Form 8-K MOSAIC CO For: Aug 02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 2, 2016

THE MOSAIC COMPANY

(Exact name of registrant as specified in its charter)

Delaware | 001-32327 | 20-1026454 | ||

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) | ||

3033 Campus Drive Suite E490 Plymouth, Minnesota | 55441 | |

(Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (800) 918-8270

Not applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02. Results of Operations and Financial Condition.

The following information is being “furnished” in accordance with General Instruction B.2. of Form 8-K and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as expressly set forth by specific reference in such filing:

On August 2, 2016, The Mosaic Company hosted a conference call discussing its financial results for the quarter ended June 30, 2016. Furnished herewith as Exhibits 99.1 and 99.2 and incorporated by reference herein are copies of the transcript of the conference call and slides that were shown during the webcast of the conference call.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

Reference is made to the Exhibit Index hereto with respect to the exhibits furnished herewith. The exhibits listed in the Exhibit Index hereto are being “furnished” in accordance with General Instruction B.2. of Form 8-K and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, nor shall they be deemed to be incorporated by reference in any filing under the Securities Act or the Exchange Act, except as expressly set forth by specific reference in such filing.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

THE MOSAIC COMPANY | ||||||

Date: August 4, 2016 | By: | /s/ Mark J. Isaacson | ||||

Name: | Mark J. Isaacson | |||||

Title: | Senior Vice President, General Counsel | |||||

and Corporate Secretary | ||||||

EXHIBIT INDEX

Exhibit No. | Description | |

99.1 | Transcript of conference call of The Mosaic Company held on August 2, 2016 | |

99.2 | Slides shown during the webcast of the conference call of The Mosaic Company held on August 2, 2016 | |

The Mosaic Co. | MOS | Q2 2016 Earnings Call | Aug. 2, 2016 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

PARTICIPANTS

Corporate Participants

Laura C. Gagnon – Vice President, Investor Relations, The Mosaic Co.

James C. O’Rourke – President, Chief Executive Officer & Director, The Mosaic Co.

Mike Rahm – Vice President of Market and Strategic Analysis, The Mosaic Co.

Richard L. Mack – Chief Financial Officer & Executive Vice President, The Mosaic Co.

Richard N. McLellan – Senior Vice President-Commercial, The Mosaic Co.

Other Participants

Carl Chen – Analyst, Scotia Capital, Inc. (Broker)

Adam Samuelson – Analyst, Goldman Sachs & Co.

Don Carson – Analyst, Susquehanna Financial Group LLLP

Jeffrey J. Zekauskas – Analyst, JPMorgan Securities LLC

Christopher S. Parkinson – Analyst, Credit Suisse Securities (USA) LLC (Broker)

Sandy H. Klugman – Analyst, Vertical Research Partners LLC

Jonas Oxgaard – Analyst, Sanford C. Bernstein & Co. LLC

P.J. Juvekar – Analyst, Citigroup Global Markets, Inc. (Broker)

Joel Jackson – Analyst, BMO Capital Markets (Canada)

Andrew Wong – Analyst, RBC Dominion Securities, Inc.

Mark Connelly – Analyst, CLSA Americas LLC

Edlain Rodriguez – Analyst, UBS Securities LLC

Vincent Stephen Andrews – Analyst, Morgan Stanley & Co. LLC

Yonah Weisz – Analyst, HSBC Bank Plc (Tel Aviv Branch)

MANAGEMENT DISCUSSION SECTION

Operator: Good morning, ladies and gentlemen, and welcome to The Mosaic Company Second Quarter 2016 Earnings Conference Call. At this time, all participants have been placed in a listen-only mode. After the company completes their prepared remarks, the lines will be open to take your questions.

Your host for today’s call is Laura Gagnon, Vice President, Investor Relations of The Mosaic Company. Ms. Gagnon, you may begin.

Laura C. Gagnon, Vice President, Investor Relations

Thank you, and welcome to our second quarter 2016 earnings call. Presenting today will be Joc O’Rourke, President and Chief Executive Officer; and Rich Mack, Executive Vice President and Chief Financial Officer; and Dr. Mike Rahm, Vice President, Strategy and Market Analysis. We also have other members of the senior leadership team available to answer your questions after our prepared remarks. The presentation slides we are using during the call are available on our website at mosaicco.com.

1

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2016 CallStreet |

The Mosaic Co. | MOS | Q2 2016 Earnings Call | Aug. 2, 2016 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

We will be making forward-looking statements during this conference call. The statements include but are not limited to statements about future financial and operating results. They are based on management’s beliefs and expectations as of today’s date and are subject to significant risks and uncertainties. Actual results may differ materially from projected results. Factors that could cause actual results to differ materially from those in the forward-looking statements are included in our press release issued this morning and in our reports filed with the Securities and Exchange Commission.

In addition, during this call, we will present both GAAP and non-GAAP financial measures. Reconciliations of GAAP to non-GAAP measures are in today’s press release.

Now, I’d like to turn the call over to Joc.

James C. O’Rourke, President, Chief Executive Officer & Director

Good morning. Thank you for joining our second quarter earnings discussion. Today, we’re going to discuss two primary topics; the market environment and the actions we’re taking to ensure Mosaic is competitive at all points in the cycle. Let’s start with the markets.

We thought it would be useful for you to hear directly from Dr. Mike Rahm, who leads Market and Strategic Analysis for Mosaic. Mike has been analyzing global agriculture and fertilizer markets for decades. So it’s safe to say that he understands a wide range of market conditions. Mike.

Mike Rahm, Vice President of Market and Strategic Analysis, The Mosaic Co.

Thanks, Joc. Let me start by acknowledging the obvious. Industry phosphate and potash margins have declined significantly as evident in our earnings so far this year, as well as our third quarter guidance. The drivers of the downturn range from a collapse of key phosphate and potash currencies to the deferral of demand this year to elevated channel inventories to the startup or even the expectation of the startup of new capacity.

Buyer sentiment remains cautious for several reasons, such as volatile crop prices and exchange rate uncertainties. But we do think the global supply and demand balance is not as far out of kilter as current prices indicate. More importantly, low prices are causing material adjustments on both the supply and demand side of the ledger. High cost production is moving offline and demand is accelerating, especially in key growth markets.

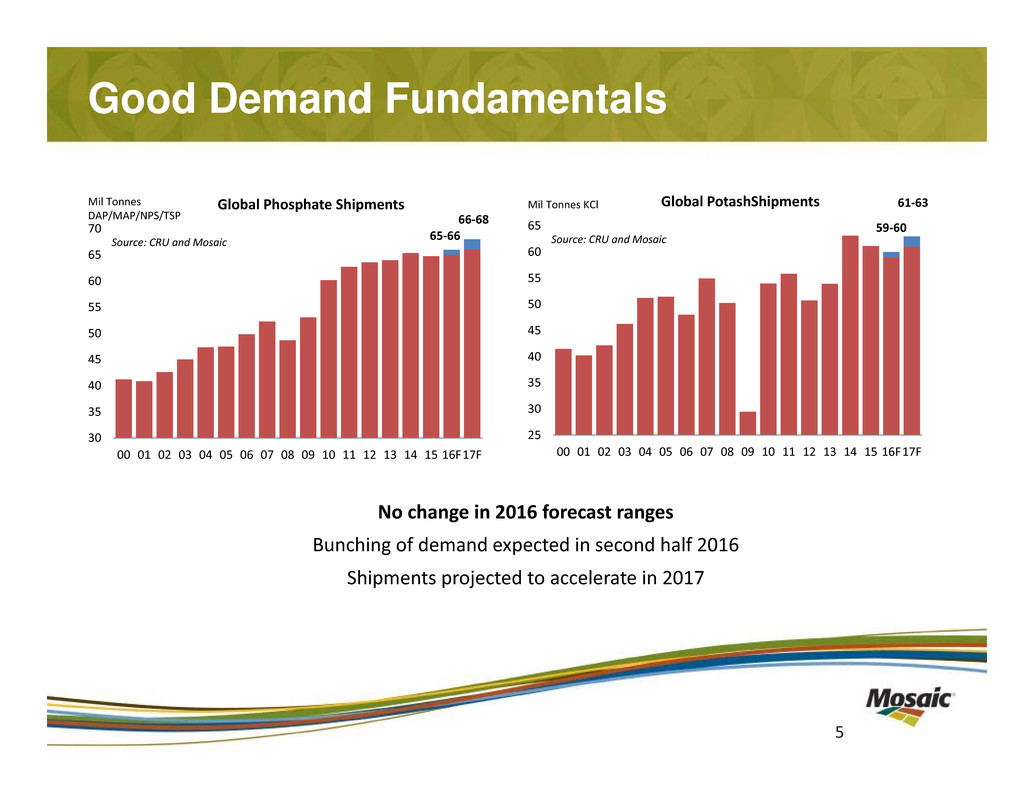

On the demand side, prospects remain solid. In fact, we have not changed our P&K shipment guidance for 2016. We still project that global phosphate shipments will total 65 million tons to 66 million tons this year and global MLP shipments will total 59 million tons to 60 million tons, despite the long delays in settling contracts with Chinese and Indian buyers.

Furthermore, we see a high likelihood of seasonal bunching of demand for both P&K in the second half of the year. Our first look at 2017 indicates that phosphate shipments are forecast to climb to 66 million tons to 68 million tons and global MLP shipments are projected to increase to 61 million tons to 63 million tons next year.

Several economic and agronomic factors underpins constructive outlook. First, plant nutrients remain affordable despite lower and volatile crop prices. In fact, our affordability metric at the end of

2

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2016 CallStreet |

The Mosaic Co. | MOS | Q2 2016 Earnings Call | Aug. 2, 2016 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

July indicated that plant nutrients were 21% more affordable than the average since 2010. It is worth noting that our affordability metric is calculated using only corn, soybean and wheat prices, and crop prices are not moving in lockstep. Corn, soybean and wheat prices have fallen, while other prices, including sugar, cotton and coffee have increased significantly this year.

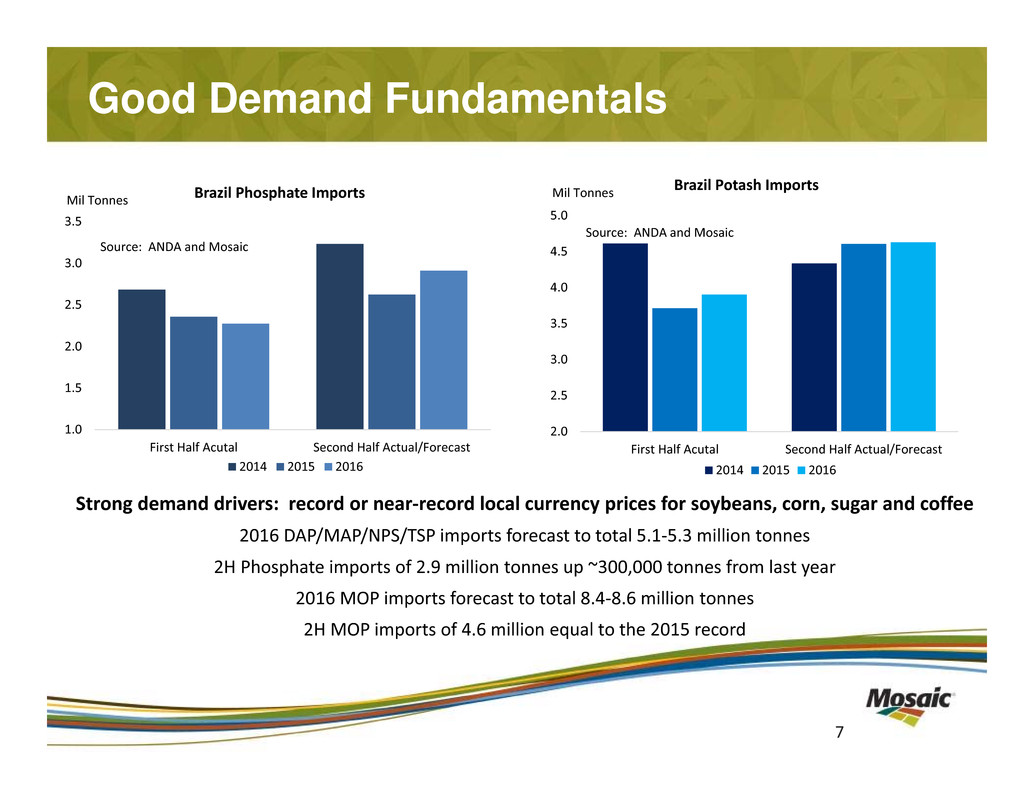

Second, shipment prospects are bolstered by the pull-down of channel inventory so far this year, especially throughout the Americas. Our sales team tells us that channel inventories are thin, heading into what is expected to be another very good fall application season in North America. In Brazil, the most recent statistics show that phosphate and potash inventories throughout the distribution channel shrunk nearly 600,000 tons and almost 200,000 tons, respectively, during the first half of this year.

Third, Brazilian demand forecast just keep getting revised higher and higher, despite the chaotic political backdrop, a volatile exchange rate and tight farm credit. That is not a surprise given record-high local currency prices for soybeans, corn, sugar, cotton and coffee. Based on record first half shipments, our team now projects that total fertilizer shipments will top 32 million tons this year, up 10% from forecast just six months ago. Shipments this year could best the previous high mark of 32.2 million tons in 2014.

Fourth, demand in India looks to be back on a solid growth trajectory. The monsoon is delivering above average rainfall across nearly all of the country for the first time in three years. In addition, the combination of lower international prices, modest cuts in subsidies and a relatively stable rupee has resulted in declines in retail DAP and MAP prices of roughly 15% and 30%, respectively, and sets the stage for strong P&K use. Demand prospects in other Latin American and Asian countries, such as Argentina and Pakistan, remain positive. Furthermore, significant demand is emerging from other regions, such as the former Soviet Union and Africa that are not necessarily on most radar screens.

On the supply side of the ledger, several adjustments have occurred and more are underway today. In the case of phosphate, China has shuttered capacity as evidenced by the 1.5 million ton decline in DAP, MAP and TSP exports during the first half of this year. Restructuring of China’s large phosphate sector is beginning to take place and plans outlined at the national phosphate and compound fertilizer industry association’s annual conference in May called for the permanent closure of outdated facilities with capacity of 3 million tons of P2O5 or the equivalent of 6.5 million tons of DAP by the end of this decade.

In the case of potash, large producers continue to optimize operations by idling or shutting down higher cost facilities and maximizing operating rates at lower cost facilities in order to compete with producers who have benefited from a collapse of their currencies. For example, all of the North American facilities that were at the right end of every estimate of the industry cost curve have closed. The closure of six North American mines has resulted in a net loss of 2.25 million tons of capacity.

Finally, foreign exchange tailwinds are beginning to diminish for some producers. Currencies like the ruble are recovering along with the price of oil. Inflation, as expected, is picking up in these countries, and most importantly, P&K prices have come down significantly. In our view, the large drop in potash prices is more the result of the collapse that keep potash currencies rather than a surge of new capacity. This is an important part of our thesis that fundamentals are in better balance than current P&K prices would indicate.

In summary, adjustments are taking place in response to low prices and margins. Demand is beginning to accelerate and high cost capacity is shutting down. As a result, we project relatively stable global phosphate and potash operating rates through the rest of this decade. While we’re not

3

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2016 CallStreet |

The Mosaic Co. | MOS | Q2 2016 Earnings Call | Aug. 2, 2016 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

wildly bullish, we see some positive developments that markets seem to be ignoring or discounting for now.

Joc?

James C. O’Rourke, President, Chief Executive Officer & Director

Thanks for that insight, Mike. Clearly, the current environment is very challenging even with the strong global demand Mike described. While this weak part of the cycle has been more pronounced than we anticipated, we do understand commodity businesses are cyclical and that the troughs can be difficult. We also understand the imperative to navigate the troughs while enhancing our ability to outperform in better times. We are taking the necessary actions to do just that. We’re conserving cash and protecting our balance sheet so that we can continue to meet our customers’ needs and seek opportunities to drive future shareholder value.

We’ve taken a number of steps to reduce costs. First, we’re well on our way to achieving the five-year $500 million expense reduction goal we established almost three years ago. The cuts have been implemented across the business.

Second, on our last earnings call, we told you that we are targeting an additional $75 million in savings in our support functions. With the actions we took in June, we are well on our way to achieving that goal.

Third, we are continuing to optimize our assets, so that we can produce enough crop nutrients to meet our customers’ demands while reducing our cost per ton. With the decision to idle our Colonsay Potash Mine for the remainder of 2016, we will be able to meet market demand with our lower-cost Belle Plaine and Esterhazy mines, as well as our existing potash inventory.

And fourth, we’re managing our capital carefully without starving our operations or risking employee safety. We are deferring or permanently eliminating capital spending when and where we can.

All these decisions have reduced our costs. Our MOP cash production cost per ton came in this quarter at $98 per ton, which included $21 per ton of brine management costs. For the first half of 2016, our MOP cash costs came in at $93 per ton, which is $74 of direct production costs and $19 per ton of brine management costs. This was comparable to last year, despite a much lower operating rate. It is important to highlight that every big producer has its own cost curve, mine by mine, and you can see ours on this slide.

When we run our Esterhazy and Belle Plaine mines at optimal rates, as we intend to do in the second half of 2016 with Colonsay down, we can achieve significantly lower costs. Esterhazy is capable of achieving direct production cash cost per ton close to $50 when we eliminate brine management costs in the mid-2020s. And Belle Plaine can produce at approximately $70 per ton. As a reminder, we look at our costs excluding brine expenses because brine management is largely a fixed cost. As you know, we have a plan to eliminate brine expenses over time. Our costs are also well controlled in phosphate, even with lower operating rates.

So, we are making good progress, but we’re not conserving cash just to weather the market storm. We are mindful that opportunities arise at the low points of the cycle and especially when the low point lasts longer than usual. Of course, we will maintain our strategic discipline as we consider potential opportunities.

4

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2016 CallStreet |

The Mosaic Co. | MOS | Q2 2016 Earnings Call | Aug. 2, 2016 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

In total, yes, the business environment is challenging, but we believe in the bright future of this industry and of Mosaic. We are managing aggressively to ensure the company’s competitiveness for now and for better markets. It is in times like this that management can make a real difference.

Now, before we take your questions, I’ll ask Rich Mack to provide a bit more detail on the quarter, as well as our guidance.

Richard L. Mack, Chief Financial Officer & Executive Vice President

Thanks, Joc. I would like to reiterate the key points made by both Mike and Joc. No doubt, our markets are challenging right now, with prices failing to rise even with strong global demand. That said though, we do expect conditions to improve in the second half of the year. Mosaic has the ability to withstand challenging conditions longer, if necessary, and to thrive as market prices improve.

As a reminder, Mosaic has a $2.5 billion liquidity buffer which remains untapped. So we continue to have ample financial flexibility even during this down part of the cycle.

The notable items this quarter, which netted out to a negative $37 million or $0.09 a share, included $69 million in after-tax charges that reflect our deliberate focus on reducing spend and preserving cash. We recorded charges for severance, the write-down of the initial construction of a second ammonia barge and for our share of the decision not to pursue a Canpotex port project at Prince Rupert.

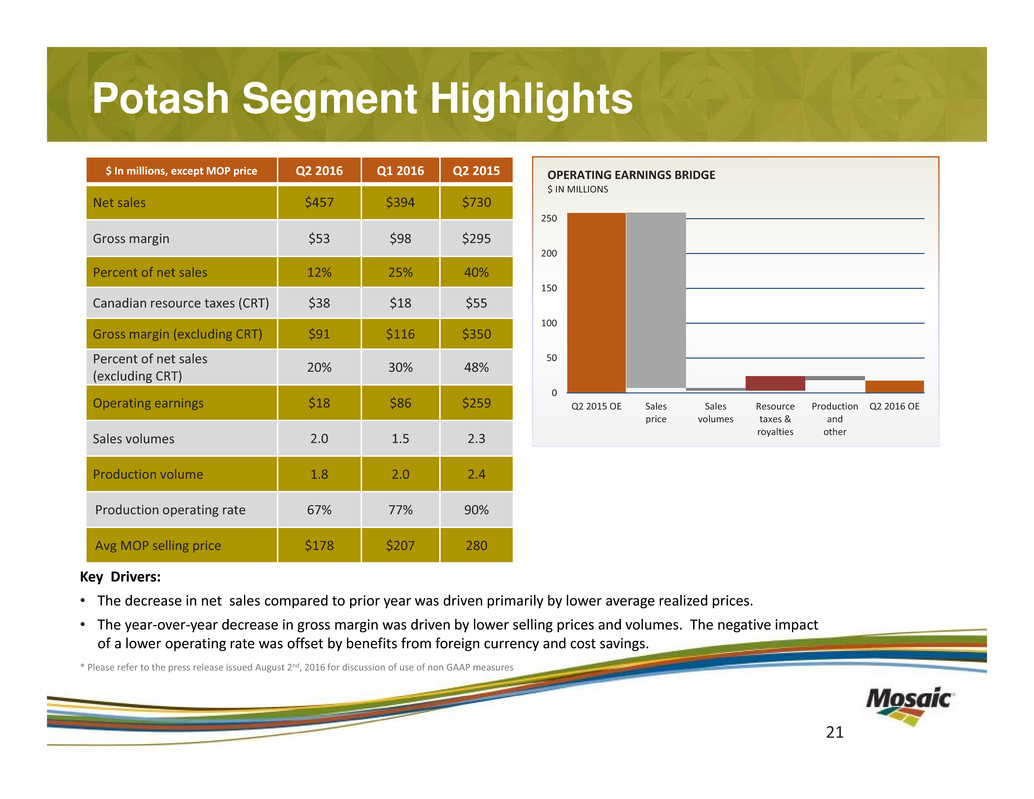

Now, I’d like to provide a brief review of our results and our expectations for each segment. In Potash, our sales volumes for the second quarter were within our guidance range, which anticipated a lack of shipments to India and China. Prices fell further during the quarter, with Mosaic recording an average realized price of $178 per ton. With uncertainty in China and India now resolved, we expect that the pricing floor is now established, with the third quarter potash prices to be in the range of $160 per ton to $175 per ton, which reflects a heavier mix of lower-priced export sales.

As Joc noted, the Colonsay shutdown will lead to a lower operating rate of around 65%. Notwithstanding Colonsay, however, we are maintaining our annual sales guidance of 7.5 million tons to 8.0 million tons of potash. In the second quarter, our Potash gross margin rate was 12%, and 20% excluding Canadian resource taxes. As you know, we have been relentlessly focused on costs, which has helped us maintain reasonable margins during the downturn. In the third quarter, we expect gross margin rate to decline as a result of lower prices and the impact of a lower operating rate.

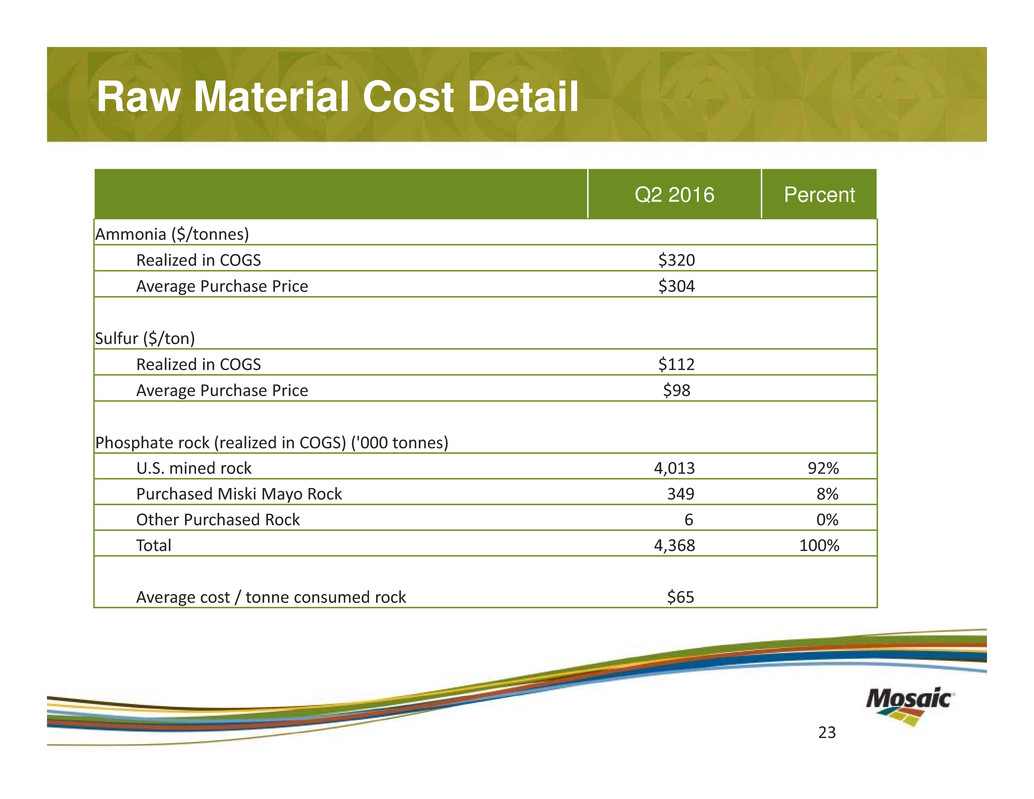

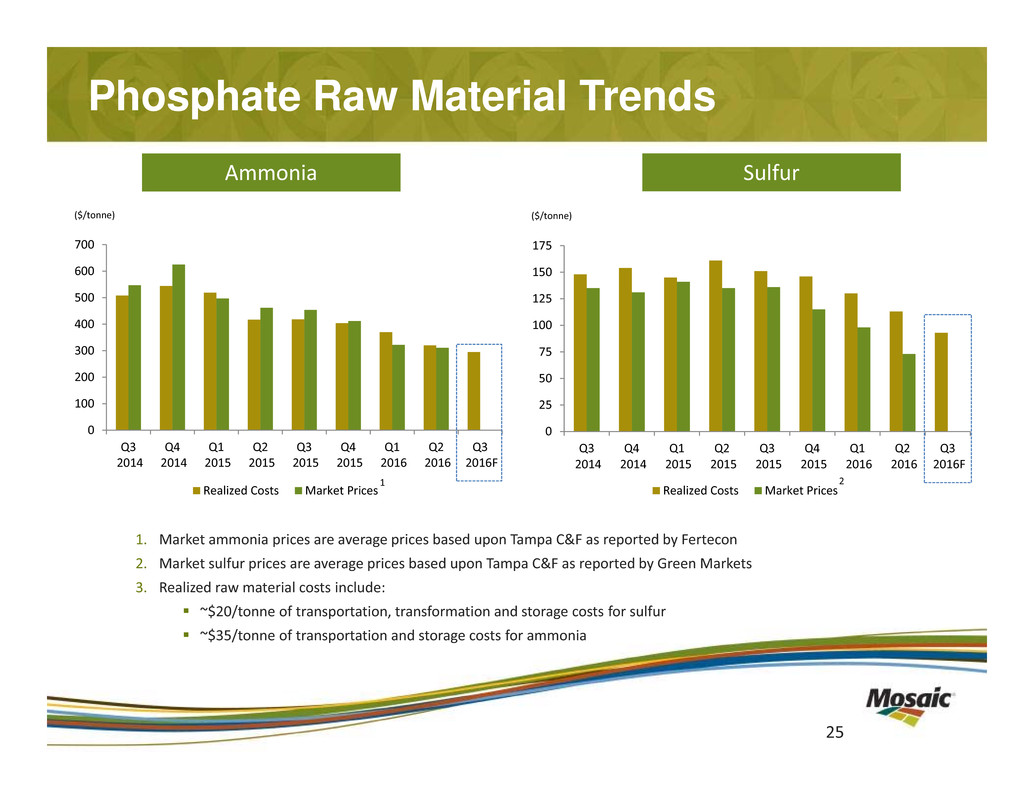

In Phosphates, second quarter sales volumes were well within our guidance ranges as global demand remained strong. Our average realized price came in at the low end of our guidance range while raw material costs also declined. The result was a gross margin rate of 10%, which was in line with our expectations. We expect the gross margin rate in Phosphates to stay around 10% in the third quarter with additional benefit from lower sulphur and ammonia costs, offsetting expected lower realized prices and higher phosphate rock costs. We plan to run our phosphate facilities at a relatively high operating rate in order to meet North American fall demand. Our guidance for third quarter Phosphate sales is 2.4 million tons to 2.7 million tons.

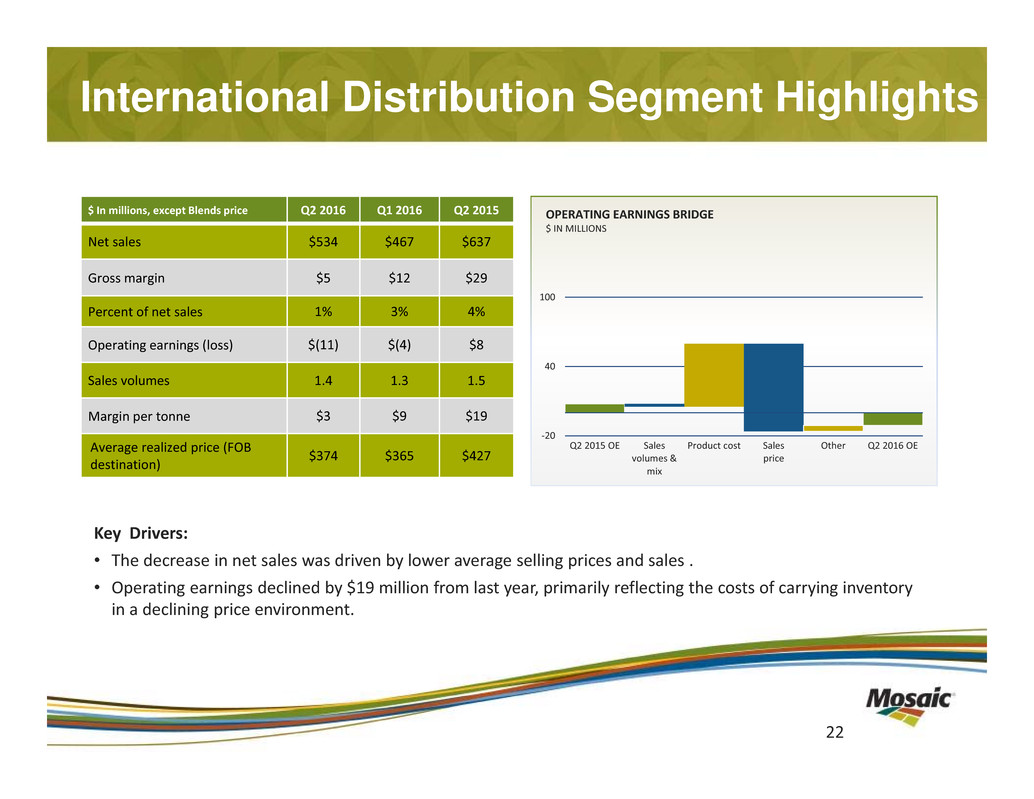

In the International Distribution segment, as Mike noted, demand is strong in Brazil and India, and the agricultural situation in both of these key regions remains promising. Our margins in International Distribution continue to be muted by lower fertilizer prices. For the third quarter, we

5

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2016 CallStreet |

The Mosaic Co. | MOS | Q2 2016 Earnings Call | Aug. 2, 2016 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

expect International Distribution sales to be in the range of 2.1 million tons to 2.4 million tons and a sequential improvement in profitability with the gross margin dollars per ton in the $15 to $20 range, which assumes a stable real.

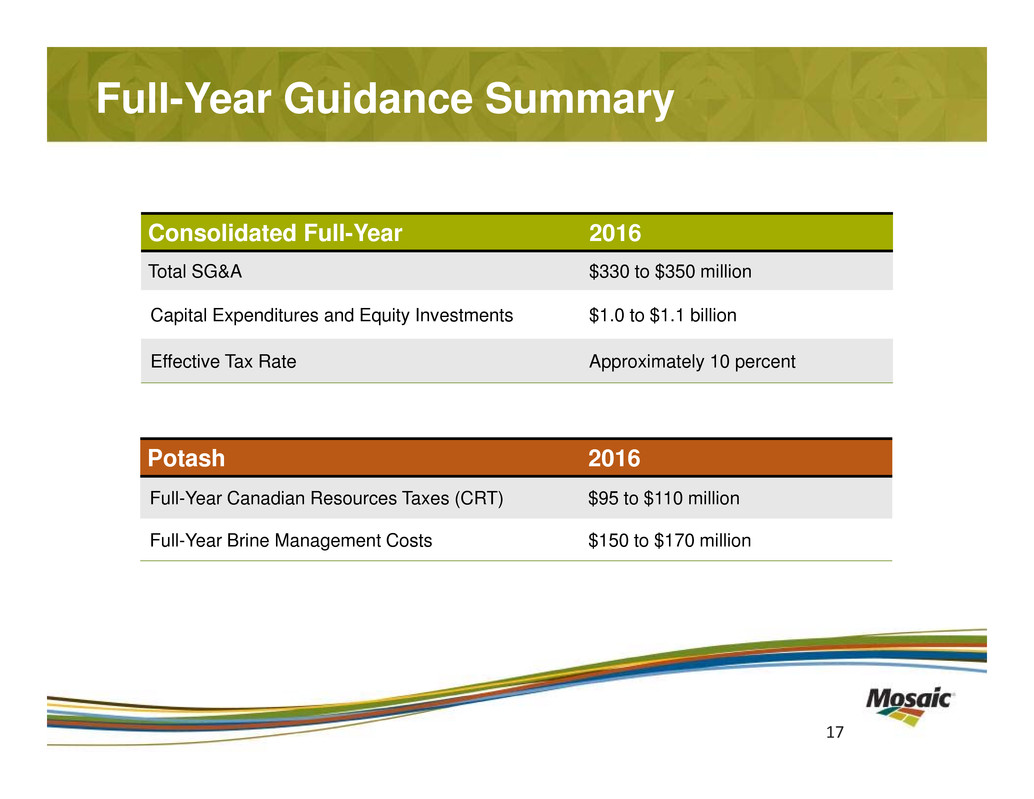

We have lowered again our full year SG&A guidance to be in the range of $330 million to $350 million, down from the initial guidance of $350 million to $370 million. Just as a reminder, SG&A at Mosaic was $394 million in 2013 prior to the CF and ADM acquisitions. We have also lowered our capital expenditures by an additional $50 million this quarter to a range of $750 million to $850 million, which is in addition to our investment in the Ma’aden joint venture, which was $220 million in 2016.

Because of the lower expected earnings, we are revising our effective tax rate guidance to be around 10% for 2016. We have also lowered our expected full year brine management costs from $150 million to $170 million compared to our prior estimate of $160 million to $180 million. Finally, we expect Canadian resource taxes to range from $95 million to $110 million in 2016.

To summarize, we continue to benefit from our strong financial foundation and we are pulling the necessary levers to ensure that we can compete across the cycle. We now have the long desired clarity on China and India potash needs. And along with strong global demand and supply adjustments, we believe potash prices have bottomed and we see potential for modest price increases in the second half of the year. In what we believe will be an improving environment, we will continue to assess the market and our respective balance sheet and capital management positions and we will adapt as necessary as the business environment evolves.

With that, I’m going to turn the call back over to Joc to moderate our Q&A session.

James C. O’Rourke, President, Chief Executive Officer & Director

Thanks, Rich. Operator, please open the call for questions.

6

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2016 CallStreet |

The Mosaic Co. | MOS | Q2 2016 Earnings Call | Aug. 2, 2016 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

QUESTION AND ANSWER SECTION

Operator: [Operator Instructions] And your first question comes from the line of Ben Isaacson from Scotiabank. Your line is open.

<Q – Carl Chen – Scotia Capital, Inc. (Broker)>: Hi. This is Carl Chen stepping in for Ben. Thank you for taking my question. Joc, now that you have lowered your CapEx guidance for the past two quarters, is this largely a function of project ramp-up deferral or is there a cost savings baked in there as well? And how should we think about the K3 ramp-up schedule going forward?

<A – Joc O’Rourke – The Mosaic Co.>: Thanks, Carl. Good morning. Let me start by describing how we think about CapEx in general. We prioritize all of our capital based on what is most critical to maintaining our operations and of course, what’s critical to maintaining the safety of all of our employees. That we certainly will not compromise. What we have looked at is capital that we feel that we can defer with limited risk to operational continuity. It may incur slightly higher costs in terms of operating over a short-term. But we believe that the cash conservation is valuable.

In terms of K3, our thinking has been ancillary equipment, any of those type costs, yes, we will consider. But we are being very cognizant that we want to maintain the critical path of the K3 project. So, on that basis, we’re taking out costs we believe we can defer, but making sure we’re not compromising the integrity of our business.

Operator: Your next question comes from the line of Adam Samuelson from Goldman Sachs. Your line is open.

<Q – Adam Samuelson – Goldman Sachs & Co.>: Yes. Thanks. Good morning, everyone. Maybe a couple of questions on phosphate, if you don’t mind. Maybe, first, in the quarter, and you alluded to in the third quarter as well, your rock costs have been higher. Maybe a little bit more clarity about the drivers there. Second, you deferred or you canceled the second ammonia barge related to the CF ammonia contract for next year. Can you talk about what volume capability that gives you under the terms of that agreement, if you can still take the full volumes, or if not, if there’s any penalties associated with that? And then finally, on phosphate, just want to get your thoughts on India for the second half and confidence on DAP imports? Thank you.

<A – Joc O’Rourke – The Mosaic Co.>: Okay. Thanks, Adam. Let me just put these in some order here. Okay. Let me take them one at a time and I’ll probably hand the India second quarter over to Rick [Rick McLellan] and Mike. But let me talk on rock costs. Clearly, on the long-term, we’ve been able to manage our rock costs extremely well in our Phosphate business. What’s happening today is we’ve run into some, what I would call, short-term geology changes that have meant that the grade or the amount of ore that we’re able to pull per ton of mining’s decreased at our Four Corners Mine. It’s one portion of the mine. We’re talking about a decade-long reserves. And sometimes those are variable. Sometimes we hit areas where the rock quality is much higher than we expect, and other times we hit rock quality that’s maybe lower than what we expect. We do expect it to be transitory. And on the long-term, we hold with our expectations of superior rock costs.

In terms of the ammonia barge, yes, we certainly can move full volumes with one ammonia barge. We have a little less buffer, I guess, would be the way I would put it, and maybe five years or six years from now when we have to have some statutory shutdowns of those barges for repairs, there may be short periods of time where we’ll have to come up with different plans. But overall, we believe we’ve managed the risk very well while still conserving as much cash as we can.

7

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2016 CallStreet |

The Mosaic Co. | MOS | Q2 2016 Earnings Call | Aug. 2, 2016 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

Now, in terms of India’s second half, I’m just going to hand that straight over to Mike and let him talk about that.

<A – Mike Rahm – The Mosaic Co.>: Okay. Good morning, Adam. Yes, why don’t I give you some numbers and, Rick, you can provide some color commentary here. Yes, in general, the outlook in India remains very positive. As you know, the monsoon is delivering above average rainfall. Retail prices for DAP are off about 15%. The rupee has been very stable compared to other currencies. And finally, importer margins, given all those parameters, are profitable. So, all the stars and moons are lined up to make import economics work. We’re projecting about 5.6 million tons of imports this calendar year in India. First half of the year, they imported 1.8 million. That would leave about 3.8 million tons second half of the year that we think they need to import into the country.

And so that’s a big number. That’s 500,000 tons more than what they did last year which was a very good second half for them. And on the comments here, we mentioned the bunching of demand in the second half of the year. I guess if you put the 3.8 million tons that India has to import alongside the 2.9 million tons we think Brazil needs to import, plus the prospects for a good North American season, we do believe that there will be some pretty strong seasonal pulls on shipments second half of the year.

<Q – Adam Samuelson – Goldman Sachs & Co.>: Thank you. Got it.

Operator: Your next question comes from the line of Don Carson from Susquehanna. Your line is open.

<Q – Don Carson – Susquehanna Financial Group LLLP>: Yes. Thank you. Question on capital allocation, you talked about being positioned to buy assets at the bottom of the cycle. I know you’ve been looking at phosphate assets in Brazil. I guess the question would be, with the upcoming Ma’aden investment, why would you be looking to expand your phosphate production capability via acquisition, particularly given where your own shares are trading, which would seem to be at a lower multiple of replacement costs than an acquisition might be?

<A – Joc O’Rourke – The Mosaic Co.>: Okay. Thank you, Don. Between Rich and I, we’ll answer that question. Let me start by saying, we fundamentally believe that some of the best opportunities come at the low part of the cycle. So, we’ll continue to look at those opportunities. However, we’ll always continue to be prudent with how we manage our balance sheet and our investment-grade balance sheet in particular. We always look for opportunities that add long-term shareholder value. And I think we’ve said it before, each time we look at those, though, we measure those against the value of buying back our own shares and how that looks for the long-term. So, we’ll always take into account our normal capital allocation requirements and priorities and then balance the opportunity against that and the long-term opportunity it gives us.

Rich, do you want to add some color there?

<A – Rich Mack – The Mosaic Co.>: Sure. Thanks, Joc, and hi, Don. The only thing that I would say is, if you go back and you take a look at the history of Mosaic and really even the formation of Mosaic, there are periods of time when there are very strategic assets that do become available for sale and compelling opportunities do arise. And so, that has been our history in a number of acquisitions likely to continue to be our history as we move forward. But I think, as Joc noted, anything that we do has got to have a very high strategic fit, and it goes through a very high bar in terms of an investment analysis. And so, certainly, one of the things that we would look at is the opportunity cost of not repurchasing our own shares.

<A – Joc O’Rourke – The Mosaic Co.>: And I guess the last thing to leave this with is, fundamentally, we believe there’s room for consolidation in both the Phosphates and the Potash

8

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2016 CallStreet |

The Mosaic Co. | MOS | Q2 2016 Earnings Call | Aug. 2, 2016 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

industry, and we believe that there could be some real value-added by that consolidation. So, we’re certainly not against consolidation and we think there could be some value-added.

Operator: Your next question comes from the line of Jeff Zekauskas from JPMorgan. Your line is open.

<Q – Jeff Zekauskas – JPMorgan Securities LLC>: Hi. Good morning. I think in your quarter, your adjusted corporate gross margin was about negative $34 million. Why was that, in that it’s much larger than what you had in the first quarter? Why is your tax rate going to 10% and why in the future is there no more Canadian resource tax guidance?

<A – Joc O’Rourke – The Mosaic Co.>: I’m going to hand that straight to Rich, because it’s a fairly technical question. Did you...

<A – Rich Mack – The Mosaic Co.>: Yes. I think I got it, Jeff. There’s an elimination of profit in inventory in the corporate segment that really relates to the buildup of inventory in Brazil in anticipation of a large season coming up there.

And then with respect to the Canadian resource taxes, the increase this quarter was generally related to a catch-up accrual of about $10 million. And also, you have to take into account where the production is occurring and what the profitability is on a mine-by-mine basis. And so with the shutdown of Colonsay and less production there, more production coming out of Esterhazy and Belle Plaine, in particular, leads to a slightly higher Canadian resource taxes this quarter, which I would expect to fall back to what I’ll call more normal levels in Q3 and Q4.

And just as a reminder, this year, year-to-date, Canadian resource taxes are just slightly more than, I’ll say, $50 million compared to last year, where they were about $130 million to $140 million.

Operator: Your next question comes from the line of Chris Parkinson from Credit Suisse. Your line is open.

<Q – Chris Parkinson – Credit Suisse Securities (USA) LLC (Broker)>: Perfect. Thank you very much. Can you just offer a little more commentary on your expectations for Phosphate margins as we head into the latter half of the – second half of 2016, and even into 2017 given the current trends you’re seeing in ammonia, sulfur, some of the cost-cutting efforts you’ve made? But also your expectations for quarterly Phosphate op expenses, just any color would be appreciated. Thank you.

<A – Joc O’Rourke – The Mosaic Co.>: So, three questions if I understand it. Phosphate margins as we head into quarter three and quarter four, and then a look at 2017, is that correct, Chris?

<Q – Chris Parkinson – Credit Suisse Securities (USA) LLC (Broker)>: Sure. That’s it generally. Thank you.

<A – Joc O’Rourke – The Mosaic Co.>: And then operating expenses, of course.

<Q – Chris Parkinson – Credit Suisse Securities (USA) LLC (Broker)>: Yes.

<A – Joc O’Rourke – The Mosaic Co.>: Okay. I think it’s probably best just to hand that straight to Rick and Mike to talk about how we’re looking at this next quarter.

<A – Rick McLellan – The Mosaic Co.>: Yes. I think Mike covered it in his prepared comments, talking about bunching of demand. And as we look at what we’ve faced so far for margins, we’ve seen impact from a strong U.S. dollar, deferred buying, and effectively some increased pipeline

9

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2016 CallStreet |

The Mosaic Co. | MOS | Q2 2016 Earnings Call | Aug. 2, 2016 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

inventories at our customers’ hands. Those have cleaned themselves out, so we expect good North American and South American demand. A good indicator of South American demand is the fact that our Distribution business took $300 million in prepayments from customers for all fertilizer products, which means that farmers there, it underpins the 32 million ton overall demand forecast that we talked about for Brazil. So, as we go through the quarter – through the third quarter and into the fourth quarter, we see margins improving as demand starts to bunch up in all of those markets; India, Brazil, Argentina and North America.

<A – Joc O’Rourke – The Mosaic Co.>: Mike, do you have any...

<A – Mike Rahm – The Mosaic Co.>: I guess the only thing I would add is, I think it may get interesting sort of from the middle of September to the middle of November as far as the seasonal bunching. And I think we’re beginning to see evidence of a price uplift from demand finally coming to the market. Barge prices have increased. C&F price in Brazil has moved up here recently. And we know that raw material prices for sulfur in the third quarter have come down $5, ammonia prices at $2.70 for August, and we don’t see much of a threat in terms of any uptick in those, and potentially more downside as well. So, put that all together and as we said, we’re not wildly bullish, but we think that the combination of all of that is going to improve margins as we head into late third quarter and into the first part of fourth quarter.

<A – Joc O’Rourke – The Mosaic Co.>: Let me just sort of pull that together really quickly. Basically, what we’re seeing is an increase in demand. So, we see a volume increase, which should lead to better costs in general because of the better usage of our assets. And then in terms of margins, we’re probably – a minor ability to improve from sulfur and ammonia perspective. So, we see the costs being fairly flat to down because of a higher operating rate. And then in terms of going forward into 2017, again, we see this market as fairly well balanced. So, we think 2017 should be a fairly good year for our Phosphate business.

<Q – Chris Parkinson – Credit Suisse Securities (USA) LLC (Broker)>: Okay. That’s helpful color. And just very quickly, just most producers that have reported, as well as some of your international peers, have increased North American potash shipments fairly significantly during the first half of the year. And it also looks like you just tweaked or cut your regional guidance on demand a bit. So, can you just comment on what you believe inventory levels are relative to the beginning of the second quarter, and then how you expect this to flow into the summer fill tons and eventually the fall, just any change there? And then also whether or not you’ve seen an increase in consignment tons. Thank you.

<A – Joc O’Rourke – The Mosaic Co.>: Okay. I’m going to hand that back to Rick and Mike again to talk about our inventories and regional inventories.

<A – Rick McLellan – The Mosaic Co.>: Yes. Good morning. I’ll start with just saying, what our sales team has come back and reported is that after a very good spring, where buyers bought their last ton of both potash and phosphate, inventories, pipeline inventories in the hands of retailers and distributors in North America have been drawn down. And they’re at lower levels than they were last year. We see continued movement in kind of a summer fill program happening right now and prices – uptake of those have been good in both P&K. And for ourselves, we have agreements with customers where we separate shipment from invoicing our FPD program. And frankly, we’re seeing people step in and buy product that’s in inventory right now as well as buy product that’s coming to them. So, frankly, we see very good, solid position.

Mike?

<A – Mike Rahm – The Mosaic Co.>: Yes, in terms of the numbers, the North American potash market has been a pretty stable market for a long time, despite all of the cries and concerns about

10

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2016 CallStreet |

The Mosaic Co. | MOS | Q2 2016 Earnings Call | Aug. 2, 2016 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

cutbacks in application rates. In 2015 calendar year, we think shipments were about 8.9 million tons. And we think this year they’ll inch up a little bit to 9 million tons and then drop off back to about 8.9 million tons. But I think the important point there is when you look at imports, imports surged to, by our count, about 1.4 million metric tons in calendar year 2015. Those have come down. We think 2016 will end the year with 1 million tons and probably another reduction in 2017, largely because of the big price discount in North America that’s just not as attractive to move tons into North America now. And there are better options with decent demand prospects in other parts of the world.

<Q – Chris Parkinson – Credit Suisse Securities (USA) LLC (Broker)>: Perfect. Thank you very much.

Operator: Your next question comes from the line of Sandy Klugman from Vertical Research. Your line is open.

<Q – Sandy Klugman – Vertical Research Partners LLC>: Good morning. You highlighted the strength of the Brazilian agricultural industry. So, can you comment on the credit environment and what type of access to capital Brazilian growers currently have for fertilizer purchases?

<A – Joc O’Rourke – The Mosaic Co.>: Thank you, Sandy. Let me start by saying we are seeing a great deal of improvement in terms of access to capital. I’m going to hand that to Rick to talk a little more in detail about it. But in general, we’re seeing, as you’ve heard already, we’re seeing a really good start to the second half of the year in Brazil, including a record prepay. And that record prepay is a good indication of credit availability.

Rick, do you want to just give a little more color there?

<A – Rick McLellan – The Mosaic Co.>: Yes. I think that what we’re seeing – no, I don’t think. I know that what we’re seeing there is at times when the grain market has been where it’s at and the currency has been frankly where it’s at today, those Brazilian farmers had stepped in because the cost of crop nutrients compared to the price of grain is probably at its best level that it’s been in, in the last 12 years. And so, we’re seeing farmers step up.

Credit availability in a marketplace like Brazil that’s still developing is always going to be an issue. But we don’t see any constriction to what we’re selling there from a credit availability standpoint.

<A – Joc O’Rourke – The Mosaic Co.>: I’d just add, regardless of the conditions, they’re getting the job done. Our first half shipments of all fertilizer products in Brazil were at a record level, 13.2 million metric tons, the largest amount of fertilizer that’s ever been shipped in the first half of the year. So, as we said, despite the political chaos, exchange rate concerns, credit concerns, they’re getting fertilizer to the farm.

Operator: Your next question comes from the line of Jonas Oxgaard from Bernstein. Your line is open.

<Q – Jonas Oxgaard – Sanford C. Bernstein & Co. LLC>: Morning, guys.

<A – Joc O’Rourke – The Mosaic Co.>: Good morning, Jonas.

<Q – Jonas Oxgaard – Sanford C. Bernstein & Co. LLC>: A question on the cash generation. Your earnings is almost nothing, yet you generate as much cash as you did last year in this quarter. Can you comment on that?

11

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2016 CallStreet |

The Mosaic Co. | MOS | Q2 2016 Earnings Call | Aug. 2, 2016 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

<A – Joc O’Rourke – The Mosaic Co.>: Yes. We can comment on that, for sure. And I’ll hand it to Rich to really give it the detail. But I think, the biggest piece of that is what we’ve just mentioned. I think some number of $360 million worth of prepay into Brazil is a heck of a lot of cash coming in and really makes a big difference to how we’re setting up for the second half of the year.

Rich, do you want to go through the full details on that?

<A – Rich Mack – The Mosaic Co.>: Yes, it’s prepay which is a large percentage of it, Jonas. And then it is favorable working capital adjustments during the quarter. But you’re right. It led to a very strong cash flow of nearly $600 million.

<A – Joc O’Rourke – The Mosaic Co.>: And I don’t want to miss taking credit for some of the costs that we’ve actually reduced and some of the expenditures we haven’t made, which again has conserved cash through this period.

Operator: Your next question comes from the line of P.J. Juvekar from Citigroup. Your line is open.

<Q – P.J. Juvekar – Citigroup Global Markets, Inc. (Broker)>: Thank you and good morning. Quickly, I have a question on potash and you were expecting potash volume growth of 4% next year, driven by inventory build. And my question is really on China, but can the inventory situation, or destocking, continue next year? I look at Chinese potash inventories and they’re down from the peak, but they’re still quite high at 2 million tons. And then Qinghai Salt Lake is also adding about 0.5 million ton capacity in 2016 and 2017. So, when you look at that, why do you think Chinese potash import will continue to grow?

<A – Joc O’Rourke – The Mosaic Co.>: Okay, P.J., I’m going to hand a lot of this over to Mike Rahm, who does a heck of a lot of work on the world S&D for potash, obviously. But we do see a rundown of Chinese inventory over this year. We continue to see more product go to the actual ground, which is – what gets shipped is one thing. What actually gets used to produce crops is really what matters in the long-term. So, we do see China’s need for potash fertilizer in particular continuing to grow, and they will have to supply that in the years to come as they have in the years past.

But with that, I’m going to hand it to Mike to talk about the details of the S&D.

<A – Mike Rahm – The Mosaic Co.>: Okay. Good morning, P.J. Yes, China, as you know, is a big complicated country. And frankly, I think there’s something going on there in terms of potash consumption. I think all the numbers would suggest that maybe potash consumption is a little bit better than everyone is giving China credit for.

Just to review some of the numbers, China imported a record 9.4 million tons last year. We think they’ve produced about 6.6 million tons and shipments, probably in that 16 million ton range. So, there’s a little bit of an inventory build last year. We think that’s getting pulled down. Our shipment number this year is 12.9 million tons. We think it’ll increase to 13.9 million tons next year. So, imports, we think imports this year probably will be in that 8 million ton range, so down from last year, and it probably stays in that range in 2017.

The other factor, you mentioned Qinghai Salt Lake, our team in Beijing believes that production has dropped this year, probably closer to 6 million tons to 6.2 million tons. So, while there’s some additional capacity coming on, I think there’s been some adjustment in terms of domestic production in response to the current price environment as well. But I think the bottom line is we don’t have a record shipment number factored in for China next year. And we think the imports are going to be relatively stable at about 8 million tons.

12

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2016 CallStreet |

The Mosaic Co. | MOS | Q2 2016 Earnings Call | Aug. 2, 2016 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

<A – Joc O’Rourke – The Mosaic Co.>: And let me just talk a little bit about the port inventories, which I think you mentioned at 2 million tons. I believe our last number was about 1.8 million tons. But remember, 1 million tons of that is in bonded warehouses, which will now get turned into sales fairly quickly. So, the actual port inventory of non-bonded warehouses isn’t as high as all that. And the other thing you have to consider in China is upcountry inventory, which I think can play a big, big role in this. And what we’re hearing from both our own distribution team and from Canpotex is those upcountry inventories are certainly being depleted now. So, thanks, P.J.

Operator: Your next question comes from the line of Joel Jackson from BMO Capital Markets. Your line is open.

<Q – Joel Jackson – BMO Capital Markets (Canada)>: Hi. Good morning. When would you make a decision whether Colonsay would be ramped back up for 2017? What would be the factors around it? It seems like, considering some of the different things going on in the industry, the Rocanville proving run, the legacy ramp, your demand projection, you might not need the Colonsay tons for some time.

And a second question as well which would be, you did not lower your dividend like one of your Canpotex partners did last week. You’re running maybe around 200% payout ratio right now. What would have to happen for you to revise your dividend? Thanks.

<A – Joc O’Rourke – The Mosaic Co.>: Okay, Joel, thank you for those questions. First, Colonsay, I mean, Colonsay’s decision is clearly how do we meet our customer needs while optimizing our overall cost and cash output. So, we’ll have to make another decision on Colonsay towards the end of the year. Our expectation at this stage is we will bring it up in January as per what we’ve previously announced. I mean, really the deciding factor there will be how much we think we’ll need for our spring season and how well-positioned we are at the end of the year for that spring season. But at this stage, we’re expecting we will bring up Colonsay in January.

In terms of the dividend, look, at this point, we don’t plan to cut our dividend as you’ve said. We see the fundamentals improving in the second half of the year which mitigates the need for a dividend cut. Now, if the markets don’t improve or if they deteriorate, we may have to revisit the affordability of our dividend.

However, just let me point out in the first half of the year, we generated sufficient cash to cover all of our commitments including capital and our dividend. So, our $1 billion of cash is still intact and our $2.5 billion liquidity buffer is still intact. So, we don’t see an impending need to review our dividend at this stage. We leave that open that we may in the future. And, Rich, do you want to just add anything to that?

<A – Rich Mack – The Mosaic Co.>: Yes, I would just say, Joel, that obviously it’s something that we closely monitor and we’ll continue to closely monitor in the future, Joc noted. And we have a conservative liquidity buffer of $2.5 billion. Interestingly enough, we’ve never really dipped into the liquidity buffer in our history, and we’ve got over $1 billion of cash on the balance sheet. And at the same time, we’re reducing our cash spend. So, we’re lowering our capital, we’re reducing our SG&A. We’re maximizing working capital as much as we possibly can. And so this is something that we’ll continue to review, obviously with the mindset of maintaining a solid investment-grade credit rating going forward.

Operator: Your next question comes from the line of Andrew Wong from RBC Capital Markets. Your line is open.

<Q – Andrew Wong – RBC Dominion Securities, Inc.>: Hi. Good morning. Thank you. Could you remind us on some of your CapEx requirements? How much is left for Esterhazy K3 and what’s the

13

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2016 CallStreet |

The Mosaic Co. | MOS | Q2 2016 Earnings Call | Aug. 2, 2016 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

timing and CapEx requirements for phosphate mine development? I don’t think we’ve had an update on that in a while. And then just on your targeted leverage ratios and what that level currently is? Thanks.

<A – Joc O’Rourke – The Mosaic Co.>: Okay. So, first of all, CapEx. We are in the process today of looking at all of the opportunities and possibilities around a new phosphate mine. I think our latest says that we will need to have that in place by, I think, the 2023 type timeframe. So, certainly, we’re in the planning phase now. I’m trying to go back to our last Investor Day, where I believe we said the cost of that would be circa $600 million now that we’re expanding South Pasture Mine rather than building a brand new Ona Mine.

In terms of the capital requirements left for K3, we are largely finished the shaft sinking on K3. Our incremental cost going forward, not including what we save in taxes because of the write-downs of capital, would be in the range of $600 million. And those are for mine development, infrastructure and conveyor ways between K3, K1 and K2.

In terms of our leverage targets, I’m going to hand that straight over to Rich to give the details.

<A – Rich Mack – The Mosaic Co.>: Yes. Andrew, our leverage targets, as stated, are roughly between 1.5 times and two times. But keep in mind that that is kind of a through-cycle target. And so, at any given point, you’re going to have a spot leverage ratio that may be higher or lower than that. And so, we look at it on a through-cycle basis. Right now, we’re slightly higher than the upper end of that range, but when you take a look at it as a rating agency would look at it over, call it, a three-year to five-year period of time, we’re comfortable with where we’re at right now, and obviously we’re at the bottom end of the cycle.

Operator: Your next question comes from the line of Mark Connelly from CLSA. Your line is open.

<Q – Mark Connelly – CLSA Americas LLC>: Thank you. Just following on the K3 comments, does the goal of cutting CapEx influence how you’re thinking about that transition or managing it? Are you looking to speed it up or slow it down, or is that still up in the air?

And then the second question, do you anticipate spending more on the Brazil distribution build-out near-term? I just wonder if you could give us an update there and let us know whether you’re still seeking to expand?

<A – Joc O’Rourke – The Mosaic Co.>: Okay, Mark. Thank you. So, first of all, let’s talk about K3 and then move on to Brazil. What we’ve said today is we will continue on the critical path of K3. So, the big thing right now is finishing the shaft sinking, build the loading pockets, build the infrastructure, so that we can start mining at K3. How fast we ramp that up greatly depends on market conditions and what the needs are for product at that stage. So, that I think is going to come in a couple of years when we really know what’s going on there. But in general, I would say if times are tougher, it would push you more towards moving from K1 and K2 to K3 earlier to reduce the brine inflow costs. But I think that decision is a ways out.

In terms of Brazil distribution, we believe our footprint right now is pretty strong in Brazil. We like where we stand. Over the longer-term, we can see ourselves expanding into the Northwest into areas of Mato Grosso and towards the northern region, towards Amazonia. But in the near-term, the only expansion plans that we will consider is if we need to expand our port capacity at Paranaguá, which we may feel we need for good logistics.

Operator: Your next question comes from the line of Edlain Rodriguez from UBS. Your line is open.

14

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2016 CallStreet |

The Mosaic Co. | MOS | Q2 2016 Earnings Call | Aug. 2, 2016 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

<Q – Edlain Rodriguez – UBS Securities LLC>: Thank you. Good morning, guys. Just one quick question. Before you’ve talked about the potential for potash prices to move higher in the near-term, so, like how does the softness in crop prices play a role in farmers’ reluctance to either pay up or not, especially in the U.S.?

<A – Joc O’Rourke – The Mosaic Co.>: Thank you, Edlain. Let me start by just highlighting that, certainly, lower crop prices does impact at least the psychology of fertilizer. Having said that, fertilizer’s very affordable to the farmer right now. Our fertilizer to crop price ratio is probably as good as it’s been in a long, long time. But recognize that the impact – the soft crops prices are driven by higher yields. And those higher yields means higher fertilizer removed from the soil. And so, that in itself tends to drive higher demand.

The other thing I want to highlight on that is we talk about soft crop prices, we normally are talking about corn. If corn acres goes down in the U.S. for instance, they’ll probably be replaced by soybean acres and so likely for us, there won’t be that big an impact. And also remember, only 30% of fertilizers are used on the corn, wheat, bean complex. The rest is crops like sugar, coffee, which are doing very well.

So, with that, Mike, did you want to add anything to that?

<A – Mike Rahm – The Mosaic Co.>: Yes. I think that’s a good question, and certainly a concern that we have and monitor. I think one of the things, we had a very good run in prices in June and our intelligence tells us that farmers sold pretty heavily into that, as well as probably forward priced some of their 2016 crop. So, I don’t think you want to focus too much on current spot prices. Clearly, there’s a big crop that’s coming in shortly and that’s impacting prices now, but there’s still a fair amount of uncertainty about what happens in the Southern Hemisphere, particularly with the expectation of a La Niña event and the negative consequences that typically has towards Southern Hemisphere harvest.

So, if you look at the 2017 new crop prices, they’re still at levels that we think underpin decent demand. And as Joc said, we’re very much corn, soybean, wheat-focused and the 30% number Joc referred to is that 30% of the potash worldwide is applied to those three crops. For phosphate, it’s about 40%. So, the fact that you’re seeing dramatic increases in sugar prices, cotton prices, coffee prices, fruits and vegetables, those are the ones that are going to, I think, provide a very good demand base.

Operator: Your next question comes from the line of Vincent Andrews from Morgan Stanley. Your line is open.

<Q – Vince Andrews – Morgan Stanley & Co. LLC>: Thanks. A question on Brazil for 2017 for potash and phosphate volume, how much do you expect it to increase if you expect it to increase at all next year? And are you assuming that the current very attractive soft commodity prices there in local currency stay intact for next year?

<A – Joc O’Rourke – The Mosaic Co.>: Thank you, Vincent. I’m going to hand a lot of this over to Rick. But let me start by saying, we expect to see the growth of agricultural output and as such, the use of fertilizers to grow at about a 5% per year in Brazil over the next number of years. So, we expect that to continue.

And in terms of the softness and the underlying prices, most of the projections show a continued weak real or even a weakening real, which all bodes very well for the economics of farming in Brazil. So, we expect 2017 to be another good year. I don’t have the exact numbers. Mike can give you those. But in terms of ongoing growth, we expect 5% a year for the next number of years.

15

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2016 CallStreet |

The Mosaic Co. | MOS | Q2 2016 Earnings Call | Aug. 2, 2016 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

Mike, do you want to give the specifics there?

<A – Mike Rahm – The Mosaic Co.>: Yes. Good morning, Vincent. Yes. We see the demand continuing to grow in Brazil. We’re projecting potash shipments of about 9.1 million tons this year, increasing to 9.4 million tons next year, and of that, imports going from 8.5 million tons this year to 9 million tons next year. So, very good demand prospects there. We see the real probably remaining fairly stable. And yet the local currency prices of the key crops in Brazil remaining attractive and causing more acreage and decent input usage.

In the case of phosphate and in terms of import demand, we think imports of DAP, MAP, NPS and TSP will go from about 5.2 million tons this year to 5.6 million tons next year. And so, yes, there’s nothing at this point that we see that sort of derails the growth trajectory that we’re seeing in Brazil.

I don’t know, Rick, do you have any comments?

<A – Rick McLellan – The Mosaic Co.>: The only thing – I’d go back to something that Joc mentioned, and it’s really around farmer economics. At today’s grain prices, despite them softening and the currency where it is, returns for this crop that will be planted and harvested – planted this fall and harvested in January, February, are very, very good. And the prospects for the 2017-2018 crop are just the same. So, that really underpins demand. Farmers needing the product to get the yields that they need, plus having good, solid economics.

<A – Joc O’Rourke – The Mosaic Co.>: So, we only have time for one last question and then close this call. So, Yonah, I think it’s Yonah that’s up next.

Operator: Yonah Weisz, your line is open.

<Q – Yonah Weisz – HSBC Bank Plc (Tel Aviv Branch)>: Hi. Thank you very much for taking my question. I guess, perhaps, talking, you mentioned about Brazil and the improving environment there, which has really occurred for the most part of this year. I’m just wondering why you don’t think there’s been more leverage on that in actual potash pricing, even though demand appears to be fairly healthy?

On the same note, if you talk about bunching of demand into 2H 2016, why is your phosphate price or DAP price range at the top of its range flat with current pricing and actually shows a potential for a drop in 10% to $310 per ton?

<A – Joc O’Rourke – The Mosaic Co.>: Thank you, Yonah. So, we’ll hit these one at a time. First of all, Brazil, I think we are seeing some potash improvements in terms of near-term pricing in Brazil. There’s been some $10, $20 up in the last couple of weeks. And we expect that to continue as we get closer to their main planting season. I’ll let Rick and Mike just talk about that quickly.

And the next question is, why is pricing flat despite the bunching? I mean, we would hope for an improvement in both margin and pricing in the second half. But we need to see the demand first and then the price will follow.

<A – Mike Rahm – The Mosaic Co.>: Yes, Yonah, good morning. We said there’s some bunching in the second half. We think that the impact on price probably doesn’t show up in spades until probably the – maybe the second half of September. I talked about things probably getting interesting from the second half of September through the first half of November. And that’s when peak demand is going to be hitting in terms of shipments into the big markets, whether it’s India, Brazil, North America. And so, I think that’s reflected in our third quarter price projections.

16

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2016 CallStreet |

The Mosaic Co. | MOS | Q2 2016 Earnings Call | Aug. 2, 2016 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

<A – Rick McLellan – The Mosaic Co.>: The only thing I can add, in Brazil, you’ve seen for the first half of the year deferred buying. In the second half, they can’t defer it anymore. Inventories are used up. And so, that’s where we see some price momentum in Brazil both for P&K.

James C. O’Rourke, President, Chief Executive Officer & Director

So, to conclude our call, I just want to reinforce our key points. The business environment remains tough, but we see signs of stability and improvement. We expect strong global demand and modest improving prices in the second half of the year. At Mosaic, we’re taking the necessary actions to withstand the current environment and thrive when the markets do improve. We’re conserving cash by cutting our costs and our capital spending. We are continually looking for opportunities to create shareholder value now and into the years ahead.

So, thank you very much for joining us. Have a great day.

Operator: This concludes today’s conference. You may now disconnect.

Disclaimer

The information herein is based on sources we believe to be reliable but is not guaranteed by us and does not purport to be a complete or error-free statement or summary of the available data. As such, we do not warrant, endorse or guarantee the completeness, accuracy, integrity, or timeliness of the information. You must evaluate, and bear all risks associated with, the use of any information provided hereunder, including any reliance on the accuracy, completeness, safety or usefulness of such information. This information is not intended to be used as the primary basis of investment decisions. It should not be construed as advice designed to meet the particular investment needs of any investor. This report is published solely for information purposes, and is not to be construed as financial or other advice or as an offer to sell or the solicitation of an offer to buy any security in any state where such an offer or solicitation would be illegal. Any information expressed herein on this date is subject to change without notice. Any opinions or assertions contained in this information do not represent the opinions or beliefs of FactSet CallStreet, LLC. FactSet CallStreet, LLC, or one or more of its employees, including the writer of this report, may have a position in any of the securities discussed herein.

THE INFORMATION PROVIDED TO YOU HEREUNDER IS PROVIDED "AS IS," AND TO THE MAXIMUM EXTENT PERMITTED BY APPLICABLE LAW, FactSet CallStreet, LLC AND ITS LICENSORS, BUSINESS ASSOCIATES AND SUPPLIERS DISCLAIM ALL WARRANTIES WITH RESPECT TO THE SAME, EXPRESS, IMPLIED AND STATUTORY, INCLUDING WITHOUT LIMITATION ANY IMPLIED WARRANTIES OF MERCHANTABILITY, FITNESS FOR A PARTICULAR PURPOSE, ACCURACY, COMPLETENESS, AND NON-INFRINGEMENT. TO THE MAXIMUM EXTENT PERMITTED BY APPLICABLE LAW, NEITHER FACTSET CALLSTREET, LLC NOR ITS OFFICERS, MEMBERS, DIRECTORS, PARTNERS, AFFILIATES, BUSINESS ASSOCIATES, LICENSORS OR SUPPLIERS WILL BE LIABLE FOR ANY INDIRECT, INCIDENTAL, SPECIAL, CONSEQUENTIAL OR PUNITIVE DAMAGES, INCLUDING WITHOUT LIMITATION DAMAGES FOR LOST PROFITS OR REVENUES, GOODWILL, WORK STOPPAGE, SECURITY BREACHES, VIRUSES, COMPUTER FAILURE OR MALFUNCTION, USE, DATA OR OTHER INTANGIBLE LOSSES OR COMMERCIAL DAMAGES, EVEN IF ANY OF SUCH PARTIES IS ADVISED OF THE POSSIBILITY OF SUCH LOSSES, ARISING UNDER OR IN CONNECTION WITH THE INFORMATION PROVIDED HEREIN OR ANY OTHER SUBJECT MATTER HEREOF.

The contents and appearance of this report are Copyrighted FactSet CallStreet, LLC 2016. CallStreet and FactSet CallStreet, LLC are trademarks and service marks of FactSet CallStreet, LLC. All other trademarks mentioned are trademarks of their respective companies. All rights reserved.

17

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2016 CallStreet |

The Mosaic Company

Earnings Conference Call – Second Quarter 2016

August 2, 2016

Joc O’Rourke, President and Chief Executive Officer

Rich Mack, Executive Vice President and Chief Financial Officer

Dr. Mike Rahm, Vice President Market and Strategic Analysis

Laura Gagnon, Vice President Investor Relations

Safe Harbor Statement

This document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include,

but are not limited to, statements about the Wa’ad Al Shamal Phosphate Company (also known as MWSPC) and other proposed or pending future

transactions or strategic plans and other statements about future financial and operating results. Such statements are based upon the current beliefs and

expectations of The Mosaic Company’s management and are subject to significant risks and uncertainties. These risks and uncertainties include but are

not limited to risks and uncertainties arising from the ability of MWSPC to obtain additional planned funding in acceptable amounts and upon acceptable

terms, the timely development and commencement of operations of production facilities in the Kingdom of Saudi Arabia, the future success of current plans

for MWSPC and any future changes in those plans; difficulties with realization of the benefits of our long term natural gas based pricing ammonia supply

agreement with CF Industries, Inc., including the risk that the cost savings initially anticipated from the agreement may not be fully realized over its term or

that the price of natural gas or ammonia during the term are at levels at which the pricing is disadvantageous to Mosaic; customer defaults; the effects of

Mosaic’s decisions to exit business operations or locations; the predictability and volatility of, and customer expectations about, agriculture, fertilizer, raw

material, energy and transportation markets that are subject to competitive and other pressures and economic and credit market conditions; the level of

inventories in the distribution channels for crop nutrients; the effect of future product innovations or development of new technologies on demand for our

products; changes in foreign currency and exchange rates; international trade risks and other risks associated with Mosaic’s international operations and

those of joint ventures in which Mosaic participates, including the risk that protests against natural resource companies in Peru extend to or impact the

Miski Mayo mine; changes in government policy; changes in environmental and other governmental regulation, including expansion of the types and extent

of water resources regulated under federal law, greenhouse gas regulation, implementation of numeric water quality standards for the discharge of

nutrients into Florida waterways or efforts to reduce the flow of excess nutrients into the Mississippi River basin, the Gulf of Mexico or elsewhere; further

developments in judicial or administrative proceedings, or complaints that Mosaic’s operations are adversely impacting nearby farms, business operations

or properties; difficulties or delays in receiving, increased costs of or challenges to necessary governmental permits or approvals or increased financial

assurance requirements; resolution of global tax audit activity; the effectiveness of Mosaic’s processes for managing its strategic priorities; adverse

weather conditions affecting operations in Central Florida, the Mississippi River basin, the Gulf Coast of the United States or Canada, and including

potential hurricanes, excess heat, cold, snow, rainfall or drought; actual costs of various items differing from management’s current estimates, including,

among others, asset retirement, environmental remediation, reclamation or other environmental regulation, Canadian resources taxes and royalties, or the

costs of the MWSPC, its existing or future funding and Mosaic’s commitments in support of such funding; reduction of Mosaic’s available cash and liquidity,

and increased leverage, due to its use of cash and/or available debt capacity to fund financial assurance requirements and strategic investments; brine

inflows at Mosaic’s Esterhazy, Saskatchewan, potash mine or other potash shaft mines; other accidents and disruptions involving Mosaic’s operations,

including potential mine fires, floods, explosions, seismic events, sinkholes or releases of hazardous or volatile chemicals; and risks associated with cyber

security, including reputational loss, as well as other risks and uncertainties reported from time to time in The Mosaic Company’s reports filed with the

Securities and Exchange Commission. Actual results may differ from those set forth in the forward-looking statements.

2

Summary

3

Mosaic is Well Positioned to Weather the Cycle

Market

Environment

Mosaic’s Actions

Capital

Stewardship

Market Update

Good Demand Fundamentals

5

No change in 2016 forecast ranges

Bunching of demand expected in second half 2016

Shipments projected to accelerate in 2017

65‐66

66‐68

30

35

40

45

50

55

60

65

70

00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16F17F

Global Phosphate ShipmentsMil Tonnes

DAP/MAP/NPS/TSP

Source: CRU and Mosaic

59‐60

61‐63

25

30

35

40

45

50

55

60

65

00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16F17F

Global PotashShipmentsMil Tonnes KCl

Source: CRU and Mosaic

Good Demand Fundamentals

6

Corn, soybeans and wheat prices

are making headlines

But El Niño left its mark on several

commodities

Brazil especially benefits from high

sugar, cotton and coffee prices

10

11

12

13

14

15

16

17

18

19

20

21

Sep-15 Dec-15 Mar-16 Jun-16

US$

CWT

Source: NYMEX

Sugar Prices

Daily Close of Nearby Option

1,900

2,000

2,100

2,200

2,300

2,400

2,500

2,600

2,700

2,800

2,900

Sep-15 Dec-15 Mar-16 Jun-16

Rngts

Tonne

Source: CRB

Malaysian Palm Oil Prices

Daily Close of Nearby Option

100

110

120

130

140

150

160

Sep-15 Dec-15 Mar-16 Jun-16

US$

CWT

Source: NYMEX

Coffee Prices

Daily Close of Nearby Option

55

58

60

63

65

68

70

73

75

Sep-15 Dec-15 Mar-16 Jun-16

US$

CWT

Source: NYMEX

Cotton Prices

Daily Close of Nearby Option

Good Demand Fundamentals

7

Strong demand drivers: record or near‐record local currency prices for soybeans, corn, sugar and coffee

2016 DAP/MAP/NPS/TSP imports forecast to total 5.1‐5.3 million tonnes

2H Phosphate imports of 2.9 million tonnes up ~300,000 tonnes from last year

2016 MOP imports forecast to total 8.4‐8.6 million tonnes

2H MOP imports of 4.6 million equal to the 2015 record

1.0

1.5

2.0

2.5

3.0

3.5

First Half Acutal Second Half Actual/Forecast

Mil Tonnes

Source: ANDA and Mosaic

Brazil Phosphate Imports

2014 2015 2016

2.0

2.5

3.0

3.5

4.0

4.5

5.0

First Half Acutal Second Half Actual/Forecast

Mil Tonnes

Source: ANDA and Mosaic

Brazil Potash Imports

2014 2015 2016

Good Demand Fundamentals

8

Strong demand drivers: above‐average monsoon, lower retail P&K prices, profitable import economics

2016 DAP imports forecast to total 5.5‐5.7 million tonnes

2H DAP import arrivals projected at ~3.8 million tonnes, up ~500,000 tonnes from last year

2016 MOP imports forecast to total 4.1‐4.3 million tonnes

2H MOP import arrivals projected at ~2.9 million tonnes, up ~600,000 tonnes from last year

0.5

1.0

1.5

2.0

2.5

3.0

3.5

4.0

First Half Acutal Second Half Actual/Forecast

Mil Tonnes

Source: FAI and Mosaic

India DAP Imports

2014 2015 2016

0.0

0.5

1.0

1.5

2.0

2.5

3.0

First Half Acutal Second Half Actual/Forecast

Mil Tonnes

Source: FAI and Mosaic

India Potash Imports

2014 2015 2016

FX Impact on Supply

9

FSU exporters have benefited from a collapse of local currencies

Russian ruble and Belarussian ruble are down 45% and 50% since 2014 Q1

Brazil potash price has declined 60% in dollars but is off just 5% in Belarussian rubles since January 2012

40

50

60

70

80

90

100

110

Jan-14 Jul-14 Jan-15 Jul-15 Jan-16 Jul-16

Index

Source: CRB

Key Potash Exporter Exchange Rates

2014 Q1=100

Canadian Dollar Russian Ruble Belarus Ruble

0

750

1500

2250

3000

3750

4500

5250

6000

200

250

300

350

400

450

500

550

600

Jan-10 Jan-11 Jan-12 Jan-13 Jan-14 Jan-15 Jan-16

1000 Belarus

Rubles Tonne

US$

Tonne

Source: Argus FMB and CRB

MOP Price

c&f Brazil Port

US$ Tonne 1000 Belarussian Rubles Tonne

Managing Costs and Capital

• $500 million Expense Reduction

• +$75 million from Support Functions

• Asset Optimization

• Lower Capital Spending

10

Multiple Actions to Reduce Costs

11

*Production costs are reflective of actual costs, excluding realized mark‐to‐market gains and

losses. These costs are captured in inventory and are not necessarily reflective of costs

included in costs of goods sold for the period.

$67 $73

$100

$74

$36 $19

$‐

$20

$40

$60

$80

$100

$120

Esterhazy Belle Plaine Colonsay EnterpriseC

a

s

h

c

o

s

t

s

i

n

c

l

u

d

i

n

g

r

o

y

a

l

t

i

e

s

,

e

x

c

l

u

d

i

n

g

r

e

s

o

u

r

c

e

t

a

x

e

s

a

n

d

r

e

a

l

i

z

e

d

d

e

r

i

v

a

t

i

v

e

g

a

i

n

s

/

(

l

o

s

s

e

s

)

Cash Costs by Mine H1 2016

Brine Cash costs including royalites, excluding resource taxes, brine and realized derivative gains/(losses)

average

Low Cash Cost Opportunity

12

*Production costs are reflective of actual costs, excluding realized mark‐to‐market gains and

losses. These costs are captured in inventory and are not necessarily reflective of costs

included in costs of goods sold for the period.

*Assumes 1.30: 1 CAD to USD.

$53

$71 $66

$26

$18

$‐

$10

$20

$30

$40

$50

$60

$70

$80

$90

Esterhazy Belle Plaine Enterprise

C

a

s

h

c

o

s

t

s

i

n

c

l

u

d

i

n

g

r

o

y

a

l

t

i

e

s

,

e

x

c

l

u

d

i

n

g

r

e

s

o

u

r

c

e

t

a

x

e

s

a

n

d

r

e

a

l

i

z

e

d

d

e

r

i

v

a

t

i

v

e

g

a

i

n

s

/

(

l

o

s

s

e

s

)

Cash Costs by Mine (95% Operating Rate)

Brine Cash costs including royalties, excluding resource taxes, brine and realized derivative gains/(losses)

average

Financial Results Review

Potash Guidance

Potash 2016

Q3 Sales Volumes 1.8 to 2.1 million tonnes

Q3 MOP Selling Price $160 to $175 per tonne

Q3 Gross Margin Rate Mid-single digits

Q3 Operating Rate Around 65 percent