Form 8-K TWO HARBORS INVESTMENT For: Feb 03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report: February 3, 2016

Two Harbors Investment Corp.

(Exact name of registrant as specified in its charter)

Maryland | 001-34506 | 27-0312904 | ||

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) | ||

590 Madison Avenue, 36th Floor New York, NY 10022 |

(Address of principal executive offices) (Zip Code) |

Registrant’s telephone number, including area code: (612) 629-2500

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 Results of Operations and Financial Condition.

On February 3, 2016, Two Harbors Investment Corp. (the "Company") issued a press release announcing its financial results for the fiscal quarter ended December 31, 2015. A copy of the press release and the 2015 Fourth Quarter Earnings Call Presentation are attached hereto as Exhibits 99.1 and 99.2, respectively, and are incorporated herein by reference.

The information in this Current Report, including Exhibits 99.1 and 99.2 attached hereto, is furnished pursuant to Item 2.02 of Form 8-K and shall not be deemed to be “filed” for any other purpose, including for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. The information in Item 2.02 of this Current Report, including Exhibits 99.1 and 99.2, shall not be deemed incorporated by reference into any filing of the registrant under the Securities Act of 1933 or the Exchange Act, whether made before or after the date hereof, regardless of any general incorporation language in such filings (unless the registrant specifically states that the information or exhibit in this Item 2.02 is incorporated by reference).

Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

Exhibit No. | Description | ||

99.1 | Press Release of Two Harbors Investment Corp., dated February 3, 2016. | ||

99.2 | 2015 Fourth Quarter Earnings Call Presentation. | ||

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

TWO HARBORS INVESTMENT CORP. | ||

By: | /s/ REBECCA B. SANDBERG | |

Rebecca B. Sandberg | ||

General Counsel and Secretary | ||

Date: February 3, 2016 | ||

Exhibit Index

Exhibit No. | Description | Filing Method | ||

99.1 | Press Release of Two Harbors Investment Corp., dated February 3, 2016. | Electronically | ||

99.2 | 2015 Fourth Quarter Earnings Call Presentation. | Electronically | ||

Two Harbors Investment Corp. Reports Fourth Quarter 2015 Financial Results

Significant Capital Reallocation in 2015

NEW YORK, February 3, 2016 - Two Harbors Investment Corp. (NYSE: TWO), a real estate investment trust that invests in residential mortgage-backed securities (RMBS), residential mortgage loans, mortgage servicing rights (MSR), commercial real estate and other financial assets, today announced its financial results for the quarter ended December 31, 2015.

2015 Summary

• | Sponsored seven securitizations issuing securities backed by approximately $2.0 billion in unpaid principal balance (UPB) of prime jumbo residential mortgage loans, attaining stated goal of sponsoring six to ten during the year. |

• | Substantially developed commercial real estate effort including adding senior and mezzanine commercial real estate assets with an aggregate carrying value of $661.0 million at December 31, 2015. |

• | Added six flow-sale MSR relationships and completed four bulk MSR acquisitions. |

• | Generated total annual return on book value of 0.5%, after accounting for dividends of $1.04.(1) |

• | Repurchased 13.7 million shares, at an average price of $8.43 per share, which was accretive to book value by $0.07 per share. |

Quarterly Summary

• | Repurchased 12.3 million shares of common stock at an average price of $8.37 per share, which was accretive to book value by $0.06 per share. |

• | Added commercial real estate assets with an aggregate carrying value of $371.9 million. |

• | Book value was $10.11 per common share, representing a 0.7%(2) quarterly total return on book value, after accounting for a dividend of $0.26 per share. |

• | Reported Core Earnings of $72.1 million, or $0.20 per weighted average common share.(3) |

• | Sponsored a securitization issuing securities backed by approximately $332.8 million UPB of prime jumbo residential mortgage loans. |

“We are proud of our achievements in 2015. During the year, we sponsored seven prime jumbo securitizations and were a leading issuer in the market. We also added MSR through both flow-sale and bulk purchases,” stated Thomas Siering, Two Harbors’ President and Chief Executive Officer. “Additionally, we completed the build out of our commercial real estate team and began deploying capital to these assets. We believe allocating resources and capital thusly will build franchise value for our stockholders over the long-term.”

(1) | Return on book value for the year ended December 31, 2015 is defined as the decrease in book value from December 31, 2014 to December 31, 2015 of $0.99, plus dividends declared of $1.04, divided by the December 31, 2014 book value of $11.10 per share. |

(2) | Return on book value for the quarter ended December 31, 2015 is defined as the decrease in book value from September 30, 2015 to December 31, 2015 of $0.19, plus the dividend declared of $0.26 per share, divided by September 30, 2015 book value of $10.30 per share. |

(3) | Core Earnings is a non-GAAP measure. Please see page 13 for a definition of Core Earnings and a reconciliation of GAAP to non-GAAP financial information. |

- 1 -

Operating Performance

The following table summarizes the company’s GAAP and non-GAAP earnings measurements and key metrics for the respective periods in 2015:

Two Harbors Investment Corp. Operating Performance (unaudited) | |||||||||||||||||||||

(dollars in thousands, except per share data) | |||||||||||||||||||||

Three Months Ended December 31, 2015 | Year Ended December 31, 2015 | ||||||||||||||||||||

Earnings | Earnings | Per weighted share | Annualized return on average equity | Earnings | Per weighted share | Annualized return on average equity | |||||||||||||||

Core Earnings(1) | $ | 72,133 | $ | 0.20 | 7.8 | % | $ | 325,781 | $ | 0.89 | 8.2 | % | |||||||||

GAAP Net Income | $ | 210,706 | $ | 0.59 | 22.7 | % | $ | 492,210 | $ | 1.35 | 12.5 | % | |||||||||

Comprehensive Loss | $ | (3,234 | ) | $ | (0.01 | ) | (0.3 | )% | $ | (4,518 | ) | $ | (0.01 | ) | (0.1 | )% | |||||

Operating Metrics | |||||||||||||||||||||

Dividend per common share | $0.26 | ||||||||||||||||||||

Book value per share at period end | $10.11 | ||||||||||||||||||||

Other operating expenses as a percentage of average equity | 1.7% | ||||||||||||||||||||

________________

(1) | Please see page 13 for a reconciliation of GAAP to non-GAAP financial information. |

Earnings Summary

Two Harbors reported Core Earnings for the quarter ended December 31, 2015 of $72.1 million, or $0.20 per weighted average common share outstanding, as compared to Core Earnings for the quarter ended September 30, 2015 of $79.4 million, or $0.22 per weighted average common share outstanding. On a Core Earnings basis, the company recognized an annualized return on average equity of 7.8% and 8.1% for the quarters ended December 31, 2015 and September 30, 2015, respectively.

For the fourth quarter of 2015, the company recognized:

• | net realized gains on RMBS and mortgage loans held-for-sale of $100.5 million, net of tax; |

• | unrealized losses on RMBS and mortgage loans held-for-sale of $14.7 million, net of tax; |

• | net losses of $77.7 million, net of tax, related to swap and swaption terminations and expirations; |

• | net unrealized gains of $134.2 million, net of tax, associated with interest rate swaps and swaptions economically hedging its investment portfolio, repurchase agreements and Federal Home Loan Bank (FHLB) of Des Moines advances; |

• | net realized and unrealized losses on other derivative instruments of approximately $6.9 million, net of tax; |

• | net realized and unrealized losses on consolidated financing securitizations of $7.0 million, net of tax; |

• | a net decrease in fair value of $0.2 million(2) on MSR, net of tax; and |

• | securitization deal costs of $0.8 million, net of tax. |

(2) | Decrease in fair value on MSR, net of tax, of $0.2 million is comprised of a increase in fair value of $11.3 million, net of tax, excluded from Core Earnings and $11.5 million, net of tax, of estimated amortization included in Core Earnings. |

- 2 -

The company reported GAAP Net Income of $210.7 million, or $0.59 per weighted average common share outstanding, for the quarter ended December 31, 2015, as compared to a GAAP Net Loss of $34.8 million, or $0.09 per weighted average common share outstanding, for the quarter ended September 30, 2015. On a GAAP Net Income basis, the company recognized an annualized return on average equity of 22.7% and (3.5%) for the quarters ended December 31, 2015 and September 30, 2015, respectively.

The company reported a Comprehensive Loss of $3.2 million, or $0.01 per weighted average common share outstanding, for the quarter ended December 31, 2015, as compared to a Comprehensive Loss of $92.8 million, or $0.25 per weighted average common share outstanding, for the quarter ended September 30, 2015. The company records unrealized fair value gains and losses on the majority of RMBS, classified as available-for-sale, in Other Comprehensive Income. On a Comprehensive Income basis, the company recognized an annualized return on average equity of (0.3%) and (9.4%) for the quarters ended December 31, 2015 and September 30, 2015, respectively.

Other Key Metrics

Two Harbors declared a quarterly cash dividend of $0.26 per common share for the quarter ended December 31, 2015. The annualized dividend yield on the company’s common stock for the fourth quarter of 2015, based on the December 31, 2015 closing price of $8.10, was 12.8%.

The company’s book value per share, after taking into account the fourth quarter 2015 dividend of $0.26 per share, was $10.11 as of December 31, 2015, compared to $10.30 as of September 30, 2015, which represented a total return on book value for the fourth quarter of 2015 of 0.7%.(1) For the year ended December 31, 2015, the company reported a total return on book value of 0.5%.(2)

Other operating expenses for the quarter ended December 31, 2015 were approximately $16.1 million, or 1.7% of average equity, compared to approximately $16.1 million, or 1.6% of average equity, for the quarter ended September 30, 2015.

Portfolio Summary

The company’s aggregate portfolio is principally comprised of RMBS available-for-sale securities, inverse interest-only securities (Agency Derivatives), MSR, residential mortgage loans held-for-sale, net economic interests in consolidated securitization trusts and commercial real estate assets. As of December 31, 2015, the total value of the company’s portfolio was $11.1 billion.

The company’s portfolio includes rates, credit and commercial real estate strategies. The rates strategy consisted of $6.6 billion of Agency RMBS, Agency Derivatives and MSR as well as their associated notional hedges as of December 31, 2015. The credit strategy consisted of $3.8 billion of non-Agency RMBS, net economic interests in consolidated securitization trusts, prime jumbo residential mortgage loans and credit sensitive residential mortgage loans, as well as their associated notional hedges as of December 31, 2015. The commercial strategy consisted of senior and mezzanine commercial real estate assets with an aggregate carrying value of $661.0 million as of December 31, 2015.

For the quarter ended December 31, 2015, the annualized yield on the company’s average aggregate portfolio was 4.56% and the annualized cost of funds on the associated average borrowings, which includes net interest rate spread expense on interest rate swaps, was 1.30%. This resulted in a net interest rate spread of 3.26%.

(1) | Return on book value for the quarter ended December 31, 2015 is defined as the decrease in book value from September 30, 2015 to December 31, 2015 of $0.19, plus the dividend declared of $0.26 per share, divided by September 30, 2015 book value of $10.30 per share. |

(2) | Return on book value for the year ended December 31, 2015 is defined as the decrease in book value from December 31, 2014 to December 31, 2015 of $0.99, plus dividends declared of $1.04, divided by the December 31, 2014 book value of $11.10 per share. |

- 3 -

RMBS and Agency Derivatives

For the quarter ended December 31, 2015, the annualized yield on average RMBS and Agency Derivatives was 4.4%, consisting of an annualized yield of 3.5% in Agency RMBS and Agency Derivatives and 7.8% in non-Agency RMBS.

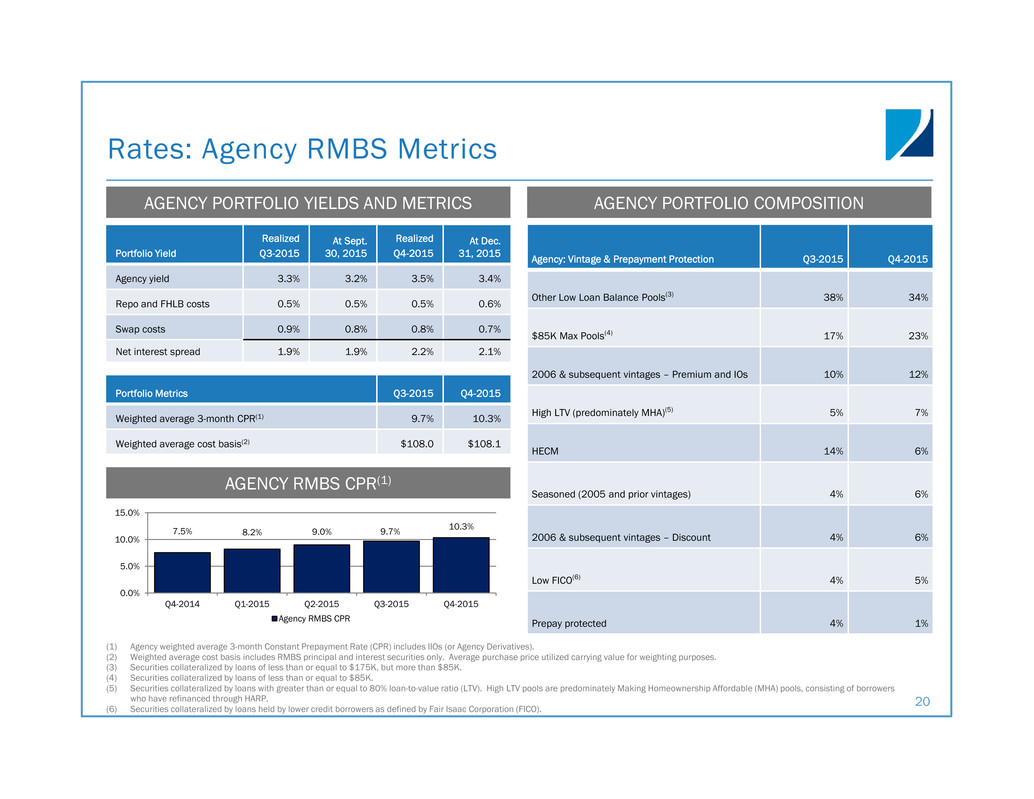

The company experienced a three-month average constant prepayment rate (CPR) of 10.3% for Agency RMBS and Agency Derivatives held as of December 31, 2015, as compared to 9.7% for those securities held as of September 30, 2015. The weighted average cost basis of the principal and interest Agency portfolio was 108.1% of par as of December 31, 2015 and 108.0% of par as of September 30, 2015. The net premium amortization was $25.3 million and $34.7 million for the quarters ended December 31, 2015 and September 30, 2015, respectively.

The company experienced a three-month average CPR of 6.2% for non-Agency principal and interest RMBS held as of December 31, 2015, as compared to 6.9% for those securities held as of September 30, 2015. The weighted average cost basis of the non-Agency portfolio was 60.4% of par as of December 31, 2015, compared to 63.7% of par as of September 30, 2015. The discount accretion was $19.2 million for the quarter ended December 31, 2015, compared to $24.1 million for the quarter ended September 30, 2015. The total net discount remaining was $1.1 billion as of December 31, 2015, compared to $1.3 billion as of September 30, 2015, with $0.4 billion designated as credit reserve as of December 31, 2015.

As of December 31, 2015, fixed-rate investments composed 75.7% and adjustable-rate investments composed 24.3% of the company’s RMBS and Agency Derivatives portfolio.

As of December 31, 2015, the company had residential mortgage loans held-for-investment with a carrying value of $3.2 billion and the company’s collateralized borrowings had a carrying value of $2.0 billion, resulting in net economic interests in consolidated securitization trusts of $1.2 billion.

Mortgage Servicing Rights

The company held MSR on mortgage loans with UPB totaling $51.4 billion as of December 31, 2015. The MSR had a fair market value of $493.7 million as of December 31, 2015, and the company recognized unrealized losses of $3.3 million during the quarter ended December 31, 2015.

The company does not directly service mortgage loans, but instead contracts with fully licensed subservicers to handle substantially all servicing functions for the loans underlying the company’s MSR. The company recognized $32.8 million of servicing income, $7.3 million in servicing expenses and $0.8 million in reserve expense for representation and warranty obligations during the quarter ended December 31, 2015.

Residential Mortgage Loans Held-for-Sale

As of December 31, 2015, the company held prime jumbo residential mortgage loans with a fair market value of $764.3 million and had outstanding purchase commitments to acquire an additional $286.1 million UPB of residential mortgage loans, subject to fallout if the loans do not close. For the quarter ended December 31, 2015, the annualized yield on the prime jumbo residential mortgage loan portfolio was 4.0%, as compared to 3.9% for the quarter ended September 30, 2015.

During the quarter, the company sponsored a securitization, Agate Bay Mortgage Trust 2015-7. The trust issued securities backed by approximately $332.8 million UPB of prime jumbo residential mortgage loans.

- 4 -

Commercial Real Estate

The Company originates and acquires senior and mezzanine commercial real estate assets. These assets are U.S.-domiciled and are secured by a diverse mix of property types, which includes office, retail, multifamily and hotel properties.

As of December 31, 2015, the company held commercial real estate assets with an aggregate carrying value of $661.0 million. For the quarter ended December 31, 2015 the annualized yield on commercial real estate assets was 6.0% as compared to 7.9% for the quarter ended September 30, 2015.

Other Investments and Risk Management Derivatives

The company held $297.0 million notional of net long TBAs as of December 31, 2015, which are accounted for as derivative instruments in accordance with U.S. GAAP.

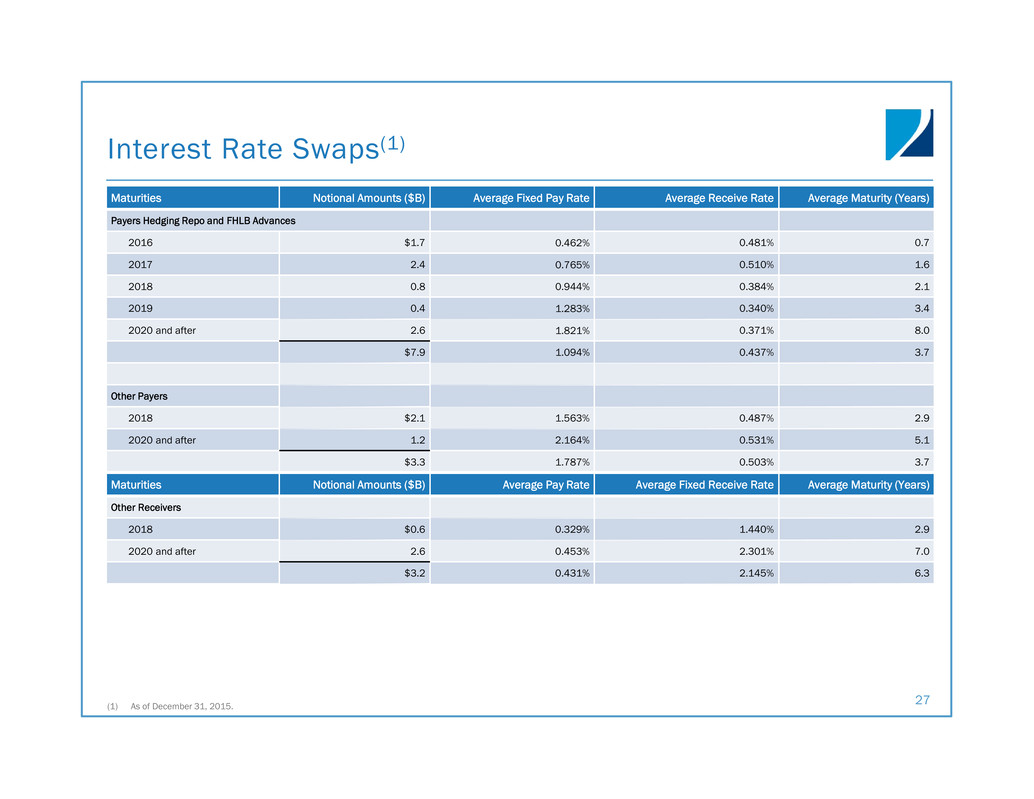

As of December 31, 2015, the company was a party to interest rate swaps and swaptions with a notional amount of $19.5 billion. Of this amount, $7.9 billion notional in swaps were utilized to economically hedge interest rate risk associated with the company’s LIBOR-based repurchase agreements and FHLB advances, $6.4 billion notional in swaps were utilized to economically hedge interest rate risk associated with the company’s investment portfolio, and $5.2 billion net notional in swaptions were utilized as macroeconomic hedges.

The following tables summarize the company’s investment portfolio:

Two Harbors Investment Corp. Portfolio | ||||||||||||||

(dollars in thousands) | ||||||||||||||

Portfolio Composition | As of December 31, 2015 | As of December 31, 2014 | ||||||||||||

(unaudited) | (unaudited) | |||||||||||||

Rates Strategy | ||||||||||||||

Agency Bonds | ||||||||||||||

Fixed Rate Bonds | $ | 5,864,294 | 52.7 | % | $ | 11,164,032 | 69.6 | % | ||||||

Hybrid ARMs | 108,596 | 1.0 | % | 128,285 | 0.8 | % | ||||||||

Total Agency | 5,972,890 | 53.7 | % | 11,292,317 | 70.4 | % | ||||||||

Agency Derivatives | 157,906 | 1.4 | % | 186,404 | 1.2 | % | ||||||||

Mortgage servicing rights | 493,688 | 4.4 | % | 452,006 | 2.8 | % | ||||||||

Ginnie Mae buyout residential mortgage loans | 36,069 | 0.3 | % | — | — | % | ||||||||

Credit Strategy | ||||||||||||||

Non-Agency Bonds | ||||||||||||||

Senior Bonds | 1,313,695 | 11.8 | % | 2,370,435 | 14.8 | % | ||||||||

Mezzanine Bonds | 532,572 | 4.8 | % | 670,421 | 4.2 | % | ||||||||

Non-Agency Other | 6,163 | 0.1 | % | 7,929 | — | % | ||||||||

Total Non-Agency | 1,852,430 | 16.7 | % | 3,048,785 | 19.0 | % | ||||||||

Net Economic Interest in Securitization(1) | 1,173,617 | 10.6 | % | 535,083 | 3.3 | % | ||||||||

Residential mortgage loans held-for-sale | 775,362 | 7.0 | % | 535,712 | 3.3 | % | ||||||||

Commercial real estate assets | 660,953 | 5.9 | % | — | — | % | ||||||||

Aggregate Portfolio | $ | 11,122,915 | $ | 16,050,307 | ||||||||||

________________

(1) | Net economic interest in securitization consists of residential mortgage loans held-for-investment, net of collateralized borrowings in consolidated securitization trusts. |

- 5 -

Portfolio Metrics | Three Months Ended December 31, 2015 | ||||

(unaudited) | |||||

Annualized portfolio yield during the quarter | 4.56 | % | |||

Rates Strategy | |||||

Agency RMBS, Agency Derivatives and mortgage servicing rights | 3.8 | % | |||

Credit Strategy | |||||

Non-Agency RMBS, Legacy(1) | 8.4 | % | |||

Non-Agency RMBS, New issue(1) | 4.0 | % | |||

Net economic interest in securitizations | 4.6 | % | |||

Residential mortgage loans held-for-sale | |||||

Prime nonconforming residential mortgage loans | 4.0 | % | |||

Credit sensitive residential mortgage loans | 4.6 | % | |||

Commercial Strategy | 6.0 | % | |||

Annualized cost of funds on average borrowing balance during the quarter(2) | 1.30 | % | |||

Annualized interest rate spread for aggregate portfolio during the quarter | 3.26 | % | |||

Debt-to-equity ratio at period-end(3) | 2.5 | :1.0 | |||

Portfolio Metrics Specific to RMBS and Agency Derivatives as of December 31, 2015 | |||||

Weighted average cost basis of principal and interest securities | |||||

Agency(4) | $ | 108.10 | |||

Non-Agency(5) | $ | 60.42 | |||

Weighted average three month CPR | |||||

Agency | 10.3 | % | |||

Non-Agency | 6.2 | % | |||

Fixed-rate investments as a percentage of aggregate RMBS and Agency Derivatives portfolio | 75.7 | % | |||

Adjustable-rate investments as a percentage of aggregate RMBS and Agency Derivatives portfolio | 24.3 | % | |||

________________

(1) | Legacy non-Agency RMBS includes non-Agency bonds issued up to and including 2009. New issue non-Agency RMBS includes bonds issued after 2009. |

(2) | Cost of funds includes interest spread expense associated with the portfolio's interest rate swaps. |

(3) | Defined as total borrowings to fund RMBS, residential mortgage loans held-for-sale, commercial real estate assets and Agency Derivatives, divided by total equity. |

(4) | Weighted average cost basis includes RMBS principal and interest securities only. Average purchase price utilized carrying value for weighting purposes. |

(5) | Average purchase price utilized carrying value for weighting purposes. If current face were utilized for weighting purposes, total non-Agency RMBS excluding the company's non-Agency interest-only portfolio would be $55.80 at December 31, 2015. |

“In 2015, we reallocated capital to the mortgage loan conduit, MSR and commercial real estate assets, increasing the capital allocation to 38% at year end from 22% at December 31, 2014, ” stated Bill Roth, Two Harbors’ Chief Investment Officer. “While this transition created a drag on core earnings, we believe this repositions our portfolio to drive attractive stockholder returns over the long-term.”

Financing Summary

The company reported a debt-to-equity ratio, defined as total borrowings under repurchase agreements and FHLB advances to fund RMBS, Agency Derivatives, residential mortgage loans held-for-sale and commercial real estate assets divided by total equity, of 2.5:1.0 and 3.1:1.0 as of December 31, 2015 and September 30, 2015, respectively.

As of December 31, 2015, the company had outstanding $5.0 billion of repurchase agreements funding RMBS, Agency Derivatives, residential mortgage loans held-for-sale and commercial real estate assets with 21 different counterparties. Excluding the effect of the company’s interest rate swaps, the repurchase agreements had a weighted average borrowing rate of 1.1% as of December 31, 2015.

- 6 -

The company’s wholly owned subsidiary, TH Insurance Holdings Company LLC (TH Insurance), is a member of the FHLB. As a member of the FHLB, TH Insurance has access to a variety of products and services offered by the FHLB, including secured advances. As of December 31, 2015, TH Insurance had $3.8 billion in outstanding secured advances with a weighted average borrowing rate of 0.58%, and had an additional $215.0 million of available uncommitted credit for borrowings.

As of December 31, 2015, the company’s aggregate repurchase agreements and FHLB advances funding RMBS, Agency Derivatives, residential mortgage loans held-for-sale and commercial real estate assets had 5.6 weighted average years to maturity.

The following table summarizes the company’s borrowings by collateral type under repurchase agreements and FHLB advances and the related cost of funds:

As of December 31, 2015 | ||||

(in thousands) | (unaudited) | |||

Collateral type: | ||||

Agency RMBS and Agency Derivatives | $ | 5,709,003 | ||

Mortgage servicing rights | — | |||

Non-Agency RMBS | 1,278,214 | |||

Net economic interests in consolidated securitization trusts(1) | 983,290 | |||

Residential mortgage loans held-for-sale | ||||

Prime nonconforming residential mortgage loans | 596,156 | |||

Credit sensitive residential mortgage loans | — | |||

Commercial real estate assets | 226,611 | |||

$ | 8,793,274 | |||

Cost of Funds Metrics | Three Months Ended December 31, 2015 | |||

(unaudited) | ||||

Annualized cost of funds on average borrowings during the quarter: | 0.8 | % | ||

Agency RMBS and Agency Derivatives | 0.5 | % | ||

Mortgage servicing rights | — | % | ||

Non-Agency RMBS | 2.0 | % | ||

Net economic interests in consolidated securitization trusts(1) | 0.8 | % | ||

Residential mortgage loans held-for-sale | ||||

Prime nonconforming residential mortgage loans | 0.5 | % | ||

Credit sensitive residential mortgage loans | — | % | ||

Commercial real estate assets | 1.2 | % | ||

________________

(1) | Includes the retained interests from on-balance sheet securitizations, which are eliminated in consolidation in accordance with U.S. GAAP. |

On January 12, 2016, the Federal Housing Finance Agency (FHFA) released final rules that exclude captive insurers from holding membership in the FHLB system. As a result, at the end of a 5-year grace period, TH Insurance's FHLB membership will terminate, though outstanding advances will be allowed to expire at their stated maturity.

- 7 -

Share Repurchase Program

During the fourth quarter, the company repurchased 12.3 million shares of its common stock pursuant to its share repurchase program at an average price of $8.37 per share, which was accretive to book value by $0.06 per share, for a total cost of $102.7 million. For the year ended December 31, 2015, the company repurchased 13.7 million shares, for a total cost of $115.2 million. Since the inception of the program, through December 31, 2015, the company had repurchased an aggregate of 16.1 million shares at a cost of $139.1 million, with an additional 8.9 million shares remaining available for purchase pursuant to its share repurchase program.

Subsequent to year end, the company disclosed that its Board of Directors had authorized the repurchase of up to an additional 50 million shares of common stock pursuant to the company’s ongoing share repurchase program.

Dividends and Taxable Income

The company declared cash dividends to stockholders of $1.04 per share during the 2015 taxable year. As a REIT, the company fulfilled its requirement to distribute at least 90% of its taxable income to stockholders.

2016 Dividend Outlook

The company expects to issue a dividend of $0.23 per share for the first quarter of 2016, subject to approval by its Board of Directors. The company anticipates that a quarterly dividend level of $0.23 per share will be sustainable for the year.

Conference Call

Two Harbors Investment Corp. will host a conference call on February 4, 2016 at 9:00 a.m. EST to discuss fourth quarter 2015 financial results and related information. To participate in the teleconference, please call toll-free (877) 868-1835 (or (914) 495-8581 for international callers), Conference Code 15148357, approximately 10 minutes prior to the above start time. You may also listen to the teleconference live via the Internet on the company’s website at www.twoharborsinvestment.com in the Investor Relations section under the Events and Presentations link. For those unable to attend, a telephone playback will be available beginning at 12:00 p.m. EST on February 4, 2016, through 12:00 a.m. EST on February 11, 2016. The playback can be accessed by calling (855) 859-2056 (or (404) 537-3406 for international callers), Conference Code 15148357. The call will also be archived on the company’s website in the Investor Relations section under the Events and Presentations link.

Two Harbors Investment Corp.

Two Harbors Investment Corp., a Maryland corporation, is a real estate investment trust that invests in residential mortgage-backed securities, residential mortgage loans, mortgage servicing rights, commercial real estate and other financial assets. Two Harbors is headquartered in New York, New York, and is externally managed and advised by PRCM Advisers LLC, a wholly owned subsidiary of Pine River Capital Management L.P. Additional information is available at www.twoharborsinvestment.com.

Forward-Looking Statements

This presentation includes “forward-looking statements” within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. Actual results may differ from expectations, estimates and projections and, consequently, readers should not rely on these forward-looking statements as predictions of future events. Words such as “expect,” “target,” “assume,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believe,” “predicts,” “potential,” “continue,” and similar expressions are intended to identify such forward-looking statements. These forward-looking statements involve significant risks and uncertainties that could cause actual results to differ materially from expected results, including, among other things, those described in our Annual Report on Form 10-K for the year ended December 31, 2014, and any subsequent Quarterly Reports on Form 10-Q, under the caption “Risk Factors.” Factors that could cause actual results to differ include, but are not limited to: the

- 8 -

state of credit markets and general economic conditions; changes in interest rates and the market value of our assets; changes in prepayment rates of mortgages underlying our target assets; the rates of default or decreased recovery on the mortgages underlying our target assets; the occurrence, extent and timing of credit losses within our portfolio; the concentration of credit risks we are exposed to; declines in home prices; our ability to establish, adjust and maintain appropriate hedges for the risks in our portfolio; the availability and cost of our target assets; the availability and cost of financing; changes in the competitive landscape within our industry; our ability to successfully implement new strategies and to diversify our business into new asset classes; our ability to manage various operational risks and costs associated with our business; interruptions in or impairments to our communications and information technology systems; our ability to acquire mortgage loans and successfully securitize the mortgage loans we acquire; our ability to acquire mortgage servicing rights (MSR) and successfully operate our seller-servicer subsidiary and oversee our subservicers; the impact of any deficiencies in the servicing or foreclosure practices of third parties and related delays in the foreclosure process; our exposure to legal and regulatory claims; legislative and regulatory actions affecting our business; the impact of new or modified government mortgage refinance or principal reduction programs; our ability to maintain our REIT qualification; the state of commercial real estate markets and our ability to acquire or originate commercial real estate loans or related assets; and limitations imposed on our business due to our REIT status and our exempt status under the Investment Company Act of 1940.

Readers are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Two Harbors does not undertake or accept any obligation to release publicly any updates or revisions to any forward-looking statement to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based. Additional information concerning these and other risk factors is contained in Two Harbors’ most recent filings with the Securities and Exchange Commission (SEC). All subsequent written and oral forward-looking statements concerning Two Harbors or matters attributable to Two Harbors or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above.

Non-GAAP Financial Measures

In addition to disclosing financial results calculated in accordance with United States generally accepted accounting principles (GAAP), this press release and the accompanying investor presentation present non-GAAP financial measures, such as Core Earnings and Core Earnings per common share, that exclude certain items. Two Harbors’ management believes that these non-GAAP measures enable it to perform meaningful comparisons of past, present and future results of the company’s core business operations, and uses these measures to gain a comparative understanding of the company’s operating performance and business trends. The non-GAAP financial measures presented by the company represent supplemental information to assist investors in analyzing the results of its operations. However, because these measures are not calculated in accordance with GAAP, they should not be considered a substitute for, or superior to, the financial measures calculated in accordance with GAAP. The company’s GAAP financial results and the reconciliations from these results should be carefully evaluated. See the GAAP to non-GAAP reconciliation table on page 13 of this release.

Additional Information

Stockholders of Two Harbors and other interested persons may find additional information regarding the company at the SEC’s Internet site at www.sec.gov or by directing requests to: Two Harbors Investment Corp., Attn: Investor Relations, 590 Madison Avenue, 36th Floor, New York, NY 10022, telephone (612) 629-2500.

Contact

July Hugen, Director of Investor and Media Relations, Two Harbors Investment Corp., (612) 629-2514 or

# # #

- 9 -

TWO HARBORS INVESTMENT CORP. | |||||||

CONSOLIDATED BALANCE SHEETS | |||||||

(dollars in thousands, except share data) | |||||||

December 31, 2015 | December 31, 2014 | ||||||

(unaudited) | |||||||

ASSETS | |||||||

Available-for-sale securities, at fair value | $ | 7,825,320 | $ | 14,341,102 | |||

Trading securities, at fair value | — | 1,997,656 | |||||

Residential mortgage loans held-for-sale, at fair value | 811,431 | 535,712 | |||||

Residential mortgage loans held-for-investment in securitization trusts, at fair value | 3,173,727 | 1,744,746 | |||||

Commercial real estate assets | 660,953 | — | |||||

Mortgage servicing rights, at fair value | 493,688 | 452,006 | |||||

Cash and cash equivalents | 737,831 | 1,005,792 | |||||

Restricted cash | 262,562 | 336,771 | |||||

Accrued interest receivable | 49,970 | 65,529 | |||||

Due from counterparties | 17,206 | 35,625 | |||||

Derivative assets, at fair value | 271,509 | 380,791 | |||||

Other assets | 271,575 | 188,579 | |||||

Total Assets | $ | 14,575,772 | $ | 21,084,309 | |||

LIABILITIES AND STOCKHOLDERS’ EQUITY | |||||||

Liabilities | |||||||

Repurchase agreements | $ | 5,008,274 | $ | 12,932,463 | |||

Collateralized borrowings in securitization trusts, at fair value | 2,000,110 | 1,209,663 | |||||

Federal Home Loan Bank advances | 3,785,000 | 2,500,000 | |||||

Derivative liabilities, at fair value | 7,285 | 90,233 | |||||

Due to counterparties | 34,294 | 124,206 | |||||

Dividends payable | 92,016 | 95,263 | |||||

Other liabilities | 72,232 | 64,439 | |||||

Total Liabilities | $ | 10,999,211 | $ | 17,016,267 | |||

Stockholders’ Equity | |||||||

Preferred stock, par value $0.01 per share; 50,000,000 shares authorized; no shares issued and outstanding | — | — | |||||

Common stock, par value $0.01 per share; 900,000,000 shares authorized and 353,906,807 and 366,395,920 shares issued and outstanding, respectively | 3,539 | 3,664 | |||||

Additional paid-in capital | 3,705,519 | 3,811,027 | |||||

Accumulated other comprehensive income | 359,061 | 855,789 | |||||

Cumulative earnings | 1,684,755 | 1,195,536 | |||||

Cumulative distributions to stockholders | (2,176,313 | ) | (1,797,974 | ) | |||

Total Stockholders’ Equity | 3,576,561 | 4,068,042 | |||||

Total Liabilities and Stockholders’ Equity | $ | 14,575,772 | $ | 21,084,309 | |||

- 10 -

TWO HARBORS INVESTMENT CORP. | |||||||||||||||

CONSOLIDATED STATEMENTS OF COMPREHENSIVE (LOSS) INCOME | |||||||||||||||

(dollars in thousands) | |||||||||||||||

Certain prior period amounts have been reclassified to conform to the current period presentation | |||||||||||||||

Three Months Ended December 31, | Year Ended December 31, | ||||||||||||||

2015 | 2014 | 2015 | 2014 | ||||||||||||

(unaudited) | (unaudited) | ||||||||||||||

Interest income: | |||||||||||||||

Available-for-sale securities | $ | 88,543 | $ | 131,694 | $ | 458,515 | $ | 506,268 | |||||||

Trading securities | — | 4,739 | 8,676 | 12,913 | |||||||||||

Residential mortgage loans held-for-sale | 7,698 | 3,536 | 28,966 | 16,089 | |||||||||||

Residential mortgage loans held-for-investment in securitization trusts | 30,832 | 16,040 | 95,740 | 41,220 | |||||||||||

Commercial real estate assets | 6,297 | — | 9,138 | — | |||||||||||

Cash and cash equivalents | 235 | 211 | 902 | 717 | |||||||||||

Total interest income | 133,605 | 156,220 | 601,937 | 577,207 | |||||||||||

Interest expense: | |||||||||||||||

Repurchase agreements | 14,851 | 19,493 | 73,049 | 76,177 | |||||||||||

Collateralized borrowings in securitization trusts | 17,815 | 10,137 | 57,216 | 26,760 | |||||||||||

Federal Home Loan Bank advances | 3,909 | 2,074 | 11,921 | 4,513 | |||||||||||

Total interest expense | 36,575 | 31,704 | 142,186 | 107,450 | |||||||||||

Net interest income | 97,030 | 124,516 | 459,751 | 469,757 | |||||||||||

Other-than-temporary impairment losses | — | (180 | ) | (535 | ) | (392 | ) | ||||||||

Other income (loss): | |||||||||||||||

Gain (loss) on investment securities | 99,867 | 28,697 | 363,379 | 87,201 | |||||||||||

Gain (loss) on interest rate swap and swaption agreements | 42,526 | (152,619 | ) | (210,621 | ) | (345,647 | ) | ||||||||

Loss on other derivative instruments | (2,077 | ) | (5,184 | ) | (5,049 | ) | (17,529 | ) | |||||||

(Loss) gain on residential mortgage loans held-for-sale | (4,015 | ) | 11,064 | 14,285 | 17,297 | ||||||||||

Servicing income | 32,799 | 31,587 | 127,412 | 128,160 | |||||||||||

Loss on servicing asset | (3,267 | ) | (55,346 | ) | (99,584 | ) | (128,388 | ) | |||||||

Other (loss) income | (5,525 | ) | (1,409 | ) | (21,790 | ) | 18,539 | ||||||||

Total other income (loss) | 160,308 | (143,210 | ) | 168,032 | (240,367 | ) | |||||||||

Expenses: | |||||||||||||||

Management fees | 12,270 | 12,244 | 50,294 | 48,803 | |||||||||||

Securitization deal costs | 1,200 | 1,283 | 8,971 | 4,638 | |||||||||||

Servicing expenses | 8,252 | 1,330 | 28,101 | 25,925 | |||||||||||

Other operating expenses | 16,130 | 14,950 | 64,162 | 56,231 | |||||||||||

Total expenses | 37,852 | 29,807 | 151,528 | 135,597 | |||||||||||

Income (loss) before income taxes | 219,486 | (48,681 | ) | 475,720 | 93,401 | ||||||||||

Provision for (benefit from) income taxes | 8,780 | (11,718 | ) | (16,490 | ) | (73,738 | ) | ||||||||

Net income (loss) | $ | 210,706 | $ | (36,963 | ) | $ | 492,210 | $ | 167,139 | ||||||

Basic and diluted earnings (loss) per weighted average common share | $ | 0.59 | $ | (0.10 | ) | $ | 1.35 | $ | 0.46 | ||||||

Dividends declared per common share | $ | 0.26 | $ | 0.26 | $ | 1.04 | $ | 1.04 | |||||||

Basic and diluted weighted average number of shares of common stock outstanding | 360,090,432 | 366,230,566 | 365,247,738 | 366,011,855 | |||||||||||

- 11 -

TWO HARBORS INVESTMENT CORP. | |||||||||||||||

CONSOLIDATED STATEMENTS OF COMPREHENSIVE (LOSS) INCOME | |||||||||||||||

(dollars in thousands) | |||||||||||||||

Certain prior period amounts have been reclassified to conform to the current period presentation | |||||||||||||||

Three Months Ended December 31, | Year Ended December 31, | ||||||||||||||

2015 | 2014 | 2015 | 2014 | ||||||||||||

(unaudited) | (unaudited) | ||||||||||||||

Comprehensive (loss) income: | |||||||||||||||

Net income (loss) | $ | 210,706 | $ | (36,963 | ) | $ | 492,210 | $ | 167,139 | ||||||

Other comprehensive (loss) income, net of tax: | |||||||||||||||

Unrealized (loss) gain on available-for-sale securities | (213,940 | ) | 79,141 | (496,728 | ) | 411,054 | |||||||||

Other comprehensive (loss) income | (213,940 | ) | 79,141 | (496,728 | ) | 411,054 | |||||||||

Comprehensive (loss) income | $ | (3,234 | ) | $ | 42,178 | $ | (4,518 | ) | $ | 578,193 | |||||

- 12 -

TWO HARBORS INVESTMENT CORP. | |||||||||||||||

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL INFORMATION | |||||||||||||||

(dollars in thousands, except share data) | |||||||||||||||

Certain prior period amounts have been reclassified to conform to the current period presentation | |||||||||||||||

Three Months Ended December 31, | Year Ended December 31, | ||||||||||||||

2015 | 2014 | 2015 | 2014 | ||||||||||||

(unaudited) | (unaudited) | ||||||||||||||

Reconciliation of net income (loss) to Core Earnings: | |||||||||||||||

Net income (loss) | $ | 210,706 | $ | (36,963 | ) | $ | 492,210 | $ | 167,139 | ||||||

Adjustments for non-core earnings: | |||||||||||||||

Gain on sale of securities and residential mortgage loans, net of tax | (100,548 | ) | (30,447 | ) | (371,080 | ) | (95,175 | ) | |||||||

Unrealized loss (gain) on securities and residential mortgage loans held-for-sale, net of tax | 14,668 | (3,983 | ) | 19,612 | (1,191 | ) | |||||||||

Other-than-temporary impairment loss, net of tax | — | 180 | 535 | 392 | |||||||||||

Realized loss on termination or expiration of swaps and swaptions, net of tax | 77,672 | 8,458 | 190,242 | 42,938 | |||||||||||

Unrealized (gain) loss on interest rate swaps and swaptions economically hedging investment portfolio, repurchase agreements and FHLB advances, net of tax | (134,182 | ) | 103,239 | (91,874 | ) | 157,972 | |||||||||

Loss on other derivative instruments, net of tax | 6,880 | 6,028 | 17,108 | 20,113 | |||||||||||

Realized and unrealized loss (gain) on financing securitizations, net of tax | 6,997 | 2,129 | 26,384 | (16,854 | ) | ||||||||||

Realized and unrealized (gain) loss on mortgage servicing rights, net of tax | (11,342 | ) | 36,978 | 36,607 | 64,320 | ||||||||||

Securitization deal costs, net of tax | 780 | 834 | 5,831 | 3,015 | |||||||||||

Amortization of business combination intangible assets, net of tax | — | — | — | 346 | |||||||||||

Change in representation and warranty reserve, net of tax | 502 | (3,345 | ) | 206 | 793 | ||||||||||

Core Earnings(1) | $ | 72,133 | $ | 83,108 | $ | 325,781 | (2) | $ | 343,808 | ||||||

Weighted average shares outstanding | 360,090,432 | 366,230,566 | 365,247,738 | 366,011,855 | |||||||||||

Core Earnings per weighted average share outstanding | $ | 0.20 | $ | 0.23 | $ | 0.89 | $ | 0.94 | |||||||

(1) | Core Earnings is a non-GAAP measure that we define as GAAP net income, excluding impairment losses, realized and unrealized gains or losses on the aggregate portfolio, amortization of business combination intangible assets, reserve expense for representation and warranty obligations on MSR and certain upfront costs related to securitization transactions. As defined, Core Earnings includes interest income or expense and premium income or loss on derivative instruments and servicing income, net of estimated amortization on MSR. Core Earnings is provided for purposes of comparability to other peer issuers. |

(2) | Effective July 1, 2015, we refined the MSR amortization methodology utilized for Core Earnings. If this methodology was applied retroactively to the first 6 months of 2015, it would have resulted in an additional $8.6 million expense, net of tax, or $0.03 per weighted average share for that period. |

- 13 -

TWO HARBORS INVESTMENT CORP. | |||||||||||||||||||

SUMMARY OF QUARTERLY CORE EARNINGS | |||||||||||||||||||

(dollars in millions, except per share data) | |||||||||||||||||||

Certain prior period amounts have been reclassified to conform to the current period presentation | |||||||||||||||||||

Three Months Ended | |||||||||||||||||||

December 31, 2015 | September 30, 2015 | June 30, 2015 | March 31, 2015 | December 31, 2014 | |||||||||||||||

(unaudited) | |||||||||||||||||||

Net Interest Income: | |||||||||||||||||||

Interest income | $ | 133.6 | $ | 152.8 | $ | 152.5 | $ | 163.0 | $ | 156.2 | |||||||||

Interest expense | 36.6 | 37.0 | 35.0 | 33.5 | 31.7 | ||||||||||||||

Net interest income | 97.0 | 115.8 | 117.5 | 129.5 | 124.5 | ||||||||||||||

Other income (loss): | |||||||||||||||||||

Interest spread on interest rate swaps | (12.6 | ) | (19.4 | ) | (26.2 | ) | (27.5 | ) | (32.2 | ) | |||||||||

Interest spread on other derivative instruments | 6.0 | 5.6 | 6.4 | 7.7 | 7.0 | ||||||||||||||

Servicing income, net of amortization(1) | 16.8 | 10.8 | 17.2 | 19.1 | 17.9 | ||||||||||||||

Other income | 1.4 | 1.1 | 1.0 | 1.0 | 0.7 | ||||||||||||||

Total other income (loss) | 11.6 | (1.9 | ) | (1.6 | ) | 0.3 | (6.6 | ) | |||||||||||

Expenses | 35.8 | 35.6 | 35.3 | 35.4 | 33.7 | ||||||||||||||

Core Earnings before income taxes | 72.8 | 78.3 | 80.6 | 94.4 | 84.2 | ||||||||||||||

Income tax expense (benefit) | 0.7 | (1.1 | ) | 0.4 | 0.3 | 1.1 | |||||||||||||

Core Earnings | $ | 72.1 | $ | 79.4 | $ | 80.2 | $ | 94.1 | $ | 83.1 | |||||||||

Basic and diluted weighted average Core EPS | $ | 0.20 | $ | 0.22 | $ | 0.22 | $ | 0.26 | $ | 0.23 | |||||||||

________________

(1) | Amortization refers to the portion of change in fair value of MSR primarily attributed to the realization of expected cash flows (runoff) of the portfolio. This amortization has been deducted from Core Earnings. Amortization of MSR is deemed a non-GAAP measure due to the company’s decision to account for MSR at fair value. |

- 14 -

Februar y 4 , 2016 Fourth Quarter 2015 Earnings Call

Safe Harbor Statement F O R W A R D - L O O K I N G S T A T E M E N T S This presentation includes “forward-looking statements” within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. Actual results may differ from expectations, estimates and projections and, consequently, readers should not rely on these forward-looking statements as predictions of future events. Words such as “expect,” “target,” “assume,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believe,” “predicts,” “potential,” “continue,” and similar expressions are intended to identify such forward-looking statements. These forward- looking statements involve significant risks and uncertainties that could cause actual results to differ materially from expected results, including, among other things, those described in our Annual Report on Form 10-K for the year ended December 31, 2014, and any subsequent Quarterly Reports on Form 10-Q, under the caption “Risk Factors.” Factors that could cause actual results to differ include, but are not limited to: the state of credit markets and general economic conditions; changes in interest rates and the market value of our assets; changes in prepayment rates of mortgages underlying our target assets; the rates of default or decreased recovery on the mortgages underlying our target assets; the occurrence, extent and timing of credit losses within our portfolio; the concentration of credit risks we are exposed to; declines in home prices; our ability to establish, adjust and maintain appropriate hedges for the risks in our portfolio; the availability and cost of our target assets; the availability and cost of financing; changes in the competitive landscape within our industry; our ability to successfully implement new strategies and to diversify our business into new asset classes; our ability to manage various operational risks and costs associated with our business; interruptions in or impairments to our communications and information technology systems; our ability to acquire mortgage loans and successfully securitize the mortgage loans we acquire; our ability to acquire mortgage servicing rights (MSR) and successfully operate our seller-servicer subsidiary and oversee our subservicers; the impact of any deficiencies in the servicing or foreclosure practices of third parties and related delays in the foreclosure process; the state of commercial real estate markets and our ability to acquire or originate commercial real estate loans or related assets; our exposure to legal and regulatory claims; legislative and regulatory actions affecting our business; the impact of new or modified government mortgage refinance or principal reduction programs; our ability to maintain our REIT qualification; and limitations imposed on our business due to our REIT status and our exempt status under the Investment Company Act of 1940. Readers are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Two Harbors does not undertake or accept any obligation to release publicly any updates or revisions to any forward-looking statement to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based. Additional information concerning these and other risk factors is contained in Two Harbors’ most recent filings with the Securities and Exchange Commission (SEC). All subsequent written and oral forward-looking statements concerning Two Harbors or matters attributable to Two Harbors or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above. This presentation may include industry and market data obtained through research, surveys, and studies conducted by third parties and industry publications. We have not independently verified any such market and industry data from third-party sources. This presentation is provided for discussion purposes only and may not be relied upon as legal or investment advice, nor is it intended to be inclusive of all the risks and uncertainties that should be considered. This presentation does not constitute an offer to purchase or sell any securities, nor shall it be construed to be indicative of the terms of an offer that the parties or their respective affiliates would accept. Readers are advised that the financial information in this presentation is based on company data available at the time of this presentation and, in certain circumstances, may not have been audited by the company’s independent auditors. 2

Financial Summary F U L L Y E A R 2 015 • Total return on book value of 0.5%(1) – Cash dividends totaling $1.04 per share • Comprehensive Loss of $4.5 million, or $0.01 per share • Core Earnings(2) of $325.8 million, or $0.89 per share • Repurchased 13.7 million shares of common stock – Average purchase price of $8.43 per share; aggregate cost of $115.2 million – Accretive to book value by $0.07 per share FOURTH QUARTER 2015 • Total return on book value of 0.7%(1) – Cash dividend of $0.26 per share • Comprehensive Loss of $3.2 million, or $0.01 per share • Core Earnings(2) of $72.1 million, or $0.20 per share • Repurchased 12.3 million shares of common stock – Average purchase price of $8.37 per share; aggregate cost of $102.7 million – Accretive to book value by $0.06 per share 3(1) See Appendix slide 16 for calculation of Q4-2015 and FY-2015 return on book value. (2) Core Earnings is a non-GAAP measure. Please see Appendix slide 19 of this presentation for a definition of Core Earnings and a reconciliation of GAAP to non-GAAP financial information.

Business Overview(1) MORTGAGE LOAN CONDUIT • Sponsored seven securitizations totaling $2.0 billion in unpaid principal balance (UPB) – Attained goal of sponsoring six to ten securitizations during 2015 • Expanded originator partner network M O RTG AG E S E RV I C I N G R I G H T S • Added six MSR flow sellers – Achieved goal of adding five to ten flow sellers in 2015 • Closed on four bulk MSR acquisitions; total UPB of $8.5 billion C O M M E RC I A L R E A L E STAT E • Completed build out of team and resources to manage and support investments • Deployed significant equity capital • Closed on 18 assets; aggregate carrying value of $661.0 million at December 31, 2015 4 (1) Data for the year ended December 31, 2015.

Market and Policy Update MACRO CONSIDERAT IONS • Volatile market and interest rate environment – Wider Agency and credit asset spreads – Federal Reserve raised interest rates in December 2015 • Continued home price appreciation – CoreLogic Home Price Index up 6.3% on rolling 12-month basis(1) • Mixed employment data – Improvement in unemployment rate; 5.0% in December 2015 versus 5.6% in December 2014(2) – Tepid labor force participation P O L I C Y M AT T E R S • Remain actively engaged with a variety of parties in Washington, D.C. – Credit risk transfer – Private label securitization market – Role of private capital – FHFA ruling 5(1) Source: CoreLogic Home Price Index rolling 12-month change as of December 31, 2015. (2) Source: U.S. Bureau of Labor Statistics.

(Dollars in millions, except per share data) Q4-2015 Book Value Q4-2015 Book Value per share FY-2015 Book Value FY-2015 Book Value per share Beginning stockholders’ equity $3,772.7 $10.30 $4,068.0 $11.10 Cumulative effect of adoption of new accounting principle (ASU 2014-13) n/a (3.0) Beginning stockholders’ equity - adjusted $3,772.7 $10.30 $4,065.0 $11.09 GAAP Net Income: Core Earnings, net of tax 72.1 325.8 Realized gains, net of tax 15.1 134.6 Unrealized mark-to-market gains, net of tax 123.5 31.8 Other comprehensive loss (213.9) (496.7) Dividend declaration (92.0) (378.3) Other 1.7 9.0 Balance before capital transactions 3,679.2 3,691.2 Repurchase of common stock (102.7) (115.2) Issuance of common stock, net of offering costs 0.1 0.6 Ending stockholders’ equity $3,576.6 $10.11 $3,576.6 $10.11 Book Value 6 Q4-2015 Comprehensive Loss of $3.2 million; $4.5 million loss in 2015 Declared Q4-2015 dividend of $0.26 per share; $1.04 per share total in 2015 Share repurchases accretive to book value by $0.06 per share in Q4-2015; $0.07 per share in 2015

$404.8 $376.0 $0 $75 $150 $225 $300 $375 $450 2015 REIT Taxable Income 2015 Dividend Declarations M i l l i o n s Tax Characterization of Dividend • Generated REIT taxable income of $404.8 million in 2015 – Includes net capital gains of approximately $261.1 million • 2015 dividend declarations totaled $376.0 million – Fulfilled REIT dividend distribution requirements – Distributed 92.9% of REIT taxable income – Carrying approximately $28.8 million of ordinary income into 2016 • Distributions fully taxable when characterized on Form 1099-DIV(1) – 61.7% deemed long-term taxable gains 7 FULL YEAR 2015 DIVIDEND SUMMARY 92.9% of REIT Taxable Income (1) The U.S. federal income tax treatment of holding Two Harbors common stock to any particular stockholder will depend on the stockholder’s particular tax circumstances. You are urged to consult your tax advisor regarding the U.S. federal, state, local and foreign income and other tax consequences to you, in light of your particular investment or tax circumstances, of acquiring, holding and disposing of Two Harbors common stock. Two Harbors does not provide tax, accounting or legal advice. Any tax statements contained herein were not intended or written to be used, and cannot be used for the purpose of avoiding U.S., federal, state or local tax penalties. Please consult your advisor as to any tax, accounting or legal statements made herein.

(Dollars in millions) Q3-2015 Q4-2015 Variance ($) Variance (%) Interest income $152.8 $133.6 ($19.2) (12.6%) Interest expense $37.0 $36.6 $0.4 1.4% Net interest income $115.8 $97.0 ($18.8) (16.2%) Loss on swaps and swaptions ($19.4) ($12.6) $6.8 35.3% Gain on other derivatives $5.6 $6.0 $0.4 6.8% Servicing income, net of amortization on MSR $10.8 $16.8 $6.0 54.9% Other $1.1 $1.4 $0.3 29.7% Total other income ($1.9) $11.6 $13.5 n/a Expenses $35.6 $35.8 ($0.2) (0.8%) Income taxes ($1.1) $0.7 ($1.8) n/a Core Earnings(1) $79.4 $72.1 ($7.3) (9.2%) Core Earnings Summary(1) 8 Q4-2015 F INANCIAL HIGHLIGHTS (1) Core Earnings is a non-GAAP measure. Please see Appendix slide 19 for a definition of Core Earnings and a reconciliation of GAAP to non-GAAP financial information. • Interest income down 12.6% quarter-over-quarter ― Earnings drag due primarily to reallocation of capital ― Sold approximately $2.7 billion Agency securities ― Offset by an increase in mortgage loans held-for-investment in securitization trusts and commercial real estate loans • Swap costs decreased by 35.3% ― Lower average notional balance ― Average interest spread on swaps decreased • Other operating expenses ― 1.7% of average equity in Q4-2015; up from 1.6% in Q3- 2015 • Expenses are consistent but stockholders’ equity declined due to share repurchase activity ― Added resources to create operational capabilities within the conduit, MSR and commercial real estate, expanded vendor relationships and fortified information technology infrastructure • Combined with variable expenses, could result in a higher expense ratio in 2016

Financing Profile 9 REPURCHASE AGREEMENTS • Focused on diversification and financial stability across repo counterparties • Outstanding borrowings of $5.0 billion with 21 active counterparties; 30 total counterparties • Continued to ladder repo maturities FEDERAL HOME LOAN BANK OF DES MOINES • Outstanding secured advances of $3.8 billion • Average borrowing rate 0.58% • FHFA rulemaking SECURED $250 MILL ION F INANCING FACIL IT Y FOR COMMERCIAL REAL ESTATE LOANS

Portfolio Performance and Hedging 10 Q 4 - 2 015 P E R FO R M A N C E H I G H L I G H T S (1) “Legacy” non-Agency RMBS includes non-Agency bonds issued up to and including 2009. “New issue” non-Agency RMBS includes bonds issued after 2009. (2) Cost of funds includes interest spread expense associated with the portfolio's interest rate swaps. (3) Defined as total borrowings to fund RMBS, residential mortgage loans held-for-sale, commercial real estate assets and Agency Derivatives, divided by total equity. NET INTEREST MARGIN BEGINNING TO BENEFIT FROM REALLOCATION OF CAPITAL TO HIGHER Y IELDING ASSETS RATES • Solid Interest-Only and MSR performance CREDIT • Credit yields were stable COMMERCIAL • Initial holdings performed as expected HEDGING • Maintained low interest rate exposure and leverage • Debt-to-equity of 2.5x at December 31, 2015, down from 3.1x at September 30, 2015(3) Q4 -2015 PORTFOL IO METR ICS Three Months Ended Sept. 30, 2015 Dec. 31, 2015 Annualized portfolio yield during the quarter 4.14% 4.56% Rates Agency RMBS, Agency Derivatives and MSR 3.3% 3.8% Credit Non-Agency RMBS, Legacy(1) 8.6% 8.4% Non-Agency RMBS, New issue(1) 4.1% 4.0% Net economic interest in securitization trusts 4.9% 4.6% Prime jumbo residential mortgage loans 3.9% 4.0% Commercial 7.9% 6.0% Annualized cost of funds on average repurchase and advance balance during the quarter(2) 1.31% 1.30% Annualized interest rate spread for aggregate portfolio during the quarter 2.83% 3.26%

HISTORICAL CAPITAL ALLOCATIONPORTFOLIO COMPOSIT ION (1) Portfolio Composition 11 $11.1 BILLION PORTFOLIO AS OF DECEMBER 31, 2015 ($ billions) (1) For additional detail on the portfolio, see Appendix slides 20-25. (2) Commercial consists of senior and mezzanine commercial real estate debt and related instruments. (3) MSR includes Ginnie Mae buyout residential mortgage loans. (4) Assets in “Rates” include Agency RMBS, Agency Derivatives, MSR and Ginnie Mae buyout residential mortgage loans. (5) Assets in “Credit” include non-Agency RMBS, prime jumbo residential mortgage loans, net economic interest in securitization trusts and CSL. (6) The capital allocation strategies are intended to be illustrative of allocation trends and reflect the company’s current expectations based on a variety of market, economic and regulatory factors. Actual portfolio composition and allocation strategies may differ materially. Rates(3) $10,766 Commercial(2) $0.66 Dec. 31, 2013 Dec. 31, 2014 Dec. 31, 2015 Long-Term Trend(6) Rates(4) Agency 44% 44% 35% MSR 13% 12% 14% Credit(5) Non-Agency 38% 34% 27% Conduit 5% 10% 16% Commercial n/a n/a 8% INCREASED CAPITAL ALLOCATION TO MSR, CONDUIT AND COMMERCIAL REAL ESTATE Agency $6.13 MSR(3) $0.53 Non-Agency $1.85 Conduit $1.95 Rates(4) $6.66B Credit(5) $3.80B Commercial $0.66B

• Sponsored ABMT 2015-7; $332.8 million securitization • Significant issuer in private label securities market – Approximately 16% market share of new prime jumbo issuance in 2015(2) – Broad investor interest and participation; over 50 different investors in program since inception(4) – Agate Bay pricing improved throughout 2015 – Sponsored ABMT 2016-1 in January 2016; $299.3 million securitization • Retained interest in securitization trusts of $1.2 billion at December 31, 2015 Conduit and MSR Update(1) 12 (1) Data for the three months ended December 31, 2015, except where noted. (2) Source: Two Harbors Investment Corp. research. (3) Gross yield includes servicing income, sub-servicing expense and amortization. (4) As of January 31, 2016. (5) Total investors considers only new issue buyers. MORTGAGE LOAN CONDUIT MORTGAGE SERVICING RIGHTS • Added four MSR flow seller relationships • Closed on two bulk MSR acquisitions; total UPB of $2.4 billion • Gross yields remain healthy; 7.2% in Q4-2015(3) • Invested $124 million in 2015 • Fair value of $493.7 million at December 31, 2015 AG ATE B AY M O RTG AG E T RU ST ( A B M T ) S U M M A RY 1 3 7 7 13 38 $434 $998 $2,007 $0 $500 $1,000 $1,500 $2,000 $2,500 0 10 20 30 40 2013 2014 2015 M i l l i o n s C o u n t Securitizations Total Investors Total UPB(5)

• Added nine commercial real estate assets during the fourth quarter • Twelve senior and six mezzanine assets at December 31, 2015 ― Secured by a diverse group of properties throughout the United States ― Weighted average initial loan-to-value of 72.3%; weighted average spread of LIBOR plus 507 basis points • Working to secure additional financing options • Opportunities in the commercial real estate market remain attractive Commercial Real Estate Update 13 PORTFOLIO BY PROPERTY TYPE PORTFOLIO BY LOAN TYPE 38.6% 28.1% 21.1% 12.2% Office Retail Multifamily Hotel (1) Defined as total borrowings to fund commercial real estate assets divided by total equity in investments. 76.9% 23.1% Senior Mezzanine

2016 Outlook 14 O P P O RTU N I ST I C A L LY D E P LOY C A P I TAL TO M A X I MI Z E STO C K H O L D E R VALUE OVE R T H E LON G -TE R M • Diversify asset base to deliver high-quality returns with dampened volatility • Allocate capital to sectors with more attractive returns, including: – Mortgage loan conduit – MSR – Commercial real estate assets • Pursue Agency and non-Agency opportunities when attractive INCREASE OPT IONAL IT Y AND FLEX IB IL I T Y IN BUS INESS MODEL • Broaden financing capabilities • Maintain a low risk profile • Leverage operational capabilities STOC K R E P URC H AS E S • Expect to continue to repurchase stock, subject to stock price and market conditions • Additional 50 million shares available pursuant to the stock repurchase program DIV IDEND SUSTA INAB IL IT Y • Anticipate issuing a quarterly dividend of $0.23 per share in March • Expect quarterly dividend of $0.23 per share to be sustainable in 2016 • Remains subject to board approval

Appendix

Return on Book Value 16 (1) Return on book value for twelve-month period ended December 31, 2015 is defined as the decrease in book value from December 31, 2014 to December 31, 2015 of $0.99 per share, plus dividends declared of $1.04 per share, divided by December 31, 2014 book value of $11.10 per share. (2) Return on book value for three-month period ended December 31, 2015 is defined as the decrease in book value from September 30, 2015 to December 31, 2015 of $0.19 per share, plus dividends declared of $0.26 per share, divided by September 30, 2015 book value of $10.30 per share. Return on book value FY-2015 (Per share amounts, except for percentage) Book value at December 31, 2014 $11.10 Book value at December 31, 2015 10.11 Decrease in book value (0.99) Dividends declared in 2015 1.04 Return on book value 2015 $0.05 Percent return on book value 2015(1) 0.5% Return on book value Q4-2015 (Per share amounts, except for percentage) Book value at September 30, 2015 $10.30 Book value at December 31, 2015 10.11 Decrease in book value (0.19) Dividends declared in Q4-2015 0.26 Return on book value Q4-2015 $0.07 Percent return on book value Q4-2015(2) 0.7%

DIVIDENDS (1) Financial Performance 17 COMPREHENSIVE INCOME (LOSS) BOOK VALUE AND DIV IDEND PER SHARE (1) GAAP NET (LOSS) INCOME (1) Historical dividends may not be indicative of future dividend distributions. The company ultimately distributes dividends based on its taxable income per common share, not GAAP earnings. The annualized dividend yield on the company’s common stock is calculated based on the closing price of the last trading day of the relevant quarter. $42.2 $88.9 $2.7 ($92.8) ($3.2) 4.1% 8.7% 0.3% (9.4%) (0.3%) -10.0% -5.0% 0.0% 5.0% 10.0% 15.0% $(100) $(50) $- $50 $100 Q4-2014 Q1-2015 Q2-2015 Q3-2015 Q4-2015 Comp. Income ($M) Comp. Income ROAE (%) $11.10 $11.08 $10.81 $10.30 $10.11 $0.26 $0.26 $0.26 $0.26 $0.26 $6.00 $9.00 $12.00 Q4-2014 Q1-2015 Q2-2015 Q3-2015 Q4-2015 Book Value ($) Dividend Declared ($) $0.26 $0.26 $0.26 $0.26 $0.26 10.4% 9.8% 10.7% 11.8% 12.8% 0.0% 5.0% 10.0% 15.0% $0.00 $0.10 $0.20 $0.30 Q4-2014 Q1-2015 Q2-2015 Q3-2015 Q4-2015 Dividend per Share ($) Dividend Yield (%) ($37.0) $94.8 $221.5 ($34.8) $210.7 ($0.10) $0.26 $0.60 ($0.09) $0.59 ($1.00) ($0.50) $0.00 $0.50 $1.00 $(250) $(125) $- $125 $250 Q4-2014 Q1-2015 Q2-2015 Q3-2015 Q4-2015 GAAP Net Inc. ($M) GAAP EPS ($)

Operating Performance (In millions, except for per share data) Core Earnings(1) Realized Gains Unrealized MTM Q3-2015 Financials Core Earnings(1) Realized Gains Unrealized MTM Q4-2015 Financials Interest income $152.8 $ - $ - $152.8 $133.6 $ - $ - $133.6 Interest expense 37.0 - - 37.0 36.6 - - 36.6 Net interest income 115.8 - - 115.8 97.0 - - 97.0 Net other-than-temporary impairment losses - - (0.2) (0.2) - - - - Gain (loss) on investment securities - 66.4 (2.3) 64.1 - 109.6 (9.7) 99.9 (Loss) gain on interest rate swaps and swaptions (19.4) (61.9) (90.4) (171.7) (12.6) (101.1) 156.2 42.5 Gain (loss) on other derivative instruments 5.6 (20.0) 13.9 (0.5) 6.0 (6.8) (1.3) (2.1) Gain (loss) on residential mortgage loans held-for-sale - 5.6 10.4 16.0 - 3.6 (7.7) (4.1) Servicing income 32.0 - - 32.0 32.8 - - 32.8 (Loss) gain on servicing asset (21.2) - (40.3) (61.5) (16.0) - 12.8 (3.2) Other income (loss) 1.1 (1.5) 2.6 2.2 1.4 (2.0) (4.9) (5.5) Total other (loss) income (1.9) (11.4) (106.1) (119.4) 11.6 3.3 145.4 160.3 Management fees & other operating expenses 35.6 3.1 - 38.7 35.8 2.0 - 37.8 Net income (loss) before income taxes 78.3 (14.5) (106.3) (42.5) 72.8 1.3 145.4 219.5 Income tax (benefit) expense (1.1) (11.4) 4.8 (7.7) 0.7 (13.8) 21.9 8.8 Net income (loss) $79.4 ($3.1) ($111.1) ($34.8) $72.1 $15.1 $123.5 $210.7 Weighted average EPS $0.22 ($0.01) ($0.30) ($0.09) $0.20 $0.04 $0.34 $0.59 18(1) Core Earnings is a non-GAAP measure. Please see Appendix slide 19 of this presentation for a definition of Core Earnings and a reconciliation of GAAP to non-GAAP financial information.

GAAP to Core Earnings Reconciliation(1) Reconciliation of GAAP to non-GAAP Information (In thousands, except for per share data) Three Months Ended September 30, 2015 Three Months Ended December 31, 2015 Reconciliation of net (loss) income to Core Earnings: Net (loss) income ($34,790) $210,706 Adjustments for non-core earnings: Gain on sale of securities and residential mortgage loans, net of tax (62,372) (100,548) Unrealized (gain) loss on securities and residential mortgage loans held-for-sale, net of tax (4,444) 14,668 Other-than-temporary impairment loss 238 - Unrealized loss (gain) on interest rate swaps and swaptions economically hedging investment portfolio, repurchase agreements and FHLB advances, net of tax 89,062 (134,182) Realized loss on termination or expiration of swaps and swaptions, net of tax 48,972 77,672 Loss on other derivative instruments, net of tax 2,656 6,880 Realized and unrealized (gain) loss on financing securitizations, net of tax (1,108) 6,997 Realized and unrealized loss (gain) on mortgage servicing rights, net of tax 39,209 (11,342) Securitization deal costs, net of tax 1,740 780 Change in representation and warranty reserve, net of tax 253 502 Core Earnings $79,416 $72,133 Weighted average shares outstanding 367,365,973 360,090,432 Core Earnings per weighted average share outstanding $0.22 $0.20 19 (1) Core Earnings is a non-GAAP measure that we define as GAAP net income, excluding impairment losses, realized and unrealized gains or losses on the aggregate portfolio, amortization of business combination intangible assets, reserve expense for representation and warranty obligations on MSR and certain upfront costs related to securitization transactions. As defined, Core Earnings includes interest income or expense and premium income or loss on derivative instruments and servicing income, net of estimated amortization on MSR. Core Earnings is provided for purposes of comparability to other peer issuers.

Rates: Agency RMBS Metrics 20 AGENCY RMBS CPR(1) AGENCY PORTFOLIO YIELDS AND METRICS (1) Agency weighted average 3-month Constant Prepayment Rate (CPR) includes IIOs (or Agency Derivatives). (2) Weighted average cost basis includes RMBS principal and interest securities only. Average purchase price utilized carrying value for weighting purposes. (3) Securities collateralized by loans of less than or equal to $175K, but more than $85K. (4) Securities collateralized by loans of less than or equal to $85K. (5) Securities collateralized by loans with greater than or equal to 80% loan-to-value ratio (LTV). High LTV pools are predominately Making Homeownership Affordable (MHA) pools, consisting of borrowers who have refinanced through HARP. (6) Securities collateralized by loans held by lower credit borrowers as defined by Fair Isaac Corporation (FICO). Portfolio Yield Realized Q3-2015 At Sept. 30, 2015 Realized Q4-2015 At Dec. 31, 2015 Agency yield 3.3% 3.2% 3.5% 3.4% Repo and FHLB costs 0.5% 0.5% 0.5% 0.6% Swap costs 0.9% 0.8% 0.8% 0.7% Net interest spread 1.9% 1.9% 2.2% 2.1% Portfolio Metrics Q3-2015 Q4-2015 Weighted average 3-month CPR(1) 9.7% 10.3% Weighted average cost basis(2) $108.0 $108.1 Agency: Vintage & Prepayment Protection Q3-2015 Q4-2015 Other Low Loan Balance Pools(3) 38% 34% $85K Max Pools(4) 17% 23% 2006 & subsequent vintages – Premium and IOs 10% 12% High LTV (predominately MHA)(5) 5% 7% HECM 14% 6% Seasoned (2005 and prior vintages) 4% 6% 2006 & subsequent vintages – Discount 4% 6% Low FICO(6) 4% 5% Prepay protected 4% 1% AGENCY PORTFOLIO COMPOSITION 7.5% 8.2% 9.0% 9.7% 10.3% 0.0% 5.0% 10.0% 15.0% Q4-2014 Q1-2015 Q2-2015 Q3-2015 Q4-2015 Agency RMBS CPR

Rates: Agency RMBS 21 As of Dec. 31, 2015 Par Value ($M) Market Value ($M) % of Agency Portfolio Amortized Cost Basis ($M) Weighted Average Coupon Weighted Average Age (Months) 30-Year fixed 4.0-4.5% $3,979 $4,290 70.0% $4,285 4.2% 30 ≥ 5.0% 562 633 10.3% 607 5.5% 84 4,541 4,923 80.3% 4,892 4.4% 37 15-Year fixed 4.0-4.5% 1 2 0.1% 2 4.0% 66 ≥ 5.0% 1 1 0.0% 1 6.6% 118 2 3 0.1% 3 4.5% 76 HECM 366 386 6.3% 384 4.5% 43 Hybrid ARMs 102 108 1.7% 106 3.6% 142 Other-fixed 328 325 5.3% 313 4.6% 116 IOs and IIOs 3,850 386(1) 6.3% 372 3.7% 74 Total $9,189 $6,131 100.0% $6,070 4.3% 46 (1) Represents the market value of $227.9 million of IOs and $157.9 million of Agency Derivatives.

Rates: Mortgage Servicing Rights 22 As of Mar. 31, 2015 As of June 30, 2015 As of Sept. 30, 2015 As of Dec. 31, 2015 Fair value ($M) $410.2 $437.6 $447.3 $493.7 Unpaid principal balance ($M) $43,974.9 $42,811.3 $48,117.3 $51,386.1 Weighted average coupon 3.9% 3.9% 3.9% 3.9% Original FICO score 748 749 751 751 Original LTV 74% 74% 74% 73% 60+ day delinquencies 1.3% 1.4% 1.1% 1.1% Net servicing spread 28.2 basis points 28.2 basis points 27.8 basis points 27.4 basis points Vintage: Pre-2009 3.4% 3.4% 2.9% 2.6% 2009-2012 60.4% 59.1% 52.8% 47.3% Post 2012 36.2% 37.5% 44.3% 50.1% Percent of MSR portfolio: Conventional 73.6% 74.4% 78.3% 80.5% Government FHA 19.7% 19.1% 16.2% 14.5% Government VA/USDA 6.7% 6.5% 5.5% 5.0%

Credit: Non-Agency RMBS Metrics 23 NON-AGENCY PORTFOLIO COMPOSITIONNON-AGENCY PORTFOLIO YIELDS AND METRICS (1) Weighted average cost basis includes RMBS principal and interest securities only. Average purchase price utilized carrying value for weighting purposes. If current face were utilized for weighting purposes, total non-Agency RMBS excluding the company’s non-Agency interest-only portfolio would have been $55.80 at December 31, 2015. Portfolio Yield Realized Q3-2015 At Sept. 30, 2015 Realized Q4-2015 At Dec. 31, 2015 Non-Agency yield 7.8% 7.5% 7.8% 8.1% Repo and FHLB costs 1.9% 1.9% 2.0% 2.1% Swap costs 0.0% 0.0% 0.1% 0.1% Net interest spread 5.9% 5.6% 5.7% 5.9% NON-AGENCY RMBS CPR Non-Agency: Loan Type Q3-2015 Q4-2015 Sub-prime 63% 68% Option-ARM 7% 8% Prime 13% 6% Alt-A 3% 4% Other 14% 14% Portfolio Metrics Q3-2015 Q4-2015 Weighted average 3-month CPR 6.9% 6.2% Weighted average cost basis(1) $63.7 $60.4 4.2% 5.1% 6.0% 6.9% 6.2% 0.0% 5.0% 10.0% Q4-2014 Q1-2015 Q2-2015 Q3-2015 Q4-2015 Non-Agency RMBS CPR

Credit: Non-Agency RMBS 24 As of December 31, 2015 Senior Bonds Mezzanine Bonds Total P&I Portfolio characteristics: Carrying value ($M) $1,313.7 $532.6 $1,846.3 % of non-agency portfolio 71.2% 28.8% 100% Average purchase price(1) $52.88 $79.01 $60.42 Average coupon 2.8% 3.0% 2.9% Weighted average market price(2) $72.93 $85.31 $76.12 Collateral attributes: Average loan age (months) 112 85 105 Average loan size ($K) $361 $300 $346 Average original Loan-to-Value 71.3% 73.0% 71.8% Average original FICO(3) 634 695 649 Current performance: 60+ day delinquencies 28.1% 12.2% 24.0% Average credit enhancement(4) 9.1% 12.9% 10.1% 3-Month CPR(5) 4.4% 10.7% 6.2% (1) Average purchase price utilized carrying value for weighting purposes. If current face were utilized for weighting purposes, the average purchase price for senior, mezzanine and total non-Agency RMBS, excluding our non-Agency interest-only portfolio, would have been $48.92, $75.63 and $55.80, respectively. (2) Weighted average market price utilized current face for weighting purposes. (3) FICO represents a mortgage industry accepted credit score of a borrower. (4) Average credit enhancement remaining on our non-Agency RMBS portfolio, which is the average amount of protection available to absorb future credit losses due to defaults on the underlying collateral. (5) 3-Month CPR is reflective of the prepayment speed on the underlying securitization; however, it does not necessarily indicate the proceeds received on our investment tranche. Proceeds received for each security are dependent on the position of the individual security within the structure of each deal.