Form 8-K DYNASIL CORP OF AMERICA For: Feb 25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant to section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 25, 2016

------------------

Dynasil Corporation of America

------------------------------------------------------------

(Exact name of registrant as specified in its charter)

| Delaware | 000-27503 | 22-1734088 |

| ----------- | ----------- | ---------- |

| (State or other | (Commission File Number) | (IRS Employer |

| jurisdiction of incorporation) | Identification No.) |

313 Washington Street, Suite 403, Newton, MA 02458

------------------------------------------------------------

(Address of principal executive offices)

(617)-668-6855

------------------------------------------------------------

(Registrant's telephone number, including area code)

Not Applicable

______________________________________________

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to

Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 7.01 Regulation FD Disclosure

Pursuant to Regulation FD, Dynasil Corporation of America (“Dynasil” or the “Company”) hereby furnishes slides that the Company will present to stockholders and investors on or after February 25, 2016. The slides are attached hereto as Exhibit 99.1. These slides will be available on Dynasil’s website at www.dynasil.com. The information furnished by the Company pursuant to this item, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, (the “Exchange Act”) or otherwise subject to the liability of that section, and shall not be deemed to be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act.

Item 9.01 Financial Statements and Exhibits

| (d) | Exhibits |

99.1 Slides presented by Dynasil Corporation of America to stockholders on or after February 25, 2016.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| DYNASIL CORPORATION OF AMERICA | |||

| Date: February 25, 2016 | By: | /s/ Peter Sulick | |

| Name: | Peter Sulick | ||

| Title: | Chief Executive Officer | ||

EXHIBIT INDEX

| Exhibit No. | Description |

| 99.1 | Slides presented by Dynasil Corporation of America to stockholders on or after February 25, 2016. |

Exhibit 99.1

Dynasil Corporation of America Annual Meeting of Stockholders Peter Sulick, Chairman, President and CEO February 25, 2016

2 Forward - Looking Statements The statements made in this presentation which are not statements of historical fact are forward looking statements within the meaning of Section 27 A of the Securities Act of 1933 and Section 21 E of the Securities Exchange Act of 1934 . Forward - looking statements involve known and unknown risks, uncertainties and other factors . The words “potential,” “develop,” “promising,” “believe,” “will,” “would,” “expect,” “anticipate,” “intend,” “estimate,” “plan,” “may,” “likely,” “could,” and other expressions which are predictions of or indicate future events and trends and which do not constitute historical matters identify forward - looking statements . Forward - looking statements include statements regarding management’s discussion of the company’s strategic plans and objectives and the development of, and potential market for, Xcede’s product pipeline . Future results of operations, projections, and expectations, which may relate to this presentation, involve certain risks and uncertainties that could cause actual results to differ materially from the forward - looking statements . Factors that would cause or contribute to such differences include, but are not limited to, our ability to develop and commercialize the Xcede patch, including obtaining regulatory approvals, the size and growth of the potential markets for our products and our ability to serve those markets, the rate and degree of market acceptance of any of our products, our ability to identify acquisition and other strategic opportunities, our ability to obtain and maintain intellectual property protection for our products, competition, the loss of key management and technical personnel, the availability of financing sources, as well as the factors detailed in the Company's Annual Report on Form 10 - K and Quarterly Reports on Form 10 - Q, as well as in the Company's other Securities and Exchange Commission filings . We undertake no obligation to update the foregoing information to reflect subsequently occurring events or circumstances .

3 Corporate Objectives - Ongoing 1. Continued growth in Optics revenue through organic growth and opportunistic acquisitions to replace loss of Dynasil Products’ revenue and lower Contract Research revenue. 2. Conversion of job shop revenue stream across the Optics companies to more predictable, longer term, recurring revenue. 3. Develop technology and transfer into commercial development: • RMD scintillator technology (CLYC, CsI , Thin Film, SrI , others) • Dynasil Biomedical – Xcede Patch 4. Maintain conformity with loan covenants. Improve overall cost of capital through conversion to lower cost funding where possible. 5. Capital allocation to support the above objectives . 6. Continued search for complementary acquisition or merger partners.

4 Financial Summary Fiscal Year 2015 vs. 2014 Revenue decreased from $42.3 million in fiscal 2014 to $ 40.5 million in 2015. • Optics revenue increased 11%, from $19.6 million to $21.8 million. • Contract Research revenue declined 15% from $21.9 million to $18.8 million • Instruments segment had no revenues, as substantially all of the assets were sold in the first quarter of fiscal 2014. Net Income from Operations of $0.1 million versus $2.1 million in the prior year .

5 Fiscal Year 2015 Performance Highlights Record Revenue at Three Optics Operational Units Optometrics - Secured the L - 3 grating contract followed by capital and construction requirements to meet the L - 3 production demands. Complete realignment of production floor and relocation of the administrative offices. EMF - Acquired DichroTec assets in Rochester, NY. Integrated operation into EMF. Hilger – Continued support for CLYC, CsI and LYSO product development. Building improvements and capital acquisitions to support LYSO product line. RMD – Maintain 18 month backlog. Ongoing management of funded vs. unfunded backlog. Separate report to follow. Xcede – Separate report to follow.

6 Debt

7 Corporate Objectives - 2016 1. Secure external funding of Xcede Technologies for ongoing development of the tissue sealant technology. 2. Yield improvements across our Optics companies. 3. Continued commercial revenue growth in the double digit range. 4. Maintenance of 18+ month backlog in our research operation – continued management diligence on matching approved project funding with direct and indirect costs. 5. Capital support of specific revenue opportunities: • Chamber upgrades at both EMF sites • LYSO array fabrication and processing at Hilger • New filter product line at Optometrics 6. Development of a long - term strategic plan for Company operations through 2020.

8 Fiscal Year 2016 1 st Quarter Financial Summary First quarter fiscal 2016 r evenue grew to $11.2 million from $9.6 million in the 1 st quarter of fiscal 2015: • Contract Research revenue increased by 7% to $5.0 million. • Optics revenue increased by 26% to $6.2 million as a result of internal revenue growth. Net operating income grew to $164,000 in the 1 st quarter of fiscal 2016 from a loss of $429,000 in the 1 st quarter of fiscal 2015. Net income of $106,000 in the 1 st quarter of fiscal 2016 versus a loss of $533,000 in the 1 st quarter of fiscal 2015.

9 1 st Quarter Fiscal 2016 – Performance Highlights • Optics revenue of $6.2 million, RMD revenue at $5.0 million • Increased array shipments at Hilger • Development of Hybrid Filter product line at Optometrics launched at Photonics West • Completion of Xcede/Cook definitive agreement • Initiation of new Strategic Planning process

RMD Highlights Dr. Kanai Shah February 2016

Fiscal Year 2015 Highlights 11 Closed fiscal year 2015 at $ 19.33 million , 1 st quarter f iscal 20 16 at $5.05 million B acklog of ~$31 million as of Feb 1, 2016 Continued push for larger projects & strategic bidding Launched 3” CLYC as a product, 3 instruments now use CLYC 5 Patents awarded and 20 a pplications filed in fiscal year 2015; current count of 62 total Patents Delays observed from government agencies Exciting progress in crystals, polycrystals , sensors and systems

12 Commercial Products Thermo - Scientific T arget Systemelectronik INL Neutron Imaging System: Commercial Sale Zetec ECT Power Plant Probe 3” CLYC Crystals CLYC Pillars CLYC - SSPM Modules 1.5” SrI 2 :Eu

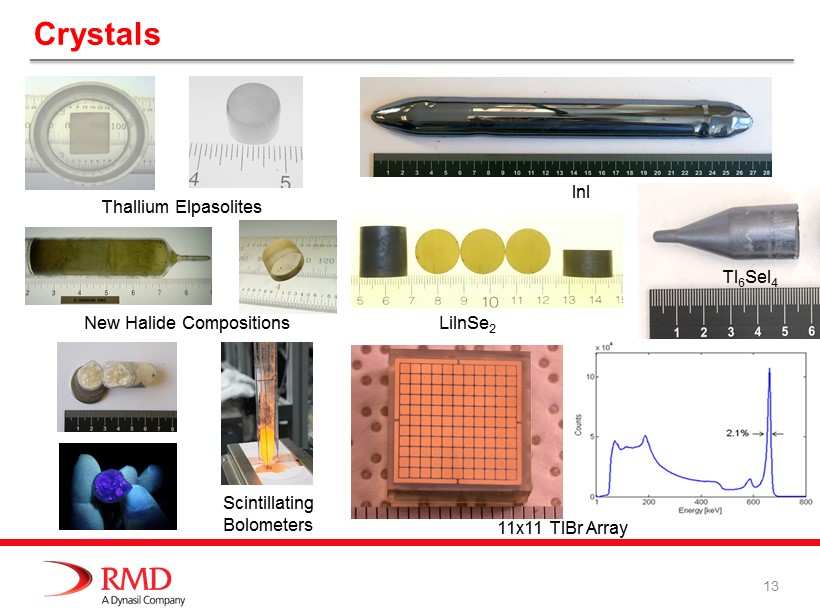

Crystals 13 Thallium Elpasolites Scintillating Bolometers New Halide C ompositions InI Tl 6 SeI 4 LiInSe 2 11x11 TlBr Array

14 Plastics, Organic, and Ceramic Materials Tin Loaded Plastics 4”x5”Neutron/Gamma P lastics > 1.5”x1.5”x1” Garnet Ceramics 4” DPA 12x12 Garnet Ceramic Array 2.6x2.6x20 mm3 pixels for PET Garnet Array read by 8x8 SiPM

15 Storage Phosphors K 2 CsSb Cs 3 Sb Photocathodes Films, Photocathodes , Photonic C rystals LNI & GdI 3 :Ce LuI 3 :Ce Photonic C rystals Lu 2 O 3 :Eu ALD Coatings for Night Vision

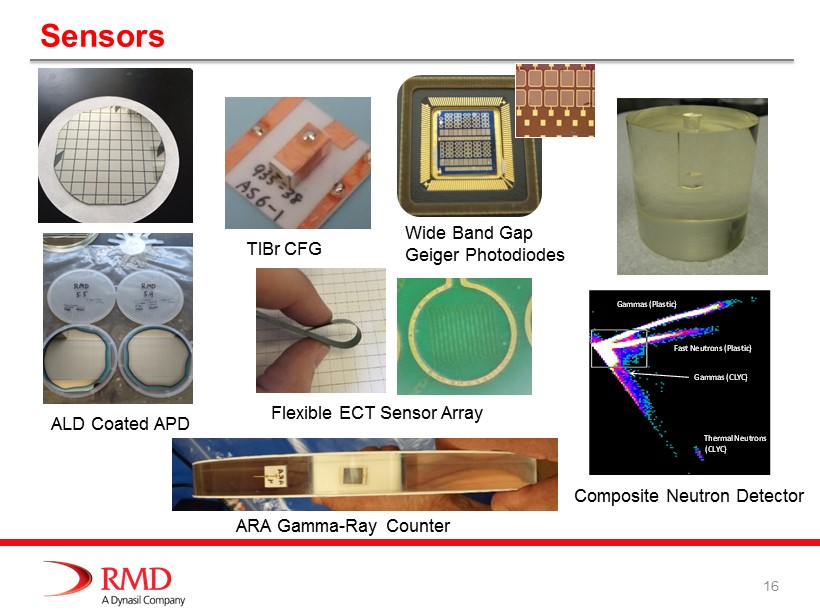

16 Sensors Gammas (Plastic) Fast Neutrons (Plastic) Thermal Neutrons (CLYC) Gammas (CLYC) ALD Coated APD Composite Neutron Detector TlBr CFG Flexible ECT Sensor Array Wide Band Gap Geiger Photodiodes ARA Gamma - Ray Counter

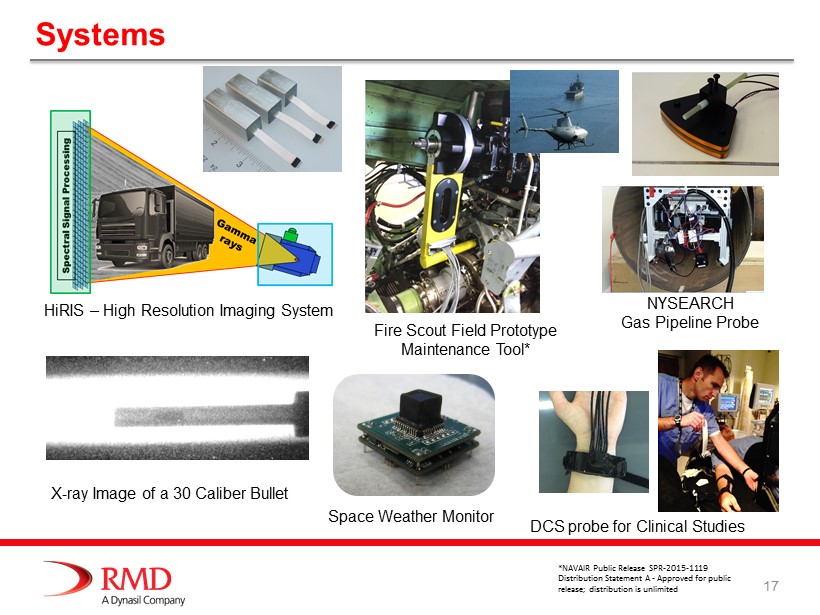

17 Systems HiRIS – High Resolution Imaging System X - ray Image of a 30 Caliber Bullet NYSEARCH Gas Pipeline Probe Fire Scout Field Prototype M aintenance Tool* DCS probe for Clinical Studies Space W eather Monitor *NAVAIR Public Release SPR - 2015 - 1119 Distribution Statement A - Approved for public release; distribution is unlimited

Dynasil Annual Stockholders’ Meeting February 2016

5 4 3 2 About Xcede 19 1 Large Market Opportunity Initial cumulative target markets of over $1 billion in mild, moderate and severe bleeding with significant expansion potential Unique Technology Fully bioresorbable , hemostatic patch backed by proprietary technology and extensive IP protection Strong Strategic Partnerships Executed and late stage partnership agreements with Mayo Clinic (existing investor) and Cook Biotech Experienced Management Extensive experience in taking products from development to approval, private and public company management and M&A Diverse Product Pipeline First product in advanced pre - clinical stages with four follow - on and next - generation products in development for additional revenue growth Dedicated to the development and commercialization of innovative hemostatic and sealant products for surgical applications with an emphasis on severe, traumatic bleeding

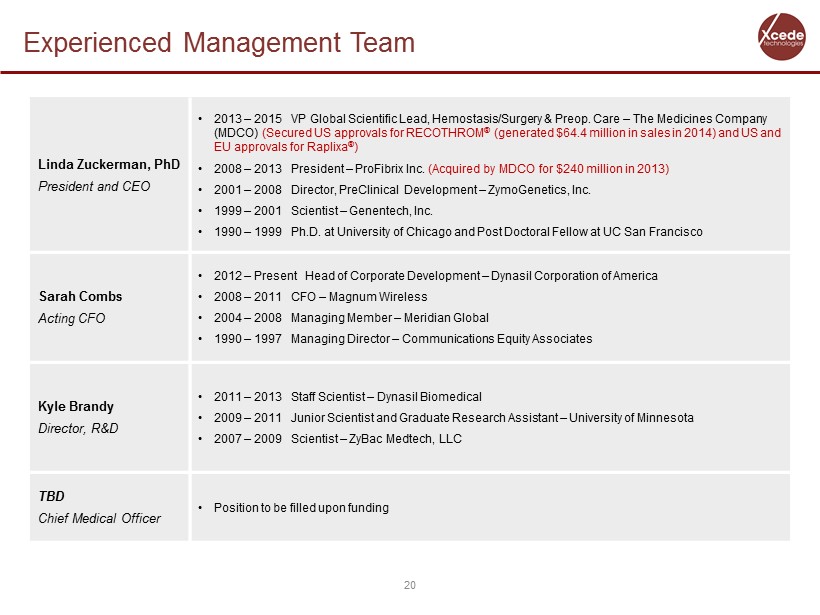

Experienced Management Team Linda Zuckerman, PhD President and CEO • 2013 – 2015 VP Global Scientific Lead, Hemostasis /Surgery & Preop . Care – The Medicines Company (MDCO) (Secured US approvals for RECOTHROM ® (generated $64.4 million in sales in 2014) and US and EU approvals for Raplixa ® ) • 2008 – 2013 President – ProFibrix Inc. (Acquired by MDCO for $240 million in 2013) • 2001 – 2008 Director, PreClinical Development – ZymoGenetics , Inc. • 1999 – 2001 Scientist – Genentech, Inc. • 1990 – 1999 Ph.D. at University of Chicago and Post Doctoral Fellow at UC San Francisco Sarah Combs Acting CFO • 2012 – Present Head of Corporate Development – Dynasil Corporation of America • 2008 – 2011 CFO – Magnum Wireless • 2004 – 2008 Managing Member – Meridian Global • 1990 – 1997 Managing Director – Communications Equity Associates Kyle Brandy Director, R&D • 2011 – 2013 Staff Scientist – Dynasil Biomedical • 2009 – 2011 Junior Scientist and Graduate Research Assistant – University of Minnesota • 2007 – 2009 Scientist – ZyBac Medtech , LLC TBD Chief Medical Officer • Position to be filled upon funding 20

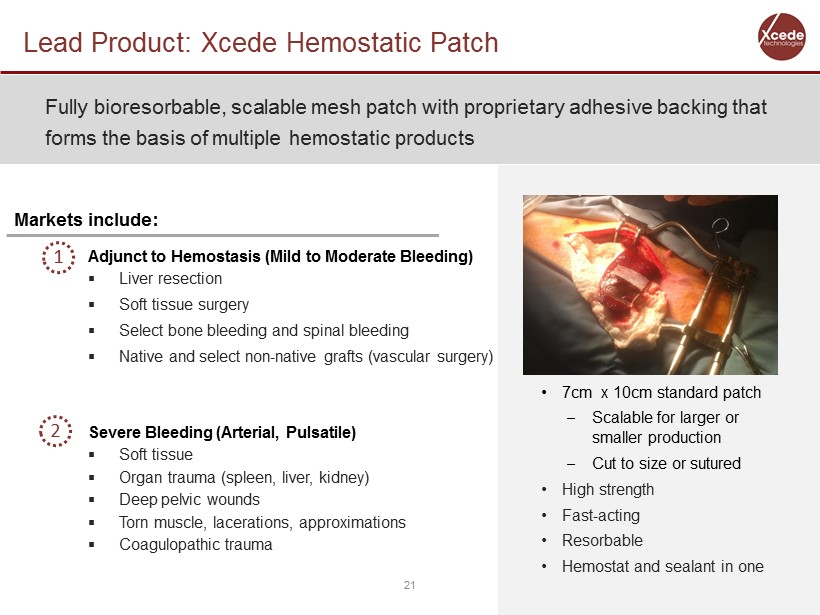

Lead Product: Xcede Hemostatic Patch 21 Fully bioresorbable , scalable mesh patch with proprietary adhesive backing that forms the basis of multiple hemostatic products Adjunct to Hemostasis (Mild to Moderate Bleeding) ▪ Liver resection ▪ Soft tissue surgery ▪ Select bone bleeding and spinal bleeding ▪ Native and select non - native grafts (vascular surgery) Severe Bleeding (Arterial, Pulsatile) ▪ Soft tissue ▪ Organ trauma (spleen, liver, kidney) ▪ Deep pelvic wounds ▪ Torn muscle, lacerations, approximations ▪ Coagulopathic trauma Markets include: • 7cm x 10cm standard patch – Scalable for larger or smaller production – Cut to size or sutured • High strength • Fast - acting • Resorbable • Hemostat and sealant in one 2 1

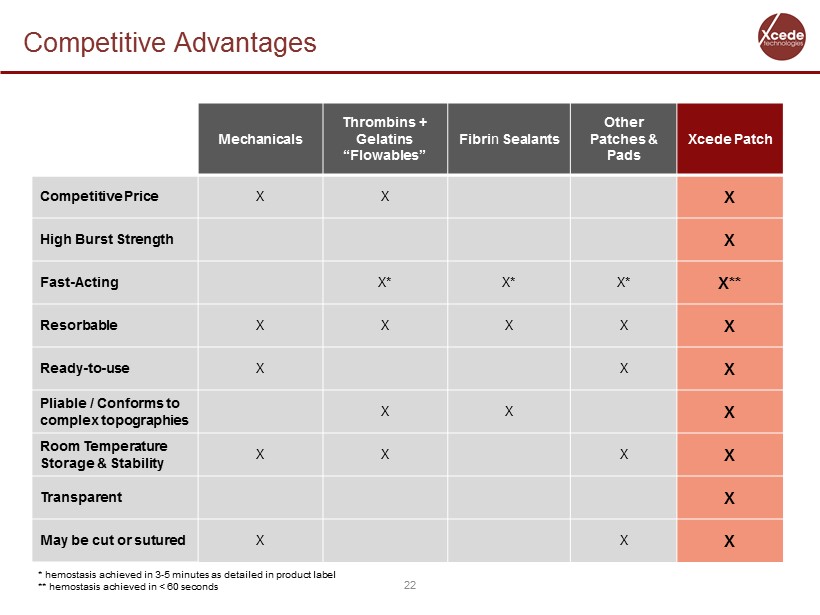

Competitive Advantages 22 Mechanicals Thrombins + Gelatins “ Flowables ” Fibri n Sealants Other Patches & Pads Xcede Patch Competitive Price X X X High Burst Strength X Fast - Acting X* X* X* X** Resorbable X X X X X Ready - to - use X X X Pliable / Conforms to complex topographies X X X Room Temperature Storage & Stability X X X X Transparent X May be cut or sutured X X X * hemostasis achieved in 3 - 5 minutes as detailed in product label ** hemostasis achieved in < 60 seconds

US and EU Markets for the Xcede Patch EU Adjunct to Hemostasis Market $537 M $87 M $1.09 Billion $465 M Untapped Severe Bleeding Market 23 US Adjunct to Hemostasis Market

Why Stop at Hemostasis? Xcede’s Portfolio Development 24 Product Indication 2017 2018 2019 2020 2021 Lung Sealing Traumatic Pneumothorax Laparoscopic Adjunct to hemostasis in laparoscopic surgery Vascular Surgery Adjunct to hemostasis for mechanical sealing in vascular surgery Femoral Artery Femoral artery closing after various interventional procedures Tox Phase I Pivotal PMA/CE Tox Phase I Pivotal PMA/CE Tox Phase I Pivotal Tox Phase I Pivotal

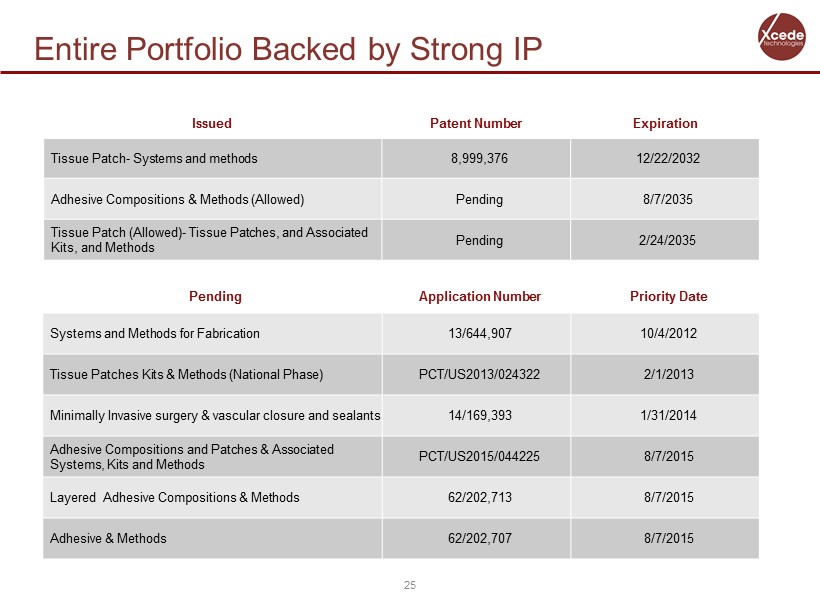

Entire Portfolio Backed by Strong IP Issued Patent Number Expiration Tissue Patch - Systems and methods 8,999,376 12/22/2032 Adhesive Compositions & Methods (Allowed) Pending 8/7/2035 Tissue Patch (Allowed) - Tissue Patches, and Associated Kits, and Methods Pending 2/24/2035 Pending Application Number Priority Date Systems and Methods for Fabrication 13/644,907 10/4/2012 Tissue Patches Kits & Methods (National Phase) PCT/US2013/024322 2/1/2013 Minimally Invasive surgery & vascular closure and sealants 14/169,393 1/31/2014 Adhesive Compositions and Patches & Associated Systems, Kits and Methods PCT/US2015/044225 8/7/2015 Layered Adhesive Compositions & Methods 62/202,713 8/7/2015 Adhesive & Methods 62/202,707 8/7/2015 25

New Strategic Partnership 26 Cook Biotech 3 Agreements signed in January of 2016: • Patch Development • Manufacture and Supply • Royalty bearing license to our adhesive technology for products outside of Xcede’s field of use

Use of Proceeds 27 Target milestones with funding of additional $7M 1. Completion of tech transfer to Cook 2. Continued hiring of experienced management team 3. Initiation of First - in - human (FIH) safety study 4. Positive safety & efficacy results from FIH Research & Development Clinical Trials General & Administrative Working Capital $1,000,000 $2,000,000 $3,000,000 $1,000,000

Investment Outreach and Valuation Sensitivity 28 Fundraising - Engaged Chardan Capital Markets for Private Equity Round of $3 million - $7 million - Kicked off Roadshow on December 15, 2015 - Active discussion are ongoing - Reviewing strategic alternatives - Targeted closing mid - 2016 Dynasil Ownership Sensitivity 30 35 40 45 50 55 60 3M 5M 7M Amount Raised % of O wnership $20M $30M $15M Pre - Money Valuation

29 Questions

Dynasil Corporation of America Annual Meeting of Stockholders Peter Sulick Chairman, President and CEO February 26, 2015

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Entergy Texas’ First Solar Resource Helps Customers Meet Sustainability Goals

- Ocugen to Present on Modifier Gene Therapy Platform at Association for Research in Vision and Ophthalmology 2024 Annual Meeting

- Gravity Announces Filing of Annual Report on Form 20-F for Fiscal Year 2023

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share