Form 8-K MEDICAL PROPERTIES TRUST For: Oct 30

�

�

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

�

�

FORM 8-K

�

�

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): October�30, 2014

�

�

MEDICAL PROPERTIES TRUST, INC.

(Exact Name of Registrant as Specified in Charter)

�

�

Commission File Number 001-32559

�

| Maryland | � | 20-0191742 |

| (State or other jurisdiction of incorporation or organization ) |

� | (I. R. S. Employer Identification No.) |

| 1000 Urban Center Drive, Suite 501 Birmingham, AL |

� | 35242 |

| (Address of principal executive offices) | � | (Zip Code) |

Registrant�s telephone number, including area code

(205) 969-3755

�

�

Check the appropriate box below if the Form�8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

�

| � | Written communications pursuant to Rule�425 under the Securities Act (17�CFR�230.425) |

�

| � | Soliciting material pursuant to Rule�14a-12 under the Exchange Act (17�CFR�240.14a-12) |

�

| � | Pre-commencement communications pursuant to Rule�14d-2(b) under the Exchange Act (17�CFR�240.14d-2(b)) |

�

| � | Pre-commencement communications pursuant to Rule�13e-4(c) under the Exchange Act (17�CFR�240.13e-4(c)) |

�

�

�

Item�2.02. Results of Operations and Financial Condition.

On October�30, 2014, Medical Properties Trust, Inc. (the �Company�) issued a press release announcing its financial results for the three and nine months ended September�30, 2014, a copy of which is furnished as Exhibit�99.1 to this Current Report on Form�8-K and is incorporated herein by reference. The Company also posted certain third quarter 2014 supplemental information on its website at www.medicalpropertiestrust.com, a copy of which is furnished as Exhibit�99.2 hereto and is incorporated herein by reference. The information furnished pursuant to this Item�2.02, including Exhibit�99.1 and Exhibit�99.2, shall not be deemed �filed� for purposes of Section�18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liability of that section or Sections�11 and 12(a)(2) of the Securities Act of 1933, as amended. In addition, this information shall not be deemed incorporated by reference in any filing of the Company with the Securities and Exchange Commission, except as expressly set forth by specific reference in any such filing.

The Company disclosed three non-GAAP financial measures in the attached press release for the three and nine months ended September�30, 2014: Funds from operations, Normalized funds from operations and Adjusted funds from operations. The most directly comparable GAAP financial measure to each of these non-GAAP financial measures is net income, which was $28.5�million, or $0.16�per diluted share for the three months ended September�30, 2014 compared to $25.6�million, or $0.16�per diluted share for the three months ended September�30, 2013. For the nine months ended September�30, 2014, net income was $35.6�million, or $0.21�per diluted share compared to $79.2�million, or $0.53�per diluted share for the nine months ended September�30, 2013. In the attached press release, the Company disclosed Funds from operations of $41.7�million and $80.5�million for the three and nine months ended September�30, 2014, respectively, and Normalized funds from operations of $46.6�million and $133.8�million for the three and nine months ended September�30, 2014, respectively. Adjusted funds from operations were disclosed in the press release as $42.6�million and $126.0�million for the three and nine months ended September�30, 2014, respectively.

A reconciliation of the non-GAAP financial measures to net income as well as a statement disclosing the reasons why the Company�s management believes that presentation of these non-GAAP financial measures provides useful information to investors regarding the Company�s financial condition and results of operations are included in Exhibits�99.1 and 99.2.

Item�8.01. Other Events.

On October�30, 2014, Medical Properties Trust, Inc. announced its financial results for the three and nine months ended September�30, 2014. The Company had income from continuing operations of $28.7�million ($0.16�per diluted share) for the three months ended September�30, 2014, compared with income from continuing operations for the corresponding period in 2013 of $25.4�million ($0.16�per diluted share). For the nine months ended September�30, 2014, the Company had income from continuing operations of $35.8�million ($0.21�per diluted share), compared with income from continuing operations of $76.0�million ($0.51�per diluted share) for the nine months ended September�30, 2013. The Company had net income of $28.5�million ($0.16�per diluted share) for the three months ended September�30, 2014, compared with net income for the corresponding period in 2013 of $25.6�million ($0.16�per diluted share). For the nine months ended September�30, 2014, the Company had net income of $35.6�million ($0.21�per diluted share), compared with net income of $79.2�million ($0.53�per diluted share) for the nine months ended September�30, 2013.

The financial results are unaudited; however in the opinion of management, all adjustments considered necessary for a fair presentation of these financial results have been made.

Item�9.01. Financial Statements and Exhibits.

�

| (d) | Exhibits. |

�

| Exhibit�Number |

�� | Description |

| 99.1 | �� | Press release dated October 30, 2014 reporting financial results for the three and nine months ended September�30, 2014 |

| 99.2 | �� | Medical Properties Trust, Inc. 3rd Quarter 2014 Supplemental Information |

�

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

�

| MEDICAL PROPERTIES TRUST, INC. (Registrant) | ||

| By: | � | /s/ R. Steven Hamner |

| � | R. Steven Hamner Executive Vice President and Chief Financial Officer (Principal Financial and Accounting Officer) | |

Date: October�30, 2014

�

3

INDEX TO EXHIBITS

�

| Exhibit�Number |

�� | Description |

| 99.1 | �� | Press release dated October�30, 2014 reporting financial results for the three and nine months ended September�30, 2014 |

| 99.2 | �� | Medical Properties Trust, Inc. 3rd Quarter 2014 Supplemental Information |

�

4

Exhibit 99.1

�

�

�

| � | Contact: Tim Berryman Director � Investor Relations Medical Properties Trust, Inc. (205) 397-8589 |

MEDICAL PROPERTIES TRUST, INC. CONTINUES 33% ANNUAL GROWTH

THIRD QUARTER NORMALIZED FFO PER SHARE UP 8% AND COMPANY INDICATES DOUBLE DIGIT GROWTH OUTLOOK

Additional Details of Median Transaction Announced

Birmingham, AL � October�30, 2014 � Medical Properties Trust, Inc. (the �Company� or �MPT�) (NYSE: MPW) today announced financial and operating results for the third quarter ended September�30, 2014.

THIRD QUARTER AND RECENT HIGHLIGHTS

�

| � | � | � | Earned third quarter Normalized Funds from Operations (�FFO�) per diluted share of $0.27, up 8% compared to $0.25 per diluted share reported in the third quarter of 2013; year to date Normalized FFO of $0.79 per diluted share also grew 8% compared to 2013; |

�

| � | � | � | Entered binding agreements for the immediately and strongly accretive acquisitions of 38 rehabilitation and two acute care MEDIAN Kliniken Group hospitals in a transaction valued at approximately �705�million ($900 million), and three RHM Klinik rehabilitation facilities in a transaction valued at �63.6�million ($80.8 million); |

�

| � | � | � | Announced U.S. investments and commitments in acute facilities in Alabama, Texas and West Virginia totaling approximately $74 million; |

�

| � | � | � | Completed construction of and commenced collection of rent from eight Adeptus� First Choice ER facilities (for a total of 17 completed facilities with four more under construction and 19 in pre-construction diligence reviews); |

�

| � | � | � | Completed the previously announced �29.4�million ($49.9 million) acquisition of an acute care hospital facility in Bath, England and $150 million commitment to Adeptus Health in the third quarter. |

�

1

Included in the financial tables accompanying this press release is information about the Company�s assets and liabilities, net income and reconciliations of net income to FFO and Adjusted Funds from Operations (�AFFO�), all on a basis comparable to 2013 periods.

�Less than two weeks ago, we announced a series of milestone transactions totaling more than $1 billion in new strategic investments which once again demonstrate MPT�s status as the real estate capital provider of choice for hospital operators in the U.S. and abroad,� said Edward K. Aldag, Jr., Chairman, President and CEO of Medical Properties Trust. �Year-to-date we have announced hospital investments totaling more than $1.4 billion, which is the highest level of acquisition activity we have ever reported. Since the beginning of 2011 we have grown our total assets at a compound annual growth rate of 33%. Following completion of the recently announced transactions, we will have an asset base of approximately $4.5 billion, and with our enhanced scale, portfolio diversity and near-term pipeline, we are confident that we will continue to generate similar opportunities for strong growth in the near future.�

PORTFOLIO UPDATE AND OUTLOOK

MPT today also provided additional information regarding the recently announced additional commitments and investments of approximately $1.05 billion.

�

| � | � | � | Median Kliniken: The 40 facilities will be master leased for 27 years with an initial GAAP lease rate of approximately 9.3%. Lease payments will increase each year without limit at the greater of 1.0% or 70% of German CPI. Based on Median�s historical and expected 2015 operating results, the expected EBITDAR of the Median group will cover MPT�s rent by more than 170%. |

�

| � | � | � | RHM Klinik: �63.6�million ($80.8 million) commitment, for the acquisition of three RHM rehabilitation facilities in Germany. MPT will acquire Bad Mergentheim (211 beds), Bad Tolz (248 beds), and Bad Liebenstein (271 beds). All three properties will be included under MPT�s existing master lease agreement with RHM Klinik and are expected to close in the fourth quarter. |

�

| � | � | � | Wilson N. Jones Regional Medical Center: $40 million commitment for 237-bed acute care hospital, four medical office buildings and a behavioral health facility in Sherman, Texas. Alecto Healthcare Services will become the tenant and operator and is expected to close the transaction in 2014�s fourth quarter. |

�

| � | � | � | Fairmont Regional Medical Center: $25 million acquisition in the third quarter of a 207-bed acute care hospital in Fairmont, West Virginia. Alecto Healthcare Services is the tenant and operator. |

�

| � | � | � | Medical West: $8.65 million development of a freestanding emergency department in Hoover, Alabama. Construction of the facility is underway and is expected to be completed in the second quarter of 2015. The tenant will be an Affiliate of the University of Alabama Birmingham Health System. |

The weighted average initial cash lease rate for these assets (other than Median) approximates 9.3% with annual escalation provisions tied to inflation.

�

2

�As the Median and these additional transactions demonstrate, we continue to source investments with extremely attractive long-term, inflation protected returns from infrastructure-like assets with assured demand and government mandated reimbursement sources,� said Aldag. �In Germany, where a citizen�s right to rehab care is imbedded in the social compact, demographics and spending patterns continue to improve, and government funding sources operate in surplus conditions, the opportunity for investment is outstanding.�

As of September�30, 2014, and pro forma for the recently announced acquisitions, the Company will have total real estate and related investments of approximately $4.5 billion comprised of 169 healthcare properties in 27 states and in Germany and the United Kingdom. The properties are leased to or mortgaged by 28 hospital operating companies.

As previously disclosed on October�20, 2014, the Company estimates that based on the portfolio as of September�30 plus additional investment commitments disclosed on October�20, the Company expects that the Normalized FFO run rate following the completion of permanent financing will approximate $1.19 to $1.26 per diluted share. This run rate is based on MPT�s recent share price, estimated interest costs of 3.5% and 5.0% for secured and unsecured long-term debt for the MEDIAN transaction, respectively, and maintenance of MPT�s target leverage of approximately 45% of total assets. Actual 2014 Normalized FFO will differ from this range and the Company will provide periodic updates as acquisitions are finalized.

The annualized run-rate guidance estimate does not include the effects, if any, of real estate operating costs, litigation costs, debt refinancing costs, acquisition costs, interest rate hedging activities, write-offs of straight-line rent or other non-recurring or unplanned transactions. These estimates will change if the Company acquires assets totaling more or less than its expectations, the timing of acquisitions varies from expectations, capitalization rates vary from expectations, market interest rates change, debt is refinanced, new shares are issued, additional debt is incurred, assets are sold, other operating expenses vary, income from investments in tenant operations vary from expectations, or existing leases do not perform in accordance with their terms.

OPERATING RESULTS

Third quarter 2014 total revenues increased 34% to $80.8 million compared to $60.1 million for the third quarter of 2013. Normalized FFO for the quarter increased 21% to $46.6 million compared to $38.4 million in the third quarter of 2013. Per share Normalized FFO increased 8% to $0.27 per diluted share in the third quarter of 2014 compared to $0.25 per diluted share in the third quarter of 2013.

For the first nine months of 2014, Normalized FFO per diluted share increased 8% to $0.79 compared to $0.73 for the first nine months of 2013. Revenue for the first nine months of 2014 increased 32% to $230.4 million from $174.8 million in the first nine months of 2013. Net income for the nine months ended September�30, 2014 was $35.6 million (or $0.21 per diluted share) compared to net income of $79.2 million (or $0.53 per diluted share) for the first nine months of 2013.

�

3

CONFERENCE CALL AND WEBCAST

The Company has scheduled a conference call and webcast for Thursday, October�30, 2014 at 11:00 a.m. Eastern Time to present the Company�s financial and operating results for the quarter ended September�30, 2014. The dial-in numbers for the conference call are 877-415-3180 (U.S.) and 857-244-7323 (international); both numbers require passcode 31426841. The conference call will also be available via webcast in the Investor Relations� section of the Company�s website, www.medicalpropertiestrust.com.

A telephone and webcast replay of the call will be available beginning shortly after the call�s completion through November�13, 2014. Dial-in numbers for the replay are 888-286-8010 and 617-801-6888 for U.S. and International callers, respectively. The replay passcode for both U.S. and international callers is 56106015.

The Company�s supplemental information package for the current period will also be available on the Company�s website under the �Investor Relations� section.

About Medical Properties Trust, Inc.

Medical Properties Trust, Inc. is a Birmingham, Alabama based self-advised real estate investment trust formed to capitalize on the changing trends in healthcare delivery by acquiring and developing net-leased healthcare facilities. MPT�s financing model allows hospitals and other healthcare facilities to unlock the value of their underlying real estate in order to fund facility improvements, technology upgrades, staff additions and new construction. Facilities include acute care hospitals, inpatient rehabilitation hospitals, long-term acute care hospitals, and other medical and surgical facilities. For more information, please visit the Company�s website at www.medicalpropertiestrust.com.

The statements in this press release that are forward looking are based on current expectations and actual results or future events may differ materially. Words such as �expects,� �believes,� �anticipates,� �intends,� �will,� �should� and variations of such words and similar expressions are intended to identify such forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results of the Company or future events to differ materially from those expressed in or underlying such forward-looking statements, including without limitation: the satisfaction of all conditions to, and the timely closing (if at all) of the Median acquisition and sale-leaseback transactions; the Company financing of the transactions described herein; Median�s expected rent coverage; the capacity of Median and the Company�s other tenants to meet the terms of their agreements; Normalized FFO per share; expected payout ratio, the amount of acquisitions of healthcare real estate, if any; capital markets conditions, the repayment of debt arrangements; statements concerning the additional income to the Company as a result of ownership interests in certain hospital operations and the timing of such income; the payment of future dividends, if any; completion of additional debt arrangement, and additional investments; national and international economic, business, real estate and other market conditions; the competitive environment in which the Company operates; the execution of the Company�s business plan;

�

4

financing risks; the Company�s ability to maintain its status as a REIT for federal income tax purposes; acquisition and development risks; potential environmental and other liabilities; and other factors affecting the real estate industry generally or healthcare real estate in particular. For further discussion of the factors that could affect outcomes, please refer to the �Risk factors� section of the Company�s Annual Report on Form 10-K for the year ended December�31, 2013, and as updated by the Company�s subsequently filed Quarterly Reports on Form 10-Q and other SEC filings. Except as otherwise required by the federal securities laws, the Company undertakes no obligation to update the information in this press release.

# # #

�

5

MEDICAL PROPERTIES TRUST, INC. AND SUBSIDIARIES

Consolidated Balance Sheets

�

| � | �� | September 30, 2014 |

� | � | December 31, 2013 |

� | ||

| � | �� | (Unaudited) | � | � | (A) | � | ||

| Assets |

�� | � | ||||||

| Real estate assets |

�� | � | ||||||

| Land, buildings and improvements, and intangible lease assets |

�� | $ | 2,057,466,045 | �� | � | $ | 1,823,683,129 | �� |

| Construction in progress and other |

�� | � | 3,716,682 | �� | � | � | 41,771,499 | �� |

| Net investment in direct financing leases |

�� | � | 436,385,781 | �� | � | � | 431,024,228 | �� |

| Mortgage loans |

�� | � | 385,093,819 | �� | � | � | 388,756,469 | �� |

| �� | � |

� |

� | � | � |

� |

� | |

| Gross investment in real estate assets |

�� | � | 2,882,662,327 | �� | � | � | 2,685,235,325 | �� |

| Accumulated depreciation and amortization |

�� | � | (191,282,358 | )� | � | � | (159,776,091 | )� |

| �� | � |

� |

� | � | � |

� |

� | |

| Net investment in real estate assets |

�� | � | 2,691,379,969 | �� | � | � | 2,525,459,234 | �� |

| Cash and cash equivalents |

�� | � | 132,811,984 | �� | � | � | 45,979,648 | �� |

| Interest and rent receivable |

�� | � | 50,239,677 | �� | � | � | 58,565,294 | �� |

| Straight-line rent receivable |

�� | � | 56,402,851 | �� | � | � | 45,828,685 | �� |

| Other assets |

�� | � | 238,305,817 | �� | � | � | 228,862,582 | �� |

| �� | � |

� |

� | � | � |

� |

� | |

| Total Assets |

�� | $ | 3,169,140,298 | �� | � | $ | 2,904,695,443 | �� |

| �� | � |

� |

� | � | � |

� |

� | |

| Liabilities and Equity |

�� | � | ||||||

| Liabilities |

�� | � | ||||||

| Debt, net |

�� | $ | 1,618,981,006 | �� | � | $ | 1,421,680,749 | �� |

| Accounts payable and accrued expenses |

�� | � | 85,426,139 | �� | � | � | 94,289,615 | �� |

| Deferred revenue |

�� | � | 30,830,430 | �� | � | � | 24,114,374 | �� |

| Lease deposits and other obligations to tenants |

�� | � | 26,797,144 | �� | � | � | 20,402,058 | �� |

| �� | � |

� |

� | � | � |

� |

� | |

| Total liabilities |

�� | � | 1,762,034,719 | �� | � | � | 1,560,486,796 | �� |

| Equity |

�� | � | ||||||

| Preferred stock, $0.001 par value. Authorized 10,000,000�shares; no shares outstanding |

�� | � | ��� | �� | � | � | ��� | �� |

| Common stock, $0.001 par value. Authorized 250,000,000�shares; issued and outstanding�� 171,625,865�shares at September�30, 2014 and 161,309,725�shares at December�31, 2013 |

�� | � | 171,626 | �� | � | � | 161,310 | �� |

| Additional paid in capital |

�� | � | 1,752,885,129 | �� | � | � | 1,618,054,133 | �� |

| Distributions in excess of net income |

�� | � | (337,816,524 | )� | � | � | (264,803,804 | )� |

| Accumulated other comprehensive income (loss) |

�� | � | (7,872,309 | )� | � | � | (8,940,649 | )� |

| Treasury shares, at cost |

�� | � | (262,343 | )� | � | � | (262,343 | )� |

| �� | � |

� |

� | � | � |

� |

� | |

| Total Equity |

�� | � | 1,407,105,579 | �� | � | � | 1,344,208,647 | �� |

| �� | � |

� |

� | � | � |

� |

� | |

| Total Liabilities and Equity |

�� | $ | 3,169,140,298 | �� | � | $ | 2,904,695,443 | �� |

| �� | � |

� |

� | � | � |

� |

� | |

�

| (A) | Financials have been derived from the prior year audited financials and include certain minor reclasses to be consistent with the 2014 presentation. |

MEDICAL PROPERTIES TRUST, INC. AND SUBSIDIARIES

Consolidated Statements of Income

(Unaudited)

�

| � | �� | For the Three Months Ended | � | � | For the Nine Months Ended | � | ||||||||||

| � | �� | September�30, 2014 |

� | � | September�30, 2013 |

� | � | September�30, 2014 |

� | � | September�30, 2013 |

� | ||||

| � | �� | � | � | � | (A) | � | � | � | � | � | (A) | � | ||||

| Revenues |

�� | � | � | � | ||||||||||||

| Rent billed |

�� | $ | 48,063,143 | �� | � | $ | 31,544,164 | �� | � | $ | 136,952,379 | �� | � | $ | 94,071,842 | �� |

| Straight-line rent |

�� | � | 5,281,948 | �� | � | � | 2,883,799 | �� | � | � | 10,648,500 | �� | � | � | 8,351,946 | �� |

| Income from direct financing leases |

�� | � | 12,308,092 | �� | � | � | 11,297,974 | �� | � | � | 36,786,857 | �� | � | � | 29,284,432 | �� |

| Interest and fee income |

�� | � | 15,123,935 | �� | � | � | 14,380,554 | �� | � | � | 46,038,504 | �� | � | � | 43,135,858 | �� |

| �� | � |

� |

� | � | � |

� |

� | � | � |

� |

� | � | � |

� |

� | |

| Total revenues |

�� | � | 80,777,118 | �� | � | � | 60,106,491 | �� | � | � | 230,426,240 | �� | � | � | 174,844,078 | �� |

| Expenses |

�� | � | � | � | ||||||||||||

| Real estate depreciation and amortization |

�� | � | 13,353,867 | �� | � | � | 8,714,295 | �� | � | � | 39,485,246 | �� | � | � | 25,826,388 | �� |

| Impairment charges |

�� | � | ��� | �� | � | � | ��� | �� | � | � | 50,127,895 | �� | � | � | ��� | �� |

| Property-related |

�� | � | 700,335 | �� | � | � | 458,231 | �� | � | � | 1,400,734 | �� | � | � | 1,520,235 | �� |

| Acquisition expenses |

�� | � | 4,886,470 | �� | � | � | 4,178,765 | �� | � | � | 7,933,270 | �� | � | � | 6,457,217 | �� |

| General and administrative |

�� | � | 8,671,715 | �� | � | � | 6,285,196 | �� | � | � | 25,836,390 | �� | � | � | 21,161,682 | �� |

| �� | � |

� |

� | � | � |

� |

� | � | � |

� |

� | � | � |

� |

� | |

| Total operating expenses |

�� | � | 27,612,387 | �� | � | � | 19,636,487 | �� | � | � | 124,783,535 | �� | � | � | 54,965,522 | �� |

| �� | � |

� |

� | � | � |

� |

� | � | � |

� |

� | � | � |

� |

� | |

| Operating income |

�� | � | 53,164,731 | �� | � | � | 40,470,004 | �� | � | � | 105,642,705 | �� | � | � | 119,878,556 | �� |

| Interest and other income (expense) |

�� | � | (24,252,698 | )� | � | � | (14,984,097 | )� | � | � | (69,642,313 | )� | � | � | (43,629,496 | )� |

| Income tax expense |

�� | � | (248,851 | )� | � | � | (94,409 | )� | � | � | (231,962 | )� | � | � | (261,489 | )� |

| �� | � |

� |

� | � | � |

� |

� | � | � |

� |

� | � | � |

� |

� | |

| Income from continuing operations |

�� | � | 28,663,182 | �� | � | � | 25,391,498 | �� | � | � | 35,768,430 | �� | � | � | 75,987,571 | �� |

| Income (loss) from discontinued operations |

�� | � | ��� | �� | � | � | 311,556 | �� | � | � | (1,500 | )� | � | � | 3,330,016 | �� |

| �� | � |

� |

� | � | � |

� |

� | � | � |

� |

� | � | � |

� |

� | |

| Net income |

�� | � | 28,663,182 | �� | � | � | 25,703,054 | �� | � | � | 35,766,930 | �� | � | � | 79,317,587 | �� |

| Net income (loss) attributable to non-controlling interests |

�� | � | (126,450 | )� | � | � | (55,002 | )� | � | � | (191,922 | )� | � | � | (165,217 | )� |

| �� | � |

� |

� | � | � |

� |

� | � | � |

� |

� | � | � |

� |

� | |

| Net income attributable to MPT common stockholders |

�� | $ | 28,536,732 | �� | � | $ | 25,648,052 | �� | � | $ | 35,575,008 | �� | � | $ | 79,152,370 | �� |

| �� | � |

� |

� | � | � |

� |

� | � | � |

� |

� | � | � |

� |

� | |

| Earnings per common share�� basic: |

�� | � | � | � | ||||||||||||

| Income from continuing operations |

�� | $ | 0.16 | �� | � | $ | 0.16 | �� | � | $ | 0.21 | �� | � | $ | 0.51 | �� |

| Income from discontinued operations |

�� | � | ��� | �� | � | � | ��� | �� | � | � | ��� | �� | � | � | 0.02 | �� |

| �� | � |

� |

� | � | � |

� |

� | � | � |

� |

� | � | � |

� |

� | |

| Net income attributable to MPT common stockholders |

�� | $ | 0.16 | �� | � | $ | 0.16 | �� | � | $ | 0.21 | �� | � | $ | 0.53 | �� |

| �� | � |

� |

� | � | � |

� |

� | � | � |

� |

� | � | � |

� |

� | |

| Earnings per common share�� diluted: |

�� | � | � | � | ||||||||||||

| Income from continuing operations |

�� | $ | 0.16 | �� | � | $ | 0.16 | �� | � | $ | 0.21 | �� | � | $ | 0.51 | �� |

| Income from discontinued operations |

�� | � | ��� | �� | � | � | ��� | �� | � | � | ��� | �� | � | � | 0.02 | �� |

| �� | � |

� |

� | � | � |

� |

� | � | � |

� |

� | � | � |

� |

� | |

| Net income attributable to MPT common stockholders |

�� | $ | 0.16 | �� | � | $ | 0.16 | �� | � | $ | 0.21 | �� | � | $ | 0.53 | �� |

| �� | � |

� |

� | � | � |

� |

� | � | � |

� |

� | � | � |

� |

� | |

| Dividends declared per common share |

�� | $ | 0.21 | �� | � | $ | 0.20 | �� | � | $ | 0.63 | �� | � | $ | 0.60 | �� |

| �� | � | � | . | �� | � | � | � | . | �� | |||||||

| Weighted average shares outstanding�� basic |

�� | � | 171,893,007 | �� | � | � | 154,757,902 | �� | � | � | 169,194,878 | �� | � | � | 148,204,479 | �� |

| Weighted average shares outstanding�� diluted |

�� | � | 172,639,224 | �� | � | � | 155,968,954 | �� | � | � | 169,852,264 | �� | � | � | 149,517,040 | �� |

�

| (A) | Financials have been restated to reclass the operating results of certain properties sold after the 2013 third quarter to discontinued operations. |

MEDICAL PROPERTIES TRUST, INC. AND SUBSIDIARIES

Reconciliation of Net Income to Funds From Operations

(Unaudited)

�

| � | �� | For the Three Months Ended | � | � | For the Nine Months Ended | � | ||||||||||

| � | �� | September�30, 2014 |

� | � | September�30, 2013 |

� | � | September�30, 2014 |

� | � | September�30, 2013 |

� | ||||

| � | �� | � | � | � | (A) | � | � | � | � | � | (A) | � | ||||

| FFO information: |

�� | � | � | |||||||||||||

| Net income attributable to MPT common stockholders |

�� | $ | 28,536,732 | �� | � | $ | 25,648,052 | �� | � | $ | 35,575,008 | �� | � | $ | 79,152,370 | �� |

| Participating securities� share in earnings |

�� | � | (179,303 | )� | � | � | (166,066 | )� | � | � | (583,796 | )� | � | � | (538,391 | )� |

| �� | � |

� |

� | � | � |

� |

� | � | � |

� |

� | � | � |

� |

� | |

| Net income, less participating securities� share in earnings |

�� | $ | 28,357,429 | �� | � | $ | 25,481,986 | �� | � | $ | 34,991,212 | �� | � | $ | 78,613,979 | �� |

| Depreciation and amortization: |

�� | � | � | |||||||||||||

| Continuing operations |

�� | � | 13,353,867 | �� | � | � | 8,714,295 | �� | � | � | 39,485,246 | �� | � | � | 25,826,388 | �� |

| Discontinued operations |

�� | � | ��� | �� | � | � | 74,753 | �� | � | � | ��� | �� | � | � | 327,454 | �� |

| Real estate impairment charges |

�� | � | ��� | �� | � | � | ��� | �� | � | � | 5,974,400 | �� | � | � | ��� | �� |

| Gain on sale of real estate |

�� | � | ��� | �� | � | � | ��� | �� | � | � | ��� | �� | � | � | (2,054,229 | )� |

| �� | � |

� |

� | � | � |

� |

� | � | � |

� |

� | � | � |

� |

� | |

| Funds from operations |

�� | $ | 41,711,296 | �� | � | $ | 34,271,034 | �� | � | $ | 80,450,858 | �� | � | $ | 102,713,592 | �� |

| Write-off straight line rent |

�� | � | ��� | �� | � | � | ��� | �� | � | � | 950,338 | �� | � | � | ��� | �� |

| Debt refinancing costs |

�� | � | ��� | �� | � | � | ��� | �� | � | � | 290,635 | �� | � | � | ��� | �� |

| Loan and other impairment charges |

�� | � | ��� | �� | � | � | ��� | �� | � | � | 44,153,495 | �� | � | � | ��� | �� |

| Acquisition costs |

�� | � | 4,886,470 | �� | � | � | 4,178,765 | �� | � | � | 7,933,270 | �� | � | � | 6,457,217 | �� |

| �� | � |

� |

� | � | � |

� |

� | � | � |

� |

� | � | � |

� |

� | |

| Normalized funds from operations |

�� | $ | 46,597,766 | �� | � | $ | 38,449,799 | �� | � | $ | 133,778,596 | �� | � | $ | 109,170,809 | �� |

| Share-based compensation |

�� | � | 2,059,493 | �� | � | � | 1,815,195 | �� | � | � | 6,178,479 | �� | � | � | 6,019,100 | �� |

| Debt costs amortization |

�� | � | 1,247,104 | �� | � | � | 871,974 | �� | � | � | 3,440,386 | �� | � | � | 2,624,123 | �� |

| Additional rent received in advance (B) |

�� | � | (300,000 | )� | � | � | (300,000 | )� | � | � | (900,000 | )� | � | � | (900,000 | )� |

| Straight-line rent revenue and other |

�� | � | (6,978,960 | )� | � | � | (4,461,141 | )� | � | � | (16,512,352 | )� | � | � | (12,365,795 | )� |

| �� | � |

� |

� | � | � |

� |

� | � | � |

� |

� | � | � |

� |

� | |

| Adjusted funds from operations |

�� | $ | 42,625,403 | �� | � | $ | 36,375,827 | �� | � | $ | 125,985,109 | �� | � | $ | 104,548,237 | �� |

| �� | � |

� |

� | � | � |

� |

� | � | � |

� |

� | � | � |

� |

� | |

| Per diluted share data: |

�� | � | � | |||||||||||||

| Net income, less participating securities� share in earnings |

�� | $ | 0.16 | �� | � | $ | 0.16 | �� | � | $ | 0.21 | �� | � | $ | 0.53 | �� |

| Depreciation and amortization: |

�� | � | � | |||||||||||||

| Continuing operations |

�� | � | 0.08 | �� | � | � | 0.06 | �� | � | � | 0.22 | �� | � | � | 0.17 | �� |

| Discontinued operations |

�� | � | ��� | �� | � | � | ��� | �� | � | � | ��� | �� | � | � | ��� | �� |

| Real estate impairment charges |

�� | � | ��� | �� | � | � | ��� | �� | � | � | 0.04 | �� | � | � | ��� | �� |

| Gain on sale of real estate |

�� | � | ��� | �� | � | � | ��� | �� | � | � | ��� | �� | � | � | (0.01 | )� |

| �� | � |

� |

� | � | � |

� |

� | � | � |

� |

� | � | � |

� |

� | |

| Funds from operations |

�� | $ | 0.24 | �� | � | $ | 0.22 | �� | � | $ | 0.47 | �� | � | $ | 0.69 | �� |

| Write-off straight line rent |

�� | � | ��� | �� | � | � | ��� | �� | � | � | 0.01 | �� | � | � | ��� | �� |

| Debt refinancing costs |

�� | � | ��� | �� | � | � | ��� | �� | � | � | ��� | �� | � | � | ��� | �� |

| Loan and other impairment charges |

�� | � | ��� | �� | � | � | ��� | �� | � | � | 0.26 | �� | � | � | ��� | �� |

| Acquisition costs |

�� | � | 0.03 | �� | � | � | 0.03 | �� | � | � | 0.05 | �� | � | � | 0.04 | �� |

| �� | � |

� |

� | � | � |

� |

� | � | � |

� |

� | � | � |

� |

� | |

| Normalized funds from operations |

�� | $ | 0.27 | �� | � | $ | 0.25 | �� | � | $ | 0.79 | �� | � | $ | 0.73 | �� |

| Share-based compensation |

�� | � | 0.01 | �� | � | � | 0.01 | �� | � | � | 0.04 | �� | � | � | 0.04 | �� |

| Debt costs amortization |

�� | � | 0.01 | �� | � | � | ��� | �� | � | � | 0.02 | �� | � | � | 0.02 | �� |

| Additional rent received in advance (B) |

�� | � | ��� | �� | � | � | ��� | �� | � | � | (0.01 | )� | � | � | (0.01 | )� |

| Straight-line rent revenue and other |

�� | � | (0.04 | )� | � | � | (0.03 | )� | � | � | (0.10 | )� | � | � | (0.08 | )� |

| �� | � |

� |

� | � | � |

� |

� | � | � |

� |

� | � | � |

� |

� | |

| Adjusted funds from operations |

�� | $ | 0.25 | �� | � | $ | 0.23 | �� | � | $ | 0.74 | �� | � | $ | 0.70 | �� |

| �� | � |

� |

� | � | � |

� |

� | � | � |

� |

� | � | � |

� |

� | |

�

| (A) | Financials have been restated to reclass the operating results of certain properties sold after the 2013 third quarter to discontinued operations. |

| (B) | Represents additional rent from one tenant in advance of when we can recognize as revenue for accounting purposes. This additional rent is being recorded to revenue on a straight-line basis over the lease life. |

Investors and analysts following the real estate industry utilize funds from operations, or FFO, as a supplemental performance measure. FFO, reflecting the assumption that real estate asset values rise or fall with market conditions, principally adjusts for the effects of GAAP depreciation and amortization of real estate assets, which assumes that the value of real estate diminishes predictably over time. We compute FFO in accordance with the definition provided by the National Association of Real Estate Investment Trusts, or NAREIT, which represents net income (loss) (computed in accordance with GAAP), excluding gains (losses) on sales of real estate and impairment charges on real estate assets, plus real estate depreciation and amortization and after adjustments for unconsolidated partnerships and joint ventures.

In addition to presenting FFO in accordance with the NAREIT definition, we also disclose normalized FFO, which adjusts FFO for items that relate to unanticipated or non-core events or activities or accounting changes that, if not noted, would make comparison to prior period results and market expectations less meaningful to investors and analysts. We believe that the use of FFO, combined with the required GAAP presentations, improves the understanding of our operating results among investors and the use of normalized FFO makes comparisons of our operating results with prior periods and other companies more meaningful. While FFO and normalized FFO are relevant and widely used supplemental measures of operating and financial performance of REITs, they should not be viewed as a substitute measure of our operating performance since the measures do not reflect either depreciation and amortization costs or the level of capital expenditures and leasing costs necessary to maintain the operating performance of our properties, which can be significant economic costs that could materially impact our results of operations. FFO and normalized FFO should not be considered an alternative to net income (loss) (computed in accordance with GAAP) as indicators of our financial performance or to cash flow from operating activities (computed in accordance with GAAP) as an indicator of our liquidity.

We calculate adjusted funds from operations, or AFFO, by subtracting from or adding to normalized FFO (i)�unbilled rent revenue, (ii)�non-cash share-based compensation expense, and (iii)�amortization of deferred financing costs. AFFO is an operating measurement that we use to analyze our results of operations based on the receipt, rather than the accrual, of our rental revenue and on certain other adjustments. We believe that this is an important measurement because our leases generally have significant contractual escalations of base rents and therefore result in recognition of rental income that is not collected until future periods, and costs that are deferred or are non-cash charges. Our calculation of AFFO may not be comparable to AFFO or similarly titled measures reported by other REITs. AFFO should not be considered as an alternative to net income (calculated pursuant to GAAP) as an indicator of our results of operations or to cash flow from operating activities (calculated pursuant to GAAP) as an indicator of our liquidity.

Exhibit 99.2

�

Exhibit 99.2

THIRD QUARTER 2014

SUPPLEMENTAL INFORMATION

Table of Contents

Company Information 1

Reconciliation of Net Income to Funds from Operations. 2

Investment and Revenue by Asset Type, Operator, Country and State 3

Lease Maturity Schedule 4

Debt Summary 5

Consolidated Statements of Income 6

Consolidated Balance Sheets 7

Acquisitions and Summary of Development Projects 8

Detail of Other Assets .9

The information in this supplemental information package should be read in conjunction with the Company�s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other information filed with the Securities and Exchange Commission. You can access these documents free of charge at www.sec.gov and from the Company�s website at www.medicalpropertiestrust.com. The information contained on the Company�s website is not incorporated by reference into, and should not be considered a part of, this supplemental package.

For more information, please contact:

Charles Lambert, Managing Director�Capital Markets at (205)�397-8897 Tim Berryman, Director�Investor Relations at (205)�397-8589

United Kingdom

Germany

Company Information

Headquarters: Medical Properties Trust, Inc. 1000 Urban Center Drive, Suite 501 Birmingham, AL 35242 (205)�969-3755 Fax: (205)�969-3756

Website: www.medicalpropertiestrust.com

Executive Officers: Edward K. Aldag, Jr., Chairman, President and Chief Executive Officer R. Steven Hamner, Executive Vice President and Chief Financial Officer Emmett E. McLean, Executive Vice President, Chief Operating Officer, Secretary and Treasurer

Frank R. Williams, Senior Vice President, Senior Managing Director�Acquisitions

Investor Relations: Medical Properties Trust, Inc. 1000 Urban Center Drive, Suite 501 Birmingham, AL 35242 Attn: Tim Berryman (205)�397-8589 [email protected]

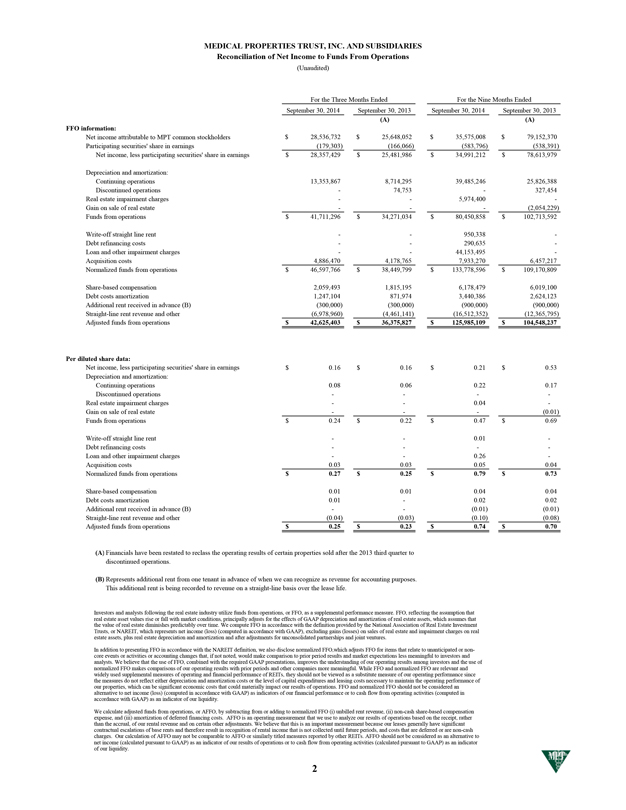

MEDICAL PROPERTIES TRUST, INC. AND SUBSIDIARIES Reconciliation of Net Income to Funds From Operations

(Unaudited)

For the Three Months Ended For the Nine Months Ended

September�30, 2014�September�30, 2013�September�30, 2014�September�30, 2013

(A)(A)

FFO information:

Net income attributable to MPT common stockholders $ 28,536,732 $ 25,648,052 $ 35,575,008 $ 79,152,370

Participating securities� share in earnings(179,303)(166,066)(583,796)(538,391)

Net income, less participating securities� share in earnings $ 28,357,429 $ 25,481,986 $ 34,991,212 $ 78,613,979

Depreciation and amortization:

Continuing operations 13,353,867 8,714,295 39,485,246 25,826,388

Discontinued operations�74,753�327,454

Real estate impairment charges � 5,974,400 -

Gain on sale of real estate � -(2,054,229)

Funds from operations $ 41,711,296 $ 34,271,034 $ 80,450,858 $ 102,713,592

Write-off straight line rent � 950,338 -

Debt refinancing costs � 290,635 -

Loan and other impairment charges � 44,153,495 -

Acquisition costs 4,886,470 4,178,765 7,933,270 6,457,217

Normalized funds from operations $ 46,597,766 $ 38,449,799 $ 133,778,596 $ 109,170,809

Share-based compensation 2,059,493 1,815,195 6,178,479 6,019,100

Debt costs amortization 1,247,104 871,974 3,440,386 2,624,123

Additional rent received in advance (B)(300,000)(300,000)(900,000)(900,000)

Straight-line rent revenue and other(6,978,960)(4,461,141)(16,512,352)(12,365,795)

Adjusted funds from operations $ 42,625,403 $ 36,375,827 $ 125,985,109 $ 104,548,237

Per diluted share data:

Net income, less participating securities� share in earnings $ 0.16 $ 0.16 $ 0.21 $ 0.53

Depreciation and amortization:

Continuing operations 0.08 0.06 0.22 0.17

Discontinued operations � �

Real estate impairment charges � 0.04 -

Gain on sale of real estate � -(0.01)

Funds from operations $ 0.24 $ 0.22 $ 0.47 $ 0.69

Write-off straight line rent � 0.01 -

Debt refinancing costs � �

Loan and other impairment charges � 0.26 -

Acquisition costs 0.03 0.03 0.05 0.04

Normalized funds from operations $ 0.27 $ 0.25 $ 0.79 $ 0.73

Share-based compensation 0.01 0.01 0.04 0.04

Debt costs amortization 0.01�0.02 0.02

Additional rent received in advance (B)��(0.01)(0.01)

Straight-line rent revenue and other(0.04)(0.03)(0.10)(0.08)

Adjusted funds from operations $ 0.25 $ 0.23 $ 0.74 $ 0.70

(A) Financials have been restated to reclass the operating results of certain properties sold after the 2013 third quarter to discontinued operations.

(B) Represents additional rent from one tenant in advance of when we can recognize as revenue for accounting purposes. This additional rent is being recorded to revenue on a straight-line basis over the lease life.

Investors and analysts following the real estate industry utilize funds from operations, or FFO, as a supplemental performance measure. FFO, reflecting the assumption that real estate asset values rise or fall with market conditions, principally adjusts for the effects of GAAP depreciation and amortization of real estate assets, which assumes that the value of real estate diminishes predictably over time. We compute FFO in accordance with the definition provided by the National Association of Real Estate Investment Trusts, or NAREIT, which represents net income (loss) (computed in accordance with GAAP), excluding gains (losses) on sales of real estate and impairment charges on real estate assets, plus real estate depreciation and amortization and after adjustments for unconsolidated partnerships and joint ventures.

In addition to presenting FFO in accordance with the NAREIT definition, we also disclose normalized FFO,which adjusts FFO for items that relate to unanticipated or non-core events or activities or accounting changes that, if not noted, would make comparison to prior period results and market expectations less meaningful to investors and analysts. We believe that the use of FFO, combined with the required GAAP presentations, improves the understanding of our operating results among investors and the use of normalized FFO makes comparisons of our operating results with prior periods and other companies more meaningful. While FFO and normalized FFO are relevant and widely used supplemental measures of operating and financial performance of REITs, they should not be viewed as a substitute measure of our operating performance since the measures do not reflect either depreciation and amortization costs or the level of capital expenditures and leasing costs necessary to maintain the operating performance of our properties, which can be significant economic costs that could materially impact our results of operations. FFO and normalized FFO should not be considered an alternative to net income (loss) (computed in accordance with GAAP) as indicators of our financial performance or to cash flow from operating activities (computed in accordance with GAAP) as an indicator of our liquidity.

We calculate adjusted funds from operations, or AFFO, by subtracting from or adding to normalized FFO (i)�unbilled rent revenue, (ii)�non-cash share-based compensation expense, and (iii)�amortization of deferred financing costs. AFFO is an operating measurement that we use to analyze our results of operations based on the receipt, rather than the accrual, of our rental revenue and on certain other adjustments. We believe that this is an important measurement because our leases generally have significant contractual escalations of base rents and therefore result in recognition of rental income that is not collected until future periods, and costs that are deferred or are non-cash charges. Our calculation of AFFO may not be comparable to AFFO or similarly titled measures reported by other REITs. AFFO should not be considered as an alternative to net income (calculated pursuant to GAAP) as an indicator of our results of operations or to cash flow from operating activities (calculated pursuant to GAAP) as an indicator of our liquidity.

2

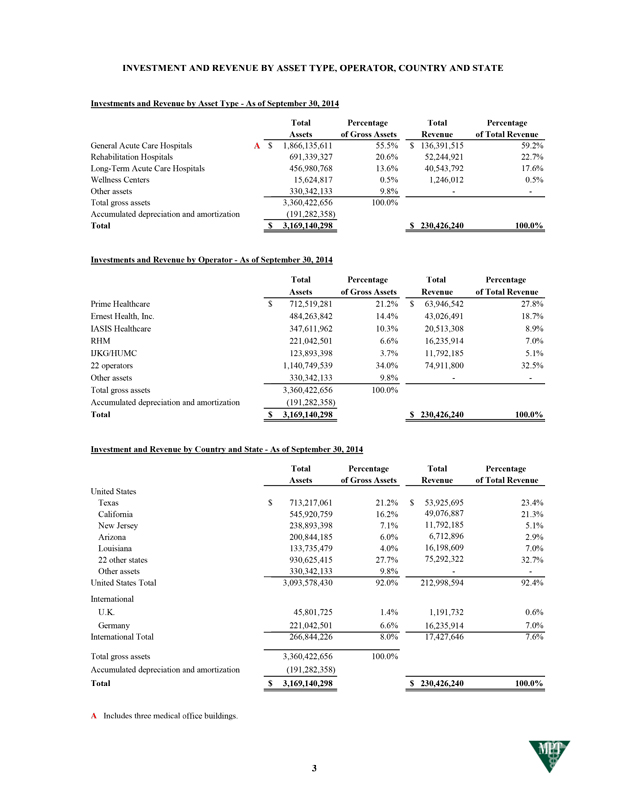

INVESTMENT AND REVENUE BY ASSET TYPE, OPERATOR, COUNTRY AND STATE

Investments and Revenue by Asset Type�As of September�30, 2014

Total Assets

Percentage of Gross Assets

Total Revenue

Percentage of Total Revenue

General Acute Care Hospitals A $ 1,866,135,611 55.5% $ 136,391,515 59.2%

Rehabilitation Hospitals 691,339,327 20.6% 52,244,921 22.7%

Long-Term Acute Care Hospitals 456,980,768 13.6% 40,543,792 17.6%

Wellness Centers 15,624,817 0.5% 1,246,012 0.5%

Other assets 330,342,133 9.8% �

Total gross assets 3,360,422,656 100.0%

Accumulated depreciation and amortization(191,282,358)

Total $ 3,169,140,298 $ 230,426,240 100.0%

Investments and Revenue by Operator�As of September�30, 2014

Total Assets

Percentage of Gross Assets

Total Revenue

Percentage of Total Revenue

Prime Healthcare $ 712,519,281 21.2% $ 63,946,542 27.8%

Ernest Health, Inc. 484,263,842 14.4% 43,026,491 18.7%

IASIS Healthcare 347,611,962 10.3% 20,513,308 8.9%

RHM 221,042,501 6.6% 16,235,914 7.0%

IJKG/HUMC 123,893,398 3.7% 11,792,185 5.1%

22 operators 1,140,749,539 34.0% 74,911,800 32.5%

Other assets 330,342,133 9.8% �

Total gross assets 3,360,422,656 100.0%

Accumulated depreciation and amortization(191,282,358)

Total $ 3,169,140,298 $ 230,426,240 100.0%

Investment and Revenue by Country and State�As of September�30, 2014

Total Assets

Percentage of Gross Assets

Total Revenue

Percentage of Total Revenue

United States

Texas $ 713,217,061 21.2% $ 53,925,695 23.4%

California 545,920,759 16.2% 49,076,887 21.3%

New Jersey 238,893,398 7.1% 11,792,185 5.1%

Arizona 200,844,185 6.0% 6,712,896 2.9%

Louisiana 133,735,479 4.0% 16,198,609 7.0%

22 other states 930,625,415 27.7% 75,292,322 32.7%

Other assets 330,342,133 9.8% �

United States Total 3,093,578,430 92.0% 212,998,594 92.4%

International

U.K. 45,801,725 1.4% 1,191,732 0.6%

Germany 221,042,501 6.6% 16,235,914 7.0%

International Total 266,844,226 8.0% 17,427,646 7.6%

Total gross assets 3,360,422,656 100.0%

Accumulated depreciation and amortization(191,282,358)

Total $ 3,169,140,298 $ 230,426,240 100.0%

A Includes three medical office buildings.

3

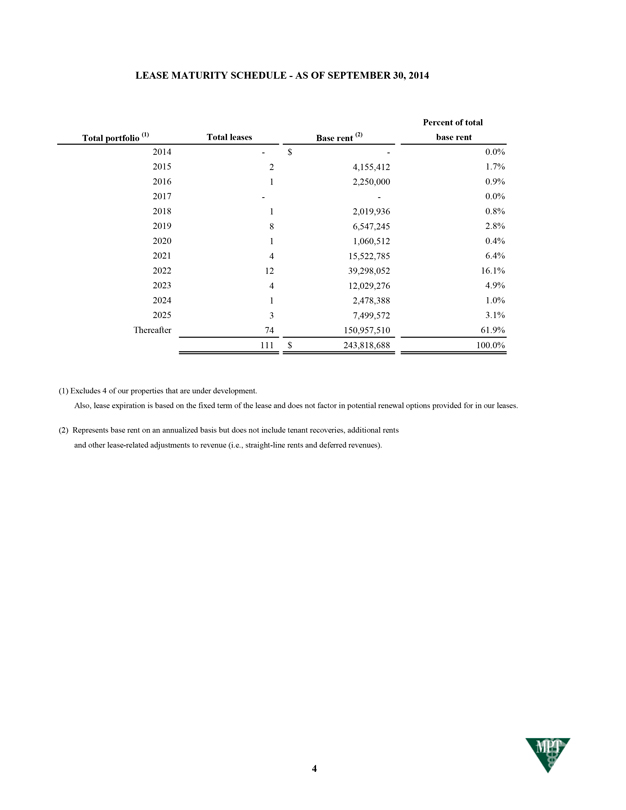

LEASE MATURITY SCHEDULE�AS OF SEPTEMBER 30, 2014

Percent of total base rent

Total portfolio (1)�Total leases Base rent (2)

2014�$�0.0%

2015 2 4,155,412 1.7%

2016 1 2,250,000 0.9%

2017 � 0.0%

2018 1 2,019,936 0.8%

2019 8 6,547,245 2.8%

2020 1 1,060,512 0.4%

2021 4 15,522,785 6.4%

2022 12 39,298,052 16.1%

2023 4 12,029,276 4.9%

2024 1 2,478,388 1.0%

2025 3 7,499,572 3.1%

Thereafter 74 150,957,510 61.9%

111 $ 243,818,688 100.0%

(1) Excludes 4 of our properties that are under development.

Also, lease expiration is based on the fixed term of the lease and does not factor in potential renewal options provided for in our leases.

(2) Represents base rent on an annualized basis but does not include tenant recoveries, additional rents and other lease-related adjustments to revenue (i.e., straight-line rents and deferred revenues).

4

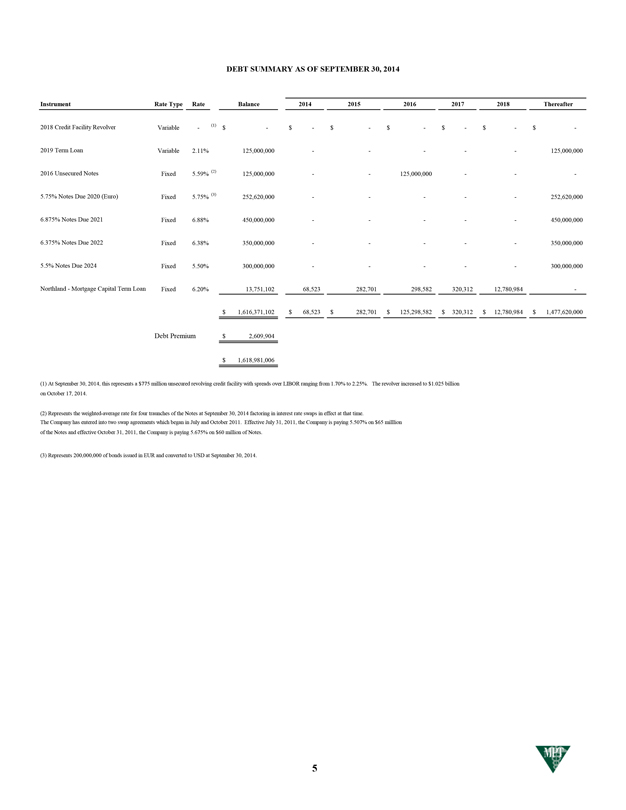

DEBT SUMMARY AS OF SEPTEMBER 30, 2014

Instrument Rate Type Rate Balance 2014 2015 2016 2017 2018 Thereafter

2018 Credit Facility Revolver Variable�(1)�$�$�$�$�$�$�$ -

2019 Term Loan Variable 2.11% 125,000,000 � ��125,000,000

2016 Unsecured Notes Fixed 5.59% (2)�125,000,000 � 125,000,000 � -

5.75% Notes Due 2020 (Euro) Fixed 5.75% (3)�252,620,000 � ��252,620,000

6.875% Notes Due 2021 Fixed 6.88% 450,000,000 � ��450,000,000

6.375% Notes Due 2022 Fixed 6.38% 350,000,000 � ��350,000,000

5.5% Notes Due 2024 Fixed 5.50% 300,000,000 � ��300,000,000

Northland�Mortgage Capital Term Loan Fixed 6.20% 13,751,102 68,523 282,701 298,582 320,312 12,780,984 -

$ 1,616,371,102 $ 68,523 $ 282,701 $ 125,298,582 $ 320,312 $ 12,780,984 $ 1,477,620,000

Debt Premium $ 2,609,904

$ 1,618,981,006

(1) At September�30, 2014, this represents a $775 million unsecured revolving credit facility with spreads over LIBOR ranging from 1.70% to 2.25%. The revolver increased to $1.025 billion on October�17, 2014.

(2) Represents the weighted-average rate for four traunches of the Notes at September�30, 2014 factoring in interest rate swaps in effect at that time.

The Company has entered into two swap agreements which began in July and October 2011. Effective July�31, 2011, the Company is paying 5.507% on $65 milllion of the Notes and effective October�31, 2011, the Company is paying 5.675% on $60 million of Notes.

(3) Represents 200,000,000 of bonds issued in EUR and converted to USD at September�30, 2014.

5

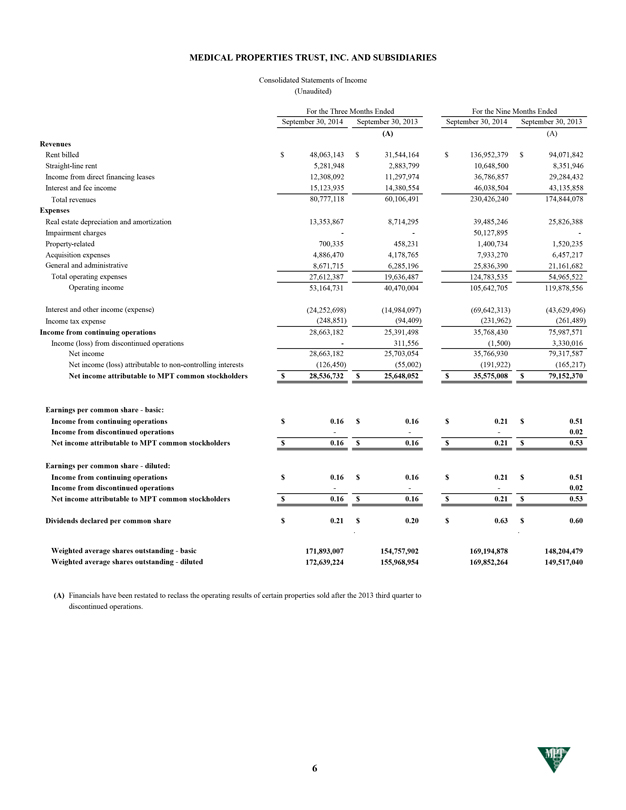

MEDICAL PROPERTIES TRUST, INC. AND SUBSIDIARIES

Consolidated Statements of Income

(Unaudited)

For the Three Months Ended For the Nine Months Ended

September�30, 2014�September�30, 2013�September�30, 2014�September�30, 2013

(A)(A)

Revenues

Rent billed $ 48,063,143 $ 31,544,164 $ 136,952,379 $ 94,071,842

Straight-line rent 5,281,948 2,883,799 10,648,500 8,351,946

Income from direct financing leases 12,308,092 11,297,974 36,786,857 29,284,432

Interest and fee income 15,123,935 14,380,554 46,038,504 43,135,858

Total revenues 80,777,118 60,106,491 230,426,240 174,844,078

Expenses

Real estate depreciation and amortization 13,353,867 8,714,295 39,485,246 25,826,388

Impairment charges � 50,127,895 -

Property-related 700,335 458,231 1,400,734 1,520,235

Acquisition expenses 4,886,470 4,178,765 7,933,270 6,457,217

General and administrative 8,671,715 6,285,196 25,836,390 21,161,682

Total operating expenses 27,612,387 19,636,487 124,783,535 54,965,522

Operating income 53,164,731 40,470,004 105,642,705 119,878,556

Interest and other income (expense)(24,252,698)(14,984,097)(69,642,313)(43,629,496)

Income tax expense(248,851)(94,409)(231,962)(261,489)

Income from continuing operations 28,663,182 25,391,498 35,768,430 75,987,571

Income (loss) from discontinued operations�311,556(1,500) 3,330,016

Net income 28,663,182 25,703,054 35,766,930 79,317,587

Net income (loss) attributable to non-controlling interests(126,450)(55,002)(191,922)(165,217)

Net income attributable to MPT common stockholders $ 28,536,732 $ 25,648,052 $ 35,575,008 $ 79,152,370

Earnings per common share�basic:

Income from continuing operations $ 0.16 $ 0.16 $ 0.21 $ 0.51

Income from discontinued operations ��0.02

Net income attributable to MPT common stockholders $ 0.16 $ 0.16 $ 0.21 $ 0.53

Earnings per common share�diluted:

Income from continuing operations $ 0.16 $ 0.16 $ 0.21 $ 0.51

Income from discontinued operations ��0.02

Net income attributable to MPT common stockholders $ 0.16 $ 0.16 $ 0.21 $ 0.53

Dividends declared per common share $ 0.21 $ 0.20 $ 0.63 $ 0.60

Weighted average shares outstanding�basic 171,893,007 154,757,902 169,194,878 148,204,479

Weighted average shares outstanding�diluted 172,639,224 155,968,954 169,852,264 149,517,040

(A) Financials have been restated to reclass the operating results of certain properties sold after the 2013 third quarter to

discontinued operations.

6

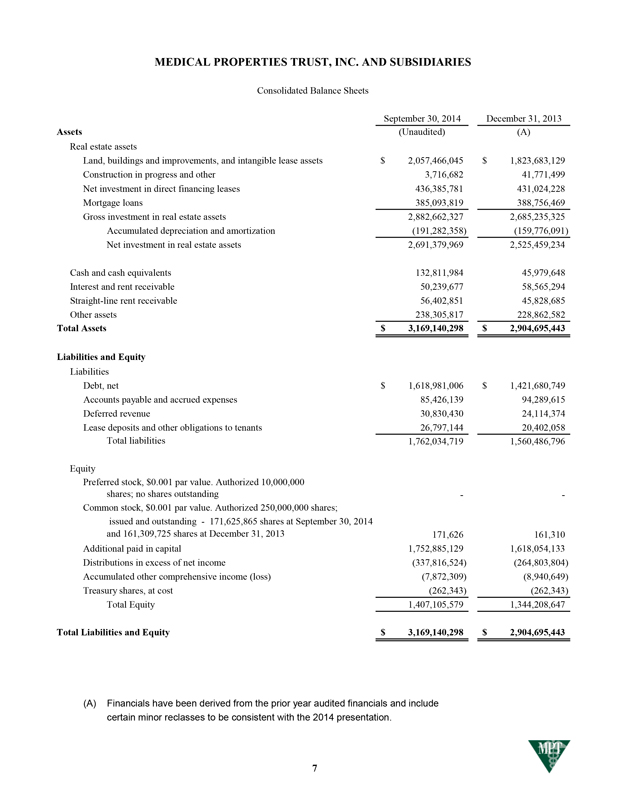

MEDICAL PROPERTIES TRUST, INC. AND SUBSIDIARIES

Consolidated Balance Sheets

September�30, 2014�December�31, 2013

Assets(Unaudited)(A)

Real estate assets

Land, buildings and improvements, and intangible lease assets $ 2,057,466,045 $ 1,823,683,129

Construction in progress and other 3,716,682 41,771,499

Net investment in direct financing leases 436,385,781 431,024,228

Mortgage loans 385,093,819 388,756,469

Gross investment in real estate assets 2,882,662,327 2,685,235,325

Accumulated depreciation and amortization(191,282,358)(159,776,091)

Net investment in real estate assets 2,691,379,969 2,525,459,234

Cash and cash equivalents 132,811,984 45,979,648

Interest and rent receivable 50,239,677 58,565,294

Straight-line rent receivable 56,402,851 45,828,685

Other assets 238,305,817 228,862,582

Total Assets $ 3,169,140,298 $ 2,904,695,443

Liabilities and Equity

Liabilities

Debt, net $ 1,618,981,006 $ 1,421,680,749

Accounts payable and accrued expenses 85,426,139 94,289,615

Deferred revenue 30,830,430 24,114,374

Lease deposits and other obligations to tenants 26,797,144 20,402,058

Total liabilities 1,762,034,719 1,560,486,796

Equity

Preferred stock, $0.001 par value. Authorized 10,000,000

shares; no shares outstanding �

Common stock, $0.001 par value. Authorized 250,000,000 shares;

issued and outstanding�171,625,865 shares at September�30, 2014

and 161,309,725 shares at December�31, 2013 171,626 161,310

Additional paid in capital 1,752,885,129 1,618,054,133

Distributions in excess of net income(337,816,524)(264,803,804)

Accumulated other comprehensive income (loss)(7,872,309)(8,940,649)

Treasury shares, at cost(262,343)(262,343)

Total Equity 1,407,105,579 1,344,208,647

Total Liabilities and Equity $ 3,169,140,298 $ 2,904,695,443

(A) Financials have been derived from the prior year audited financials and include certain minor reclasses to be consistent with the 2014 presentation.

7

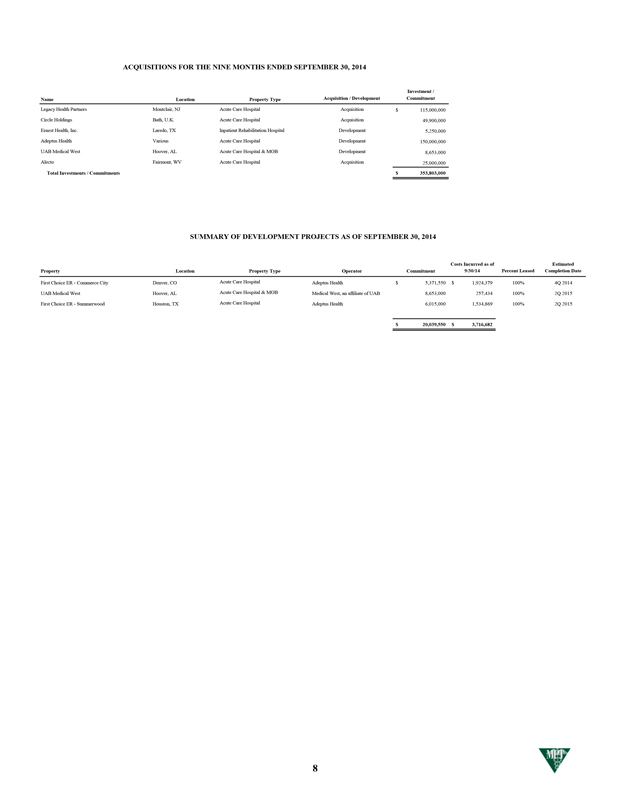

ACQUISITIONS FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2014

Name Location Property Type Acquisition / Development Investment / commitment

Legacy Health Partners Montclair, NJ Acute Care Hospital Acquisition $ 115,000,000

Circle Holdings Bath, U.K. Acute Care Hospital Acquisition 49,900,000

Ernest Health, Inc. Laredo, TX Inpatient Rehabilitation Hospital Development 5,250,000

Adeptus Health Various Acute Care Hospital Development 150,000,000

UAB Medical West Hoover, AL Acute Care Hospital�& MOB Development 8,653,000

Alecto Fairmont, WV Acute Care Hospital Acquisition 25,000,000

Total Investments / Commitments $ 353,803,000

SUMMARY OF DEVELOPMENT PROJECTS AS OF SEPTEMBER 30, 2014

Property Location Property Type Operator Commitment Costs Incurred as of 9/30/14 Percent Leased Estimated Completion Date

First Choice ER�Commerce City Denver, CO Acute Care Hospital Adeptus Health $ 5,371,550 $ 1,924,379 100% 4Q 2014

UAB Medical West Hoover, AL Acute Care Hospital�& MOB Medical West, an affiliate of UAB 8,653,000 257,434 100% 2Q 2015

First Choice ER�Summerwood Houston, TX Acute Care Hospital Adeptus Health 6,015,000 1,534,869 100% 2Q 2015

$ 20,039,550 $ 3,716,682

8

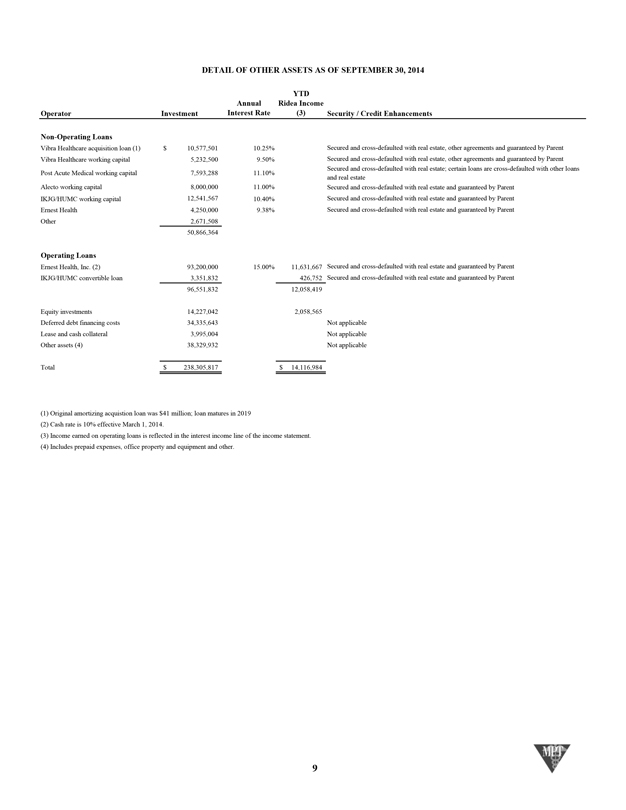

DETAIL OF OTHER ASSETS AS OF SEPTEMBER 30, 2014

Operator Investment

Annual Interest Rate

YTD Ridea Income (3)

Security / Credit Enhancements

Non-Operating Loans

Vibra Healthcare acquisition loan (1)�$ 10,577,501 10.25% Secured and cross-defaulted with real estate, other agreements and guaranteed by Parent

Vibra Healthcare working capital 5,232,500 9.50% Secured and cross-defaulted with real estate, other agreements and guaranteed by Parent

Post Acute Medical working capital 7,593,288 11.10% Secured and cross-defaulted with real estate; certain loans are cross-defaulted with other loans

and real estate

Alecto working capital 8,000,000 11.00% Secured and cross-defaulted with real estate and guaranteed by Parent

IKJG/HUMC working capital 12,541,567 10.40% Secured and cross-defaulted with real estate and guaranteed by Parent

Ernest Health 4,250,000 9.38% Secured and cross-defaulted with real estate and guaranteed by Parent

Other 2,671,508

50,866,364

Operating Loans

Ernest Health, Inc. (2)�93,200,000 15.00% 11,631,667 Secured and cross-defaulted with real estate and guaranteed by Parent

IKJG/HUMC convertible loan 3,351,832 426,752 Secured and cross-defaulted with real estate and guaranteed by Parent

96,551,832 12,058,419

Equity investments 14,227,042 2,058,565

Deferred debt financing costs 34,335,643 Not applicable

Lease and cash collateral 3,995,004 Not applicable

Other assets (4)�38,329,932 Not applicable

Total $ 238,305,817 $ 14,116,984

(1) Original amortizing acquistion loan was $41 million; loan matures in 2019

(2) Cash rate is 10% effective March�1, 2014.

(3) Income earned on operating loans is reflected in the interest income line of the income statement.

(4) Includes prepaid expenses, office property and equipment and other.

9

Medical Properties Trust, Inc. 1000 Urban Center Drive, Suite 501 Birmingham, AL 35242 (205)�969-3755 www.medicalpropertiestrust.com

Contact:

Charles Lambert, Managing Director�Capital Markets (205)�397-8897 or [email protected] or Tim Berryman, Director�Investor Relations (205)�397-8589 or [email protected]

InvestIng In the future of healthcare.

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Atour Lifestyle Holdings Limited Filed 2023 Annual Report on Form 20-F

- BitFuFu Files 2023 Annual Report on Form 20-F

- Vinhomes, Vietnam largest property developer, unveils a series of new entertainment and shopping destinations

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share