Form 8-K KCG Holdings, Inc. For: Apr 21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 21, 2016

KCG HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| DELAWARE | 000-54991 | 38-3898306 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No. |

545 Washington Boulevard, Jersey City, NJ 07310

(Address of principal executive offices) (Zip Code)

(201) 222-9400

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 2.02 | Results of Operation and Financial Condition |

See Item 9.01

| Item 7.01 | Regulation FD Disclosure |

The following information is furnished under Item 2.02, “Results of Operations and Financial Condition”, Item 7.01, “Regulation FD Disclosure”, and Item 9.01 “Financial Statements and Exhibits.” This information, including Exhibits 99.1 and 99.2, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

On April 21, 2016, KCG Holdings, Inc. (the “Company” or “KCG”) issued a press release announcing its earnings for the first quarter of 2016. The press release did not include certain financial statements, related footnotes and certain other financial information relating to the Company that will be filed with the Securities and Exchange Commission as part of the Company’s Quarterly Report on Form 10-Q. A copy of the press release is attached hereto as Exhibit 99.1. Executives from KCG will review the earnings via teleconference and live audio webcast at 9:00 a.m. Eastern time on April 21, 2016. A copy of a visual presentation that will be a part of that review is attached as Exhibit 99.2. Exhibits 99.1 and 99.2 are incorporated by reference into this Current Report on Form 8-K.

| Item 9.01 | Financial Statements and Exhibits |

| (a) | Financial Statements of Businesses Acquired |

Not Applicable

| (b) | Pro Forma Financial Information |

Not Applicable

| (c) | Shell Company Transactions |

Not Applicable

| (d) | Exhibits |

Exhibit 99.1 – Press Release of KCG Holdings, Inc., issued on April 21, 2016.

Exhibit 99.2 – KCG Holdings, Inc. Earnings Presentation, dated April 21, 2016.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned’s duly authorized signatory.

Dated: April 21, 2016

| KCG HOLDINGS, INC. | ||

| By: | /s/ John McCarthy | |

| Name: | John McCarthy | |

| Title: | General Counsel | |

EXHIBIT INDEX

| Exhibit |

Description | |

| 99.1 | Press Release of KCG Holdings, Inc., issued on April 21, 2016. | |

| 99.2 | KCG Holdings, Inc. Earnings Presentation, dated April 21, 2016. | |

EXHIBIT 99.1

KCG ANNOUNCES CONSOLIDATED EARNINGS OF $0.41 PER DILUTED

SHARE FOR THE FIRST QUARTER OF 2016

KCG reports consolidated revenues of $345.4 million

and pre-tax earnings of $60.0 million for the quarter

KCG increases book value to $16.42 per share and

tangible book value to $15.30 per share

KCG’s Board of Directors authorizes expanded share repurchase program

of up to $200 million of KCG common stock and warrants

JERSEY CITY, New Jersey – April 21, 2016 – KCG Holdings, Inc. (NYSE: KCG) today reported consolidated earnings of $37.2 million, or $0.41 per diluted share, for the first quarter of 2016. Included in these results is $9.5 million of other income primarily related to sales of certain assets and gains on repurchases of the company’s debt.

Select Financial Results

| ($ in thousands, except EPS) | ||||||||||||

| 1Q16 | 4Q15 | 1Q15 | ||||||||||

| GAAP Revenues |

345,424 | 264,036 | 696,156 | |||||||||

| Non-GAAP revenues* |

345,424 | 247,509 | 311,130 | |||||||||

| Trading revenues, net |

223,938 | 145,959 | 208,795 | |||||||||

| Commissions and fees |

106,101 | 94,315 | 99,961 | |||||||||

| GAAP pre-tax income (loss) |

59,965 | (4,471 | ) | 406,128 | ||||||||

| GAAP EPS |

0.41 | (0.03 | ) | 2.19 | ||||||||

| Non-GAAP pre-tax income (loss)* |

59,965 | (4,845 | ) | 32,427 | ||||||||

| * | Effective January 1, 2016, KCG will no longer adjust GAAP results for writedowns, investment gains and losses and similar items. See Exhibit 4 for a reconciliation of GAAP to non-GAAP results for pre-2016 periods. |

First Quarter Highlights

| • | KCG U.S. equity market making grew revenues 22 percent year over year |

| • | KCG Institutional Equities grew average daily U.S. equity share volume 17 percent year over year |

| • | KCG BondPoint set a new quarterly record for average daily fixed income par value traded with growth of 32 percent year over year |

| • | KCG announced an agreement to sell its NYSE Designated Market Maker (DMM) and completed the sales of assets related to retail U.S. options market making |

| • | KCG repurchased 1.8 million shares of KCG Class A Common Stock for $20.5 million, $1.0 million in warrants and $35.0 million par value of its 6.875 percent Senior Secured Notes for $31.2 million |

Daniel Coleman, Chief Executive Officer of KCG, said, “KCG generated strong financial results in the first quarter of 2016 as a result of the market conditions in U.S. equities, increased penetration of strategic clients and the performance of KCG’s trading models. KCG U.S. equity market making posted strong revenues from client and exchange-based activities. We took further action to streamline and simplify KCG by exiting certain businesses following a strategic review. In addition, we utilized free cash to repurchase shares, warrants and debt as opportunities arose. Subsequent to the first quarter, we monetized a portion of our stake in Bats Global Markets, which added to free cash available for deployment.”

Market Making

The Market Making segment encompasses direct-to-client and non-client, exchange-based market making across multiple asset classes and is an active participant in all major cash, options and futures markets in the U.S., Europe and Asia. During the first quarter of 2016, the segment generated total revenues of $258.9 million and pre-tax income of $75.5 million. Included in first quarter revenues is a $2.9 million gain from the sale of assets related to retail U.S. options market making.

In the first quarter of 2016, the market selloff to start the year contributed to a 7 percent rise in consolidated U.S. equity dollar volume, a widening of spreads and higher realized volatility for the S&P 500 year-over-year. In addition, the market produced seasonally strong retail trading activity and a 31 percent increase in U.S. equity futures contracts. Outside of U.S. equities, results were affected by the rise in market volumes of U.S. Treasuries and Asian equities year-over-year, offset in part by the declines in market volumes of European equities and foreign exchange as well as the continued deterioration in prices of commodities. For the quarter, revenues for the Market Making segment rose 15.3 percent year over year.

Mr. Coleman commented, “Despite the difficulties presented by the market selloff in the first half of January and heightened competition for retail order flow, market making in U.S. equities generated a substantial contribution to KCG’s first quarter results. We continued to focus on strategic clients as well as develop the pipeline of new strategies and enhance currently deployed models. The results from global equities and FICC rebounded from the previous quarter. KCG Acknowledge FI more than doubled client market making volume in U.S. Treasuries year over year. In Asia, trading during the quarter was led by Japan and Singapore.”

In the fourth quarter of 2015, the segment generated total revenues of $168.2 million and a pre-tax loss of $5.1 million. Excluding charges related to asset writedowns of $14.2 million, the segment generated non-GAAP pre-tax income of $9.1 million.

During the first quarter of 2015, the segment generated total revenues of $224.5 million and pre-tax income of $39.3 million.

Select Trade Statistics: U.S. Equity Market Making

| 1Q16 | 4Q15 | 1Q15 | ||||||||||

| Average daily dollar volume traded ($ millions) |

30,888 | 28,842 | 31,025 | |||||||||

| Average daily trades (thousands) |

4,236 | 3,667 | 3,947 | |||||||||

| Average daily shares traded (millions) |

4,816 | 4,698 | 5,048 | |||||||||

| NYSE and NASDAQ shares traded |

1,109 | 922 | 933 | |||||||||

| OTC Bulletin Board and OTC Market shares traded |

3,707 | 3,775 | 4,115 | |||||||||

| Average revenue capture per U.S. equity dollar value traded (bps) |

1.13 | 0.77 | 0.92 | |||||||||

Global Execution Services

The Global Execution Services segment comprises agency execution services and trading venues. During the first quarter of 2016, the segment generated total revenues of $76.4 million and pre-tax income of $6.3 million.

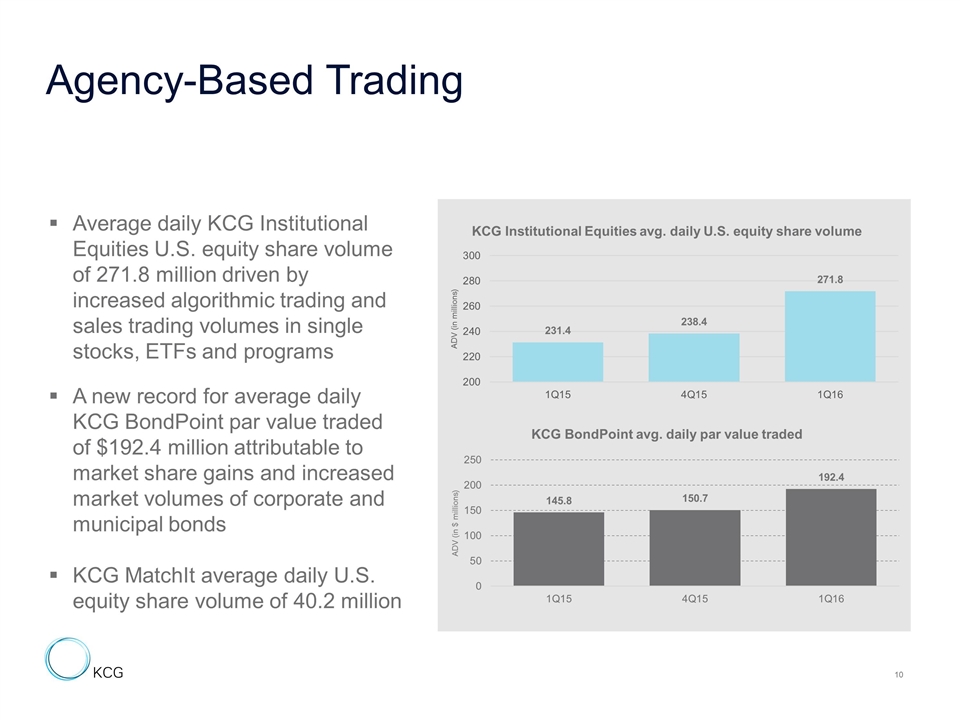

In the first quarter of 2016, institutional trading activity drove the heightened U.S. equity market volumes and volatility to start the year. The deleveraging in January shifted to rebalancing which prolonged the high levels of trading through February. KCG Institutional Equities grew volumes of U.S. equities year over year from algorithmic trading and high touch sales trading in single stocks, ETFs and programs. KCG BondPoint set a new quarterly record for fixed income par value traded, which was attributable to market share gains compounded by increased market volumes of corporate and municipal bonds. The decline in revenues for the Global Execution Services segment year over year is attributable to the sale of KCG Hotspot, which was completed on March 13, 2015.

Mr. Coleman commented, “During the first quarter, KCG Algorithmic Trading grew U.S. equity share volume from the 25 largest U.S. asset managers 67 percent year over year. KCG’s ETF trading team posted strong results from facilitating standard orders, risk markets for blocks, NAV-based executions, and creations and redemptions. In addition, KCG BondPoint grew trade volumes from a combination of new and existing retail broker clients.”

In the fourth quarter of 2015, the segment generated total revenues of $70.2 million and a pre-tax loss of $1.1 million. Excluding a writedown of goodwill of $0.9 million, the segment generated a non-GAAP pre-tax loss of $0.2 million.

In the first quarter of 2015, excluding the gain of $385.0 million on the sale of KCG Hotspot and related professional and compensation expenses totaling $11.2 million, the segment generated non-GAAP total revenues of $79.2 million and pre-tax income of $7.2 million.

Select Trade Statistics: Agency Execution and Trading Venues

| 1Q16 | 4Q15 | 1Q15 | ||||||||||

| Average daily KCG Institutional Equities U.S. equities shares traded (millions) (1) |

271.8 | 238.4 | 231.4 | |||||||||

| Average daily KCG BondPoint fixed income par value traded ($ millions) |

192.4 | 150.7 | 145.8 | |||||||||

| (1) | KCG Institutional Equities average daily U.S. National Market System (NMS) equity share volume represents trading on behalf of clients covering algorithmic trading and high touch sales trading in single stocks, ETFs and programs. In 2016, KCG modified the reporting of trading volumes within the Global Execution Services segment to remove internal volume generated by KCG trading desks and add volume from sales trading. Prior periods have been recast for this new presentation. |

Corporate and Other

The Corporate and Other segment includes strategic investments and corporate overhead expenses. During the first quarter of 2016, the segment generated total revenues of $10.1 million and a pre-tax loss of $21.8 million. Included in first quarter revenues are a $3.7 million gain from KCG’s repurchase of a portion of its 6.875 percent Senior Secured Notes and a $2.8 million net gain primarily tied to a distribution from an investment.

In the fourth quarter of 2015, the segment generated total revenues of $25.6 million and pre-tax income of $1.8 million. Excluding gains on sales and writedowns of investments of $19.8 million and $3.2 million, respectively and a $1.0 million writedown of an intangible asset, the segment generated a non-GAAP pre-tax loss of $13.7 million.

In the first quarter of 2015, the segment generated total revenues of $7.3 million and a pre-tax loss of $14.3 million.

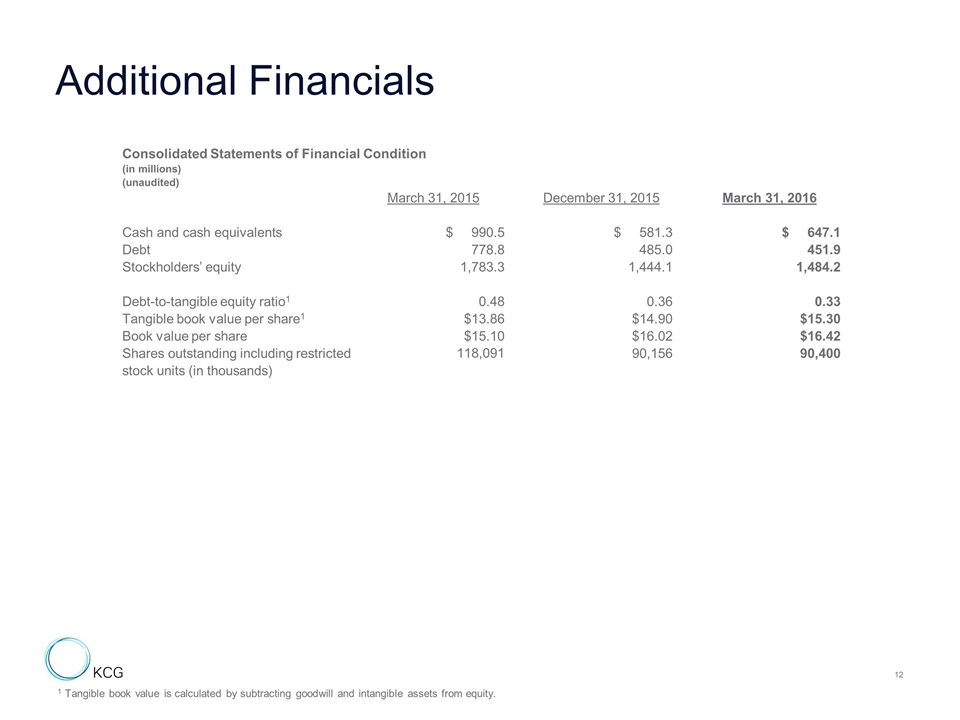

Financial Condition

As of March 31, 2016, KCG had $647.1 million in cash and cash equivalents. Total outstanding debt was $451.9 million. KCG had $1.48 billion in stockholders’ equity, equivalent to a book value of $16.42 per share and tangible book value, which includes the value of its assets of businesses held for sale, of $15.30 per share based on total shares outstanding of 90.4 million, including restricted stock units.

During the first quarter of 2016, KCG repurchased 1.8 million shares for approximately $20.5 million, $1.0 million in warrants and $35.0 million par value of its 6.875 percent Senior Secured Notes for $31.2 million.

KCG’s headcount was 972 full-time employees at March 31, 2016, compared to 1,006 at December 31, 2015.

Subsequent Events

On April 15, 2016, shares of Bats Global Markets, Inc. common stock began trading on the BATS BZX Exchange under ticker symbol BATS. As part of the initial public offering, KCG sold 2.6 million shares for approximately $46 million after commissions and will recognize a pre-tax gain of approximately $33 million in the second quarter of 2016 on this sale. Following the offering, KCG’s ownership stake in Bats was reduced to approximately 13.7 percent.

On April 20, 2016, KCG’s Board of Directors authorized an expanded share repurchase program of up to $200 million of KCG common stock and warrants (including the remaining capacity under the previously authorized repurchase program), subject to compliance with the covenants contained in the company’s debt indenture. Under the program, the company may repurchase shares of common stock or warrants from time to time in open market transactions, accelerated stock buyback programs, tender offers, privately-negotiated transactions or by other means. Repurchases of shares may also be made under a Rule 10b5-1 plan. The timing and amount of repurchase transactions will be based on market conditions, share price, legal requirements and other factors. The program has no expiration date and may be suspended, modified or discontinued at any time without prior notice. There are no assurances that any repurchases of shares of common stock or warrants may actually occur.

Conference Call

KCG will hold a conference call to discuss first quarter 2016 financial results starting at 9:00 a.m. Eastern Time today, April 21, 2016. To access the call, dial 800-344-6698 (domestic) or 785-830-7979 (international) and enter passcode 5948540. In addition, the call will be webcast at http://edge.media-server.com/m/p/kbqkwypj. Following the conclusion of the call, a replay will be available by selecting a number based on country of origin from a list posted at: https://replaynumbers.conferencinghub.com/index.aspx?confid=5948540&passcode=5948540 and entering passcode 5948540.

Additional information for investors, including a presentation of the first quarter financial results, can be found at http://investors.kcg.com.

Non-GAAP Financial Presentations

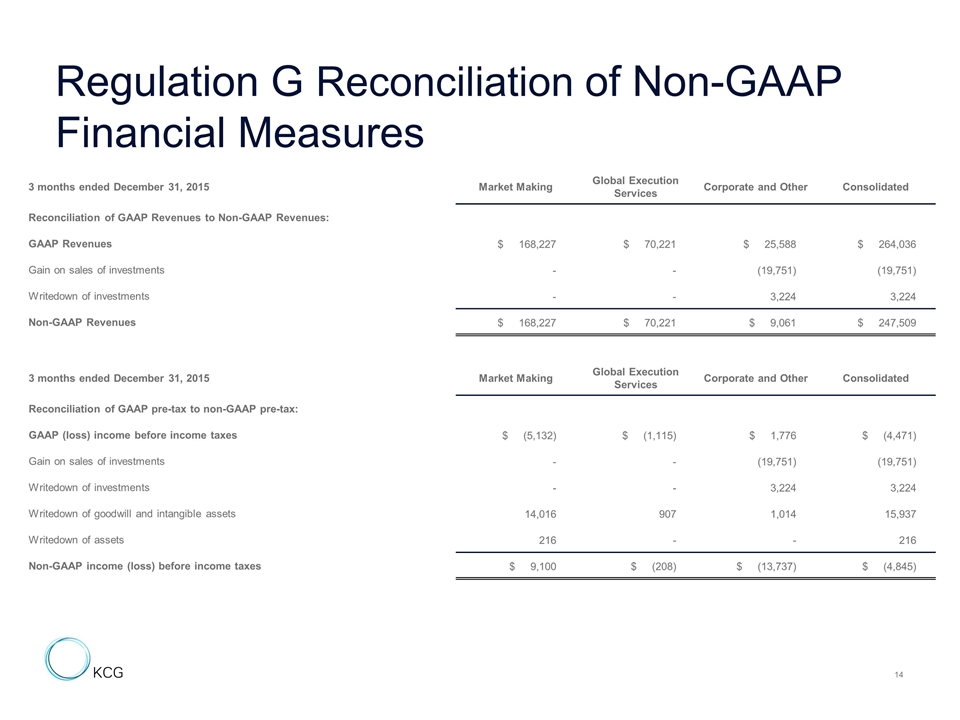

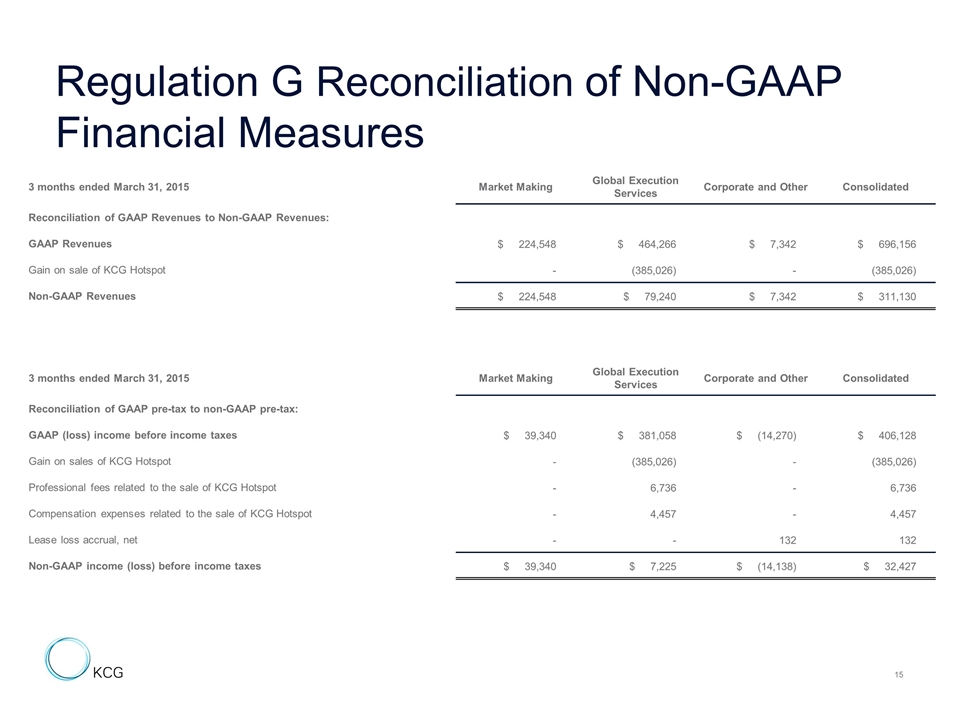

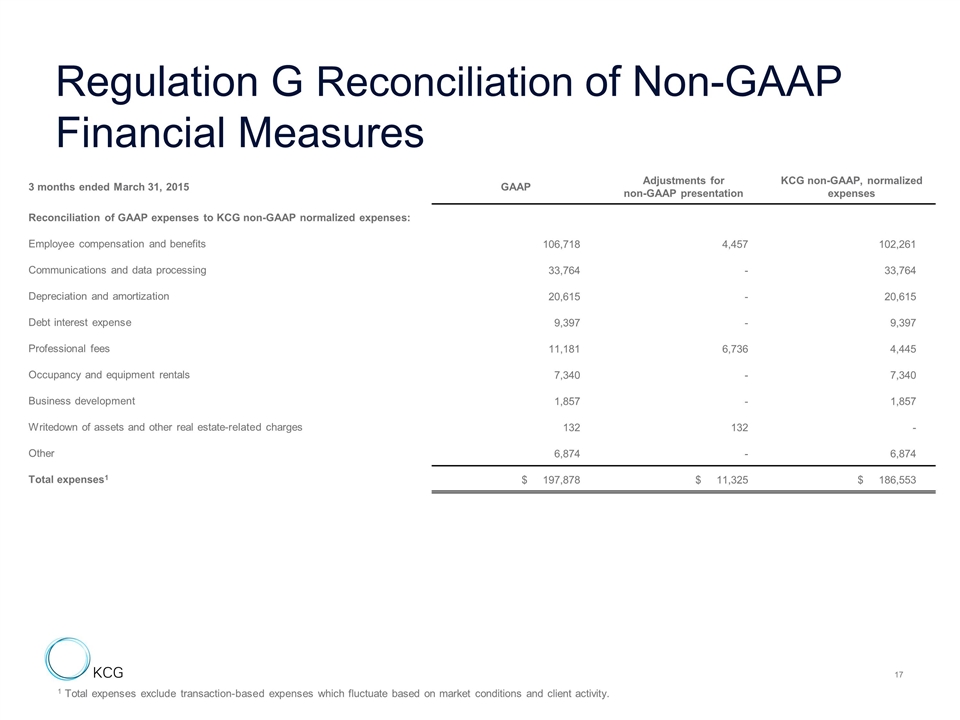

KCG believes that certain non-GAAP financial presentations, when taken into consideration with the corresponding GAAP financial presentations, are important in understanding operating results. Selected financial information is included in the non-GAAP financial presentations for the three months ended December 31, 2015 and March 31, 2015. KCG believes the presentations provide a meaningful summary of revenues and results of operations for each of the three month periods. Reconciliations of GAAP to non-GAAP results are included in the schedules in Exhibit 4.

About KCG

KCG is a leading independent securities firm offering investors a range of services designed to address trading needs across asset classes, product types and time zones. The firm combines advanced technology with specialized client service across market making, agency execution and venues and also engages in principal trading via exchange-based market making. KCG has multiple access points to trade global equities, fixed income, options, currencies and commodities via voice or automated execution. www.kcg.com

Certain statements contained herein and the documents incorporated by reference containing the words “believes,” “intends,” “expects,” “anticipates,” and words of similar meaning, may constitute forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. These “forward-looking statements” are not historical facts and are based on current expectations, estimates and projections about KCG’s industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond our control. Any forward-looking statement contained herein speaks only as of the date on which it is made. Accordingly, readers are cautioned that any such forward-looking statements are not guarantees of future performance and are subject to certain risks, uncertainties and assumptions that are difficult to predict including, without limitation, risks associated with: (i) the inability to manage trading strategy performance and sustain revenue and earnings growth; (ii) the sale of KCG Hotspot, including the receipt of additional payments that are subject to certain contingencies; (iii) changes in market structure, legislative, regulatory or financial reporting rules, including the increased focus by Congress, federal and state regulators, the SROs and the media on market structure issues, and in particular, the scrutiny of high frequency trading, alternative trading systems, market fragmentation, colocation, access to market data feeds, and remuneration arrangements such as payment for order flow and exchange fee structures; (iv) past or future changes to KCG’s organizational structure and management; (v) KCG’s ability to develop competitive new products and services in a timely manner and the acceptance of such products and services by KCG’s customers and potential customers; (vi) KCG’s ability to keep up with technological changes; (vii) KCG’s ability to effectively identify and manage market risk, operational and technology risk, cybersecurity risk, legal risk, liquidity risk, reputational risk, counterparty and credit risk, international risk, regulatory risk, and compliance risk; (viii) the cost and other effects of material contingencies, including litigation contingencies, and any adverse judicial, administrative or arbitral rulings or proceedings; (ix) the effects of increased competition and KCG’s ability to maintain and expand market share; (x) the announced plan to relocate KCG’s global headquarters from Jersey City, NJ to New York, NY; and (xi) KCG’s ability to complete the sale or disposition of any or all of the assets or businesses that are classified as held for sale. The list above is not exhaustive. Because forward looking statements involve risks and uncertainties, the actual results and performance of KCG may materially differ from the results expressed or implied by such statements. Given these uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. Unless otherwise required by law, KCG also disclaims any obligation to update its view of any such risks or uncertainties or to announce publicly the result of any revisions to the forward-looking statements made herein. Readers should carefully review the risks and uncertainties disclosed in KCG’s reports with the U.S. Securities and Exchange Commission (“SEC”), including those detailed in “Risk Factors” in Part I, Item 1A of KCG’s Annual Report on Form10-K for the year ended December 31, 2015, “Legal Proceedings” in Part I, Item 3, under “Certain Factors Affecting Results of Operations” in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Part II, Item 7, in “Quantitative and Qualitative Disclosures About Market Risk” in Part II, Item 7A, and in other reports or documents KCG files with, or furnishes to, the SEC from time to time. This information should be read in conjunction with KCG’s Consolidated Financial Statements and the Notes thereto contained in its Annual Report on Form 10-K, and in other reports or documents KCG files with, or furnishes to, the SEC from time to time.

CONTACTS

| Sophie Sohn | Jonathan Mairs | |

| Communications & Marketing | Investor Relations | |

| 312-931-2299 | 201-356-1529 | |

| [email protected] | [email protected] |

| KCG HOLDINGS, INC. | Exhibit 1 |

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| For the three months ended | ||||||||||||

| March 31, 2016 | December 31, 2015 | March 31, 2015 | ||||||||||

| (In thousands, except per share amounts) | ||||||||||||

| Revenues |

||||||||||||

| Trading revenues, net |

$ | 223,938 | $ | 145,959 | $ | 208,795 | ||||||

| Commissions and fees |

106,101 | 94,315 | 99,961 | |||||||||

| Interest, net |

117 | (429 | ) | (23 | ) | |||||||

| Investment income and other, net |

15,268 | 24,191 | 387,423 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total revenues |

345,424 | 264,036 | 696,156 | |||||||||

|

|

|

|

|

|

|

|||||||

| Expenses |

||||||||||||

| Employee compensation and benefits |

97,586 | 67,823 | 106,718 | |||||||||

| Execution and clearance fees |

73,634 | 66,613 | 68,473 | |||||||||

| Communications and data processing |

35,657 | 36,003 | 33,764 | |||||||||

| Depreciation and amortization |

21,905 | 25,077 | 20,615 | |||||||||

| Payments for order flow |

12,655 | 14,464 | 15,221 | |||||||||

| Debt interest expense |

9,492 | 10,025 | 9,397 | |||||||||

| Collateralized financing interest |

9,163 | 8,746 | 8,456 | |||||||||

| Occupancy and equipment rentals |

8,990 | 7,842 | 7,340 | |||||||||

| Professional fees |

6,057 | 5,774 | 11,181 | |||||||||

| Business development |

1,119 | 1,751 | 1,857 | |||||||||

| Writedown of assets and other real estate related charges |

— | 16,154 | 132 | |||||||||

| Other |

9,201 | 8,235 | 6,874 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total expenses |

285,459 | 268,507 | 290,028 | |||||||||

|

|

|

|

|

|

|

|||||||

| Income (loss) before income taxes |

59,965 | (4,471 | ) | 406,128 | ||||||||

| Income tax expense (benefit) |

22,800 | (1,500 | ) | 156,827 | ||||||||

|

|

|

|

|

|

|

|||||||

| Net income (loss) |

$ | 37,165 | $ | (2,971 | ) | $ | 249,301 | |||||

|

|

|

|

|

|

|

|||||||

| Basic earnings (loss) per share |

$ | 0.42 | $ | (0.03 | ) | $ | 2.25 | |||||

|

|

|

|

|

|

|

|||||||

| Diluted earnings (loss) per share |

$ | 0.41 | $ | (0.03 | ) | $ | 2.19 | |||||

|

|

|

|

|

|

|

|||||||

| Shares used in computation of basic earnings (loss) per share |

88,458 | 89,184 | 110,782 | |||||||||

|

|

|

|

|

|

|

|||||||

| Shares used in computation of diluted earnings (loss) per share |

89,605 | 89,184 | 113,615 | |||||||||

|

|

|

|

|

|

|

|||||||

| KCG HOLDINGS, INC. | Exhibit 2 |

CONSOLIDATED STATEMENTS OF FINANCIAL CONDITION

(In thousands)

(Unaudited)

| March 31, 2016 | December 31, 2015 | |||||||

| ASSETS |

||||||||

| Cash and cash equivalents |

$ | 647,070 | $ | 581,313 | ||||

| Cash and cash equivalents segregated under federal and other regulations |

3,000 | 3,000 | ||||||

| Financial instruments owned, at fair value: |

||||||||

| Equities |

2,350,324 | 2,129,208 | ||||||

| Listed options |

11,801 | 178,360 | ||||||

| Debt securities |

174,222 | 136,387 | ||||||

| Other financial instruments |

204 | 445 | ||||||

|

|

|

|

|

|||||

| Total financial instruments owned, at fair value |

2,536,551 | 2,444,400 | ||||||

| Collateralized agreements: |

||||||||

| Securities borrowed |

1,681,886 | 1,636,284 | ||||||

| Receivable from brokers, dealers and clearing organizations |

656,081 | 681,211 | ||||||

| Fixed assets and leasehold improvements, less accumulated depreciation and amortization |

93,190 | 94,858 | ||||||

| Investments |

98,138 | 98,943 | ||||||

| Goodwill and Intangible assets, less accumulated amortization |

101,277 | 100,471 | ||||||

| Deferred tax asset, net |

151,196 | 151,225 | ||||||

| Assets of businesses held for sale |

24,444 | 25,999 | ||||||

| Other assets |

203,465 | 222,831 | ||||||

|

|

|

|

|

|||||

| Total assets |

$ | 6,196,298 | $ | 6,040,535 | ||||

|

|

|

|

|

|||||

| LIABILITIES & EQUITY |

||||||||

| Liabilities |

||||||||

| Financial instruments sold, not yet purchased, at fair value: |

||||||||

| Equities |

$ | 1,743,843 | $ | 1,856,171 | ||||

| Listed options |

9,635 | 151,893 | ||||||

| Debt securities |

301,984 | 105,340 | ||||||

|

|

|

|

|

|||||

| Total financial instruments sold, not yet purchased, at fair value |

2,055,462 | 2,113,404 | ||||||

| Collateralized financings: |

||||||||

| Securities loaned |

527,358 | 463,377 | ||||||

| Financial instruments sold under agreements to repurchase |

909,304 | 954,902 | ||||||

|

|

|

|

|

|||||

| Total collateralized financings |

1,436,662 | 1,418,279 | ||||||

| Payable to brokers, dealers and clearing organizations |

574,660 | 273,805 | ||||||

| Payable to customers |

11,640 | 17,387 | ||||||

| Accrued compensation expense |

55,053 | 154,547 | ||||||

| Accrued expenses and other liabilities |

126,783 | 134,026 | ||||||

| Debt |

451,864 | 484,989 | ||||||

|

|

|

|

|

|||||

| Total liabilities |

4,712,124 | 4,596,437 | ||||||

|

|

|

|

|

|||||

| Equity |

||||||||

| Class A Common Stock |

1,090 | 1,060 | ||||||

| Additional paid-in capital |

1,470,284 | 1,436,671 | ||||||

| Retained earnings |

229,285 | 192,120 | ||||||

| Treasury stock, at cost |

(216,770 | ) | (186,103 | ) | ||||

| Accumulated other comprehensive income |

285 | 350 | ||||||

|

|

|

|

|

|||||

| Total equity |

1,484,174 | 1,444,098 | ||||||

|

|

|

|

|

|||||

| Total liabilities and equity |

$ | 6,196,298 | $ | 6,040,535 | ||||

|

|

|

|

|

|||||

| KCG HOLDINGS, INC. | Exhibit 3 |

PRE-TAX EARNINGS (LOSS) BY BUSINESS SEGMENT*

(In thousands)

(Unaudited)

| For the three months ended | ||||||||||||

| March 31, 2016 | December 31, 2015 | March 31, 2015 | ||||||||||

| Market Making |

||||||||||||

| Revenues |

$ | 258,918 | $ | 168,227 | $ | 224,548 | ||||||

| Expenses |

183,429 | 173,359 | 185,208 | |||||||||

|

|

|

|

|

|

|

|||||||

| Pre-tax earnings (loss) |

75,489 | (5,132 | ) | 39,340 | ||||||||

|

|

|

|

|

|

|

|||||||

| Global Execution Services |

||||||||||||

| Revenues |

76,394 | 70,221 | 464,266 | |||||||||

| Expenses |

70,133 | 71,336 | 83,208 | |||||||||

|

|

|

|

|

|

|

|||||||

| Pre-tax earnings (loss) |

6,261 | (1,115 | ) | 381,058 | ||||||||

|

|

|

|

|

|

|

|||||||

| Corporate and Other |

||||||||||||

| Revenues |

10,112 | 25,588 | 7,342 | |||||||||

| Expenses |

31,897 | 23,812 | 21,612 | |||||||||

|

|

|

|

|

|

|

|||||||

| Pre-tax (loss) earnings |

(21,785 | ) | 1,776 | (14,270 | ) | |||||||

|

|

|

|

|

|

|

|||||||

| Consolidated |

||||||||||||

| Revenues |

345,424 | 264,036 | 696,156 | |||||||||

| Expenses |

285,459 | 268,507 | 290,028 | |||||||||

|

|

|

|

|

|

|

|||||||

| Pre-tax earnings (loss) |

$ | 59,965 | $ | (4,471 | ) | $ | 406,128 | |||||

|

|

|

|

|

|

|

|||||||

| * | Totals may not add due to rounding. |

| KCG HOLDINGS, INC. | Exhibit 4 |

Regulation G Reconciliation of Non-GAAP financial measures*

(In thousands)

(Unaudited)

| Three months ended December 31, 2015 |

Market Making | Global Execution Services |

Corporate and Other | Consolidated | ||||||||||||

| Reconciliation of GAAP Revenues to Non-GAAP Revenues: |

||||||||||||||||

| GAAP Revenues |

$ | 168,227 | $ | 70,221 | $ | 25,588 | $ | 264,036 | ||||||||

| Gain on sales of investments |

— | — | (19,751 | ) | (19,751 | ) | ||||||||||

| Writedowns of investments |

— | — | 3,224 | 3,224 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Non- GAAP Revenues |

$ | 168,227 | $ | 70,221 | $ | 9,061 | $ | 247,509 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Three months ended December 31, 2015 |

Market Making | Global Execution Services |

Corporate and Other | Consolidated | ||||||||||||

| Reconciliation of GAAP Pre-Tax to Non-GAAP Pre-Tax: |

||||||||||||||||

| GAAP (Loss) income before income taxes |

$ | (5,132 | ) | $ | (1,115 | ) | $ | 1,776 | $ | (4,471 | ) | |||||

| Gain on sales of investments |

— | — | (19,751 | ) | (19,751 | ) | ||||||||||

| Writedowns of investments |

— | — | 3,224 | 3,224 | ||||||||||||

| Writedown of goodwill and intangible assets |

14,016 | 907 | 1,014 | 15,937 | ||||||||||||

| Writedown of assets |

216 | — | — | 216 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Non GAAP Income (loss) before income taxes |

$ | 9,100 | $ | (208 | ) | $ | (13,737 | ) | $ | (4,845 | ) | |||||

|

|

|

|

|

|

|

|

|

|||||||||

| Three months ended March 31, 2015 |

Market Making | Global Execution Services |

Corporate and Other | Consolidated | ||||||||||||

| Reconciliation of GAAP Revenues to Non-GAAP Revenues: |

||||||||||||||||

| GAAP Revenues |

$ | 224,548 | $ | 464,266 | $ | 7,342 | $ | 696,156 | ||||||||

| Gain on sale of KCG Hotspot |

— | (385,026 | ) | — | (385,026 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Non- GAAP Revenues |

$ | 224,548 | $ | 79,240 | $ | 7,342 | $ | 311,130 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Three months ended March 31, 2015 |

Market Making | Global Execution Services |

Corporate and Other | Consolidated | ||||||||||||

| Reconciliation of GAAP Pre-Tax to Non-GAAP Pre-Tax: |

||||||||||||||||

| GAAP Income (loss) before income taxes |

$ | 39,340 | $ | 381,058 | $ | (14,270 | ) | $ | 406,128 | |||||||

| Gain on sale of KCG Hotspot |

— | (385,026 | ) | — | (385,026 | ) | ||||||||||

| Professional fees related to the sale of KCG Hotspot |

— | 6,736 | — | 6,736 | ||||||||||||

| Compensation expense related to the sale of KCG Hotspot |

— | 4,457 | — | 4,457 | ||||||||||||

| Lease loss accrual, net |

— | — | 132 | 132 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Non-GAAP Income (loss) before income taxes |

$ | 39,340 | $ | 7,225 | $ | (14,138 | ) | $ | 32,427 | |||||||

|

|

|

|

|

|

|

|

|

|||||||||

* Totals may not add due to rounding.

KCG Holdings, Inc. (KCG) 1st Quarter 2016 Earnings Presentation April 21, 2016 Exhibit 99.2

Safe Harbor Certain statements contained herein and the documents incorporated by reference containing the words “believes,” “intends,” “expects,” “anticipates,” and words of similar meaning, may constitute forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. These “forward-looking statements” are not historical facts and are based on current expectations, estimates and projections about KCG's industry, management's beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond our control. Any forward-looking statement contained herein speaks only as of the date on which it is made. Accordingly, readers are cautioned that any such forward-looking statements are not guarantees of future performance and are subject to certain risks, uncertainties and assumptions that are difficult to predict including, without limitation, risks associated with: (i) the inability to manage trading strategy performance and sustain revenue and earnings growth; (ii) the sale of KCG Hotspot, including the receipt of additional payments that are subject to certain contingencies; (iii) changes in market structure, legislative, regulatory or financial reporting rules, including the increased focus by Congress, federal and state regulators, the SROs and the media on market structure issues, and in particular, the scrutiny of high frequency trading, alternative trading systems, market fragmentation, colocation, access to market data feeds, and remuneration arrangements such as payment for order flow and exchange fee structures; (iv) past or future changes to KCG's organizational structure and management; (v) KCG's ability to develop competitive new products and services in a timely manner and the acceptance of such products and services by KCG's customers and potential customers; (vi) KCG's ability to keep up with technological changes; (vii) KCG's ability to effectively identify and manage market risk, operational and technology risk, cybersecurity risk, legal risk, liquidity risk, reputational risk, counterparty and credit risk, international risk, regulatory risk, and compliance risk; (viii) the cost and other effects of material contingencies, including litigation contingencies, and any adverse judicial, administrative or arbitral rulings or proceedings; (ix) the effects of increased competition and KCG's ability to maintain and expand market share; (x) the announced plan to relocate KCG’s global headquarters from Jersey City, NJ to New York, NY; and (xi) KCG’s ability to complete the sale or disposition of any or all of the assets or businesses that are classified as held for sale. The list above is not exhaustive. Because forward looking statements involve risks and uncertainties, the actual results and performance of KCG may materially differ from the results expressed or implied by such statements. Given these uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. Unless otherwise required by law, KCG also disclaims any obligation to update its view of any such risks or uncertainties or to announce publicly the result of any revisions to the forward-looking statements made herein. Readers should carefully review the risks and uncertainties disclosed in KCG’s reports with the U.S. Securities and Exchange Commission (“SEC”), including those detailed in “Risk Factors” in Part I, Item 1A of KCG's Annual Report on Form 10-K for the year ended December 31, 2015, “Legal Proceedings” in Part I, Item 3, under “Certain Factors Affecting Results of Operations” in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Part II, Item 7, in “Quantitative and Qualitative Disclosures About Market Risk” in Part II, Item 7A, and in other reports or documents KCG files with, or furnishes to, the SEC from time to time. This information should be read in conjunction with KCG’s Consolidated Financial Statements and the Notes thereto contained in its Annual Report on Form 10-K, and in other reports or documents KCG files with, or furnishes to, the SEC from time to time. For additional disclosures, please see https://www.kcg.com/legal/global-disclosures.

KCG’s strong financial results in 1Q16 attributable to the market conditions in U.S. equities, increased penetration of strategic clients and performance of trading models KCG U.S. equity market making grew revenues 22 percent year over year KCG Institutional Equities grew average daily U.S. equity share volume 17 percent year over year KCG BondPoint set a new quarterly record for average daily fixed income par value traded with growth of 32 percent year over year KCG announced an agreement to sell its NYSE Designated Market Maker (DMM) and completed the sales of assets related to retail U.S. options market making KCG repurchased 1.8 million shares of KCG Class A Common Stock for $20.5 million, $1 million in warrants and $35 million par value of 6.875 percent Senior Secured Notes for $31.2 million 1st Quarter 2016 Summary

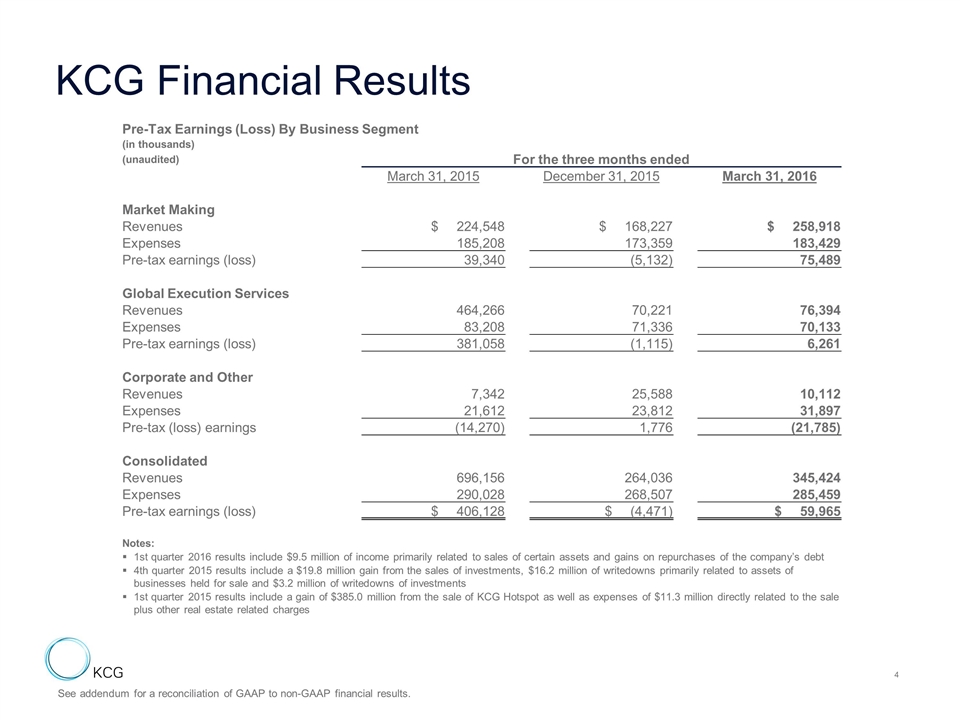

KCG Financial Results Pre-Tax Earnings (Loss) By Business Segment (in thousands) (unaudited) For the three months ended March 31, 2015 December 31, 2015 March 31, 2016 Market Making Revenues $ 224,548 $ 168,227 $ 258,918 Expenses 185,208 173,359 183,429 Pre-tax earnings (loss) 39,340 (5,132) 75,489 Global Execution Services Revenues 464,266 70,221 76,394 Expenses 83,208 71,336 70,133 Pre-tax earnings (loss) 381,058 (1,115) 6,261 Corporate and Other Revenues 7,342 25,588 10,112 Expenses 21,612 23,812 31,897 Pre-tax (loss) earnings (14,270) 1,776 (21,785) Consolidated Revenues 696,156 264,036 345,424 Expenses 290,028 268,507 285,459 Pre-tax earnings (loss) $ 406,128 $ (4,471) $ 59,965 Notes: 1st quarter 2016 results include $9.5 million of income primarily related to sales of certain assets and gains on repurchases of the company’s debt 4th quarter 2015 results include a $19.8 million gain from the sales of investments, $16.2 million of writedowns primarily related to assets of businesses held for sale and $3.2 million of writedowns of investments 1st quarter 2015 results include a gain of $385.0 million from the sale of KCG Hotspot as well as expenses of $11.3 million directly related to the sale plus other real estate related charges See addendum for a reconciliation of GAAP to non-GAAP financial results.

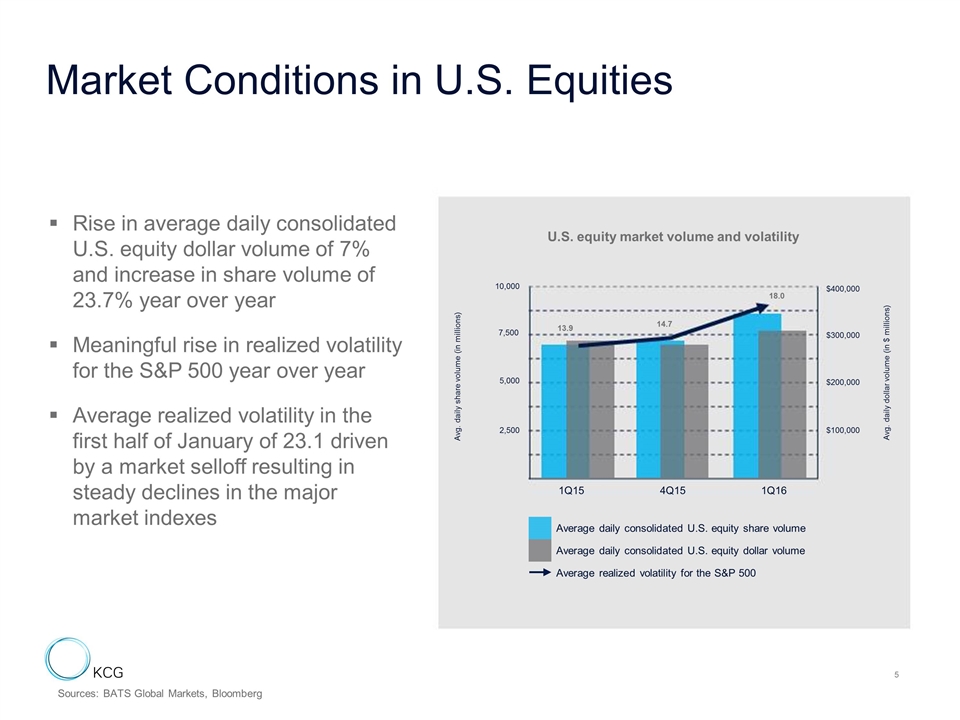

Market Conditions in U.S. Equities Rise in average daily consolidated U.S. equity dollar volume of 7% and increase in share volume of 23.7% year over year Meaningful rise in realized volatility for the S&P 500 year over year Average realized volatility in the first half of January of 23.1 driven by a market selloff resulting in steady declines in the major market indexes Sources: BATS Global Markets, Bloomberg Average daily consolidated U.S. equity share volume Average daily consolidated U.S. equity dollar volume Average realized volatility for the S&P 500 U.S. equity market volume and volatility 13.9 14.7 18.0 Avg. daily share volume (in millions) Avg. daily dollar volume (in $ millions) 10,000 7,500 5,000 2,500 $400,000 $300,000 $200,000 $100,000 1Q15 4Q15 1Q16

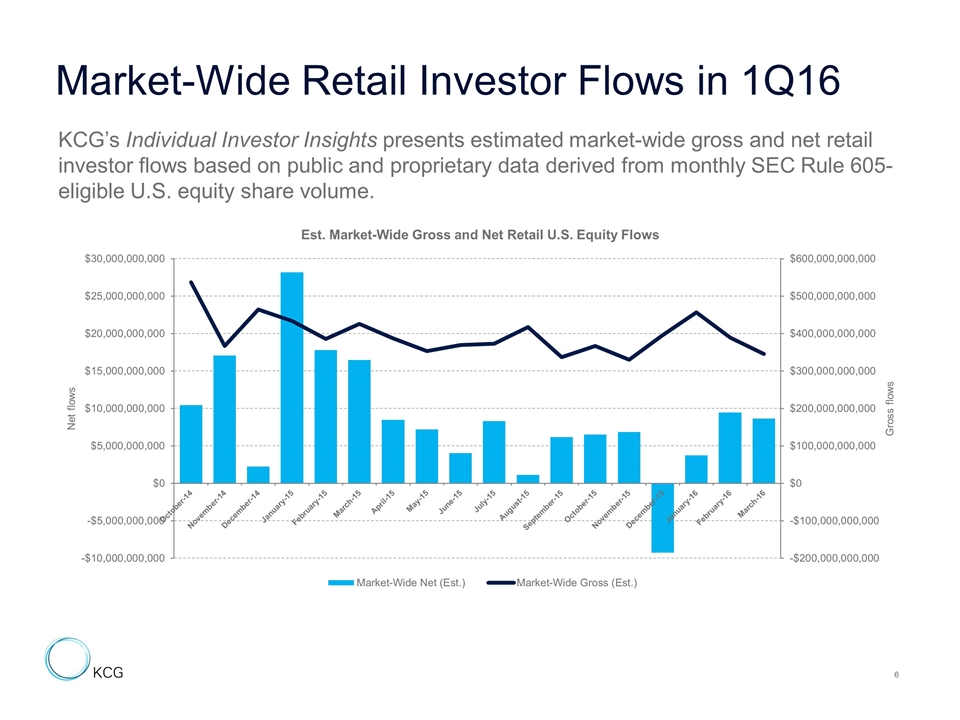

Market-Wide Retail Investor Flows in 1Q16 KCG’s Individual Investor Insights presents estimated market-wide gross and net retail investor flows based on public and proprietary data derived from monthly SEC Rule 605-eligible U.S. equity share volume.

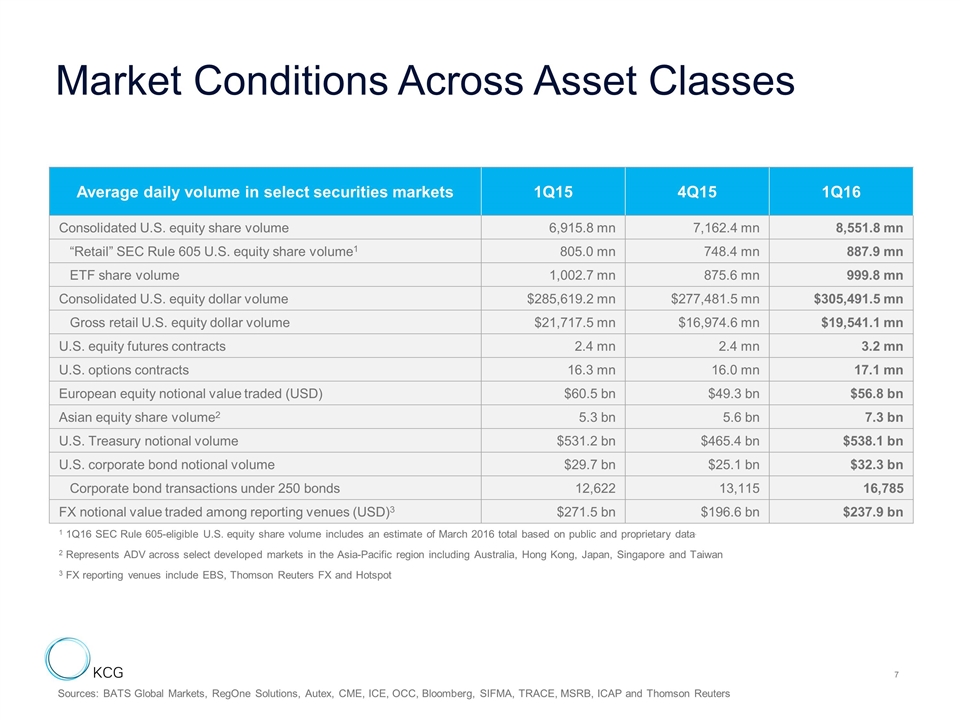

Market Conditions Across Asset Classes Average daily volume in select securities markets 1Q15 4Q15 1Q16 Consolidated U.S. equity share volume 6,915.8 mn 7,162.4 mn 8,551.8 mn “Retail” SEC Rule 605 U.S. equity share volume1 805.0 mn 748.4 mn 887.9 mn ETF share volume 1,002.7 mn 875.6 mn 999.8 mn Consolidated U.S. equity dollar volume $285,619.2 mn $277,481.5 mn $305,491.5 mn Gross retail U.S. equity dollar volume $21,717.5 mn $16,974.6 mn $19,541.1 mn U.S. equity futures contracts 2.4 mn 2.4 mn 3.2 mn U.S. options contracts 16.3 mn 16.0 mn 17.1 mn European equity notional value traded (USD) $60.5 bn $49.3 bn $56.8 bn Asian equity share volume2 5.3 bn 5.6 bn 7.3 bn U.S. Treasury notional volume $531.2 bn $465.4 bn $538.1 bn U.S. corporate bond notional volume $29.7 bn $25.1 bn $32.3 bn Corporate bond transactions under 250 bonds 12,622 13,115 16,785 FX notional value traded among reporting venues (USD)3 $271.5 bn $196.6 bn $237.9 bn 1 1Q16 SEC Rule 605-eligible U.S. equity share volume includes an estimate of March 2016 total based on public and proprietary data. 2 Represents ADV across select developed markets in the Asia-Pacific region including Australia, Hong Kong, Japan, Singapore and Taiwan 3 FX reporting venues include EBS, Thomson Reuters FX and Hotspot Sources: BATS Global Markets, RegOne Solutions, Autex, CME, ICE, OCC, Bloomberg, SIFMA, TRACE, MSRB, ICAP and Thomson Reuters

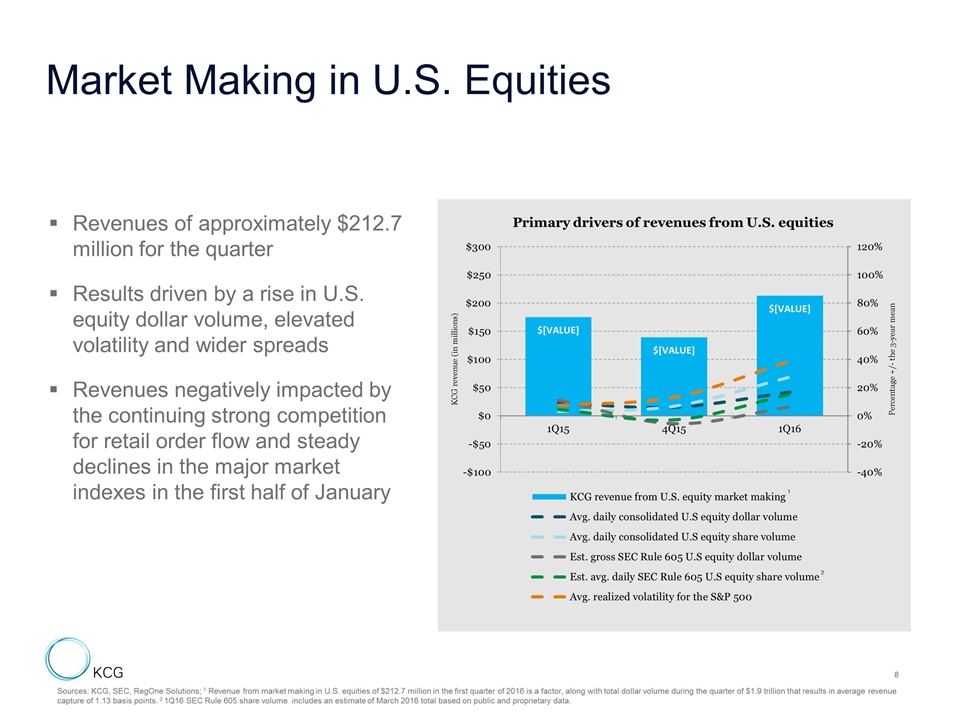

Market Making in U.S. Equities Sources: KCG, SEC, RegOne Solutions; 1 Revenue from market making in U.S. equities of $212.7 million in the first quarter of 2016 is a factor, along with total dollar volume during the quarter of $1.9 trillion that results in average revenue capture of 1.13 basis points. 2 1Q16 SEC Rule 605 share volume includes an estimate of March 2016 total based on public and proprietary data. Revenues of approximately $212.7 million for the quarter Results driven by a rise in U.S. equity dollar volume, elevated volatility and wider spreads Revenues negatively impacted by the continuing strong competition for retail order flow and steady declines in the major market indexes in the first half of January 1 2

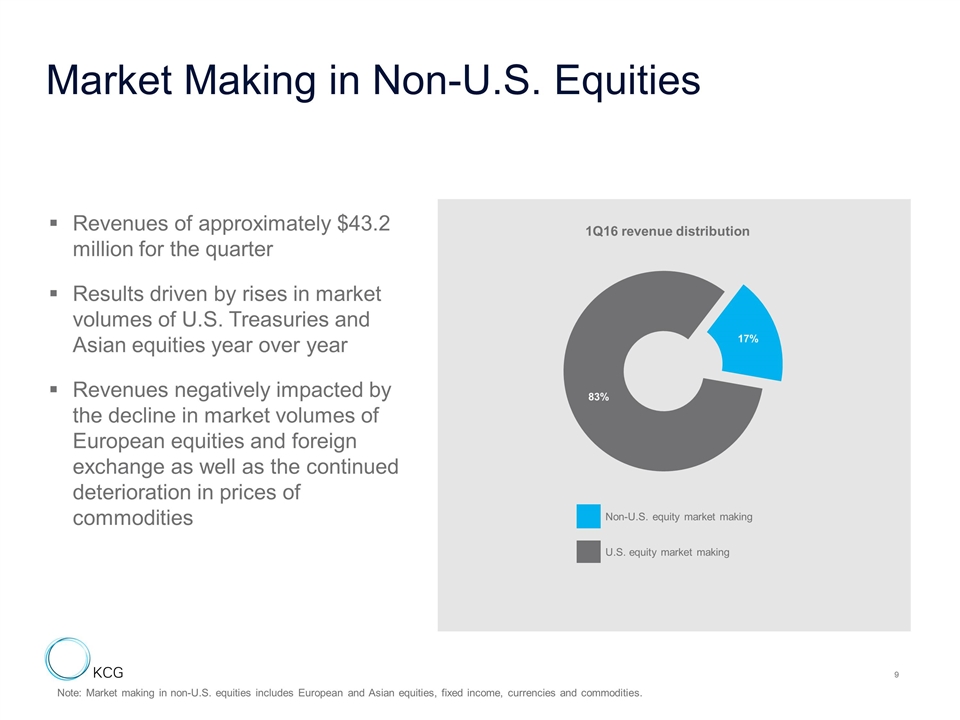

Market Making in Non-U.S. Equities Note: Market making in non-U.S. equities includes European and Asian equities, fixed income, currencies and commodities. Revenues of approximately $43.2 million for the quarter Results driven by rises in market volumes of U.S. Treasuries and Asian equities year over year Revenues negatively impacted by the decline in market volumes of European equities and foreign exchange as well as the continued deterioration in prices of commodities Non-U.S. equity market making U.S. equity market making 1Q16 revenue distribution

Agency-Based Trading Average daily KCG Institutional Equities U.S. equity share volume of 271.8 million driven by increased algorithmic trading and sales trading volumes in single stocks, ETFs and programs A new record for average daily KCG BondPoint par value traded of $192.4 million attributable to market share gains and increased market volumes of corporate and municipal bonds KCG MatchIt average daily U.S. equity share volume of 40.2 million KCG Institutional Equities avg. daily U.S. equity share volume KCG BondPoint avg. daily par value traded

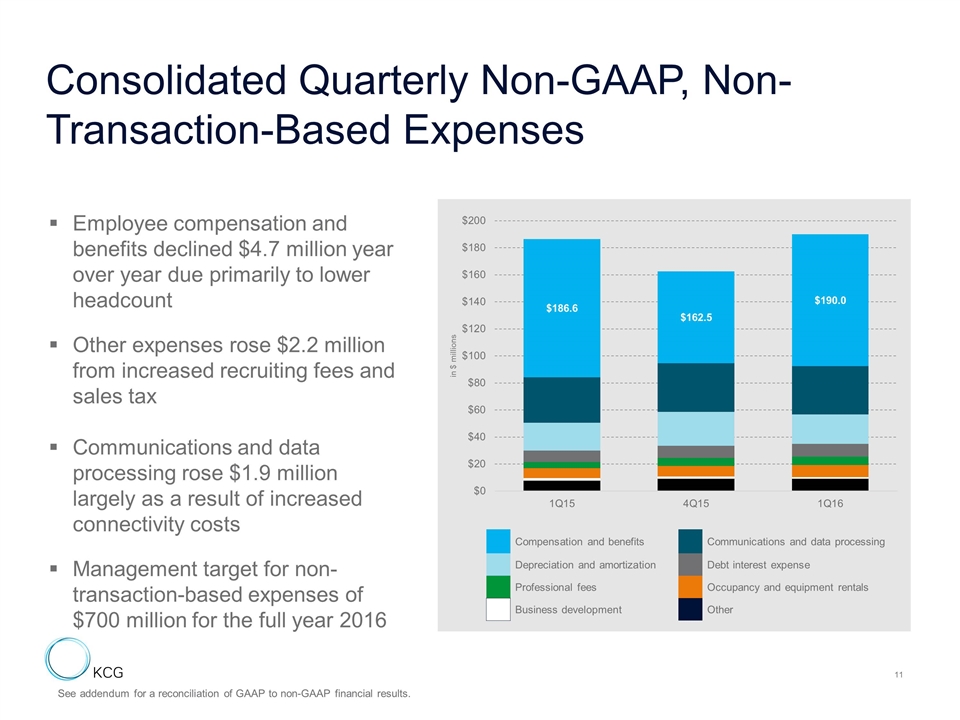

Consolidated Quarterly Non-GAAP, Non-Transaction-Based Expenses Employee compensation and benefits declined $4.7 million year over year due primarily to lower headcount Other expenses rose $2.2 million from increased recruiting fees and sales tax Communications and data processing rose $1.9 million largely as a result of increased connectivity costs Management target for non-transaction-based expenses of $700 million for the full year 2016 Compensation and benefits Communications and data processing Depreciation and amortization Debt interest expense Professional fees Occupancy and equipment rentals Business development Other See addendum for a reconciliation of GAAP to non-GAAP financial results.

Additional Financials Consolidated Statements of Financial Condition (in millions) (unaudited) March 31, 2015 December 31, 2015 March 31, 2016 Cash and cash equivalents $ 990.5 $ 581.3 $ 647.1 Debt 778.8 485.0 451.9 Stockholders’ equity 1,783.3 1,444.1 1,484.2 Debt-to-tangible equity ratio1 0.48 0.36 0.33 Tangible book value per share1 $13.86 $14.90 $15.30 Book value per share $15.10 $16.02 $16.42 Shares outstanding including restricted 118,091 90,156 90,400 stock units (in thousands) 1 Tangible book value is calculated by subtracting goodwill and intangible assets from equity.

As part of the Bats Global Markets IPO on April 15, 2016, KCG sold 2.6 million shares for approximately $46 million after commissions KCG will recognize a pre-tax gain of approximately $33 million in 2Q16 from this sale Post-IPO, KCG’s ownership stake in Bats is approximately 13.7% of the 96.6 million total shares outstanding as of the IPO date Post-IPO, KCG will continue to account for it’s ownership stake in Bats under the equity method of accounting KCG’s Board of Directors authorized an expanded share repurchase program on April 20, 2016 of up to $200 million of KCG common stock and warrants Amount includes the remaining capacity under the previously authorized repurchase program KCG may repurchase shares or warrants in open market transactions, accelerated stock buyback programs, tender offers, privately-negotiated transactions, under a Rule 10b5-1 plan or by other means Repurchases subject to compliance with covenants contained in KCG’s debt indenture Subsequent Events

Regulation G Reconciliation of Non-GAAP Financial Measures 3 months ended December 31, 2015 Market Making Global Execution Services Corporate and Other Consolidated Reconciliation of GAAP Revenues to Non-GAAP Revenues: GAAP Revenues $ 168,227 $ 70,221 $ 25,588 $ 264,036 Gain on sales of investments - - (19,751) (19,751) Writedown of investments - - 3,224 3,224 Non-GAAP Revenues $ 168,227 $ 70,221 $ 9,061 $ 247,509 3 months ended December 31, 2015 Market Making Global Execution Services Corporate and Other Consolidated Reconciliation of GAAP pre-tax to non-GAAP pre-tax: GAAP (loss) income before income taxes $ (5,132) $ (1,115) $ 1,776 $ (4,471) Gain on sales of investments - - (19,751) (19,751) Writedown of investments - - 3,224 3,224 Writedown of goodwill and intangible assets 14,016 907 1,014 15,937 Writedown of assets 216 - - 216 Non-GAAP income (loss) before income taxes $ 9,100 $ (208) $ (13,737) $ (4,845) 14

Regulation G Reconciliation of Non-GAAP Financial Measures 3 months ended March 31, 2015 Market Making Global Execution Services Corporate and Other Consolidated Reconciliation of GAAP Revenues to Non-GAAP Revenues: GAAP Revenues $ 224,548 $ 464,266 $ 7,342 $ 696,156 Gain on sale of KCG Hotspot - (385,026) - (385,026) Non-GAAP Revenues $ 224,548 $ 79,240 $ 7,342 $ 311,130 3 months ended March 31, 2015 Market Making Global Execution Services Corporate and Other Consolidated Reconciliation of GAAP pre-tax to non-GAAP pre-tax: GAAP (loss) income before income taxes $ 39,340 $ 381,058 $ (14,270) $ 406,128 Gain on sales of KCG Hotspot - (385,026) - (385,026) Professional fees related to the sale of KCG Hotspot - 6,736 - 6,736 Compensation expenses related to the sale of KCG Hotspot - 4,457 - 4,457 Lease loss accrual, net - - 132 132 Non-GAAP income (loss) before income taxes $ 39,340 $ 7,225 $ (14,138) $ 32,427 15

3 months ended December 31, 2015 GAAP Adjustments for non-GAAP presentation KCG non-GAAP, normalized expenses Reconciliation of GAAP expenses to KCG non-GAAP normalized expenses: Employee compensation and benefits 67,823 - 67,823 Communications and data processing 36,003 - 36,003 Depreciation and amortization 25,077 - 25,077 Debt interest expense 10,025 - 10,025 Occupancy and equipment rentals 7,842 - 7,842 Professional fees 5,774 - 5,774 Business development 1,751 - 1,751 Writedown of assets and other real estate-related charges 16,154 16,154 - Other 8,235 - 8,235 Total expenses1 $ 178,674 $ 16,154 $ 162,530 Regulation G Reconciliation of Non-GAAP Financial Measures 1 Total expenses exclude transaction-based expenses which fluctuate based on market conditions and client activity. 16

Regulation G Reconciliation of Non-GAAP Financial Measures 1 Total expenses exclude transaction-based expenses which fluctuate based on market conditions and client activity. 3 months ended March 31, 2015 GAAP Adjustments for non-GAAP presentation KCG non-GAAP, normalized expenses Reconciliation of GAAP expenses to KCG non-GAAP normalized expenses: Employee compensation and benefits 106,718 4,457 102,261 Communications and data processing 33,764 - 33,764 Depreciation and amortization 20,615 - 20,615 Debt interest expense 9,397 - 9,397 Professional fees 11,181 6,736 4,445 Occupancy and equipment rentals 7,340 - 7,340 Business development 1,857 - 1,857 Writedown of assets and other real estate-related charges 132 132 - Other 6,874 - 6,874 Total expenses1 $ 197,878 $ 11,325 $ 186,553 17

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Trailbreaker Commences Drilling at the Liberty Copper Property, BC.

- Dicello Levitt LLP Announces Investor Class Action Lawsuit Filed Against QuidelOrtho Corp. f/k/a Quidel Corp. (NASDAQ: QDEL) And Lead Plaintiff Deadline

- Victory Sells Tahlo Lake Property in British Columbia

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share