Form 8-K FIRST MERCHANTS CORP For: Nov 10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT (Date of earliest event reported): November 10, 2016

Commission File Number 0-17071

FIRST MERCHANTS CORPORATION

(Exact name of registrant as specified in its charter)

INDIANA | 35-1544218 |

(State or other jurisdiction of incorporation) | (IRS Employer Identification No.) |

200 East Jackson Street

P.O. Box 792

Muncie, IN 47305-2814

(Address of principal executive offices, including zip code)

(765) 747-1500

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 7.01. Regulation FD Disclosure.

The executive officers of First Merchants Corporation intend to use the material filed herewith, in whole or in part, in one or more meetings with investors and analysts. A copy of the investor presentation is attached hereto as Exhibit 99.1.

First Merchants Corporation does not intend for this Item 7.01 or Exhibit 99.1 to be treated as "filed" for purposes of the Securities Exchange Act of 1934, as amended, or incorporated into its filings under the Securities Act of 1933, as amended.

Item 9.01. Financial Statements and Exhibits.

(d) (99.1) First Merchants Corporation Investor Presentation

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

DATE: November 10, 2016

FIRST MERCHANTS CORPORATION

By: /s/ Mark K. Hardwick

Mark K. Hardwick

Executive Vice President,

Chief Financial Officer and Chief Operating Officer

FIRST MERCHANTS

CORPORATION

THE STRENGTH OF BIG. THE SERVICE OF SMALL. www.firstmerchants.com

NASDAQ: FRME

Michael C. Rechin Mark K. Hardwick Michael J. Stewart John J. Martin

President Executive Vice President Executive Vice President Executive Vice President

Chief Executive Officer Chief Financial Officer Chief Banking Officer Chief Credit Officer

Chief Operating Officer

®

3rd Quarter 2016

THE STRENGTH OF BIG. THE SERVICE OF SMALL.

www.firstmerchants.com

2

The Corporation may make forward-looking statements about its relative business outlook. These

forward-looking statements and all other statements made during this meeting that do not concern

historical facts are subject to risks and uncertainties that may materially affect actual results. Specific

forward-looking statements include, but are not limited to, any indications regarding the financial

services industry, the economy and future growth of the balance sheet or income statement. Please

refer to our press releases, Form 10-Qs and 10-Ks concerning factors that could cause actual results to

differ materially from any forward-looking statements.

Non-GAAP Financial Measures

These slides contain non-GAAP financial measures. For purposes of Regulation G, a non-GAAP

financial measure is a numerical measure of the registrant’s historical or future financial performance,

financial position or cash flows that excludes amounts, or is subject to adjustments that have the effect

of excluding amounts, that are included in the most directly comparable measure calculated and

presented in accordance with GAAP in the statement of income, balance sheet or statement of cash

flows (or equivalent statements) of the issuer; or includes amounts, or is subject to adjustments that

have the effect of including amounts, that are excluded from the most directly comparable measure so

calculated and presented. In this regard, GAAP refers to generally accepted accounting principles in

the United States. Pursuant to the requirements of Regulation G, First Merchants Corporation has

provided reconciliations within the slides, as necessary, of the non-GAAP financial measure to the most

directly comparable GAAP financial measure.

Forward-Looking Statement ®

THE STRENGTH OF BIG. THE SERVICE OF SMALL.

Why Invest in First Merchants?

www.firstmerchants.com

3

®

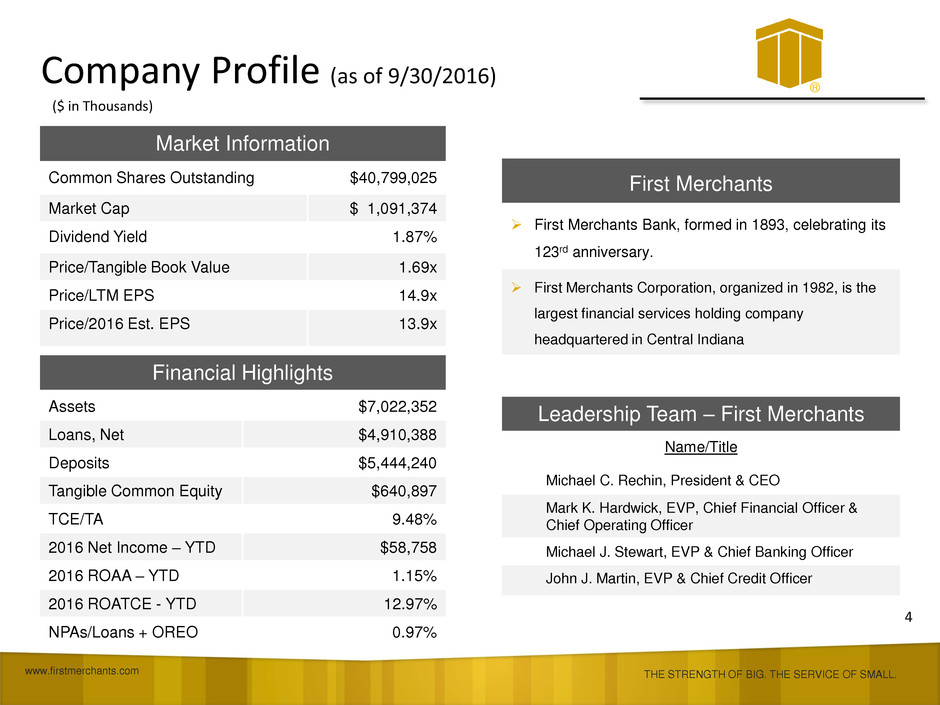

Financial Highlights

Assets $7,022,352

Loans, Net $4,910,388

Deposits $5,444,240

Tangible Common Equity $640,897

TCE/TA 9.48%

2016 Net Income – YTD $58,758

2016 ROAA – YTD 1.15%

2016 ROATCE - YTD 12.97%

NPAs/Loans + OREO 0.97%

THE STRENGTH OF BIG. THE SERVICE OF SMALL.

Company Profile (as of 9/30/2016)

www.firstmerchants.com

4

Market Information

Common Shares Outstanding $40,799,025

Market Cap $ 1,091,374

Dividend Yield 1.87%

Price/Tangible Book Value 1.69x

Price/LTM EPS 14.9x

Price/2016 Est. EPS 13.9x

Leadership Team – First Merchants

Name/Title

Michael C. Rechin, President & CEO

Mark K. Hardwick, EVP, Chief Financial Officer &

Chief Operating Officer

Michael J. Stewart, EVP & Chief Banking Officer

John J. Martin, EVP & Chief Credit Officer

First Merchants

First Merchants Bank, formed in 1893, celebrating its

123rd anniversary.

First Merchants Corporation, organized in 1982, is the

largest financial services holding company

headquartered in Central Indiana

®

($ in Thousands)

THE STRENGTH OF BIG. THE SERVICE OF SMALL.

Our Franchise

www.firstmerchants.com

5

First Merchants Corporation

operates more than 100 locations

in 27 Indiana counties, 2 Ohio

counties, and 2 Illinois counties

Key Market Profiles

Loans Deposits

$2,176M Indianapolis $1,542M

940M Muncie 1,559M

643M Munster 981M

573M Lafayette 1,005M

642M Columbus 357M

(as of September 30, 2016)

®

County Region/Type Market Position Market % $ Deposits

Delaware County, IN Muncie (Established) 1 46.17% $ 893,981

Jasper County, IN Lafayette (Established) 1 31.26% 198,089

White County, IN Lafayette (Established) 1 33.24% 159,014

Shelby County, IN Indianapolis (Growth) 1 19.18% 103,239

Jay County, IN Muncie (Established) 1 44.32% 91,506

Union County, IN Muncie (Established) 1 43.39% 47,973

Tippecanoe County, IN Lafayette (Established) 2 20.91% 510,925

Madison County, IN Indianapolis (Growth) 2 24.59% 325,704

Henry County, IN Muncie (Established) 2 37.87% 238,625

Wabash County, IN Muncie (Established) 2 14.87% 54,790

Hendricks County, IN Indianapolis (Growth) 3 11.33% 240,483

Adams County, IN Muncie (Established) 3 16.69% 104,959

Randolph County, IN Muncie (Established) 3 7.61% 63,409

Clinton County, IN Lafayette (Established) 3 13.77% 60,689

Morgan County, IN Indianapolis (Growth) 4 11.59% 98,643

Hancock County, IN Indianapolis (Growth) 4 8.61% 80,930

Carroll County, IN Lafayette (Established) 4 10.66% 32,907

Brown County, IN Indianapolis (Growth) 4 19.11% 18,656

Lake County, IN Lafayette (Established) 5 7.83% 670,030

Hamilton County, IN Indianapolis (Growth) 5 6.37% 522,258

Johnson County, IN Indianapolis (Growth) 5 7.23% 142,769

Fayette County, IN Muncie (Established) 5 8.47% 26,526

Miami County, IN Muncie (Established) 5 7.99% 31,331

Sub Total $4,717,436

First Merchants Total $5,447,848

Key FMC Deposit Market Share

FDIC Data June 30, 2016

6 THE STRENGTH OF BIG. THE SERVICE OF SMALL. www.firstmerchants.com

THE STRENGTH OF BIG. THE SERVICE OF SMALL.

First Merchants Strategy

www.firstmerchants.com

7

Commercial Bank

• Lending Engine

Supported by Consumer Retail Bank

• Deposit Engine

Growth

• Organic

• Growth by Acquisition

®

THE STRENGTH OF BIG. THE SERVICE OF SMALL.

First Merchants Strategy

www.firstmerchants.com

8

Commercial Bank

• Located in Prime Growth Commercial Banking Markets

• Indianapolis, Indiana

• Columbus, Ohio

• Lafayette, Indiana

• Northwest Indiana

• Hire the Best Talent Supported with the Finest:

• Sales Management Process

• Lending and Cash Management Services

• Revenue-Based Incentive System

®

THE STRENGTH OF BIG. THE SERVICE OF SMALL.

First Merchants Strategy

www.firstmerchants.com

9

Consumer Retail Bank

• Diversely Located in Stable Rural and Growth Metro

Markets

• Supported by:

• Talented Customer Service Oriented Banking Center

and Call Center Professionals

• State-of-the-Art Deposit and CRM Systems

• Highly Usable Online Banking System

• Widely Available Mobile Banking System

• Customer Service and Relationship Growth-Oriented

Incentive System

®

THE STRENGTH OF BIG. THE SERVICE OF SMALL.

First Merchants Strategy

www.firstmerchants.com

10

“Service-driven alternative to super-regional bank competitors.

Deliver superior service with presence close to the customer for . . . ”

“We specialize in our communities”

Retail Banking

Mortgage Banking

Commercial Banking

• Business Banking

• Commercial & Industrial

• Agriculture

• Specialty Finance

• Healthcare Services

• Real Estate

• Cash Management Services

Private Wealth Advisory (private banking, investment management, personal trust,

brokerage, and retirement)

®

THE STRENGTH OF BIG. THE SERVICE OF SMALL. www.firstmerchants.com

11

WEALTH

ADVISORY

MORTGAGE COMMERCIAL

BANKING

RETAIL

BANKING

Supported by LOB Strategies

Indianapolis

Higher Growth

Brown, Hamilton,

Hancock, Hendricks,

Johnson, Madison,

Marion, Morgan,

Shelby Counties

Columbus, OH

Higher Growth

Franklin County, OH

Lafayette

Established

Carroll, Clinton,

Jasper, Montgomery,

Tippecanoe, White

Counties

Muncie

Established

Adams, Delaware,

Fayette, Henry, Jay,

Miami, Randolph,

Union, Wabash,

Wayne Counties, IN

Butler, County, OH

Munster

Higher Growth

Lake & Porter, IN

Cook & DuPage, IL

Vision, Mission, Culture Statement, Core Values, Business Model

How We Deliver ®

THE STRENGTH OF BIG. THE SERVICE OF SMALL.

Organic Growth Opportunities

Exists in All Directions

www.firstmerchants.com

12

Lafayette MSA

Entered: 2002

Total Population: 217,817

Deposit Market Share: 18.18%

Indianapolis MSA

Entered: 1998

Total Population: 2,017,134

Deposit Market Share: 3.41%

Columbus, Ohio MSA

Entered: 2003

Total Population: 2,058,417

Deposit Market Share: .55%

Northwest Indiana MSA*

Entered: 2013

Total Population: 687,070

Deposit Market Share: 13.72%

*Includes Jasper, Lake, and Porter counties

®

LEGACY MARKET

Muncie MSA

Established: 1893

Total Population:

116,511

Current Market

Share: 46.17%

13

Ranked Best in the Midwest

for Business*

AAA Credit Rating**

1st in the Nation for Small Business Growth

1st Nationally for Cost of Doing Business

1st Nationally for Highway Accessibility

1st in the Midwest/8th Nationally for Low Taxes

2nd Nationally for Availability of Skilled Labor

2nd Best City in the Nation for Recent Graduates

(Indianapolis)

Home to the 2nd Largest Global Fed Ex Air Hub

Regulatory Climate Ranks 2nd in the Nation

4th Nationally for Cost of Living

8th Best State for Business

Indiana

THE STRENGTH OF BIG. THE SERVICE OF SMALL. www.firstmerchants.com

*IEDC

**S&P, Moody’s & Fitch

14

Delaware County, IN*

Rank

Branches

Deposits

Mkt.

Share

1 First Merchants Corporation 12 893,981 46.17%

2 Mutual First Financial 9 476,957 24.63%

3 J.P. Morgan Chase 4 220,534 11.39%

4 Old National Bancorp 7 206,538 10.67%

5 Star Financial Group 3 136,933 7.07%

6 Woodforest Financial Group 1 1,391 0.07%

Market Total 38 $1,936,334

Projected HHI & Pop. Change 2017-2022

*SNL Financial FDIC Summary of Deposits as of June 30, 2016

Notable Major Employers

Located 58 miles northeast of Indianapolis in the east central portion of the

state

Described by several national studies as a typical American community,

Delaware County offers the advantages of larger cities without the hassles

and costs associated with living in major metropolitan areas.

Easy access to the top 100 markets in the country, Muncie-Delaware

County has a diverse economic landscape

Ranked #27, Forbes Best Small Places for Business and Careers

Workforce experienced in life science, advanced manufacturing, 21st

century logistics and information technology

Home to Ball State University

Muncie Market

®

7.27%

8.00% 8.01%

3.77%

2.11%

0.15%

U.S. Indiana Delaware Co.

HHI Pop.

7.27%

8.00%

8.97%

3.77%

2.11%

7.34%

U.S. Indiana Hamilton Co.

HHI Pop.

Projected HHI & Pop. Change 2017-2022

15

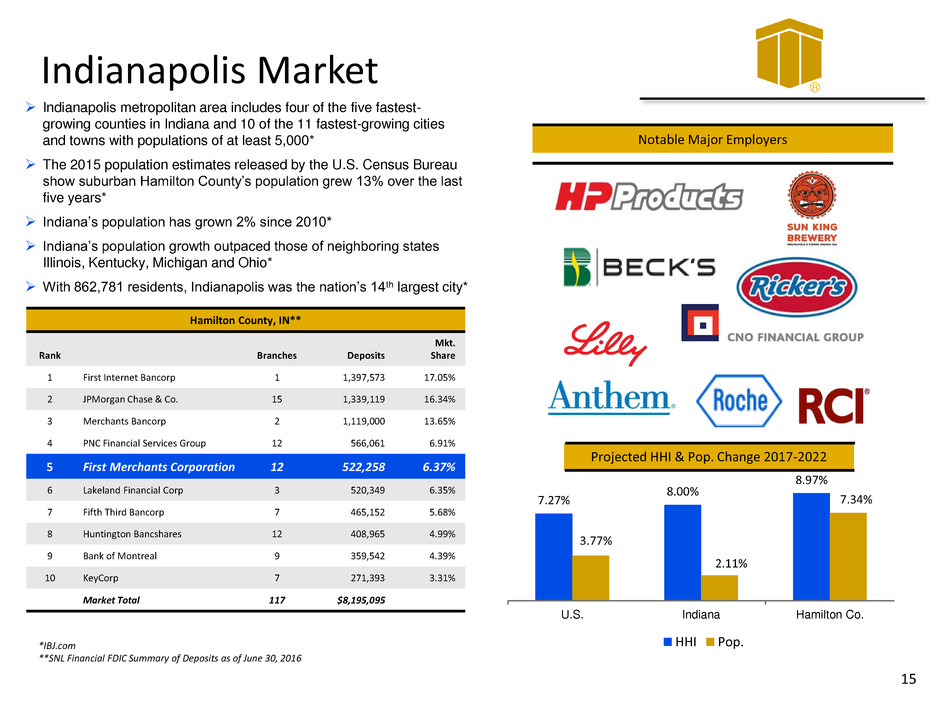

Hamilton County, IN**

Rank

Branches

Deposits

Mkt.

Share

1 First Internet Bancorp 1 1,397,573 17.05%

2 JPMorgan Chase & Co. 15 1,339,119 16.34%

3 Merchants Bancorp 2 1,119,000 13.65%

4 PNC Financial Services Group 12 566,061 6.91%

5 First Merchants Corporation 12 522,258 6.37%

6 Lakeland Financial Corp 3 520,349 6.35%

7 Fifth Third Bancorp 7 465,152 5.68%

8 Huntington Bancshares 12 408,965 4.99%

9 Bank of Montreal 9 359,542 4.39%

10 KeyCorp 7 271,393 3.31%

Market Total 117 $8,195,095

Indianapolis metropolitan area includes four of the five fastest-

growing counties in Indiana and 10 of the 11 fastest-growing cities

and towns with populations of at least 5,000*

The 2015 population estimates released by the U.S. Census Bureau

show suburban Hamilton County’s population grew 13% over the last

five years*

Indiana’s population has grown 2% since 2010*

Indiana’s population growth outpaced those of neighboring states

Illinois, Kentucky, Michigan and Ohio*

With 862,781 residents, Indianapolis was the nation’s 14th largest city*

*IBJ.com

**SNL Financial FDIC Summary of Deposits as of June 30, 2016

Notable Major Employers

Indianapolis Market

®

7.27%

8.00%

3.77% 3.77%

2.11%

5.19%

U.S. Indiana Tippecanoe Co.

HHI Pop.

16

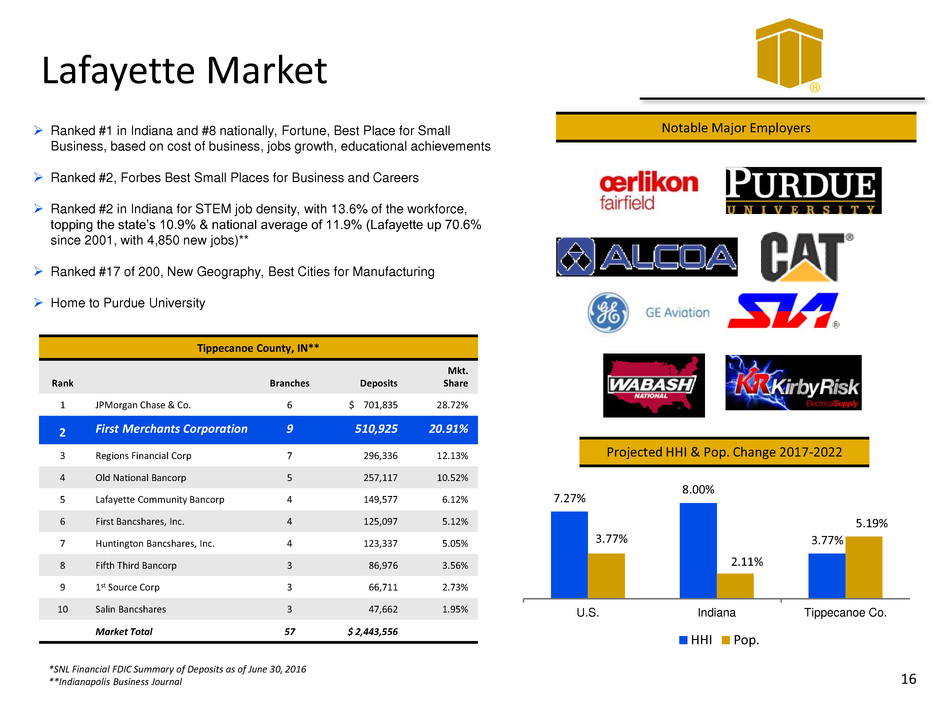

Tippecanoe County, IN**

Rank

Branches

Deposits

Mkt.

Share

1 JPMorgan Chase & Co. 6 $ 701,835 28.72%

2 First Merchants Corporation 9 510,925 20.91%

3 Regions Financial Corp 7 296,336 12.13%

4 Old National Bancorp 5 257,117 10.52%

5 Lafayette Community Bancorp 4 149,577 6.12%

6 First Bancshares, Inc. 4 125,097 5.12%

7 Huntington Bancshares, Inc. 4 123,337 5.05%

8 Fifth Third Bancorp 3 86,976 3.56%

9 1st Source Corp 3 66,711 2.73%

10 Salin Bancshares 3 47,662 1.95%

Market Total 57 $ 2,443,556

Ranked #1 in Indiana and #8 nationally, Fortune, Best Place for Small

Business, based on cost of business, jobs growth, educational achievements

Ranked #2, Forbes Best Small Places for Business and Careers

Ranked #2 in Indiana for STEM job density, with 13.6% of the workforce,

topping the state’s 10.9% & national average of 11.9% (Lafayette up 70.6%

since 2001, with 4,850 new jobs)**

Ranked #17 of 200, New Geography, Best Cities for Manufacturing

Home to Purdue University

Projected HHI & Pop. Change 2017-2022

Notable Major Employers

*SNL Financial FDIC Summary of Deposits as of June 30, 2016

**Indianapolis Business Journal

Lafayette Market

®

17

Lake County, IN*

Rank

Branches

Deposits

Mkt.

Share

1 JPMorgan Chase & Co. 24 $ 1,812,142 21.17%

2 First Bancshares, Inc. 29 1,790,048 20.91%

3 First Midwest Bancorp 21 1,015,796 11.87%

4 Northwest Indiana Bancorp 15 731,032 8.54%

5 First Merchants Corporation 11 670,030 7.83%

6 First Financial Bancorp 7 652,030 7.62%

7 Fifth Third Bancorp 13 499,788 5.84%

8 Bank of Montreal 15 478,887 5.59%

9 PNC Financial Services Group 4 172,235 2.01%

10 AMB Financial Corp 4 172,143 2.01%

Market Total 163 $ 8,560,942

Indiana’s second-most populous market

Benefit from its Chicago proximity

Continue to produce finest steels, refine the cleanest fuels and deliver

the best products to the Midwest**

New investments by world-class companies like BP, Pratt Industries,

Alcoa Howmet, Urschel Labs and Monosol**

Lakefront being revitalized through the Marquette Plan and

assistance of the Regional Development Authority**

7.27%

8.00% 8.16%

3.77%

2.11%

-0.54%

U.S. Indiana Lake County

HHI Pop.

Notable Major Employers

*SNL Financial FDIC Summary of Deposits as of June 30, 2016

**www.nwiforum.org/nwi-becoming-an-economic powerhouse

Northwest Indiana Market

®

Projected HHI & Pop. Change 2017-2022

18

Second-most populous county in Ohio

Within 600 miles of 60% of All U.S. and Canadian Population

Ranked 2nd in CNBC’s 2010 study of state transportation systems for

its infrastructure, vitality, quality roads, and ability to cost-effectively

ship goods by land, air, and water**

Home to Ohio State University

7.27%

8.07% 7.59%

3.77%

0.89%

5.04%

U.S. Ohio Franklin County

HHI Pop.

Projected HHI & Pop. Change 2017-2022

Notable Major Employers

*SNL Financial FDIC Summary of Deposits as of June 30, 2016

**http://jobs-ohio.com/manufacturing/

Franklin County, OH*

Rank

Branches

Deposits

Mkt.

Share

1 Huntington Bancshares 70 $ 19,176,982 39.51%

2 JP Morgan Chares & Co 49 12,524,687 25.80%

3 PNC Financial Services Group 42 5,243,661 10.80%

4 Fifth Third Bancorp 42 4,775,613 9.84%

5 U. S. Bancorp 34 1,282,621 2.64%

6 Key Corp 21 1,171,856 2.41%

7 Wells Fargo & Co 1 802,026 1.65%

8 Heartland BancCorp 11 508,956 1.05%

9 WesBanco Inc. 10 466,849 .96%

10 First Financial Bancorp 6 458,581 .94%

12 First Merchants Corporation 7 325,171 0.67%

Market Total 330 $ 48,539,002

Columbus, Ohio Market

®

THE STRENGTH OF BIG. THE SERVICE OF SMALL.

Growth Through Acquisition

www.firstmerchants.com

19

Experienced Acquirer

Expand in Current High-Growth Markets

Extend into Additional High-Growth Markets

Add to Franchise with Stable Deposit Gathering Markets

®

THE STRENGTH OF BIG. THE SERVICE OF SMALL.

20

FIRST MERCHANTS

ACQUISITION EXPERIENCE

1893-2016

®

21

Continuous Relationship Building

Complete and Thorough Due Diligence Process

Demonstrated Pricing Discipline:

• Average Price to TBV of 129%

• Average EPS Accretion within One Year

• Average TBV Earn-back of 2.8 Years

Detailed Project Managed Integration Process

Single Charter Operating Environment

Scalable Technology and Operations Center

FIRST MERCHANTS

ACQUISITION PROCESS

®

THE STRENGTH OF BIG. THE SERVICE OF SMALL.

Operational Delivery Highlights

www.firstmerchants.com

22

Daleville Operations Facility

Strategic differentiator in support of growth and scalability

Operational services execution “hub” focusing on value creation

Functional focus:

• Operations • Credit Administration

• Risk Management • Technology

• Project Management • Vendor Management

Located off interstate, less than an hour north of Indianapolis, IN

60,000+ square feet of flexible space

Strategic Vendor Partners

®

Retail Households: 145K

Online Banking/Digital Channel

• Consumer: 62K Users

• 810K logins monthly

• 12K bill pay users

• 74K payments monthly

Cash Management Annual Volume

• Automated Clearing House (ACH)

• # Originated: 2M Items ($5B)

• # Received: 12M Items ($17B)

• Mobile: 26K Users

• 22 average logins per month

• 80% average active user rate

• Domestic Wires

• # Originated: 33K Items ($9B)

• # Received: 31K Items ($14B)

• Business: 9K Users

• 10% use ACH/Wire/Positive Pay

• International Wires

• # Originated: 4K Items ($207M)

• # Received: 530 Items ($8M)

• Total ATMS: 124

Total Debit Cards

• 137K active cards

• 3M monthly card swipes

• $100M in monthly volume

• Commercial Remote Deposit Capture

• 462 businesses using solution

• 117K deposits annually

• 1.3M items deposited annually

• $2.7B in total deposits

23

Operational Delivery Highlights

Customer, Digital Channel & Transaction Activity

THE STRENGTH OF BIG. THE SERVICE OF SMALL. www.firstmerchants.com

®

THE STRENGTH OF BIG. THE SERVICE OF SMALL. www.firstmerchants.com

24

3rd Quarter 2016 Highlights

Record Net Income of $21.1 Million, a 23.4% Increase over 3Q2015

Earnings Per Share of $0.51, a 13.3% Increase over 3Q2015; Highest in Company’s History

Total Assets Crossed the $7 Billion Level and Grew by 13.5% over 3Q2015

$280 Million of Organic Loan Growth for the Year Reflects an 8% Annualized Growth Rate

Net Interest Margin Stays Strong; Expanding to 3.94%

1.22% Return on Average Assets

Efficiency Ratio of 55.12%

®

“Record Level Performance Metrics”

25

Total Assets

($ in Millions)

THE STRENGTH OF BIG. THE SERVICE OF SMALL. www.firstmerchants.com

®

2014 2015 Q1-’16 Q2-’16 Q3-’16

1. Investments $1,181 $1,277 $1,271 $1,298 $1,300

2. Loans Held for Sale 7 10 4 19 1

3. Loans 3,925 4,694 4,710 4,791 4,974

4. Allowance (64) (62) (62) (62) (63)

5. CD&I & Goodwill 219 260 262 261 260

6. BOLI 169 201 201 201 202

7. Other 387 381 413 398 348

8. Total Assets $5,824 $6,761 $6,799 $6,906 $7,022

9. Annualized Asset Growth 16.1% 5.1%

®

THE STRENGTH OF BIG. THE SERVICE OF SMALL. www.firstmerchants.com

Commercial &

Industrial

23.0%

Commercial

Real Estate

Owner-Occupied

10.5%

Commercial

Real Estate

Non-Owner

Occupied

25.4%

Construction Land

& Land

Development

7.4%

Agricultural

Land

3.1%

Agricultural

Production

1.9%

Other

Commercial

4.2%

Residential

Mortgage

14.9%

Home

Equity

8.0%

Other

Consumer

1.6%

QTD Yield = 4.64%

YTD Yield = 4.59%

Total Loans = $5.0 Billion

Loan and Yield Detail

(as of 9/30/2016)

26

®

THE STRENGTH OF BIG. THE SERVICE OF SMALL. www.firstmerchants.com

Mortgage-

Backed

Securities

32%

Collateralized

Mortgage

Obligations

21%

U. S. Agencies

3%

Corporate

Obligations

1%

Tax-Exempt

Municipals

43%

Investment Portfolio

(as of 9/30/2016)

$1.3 Billion

Modified duration of 4.1 years

Tax equivalent yield of 3.69%

Net unrealized gain of $53.3 Million

27

2014 2015 Q1-’16 Q2-’16 Q3-’16

1. Customer Non-Maturity Deposits $3,523 $4,096 $4,140 $4,269 $4,290

2. Customer Time Deposits 784 880 841 820 795

3. Brokered Deposits 334 314 330 319 359

4. Borrowings 290 446 420 435 500

5. Other Liabilities 44 51 79 53 55

6. Hybrid Capital 122 123 122 122 122

7. Common Equity 727 851 867 888 901

8. Total Liabilities and Capital $5,824 $6,761 $6,799 $6,906 $7,022

Total Liabilities and Capital

($ in Millions)

THE STRENGTH OF BIG. THE SERVICE OF SMALL. www.firstmerchants.com

®

28

®

THE STRENGTH OF BIG. THE SERVICE OF SMALL. www.firstmerchants.com

Deposit Detail

(as of 09/30/2016)

QTD Cost = .38%

YTD Cost = .39%

Total = $5.4 Billion

29

Demand Deposits

50%

Savings Deposits

28%

Certificates &

Time Deposits of

>$100,000

6%

Certificates &

Time Deposits of

<$100,000

9% Brokered

Deposits

7%

11.16%

11.40%

11.37%

11.22%

11.31% 11.49% 11.42% 11.39%

11.05%

8.97% 9.06%

9.21%

8.95%

9.17% 9.08% 9.26%

9.43% 9.48%

15.21%

15.34%

15.12%

14.92% 14.85% 14.94% 14.79% 14.67%

14.18%

6.00%

7.00%

8.00%

9.00%

10.00%

11.00%

12.00%

13.00%

14.00%

15.00%

16.00%

17.00%

18.00%

3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16

THE STRENGTH OF BIG. THE SERVICE OF SMALL. www.firstmerchants.com

Total Risk-Based Capital Ratio (Target = 13.50%)

Common Equity Tier 1 Capital Ratio (Target = 10.00%)

Tangible Common Equity Ratio (TCE) (Target = 8.50%) 30

Capital Ratios

(Target)

(Target)

(Target)

®

THE STRENGTH OF BIG. THE SERVICE OF SMALL. www.firstmerchants.com

31

Net Interest Margin

®

($ in Millions) Q3 - '14 Q4 - '14 Q1 - '15 Q2 - '15 Q3 - '15 Q4 - '15 Q1 - '16 Q2 - '16 Q3 - '16

Net Interest Income - FTE $ 49.9 $ 49.2 $ 49.2 $ 51.7 $ 53.3 $ 53.2 $ 57.6 $ 59.2 $ 61.1

Fair Value Accretion $ 3.5 $ 1.4 $ 2.2 $ 2.2 $ 2.0 $ 1.9 $ 2.5 $ 3.2 $ 3.8

Tax Equivalent Yield on Earning

Assets 4.41% 4.26% 4.24% 4.26% 4.30% 4.20% 4.28% 4.30% 4.37%

Cost of Supporting Liabilities 0.43% 0.46% 0.46% 0.45% 0.45% 0.45% 0.45% 0.44% 0.43%

Net Interest Margin 3.98% 3.80% 3.78% 3.81% 3.85% 3.75% 3.83% 3.86% 3.94%

3.98%

3.80% 3.78%

3.81% 3.85%

3.75%

3.83% 3.86%

3.94%

3.71% 3.69% 3.61% 3.65%

3.71%

3.62%

3.66% 3.65%

3.70%

2.60%

2.80%

3.00%

3.20%

3.40%

3.60%

3.80%

4.00%

4.20%

$34

$38

$42

$46

$50

$54

$58

$62

Q3 - '14 Q4 - '14 Q1 - '15 Q2 - '15 Q3 - '15 Q4 - '15 Q1 - '16 Q2 - '16 Q3 - '16

Net Interest Income - FTE ($millions) Net Interest Margin Net Interest Margin - Adjusted for Fair Value Accretion

31

32

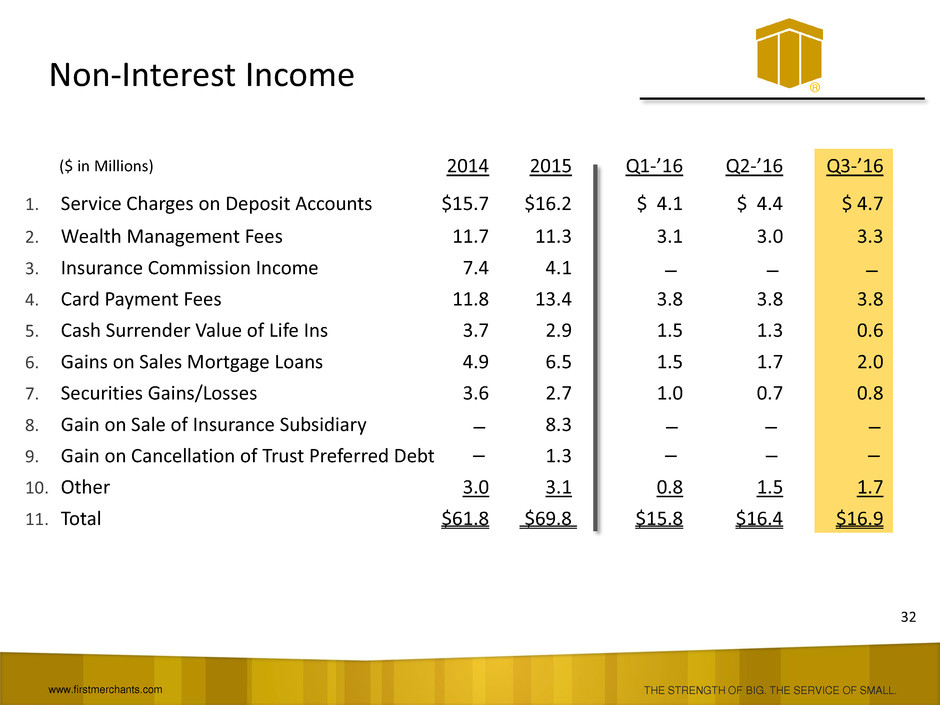

Non-Interest Income

THE STRENGTH OF BIG. THE SERVICE OF SMALL. www.firstmerchants.com

®

–

–

–

–

–

–

–

–

–

–

–

2014 2015 Q1-’16 Q2-’16 Q3-’16

1. Service Charges on Deposit Accounts $15.7 $16.2 $ 4.1 $ 4.4 $ 4.7

2. Wealth Management Fees 11.7 11.3 3.1 3.0 3.3

3. Insurance Commission Income 7.4 4.1

4. Card Payment Fees 11.8 13.4 3.8 3.8 3.8

5. Cash Surrender Value of Life Ins 3.7 2.9 1.5 1.3 0.6

6. Gains on Sales Mortgage Loans 4.9 6.5 1.5 1.7 2.0

7. Securities Gains/Losses 3.6 2.7 1.0 0.7 0.8

8. Gain on Sale of Insurance Subsidiary 8.3

9. Gain on Cancellation of Trust Preferred Debt 1.3

10. Other 3.0 3.1 0.8 1.5 1.7

11. Total $61.8 $69.8 $15.8 $16.4 $16.9

($ in Millions)

33

Non-Interest Expense

2014 2015 Q1-’16 Q2-’16 Q3-’16

1. Salary & Benefits $ 96.5 $101.9 $27.3 $25.6 $26.7

2. Premises & Equipment 23.2 25.5 7.3 7.3 7.3

3. Core Deposit Intangible Amortization 2.4 2.8 1.0 1.0 1.0

4. Professional & Other Outside Services 8.1 9.9 2.2 1.5 1.2

5. OREO/Credit-Related Expense 3.4 3.9 0.7 0.9 0.6

6. FDIC Expense 3.7 3.7 1.0 1.0 0.5

7. Outside Data Processing 7.3 7.1 2.1 2.0 2.4

8. Marketing 3.5 3.5 0.7 0.9 0.6

9. Other 15.8 16.5 4.1 4.7 3.8

10. Non-Interest Expense $163.9 $174.8 $46.4 $44.9 $44.1

($ in Millions)

THE STRENGTH OF BIG. THE SERVICE OF SMALL. www.firstmerchants.com

®

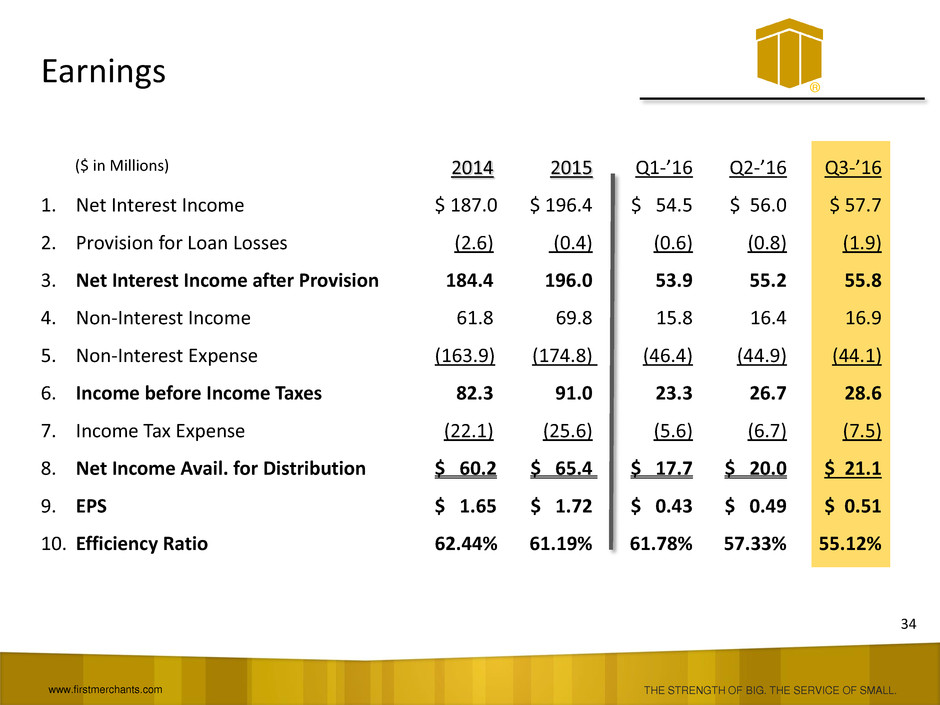

34

2014 2015 Q1-’16 Q2-’16 Q3-’16

1. Net Interest Income $ 187.0 $ 196.4 $ 54.5 $ 56.0 $ 57.7

2. Provision for Loan Losses (2.6) (0.4) (0.6) (0.8) (1.9)

3. Net Interest Income after Provision 184.4 196.0 53.9 55.2 55.8

4. Non-Interest Income 61.8 69.8 15.8 16.4 16.9

5. Non-Interest Expense (163.9) (174.8) (46.4) (44.9) (44.1)

6. Income before Income Taxes 82.3 91.0 23.3 26.7 28.6

7. Income Tax Expense (22.1) (25.6) (5.6) (6.7) (7.5)

8. Net Income Avail. for Distribution $ 60.2 $ 65.4 $ 17.7 $ 20.0 $ 21.1

9. EPS $ 1.65 $ 1.72 $ 0.43 $ 0.49 $ 0.51

10. Efficiency Ratio 62.44% 61.19% 61.78% 57.33% 55.12%

Earnings

($ in Millions)

THE STRENGTH OF BIG. THE SERVICE OF SMALL. www.firstmerchants.com

®

35

Per Share Results

THE STRENGTH OF BIG. THE SERVICE OF SMALL. www.firstmerchants.com

®

2015 Q1 Q2 Q3 Q4 Total

1. Earnings Per Share $ .43 $ .47 $ .45 $ .37 $ 1.72

2. Dividends $ .08 $ .11 $ .11 $ .11 $ .41

3. Tangible Book Value $13.96 $14.15 $14.59 $ 14.68

2016 Q1 Q2 Q3 Q4 Total

1. Earnings Per Share $ .43 $ .49 $ .51 – $ 1.43

2. Dividends $ .11 $ .14 $ .14 – $ .39

2. Tangible Book Value $15.02 $15.53 $15.86 –

$9.21 $9.64

$10.95

$12.17

$13.65

$14.68

$15.86

THE STRENGTH OF BIG. THE SERVICE OF SMALL.

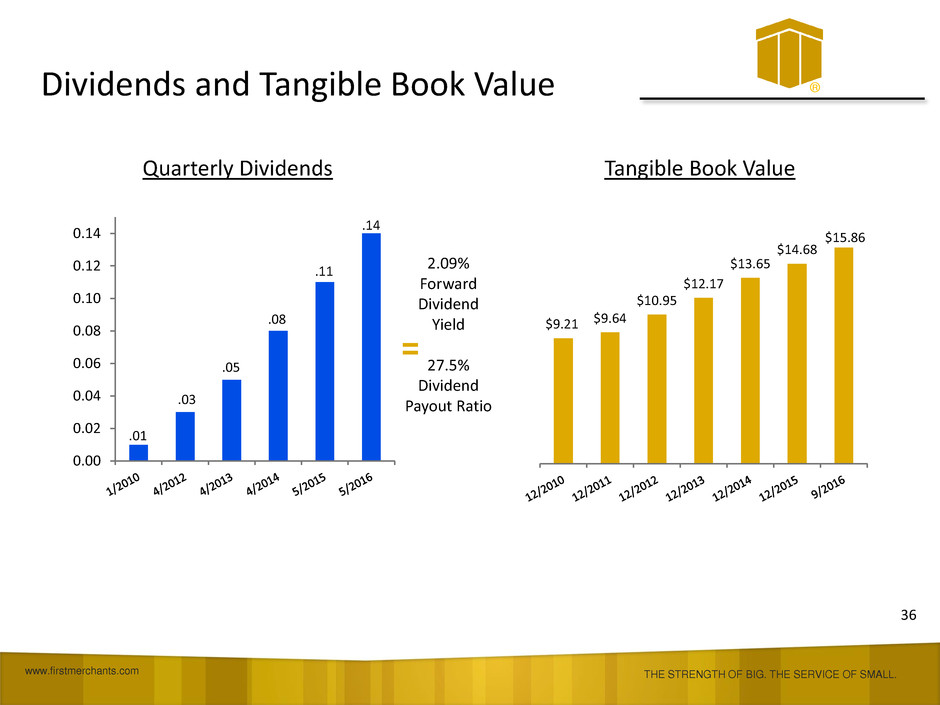

Dividends and Tangible Book Value

0.00

0.02

0.04

0.06

0.08

0.10

0.12

0.14

.08

www.firstmerchants.com

®

.01

.03

.05

.11

.14

2.09%

Forward

Dividend

Yield

27.5%

Dividend

Payout Ratio

=

Quarterly Dividends Tangible Book Value

36

37

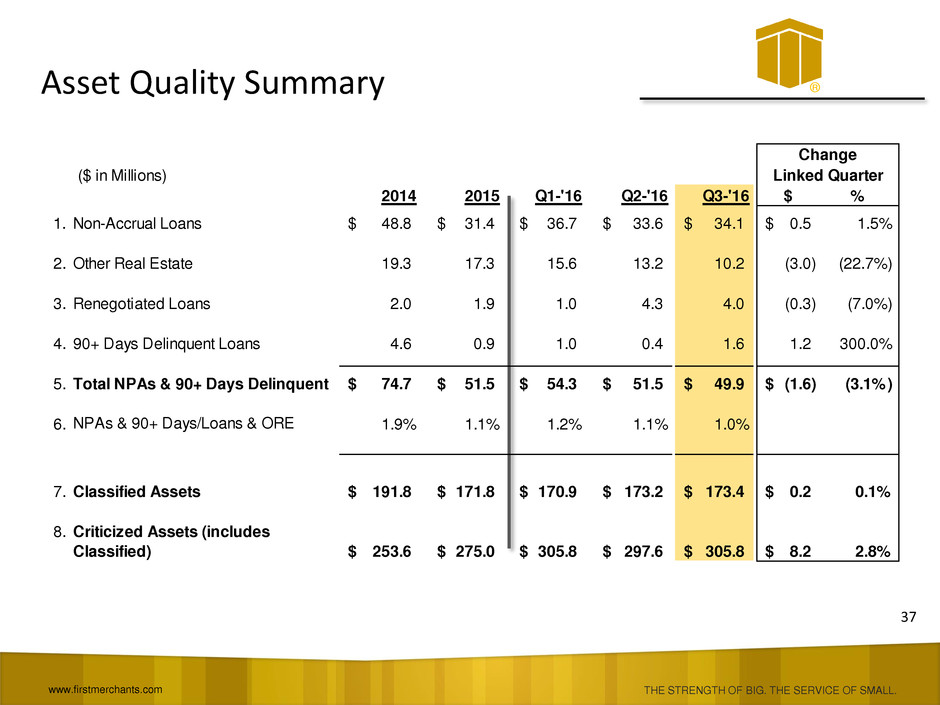

Asset Quality Summary

THE STRENGTH OF BIG. THE SERVICE OF SMALL. www.firstmerchants.com

®

($ in Millions)

2014 2015 Q1-'16 Q2-'16 Q3-'16 $ %

1. Non-Accrual Loans 48.8$ 31.4$ 36.7$ 33.6$ 34.1$ 0.5$ 1.5%

2. Other Real Estate 19.3 17.3 15.6 13.2 10.2 (3.0) (22.7%)

3. Renegotiated Loans 2.0 1.9 1.0 4.3 4.0 (0.3) (7.0%)

4. 90+ Days Delinquent Loans 4.6 0.9 1.0 0.4 1.6 1.2 300.0%

5. Total NPAs & 90+ Days Delinquent 74.7$ 51.5$ 54.3$ 51.5$ 49.9$ (1.6)$ (3.1%)

6. NPAs & 90+ Days/Loans & ORE 1.9% 1.1% 1.2% 1.1% 1.0%

7. Classified Assets 191.8$ 171.8$ 170.9$ 173.2$ 173.4$ 0.2$ 0.1%

8. Criticized Assets (includes

Classified) 253.6$ 275.0$ 305.8$ 297.6$ 305.8$ 8.2$ 2.8%

Change

Linked Quarter

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

2012 2013 Q1-'14 Q2-'14 Q3-'14 Q4-'14 Q1-'15 Q2-'15 Q3-'15 Q4-'15 Q1-'16 Q2-'16 Q3-'16

Cumulative Loan

Income

Cumulative Offset

Charge-Offs

Remaining Fair

Value Adjustment

38

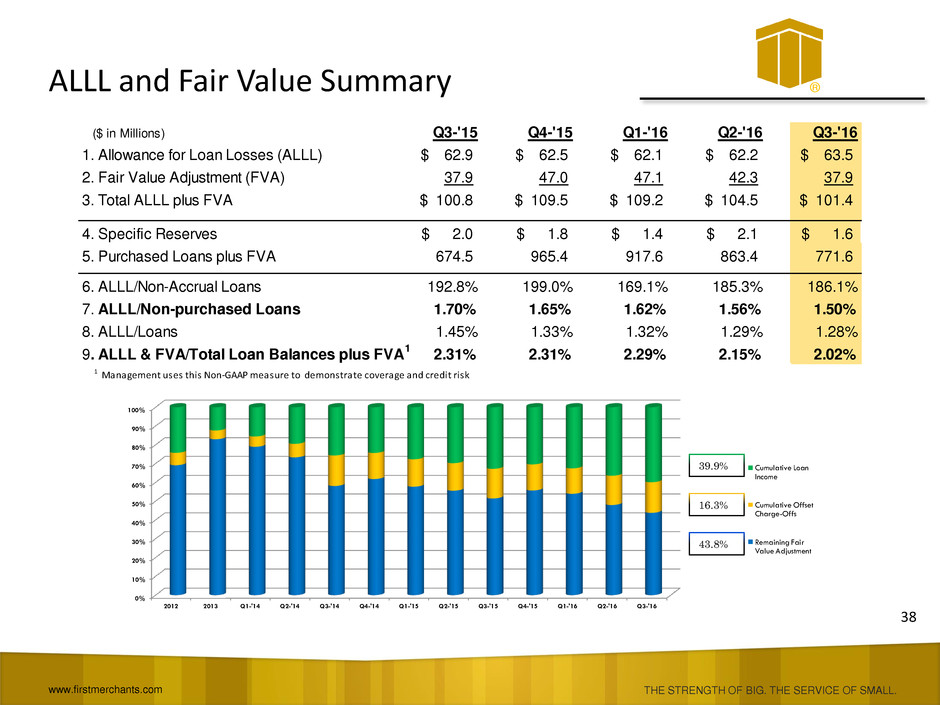

ALLL and Fair Value Summary

THE STRENGTH OF BIG. THE SERVICE OF SMALL. www.firstmerchants.com

®

16.3%

43.8%

39.9%

($ in Millions) Q3-'15 Q4-'15 Q1-'16 Q2-'16 Q3-'16

1. Allowance for Loan Losses (ALLL) 62.9$ 62.5$ 62.1$ 62.2$ 63.5$

2. Fair Value Adjustment (FVA) 37.9 47.0 47.1 42.3 37.9

3. Total ALLL plus FVA 100.8$ 109.5$ 109.2$ 104.5$ 101.4$

4. Specific Reserves 2.0$ 1.8$ 1.4$ 2.1$ 1.6$

5. Purchased Loans plus FVA 674.5 965.4 917.6 863.4 771.6

6. ALLL/Non-Accrual Loans 192.8% 199.0% 169.1% 185.3% 186.1%

7. ALLL/Non-purchased Loans 1.70% 1.65% 1.62% 1.56% 1.50%

8. ALLL/Loans 1.45% 1.33% 1.32% 1.29% 1.28%

9. ALLL & FVA/Total Loan Balances plus FVA

1

2.31% 2.31% 2.29% 2.15% 2.02%

1 Management uses this Non-GAAP measure to demonstrate coverage and credit risk

THE STRENGTH OF BIG. THE SERVICE OF SMALL.

www.firstmerchants.com

39

-50

0

50

100

150

200

250

First Merchants Corporation SNL U.S. Bank Russell 2000

Total Return Performance

®

12/31/10 12/31/11 12/31/12 12/31/13 12/31/14 12/31/15

%

9/30/16

40

FMC Strategy and Tactics Overview

THE STRENGTH OF BIG. THE SERVICE OF SMALL. www.firstmerchants.com

Looking Forward . . .

®

Continue to Win in our Markets – Geographic Community-Based Banking Model

Increase Focus on Treasury Management Services for Deposit and Fee Generation

Exploit Back-Office Infrastructure for Efficiency and Operating Leverage

Mergers and Acquisitions as a Core Competency

Build or Acquire Specialty Finance Businesses and Lending Verticals

Persistent Focus on Banking Center Optimization in Alignment with Digital

Channels Migration

Capital Optimization

41

Why Invest in First Merchants?

Attractive and Growing Earnings Stream

One of SNL’s Top 25 Best-Performing Regional Banks in 2015

2nd Largest Indiana Bank with an Energized and Experienced

Management Team

Attractive Long-Term Deposit Market Shares

Commercial Presence that Creates a Client Preference

State-of-the-Art Technology and Operations Center

Successful Acquisition and Integration Track Record

THE STRENGTH OF BIG. THE SERVICE OF SMALL. www.firstmerchants.com

®

42

D. A. Davidson

FIG Partners

Keefe, Bruyette & Woods, Inc.

Piper Jaffray

Sandler O’Neill + Partners, L.P.

Stephens, Inc.

Research Coverage

THE STRENGTH OF BIG. THE SERVICE OF SMALL. www.firstmerchants.com

®

43

Contact Information

First Merchants Corporation common stock is

traded on the NASDAQ Global Select Market

under the symbol FRME.

Additional information can be found at

www.FIRSTMERCHANTS.COM

Investor inquiries:

David L. Ortega

Investor Relations

Telephone: 765.378.8937

[email protected]

THE STRENGTH OF BIG. THE SERVICE OF SMALL. www.firstmerchants.com

®

44

Appendix

®

45

THE STRENGTH OF BIG. THE SERVICE OF SMALL. www.firstmerchants.com

Appendix – Non-GAAP Reconciliation ®

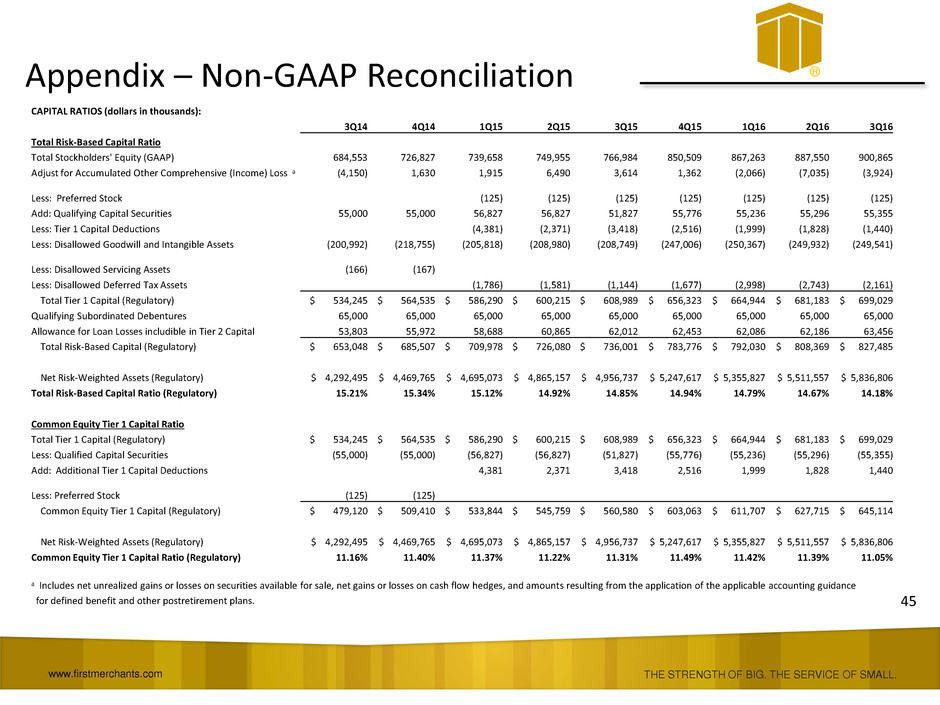

CAPITAL RATIOS (dollars in thousands):

3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16

Total Risk-Based Capital Ratio

Total Stockholders' Equity (GAAP) 684,553 726,827 739,658 749,955 766,984 850,509 867,263 887,550 900,865

Adjust for Accumulated Other Comprehensive (Income) Loss a (4,150) 1,630 1,915 6,490 3,614 1,362 (2,066) (7,035) (3,924)

Less: Preferred Stock

(125)

(125)

(125)

(125)

(125)

(125)

(125)

Add: Qualifying Capital Securities 55,000 55,000 56,827 56,827 51,827 55,776 55,236 55,296 55,355

Less: Tier 1 Capital Deductions (4,381) (2,371) (3,418) (2,516) (1,999) (1,828) (1,440)

Less: Disallowed Goodwill and Intangible Assets (200,992) (218,755) (205,818) (208,980) (208,749) (247,006) (250,367) (249,932) (249,541)

Less: Disallowed Servicing Assets

(166)

(167)

Less: Disallowed Deferred Tax Assets (1,786) (1,581) (1,144) (1,677) (2,998) (2,743) (2,161)

Total Tier 1 Capital (Regulatory) $ 534,245 $ 564,535 $ 586,290 $ 600,215 $ 608,989 $ 656,323 $ 664,944 $ 681,183 $ 699,029

Qualifying Subordinated Debentures 65,000 65,000 65,000 65,000 65,000 65,000 65,000 65,000 65,000

Allowance for Loan Losses includible in Tier 2 Capital 53,803 55,972 58,688 60,865 62,012 62,453 62,086 62,186 63,456

Total Risk-Based Capital (Regulatory) $ 653,048 $ 685,507 $ 709,978 $ 726,080 $ 736,001 $ 783,776 $ 792,030 $ 808,369 $ 827,485

Net Risk-Weighted Assets (Regulatory) $ 4,292,495 $ 4,469,765 $ 4,695,073 $ 4,865,157 $ 4,956,737 $ 5,247,617 $ 5,355,827 $ 5,511,557 $ 5,836,806

Total Risk-Based Capital Ratio (Regulatory) 15.21% 15.34% 15.12% 14.92% 14.85% 14.94% 14.79% 14.67% 14.18%

Common Equity Tier 1 Capital Ratio

Total Tier 1 Capital (Regulatory) $ 534,245 $ 564,535 $ 586,290 $ 600,215 $ 608,989 $ 656,323 $ 664,944 $ 681,183 $ 699,029

Less: Qualified Capital Securities (55,000) (55,000) (56,827) (56,827) (51,827) (55,776) (55,236) (55,296) (55,355)

Add: Additional Tier 1 Capital Deductions 4,381 2,371 3,418 2,516 1,999 1,828 1,440

Less: Preferred Stock

(125)

(125)

Common Equity Tier 1 Capital (Regulatory) $ 479,120 $ 509,410 $ 533,844 $ 545,759 $ 560,580 $ 603,063 $ 611,707 $ 627,715 $ 645,114

Net Risk-Weighted Assets (Regulatory) $ 4,292,495 $ 4,469,765 $ 4,695,073 $ 4,865,157 $ 4,956,737 $ 5,247,617 $ 5,355,827 $ 5,511,557 $ 5,836,806

Common Equity Tier 1 Capital Ratio (Regulatory) 11.16% 11.40% 11.37% 11.22% 11.31% 11.49% 11.42% 11.39% 11.05%

a Includes net unrealized gains or losses on securities available for sale, net gains or losses on cash flow hedges, and amounts resulting from the application of the applicable accounting guidance

for defined benefit and other postretirement plans.

46

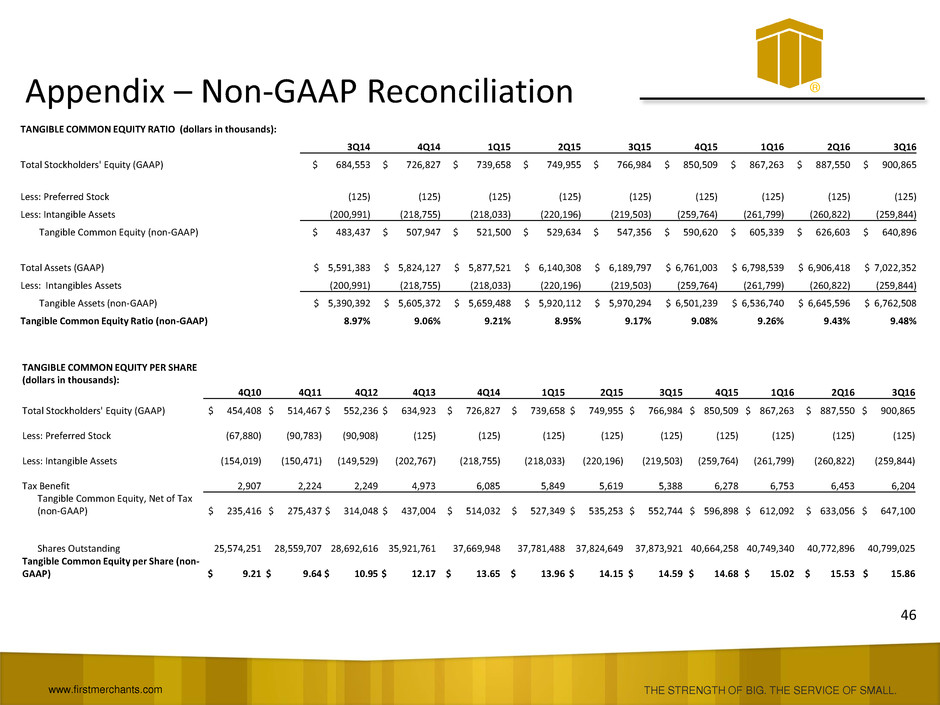

Appendix – Non-GAAP Reconciliation

THE STRENGTH OF BIG. THE SERVICE OF SMALL. www.firstmerchants.com

®

TANGIBLE COMMON EQUITY RATIO (dollars in thousands):

3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16

Total Stockholders' Equity (GAAP) $ 684,553 $ 726,827 $ 739,658 $ 749,955 $ 766,984 $ 850,509 $ 867,263 $ 887,550 $ 900,865

Less: Preferred Stock (125) (125) (125) (125) (125) (125) (125) (125) (125)

Less: Intangible Assets (200,991) (218,755) (218,033) (220,196) (219,503) (259,764) (261,799) (260,822) (259,844)

Tangible Common Equity (non-GAAP) $ 483,437 $ 507,947 $ 521,500 $ 529,634 $ 547,356 $ 590,620 $ 605,339 $ 626,603 $ 640,896

Total Assets (GAAP) $ 5,591,383 $ 5,824,127 $ 5,877,521 $ 6,140,308 $ 6,189,797 $ 6,761,003 $ 6,798,539 $ 6,906,418 $ 7,022,352

Less: Intangibles Assets (200,991) (218,755) (218,033) (220,196) (219,503) (259,764) (261,799) (260,822) (259,844)

Tangible Assets (non-GAAP) $ 5,390,392 $ 5,605,372 $ 5,659,488 $ 5,920,112 $ 5,970,294 $ 6,501,239 $ 6,536,740 $ 6,645,596 $ 6,762,508

Tangible Common Equity Ratio (non-GAAP) 8.97% 9.06% 9.21% 8.95% 9.17% 9.08% 9.26% 9.43% 9.48%

TANGIBLE COMMON EQUITY PER SHARE

(dollars in thousands):

4Q10 4Q11 4Q12 4Q13 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16

Total Stockholders' Equity (GAAP) $ 454,408 $ 514,467 $ 552,236 $ 634,923 $ 726,827 $ 739,658 $ 749,955 $ 766,984 $ 850,509 $ 867,263 $ 887,550 $ 900,865

Less: Preferred Stock

(67,880)

(90,783)

(90,908)

(125)

(125)

(125)

(125)

(125)

(125)

(125)

(125)

(125)

Less: Intangible Assets

(154,019)

(150,471)

(149,529)

(202,767) (218,755) (218,033)

(220,196)

(219,503)

(259,764)

(261,799) (260,822) (259,844)

Tax Benefit

2,907

2,224

2,249

4,973

6,085

5,849

5,619

5,388

6,278

6,753 6,453 6,204

Tangible Common Equity, Net of Tax

(non-GAAP) $ 235,416 $ 275,437 $ 314,048 $ 437,004 $ 514,032 $ 527,349 $ 535,253 $ 552,744 $ 596,898 $ 612,092 $ 633,056 $ 647,100

Shares Outstanding

25,574,251 28,559,707

28,692,616

35,921,761 37,669,948 37,781,488

37,824,649 37,873,921 40,664,258 40,749,340 40,772,896 40,799,025

Tangible Common Equity per Share (non-

GAAP) $ 9.21 $ 9.64 $ 10.95 $ 12.17 $ 13.65 $ 13.96 $ 14.15 $ 14.59 $ 14.68 $ 15.02 $ 15.53 $ 15.86

47

Appendix – Non-GAAP Reconciliation

THE STRENGTH OF BIG. THE SERVICE OF SMALL. www.firstmerchants.com

®

EFFICIENCY RATIO (dollars in thousands):

2014 2015 1Q16 2Q16 3Q16

Non Interest Expense (GAAP) $ 164,008 $ 174,806 $ 46,475 $ 44,835 $ 44,115

Less: Core Deposit Intangible Amortization (2,445) (2,835) (978) (977) (978)

Less: OREO and Foreclosure Expenses (3,462) (3,956) (751) (915) (637)

Adjusted Non Interest Expense (non-GAAP) 158,101 168,015 44,746 42,943 42,500

Net Interest Income (GAAP) 187,037 196,404 54,455 55,962 57,682

Plus: Fully Taxable Equivalent Adjustment 7,921 10,975 3,136 3,256 3,402

Net Interest Income on a Fully Taxable Equivalent Basis (non-GAAP) 194,958 207,379 57,591 59,218 61,084

Non Interest Income (GAAP) 61,816 69,868 15,837 16,385 16,861

Less: Investment Securities Gains (Losses) (3,581) (2,670) (997) (706) (839)

Adjusted Non Interest Income (non-GAAP) 58,235 67,198 14,840 15,679 16,022

Adjusted Revenue (non-GAAP) 253,193 274,577 72,431 74,897 77,106

Efficiency Ratio (non-GAAP) 62.44% 61.19% 61.78% 57.33% 55.12%

ALLOWANCE AS A PERCENTAGE OF NON-PURCHASED LOANS (dollars in thousands):

3Q15 4Q15 1Q16 2Q16 3Q16

Loans Held for Sale (GAAP) $ 1,943 $ 9,894 $ 3,628 $ 18,854 $ 1,482

Loans (GAAP) 4,321,715 4,693,822 4,709,907 4,791,429 4,973,844

Total Loans 4,323,658 4,703,716 4,713,535 4,810,283 4,975,326

Less: Purchased Loans (636,581) (917,589) (870,507) (821,158) (733,715)

Non-Purchased Loans (non-GAAP) $ 3,687,077 $ 3,786,127 $ 3,843,028 $ 3,989,125 $ 4,241,611

Allowance for Loan Losses (GAAP) $ 62,861 $ 62,453 $ 62,086 $ 62,186 $ 63,456

Fair Value Adjustment (FVA) (GAAP) 37,922 47,057 47,104 42,291 37,898

Allowance plus FVA (non-GAAP) $ 100,783 $ 109,510 $ 109,190 $ 104,477 $ 101,354

Total Loans $ 4,323,658 $ 4,703,716 $ 4,713,535 $ 4,810,283 $ 4,975,326

Fair Value Adjustment (FVA) (GAAP) 37,922 47,057 47,104 42,291 37,898

Total Loans plus FVA (non-GAAP) $ 4,361,580 $ 4,750,773 $ 4,760,639 $ 4,852,574 $ 5,013,224

Allowance as a Percentage of Non-Purchased Loans (non-GAAP) 1.70% 1.65% 1.62% 1.56% 1.50%

Allowance plus FVA as a Percentage of Total Loans plus FVA (non-GAAP) 2.31% 2.31% 2.29% 2.15% 2.02%

48

Appendix – Non-GAAP Reconciliation

THE STRENGTH OF BIG. THE SERVICE OF SMALL. www.firstmerchants.com

®

CONSTRUCTION AND INVESTMENT REAL ESTATE CONCENTRATIONS (dollars in thousands):

1Q16 2Q16 3Q16

Total Risk-Based Capital (Subsidiary Bank Only)

Total Stockholders' Equity (GAAP) $ 945,283 $ 967,099 $ 972,182

Adjust for Accumulated Other Comprehensive (Income) Loss 1 (4,566) (9,699) (6,332)

Less: Preferred Stock (125) (125) (125)

Less: Tier 1 Capital Deductions (1,805) (1,427) (889)

Less: Disallowed Goodwill and Intangible Assets (249,919) (249,484) (249,093)

Less: Disallowed Deferred Tax Assets (2,708) (2,141) (1,334)

Total Tier 1 Capital (Regulatory) 686,160 704,223 714,409

Allowance for Loan Losses includible in Tier 2 Capital 62,086 62,186 63,456

Total Risk-Based Capital (Regulatory) $ 748,246 $ 766,409 $ 777,865

Construction, Land and Land Development Loans $ 391,621 $ 352,980 $ 368,241

Concentration as a % of the Bank's Risk-Based Capital 52.3% 46.1% 47.3%

Construction, Land and Land Development Loans $ 391,621 $ 352,980 $ 368,241

Investment Real Estate Loans 1,107,288 1,178,660 1,264,304

Total Construction and Investment RE Loans $ 1,498,909 $ 1,531,640 $ 1,632,545

Concentration as a % of the Bank's Risk-Based Capital 200.4% 199.8% 209.9%

1 Includes net unrealized gains or losses on securities available for sale, net gains or losses on cash flow hedges, and amounts resulting from the

application of the applicable accounting guidance for defined benefit and other postretirement plans.

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- First Merchants Corp (FRME) Tops Q1 EPS by 3c

- Block listing Interim Review

- AS Tallinna Vesi will hold an Investor Conference Webinar to introduce the results for the 1st quarter of 2024

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share