Form 8-K OLD NATIONAL BANCORP For: Feb 17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): February 17, 2015

OLD NATIONAL BANCORP

(Exact name of Registrant as specified in its charter)

| Indiana | 001-15817 | 35-1539838 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

| One Main Street Evansville, Indiana |

47708 | |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s telephone number, including area code: (812) 464-1294

(Former name or former address if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 7.01 | Regulation FD Disclosure |

The executive officers of Old National Bancorp intend to use the materials filed herewith, in whole or in part, in one or more meetings with investors and analysts. A copy of the investor presentation is attached hereto as Exhibit 99.1.

Old National Bancorp does not intend for this Item 7.01 or Exhibit 99.1 to be treated as “filed” for purposes of the Securities Exchange Act of 1934, as amended, or incorporated by reference into its filings under the Securities Act of 1933, as amended.

| Item 9.01 | Financial Statements and Exhibits |

| (d) | Exhibits. The following exhibit is furnished herewith: |

The following exhibit shall not be deemed to be “filed” for purposes of the Securities Exchange Act of 1934, as amended:

| 99.1 | Old National Bancorp Investment Thesis |

* * * * * * *

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: February 17, 2015

| OLD NATIONAL BANCORP | ||||||

| By: | /s/ Christopher A. Wolking | |||||

| Christopher A. Wolking | ||||||

| Senior Executive Vice President and | ||||||

| Chief Financial Officer | ||||||

3

Exhibit Index

| Exhibit No. |

Description | |

| 99.1 | Old National Bancorp Investment Thesis | |

4

Investment Thesis

Financial Data as of 12-31-14

Dated: February 17, 2015

Exhibit 99.1 |

Investment Thesis

Executive Summary

Slides 2 to 19

Financial Data as of 12-31-14

Dated: February 17, 2015

*

*

*

* |

3

Forward-Looking Statement

This presentation contains certain forward-looking statements within the meaning of

the Private Securities Litigation Reform Act of 1995. These statements

include, but are not limited to, descriptions of Old National Bancorp’s (“Old

National’s”) financial condition, results of operations, asset and credit

quality trends and profitability. Forward- looking statements can be

identified by the use of the words “anticipate,” “believe,” “expect,” “intend,” “could” and

“should,” and other words of similar meaning. These forward-looking

statements express management’s current expectations or forecasts of future

events and, by their nature, are subject to risks and uncertainties and there are a

number of factors that could cause actual results to differ materially from those in such

statements. Factors that might cause such a difference include, but are not

limited to: expected cost savings, synergies and other financial benefits from the

recently completed mergers might not be realized within the expected timeframes and costs or

difficulties relating to integration matters might be greater than expected; market,

economic, operational, liquidity, credit and interest rate risks associated with

Old National’s business; competition; government legislation and policies

(including the impact of the Dodd-Frank Wall Street Reform and Consumer Protection Act and its related

regulations); ability of Old National to execute its business plan; changes in the

economy which could materially impact credit quality trends and the ability to

generate loans and gather deposits; failure or circumvention of our internal

controls; failure or disruption of our information systems; significant changes in accounting, tax or regulatory

practices or requirements; new legal obligations or liabilities or unfavorable

resolutions of litigations; other matters discussed in this presentation and other

factors identified in our Annual Report on Form 10-K and other periodic

filings with the SEC. These forward-looking statements are made only as of the

date of this presentation, and Old National does not undertake an obligation to

release revisions to these forward-looking statements to reflect events or

conditions after the date of this

presentation. |

4

Non-GAAP Financial Measures

These slides contain non-GAAP financial measures. For

purposes of Regulation G, a non-GAAP financial measure is a

numerical measure of the registrant's historical or future

financial performance, financial position or cash flows that

excludes amounts, or is subject to adjustments that have the

effect of excluding amounts, that are included in the most

directly comparable measure calculated and presented in

accordance with GAAP in the statement of income, balance

sheet or statement of cash flows (or equivalent statements) of

the registrant; or includes amounts, or is subject to adjustments

that have the effect of including amounts, that are excluded

from the most directly comparable measure so calculated and

presented. In this regard, GAAP refers to generally accepted

accounting principles in the United States. Pursuant to the

requirements of Regulation G, Old National Bancorp has

provided reconciliations within the slides, as necessary, of the

non-GAAP financial measure to the most directly comparable

GAAP financial measure. |

5

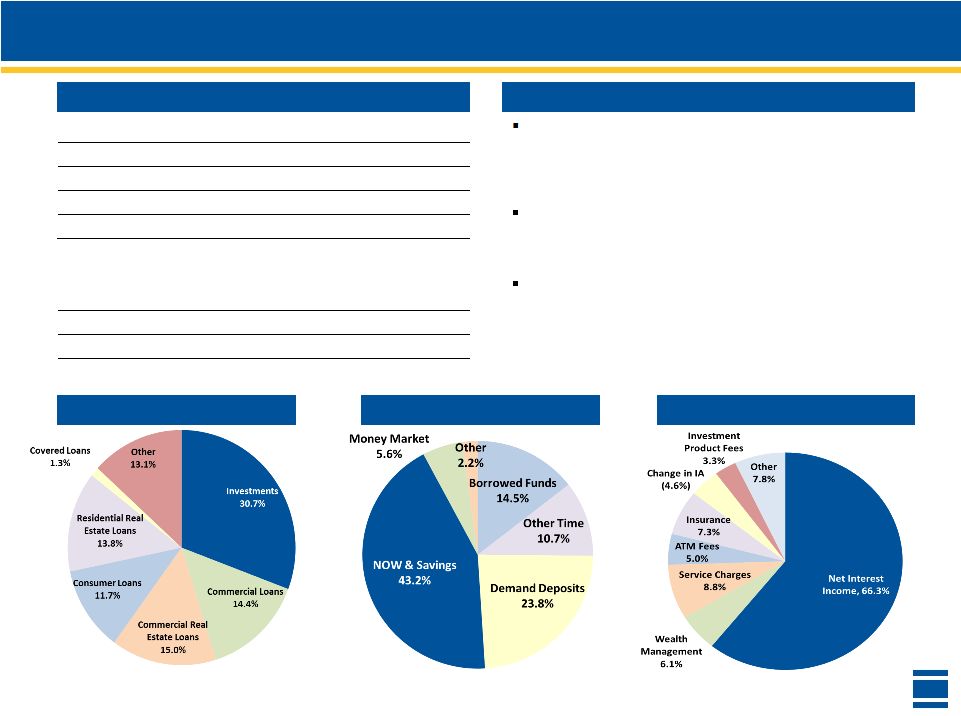

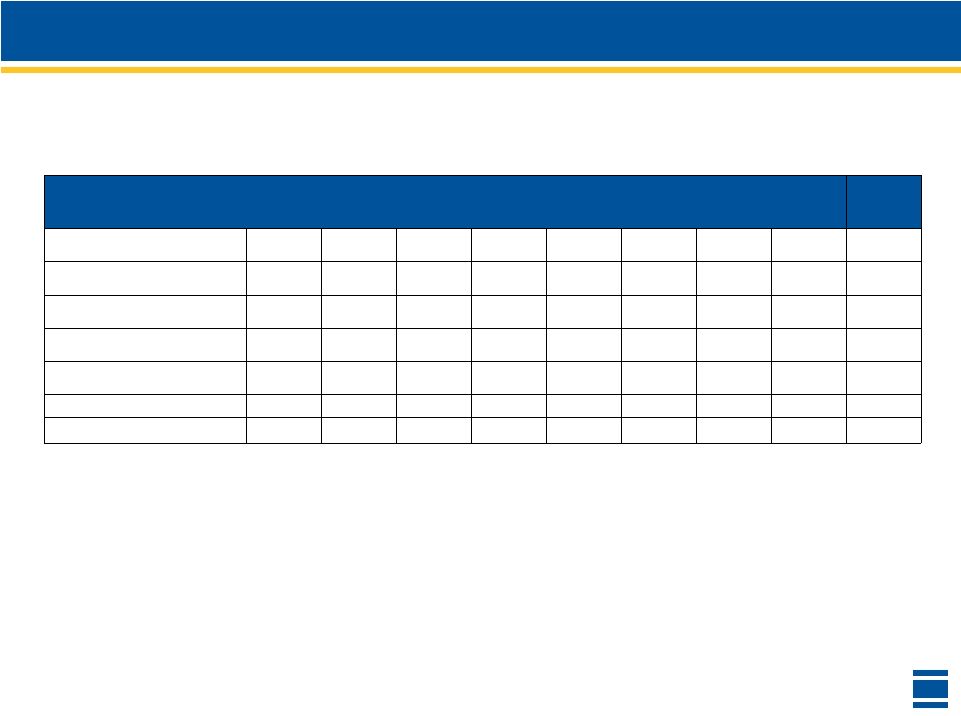

Snapshot of Old National

Source: SNL Financial, Company filings, FactSet Estimates

Note: Market data as of February 6, 2015; financial information as of December 31, 2014.

Summary Overview

Company Description

Headquarters

Evansville, IN

Market Cap (millions)

$ 1,628

2015E P / E

12.8 x

P / TBV

182%

Dividend Yield

3.4 %

LTM Average Daily Volume

677,985

Total Assets

$ 11,648

Trust Assets Under Management

$ 7,441

Total Deposits

$ 8,491

4Q14 ROAA

1.03 %

$ in millions, except noted

–

195 financial centers

–

211 ATMs

Focused on community banking with a full suite of product offerings:

–

Retail and small business

–

Wealth management

–

Leasing

Guided by three strategic imperatives

–

Strengthen the risk profile

–

Enhance management discipline

–

Achieve consistent quality earnings

–

Investment services

–

Capital markets

–

Insurance

Asset Mix

Liability Breakdown

4Q14 Revenue Breakdown

Largest financial services bank holding company headquartered in Indiana with

a presence throughout Indiana, Western Kentucky and Louisville, Southern

Illinois and Central and Western Michigan

|

6

Attractive footprint that offers both leading share in mature markets

and room to expand in higher growth markets

Consistent financial performance with distinct revenue streams and

improving efficiency

Diverse loan portfolio with growth accelerating while maintaining

strong credit metrics

Disciplined acquisitions that are exceeding expectations with robust

future opportunities

Steward of capital –

organic growth, dividend / share repurchases,

and acquisitions

Achieving strategic imperatives

Investment Thesis |

7

Commitment to Excellence |

8

Our Indiana Footprint

Economic Vital Signs

Indicator

Outlook

Latest Statistics (December 2014)

Trend (YoY change from Dec. 2013)

Jobs

Employment

Unemployed

3,267,300

189,500

•

Labor Force increased 83,100

•

Unemployment rate decreased to 5.6%

(December 2013 rate was 6.7%)

Unemployment

Insurance Claims

Initial Claims

Weeks Claimed

27,922

144,182

•

Initial claims decreased 23.2%

•

Weeks claimed decreased 36.8%

Home Sales

Units Sold

Median Home Price

5,994

$125,000

•

The number of home sales increased 8.5%

•

The median sale price increased 5.2%

Regional Spending

Net Sales Tax Collected

$617.1 MM

•

Sales tax collections increased 5.4%

Local Indiana HQ

Stock Performance

Price Change during 4Q14

CMI: 10.0%

LLY: 6.0%

NI: 3.8%

SPG: 10.4%

STLD: (10.6)%

ANTM: 6.4%

ZMH: 12.6%

•

Stock prices have generally increased as

overall economy improves

Sources: US Bureau of Labor Statistics, US Dept. of Labor, Indiana Association of Realtors, IN Dept.

of Revenue and Bloomberg Strong

Stable or Mixed Decline

|

9

4.6%

2.6%

2.2%

5.7%

0.0%

4.7%

USA

Indiana

Michigan

Ann Arbor

Kalamazoo

Grand Rapids

Our Michigan Footprint

Projected 2019 Median Household Income

Ann Arbor, Michigan (MSA Population: 354,530)

Kalamazoo, Michigan (MSA Population: 332,269)

Projected 2014-2019 Median HHI Growth

Grand Rapids, Michigan (MSA Population: 1,017,542)

$53,941

$48,365

$47,494

$62,065

$43,734

$53,389

USA

Indiana

Michigan

Ann Arbor

Kalamazoo

Grand Rapids

(1)

Crain’s Detroit Business, article published July 16, 2014

Michigan named "most improved" in ranking of pro-business states in 2014 by

the American Economic Institute

(improved

from

39th

to

18th)

1

Highest

median

household

income

MSA

in

Michigan

December

2014

unemployment

rate

of

3.2%,

compared

to

the

national

rate

of

5.6%

Listed

in

Forbes’

2013

“Best

Places

for

Business

and

Careers”

and

was

Livability.com’s

13th

“Best

Place

to

Live”

Popular area for healthcare and pharmaceutical

organizations, with major companies such as Pfizer, Perrigo

and Stryker housing large operations

December 2014 unemployment rate of 4.5% compared to the

national rate of 5.6%

Home to five of the world’s leading office furniture

companies.

December 2014 unemployment rate of 3.6%, compared to the

national rate of 5.6%

Source: SNL Financial and Bureau of Labor Statistics as of October 2014 |

10

Indiana’s Economic Achievements

“AAA”

Credit Rating –

Fitch, Moody’s and Standard and

Poor’s

1

3

rd

Best

U.S.

State

for

Manufacturing

Jobs

2

6

th

Best

State

for

Business

–

CEO

Magazine

3

280 new manufacturing jobs created –

Berry Plastics,

Evansville,

Indiana

4

230

new

jobs

created

–

GE

Aviation,

Lafayette,

Indiana

5

Sources:

(1)

December 2013

(2)

June 2013; National Association of Manufacturers

(3)

May 2014

(4)

January 2014 press release of Berry Plastics

(5)

January 2015 press release of GE Aviation |

11

Executing the Plan –

4Q14 Highlights

•

Execution of our M&A strategy of adding higher-growth markets

Continue to

Grow Core

Revenue

•

Organic

loan

growth

of

$51.9

million

1

,

or

3.4%

annualized,

over

3Q14

and

organic

growth

of

$339.6

million

1

,

or

7.0%,

over

4Q13

•

Revenue

growth

2

of

11.9%

from

4Q13

•

Organic growth in Banking, Wealth Management and Insurance

•

Core net interest margin decreased 17 bps from 3Q14

Reduce

Operating

Expenses

Transform

the

Franchise

Into Higher-

Growth

Markets

•

Operational

expenses

3

increased

$.4

million

from

3Q14

•

Expected Tower cost savings of 35%+ on track as announced

•

Expected United Bancorp, Inc. cost savings of 32% on track as announced

1

Excluding change in FDIC covered loans and loans acquired in the

Tower, United and Lafayette acquisitions

2

Excluding changes in securities gains, accretion income and amortization of the

indemnification asset 3

Refer to slide 41 for a definition of operational expenses

Ann Arbor, MI –

United Bancorp acquisition closed and fully converted

Lafayette,

IN

–

LSB

Financial

Corp.

acquisition

closed

–

anticipate

1Q15

conversion

Grand

Rapids,

MI

–Founders

Financial

Corporation

acquisition

closed

–

anticipate

2Q15

conversion |

12

4Q14 Financials

Net income of $29.3 million or $.25 per share

–

19.1% increase over the $24.5 million in net

income in 4Q13

Included in 4Q14 are the following pre-tax

items

–

$3.1 million in merger and integration charges

–

$6.2 million amortization of the indemnification

asset

–

$16.6

million

in

accretion

income

1

1

Income in excess of contractual interest |

13

2014 Financials

Net income of $103.7 million or $.95 per share

–

2.7% increase over the $100.9 million in net

income in 2013

Included in 2014 are the following pre-tax

items

–

$15.6 million in merger and integration charges

–

$43.2 million amortization of the indemnification

asset

–

$86.5

million

in

accretion

income

1

1

Income in excess of contractual interest |

14

3.30%

3.32%

3.15%

4Q13

3Q14

4Q14

0.19%

0.03%

0.08%

4Q13

3Q14

4Q14

$43.2

$86.9

$51.9

4Q13

3Q14

4Q14

$28.6

$33.1

$36.5

4Q13

3Q14

4Q14

$85.1

$90.7

$91.1

4Q13

3Q14

4Q14

$111.9

$124.9

$125.2

4Q13

3Q14

4Q14

Basic Banking

Adjusted

Income

3

Operational

Expenses

2

Organic

Loan

Growth

4

Core

NIM

5

Consolidated NCOs

$ in millions

1

Refer to slide 39

2

Refer to slide 41

End of period balances

3

See appendix for non-GAAP reconciliation

4

Refer to slide 22

5

Refer to slide 32

Revenue

1 |

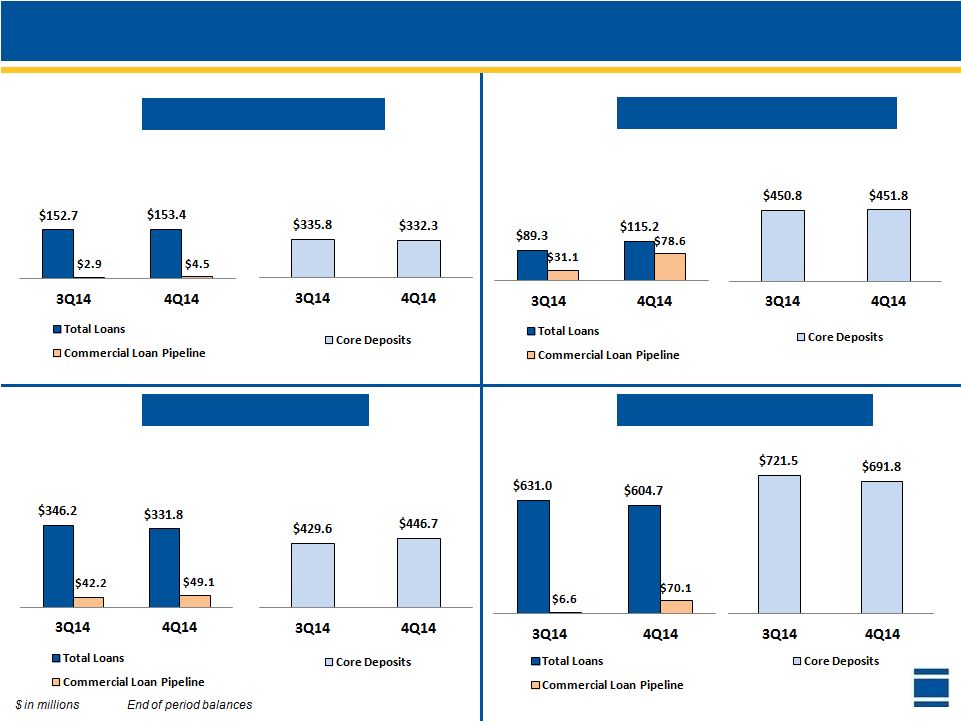

Update on New Markets

Ft Wayne, IN

Ann Arbor, MI

Columbus, IN

MI / Northern IN

(Indiana Community —

Closed 9/15/12)

(BofA Branches —

Closed 7/12/13)

(Tower —

Closed 4/25/14)

(United —

Closed 7/31/14)

15 |

16

Fee-Based Business Revenue

$ in millions

ONB Less Tower & United

Tower

United |

17

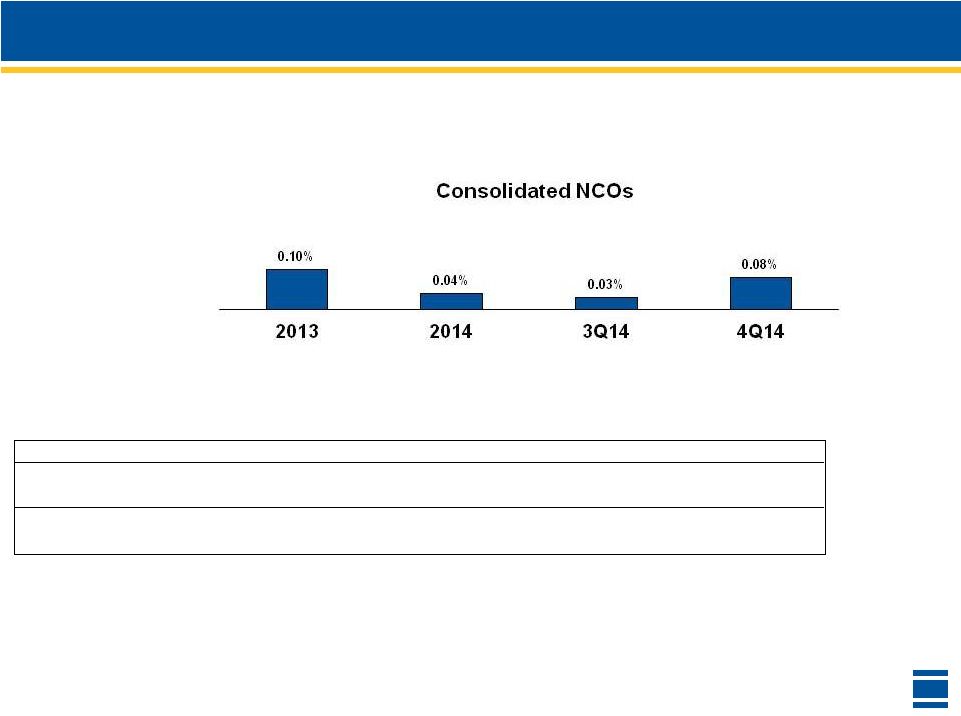

Net Charge-Offs / Provision

$ in millions

1

Excludes FDIC-covered loans

2013

2014

3Q14

4Q14

($3.9)

$4.4

$3.0

$0.7

($2.3)

$3.1

$2.6

$0.9

1

Provision for Loan Losses

Consolidated Provision for

Loan Losses |

18

$ in millions

Credit Quality –

Excluding Covered Loans

$135.4

$170.5

$194.8

$121.8

$116.5

4Q13

3Q14

4Q14

Special Mention Loans

$63.2

$100.6

$107.8

$87.2

$93.8

4Q13

3Q14

4Q14

Substandard Accruing Loans

$96.6

$125.4

$125.7

$81.1

$73.9

4Q13

3Q14

4Q14

Substandard Nonaccruing + Doubtful

Loans

Excludes loans acquired through Tower, United and Lafayette transactions

|

19

2015 Initiatives –

Execution is KEY

Grow organic revenue

–

Redesigned checking product lineup

New checking account product has reduced attrition over 50%

–

Leverage fee income businesses

Enhanced referral program

Sales summit

Leverage new markets

Improve operating leverage

Close/consolidate 19 banking centers

Sale of Southern Illinois market (12 locations)

Sale of 5 banking centers (4 in Eastern Indiana + 1 in Ohio)

Early retirement program

–

Gains on sales should offset costs associated with these actions

–

New

efficiency

ratio

target

is

63.0%

in

4Q15

–

in

2015,

25%

of

short-term

incentives

Prudent use of capital

–

Recently announced 9% increase in cash dividend

–

Share buyback program

–

Pause means pause

Anticipated timing of branch actions: 6 consolidations mid-March, 13

consolidations mid-May, sales should be completed by mid 3Q15 Approx. $620

million in deposits and $200 million in loans combined

Recently announced actions should provide annualized noninterest expense savings of $23

million to $27 million

|

Investment Thesis

Financial Data as of 12-31-14

Dated: February 17, 2015

*

*

*

*

* |

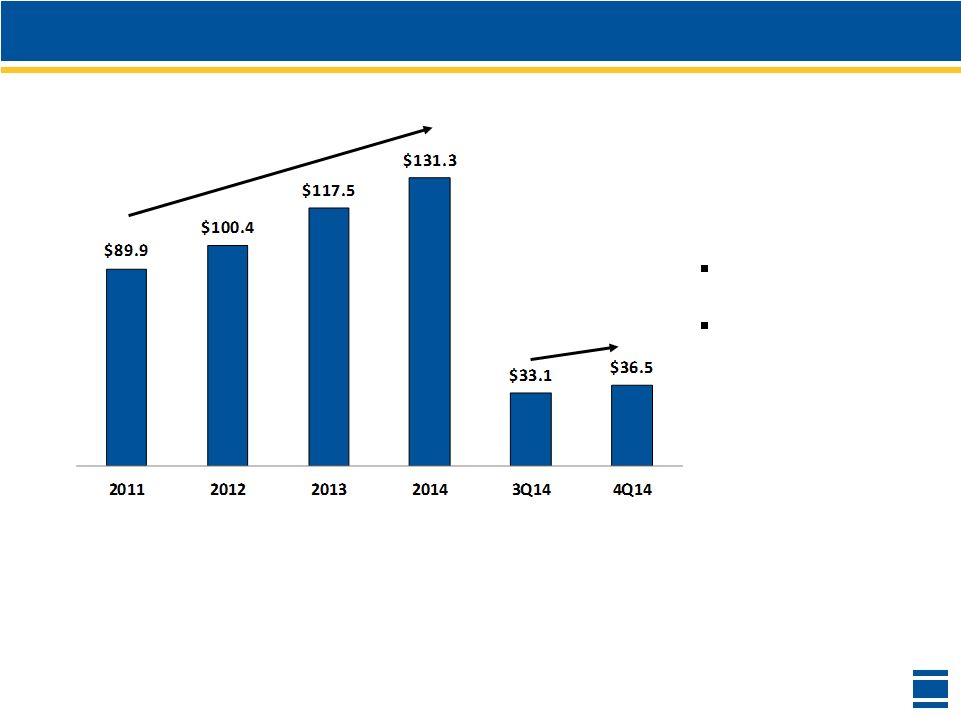

21

Adjusted

Income

1

–

Strong

Growth

$ in millions

Adjusted income represents income before taxes less accretion income, change in

indemnification assets, merger/integration expenses and costs associated with

branch divestitures CAGR of 13.5%

from 2011 to 2014

Growth of 10.3%

3Q14 vs 4Q14

13.5%

10.3%

1

Non-GAAP financial measure which Management believes is useful in evaluating the financial results

of the Company – see Appendix for Non-GAAP reconciliation |

22

$6,097.0

$6,384.0

$235.1

$51.9

3Q14

Loans Obtained

Through LSB Acquisition

Organic Growth

4Q14

Loan Growth –

Excluding Covered Loans

$ in millions

1

Loan production net of principal pay-downs, prepayments and loan sales to the

secondary market $4,872.8

$6,384.0

$1,171.6

$339.6

4Q13

Loans Obtained

Through Tower, United

& LSB Acquisitions

Organic Growth

4Q14

End of Period Balance

1

1 |

23

Loan Production Trends

$ in millions

Commercial

Residential Mortgage

Consumer Direct

Consumer Indirect

Full-year total production increased 10.7% over 2013

|

24

Commercial Loans

$ in millions

1% of line utilization = $13.5

million in outstandings

37.7%

2007-2008 Average = 39.9%

39.1%

Commercial Line Utilization

Commercial Loan Pipeline |

25

Loan Concentrations –

Excluding Covered Loans

At 12-31-14

Commercial

Commercial Real Estate

Diversified Commercial Loan Portfolio |

26

Credit Quality –

Excluding Covered Loans

See Appendix for definition of Peer Group

1

As a % of end of period total loans

Peer Group data per SNL Financial

1.07%

0.81%

4Q13

3Q14

4Q14

30+

Day

Delinquent Loans

ONB

Peer Group Average

0.00%

0.01%

0.01%

0.40%

4Q13

3Q14

4Q14

90+

Day

Delinquent Loans

ONB

Peer Group Average

0.42%

0.43%

0.45%

0.29%

1

1 |

27

Credit Quality –

ALLL and Mark Summary

$ in millions

1

Non-GAAP financial measure which Management believes useful to demonstrate that

the remaining discount considers credit risk and should be included as part

of total coverage N/A = not

applicable At December 31, 2014

ONB Legacy

Monroe

Integra

Indiana

Community

Tower

United

Lafayette

Total

Allowance for Loan Losses (ALLL)

$42.8

$1.3

$3.6

-

-

$0.1

-

$47.8

Loan Mark

N/A

$7.4

$37.2

$24.4

$21.1

$35.7

$22.6

$148.5

Total ALLL/Mark

$42.8

$8.8

$40.8

$24.4

$21.1

$35.8

$22.6

$196.3

Pre-Mark Loan Balance

$4,859.9

$115.5

$193.3

$177.4

$310.1

$553.7

$256.8

$6,466.7

ALLL/Pre-Mark Loan Balance

0.88%

1.15%

1.87%

0.00%

0.00%

0.03%

0.00%

0.74%

Mark/Pre-Mark Loan Balance

N/A

6.44%

19.26%

13.77%

6.81%

6.44%

8.82%

2.30%

0.88%

7.59%

21.13%

13.77%

6.81%

6.46%

8.82%

3.04%

Combined ALLL & Mark/Pre-Mark

Loan Balance

1 |

28

Conservative Lending Limits/Risk Grades

Borrower

1

Asset

Quality

Rating

(Risk Grades)

In-House

Lending

Limit

1

($ in millions)

0 –

Investment Grade

$30

1 –

Minimal Risk

$25

2 –

Modest Risk

$25

3 –

Average Risk

$22.5

4 –

Monitor

$15

5 –

Weak Monitor

$10

6 –

Watch

$7.5

7 –

Criticized (Special Mention)

$5

In-house lending limits conservative relative to ONB’s legal lending limit

at 12-31-14 of $142.4 million per borrower

1

Includes entire relationship with borrower

Borrower

1

Asset

Quality

Rating

(Risk Grades)

8 –

Classified (Problem)

9 –

Nonaccrual |

29

Indemnification Asset Balance

At December 31, 2014, $9.7 million of the remaining IA balance is expected to

be

amortized

and

reported

in

noninterest

income

over

the

next

21

months

$ in millions |

30

Investment Portfolio Purchases 4Q14

1

1

Data as of December 31, 2014

Q4 2014 Purchases-

Book Value

Treasuries

8,043,738

Agencies

101,523,641

Pools

52,122,658

CMOs

6,704,359

Municipals

56,123,782

Corporates

26,817,592

ABS

28,311,522

Equity

0

Total

279,647,292

0.00%

1.00%

2.00%

3.00%

4.00%

5.00%

Total

ABS

Corporates

Municipals

CMOs

Pools

Agencies

Treasuries

2.29%

1.49%

2.32%

4.79%

1.69%

2.45%

1.61%

0.35%

T/E Book Yield of Purchases

0.00

2.00

4.00

6.00

8.00

10.00

12.00

Total

ABS

Corporates

Municipals

CMOs

Pools

Agencies

Treasuries

3.78

0.35

4.57

9.23

2.41

3.94

2.60

1.10

Duration of Purchases |

31

CD Maturity Schedule

Represents CD maturities at December 31, 2014

Bucket

Amount

($ in 000's)

Rate

0-30 days

69,665

0.59%

31-60 days

57,873

0.70%

61-90 days

69,507

0.55%

91-120 days

58,398

0.92%

121-150 days

36,586

0.47%

151-180 days

53,533

0.43%

181-210 days

46,855

0.62%

211-240 days

40,688

0.49%

241-270 days

45,310

0.89%

271-300 days

45,988

1.74%

301-330 days

32,864

0.94%

331-365 days

43,976

0.91%

1-2 years

257,087

2.02%

2-3 years

98,146

0.81%

3-4 years

59,874

1.19%

4-5 years

46,822

1.51%

Over 5 years

25,846

1.59% |

32

Net

Interest

Margin

1

1

Fully

taxable

equivalent

basis,

non-GAAP

financial

measure

which

Management

believes

is

useful

in

evaluating

the

financial

results

of

the

Company

–

see

Appendix for Non-GAAP reconciliation

2

ONB Core includes contractual interest income of Monroe, Integra, IN Community,

Tower, United and Lafayette loans 2

4Q13

3Q14

4Q14

Total NIM

4.11%

4.78%

3.83%

Lafayette Accretion

0.00%

0.00%

0.03%

United Accretion

0.00%

0.14%

0.14%

Tower Accretion

0.00%

0.11%

0.06%

IN Community Accretion

0.37%

0.13%

0.13%

Integra Accretion

0.35%

1.05%

0.29%

Monroe Accretion

0.09%

0.03%

0.03%

ONB Core

3.30%

3.32%

3.15%

4.78%

4.11%

3.83% |

33

Core Net Interest Margin

1

1

Refer to slide 32 |

34

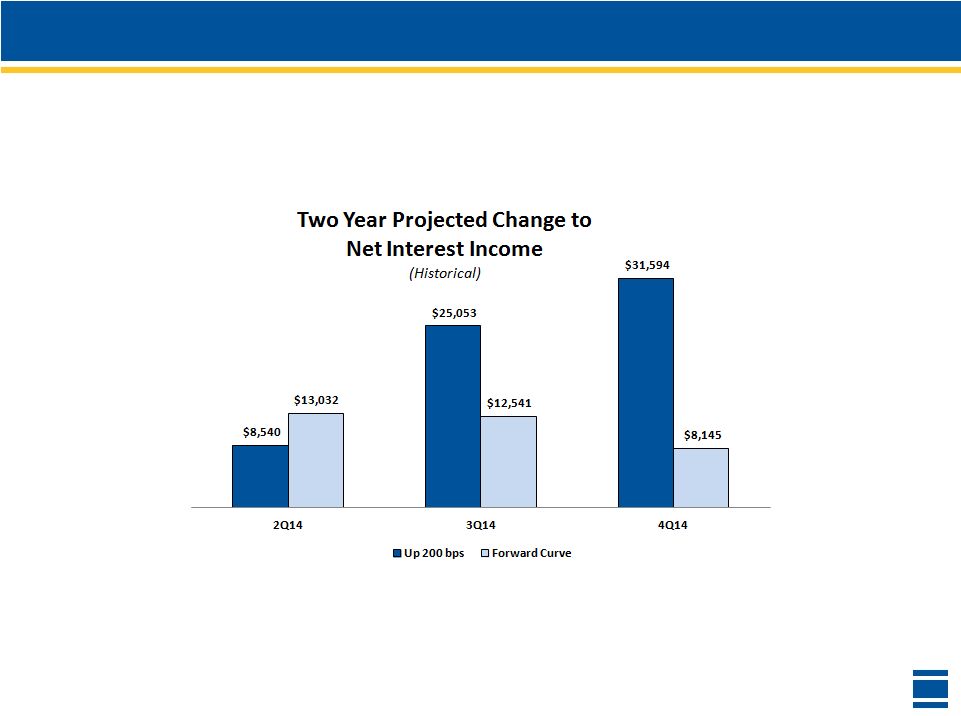

Modeled Interest Rate Sensitivity

$ in thousands

Change to Net Interest Income based on a one year time horizon

Refer to slide 36 for rate curves

Total non-maturity, interest-

bearing accounts increase from

0.08% to 0.39% in the “Up 100

bps”

scenario

21.6% of total non-interest

bearing DDA are considered rate

sensitive

43% of C&I and CRE loans

reprice within one year

17% of loans have floors; less

than 1% of these loans are

currently below their floor rates

Investment portfolio duration of

3.76 at 12/31/14, down from 4.16

at 9/30/14.

3Q14

2Q14 |

35

Modeled Interest Rate Sensitivity

$ in thousands

Change to Net Interest Income based on a one year time horizon

Refer to slide 36 for rate curves |

36

Interest Rate Curves |

37

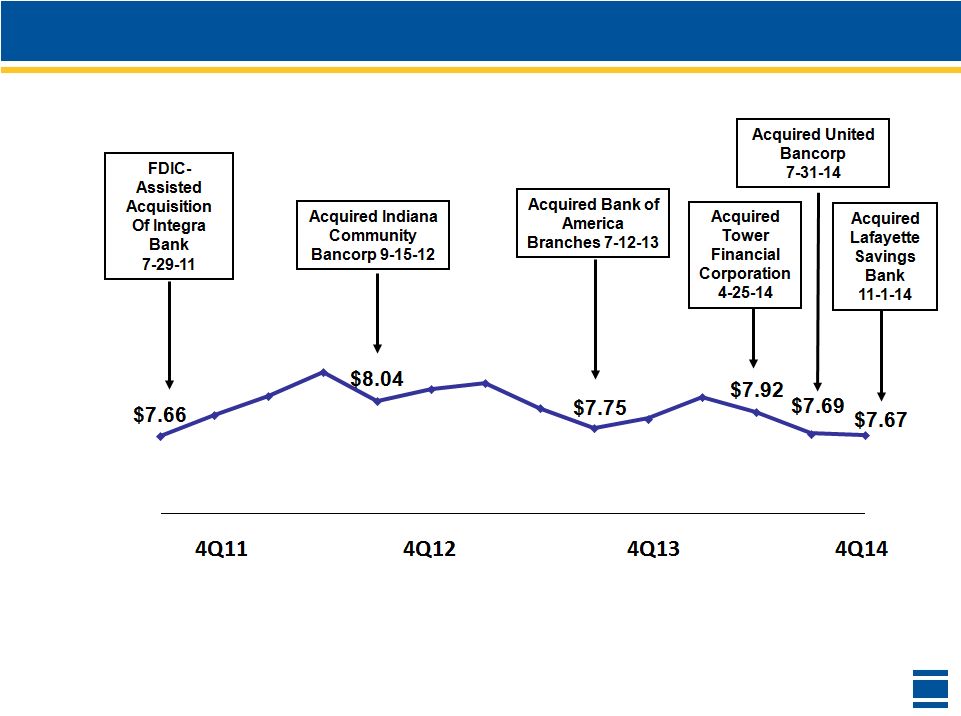

Tangible Common Book Value

1

Non-GAAP financial measure management believes is useful in evaluating the financial results of

the Company – see Appendix for Non-GAAP reconciliation

1 |

38

Capital Ratios

Peer Group data per SNL Financial

See Appendix for definition of Peer Group

1

See Appendix for Non-GAAP reconciliation

On October 23, 2014, ONB Board of Directors authorized repurchase of up to 6.0

million shares through January,

2016

As of January 21, 2015, 1.1 million shares of ONB common stock have been

repurchased under the repurchase

plan |

39

Total Revenue –

Positive Trends

$ in millions

Revenue

growth

1

of

11.9% from 4Q13

11.9%

Revenue less securities gains, accretion income and amortization of indemnification asset 1

|

40

Noninterest Income

$ in millions

$(3.4)

$(19.1)

$(6.2)

$12.8

$12.5

$12.0

$7.9

$8.1

$7.9

$19.8

$23.4

$25.1

$7.0

$6.8

$6.8

$44.1

$31.7

$45.6

4Q13

3Q14

4Q14

Debit Card and ATM Fees

Fee-based business: Wealth Management, Insurance, Mortgage and

Investments

Other Income

Service Charges on Deposits

Amortization of Idemnification Asset |

41

*Other Expenses include:

In 4Q13, $.5 in BSA/AML penalties, $.4 million in pension adjustments and a $.3

million reversal of provision for unfunded commitments

In 3Q14, $1.0 million reversal of hospitalization expense, a $0.7 million adjustment

in incentive of stock-based compensation and a $.3 million impairment on

a branch held for sale In 4Q14, a $1.4 million reversal of lease termination

fee, a $1.0 million reversal of hospitalization expense and a $.9 million

reversal of provision for unfunded commitments

$85.1

$90.7

$91.1

$0.6

$2.5

$3.6

$3.1

$4.5

$5.7

$2.6

$2.1

$1.4

$88.2

$100.0

$100.1

4Q13

3Q14

4Q14

Operational Expenses

Other Expenses*

Merger/Integration Costs

United Operational Costs

Tower Operational Costs

Lafayette Operational Costs

$ in millions

Operational expenses = total noninterest expense less Tower, United and Lafayette

operational costs, merger/integration costs and other expenses Noninterest

Expense – Well Controlled

Reported 4Q14

efficiency ratio of

69.54%

4Q14 efficiency ratio

excluding

merger/integration

costs

of

67.34%

1

Anticipated

merger/integration

costs in 1Q15 of $4.0

million to $5.0 million

($1.4)

1

Non-GAAP financial measure which Management believes is useful in evaluating

the financial results of the Company – see Appendix for Non-GAAP

reconciliation ($3.3) |

42

Returned to

community

bank model

2004

2005

Sold non-

strategic

market –

Clarksville, TN

–

5 branches

2006

Sold non-

strategic market

–

O’Fallon, IL –

1 branch

2007

2008

2009

2010

2011

2012

2013

Acquired St.

Joseph Capital –

Entry into

Northern IN

market

February, 2007

Acquired 65

Charter One

branches

throughout

Indiana

March, 2009

Acquired Monroe

Bancorp –

Enhanced

Bloomington, IN

presence

January, 2011

Acquired Indiana

Community –

Entry into

Columbus, IN

September, 2012

FDIC-assisted

acquisition of

Integra Bank

July, 2011

Sold non-

strategic

market –

Chicago-area -

4 branches

Consolidation of

21 branches

Acquired 24

MI / IN branches

July, 2013

Consolidation

of 2 branches

Consolidation

of 8 branches

Consolidation

of 1 branch

Consolidation

of 10 branches

Consolidation

of 12 branches

Consolidation

of 44 branches

Consolidation

of 5 branches

Sold 12

branches

Consolidation

of 22 branches

Acquired 209

Sold 22

Consolidated 129

Acquired Tower

Financial –

Enhancing Ft.

Wayne, IN

presence April,

2014

Transforming Old National’s Landscape

Acquired

United

Bancorp —

Entering Ann

Arbor, MI July,

2014

2014

Consolidation

of 4 branches

Acquired LSB

Financial Corp.–

Enhancing

Lafayette, IN

presence

November 1,

2014

Acquired

Founders

Financial

Corporation–

Entry into

Grand

Rapids , MI

January 1, 2015

2015 |

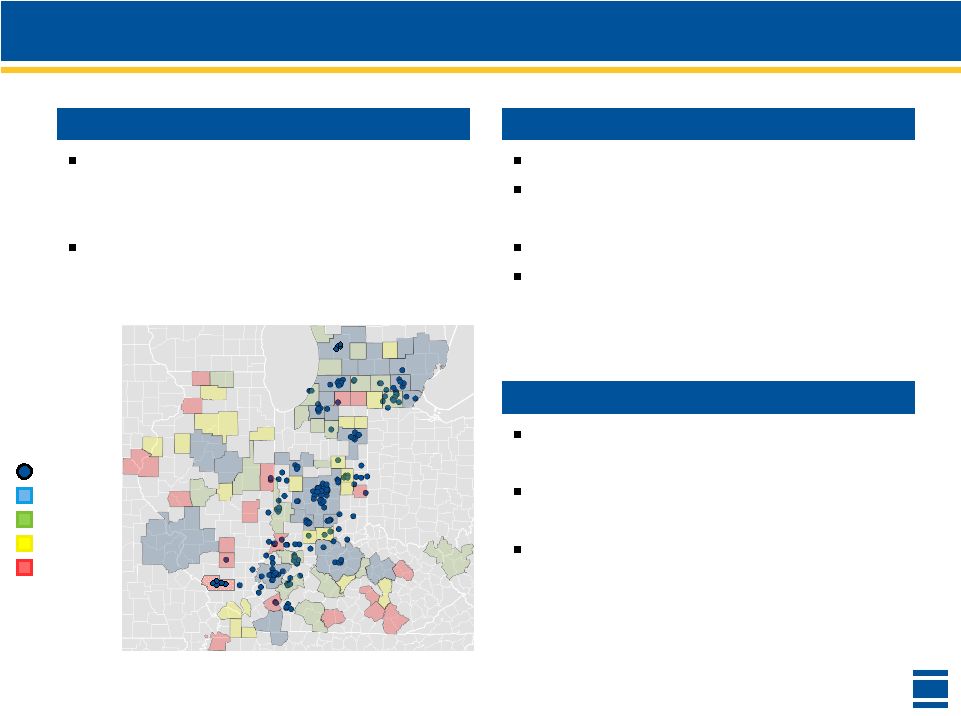

43

Strategy

Process

Emerging Trends

Focus on community banks with strong

client relationships and deposit

franchises

Mid-sized markets within or near existing

franchise with above average growth

rates

Must pass rigorous due diligence process

Must align both strategically and

culturally

Must meet/exceed financial targets

Must enhance Old National’s mission of

being a true “community bank”

M&A –

Partnerships

Rising M&A competition is increasing

price multiples

Resurgence of MOEs giving potential

targets an alternative to selling

Cash deals becoming more in favor by

targets

Legend

ONB

1

st

Quartile

2

nd

Quartile

3

rd

Quartile

4

th

Quartile

Represents MSAs with more than 15,000 households in IN,KY,IL, southern MI, Cincinnati and St. Louis.

MSA quartile rankings weighted as follows: 25% number of households, 20% median HH income, 10%

unemployment, 10% median HH income 5-year growth, 10% population 5-year growth, 10% deposits/branch ratio and

15% households/branch ratio. |

44

Shifting to higher-growth

markets from lower-growth

markets

–

Entry and fill-in of existing

higher-growth markets

through strategic acquisitions

Acquired 209 branches since

2004

–

Sale or consolidations in

lower-growth, non-core

markets

Consolidated 129 branches

Sold 22 branches

44

Old National’s Landscape |

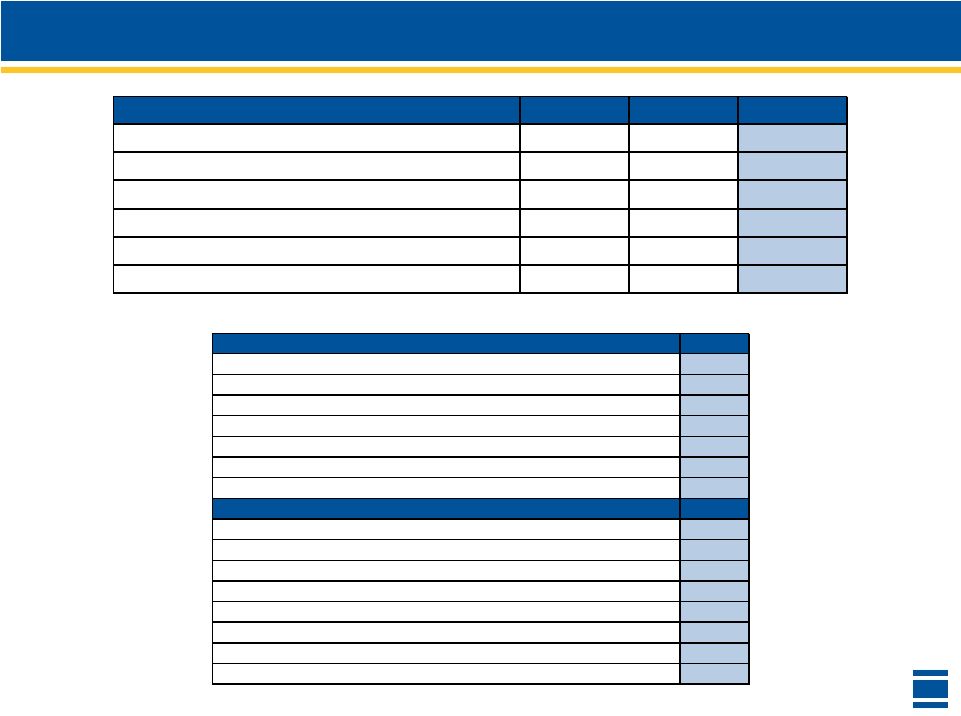

45

$ in millions

N/A equals not applicable

(1) Based on end of quarter assets immediately preceding announcement date

Completed Acquisitions

Acquisition

RBS

Citizens-65

Branches

Monroe

Integra Bank

Indiana

community

BofA -

24

Branches

Tower

Financial

United

Bancorp

LSB

Founders

Deal Type

Branch Deal

Traditional

FDIC-Assisted

Traditional

Branch Deal

Traditional

Traditional

Traditional

Traditional

Principal Geography

Indianapolis,

IN

Bloomington,

IN

Evansville,

IN

Columbus,

IN

/

I-65

Corridor

Southwest

MI

/

Northern

IN

Fort

Wayne,

IN

Ann

Arbor,

MI

Lafayette,

IN

Grand

Rapids,

MI

Purchase Price at Announcement

$16

$84

N/A

$79

$23

$108

$173

$67

$88

NA

$838

$1,900

$985

N/A

$681

$919

$366

$466

% Stock Consideration at Announcement

0%

100%

N/A

100%

0%

71%

80%

75%

54%

Announce Date

11/24/2008

10/6/2010

7/29/2011

1/25/2012

1/9/2013

9/10/2013

1/8/2014

6/4/2014

7/28/2014

Close Date

3/20/2009

1/1/2011

7/29/2011

9/15/2012

7/12/2013

4/25/2014

7/31/2014

11/1/2014

1/1/2015

Total Assets at Announcement

1 |

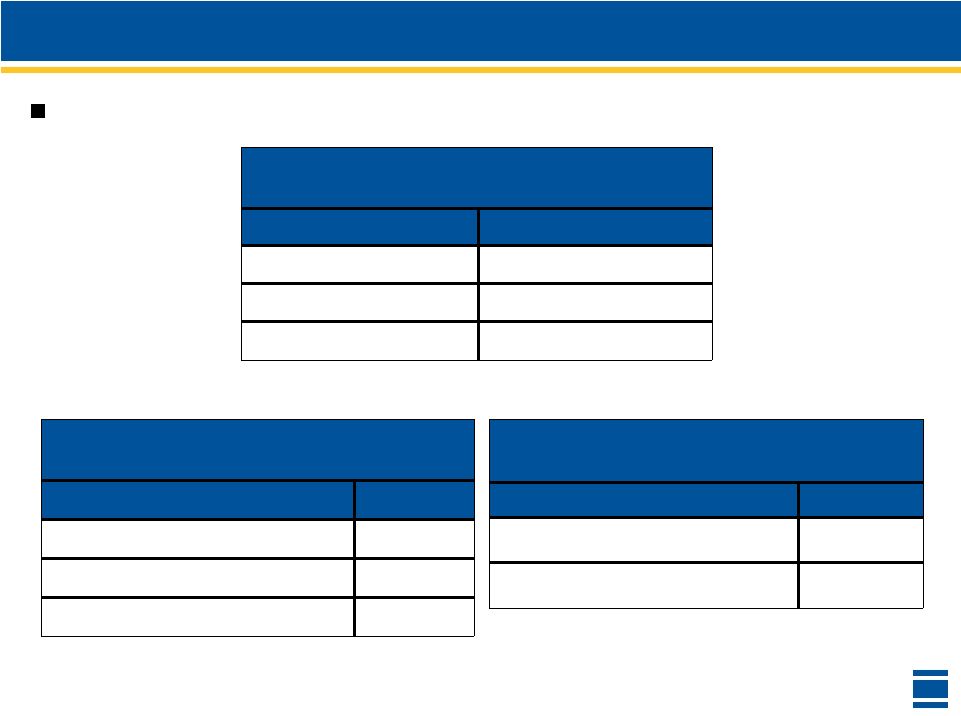

46

Committed to Strong Corporate Governance

Stock ownership guidelines have been

established for named executive officers as

follows:

As of December 31, 2014, each named

executive officer has met their stock

ownership requirement

Position or Salary

Target Ownership Guidelines

Chief Executive Officer

5X salary in stock or 200,000 shares

Chief Operating Officer

4X salary in stock or 100,000 shares

Salary equal to or greater than $250,000

3X salary in stock or 50,000 shares

Salary below $250,000

2X salary in stock or 25,000 shares

Salary equal to or less than $150,000

1X salary in stock or 15,000 shares |

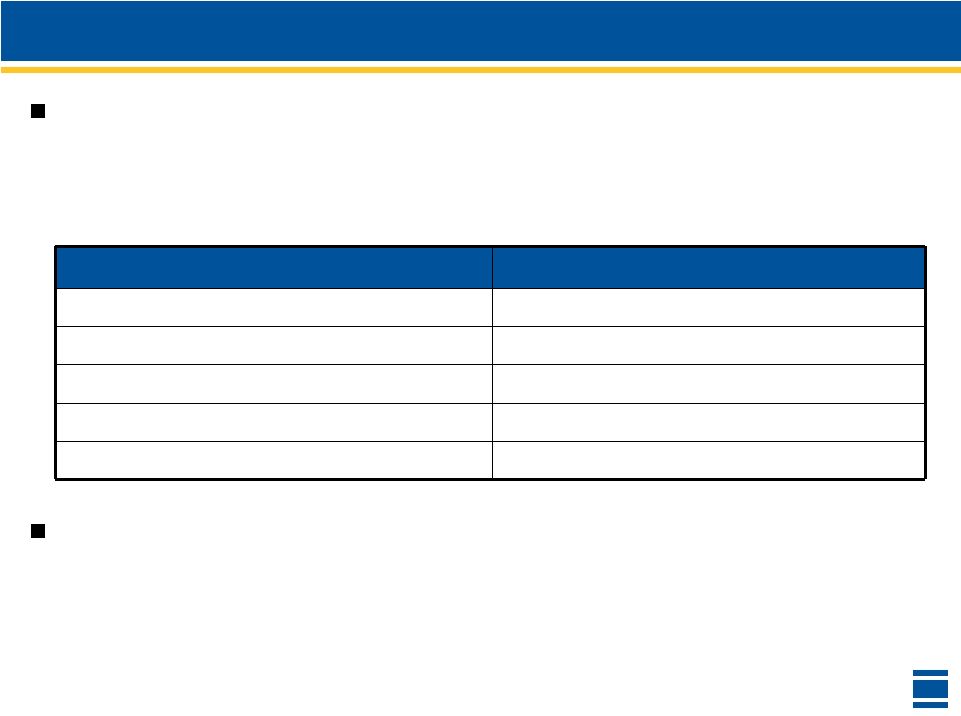

47

Executive Compensation

Tied to long term shareholder value:

Short Term Incentive Plan

(CEO, CFO, CBA, CCO, Chief Legal Counsel)

Performance Measure

Weight

Corporate Net Income

60%

Net Charge-Offs

15%

Efficiency Ratio

25%

Long Term Incentive Plan

(CFO,CBA, CCO, Chief Legal Counsel)

Performance Measure

Weight

Performance-based

75%

(67% TSR & 33% EPS Growth)

Service-based

25%

Long Term Incentive Plan

(CEO)

Performance Measure

Weight

Performance-based

100%

(75% TSR & 25% EPS Growth) |

Appendix

*

*

*

*

*

* |

49

Tangible Common Equity

Tangible Common Equity – 9/30/2014

$876.7

4Q14 Earnings

29.3

4Q14 Dividend

(12.9)

4Q14 Share Repurchase

(10.6)

Issuance of Shares from Acquisition

51.8

Changes in OCI – Securities

5.5

Changes in OCI – Other

(4.6)

Increase in Goodwill & Intangibles

(39.0)

Tangible Common Equity – 12/31/2014

$896.2

$ in millions |

50

2011

2012

2013

2014

4Q13

3Q14

4Q14

Total Revenues

$455.8

$498.6

$502.2

$531.5

$125.6

$142.8

$140.5

Less: Provision for Loan Losses

($7.5)

($5.0)

$2.3

($3.1)

($2.3)

($2.6)

($0.9)

Less: Noninterest Expense

($348.5)

($365.8)

($362.0)

($386.4)

($88.2)

($100.0)

($100.1)

Taxable Equivalent Adjustment

$11.8

$13.2

$16.9

$17.0

$4.4

$4.5

$4.3

Pre-tax Income (FTE)

$111.6

$141.0

$159.4

$159.0

$39.5

$44.7

$43.8

Less: Total Accretion

$36.9

$57.5

$59.0

$86.5

$16.8

$34.3

$16.6

Change in IA

($0.4)

$3.4

$9.3

$43.2

$3.4

$19.1

$6.2

Mergers/Integration Expenses

$16.9

$7.9

$5.9

$15.6

$2.5

$3.6

$3.1

Branch Divestitures

($1.2)

$5.7

$1.9

$0.0

$0.0

$0.0

$0.0

Adjusted Income

$89.9

$100.4

$117.5

$131.3

$28.6

$33.1

$36.5

Non-GAAP Reconciliations

$ in millions |

51

Non-GAAP Reconciliations

$ in millions

end of period balances

4Q13

3Q14

4Q14

Total Shareholders’ Equity

$1,162.6

$1,407.2

$1,465.8

Deduct: Goodwill and Intangible Assets

(378.7)

(530.5)

(569.5)

Tangible Common Shareholders’ Equity

$784.0

$876.7

$896.2

Total Assets

$9,581.7

$11,179.8

$11,647.6

Add: Trust Overdrafts

0.1

0.1

0.2

Deduct: Goodwill and Intangible Assets

(378.7)

(530.5)

(569.5)

Tangible Assets

$9,203.1

$10,649.4

$11,078.2

Tangible Equity to Tangible Assets

8.52%

8.23%

8.09%

Tangible Common Equity to Tangible

Assets

8.52%

8.23%

8.09%

Net Income

$24.5

$29.1

$29.3

After-Tax Intangible Amortization

1.5

2.2

2.5

Tangible Net Income

$26.1

$31.3

$31.7

ROTCE

13.31%

14.29%

14.15% |

52

Non-GAAP Reconciliations

$ in millions

end of period balances

4Q13

3Q14

4Q14

Total Shareholders’ Equity

$1,162.6

$1,407.2

$1,465.8

Deduct: Goodwill and Intangible Assets

(378.7)

(530.5)

(569.5)

Tangible Common Shareholders’ Equity

$784.0

$876.7

$896.2

Risk Weighted Assets

$5,734.0

$7,063.5

$7,333.4

Tangible Common Equity to Risk Weighted Assets

13.67%

12.41%

12.22%

end of period balances

3Q11

3Q12

3Q13

1Q14

2Q14

3Q14

4Q14

Total Shareholders’ Equity

$1,027.7

$1,186.8

$1,159.3

$1,185.2

$1,277.3

$1,407.2

$1,465.8

Deduct: Goodwill and Intangible Assets

(302.3)

(371.2)

(379.3)

(376.8)

(439.3)

(530.5)

(569.5)

Tangible Common Shareholders’ Equity

$725.4

$815.6

$779.9

$808.4

$838.1

$876.7

$896.2

Common Shares Issued and Outstanding at Period End

94,752

101,403

100,693

100,084

105,851

113,984

116,847

Tangible Common Book Value

7.66

$8.04

$7.75

$8.08

$7.92

$7.69

$7.67 |

53

Non-GAAP Reconciliations

4Q13

3Q14

4Q14

Net Interest Income ($ in 000's)

$81,187

$108,367

$90,043

Taxable Equivalent Adjustment

4,359

4,488

4,324

Net Interest Income – Taxable Equivalent

$85,546

$112,855

$94,367

Average Earning Assets

$8,322,334

$9,444,853

$9,858,522

Net Interest Margin

3.90%

4.59%

3.65%

Net Interest Margin – Fully Taxable Equivalent

4.11%

4.78%

3.83%

Efficiency Ratio - As Reported

4Q14

Net Interest Income (FTE) ($ in millions)

$94.4

Noninterest Income Less Security Gains

45.6

Revenue Less Security Gains

139.9

Noninterest Expense

100.1

Intangible Amortization

2.8

Noninterest Expense Less Intangible Amortization

97.3

Efficiency Ratio

69.54%

Efficiency Ratio Excluding Acquisition Costs

4Q14

Net Interest Income (FTE) ($ in millions)

$94.4

Noninterest Income Less Security Gains

45.6

Revenue Less Security Gains

139.9

Noninterest Expense

100.1

Intangible Amortization

2.8

Acquisition Costs

3.1

Noninterest Expense Less Intangible Amortization and Acquisition Costs

94.2

Efficiency Ratio

67.34% |

54

Old National’s Peer Group

Associated Banc-Corporation

ASB

MB Financial Inc.

MBFI

BancFirst Corporation

BANF

National Penn Bancshares Inc.

NPBC

BancorpSouth, Inc.

BXS

Park National Corporation

PRK

Bank of Hawaii Corporation

BOH

PrivateBancorp, Inc.

PVTB

Chemical Financial Corporation

CHFC

Prosperity Bancshares Inc.

PB

Commerce Bancshares, Inc.

CBSH

Renasant Corporation

RNST

Cullen/Frost Bankers, Inc.

CFR

South State Corporation

SSB

F.N.B. Corporation

FNB

Susquehanna Bancshares, Inc.

SUSQ

First Commonwealth Financial Corporation

FCF

TCF Financial Corporation

TCB

First Finanacial Bancorp.

FFBC

TFS Financial Corporation

TFSL

First Merchants Corporation

FRME

Trustmark Corporation

TRMK

First Midwest Bancorp Inc.

FMBI

UMB Financial Corporation

UMBF

FirstMerit Corporation

FMER

United Bankshares Inc.

UBSI

Flagstar Bancorp Inc.

FBC

Valley National Bancorp

VLY

Fulton Financial Corporation

FULT

WesBanco Inc.

WSBC

Home Bancshares, Inc.

HOMB

Wintrust Financial Corporation

WTFC

IberiaBank Corporation

IBKC

•

Like-size, publicly-traded financial services companies, generally in the

Midwest, serving comparable demographics with comparable services as ONB

|

55

Investor Contact

Additional information can be found on the

Investor Relations web pages at

www.oldnational.com

Investor Inquiries:

Lynell J. Walton, CPA

SVP –

Director of Investor Relations

812-464-1366

lynell.walton@oldnational.com |

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Old National Bancorp Reports First Quarter 2024 Results

- Form 8.5 (EPT/RI) - Accrol Group Holdings Plc

- CTT Systems AB (publ.) - Interim Report First Quarter 2024

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share