Form 8-K MEREDITH CORP For: Mar 09

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 8-K CURRENT REPORT Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934 |

Date of Report (Date of earliest event reported): March 9, 2015 |

MEREDITH CORPORATION | ||

(Exact name of registrant as specified in its charter) | ||

IOWA | 1-5128 | 42-0410230 | ||

(State or other jurisdiction of incorporation or organization) | (Commission file number) | (I.R.S. Employer Identification No.) | ||

1716 Locust Street, Des Moines, Iowa | 50309-3023 | |||

(Address of principal executive offices) | (Zip Code) | |||

(515) 284-3000 | ||||

(Registrant's telephone number, including area code) | ||||

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 7.01 | Regulation FD Disclosure |

Meredith Corporation (the Company) presented at the Deutsche Bank Media, Internet and Telecom Conference on March 9, 2015. Chief Executive Officer Stephen M. Lacy and Chief Financial Officer Joseph Ceryanec discussed Company developments and responded to questions. The slide presentation is attached as an exhibit. An audio archive of the presentation will be accessible to the public on the Company's website, meredith.com. The audio archive will remain there through April 9, 2015.

Item 9.01 | Financial Statements and Exhibits | ||

(c) | Exhibits | ||

99 | Slide presentation at the Deutsche Bank Media, Internet and Telecom Conference on March 9, 2015. | ||

SIGNATURE | |||

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. | |||

MEREDITH CORPORATION Registrant | |||

/s/ Joseph Ceryanec | |||

Joseph Ceryanec Vice President - Chief Financial Officer (Principal Financial and Accounting Officer) | |||

Date: March 9, 2015 | |||

Index to Exhibits | ||

Exhibit Number | Item | |

99 | Slide presentation at the Deutsche Bank Media, Internet and Telecom Conference on March 9, 2015. | |

2015 Deutsche Bank Media, Internet & Telecom Conference March 9, 2015

Safe Harbor This presentation and management’s public commentary contain certain forward-looking statements that are subject to risks and uncertainties. These statements are based on management’s current knowledge and estimates of factors affecting the Company and its operations. Statements in this presentation that are forward-looking include, but are not limited to, the statements regarding advertising revenues and investment spending, along with the Company’s revenue and earnings per share outlook. Actual results may differ materially from those currently anticipated. Factors that could adversely affect future results include, but are not limited to, downturns in national and/or local economies; a softening of the domestic advertising market; world, national, or local events that could disrupt broadcast television; increased consolidation among major advertisers or other events depressing the level of advertising spending; the unexpected loss or insolvency of one or more major clients or vendors; the integration of acquired businesses; changes in consumer reading, purchasing and/or television viewing patterns; increases in paper, postage, printing, syndicated programming or other costs; changes in television network affiliation agreements; technological developments affecting products or methods of distribution; changes in government regulations affecting the Company’s industries; increases in interest rates; and the consequences of any acquisitions and/or dispositions. The Company undertakes no obligation to update any forward-looking statement, whether as a result of new information, future events, or otherwise. 2

Agenda Meredith Overview National Media Group Local Media Group Total Shareholder Return 3

Meredith at a Glance National Media Revenue: $1B EBITDA: $150M 4 WORKING YOU WSM V -TV WSM V-DT NASHVILL E Local Media Revenue: $550M EBITDA: $200M Figures represent consensus estimates for Fiscal 2015

Recent Strategic Accomplishments Rapid growth in digital, mobile, video and social platform Added Shape and Martha Stewart properties to portfolio Acquired Selectable Media digital ad technology platform Established presence in the wedding marketplace Strong performance from brand licensing and marketing services activities National Media 5

Recent Strategic Accomplishments Added strong stations to group; created 2 duopolies Record revenue and EBITDA performance Stronger-than-expected political advertising revenue Increased retransmission revenue and contribution Expanded digital and mobile businesses Local Media 6

Recent Strategic Accomplishments Grew dividend for 22st straight year; Yielding 3-4 percent Authorized $100 million for share repurchases Invested more than $500 million in acquisitions Fixed more than half of debt at low rate Successful execution of Total Shareholder Return Strategy Corporate 7

Agenda Meredith Overview National Media Group Local Media Group Total Shareholder Return 8

National Media Group Footprint Largest female audience across every life stage and platform 9 YOUNG WOMEN YOUNG FAMILIES ESTABLISHED FAMILIES WOMEN OF WORTHNEW NESTERS

Our Brands Speak to Her About What Matters Most Seasons and styles change but women’s priorities remain the same 10 HER HOME HER FAMILY HERSELF

11 Our Brands Resonate Across Generations Meredith Reaches 60 Percent of Millennial Women 1979-1995 1965-1978 1946-1964 MILLENNIALS GEN X BABY BOOMERS 60% 67% 73%

50 75 100 125 150 175 200 2009 2010 2011 2012 2013 2014 12 Our Consumer Connection is Growing Digital is adding to our total audience, and is not cannibalizing print A u d ie n c e ( in m il li on s ) Print Online Mobile 15% of audience 25% of audience 60% of audience Source: MRI and ComScore

First Party Data is Our Differentiator 13 • We focus on women at scale: ― 100 million consumers ― 70 million unique visitors • 1st party data is based on direct behavioral engagement • We operate across platforms • Data is our DNA ― Team of expert data analysts ― Identify trends and consumer intent ― Used to find, inform and reach consumers throughout purchase path

Advertising Mix Increasingly Multi-Platform 14 Microsoft App Ghirardelli Crocs Aetna

Increasing Digital Advertising Revenue 0% 5% 10% 15% 20% 25% 30% 1H-07 1H-09 1H-11 1H-13 1H-15 15 5% 25%

Strong Performance from Non-Advertising Activities 16 brand licensing International Media Licensing Real Estate ServicesFTD Floral Program Digital Syndication Cookware Licensee Walmart Direct to Retail

Expanding Our Competitive Position Shape Shape.com Martha Stewart Living Marthastewart.com 17 Women’s Lifestyle: Martha Stewart Weddings Mywedding.com Wedding media: Eat This, Not That! New product launches: Selectable Media Advertising technology:

Agenda Meredith Overview National Media Group Local Media Group Total Shareholder Return 18

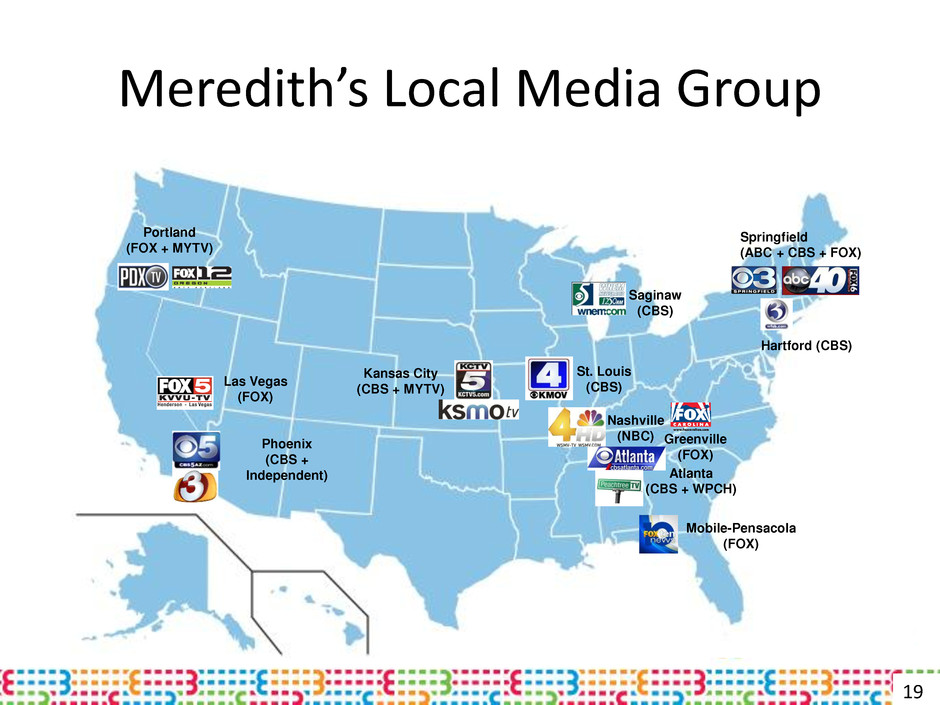

Meredith’s Local Media Group 19 Portland (FOX + MYTV) Las Vegas (FOX) Phoenix (CBS + Independent) Kansas City (CBS + MYTV) Saginaw (CBS) Atlanta (CBS + WPCH) Nashville (NBC) Springfield (ABC + CBS + FOX) St. Louis (CBS) Greenville (FOX) Mobile-Pensacola (FOX) Hartford (CBS)

Record Revenue and EBITDA 17 0 50 100 150 200 250 300 1H FY2011 1H FY2013 1H FY2015 $33 $38 $42 $239 Non-political revenue Political advertising revenue 20 $160 $140 $178 $198 $281 $ in millions

Growing Retransmission Revenue and Contribution 21 MVPD Renewal Date MVPD Satellite FY 2017 Phone FY 2016 Cable FY 2016 - 2018 Network Affiliation / Market Renewal Date CBS Hartford/Springfield FY 2016 St. Louis FY 2017 Atlanta, Phoenix, Kansas City, Flint/Saginaw FY 2018 FOX Springfield FY 2016 Portland, Las Vegas, Greenville, Mobile-Pensacola FY 2018 NBC Nashville FY 2018 ABC Springfield FY 2020

Great Stations Added to Portfolio Increases Number of Duopolies to 5 Powerful station that produces most news in Arizona Phoenix: Market 11 St. Louis: Market 21 CBS affiliate ranks #1 in midday, evening and late news ABC affiliate/Fox on digital tier strengthens competitive position Springfield, MA Market leading Fox affiliate in fast-growing region Mobile: Market 59 22

Agenda Meredith Overview National Media Group Local Media Group Total Shareholder Return 23

Three Year Shareholder Exceed Broader Market 24 71% 124% S&P 500 Actual MDP Actual TSR (%) 50 150 100 0 Multiple sources including BCG Investor Survey and Value Line * Actual represents the period of Oct. 25, 2011 to Oct. 24, 2014

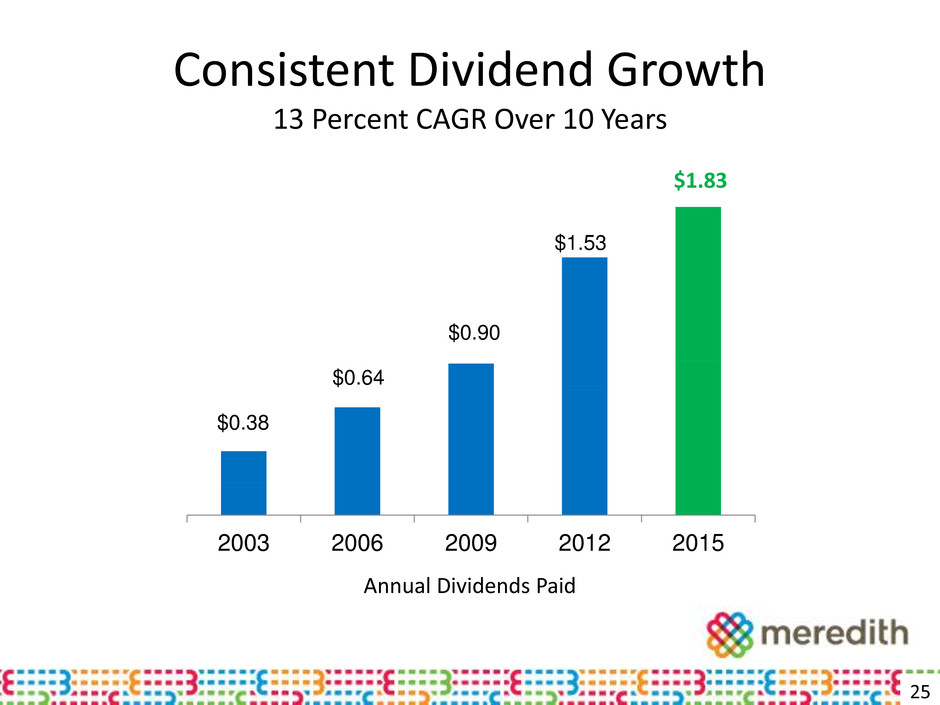

Consistent Dividend Growth 13 Percent CAGR Over 10 Years 25 $0.38 $0.64 $0.90 $1.53 2003 2006 2009 2012 2015 $1.83 Annual Dividends Paid

$30 $200 $550 $600 $760 FY02 FY05 FY08 FY11 FY14 Cumulative Share Repurchases Active Share Repurchase Program 26

Grow non-political advertising revenue Increase retransmission revenue and contribution Enhance digital and mobile platforms Complete integration of station acquisitions Local Media National Media Evolve and strengthen our advertising activities Aggressively expand our digital-related businesses Integrate new business additions Grow revenue from individual consumer Corporate Continue to consolidate our respective industries Increase cash returned to shareholders Execute Total Shareholder Return strategy 27 Our Strategic Priorities

5 Reasons to Invest in Meredith 1 Largest reach to American women across life stages 2 Powerful national and local media brands 3 Growing digital and mobile activities 4 Aggressively adding new revenue streams 5 Track record of returning cash to shareholders 28

2015 Deutsche Bank Media, Internet & Telecom Conference March 9, 2015

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Valstybės investicinis kapitalas UAB audited Annual information for the year 2023

- NorthStar Gaming Announces Extension of Strategic Marketing Agreement and Short-Term Financing from Playtech

- LINCOLN ALERT: Bragar Eagel & Squire, P.C. Announces that a Class Action Lawsuit Has Been Filed Against Lincoln National Corporation and Encourages Investors to Contact the Firm

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share