Form 8-K PILGRIMS PRIDE CORP For: Oct 28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K |

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): October 28, 2015

PILGRIM'S PRIDE CORPORATION

(Exact Name of registrant as specified in its charter)

Delaware | 1-9273 | 75-1285071 | |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) | |

1770 Promontory Circle Greeley, CO | 80634-9038 | ||

(Address of principal executive offices) | (Zip Code) | ||

Registrant's telephone number, including area code: (970) 506-8000

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 7.01. Regulation FD Disclosure

Attached hereto as Exhibit 99.1 is an overview of Pilgrim's Pride Corporation to be referenced during the Company's earnings conference call of October 29, 2015.

The information furnished in Item 7.01 and in Exhibit 99.1 shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or incorporated by reference in any of Pilgrim's Pride Corporation's filings under the Securities Act of 1933, as amended, or the Exchange Act.

Item 9.01 Financial Statements and Exhibits.

Exhibit 99.1 Press release dated October 28, 2015

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

PILGRIM’S PRIDE CORPORATION | |||

Date: | October 28, 2015 | /s/ Fabio Sandri | |

Fabio Sandri | |||

Chief Financial Officer | |||

Exhibit Index

Exhibit 99.1 Press release dated October 28, 2015

Pilgrim’s Pride Corporation Financial Results for Third Quarter Ended Sep 27, 2015

Statements contained in this presentation that share our intentions, beliefs, expectations or predictions for the future, denoted by the words “anticipate,” “believe,” “estimate,” “should,” “expect,” “project,” “plan,” “imply,” “intend,” “foresee” and similar expressions, are forward-looking statements that reflect our current views about future events and are subject to risks, uncertainties and assumptions. Such risks, uncertainties and assumptions include the following matters affecting the chicken industry generally, including fluctuations in the commodity prices of feed ingredients and chicken; actions and decisions of our creditors; our ability to obtain and maintain commercially reasonable terms with vendors and service providers; our ability to maintain contracts that are critical to our operations; our ability to retain management and other key individuals; certain of our reorganization and exit or disposal activities, including selling assets, idling facilities, reducing production and reducing workforce, resulted in reduced capacities and sales volumes and may have a disproportionate impact on our income relative to the cost savings; risk that the amounts of cash from operations together with amounts available under our exit credit facility will not be sufficient to fund our operations; management of our cash resources, particularly in light of our substantial leverage; restrictions imposed by, and as a result of, our substantial leverage; additional outbreaks of avian influenza or other diseases, either in our own flocks or elsewhere, affecting our ability to conduct our operations and/or demand for our poultry products; contamination of our products, which has previously and can in the future lead to product liability claims and product recalls; exposure to risks related to product liability, product recalls, property damage and injuries to persons, for which insurance coverage is expensive, limited and potentially inadequate; changes in laws or regulations affecting our operations or the application thereof; new immigration legislation or increased enforcement efforts in connection with existing immigration legislation that cause our costs of business to increase, cause us to change the way in which we do business or otherwise disrupt our operations; competitive factors and pricing pressures or the loss of one or more of our largest customers; currency exchange rate fluctuations, trade barriers, exchange controls, expropriation and other risks associated with foreign operations; disruptions in international markets and distribution channels; and the impact of uncertainties of litigation as well as other risks described herein and under “Risk Factors” in the Company’s Annual Report on Form 10-K filed with the Securities and Exchange Commission (the “SEC”). Actual results could differ materially from those projected in these forward-looking statements as a result of these factors, among others, many of which are beyond our control. In making these statements, we are not undertaking, and specifically decline to undertake, any obligation to address or update each or any factor in future filings or communications regarding our business or results, and we are not undertaking to address how any of these factors may have caused changes to information contained in previous filings or communications. Although we have attempted to list comprehensively these important cautionary risk factors, we must caution investors and others that other factors may in the future prove to be important and affecting our business or results of operations. “EBITDA” is defined as net income (loss) plus interest, income taxes, depreciation and amortization. “Adjusted EBITDA” is defined as the sum of EBITDA plus restructuring charges, reorganization items and loss on early extinguishment of debt less net income attributable to noncontrolling interests. Our method of computation may or may not be comparable to other similarly titled measures used in filings with the SEC by other companies. See the consolidated statements of income and consolidated statements of cash flows included in our financial statements. EBITDA is presented because we believe it provides meaningful additional information concerning a company’s operating results and its ability to service long-term debt and to fund its growth, and we believe it is frequently used by securities analysts, investors and other interested parties, in addition to and not in lieu of results under U.S. Generally Accepted Accounting Principles (GAAP), to compare the performance of companies. We believe investors would be interested in our Adjusted EBITDA because this is how our management analyzes EBITDA. The Company also believes that Adjusted EBITDA, in combination with the Company's financial results calculated in accordance with GAAP, provides investors with additional perspective regarding the impact of certain significant items on EBITDA and facilitates a more direct comparison of its performance with its competitors. EBITDA and Adjusted EBITDA are not measurements of financial performance under GAAP and should not be considered as an alternative to cash flow from operating activities or as a measure of liquidity or an alternative to net income as indicators of our operating performance or any other measures of performance derived in accordance with GAAP. Cautionary Notes and Forward-Looking Statements 2

After expanding, Egg Sets Trending Lower than 2014 Source: USDA 3 195,432 209,093 211,630 190,499 196,489 180,000 185,000 190,000 195,000 200,000 205,000 210,000 215,000 1/ 3 1/ 17 1/ 31 2/ 14 2/ 28 3/ 14 3/ 28 4/ 11 4/ 25 5/ 9 5/ 23 6/ 6 6/ 20 7/ 4 7/ 18 8/ 1 8/ 15 8/ 29 9/ 12 9/ 26 10 /1 0 10 /2 4 11 /7 11 /2 1 12 /5 12 /1 9 Th ou sa nd Eg g United States, Selected 19 Poultry Chicken, broiler Sets '10-'14 Range '13 '14 '15 '15 Est '10-'14 Avg

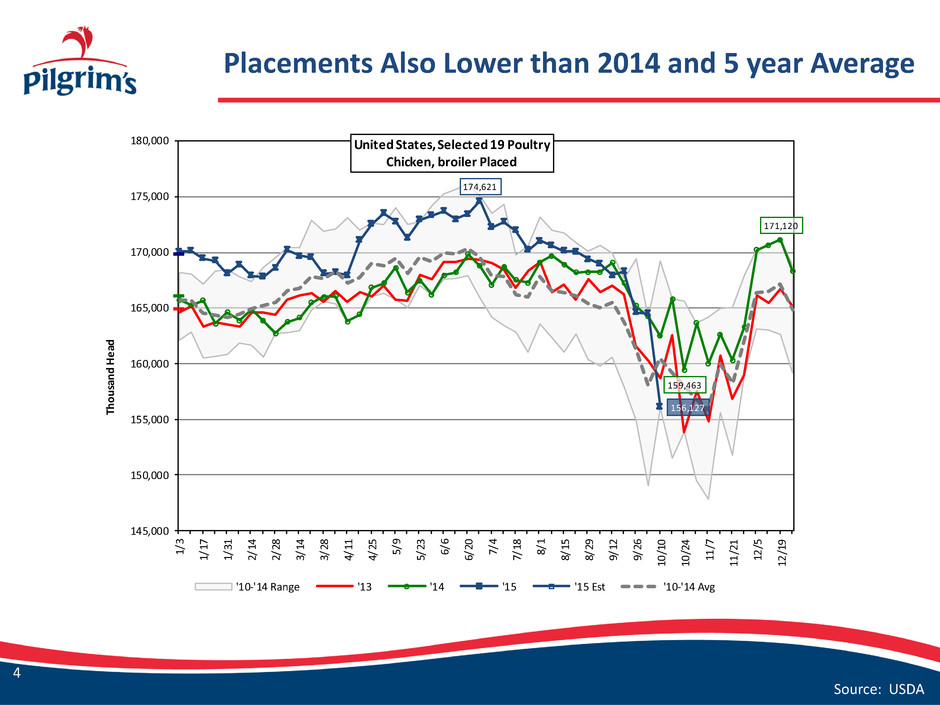

Placements Also Lower than 2014 and 5 year Average Source: USDA 4 159,463 171,120 174,621 156,127 145,000 150,000 155,000 160,000 165,000 170,000 175,000 180,000 1/ 3 1/ 17 1/ 31 2/ 14 2/ 28 3/ 14 3/ 28 4/ 11 4/ 25 5/ 9 5/ 23 6/ 6 6/ 20 7/ 4 7/ 18 8/ 1 8/ 15 8/ 29 9/ 12 9/ 26 10 /1 0 10 /2 4 11 /7 11 /2 1 12 /5 12 /1 9 Th ou sa nd H ea d United States, Selected 19 Poultry Chicken, broiler Placed '10-'14 Range '13 '14 '15 '15 Est '10-'14 Avg

Jumbo Bird Accounts for All Growth in Slaughter Source: USDA 5

Hatching layer growth remains moderate despite volatility in pullet placements. Pullet placements up 8.7% YTD. Hatching layers in Sept were up 3.9% from a year ago, up 3.5% YTD. Egg production flat. Despite Increasing Pullet Placements, Breeder Growth Still Modest Source: USDA 6

Cold Storage Higher vs 2014 Source: USDA Overall inventories higher than 2014 on bigger leg quarter and breast meat inventories due to soft exports, harder comparisons, and more big bird production. 7

Cutout Values Affected by Spot Market but Contract Still at Strong Levels Source: PPC 8 Cutout Values

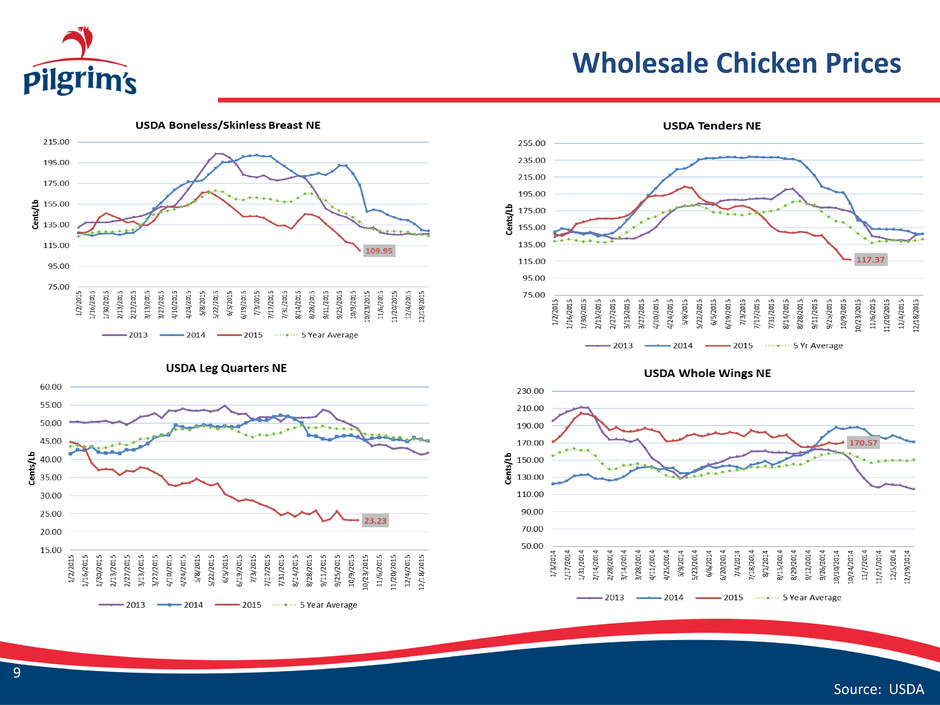

Wholesale Chicken Prices Source: USDA 9

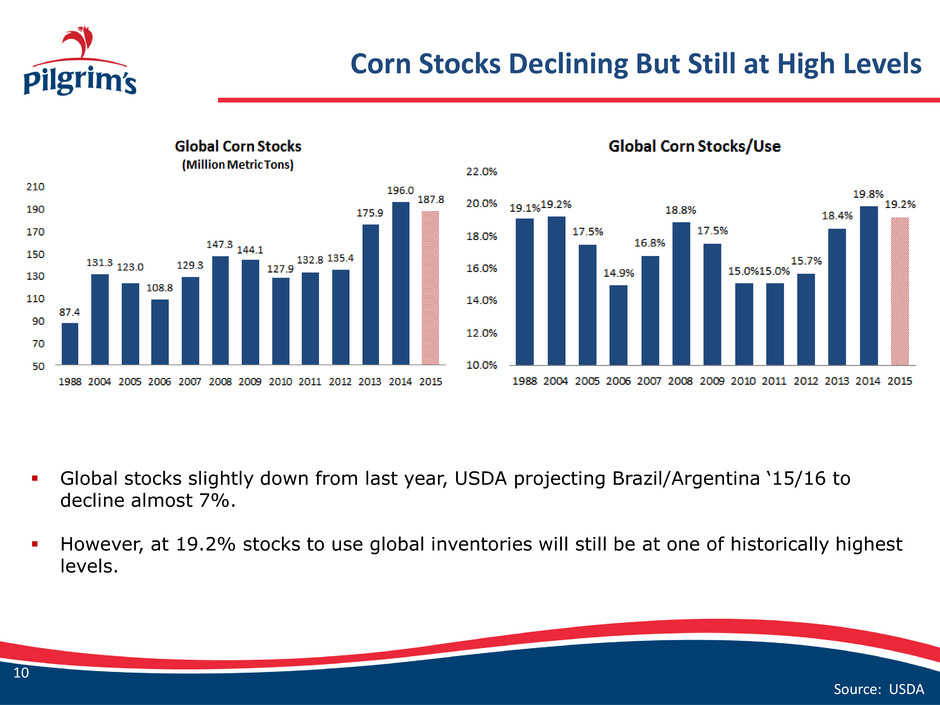

Corn Stocks Declining But Still at High Levels Global stocks slightly down from last year, USDA projecting Brazil/Argentina ‘15/16 to decline almost 7%. However, at 19.2% stocks to use global inventories will still be at one of historically highest levels. Source: USDA 10

Global Soybean Inventories Expanding A record South American crop combined with record planted acres in the U.S. pushing global inventories higher. Stocks/Use close to historically high levels. Source: USDA 11

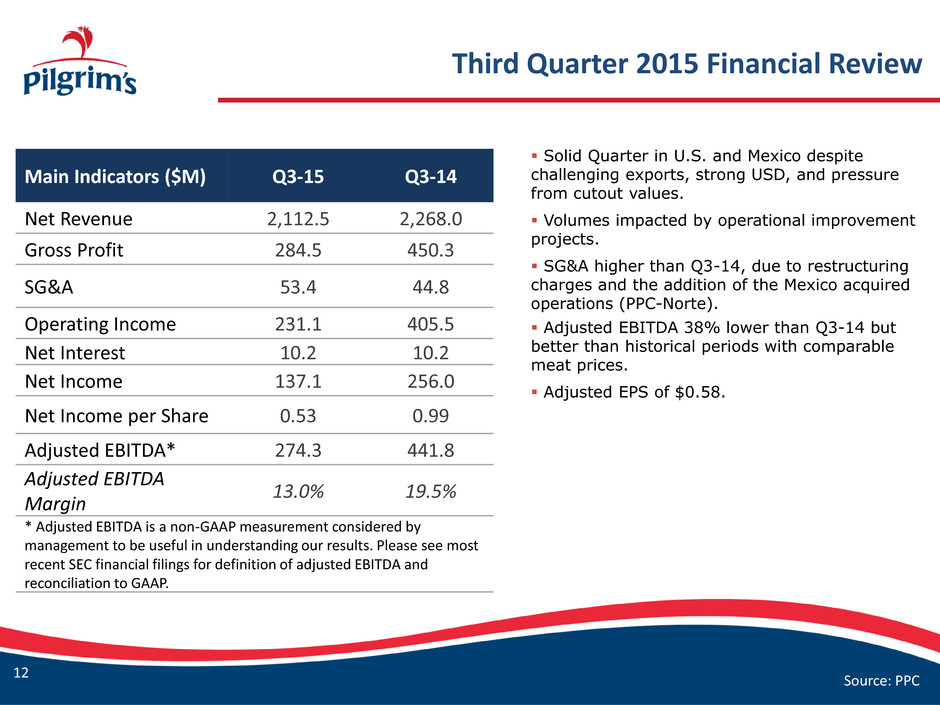

Third Quarter 2015 Financial Review Source: PPC Solid Quarter in U.S. and Mexico despite challenging exports, strong USD, and pressure from cutout values. Volumes impacted by operational improvement projects. SG&A higher than Q3-14, due to restructuring charges and the addition of the Mexico acquired operations (PPC-Norte). Adjusted EBITDA 38% lower than Q3-14 but better than historical periods with comparable meat prices. Adjusted EPS of $0.58. Main Indicators ($M) Q3-15 Q3-14 Net Revenue 2,112.5 2,268.0 Gross Profit 284.5 450.3 SG&A 53.4 44.8 Operating Income 231.1 405.5 Net Interest 10.2 10.2 Net Income 137.1 256.0 Net Income per Share 0.53 0.99 Adjusted EBITDA* 274.3 441.8 Adjusted EBITDA Margin 13.0% 19.5% * Adjusted EBITDA is a non-GAAP measurement considered by management to be useful in understanding our results. Please see most recent SEC financial filings for definition of adjusted EBITDA and reconciliation to GAAP. 12

Net Debt Remains Low Source: PPC Free Cash flow generation of $196MM in the quarter. Net debt multiple remains low at 0.42x LTM EBITDA (post PPC-Norte purchase). 13 805.4 379.1 Mexico Acquisition 307.1

Third Quarter 2015 Capital Spending Capex (US$M) Source: PPC Strong free cash flow generation has enabled us to direct more capital spending towards identified projects with rapid payback and structural projects. 14

Investor Relations Contact Investor Relations: Dunham Winoto Director, Investor Relations E-mail: [email protected] Address: 1770 Promontory Circle Greeley, CO 80634 USA Website: www.pilgrims.com 15

Appendix: EBITDA Reconciliation “EBITDA” is defined as the sum of net income (loss) plus interest, taxes, depreciation and amortization. “Adjusted EBITDA” is calculated by adding to EBITDA certain items of expense and deducting from EBITDA certain items of income that we believe are not indicative of our ongoing operating performance consisting of: (i) income (loss) attributable to non-controlling interests, (ii) restructuring charges, (iii) reorganization items, (iv) losses on early extinguishment of debt and (v) foreign currency transaction losses (gains). EBITDA is presented because it is used by management and we believe it is frequently used by securities analysts, investors and other interested parties, in addition to and not in lieu of results prepared in conformity with accounting principles generally accepted in the US (“GAAP”), to compare the performance of companies. We believe investors would be interested in our Adjusted EBITDA because this is how our management analyzes EBITDA. The Company also believes that Adjusted EBITDA, in combination with the Company’s financial results calculated in accordance with GAAP, provides investors with additional perspective regarding the impact of certain significant items on EBITDA and facilitates a more direct comparison of its performance with its competitors. EBITDA and Adjusted EBITDA are not measurements of financial performance under GAAP. They should not be considered as an alternative to cash flow from operating activities or as a measure of liquidity or an alternative to net income as indicators of our operating performance or any other measures of performance derived in accordance with GAAP. Source: PPC 16 PILGRIM'S PRIDE CORPORATION Reconciliation of Adjusted EBITDA (Unaudited) Thirteen Weeks Ended Thirty-Nine Weeks Ended September 27, 2015 September 28, 2014 September 27, 2015 September 28, 2014 (In thousands) Net income $ 137,095 $ 255,803 $ 582,912 $ 544,435 Add: Interest expense, net 10,182 10,201 23,784 42,433 Income tax expense (benefit) 73,153 133,693 313,751 284,932 Depreciation and amortization 41,415 36,218 116,485 112,740 Minus: Amortization of capitalized financing costs 1,119 871 2,708 7,364 EBITDA 260,726 435,044 1,034,224 977,176 Add: F ei n curre cy t ansaction losses (gains) 12,773 6,414 23,806 4,932 Restructuring charges 792 135 5,605 2,286 Minus: Net income (loss) attributable to noncontrolling interest 33 (181 ) 146 (26 ) Adjusted EBITDA $ 274,258 $ 441,774 $ 1,063,489 $ 984,420

Appendix: Reconciliation of LTM EBITDA Source: PPC The summary unaudited consolidated income statement data for the twelve months ended September 27, 2015 (the LTM Period) have been calculated by subtracting the applicable unaudited consolidated income statement data for the nine months ended September 28, 2014 from the sum of (1) the applicable audited consolidated income statement data for the year ended December 28, 2014 and (2) the applicable audited consolidated income statement data for the nine months ended September 27, 2015. 17 PILGRIM'S PRIDE CORPORATION Reconciliation of Adjusted EBITDA (Unaudited) Thirteen Weeks Ended Thirteen Weeks Ended Thirteen Weeks Ended Thirteen Weeks Ended LTM Ended December 28, 2014 March 27, 2015 June 28, 2015 September 27, 2015 September 27, 2015 (In thousands) Net income $ 167,003 $ 204,193 $ 241,624 $ 137,095 $ 749,915 Add: Interest expense, net 34,838 3,365 10,237 10,182 58,622 Income tax expense (benefit) 106,021 111,494 129,104 73,153 419,772 Depreciation and amortization 43,084 36,152 38,918 41,415 159,569 Asset impairments — — — — — Minus: Amortization of capitalized financing costs 6,348 725 864 1,119 9,056 EBITDA 344,598 354,479 419,019 260,726 1,378,822 Add: Foreign currency transaction losses (gains) 23,047 8,974 2,059 12,773 46,853 Restructuring charges — — 4,813 792 5,605 Minus: Net income (loss) attributable to noncontrolling interest (184 ) (22 ) 135 33 (38 ) Adjusted EBITDA $ 367,829 $ 363,475 $ 425,756 $ 274,258 $ 1,431,318

Appendix: Reconciliation of Adjusted Earnings Source: PPC A reconciliation of net income (loss) attributable to Pilgrim's Pride Corporation per common diluted share to adjusted net income (loss) attributable to Pilgrim's Pride Corporation per common diluted share is as follows: 18 PILGRIM'S PRIDE CORPORATION Reconciliation of Adjusted Earnings (Unaudited) Thirteen Weeks Ended Thirty-Nine Weeks Ended September 27, 2015 September 28, 2014 September 27, 2015 September 28, 2014 (In thousands, except per share data) Net income (loss) attributable to Pilgrim's Pride Corporation $ 137,062 $ 255,984 $ 582,766 $ 544,461 Loss on early extinguishment of debt — — 68 — Foreign currency transaction losses (gains) 12,773 6,414 23,806 4,932 Income (loss) before loss on early extinguishment of debt and foreign currency transaction losses (gains) 149,835 262,398 606,640 549,393 Weighted average diluted shares of common stock outstanding 259,503 259,522 259,765 259,448 Income (loss) before loss on early extinguishment of debt and foreign currency transaction losses (gains) per common diluted share $ 0.58 $ 1.01 $ 2.34 $ 2.12

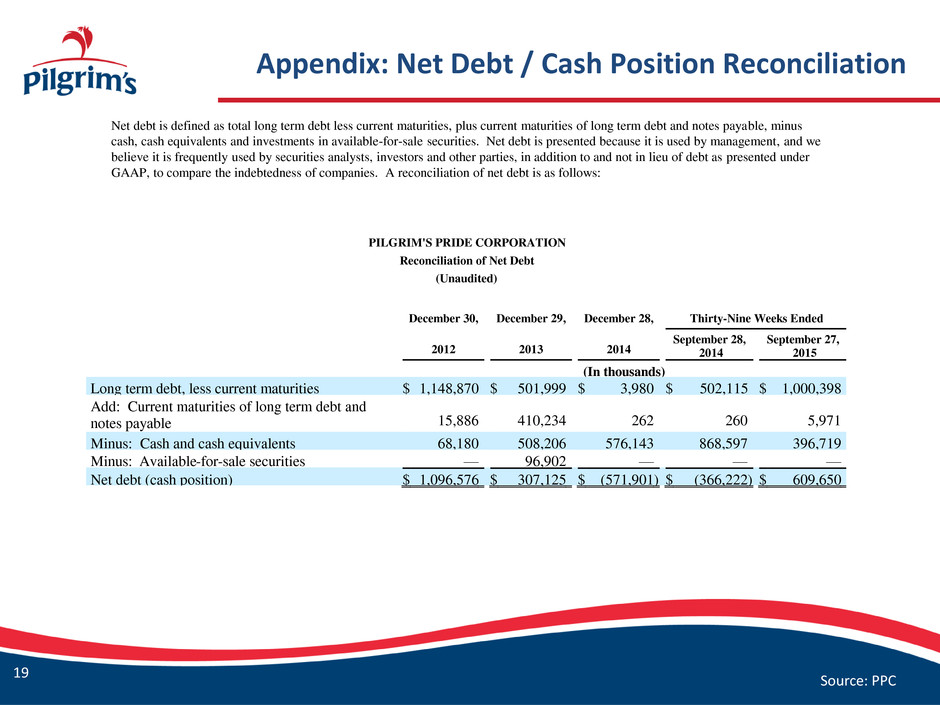

Appendix: Net Debt / Cash Position Reconciliation Source: PPC Net debt is defined as total long term debt less current maturities, plus current maturities of long term debt and notes payable, minus cash, cash equivalents and investments in available-for-sale securities. Net debt is presented because it is used by management, and we believe it is frequently used by securities analysts, investors and other parties, in addition to and not in lieu of debt as presented under GAAP, to compare the indebtedness of companies. A reconciliation of net debt is as follows: 19 PILGRIM'S PRIDE CORPORATION Reconciliation of Net Debt (Unaudited) December 30, December 29, December 28, Thirty-Nine Weeks Ended 2012 2013 2014 September 28, 2014 September 27, 2015 (In thousands) Long term debt, less current maturities $ 1,148,870 $ 501,999 $ 3,980 $ 502,115 $ 1,000,398 Add: Current maturities of long term debt and notes payable 15,886 410,234 262 260 5,971 Minus: Cash and cash equivalents 68,180 508,206 576,143 868,597 396,719 Minus: Available-for-sale securities — 96,902 — — — Net debt (cash position) $ 1,096,576 $ 307,125 $ (571,901 ) $ (366,222 ) $ 609,650

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Valstybės investicinis kapitalas UAB audited Annual information for the year 2023

- TotalEnergies BWF Thomas & Uber Cup Finals 2024 to Kick Off in Chengdu

- Robbins LLP Reminds IRobot Corporation Shareholders of the Pending May 7, 2024 Lead Plaintiff Deadline

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share