Form 8-K MEDICAL PROPERTIES TRUST For: Nov 04

Table of Contents

�

�

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

�

�

FORM 8-K

�

�

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): November�4, 2014

�

�

MEDICAL PROPERTIES TRUST, INC.

(Exact Name of Registrant as Specified in Charter)

�

�

Commission File Number 001-32559

�

| Maryland | � | 20-0191742 |

| (State or other jurisdiction of incorporation or organization ) |

� | (I. R. S. Employer Identification No.) |

| 1000 Urban Center Drive, Suite�501 Birmingham, AL |

� | 35242 |

| (Address of principal executive offices) | � | (Zip Code) |

Registrant�s telephone number, including area code

(205)�969-3755

�

�

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

�

| � | Written communications pursuant to Rule�425 under the Securities Act (17 CFR 230.425) |

�

| � | Soliciting material pursuant to Rule�14a-12 under the Exchange Act (17 CFR 240.14a-12) |

�

| � | Pre-commencement communications pursuant to Rule�14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

�

| � | Pre-commencement communications pursuant to Rule�13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

�

�

�

Table of Contents

�

| Item 7.01 Regulation FD Disclosure |

| Item 9.01 Financial Statements and Exhibits |

| SIGNATURE |

| EX-99.1 INFORMATION FOR INVESTOR MEETINGS |

Table of Contents

Item�7.01 Regulation�FD Disclosure

On November�4, 2014, the management of Medical Properties Trust, Inc. began using the investor presentation attached as Exhibit 99.1 to this Current Report on Form 8-K to be used in connection with presentations and one-on-one meetings with investors, analysts and others during the fourth quarter of 2014. A powerpoint version of these slides is located on the investor relations portion of our web site, www.medicalpropertiestrust.com . The information in this Item�7.01 of this Current Report on Form 8-K, including the exhibits hereto, shall not be deemed �filed� for purposes of Section�18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended.

In addition to the historical information contained within, the subject matters discussed in this information may contain forward-looking statements that involve risks and uncertainties. The various risk factors are discussed in our Annual Report on Form 10-K filed with the SEC for the year ended December�31, 2013. Forward-looking statements represent the Company�s judgment as of the date of this presentation. The Company disclaims any obligation to update forward-looking material.

Item�9.01 Financial Statements and Exhibits

(c)�Exhibits

�

| Exhibit |

�� | Description |

| 99.1 | �� | Information for investor meetings beginning November�4, 2014 |

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

�

| MEDICAL PROPERTIES TRUST, INC. | ||

| (Registrant) | ||

| By: | � | /s/ R. Steven Hamner |

| R. Steven Hamner | ||

| Executive Vice President and Chief Financial Officer | ||

| (Principal Financial and Accounting Officer) | ||

Date: November�4, 2014

| Exhibit 99.1 �

|

�

Exhibit 99.1

Investor Presentation

November 2014

|

|

�

Safe Harbor

This presentation includes �forward-looking statements� within the meaning of securities laws of applicable jurisdictions. Forward-looking statements can generally be identified by the use of forward-looking words such as �may�, �will�, �would�, �could�, �expect�, �intend�, �plan�, �aim�, �estimate�, �target�, �anticipate�, �believe�, �continue�, �objectives�, �outlook�, �guidance� or other similar words, and include statements regarding MPT�s plans, strategies, objectives, targets, future expansion and development activities and expected financial performance. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results of the Company or future events to differ materially from those expressed in or underlying such forward-looking statements, including without limitation: the satisfaction of all conditions to, and the timely closing (if at all) of the Median acquisition and sale-leaseback transactions; the Company�s financing of the transactions described herein; Median�s expected rent coverage; the capacity of Median and the Company�s other tenants to meet the terms of their agreements; Normalized FFO per share; expected payout ratio, the amount of acquisitions of healthcare real estate, if any; capital markets conditions, the repayment of debt arrangements; statements concerning the additional income to the Company as a result of ownership interests in certain hospital operations and the timing of such income; the payment of future dividends, if any; completion of additional debt arrangement, and additional investments; national and international economic, business, real estate and other market conditions; the competitive environment in which the Company operates; the execution of the Company�s business plan; financing risks; the Company�s ability to maintain its status as a REIT for federal income tax purposes; acquisition and development risks; potential environmental and other liabilities; and other factors affecting the real estate industry generally or healthcare real estate in particular; and the value of our real estate assets, which may limit our ability to dispose of assets at attractive prices or obtain or maintain equity or debt financing secured by our properties or on an unsecured basis, and the factors referenced under the section captioned �Item 1.A Risk Factors� in our annual report on Form 10-K for the year ended December�31, 2013. Actual results, performance or achievements may vary materially from any projections and forward looking statements and the assumptions on which those statements are based. Readers are cautioned not to place undue reliance on forward-looking statements, and MPT disclaims any responsibility to update such information.

| 2 |

� |

|

|

�

Table of Contents

MEDIAN Kliniken 4 German Rehabilitation 9 MPT Opportunities 15 Appendix 25

|

|

�

MEDIAN Overview

MEDIAN Kliniken is the leading private provider of post-acute and acute rehabilitation in Germany

Strongly capitalized with private equity backing

Focus on neurology, orthopedics, and traditional post-acute � fastest growing and most profitable sectors of German rehab

MEDIAN Kliniken currently has 43 facilities and approximately 9,400 beds

41 clinics are owned and 2 are leased

| 2 |

� |

additional acute care facilities will be acquired prior to closing (1 owned and 1 leased) |

Well-conceived plan to grow EBITDA by identified opportunities for margin improvement and continued consolidation of the German rehab market

Well diversified across clinical indications

Geographically dispersed throughout 12 states

Weserklinik Bad Gottleuba Berggie�h�bel

| 4 |

� |

|

|

�

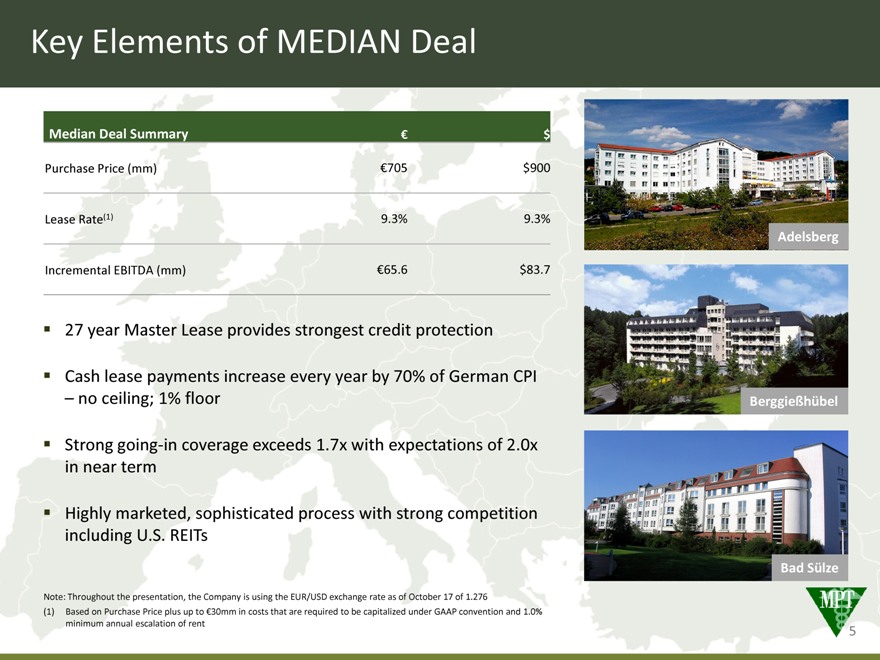

Key Elements of MEDIAN Deal

Median Deal Summary € $

Purchase Price (mm) €705 $900

Lease Rate(1) 9.3% 9.3%

Incremental EBITDA (mm) €65.6 $83.7

27 year Master Lease provides strongest credit protection

Cash lease payments increase every year by 70% of German CPI � no ceiling; 1% floor

Strong going-in coverage exceeds 1.7x with expectations of 2.0x in near term

Highly marketed, sophisticated process with strong competition including U.S. REITs

Note: Throughout the presentation, the Company is using the EUR/USD exchange rate as of October�17 of 1.276

(1) Based on Purchase Price plus up to €30mm in costs that are required to be capitalized under GAAP convention and 1.0% minimum annual escalation of rent

Adelsberg

Berggie�h�bel

Bad S�lze

| 5 |

� |

|

|

�

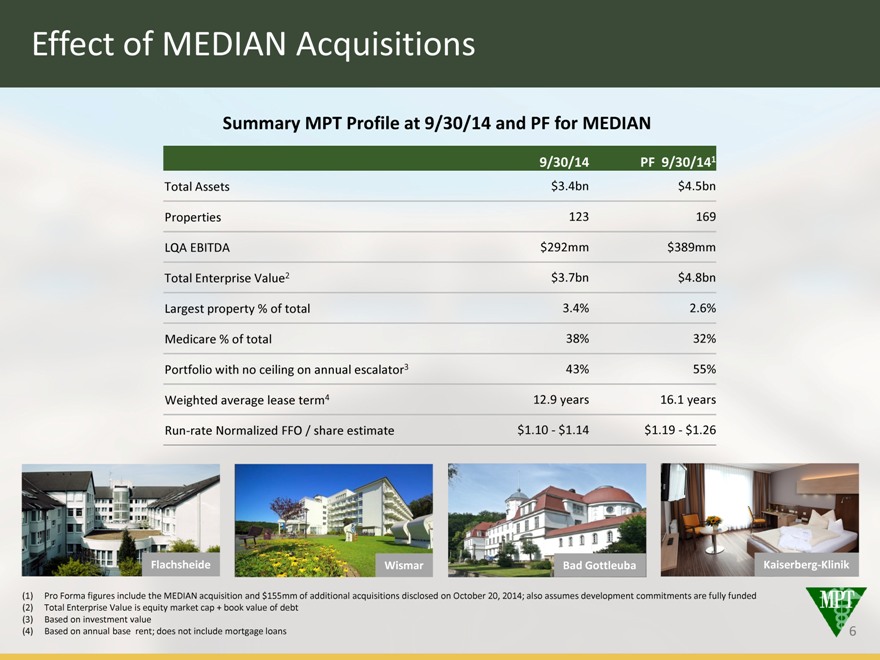

Effect of MEDIAN Acquisitions

Summary MPT Profile at 9/30/14 and PF for MEDIAN

9/30/14 PF 9/30/141

Total Assets $3.4bn $4.5bn

Properties 123 169

LQA EBITDA $292mm $389mm

Total Enterprise Value2 $3.7bn $4.8bn

Largest property % of total 3.4% 2.6%

Medicare % of total 38% 32%

Portfolio with no ceiling on annual escalator3 43% 55%

Weighted average lease term4 12.9 years 16.1 years

Run-rate Normalized FFO / share estimate $1.10�$1.14 $1.19�$1.26

(1) Pro Forma figures include the MEDIAN acquisition and $155mm of additional acquisitions disclosed on October�20, 2014; also assumes development commitments are fully funded (2)�Total Enterprise Value is equity market cap + book value of debt (3)�Based on investment value (4)�Based on annual base rent; does not include mortgage loans

Flachsheide Wismar Bad Gottleuba Kaiserberg-Klinik

| 6 |

� |

|

|

�

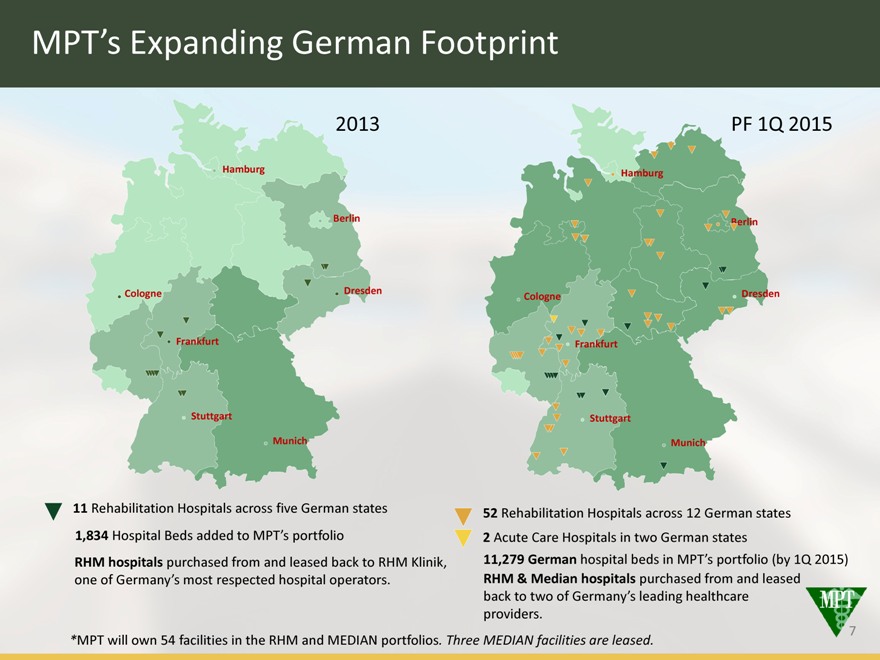

MPT�s Expanding German Footprint

2013

Hamburg

Berlin

Cologne Dresden

Frankfurt

Stuttgart

Munich

PF 1Q 2015

Hamburg

Berlin

Cologne Dresden

Frankfurt

Stuttgart

Munich

11 Rehabilitation Hospitals across five German states

1,834 Hospital Beds added to MPT�s portfolio

RHM hospitals purchased from and leased back to RHM Klinik, one of Germany�s most respected hospital operators.

52 Rehabilitation Hospitals across 12 German states

| 2 |

� |

Acute Care Hospitals in two German states |

11,279 German hospital beds in MPT�s portfolio (by 1Q 2015)

RHM�& Median hospitals purchased from and leased back to two of Germany�s leading healthcare providers.

*MPT will own 54 facilities in the RHM and MEDIAN portfolios. Three MEDIAN facilities are leased.

| 7 |

� |

|

|

�

Table of Contents

MEDIAN Kliniken 4

German Rehabilitation 9

MPT Opportunities 15

Appendix 25

| 8 |

� |

|

|

�

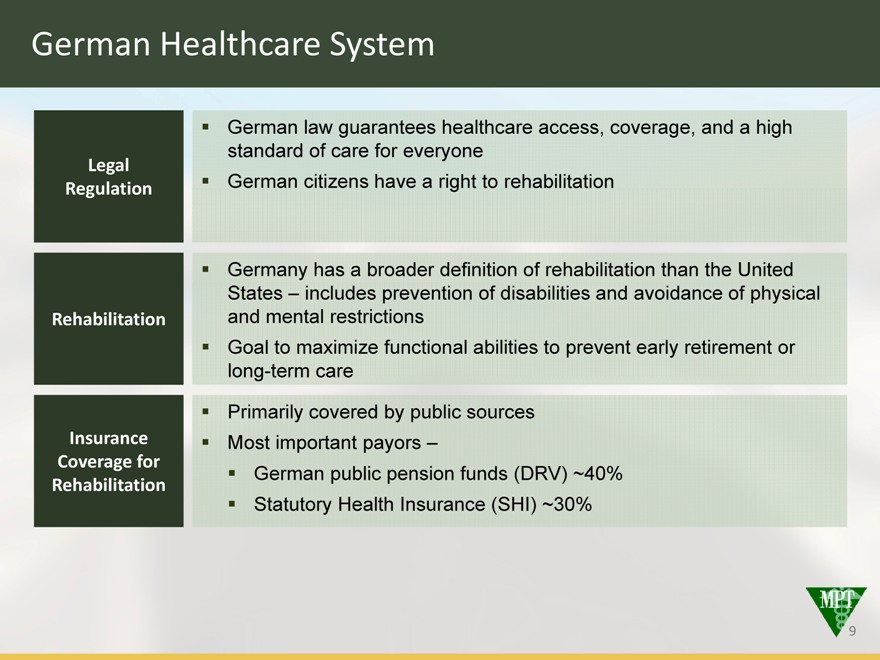

German Healthcare System

German law guarantees healthcare access, coverage, and a high

standard of care for everyone

Legal

Regulation German citizens have a right to rehabilitation

Germany has a broader definition of rehabilitation than the United

States � includes prevention of disabilities and avoidance of physical

Rehabilitation and mental restrictions

Goal to maximize functional abilities to prevent early retirement or

long-term care

Primarily covered by public sources

Insurance Most important payors �

Coverage for German public pension funds (DRV) ~40%

Rehabilitation

Statutory Health Insurance (SHI) ~30%

9

|

|

�

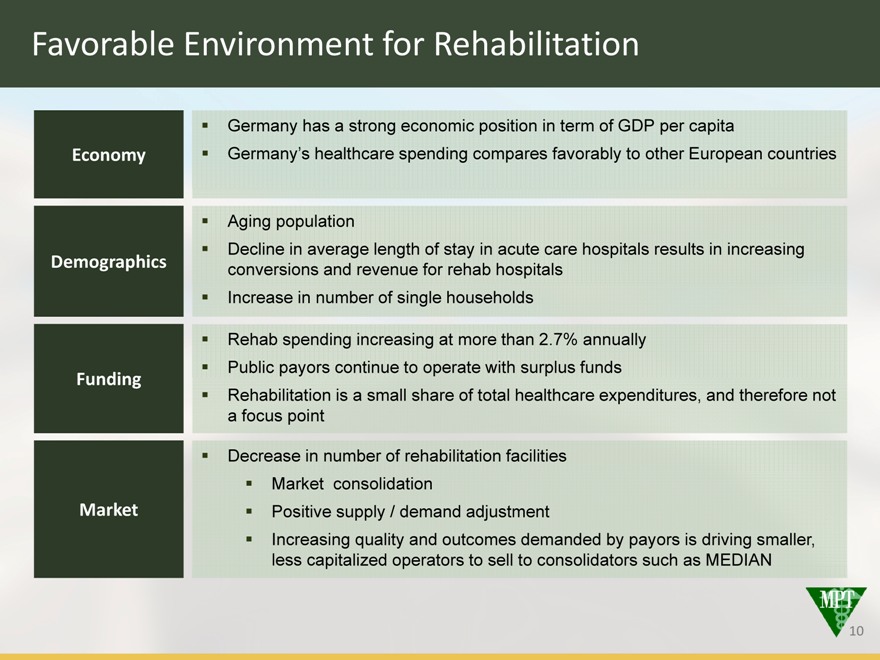

Favorable Environment for Rehabilitation

Germany has a strong economic position in term of GDP per capita

Economy Germany�s healthcare spending compares favorably to other European countries

Aging population

Decline in average length of stay in acute care hospitals results in increasing

Demographics conversions and revenue for rehab hospitals

Increase in number of single households

Rehab spending increasing at more than 2.7% annually

Public payors continue to operate with surplus funds

Funding

Rehabilitation is a small share of total healthcare expenditures, and therefore not

a focus point

Decrease in number of rehabilitation facilities

Market consolidation

Market Positive supply / demand adjustment

Increasing quality and outcomes demanded by payors is driving smaller,

less capitalized operators to sell to consolidators such as MEDIAN

10

|

|

�

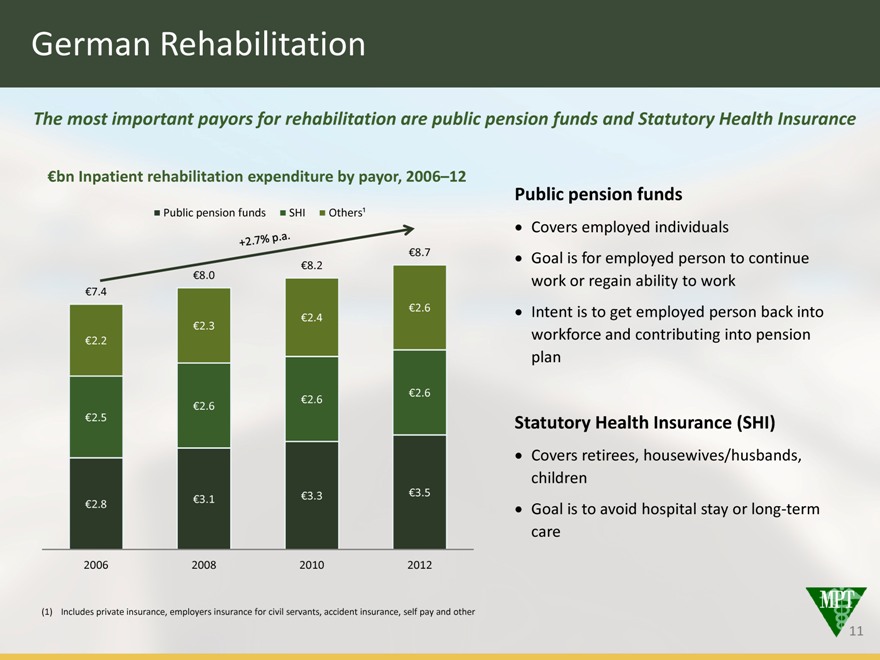

German Rehabilitation

The most important payors for rehabilitation are public pension funds and Statutory Health Insurance

€bn Inpatient rehabilitation expenditure by payor, 2006�12

Public pension funds SHI Others�

€ 7.4

€ 2.6

€ 2.4

€ 2.3

€ 2.2

€ 2.6

€ 2.6 € 2.6 €8.0 €8.2 €8.7

+2.7%p.a.

€ 2.5

€ 3.3 € 3.5

€ 2.8 € 3.1

2006 2008 2010 2012

Public pension funds

Covers employed individuals

Goal is for employed person to continue work or regain ability to work Intent is to get employed person back into workforce and contributing into pension plan

Statutory Health Insurance (SHI)

Covers retirees, housewives/husbands, children Goal is to avoid hospital stay or long-term care

| (1) |

� |

Includes private insurance, employers insurance for civil servants, accident insurance, self pay and other |

11

|

|

�

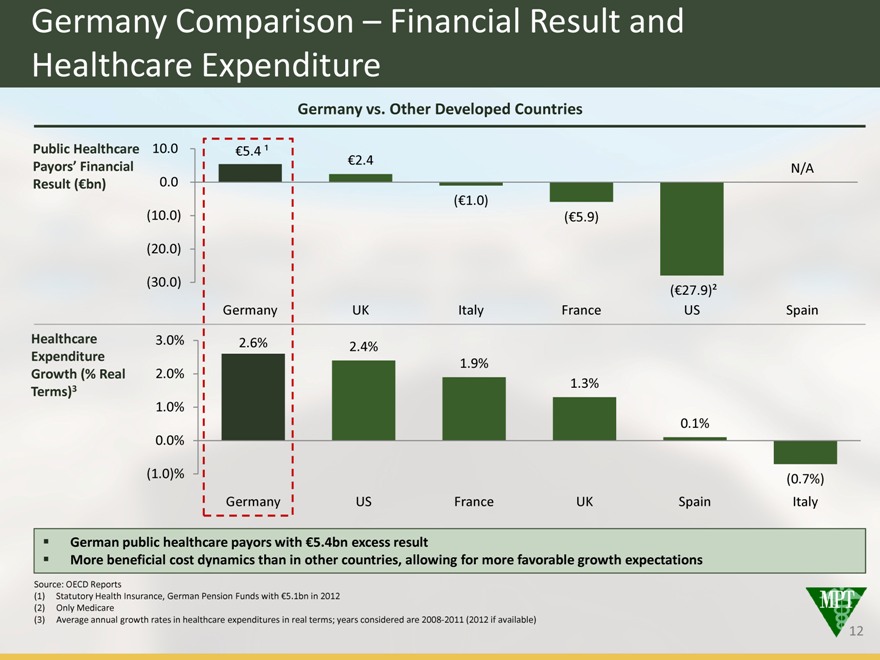

Germany Comparison � Financial Result and Healthcare Expenditure

Germany vs. Other Developed Countries

Public Healthcare 10.0 €5.4 �

€2.4

Payors� Financial N/A

Result (€bn) 0.0

(€1.0)

(10.0) (€5.9)

(20.0)

(30.0)

(€27.9)�

Germany UK Italy France US Spain

Healthcare 3.0% 2.6% 2.4%

Expenditure 1.9%

Growth (% Real 2.0%

Terms)3 1.3%

1.0%

0.1%

0.0%

(1.0)% (0.7%)

Germany US France UK Spain Italy

German public healthcare payors with €5.4bn excess result

More beneficial cost dynamics than in other countries, allowing for more favorable growth expectations

Source: OECD Reports

| (1) |

� |

Statutory Health Insurance, German Pension Funds with €5.1bn in 2012 (2)�Only Medicare |

(3) Average annual growth rates in healthcare expenditures in real terms; years considered are 2008-2011 (2012 if available)

12

|

|

�

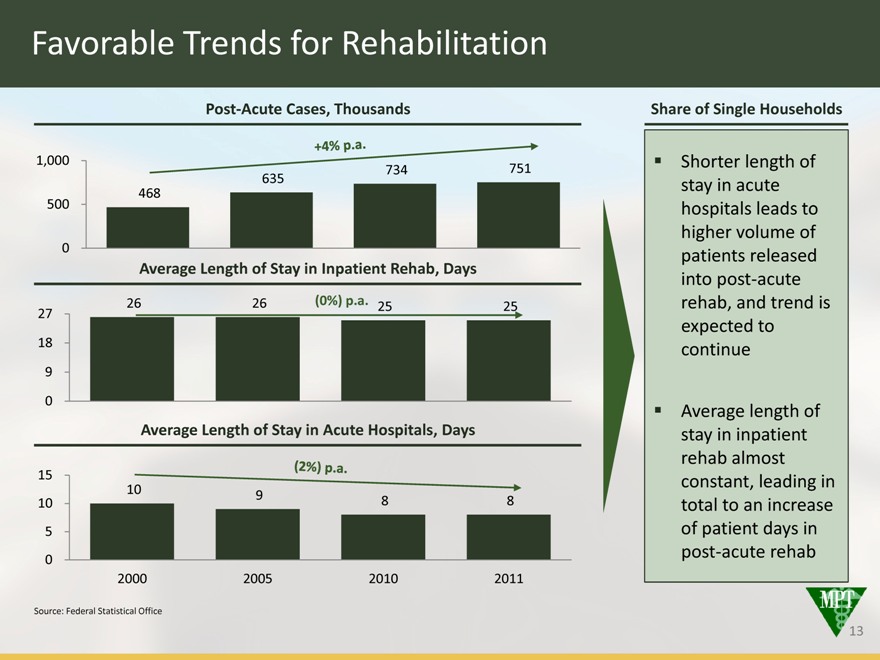

Favorable Trends for Rehabilitation

Post-Acute Cases, Thousands

1,000 +4% p.a.

734 751

635

468

500

0

Average Length of Stay in Inpatient Rehab, Days

27 26 26 (0%) p.a. 25 25

18

9

0

Average Length of Stay in Acute Hospitals, Days

15

10 9

10 8 8

| 5 |

� |

0

2000 2005 2010 2011

Source: Federal Statistical Office

Share of Single Households

Shorter length of stay in acute hospitals leads to higher volume of patients released into post-acute rehab, and trend is expected to continue

Average length of stay in inpatient rehab almost constant, leading in total to an increase of patient days in post-acute rehab

13

|

|

�

Table of Contents

MEDIAN Kliniken 4

German Rehabilitation 9

MPT Opportunities 15

Appendix 25

14

|

|

�

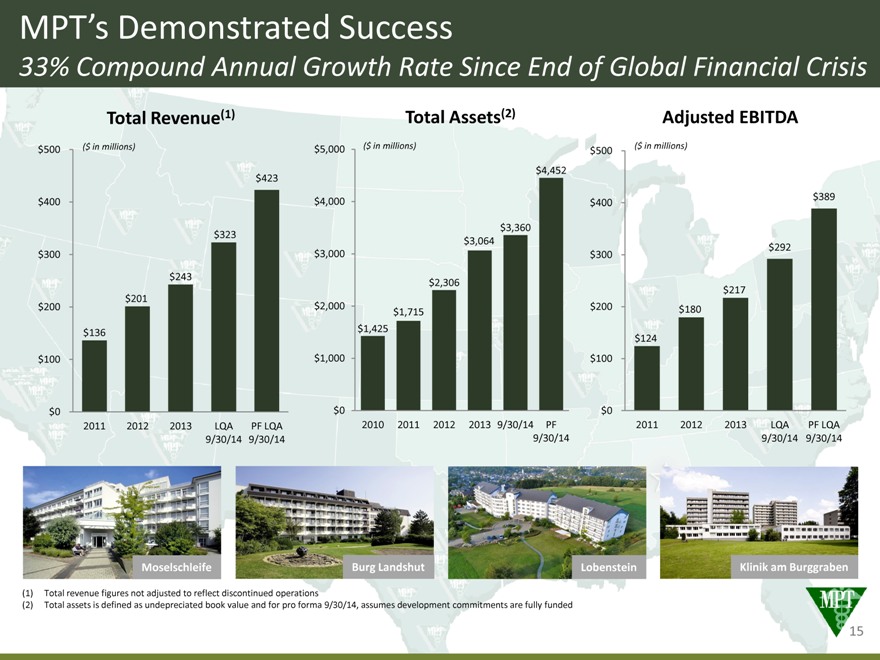

MPT�s Demonstrated Success

33% Compound Annual Growth Rate Since End of Global Financial Crisis

Total Revenue(1)

$500 ($ in millions)

$423

$400

$323

$300

$243

$201

$200

$136

$100

$0

2011 2012 2013 LQA PF LQA

9/30/14 9/30/14

Total Assets(2)

$5,000 ($ in millions)

$4,452

$4,000

$3,360

$3,064

$3,000

$2,306

$2,000 $1,715

$1,425

$1,000

$0

2010 2011 2012 2013 9/30/14 PF

9/30/14

Adjusted EBITDA

$500 ($ in millions)

$400 $389

$292

$300

$217

$200 $180

$124

$100

$0

2011 2012 2013 LQA PF LQA

9/30/14 9/30/14

Moselschleife Burg Landshut Lobenstein Klinik am Burggraben

(1) Total revenue figures not adjusted to reflect discontinued operations

(2) Total assets is defined as undepreciated book value and for pro forma 9/30/14, assumes development commitments are fully funded

15

|

|

�

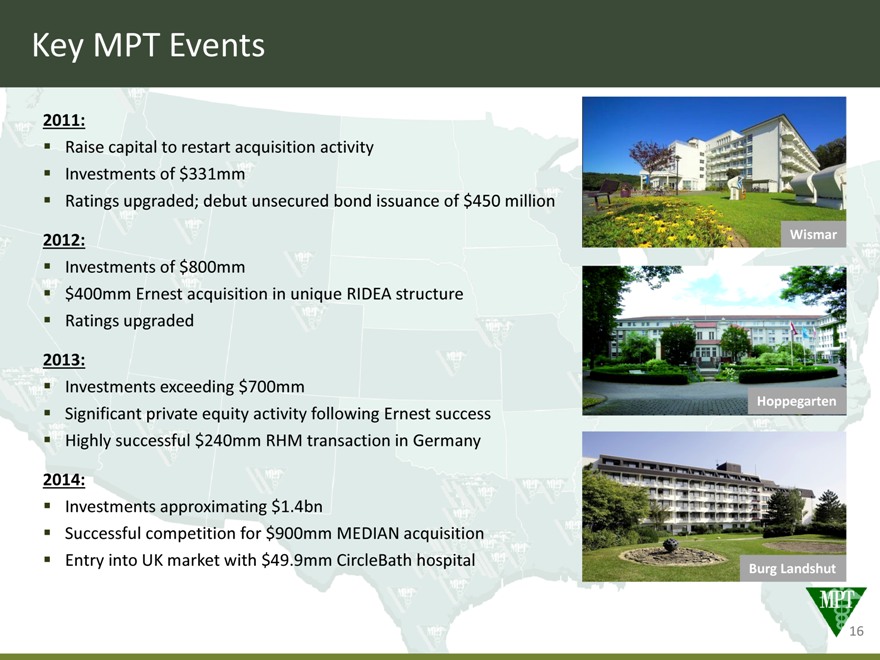

Key MPT Events

2011:

Raise capital to restart acquisition activity Investments of $331mm

Ratings upgraded; debut unsecured bond issuance of $450 million

2012:

Investments of $800mm

$400mm Ernest acquisition in unique RIDEA structure Ratings upgraded

2013:

Investments exceeding $700mm

Significant private equity activity following Ernest success Highly successful $240mm RHM transaction in Germany

2014:

Investments approximating $1.4bn

Successful competition for $900mm MEDIAN acquisition Entry into UK market with $49.9mm CircleBath hospital

Wismar

Hoppegarten

Burg Landshut

16

|

|

�

Key Market Events Since 2010

Post-crisis, hospital operators accessing sale/leaseback funding Private equity Not-for-profits IPO candidates Knowledgeable analysts and investors understand low risk of hospital reimbursement New entrants into market Non-traded REITs Large and smaller public REITs Sovereign wealth Fund managers Current returns continue to be highest of any real estate class Development of new trends in healthcare delivery Affordable Care Act Efficiency and reimbursement stability of post-acute care validated New physical plant including free-standing Emergency Rooms Aggressive conversion of not-for-profit facilities to for-profit ownership

Adelsberg

Berggie�h�bel

Bad S�lze

17

|

|

�

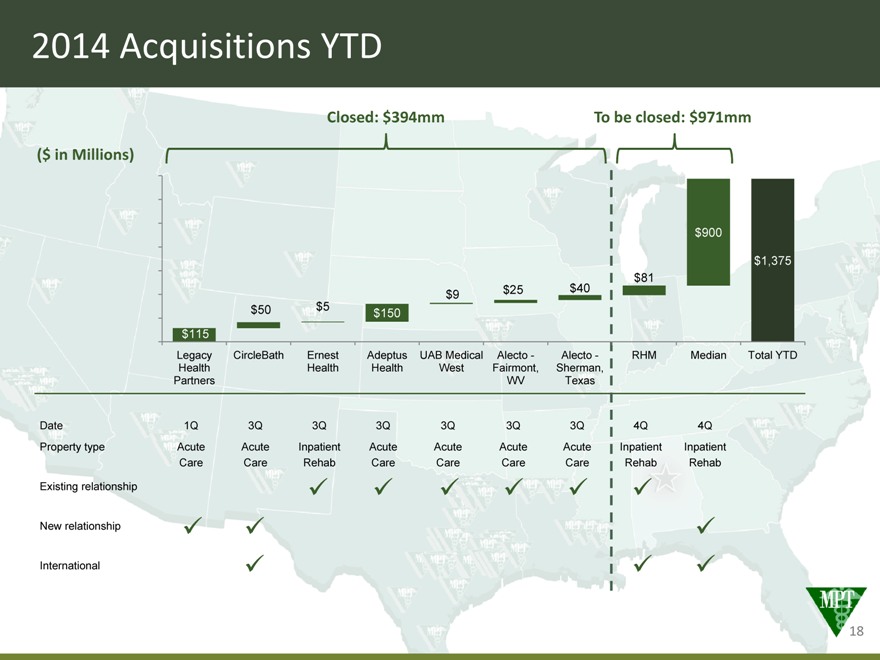

2014 Acquisitions YTD

Closed: $394mm To be closed: $971mm

($ in Millions)

$900

$1,375

$81

$9 $25 $40

$50 $5 $150

$115

Legacy CircleBath Ernest Adeptus UAB Medical Alecto� Alecto� RHM Median Total YTD

Health Health Health West Fairmont, Sherman,

Partners WV Texas

Date 1Q 3Q 3Q 3Q 3Q 3Q 3Q 4Q 4Q

Property type Acute Acute Inpatient Acute Acute Acute Acute Inpatient Inpatient

Care Care Rehab Care Care Care Care Rehab Rehab

Existing relationship

New relationship

International

18

|

|

�

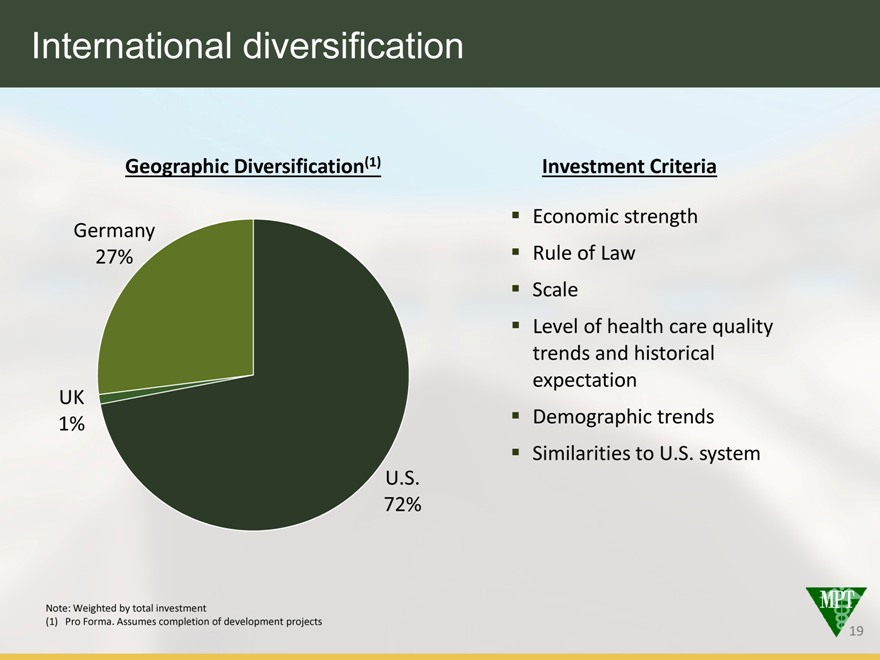

International diversification

Geographic Diversification(1)

Germany

27%

UK

1%

U.S.

72%

Investment Criteria

Economic strength Rule of Law Scale Level of health care quality trends and historical expectation

Demographic trends

Similarities to U.S. system

Note: Weighted by total investment

| (1) |

� |

Pro Forma. Assumes completion of development projects |

19

|

|

�

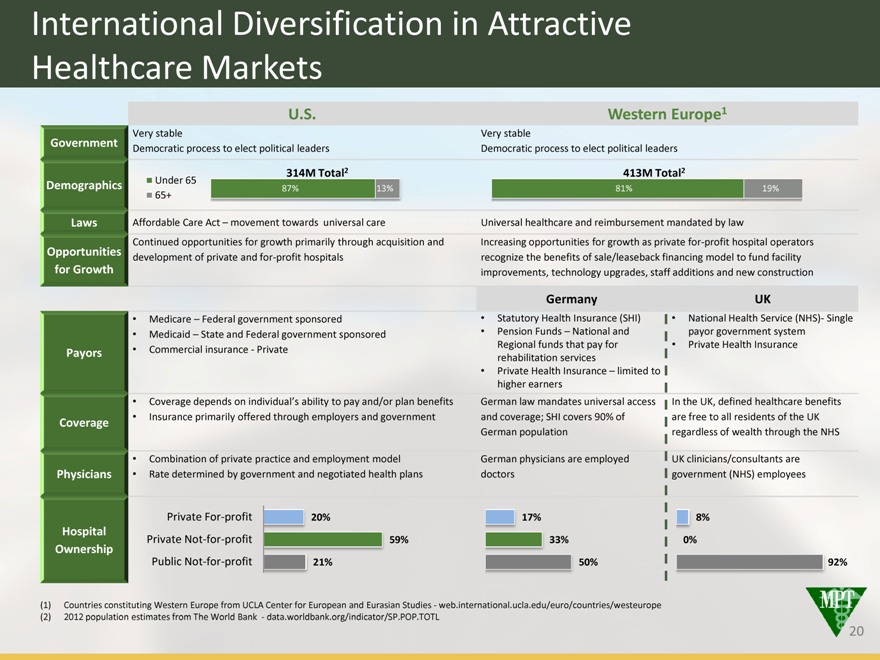

International Diversification in Attractive

Healthcare Markets

U.S.

Very stable

Government Democratic process to elect political leaders

314M Total2

Under 65

Demographics 87% 13%

65+

Laws Affordable Care Act � movement towards universal care

Continued opportunities for growth primarily through acquisition and

Opportunities development of private and for-profit hospitals

for Growth

Western Europe1

Very stable

Democratic process to elect political leaders

413M Total2

81% 19%

Universal healthcare and reimbursement mandated by law

Increasing opportunities for growth as private for-profit hospital operators

recognize the benefits of sale/leaseback financing model to fund facility

improvements, technology upgrades, staff additions and new construction

Medicare � Federal government sponsored

Medicaid � State and Federal government sponsored

Payors Commercial insurance�Private

Coverage depends on individual�s ability to pay and/or plan benefits

Coverage Insurance primarily offered through employers and government

Combination of private practice and employment model

Physicians Rate determined by government and negotiated health plans

Private For-profit 20%

Hospital

Private Not-for-profit 59%

Ownership

Germany

Public Not-for-profit 21%

Statutory Health�Insurance�(SHI)

Pension�Funds�� National�and

Regional�funds�that�pay�for�rehabilitation�services

Private�Health�Insurance�� limited�to�higher�earners German�law�mandates�universal�access�and�coverage;�SHI�covers�90%�of�German�population

German�physicians�are�employed�doctors

Public Not-for-profit 21%

UK

National Health Service (NHS)- Single payor government system

Private Health Insurance

In the UK, defined healthcare benefits are free to all residents of the UK regardless of wealth through the NHS

UK clinicians/consultants are government (NHS) employees

17% 8%

33% 0%

50% 92%

(1) Countries constituting Western Europe from UCLA Center for European and Eurasian Studies�web.international.ucla.edu/euro/countries/westeurope

| (2) |

� |

2012 population estimates from The World Bank�data.worldbank.org/indicator/SP.POP.TOTL |

20

|

|

�

|

|

�

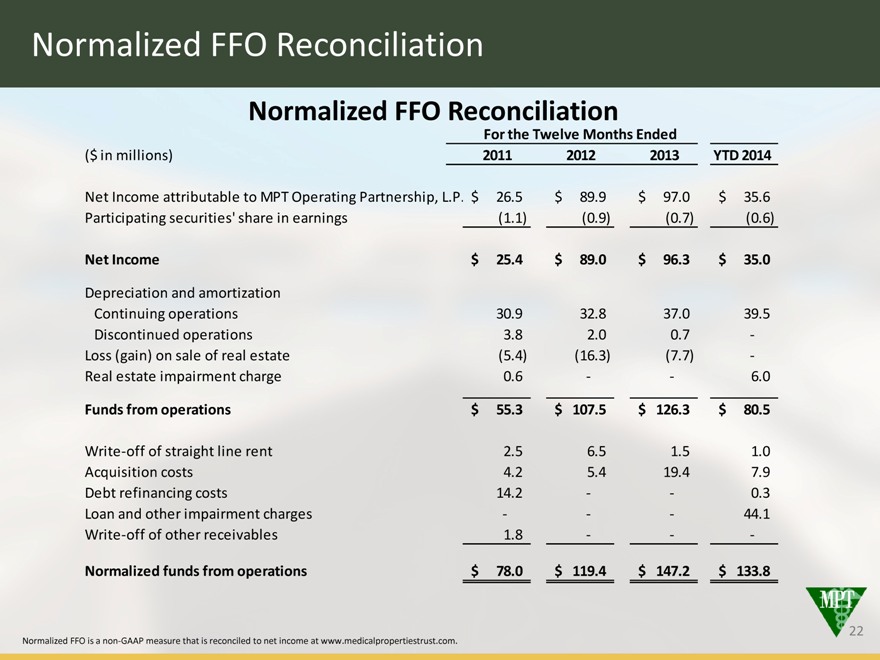

Normalized FFO Reconciliation

Normalized FFO Reconciliation

For the Twelve Months Ended

($ in millions) 2011 2012 2013 YTD 2014

Net Income attributable to MPT Operating Partnership, L.P. $ 26.5 $ 89.9 $ 97.0 $ 35.6

Participating securities� share in earnings (1.1)�(0.9) (0.7) (0.6)

Net Income $ 25.4 $ 89.0 $ 96.3 $ 35.0

Depreciation and amortization

Continuing operations 30.9 32.8 37.0 39.5

Discontinued operations 3.8 2.0 0.7 -

Loss (gain) on sale of real estate (5.4)�(16.3)�(7.7)�-

Real estate impairment charge 0.6 � � 6.0

Funds from operations $ 55.3 $ 107.5 $ 126.3 $ 80.5

Write-off of straight line rent 2.5 6.5 1.5 1.0

Acquisition costs 4.2 5.4 19.4 7.9

Debt refinancing costs 14.2 � � 0.3

Loan and other impairment charges � � � 44.1

Write-off of other receivables 1.8 � � -

Normalized funds from operations $ 78.0 $ 119.4 $ 147.2 $ 133.8

Normalized FFO is a non-GAAP measure that is reconciled to net income at www.medicalpropertiestrust.com.

22

|

|

�

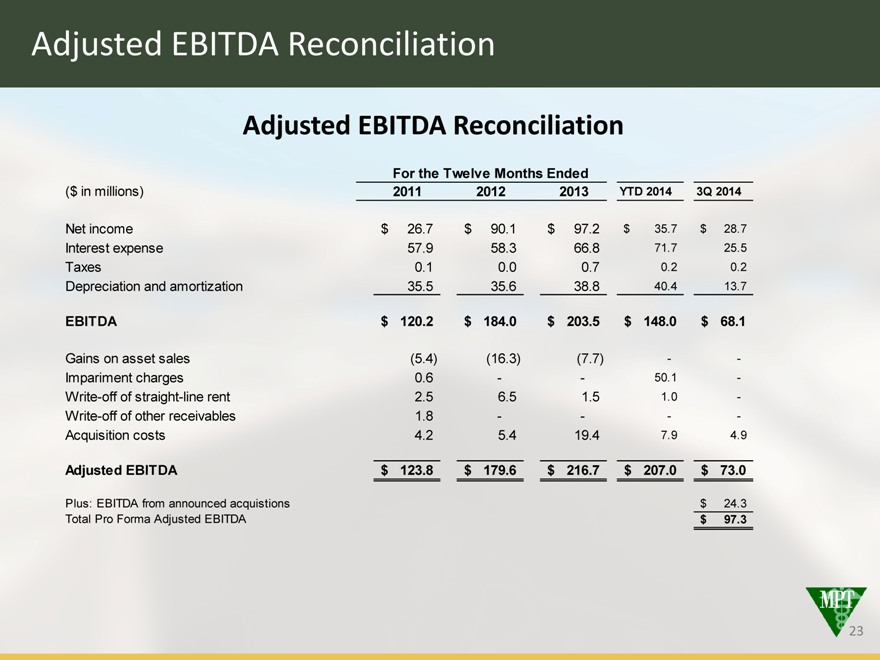

Adjusted EBITDA Reconciliation

Adjusted EBITDA Reconciliation

For the Twelve Months Ended

($ in millions) 2011 2012 2013 YTD 2014 3Q 2014

Net income $ 26.7 $ 90.1 $ 97.2 $ 35.7 $ 28.7

Interest expense 57.9 58.3 66.8 71.7 25.5

Taxes 0.1 0.0 0.7 0.2 0.2

Depreciation and amortization 35.5 35.6 38.8 40.4 13.7

EBITDA $ 120.2 $ 184.0 $ 203.5 $ 148.0 $ 68.1

Gains on asset sales (5.4)�(16.3)�(7.7)�� -

Impariment charges 0.6 � � 50.1 -

Write-off of straight-line rent 2.5 6.5 1.5 1.0 -

Write-off of other receivables 1.8 � � � -

Acquisition costs 4.2 5.4 19.4 7.9 4.9

Adjusted EBITDA $ 123.8 $ 179.6 $ 216.7 $ 207.0 $ 73.0

Plus: EBITDA from announced acquistions $ 24.3

Total Pro Forma Adjusted EBITDA $ 97.3

23

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Annual financial statements approved by the General Meeting of Shareholders of Grigeo AB on 26th April 2024

- JD.com to Report First Quarter 2024 Financial Results on May 16, 2024

- Gravity Announces Filing of Annual Report on Form 20-F for Fiscal Year 2023

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share