements which reflect our current views with respect to future events and financial performance. Such statements may include forward-looking statements both with respect to us in general and the insurance and reinsurance sectors specifically, both as to underwriting and investment matters. These statements may also include assumptions about our proposed acquisition by Sompo (including its benefits, results, effects and timing). Statements which include the words “should,” “would,” “expect,” “intend,” “plan,” “believe,” “project,” “anticipate,” “seek,” “will,” and similar statements of a future or forward-looking nature identify forward-looking statements in this material for purposes of the U.S. federal securities laws or otherwise. We intend these forward-looking statements to be covered by the safe harbor provisions for forward-looking statements in the Private Securities Litigation Reform Act of 1995.

The proposed transaction is subject to risks and uncertainties, including: (A) that Endurance and Sompo may be unable to complete the proposed transaction because, among other reasons, conditions to the closing of the proposed transaction may not be satisfied or waived; (B) uncertainty as to the timing of completion of the proposed transaction; (C) the inability to complete the proposed transaction due to the failure to obtain Endurance shareholder approval for the proposed transaction or the failure to satisfy other conditions to completion of the proposed transaction, including that a governmental entity may prohibit, delay or refuse to grant approval for the consummation of the transaction; (D) the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement; (E) risks related to disruption of management’s attention from Endurance’s ongoing business operations due to the proposed transaction; (F) the effect of the announcement of the proposed transaction on Endurance’s relationships with its clients, operating results and business generally and (G) the outcome of any legal proceedings to the extent initiated against Endurance, Sompo or others following the announcement of the proposed transaction, as well as Endurance’s and Sompo’s management's response to any of the aforementioned factors.

The foregoing review of important factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included herein and elsewhere, including the risk factors included in Endurance’s most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q and other documents of Endurance on file with the U.S. Securities and Exchange Commission (“US SEC”). Any forward-looking statements made in this material are qualified by these cautionary statements, and there can be no assurance that the actual results or developments anticipated by Endurance will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, Endurance or its business or operations. Except as required by law, the parties undertake no obligation to update publicly or revise any forward-looking statement, whether as a result of new information, future developments or otherwise.

Additional Information about the Proposed Transaction and Where to Find It

In connection with the proposed transaction, Endurance will file with the US SEC a proxy statement on Schedule 14A and may file or furnish other documents with the US SEC regarding the proposed transaction. This press release is not a substitute for the proxy statement or any other document which Endurance may file with the US SEC. INVESTORS IN AND SECURITY HOLDERS OF ENDURANCE ARE URGED TO READ THE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR FURNISHED OR WILL BE FILED OR WILL BE FURNISHED WITH THE US SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and security holders may obtain free copies of the proxy statement (when available) and other documents filed with or furnished to the US SEC by Endurance through the web site maintained by the US SEC at www.sec.gov or by contacting the investor relations department of Endurance:

Investor Relations

Endurance Specialty Holdings Ltd.

441-278-0988

Participants in the Solicitation

Endurance and its directors and executive officers may be deemed to be participants in the solicitation of proxies from Endurance’s shareholders in connection with the proposed transaction. Information regarding Endurance’s directors and executive officers, including a description of their direct interests, by security holdings or otherwise, is contained in Endurance’s annual proxy statement filed with the US SEC on April 8, 2016. A more complete description will be available in the proxy statement on Schedule 14A. You may obtain free copies of these documents as described in the preceding paragraph filed, with or furnished to the US SEC. All such documents, when filed or furnished, are available free of charge at the US SEC's website (www.sec.gov) or by directing a request to Endurance at the Investor Relations contact above.

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Proposals to the Annual General Meeting of Municipality Finance Plc

- Completion of capital reduction in Spar Nord Bank A/S

- Umicore update on trading conditions over the first quarter of 2024

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share