Form 8-K NCR CORP For: Nov 11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 11, 2015

NCR CORPORATION

(Exact name of registrant as specified in its charter)

| Maryland | 001-00395 | 31-0387920 | ||

| (State or other jurisdiction of incorporation or organization) |

Commission File Number |

(I.R.S. Employer Identification No.) |

3097 Satellite Boulevard

Duluth, Georgia 30096

(Address of principal executive offices and zip code)

Registrant’s telephone number, including area code: (937) 445-5000

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| x | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 1.01. | Entry into a Material Definitive Agreement. |

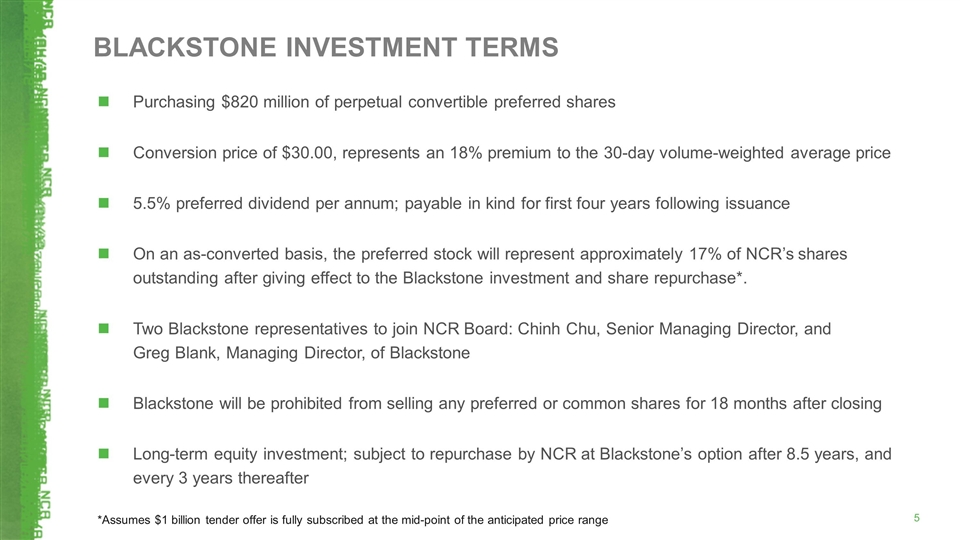

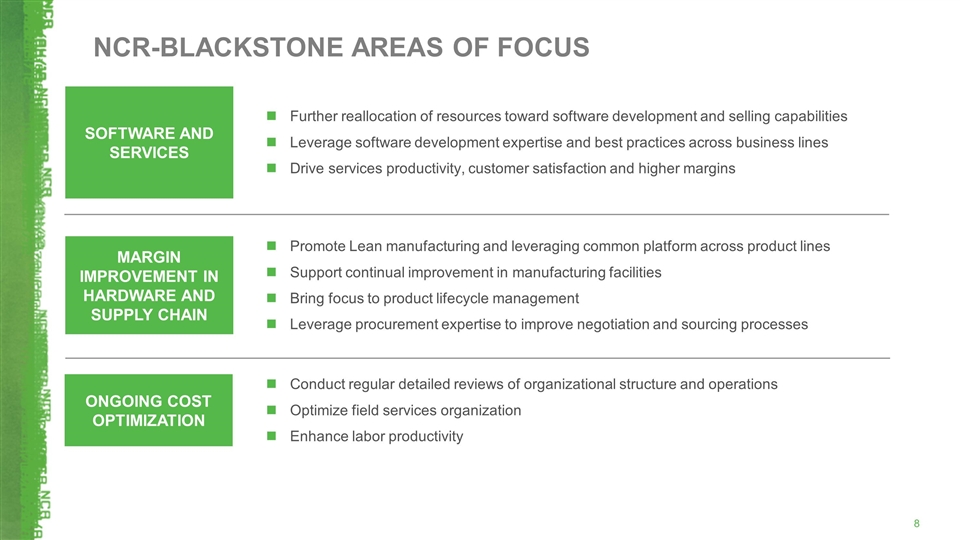

On November 12, 2015, NCR Corporation, a Maryland corporation (the “Company” or “NCR”), announced the entry into an Investment Agreement dated as of November 11, 2015 (the “Investment Agreement”) between the Company and funds managed by or affiliated with Blackstone Capital Partners VI, L.P. and Blackstone Tactical Opportunities L.L.C. (collectively, “Blackstone”) relating to the issuance and sale to Blackstone of 820,000 shares of the Company’s Series A Convertible Preferred Stock, par value $0.01 per share (the “Series A Preferred Stock”), for an aggregate purchase price of $820 million, or $1,000 per share. The closing of the transaction contemplated by the Investment Agreement is conditioned upon certain customary closing conditions, including, among others, obtaining clearance under the Hart-Scott-Rodino Antitrust Improvements Act. The Company expects the closing of the transaction to occur prior to the end of the 2015 fiscal year.

The Series A Preferred Stock will rank senior to the shares of the Company’s common stock, par value $0.01 per share (the “Common Stock”), with respect to dividend rights and rights on the distribution of assets on any voluntary or involuntary liquidation, dissolution or winding up of the affairs of the Company. The Series A Preferred Stock will have a liquidation preference of $1,000 per share. Holders of Series A Preferred Stock will be entitled to a cumulative dividend at the rate of 5.5% per annum, payable quarterly in arrears, as set forth in the Articles Supplementary classifying the Series A Preferred Stock, a form of which is attached as Annex I to the Investment Agreement (the “Articles Supplementary”). If the Company does not declare and pay a dividend, the dividend rate will increase by 2.5% to 8.0% per annum until all accrued but unpaid dividends have been paid in full. Dividends shall be paid in-kind, through the issuance of additional shares of Series A Preferred Stock, for the first sixteen dividend payment dates, after which dividends will be payable in cash or in-kind at the option of the Company.

The Series A Preferred Stock will be convertible at the option of the holders at any time into shares of Common Stock at an initial conversion price of $30.00 per share and an initial conversion rate of 33.33 shares of Common Stock per share of Series A Preferred Stock, subject to certain anti-dilution adjustments. At any time after the third anniversary of the date of the issuance of the Series A Preferred Stock (the “Closing Date”), if the volume weighted average price of the Common Stock exceeds $54.00, as may be adjusted pursuant to the Articles Supplementary, for at least 30 trading days in any period of 45 consecutive trading days, all of the Series A Preferred Stock may be converted, at the election of the Company, into the relevant number of shares of Common Stock.

Holders of Series A Preferred Stock will be entitled to vote with the holders of the Common Stock on an as-converted basis. Holders of Series A Preferred Stock will be entitled to a separate class vote with respect to amendments to the Company’s organizational documents that have an adverse effect on the Series A Preferred Stock and issuances by the Company of securities that are senior to, or equal in priority with, the Series A Preferred Stock.

On any date during the three months following March 16, 2024 and the three months following every third anniversary of such date, holders of Series A Preferred Stock will have the right to require the Company to repurchase all or any portion of the Series A Preferred Stock at 100% of the liquidation preference thereof plus all accrued but unpaid dividends. Upon certain change of control events involving the Company, holders of Series A Preferred Stock can require the Company to repurchase all or any portion of the Series A Preferred Stock at the greater of (1) an amount in cash equal to 100% of the liquidation preference thereof plus all accrued but unpaid dividends and (2) the consideration the holders would have received if they had converted their shares of Series A Preferred Stock into Common Stock immediately prior to the change of control event. The Company will have the right, upon certain change of control events involving the Company, to redeem the Series A Preferred Stock at the greater of (1) an amount in cash equal to the sum of the liquidation preference of the Series A Preferred Stock, all accrued but unpaid dividends and the present value, discounted at a rate of 10%, of any remaining scheduled dividends through the fifth anniversary of the first dividend payment date, assuming the Company chose to pay such dividends in cash and (2) the consideration the holders would have received if they had converted their shares of Series A Preferred Stock into Common Stock immediately prior to the change of control event.

Pursuant to the Investment Agreement, the Company has agreed to increase the size of its board of directors by two new director seats and elect Chinh Chu and Greg Blank to the board of directors for a term expiring

at the Company’s 2016 annual meeting of stockholders (the “2016 Annual Meeting”). At the 2016 Annual Meeting, the Company will nominate Chinh Chu for election as a Class B director with a term expiring at the Company’s 2019 annual meeting of the stockholders if its board of directors is then classified (or to its board of directors generally if the board of directors is not then classified), and Greg Blank for election as a Class C director with a term expiring at the Company’s 2017 annual meeting of the stockholders if its board of directors is then classified (or to its board of directors generally if the board of directors is not then classified).

So long as Blackstone or its affiliates beneficially own shares of Series A Preferred Stock and/or shares of Common Stock issued upon conversion of Series A Preferred Stock (“Conversion Common Stock”) that represent, on an as converted basis, at least 50% of Blackstone’s initial shares of Series A Preferred Stock on an as-converted basis, Blackstone will have the right to designate a total of two directors for election to the Company’s board of directors. So long as Blackstone or its affiliates beneficially own shares of Series A Preferred Stock and/or Conversion Common Stock that represent, on an as converted basis, at least 25% but less than 50% of Blackstone’s initial shares of Series A Preferred Stock on an as-converted basis, Blackstone will have the right to designate a total of one director for election to the Company’s board of directors.

Blackstone will be subject to certain standstill restrictions, including, among other things, that Blackstone will be restricted from acquiring additional securities of the Company, until the later of (a) the three year anniversary of the Closing Date and (b) the date that no Blackstone designee serves on the Company’s board of directors and Blackstone has no rights (or has irrevocably waived its rights) to designate directors for election to the Company’s board. Subject to certain customary exceptions, Blackstone will be restricted from transferring the Series A Preferred Stock or Conversion Common Stock until the 18 month anniversary of the Closing Date.

Blackstone and its affiliates will have certain customary registration rights with respect to the Series A Preferred Stock and the Conversion Common Stock pursuant to the terms of a registration rights agreement, a form of which is attached as Annex II to the Investment Agreement.

The foregoing description of the terms of the Series A Preferred Stock, the Investment Agreement and the transactions contemplated thereby does not purport to be complete and is subject to, and qualified in its entirety by, the full text of the Investment Agreement and the schedules and annexes thereto, which is attached hereto as Exhibit 10.1, and is incorporated herein by reference.

| Item 3.02 | Unregistered Sales of Equity Securities. |

The information contained in Item 1.01 is incorporated herein by reference.

As described in Item 1.01, under the terms of the Investment Agreement, the Company has agreed to issue shares of Series A Preferred Stock to Blackstone. This issuance and sale will be exempt from registration under the Securities Act of 1933, as amended (the “Securities Act”), pursuant to Section 4(a)(2) of the Securities Act. Blackstone represented to the Company that it is an “accredited investor” as defined in Rule 501 of the Securities Act and that the Series A Preferred Stock is being acquired for investment purposes and not with a view to, or for sale in connection with, any distribution thereof, and appropriate legends will be affixed to any certificates evidencing the shares of Series A Preferred Stock or Conversion Common Stock.

| Item 8.01 | Other Events. |

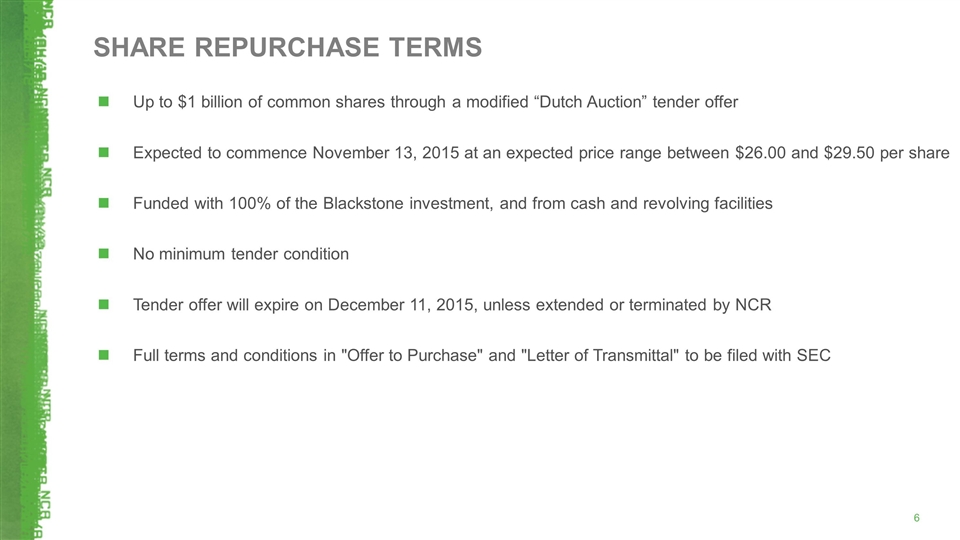

On November 12, 2015, the Company announced its intention to commence a tender offer on or about November 13, 2015 to purchase up to $1.0 billion in value of Common Stock through a modified “Dutch auction” tender offer (the “Tender Offer”). The Company will fund the tender offer with a combination of existing cash on the Company’s balance sheet, borrowings under the Company’s existing revolving credit facilities and the proceeds from the $820 million investment in the Series A Preferred Stock by Blackstone described in Item 1.01.

Attached as Exhibit 99.1 is a copy of the Company’s press release dated November 12, 2015 announcing the execution of the Investment Agreement, the transactions contemplated by the Investment Agreement and the Company’s intention to commence the Tender Offer.

On November 12, 2015, the Company held a conference call to discuss the Investment Agreement and the transactions contemplated by the Investment Agreement. A copy of the investor presentation, which was posted to the Company’s website, is attached hereto as Exhibit 99.2.

Forward-Looking Statements

This communication contains forward-looking statements. Forward-looking statements use words such as “expect,” “anticipate,” “outlook,” “intend,” “believe,” “will,” “should,” “would,” “could” and words of similar meaning. Statements that describe or relate to NCR’s plans, goals, intentions, strategies or financial outlook, statements regarding the investment by Blackstone and statements that do not relate to historical or current fact, are examples of forward-looking statements. Forward-looking statements are based on NCR’s current beliefs, expectations and assumptions, which may not prove to be accurate, and involve a number of known and unknown risks and uncertainties, many of which are out of NCR’s control. Forward-looking statements are not guarantees of future performance, and there are a number of important factors that could cause actual outcomes and results to differ materially from the results contemplated by such forward-looking statements, including factors relating to: the successful closing of the investment by Blackstone and achievement of its potential benefits; domestic and global economic and credit conditions, including, in particular, market conditions and investment trends in the retail industry, and economic and market conditions in China and Russia; the impact of our indebtedness and its terms on our financial and operating activities; our ability to successfully introduce new solutions and compete in the information technology industry; the transformation of our business model and our ability to sell higher-margin software and services; our ability to improve execution in our sales and services organizations; defects or errors in our products or problems with our hosting facilities; manufacturing disruptions; collectability difficulties in subcontracting relationships in emerging industries; the historical seasonality of our sales; foreign currency fluctuations; the availability and success of acquisitions, divestitures and alliances, including the acquisition of Digital Insight; our pension strategy and underfunded pension obligation; the success of our ongoing restructuring plan; tax rates; compliance with data privacy and protection requirements; reliance on third party suppliers; development and protection of intellectual property; workforce turnover and the ability to attract and retain skilled employees; environmental exposures from our historical and ongoing manufacturing activities; uncertainties with regard to regulations, lawsuits, claims and other matters across various jurisdictions; and the other risks and uncertainties described in NCR’s filings with the Securities and Exchange Commission (the “SEC”), including under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in NCR’s annual report on Form 10-K for the year ended December 31, 2014 filed with the SEC on February 27, 2015 and in any of NCR’s subsequently filed Form 10-Qs. Any forward-looking statement speaks only as of the date on which it is made. NCR does not undertake any obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Important Information

This communication is for informational purposes only and does not constitute an offer to buy or a solicitation of an offer to sell any securities of NCR. The tender offer described in these materials has not yet commenced, and there can be no assurances that NCR will commence the tender offer on the terms described in these materials or at all. If NCR commences the tender offer, the tender offer will be made solely by an Offer to Purchase and related materials, which NCR will file with the SEC. Investors are urged to read these materials when they become available, as well as any other relevant documents filed with the SEC when they become available, carefully and in their entirety because they will contain important information, including the terms and conditions of the tender offer. If NCR commences the tender offer, it will file each of the documents referenced in this paragraph with the SEC, and, when available, investors may obtain a free copy of them from the SEC at its website www.sec.gov, or free of charge from NCR at http://investor.ncr.com or by directing a request to Gavin Bell, Vice President of Investor Relations, at 212-589-8468 or [email protected].

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

The following exhibits are attached with this Current Report on Form 8-K:

| Exhibit |

Description | |

| 10.1 | Investment Agreement dated as of November 11, 2015, by and between NCR Corporation and the affiliates of Blackstone Capital Partners VI, L.P. and Blackstone Tactical Opportunities L.L.C. named therein. | |

| 99.1 | Press Release dated as of November 12, 2015. | |

| 99.2 | Investor Presentation dated as of November 12, 2015. | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| NCR Corporation | ||

| By: | /s/ Robert Fishman | |

| Robert Fishman | ||

| Senior Vice President and Chief Financial Officer | ||

Date: November 12, 2015

Index to Exhibits

The following exhibits are attached with this Current Report on Form 8-K:

| Exhibit |

Description | |

| 10.1 | Investment Agreement dated as of November 11, 2015, by and between NCR Corporation and the affiliates of Blackstone Capital Partners VI, L.P. and Blackstone Tactical Opportunities L.L.C. named therein. | |

| 99.1 | Press Release dated as of November 12, 2015. | |

| 99.2 | Investor Presentation dated as of November 12, 2015. | |

Exhibit 10.1

EXECUTION VERSION

INVESTMENT AGREEMENT

by and between

NCR CORPORATION

and

EACH OF THE PURCHASERS LISTED ON THE SIGNATURE PAGES HERETO

Dated as of November 11, 2015

TABLE OF CONTENTS

| PAGE | ||||||

| ARTICLE I | ||||||

| DEFINITIONS | ||||||

| Section 1.01 |

Definitions |

1 | ||||

| ARTICLE II | ||||||

| PURCHASE AND SALE | ||||||

| Section 2.01 |

Purchase and Sale |

9 | ||||

| Section 2.02 |

Closing |

10 | ||||

| ARTICLE III | ||||||

| REPRESENTATIONS AND WARRANTIES OF THE COMPANY | ||||||

| Section 3.01 |

Organization; Standing |

11 | ||||

| Section 3.02 |

Capitalization |

11 | ||||

| Section 3.03 |

Authority; Noncontravention |

12 | ||||

| Section 3.04 |

Governmental Approvals |

13 | ||||

| Section 3.05 |

Company SEC Documents; Undisclosed Liabilities |

13 | ||||

| Section 3.06 |

Absence of Certain Changes |

14 | ||||

| Section 3.07 |

Legal Proceedings |

15 | ||||

| Section 3.08 |

Compliance with Laws; Permits |

15 | ||||

| Section 3.09 |

Tax Matters |

15 | ||||

| Section 3.10 |

Environmental Matters |

16 | ||||

| Section 3.11 |

No Rights Agreement; Anti-Takeover Provisions |

16 | ||||

| Section 3.12 |

Brokers and Other Advisors |

17 | ||||

| Section 3.13 |

Sale of Securities |

17 | ||||

| Section 3.14 |

Listing and Maintenance Requirements |

17 | ||||

| Section 3.15 |

Status of Securities |

17 | ||||

| Section 3.16 |

Indebtedness |

18 | ||||

| Section 3.17 |

No Other Representations or Warranties |

18 | ||||

| Section 3.18 |

No Other Purchaser Representations or Warranties |

18 | ||||

| ARTICLE IV | ||||||

| REPRESENTATIONS AND WARRANTIES OF THE PURCHASERS | ||||||

| Section 4.01 |

Organization; Standing |

19 | ||||

| Section 4.02 |

Authority; Noncontravention |

19 | ||||

i

| Section 4.03 |

Governmental Approvals |

20 | ||||

| Section 4.04 |

Financing |

20 | ||||

| Section 4.05 |

Ownership of Company Stock |

20 | ||||

| Section 4.06 |

Brokers and Other Advisors |

20 | ||||

| Section 4.07 |

Non-Reliance on Company Estimates, Projections, Forecasts, Forward-Looking Statements and Business Plans |

21 | ||||

| Section 4.08 |

Purchase for Investment |

21 | ||||

| Section 4.09 |

No Other Company Representations or Warranties |

22 | ||||

| ARTICLE V | ||||||

| ADDITIONAL AGREEMENTS | ||||||

| Section 5.01 |

Negative Covenants |

22 | ||||

| Section 5.02 |

Reasonable Best Efforts; Filings |

24 | ||||

| Section 5.03 |

Corporate Actions |

25 | ||||

| Section 5.04 |

Public Disclosure |

27 | ||||

| Section 5.05 |

Confidentiality |

27 | ||||

| Section 5.06 |

NYSE Listing of Shares |

28 | ||||

| Section 5.07 |

Standstill |

28 | ||||

| Section 5.08 |

Transfer Restrictions |

30 | ||||

| Section 5.09 |

Legend |

31 | ||||

| Section 5.10 |

Election of Directors |

32 | ||||

| Section 5.11 |

Voting |

35 | ||||

| Section 5.12 |

Tax Matters |

36 | ||||

| Section 5.13 |

Use of Proceeds |

37 | ||||

| Section 5.14 |

Blackstone |

37 | ||||

| Section 5.15 |

Information Rights |

37 | ||||

| Section 5.16 |

Participation |

39 | ||||

| ARTICLE VI | ||||||

| CONDITIONS TO CLOSING | ||||||

| Section 6.01 |

Conditions to the Obligations of the Company and the Purchasers |

42 | ||||

| Section 6.02 |

Conditions to the Obligations of the Company |

42 | ||||

| Section 6.03 |

Conditions to the Obligations of the Purchasers |

43 | ||||

| ARTICLE VII | ||||||

| TERMINATION; SURVIVAL | ||||||

| Section 7.01 |

Termination |

44 | ||||

| Section 7.02 |

Effect of Termination |

45 | ||||

| Section 7.03 |

Survival |

45 | ||||

ii

| ARTICLE VIII | ||||||

| MISCELLANEOUS | ||||||

| Section 8.01 |

Amendments; Waivers |

46 | ||||

| Section 8.02 |

Extension of Time, Waiver, Etc. |

46 | ||||

| Section 8.03 |

Assignment |

46 | ||||

| Section 8.04 |

Counterparts |

46 | ||||

| Section 8.05 |

Entire Agreement; No Third-Party Beneficiaries; No Recourse |

46 | ||||

| Section 8.06 |

Governing Law; Jurisdiction |

47 | ||||

| Section 8.07 |

Specific Enforcement |

48 | ||||

| Section 8.08 |

WAIVER OF JURY TRIAL |

48 | ||||

| Section 8.09 |

Notices |

49 | ||||

| Section 8.10 |

Severability |

50 | ||||

| Section 8.11 |

Expenses |

50 | ||||

| Section 8.12 |

Interpretation |

50 | ||||

| Section 8.13 |

Acknowledgment of Securities Laws |

51 | ||||

| Section 8.14 |

Purchaser Representatives |

51 | ||||

ANNEXES

Annex I – Form of Articles Supplementary

Annex II – Form of Registration Rights Agreement

Annex III – Form of VCOC Letter

Annex IV – Form of Press Release

iii

INVESTMENT AGREEMENT, dated as of November 11, 2015 (this “Agreement”), by and between NCR CORPORATION, a Maryland corporation (the “Company”), the purchasers set forth on the signature pages affixed hereto under the heading “BTO Purchasers” (together with their successors, each a “BTO Purchaser” and collectively, the “BTO Purchasers”), Blackstone Capital Partners VI, L.P., a Delaware limited partnership (“BCP VI”) and Blackstone Family Investment Partnership VI - ESC L.P., a Delaware partnership (together with its successors, “BFIP VI” and together with BCP VI, “BCP VI Purchaser” and together with the BTO Purchasers, the “Purchasers” and each, a “Purchaser”) and, solely for purposes of Section 8.14 and in its capacity as the BTO Representative, Blackstone Tactical Opportunities Associates L.L.C. (“BTO Representative”).

WHEREAS, the Company desires to issue, sell and deliver to the Purchasers, and the Purchasers desire to purchase and acquire from the Company, pursuant to the terms and conditions set forth in this Agreement, an aggregate of 820,000 shares of the Company’s Series A Convertible Preferred Stock, par value $0.01 per share (the “Series A Preferred Stock”), having the designation, preferences, conversion or other rights, voting powers, restrictions, limitations as to dividends, qualifications and terms and conditions, as specified in the form of Articles Supplementary attached hereto as Annex I (the “Articles Supplementary”);

NOW, THEREFORE, in consideration of the mutual covenants, representations, warranties and agreements contained in this Agreement, the receipt and sufficiency of which are hereby acknowledged, the parties to this Agreement hereby agree as follows:

ARTICLE I

Definitions

Section 1.01 Definitions. (a) As used in this Agreement (including the recitals hereto), the following terms shall have the following meanings:

“20% Entity” means any Person that, after giving effect to a proposed Transfer, would beneficially own, on an as converted basis, greater than 20% of the then outstanding Common Stock, on an as converted basis.

“25% Beneficial Ownership Requirement” means that the Purchaser Parties continue to beneficially own at all times shares of Series A Preferred Stock and/or shares of Common Stock that were issued upon conversion of shares of Series A Preferred Stock that represent, in the aggregate and on an as converted basis, at least 25% of the number of shares of Common Stock beneficially owned by the Purchaser Parties, on an as converted basis, as of the Closing.

“50% Beneficial Ownership Requirement” means that the Purchaser Parties continue to beneficially own at all times shares of Series A Preferred Stock and/or shares of Common Stock that were issued upon conversion of shares of Series A

Preferred Stock that represent in the aggregate and on an as converted basis, at least 50% of the number of shares of Common Stock beneficially owned by the Purchaser Parties, on an as converted basis, as of the Closing.

“Affiliate” means, as to any Person, any other Person that, directly or indirectly, controls, or is controlled by, or is under common control with, such Person; provided, however, (i) that the Company and its Subsidiaries shall not be deemed to be Affiliates of any Purchaser Party or any of its Affiliates, (ii) portfolio companies in which any Purchaser Party or any of its Affiliates has an investment (whether as debt or equity) shall not be deemed an Affiliate of such Purchaser Party and (iii) the Excluded Blackstone Parties shall not be deemed to be Affiliates of any Purchaser Party, the Company or any of the Company’s Subsidiaries. For this purpose, “control” (including, with its correlative meanings, “controlled by” and “under common control with”) shall mean the possession, directly or indirectly, of the power to direct or cause the direction of management or policies of a Person, whether through the ownership of securities or partnership or other ownership interests, by contract or otherwise.

“as converted basis” means (i) with respect to the outstanding shares of Common Stock as of any date, all outstanding shares of Common Stock calculated on a basis in which all shares of Common Stock issuable upon conversion of the outstanding shares of Series A Preferred Stock (at the Conversion Rate in effect on such date as set forth in the Articles Supplementary) are assumed to be outstanding as of such date and (ii) with respect to any outstanding shares of Series A Preferred Stock as of any date, the number of shares of Common Stock issuable upon conversion of such shares of Series A Preferred Stock on such date (at the Conversion Rate in effect on such date as set forth in the Articles Supplementary).

Any Person shall be deemed to “beneficially own”, to have “beneficial ownership” of, or to be “beneficially owning” any securities (which securities shall also be deemed “beneficially owned” by such Person) that such Person is deemed to “beneficially own” within the meaning of Rules 13d-3 and 13d-5 under the Exchange Act; provided that any Person shall be deemed to beneficially own any securities that such Person has the right to acquire, whether or not such right is exercisable immediately (including assuming conversion of all Series A Preferred Stock, if any, owned by such Person to Common Stock).

“Board” means the Board of Directors of the Company.

“Business Day” means any day except a Saturday, a Sunday or other day on which the SEC or banks in the City of New York are authorized or required by Law to be closed.

“Common Stock” means the common stock, par value $0.01 per share, of the Company.

2

“Company Charter Documents” means the Company’s charter and bylaws, each as amended to the date of this Agreement, and shall include the Articles Supplementary, when filed with and accepted for record by the SDAT.

“Company Plan” means each plan, program, policy, agreement or other arrangement covering current or former employees, directors or consultants, that is (i) an employee welfare plan within the meaning of Section 3(1) of ERISA, (ii) an employee pension benefit plan within the meaning of Section 3(2) of ERISA, other than any plan which is a “multiemployer plan” (as defined in Section 4001(a)(3) of ERISA), (iii) a stock option, stock purchase, stock appreciation right or other stock-based agreement, program or plan, (iv) an individual employment, consulting, severance, retention or other similar agreement or (v) a bonus, incentive, deferred compensation, profit-sharing, retirement, post-retirement, vacation, severance or termination pay, benefit or fringe-benefit plan, program, policy, agreement or other arrangement, in each case that is sponsored, maintained or contributed to by the Company or any of its Subsidiaries or to which the Company or any of its Subsidiaries contributes or is obligated to contribute to or has or may have any liability, other than any plan, program, policy, agreement or arrangement sponsored and administered by a Governmental Authority.

“Company PSU” means a restricted stock unit of the Company subject to both time-based and performance-based vesting conditions.

“Company Restricted Share” means a share of Common Stock that is subject to forfeiture conditions.

“Company RSU” means a restricted stock unit of the Company subject solely to time-based vesting conditions.

“Company Stock Option” means an option to purchase shares of Common Stock.

“Company Stock Plans” means the 2013 Stock Incentive Plan, the Amended and Restated 2011 Stock Incentive Plan and the Management Stock Plan, in each case as amended.

“Conversion Rate” has the meaning set forth in the Articles Supplementary.

“ERISA” means the Employee Retirement Income Security Act of 1974, as amended.

“Exchange Act” means the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder.

“Fall-Away of Purchaser Board Rights” means the first day on which the 25% Beneficial Ownership Requirement is not satisfied.

3

“Fair Market Value” means, with respect to any security or other property, the fair market value of such security or other property as reasonably determined in good faith by a majority of the Board, or an authorized committee thereof, (i) after consultation with an Independent Financial Advisor, as to any security or other property with a Fair Market Value of less than $50,000,000, or (ii) otherwise using an Independent Financial Advisor to provide a valuation opinion.

“GAAP” means generally accepted accounting principles in the United States, consistently applied.

“Governmental Authority” means any government, court, regulatory or administrative agency, commission, arbitrator or authority or other legislative, executive or judicial governmental entity (in each case including any self-regulatory organization), whether federal, state or local, domestic, foreign or multinational.

“HSR Act” means the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, and the rules and regulations promulgated thereunder.

“Indentures” means, collectively, the (i) Indenture, dated September 17, 2012, among the Company, as issuer, NCR International, Inc. and Radiant Systems Inc., as subsidiary guarantors, and U.S. Bank National Association, as trustee, (ii) Indenture, dated December 18, 2012, among the Company, as issuer, NCR International, Inc. and Radiant Systems Inc., as subsidiary guarantors, and U.S. Bank National Association, as trustee, (iii) Indenture, dated December 19, 2013, between NCR Escrow Corp., as issuer, and U.S. Bank National Association, as trustee, as supplemented by the First Supplemental Indenture, dated January 10, 2014, among the Company, NCR International, Inc. and U.S. Bank National Association, as trustee and (iv) Indenture, dated December 19, 2013, between NCR Escrow Corp., as issuer, and U.S. Bank National Association, as trustee, as supplemented by the First Supplemental Indenture relating to the 6.375% Notes, dated January 10, 2014, among the Company, NCR International, Inc. and U.S. Bank National Association, as trustee.

“Independent Financial Advisor” means an accounting, appraisal, investment banking firm or consultant of nationally recognized standing; provided, however, that such firm or consultant (i) is not an Affiliate of the Company and (ii) so long as the Purchaser meets the 50% Beneficial Ownership Requirement, is reasonably acceptable to the Purchasers.

“Knowledge” means, with respect to the Company, the actual knowledge of the individuals listed on Section 1.01 of the Company Disclosure Letter, after reasonable inquiry of an officer or employee of the Company that has primary responsibility for such matter.

“Liens” means any mortgage, pledge, lien, charge, encumbrance, security interest or other restriction of any kind or nature, whether based on common law, statute or contract.

4

“Material Adverse Effect” means any effect, change, event or occurrence that has or would reasonably be expected to have, individually or in the aggregate, a material adverse effect on (x) the business, results of operations, assets or financial condition of the Company and its Subsidiaries, taken as a whole or (y) (i) the ability of the Company to consummate the Transactions on a timely basis or (ii) the ability of the Company to comply with its obligations under this Agreement; provided, however, that, for purposes of clause (x) above, none of the following, and no effect, change, event or occurrence arising out of, or resulting from, the following, shall constitute or be taken into account in determining whether a Material Adverse Effect has occurred or would reasonably be expected to occur: any effect, change, event or occurrence (A) generally affecting (1) the industry in which the Company and its Subsidiaries operate or (2) the economy, credit or financial or capital markets, in the United States or elsewhere in the world, including changes in interest or exchange rates, or (B) to the extent arising out of, resulting from or attributable to (1) changes or prospective changes in Law or in GAAP or in accounting standards, or any changes or prospective changes in the interpretation or enforcement of any of the foregoing, or any changes or prospective changes in general legal, regulatory or political conditions, (2) the negotiation, execution or announcement of this Agreement or the consummation of the Transactions, including the impact thereof on relationships, contractual or otherwise, with customers, suppliers, distributors, partners, employees or regulators, or any claims or litigation arising from allegations of breach of fiduciary duty or violation of Law relating to this Agreement or the Transactions, (3) acts of war (whether or not declared), sabotage or terrorism, or any escalation or worsening of any such acts of war (whether or not declared), sabotage or terrorism, (4) volcanoes, tsunamis, pandemics, earthquakes, hurricanes, tornados or other natural disasters, (5) any action taken by the Company or its Subsidiaries that is required by this Agreement or with a Purchaser’s express written consent or at a Purchaser’s express written request, (6) any change resulting or arising from the identity of, or any facts or circumstances relating to, the Purchasers or any of their Affiliates, (7) any change or prospective change in the Company’s credit ratings, (8) any decline in the market price, or change in trading volume, of the capital stock of the Company or (9) any failure to meet any internal or public projections, forecasts, guidance, estimates, milestones, budgets or internal or published financial or operating predictions of revenue, earnings, cash flow or cash position (it being understood that the exceptions in clauses (7), (8) and (9) shall not prevent or otherwise affect a determination that the underlying cause of any such change, decline or failure referred to therein (if not otherwise falling within any of the exceptions provided by clause (A) and clauses (B)(1) through (9) hereof) is a Material Adverse Effect); provided further, however, that any effect, change, event or occurrence referred to in clause (A) or clauses (B)(1), (3) or (4) may be taken into account in determining whether there has been, or would reasonably be expected to be, individually or in the aggregate, a Material Adverse Effect to the extent such effect, change, event or occurrence has a disproportionate adverse effect on the business, results of operations, assets or financial condition of the Company and its Subsidiaries, taken as a whole, as compared to other participants in the industry in which the Company and its Subsidiaries operate (in which case the incremental disproportionate impact or impacts may be taken into account in determining whether there has been, or would reasonably be expected to be, a Material Adverse Effect).

5

“MGCL” means the Maryland General Corporation Law, as amended, supplemented or restated from time to time.

“NYSE” means the New York Stock Exchange.

“Offer to Purchase” has the meaning set forth in Section 5.03(d).

“Permitted Transferee” means, with respect to any Person, (i) any Affiliate of such Person, (ii) any successor entity of such Person and (iii) with respect to any Person that is an investment fund, vehicle or similar entity, any other investment fund, vehicle or similar entity of which such Person or an Affiliate, advisor or manager of such Person serves as the general partner, manager or advisor.

“Person” means an individual, corporation, limited liability company, partnership, joint venture, association, trust, unincorporated organization or any other entity, including a Governmental Authority.

“Prohibited Transferee” means the Persons listed on Section 1.01 of the Company Disclosure Letter as a “Prohibited Transferee” and the Affiliates thereof.

“Purchaser Designee” means an individual designated in writing by the Purchasers and reasonably acceptable to the Board (and the Committee on Directors and Governance of the Board) to be elected or nominated by the Company for election to the Board pursuant to Section 5.10(a), Section 5.10(d) or Section 5.10(e), as applicable.

“Purchaser Director” means a member of the Board who was elected to the Board as a Purchaser Designee.

“Purchasers” means BCP VI Purchaser and BTO Purchaser. Any reference to any action by the Purchasers in this Agreement shall require an instrument in writing signed by each of the Purchasers; provided that an instrument in writing signed by (i) the BTO Representative shall be deemed to be an instrument in writing signed by each of the BTO Purchasers and (ii) BCP VI shall be deemed to be an instrument in writing signed by each of the BCP VI Purchasers.

“Purchaser Material Adverse Effect” means any effect, change, event or occurrence that would prevent or materially delay, interfere with, hinder or impair (i) the consummation by the Purchasers of any of the Transactions on a timely basis or (ii) the compliance by the Purchasers with their obligations under this Agreement.

“Purchaser Parties” means the Purchasers and each Permitted Transferee of the Purchasers to whom shares of Series A Preferred Stock or Common Stock are transferred pursuant to Section 5.08(b)(i).

“Registration Rights Agreement” means that certain Registration Rights Agreement to be entered into by the Company and the Purchasers, the form of which is set forth as Annex II hereto.

6

“Representatives” means, with respect to any Person, its officers, directors, principals, partners, managers, members, employees, consultants, agents, financial advisors, investment bankers, attorneys, accountants, other advisors and other representatives.

“SDAT” means the State Department of Assessments and Taxation of Maryland.

“SEC” means the Securities and Exchange Commission.

“Securities Act” means the Securities Act of 1933, as amended, and the rules and regulations promulgated thereunder.

“Specified Share Repurchase” means the purchase of shares of Common Stock by the Company pursuant to the Offer to Purchase.

“Subsidiary”, when used with respect to any Person, means any corporation, limited liability company, partnership, association, trust or other entity of which (x) securities or other ownership interests representing more than 50% of the ordinary voting power (or, in the case of a partnership, more than 50% of the general partnership interests) or (y) sufficient voting rights to elect at least a majority of the board of directors or other governing body are, as of such date, owned by such Person or one or more Subsidiaries of such Person or by such Person and one or more Subsidiaries of such Person. “Tax” means any and all federal, state, local or foreign taxes, fees, levies, duties, tariffs, imposts, and other similar charges (together with any and all interest, penalties and additions to tax) imposed by any Governmental Authority, including taxes or other charges on or with respect to income, franchises, windfall or other profits, gross receipts, property, sales, use, capital stock, payroll, employment, social security, workers’ compensation, unemployment compensation or net worth; taxes or other charges in the nature of excise, withholding, ad valorem, stamp, transfer, value added or gains taxes; license, registration and documentation fees; and customs duties, tariffs and similar charges, together with any interest or penalty, in addition to tax or additional amount imposed by any Governmental Authority.

“Tax Return” means returns, reports, claims for refund, declarations of estimated Taxes and information statements, including any schedule or attachment thereto or any amendment thereof, with respect to Taxes filed or required to be filed with any Governmental Authority, including consolidated, combined and unitary tax returns.

“Transaction Documents” means this Agreement, the Articles Supplementary, the Registration Rights Agreement and all other documents, certificates or agreements executed in connection with the transactions contemplated by this Agreement, the Articles Supplementary and the Registration Rights Agreement.

“Transactions” means the Purchase and the other transactions expressly contemplated by this Agreement and the other Transaction Documents, including, without limitation, the exercise by any Purchaser Party of the right to convert Acquired Shares into shares of Common Stock; provided that, for the avoidance of doubt, “Transactions” shall not be deemed to include the Specified Share Repurchase.

7

“Transfer” by any Person means, directly or indirectly, to sell, transfer, assign, pledge, encumber, hypothecate or otherwise dispose of or transfer (by the operation of law or otherwise), either voluntarily or involuntarily, or to enter into any contract, option or other arrangement, agreement or understanding with respect to the sale, transfer, assignment, pledge, encumbrance, hypothecation or other disposition or transfer (by the operation of law or otherwise), of any interest in any equity securities beneficially owned by such Person; provided, however, that, notwithstanding anything to the contrary in this Agreement, a Transfer shall not include (i) the conversion of one or more shares of Series A Preferred Stock into shares of Common Stock pursuant to the Articles Supplementary, (ii) the redemption or other acquisition of Common Stock or Series A Preferred Stock by the Company, (iii) the transfer (other than by a Purchaser or an Affiliate of a Purchaser) of any limited partnership interests or other equity interests in a Purchaser (or any direct or indirect parent entity of such Purchaser) (provided that if any transferor or transferee referred to in this clause (iii) ceases to be controlled (directly or indirectly) by the Person (directly or indirectly) controlling such Person immediately prior to such transfer, such event shall be deemed to constitute a “Transfer”) or (iv) any Hedge.

(b) In addition to the terms defined in Section 1.01(a), the following terms have the meanings assigned thereto in the Sections set forth below:

| Term |

Section | |

| Acquired Shares | 2.01 | |

| Action | 3.07 | |

| Agreement | Preamble | |

| Announcement | 5.04 | |

| Articles Supplementary | Recitals | |

| Balance Sheet Date | 3.05(c) | |

| Bankruptcy and Equity Exception | 3.03(a) | |

| BCP VI Purchaser | Preamble | |

| Blackstone Group | 5.14 | |

| BMP | 5.15 | |

| BTO Purchaser | Preamble | |

| BTO Purchasers | Preamble | |

| BTO Representative | Preamble | |

| Capitalization Date | 3.02(a) | |

| Closing | 2.02(a) | |

| Closing Date | 2.02(a) | |

| Code | 5.12(b) | |

| Company | Preamble | |

| Company Disclosure Letter | Article III | |

| Company Preferred Stock | 3.02(a) | |

| Company SEC Documents | 3.05(a) |

8

| Company Securities | 3.02(b) | |

| Confidential Information | 5.05 | |

| Confidentiality Agreement | 5.05 | |

| Contract | 3.03(b) | |

| Credit Agreement | 6.02(d) | |

| DOJ | 5.02(c) | |

| Environmental Laws | 3.10 | |

| Excluded Blackstone Parties | 5.14 | |

| Excluded Issuance | 5.16(a) | |

| Filed SEC Documents | Article III | |

| FTC | 5.02(c) | |

| Hedge | 5.08(a) | |

| HSR Form | 5.02(b) | |

| Initial Purchaser Director Designees | 5.10(a) | |

| IRS | 5.12(a) | |

| Judgments | 3.07 | |

| Laws | 3.08(a) | |

| Non-Recourse Party | 8.05(b) | |

| OFAC | 3.08(b) | |

| Offer to Purchase | 5.03(d) | |

| Participation Portion | 5.16(b)(ii) | |

| Permits | 3.08(a) | |

| Proposed Securities | 5.16(b)(i) | |

| Purchase | 2.01 | |

| Purchase Price | 2.01 | |

| Purchaser | Preamble | |

| Restraints | 6.01(a) | |

| Restricted Issuance Information | 5.16(b)(ii) | |

| Series A Preferred Stock | Recitals | |

| Standstill Expiration Date | 5.07 | |

| Takeover Law | 3.11(b) | |

| Termination Date | 7.01(b) |

ARTICLE II

Purchase and Sale

Section 2.01 Purchase and Sale. On the terms of this Agreement and subject to the satisfaction (or, to the extent permitted by applicable Law, waiver by the party entitled to the benefit thereof) of the conditions set forth in Article VI, at the Closing, the Purchasers shall purchase and acquire from the Company an aggregate number of 820,000 shares of Series A Preferred Stock, and the Company shall issue, sell and deliver to each Purchaser, the shares of Series A Preferred Stock (the “Acquired Shares”) set forth opposite such Purchaser’s name on Section 2.01 of the Company Disclosure Letter, for a purchase price per Acquired Share equal to $1,000 and an

9

aggregate purchase price of $820,000,000 (such aggregate purchase price, the “Purchase Price”). The purchase and sale of the Acquired Shares pursuant to this Section 2.01 is referred to as the “Purchase”.

Section 2.02 Closing. (a) On the terms of this Agreement, the closing of the Purchase (the “Closing”) shall occur at 10:00 a.m. (New York City time) on the first Business Day after all of the conditions to the Closing set forth in Article VI of this Agreement have been satisfied or, to the extent permitted by applicable Law, waived by the party entitled to the benefit thereof (other than those conditions that by their nature are to be satisfied at the Closing, but subject to the satisfaction or waiver of those conditions at such time) at the offices of Cravath, Swaine & Moore LLP, 825 Eighth Avenue, New York, New York 10019, or at such other place, time and date as shall be agreed between the Company and the Purchasers; provided, however, that, unless otherwise agreed in writing by the Purchasers and the Company, in no event shall the Closing occur prior to December 2, 2015 (the date on which the Closing occurs, the “Closing Date”).

(b) At the Closing:

(i) the Company shall deliver to the Purchasers (1) the Acquired Shares free and clear of all Liens, except restrictions imposed by the Securities Act, Section 5.08 and any applicable securities Laws, (2) the Registration Rights Agreement, duly executed by the Company and (3) the executed VCOC Letter Agreement, in the form attached as Annex III hereto; and

(ii) the Purchasers shall (1) pay the Purchase Price to the Company, by wire transfer in immediately available U.S. federal funds, to the account designated by the Company in writing and (2) deliver to the Company the Registration Rights Agreement, duly executed by the Purchasers.

ARTICLE III

Representations and Warranties of the Company

The Company represents and warrants to each Purchaser as of the date hereof and as of the Closing (except to the extent made only as of a specified date, in which case such representation and warranty is made as of such date) that, except as (A) set forth in the confidential disclosure letter delivered by the Company to the Purchasers prior to the execution of this Agreement (the “Company Disclosure Letter”) (it being understood that any information, item or matter set forth on one section or subsection of the Company Disclosure Letter shall only be deemed disclosure with respect to, and shall only be deemed to apply to and qualify, the section or subsection of this Agreement to which it corresponds in number and each other section or subsection of this Agreement to the extent that it is reasonably apparent that such information, item or matter is relevant to such other section or subsection) or (B) disclosed in any report, schedule, form, statement or other document (including exhibits) filed with, or furnished to, the SEC and publicly available after December 31, 2014 and prior to the date hereof

10

(the “Filed SEC Documents”), other than any risk factor disclosures in any such Filed SEC Document contained in the “Risk Factors” section or any forward-looking statements within the meaning of the Securities Act or the Exchange Act thereof (it being acknowledged that nothing disclosed in the Filed SEC Documents shall be deemed to qualify or modify the representations and warranties set forth in Sections 3.02(a), 3.03, 3.11 and 3.12):

Section 3.01 Organization; Standing. (a) The Company is a corporation duly organized and validly existing under the Laws of the State of Maryland, is in good standing with the SDAT and has all requisite corporate power and corporate authority necessary to carry on its business as it is now being conducted, except (other than with respect to the Company’s due organization and valid existence) as would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect. The Company is duly licensed or qualified to do business and is in good standing (where such concept is recognized under applicable Law) in each jurisdiction in which the nature of the business conducted by it or the character or location of the properties and assets owned or leased by it makes such licensing or qualification necessary, except where the failure to be so licensed, qualified or in good standing would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect. True and complete copies of the Company Charter Documents are included in the Filed SEC Documents.

(b) Each of the Company’s Subsidiaries is duly organized, validly existing and in good standing (where such concept is recognized under applicable Law) under the Laws of the jurisdiction of its organization, except where the failure to be so organized, existing and in good standing would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect.

Section 3.02 Capitalization. (a) The authorized capital stock of the Company consists of 500,000,000 shares of Common Stock and 100,000,000 shares of preferred stock, par value $0.01 per share (“Company Preferred Stock”), of which 1,500,000 shares of Series A Junior Participating Preferred Stock, par value $0.01 per share, are authorized and 3,000,000 shares of Series A Preferred Stock, par value $0.01 per share, will be authorized as of the Closing. At the close of business on November 9, 2015 (the “Capitalization Date”), (i) 170,277,395 shares of Common Stock were issued and outstanding (and no Company Restricted Shares were issued and outstanding), (ii) 16,849,159 shares of Common Stock were reserved and available for issuance pursuant to the Company Stock Plans, (iii) 1,052,649 shares of Common Stock were subject to outstanding Company Stock Options, (iv) 3,185,209 Company RSUs were outstanding pursuant to which a maximum of 3,185,209 shares of Common Stock could be issued, (v) 1,928,057 Company PSUs were outstanding pursuant to which a maximum of 2,889,515 shares of Common Stock could be issued (assuming maximum achievement of all applicable performance conditions), (vi) 1,270,315 shares of Common Stock were reserved and available for purchase under the Company’s Employee Stock Purchase Plan and (vii) no shares of Company Preferred Stock were issued or outstanding.

11

(b) Except as described in this Section 3.02, as of the Capitalization Date, there were (i) no outstanding shares of capital stock of, or other equity or voting interests in, the Company, (ii) no outstanding securities of the Company convertible into or exchangeable for shares of capital stock of, or other equity or voting interests in, the Company, (iii) no outstanding options, warrants, rights or other commitments or agreements to acquire from the Company, or that obligate the Company to issue, any capital stock of, or other equity or voting interests (or voting debt) in, or any securities convertible into or exchangeable for shares of capital stock of, or other equity or voting interests in, the Company other than obligations under the Company Plans in the ordinary course of business, (iv) no obligations of the Company to grant, extend or enter into any subscription, warrant, right, convertible or exchangeable security or other similar agreement or commitment relating to any capital stock of, or other equity or voting interests in, the Company (the items in clauses (i), (ii), (iii) and (iv) being referred to collectively as “Company Securities”) and (v) no other obligations by the Company or any of its Subsidiaries to make any payments based on the price or value of any Company Securities. There are no outstanding agreements of any kind which obligate the Company or any of its Subsidiaries to repurchase, redeem or otherwise acquire any Company Securities (other than pursuant to the cashless exercise of Company Stock Options or the forfeiture or withholding of Taxes with respect to Company Stock Options, Company Restricted Shares, Company RSUs or Company PSUs), or obligate the Company to grant, extend or enter into any such agreements relating to any Company Securities, including any agreements granting any preemptive rights, subscription rights, anti-dilutive rights, rights of first refusal or similar rights with respect to any Company Securities. None of the Company or any Subsidiary of the Company is a party to any stockholders’ agreement, voting trust agreement, registration rights agreement or other similar agreement or understanding relating to any Company Securities or any other agreement relating to the disposition, voting or dividends with respect to any Company Securities. All outstanding shares of Common Stock have been duly authorized and validly issued and are fully paid, nonassessable and free of preemptive rights.

Section 3.03 Authority; Noncontravention. (a) The Company has all necessary corporate power and corporate authority to execute and deliver this Agreement and the other Transaction Agreements and to perform its obligations hereunder and thereunder and to consummate the Transactions. The execution, delivery and performance by the Company of this Agreement and the other Transaction Agreements, and the consummation by it of the Transactions, have been duly authorized by the Board and no other corporate action on the part of the Company is necessary to authorize the execution, delivery and performance by the Company of this Agreement and the other Transaction Agreements and the consummation by it of the Transactions. This Agreement has been duly executed and delivered by the Company and, assuming due authorization, execution and delivery hereof by the Purchasers, constitutes a legal, valid and binding obligation of the Company, enforceable against the Company in accordance with its terms, except that such enforceability (i) may be limited by bankruptcy, insolvency, fraudulent transfer, reorganization, moratorium and other similar Laws of general application affecting or relating to the enforcement of creditors’ rights generally and (ii) is subject to general principles of equity, whether considered in a proceeding at law or in equity (the “Bankruptcy and Equity Exception”).

12

(b) Neither the execution and delivery of this Agreement or the other Transaction Agreements by the Company, nor the consummation by the Company of the Transactions, nor performance or compliance by the Company with any of the terms or provisions hereof or thereof, will (i) conflict with or violate any provision of (A) the Company Charter Documents or (B) the similar organizational documents of any of the Company’s Subsidiaries or (ii) assuming that the authorizations, consents and approvals referred to in Section 3.04 are obtained prior to the Closing Date and the filings referred to in Section 3.04 are made and any waiting periods thereunder have terminated or expired prior to the Closing Date, (x) violate any Law or Judgment applicable to the Company or any of its Subsidiaries or (y) assuming that the consent referred to in Section 6.02(d) is obtained, violate or constitute a default (or constitute an event which, with notice or lapse of time or both, would violate or constitute a default) under any of the terms or provisions of any loan or credit agreement, indenture, debenture, note, bond, mortgage, deed of trust, lease, sublease, license, contract or other agreement (each, a “Contract”) to which the Company or any of its Subsidiaries is a party or accelerate the Company’s or, if applicable, any of its Subsidiaries’ obligations under any such Contract, except, in the case of clause (i)(B) and clause (ii), as would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect.

Section 3.04 Governmental Approvals. Except for (a) the filing of the Articles Supplementary with the SDAT and the acceptance for record by the SDAT of the Articles Supplementary pursuant to the MGCL, (b) filings required under, and compliance with other applicable requirements of the HSR Act and (c) compliance with any applicable state securities or blue sky laws, no consent or approval of, or filing, license, permit or authorization, declaration or registration with, any Governmental Authority is necessary for the execution and delivery of this Agreement and the other Transaction Agreements by the Company, the performance by the Company of its obligations hereunder and thereunder and the consummation by the Company of the Transactions, other than such other consents, approvals, filings, licenses, permits or authorizations, declarations or registrations that, if not obtained, made or given, would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect.

Section 3.05 Company SEC Documents; Undisclosed Liabilities. (a) The Company has filed with the SEC, on a timely basis, all required reports, schedules, forms, statements and other documents required to be filed by the Company with the SEC pursuant to the Exchange Act since January 1, 2014 (collectively, the “Company SEC Documents”). As of their respective SEC filing dates, the Company SEC Documents complied as to form in all material respects with the requirements of the Securities Act, the Exchange Act or the Sarbanes-Oxley Act of 2002 (and the regulations promulgated thereunder), as the case may be, applicable to such Company SEC Documents, and none of the Company SEC Documents as of such respective dates (or, if amended prior to the date hereof, the date of the filing of such amendment, with respect to the disclosures that are amended) contained any untrue statement of a material fact or omitted to state a material fact required to be stated therein or necessary in order to make the statements therein, in light of the circumstances under which they were made, not misleading.

13

(b) The consolidated financial statements of the Company (including all related notes or schedules) included or incorporated by reference in the Company SEC Documents complied as to form, as of their respective dates of filing with the SEC, in all material respects with the published rules and regulations of the SEC with respect thereto, have been prepared in all material respects in accordance with GAAP (except, in the case of unaudited quarterly statements, as permitted by Form 10-Q of the SEC or other rules and regulations of the SEC) applied on a consistent basis during the periods involved (except (i) as may be indicated in the notes thereto or (ii) as permitted by Regulation S-X) and fairly present in all material respects the consolidated financial position of the Company and its consolidated Subsidiaries as of the dates thereof and the consolidated results of their operations and cash flows for the periods shown (subject, in the case of unaudited quarterly financial statements, to normal year-end adjustments).

(c) Neither the Company nor any of its Subsidiaries has any liabilities of any nature (whether accrued, absolute, contingent or otherwise) that would be required under GAAP, as in effect on the date hereof, to be reflected on a consolidated balance sheet of the Company (including the notes thereto) except liabilities (i) reflected or reserved against in the balance sheet (or the notes thereto) of the Company and its Subsidiaries as of September 30, 2015 (the “Balance Sheet Date”) included in the Filed SEC Documents, (ii) incurred after the Balance Sheet Date in the ordinary course of business, (iii) as expressly contemplated by this Agreement or otherwise incurred in connection with the Transactions, (iv) that have been discharged or paid prior to the date of this Agreement or (v) as would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect.

(d) The Company has established and maintains, and at all times since January 1, 2014 has maintained, disclosure controls and procedures and a system of internal controls over financial reporting (as such terms are defined in paragraphs (e) and (f), respectively, of Rule 13a-15 under the Exchange Act) as required by Rule 13a-15 under the Exchange Act. Neither the Company nor, to the Company’s Knowledge, the Company’s independent registered public accounting firm, has identified or been made aware of “significant deficiencies” or “material weaknesses” (as defined by the Public Company Accounting Oversight Board) in the design or operation of the Company’s internal controls over and procedures relating to financial reporting which would reasonably be expected to adversely affect in any material respect the Company’s ability to record, process, summarize and report financial data, in each case which has not been subsequently remediated.

Section 3.06 Absence of Certain Changes. Since January 1, 2015 through the date of this Agreement (a) except for the execution and performance of this Agreement and the discussions, negotiations and transactions related thereto and any transaction of the type contemplated by this Agreement or other extraordinary transaction, the business of the Company and its Subsidiaries has been carried on and conducted in all material respects in the ordinary course of business and (b) there has not been any Material Adverse Effect or any event, change or occurrence that would, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect. Since September 30, 2015 through the date of this Agreement, the Company has

14

not taken any actions which, had such actions been taken after the date of this Agreement, would have required the written consent of the Purchasers pursuant to Section 5.01.

Section 3.07 Legal Proceedings. Except as would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect, to the Knowledge of the Company, as of the date of this Agreement, there is no (a) pending or threatened legal or administrative proceeding, suit, investigation, arbitration or action (an “Action”) against the Company or any of its Subsidiaries or (b) outstanding order, judgment, injunction, ruling, writ or decree of any Governmental Authority (“Judgments”) imposed upon the Company or any of its Subsidiaries, in each case, by or before any Governmental Authority.

Section 3.08 Compliance with Laws; Permits.

(a) The Company and each of its Subsidiaries are and since January 1, 2014 have been, in compliance with all state or federal laws, common law, statutes, ordinances, codes, rules or regulations or other similar requirement enacted, adopted, promulgated, or applied by any Governmental Authority (“Laws”) or Judgments, in each case, that are applicable to the Company or any of its Subsidiaries, except as would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect. The Company and each of its Subsidiaries hold all licenses, franchises, permits, certificates, approvals and authorizations from Governmental Authorities (“Permits”) necessary for the lawful conduct of their respective businesses, except where the failure to hold the same would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect.

(b) The Company and each of its Subsidiaries is, and since January 1, 2013 has been, in material compliance with (x) the Foreign Corrupt Practices Act of 1977 and any rules and regulations promulgated thereunder, (y) any other Laws applicable to the Company and its Subsidiaries, in each country in which they operate, that address the prevention of corruption and (z) all regulations, orders or other financial restrictions administered by the Office of Foreign Assets Control of the United States Treasury Department (“OFAC”), including OFAC’s Specially Designated Nationals List. Except as would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect, neither the Company nor any of its Subsidiaries maintain or need any national security clearance or authorization to access classified information or facilities to perform any current business or proposed business.

Section 3.09 Tax Matters. Except as would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect: (a) the Company and each of its Subsidiaries has prepared (or caused to be prepared) and timely filed (taking into account valid extensions of time within which to file) all Tax Returns required to be filed by any of them, and all such filed Tax Returns (taking into account all amendments thereto) are true, complete and accurate, (b) all Taxes owed by the Company and each of its Subsidiaries that are due (whether or not shown on any Tax Return) have been timely paid except for Taxes which are being contested in good faith by appropriate

15

proceedings and which have been adequately reserved against in accordance with GAAP, (c) no examination or audit of any Tax Return relating to any Taxes of the Company or any of its Subsidiaries or with respect to any Taxes due from or with respect to the Company or any of its Subsidiaries by any Governmental Authority is currently in progress or threatened in writing and (d) none of the Company or any of its Subsidiaries has engaged in, or has any liability or obligation with respect to, any “listed transaction” within the meaning of Treasury Regulations Section 1.6011-4(b)(2).

Section 3.10 Environmental Matters. Except as would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect, (a) the Company and each of its Subsidiaries has complied since January 1, 2013 with and is in compliance with all applicable Laws relating to pollution or the protection of the environment or natural resources (“Environmental Laws”), and the Company has not received any written notice since January 1, 2013 (or prior to such time if not previously resolved) alleging that the Company is in violation of or has liability under any Environmental Law, (b) the Company and its Subsidiaries possess and have complied since January 1, 2013 with and are in compliance with all Permits required under Environmental Laws for the operation of their respective businesses, (c) there is no Action under or pursuant to any Environmental Law or environmental Permit that is pending or, to the Knowledge of the Company, threatened in writing against the Company or any of its Subsidiaries, (d) neither the Company nor any of its Subsidiaries has become subject to any Judgment imposed by any Governmental Authority under which there are uncompleted, outstanding or unresolved obligations on the part of the Company or its Subsidiaries arising under Environmental Laws, (e) neither the Company nor any of its Subsidiaries has any liabilities or obligations arising from the Company’s or any of its Subsidiaries’ management disposal or release of, or exposure of any Person to, any hazardous or toxic substance, or any owned or operated property or facility contaminated by any such substance and (f) neither the Company nor any of its Subsidiaries has by contract or operation of law assumed responsibility or provided an indemnity for any liability of any other Person relating to Environmental Laws.

Section 3.11 No Rights Agreement; Anti-Takeover Provisions. (a) The Company is not party to a stockholder rights agreement, “poison pill” or similar anti-takeover agreement or plan.

(b) Assuming the accuracy of the representations and warranties set forth in Section 4.05, the approval by the Board referred to in Section 3.03(a) constitutes the only action necessary to render inapplicable to this Agreement and the Transactions the restrictions of Sections 3-601 through 3-605 of the MGCL, to the extent such restrictions would be applicable to this Agreement or the Transactions. Assuming the accuracy of the representations and warranties set forth in Section 4.05, as a result of the approval by the Board referred to in Section 3.03(a), (i) no other “business combination,” “control share acquisition,” “fair price,” “moratorium” or other anti-takeover Laws (each, a “Takeover Law”) apply or will apply to the Company pursuant to this Agreement or the Transactions and (ii) the Board has taken all such actions required such that the Purchasers shall not be “interested stockholders” as defined in Section 3-601(j) of the MGCL as a result of the consummation of the Transactions.

(c) Pursuant to Section 3-603(c) of the MGCL, the Board, by resolution adopted under Section 3-603(c) of the MGCL and made irrevocable, has exempted from the provisions of Section 3-602 of the MGCL, any Business Combination (as defined in Section 3-601(e) of the MGCL) between the Company and any one or more of any Purchaser or any affiliate or associate (as such terms are defined in Section 3-601 of the MGCL) of any Purchaser.

16

Section 3.12 Brokers and Other Advisors. Except for Atlas Strategic Advisors, LLC, J.P. Morgan Securities LLC and Merrill Lynch, Pierce, Fenner & Smith Incorporated, the fees and expenses of which will be paid by the Company, no broker, investment banker, financial advisor or other Person is entitled to any broker’s, finder’s, financial advisor’s or other similar fee or commission, or the reimbursement of expenses in connection therewith, in connection with the Transactions based upon arrangements made by or on behalf of the Company or any of its Subsidiaries.

Section 3.13 Sale of Securities. Assuming the accuracy of the representations and warranties set forth in Section 4.08, the sale of the shares of Series A Preferred Stock pursuant to this Agreement is exempt from the registration and prospectus delivery requirements of the Securities Act and the rules and regulations thereunder. Without limiting the foregoing, neither the Company nor, to the Knowledge of the Company, any other Person authorized by the Company to act on its behalf, has engaged in a general solicitation or general advertising (within the meaning of Regulation D of the Securities Act) of investors with respect to offers or sales of Series A Preferred Stock, and neither the Company nor, to the Knowledge of the Company, any Person acting on its behalf has made any offers or sales of any security or solicited any offers to buy any security, under circumstances that would cause the offering or issuance of Series A Preferred Stock under this Agreement to be integrated with prior offerings by the Company for purposes of the Securities Act that would result in none of Regulation D or any other applicable exemption from registration under the Securities Act to be available, nor will the Company take any action or steps that would cause the offering or issuance of Series A Preferred Stock under this Agreement to be integrated with other offerings by the Company.

Section 3.14 Listing and Maintenance Requirements. The Common Stock is registered pursuant to Section 12(b) of the Exchange Act and listed on the NYSE, and the Company has taken no action designed to, or which to the Knowledge of the Company is reasonably likely to have the effect of, terminating the registration of the Common Stock under the Exchange Act or delisting the Common Stock from the NYSE, nor has the Company received as of the date of this Agreement any notification that the SEC or the NYSE is contemplating terminating such registration or listing.

Section 3.15 Status of Securities. As of the Closing, the Acquired Shares will be duly classified pursuant to applicable provisions of the Company Charter Documents and the MGCL and such Acquired Shares, any shares of Series A Preferred Stock to be issued as PIK Dividends (as defined in the Articles Supplementary) and the shares of Common Stock issuable upon conversion of any of the foregoing shares will be, when issued, duly authorized by all necessary corporate action on the part of the

17

Company, validly issued, fully paid and nonassessable and issued in compliance with all applicable federal and state securities laws and will not be subject to preemptive rights of any other stockholder of the Company, and will be free and clear of all Liens, except restrictions imposed by the Securities Act, Section 5.08 and any applicable securities Laws. The shares of Series A Preferred Stock to be issued as PIK Dividends (as defined in the Articles Supplementary) and the shares of Common Stock issuable upon conversion of the Acquired Shares have been duly reserved for issuance. The respective rights, preferences, privileges, and restrictions of the Series A Preferred Stock and the Common Stock are as stated in the Company Charter Documents (including the Articles Supplementary) or as otherwise provided by applicable Law.

Section 3.16 Indebtedness. Except with respect to the covenants contained in (a) the Credit Agreement or (b) the Indentures, the Company is not party to any material Contract, and is not subject to any provision in the Company Charter Documents or resolutions of the Board that, in each case, by its terms prohibits or prevents the Company from paying dividends in form and the amounts contemplated by the Articles Supplementary. The Company and its Subsidiaries are not in material breach of, or default or violation under, the Credit Agreement or the Indentures.

Section 3.17 No Other Representations or Warranties. Except for the representations and warranties made by the Company in this Article III and in any certificate or other document delivered in connection with this Agreement, neither the Company nor any other Person acting on its behalf makes any other express or implied representation or warranty with respect to the Series A Preferred Stock, the Common Stock, the Company or any of its Subsidiaries or their respective businesses, operations, properties, assets, liabilities, condition (financial or otherwise) or prospects, notwithstanding the delivery or disclosure to the Purchasers or any of their Representatives of any documentation, forecasts or other information with respect to any one or more of the foregoing, and the Purchasers acknowledges the foregoing. In particular, and without limiting the generality of the foregoing, except for the representations and warranties made by the Company in this Article III and in any certificate or other document delivered in connection with this Agreement, neither the Company nor any other Person makes or has made any express or implied representation or warranty to the Purchasers or any of their Representatives with respect to (a) any financial projection, forecast, estimate, budget or prospect information relating to the Company, any of its Subsidiaries or their respective businesses or (b) any oral or written information presented to the Purchasers or any of their Representatives in the course of its due diligence investigation of the Company, the negotiation of this Agreement or the course of the Transactions or any other transactions or potential transactions involving the Company and the Purchasers.