Form 8-K Cornerworld Corp For: Mar 18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): March 18, 2016

CORNERWORLD CORPORATION

(Exact name of registrant as specified in its charter)

Nevada | 333-128614 | 98-0441869 |

(State or Other Jurisdiction | (Commission File Number) | (I.R.S. Employer |

13010 Preston Road, Suite 510

Dallas, Texas 75240

(Address of principal executive offices) (zip code)

(888) 837-3910

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01 | Entry into Material Definitive Agreement. |

On February 29, 2016, CornerWorld Corporation (“CornerWorld” or the “Company”) executed a merger agreement with Deportes Media, LLC (the “Merger Agreement”). Pursuant to the Merger Agreement, the Merger Agreement itself was non-binding until such time as Deportes Media, LLC (“Deportes”) was able to secure approval for the Merger Agreement from no less than 75% of its shareholders. On March 18, 2016, Deportes reported to CornerWorld that it had, in fact, obtained the approval of the Merger Agreement from more than 75% of its shareholders and that, accordingly, the Merger Agreement had become binding. Prior to the announcement of the Merger Agreement, CornerWorld and Deportes had no material relationship.

Pursuant to the Merger Agreement, CornerWorld is not contractually obligated to close the Merger Agreement, until such time as Deportes has completed certain Conditions to Close, as described in more detail below. If CornerWorld and Deportes close the Merger Agreement, Deportes shareholders will be entitled to receive 27.32 shares of CornerWorld common stock for each share of Deportes common stock. Post the capital raise, as detailed below, and the closing of the Merger Agreement, a total of approximately 13.7 million shares will be outstanding and the existing CornerWorld shareholders will own approximately 33.9% of the combined Company.

About Deportes Media, LLC

Deportes is a Spanish-language sports radio broadcasting Company and the largest affiliate of ESPN Deportes Radio network. ESPN Deportes Radio is ESPN’s dedicated sports radio network targeting the rapidly expanding Hispanic population in the US. Deportes delivers ESPN and Deportes exclusive programming, including local daytime sports talk, soccer (including assorted Mexican and other Latin American leagues), Major League Baseball (MLB), National Football League (NFL), National Basketball Association (NBA), sports news and other live programming. Today, Deportes operates ESPN Deportes affiliates in Houston, Miami, San Francisco and Dallas. In addition to its radio operations, in 2014 Deportes launched Copa ESPN (“COPA”), the first national youth soccer tournament in the country, targeting boys and girls soccer teams with players ages 7 through 17.

Closing the Merger Agreement

CornerWorld, at its sole option, if Deportes fails to perform any of the Conditions to Close as further defined below, can choose not to close the Merger Agreement. For the purpose of this current report on Form 8-K only, Conditions to Close include, but are not limited to, the following: Deportes must raise $5MM of equity capital, enter into a credit facility to be used to acquire radio stations and Deportes’ current debt holders must convert their debt to equity. Should Deportes fail to meet all the Conditions to Close, CornerWorld will be entitled to receive a break-up fee equivalent to 10% of Deportes then outstanding common shares. CornerWorld, at its sole discretion, may close the Merger Agreement without Deportes completing the Conditions to Close. However, CornerWorld will only receive the 10% break-up fee if CornerWorld terminates the Merger Agreement as a result of Deportes’ failure to execute any one of the Conditions to Close after May 31, 2016. Should Deportes fail to execute the Conditions to Close and CornerWorld does not close the transaction by September 30, 2016, the Merger Agreement will terminate of its own accord and CornerWorld will be entitled to the a breakup fee equivalent to 10% of Deportes then outstanding common shares.

Item 9.01 | Financial Statements and Exhibits. |

Exhibit Number |

| Description |

|

|

|

|

- 2 -

SIGNATURES

Pursuant to the requirements of the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| CornerWorld Corporation | |

|

|

|

|

| Dated: March 24, 2016 | By: | /s/ V. Chase McCrea III |

- 3 -

Exhibit 10.1

MERGER AGREEMENT

BY AND AMONG

CORNERWORLD CORPORATION,

THE LEADSTREAM, LLC,

and

DEPORTES MEDIA, LLC

_________________

Dated as of February 29, 2016

TABLE OF CONTENTS

| Page | ||

|

| ||

ARTICLE I. DEFINITIONS | 1 | ||

|

|

|

|

ARTICLE II. THE MERGER | 6 | ||

| 2.1 | The Merger | 6 |

| 2.2 | Closing | 6 |

| 2.3 | Effective Time | 6 |

| 2.4 | Effects of the Merger | 7 |

| 2.5 | Conversion of Equity Interests. | 7 |

| 2.6 | Issuance of Merger Consideration | 7 |

| 2.7 | Tax Free Reorganization | 8 |

| 2.8 | Reorganization of the Board of Directors and Management | 8 |

|

|

|

|

ARTICLE III. REPRESENTATIONS AND WARRANTIES OF DEPORTES MEMBERS | 8 | ||

| 3.1 | Investment Purpose. | 8 |

| 3.2 | Leakout Provision. | 9 |

| 3.3 | Share Legend | 9 |

|

|

|

|

ARTICLE IV. REPRESENTATIONS AND WARRANTIES OF DEPORTES | 10 | ||

| 4.1 | Organization and Good Standing | 10 |

| 4.2 | Capitalization of Deportes | 10 |

| 4.3 | Authorization of Transaction | 10 |

| 4.4 | Noncontravention | 11 |

| 4.5 | Deportes Financial Information | 11 |

| 4.6 | Events Subsequent to Deportes Balance Sheet | 11 |

| 4.7 | Tax Matters | 13 |

| 4.8 | Title to Assets | 15 |

| 4.9 | Deportes Intellectual Property | 15 |

| 4.10 | Affiliate Transactions | 15 |

| 4.11 | Powers of Attorney | 16 |

| 4.12 | Litigation | 16 |

| 4.13 | Employee Benefits | 16 |

| 4.14 | Insurance | 17 |

| 4.15 | Employees | 17 |

| 4.16 | Labor Relations | 19 |

| 4.17 | Legal Compliance | 19 |

| 4.18 | Brokers’ Fees | 20 |

| 4.19 | Undisclosed Liabilities | 20 |

| 4.20 | Disclosure | 20 |

|

|

|

|

ARTICLE V. REPRESENTATIONS AND WARRANTIES OF CORNERWORLD | 20 | ||

| 5.1 | Representations of CornerWorld Concerning the Transaction | 20 |

| 5.2 | Representations of CornerWorld Concerning CornerWorld | 21 |

|

|

|

|

ARTICLE VI. ACCESS TO INFORMATION AND DOCUMENTS | 24 | ||

| 6.1 | Access to Information | 24 |

i

| 6.2 | Effect of Access | 25 |

|

|

|

|

ARTICLE VII. COVENANTS | 25 | ||

| 7.1 | Preservation of Business | 25 |

| 7.2 | Current Information | 25 |

| 7.3 | Material Transactions | 26 |

| 7.4 | Public Disclosures | 28 |

| 7.5 | Confidentiality | 28 |

|

|

|

|

ARTICLE VIII. CONDITIONS TO CLOSING | 28 | ||

| 8.1 | Mutual Conditions | 28 |

| 8.2 | Conditions to the Obligations of CornerWorld | 29 |

| 8.3 | Conditions to the Obligations of Deportes | 31 |

|

|

|

|

ARTICLE IX. SURVIVAL OF REPRESENTATIONS | 32 | ||

|

|

|

|

ARTICLE X. EFFECTIVENESS, TERMINATION, AMENDMENT AND WAIVER | 32 | ||

| 10.1 | Condition to Effectiveness of Agreement. | 32 |

| 10.2 | Termination. | 33 |

| 10.3 | Effect of Termination | 34 |

| 10.4 | Amendment | 34 |

| 10.5 | Extension; Waiver | 34 |

| 10.6 | Procedure for Termination, Amendment Extension or Waiver | 34 |

|

|

|

|

ARTICLE XI. MISCELLANEOUS | 35 | ||

| 11.1 | Notices | 35 |

| 11.2 | Further Assurances | 35 |

| 11.3 | Governing Law | 36 |

| 11.4 | Commissions | 36 |

| 11.5 | Captions | 36 |

| 11.6 | Integration of Schedules | 36 |

| 11.7 | Entire Agreement | 36 |

| 11.8 | Expenses | 36 |

| 11.9 | Counterparts | 36 |

| 11.10 | Binding Effect | 37 |

| 11.11 | No Rule of Construction | 37 |

|

|

|

|

DETAIL OF SCHEDULES | 60 | ||

ii

MERGER AGREEMENT

This MERGER AGREEMENT (this “Agreement”) is entered into as of this 29th day of February, 2016, by and among CORNERWORLD CORPORATION, a Nevada corporation (“CornerWorld”), THE LEADSTREAM, LLC, a Delaware limited liability company and a wholly owned subsidiary of CornerWorld (“Merger Sub”), and DEPORTES MEDIA, LLC, a Texas limited liability company, for itself and on behalf of all of its wholly owned subsidiaries (“Deportes”).

RECITALS

WHEREAS, CornerWorld is a public company listed on the U.S. OTCQB (the “OTCQB”) having the following securities issued and outstanding: (i) Four Million Six Hundred Fifty-Five Thousand, Three Hundred Thirty-Eight (4,655,338) shares of common stock issued and outstanding (the “CornerWorld Shares”) and (ii) options for the purchase of Forty-six Thousand, Five Hundred Sixty-Seven (46,567) shares of common stock, of which Twenty-Four Thousand Four Hundred Twenty-six (24,426) are vested;

WHEREAS, Deportes has agreed to a merger pursuant to which Merger Sub, a wholly owned subsidiary of CornerWorld, would merge with and into Deportes, with the issued and outstanding equity interests in Deportes being converted into newly issued and outstanding shares of CornerWorld Common Stock, as provided herein (the “Merger”), and as a result Deportes would become a wholly owned subsidiary of CornerWorld;

WHEREAS, in furtherance thereof, the Board of Directors of CornerWorld and Merger Sub have approved the Merger in accordance with the applicable provisions of the laws of Nevada and Delaware, respectively, and upon the terms and subject to the conditions set forth herein;

WHEREAS, in furtherance thereof, the Board of Managers of Deportes and members of Deportes holding all of the issued and outstanding common units approved the Merger in accordance with the applicable provisions of the laws of Texas and upon the terms and subject to the conditions set forth herein, and directed that this Agreement be submitted for approval by the members of Deportes holding issued and outstanding Series A units; and

WHEREAS, for United States federal income tax purposes, the parties intend that the Merger shall constitute a tax-free reorganization within the meaning of Sections 368 and 1032 of the Code.

NOW, THEREFORE, in consideration of the premises, and the mutual covenants and agreements contained herein, the parties do hereby agree as follows:

ARTICLE I. DEFINITIONS

(a) “Affiliate” shall mean, as to any Person, any other Person controlled by, under the control of, or under common control with, such Person. As used in this definition, “control” shall mean possession, directly or indirectly, of the power to direct or cause the direction of management or policies (whether through ownership of securities or partnership or

other ownership interests, by Contract or otherwise), provided that, in any event, any Person which owns or holds directly or indirectly five percent (5%) or more of the voting securities or five percent (5%) or more of the partnership or other equity interests of any other Person (other than as a limited partner of such other Person) will be deemed to control such other Person.

(b) “Agreement” means this Merger Agreement.

(c) “Applicable Law” or “Applicable Laws” means any and all laws, ordinances, constitutions, regulations, statutes, treaties, rules, codes, licenses, certificates, franchises, permits, principles of common law, requirements and Orders adopted, enacted, implemented, promulgated, issued, entered or deemed applicable by or under the authority of any Governmental Body having jurisdiction over a specified Person or any of such Person’s properties or assets.

(d) “Best Efforts” means the efforts that a prudent Person desirous of achieving a result would use in similar circumstances to achieve that result as expeditiously as possible, provided, however, that a Person required to use Best Efforts under this Agreement will not be thereby required to take actions that would result in a Material Adverse Effect in the benefits to such Person of this Agreement and the Merger.

(e) “Breach” means any breach of, or any inaccuracy in, any representation or warranty or any breach of, or failure to perform or comply with, any covenant or obligation, in or of this Agreement or any other Contract.

(f) “Business” means Spanish-language sports radio broadcasting presently conducted by Deportes including, without limitation, the COPA ESPN Youth Soccer Tournament business.

(g) “Business Day” means any day other than (a) Saturday or Sunday or (b) any other day on which banks are permitted or required to be closed.

(h) “Capital Raise” has the meaning set forth in Section 8.2(a).

(i) “Closing” shall mean the completion of the Merger and the consummation of the transactions set forth herein.

(j) “Closing Date” shall mean the date on which the Closing is completed.

(k) “Code” shall mean the Internal Revenue Code of 1986, as amended.

(l) “Confidential Information” means any information pertaining to the business, operations, marketing, customers, financing, forecasts and plans of any Party provided to or learned by any other Party during the course of negotiation of the Merger. Information shall be treated as Confidential Information whether such information has been marked “confidential” or in a similar manner.

(m) “Consent” means any approval, consent, license, permits, ratification, waiver or other authorization.

2

(n) “Contract” means any agreement, contract, lease, license, consensual obligation, promise, undertaking, understanding, commitment, arrangement, instrument or document (whether written or oral and whether express or implied), whether or not legally binding.

(o) “CornerWorld Business” means CornerWorld’s business of marketing, telecom and technology companies.

(p) “CornerWorld Common Stock” means the common stock of CornerWorld, par value $0.001 per share.

(q) “CornerWorld Employee Plans” has the meaning set forth in Section 5.2(i).

(r) “CornerWorld Shares” has the meaning set forth in the Recitals.

(s) “Debt Capital” has the meaning set forth in Section 8.2(a).

(t) “Deportes” has the meaning set forth in the preamble.

(u) “Deportes Balance Sheet” has the meaning set forth in Section 4.5.

(v) “Deportes Balance Sheet Date” has the meaning set forth in Section 4.5.

(w) “Deportes’ Counsel” means Gray Reed & McGraw, PC.

(x) “Deportes Employee Plans” has the meaning set forth in Section 4.13(a).

(y) “Deportes Financial Information” has the meaning set forth in Section 4.5.

(z) “Deportes Intellectual Property” has the meaning set forth in Section 4.9.

(aa) “Deportes Operating Agreement” means the Limited Liability Company Operating Agreement, as amended, of Deportes Media, LLC, a Texas limited liability company, by and among Deportes and its members.

(bb) “DLLCA” means the Delaware Limited Liability Company Act.

(cc) “Equity Capital” has the meaning set forth in Section 8.2(a).

(dd) “Effective Date” has the meaning set forth in Section 10.1.

(ee) “Exchange Act” means the Securities Exchange Act of 1934, as amended.

(ff) “GAAP” means at any particular time generally accepted accounting principles in the United States, consistently applied on a going concern basis, using consistent audit scope and materiality standards.

3

(gg) “Governing Documents” means with respect to any particular entity, the articles or certificate of incorporation or certificate of formation and the bylaws or operating agreement (or equivalent documents for entities of foreign jurisdictions); all equity holders’ agreements, voting agreements, voting trust agreements, joint venture agreements, registration rights agreements or other agreements or documents relating to the organization, management or operation of any Person or relating to the rights, duties and obligations of the equity holders of any Person; and any amendment or supplement to any of the foregoing.

(hh) “Governmental Authorization” means any Consent, license, registration or permit issued, granted, given or otherwise made available by or under the authority of any Governmental Body or pursuant to any Applicable Law.

(ii) “Governmental Body” means: (i) nation, state, county, city, town, borough, village, district, tribe or other jurisdiction; (ii) federal, state, local, municipal, foreign, tribal or other government; (iii) governmental or quasi-governmental authority of any nature (including any agency, branch, department, board, commission, court, tribunal or other entity exercising governmental or quasi-governmental powers); (iv) multinational organization or body; (v) body exercising, or entitled or purporting to exercise, any administrative, executive, judicial, legislative, police, regulatory or taxing authority or power; or (vi) official of any of the foregoing.

(jj) “IRS” means the United States Internal Revenue Service and, to the extent relevant, the United States Department of the Treasury.

(kk) “Knowledge” means actual knowledge without independent investigation.

(ll) “Material Adverse Effect” or “Material Adverse Change” means, in connection with any Person, any event, change or effect that is materially adverse, individually or in the aggregate, to the condition (financial or otherwise), properties, assets, liabilities, revenues, income, business, operations, results of operations or prospects of such Person, taken as a whole.

(mm) “Merger” has the meaning set forth in the Recitals.

(nn) “Merger Sub” has the meaning set forth in the preamble.

(oo) “Order” means any writ, directive, order, injunction, judgment, decree, ruling, assessment or arbitration award of any Governmental Body or arbitrator.

(pp) “Ordinary Course of Business” means an action taken by a Person only if that action: (i) is consistent in nature, scope and magnitude with the past practices of such Person and is taken in the ordinary course of the normal, day-to-day operations of such Person; (ii) does not require authorization by the board of directors or shareholders of such Person (or by any Person or group of Persons exercising similar authority) and does not require any other separate or special authorization of any nature; and (iii) is similar in nature, scope and magnitude to actions customarily taken, without any separate or special authorization, in the ordinary course of the normal, day-to-day operations of other Persons that are in the same line of business as such Person.

4

(qq) “Party” or “Parties” means CornerWorld, Merger Sub and/or Deportes.

(rr) “Person” shall mean an individual, company, partnership, limited liability company, limited liability partnership, joint venture, trust or unincorporated organization, joint stock corporation or other similar organization, government or any political subdivision thereof, or any other legal entity.

(ss) “Proceeding” means any action, arbitration, audit, hearing, investigation, litigation or suit (whether civil, criminal, administrative, judicial or investigative, whether formal or informal, whether public or private) commenced, brought, conducted or heard by or before, or otherwise involving, any Governmental Body or arbitrator.

(tt) “Representative” means with respect to a particular Person, any director, officer, manager, employee, agent, consultant, advisor, accountant, financial advisor, legal counsel or other Representative of that Person.

(uu) “SEC” means the United States Securities and Exchange Commission.

(vv) “Securities Act” means the Securities Act of 1933, as amended.

(ww) “Security Interest” means any mortgage, pledge, security interest, encumbrance, charge, claim, or other lien, other than: (a) mechanic’s, materialmen’s and similar liens; (b) liens for Taxes not yet due and payable or for Taxes that the taxpayer is contesting in good faith through appropriate Proceedings; (c) liens arising under worker’s compensation, unemployment insurance, social security, retirement and similar legislation; (d) liens arising in connection with sales of foreign receivables; (e) liens on goods in transit incurred pursuant to documentary letters of credit; (f) purchase money liens and liens securing rental payments under capital lease arrangements; and (g) other liens arising in the Ordinary Course of Business and not incurred in connection with the borrowing of money.

(xx) “Subsidiary” means with respect to any Person (the “Owner”), any corporation or other Person of which securities or other interests having the power to elect a majority of that corporation’s or other Person’s board of directors or similar governing body, or otherwise having the power to direct the business and policies of that corporation or other Person (other than securities or other interests having such power only upon the happening of a contingency that has not occurred), are held by the Owner or one or more of its Subsidiaries.

(yy) “Tangible Personal Property” means all machinery, equipment, tools, furniture, office equipment, computer hardware, supplies, materials, vehicles and other items of tangible personal property of every kind owned or leased by a Party (wherever located and whether or not carried on a Party’s books), together with any express or implied warranty by the manufacturers or sellers or lessors of any item or component part thereof and all maintenance records and other documents relating thereto.

(zz) “Tax” or “Taxes” means, with respect to any Person, (i) all income taxes (including any tax on or based upon net income, gross income, gross receipts, income as specially defined, earnings, profits or selected items of income, earnings or profits) and all gross receipts, sales, use, ad valorem, transfer, franchise, license, withholding, payroll, employment,

5

excise, severance, stamp, occupation, commercial rent, premium, property or windfall profit taxes, alternative or add-on minimum taxes, customs duties and other taxes, fees, assessments or charges of any kind whatsoever, together with all interest and penalties, additions to tax and other additional amounts imposed by any taxing authority (domestic or foreign) on such person (if any), (ii) all value added taxes and (iii) any liability for the payment of any amount of the type described in clauses (i) or (ii) above as a result of (A) being a “transferee” (within the meaning of Section 6901 of the Code or any Applicable Law) of another person, (B) being a member of an affiliated, combined or consolidated group or (C) a contractual arrangement or otherwise.

(aaa) “Tax Return” means any return, declaration, report, claim for refund, or information return or statement relating to Taxes, including any schedule or attachment thereto, and including any amendment thereof.

(bbb) “TBOC” means the Texas Business Organizations Code.

(ccc) “Third Party” means a Person that is not a Party to this Agreement.

ARTICLE II. THE MERGER

2.1 The Merger. On the terms and subject to the conditions set forth in this Agreement, and in accordance with the TBOC and the DLLCA, at the Effective Time, (a) Merger Sub will merge with and into Deportes (the “Merger”), and (b) the separate company existence of Merger Sub will cease and Deportes will continue its company existence under the TBOC as the surviving entity in the Merger (sometimes referred to herein as the “Surviving Entity”).

2.2 Closing. Upon the terms and subject to the conditions set forth herein, the closing of the Merger (the “Closing”) will take place as soon as practicable after satisfaction or, to the extent permitted hereunder, waiver of all conditions to the Merger set forth in Article VIII (other than those conditions that by their nature are to be satisfied at the Closing, but subject to the satisfaction or, to the extent permitted hereunder, waiver of all such conditions), unless this Agreement has been terminated pursuant to its terms or unless the Closing has been extended to another time or date pursuant to Section 10.3(b), or otherwise in writing by the parties hereto. The actual date of the Closing is hereinafter referred to as the “Closing Date.”

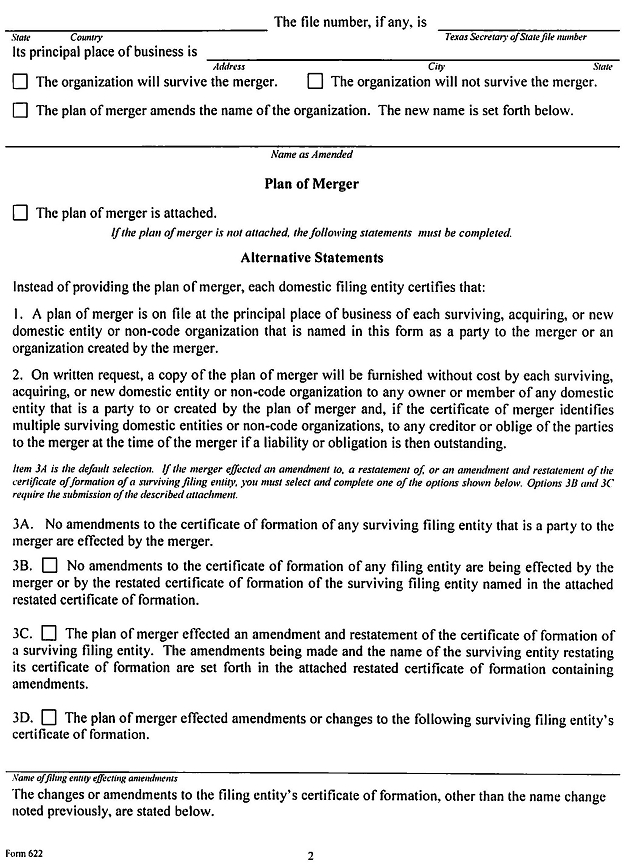

2.3 Effective Time. Prior to the Closing, Deportes shall prepare a certificate of merger to effectuate the Merger (the “Certificate of Merger”), which Certificate of Merger shall be subject to approval by CornerWorld and Merger Sub. Subject to the provisions of this Agreement, at the Closing, Deportes, CornerWorld and Merger Sub will cause the Certificate of Merger to be executed, acknowledged and filed with the Secretaries of State of the States of Delaware and Texas in accordance with the relevant provisions of the TBOC and the DLLCA and shall make all other filings or recordings required under the TBOC and the DLLCA. The Merger will become effective at such time as the Certificate of Merger has been duly filed with the Secretaries of State of the States of Delaware and Texas or at such later date or time as may be agreed by Deportes and CornerWorld in writing and specified in the Certificate of Merger in accordance with the TBOC and the DLLCA (the effective time of the Merger being hereinafter referred to as the “Effective Time”).

6

2.4 Effects of the Merger. The Merger shall have the effects set forth herein and in the applicable provisions of the TBOC. Without limiting the generality of the foregoing, and subject thereto, from and after the Effective Time, all property, rights, privileges, immunities, powers, franchises, licenses and authority of Deportes and Merger Sub shall vest in the Surviving Entity, and all debts, liabilities, obligations, restrictions and duties of each of Deportes and Merger Sub shall become the debts, liabilities, obligations, restrictions and duties of the Surviving Entity.

2.5 Conversion of Equity Interests.

(a) Conversion of Deportes Membership Interests. At the Effective Time, each issued and outstanding unit of membership interest in Deportes immediately prior to the Effective Time will no longer be outstanding and will represent only the right to receive the following (collectively, the “Merger Consideration”):

(i) The Series A units of Deportes shall be converted into the right to receive an aggregate of 554,704 fully paid and non-assessable shares of CornerWorld Common Stock;

(ii) The units of membership interests of Deportes issuable upon conversion of outstanding indebtedness of Deportes (other than the Debt Capital) shall be converted into the right to receive an aggregate of 2,533,048 fully paid and non-assessable shares of CornerWorld Common Stock; and

(iii) The issued and outstanding common units of Deportes shall be converted into the right to receive an aggregate of 1,446,146 fully paid and non-assessable shares of CornerWorld Common Stock.

(b) Merger Consideration. The Merger Consideration shall consist of an aggregate of 4,533,898 shares, representing an aggregate of 49.34% of the then issued and outstanding shares of CornerWorld Common Stock (the “Shares”), prior to giving effect to the Capital Raise. CornerWorld will issue an additional 3,832,188 shares to the additional Equity Capital investors resulting from the Capital Raise, which amount shall be adjusted, on a pro rata basis, if the aggregate gross proceeds from the Capital Raise is more or less than $5,000,000. The share distribution associated with the Merger Consideration are delineated in more detail in Schedule 2.5(a).

(c) Conversion of Merger Sub Capital Stock. The common stock of Merger Sub issued and outstanding immediately prior to the Effective Time shall be converted into and shall represent 100% of the membership interest in Deportes, which membership interest shall be fully paid and non-assessable share of common stock of the Surviving Entity.

2.6 Issuance of Merger Consideration. Following the Effective Time, CornerWorld shall cause is transfer agent (the “Exchange Agent”) to act as the agent for the purpose of issuing certificates or book-entry shares representing the Merger Consideration.

7

2.7 Tax Free Reorganization. The Parties each hereby agree to use their Best Efforts and to cooperate with each other to cause the Merger to be a tax-free reorganization within the meaning of Sections 368 and 1032 of the Code.

2.8 Reorganization of the Board of Directors and Management.

(a) CornerWorld shall cause all of the members of its board of directors to resign and shall take such action as may be necessary to appoint the individuals set forth on Schedule 2.8(a) as directors of CornerWorld, effective as of the Closing and until his/her respective successor has been duly elected or appointed and qualified or until his/her earlier death, resignation or removal in accordance with CornerWorld’s Articles of Incorporation and By-laws. Immediately following the Closing, the Board of Directors will consist of seven (7) directors: David F. Jacobs, Joseph L. Harberg, Eric Neuman, and four (4) designees to be appointed by the outgoing CornerWorld Board. One of the four CornerWorld designated Board members will be appointed Chairman of the Board of Directors by the CornerWorld designees.

(b) Those individuals set forth on Schedule 2.8(b) shall, as of the Closing, be appointed as the officers of CornerWorld until their successors have been duly elected or appointed and qualified or until their earlier death, resignation or removal in accordance with CornerWorld’s Articles of Incorporation and By-laws.

(c) If at any time after the Closing, any party shall consider that any further deeds, assignments, conveyances, agreements, documents, instruments or assurances in law or any other things are necessary or desirable to vest, perfect, confirm or record in CornerWorld the title to any property, rights, privileges, powers and franchises of, and equity in, Deportes by reason of, or as a result of, the Merger, or otherwise to carry out the provisions of this Agreement, the remaining Parties, as applicable, shall execute and deliver, upon request, any instruments or assurances, and do all other things, reasonably necessary or proper to vest, perfect, confirm or record title to such property, rights, privileges, powers, franchises, and equity of Deportes in CornerWorld, and otherwise to give effect to the provisions of this Agreement and the Merger.

ARTICLE III. REPRESENTATIONS AND

WARRANTIES OF DEPORTES MEMBERS

3.1 Investment Purpose.

By receiving the Merger Consideration, the Deportes Members shall be deemed to acknowledge and agree that they are acquiring the CornerWorld Shares for investment purposes and will not offer, sell or otherwise transfer, pledge or hypothecate any of the CornerWorld shares issued to them directly or indirectly unless:

(a) the sale is to CornerWorld;

(b) the sale is made pursuant to the exemption from registration under the Securities Act, provided by Rule 144 thereunder; or

(c) the sale does not require registration under the Securities Act, or any applicable United States state laws and regulations governing the offer and sale of securities, and

8

the Deportes Member have furnished to CornerWorld an opinion of counsel to that effect or such other written opinion as may be reasonably required by CornerWorld.

3.2 Leakout Provision.

(a) Without the prior written consent of the CornerWorld Board, the Deportes Members shall not be allowed to sell any shares of CornerWorld Common Stock for twelve (12) months subsequent to the Closing Date (the “Lock-Up Period”).

(b) For twelve (12) months following expiration of the Lock-Up Period, the Deportes Members shall only publicly sell shares of CornerWorld Common Stock pursuant to and in full compliance with the provisions of Rule 144 regarding “current public information” and (e)(1)(i) of Rule 144, regarding limiting the sales volume during each three month period thereafter to 1% of the individual’s or entity’s total holdings of the Company’s common stock, for the next twelve (12) months (the “Leak-Out Period”) following the Lock-Up Period.

(c) An appropriate legend, as detailed in Section 3.3, describing the restrictions set forth in this Section 3.2 shall be imprinted on each stock certificate representing CornerWorld Common Stock issued as part of the Merger Consideration, and the transfer records of the Company’s transfer agent shall reflect such appropriate restrictions.

(d) Deportes and its Members agree that they will not engage in any short selling of CornerWorld Common Stock of the Company during the Lock-Up/Leak-Out Period.

3.3 Share Legend.

Certificates representing the CornerWorld Common Stock issued as part of the Merger Consideration shall bear the following legends:

“THE SHARES REPRESENTED BY THIS CERTIFICATE ARE SUBJECT TO AN AGREEMENT BETWEEN THE SHAREHOLDER AND THE CORPORATION AND CAN BE SOLD ONLY IN COMPLIANCE WITH SAID AGREEMENT. SALE, TRANSFER, PLEDGE, ENCUMBRANCE, HYPOTHECATION, OR DISPOSITION OF THE SHARES REPRESENTED BY THIS CERTIFICATE IS RESTRICTED BY THE PROVISIONS OF A COMMON STOCK MERGER AGREEMENT AMONG THE SHAREHOLDER AND THE COMPANY OF FEBRUARY 29, 2016. ALL PROVISIONS OF THE AGREEMENT ARE INCORPORATED BY REFERENCE IN THIS CERTIFICATE. A COPY OF THE AGREEMENT MAY BE INSPECTED AT THE PRINCIPAL OFFICE OF THE CORPORATION.

THESE SECURITIES HAVE NOT BEEN REGISTERED WITH THE SECURITIES AND EXCHANGE COMMISSION UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”) OR THE SECURITIES COMMISSION OF ANY STATE UNDER APPLICABLE STATE SECURITIES LAWS. ACCORDINGLY, THESE SECURITIES MAY NOT BE OFFERED OR SOLD EXCEPT PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE SECURITIES ACT OR PURSUANT TO AN AVAILABLE EXEMPTION FROM, OR IN A TRANSACTION NOT

9

SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND IN ACCORDANCE WITH APPLICABLE STATE SECURITIES LAWS.”

ARTICLE IV. REPRESENTATIONS AND WARRANTIES OF DEPORTES

Deportes hereby represents and warrants as follows:

4.1 Organization and Good Standing.

(a) Deportes is a limited liability company duly organized, validly existing and in good standing under the laws of Texas. Deportes is duly qualified to do business in Texas and is in good standing under the laws of each jurisdiction in which either the ownership or use of the properties owned or used by it, or the nature of the activities conducted by it, requires such qualification and the failure to be so qualified would have a Material Adverse Effect on Deportes. Deportes is duly qualified to transact the business in which it is engaged and is in good standing as a foreign limited liability company in every jurisdiction in which its ownership or use of its property or assets or the conduct of its business makes such qualification necessary, except where the failure to be so qualified would not result in a Material Adverse Effect.

(b) Except as set forth in Schedule 4.1(b), Deportes does not presently own or control, directly or indirectly, any interest in any other corporation, partnership, trust, joint venture, association, or other entity.

4.2 Capitalization of Deportes.

As of the date hereof, the issued and outstanding membership units of Deportes consist of 76,460 Series A Units and 50,000 Common Units, all of which have been duly authorized, fully paid and are nonassessable. The issued and outstanding membership units of Deportes, by holder, are set forth on Schedule 4.2. At the Closing, each Deportes Membership Unit (i) shall be duly authorized, validly issued, fully paid and non-assessable and free and clear of any and all security interests, liens, claims, encumbrances, pledges, options, taxes and charges of any kind or nature (other than those created by CornerWorld) and (ii) shall not be subject to any preemptive right, right of first refusal created by Deportes, redemption right or similar right that has not been waived on or prior to the Merger, except as set forth in and (ii) shall not be subject to any preemptive right pursuant to the Deportes Operating Agreement.

4.3 Authorization of Transaction.

(a) Deportes has full power and authority to execute and deliver this Agreement and to perform its obligations hereunder. On the Closing Date, this Agreement shall be duly and validly authorized by all necessary action on the part of Deportes, including unanimous consent by Deportes’ board of managers, in accordance with Applicable Laws and Deportes’ Governing Documents. This Agreement constitutes the valid and legally binding obligation of Deportes, enforceable in accordance with its terms and conditions. Deportes’ board of managers has duly and validly authorized the execution and delivery of this Agreement and

10

approved the consummation of the transactions contemplated hereby, and has taken all actions required to authorize the consummation of the Merger by Deportes.

4.4 Noncontravention.

Neither the execution and delivery of this Agreement, nor the consummation of the Merger, by Deportes will:

(a) violate any Applicable Law, Order, stipulation, charge or other restriction of any Governmental Body to which Deportes is subject or any provision of its Governing Documents; or

(b) conflict with, result in a Breach of, constitute a default under, result in the acceleration of, create in any Person the right to accelerate, terminate, modify or cancel, or require any notice under any Contract, lease, sublease, license, sublicense, franchise, permit, indenture, agreement or mortgage for borrowed money, instrument of indebtedness, Security Interest or other arrangement to which Deportes is a party or by which it is bound or to which any of its assets is subject (or result in the imposition of any Security Interest upon any of its assets), except where the violation, conflict, Breach, default, acceleration, termination, modification, cancellation, failure to give notice, or Security Interest would not have a Material Adverse Effect on the financial condition of Deportes or on the ability of the Parties to consummate the Merger.

(c) violate or conflict with or result in a breach of or a right of termination by any person of any provision of, or constitute a default under, or create a lien upon any properties or assets of Deportes or any of its Subsidiaries pursuant to the Deportes Operating Agreement.

(d) result in the loss or impairment of any approval, license, franchise, permit, legal privilege or legal right enjoyed or possessed by Deportes or any of its Subsidiaries;

(e) require the consent or approval of any government or governmental agency or any person.

4.5 Deportes Financial Information.

Schedule 4.5 contains the unaudited combined balance sheets and statements of operations, statements of changes in Deportes Members’ equity and cash flow as of and for the period from January 1, 2015 to December 31, 2015 for Deportes (collectively, the “Deportes Financial Information”). The balance sheet dated as of December 31, 2015 of Deportes shall be referred to herein as the “Deportes Balance Sheet” and December 31, 2015 shall be sometimes referred to herein as the “Deportes Balance Sheet Date.”

4.6 Events Subsequent to Deportes Balance Sheet. Since the Deportes Balance Sheet Date, and except as disclosed on Schedule 4.6, there has not been, occurred or arisen, with respect to Deportes:

(a) any change or amendment in its Governing Documents;

11

(b) any reclassification, split up or other change in, or amendment of or modification to, the rights of the holders of any of its membership interests;

(c) any direct or indirect redemption, purchase or acquisition by any Person of any of its membership interests or of any interest in or right to acquire any such membership interests;

(d) any issuance, sale, or other disposition of any membership interests, or any grant of any options, warrants, or other rights to purchase or obtain (including upon conversion, exchange, or exercise) any membership interests;

(e) any declaration, set aside, or payment of any dividend or any distribution with respect to its membership interests (whether in cash or in kind) or any redemption, purchase, or other acquisition of any of its membership interests;

(f) the organization of any Subsidiary or the acquisition of any membership interests by any Person or any equity or ownership interest in any business;

(g) any damage, destruction or loss of any of the its properties or assets whether or not covered by insurance;

(h) any material sale, lease, transfer, or assignment of any of its assets, tangible or intangible, other than for a fair consideration in the Ordinary Course of Business;

(i) the execution of, or any other commitment to any agreement, Contract, lease, or license (or series of related agreements, Contracts, leases, and licenses) outside the Ordinary Course of Business;

(j) any acceleration, termination, modification, or cancellation of any agreement, Contract, lease, or license (or series of related agreements, Contracts, leases, and licenses) involving more than $10,000 to which it is a party or by which it is bound;

(k) any Security Interest or encumbrance imposed upon any of its assets, tangible or intangible, notwithstanding the Senior Secured Promissory Notes defined in Section 10.1(e), executed in 2016;

(l) any grant of any license or sublicense of any rights under or with respect to any material Deportes Intellectual Property;

(m) any sale, assignment or transfer (including transfers to any employees, Affiliates or members) of any material Deportes Intellectual Property;

(n) any capital expenditure (or series of related capital expenditures) involving more than $5,000 and outside the Ordinary Course of Business;

(o) any capital investment in, any loan to, or any acquisition of the securities or assets of, any other Person (or series of related capital investments, loans, and acquisitions) involving more than $5,000 and outside the Ordinary Course of Business;

12

(p) any issuance of any note, bond, or other debt security or created, incurred, assumed, or guaranteed any indebtedness for borrowed money or capitalized lease obligation involving more than $5,000 notwithstanding the Senior Secured Promissory Notes defined in Section 10.1(e), executed in 2016;

(q) any delay or postponement of the payment of accounts payable or other liabilities, other than those being contested in good faith;

(r) any cancellation, compromise, waiver, or release of any right or claim (or series of related rights and claims) involving more than $5,000 and outside the Ordinary Course of Business;

(s) any loan to, or any entrance into any other transaction with, any of its directors, officers, and employees either involving more than $1,000 individually or $5,000 in the aggregate;

(t) the adoption, amendment, modification, or termination of any bonus, profit-sharing, incentive, severance, or other plan, Contract, or commitment for the benefit of any of its directors, officers, and employees (or taken away any such action with respect to any other Employee Benefit Plan);

(u) any employment Contract or collective bargaining agreement, written or oral, or modified the terms of any existing such Contract or agreement; Deportes has previously represented and confirms that no employment contracts currently exist;

(v) any increase in the base compensation of any of its directors, officers, and employees that is greater than One Thousand Dollars ($1,000) per annum;

(w) any charitable or other capital contribution in excess of $2,500;

(x) any taking of other action or entrance into any other transaction other than in the Ordinary Course of Business, or entrance into any transaction with any insider of CornerWorld, except as disclosed in this Agreement and the Disclosure Schedules;

(y) any other event or occurrence that may have or could reasonably be expected to have a Material Adverse Effect on Deportes (whether or not similar to any of the foregoing); or

(z) any agreement or commitment, whether in writing or otherwise, to do any of the foregoing.

4.7 Tax Matters.

(a) Except as set forth on Schedule 4.7 Deportes:

(i) has timely paid or caused to be paid all material Taxes required to be paid by it though the date hereof and as of the Closing Date (including any Taxes shown due on any Tax Return);

13

(ii) has filed or caused to be filed in a timely and proper manner (within any applicable extension periods) all Tax Returns required to be filed by it with the appropriate Governmental Body in all jurisdictions in which such Tax Returns are required to be filed; and all tax returns filed on behalf of Deportes were complete and correct in all material respects;

(iii) has not requested or caused to be requested any extension of time within which to file any Tax Return, which Tax Return has not since been filed.

(iv) has not been notified by any Governmental Body that any material issues have been raised (and no such issues are currently pending) by any Governmental Body in connection with any Tax Return filed by or on behalf of Deportes; there are no pending Tax audits and no waivers of statutes of limitations have been given or requested with respect to Deportes; no Tax liens have been filed against Deportes or unresolved deficiencies or additions to Taxes have been proposed, asserted or assessed against Deportes;

(v) has made full and adequate accrual (A) on the Deportes Balance Sheet, and the books and records of Deportes for all income taxes currently due and all accrued Taxes not yet due and payable by Deportes for all periods ending on or prior to the Deportes Balance Sheet Date, and (B) on the books and records of Deportes for all Taxes payable by Deportes for all periods beginning after the Deportes Balance Sheet Date;

(vi) has not incurred any liability for Taxes from and after the Deportes Balance Sheet Date other than Taxes incurred in the Ordinary Course of Business and consistent with past practices;

(vii) has complied in all material respects with all Applicable Laws relating to the collection or withholding of Taxes (such as Taxes or withholding of Taxes from the wages of employees); and

(viii) does not have any liability in respect of any Tax sharing agreement with any Person.

(b) No Deportes Member has incurred any liability to make any payments either alone or in conjunction with any other payments that would constitute a “Parachute Payment” within the meaning of Section 280G of the Code (or any corresponding provision of state local or foreign Applicable Law related to Taxes).

(c) No claim has been made within the last three years by any taxing authority in a jurisdiction in which Deportes does not file Tax Returns that Deportes is or may be subject to taxation by that jurisdiction.

(d) The consummation of the Merger will not trigger the realization or recognition of intercompany gain or income to Deportes or any Affiliate of Deportes under the Federal consolidated return regulations with respect to Federal, state or local taxes.

14

(e) Deportes is not currently, nor has it been at any time during the previous five years, a “U.S. real property holding corporation” and, therefore, the Shares are not “U.S. real property interests,” as such terms are defined in Section 897 of the Code.

(f) Neither Deportes nor any of its subsidiaries are a party to any employment contracts as of the date hereof and as of the Closing Date.

4.8 Title to Assets.

Deportes has good and marketable title to, or a valid leasehold interest in, the properties and assets owned or leased and used by it to operate the Business in the manner presently operated by it, as reflected in the Deportes Financial Information.

4.9 Deportes Intellectual Property.

(a) Deportes owns, or is licensed or otherwise possesses legal enforceable rights to use all: (i) trademarks and service marks (including the ESPN Deportes brand in the relevant markets in which it operates, registered or unregistered), trade dress, trade names and other names and slogans embodying business goodwill or indications of origin, all applications or registrations in any jurisdiction pertaining to the foregoing and all goodwill associated therewith; (ii) material patentable inventions, technology, computer programs and software (including password unprotected interpretive code or source code, object code, development documentation, programming tools, drawings, specifications and data) and all applications and patents in any jurisdiction pertaining to the foregoing, including re-issues, continuations, divisions, continuations-in-part, renewals or extensions; (iii) trade secrets, including confidential and other non-public information (iv) copyrights in writings, designs, software programs, mask works or other works, applications or registrations in any jurisdiction for the foregoing and all moral rights related thereto; (v) databases and all database rights; and (vi) Internet web sites, domain names and applications and registrations pertaining thereto (collectively, “Deportes Intellectual Property”) that are used in the Business except for any such failures to own, be licensed or process that would not be reasonably likely to have a Material Adverse Effect. All trademarks and web properties and other intellectual property rights are outlined on Schedule 4.9.

(b) Except as may be evidenced by patents issued after the date hereof, there are no conflicts with or infringements of any material Deportes Intellectual Property by any Third Party and the conduct of the Business as currently conducted does not conflict with or infringe any proprietary right of a Third Party.

(c) Deportes owns or has the right to use all software currently used in and material to the Business.

4.10 Affiliate Transactions.

Except as set forth in Schedule 4.10, no officer, director, or employee of Deportes or any member of the immediate family of any such officer, director or employee, or any entity in which any of such persons owns any beneficial interest (other than any publicly-held corporation whose stock is traded on a national securities exchange or in the over-the-counter market and

15

less than one percent of the stock of which is beneficially owned by any of such persons), has any agreement with Deportes or any interest in any of their property of any nature, used in or pertaining to the Business. None of the foregoing Persons has any direct or indirect interest in any competitor, supplier or customer of Deportes or in any Person from whom or to whom Deportes leases any property or transacts business of any nature.

4.11 Powers of Attorney

There are no outstanding powers of attorney executed on behalf of Deportes.

4.12 Litigation.

Except as set forth on Schedule 4.12:

(a) there is no pending or, to Deportes’ Knowledge, threatened Proceeding:

(i) by or against Deportes or that otherwise relates to or may affect the Business which, if adversely determined, would have a Material Adverse Effect; or

(ii) that challenges, or that may have the effect of preventing, delaying, making illegal or otherwise interfering with, the Merger;

(b) to the Knowledge of Deportes, no event has occurred or circumstance exists that is reasonably likely to give rise to or serve as a basis for the commencement of any such Proceeding. Deportes has delivered to CornerWorld copies, if any, of all pleadings, correspondence and other documents relating to each Proceeding;

(c) there is no material Order to which Deportes, any member of Deportes or the Business is subject;

(d) to the Knowledge of Deportes, no officer, director, agent or employee of Deportes is subject to any Order that prohibits such officer, director, agent or employee from engaging in or continuing any conduct, activity or practice relating to the Business;

(e) Deportes has been and is in compliance with all of the terms and requirements of each Order to which it or the Business is or has been subject;

(f) no event has occurred or circumstance exists that is reasonably likely to constitute or result in (with or without notice or lapse of time) a violation of or failure to comply with any term or requirement of any Order to which Deportes or the Business is subject; and

(g) with the exception of the notice of failure to pay payroll taxes to the IRS, which Deportes intends to resolve prior to Closing, Deportes has not received any notice or other communication (whether oral or written) from any Governmental Body or any other Person regarding any actual, alleged, possible or potential violation of, or failure to comply with, any term or requirement of any Order to which Deportes or the Business is subject. Deportes shall indemnify CornerWorld, its officers and directors, for any liability related to any such unpaid payroll taxes as of the Closing Date.

4.13 Employee Benefits.

16

(a) Schedule 4.13 lists all material (i) Employee Benefit Plans of the Deportes, (ii) bonus, stock option, stock purchase, stock appreciation right, incentive, deferred compensation, supplemental retirement, severance, and fringe benefit plans, programs, policies or arrangements, and (iii) employment or consulting agreements, for the benefit of, or relating to, any current or former employee (or any beneficiary thereof) of Deportes that, in the case of a plan described in (i) or (ii) above, is currently maintained by Deportes or with respect to which Deportes has an obligation to contribute, and that, in the case of an agreement described in (iii) above, is currently in effect (the “Deportes Employee Plans”).

(b) There is no Proceeding pending or, to Deportes’ Knowledge, threatened against the assets of any Deportes Employee Plan or, with respect to any Deportes Employee Plan, against Deportes, other than Proceedings that would not reasonably be expected to result in a Material Adverse Effect, and to Deportes’ Knowledge there is no Proceeding pending or threatened in writing against any fiduciary of any Deportes Employee Plan other than Proceedings that would not reasonably be expected to result in a Material Adverse Effect.

(c) Each of the Deportes Employee Plans has been operated and administered in all material respects in accordance with its terms and Applicable Law.

(d) No director, officer, or employee of Deportes will become entitled to retirement, severance or similar benefits or to enhanced or accelerated benefits (including any acceleration of vesting or lapsing of restrictions with respect to equity-based awards) under any Deportes Employee Plan solely as a result of consummation of the Merger.

4.14 Insurance.

Schedule 4.14 is an accurate and complete description of all policies of insurance of any kind or nature, including, but not limited to, fire, liability, workmen’s compensation and other forms of insurance owned or held by or covering Deportes or all or any portion of its property and assets. There are no off-balance sheet, unfunded liabilities with respect to any self-insurance policies other than as detailed in Schedule 4.14. Subsequent to the Closing Date, the Company and or Deportes shall have the right to terminate its insurance relationship with IBS Group, LLC at its sole discretion, at any time. Deportes and IBS Group, LLC, shall indemnify CornerWorld, its officers and directors, for any unfunded liabilities under such employee health plans, to the extent existing immediately prior to the Closing.

4.15 Employees.

(a) To the Knowledge of Deportes, no officer, director, agent, employee, consultant, or contractor of Deportes is bound by any Contract that purports to limit the ability of such officer, director, agent, employee, consultant, or contractor (i) to engage in or continue or perform any conduct, activity, duties or practice relating to the Business or (ii) to assign to Deportes or to any other Person any rights to any invention, improvement, or discovery. No former or current employee of Deportes is a party to, or is otherwise bound by, any Contract that in any way adversely affected, affects, or will affect the ability of Deportes or CornerWorld to conduct the Business as heretofore carried on by Deportes.

17

(b) David Jacobs will remain employed as Deportes Chief Executive Officer at his current annual salary at a rate of per annum as an at-will employee subject to the employment laws of the state of Texas. Mr. Jacobs current annual salary contemplates that payments of his healthcare premiums will be taken as deductions from his wages as they come due.

(c) Mr. Jacobs will be entitled to participate in the employee benefits and welfare programs and qualified plans of CornerWorld, as from time to time may be in effect, upon satisfaction by him of any applicable eligibility requirements.

(d) Should he be terminated for any reason, other than “Cause”, as defined below, he will be entitled to four months paid salary, payable on a semi-monthly basis in accordance with the Company’s standard employee payment policies.

(e) Mr Jacobs shares of Company stock currently held in the amount of 1,092,923, will be held in escrow in certificate form by the Company and will vest ratably, on a daily basis and distributed annually over three calendar years. Mr. Jacobs will divest 491,815 of these shares upon execution of this document as further detailed below in this item 4.15(e) leaving him 601,108 shares with respect to this tranche of securities. Mr. Jacobs shares are included in the tranche of shares denoted as “Existing Deportes Common” on Schedule 2.5(a). Should Mr. Jacobs be terminated for any reason or no reason, at any time, his then unvested shares will be sold to the Company at the Company’s share par value of $0.001 per share. In the event the Company becomes insolvent, files for bankruptcy or a foreclosure process has started on any or all of the assets of the Company, then Mr. Jacobs’ shares shall be immediately sold back to the Company at the Company’s share par value of $0.001 per share. As noted above, upon consummation of the Merger, Mr. Jacobs has agreed to sell 491,815 of his shares to certain employees and affiliates of the Company resulting in a pro rata reduction in his holdings and his vesting schedule. Such shares shall be immediately vested upon their divestiture by Mr. Jacobs.

(f) Termination for Cause is defined as follows: “Cause” means (i) Mr. Jacobs’ refusal to perform any lawful directive by the majority of the independent Board of Directors of CornerWorld which is not cured by Mr. Jacobs within 60 days of written notice of such refusal to Mr. Jacobs; (ii) commission by Mr. Jacobs of any act or omission that would constitute a felony, or lesser crime that involves CornerWorld property, or any crime of moral turpitude under Federal law or the law of the state or foreign jurisdiction in which such action occurred; (iii) dishonesty, disloyalty, fraud, embezzlement, theft, disclosure of trade secrets or Confidential Information or other acts or omissions that constitute a breach of fiduciary duty to CornerWorld or its shareholders, provided, however, that this provision will not apply to any actions taken by Mr. Jacobs pursuant to a directive from the Company and regarding which the Mr. Jacobs did not believe that such action was fraudulent; and (iv) regularly reporting to work or working under the influence of an illegal drug or a controlled substance which renders Mr. Jacobs incapable of performing his material duties to the reasonable satisfaction of CornerWorld. If Mr. Jacobs is terminated for Cause, he must immediately surrender any unvested shares and he will be entitled to further payments of salary, vacation or benefits, including those referenced in this, Article 4.15(b). With respect to this Agreement and the employment thereto

18

(g) By entering into this Agreement, Mr. Jacobs personally, and on behalf of his current and former heirs, spouse, successors, assigns, legal representatives, guardians, executors, administrators, insurers, servants, and agents, as applicable, COVENANTS NOT TO SUE AT ANY TIME IN THE FUTURE, the Company, or any individual or entity referenced in this Agreement or the Company’s agents, employees, directors, officers, shareholders, heirs, assigns, executors and administrators ever had or now have for, upon, whether or not known or unknown, from the beginning of the world to the end of time. Further, Mr. Jacobs, his current and former heirs, spouse, successors, assigns, legal representatives, guardians, executors, administrators, insurers, servants, and agents, as applicable, COVENANTS NOT TO SUE AT ANY TIME IN THE FUTURE, Scott Beck personally or any related company or affiliated company of Scott Beck or his relatives., heirs, spouse, successors, assigns, legal representatives, guardians, executors, administrators, insurers, servants, and agents, Joseph L. Harberg or V. Chase McCrea III personally for any potential cause of action whether or not known or unknown, from the beginning of the world to the end of time.

(h) Any dispute, arising hereunder and at any point in the future, if not settled by mutual agreement, shall, at either party’s option, and upon written notice by one party to the other, be settled by final and binding arbitration in Dallas, Texas. The arbitration shall be conducted in accordance with the Commercial Dispute Resolution Procedures and Rules of the American Arbitration Association (“AAA Rules”) by a single disinterested arbitrator appointed in accordance with such AAA Rules. The Arbitrator shall have authority to award relief under legal or equitable principles, including interim or preliminary relief, and to allocate responsibility for the costs of the arbitration and to award recovery of attorneys’ fees and expenses in such manner as determined by the arbitrator.

(i) Immediately after the Closing Date, it is anticipated that the CornerWorld will issue stock options to the then existing Deportes employee base. For a period of twenty-four (24) months subsequent to the Closing Date, stock options may be granted only with the approval of the majority of the CornerWorld designated board members.

4.16 Labor Relations.

Deportes is not a party to any collective bargaining or similar agreement. To the Knowledge of Deportes, there are no strikes, work stoppages, unfair labor practice charges or grievances pending or threatened against Deportes by any employee of Deportes or any other Person or entity.

4.17 Legal Compliance.

To the Knowledge of Deportes, Deportes is in material compliance with all Applicable Laws (including rules and regulations thereunder) of any Governmental Bodies having jurisdiction over Deportes, including any requirements relating to antitrust, consumer protection, currency exchange, equal opportunity, health, occupational safety, pension and securities matters.

19

4.18 Brokers’ Fees.

Deportes has no liability or obligation to pay any fees or commissions to any broker, finder or agent with respect to the Merger for which Deportes could become liable or obligated.

4.19 Undisclosed Liabilities.

To the Knowledge of Deportes, Deportes does not have any liability (and to the Knowledge of Deportes, there is no basis for any present or future Proceeding, charge, complaint, claim, or demand against any of them giving rise to any liability), except for:

(a) liabilities reflected or reserved against in the Deportes Balance Sheet; or

(b) liabilities which have arisen in the Ordinary Course of Business since the Deportes Balance Sheet Date.

4.20 Disclosure.

The representations and warranties of Deportes contained in this Agreement do not contain any untrue statement of a material fact or omit to state any material fact necessary in order to make the statements and information contained herein not misleading.

ARTICLE V. REPRESENTATIONS AND WARRANTIES OF CORNERWORLD

CornerWorld hereby represents and warrants as follows:

5.1 Representations of CornerWorld Concerning the Transaction.

(a) Organization and Good Standing

(i) CornerWorld is a corporation duly organized, validly existing and in good standing under the laws of State of Nevada. CornerWorld is duly qualified to do business as a foreign corporation and is in good standing under the laws of each state or other jurisdiction in which either the ownership or use of the properties owned or used by it, or the nature of the activities conducted by it, requires such qualification and the failure to be so qualified would have a Material Adverse Effect on CornerWorld. Merger Sub is a limited liability company duly organized, validly existing and in good standing under the laws of the State of Delaware.

(ii) CornerWorld, at its sole discretion, may divest itself of all or a portion of its remaining subsidiaries, other than Merger Sub, immediately prior to the Closing Date.

(b) Authorization of Transaction. CornerWorld and Merger Sub have the corporate or limited liability company power to execute, deliver and perform this Agreement, the Related Agreements, and, subject to the satisfaction of the conditions precedent set forth herein, and have taken all action required by law, its Governing Documents or otherwise, to authorize the execution, delivery, and performance of this Agreement and such related documents. The

20

execution and delivery of this Agreement has been approved by the Board of Directors of CornerWorld and the governing authority of Merger Sub. This Agreement is a valid obligation of CornerWorld and Merger Sub and is legally binding on CornerWorld and Merger Sub in accordance with its terms.

(c) Capitalization of CornerWorld. The entire authorized capital stock of CornerWorld consists of 250,000,000 shares of common stock, with a par value of $0.001 per share, and no shares of preferred stock, par value $0.001 per share. There are 4,655,338 shares of CornerWorld Common Stock issued and outstanding and no shares of preferred stock issued and outstanding. All issued and outstanding shares of CornerWorld Common Stock have been duly authorized, are validly issued, fully paid and nonassessable. Except as disclosed to Deportes prior to Closing, there are no outstanding or authorized options, warrants, rights, Contracts, calls, puts, rights to subscribe, conversion rights or other agreements or commitments to which CornerWorld is a party or which are binding upon CornerWorld providing for the issuance, disposition or acquisition of any of its capital stock, nor any outstanding or authorized stock appreciation, phantom stock or similar rights with respect to CornerWorld.

(d) Noncontravention. Neither the execution and delivery of this Agreement, nor consummation of the Merger, will:

(i) violate any Applicable Law, Order, stipulation, charge or other restriction of any Governmental Body to which CornerWorld or Merger Sub is subject or any provision of its Governing Documents; or

(ii) conflict with, result in a Breach of, constitute a default under, result in the acceleration of, create in any Person the right to accelerate, terminate, modify or cancel, or require any notice under any Contract, lease, sublease, license, sublicense, franchise, permit, indenture, agreement or mortgage for borrowed money, instrument of indebtedness, Security Interest, or other arrangement to which CornerWorld is a party or by which it is bound or to which any of its assets is subject (or result in the imposition of any Security Interest upon any of its assets), except where the violation, conflict, Breach, default, acceleration, termination, modification, cancellation, failure to give notice, or Security Interest would not have a Material Adverse Effect on the financial condition of CornerWorld or on the ability of the Parties to consummate the Merger.

5.2 Representations of CornerWorld Concerning CornerWorld.

(a) Affiliate Transactions. No officer, director, or employee of CornerWorld or any member of the immediate family of any such officer, director or employee, or any entity in which any of such persons owns any beneficial interest (other than any publicly-held corporation whose stock is traded on a national securities exchange or in the over-the-counter market and less than one percent of the stock of which is beneficially owned by any of such Persons), has any agreement with CornerWorld or any interest in any of their property of any nature, used in or pertaining to CornerWorld Business. None of the foregoing Persons has any direct or indirect interest in any competitor, supplier or customer of CornerWorld or in any Person from whom or to whom CornerWorld leases any property or transacts business of any nature.

21

(b) Intercompany Gain as Result of Transaction. The consummation of the Merger will not trigger the realization or recognition of intercompany gain or income to CornerWorld under the Federal consolidated return regulations with respect to Federal, state or local Taxes.

(c) Title to Assets. CornerWorld has good and marketable title to, or a valid leasehold interest in, the properties and assets owned or leased and used by it to operate CornerWorld Business in the manner presently operated by CornerWorld.

(d) CornerWorld Intellectual Property.

(i) CornerWorld owns, or is licensed or otherwise possesses legal enforceable rights to use all: (i) trademarks and service marks (registered or unregistered), trade dress, trade names and other names and slogans embodying business goodwill or indications of origin, all applications or registrations in any jurisdiction pertaining to the foregoing and all goodwill associated therewith; (ii) patentable inventions, technology, computer programs and software (including password unprotected interpretive code or source code, object code, development documentation, programming tools, drawings, specifications and data) and all applications and patents in any jurisdiction pertaining to the foregoing, including re-issues, continuations, divisions, continuations-in-part, renewals or extensions; (iii) trade secrets, including confidential and other non-public information (iv) copyrights in writings, designs, software programs, mask works or other works, applications or registrations in any jurisdiction for the foregoing and all moral rights related thereto; (v) databases and all database rights; and (vi) Internet Web sites, domain names and applications and registrations pertaining thereto (collectively, “CornerWorld Intellectual Property”) that are used in CornerWorld Business except for any such failures to own, be licensed or process that would not be reasonably likely to have a Material Adverse Effect.

(ii) CornerWorld owns or has the right to use all software currently used in and material to CornerWorld Business.

(e) SEC Reports and Financial Statements. CornerWorld has filed with the SEC all reports and other filings required to be filed by CornerWorld in accordance with the Securities Act and the Exchange Act and the rules and regulations promulgated thereunder (the “CornerWorld SEC Reports”). As of their respective dates, CornerWorld SEC Reports complied in all material respects with the applicable requirements of the Securities Act, the Exchange Act and the respective rules and regulations promulgated thereunder applicable to such CornerWorld SEC Reports and, except to the extent that information contained in any CornerWorld SEC Report has been revised or superseded by a later CornerWorld SEC Report filed and publicly available prior to the date of this Agreement, none of the CornerWorld SEC Reports contained any untrue statement of a material fact or omitted to state any material fact required to be stated therein or necessary in order to make the statements therein, in light of the circumstances under which they were made, not misleading. The financial statements of CornerWorld included in CornerWorld SEC Reports were prepared from and are in accordance with the accounting books and other financial records of CornerWorld, were prepared in accordance with GAAP (except, in the case of unaudited statements, as permitted by the rules of the SEC) applied on a consistent basis during the periods involved (except as may be indicated in

22

the notes thereto) and presented fairly the consolidated financial position of CornerWorld and its consolidated subsidiaries as of the dates thereof and the consolidated results of their operations and cash flows for the periods then ended (subject, in the case of unaudited statements, to normal year-end audit adjustments). Except as set forth in the CornerWorld SEC Reports, CornerWorld has no liabilities or obligations of any nature (whether accrued, absolute, contingent or otherwise) other than liabilities or obligations incurred in the Ordinary Course of Business.

(f) Powers of Attorney. There are no outstanding powers of attorney executed on behalf of CornerWorld.

(g) Litigation.

(i) To CornerWorld’s Knowledge, there is no pending Proceeding:

(A) by or against CornerWorld or that otherwise relates to or may affect CornerWorld Business which, if adversely determined, would have a Material Adverse Effect; or

(B) that challenges, or that may have the effect of preventing, delaying, making illegal or otherwise interfering with, the Merger.

To the Knowledge of CornerWorld, no event has occurred or circumstance exists that is reasonably likely to give rise to or serve as a basis for the commencement of any such Proceeding.

(ii) Orders:

(A) there is no material Order to which CornerWorld or CornerWorld Business is subject; and

(B) to the Knowledge of CornerWorld, no officer, director, agent or employee of CornerWorld is subject to any Order that prohibits such officer, director, agent or employee from engaging in or continuing any conduct, activity or practice relating to CornerWorld Business.

(h) Employee Benefits.

(i) Aside from stock option, healthcare, dental, vision and life insurance plans, CornerWorld has no (i) Employee Benefit Plans, (ii) bonus, stock purchase, stock appreciation right, incentive, deferred compensation, supplemental retirement, severance, and fringe benefit plans, programs, policies or arrangements, and (iii) employment or consulting agreements, for the benefit of, or relating to, any current or former employee (or any beneficiary thereof) of CornerWorld, in the case of a plan described in (i) or (ii) above, that is currently maintained by CornerWorld or with respect to which CornerWorld has an obligation to contribute, and in the case of an agreement described in (iii) above, that is currently in effect (the “CornerWorld Employee Plans”).

23

(i) Insurance. Schedule 5.2(i) is an accurate and complete description of all policies of insurance of any kind or nature, including, but not limited to, fire, liability, workmen’s compensation and other forms of insurance owned or held by or covering CornerWorld or all or any portion of its property and assets.

(j) Employees. To the Knowledge of CornerWorld, no officer, director, agent, employee, consultant, or contractor of CornerWorld is bound by any Contract that purports to limit the ability of such officer, director, agent, employee, consultant, or contractor (i) to engage in or continue or perform any conduct, activity, duties or practice relating to CornerWorld Business or (ii) to assign to CornerWorld or to any other Person any rights to any invention, improvement, or discovery. No former or current employee of CornerWorld is a party to, or is otherwise bound by, any Contract that in any way adversely affected, affects, or will affect the ability of CornerWorld to conduct CornerWorld Business. The existing CEO of CornerWorld will resign on the Closing Date and be replaced by the CEO of Deportes.

(k) Labor Relations. CornerWorld is not a party to any collective bargaining or similar agreement. To the Knowledge of CornerWorld, there are no strikes, work stoppages, unfair labor practice charges or grievances pending or threatened against CornerWorld by any employee of CornerWorld or any other person or entity.

(l) Legal Compliance. To the Knowledge of CornerWorld, CornerWorld is in material compliance with all Applicable Laws of any Governmental Bodies having jurisdiction over CornerWorld, including any requirements relating to antitrust, consumer protection, currency exchange, equal opportunity, health, occupational safety, pension and securities matters.

(m) Brokers’ Fees. CornerWorld has no liability or obligation to pay any fees or commissions to any broker, finder or agent with respect to the Merger for which Deportes could become liable or obligated.

(n) Undisclosed Liabilities. CornerWorld has no liability (and to the Knowledge of CornerWorld, there is no basis for any present or future Proceeding, charge, complaint, claim, or demand against any of them giving rise to any liability), except for liabilities which have arisen in the Ordinary Course of Business.

(o) Disclosure. The representations and warranties of CornerWorld contained in this Agreement do not contain any untrue statement of a material fact or omit to state any material fact necessary in order to make the statements and information contained herein not misleading.

ARTICLE VI. ACCESS TO INFORMATION AND DOCUMENTS

6.1 Access to Information.