Form 8-K Apollo Commercial Real For: Oct 28

�

�

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

�

�

FORM 8-K

�

�

CURRENT REPORT

Pursuant to Section�13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October�28, 2014

�

�

Apollo Commercial Real Estate Finance, Inc.

(Exact name of registrant as specified in its charter)

�

�

�

| Maryland | � | 001-34452 | � | 27-0467113 |

| (State or other jurisdiction of incorporation) |

� | (Commission File Number) |

� | (IRS Employer Identification�No.) |

�

| c/o Apollo Global Management, LLC 9 West 57th Street, 43rd Floor New York, New York |

� | 10019 |

| (Address of principal executive offices) | � | (Zip Code) |

Registrant�s telephone number, including area code: (212)�515-3200

n/a

(Former name or former address, if changed since last report.)

�

�

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

�

| � | Written�communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

�

| � | Soliciting�material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

�

| � | Pre-commencement�communications pursuant to Rule 14d-2(b) under the Exchange Act (17�CFR�240.14d-2(b)) |

�

| � | Pre-commencement�communications pursuant to Rule 13e-4(c) under the Exchange Act (17�CFR�240.13e-4(c)) |

�

�

�

| ITEM�2.02. | Results of Operations and Financial Condition. |

On October�28, 2014, Apollo Commercial Real Estate Finance, Inc. (the �Company�) issued an earnings release announcing its financial results for the quarter ended September�30, 2014. A copy of the earnings release is attached as Exhibit 99.1 hereto and incorporated herein by reference.

On October�28, 2014, the Company posted supplemental financial information on the Investor Relations section of its website (www.apolloreit.com). A copy of the supplemental financial information is furnished as Exhibit 99.2 hereto and incorporated herein by reference.

The information in Item�2.02 of this Current Report, including Exhibits 99.1 and 99.2, is being furnished and shall not be deemed �filed� for purposes of Section�18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. The information in this Current Report shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended, unless it is specifically incorporated by reference therein.

�

| ITEM�9.01. | Financial Statements and Exhibits. |

�

| (d) | Exhibits. |

�

| Exhibit |

�� | Description |

| 99.1 | �� | Earnings Release dated October 28, 2014 |

| 99.2 | �� | Supplemental Financial Information for the quarter ended September 30, 2014 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

�

| � | � | Apollo Commercial Real Estate Finance, Inc. | ||||

| � | � | By: | � | /s/ Stuart A. Rothstein | ||

| � | � | Name: | � | Stuart A. Rothstein | ||

| � | � | Title: | � | President and Chief Executive Officer | ||

| Date: October�28, 2014 | � | � | � | |||

Exhibit Index

�

| Exhibit |

�� | Description |

| 99.1 | �� | Earnings Release dated October 28, 2014 |

| 99.2 | �� | Supplemental Financial Information for the quarter ended September 30, 2014 |

Exhibit 99.1

�

�

| FOR IMMEDIATE RELEASE | �� | � | NYSE:ARI | �� | ||

| CONTACT: | �� | Hilary Ginsberg | �� | |||

| �� | Investor Relations | �� | ||||

| �� | (212) 822-0767 | �� | ||||

APOLLO COMMERCIAL REAL ESTATE FINANCE, INC. REPORTS

THIRD QUARTER 2014 FINANCIAL RESULTS AND

DECLARES A COMMON STOCK QUARTERLY DIVIDEND OF $0.40 PER SHARE

� 26% Increase in Operating Earnings Per Share �

New York, NY, October�28, 2014 � Apollo Commercial Real Estate Finance, Inc. (the �Company� or �ARI�) (NYSE: ARI) today reported financial results for the quarter and nine month period ended September�30, 2014.

Third Quarter 2014 and Recent Highlights

�

| � | � | � | Reported Operating Earnings (a non-GAAP financial measure defined below) per share of common stock of $0.44 for the quarter ended September�30, 2014, an increase of 26% as compared to Operating Earnings per share of common stock of $0.35 for the quarter ended September�30, 2013; |

�

| � | � | � | Generated $26.6 million of net interest income from the Company�s $1.5 billion commercial real estate debt portfolio, which had a weighted average underwritten internal rate of return (�IRR�) of approximately 13.1% and a levered weighted average underwritten IRR of approximately 13.7% at September�30, 2014; |

�

| � | � | � | Closed $69.5 million of commercial real estate loans and invested $35.6 million of equity into commercial mortgage-backed securities (�CMBS�) with an aggregate purchase price of $178.2 million; |

�

| � | � | � | Completed an offering of $111.0 million aggregate principal amount of 5.50% Convertible Senior Notes due 2019; |

�

| � | � | � | Closed the acquisition of a minority participation in KBC Bank Deutschland AG (�KBCD�) together with other investors, including other affiliates of Apollo Global Management, LLC (�Apollo�); and |

�

| � | � | � | Subsequent to quarter end, invested $4.7 million of equity into CMBS with an aggregate purchase price of $23.3 million, bringing year-to-date investments to $1.0 billion. |

�ARI delivered a strong quarter of operating and financial performance, driven by the Company�s diversified investment portfolio and expanded capital base,� said Stuart Rothstein, Chief Executive Officer and President of the Company. �ARI continued to deploy capital into a variety of well-structured commercial real estate debt investments, which totaled $1.0 billion year-to-date. While the commercial real estate finance market remains competitive, we believe ARI continues to benefit from Apollo�s broad origination capabilities and global integrated platform. The Company has a substantial investment pipeline with a broad mix of asset classes and geographies. Importantly, we believe ARI is well positioned for a rising interest rate environment, as 50% of the loans in the Company�s portfolio have floating interest rates and the pipeline for future investments contains predominately floating rate loans as well.�

Third Quarter 2014 Operating Results

The Company reported Operating Earnings of $20.8 million, or $0.44 per share, for the three months ended September�30, 2014, representing a per share increase of 26% as compared to Operating Earnings of $13.3 million, or $0.35 per share, for the three months ended September�30, 2013. Net income available to common stockholders for the three months ended September�30, 2014 was $17.3 million, or $0.37 per share, as compared to net income available to common stockholders of $11.0 million, or $0.29 per share, for the three months ended September�30, 2013.

For the nine months ended September�30, 2014, the Company reported Operating Earnings of $52.8 million, or $1.24 per share, representing an 18%�per share increase as compared to Operating Earnings of $37.0 million, or $1.05 per share, for the nine months ended September�30, 2013. Net income available to common stockholders for the nine months ended September�30, 2014 was $55.1 million, or $1.30 per share, as compared to net income available to common stockholders of $31.0 million, or $0.88 per share, for the nine months ended September�30, 2013.

Third Quarter 2014 Investment and Portfolio Activity

New Investments � During the third quarter, ARI closed $287.2 million of commercial real estate and real estate-related debt transactions, including the KBCD transaction. ARI�s third quarter investments included the following transactions:

�

| � | � | � | $20.0 million floating-rate mezzanine loan secured by the equity interest in a 280-key hotel in the NoMad neighborhood of New York City. The mezzanine loan has a two-year initial term and three one-year extension options and an appraised loan-to-value (�LTV�) of approximately 61%. The mezzanine loan was underwritten to generate an IRR of approximately 12%; |

�

| � | � | � | $34.5 million ($30.0 million of which was funded at closing) floating-rate, first mortgage loan secured by a newly constructed, Class-A, 63-unit multifamily property located in Brooklyn, New York, which also includes approximately 7,300 square feet of retail space and 31 parking spaces. The first mortgage loan has a two-year initial term with three one-year extension options and an appraised LTV of approximately 63% based upon the initial funding. The future funding is contingent upon the property achieving certain occupancy and cash flow hurdles. On a levered basis, the loan was underwritten to generate an IRR of approximately 12%; |

�

| � | � | � | $15 million fixed-rate subordinate loan secured by a top-tier ski resort located in Montana. ARI�s loan has a six-year term and an appraised LTV of approximately 59%. The subordinate loan has been underwritten to generate an IRR of approximately 15%; |

�

| � | � | � | �30.7�million ($39.5 million) investment in an entity that acquired a minority participation in KBCD. As of December�31, 2013, KBCD had total assets of �2,187 million. Following the closing of the transaction, KBCD was renamed Bremer Kreditbank AG and will operate under the name BKB Bank; and |

�

| � | � | � | $35.6 million of equity for the acquisition of CMBS with an aggregate purchase price of $178.2 million. ARI financed the CMBS utilizing $142.5 million of borrowings under the Company�s master repurchase agreement with Deutsche Bank AG (the �Deutsche Bank Facility�), which was amended during the quarter and then again subsequent to quarter end to expand the total borrowing capacity to $300 million from $200 million. The CMBS have a weighted average life of 2.8 years and have been underwritten to generate an IRR of approximately 17%. |

Loan Repayment � During the third quarter, ARI received a $50 million principal repayment from a mezzanine loan secured by a pledge of the equity interests in a portfolio of office properties located throughout Florida. ARI realized a 13% IRR on this mezzanine investment.

Third Quarter 2014 Capital Markets Activity

Convertible Notes Offering � In August, the Company completed a public offering of $111.0 million aggregate principal amount of its 5.50% Convertible Senior Notes due 2019 (the �Notes�). The Notes were priced at 102% of face value plus accrued interest from, and including, March�17, 2014. The Notes are an additional issuance of, are fully fungible with and form a single series with the $143,750,000 aggregate principal amount of the Company�s 5.50% Convertible Senior Notes due 2019 issued in March 2014. The conversion rate will initially equal 55.3649 shares of common stock per $1,000 principal amount of Notes, which is equivalent to a conversion price of approximately $18.06 per share of common stock.

�

2

Quarter End Commercial Real Estate Debt Portfolio Summary

The following table sets forth certain information regarding the Company�s commercial real estate debt portfolio at September�30, 2014 ($ amounts in thousands):

�

| Description |

�� | Amortized Cost |

� | �� | Weighted Average Yield |

� | � | Debt | � | �� | Cost of Funds |

� | � | Equity at Cost(1) |

� | �� | Current Weighted Average Underwritten IRR (2) |

� | � | Levered Weighted Average Underwritten IRR(2)(3) |

� | |||||||

| First mortgage loans |

�� | $ | 369,924 | �� | �� | � | 8.9 | %� | � | $ | 122,722 | �� | �� | � | 2.7 | %� | � | $ | 247,202 | �� | �� | � | 13.0 | %� | � | � | 15.6 | %� |

| Subordinate loans |

�� | � | 585,504 | �� | �� | � | 12.0 | �� | � | � | ��� | �� | �� | � | ��� | �� | � | � | 585,504 | �� | �� | � | 12.8 | �� | � | � | 12.8 | �� |

| CMBS, held-to-maturity(4)(5) |

�� | � | 64,580 | �� | �� | � | 12.2 | �� | � | � | ��� | �� | �� | � | ��� | �� | � | � | 64,580 | �� | �� | � | 12.2 | �� | � | � | 12.2 | �� |

| CMBS |

�� | � | 511,445 | �� | �� | � | 6.3 | �� | � | � | 415,044 | �� | �� | � | 3.3 | �� | � | � | 99,988 | �� | �� | � | 16.1 | �� | � | � | 16.1 | �� |

| �� | � |

� |

� | �� | � |

� |

� | � | � |

� |

� | �� | � |

� |

� | � | � |

� |

� | �� | � |

� |

� | � | � |

� |

� | |

| Total/Weighted Average |

�� | $ | 1,531,453 | �� | �� | � | 9.4 | %� | � | $ | 537,766 | �� | �� | � | 3.2 | %� | � | $ | 997,274 | �� | �� | � | 13.1 | %� | � | � | 13.7 | %� |

| �� | � |

� |

� | �� | � |

� |

� | � | � |

� |

� | �� | � |

� |

� | � | � |

� |

� | �� | � |

� |

� | � | � |

� |

� | |

�

| (1) | CMBS includes $30,127 of restricted cash related to the Company�s repurchase facility with UBS AG and $26,540 related to investments purchased but not yet settled. |

| (2) | The underwritten IRR for the investments shown in the above table and elsewhere in this press release reflect the returns underwritten by ACREFI Management, LLC, the Company�s external manager, calculated on a weighted average basis assuming no dispositions, early prepayments or defaults but assuming that extension options are exercised and that the cost of borrowings remains constant over the remaining term. With respect to certain loans, the underwritten IRR calculation assumes certain estimates with respect to the timing and magnitude of future fundings for the remaining commitments and associated loan repayments, and assumes no defaults. IRR is the annualized effective compounded return rate that accounts for the time-value of money and represents the rate of return on an investment over a holding period expressed as a percentage of the investment. It is the discount rate that makes the net present value of all cash outflows (the costs of investment) equal to the net present value of cash inflows (returns on investment). It is derived from the negative and positive cash flows resulting from or produced by each transaction (or for a transaction involving more than one investment, cash flows resulting from or produced by each of the investments), whether positive, such as investment returns, or negative, such as transaction expenses or other costs of investment, taking into account the dates on which such cash flows occurred or are expected to occur, and compounding interest accordingly. There can be no assurance that the actual IRRs will equal the underwritten IRRs shown in the table.�See �Item 1A�Risk Factors�The Company may not achieve its underwritten internal rate of return on its investments which may lead to future returns that may be significantly lower than anticipated� included in the Company�s Annual Report on Form 10-K for the year ended December�31, 2013 for a discussion of some of the factors that could adversely impact the returns received by the Company from the investments shown in the table over time. |

| (3) | The Company�s ability to achieve its underwritten levered weighted average IRR with regard to its portfolio of first mortgage loans is additionally dependent upon the Company utilizing its master repurchase agreement with JPMorgan Chase Bank, N.A. or any replacement facility with similar terms and re-borrowing approximately $52,278 in total.�Without such re-borrowing, the levered weighted average underwritten IRRs will be as indicated in the current weighted average underwritten IRR column above. |

| (4) | CMBS, held-to-maturity, represents a loan the Company closed during May 2014 that was subsequently contributed to a securitization during August 2014. During May 2014, the Company closed a $155,000 floating-rate whole loan secured by the first mortgage and equity interests in an entity that owns a resort hotel in Aruba. During June 2014, the Company syndicated a $90,000 senior participation in the loan and retained a $65,000 junior participation. During August 2014, both the $90,000 senior participation and the Company�s $65,000 junior participation were contributed to a CMBS securitization. In exchange for contributing its $65,000 junior participation, the Company received a CMBS secured solely by the $65,000 junior participation. |

| (5) | CMBS, held-to-maturity, are net of the participation sold during June 2014 described above. ARI presents the participation sold as both assets and non-recourse liabilities because the participation does not qualify as a sale according to GAAP. At September�30, 2014, ARI had one such participation sold with a carrying amount of $89,418. |

Loan-to-Value

At September�30, 2014, the Company�s commercial real estate loan portfolio, which includes CMBS, held-to-maturity, had a weighted average LTV of 58%. Within the commercial real estate loan portfolio, the first mortgage loans had a weighted average LTV of 49% and the subordinate loans and CMBS, held-to-maturity, had a weighted average LTV of 63%.

�

3

Book Value

The Company�s book value per share at September�30, 2014 was $16.42, an increase of 1% as compared to book value per share of $16.30 at June�30, 2014. For purposes of GAAP accounting, the Company carries loans at amortized cost and its CMBS are marked to market. Management has estimated that the fair value of the Company�s loan portfolio at September�30, 2014 was approximately $7.0 million greater than the carrying value as of the same date.

Subsequent Events

New Investments � Subsequent to quarter end, ARI invested $4.7 million of equity into CMBS with an aggregate purchase price of $23.3 million.

Dividend � ARI�s Board of Directors declared a dividend of $0.40 per share of common stock, which is payable on January�15, 2015 to common stockholders of record on December�31, 2014.

Definition of Operating Earnings

Operating Earnings is a non-GAAP financial measure that is used by the Company to approximate cash available for distribution and is defined by the Company as net income available to common stockholders, computed in accordance with GAAP, adjusted for (i)�equity-based compensation expense (a portion of which may become cash-based upon final vesting and settlement of awards should the holder elect net share settlement to satisfy income tax withholding); (ii)�any unrealized gains or losses or other non-cash items included in net income available to common stockholders; (iii)�unrealized income from equity investments; and (iv)�the non-cash amortization expense related to the reclassification of a portion of the senior convertible notes to stockholders� equity in accordance with GAAP.

Reconciliation of Operating Earnings to Net Income Available to Common Stockholders

The tables below reconcile Operating Earnings and Operating Earnings per share with net income available to common stockholders and net income available to common stockholders per share for the three and nine month periods ended September�30, 2014 and September�30, 2013 ($ amounts in thousands, except share and per share data):

�

| � | �� | Three Months Ended September�30, 2014 |

� | � | Earnings�Per Share (Diluted) |

� | � | Three Months Ended September�30, 2013 |

� | � | Earnings Per�Share (Diluted) |

� | ||||

| Operating Earnings: |

�� | � | � | � | ||||||||||||

| Net income available to common stockholders |

�� | $ | 17,299 | �� | � | $ | 0.37 | �� | � | $ | 11,041 | �� | � | $ | 0.29 | �� |

| Adjustments: |

�� | � | � | � | ||||||||||||

| Unrealized (gain)/loss on securities |

�� | � | 2,147 | �� | � | � | 0.04 | �� | � | � | 1,472 | �� | � | � | 0.04 | �� |

| Unrealized (gain)/loss on derivative instruments |

�� | � | (3,026 | )� | � | � | (0.07 | )� | � | � | (25 | )� | � | � | ��� | �� |

| Foreign currency loss |

�� | � | 3,596 | �� | � | � | 0.08 | �� | � | � | ��� | �� | � | � | ��� | �� |

| Equity-based compensation expense |

�� | � | 308 | �� | � | � | 0.01 | �� | � | � | 784 | �� | � | � | 0.02 | �� |

| Income from equity investment |

�� | � | 88 | �� | � | � | ��� | �� | � | � | ��� | �� | � | � | ��� | �� |

| Amortization of convertible notes related to equity reclassification |

�� | � | 356 | �� | � | � | 0.01 | �� | � | � | ��� | �� | � | � | ��� | �� |

| �� | � |

� |

� | � | � |

� |

� | � | � |

� |

� | � | � |

� |

� | |

| Total adjustments: |

�� | � | 3,469 | �� | � | � | 0.07 | �� | � | � | 2,231 | �� | � | � | 0.06 | �� |

| �� | � |

� |

� | � | � |

� |

� | � | � |

� |

� | � | � |

� |

� | |

| Operating Earnings |

�� | $ | 20,768 | �� | � | $ | 0.44 | �� | � | $ | 13,272 | �� | � | $ | 0.35 | �� |

| �� | � |

� |

� | � | � |

� |

� | � | � |

� |

� | � | � |

� |

� | |

| Basic weighted average shares of common stock outstanding: |

�� | � | 46,848,675 | �� | � | � | � | 36,883,002 | �� | � | ||||||

| Diluted weighted average shares of common stock outstanding: |

�� | � | 47,068,929 | �� | � | � | � | 37,379,469 | �� | � | ||||||

�

4

| � | �� | Nine Months Ended September�30, 2014 |

� | � | Earnings�Per Share (Diluted) |

� | � | Nine Months Ended September�30, 2013 |

� | � | Earnings Per�Share (Diluted) |

� | ||||

| Operating Earnings: |

�� | � | � | � | ||||||||||||

| Net income available to common stockholders |

�� | $ | 55,118 | �� | � | $ | 1.30 | �� | � | $ | 31,041 | �� | � | $ | 0.88 | �� |

| Adjustments: |

�� | � | � | � | ||||||||||||

| Unrealized (gain)/loss on securities |

�� | � | (4,787 | )� | � | � | (0.11 | )� | � | � | 3,973 | �� | � | � | 0.11 | �� |

| Unrealized (gain)/loss on derivative instruments |

�� | � | (1,933 | )� | � | � | (0.05 | )� | � | � | (155 | )� | � | � | ��� | �� |

| Foreign currency loss |

�� | � | 2,637 | �� | � | � | 0.06 | �� | � | � | ��� | �� | � | � | ��� | �� |

| Equity-based compensation expense |

�� | � | 1,096 | �� | � | � | 0.03 | �� | � | � | 2,095 | �� | � | � | 0.06 | �� |

| Income from equity investments |

�� | � | 88 | �� | � | � | ��� | �� | � | � | ��� | �� | � | � | ��� | �� |

| Amortization of convertible notes related to equity reclassification |

�� | � | 586 | �� | � | � | 0.01 | �� | � | � | ��� | �� | � | � | ��� | �� |

| �� | � |

� |

� | � | � |

� |

� | � | � |

� |

� | � | � |

� |

� | |

| Total adjustments: |

�� | � | (2,313 | )� | � | � | (0.06 | )� | � | � | 5,913 | �� | � | � | 0.17 | �� |

| �� | � |

� |

� | � | � |

� |

� | � | � |

� |

� | � | � |

� |

� | |

| Operating Earnings |

�� | $ | 52,805 | �� | � | $ | 1.24 | �� | � | $ | 36,954 | �� | � | $ | 1.05 | �� |

| �� | � |

� |

� | � | � |

� |

� | � | � |

� |

� | � | � |

� |

� | |

| Basic weighted average shares of common stock outstanding: |

�� | � | 42,322,380 | �� | � | � | � | 34,647,941 | �� | � | ||||||

| Diluted weighted average shares of common stock outstanding: |

�� | � | 42,538,744 | �� | � | � | � | 35,103,285 | �� | � | ||||||

Teleconference Details:

The Company will host a conference call to discuss its financial results on Wednesday, October�29, 2014 at 9:00 a.m. Eastern Time. Members of the public who are interested in participating in the Company�s third quarter 2014 earnings teleconference call should dial from the U.S., (877)�331-6553, or from outside the U.S., (760)�666-3769, shortly before 9:00 a.m. and reference the Apollo Commercial Real Estate Finance, Inc. Teleconference Call (number 15213082). Please note the teleconference call will be available for replay beginning at 1:00 p.m. on Wednesday, October�29, 2014, and ending at midnight on Wednesday, November�5, 2014. To access the replay, callers from the U.S. should dial (855)�859-2056 and callers from outside the U.S. should dial (404)�537-3406, and enter conference identification number 15213082.

Webcast:

The conference call will also be available on the Company�s website at www.apolloreit.com. To listen to a live broadcast, please go to the site at least 15 minutes prior to the scheduled start time in order to register, download and install any necessary audio software. A replay of the call will also be available for 30 days on the Company�s website.

Supplemental Information

The Company provides supplemental financial information to offer more transparency into its results and make its reporting more informative and easier to follow. The supplemental financial information is available in the investor relations section of the Company�s website at www.apolloreit.com.

About Apollo Commercial Real Estate Finance, Inc.

Apollo Commercial Real Estate Finance, Inc. (NYSE: ARI) is a real estate investment trust that primarily originates, acquires, invests in and manages performing commercial real estate mortgage loans, subordinate financings, CMBS and other commercial real estate-related debt investments. The Company is externally managed and advised by ACREFI Management, LLC, a Delaware limited liability company and an indirect subsidiary of Apollo Global Management, LLC, a leading global alternative investment manager with approximately $168 billion of assets under management at June�30, 2014.

Additional information can be found on the Company�s website at www.apolloreit.com.

�

5

Dividend Reinvestment Plan

The Company adopted a Direct Stock Purchase and Dividend Reinvestment Plan (the �Plan�). The Plan provides new investors and existing holders of the Company�s common stock with a convenient and economical method to purchase shares of its common stock. By participating in the Plan, participants may purchase additional shares of the Company�s common stock by reinvesting some or all of the cash dividends received on their shares of the Company�s common stock. In addition, the Plan permits participants to make optional cash investments of up to $10,000 per month, and, with the Company�s prior approval, optional cash investments in excess of $10,000 per month, for the purchase of additional shares of the Company�s common stock.

The Plan is administered by a division of Wells Fargo Bank, N.A. (�Wells�). Stockholders and other persons may obtain a copy of the Plan prospectus and an enrollment form by contacting Wells at (800)�468-9716 or (651)�450-4064, if outside the United States, or visiting Wells� website at www.shareowneronline.com.

This communication does not constitute an offer to sell or the solicitation of an offer to buy securities.

Forward-Looking Statements

Certain statements contained in this press release constitute forward-looking statements as such term is defined in Section�27A of the Securities Act of 1933, as amended, and Section�21E of the Securities Exchange Act of 1934, as amended, and such statements are intended to be covered by the safe harbor provided by the same. Forward-looking statements are subject to substantial risks and uncertainties, many of which are difficult to predict and are generally beyond the Company�s control. These forward-looking statements include information about possible or assumed future results of the Company�s business, financial condition, liquidity, results of operations, plans and objectives. When used in this release, the words believe, expect, anticipate, estimate, plan, continue, intend, should, may or similar expressions, are intended to identify forward-looking statements. Statements regarding the following subjects, among others, may be forward-looking: the return on equity; the yield on investments; the ability to borrow to finance assets; the Company�s ability to deploy the proceeds of its capital raises or acquire its target assets; and risks associated with investing in real estate assets, including changes in business conditions and the general economy. For a further list and description of such risks and uncertainties, see the reports filed by the Company with the Securities and Exchange Commission. The forward-looking statements, and other risks, uncertainties and factors are based on the Company�s beliefs, assumptions and expectations of its future performance, taking into account all information currently available to the Company. Forward-looking statements are not predictions of future events. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

�

6

Apollo Commercial Real Estate Finance, Inc. and Subsidiaries

Condensed Consolidated Balance Sheets (Unaudited)

(in thousands�except share and per share data)

�

| � | �� | September�30,�2014 | � | � | December�31,�2013 | � | ||

| Assets: |

�� | � | ||||||

| Cash |

�� | $ | 58,649 | �� | � | $ | 20,096 | �� |

| Restricted cash |

�� | � | 30,127 | �� | � | � | 30,127 | �� |

| Securities available-for-sale, at estimated fair value |

�� | � | 17,919 | �� | � | � | 33,362 | �� |

| Securities, at estimated fair value |

�� | � | 499,701 | �� | � | � | 158,086 | �� |

| Securities, held-to-maturity |

�� | � | 153,998 | �� | � | � | ��� | �� |

| Commercial mortgage loans, held for investment |

�� | � | 369,924 | �� | � | � | 161,099 | �� |

| Subordinate loans, held for investment |

�� | � | 585,504 | �� | � | � | 497,484 | �� |

| Investment in unconsolidated joint venture |

�� | � | 38,719 | �� | � | � | ��� | �� |

| Derivative instrument |

�� | � | 1,933 | �� | � | � | ��� | �� |

| Interest receivable |

�� | � | 17,072 | �� | � | � | 6,022 | �� |

| Deferred financing costs, net |

�� | � | 8,124 | �� | � | � | 628 | �� |

| Other assets |

�� | � | 1,342 | �� | � | � | 600 | �� |

| �� | � |

� |

� | � | � |

� |

� | |

| Total Assets |

�� | $ | 1,783,012 | �� | � | $ | 907,504 | �� |

| �� | � |

� |

� | � | � |

� |

� | |

| Liabilities and Stockholders� Equity |

�� | � | ||||||

| Liabilities: |

�� | � | ||||||

| Borrowings under repurchase agreements |

�� | $ | 537,766 | �� | � | $ | 202,033 | �� |

| Convertible senior notes, net |

�� | � | 246,054 | �� | � | � | ��� | �� |

| Participations sold |

�� | � | 89,418 | �� | � | � | ��� | �� |

| Investments purchased, not yet settled |

�� | � | 26,540 | �� | � | � | ��� | �� |

| Accounts payable and accrued expenses |

�� | � | 3,602 | �� | � | � | 2,660 | �� |

| Payable to related party |

�� | � | 3,193 | �� | � | � | 2,628 | �� |

| Dividends payable |

�� | � | 20,753 | �� | � | � | 17,227 | �� |

| �� | � |

� |

� | � | � |

� |

� | |

| Total Liabilities |

�� | � | 927,326 | �� | � | � | 224,548 | �� |

| Stockholders� Equity: |

�� | � | ||||||

| Preferred stock, $0.01 par value, 50,000,000 shares authorized and 3,450,000 shares issued and outstanding in 2014 and 2013 ($86,250 aggregate liquidation preference) |

�� | � | 35 | �� | � | � | 35 | �� |

| Common stock, $0.01 par value, 450,000,000 shares authorized, 46,848,675 and 36,888,467 shares issued and outstanding in 2014 and 2013, respectively |

�� | � | 468 | �� | � | � | 369 | �� |

| Additional paid-in-capital |

�� | � | 867,598 | �� | � | � | 697,610 | �� |

| Retained earnings (accumulated deficit) |

�� | � | (11,661 | )� | � | � | (14,188 | )� |

| Accumulated other comprehensive loss |

�� | � | (754 | )� | � | � | (870 | )� |

| �� | � |

� |

� | � | � |

� |

� | |

| Total Stockholders� Equity |

�� | � | 855,686 | �� | � | � | 682,956 | �� |

| �� | � |

� |

� | � | � |

� |

� | |

| Total Liabilities and Stockholders� Equity |

�� | $ | 1,783,012 | �� | � | $ | 907,504 | �� |

| �� | � |

� |

� | � | � |

� |

� | |

�

�

7

Apollo Commercial Real Estate Finance, Inc. and Subsidiaries

Condensed Consolidated Statement of Operations (Unaudited)

(in thousands�except share and per share data)

�

| � | �� | Three months ended September�30, |

� | � | Nine months ended September�30, |

� | ||||||||||

| � | �� | 2014 | � | � | 2013 | � | � | 2014 | � | � | 2013 | � | ||||

| Net interest income: |

�� | � | � | � | ||||||||||||

| Interest income from securities |

�� | $ | 6,129 | �� | � | $ | 2,533 | �� | � | $ | 12,914 | �� | � | $ | 8,634 | �� |

| Interest income from securities, held to maturity |

�� | � | 2,219 | �� | � | � | ��� | �� | � | � | 2,219 | �� | � | � | ��� | �� |

| Interest income from commercial mortgage loans |

�� | � | 8,025 | �� | � | � | 4,954 | �� | � | � | 18,475 | �� | � | � | 12,222 | �� |

| Interest income from subordinate loans |

�� | � | 18,983 | �� | � | � | 12,184 | �� | � | � | 51,951 | �� | � | � | 35,137 | �� |

| Interest income from repurchase agreements |

�� | � | ��� | �� | � | � | ��� | �� | � | � | ��� | �� | � | � | 2 | �� |

| Interest expense |

�� | � | (8,786 | )� | � | � | (885 | )� | � | � | (15,802 | )� | � | � | (2,909 | )� |

| �� | � |

� |

� | � | � |

� |

� | � | � |

� |

� | � | � |

� |

� | |

| Net interest income |

�� | � | 26,570 | �� | � | � | 18,786 | �� | � | � | 69,757 | �� | � | � | 53,086 | �� |

| Operating expenses: |

�� | � | � | � | ||||||||||||

| General and administrative expenses (includes $308 and $1,096 of equity-based compensation in 2014 and $784 and $2,095 in 2013, respectively) |

�� | � | (1,434 | )� | � | � | (1,793 | )� | � | � | (4,355 | )� | � | � | (5,126 | )� |

| Management fees to related party |

�� | � | (3,193 | )� | � | � | (2,625 | )� | � | � | (8,725 | )� | � | � | (7,384 | )� |

| �� | � |

� |

� | � | � |

� |

� | � | � |

� |

� | � | � |

� |

� | |

| Total operating expenses |

�� | � | (4,627 | )� | � | � | (4,418 | )� | � | � | (13,080 | )� | � | � | (12,510 | )� |

| Income from equity investment |

�� | � | (88 | )� | � | � | ��� | �� | � | � | (88 | )� | � | � | ��� | �� |

| Interest income from cash balances |

�� | � | 21 | �� | � | � | 3 | �� | � | � | 26 | �� | � | � | 19 | �� |

| Unrealized gain/(loss) on securities |

�� | � | (2,147 | )� | � | � | (1,472 | )� | � | � | 4,787 | �� | � | � | (3,973 | )� |

| Foreign currency gain/(loss) |

�� | � | (3,596 | )� | � | � | ��� | �� | � | � | (2,637 | )� | � | � | ��� | �� |

| Gain/(loss) on derivative instruments (includes $3,026 and $1,933 of unrealized gains in 2014 and $25 and $155 of unrealized gains in 2013, respectively) |

�� | � | 3,026 | �� | � | � | 1 | �� | � | � | 1,933 | �� | � | � | (1 | )� |

| �� | � |

� |

� | � | � |

� |

� | � | � |

� |

� | � | � |

� |

� | |

| Net income |

�� | � | 19,159 | �� | � | � | 12,900 | �� | � | � | 60,698 | �� | � | � | 36,621 | �� |

| �� | � |

� |

� | � | � |

� |

� | � | � |

� |

� | � | � |

� |

� | |

| Preferred dividend |

�� | � | (1,860 | )� | � | � | (1,859 | )� | � | � | (5,580 | )� | � | � | (5,580 | )� |

| �� | � |

� |

� | � | � |

� |

� | � | � |

� |

� | � | � |

� |

� | |

| Net income available to common stockholders |

�� | $ | 17,299 | �� | � | $ | 11,041 | �� | � | $ | 55,118 | �� | � | $ | 31,041 | �� |

| �� | � |

� |

� | � | � |

� |

� | � | � |

� |

� | � | � |

� |

� | |

| Basic and diluted net income per share of common stock |

�� | $ | 0.37 | �� | � | $ | 0.29 | �� | � | $ | 1.30 | �� | � | $ | 0.88 | �� |

| �� | � |

� |

� | � | � |

� |

� | � | � |

� |

� | � | � |

� |

� | |

| Basic weighted average shares of common stock outstanding |

�� | � | 46,848,675 | �� | � | � | 36,883,002 | �� | � | � | 42,332,380 | �� | � | � | 34,647,941 | �� |

| �� | � |

� |

� | � | � |

� |

� | � | � |

� |

� | � | � |

� |

� | |

| Diluted weighted average shares of common stock outstanding |

�� | � | 47,068,929 | �� | � | � | 37,379,469 | �� | � | � | 42,538,744 | �� | � | � | 35,103,285 | �� |

| �� | � |

� |

� | � | � |

� |

� | � | � |

� |

� | � | � |

� |

� | |

| Dividend declared per share of common stock |

�� | $ | 0.40 | �� | � | $ | 0.40 | �� | � | $ | 1.20 | �� | � | $ | 1.20 | �� |

| �� | � |

� |

� | � | � |

� |

� | � | � |

� |

� | � | � |

� |

� | |

�

8

October 29, 2014

Supplemental Financial Information Presentation

Q3 2014

Information is as of September 30, 2014 except as otherwise noted.�

It should not be assumed that investments made in the future will

be profitable or will equal the performance of investments in this document.

Exhibit 99.2 |

Legal Disclaimer

1

COMMERCIAL REAL ESTATE FINANCE, INC. (�ARI�)

This presentation may contain forward-looking statements that are

within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities

Exchange Act of 1934, as amended, and such statements are intended to

be covered by the safe harbor provided by the same. Forward-looking statements are subject to substantial risks

and uncertainties, many of which are difficult to predict and are

generally beyond management�s control. These forward-looking statements include information about possible

or assumed future results of Apollo Commercial Real Estate Finance,

Inc.�s (�ARI� or the �Company�) business, financial condition, liquidity, results of operations, plans and

objectives. When used in this presentation, the words

�believe,� �expect,� �anticipate,� �estimate,� �plan,� �continue,� �intend,� �should,� �may� or similar expressions, are

intended to identify forward-looking statements. Statements

regarding the following subjects, among others, may be forward-looking: ARI�s business and investment strategy; ARI�s

operating results; ARI�s ability to obtain and maintain financing

arrangements; the return on equity, the yield on investments and risks associated with investing in real estate

assets, including changes in business conditions and the general

economy. The forward-looking

statements are based on management�s beliefs, assumptions and expectations of future performance, taking into account all information currently available to ARI.

Forward-looking statements are not predictions of future events.

These beliefs, assumptions and expectations can change as a result of many possible events or factors, not all

of which are known to ARI. Some of these factors are described under

�Risk Factors,� and �Management�s Discussion and Analysis of Financial Condition and Results of

Operations� as included in ARI�s Annual Report on Form

10-K for the fiscal year ended December 31, 2013 and other periodic reports filed with the Securities and Exchange

Commission (�SEC�), which are accessible on the SEC�s

website at www.sec.gov. If a change occurs, ARI�s business, financial condition, liquidity and results of operations may vary

materially from those expressed in ARI�s forward-looking

statements. Any forward-looking statement speaks only as of the date on which it is made. New risks and uncertainties arise

over time, and it is not possible for management to predict those

events or how they may affect ARI. Except as required by law, ARI is not obligated to, and does not intend to, update or

revise any forward-looking statements, whether as a result of new

information, future events or otherwise.

This presentation contains information regarding ARI�s financial

results that is calculated and presented on the basis of methodologies other than in accordance with accounting

principles generally accepted in the United States (�GAAP�),

including Operating Earnings and Operating Earnings per share.� Please refer to slide 3 for a definition of �Operating

Earnings� and the reconciliation of �Operating Earnings�

to the applicable GAAP financial measure set forth on slide 19.

This presentation may contain statistics and other data that in some

cases has been obtained from or compiled from information made available by third-party service providers.� ARI

makes no representation or warranty, expressed or implied, with respect

to the accuracy, reasonableness or completeness of such information.

Past performance is not indicative nor a guarantee of future

returns.

Index performance and yield data are shown for illustrative purposes

only and have limitations when used for comparison or for other purposes due to, among other matters, volatility,

credit or other factors (such as number and types of securities).�

Indices are unmanaged, do not charge any fees or expenses, assume reinvestment of income and do not employ special

investment techniques such as leveraging or short selling.� No

such index is indicative of the future results of any investment by ARI. |

Apollo Commercial Real Estate Finance, Inc.

2014 Third Quarter Earnings Call

October 29, 2014

Stuart Rothstein

Chief Executive Officer and President

Scott Weiner

Chief Investment Officer of the Manager

Megan Gaul

Chief Financial Officer, Treasurer and Secretary

Hilary Ginsberg

Investor Relations Manager

2

COMMERCIAL REAL ESTATE FINANCE, INC. (�ARI�)

|

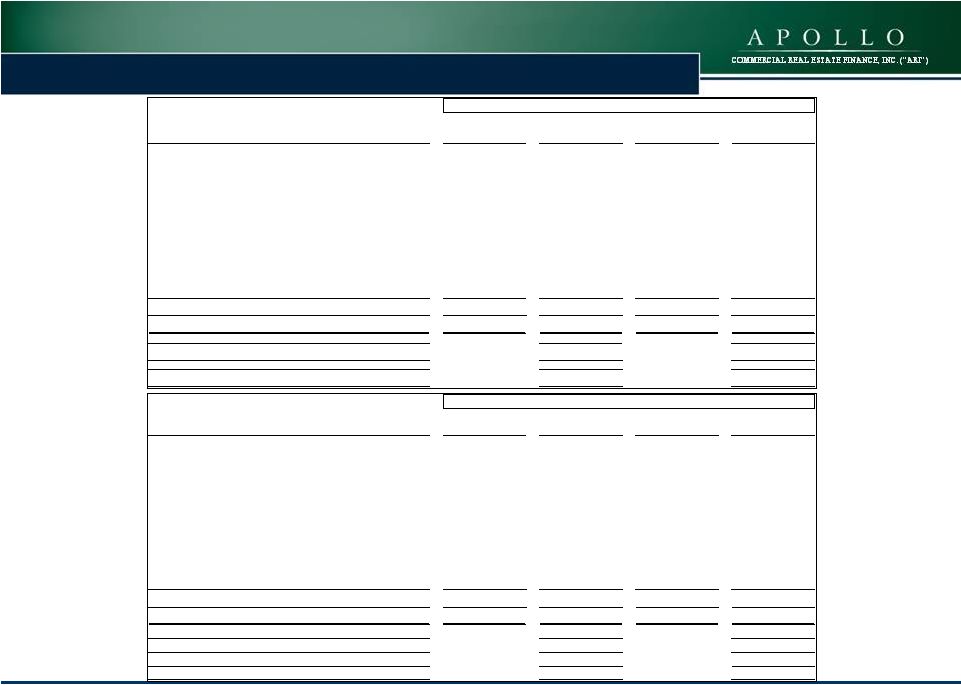

ARI �

Financial Summary

COMMERCIAL REAL ESTATE FINANCE, INC. (�ARI�)

3

(1)

Operating

Earnings

is

a

non-GAAP

financial

measure

that

is

used

by

the

Company

to

approximate

cash

available

for

distribution

and

is

defined

by

the

Company

as

net

income

available

to

common

stockholders,

computed

in

accordance

with

GAAP,

adjusted

for

(i) equity-

based

compensation

expense

(a

portion

of

which

may

become

cash-based

upon

final

vesting

and

settlement

of

awards

should

the

holder

elect

net

share

settlement

to

satisfy

income

tax

withholding),

(ii)

any

unrealized

gains

or

losses

or

other

non-cash

items

included

in

net

income,

(iii)

unrealized

income

from

equity

investments

and

(iv)

the

non-cash

amortization

expense

related

to

the

reclassification

of

a

portion

of

the

senior

convertible

notes

to

stockholders�

equity

in

accordance

with

GAAP.

Please

see

slide

19

for

a

reconciliation

of

Operating

Earnings

and

Operating

Earnings

per

Share

to

GAAP

net

income

and

GAAP

net

income

per

share.

(2)

Commercial

Mortgage

Backed

Securities,

(�CMBS�)

held-to-maturity,

are

net

of

a

participation

sold

during

June

2014.

ARI

presents

the

participation

sold

as

both

assets

and

non-recourse

liabilities

because

the

participation

does

not

qualify

as

a

sale

according

to

GAAP.

At

September

30,

2014,

ARI

had

one

such

participation

sold

with

a

carrying

amount

of

$89,418

(3)

Fixed� charge� coverage� is� EBITDA�

divided� by� interest� expense� plus� the� preferred� stock� dividends.

Net interest income

Operating earnings

1,531,453

$��

997,274

$����

Common stockholders' equity

769,436

$����

86,250

$������

537,766

$����

Convertible senior notes

246,054

$����

1.21x

3.8x

Interest income

Interest expense

Operating earnings per share

Diluted weighted average shares of common

stock outstanding

Investments at amortized cost

Net equity in investments at cost

Preferred stockholders' equity

Debt to common equity

Outstanding repurchase agreement borrowings

Fixed charge coverage

($ amounts in thousands, except per share data)

Income Statement

September 30, 2014

September 30, 2013

% Change

September 30, 2014

September 30, 2013

% Change

35,356

$������

85,559

$������

$�������

52.8%

(8,786)

$������

(15,802)

$�����

(2,909)

$��������

443.2%

26,570

$������

69,757

$������

53,086

$�������

31.4%

20,768

$������

52,805

$������

36,954

$�������

42.9%

0.44

$���������

1.24

$���������

1.05

$�����������

18.1%

47,068,929

37,379,469

25.9%

42,538,744

35,103,285

21.2%

Three Months Ended

Nine Months Ended

19,671

$�����������

79.7%

$�����������

��� 892.8%

18,786

$�����������

41.4%

13,272

$�����������

56.5%

0.35

$�����������

���� 25.7%

Balance sheet

September 30, 2014

December 31, 2013

% Change

55,995

(885)

848,761

$����������

80.4%

676,855

$����������

47.3%

596,706

$����������

28.9%

86,250

$�����������

-

202,033

$����������

166.2%

$�����������

����� 100.0%

0.4x

5.3x

(1)

(1)

(2)

(3)

- |

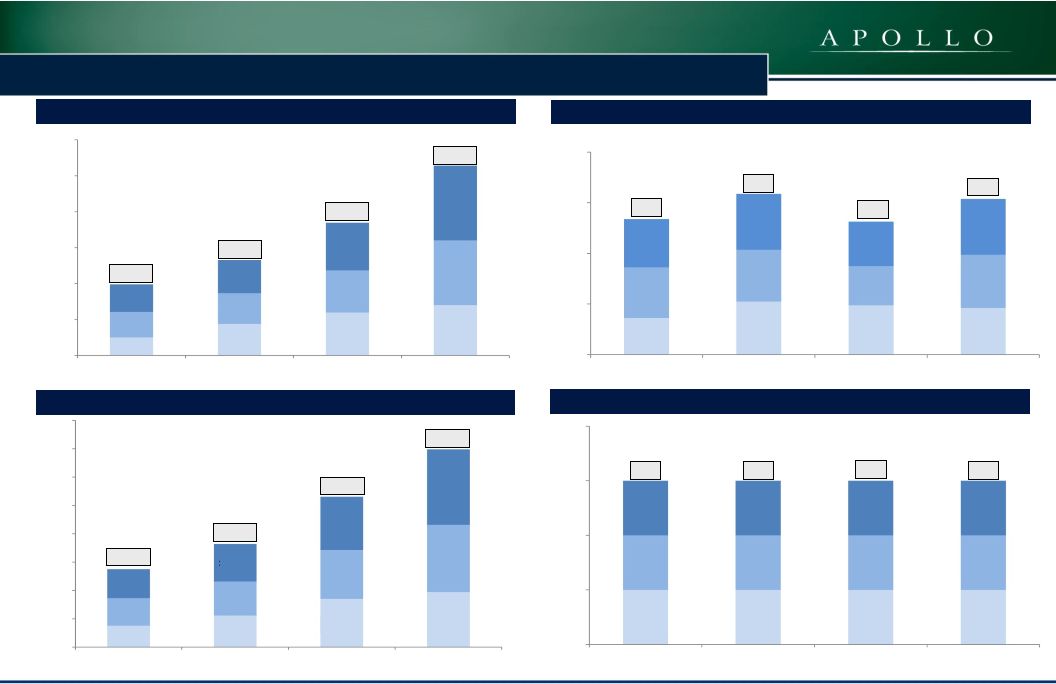

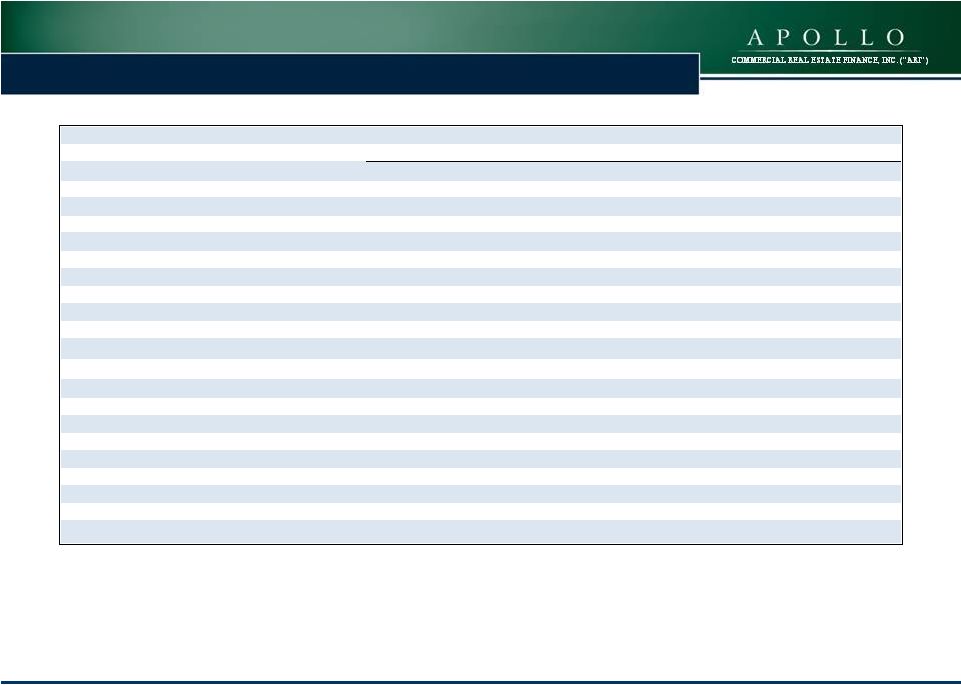

Operating Earnings ($000s)

(1)

Net Interest Income ($000s)

Dividends per Common Share

(1)

Operating Earnings is a non-GAAP financial measure that is used by

the Company to approximate cash available for distribution and is defined by the Company as net income available to common stockholders, computed in accordance with GAAP, adjusted for (i) equity-based compensation

expense (a portion of which may become cash-based upon final vesting

and settlement of awards should the holder elect net share settlement to satisfy income tax withholding), (ii) any unrealized gains or losses or other non-cash items included in net income, (iii) unrealized income from equity

investments and (iv) the non-cash amortization expense related to

the reclassification of a portion of the senior convertible notes to stockholders�

equity in accordance with GAAP.� Please see slide 19 for a

reconciliation of Operating Earnings and Operating Earnings per Share to GAAP net

income and GAAP net income per share.

Operating

Earnings

per

Common

Share

(1)

ARI �

Historical Financial Overview

$1.24

$1.05

$1.20

$1.20

$1.20

$1.20

$1.27

$1.07

$52,805

$36,954

$26,538

$19,775

$27,518

$36,375

$53,086

$69,757

$0

$10,000

$20,000

$30,000

$40,000

$50,000

$60,000

$5,047

$8,796

$7,086

$8,526

$7,643

$9,218

$11,963

$13,991

$11,721

$18,045

$13,272

$20,768

Nine Months Ended

September 30, 2011

Nine Months Ended

September 30, 2012

Nine Months Ended

September 30, 2013

Nine Months Ended

September 30, 2014

$0.00

$0.40

$0.80

$1.20

$1.60

$0.29

$0.42

$0.39

$0.37

$0.40

$0.41

$0.31

$0.42

$0.38

$0.44

$0.35

$0.44

Nine Months Ended

September 30, 2011

Nine Months Ended

September 30, 2012

Nine Months Ended

September 30, 2013

Nine Months Ended

September 30, 2014

$0

$10,000

$20,000

$30,000

$40,000

$50,000

$60,000

$70,000

$80,000

$7,599

$11,187

$17,067

$19,403

$9,683

$11,951

$17,233

$23,784

$10,236

$13,236

$18,786

$26,570

$0.00

$0.40

$0.80

$1.20

$1.60

Nine Months Ended

September 30, 2011

Nine Months Ended

September 30, 2012

Nine Months Ended

September 30, 2013

Nine Months Ended

September 30, 2014

$0.40

$0.40

$0.40

$0.40

$0.40

$0.40

$0.40

$0.40

$0.40

$0.40

$0.40

$0.40

Nine Months Ended

September 30, 2011

Nine Months Ended

September 30, 2012

Nine Months Ended

September 30, 2013

Nine Months Ended

September 30, 2014

4

COMMERCIAL REAL ESTATE FINANCE, INC. (�ARI�)

|

5

COMMERCIAL REAL ESTATE FINANCE, INC. (�ARI�)

ARI �

Q3 Financial Highlights

Financial Results & Earnings Per Share

Operating Earnings for the quarter ended September 30, 2014 of $20.8

million, or $0.44 per share of common stock, a 26% per share

increase as compared to Operating Earnings of $13.3 million, or $0.35 per share of

common

stock

for

the

quarter

ended

September

30,

2013

(1)

�

Net interest income of $26.6 million for Q3 2014

�

Total expenses of $4.6 million, comprised of management fees of $3.2

million, G&A of $1.1 million and equity-based

compensation of $0.3 million

�

Net income available to common stockholders for the quarter ended

September 30, 2014 of $17.3 million, or $0.37 per diluted share

of common stock Dividends

Declared a dividend of $0.40 per share of common stock for the quarter

ending December 31, 2014 �

9.8% annualized dividend yield based on $16.40 closing price on

October 27, 2014 Declared a dividend on the Company�s 8.625%

Series A Cumulative Redeemable Perpetual Preferred Stock of

$0.5391 per share for stockholders of record on September 30,

2014 Book Value

GAAP book value of $16.42 per share as of September 30, 2014

(1)

Operating Earnings is a non-GAAP financial measure that is used by

the Company to approximate cash available for distribution and is defined by the Company as net income available to common stockholders, computed in accordance with GAAP, adjusted for (i) equity-based compensation

expense (a portion of which may become cash-based upon final vesting

and settlement of awards should the holder elect net share settlement to satisfy income tax withholding) (ii) any unrealized gains or losses or other non-cash items included in net income (iii) unrealized

income

from

equity

investments

and

(iv)

the

non-cash

amortization

expense

related

to

the

reclassification

of

a

portion

of

the

senior

convertible

notes

to

stockholders�

equity

in

accordance

with

GAAP.

Please

see

slide

19

for

a

reconciliation

of

Operating

Earnings

and

Operating

Earnings per

Share to GAAP net income and GAAP net income per share.

|

6

COMMERCIAL REAL ESTATE FINANCE, INC. (�ARI�)

ARI �

Q3 New Investments

(1)

Based upon committed amount of loan.

(2)

The Internal Rate of Return (�IRR�) for the investments shown

in this presentation reflect the returns underwritten by ACREFI Management, LLC, the Company�s external manager (the �Manager�), calculated on a weighted average basis assuming no dispositions, early prepayments or defaults but

assuming that extension options are exercised and that the cost of

borrowings remains constant over the remaining term.� With respect to certain loans, the IRR calculation assumes certain estimates with respect to the timing and magnitude of future fundings for the remaining commitments and

associated loan repayments, and assumes no defaults. IRR is the

annualized effective compounded return rate that accounts for the time-value of money and represents the rate of return on an investment over a holding period expressed as a percentage of the investment. It is the discount rate that

makes the net present value of all cash outflows (the costs of

investment) equal to the net present value of cash inflows (returns on investment). It is derived from the negative and positive cash flows resulting from or produced by each transaction (or for a transaction involving more than one

investment,

cash

flows

resulting

from

or

produced

by

each

of

the

investments),

whether

positive,

such

as

investment

returns,

or

negative,

such

as

transaction

expenses

or

other

costs

of

investment,

taking

into

account

the

dates

on

which

such

cash

flows

occurred

or

are

expected

to

occur,

and

compounding interest accordingly. There can be no assurance that

the actual IRRs will equal the underwritten IRRs shown above.

See �Item 1A�Risk Factors�The Company may not achieve

its underwritten internal rate of return on its investments which may lead to future returns that may be

significantly lower than anticipated�

included in the Company�s Annual Report on Form 10-K for the

year ended December 31, 2013 for a discussion of some of the

factors that could adversely impact the returns received by the Company from the investments shown in the table over time.

Summary of New Investments

Q3 2014

9 Months Ended

9/30/2014

Number of Loans Closed

3

11

Capital Committed to Loans

($ in thousands)

46,725

$���������

608,715

$��������

Fixed Rate %/Floating Rate %

(1)

32%/68%

32%/68%

First Mortgage %/Subordinate Loan %

26%/74%

48%/52%

Weighted Average Loan-to-Value

63%

62%

Equity Invested in CMBS

($ in thousands)

35,631

$���������

75,001

$���������

Weighted Average Duration of CMBS

2.8 years

2.8 years

Total Capital Committed

($ in thousands)

82,356

$���������

683,716

$��������

Weighted Average IRR

(2)

15%

14% |

ARI �

Q3 Investment, Portfolio & Capital Markets Activity

Investment and Portfolio Activity

KBC Bank Deutschland AG (�KBCD�) Transaction

�30.7 million ($39.5 million) investment in an entity that

acquired a minority participation in KBCD KBCD had total assets

of �2,187 billion as of December 31, 2013 KBCD

was

renamed

Bremer

Kreditbank

AG

and

will

operate

under

the

name

BKB

Bank

Loan Repayment

$50

million

principal

repayment

from

a

mezzanine

loan

secured

by

a

portfolio

of

Florida

office

properties

Realized IRR ~ 13%

Capital Markets Activity

Convertible Notes Offering

$112.5 million net proceeds raised from the underwritten public

offering of $111.0 million aggregate principal amount of 5.50%

Convertible Senior Notes due 2019; Notes were priced at 102% of face value, plus accrued

interest from, and including, March 17, 2014

Initial conversion rate equal to 55.3649 shares of common stock per

$1,000 principal amount of Notes, which is equivalent to a

conversion price of approximately $18.06 per share of common stock

Amendment of Credit Facility

During the quarter and subsequent to quarter end, expanded borrowing

capacity of master repurchase agreement with Deutsche Bank AG to

$300.0 million from $200.0 million �

�

�

�

�

�

�

�

7

COMMERCIAL REAL ESTATE FINANCE, INC. (�ARI�)

|

8

COMMERCIAL REAL ESTATE FINANCE, INC. (�ARI�)

ARI �

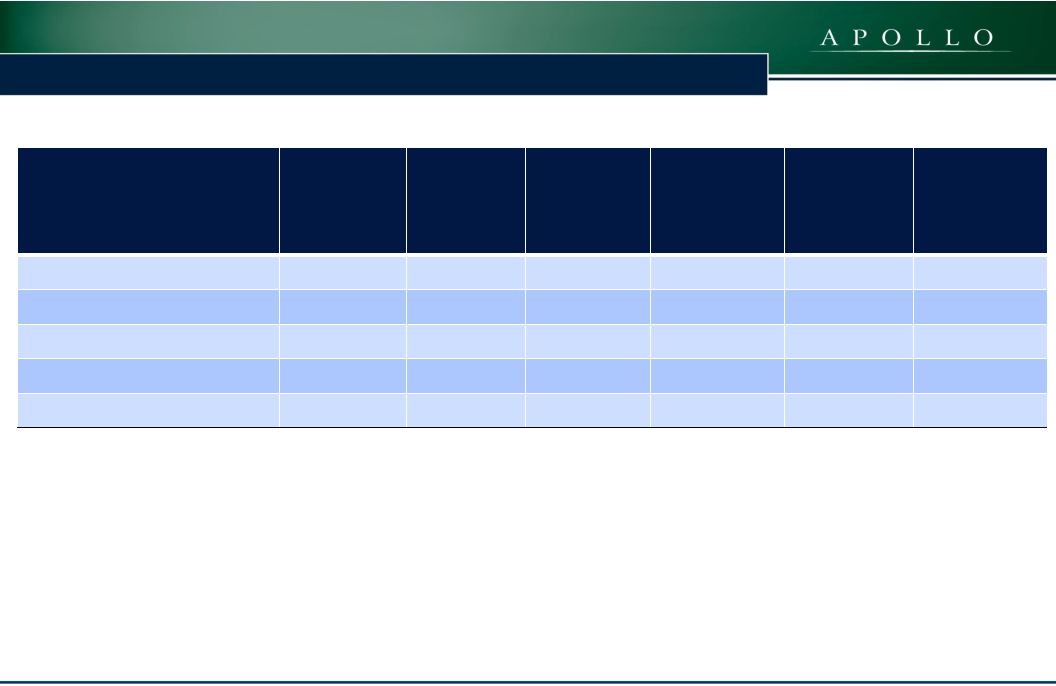

Commercial Real Estate Debt Portfolio Overview

Asset Type

($000s)

Amortized

Cost

Borrowings

Equity

at

Cost

(1)

Remaining

Weighted

Average Life

(years )

(2)

Current

Weighted

Average

Underwritten

IRR

(3)(4)

Levered

Weighted

Average

Underwritten

IRR

(3)(4)(5)

First Mortgage Loans

$����������

369,924 $���������

122,722

$����������

247,202 2.9

13.0%

15.6%

Subordinate Loans

585,504

-

585,504

3.2

12.8

12.8

CMBS,

held-to-maturity

(6)(7)

64,580

-

64,580

4.6

12.2

12.2

CMBS

511,445

-

99,988

2.5

16.1

16.1

Investments at September 30, 2014

$������� 1,531,453

$��������� 537,766

$����������

997,274 3.0 Years

13.1%

13.7%

(1)

CMBS includes $30.1 million of restricted cash related to the

Company�s master repurchase agreement with UBS AG (the �UBS Facility�) and $26.5 million related to investments purchased but not yet settled.

(2)

Remaining Weighted Average Life assumes all extension options are

exercised. (3)

Borrowings under the Company�s master repurchase agreement with

JPMorgan Chase Bank, N.A. (the �JPMorgan Facility�) bear interest at LIBOR plus 250 basis points, or 2.7% at September 30, 2014. The IRR calculation further assumes the JPMorgan Facility or any replacement facility will remain available

over the life of these investments.

(4)

The underwritten IRR for the investments shown in this table reflect the

returns underwritten by the Manager, calculated on a weighted average basis assuming no dispositions, early prepayments or defaults but assuming that extension options are exercised and that the cost of borrowings remains� constant over the

remaining term.� With respect to certain loans, the

underwritten IRR calculation assumes certain estimates with respect to the timing and magnitude of future fundings for the remaining commitments and associated loan repayments, and assumes no defaults. IRR is the annualized effective compounded

return rate that accounts for the time-value of money and

represents the rate of return on an investment over a holding period

expressed as a percentage of the investment. It is the discount rate that makes the net present value of all cash outflows (the costs of investment) equal to the net present value of cash inflows (returns on investment). It is derived from the

negative and positive cash flows resulting from or produced by

each transaction (or for a transaction involving more than one investment, cash flows resulting from or produced by each of the investments), whether positive, such as investment returns, or negative, such as transaction expenses or other costs of

investment, taking into account the dates on which such cash flows

occurred or are expected to occur, and compounding interest accordingly.

There can be no assurance that the actual IRRs will equal the underwritten IRRs shown in the table. See �Item 1A�Risk Factors�The Company may not achieve its underwritten internal rate of return on its investments which may lead to

future returns that may be significantly lower than

anticipated� included in the Company�s Annual Report on Form 10-K for the year ended December 31, 2013 for a discussion of some of the factors that could adversely impact the returns received by the Company from the investments shown

in the table over time (5) The Company's ability to achieve

its underwritten levered weighted average IRR with regard to its portfolio of first mortgage loans is additionally dependent upon the Company re-borrowing approximately $52,278 in total under the JPMorgan Facility or any replacement facility

with similar terms.�� Without such re-borrowing, the levered

weighted average underwritten IRRs will be as indicated in the current

weighted average underwritten IRR column above.��

(6)

CMBS, held-to-maturity, represents a loan the Company closed

during May 2014 that was subsequently contributed to a securitization during August 2014.� During May 2014, the Company closed a $155,000 floating-rate whole loan secured by the first mortgage and equity interests in an entity that owns a

resort hotel in Aruba. During June 2014, the Company syndicated a

$90,000 senior participation in the loan and retained a $65,000 junior participation.� During August 2014, both the $90,000 senior participation and the Company's $65,000 junior participation were contributed to a CMBS securitization.� In

exchange for contributing its $65,000 junior participation, the

Company received a CMBS secured solely by the $65,000 junior

participation. (7)

CMBS, held-to-maturity, are net of a participation

sold during June 2014.� ARI presents the participation sold as both assets and non-recourse liabilities because the participation does not qualify as a sale according to GAAP.� At September 30, 2014, ARI had one such participation sold

with a carrying amount of $89,418. |

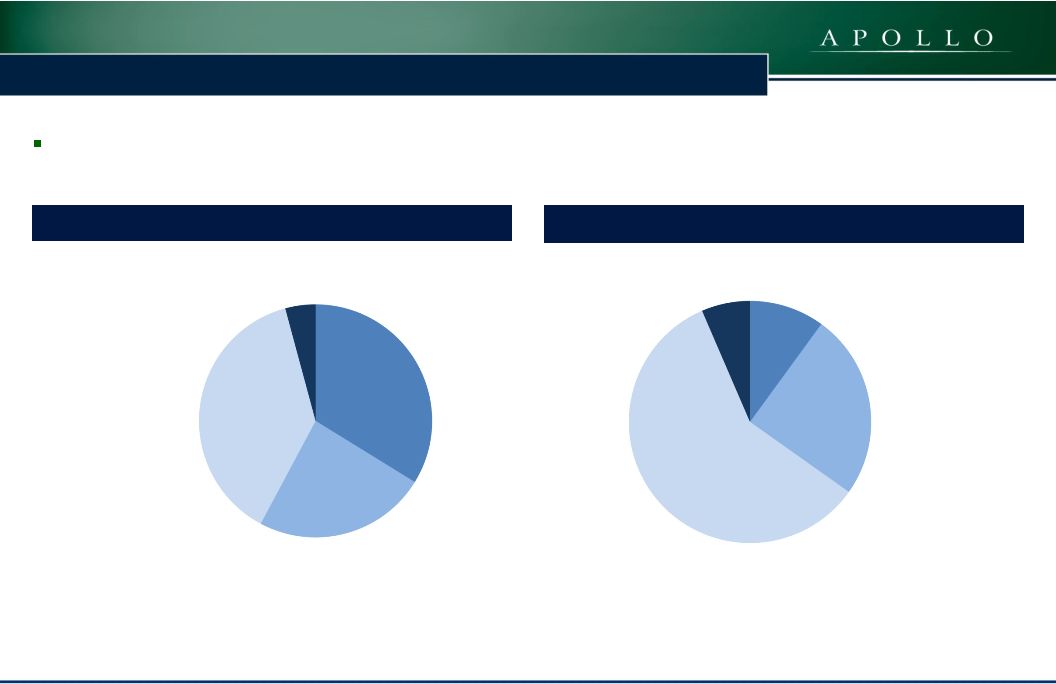

Diversified Commercial Real Estate Debt Portfolio with Amortized

Cost Basis of $1.5 billion

Net

Invested

Equity

at

Amortized

Cost

Basis

(1)

Gross

Assets

at

Amortized

Cost

Basis

(1)

(1)

CMBS,

held-to-maturity

are

net

of

a

participation

sold

during

June

2014.

ARI

presents

the

participation

sold

as

both

assets

and

non-recourse

liabilities

because

the

participation

does

not

qualify

as

a

sale

according

to

GAAP.

At

September

30,

2014,

ARI

had

one

such

participation

sold

with a carrying amount of $89,418.

ARI �

Commercial Real Estate Debt Portfolio Overview

CMBS

34%

First Mortgage Loans

24%

Subordinate Loans

38%

CMBS, held-to-

maturity

4%

CMBS

10%

First Mortgage

Loans

25%

Subordinate Loans

59%

CMBS, held-to-

maturity

6%

9

COMMERCIAL REAL ESTATE FINANCE, INC. (�ARI�)

|

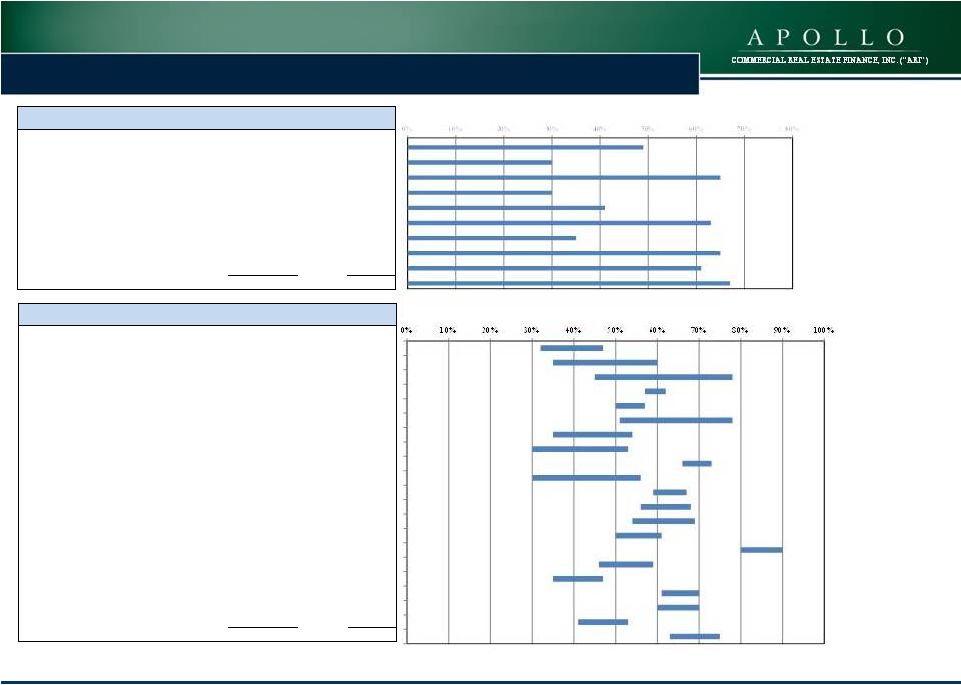

ARI �

Commercial Real Estate Debt Portfolio Diversification

The Commercial Real Estate Debt Portfolio is diversified by property

type and geographic location Geographic Diversification by Net

Equity (1)

Property Type by Net Equity

(1)

(1)

CMBS, held-to-maturity, are not included in

�Securities� for this calculation. CMBS,

held-to-maturity are net of a participation sold during June 2014.� ARI presents the participation sold as both assets and non-recourse liabilities because the participation does not qualify as a sale

according to GAAP.� At September 30, 2014, ARI had one such

participation sold with a carrying amount of $89,418. 10

Securities

13%

Residential

42%

Industrial

3%

Hotel

23%

Mixed Use

3%

Office

6%

Healthcare

5%

Ski Resort

5%

New York City

32%

Northeast (excluding

NYC)

4%

Securities

14%

Southeast

5%

Mid

-

Atlantic

6%

Midwest

7%

West

13%

Southwest

4%

International

15%

COMMERCIAL REAL ESTATE FINANCE, INC. (�ARI�)

|

11

COMMERCIAL REAL ESTATE FINANCE, INC. (�ARI�)

ARI �

Loan Portfolio -

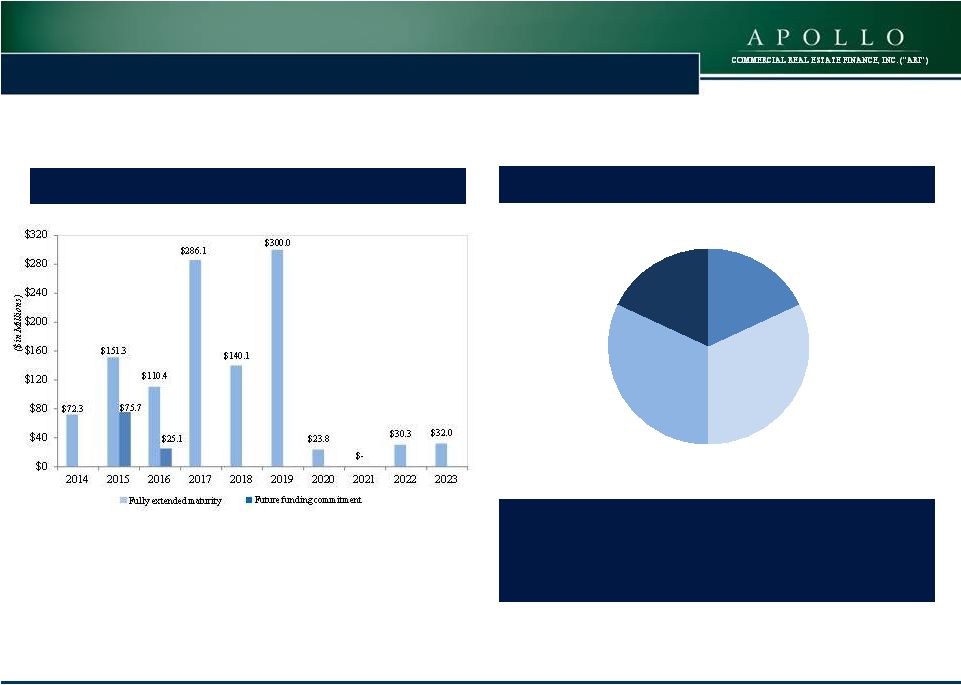

Maturity and Type

Fully Extended Loan Maturities and Future Fundings

(1)(2)(3)(4)

(1)

Basedupon

Face

Amount

of

Loans;

Doesnot

include

CMBS,butdoes

include

CMBS,held-to-maturity.

(2)

Maturities reflect the fully funded amounts of the loans.

(3)

CMBS, held-to-maturity are net of a participation sold during

June 2014.� ARI presents the participation sold as both assets and non-recourse liabilities because the participation does not qualify as a sale according to GAAP.� At September 30, 2014, ARI had onesuch participation sold with a

carrying amount of $89,418.

(4)

Future funding dates are based upon the Manager�s projections and

are subject to change. Loan

Position

and

Rate

Type

(1)(3)

50% Floating Rate/50% Fixed Rate

%

of

Floating

Rate

Loans

With

LIBOR

Floor

�

31%

Weighted

Average

LIBOR

Floor

�

0.44%

Senior Loan Fixed

18%

Subordinate Loan

Fixed

32%

Subordinate Loan

Floating

32%

Senior Loan

Floating

18% |

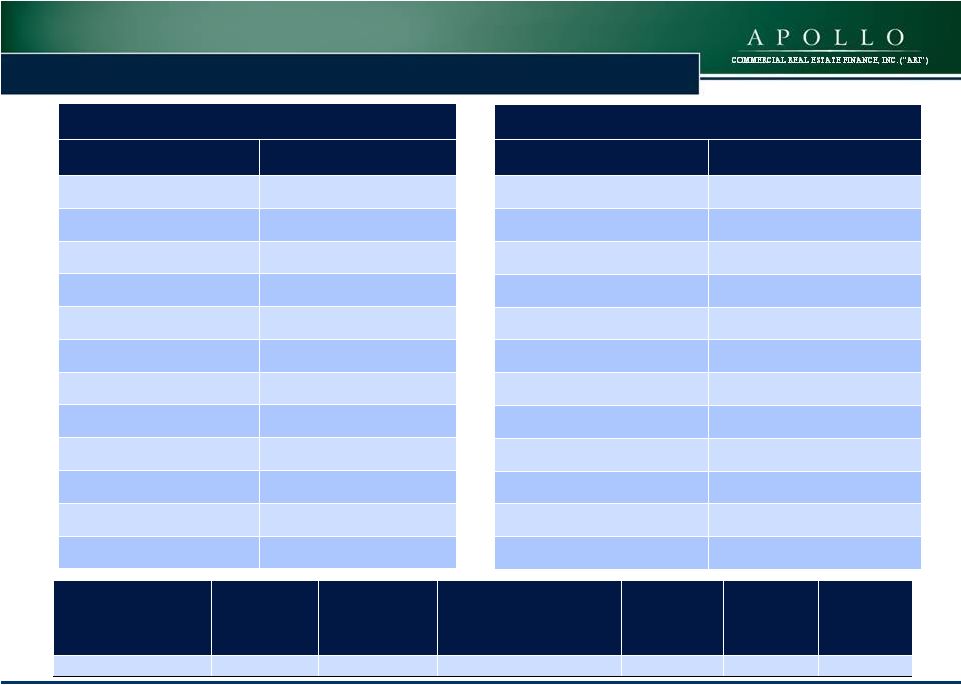

12

COMMERCIAL REAL ESTATE FINANCE, INC. (�ARI�)

ARI �

Loan Portfolio �

Loan Level LTV (Through Last Invested Dollar)

(1)

Both loans are for the same property.

(2)

Both loans are for the same property.

(3)

LTV is based upon the committed amount of $80 million.

(4)

This is CMBS, held-to-maturity and is net of a participation

sold.� ARI presents the participation sold as both assets and non-recourse liabilities because the participation does not qualify as a sale according to GAAP.� At September 30, 2014, this participation sold had a carrying amount of

$89,418. (5)

Based upon �32.1 face amount converted to USD based upon the

conversion rateon 9/30/2014. (6)

Ending LTV is based upon the committed amount of $19.5 million.

Subordinate Financings

First Mortgage Loans

Description ($ in thousands)

Location

Balance at�

9/30/2014

Starting LTV

Ending LTV

Subordinate - Condo Development

New York

73,844

$�����������

�� 32%

47%

Subordinate - Resort Hotel

(4)

Aruba

65,000

$�����������

�� 35%

60%

Subordinate - Condo Development

(5)

London

52,034

$�����������

�� 45%

78%

Subordinate - Healthcare Portfolio

Various

50,000

$�����������

�� 57%

62%

Subordinate - Hotel Portfolio

Various

47,172

$�����������

�� 50%

57%

Subordinate - Multifamily Conversion

New York

44,000

$�����������

�� 51%

78%

Subordinate - Ski Resort

California

40,000

$�����������

�� 35%

54%

Subordinate - Condo Conversion

(1)

New York

35,545

$�����������

�� 30%

53%

Subordinate - Industrial Portfolio

Various

32,000

$�����������

�� 66%

73%

Subordinate - Condo Conversion

(2)

New York

29,601

$�����������

�� 30%

56%

Subordinate - Hotel�

New York

28,250

$�����������

�� 59%

67%

Subordinate - Hotel Portfolio

Minnesota

24,560

$�����������

�� 56%

68%

Subordinate - Mixed Use

Pennsylvania

22,500

$�����������

�� 54%

69%

Subordinate - Hotel

New York

20,000

$�����������

�� 50%

61%

Subordinate - Multifamily/Condo/Hotel

(6)

Various

18,791

$�����������

�� 80%

90%

Subordinate - Ski Resort

Montana

15,000

$�����������

�� 46%

56%

Subordinate - Multifamily

New York

14,608

$�����������

�� 35%

47%

Subordinate - Office

New York

14,000

$�����������

�� 61%

70%

Subordinate - Office

Missouri

9,747

$�����������

���� 60%

70%

Subordinate - Office

Michigan

8,828

$�����������

���� 41%

53%

Subordinate - Mixed Use

North Carolina

6,525

$�����������

���� 63%

75%

Total/Weighted Average

652,005

$�����������

63%

Description ($ in thousands)

Location

Balance at

9/30/2014

Starting LTV

Ending LTV

First Mortgage - Destination Homes

Various

101,000

$�����������

-

49%

First Mortgage - Condo Conversion

(1)

New York

45,496

$�����������

�� -

30%

First Mortgage - Hotel

Pennsylvania

34,000

$�����������

�� -

65%

First Mortgage - Condo Conversion

(2)�

New York

33,675

$�����������

�� -

30%

First Mortgage - Hotel

New York�

31,115

$�����������

�� -

41%

First Mortgage - Multifamily

New York

30,000

$�����������

�� -

63%

First Mortgage - Office

New York

26,968

$�����������

�� -

35%

First Mortgage - Condo Development

(3)

Maryland

25,000

$�����������

�� -

65%

First Mortgage - Hotel

Maryland

24,684

$�����������

�� -

61%

First Mortgage - Condo Development

Maryland

20,000

$�����������

�� -

67%

Total/Weighted Average

371,938

$�����������

49% |

13

COMMERCIAL REAL ESTATE FINANCE, INC. (�ARI�)

ARI �

CMBS Portfolio

(1)

Face

Amortized Cost

Remaining Weighted

Average Life with

Extensions (years)

Estimated

Fair Value

Debt

Net Equity

at Cost

(2)

CMBS �

Total

$������������

� 521,545������������� $�������������

511,445�����������������

2.5 Years

$�����������

517,620����������� $������ 415,044���������

$������

99,988���������

CMBS

CUSIP

Description

07388YAB8

BSCMS 07-PW16 A2

61754KAC9

MSC 07-IQ14 A2

92978YAB6

WBCMT 07-C32 A2

61751NAD4

MSC 2007-HQ11 A31

92978TAB7

WBCMT 2007-C31 A2

92978PAJ8

WBCMT 2006-C29 AJ

07388QAH2

BSCMS 2007-PW17 AJ

07401DAH4

BSCMS 2007PW18 AJ

46625YVZ3

JPMCC 2005-CB13 AJ

50180CAG5

LBUBS 2006-C7 AJ

60688CAJ5

MLCFC 2007-9 AJ

05947US25

BACM 2005-3 AJ

CMBS

CUSIP

Description

59025KAG7

MLMT 2007-C1 AM

22546BAH3

CSMC 2007-C5 AM

36159XAH3

GECMC 2007-C1 AM

46627QBC1

JMPCC 2006-CB15 AM

46631BAJ4

JPMCC 2007-LD11 AM

14986DAJ9

CD 2006-CD3 AJ

17311QBN9

CGCMT 2007-C6 AJ

17313KAK7

CGCMT 2008-C7 AJ

20047QAH8

COMM 2006-C7 AJ

61755YAK0

MSC 2007-IQ15 AJ

46629YAH2

JPMCC 2007-CB18AJ

173311QAE0

CGCMT 2007-C6 AJFX

(1)

Does not include CMBS, held-to-maturity.

(2)

Includes

$30.1

million

of

restricted

cashrelated

to

the

UBS

Facility

and$26.5million

related

toinvestmentspurchased

not

yet

settled. |

14

COMMERCIAL REAL ESTATE FINANCE, INC. (�ARI�)

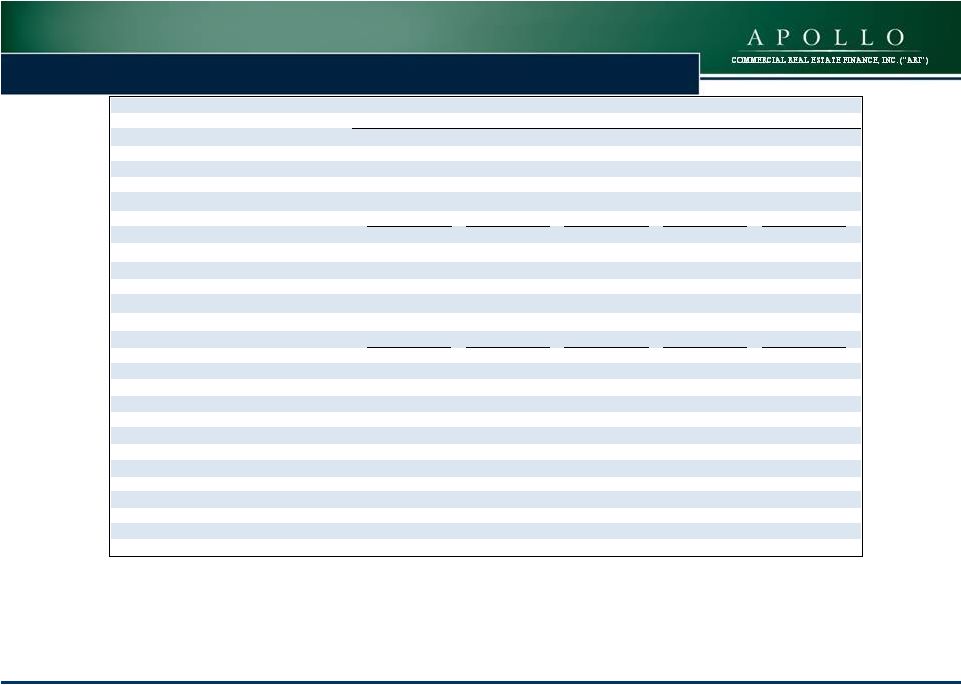

Portfolio Metrics �

Quarterly Migration Summary

Portfolio Metrics ($ in thousands)

Q3 2014

Q2 2014

Q1 2014

Q4 2013

Q3 2013

(Investment balances represent amortized cost)

First Mortgage Loans

369,924

$���������

343,810

$���������

185,516

$���������

161,099

$���������

160,893

$���������

Subordinate Loans

585,504

����������

659,045

����������

484,979

����������

497,484

����������

394,554

����������

CMBS

511,445

����������

339,724

����������

173,174

����������

190,178

����������

218,019

����������

CMBS - Held-to-Maturity

(1)

64,580

�����������

� -

�����������

������ -

�����������

������ -

�����������

������ -

�����������

������ CMBS - Hilton

-

�����������

������ -

�����������

������ -

�����������

������ -

�����������

������ 69,587

�����������

� Total Investments

1,531,453

$������

1,342,579

$������

843,669

$���������

848,761

$���������

843,053

$���������

(Investment balances represent net equity, at cost)

First Mortgage Loans

247,202

$���������

197,112

$���������

185,513

$���������

140,716

$���������

160,890

$���������

Subordinate Loans

585,504

����������

659,045

����������

484,979

����������

497,484

����������

394,554

����������

CMBS

99,988

�����������

� (4)

70,325

�����������

� (5)

36,310

�����������

� (5)

38,655

�����������

� (5)

36,760

�����������

� (6)

CMBS - Held-to-Maturity

(1)

64,580

�����������

� -

�����������

������ -

�����������

������ -

�����������

������ -

�����������

������ CMBS - Hilton

-

�����������

������ -

�����������

������ -

�����������

������ -

�����������

������ 23,049

�����������

� Net Equity in Investments at Cost

997,274

$���������

926,482

$���������

706,802

$���������

676,855

$���������

615,253

$���������

Levered Weighted Average Underwritten IRR

(2)

13.7%

(7)

13.9%

(7)

14.1%

(7)

14.1%

(7)

13.9%

(7)

Weighted Average Duration

3.0 Years

3.2 Years

3.2 Years

3.3 Years

3.0 Years

Loan Portfolio Weighted Average Ending LTV

(3)

58.0%

58.0%

58.0%

58.0%

55.0%

Borrowings Under Repurchase Agreements

537,766

$���������

446,224

$���������

166,994

$���������

202,033

$���������

227,167

$���������

Convertible Senior Notes

246,054

$���������

139,362

$���������

139,163

$���������

-

$�����������

���� -

$�����������

���� Debt-to-Common Equity

1.2x

0.9x

0.5x

0.4x

0.5x

(1)������ CMBS, held-to-maturity