Form 8-K UMB FINANCIAL CORP For: May 31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 31, 2015

UMB FINANCIAL CORPORATION

(Exact name of Registrant as specified in its charter)

| Missouri | 0-4887 | 84-0920811 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

| 1010 Grand Blvd., Kansas City, MO | 64106 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (816) 860-7000

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.01 Completion of Acquisition or Disposition of Assets

On May 31, 2015, UMB Financial Corporation (“UMB”) completed its previously announced merger with Marquette Financial Companies, a Minnesota corporation (“Marquette”). Pursuant to the terms and conditions of the Agreement and Plan of Merger, dated as of December 15, 2014 (the “Merger Agreement”), by and among UMB, Marquette, the beneficial owners of all of the outstanding shares of Marquette, and Lakes Merger Sub LLC, a Missouri limited liability company and wholly owned subsidiary of UMB (“Merger Sub”), Marquette was merged with and into Merger Sub (the “Merger”), with Merger Sub surviving the Merger. Immediately thereafter, Merger Sub was merged with and into UMB, with UMB surviving the merger.

At the effective time of the Merger, each share of Marquette common stock issued and outstanding as of the effective time was converted into and constituted the right to receive 9.2295 shares of UMB common stock, or approximately 3.470 million shares of UMB common stock in the aggregate, which is subject to a possible post-closing adjustment as provided in the Merger Agreement. The market value of the shares of UMB common stock issued at the effective time of the Merger was approximately $179.7 million, based on UMB’s closing stock price of $51.79 on May 29, 2015.

The foregoing summary of the Merger Agreement and the transactions contemplated thereby does not purport to be complete and is qualified in its entirety by reference to the full text of the Merger Agreement, which was attached as Exhibit 2.1 to UMB’s Current Report on Form 8-K filed December 15, 2014.

Item 3.02 Unregistered Sales of Equity Securities

The information regarding the issuance of shares of UMB common stock set forth in Item 2.01 of this Current Report on Form 8-K is incorporated in its entirety herein by reference. The issuance of such shares at the effective time of the Merger was a private transaction exempt from registration pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended.

Item 7.01 Regulation FD Disclosure

The information provided under Item 7.01 of this Current Report on Form 8-K is being furnished and is not deemed to be “filed” with the Securities and Exchange Commission (the “SEC”) for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section.

On June 1, 2015, UMB issued a press release announcing the completion of the Merger. A copy of the press release is attached hereto as Exhibit 99.1.

On June 1, 2015, UMB also issued a pro forma fact sheet showing combined financial statistics for UMB and Marquette as of December 31, 2014. A copy of the fact sheet is attached as Exhibit 99.2.

Cautionary Notice About Forward-Looking Statements

This Current Report contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements can be identified by the fact that they do not relate strictly to historical or current facts. Forward-looking statements often use words such as “believe,” “expect,” “anticipate,” “intend,” “estimate,” “project,” “outlook,” “forecast,” “target,” “trend,” “plan,” “goal,” or other words of comparable meaning or future-tense or conditional verbs such as “may,” “will,” “should,” “would,” or “could.” Forward-looking statements convey our expectations, intentions, or forecasts about future events, circumstances, results, or aspirations.

2

All forward-looking statements are subject to assumptions, risks, and uncertainties, which may change over time and many of which are beyond our control. Risks include factors such as the uncertain nature of the expected benefits from the Merger, risks associated with the integration of acquired businesses, risks associated with UMB’s industry or the economy generally, and other matters discussed in the “Risk Factors” section of UMB’s filings with the SEC. You should not rely on any forward-looking statement as a prediction or guarantee about the future. Our actual future objectives, strategies, plans, prospects, performance, condition, or results may differ materially from those set forth in any forward-looking statement. Some of the factors that may cause actual results or other future events, circumstances, or aspirations to differ from those in forward-looking statements are described in our Annual Report on Form 10-K for the year ended December 31, 2014, our subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K, or other applicable documents that are filed or furnished with the SEC.

Any forward-looking statement made by us or on our behalf speaks only as of the date that it was made. We do not undertake to update any forward-looking statement to reflect the impact of events, circumstances, or results that arise after the date that the statement was made. You, however, should consult further disclosures (including disclosures of a forward-looking nature) that we may make in any subsequent Annual Report on Form 10-K, Quarterly Report on Form 10-Q, Current Report on Form 8-K, or other applicable document that is filed or furnished with the SEC.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| Exhibit No. |

Description | |

| 99.1 | Press release dated June 1, 2015 | |

| 99.2 | Pro forma fact sheet | |

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| UMB FINANCIAL CORPORATION | ||||||

| Date: June 1, 2015 | By: | /s/ Brian J. Walker | ||||

| Brian J. Walker | ||||||

| EVP, Chief Financial Officer and Chief Accounting Officer | ||||||

4

EXHIBIT INDEX

| Exhibit No. |

Description | |

| 99.1 | Press release dated June 1, 2015 | |

| 99.2 | Pro forma fact sheet | |

5

Exhibit 99.1

News Release

UMB Financial Corporation

1010 Grand Boulevard

Kansas City, MO 64106

Media Contact:

Kelli Christman

816.860.5088

Investor Relations Contact:

Abby Wendel

816.860.1685

UMB Financial Corporation Finalizes Acquisition of Marquette Financial Companies

Expands Presence in Key Texas and Arizona Markets; Adds Specialty Lending Businesses and Asset Management Firm

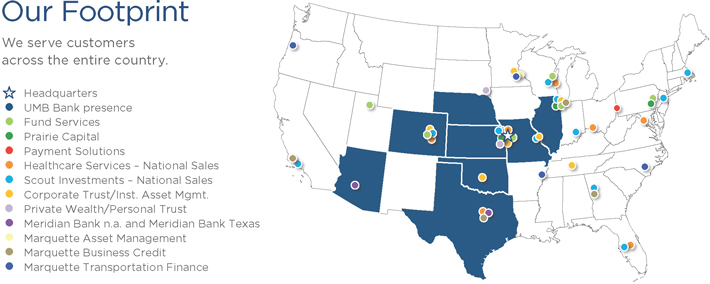

KANSAS CITY, Mo. (June 1, 2015) —UMB Financial Corporation (Nasdaq: UMBF), a $16.7 billion diversified financial holding company, headquartered in Kansas City, Mo., has completed the acquisition of Marquette Financial Companies (MFC), a $1.4 billion financial-services company owned by the Pohlad family, in an all-stock transaction. With this deal, UMB has acquired 13 branches in Arizona and Texas, two national specialty lending businesses focused on asset-based lending and factoring as well as an asset management firm.

“This is an incredible time at UMB as we embark on a new and exciting chapter in our company’s history,” said Mariner Kemper, chairman and CEO, UMB Financial Corporation. “This acquisition has an immediate impact on our presence in two key growth markets for UMB – Arizona and Texas. In addition, the acquisition of two specialty lending businesses and an asset management firm expands our offerings and builds upon our existing commercial banking services through a national footprint.”

As part of this acquisition, the Phoenix-based Meridian Bank, n.a. and the Ft. Worth-based Meridian Bank Texas were merged into UMB Bank, n.a. The merger adds eight branches in the Phoenix area, with total assets of $745 million, net loans of $530 million and deposits of $584 million, as of March 31, 2015, and five branches in Ft. Worth, Dallas and Denton, Texas, with total assets of $442 million, net loans of $321 million and deposits of $384 million, as of March 31, 2015.

UMB also acquired Dallas-based Marquette Business Credit, which provides asset-based loans for working capital, recapitalization, growth, and mergers and acquisitions; Marquette Transportation Finance, which provides accounts-receivable financing and factoring primarily for transportation businesses, and its division, Marquette Commercial Finance; and Marquette Asset Management, which provides private asset management to individuals, families and institutions, based in Minneapolis, Minn.

“The realization of this acquisition benefits our customers by combining the strength of our two companies and expands our services and product sets,” James O. Pohlad, Chairman Marquette Financial Companies. “We are pleased to continue our enduring commitment to serving our customers and the communities where we do business.”

RBC Capital Markets, LLC served as exclusive financial adviser to UMB. Sullivan & Cromwell and Holland & Hart served as legal counsel to UMB. D.A. Davidson served as exclusive financial adviser to MFC. Briggs and Morgan served as legal counsel to MFC.

About UMB

UMB Financial Corporation (Nasdaq: UMBF) is a diversified financial holding company headquartered in Kansas City, Mo., offering complete banking services, payment solutions, asset servicing and institutional investment management to

customers. UMB operates banking and wealth management centers throughout Missouri, Illinois, Colorado, Kansas, Oklahoma, Nebraska, Arizona and Texas. Subsidiaries of the holding company include companies that offer services to mutual funds and alternative-investment entities and registered investment advisors that offer equity and fixed income strategies to institutions and individual investors. For more information, visit umbfinancial.com, umb.com, blog.umb.com or follow us on Twitter at @UMBBank, Facebook at facebook.com/UMBBank and LinkedIn at linkedin.com/company/umb-bank.

###

Exhibit 99.2

| UMB Financial Corporation |

| |

| Pro Forma Fact Sheet |

Pro forma is defined as financial data as of 12/31/14 for UMB Financial Corporation and Marquette Financial Companies on a combined basis with no purchase-accounting adjustments or growth projections.

Financial data for Marquette Financial Companies is based on its financial reports and regulatory filings.

| * Only UMB |

|

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- CIDARA Therapeutics ALERT: Bragar Eagel & Squire, P.C. is Investigating Cidara Therapeutics, Inc. on Behalf of Cidara Therapeutics Stockholders and Encourages Investors to Contact the Firm

- Banco Itaú Chile Files Material Event Notice announcing Extraordinary General Shareholders’ Meeting Agreements

- LINCOLN ALERT: Bragar Eagel & Squire, P.C. Announces that a Class Action Lawsuit Has Been Filed Against Lincoln National Corporation and Encourages Investors to Contact the Firm

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share