Form DEF 14A PROGRESS SOFTWARE CORP For: May 17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant ý

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ | Preliminary Proxy Statement |

¨ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý | Definitive Proxy Statement |

¨ | Definitive Additional Materials |

¨ | Soliciting Material Pursuant to §240.14a-12 |

PROGRESS SOFTWARE CORPORATION

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

ý | No fee required. |

¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

1) | Title of each class of securities to which transaction applies: | |

2) | Aggregate number of securities to which transaction applies: | |

3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

4) | Proposed maximum aggregate value of transaction: | |

5) | Total fee paid: | |

¨ | Fee paid previously with preliminary materials. | |

¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing Form or Schedule and the date of its filing. | |

1) | Amounts Previously Paid: | |

2) | Form, Schedule or Registration Statement No.: | |

3) | Filing Party: | |

4) | Date Filed: | |

PROGRESS SOFTWARE CORPORATION

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

WEDNESDAY, MAY 17, 2016

10:00 AM EST

Progress Software Corporation

14 Oak Park

Bedford, MA 01730

Proposal | Board Recommendation |

Elect seven directors to serve until the 2017 Annual Meeting | FOR |

Advisory vote to approve the 2015 compensation of our named executive officers (say-on-pay). | FOR |

Approve an increase in the number of shares authorized for issuance under the 1991 Employee Stock Purchase Plan | FOR |

Ratify the selection of Deloitte & Touche LLP as our independent registered public accounting firm for our current fiscal year | FOR |

Other matters properly brought before the meeting may also be considered.

Stockholders as of the close of business on March 31, 2016 are entitled to vote.

Please vote your shares before the meeting, even if you plan to attend the meeting.

Your broker will not be able to vote your shares on the election of directors, the say-on-pay vote or the employee stock purchase plan proposal unless you have given your broker specific instructions to do so.

By Order of the Board of Directors,

Stephen H. Faberman

Secretary

April 18, 2016

Bedford, Massachusetts

PROXY STATEMENT SUMMARY

This summary highlights information contained elsewhere in this Proxy Statement. For more complete information about these topics, please review our Annual Report on Form 10-K and the entire Proxy Statement.

This Proxy Statement and the accompanying proxy card, including an Internet link to our previously filed 2015 Annual Report on Form 10-K, were first made available to stockholders on or about April 18, 2016.

2016 Annual Meeting of Stockholders

Date and Time Wednesday, May 17, 2016 10:00 AM EST Place Progress Software Corporation 14 Oak Park Bedford, MA 01730 Record Date March 31, 2016 | Attendance You are entitled to attend the Annual Meeting only if you are a stockholder as of the close of business on March 31, 2016, the record date, or hold a valid proxy for the meeting. If you plan to attend the Annual Meeting, you will need to provide photo identification, such as a driver’s license, and proof of ownership of Progress common stock as of March 31, 2016 in order to be admitted. We will be unable to admit anyone who does not present identification or refuses to comply with our security procedures | |

Voting Roadmap

Proposal | Board Recommendation | Page(s) |

Election of seven directors | For each nominee | 5 |

Advisory vote to approve executive compensation | For | 17 |

Approve an increase in the number of shares authorized for issuance under the 1991 Employee Stock Purchase Plan | For | 18 |

Ratify the selection of Deloitte & Touche LLP as our independent registered public accounting firm for our current fiscal year | For | 21 |

Corporate Governance Highlights | |

Number of Directors on Board | 7 |

Number of Directors Who Are Independent | 6 |

Annual Director Elections | Yes |

Director Majority Voting Policy | Yes |

Separate Chairman and Chief Executive Officer | Yes |

100% Independent Board Committees | Yes |

Regular Sessions of Independent Directors | Yes |

Director and executive officer stock ownership guidelines | Yes |

No Stockholder Rights Plan (“Poison Pill”) | Yes |

Stockholder Right to Call a Special Meeting | Yes |

Pay-for-Performance Executive Compensation | Yes |

Anti-Hedging Policy | Yes |

Executive Incentive Compensation Clawback Policy | Yes |

-i-

Director Nominees

In Proposal One, we are asking you to vote “FOR” each of the director nominees listed below. Each director attended at least 75% of all Board meetings and applicable committee meetings during fiscal 2015.

Nominee | Independence | Committees | Director Since |

John R. Egan Chairman of the Board | Independent | Compensation; Nominating & Corporate Governance | 2011 |

Barry N. Bycoff | Independent | N/A | 2007 |

Ram Gupta | Independent | Chair, Nominating & Corporate Governance Audit | 2008 |

Charles F. Kane | Independent | Chair, Audit Compensation | 2006 |

David A. Krall | Independent | Chair, Compensation Nominating & Corporate Governance | 2008 |

Michael L. Mark | Independent | Audit; Nominating & Corporate Governance | 1987 |

Philip M. Pead | President and CEO, Progress | N/A | 2011 |

Executive Compensation Highlights

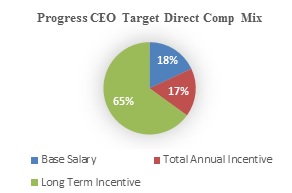

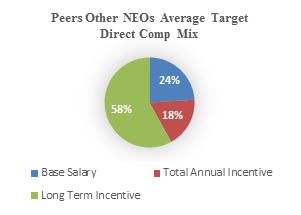

Consistent with its pay-for-performance philosophy, the Compensation Committee, in designing our executive compensation programs for fiscal 2015, emphasized alignment with our aggressive short- and long-term business goals. Among the highlights of our executive compensation design for fiscal 2015:

• | Base salaries for our named executive officers targeted at market competitive levels. |

• | Annual bonus plans in which the payout of bonuses was tied exclusively to financial performance and payout would not occur if we failed to achieve total revenue and operating income of at least 95% of our annual operating plan and budget. |

• | Business Unit Bonus Plans applicable to the Business Unit Presidents in which we tied payout of bonuses to achievement of both corporate measures and specific business unit metrics to ensure alignment with our new organizational structure. |

• | Payouts under the Corporate and Business Unit Bonus Plans capped at 150% of target amounts. |

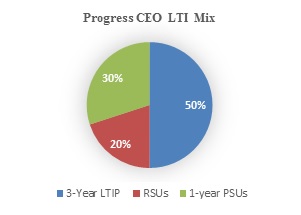

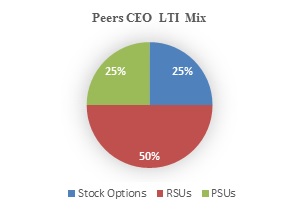

• | Equity plans in which a greater proportion of executives’ compensation was tied to long-term performance. |

• | Reduced annual performance equity awards that utilized a different one-year performance metric than the annual cash bonus plan. |

• | 70% of our named executive officers’ target total direct compensation was performance-based. |

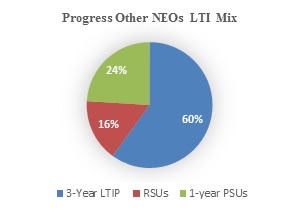

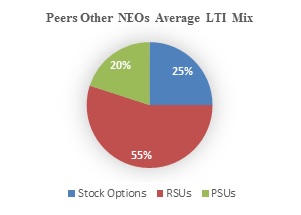

• | 80% of Mr. Pead’s and our other named executive officers’ long term equity incentive compensation was delivered in the form of performance-based awards. |

-ii-

Deloitte & Touche LLP Services and Fees | ||||||

2015 | 2,014 | |||||

Audit Fees (1) | $ | 2,394,392 | $ | 1,945,917 | ||

Tax Fees (2) | 57,829 | 310,468 | ||||

Audit-Related Fees (3) | 532,256 | 405,200 | ||||

All Other Fees (4) | — | 2,600 | ||||

__________

(1) | Represents fees billed for each of the last two fiscal years for professional services rendered for the audit of our annual financial statements included in Form 10-K and reviews of financial statements included in our interim filings on Form 10-Q, as well as statutory audit fees related to our wholly-owned foreign subsidiaries. In accordance with the policy on Audit Committee pre-approval, 100% of audit services provided by the independent registered public accounting firm are pre-approved. |

(2) | Includes fees primarily for tax services. In accordance with the policy on Audit Committee pre-approval, 100% of tax services provided by the independent registered public accounting firm are pre-approved. |

(3) | Represents fees billed for due diligence services in connection with the acquisition of Telerik AD. |

(4) | Represents fees billed for the subscription to an online accounting tool. |

-iii-

PROGRESS SOFTWARE CORPORATION

14 Oak Park

Bedford, Massachusetts 01730

______________________________

PROXY STATEMENT

______________________________

This proxy statement is being furnished in connection with the solicitation by the Board of Directors of Progress Software Corporation of proxies for use at the 2016 Annual Meeting of Stockholders to be held on Wednesday, May 17, 2016, at 10:00 a.m., local time, at our principal executive offices located at 14 Oak Park, Bedford, Massachusetts 01730. We anticipate that this proxy statement and the form of proxy card will first be mailed to stockholders on or about April 18, 2016.

Important Notice Regarding the Availability of Proxy Materials for the Annual

Meeting of Stockholders to Be Held on May 17, 2016:

This proxy statement and our 2015 Annual Report on Form 10-K are available at:

http://materials.proxyvote.com/743312

ABOUT THE MEETING AND VOTING

Q: Who is soliciting my vote? | ||||

A: The Board of Directors of Progress is soliciting your vote at the 2016 Annual Meeting of Stockholders. | ||||

Q: What is the purpose of the annual meeting? | ||||

A: You will be voting on the following items of business: 1. To elect seven directors to serve until the annual meeting of stockholders held in 2017; 2. To hold an advisory vote on the compensation of our named executive officers; 3. To approve the amendment of the Progress Software Corporation 1991 Employee Stock Purchase Plan, as amended, to increase the maximum number of shares that may be issued under that plan by 800,000 shares; 4. To ratify the selection of Deloitte & Touche LLP as our independent registered public accounting firm for fiscal year 2016; and 5. To transact any other business as may properly come before the annual meeting and any adjournment or postponement of that meeting. | ||||

-1-

Q: Who can attend the meeting? | ||||

A: All stockholders as of the close of business on March 31, 2016, the record date, or their duly appointed proxies, may attend the meeting. If you plan to attend the meeting, please note that you will need to bring your proxy card or voting instruction card and valid picture identification, such as a driver’s license or passport. Cameras, recording devices and other electronic devices will not be permitted at the meeting and all mobile phones must be silenced during the meeting. Please also note that if you hold your shares through a broker or other nominee, you will need to bring a copy of a brokerage statement reflecting your stock ownership as of the record date. | ||||

Q: Who is entitled to vote at the meeting? | ||||

A: Only stockholders of record at the close of business on March 31, 2016, the record date for the meeting, are entitled to receive notice of and to participate in the annual meeting. If you were a stockholder of record on that date, you will be entitled to vote all of the shares that you held on that date at the meeting, or any postponements or adjournments of the meeting. There were 50,317,018 shares of our common stock outstanding on the record date. | ||||

Q: What are the voting rights of the holders of our common stock? | ||||

A: Each share of our common stock outstanding on the record date will be entitled to one vote on each matter considered at the meeting. | ||||

Q: What is the difference between holding shares as a stockholder of record and a beneficial owner? | ||||

A: If your shares are registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, you are considered the stockholder of record with respect to those shares, and these proxy materials are being sent directly to you by us. As the stockholder of record, you have the right to grant your voting proxy directly to us by completing, signing, dating and returning a proxy card, or to vote in person at the annual meeting. Many of our stockholders hold their shares through a broker, bank or other nominee rather than directly in their own name. If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of your shares. We have sent these proxy materials to your broker or bank. As the beneficial owner, you have the right to direct your broker, bank or nominee on how to vote and you are also invited to attend the annual meeting. However, since you are not the stockholder of record, you may not vote these shares in person at the annual meeting unless you request and obtain a proxy from your broker, bank or nominee. Your broker, bank or nominee will provide a voting instruction card for you to use in directing the broker, bank or nominee regarding how to vote your shares. | ||||

Q: What is a quorum? | ||||

A: A quorum is the minimum number of our shares of common stock that must be represented at a duly called meeting in person or by proxy in order to legally conduct business at the meeting. For the annual meeting, the presence, in person or by proxy, of the holders of at least 25,185,510 shares, which is a simple majority of the 50,317,018 shares outstanding as of the record date, will be considered a quorum allowing votes to be taken and counted for the matters before the stockholders. If you are a stockholder of record, you must deliver your vote by mail or attend the annual meeting in person and vote in order to be counted in the determination of a quorum. Abstentions and broker “non-votes” will be counted as present or represented at the annual meeting for purposes of determining the presence or absence of a quorum. A broker “non-vote” occurs when a broker or other nominee who holds shares for a beneficial owner withholds its vote on a particular proposal with respect to which it does not have discretionary voting power or instructions from the beneficial owner. | ||||

-2-

Q: What is the difference between a routine matter and a non-routine matter? | ||||

A: Brokers cannot vote on their customers’ behalf on “non-routine” proposals such as Proposal One, the election of directors, Proposal Two, the advisory vote on executive compensation, and Proposal Three, the amendment of our employee stock purchase plan. Because brokers require their customers’ direction to vote on such non-routine matters, it is critical that stockholders provide their brokers with voting instructions. Proposal Four, ratification of the appointment of our independent registered public accounting firm, will be a “routine” matter for which your broker does not need your voting instruction in order to vote your shares. | ||||

Q: How do I vote? | ||||

A: If you are a stockholder of record, you have the option of submitting your proxy card by mail or attending the meeting and delivering the proxy card. The designated proxy will vote according to your instructions. You may also attend the meeting and personally vote by ballot. If you are a beneficial owner of shares, in order to vote at the meeting, you will need to obtain a signed proxy from the broker or nominee that holds your shares. If you have the broker’s proxy, you may vote by ballot or you may complete and deliver another proxy card in person at the meeting. When you vote, you are giving your “proxy” to the individuals we have designated to vote your shares at the meeting as you direct. If you do not make specific choices, they will vote your shares to: ● elect the seven directors nominated by our Board of Directors; ● approve the advisory vote on the compensation of our named executive officers; ● approve the amendment of the Progress Software Corporation 1991 Employee Stock Purchase Plan, as amended, to increase the maximum number of shares that may be issued under that plan by 800,000 shares; and ● approve the ratification of the selection of Deloitte & Touche LLP as our independent registered public accounting firm for fiscal year 2016. If any matter not listed in the Notice of Meeting is properly presented at the meeting, the proxies will vote your shares in accordance with their best judgment. As of the date of this proxy statement, we knew of no matters that needed to be acted on at the meeting other than as discussed in this proxy statement. | ||||

Q: How does the Board of Directors recommend that I vote? | ||||

A: The Board recommends that you vote your shares as follows: ● FOR Proposal One - elect the seven nominees to the Board of Directors. ● FOR Proposal Two - approve the advisory vote on the compensation of our named executive officers. ● FOR Proposal Three - approve the amendment to our 1991 Employee Stock Purchase Plan, as amended. ● FOR Proposal Four - approve the ratification of the selection of Deloitte &Touche LLP as our independent registered public accounting firm for the fiscal year ending November 30, 2016. | ||||

Q: Can I change or revoke my vote? | ||||

A: You may revoke your vote at any time before the proxy is exercised by filing with our secretary a written notice of revocation or by signing and duly delivering a proxy bearing a later date. At the meeting, you may revoke or change your vote by submitting a proxy to the inspector of elections or voting by ballot. Your attendance at the meeting will not by itself revoke your vote. | ||||

-3-

Q: How many votes are required to elect directors (Proposal One)? | ||||

A: The nominees who receive the most votes (also known as a “plurality” of the votes cast) will be elected. You may vote either FOR the nominee or WITHHOLD your vote from the nominee. Votes that are withheld will not be included in the vote tally for the election of the directors. Brokerage firms do not have authority to vote customers’ unvoted shares held by the firms in street name for the election of the director. As a result, any shares not voted by a customer will be treated as a broker non-vote. These broker non-votes will have no effect on the results of this vote. In an uncontested election, if a nominee receives a greater number of votes “withheld” from his election than votes “for” such election, that nominee will submit his offer of resignation for consideration by our Nominating and Corporate Governance Committee in accordance with our majority vote policy discussed in more detail on page 12 of this proxy statement. | ||||

Q: How many votes are required to adopt the other proposals (Proposals Two through Four)? | ||||

A: All of the other proposals will be approved if these proposals receive the affirmative vote of a majority of the shares present or represented and voting on these proposals. Abstentions will not be counted towards the vote totals and will have no effect on the results of the vote. Brokerage firms do not have authority to vote customers’ unvoted shares held by the firms in street name on Proposals Two and Three. As a result, any shares not voted by a customer will be treated as a broker non-vote. Those broker non-votes will have no effect on the results of the vote with respect to these Proposals. Brokerage firms do have authority to vote customers’ unvoted shares held by the firms in street name on Proposal Four (Ratification of Appointment of Independent Registered Public Accounting Firm). If a broker does not exercise this authority, such broker non-votes will have no effect on the results of this vote. We are not required to obtain the approval of our stockholders to appoint Deloitte & Touche LLP as our independent registered public accounting firm. However, if our stockholders do not ratify the selection of Deloitte & Touche LLP as our independent registered public accounting firm for our fiscal year ending November 30, 2016, the Audit Committee of our Board will consider the results of this vote when selecting auditors in the future. | ||||

Q: What is “householding” of proxy materials? | ||||

A: In some cases, stockholders holding their shares in a brokerage or bank account who share the same surname and address and have not given contrary instructions received only one copy of the proxy materials. This practice is designed to reduce duplicate mailings and save printing and postage costs. If you would like to have a separate copy of our 10-K and/or proxy statement mailed to you or to receive separate copies of future mailings, please submit your request to the address or phone number that appears on your proxy card. We will deliver such additional copies promptly upon receipt of such request. In other cases, stockholders receiving multiple copies at the same address may wish to receive only one. If you now receive more than one copy, and would like to receive only one copy, please submit your request to the address or phone number that appears on your proxy card. | ||||

Q: Who will count the votes and where can I find the voting results? | ||||

A: Broadridge Financial Services, Inc. will tabulate the voting results. We will announce the voting results at the annual meeting and we will publish the results by filing a Current Report on Form 8-K with the Securities and Exchange Commission within four business days of the annual meeting. | ||||

-4-

PROPOSAL ONE: ELECTION OF DIRECTORS

Our Board of Directors is currently composed of seven members. Upon the recommendation of the Nominating and Corporate Governance Committee, our Board of Directors has nominated for election as directors Barry N. Bycoff, John R. Egan, Ram Gupta, Charles F. Kane, David A. Krall, Michael L. Mark and Philip M. Pead, each of whom is currently a director of our company.

Each director elected at the annual meeting will hold office until the next annual meeting of stockholders or special meeting in lieu of such annual meeting or until his successor has been duly elected and qualified, or until his earlier death, resignation or removal. There are no family relationships among any of our executive officers or directors.

Each of the director nominees named in this proxy statement has agreed to serve as a director if elected, and we have no reason to believe that any nominee will be unable to serve. In the event that before the annual meeting one or more nominees named in this proxy statement should become unable to serve or for good cause will not serve, the persons named in the enclosed proxy will vote the shares represented by any proxy received by our Board of Directors for such other person or persons as may thereafter be nominated for director by the Nominating and Corporate Governance Committee and our Board of Directors.

Our Board of Directors recommends that you vote FOR the election of the following seven individuals as directors: Barry N. Bycoff, John R. Egan, Ram Gupta, Charles F. Kane, David A. Krall, Michael L. Mark and Philip M. Pead. | ||||

-5-

NOMINEES FOR DIRECTORS

Barry N. Bycoff

Director since 2007 Current Board Committees

Age: 67 N/A

Mr. Bycoff has been a director since May 2007. Mr. Bycoff was our Executive Chairman from March 2009 until April 2011. From May 2005 to July 2007, Mr. Bycoff was a venture partner of Pequot Ventures, the venture capital arm of Pequot Capital Management, Inc. Mr. Bycoff has also served as Chairman of Aveksa Inc., Chairman of Day Software Holding AG, and on the Board of Directors of StubHub Inc.

As the founder and former Chief Executive Officer of Netegrity, Inc., a public technology company, Mr. Bycoff demonstrated leadership, management and strategic experience, as well as significant financial, operational and corporate governance experience. Mr. Bycoff also has significant management experience from working in a variety of software companies. Mr. Bycoff also has valuable experience as a current and former board member of a number of public and private technology-related companies. Mr. Bycoff also brings to the Board of Directors his investing experience from his tenure at Pequot Ventures. |

John R. Egan

Director since 2011 Chairman of the Board

Age: 58 Current Board Committees

Compensation, Nominating & Corporate Governance

Mr. Egan became our Non-Executive Chairman of the Board in December 2012. Mr. Egan has been a director since September 2011. Mr. Egan is managing partner of Carruth Management, LLC, a Boston based venture capital fund he founded in October 1998 that specializes in technology and early stage investments. From October 1986 until September 1998, Mr. Egan served in a number of executive positions with EMC Corporation (NYSE: EMC), a publicly-held global leader in information technology, including Executive Vice President, Products and Offerings, Executive Vice President, Sales and Marketing, Executive Vice President, Operations and Executive Vice President, International Sales. Mr. Egan serves on the Board of Directors for other publicly-traded and privately-held companies. They include: EMC Corporation (NYSE: EMC), VMWare, Inc. (NYSE: VMW), a publicly-traded leader in virtualization and cloud infrastructure; Verint Systems, Inc. (NASDAQ: VRNT), a publicly-held provider of systems to the internet security market, and NetScout Systems, Inc. (NASDAQ: NTCT), a publicly-held network performance management company, where he serves as Lead Director.

Mr. Egan brings to our Board of Directors extensive understanding and expertise in the information technology industry as a result of his service on other boards of directors combined with his executive leadership roles at EMC Corp. His broad experience ranges from venture capital investments in early-stage technology companies to extensive sales and marketing experience, to executive leadership and management roles. Mr. Egan brings to the Board business acumen, substantial operational experience, and expertise in corporate strategy and development. Mr. Egan also has extensive experience serving as a director of publicly-traded companies. |

Ram Gupta

Director since 2008 Current Board Committees

Age: 54 | Nominating & Corporate Governance (Chair), Audit |

Mr. Gupta has been a director since May 2008. From May 2007 until May 2010, Mr. Gupta was Executive Chairman of CAST Iron Systems, Inc., a leading software-as-a-service (SaaS) and cloud application integration provider. Prior to that time, from November 2005 until May 2007, Mr. Gupta was President and Chief Executive Officer of CAST Iron Systems, Inc. Mr. Gupta was previously a director of S1 Corp. and Source Forge, Inc. Mr. Gupta also has served in a variety of leadership roles within

-6-

the Board of Directors of several privately-held technology companies including Platform Computing Corporation, Persistent Systems Limited, Accruent Inc. and Yodlee Inc.

Mr. Gupta has extensive strategic marketing and management expertise at global technology companies, including responsibility for strategy, marketing, development, customer support, alliances and mergers and acquisitions. As a former executive and board member of several technology-related public companies, Mr. Gupta offers industry specific, public company board experience to our Board of Directors. His extensive experience in the software industry, particularly in the area of strategy and marketing, is a significant asset to the Board of Directors |

Charles F. Kane

Director since 2006 Current Board Committees

Age: 58 | Audit (Chair), Compensation |

Mr. Kane has been a director since November 2006. Mr. Kane is an adjunct professor of International Finance at the MIT Sloan Graduate Business School of Management. Mr. Kane is currently a Director and Strategic Advisor of One Laptop Per Child, a non-profit organization that provides computing and internet access for students in the developing world, for whom he served as President and Chief Operating Officer from 2008 until 2009. Mr. Kane served as Executive Vice President and Chief Administrative Officer of Global BPO Services Corp., a special purpose acquisition corporation, from July 2007 until March 2008, and as Chief Financial Officer of Global BPO from August 2007 until March 2008. Prior to joining Global BPO, he served as Chief Financial Officer of RSA Security Inc., a provider of e-security solutions, from May 2006 until RSA was acquired by EMC Corporation in October 2006. From July 2003 until May 2006, he served as Chief Financial Officer of Aspen Technology, Inc. (NYSE: AZPN), a publicly-traded provider of supply chain management software and professional services. Mr. Kane is currently a director of Demandware, Inc. (NYSE: DWRE), a publicly-traded leading provider of software-as-a-service (SaaS) ecommerce solutions that enable companies to deliver customized shopping experiences to consumers in the digital world, Carbonite, Inc. (NASDAQ: CARB), a publicly-traded leading provider of online backup solutions for consumers and small and medium sized businesses, and Realpage Inc. (NASDAQ: RP), a publicly-traded company providing on-demand software solutions for the rental housing industry. Mr. Kane was previously a director of Netezza Corporation, Borland Software Corporation and Applix Inc.

As our Audit Committee financial expert and Chairman of the Audit Committee, Mr. Kane provides a high level of expertise and leadership experience in the areas of finance, accounting, audit oversight and risk analysis derived from his experience as the chief financial officer of publicly-traded technology companies. Mr. Kane also offers substantial public company board experience to our Board of Directors. |

David A. Krall

Director since 2008 Current Board Committees

Age: 55 | Compensation (Chair), Nominating & Corporate Governance |

Mr. Krall has been a director since February 2008. Mr. Krall has served as a strategic advisor to Roku, Inc., a leading manufacturer of media players for streaming entertainment, since December 2010 and to Avegant Corp., a privately-held leading developer of the next generation of wearable devices, since February, 2016. From February 2010 to November 2010, he served as President and Chief Operating Officer of Roku, where he was responsible for managing all functional areas of the company. Prior to that, Mr. Krall spent two years as President and Chief Executive Officer of QSecure, Inc., a privately-held developer of secure credit cards based on micro-electro-mechanical-system technology. From 1995 to July 2007, he held a variety of positions of increasing responsibility and scope at Avid Technology, Inc. (NYSE: AVID), a publicly-traded leading provider of digital media creation tools for the media and entertainment industry. His tenure at Avid included serving seven years as the company’s President and Chief Executive Officer. Mr. Krall also currently serves on the Board of Directors for Universal Audio, Inc., a privately-held manufacturer of audio hardware and software plug-ins, WeVideo, Inc., privately-held a

-7-

provider of a collaborative video editing platform, Audinate Pty Ltd., a creator of the industry-leading media networking technology, and Quantum Corp. (NYSE: QTM), a publicly-traded global expert in data protection and big data management.

Mr. Krall has significant leadership, management and operational experience through his service in a broad range of executive positions within the software and technology industries. From working in companies ranging from small startups to public companies with thousands of employees serving worldwide marketplaces, Mr. Krall brings experience in the areas of new product development, integration of complex software and hardware solutions, strategy formation, and general management. |

Michael L. Mark

Director since 1987 Current Board Committees

Age: 70 | Audit, Nominating & Corporate Governance |

Mr. Mark has been a director since July 1987. He was our Non-Executive Chairman of the Board from April 2011 until May 2012 and also from December 2006 until March 2009. From March 2009 until April 2011, Mr. Mark served as Lead Independent Director. Mr. Mark is a private investor and member of Walnut Venture Associates, an investment group seeking opportunities in early-stage and emerging high-tech companies in New England. Mr. Mark was a founder of several high-tech companies, including Intercomp Company, American Energy Services, Inc., and Cadmus Computer Systems Corporation. Mr. Mark is also an investor in numerous early-stage companies and serves on several private boards of directors.

Mr. Mark has served on our Board of Directors for almost thirty years, spanning the entire time that we have been a public company. As a result, Mr. Mark provides our Board of Directors with critical historical knowledge and insights on our business and the software industry generally. Mr. Mark also has extensive experience as a director of public and private companies. |

Philip M. Pead

Director since 2011 Chief Executive Officer

Age: 63

Mr. Pead became our President and Chief Executive Officer on December 7, 2012. Prior to that time, Mr. Pead was our Interim Chief Executive Officer, a position he assumed on November 2, 2012. Mr. Pead served as Executive Chairman of the Board from October 8, 2012 until December 7, 2012. Mr. Pead was our Non-Executive Chairman of the Board from May 2012 until October 2012. Mr. Pead has been a director since July 2011. Mr. Pead was formerly the Chairman of the Board of Allscripts Health Solutions Inc. (NASDAQ: MDRX), a publicly-traded leading health care information technology company. Mr. Pead was also the President and Chief Executive Officer of Eclipsys Corporation, a leading provider of enterprise clinical and financial software for hospitals, which was merged with Allscripts in August 2010. From March 2007 to May 2009, Mr. Pead served as the Managing Partner of Beacon Point Partners LLC, a healthcare consulting firm. Mr. Pead served as President and Chief Executive Officer of Per-Se Technologies Inc., a provider of healthcare information technology services, from November 2000 until its acquisition by McKesson Corporation in January 2007. In addition to our company, Mr. Pead serves on the Board of Directors of Change Healthcare Holdings, Inc. (f/k/a/ Emdeon Inc.), which was a publicly-traded company until it was acquired by The Blackstone Group L.P. and Hellman & Friedman LLC., and aLabs Corp., doing business as Accumen, a privately-held technology company focused on partnering with health systems to deliver lab excellence.

As our Chief Executive Officer, Mr. Pead provides key insight and advice with respect to corporate strategy and management development and a deeper understanding of our products, technology and market opportunities. Furthermore, Mr. Pead provides our company with industry insight and knowledge as a result of his many years of experience in the software industry, working in executive roles in several publicly- and privately-held companies, including Per-Se Technologies, Dun & Bradstreet Corporation and Attachmate Corporation. |

-8-

THE BOARD OF DIRECTORS AND COMMITTEES OF THE BOARD

Board of Directors

Our Board of Directors met eleven times during the fiscal year ended November 30, 2015. Each of our directors attended at least 75% of the aggregate of the total number of meetings of our Board of Directors and the total number of meetings of all committees of our Board of Directors on which he served during 2015. Our Board of Directors has standing Audit, Compensation, and Nominating and Corporate Governance Committees.

Audit Committee

The Audit Committee of our Board of Directors during 2015 consisted of Messrs. Gupta, Kane and Mark, with Mr. Kane serving as Chairman. The Audit Committee met eight times during 2015.

Our Board of Directors has determined that each member of the Audit Committee meets the independence requirements promulgated by NASDAQ and the SEC, including Rule 10A-3(b)(1) under the Securities Exchange Act of 1934, as amended, or the Exchange Act. In addition, our Board of Directors has determined that each member of the Audit Committee is financially literate and that Mr. Kane qualifies as an “audit committee financial expert” under the rules of the SEC.

The Audit Committee operates under a written charter adopted by our Board of Directors, a copy of which can be found on our website at www.progress.com under the heading “Corporate Governance” located on the “Company Info/Who We Are” page.

The Audit Committee assists our Board of Directors in fulfilling its oversight responsibilities for accounting and financial reporting compliance. The Audit Committee meets with management and with our independent registered public accounting firm to discuss our financial reporting policies and procedures, our internal control over financial reporting, the results of the independent registered public accounting firm’s examinations, our critical accounting policies and the overall quality of our financial reporting, and the Audit Committee reports on these matters to our Board of Directors. The Audit Committee meets with the independent registered public accounting firm with and without our management present.

For 2015, among other functions, the Audit Committee:

• | appointed the independent registered public accounting firm; |

• | reviewed with our independent registered public accounting firm the scope of the audit for the year and the results of the audit when completed; |

• | reviewed the independent registered public accounting firm’s fees for services performed; |

• | reviewed with management and the independent registered public accounting firm the annual audited financial statements and the quarterly financial statements, prior to the filing of reports containing those financial statements with the SEC; |

• | reviewed with management our major financial risks and the steps management has taken to monitor and control those risks; and |

• | reviewed with management various matters related to our internal controls. |

Compensation Committee

The Compensation Committee of our Board of Directors during 2015 consisted of Messrs. Egan, Kane and Krall, with Mr. Krall serving as Chairman. The Compensation Committee met five times during 2015. Our Board of Directors has determined that each member of the Compensation Committee meets the independence requirements promulgated by NASDAQ.

Our Compensation Committee operates under a written charter adopted by our Board of Directors, a copy of which can be found on our website at www.progress.com under the heading “Corporate Governance” located on the “Company Info/Who We Are” page.

-9-

In accordance with its charter, the Compensation Committee:

• | oversees our overall executive compensation structure, policies and programs; |

• | administers our equity-based plans; |

• | reviews, and recommends to our Board of Directors for its approval, the compensation of our Chief Executive Officer; |

• | reviews and determines the compensation of all direct reports of the Chief Executive Officer; |

• | reviews and makes recommendations to our Board of Directors regarding the compensation of our directors; and |

• | is responsible for producing the annual report included in this proxy statement. |

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee of our Board of Directors during 2015 consisted of Messrs. Egan, Gupta, Krall, and Mark, with Mr. Gupta serving as Chairman. The Nominating and Corporate Governance Committee met once during 2015. The Board of Directors has determined that each member of the Nominating and Corporate Governance Committee meets the independence requirements promulgated by NASDAQ.

The Nominating and Corporate Governance Committee operates under a written charter adopted by our Board of Directors, a copy of which can be found on our website at www.progress.com under the heading “Corporate Governance” located on the “Company Info/Who We Are” page.

In accordance with its charter, the Nominating and Corporate Governance Committee:

• | is responsible for identifying qualified candidates for election to our Board of Directors and recommending nominees for election as directors at the annual meeting; |

• | assists in determining the composition of our Board of Directors and its committees; |

• | assists in developing and monitoring a process to assess the effectiveness of our Board of Directors; |

• | assists in developing and reviewing succession plans for our senior management, including the Chief Executive Officer; and |

• | assists in developing and implementing our Corporate Governance Guidelines. |

Director Nomination Process

Our Board of Directors has delegated the search for, and recommendation of, director nominees to the Nominating and Corporate Governance Committee. When considering a potential candidate for membership on our Board of Directors, the Nominating and Corporate Governance Committee will consider any criteria it deems appropriate, including, among other things, the experience and qualifications of any particular candidate as well as such candidate’s past or anticipated contributions to our Board of Directors and its committees. At a minimum, each nominee is expected to have the highest personal and professional integrity and demonstrated exceptional ability and judgment, and to be effective, with the other directors, in collectively serving the long-term interests of our stockholders. In addition, the Nominating and Corporate Governance Committee has established the following minimum requirements:

• | at least five years of business experience; |

• | no identified conflicts of interest as a prospective director of our company; |

• | no convictions in a criminal proceeding (aside from traffic violations) during the five years prior to the date of selection; and |

• | willingness to comply with our Code of Conduct and Business Ethics. |

The Board of Directors retains the right to modify these minimum qualifications from time to time, and exceptional candidates who do not meet all of these criteria may still be considered.

In addition to any other standards the Nominating and Corporate Governance Committee may deem appropriate from time to time for the overall structure and composition of our Board of Directors, the Nominating and Corporate Governance Committee may consider the following factors when recommending that our Board of Directors select persons for nomination:

• | Whether the nominee has direct experience in the software industry or in the markets in which we operate. |

• | Whether the nominee, if elected, assists in achieving a mix of members on our Board of Directors that represents a diversity of background, experience, skills, ages, race and gender. |

The Nominating and Corporate Governance Committee may also consider other criteria that it deems appropriate from time to time for the overall composition and structure of our Board of Directors. The Nominating and Corporate Governance

-10-

Committee does not assign specific weights to particular criteria and no criterion is necessarily applicable to all prospective nominees. Neither the Nominating and Corporate Governance Committee nor our Board of Directors has a specific policy with regard to the consideration of diversity in identifying director nominees, although, as described above, both may consider diversity when identifying and evaluating proposed director candidates.

In the case of incumbent directors, the Nominating and Corporate Governance Committee reviews each incumbent director’s overall past service to us, including the number of meetings attended, level of participation, quality of performance, and whether the director continues to meet applicable independence standards. In the case of a new director candidate, the Nominating and Corporate Governance Committee determines whether the candidate meets the applicable independence standards, and the level of the candidate’s financial expertise. The candidate will also be interviewed by the Nominating and Corporate Governance Committee.

Generally, the Nominating and Corporate Governance Committee identifies candidates for director nominees in consultation with the other directors and management, through the use of search firms or other advisors, through recommendations submitted by stockholders or through other methods that the Nominating and Corporate Governance Committee deems to be helpful to identify candidates. Once a candidate has been identified, the Nominating and Corporate Governance Committee confirms that the candidate meets all of the minimum qualifications for a director nominee established by the Committee. The Nominating and Corporate Governance Committee then meets to discuss and evaluate the qualities and skills of each candidate, both on an individual basis and taking into account the overall composition and needs of our Board of Directors. The same procedures apply to all candidates for director nomination, including candidates submitted by stockholders.

Based on the results of the evaluation process, the Nominating and Corporate Governance Committee recommends candidates for our Board of Directors’ approval as director nominees for election to our Board of Directors. The Nominating and Corporate Governance Committee also recommends candidates to our Board of Directors for appointment to its committees.

The Nominating and Corporate Governance Committee will consider director nominee candidates who are recommended by stockholders of our company. Stockholder nominees are evaluated on the same basis as other director candidates. Recommendations sent by stockholders must provide the following information:

• | the name and address of record of the stockholder; |

• | a representation that the stockholder is a record holder of our common stock, or if the stockholder is not a record holder, evidence of ownership in accordance with Rule 14a-8(b)(2) of the Exchange Act; |

• | the name, age, business and residential address, educational background, current principal occupation or employment, and principal occupation or employment for the preceding five full fiscal years of the proposed director candidate; |

• | a description of the qualifications and background of the proposed director candidate which addresses the minimum qualifications described above; |

• | a description of all arrangements or understandings between the stockholder and the proposed director candidate; and |

• | any other information regarding the proposed director candidate that is required to be included in a proxy statement filed under SEC rules. |

The submission must be accompanied by a written consent of the individual to be named in our proxy statement as standing for election if nominated by our Board of Directors and to serve if elected by the stockholders. Stockholder recommendations of candidates for election as directors at an annual meeting of stockholders must be given at least 120 days prior to the date on which our proxy statement was released to stockholders in connection with our previous year’s annual meeting.

Stockholders may recommend director candidates for consideration by the Nominating and Corporate Governance Committee by sending a written communication to the Committee at our offices located at 14 Oak Park, Bedford, Massachusetts 01730, c/o Corporate Secretary.

-11-

CORPORATE GOVERNANCE

Corporate Governance Guidelines

Our Board of Directors has adopted Corporate Governance Guidelines which can be found on our website at www.progress.com under the heading “Corporate Governance” located on the “Company Info/Who We Are” page. Our Corporate Governance Guidelines deal with the following matters:

● director qualifications; ● director majority voting policy; ● executive sessions and leadership roles; ● conflicts of interest; ● board committees; ● director access to officers and employees; | ● director orientation and continuing education; ● director and executive officer stock ownership; ● stockholder communications with the Board; and ● performance evaluation of the Board and its Committees. | ||

Codes of Conduct and Business Ethics

Our Board of Directors has adopted a Code of Conduct and Business Ethics that applies to all of our officers, directors and employees. Copies of the Code of Conduct and Business Ethics can be found on our website at www.progress.com under the heading “Corporate Governance” located on the “Company Info/Who We Are” page.

Majority Vote Policy

It is our policy that any nominee for election to the Board in an uncontested election who receives a greater number of votes “withheld” from his or her election than votes “for” such election is to submit his or her offer of resignation for consideration by the Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee is to consider all of the relevant facts and circumstances and recommend to the Board the action to be taken with respect to that offer of resignation. The Board will then act on the Nominating and Corporate Governance Committee’s recommendation.

Independence of Members of our Board of Directors

We have determined that all of our current directors except Mr. Pead (our current President and Chief Executive Officer) are independent within the meaning of the director independence standards of NASDAQ and the applicable rules of the SEC. In making this determination, we solicited information from each of the directors regarding whether that director or any member of his immediate family, had a direct or indirect material interest in any transactions involving our company, was involved in a debt relationship with our company or received personal benefits outside the scope of the director’s normal compensation. We considered the responses of the directors, and independently considered the commercial agreements, acquisitions and other material transactions entered into by us during 2015, and determined that none of our non-employee directors had a material interest in those transactions.

Board Leadership Structure

Our Corporate Governance Guidelines do not require the separation of the roles of Chairman of the Board and Chief Executive Officer, as our Board believes that effective board leadership structure can be highly dependent on the experience, skills and personal interaction between persons in leadership roles. In recent years, we have had, alternately, an independent Chairman and a non-independent Executive Chairman with a Lead Independent Director. Our policy is to have a Lead Independent Director if the Chairman is not independent.

Our Board leadership structure is currently composed of a non-executive Chairman (Mr. Egan). We believe the current Board leadership structure serves us and our stockholders well by having a strong non-executive Chairman to provide independent leadership of the Board. This leadership structure, coupled with a strong emphasis on Board independence,

-12-

provides effective independent oversight of management. Board members have complete access to and are encouraged to utilize members of our senior management regularly, and they have the authority to retain independent advisors as they deem necessary. The Board believes this leadership structure affords our company an effective combination of internal and external experience, continuity and independence.

Executive Sessions of Independent Directors

Our independent directors meet in executive session without the Chief Executive Officer at every regularly scheduled Board meeting to discuss, among other matters, the performance of the Chief Executive Officer. Executive sessions do not include the employee directors of our company, and the Chairman is responsible for chairing the executive sessions.

Board of Directors’ Role in Risk Oversight

Our Board of Directors believes that its oversight responsibility with respect to the various risks confronting our company is one of its most important areas of responsibility and provides further checks and balances on our leadership structure. Our Board of Directors views its oversight of risk as an ongoing process that occurs throughout the year in the course of evaluating the strategic direction and actions of our company. A fundamental aspect of risk management is not only understanding the risks a company faces and what steps management is taking to manage those risks, but also determining what level of risk is appropriate for the company. We believe that having an independent Chairman enhances our board’s ability to oversee our risks.

In carrying out this critical function, our Board is involved in risk oversight through direct decision-making authority with respect to significant matters and the oversight of management directly by our Board and through its committees. Each committee’s specific area of responsibility is as follows:

• | The Audit Committee is primarily responsible for overseeing risk management as it relates to our financial condition, financial statements, financial reporting process, internal controls and accounting matters. The Audit Committee also assists our Board of Directors in fulfilling its oversight responsibilities with respect to conflict of interest issues that may arise. |

• | The Compensation Committee is responsible for overseeing our overall compensation practices, policies and programs and assessing the risks arising from those policies and programs. |

• | The Nominating and Corporate Governance Committee considers risks related to corporate governance, including evaluating and considering evolving corporate governance best practices and director and management succession planning. |

Our Board of Directors receives reports from members of senior management on the functional areas for which they are responsible. These reports may include operational, financial, sales, competitive, legal and regulatory, strategic and other risks, as well as any related management and mitigation.

Stock Ownership Guidelines for Directors

In January 2013, our Board of Directors adopted revised stock ownership guidelines for non-employee directors. These guidelines provide for all non-employee directors to hold an amount of our common stock, vested stock options and/or deferred stock units having a value equal to at least three times the annual cash retainer. Directors have five years to attain this ownership threshold. As of March 31, 2016, all of our directors met our stock ownership guidelines.

Relationships Among Directors, Executive Officers and Director Nominees

There are no family relationships between any director, executive officer or director nominee.

Policy Governing Stockholder Communications with our Board of Directors

Our Board of Directors welcomes communications from stockholders. Any stockholder may communicate either with our Board of Directors as a whole, or with any individual director, by sending a written communication addressed to the Board of Directors or to such director at our offices located at 14 Oak Park, Bedford, Massachusetts 01730, or by submitting an email communication to [email protected]. All communications sent to our Board of Directors will be forwarded to the Board of Directors, as a whole, or to the individual director to whom such communication was addressed.

-13-

Policy Governing Director Attendance at Annual Meetings of Stockholders

We do not require members of our Board of Directors to attend the annual meeting of stockholders. One of the members of our Board of Directors attended the 2015 annual meeting of stockholders.

-14-

DIRECTOR COMPENSATION

Director Compensation Plan - Fiscal 2015

We pay our directors a mix of cash and equity compensation. Employee directors receive no compensation for their service as directors.

In accordance with the 2015 Director Compensation Plan adopted by the Board, for 2015, our non-employee directors were paid an annual retainer of $250,000. This annual retainer was paid $50,000 in cash and $200,000 in equity (with the equity paid in the form of restricted stock units (RSUs) or stock options or any combination of the two, at the election of the individual director). The non-executive Chairman of the Board was paid an additional cash retainer of $30,000. Prior to adopting the 2015 Director Compensation Plan, the Compensation Committee received market data from its external compensation consultant and considered whether any changes in director compensation were required. Based on the market data, the Compensation Committee recommended to the Board that there should be no changes to the director compensation plan then in effect.

For purposes of the equity compensation paid to our directors, the number of options was determined by dividing the compensation amount by the grant date Black-Scholes value. The number of RSUs was determined by dividing the compensation amount by the grant date closing price of our common stock as reported by the NASDAQ Global Select Market. Upon issuance, the options and RSUs vested in a single installment on December 1, 2015, subject to continued service on our Board of Directors.

With respect to service on the committees of our Board of Directors, the following fees were paid:

• | Audit Committee - $25,000 for the Chairman and $20,000 for the other members; |

• | Compensation Committee - $20,000 for the Chairman and $15,000 for the other members; and |

• | Nominating and Corporate Governance Committee - $12,500 for the Chairman and $10,000 for the other members. |

The fees paid for service on the committees of our Board of Directors were paid in cash.

The fiscal 2015 director compensation was paid to our non-employee directors in one installment on April 6, 2015.

Each newly elected director receives an initial director appointment grant of $300,000 of option equivalent shares at the first April or October grant date following his or her election to our Board of Directors. This initial grant may be received in the form of options, deferred stock units or a combination of the two. The split between options and deferred stock units is determined by each director individually by written election made prior to the newly elected director’s appointment to our Board of Directors. The election will be expressed as a percentage of the initial director appointment grant (e.g., 50% in options and 50% in deferred stock units) and may consist of all options, all deferred stock units or any combination thereof. Options and deferred stock units vest over a 48-month period, beginning on the first day of the month following the month the director joins our Board of Directors, with full acceleration of vesting upon a change in control.

Director Compensation Table - Fiscal 2015

The following table sets forth a summary of the compensation earned by or paid to our non-employee directors in 2015.

Name | Fees Earned or Paid in Cash ($) | Stock Awards (1) (2) ($) | Option Awards (3)(4) ($) | Total ($) | ||||

Barry N. Bycoff | 50,000 | 200,001 | — | 250,001 | ||||

John R. Egan | 95,000 | 196,701 | 39,986 | 331,687 | ||||

Ram Gupta | 82,500 | 200,001 | — | 282,501 | ||||

Charles F. Kane | 90,000 | 200,001 | — | 290,001 | ||||

David A. Krall | 80,000 | 200,001 | — | 280,001 | ||||

Michael L. Mark | 80,000 | 200,001 | — | 280,001 | ||||

______________

(1) | Represents RSUs issued to the named directors electing to receive RSUs in the following amounts: |

-15-

Name | Total RSUs Granted in 2015 |

Mr. Bycoff | 7,764 |

Mr. Egan | 6,212 |

Mr. Gupta | 7,764 |

Mr. Kane | 7,764 |

Mr. Krall | 7,764 |

Mr. Mark | 7,764 |

The RSUs to the named directors in the table above vested on December 1, 2015.

(2) | Represents the grant date fair value of RSUs granted on April 6, 2015. The grant date fair value is equal to the number of RSUs granted multiplied by $25.76, the closing price on the date of grant. In the case of Mr. Egan, also includes the fair value of deferred stock units that vested during 2015 that he received in connection with his initial appointment to the Board in September 2011. |

(3) | Mr. Egan elected to receive 20% of the equity compensation portion of his annual retainer in the form of stock options. As a result, Mr. Egan was granted an option to purchase 5,889 shares of our common stock with an exercise price of $25.76 on April 6, 2015, which became fully exercisable on December 1, 2015. The aggregate grant date fair value of these options was approximately $40,000. |

Each non-employee director had the following unexercised stock options outstanding as of the record date:

Name | Unexercised Stock Options Outstanding at Record Date | ||

Mr. Bycoff | 5,664 | ||

Mr. Egan | 72,632 | ||

Mr. Gupta | — | ||

Mr. Kane | 7,705 | ||

Mr. Krall | 7,705 | ||

Mr. Mark | 146,649 | ||

(4) | Represents the grant date fair value of options granted on April 6, 2015. The grant date fair value of our options is equal to the number of shares subject to the option by the fair value of our options on the date of grant determined by using the Black-Scholes option valuation model. The Black-Scholes value of our options on April 6, 2015 was $6.79. The methodology and assumptions used to calculate the Black-Scholes value of our options are described in Note 12 of the consolidated financial statements contained in our Annual Report on Form 10-K for the fiscal year ended November 30, 2015. |

-16-

PROPOSAL TWO: ADVISORY VOTE ON COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS

We are asking our stockholders to approve, on an advisory basis, the compensation of our named executive officers as disclosed in this proxy statement. We urge you to read the “Compensation Discussion and Analysis” and “Executive Compensation” sections of this proxy statement which describe in more detail how our executive compensation policies and procedures operate and are designed to achieve our compensation objectives, as well as the related compensation tables and narrative, which provide detailed information on the 2015 compensation of our named executive officers.

Required Vote and Board Recommendation

We are asking our stockholders to indicate their support for the compensation of our named executive officers, as described in this proxy statement. This proposal, commonly known as a “say-on-pay” proposal, is not intended to address any specific item of compensation, but rather the overall compensation of our named executive officers and the philosophy, policies and practices described in this proxy statement. Accordingly, we ask our stockholders to vote “FOR” the following resolution at our annual meeting:

“RESOLVED, that the company’s stockholders approve, on an advisory basis, the compensation of the named executive officers, as disclosed in the company’s proxy statement for the 2016 annual meeting of stockholders pursuant to the compensation disclosure rules of the SEC, including the “Compensation Discussion and Analysis,” the “Summary Compensation Table - Fiscal Years 2015, 2014, and 2013” and the other related tables and narrative disclosure.”

This say-on-pay vote is advisory only and not binding on the company, the Compensation Committee or our Board of Directors. Although the vote is advisory, we, our Board of Directors and our Compensation Committee value the opinions of our stockholders and expect to take the outcome of this vote into account when considering future compensation arrangements for our executive officers.

Our Board of Directors recommends that you vote FOR the approval of the compensation of our named executive officers. | ||||

-17-

PROPOSAL THREE: AMENDMENT TO THE PROGRESS SOFTWARE CORPORATION

1991 EMPLOYEE STOCK PURCHASE PLAN

The Progress Software Corporation 1991 Employee Stock Purchase Plan, or the ESPP, was adopted by our stockholders at a special meeting of shareholders held on July 1, 1991. The ESPP was amended and restated in March 1998, and further amended in September 2006, April 2007, May 2009, April 2010, and May 2012, in each case, to add to the reserve for shares for issuance. As of March 31, 2016, a total of 8,650,000 shares of our common stock were authorized for issuance under the ESPP, of which approximately 440,000 remained available and reserved for issuance.

Why Adding Shares to the ESPP is Important

We believe that the availability of an adequate reserve of shares for issuance under the ESPP will benefit us by providing employees with an opportunity to acquire shares of our common stock and will enable us to attract, retain and motivate valued employees. On March 23, 2016, our Board of Directors unanimously approved an increase in the number of shares of our common stock reserved for issuance under the ESPP by 800,000 shares to a total of 9,450,000 shares, which increase is subject to stockholder approval being received at the 2016 Annual Meeting. A copy of the ESPP, as proposed to be amended, is attached as Appendix A to this Proxy Statement.

If a quorum is present at the 2016 Annual Meeting, a majority of the votes properly cast will be necessary to approve the proposed amendment to the ESPP.

Summary of the Provisions of the ESPP

The following summary of the ESPP, as amended, is qualified in its entirety by the specific language of the ESPP, a copy of which is attached as Appendix A.

It is our intention that the ESPP qualify as an “employee stock purchase plan” under Section 423 of the Internal Revenue Code of 1986, as amended, or the Code.

Generally, all employees of our company and its subsidiaries who are customarily employed for more than 20 hours per week and more than five months in the calendar year are eligible to participate in the ESPP.

Participation in the ESPP is limited to eligible employees who authorize payroll deductions (within ranges specified by the Compensation Committee) pursuant to the ESPP. There are currently approximately 1,700 employees eligible to participate in the ESPP, of whom approximately 600 are participating. Once an employee becomes a participant in the ESPP, that employee will automatically participate in successive offering periods, as described below, until such time as that employee withdraws from the ESPP, becomes ineligible to participate in the ESPP, or his or her employment ceases. A participant may be enrolled in only one offering period at a time.

No person who owns or holds, or as a result of participation in the ESPP would own or hold, stock or options to purchase stock, together equal to 5% or more of our total outstanding common stock is entitled to participate in the ESPP. No employee may purchase our common stock having a value of more than $25,000 (determined using the fair market value of the stock at the time such option is granted) in any calendar year.

Each offering of our common stock under the ESPP is for a period of 27 months, which we refer to as an “offering period.” Offering periods are overlapping, with a new 27-month offering period beginning every three months. New offering periods begin on each January 1, April 1, July 1 and October 1. Each offering period is comprised of nine three-month exercise periods. Shares are purchased on the last business day of each exercise period, in March, June, September and December, with that day being referred to as an “exercise date”. Our Board of Directors may establish different offering periods or exercise periods under the ESPP.

The purchase price per share in any offering will be 85% of the lower of the fair market value of the common stock on the first day or the last day of the offering period.

Participants may withdraw from any offering at any time before stock is purchased. Participation terminates automatically upon termination of employment for any reason, including retirement and disability, but excluding termination of employment by reason of death. Upon termination of a participant’s participation in the ESPP, all payroll deductions credited to the participant’s account or amounts paid that were not used to purchase shares of our common stock will be refunded to him or her.

The ESPP is administered by the Compensation Committee of our Board of Directors. The Compensation Committee, at its sole discretion, may establish a minimum holding period, for shares of stock acquired by a participant or a participant’s

-18-

beneficiary under the ESPP. Currently, the Compensation Committee has set a three month holding period. The ESPP will continue until terminated by our Board of Directors.

If the increase in the number of shares reserved for issuance under the ESPP is approved by our stockholders, we intend to file a Registration Statement on Form S-8 covering the shares of our common stock issuable as a result of that increase, and upon the effectiveness of such registration statement all such shares will be, when issued, eligible for resale in the public market.

Our Board of Directors may, in its discretion, at any time, terminate or amend the ESPP except that no termination may affect shares previously granted nor may any amendment make a change in any share previously granted which would adversely affect the rights of a participant under the ESPP.

Summary of Federal Income Tax Consequences

A participant in the ESPP recognizes no taxable income either as a result of participation in the ESPP or upon the purchase of shares of our common stock under the terms of the ESPP.

If a participant disposes of shares purchased under the ESPP within two years from the first day of the applicable offering period or within one year from the exercise date, which we refer to as a “disqualifying disposition”, the participant will realize ordinary income in the year of that disposition equal to the amount by which the fair market value of the shares on the date the shares were purchased exceeds the purchase price. The amount of ordinary income will be added to the participant’s basis in the shares, and any additional gain or resulting loss recognized on the disposition of the shares will be a capital gain or loss. A capital gain or loss will be long-term if the participant’s holding period is more than 12 months, or short-term if the participant’s holding period is 12 months or less.

If the participant disposes of shares purchased under the ESPP at least two years after the first day of the applicable offering period and at least one year after the exercise date, the participant will realize ordinary income in the year of disposition equal to the lesser of (1) the excess of the fair market value of the shares on the date of disposition over the exercise price or (2) the excess of the fair market value of the shares on the first day of the applicable offering period over the exercise price. The amount of any ordinary income will be added to the participant’s basis in the shares, and any additional gain recognized upon the disposition after that basis adjustment will be a long-term capital gain. If the fair market value of the shares on the date of disposition is less than the exercise price, there will be no ordinary income and any loss recognized will be a long-term capital loss.

If the participant still owns the shares at the time of death, the lesser of (1) the excess of the fair market value of the shares on the date of death over the exercise price or (2) the excess of the fair market value of the shares on the first day of the offering period in which the shares were purchased over the exercise price will constitute ordinary income in the year of death.

We are generally entitled to a tax deduction in the year of a disqualifying disposition equal to the amount of ordinary income recognized by the participant as a result of that disposition. In all other cases, we are not allowed a deduction.

The foregoing is only a summary of the effect of the United States income tax laws and regulations upon an employee and us with respect to an employee’s participation in the ESPP. This summary does not purport to be a complete description of all federal tax implications of participation in the ESPP, nor does it discuss the income tax laws of any municipality, state or foreign country in which a participant may reside or otherwise be subject to tax. Participants are strongly urged to consult their own tax advisor concerning the application of the various tax laws that may apply to a participant’s particular situation.

-19-

Plan Benefits

The following table sets forth, for each of the individuals and groups indicated, the number of shares of our common stock previously purchased under the ESPP as of March 31, 2016:

Name and Position | Number of Shares Purchased | |

Philip Pead President and Chief Executive Officer | — | |

Chris Perkins Chief Financial Officer | — | |

Jerry Rulli Chief Operating Officer | — | |

Matthew Robinson Chief Technology Officer | — | |

Michael Benedict Chief Product Officer | 9,775 | |

Karen Tegan Padir Former President, Application Development & Deployment Business Unit | — | |

All current executive officers as a group | 19,873 | |

All current directors who are not executive officers* | — | |

Each nominee for election as director* | — | |

Each associate of any executive officer, current director or director nominee | — | |

Each other person who has received or is to receive 5% of awards | — | |

All employees, including all current officers who are not executive officers, as a group | 8,210,000 | |

____________________

* Ineligible to participate

Our Board of Directors recommends that you vote FOR the proposal to amend the ESPP to increase the maximum number of shares issuance under the ESPP by 800,000 shares. | ||||

-20-

PROPOSAL FOUR: RATIFICATION OF THE SELECTION OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

Proposal Four is to ratify the selection by the Audit Committee of Deloitte & Touche LLP as our independent registered public accounting firm for the current fiscal year ending November 30, 2016. Deloitte & Touche LLP was the independent registered public accounting firm for our company for the fiscal year ended November 30, 2015.

Although ratification by stockholders is not required by law or by our Bylaws, the Audit Committee believes that submission of its selection to stockholders is a matter of good corporate governance. Even if the selection is ratified, the Audit Committee, in its discretion, may select a different independent registered public accounting firm at any time if the Audit Committee believes that such a change would be in the best interests of our company and its stockholders. If our stockholders do not ratify the selection of Deloitte & Touche LLP, the Audit Committee will take that fact into consideration, together with such other factors it deems relevant, in determining its next selection of an independent registered public accounting firm.

We have been advised that a representative of Deloitte & Touche LLP will be present at the annual meeting. This representative will have the opportunity to make a statement if he or she desires and will be available to respond to appropriate questions presented at the meeting.

Independent Registered Public Accounting Firm Fees

Aggregate fees billed to us for services performed for the fiscal years ended November 30, 2015 and November 30, 2014 by our independent registered public accounting firm, Deloitte & Touche LLP, were as follows:

2015 | 2014 | ||||

Audit Fees (1) | $ | 2,394,392 | $ | 1,945,917 | |

Tax Fees (2) | 57,829 | 310,468 | |||

Audit-Related Fees (3) | 532,256 | 405,200 | |||

All Other Fees (4) | — | 2,600 | |||

__________

(1) | Represents fees billed for each of the last two fiscal years for professional services rendered for the audit of our annual financial statements included in Form 10-K and reviews of financial statements included in our interim filings on Form 10-Q, as well as statutory audit fees related to our wholly-owned foreign subsidiaries. In accordance with the policy on Audit Committee pre-approval, 100% of audit services provided by the independent registered public accounting firm are pre-approved. |

(2) | Includes fees primarily for tax services. In accordance with the policy on Audit Committee pre-approval, 100% of tax services provided by the independent registered public accounting firm are pre-approved. |

(3) | Represents fees billed for due diligence services in connection with the acquisition of Telerik AD. |

(4) | Represents fees billed for the subscription to an online accounting tool. |

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Registered Public Accounting Firm

The Audit Committee is responsible for appointing, setting compensation, and overseeing the work of our independent registered public accounting firm. The Audit Committee has established a policy regarding pre-approval of all audit and permissible non-audit services provided by the independent registered public accounting firm.

Requests for specific services by the independent registered public accounting firm which comply with the auditor services policy are reviewed by our Finance, Tax, and Internal Audit departments. Requests approved by the group are aggregated and submitted to the Audit Committee in one of the following ways:

• | Request for approval of services at a meeting of the Audit Committee; or |