Form 8-K TerraForm Power, Inc. For: Jul 26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report: July 26, 2016

TERRAFORM POWER, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

001-37528

|

47-1919173

|

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

7550 Wisconsin Avenue, 9th Floor, Bethesda, Maryland 20814

(Address of principal executive offices, including zip code)

(240) 762-7700

(Registrant’s telephone number, including area code)

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 7.01 | Regulation FD Disclosure |

On July 26, 2016, TerraForm Power, Inc. (the “Company”) provided certain selected information to the beneficial holders (collectively, the “Holders”) of TerraForm Power Operating, LLC’s 5.875% Senior Notes due 2023 issued pursuant to the indenture dated as of January 28, 2015, and its 6.125% Senior Notes due 2025 issued pursuant to the indenture dated as of March 30, 2016 (together, the “Indentures”), and certain of their advisors. This information contains preliminary unaudited financial information from the fourth quarter of 2015 and the first quarter of 2016, and a discussion of the principal risks facing the Company. The financial information may change materially as a result of the completion of the audit of the Company’s financial results for fiscal year 2015. The information does not represent a complete picture of the Company’s financial position, results of operations or cash flows and is not a replacement for full financial statements prepared in accordance with U.S. GAAP. The disclosure of this information takes place during the Company’s ongoing solicitation of consents from the Holders to waive covenants under the Indentures that require the Company to file with the Securities and Exchange Commission (the “SEC”) or make publicly available annual and quarterly reports within the time periods specified in the SEC rules and regulations. A Press Release announcing the disclosure is attached hereto as Exhibit 99.1. The preliminary unaudited financial information, attached as Exhibit 99.2, was accompanied by commentary regarding key initiatives being pursued by the Company. The risk factors, a copy of which is included as Exhibit 99.3, update the discussion of risks of holding the Company’s Class A common stock included in the Company’s annual report on Form 10-K for fiscal year ended December 31, 2014, and in the Company’s Form 10-Q for the period ended September 30, 2015, which contains the most recent interim financial statements the Company has filed with the SEC.

| Item 9.01 | Financial Statement and Exhibits. |

(d) Exhibits

|

Exhibit

No.

|

Description

|

|

Press release, dated July 26, 2016, titled “TerraForm Power Provides Preliminary Financial Data for Bondholders”

|

|

Slide Deck, dated July 26, 2016, titled “TerraForm Power Supplemental Information Requested by Bondholders”

|

|

Document, dated July 26, 2016, titled “TerraForm Power Risk Factors”

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

TERRAFORM POWER, INC.

|

||

|

By:

|

/s/ Rebecca Cranna

|

|

|

Name: Rebecca Cranna

|

||

|

Title: Executive Vice President and Chief Financial Officer

|

||

|

Date: July 26, 2016

|

||

Exhibit 99.1

TerraForm Power Provides Preliminary Financial Data for Bondholders

BETHESDA, Md., July 26, 2016 – TerraForm Power, Inc. (Nasdaq: TERP, “the Company”), an owner and operator of clean energy power plants, at the request of certain of its bondholders, has posted a presentation on its website today containing selected financial information. This presentation contains preliminary unaudited financial information for the fourth quarter of 2015 and first quarter of 2016. The financial information may change materially as a result of the completion of the audit of the Company’s financial results for fiscal year 2015. The information does not represent a complete picture of the Company’s financial position, results of operations or cash flows and is not a replacement for full financial statements prepared in accordance with U.S. GAAP.

TerraForm Power has also posted an updated disclosure addressing risk factors relating to the Company’s business. The risk factors update the discussion of risks included in the Company’s annual report on Form 10-K for the fiscal year ended December 31, 2014, and in its Form 10-Q for the period ended September 30, 2015, which contains the Company’s most recent published interim financial statements.

The financial information and risk factors may be found on the Investor section of the Company’s website at www.terraformpower.com. They have also been included as exhibits to a Form 8-K furnished by the Company to the Securities and Exchange Commission.

About TerraForm Power

TerraForm Power is a renewable energy company that is changing how energy is generated, distributed and owned. TerraForm Power creates value for its investors by owning and operating clean energy power plants. For more information about TerraForm Power, please visit: www.terraformpower.com.

Cautionary Note Regarding Forward-Looking Statements

This communication contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. These statements involve estimates, expectations, projections, goals, assumptions, known and unknown risks, and uncertainties and typically include words or variations of words such as “expect,” “anticipate,” “believe,” “intend,” “plan,” “seek,” “estimate,” “predict,” “project,” “goal,” “guidance,” “outlook,” “objective,” “forecast,” “target,” “potential,” “continue,” “would,” “will,” “should,” “could,” or “may” or other comparable terms and phrases. All statements that address operating performance, events, or developments that TerraForm Power expects or anticipates will occur in the future are forward-looking statements. They may include estimates of expected adjusted EBITDA, cash available for distribution (CAFD), earnings, revenues, capital expenditures, liquidity, capital structure, future growth, financing arrangement and other financial performance items (including future dividends per share), descriptions of management’s plans or objectives for future operations, products, or services, or descriptions of assumptions underlying any of the above. Forward-looking statements provide TerraForm Power’s current expectations or predictions of future conditions, events, or results and speak only as of the date they are made. Although TerraForm Power believes its respective expectations and assumptions are reasonable, it can give no assurance that these expectations and assumptions will prove to have been correct and actual results may vary materially.

By their nature, forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those suggested by the forward-looking statements. Factors that might cause such differences include, but are not limited to, our relationship with SunEdison, including SunEdison’s bankruptcy filings and our reliance on SunEdison to perform under material intercompany agreements and to provide management and accounting services, project level operation and maintenance and asset management services, to maintain critical information technology and accounting systems and to provide our employees; our ability to integrate the projects we acquire from third parties or otherwise realize the anticipated benefits from such acquisitions; actions of third parties, including but not limited to the failure of SunEdison, to fulfill its obligations; price fluctuations, termination provisions and buyout provisions in offtake agreements; delays or unexpected costs during the completion of projects under construction; our ability to successfully identify, evaluate, and consummate acquisitions from SunEdison or third parties or changes in expected terms and timing of any acquisitions; regulatory requirements and incentives for production of renewable power; operating and financial restrictions under agreements governing indebtedness; the condition of the debt and equity capital markets and our ability to borrow additional funds and access capital markets; the impact of foreign exchange rate fluctuations; our ability to compete against traditional and renewable energy companies; hazards customary to the power production industry and power generation operations, such as unusual weather conditions and outages or other curtailment of our power plants; departure of some or all of SunEdison’s employees that are dedicated to the Company; pending and future litigation; and our ability to operate our business efficiently, to operate and maintain our information technology, technical, accounting and generation monitoring systems, to manage and complete governmental filings on a timely basis, and to manage our capital expenditures. Furthermore, any dividends are subject to available capital, market conditions, and compliance with associated laws and regulations. Many of these factors are beyond TerraForm Power’s control.

TerraForm Power disclaims any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions, factors, or expectations, new information, data, or methods, future events, or other changes, except as required by law. The foregoing list of factors that might cause results to differ materially from those contemplated in the forward-looking statements should be considered in connection with information regarding risks and uncertainties which are described in TerraForm Power’s Form 10-K for the fiscal year ended December 31, 2014, and Forms 10-Q with respect to the second and third quarters of 2015, as well as additional factors it may describe from time to time in other filings with the Securities and Exchange Commission or incorporated herein. You should understand that it is not possible to predict or identify all such factors and, consequently, you should not consider any such list to be a complete set of all potential risks or uncertainties.

Contacts:

Investors / Analysts:

Brett Prior

Media:

Exhibit 99.2

TerraForm PowerSupplemental Information Requested by BondholdersJuly 26, 2016

Forward Looking Statements This communication contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. These statements involve estimates, expectations, projections, goals, assumptions, known and unknown risks, and uncertainties and typically include words or variations of words such as “expect,” “anticipate,” “believe,” “intend,” “plan,” “seek,” “estimate,” “predict,” “project,” “goal,” “guidance,” “outlook,” “objective,” “forecast,” “target,” “potential,” “continue,” “would,” “will,” “should,” “could,” or “may” or other comparable terms and phrases. All statements that address operating performance, events, or developments that TerraForm Power expects or anticipates will occur in the future are forward-looking statements. They may include estimates of expected adjusted EBITDA, cash available for distribution (CAFD), earnings, revenues, capital expenditures, liquidity, capital structure, future growth, financing arrangements and other financial performance items (including future dividends per share), descriptions of management’s plans or objectives for future operations, products, or services, or descriptions of assumptions underlying any of the above. Forward-looking statements provide TerraForm Power’s current expectations or predictions of future conditions, events, or results and speak only as of the date they are made. Although TerraForm Power believes its respective expectations and assumptions are reasonable, it can give no assurance that these expectations and assumptions will prove to have been correct and actual results may vary materially. By their nature, forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those suggested by the forward-looking statements. Factors that might cause such differences include, but are not limited to, our relationship with SunEdison, including SunEdison’s bankruptcy filings and our reliance on SunEdison to perform under material intercompany agreements and to provide management and accounting services, project level operation and maintenance and asset management services, to maintain critical information technology and accounting systems and to provide our employees; our ability to integrate the projects we acquire from third parties or otherwise realize the anticipated benefits from such acquisitions; actions of third parties, including but not limited to the failure of SunEdison, to fulfill its obligations; price fluctuations, termination provisions and buyout provisions in offtake agreements; delays or unexpected costs during the completion of projects under construction; our ability to successfully identify, evaluate, and consummate acquisitions from SunEdison or third parties or changes in expected terms and timing of any acquisitions; regulatory requirements and incentives for production of renewable power; operating and financial restrictions under agreements governing indebtedness; the condition of the debt and equity capital markets and our ability to borrow additional funds and access capital markets; the impact of foreign exchange rate fluctuations; our ability to compete against traditional and renewable energy companies; hazards customary to the power production industry and power generation operations, such as unusual weather conditions and outages or other curtailment of our power plants; departure of some or all of SunEdison’s employees that are dedicated to the Company; pending and future litigation; and our ability to operate our business efficiently, to operate and maintain our information technology, technical, accounting and generation monitoring systems, to manage and complete governmental filings on a timely basis, and to manage our capital expenditures. Furthermore, any dividends are subject to available capital, market conditions, and compliance with associated laws and regulations. Many of these factors are beyond TerraForm Power’s control. TerraForm Power disclaims any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions, factors, or expectations, new information, data, or methods, future events, or other changes, except as required by law. The foregoing list of factors that might cause results to differ materially from those contemplated in the forward-looking statements should be considered in connection with information regarding risks and uncertainties which are described in TerraForm Power’s Form 10-K for the fiscal year ended December 31, 2014, and Forms 10-Q with respect to the first, second and third quarters of 2015, as well as additional factors it may describe from time to time in other filings with the Securities and Exchange Commission or incorporated herein. You should understand that it is not possible to predict or identify all such factors and, consequently, you should not consider any such list to be a complete set of all potential risks or uncertainties.

Introduction & Importance of our Updated Risk Factors The following information is being provided at the request of bondholders and their advisorsThe financial information presented on the following slides is preliminary and unaudited. Financial information may change materially as a result of the completion of the audit for fiscal year 2015The information does not represent a complete picture of the financial position, results of operation or cash flows of TerraForm Power (“TerraForm Power” or the “Company”), and is not a replacement for full financial statements prepared in accordance with U.S. GAAPThe Company’s last annual or quarterly report was its Form 10-Q for the period ended September 30, 2015. The Company has not filed its Form 10-K for 2015. The circumstances of the Company and the risks it faces have changed substantially since the date of its last filing on Form 10-Q in November 2015. You should review the updated Risk Factors relating to the Company provided simultaneously with this presentation, which include a description of important new risks relating to the chapter 11 proceedings of SunEdison, the consequences of the absence of audited financial information, pending litigation and other matters. These materials and the Risk Factors also have been filed with the SEC on a Form 8-K, dated July 26, 2016

Situation Update Management is motivated to maximize value for all stakeholders and position TerraForm Power for long-term growthTerraForm Power is focused on key areas of executionContinuity of operationsIndependence: governance, systems, employeesStrengthen balance sheetOptimize portfolio through non-recourse project financings and selective divestituresUpdate on the Sale of SunEdison’s Interests in the Company:SunEdison has requested that the Company share confidential information about the Company and take other steps to facilitate the marketing of SunEdison’s interests in the Company, and the Company is considering this requestTerraForm Power has announced that it is working with SunEdison to explore potential value creating options for SunEdison’s interests in the Company. The Company has made no decision to support any particular bidder, structure or transactionThe Company adopted a stockholder protection rights agreement in response to the potential sale by SunEdison and the announced accumulation of TerraForm Power’s Class A shares by third parties

Geographically Diverse Fleet of 3.0 GW1 Wind Solar Reflects portfolio as of June 30, 2016. Diversified Portfolio Across Key Markets

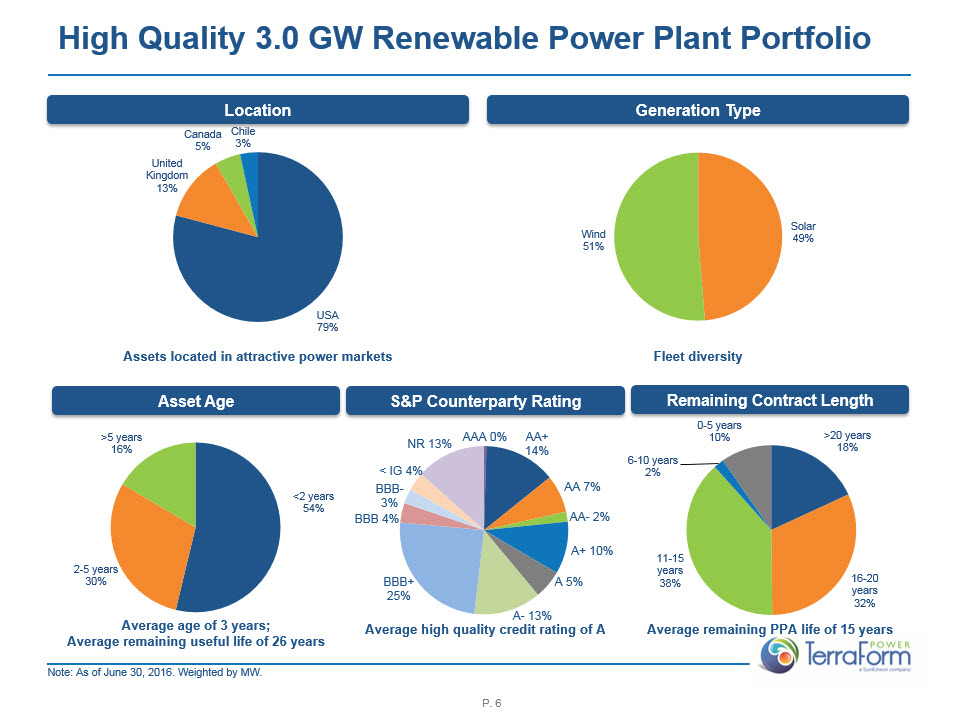

High Quality 3.0 GW Renewable Power Plant Portfolio Location Asset Age Assets located in attractive power markets Remaining Contract Length Average remaining PPA life of 15 years Average age of 3 years; Average remaining useful life of 26 years S&P Counterparty Rating Average high quality credit rating of A Generation Type Fleet diversity Note: As of June 30, 2016. Weighted by MW.

MW Current View of Portfolio Formation Note: Reflects net capacity based on economic ownership.Excludes 98 MW Prairie Breeze II and III assets which have not closed.Additional distributed generation and residential dropdowns from SunEdison, net of cancellations, and capacity updates.Includes 18 MW River Mountain and 1 MW distributed generation drop downs from SunEdison and 1 MW final closing of Moose Power acquisition. No assets were acquired in 2Q 2016. TerraForm Power has committed to make up to $35M in remaining purchase price payments to SunEdison for assets that have already been acquired, subject to satisfaction of customary conditions precedent. In the third quarter, TerraForm Power expects to terminate the commitment to SunEdison to acquire the Comanche solar project for $163M. Additionally, TerraForm Power does not expect to acquire incremental projects from SunEdison or enter into any new commitments to SunEdison in 2016. 1 12/31/15: 2,967 MW 2 3

Preliminary Unaudited 2015 Results Note: Ranges have been provided for key financial metrics as the 2015 audit has not yet been completed.Adjusted for amortization of favorable or unfavorable rate revenue contracts, unrealized gains or losses on energy derivatives, and amortization of ITC revenue.Excludes 98 MW Prairie Breeze II and III assets which have not closed.Accounting treatment of First Wind prepaid warranty and deposits for asset purchases may change based on various factors and outcome of SunEdison’s bankruptcy proceedings Commentary 2015 operating results in line with management expectations driven by balanced portfolio with generation and geographic mixGrew operating portfolio by 1,989 MW Y-o-Y including: 832 MW acquisition of Invenergy wind assets2521 MW acquisition of First Wind operating assets574 MW of SunEdison drop downs 61 MW of other third party acquisitionsNet loss impacted by:$56M contingent loss related to First Wind prepaid warranty and deposits for asset purchases from SunEdison3$55M acquisition-related expense$37M loss on unrealized FX and extinguishment of debt$26M amortization of deferred financing and debt discount (included in interest expense)$10M LAP acquisition termination settlement Metric 2015 Net MW Owned (Period End) 2,967 Production (GWh) 3,462 Capacity Factor 24% Revenue $467M - $473M Adjusted Revenue1 $464M – $470M Adjusted Revenue / MWh $135 – $136 Net Loss ($203M) – ($181M) Adjusted EBITDA $354M – $364M CAFD $224M – $234M

Preliminary 1Q 2016 Results Note: Ranges have been provided for key financial metrics as the interim financial statements for the period ended March 31, 2016 are still under review.Adjusted for amortization of favorable or unfavorable rate revenue contracts, unrealized gains or losses on energy derivatives, and amortization of ITC revenue. Commentary 1Q 2016 operating fleet performance ahead of management expectations driven by prudent project cost management and favorable Northeast and Central wind resource Modest portfolio growth vs. 4Q 2015 includes SunEdison dropdowns of utility and distributed generation solar projects and final closing of Moose Power acquisitionNet loss impacted by:$9M amortization of deferred financing and debt discount (included in interest expense) $8M advisory and legal expenses related to SunEdison bankruptcy$3M acquisition-related expenses Metric 1Q 2016 Net MW Owned (Period End) 2,987 Production (GWh) 2,072 Capacity Factor 30% Revenue $151M - $159M Adjusted Revenue1 $158M – $166M Adjusted Revenue / MWh $76 – $80 Net Loss ($46M) – ($32M) Adjusted EBITDA $117M – $125M CAFD $58M – $66M

$M, unless otherwise noted Holdco Cash Walk from 3Q 2015 to 4Q 2015 Note: As of 12/31/2015, Company characterizes restricted cash as (i) cash on deposit in collateral account, debt service, maintenance and other reserves and (ii) in operating accounts but subject to distribution restrictions due to defaults.Holdco unrestricted cash excludes unrestricted project cash and restricted cash at the corporate level, project level or in escrow. 1 1 YE 2015 Holdco unrestricted cash of $499M, inclusive of $655M revolver draws in October and November$133M net proceeds from UK refinancing in November (additional $7M net proceeds received in 1Q 2016)$63M of project distributions received during 4Q 2015$865M paid for first closing of Invenergy wind assets and SunEdison drop downs including South Plains I $10M debt service includes $8M Senior Notes interest payment and $2M payment of revolver fees and interest$67M other includes 3Q 2015 dividend payment of $49M and net payables & other of $19M, partially offset by FX hedge gains of $1M

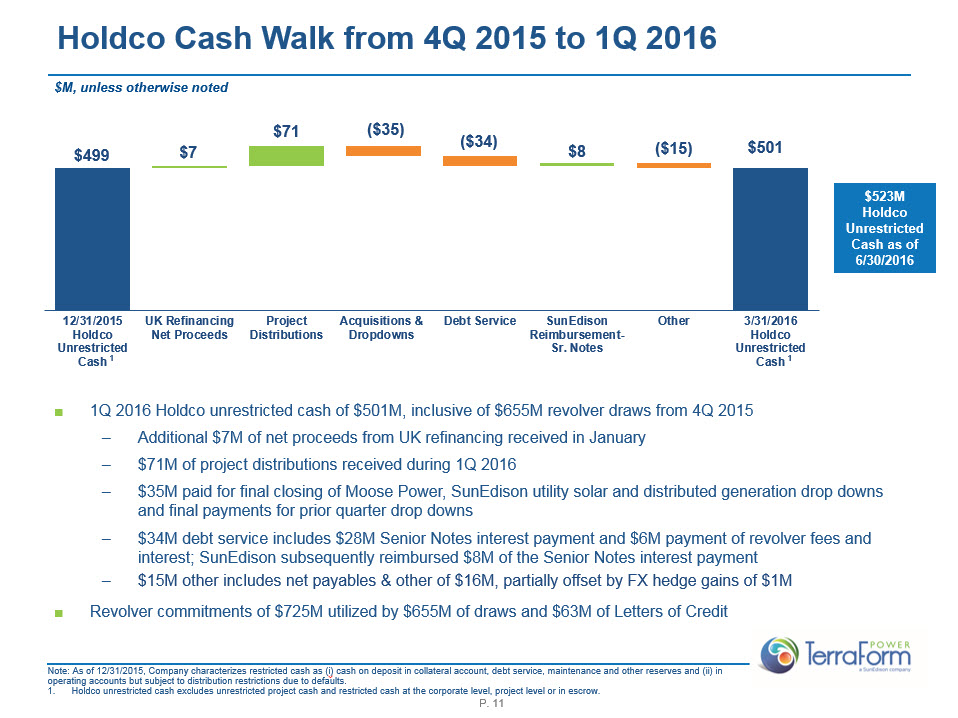

$M, unless otherwise noted Holdco Cash Walk from 4Q 2015 to 1Q 2016 Note: As of 12/31/2015, Company characterizes restricted cash as (i) cash on deposit in collateral account, debt service, maintenance and other reserves and (ii) in operating accounts but subject to distribution restrictions due to defaults.Holdco unrestricted cash excludes unrestricted project cash and restricted cash at the corporate level, project level or in escrow. 1 1 1Q 2016 Holdco unrestricted cash of $501M, inclusive of $655M revolver draws from 4Q 2015Additional $7M of net proceeds from UK refinancing received in January$71M of project distributions received during 1Q 2016$35M paid for final closing of Moose Power, SunEdison utility solar and distributed generation drop downs and final payments for prior quarter drop downs$34M debt service includes $28M Senior Notes interest payment and $6M payment of revolver fees and interest; SunEdison subsequently reimbursed $8M of the Senior Notes interest payment$15M other includes net payables & other of $16M, partially offset by FX hedge gains of $1MRevolver commitments of $725M utilized by $655M of draws and $63M of Letters of Credit $523M Holdco Unrestricted Cash as of 6/30/2016

Appendix

Risk Factors Please refer to the risk factors provided simultaneously and to be read in conjunction with this presentation

Definitions: Adjusted Revenue, Adjusted EBITDA, CAFD Adjusted RevenueWe define Adjusted Revenue as operating revenues, net adjusted for non-cash items including unrealized gain/loss on derivatives, amortization of favorable and unfavorable rate revenue contracts, net and other non-cash items. We believe Adjusted Revenue is useful to investors in evaluating our operating performance because securities analysts and other interested parties use such calculations as a measure of financial performance. Adjusted Revenue is a non-GAAP measure used by our management for internal planning purposes, including for certain aspects of our consolidated operating budget.Adjusted EBITDAWe define Adjusted EBITDA as net income plus interest expense, net; income taxes; depreciation, accretion and amortization expense; stock-based compensation expense; and certain other non-cash charges, unusual or non-recurring items and other items that we believe are not representative of our core business or future operating performance. Our definitions and calculations of these items may not necessarily be the same as those used by other companies. Adjusted EBITDA is not a measure of liquidity or profitability and should not be considered as an alternative to net income, operating income, net cash provided by operating activities or any other measure determined in accordance with U.S. GAAP.Cash Available For Distribution (CAFD)We define CAFD as net cash provided by operating activities of Terra LLC as adjusted for certain other cash flow items that we associate with our operations. It is a non-GAAP measure of our ability to generate cash to service our dividends. As used in this report, CAFD represents net cash provided by (used in) operating activities of Terra LLC (i) plus or minus changes in assets and liabilities as reflected on our statements of cash flows, (ii) minus deposits into (or plus withdrawals from) restricted cash accounts required by project financing arrangements to the extent they decrease (or increase) cash provided by operating activities, (iii) minus cash distributions paid to non-controlling interests in our renewable energy facilities, if any, (iv) minus scheduled project-level and other debt service payments and repayments in accordance with the related borrowing arrangements, to the extent they are paid from operating cash flows during a period, (v) minus non-expansionary capital expenditures, if any, to the extent they are paid from operating cash flows during a period, (vi) plus cash contributions from SunEdison pursuant to the Interest Payment Agreement and the Amended Interest Payment Agreement, (vii) plus operating costs and expenses paid by SunEdison pursuant to the MSA to the extent such costs or expenses exceed the fee payable by us pursuant to such agreement but otherwise reduce our net cash provided by operating activities and (viii) plus or minus operating items as necessary to present the cash flows we deem representative of our core business operations, with the approval of the audit committee. CAFD is a non-GAAP measure and should not be considered an alternative to net income (loss), net cash provided by operating activities or any other liquidity measure determined in accordance with U.S. GAAP, nor is it indicative of funds available to fund our cash needs.Restricted Cash Accounting Policy ChangeNote: As of December 31, 2015, TerraForm Power changed its policy regarding restricted cash to characterize the following as restricted cash: (i) cash on deposit in collateral accounts, debt service reserve accounts, maintenance and other reserve accounts, and (ii) cash on deposit in operating accounts but subject to distribution restrictions relating to covenant defaults on debt existing as of the balance sheet date. Previously, project-level cash available for operating purposes, but subject to compliance procedures and lender approvals prior to distribution from project level accounts, was also considered restricted. This project-level cash is now considered unrestricted but is designated as unavailable for immediate corporate purposes. The impact of the new accounting policy on reported CAFD is immaterial for 2015 and is expected to be immaterial for 2016.

Reg G: Reconciliation of Net Operating Revenue to Adjusted Revenue (Midpoint of Range) Represents the change in the fair value of commodity contracts not designated as hedges.Represents net amortization of favorable and unfavorable rate revenue contracts included within operating revenues, net.Primarily represents deferred revenue recognized related to the upfront sale of investment tax credits to non-controlling interest members. 2015 1Q 2016 Net Operating Revenue (Midpoint of Range) $470 $155 Unrealized loss (gain) on derivatives, net (a) 1 (0) Amortization of favorable and unfavorable rate revenue contracts, net (b) 5 9 Other non-cash (c) (9) (2) Adjusted Revenue - Midpoint of Range $467 $162 $M, unless otherwise noted

Reg G: Reconciliation of Net Loss to Adjusted EBITDA (Midpoint of Range) 2015 1Q 2016 Net loss (Midpoint of Range) ($192) ($39) Add (subtract): Interest expense, net (a) 168 69 Income tax benefit (11) 0 Depreciation, accretion and amortization expense (b) 167 74 General and administrative expenses - affiliate (c) 53 19 Stock-based compensation expense 13 1 Acquisition and related costs, including affiliate (d) 55 3 Loss on prepaid warranty and other investments (e) 57 - Unrealized loss on derivatives, net (f) 1 (0) Loss on extinguishment of debt, net (g) 16 - LAP settlement (h) 10 - Facility-level non-controlling interest member transaction fees (i) 4 - Loss (gain) on foreign currency exchange, net (j) 19 (5) Other non-cash operating revenues (k) (9) (2) Other non-operating expenses (l) 8 1 Adjusted EBITDA - Midpoint of Range $359 $121 $M, unless otherwise noted

Footnotes to Reg G: Reconciliation of Net Loss to Adjusted EBITDA (Midpoint of Range) We received an equity contribution of $4.0 million from SunEdison pursuant to the Interest Payment Agreement for the year ended December 31, 2015. We received an equity contribution from SunEdison of $6.6 million and $8.0 million pursuant to the Amended Interest Payment Agreement during the year ended December 31, 2015 and the three months ended March 31, 2016, respectively.Includes a $5.3 million and $8.9 million reduction within operating revenues, net due to net amortization of favorable and unfavorable rate revenue contracts for the year ended December 31, 2015 and the three months ended March 31, 2016, respectively.General and administrative expenses – affiliate represent costs incurred by SunEdison for services provided to the Company pursuant to the MSA. In conjunction with the closing of the IPO on July 23, 2014, we entered into the MSA with SunEdison, pursuant to which SunEdison agreed to provide or arrange for other service providers to provide management and administrative services to us. Cash consideration paid to SunEdison for these services for the year ended December 31, 2015 and the three months ended March 31, 2016 totaled $4.0 million and $1.8 million, respectively. The amount of general and administrative expenses in excess of the fees paid to SunEdison in each period is treated as an addback in the reconciliation of net income (loss) to Adjusted EBITDA.Represents transaction related costs, including affiliate acquisition costs, associated with the acquisitions completed during the year ended December 31, 2015 and the three months ended March 31, 2016.In conjunction with the First Wind Acquisition, SunEdison committed to reimburse us for capital expenditures and operations and maintenance labor fees in excess of budgeted amounts (not to exceed $53.9 million through 2019) for certain of our wind power plants. During the year ended December 31, 2015, the Company received contributions pursuant to this agreement of $4.3 million. As a result of the SunEdison Bankruptcy, the Company recorded a loss of $45.4 million related to the write-off of this prepaid warranty agreement, which is no longer considered collectible. In addition, during 2015, we made an investment in residential assets to be acquired from SunEdison. As a result of the SunEdison Bankruptcy, we do not expect to receive these assets and have recognized an $11.3 million loss related to this investment.Represents the change in the fair value of commodity contracts not designated as hedges.We recognized a net loss on extinguishment of debt of $16.2 million for the year ended December 31, 2015, driven by the following: i) the termination of the Term Loan and related interest rate swap, ii) the exchange of the previous revolver with a new revolving credit facility in January 2015, iii) prepayment of premium paid in conjunction with the payoff of First Wind indebtedness at the acquisition date, and iv) the refinancing of project-level indebtedness of our U.K. portfolio. These losses were partially offset by a gain resulting from the termination of financing lease obligations upon acquisition of the Duke Energy operating facility.Pursuant to the Settlement Agreement, TERP made a one-time payment to LAP in the amount of $10.0 million in April 2016 in exchange for and contingent on the termination of the Arbitration against TERP. The expense incurred as a result of the one-time payment was recorded to general and administrative expenses for the year ended December 31, 2015.Represents professional fees for legal, tax, and accounting services related to entering into certain tax equity financing arrangements and are not deemed representative of our core business operations. We incurred a net loss of $19.5 million and a net gain of $5.1 million on foreign currency exchange for the year ended December 31, 2015 and the three months ended March 31, 2016, respectively, due primarily to unrealized gains/losses on the re-measurement of intercompany loans which are primarily denominated in British pounds.Primarily represents deferred revenue recognized related to the upfront sale of investment tax credits to non-controlling interest members. Represents certain other non-cash charges or unusual or non-recurring items that we believe are not representative of our core business or future operating performance.

Reg G: Reconciliation of Cash from Operations to CAFD (Midpoint of Range) Adjustments to reconcile net cash provided by operating activities to cash available for distribution: 2015 1Q 2016 Net cash provided by operating activities (Midpoint of Range) $122 $35 Changes in operating assets and liabilities (23) 5 Deposits (into) or withdrawals from restricted cash accounts 7 (9) Cash distributions to non-controlling interests (24) (2) Scheduled project level and other debt service and repayments (44) (7) Non-expansionary capital expenditures (23) (3) Other: General and administrative expenses - affiliate (a) 53 19 Acquisition and related costs, including affiliate (b) 55 3 Change in accrued interest 13 0 LAP settlement (c) 10 - Economic ownership adjustment (d) 54 - Facility-level non-controlling interest member transaction fees (e) 4 - Contributions received pursuant to agreements with SunEdison (f) 15 8 Other items 10 13 Estimated cash available for distribution - Midpoint of Range (g) $229 $62 $M, unless otherwise noted

Footnotes to Reg G: Reconciliation of Cash from Operations to CAFD (Midpoint of Range) General and administrative expenses – affiliate represent costs incurred by SunEdison for services provided to the Company pursuant to the MSA. In conjunction with the closing of the IPO on July 23, 2014, we entered into the MSA with SunEdison, pursuant to which SunEdison agreed to provide or arrange for other service providers to provide management and administrative services to us. Cash consideration paid to SunEdison for these services for the year ended December 31, 2015 and the three months ended March 31, 2016 totaled $4.0 million and $1.8 million, respectively. The amount of general and administrative expenses in excess of the fees paid to SunEdison in each period is treated as an addback in the reconciliation of net cash provided by operating activities to CAFD.Represents transaction related costs, including affiliate acquisition costs, associated with the acquisitions completed during the year ended December 31, 2015 and the three months ended March 31, 2016.Pursuant to the Settlement Agreement, TERP made a one-time payment to LAP in the amount of $10.0 million in April 2016 in exchange for and contingent on the termination of the Arbitration against TERP. The expense incurred as a result of the one-time payment was recorded to general and administrative expenses for the year ended December 31, 2015.Represents economic ownership of certain acquired operating assets which accrued to us prior to the acquisition close date. The amount recognized for the year ended December 31, 2015 primarily related to our acquisition of Invenergy Wind, First Wind, and Northern Lights. Per the terms of the Invenergy Wind acquisition, we received economic ownership of the Invenergy Wind assets effective July 1, 2015 and $40.6 million of CAFD accrued to us from July 1, 2015 through the December 15, 2015 closing date. Per the terms of the First Wind acquisition, we received economic ownership of the First Wind operating assets effective January 1, 2015 and $7.2 million of CAFD accrued to us from January 1, 2015 through the January 29, 2015 closing date. Per the terms of the Northern Lights acquisition, we received economic ownership of the Northern Lights facilities effective January 1, 2015 and $3.7 million of CAFD accrued to us from January 1, 2015 through the June 30, 2015 closing date. The remaining $2.7 million of economic ownership related to our acquisitions of Moose Power and Integrys, which both closed in the second quarter of 2015.Represents professional fees for legal, tax, and accounting services related to entering into certain tax equity financing arrangements and are not deemed representative of our core business operations. We received an equity contribution of $4.0 million from SunEdison pursuant to the Interest Payment Agreement for the year ended December 31, 2015. We received an equity contribution from SunEdison of $6.6 million and $8.0 million pursuant to the Amended Interest Payment Agreement during the year ended December 31, 2015 and the three months ended March 31, 2016, respectively. In addition, in conjunction with the First Wind Acquisition, SunEdison committed to reimburse us for capital expenditures and operations and maintenance labor fees in excess of budgeted amounts (not to exceed $53.9 million through 2019) for certain of our wind power plants. During the year ended December 31, 2015, the Company received contributions pursuant to this agreement of $4.3 million. TERP implemented an updated policy for the accounting for restricted cash effective for the year ending December 31, 2015. The impact of the new accounting policy on reported CAFD is immaterial for 2015 and is expected to be immaterial for 2016. However, the new policy causes timing differences in quarter-to-quarter CAFD recognition within a calendar year, and 1Q 2016 CAFD would be estimated to be in the range of $20 million to $28 million if reported under the prior policy. For a full discussion of the new policy for accounting for restricted cash, please refer to page 14 of this document.

Exhibit 99.3

TERRAFORM POWER, INC.

RISK FACTORS

July 26, 2016

The following pages discuss the principal risks we face. These include, but are not limited to, risks arising from the bankruptcy of our controlling shareholder, SunEdison. These risk factors update the discussion of risks included in our annual report on Form 10-K for the fiscal year ended December 31, 2014, and in our Form 10-Q for the period ended September 30, 2015, which contains the most recent interim financial statements that we have filed with the Securities and Exchange Commission. Some of the terms used in the discussion below are defined in our Form 10-K or Form 10-Q, or in subsequent Form 8-K’s that we have filed or furnished with the Securities and Exchange Commission.

Risks Related to our Delayed Exchange Act Filings

Delays in our filing of our Form 10-K for the fiscal year ended December 31, 2015 and Form 10-Q for the fiscal quarter ended March 31, 2016, as well as delays in preparation of audited financial statements at the project level could have a material adverse effect.

We have not filed our Form 10-K for the fiscal year ended December 31, 2015 or Form 10-Q for the fiscal quarter ended March 31, 2016 principally due to the need to complete all steps and tasks necessary to finalize our annual financial statements and other disclosures. On March 15, 2016, we received a notification letter from a Director of Nasdaq Listing Qualifications. The notification letter stated that because the Company had not yet filed its Form 10-Q for the quarter ended March 31, 2016, and because it remained delinquent in filing its Form 10-K for the year ended December 31, 2015 the Company was not in compliance with Nasdaq Listing Rule 5250(c)(1). On May 12, 2016, we received an additional notification letter from a Director of Nasdaq Listing Qualifications. The notification letter stated that because the Company had not yet filed its Form 10-Q for the quarter ended March 31, 2016, the Company was not in compliance with Nasdaq Listing Rule 5250(c)(1). On May 16, 2016, in compliance with the deadline specified in the notification letters, the Company submitted a plan to Nasdaq as to how it plans to regain compliance with Nasdaq’s continued listing requirements. On May 20, 2016, the Company received a letter from a Director of Nasdaq Listing Qualifications granting the Company an exception of 180 calendar days from the due date of the Form 10-K for the year ended December 31, 2015, or until September 12, 2016, to regain compliance with Nasdaq’s continued listing requirements. The Company may regain compliance at any time during the extension period upon filing with the SEC its Form 10-K for the fiscal year ended December 31, 2015, Form 10-Q for the quarter ended March 31, 2016, as well as all subsequent required periodic financial reports that are due within that period.

In accordance with the current terms of our Revolver, we delivered to the lenders thereunder unaudited financial statements for the fiscal quarter ended March 31, 2016 by June 30, 2016. The Revolver also requires us to deliver our financial statements and the accompanying audit report with respect to fiscal year 2015 by the earlier of (a) the tenth business day prior to the date on which the failure to deliver such financial statements would constitute an event of default under our Senior Notes due 2023 and (b) March 30, 2017. The Revolver also requires us to deliver unaudited financial statements with respect to fiscal quarters ending June 30, 2016 and September 30, 2016, by the date that is 75 days after the end of each fiscal quarter. If we are unable to provide such annual statements and report or quarterly statements before the end of the cure period or to obtain an additional waiver or forbearance, the lenders could accelerate the maturity of this facility, which would result in an event of default under our Senior Notes due 2023 and 2025.

The Senior Notes due 2023 and 2025 require the Company to deliver audited financial statements for the fiscal year 2015 and a quarterly reports for the fiscal quarter ended March 31, 2016 and the fiscal quarter ended June 30 no later than 60 days following the date required by the SEC's rules and regulations (including extensions thereof), with a 90 day grace period upon providing written notice in accordance with the Senior Notes due 2023 and 2025. If we are unable to provide such a report and statements before the end of the cure period, the trustee or the holders of at least 25% in aggregate principal amount of notes outstanding could accelerate the notes under the indenture, which would also result in a cross default under the Revolver that would permit the lenders holding more than 50% of the aggregate exposure under the Revolver to accelerate the outstanding principal amount of loans and terminate the outstanding commitments under our Revolver.

On June 24, 2016, the Company announced the commencement by Terra Operating, LLC of a consent solicitation from holders of record as of 5:00 p.m., New York City time, on June 23, 2016 of its Senior Notes due 2023 and 2025 to obtain waivers of reporting covenants related to the delivery of audited financial statements under the indentures, in each case, through December 31, 2016, in exchange for payment of a consent fee and monthly waiver extension fees beginning on August 29, 2016. The consent solicitation is set to expire on July 29, 2016.

The delay in our Form 10-K and audited financial statements and our Form 10-Qs may impair our ability to obtain financing and access the capital markets. An inability to obtaining financing may have a material adverse effect on our ability to grow our business, acquire assets through acquisitions or optimize our portfolio and capital structure. Additionally, the delay in audited financial statements may reduce the comfort of our board of directors (the “Board”) with approving the payment of dividends.

Audited financial statements at the project-level have also been delayed. This delay and the delay in SunEdison’s audited financial statements have created defaults under most its non-recourse financing agreements,1 which, if not cured or waived may restrict the ability of the project-level subsidiaries to make distributions to us or entitle the related lenders to demand repayment or enforce their security interests, which could have a material adverse effect on our business, results of operations, financial condition and ability to pay dividends.

Risks Related to our Relationship with SunEdison and the SunEdison Bankruptcy

We are highly dependent on SunEdison and the SunEdison Bankruptcy poses substantial risk to our business, operations and financial condition.

We have significant relationships with, and in certain areas depend significantly on, SunEdison, for important corporate and project services, acquisitions and other matters, including the asset management and operation and maintenance of most of our projects. Because of our dependence on SunEdison, the risks and uncertainties of the SunEdison Bankruptcy pose a substantial risk to our business, operations and financial condition. The SunEdison Bankruptcy is likely to have (or has had) a material adverse effect on our business, results of operations and financial condition and these risks and uncertainties could increase the impact of the SunEdison Bankruptcy. Although the SunEdison Bankruptcy poses risks to our financial condition due to the potential resulting costs and diminished revenues, the Company does not rely substantially on SunEdison for funding or liquidity and believes that the Company continues to have sufficient liquidity to support its ongoing operations.

Such risks and uncertainties of the SunEdison Bankruptcy include:

| • | SunEdison’s decisions during bankruptcy, including what contracts it seeks to assume, assume and assign or reject or what dispositions it chooses to make, potential opposition to such decisions from SunEdison’s creditors and other parties in interest and the requirement that the bankruptcy court approve many of SunEdison’s decisions during bankruptcy, including the assumption, assumption and assignment or rejection of contracts by SunEdison and any transactions entered into by SunEdison outside the ordinary course of business; |

| • | SunEdison’s ability to confirm and consummate a plan of reorganization; |

| • | SunEdison’s ability to maintain or obtain sufficient financing sources for its operations during the pendency of the bankruptcy or to obtain sufficient exit financing; |

| • | The bankruptcy court’s rulings, which as a result of the bankruptcy court’s equitable powers, are difficult to predict with any certainty; |

2

| • | Potential increased difficulty in retaining and motivating SunEdison’s key employees through the process of reorganization, and increased difficulty in attracting new employees; |

| • | The actions and decisions of SunEdison’s stakeholders, including creditors, regulators and other third parties; |

| • | The resolution of intercompany claims between us and SunEdison. |

The SunEdison Bankruptcy could result in a liquidation of SunEdison. Because of our dependence on SunEdison, a liquidation of SunEdison is likely to have a material adverse effect on our business, results of operations and financial condition. A disorganized liquidation would increase the risk of material adverse effect on our business.

We rely on SunEdison for management services. Breach, rejection or renegotiation of the Management Services Agreement by SunEdison or the departure of some or all of SunEdison’s employees could have a material adverse effect on our business, results of operations and financial condition.

We rely on SunEdison to provide us with management services under the MSA, including management, secretarial, accounting, banking, treasury, administrative, regulatory and reporting functions (including critical systems and technology); developing and implementing business strategy (such as recommending acquisitions, dispositions and the raising of funds and, assisting in such matters where requested); maintenance of books and records; calculation and payment of taxes; and preparation of audited and unaudited financial statements.

In addition to the termination provisions within the MSA, as described under the risk factor “SunEdison is a party to important agreements at the corporate and project-levels, which may be adversely affected by the SunEdison Bankruptcy,” SunEdison could also seek to reject or renegotiate the MSA as part of the SunEdison Bankruptcy. If SunEdison terminates or rejects the MSA, or defaults or is otherwise unable or unwilling to perform its obligations under the agreement or seeks to significantly renegotiate the agreement, we may be unable to contract with a substitute service provider on similar terms or at all. We may also be unable to perform the services ourselves, through hiring employees and migrating or establishing separate systems. The fees of substitute service providers or the costs of performing all or a portion of the services ourselves would likely be substantially more than the fees that we currently pay under the MSA, which are subject to caps of $7.0 million and $9.0 million for 2016 and 2017, respectively. In addition, in light of SunEdison’s familiarity with our assets, a substitute service provider may not be able to provide the same level of service. If we cannot locate a service provider that is able to provide us with substantially similar services as SunEdison does under the MSA on similar terms, or perform those services ourselves, it would likely have a material adverse effect on our business, financial condition, and results of operations.

Due to our relationship with SunEdison under the MSA, all of the personnel that manage the Company's operations are employees of SunEdison except for our Chairman and Interim Chief Executive Officer Mr. Blackmore. Our growth strategy relies on our executive officers and key employees for their strategic guidance and expertise in the selection of renewable energy facilities that we may acquire in the future. As the solar energy industry and wind energy industry are relatively new, there is a scarcity of experienced executives and employees in these industries and the clean energy industry more widely. SunEdison has experienced departures of key professionals and personnel in the past, including the recent departure of several key employees. The departure of key employees or the departure of a material number of SunEdison’s employees who perform services for us or on our behalf, the failure to appoint qualified or effective successors in the event of such departures or a change to the MSA as described above, could have a material adverse effect on our ability to achieve our objectives. The MSA does not require SunEdison to maintain the employment of any of its professionals or, except with respect to the dedicated TerraForm Power personnel, to cause any particular professional to provide services to us or on our behalf and SunEdison may terminate the employment of any professional. In addition to our dependence on SunEdison’s employees pursuant to the MSA, we rely on the employees of SunEdison’s global asset management business unit and its associated entities for the operation, maintenance and asset management of most of our projects, pursuant to project level operation and maintenance and asset management agreements. The departure of employees of SunEdison's global asset management business unit could have a material adverse effect on the performance of these services, and several such employees have recently departed from SunEdison.

3

The SunEdison Bankruptcy will limit SunEdison’s ability to provide certain types of compensation to its employees without authorization from the bankruptcy court, and may increase the likelihood that other executive officers or key employees to choose to depart SunEdison, including employees that are solely dedicated to performing services for our benefit. Furthermore, SunEdison may elect to reduce its employee headcount as part of the SunEdison Bankruptcy process. Departure of such key executives and other employees, including employees that are solely dedicated to performing services for our benefit or are performing under our project level operation and maintenance and asset management agreements, could have a material adverse effect on our business, results of operations and financial condition.

Due to our management services arrangement with SunEdison under the MSA, our financial reporting and control processes rely to a significant extent on SunEdison systems and personnel.

Under the MSA, SunEdison provides the systems and personnel for our financial reporting and control processes (such as information technology, enterprise resource management and accounting systems) and, as a result, our financial reporting and control processes rely to a significant extent on SunEdison systems and personnel. If there are control deficiencies at SunEdison, including with respect to the systems we utilize, it is necessary for us to assess whether those deficiencies could affect our financial reporting and, if so, address them to the extent necessary and appropriate.

On February 29, 2016, SunEdison announced that its delay in filing its Form 10-K was principally due to (1) the need to complete all tasks and steps necessary to finalize the annual financial statements and the other disclosures required to be included in that filing, and (2) ongoing inquiries and investigations by the audit committee of its board of directors and its advisors relating to allegations concerning the accuracy of SunEdison’s anticipated financial position based on certain issues raised by former executives and current and former employees of SunEdison. On March 16, SunEdison announced a further delay in filing its Form 10-K, stating that this delay was due to the additional scope of work required from the identification by SunEdison’s management of material weaknesses in its internal controls over financial reporting, primarily due to deficient information technology controls in connection with newly implemented systems. On April 14, SunEdison announced that the independent directors of the board of SunEdison completed their evaluation of materials regarding the anticipated financial position previously disclosed to SunEdison’s board based on allegations made by former executives and current and former employees. SunEdison announced that the independent directors determined that as of date of the report from independent counsel, there were no identified material misstatements in SunEdison’s historical financial statements as well as no substantial evidence to support a finding of fraud or willful misconduct of management, other than with respect to the conduct of one former non-executive employee, but that the independent counsel materials identified issues with SunEdison’s overly optimistic culture and its tone at the top. The independent directors of SunEdison also identified several issues regarding the Company’s cash forecasting and liquidity management practices and adopted a remedial plan (the “SunEdison Remedial Plan”).

We have been assessing whether these issues could affect our financial statements. This assessment could continue to require significant internal resources and management time. To date, we have not identified any material misstatements or restatements of our audited or unaudited financial statements or disclosures for any period previously reported. The material weaknesses that we have identified as of the date hereof and the associated risks of such or other material weaknesses are described under “Our failure to achieve and maintain effective internal control over financial reporting in accordance with Section 404 of the Sarbanes-Oxley Act as a public company could have a material adverse effect on our business and share price.” For a discussion of the consequences of the delay in our audited financial statements, see “Delays in our filing of our Form 10-K for the fiscal year ended December 31, 2015 and Form 10-Q for the fiscal quarter ended March 31, 2016, as well as delays in preparation of audited financial statements at the project level could have a material adverse effect” above.

Implementing additional controls and procedures and taking remedial actions could require substantial time and resources and we can provide no assurance that our ongoing review will not identify additional material weaknesses or other issues that would require remediation.

4

The SunEdison Bankruptcy could result in a material adverse effect on many of our projects because SunEdison is a party to a material project agreement or a guarantor thereof, or because SunEdison was the original owner of the project.

In most of our debt-financed projects, SunEdison is a party to one or more material project agreements, including asset management or O&M agreements in its capacity as our O&M provider or asset manager, or is a guarantor of the obligations of those service providers. Many of our project-debt financing agreements contain covenants or defaults relating to such agreements or guarantees. As a result, the SunEdison Bankruptcy could result in (or may have resulted in) defaults under many of our project-debt financing agreements, which are generally curable. We are currently working with our project lenders and finance parties to obtain waivers and/or forbearance agreements as we seek to cure such defaults; however, no assurances can be given that such waivers and/or forbearance agreements will be obtained. Similarly, in most of our tax equity-financed projects, SunEdison is a party to one or more material project agreements, including asset management or O&M contract agreements, or is a guarantor thereof. Many of our tax equity financed project agreements contain provisions related to, or that could be impacted by, such agreements. As a result, the SunEdison Bankruptcy could result in adverse consequences to us under many of our tax equity-financed projects. Although most of the capital contributions from our tax equity partners have been fully funded, certain facilities have not been fully funded for which the SunEdison Bankruptcy also cause our tax equity partner to assert the right not to fund additional capital contributions. Several of our tax-equity projects are structured as master lease arrangements, under which the SunEdison Bankruptcy may trigger termination rights of the applicable tax investors.

Such defaults in our debt-financed projects and adverse consequences to us in tax equity-financed projects, if not cured or waived, may restrict the ability of the project-level subsidiaries to make distributions to us. These defaults may also entitle the related lenders or lessees under the master lease arrangements to demand repayment, sweep or net project cash flows or enforce their security interests, which could have a material adverse effect on our business, results of operations and financial condition. If we are unable to make distributions from our project-level subsidiaries, it would likely have a material adverse effect on our ability to service our corporate-level indebtedness and pay dividends to holders of our Class A common stock.

While our relevant review remains ongoing, we have not identified any significant PPAs that include a provision that would directly permit the offtake counterparty to terminate the agreement in the event of a SunEdison bankruptcy. However, to date we have identified a PPA that contains an event of default that can be triggered by certain events of default under the related project-level credit agreements. It is possible that the SunEdison Bankruptcy or our failure to deliver project-level audited financial statements could be an event of default under the corresponding credit agreements if the bankruptcy could reasonably be expected to result in a material adverse effect or the borrower is unable to replace the debtor party or parties triggering such an event of default. This project is expected to provide approximately $8.3 million of project-level cash available for distribution for 2016. We are working to obtain waivers or forbearance agreements from our project level lenders that would avoid triggering this default under this PPA. Although we believe our lenders will likely be incentivized to take steps to avoid defaults under this PPA given the importance of maintaining our PPAs, we cannot be certain that we will be permitted to replace the debtor parties during the pendency of the SunEdison Bankruptcy.

Although SunEdison continues to indicate its intent to perform under the O&M and asset management agreements, as detailed under “SunEdison is a party to important agreements at the corporate and project-levels, which may be adversely affected by the SunEdison Bankruptcy,” SunEdison may choose in the future during the SunEdison Bankruptcy not to perform under or assume any or all of the O&M and asset management agreements, and the bankruptcy court also may decline to authorize the assumption of any or all of the O&M and asset management agreements. If SunEdison does not substantially perform under these agreements or rejects these agreements and we are unable to secure replacement service providers, it could lead to defaults under the terms of project-level debt contracts, hedging agreements, and tax equity agreements, as well as adverse consequences for our unlevered projects. An inability to secure replacement service providers and the resulting defaults and other consequences would be expected to have a material adverse effect on our business, results of operations and financial condition. Securing replacement service providers on less favorable terms or at higher costs than our existing contracts could also have a material adverse effect on our business, results of operations and financial condition. Additionally, if we are unable to enter into long-term replacement agreements to provide for O&M and asset management and other required services for our facilities, we would seek to purchase the related services under short-term agreements, exposing us to market price volatility.

5

SunEdison was the construction contractor or module supplier for many of our projects, and it is unlikely that we will be able to recover on any claims under those contracts or related warranties.

SunEdison served as the prime construction contractor pursuant to engineering, procurement and construction contracts with our subsidiaries for most of our renewable energy facilities acquired from SunEdison. These contracts are generally fixed price, turn-key construction contracts that include workmanship and other warranties with respect to the design and construction of the facilities that survive for a period of time after the completion of construction. These contracts or related contracts (including operation and maintenance agreements) also often include production or availability guarantees with respect to the output or availability of the facility that survive completion of construction. Moreover, we also generally obtained solar module warranties from SunEdison, including module workmanship warranties and output guarantees, for those solar facilities that we acquired from SunEdison that utilized SunEdison modules. Because of these relationships, we have existing warranty or contract claims and will likely in the future have such claims. The SunEdison Bankruptcy will likely reduce or eliminate our recoveries on claims under these agreements and warranties, which may have a material adverse effect on our business, results of operation and financial condition.

SunEdison is a party to important agreements at the corporate and project-levels, which may be adversely affected by the SunEdison Bankruptcy.

As detailed in other risk factors under “Risks Related to our Relationship with SunEdison and the SunEdison Bankruptcy,” we have a number of important agreements with SunEdison at the corporate and project-levels and for acquisitions. In addition to those agreements, SunEdison also has cash payment obligations under the Amended Interest Payment Agreement, which are expected to be an additional $8.0 million during the remainder of 2016 ($8.0 million was paid in the first quarter of 2016) and $16.0 million in 2017 and in conjunction with the First Wind acquisitions has committed to reimburse the Company for capital expenditures and operations and maintenance and labor fees in excess of budgeted amounts (not to exceed $53.9 million through 2019) for certain of its wind power plants.

The SunEdison Bankruptcy could adversely affect these agreements in a number of respects. For example, the protection of the automatic stay, which arises upon the commencement of a bankruptcy case, prohibits us from terminating a contract with any of the debtor entities (which includes SunEdison, Inc.). Similarly, the Bankruptcy Code invalidates certain clauses that permit a party to terminate an executory contract (a contract where both parties have performance remaining) based on the counterparty’s financial condition, insolvency or commencement of bankruptcy proceedings. Legal proceedings to obtain relief from the automatic stay, to terminate agreements or to enforce rights under agreements can be time consuming, costly and uncertain as to outcome. SunEdison may require bankruptcy court approval in order to continue performing under certain agreements. Agreements with entities that are debtors may not be enforceable until SunEdison seeks (and receives) bankruptcy court approval to assume (accept) those contracts. SunEdison has discretion on whether to seek to assume, assume and assign (in certain cases) or reject executory contracts and we do not control this decision. Approval of the bankruptcy court is required for such assumption, assumption and assignment or rejection and parties in interest have the right to object to such assumption, assumption and assignment or rejection. Although assumption, assumption and assignment or rejection generally must be of the entire agreement, SunEdison could alternatively seek to renegotiate such contracts with us. SunEdison has agreed and could agree in the future to provisions in its DIP financing that limit its ability to perform under agreements with us and that give the DIP lenders significant power over such performance.

Our ability to recover for breach, failure to perform or rejection of contracts (particularly for prepetition claims) is likely to be limited, and may be eliminated, depending on the recoveries generally for SunEdison’s unsecured creditors, due to competing claims with higher priority and the limited financial resources of SunEdison.

6

These effects of the SunEdison Bankruptcy on our agreements with SunEdison could also have a material adverse effect on our business, results of operations and financial condition.

Our audited financial statements for the year ended December 31, 2015 may include a going concern explanatory note because of the risk that our assets and liabilities could be consolidated with those of SunEdison in the SunEdison Bankruptcy.

We believe that we have observed formalities and operating procedures to maintain our separate existence from SunEdison, that our assets and liabilities can be readily identified as distinct from those of SunEdison and that we do not rely substantially on SunEdison for funding or liquidity and will have sufficient liquidity to support our ongoing operations. Our contingency planning with respect to the SunEdison Bankruptcy has included and will include, among other things, establishing stand-alone information technology, accounting and other critical systems and infrastructure, establishing separate human resources systems and employee retention efforts, and seeking proposals for backup operation and maintenance and asset management services for our power plants from other providers.

However, there is a risk that an interested party in the SunEdison Bankruptcy could request that the assets and liabilities of the Company be substantively consolidated with SunEdison and that the Company and/or its assets and liabilities be included in the SunEdison Bankruptcy. Substantive consolidation is an equitable remedy in bankruptcy that results in the pooling of assets and liabilities of the debtor and one or more of its affiliates solely for purposes of the bankruptcy case, including for purposes of distributions to creditors and voting on and treatment under a reorganization plan. While it has not been requested to date and we believe there is no basis for substantive consolidation in our circumstances, we cannot provide assurance that substantive consolidation will not be requested in the future or that the bankruptcy court would not consider it.

To the extent the bankruptcy court were to determine that substantive consolidation was appropriate under the facts and circumstances, then the assets and liabilities of any entity that was subject to the substantive consolidation order could be available to help satisfy the debt or contractual obligations of other entities. Bankruptcy courts have broad equitable powers, and as a result, outcomes in bankruptcy proceedings are inherently difficult to predict. Due to the significant liabilities of SunEdison, substantive consolidation of the Company with SunEdison and inclusion in the SunEdison Bankruptcy would impede our ability to satisfy our liabilities in the normal course of business and otherwise restrict our operations and capacity to function as a standalone enterprise. As a result of the foregoing, our financial statements for the year ended December 31, 2015 or the related audit report may include an explanatory note regarding the Company’s ability to continue as a going concern. An event of default under our Revolver may occur to the extent that any such explanatory note or references thereto in the related audit report would constitute a failure to deliver financial statements or an audit report that is unqualified as to going concern. If this were to occur, lenders representing 50% of the aggregate exposure under our Revolver could accelerate the maturity of the Revolver, which would result in an event of default under our Senior Notes due 2023 and 2025.

We have expended and may continue to expend significant resources in connection with the SunEdison Bankruptcy.

Due to SunEdison’s liquidity constraints and in preparation for the SunEdison Bankruptcy, we have expended significant resources on contingency planning. During the SunEdison Bankruptcy, we have expended significant resources in connection with the SunEdison Bankruptcy and related matters, including legal fees, consultant and financial advisor fees and related expenses, and it is likely that such expenses will continue during the duration of the SunEdison Bankruptcy. We have also dedicated, and anticipate that we will continue to dedicate, significant internal resources and management time to contingency planning and to addressing the consequences of the SunEdison Bankruptcy. This could reduce the internal time and resources available for other areas of our business, and substantially increase our operating expenses.

The SunEdison Bankruptcy has subjected us to increased litigation risk.

The SunEdison Bankruptcy has increased the risk that we will be subject to litigation and could increase our potential exposure to litigation costs. In particular, there is a risk that SunEdison or its creditors may bring actions against us to avoid payment made to us by SunEdison or transactions that we consummated with SunEdison. We also face increased risks of liability and litigation to the extent that the SunEdison Bankruptcy results in SunEdison becoming unable to fulfill its contractual commitments in circumstances where the Company has a financial interest (for example, with respect to projects that have been paid for but have not been transferred).

7

Additionally, because our directors’ and officers’ insurance policies through the period of July 15, 2016 are shared with SunEdison, including a number of policies under which SunEdison is the named insured, the SunEdison Bankruptcy will limit our ability to utilize such insurance to cover the liability of, and our indemnification obligations to, our directors and officers. This may materially adversely affect our business, financial condition and results of operations.

Our growth strategy has been substantially dependent on SunEdison and the SunEdison Bankruptcy could have a material adverse effect on our future growth.

Our business, including our growth strategy, has been substantially dependent on SunEdison, including its ability to obtain financing and generate sufficient cash to adequately fund its operations and on SunEdison’s ability to fund the construction and development of Call Right Projects under the Support Agreement and the Intercompany Agreement. As detailed under “SunEdison may offer certain Call Right Projects to unaffiliated third parties or remove Call Right Projects identified in the Support Agreement and in the Intercompany Agreement and we must still agree on a number of additional matters covered by the Support Agreement,” as part of the SunEdison Bankruptcy, SunEdison may seek to reject the Support Agreement, Intercompany Agreement or other agreements with respect to the Call Rights Projects or may elect not to perform under such agreements, or may not be permitted to assume and/or perform under such agreements by the bankruptcy court. In addition, even if SunEdison is willing to satisfy its obligations to us under the Support Agreement, Intercompany Agreement or other agreements with respect to the Call Rights Projects, SunEdison must be able to fund the development and completion of projects to be transferred thereunder and there is substantial risk that SunEdison will be unable to do so. In addition, the approval of the Bankruptcy court and SunEdison’s DIP lenders may also be required for the performance of these contracts outside of the ordinary course of business.

In addition, bankruptcy court and/or creditor approval would be required for performance under these contracts outside of the ordinary course of business. Acquisitions from SunEdison generally will be subject to bankruptcy court approval and/or the approval of SunEdison’s key creditors during the SunEdison Bankruptcy, and receipt of such approvals cannot be assured. As a result, our financial and operating performance and prospects, including our ability to grow our dividend per share, may be affected by the performance, prospects, and priorities of SunEdison. Material adverse developments at SunEdison, including the SunEdison Bankruptcy, or changes in its strategic priorities may reduce our cash available for distribution and materially and adversely affect our growth, business, financial condition and results of operations.

The SunEdison Bankruptcy may adversely affect our relationships with current or potential counterparties.