Form 8-K Allegiant Travel CO For: Nov 13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

_______________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 13, 2014

Allegiant Travel Company

_______________________________________________

(Exact name of registrant as specified in its charter)

Nevada | 001-33166 | 20-4745737 |

(State or other�jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

1201 N. Town Center Drive, Las Vegas, NV | 89144 | |

(Address of principal executive offices) | (Zip Code) | |

��

Registrants telephone number, including area code: (702) 851-7300

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Section�7����Regulation FD

�

Item 7.01����Regulation FD.

�

The Company is furnishing under Item�7.01 of this Current Report on Form�8-K the information included as Exhibit�99.1 to this report. The Exhibit�contains certain information about the Company, its financial and operating results, competitive position, fleet strategy and business strategy. This information is being presented at meetings with investors or is otherwise being made available to interested parties. Statements in the presentation included as Exhibit�99.1 regarding the airline industry and market conditions for aircraft are based on managements views of current market conditions.

The information in Sections 7 and 9 of this Current Report on Form�8-K, including the information set forth in the Exhibit, is furnished pursuant to Item�7.01 of Form�8-K and shall not be deemed to be

filed

for the purposes of Section�18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that Section. As such, this information shall not be incorporated by reference into any of the Companys reports or other filings made with the Securities and Exchange Commission.

Forward-Looking Statements:�Under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, statements in the management presentation that are not historical facts are forward-looking statements. These forward-looking statements are only estimates or predictions based on our management's beliefs and assumptions and on information currently available to our management. Forward-looking statements�may include, among others, our ability to consummate announced aircraft transactions, timing of aircraft deliveries, aircraft utilization rates and values, future revenue and operating costs, future capacity and departure growth, future capital expenditures, future hiring and training schedules, implementation of international service and other statements or comments about our future performance or strategic plans. Forward-looking statements include all statements that are not historical facts and can be identified by the use of forward-looking terminology such as the words "believe," "expect,"

guidance,

"anticipate," "intend," "plan," "estimate,"

project

,

hope

��or similar expressions.

Forward-looking statements involve risks, uncertainties and assumptions. Actual results may differ materially from those expressed in the forward-looking statements. Important risk factors that could cause our results to differ materially from those expressed in the forward-looking statements generally may be found in our periodic reports and registration statements filed with the Securities and Exchange Commission at www.sec.gov. These risk factors include, without limitation, volatility of fuel costs, labor issues, the effect of the economic conditions on leisure travel, debt balances, debt covenants, terrorist attacks, risks inherent to airlines, availability of pilots, demand for air services to our leisure destinations from the markets served by us,�our dependence on our leisure destination markets, our competitive environment, an accident involving or problems with our aircraft, our reliance on our automated systems, our reliance on third parties who provide facilities or services to us, the possible loss of key personnel, economic and other conditions in markets in which we operate, aging aircraft and other governmental regulation, increases in maintenance costs and cyclical and seasonal fluctuations in our operating results.

Any forward-looking statements are based on information available to us today and we undertake no obligation to update publicly any forward-looking statements, whether as a result of future events, new information or otherwise.

Section 9����Financial Statements and Exhibits

Item 9.01����Financial Statements and Exhibits.

(a) | Not applicable. |

(b) | Not applicable. |

(c) | Not applicable. |

(d) | Exhibits |

Exhibit No. | Description of Document |

99.1 | Investor Day Presentation. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, Allegiant Travel Company has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: November 13, 2014����������������������������ALLEGIANT TRAVEL COMPANY

By: /s/ Scott Sheldon |

Name: Scott Sheldon |

Title: Chief Financial Officer |

EXHIBIT INDEX

Exhibit No.��������Description of Document

99.1 | Management Presentation. |

Allegiant Travel Company 2014 Investor day November 2014

�

Operations update Kris Bauer Interim COO

�

Forward looking statements 3 This presentation as well as oral statements made by officers or directors of Allegiant Travel Company, its advisors and affiliates (collectively or separately, the "Company

) will contain forward- looking statements that are only predictions and involve risks and uncertainties. Forward-looking statements may include, among others, references to future performance and any comments about our strategic plans. There are many risk factors that could prevent us from achieving our goals and cause the underlying assumptions of these forward-looking statements, and our actual results, to differ materially from those expressed in, or implied by, our forward-looking statements. These risk factors and others are more fully discussed in our filings with the Securities and Exchange Commission. Any forward-looking statements are based on information available to us today and we undertake no obligation to update publicly any forward-looking statements, whether as a result of future events, new information or otherwise. The Company cautions users of this presentation not to place undue reliance on forward looking statements, which may be based on assumptions and anticipated events that do not materialize.

�

Pilot staffing how did we get here? n Government shutdown n New fleet type n Still operating a growing airline 4

�

Hiring requirements n 2014 has been unique 5 2014 - expected new pilots hired throughout the year

�

Resources - instructors 6 Actual 2014 / Forecasted 2014

�

Resources simulators 7 Actual 2014 / Forecasted 2014

�

Resources line check airmen 8 Actual 2014 / Forecasted 2014

�

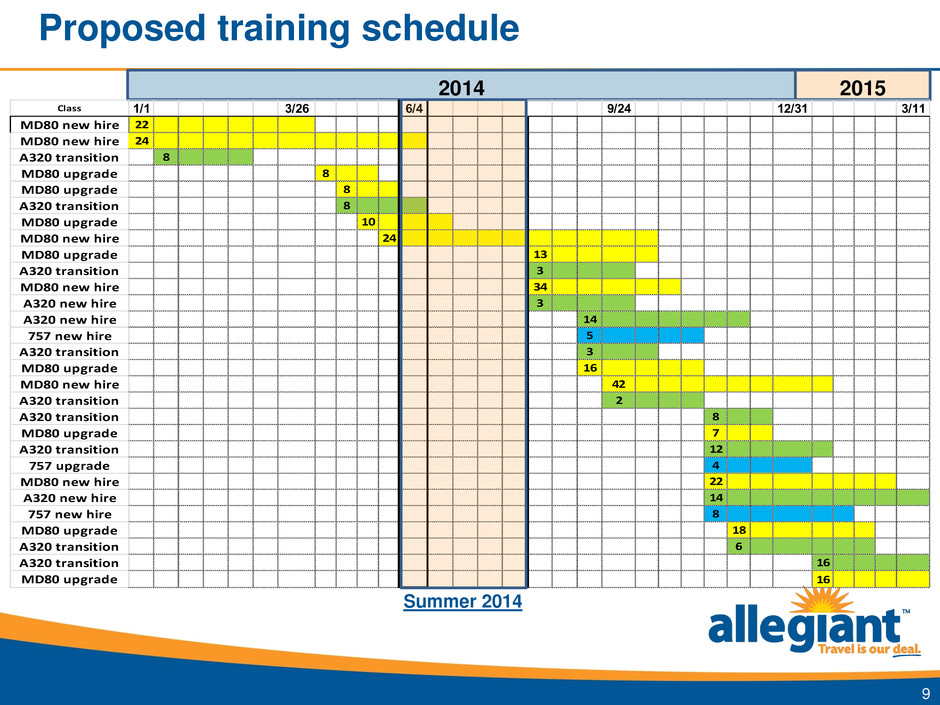

Proposed training schedule 9 Class 1/1 3/26 6/4 9/24 12/31 3/11 MD80 new hire 22 MD80 new hire 24 A320 transition 8 MD80 upgrade 8 MD80 upgrade 8 A320 transition 8 MD80 upgrade 10 MD80 new hire 24 MD80 upgrade 13 A320 transition 3 MD80 new hire 34 A320 new hire 3 A320 new hire 14 757 new hire 5 A320 transition 3 MD80 upgrade 16 MD80 new hire 42 A320 transition 2 A320 transition 8 MD80 upgrade 7 A320 transition 12 757 upgrade 4 MD80 new hire 22 A320 new hire 14 757 new hire 8 MD80 upgrade 18 A320 transition 6 A320 transition 16 MD80 upgrade 16 2014 2015 Summer 2014

�

MD-80 captain requirements 10 100 110 120 130 140 150 160 8/3/2014 9/3/2014 10/3/2014 11/3/2014 12/3/2014 1/3/2015 2/3/2015 3/3/2015 4/3/2015 5/3/2015 6/3/2015 MD-80 captains trained vs needed MD-80 Captains required MD-80 Captains trained Shaded area is forecasted

�

New hire pilot data n Not having issues finding quality pilots 11/14/2014 Class: average total flight time 5,741 hours 10/14/2014 Class: average total flight time 5,462 hours 09/19/2014 Class: average total flight time 5,528 hours 09/05/2014 Class: average total flight time 6,613 hours 11

�

Network update Lukas Johnson VP Network & Pricing

�

Forward looking statements 13 This presentation as well as oral statements made by officers or directors of Allegiant Travel Company, its advisors and affiliates (collectively or separately, the "Company

) will contain forward- looking statements that are only predictions and involve risks and uncertainties. Forward-looking statements may include, among others, references to future performance and any comments about our strategic plans. There are many risk factors that could prevent us from achieving our goals and cause the underlying assumptions of these forward-looking statements, and our actual results, to differ materially from those expressed in, or implied by, our forward-looking statements. These risk factors and others are more fully discussed in our filings with the Securities and Exchange Commission. Any forward-looking statements are based on information available to us today and we undertake no obligation to update publicly any forward-looking statements, whether as a result of future events, new information or otherwise. The Company cautions users of this presentation not to place undue reliance on forward looking statements, which may be based on assumptions and anticipated events that do not materialize.

�

Bio n Responsible for: Network Revenue management Air ancillary Crew planning n Joined Allegiant in 2010 n Previously worked in actuarial consulting n B.A. Math - Northwestern University 14

�

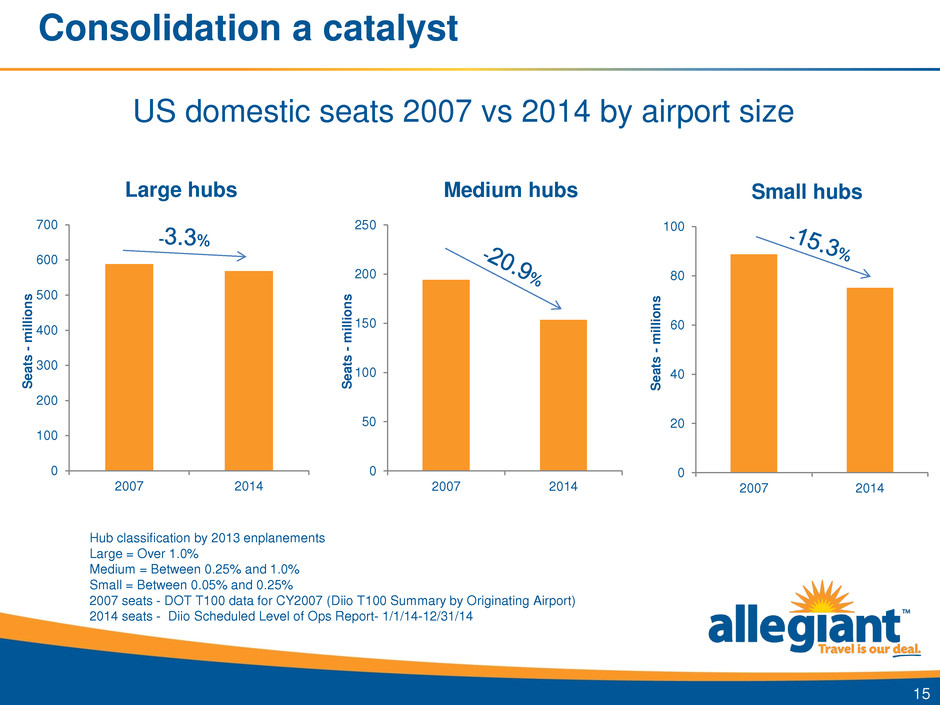

Consolidation a catalyst US domestic seats 2007 vs 2014 by airport size 15 0 100 200 300 400 500 600 700 2007 2014 S e a ts - millio n s Large hubs 0 50 100 150 200 250 2007 2014 S e a ts - m ill io n s Medium hubs 0 20 40 60 80 100 2007 2014 S e a ts - millio n s Small hubs Hub classification by 2013 enplanements Large = Over 1.0% Medium = Between 0.25% and 1.0% Small = Between 0.05% and 0.25% 2007 seats - DOT T100 data for CY2007 (Diio T100 Summary by Originating Airport) 2014 seats - Diio Scheduled Level of Ops Report- 1/1/14-12/31/14

�

Evolving our network n New cities announced 11/12/14 Indianapolis, IN Pittsburgh, PA Jacksonville, FL Omaha, NE Richmond, VA n Focus on underserved leisure/VFR markets Not business routes or fortress hubs n Larger origination cities Opens up new secondary destinations Less discounting for off-peak flying increased utilization Airports are hungry for new service, will incentivize 16

�

Passenger stimulation 17 0 50 100 150 200 250 300 4Q12 - 2Q13 4Q13 - 2Q14 P D E W AUS-LAS WN G4 $168 $165 $70 0 200 400 600 800 1000 1200 1400 1600 4Q12 - 2Q13 4Q13 - 2Q14 P D E W LAX-HNL Other G4 $251 $278 $167 Numbers above PDEW bar = Average net fare in period per Diio Mi WN Southwest Airlines G4 Allegiant PDEW passengers per day each way

�

Airbus utilization n Airbus aircraft allows previously marginal flying to be profitable Longer routes (Bismarck, ND to Orlando) Off-peak day flying (Columbus, OH to St. Pete Wed/Sat 2x weekly) Off-peak season flying (Syracuse, NY to St. Pete in September) Previously canceled markets (Ft. Wayne, IN to Phoenix) 18 2014 Utilization by A/C type Peak Off-Peak Total Airbus 9.9 5.3 7.9 Non-Airbus 7.1 1.9 4.9 All Aircraft 7.5 2.4 5.3

�

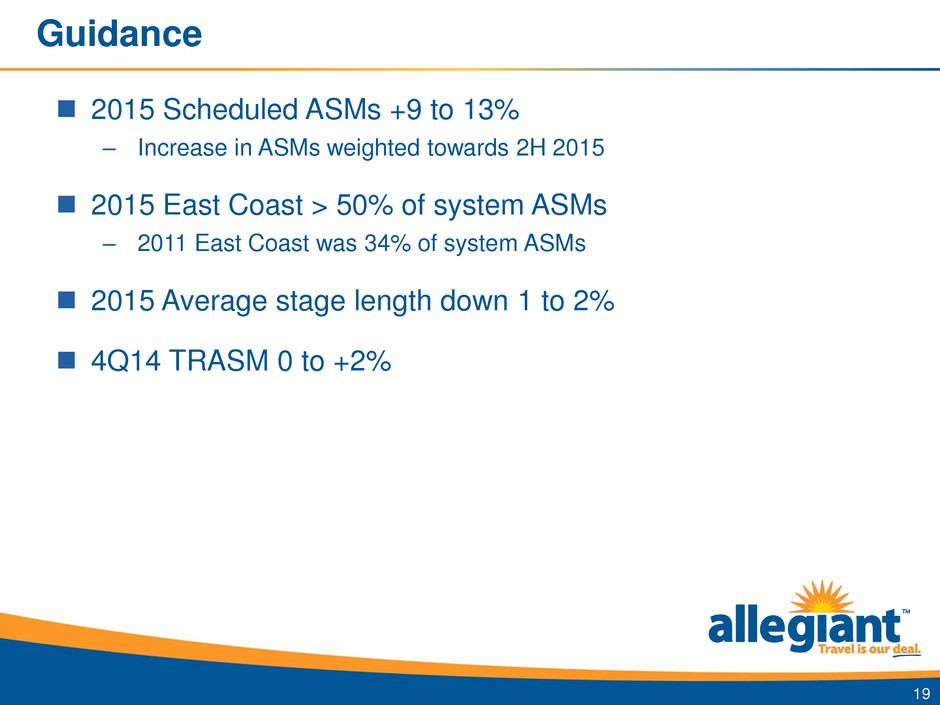

n 2015 Scheduled ASMs +9 to 13% Increase in ASMs weighted towards 2H 2015 n 2015 East Coast > 50% of system ASMs 2011 East Coast was 34% of system ASMs n 2015 Average stage length down 1 to 2% n 4Q14 TRASM 0 to +2% Guidance 19

�

Cost update Trent Porter VP Financial Planning & Analysis

�

Forward looking statements 21 This presentation as well as oral statements made by officers or directors of Allegiant Travel Company, its advisors and affiliates (collectively or separately, the "Company

) will contain forward- looking statements that are only predictions and involve risks and uncertainties. Forward-looking statements may include, among others, references to future performance and any comments about our strategic plans. There are many risk factors that could prevent us from achieving our goals and cause the underlying assumptions of these forward-looking statements, and our actual results, to differ materially from those expressed in, or implied by, our forward-looking statements. These risk factors and others are more fully discussed in our filings with the Securities and Exchange Commission. Any forward-looking statements are based on information available to us today and we undertake no obligation to update publicly any forward-looking statements, whether as a result of future events, new information or otherwise. The Company cautions users of this presentation not to place undue reliance on forward looking statements, which may be based on assumptions and anticipated events that do not materialize.

�

Bio n Responsible for: Financial planning Labor negotiations Budgeting/forecasting Business intelligence & analytics n Joined Allegiant in 2009 n Capital & Long Term Strategic Planning at US Airways n B.S. Degrees in Accounting, Finance & Economics (Utah State) n MBA Finance (Univ. of AZ); MIM Global Finance (Thunderbird) 22

�

2014 CASM ex-Fuel 23 *Non-Core includes Teesnap, Game Plane, GMS Racing Levy payout is associated with accelerated vesting of equity grants upon Andrew Levys departure from the company 5.60 0.10 0.05 0.03 0.01 0.08 0.12 0.04 0.07 5.40 5.50 5.60 5.70 5.80 5.90 6.00 6.10 6.20 6.30 '13 CASM ex Heavy Mtx IT Non-Core* FA Buyout Levy Payout Subservice Training/Prod AC on Lease Dep '14 CASM ex +9.5 - 10.5% Original 2014 Guidance (4Q13): +4% - 7%

�

n Fuel 2015 Expectations 24 Airbus AC 14% 21% 2014 2015 Airbus Block Hours 20% 32% 2014 2015 26 16 14 12 - 5 10 15 20 25 30 B757 MD80 A319 A320 Gallons/Pax n Salaries & Benefits Realization of efficiencies from multi-fleet overhead investments Build back Pilot & Flight Attendant Productivity 70.7% 62.5% 64.6% 83.1% 79.8% 83.7% 0.0% 50.0% 100.0% 2013 2014E 2015E Crew Productivity Pilot Productivity Flight Attendant Productivity Productivity is measured as block hours / paid hours

�

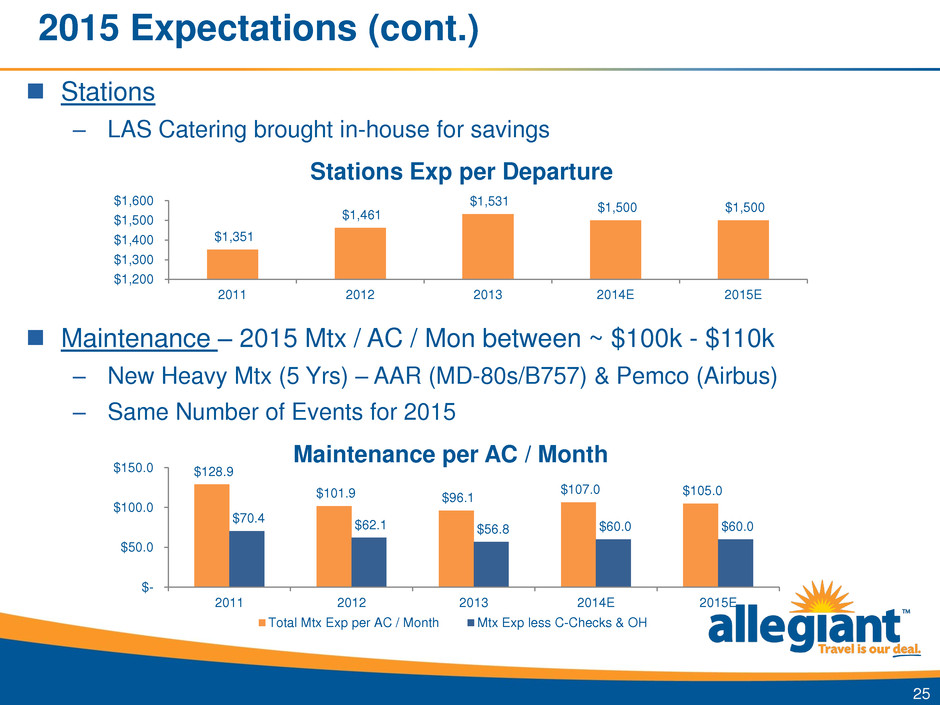

2015 Expectations (cont.) n Maintenance 2015 Mtx / AC / Mon between ~ $100k - $110k New Heavy Mtx (5 Yrs) AAR (MD-80s/B757) & Pemco (Airbus) Same Number of Events for 2015 25 $128.9 $101.9 $96.1 $107.0 $105.0 $70.4 $62.1 $56.8 $60.0 $60.0 $- $50.0 $100.0 $150.0 2011 2012 2013 2014E 2015E Maintenance per AC / Month Total Mtx Exp per AC / Month Mtx Exp less C-Checks & OH n Stations LAS Catering brought in-house for savings $1,351 $1,461 $1,531 $1,500 $1,500 $1,200 $1,300 $1,400 $1,500 $1,600 2011 2012 2013 2014E 2015E Stations Exp per Departure

�

2015 Expectations (cont.) 26 n Depreciation $59.8 $74.6 $91.4 $93.0 $95.0 $- $20.0 $40.0 $60.0 $80.0 $100.0 $120.0 2011 2012 2013 2014E 2015E Depreciation ex AC on Lease AC on Lease Dep Depreciation per in-service AC / month n Sales & Marketing Game Plane Investments & GMS Racing sponsorship Credit Card Surcharge n Other Expenses Continue TDY Bases & Non Cap IT Opex Investment 2014 +$1.0M Merlot Implementation

�

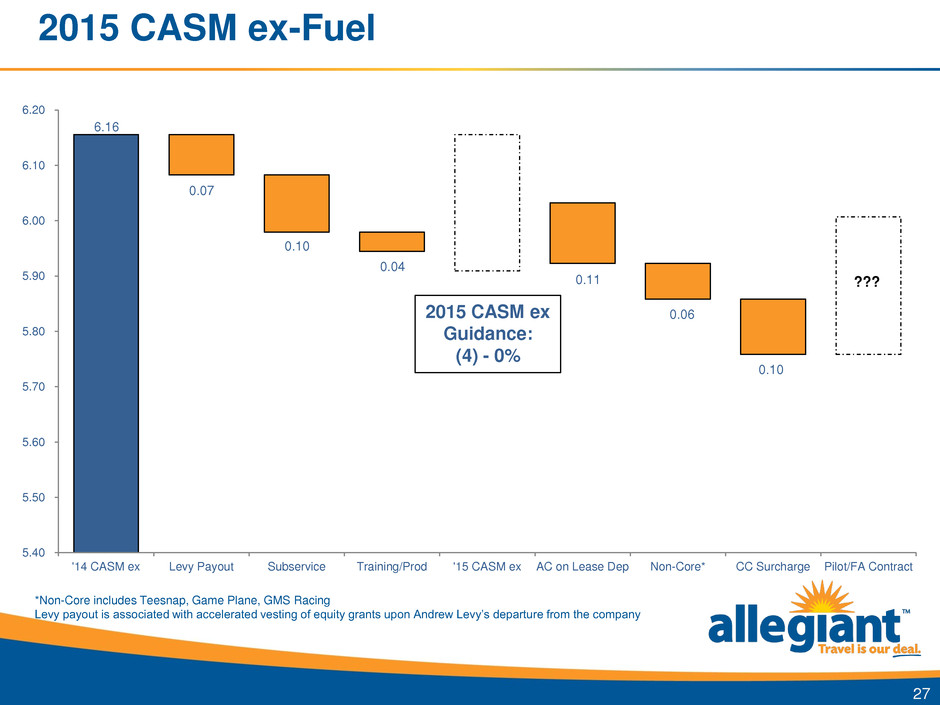

2015 CASM ex-Fuel 27 6.16 0.07 0.10 0.04 0.11 0.06 0.10 5.40 5.50 5.60 5.70 5.80 5.90 6.00 6.10 6.20 '14 CASM ex Levy Payout Subservice Training/Prod '15 CASM ex AC on Lease Dep Non-Core* CC Surcharge Pilot/FA Contract ??? 2015 CASM ex Guidance: (4) - 0% *Non-Core includes Teesnap, Game Plane, GMS Racing Levy payout is associated with accelerated vesting of equity grants upon Andrew Levys departure from the company

�

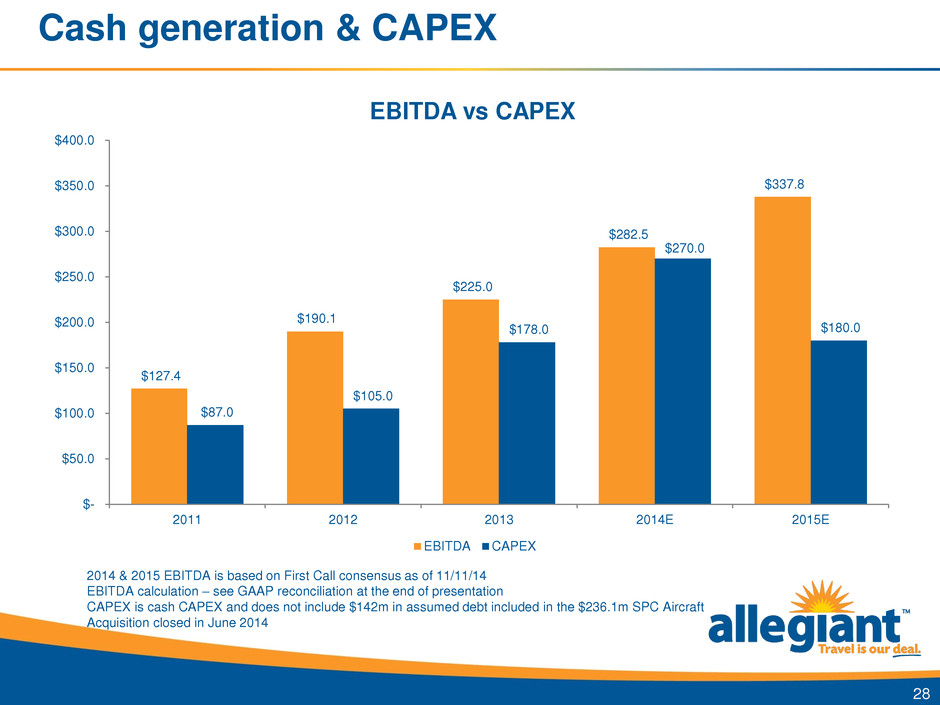

Cash generation & CAPEX 28 $127.4 $190.1 $225.0 $282.5 $337.8 $87.0 $105.0 $178.0 $270.0 $180.0 $- $50.0 $100.0 $150.0 $200.0 $250.0 $300.0 $350.0 $400.0 2011 2012 2013 2014E 2015E EBITDA vs CAPEX EBITDA CAPEX 2014 & 2015 EBITDA is based on First Call consensus as of 11/11/14 EBITDA calculation see GAAP reconciliation at the end of presentation CAPEX is cash CAPEX and does not include $142m in assumed debt included in the $236.1m SPC Aircraft Acquisition closed in June 2014

�

Cumulative return to shareholders $0.6 $17.4 $42.7 $96.5 $98.4 $103.4 $187.0 $316.3 $14.9 $14.9 $53.5 $53.5 $95.3 -$30 $20 $70 $120 $170 $220 $270 $320 $370 $420 2007 2008 2009 2010 2011 2012 2013 2014 $ m m Share repurchases Dividends 29 $412m returned to shareholders since 2007 $100m remaining in share repurchase authority* *- As per announcement on 10/22/14 **-Diluted share count in 2007 20.5m, share count 1st 9 mos of 2014 17.9 m 2014 includes activity up to 9/30/14 Reduced diluted share count by 12.7% since 2007**

�

Fleet update Tom Doxey VP Fleet & Corporate Finance

�

Forward looking statements 31 This presentation as well as oral statements made by officers or directors of Allegiant Travel Company, its advisors and affiliates (collectively or separately, the "Company

) will contain forward- looking statements that are only predictions and involve risks and uncertainties. Forward-looking statements may include, among others, references to future performance and any comments about our strategic plans. There are many risk factors that could prevent us from achieving our goals and cause the underlying assumptions of these forward-looking statements, and our actual results, to differ materially from those expressed in, or implied by, our forward-looking statements. These risk factors and others are more fully discussed in our filings with the Securities and Exchange Commission. Any forward-looking statements are based on information available to us today and we undertake no obligation to update publicly any forward-looking statements, whether as a result of future events, new information or otherwise. The Company cautions users of this presentation not to place undue reliance on forward looking statements, which may be based on assumptions and anticipated events that do not materialize.

�

Bio n Responsible for: Fleet Planning Aircraft Transactions Corporate Finance Materials / Supply Chain n Joined Allegiant in 2009 n Held various finance-related roles at US Airways prior to joining Allegiant n BA, Brigham Young University n MBA, Arizona State University 32

�

Topics of discussion n Current fleet plan & transaction focus n Overview of recently executed fleet deals n Airbus update n MD-80 update n Financing flexibility 33

�

Current fleet plan & transaction focus 2013 2014E 2015E 2016E 2017E 2018E MD-80 (150 seat) 1 0 0 0 0 0 MD-80 (166 seat) 51 53 53 53 53 53 757 (218 seat) 6 6 6 6 6 6 A319 (156 seat) 3 4 9 12 12 24 A320 (177 seat) 5 7 10 10 10 10 Total 66 70 78 81 81 93 y/y fleet growth 5% 6% 11% 4% 0% 15% % Airbus Aircraft 12% 16% 24% 27% 27% 37% 34 Actual and projected fleet count of in service aircraft end of period n Continuously evaluate potential aircraft transactions and seek to acquire additional aircraft opportunistically n The following counts include only executed transactions:

�

Fleet deals executed during 2014 n Transactions for 16 future A320 series aircraft have been executed so far during 2014 Forward Purchase Transactions: " 1 A320 delivering in 2015 " 1 A319 delivering in 2016 " 2 A319s delivering in 2016 Purchase of Aircraft Currently on Lease: " 12 A319s redelivering in 2018 n Discussions are ongoing for additional transactions 35

�

Purchase of 12 leased A319s n In June 2014, the Company entered into separate agreements to acquire the ownership interests in twelve special purpose companies each owning one A319 aircraft currently on lease to a European carrier until 2018 n Allegiant does not intend to become a leasing company n Strategy is vastly different from other airlines that have announced intention to become a leasing company (quantities, timing, growth expectations, etc.) n Sale and lease back transactions are one type of acquisition strategy and provide aircraft commonality and greater fleet plan certainty than spot market transactions n Leasing is not a core business but is P&L accretive (3Q14 totals in $USD 000s): n Hedged foreign currency income 36 Revenue 10,225 Expenses 5,593 3Q14 Pre-tax Income 4,632

�

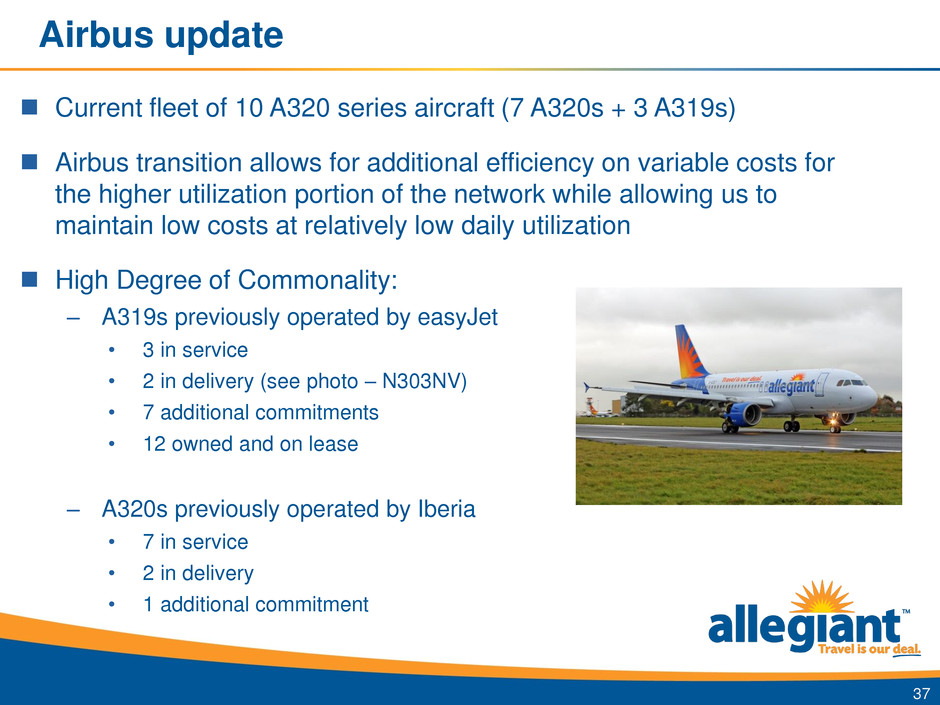

Airbus update n Current fleet of 10 A320 series aircraft (7 A320s + 3 A319s) n Airbus transition allows for additional efficiency on variable costs for the higher utilization portion of the network while allowing us to maintain low costs at relatively low daily utilization n High Degree of Commonality: A319s previously operated by easyJet " 3 in service " 2 in delivery (see photo N303NV) " 7 additional commitments " 12 owned and on lease A320s previously operated by Iberia " 7 in service " 2 in delivery " 1 additional commitment 37

�

Airbus update (contd) n A320 Market Update Lease rates have firmed somewhat over the past 18 months Pricing for sale transactions has remained relatively constant Fewer A320s available for sale, as many lessors have opted to lease mid- aged A320s into emerging market airlines Many airlines

bridging

to the NEO through short-term extensions More weakness in A319s than in A320s n Additional Aircraft Sourcing We remain confident in our ability to continue to source the aircraft needed to support fleet growth and eventual MD-80 replacement We maintain close relationships with most airlines that have large owned fleets of A320s Specialized technical & commercial knowledge of asset 38

�

Fleet flexibility with MD-80 aircraft n MD-80 remains an important and viable component of the fleet n Depreciation roll off provides flexibility to keep aircraft in the fleet or to retire aircraft if large A320 family transaction becomes available 39 - 10,000 20,000 30,000 40,000 50,000 60,000 70,000 2015 2016 2017 2018 2019 2020 MD-80 Depreciation per Aircraft per Month ($) Engines Airframe 166-seat Project Chart above is for current fleet only

�

Fleet flexibility with MD-80 aircraft (contd) n Maintenance costs have been stable over the long-term n Due to maintenance program timing, costs will be lumpy in the short-term 40 $103.35 $103.01 $129.56 $102.28 $96.50 $107 (1) $90 $95 $100 $105 $110 $115 $120 $125 $130 $135 2009 2010 2011 2012 2013 2014EM a int e n a n c e p e r A C p e r m o s th o u s a n d U S D Maintenance per aircraft per month (1) Represents midpoint of previously guided $105,000 - $110,000 per month per aircraft

�

Fleet flexibility with MD-80 aircraft (contd) n Boeing has completed the FAA approval for the Widespread Fatigue Damage / Limit of Validity for the MD-80 at 110,000 cycles and 150,000 flight hours 41 ~ 58,000 cycles remaining on most restrictive aircraft = 77 yrs. @750 cycles / yr. ~ 80,000 flight hours remaining on most restrictive aircraft = 46 yrs. @1,750 flight hours /yr.

�

Current debt / financing flexibility n Steep amortization of current loan balances will provide significant flexibility to optimize cash levels 42 Aircraft values are estimates using appraised market value forecasts and include current and committed aircraft only. Debt balances are based on amortization schedules for debt pertaining to current owned aircraft.

�

Marketing update Brian Davis VP Business Development

�

Forward looking statements 44 This presentation as well as oral statements made by officers or directors of Allegiant Travel Company, its advisors and affiliates (collectively or separately, the "Company

) will contain forward- looking statements that are only predictions and involve risks and uncertainties. Forward-looking statements may include, among others, references to future performance and any comments about our strategic plans. There are many risk factors that could prevent us from achieving our goals and cause the underlying assumptions of these forward-looking statements, and our actual results, to differ materially from those expressed in, or implied by, our forward-looking statements. These risk factors and others are more fully discussed in our filings with the Securities and Exchange Commission. Any forward-looking statements are based on information available to us today and we undertake no obligation to update publicly any forward-looking statements, whether as a result of future events, new information or otherwise. The Company cautions users of this presentation not to place undue reliance on forward looking statements, which may be based on assumptions and anticipated events that do not materialize.

�

Bio n Responsible for: Marketing Public relations Loyalty Co-branded credit card n Joined Allegiant in 2005 n Worked in government affairs, charters, fuel, and airport group at Allegiant n The Wharton School University of Pennsylvania Master of Business Administration 45

�

�

Allegiant 15 Years of Sunshine

�

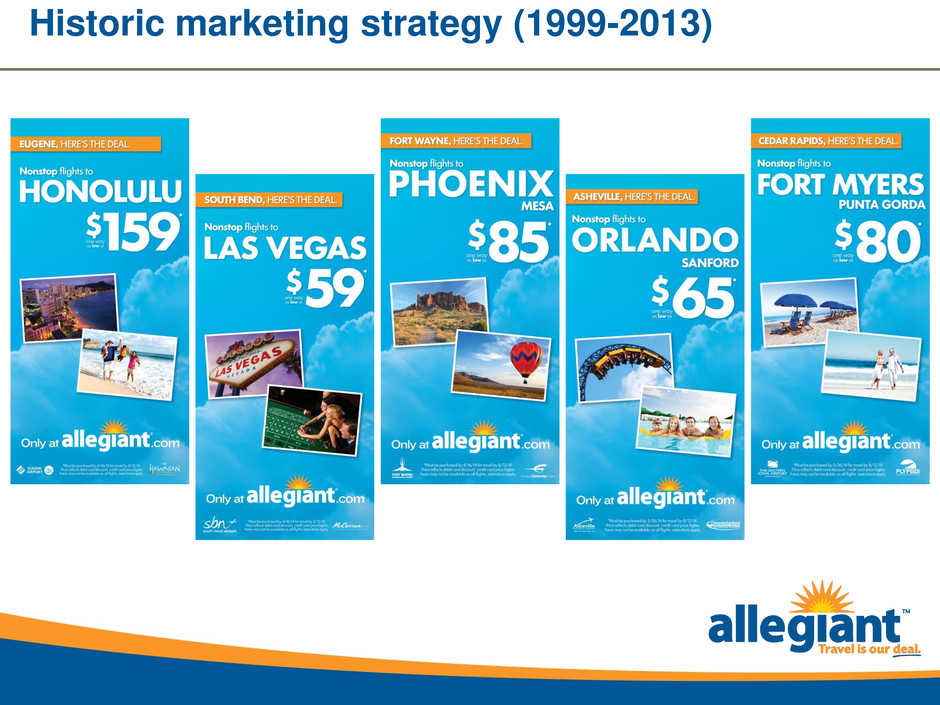

Historic marketing strategy (1999-2013)

�

Individual Local National � 2013 2014 � Allegiant evolution of marketing strategy

�

National marketing television ads

�

National marketing The Game Plane � Aligned with ALGTs leisure focus Distributed through syndication to: � 77% of US television households � markets with 83% of G4 capacity

�

National Marketing GMS Racing � Sponsorship of three drivers in ARCA and Truck Series racing � High visibility among demographic with significant overlap to ALGT customers

�

n 75% of all Make-A-Wish wishes involve air transportation n Allegiant celebrated our 210th wish in November 2014 n Created special aircraft livery to celebrate our 100th wish National marketing Allegiant & Make-A-Wish

�

Outdoor Print Television Local marketing advertising

�

Dynamically populated with lowest price currently available from nearest airport Direct marketing targeted online

�

Launched in October 2013: n OTA Display " Priceline, Orbitz, CheapFlights, CheapTickets n Search Result Display n Ad Network Display Direct marketing targeted online

�

Industry Allegiant Unique Opens 10.7% 17.4% Click Through 1.5% 3.8% Unsubscribe 0.14% 0.12% " 4.6 Million Active Subscribers " Dynamic, Market-Specific Deals " Deep Links to Featured Deals Direct marketing weekly email deals

�

Individual Local National � 2013 2014 � Evolution of marketing strategy

�

Marketing measuring effectiveness n When compared to Googles index of

travel

, the three-tiered marketing strategy has shown significant increases in first-time visitors to the website.

�

Technology update Todd Cinnamon VP IT

�

Forward looking statements 61 This presentation as well as oral statements made by officers or directors of Allegiant Travel Company, its advisors and affiliates (collectively or separately, the "Company

) will contain forward- looking statements that are only predictions and involve risks and uncertainties. Forward-looking statements may include, among others, references to future performance and any comments about our strategic plans. There are many risk factors that could prevent us from achieving our goals and cause the underlying assumptions of these forward-looking statements, and our actual results, to differ materially from those expressed in, or implied by, our forward-looking statements. These risk factors and others are more fully discussed in our filings with the Securities and Exchange Commission. Any forward-looking statements are based on information available to us today and we undertake no obligation to update publicly any forward-looking statements, whether as a result of future events, new information or otherwise. The Company cautions users of this presentation not to place undue reliance on forward looking statements, which may be based on assumptions and anticipated events that do not materialize.

�

Bio n Responsible for: Software development lifecycle for Allegiant portfolio n Joined Allegiant in 2012 n 24+ years in the travel space, including American Airlines, Sabre, GetThere.com and United (pre-merger) n BS in Computer Science, Rensselaer Polytechnic Institute n Masters in Software Engineering, Texas Christian University 62

�

Platform advantages n Scalability n Flexibility and agility n Marketing drives, not IT n Code/service re-use n Ability to perform Quality Assurance at all levels of the platform 63

�

Platform overview 64 AIS Airline Inventory Website Mobile Apps Booking Engine Hotels Cars Products Shared Services G4Plus OTA DB Loyalty

�

IT wins - commercial n Loyalty/Co-Branded credit card platform n Add car/hotel to existing bookings on WWW n Customer Database / My Accounts on WWW n Promo Codes n Seat Masking n Legroom Plus / Giant Seats n New Pricing Rules Engine for Car and TripFlex n Fare Buckets n iPad kiosk at airport ticket counters for check-in and bag drop n New call center tools for creating/modifying reservations 65

�

IT wins airline operations n iPads for mechanics on the line n New boarding software at airport gates (DCS 1.0) n Automated weight and balance / Eliminate F/A counts n Mobile Check in 66

�

End of year pipeline n Hotels for small markets (Priceline) n Credit card surcharge 67

�

Ancillary update Jude Bricker SVP Planning

�

Forward looking statements 69 This presentation as well as oral statements made by officers or directors of Allegiant Travel Company, its advisors and affiliates (collectively or separately, the "Company

) will contain forward- looking statements that are only predictions and involve risks and uncertainties. Forward-looking statements may include, among others, references to future performance and any comments about our strategic plans. There are many risk factors that could prevent us from achieving our goals and cause the underlying assumptions of these forward-looking statements, and our actual results, to differ materially from those expressed in, or implied by, our forward-looking statements. These risk factors and others are more fully discussed in our filings with the Securities and Exchange Commission. Any forward-looking statements are based on information available to us today and we undertake no obligation to update publicly any forward-looking statements, whether as a result of future events, new information or otherwise. The Company cautions users of this presentation not to place undue reliance on forward looking statements, which may be based on assumptions and anticipated events that do not materialize.

�

Revenue initiatives n Fare buckets n Seat assignment pricing n Pre-paid bag pricing n Charge for check-in n TripFlex pricing 70

�

Driving more towards ancillary n Fare is critical decision point for customer 71 25.0% 30.0% 35.0% 40.0% 45.0% 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 Ancillary as a percentage of total fare Spirit Allegiant Data from public filings

�

Third party ancillary n Factors on hotels Network shift to the East End of most favorable room rates from the CET contract in August 2013 End of the air subsidy in November 2012 n Car bookings are improving based on new pricing tools 72

�

Network shift away from Las Vegas n Opportunities have favored the east coast Bulk of hotel bookings occur in Las Vegas 73 10% 15% 20% 25% 30% 35% 40% 45% 50% 1 /1/ 2 0 0 9 3 /1/ 2 0 0 9 5 /1/ 2 0 0 9 7 /1/ 2 0 0 9 9 /1/ 2 0 0 9 1 1 /1 /2 0 0 9 1 /1/ 2 0 1 0 3 /1/ 2 0 1 0 5 /1/ 2 0 1 0 7 /1/ 2 0 1 0 9 /1/ 2 0 1 0 1 1 /1 /2 0 1 0 1 /1/ 2 0 1 1 3 /1/ 2 0 1 1 5 /1/ 2 0 1 1 7 /1/ 2 0 1 1 9 /1/ 2 0 1 1 1 1 /1 /2 0 1 1 1 /1/ 2 0 1 2 3 /1/ 2 0 1 2 5 /1/ 2 0 1 2 7 /1/ 2 0 1 2 9 /1/ 2 0 1 2 1 1 /1 /2 0 1 2 1 /1/ 2 0 1 3 3 /1/ 2 0 1 3 5 /1/ 2 0 1 3 7 /1/ 2 0 1 3 9 /1/ 2 0 1 3 1 1 /1 /2 0 1 3 1 /1/ 2 0 1 4 3 /1/ 2 0 1 4 5 /1/ 2 0 1 4 7 /1/ 2 0 1 4 9 /1/ 2 0 1 4 Percent of total passengers Rolling 12 month average Las Vegas East Coast West Coast ex Las Vegas

�

Counterintuitive to Las Vegas macro n Stronger Las Vegas strip, reduces access to hotel inventory 74 0.2 0.21 0.22 0.23 0.24 0.25 0.26 0.27 0.28 0.29 $105 $107 $109 $111 $113 $115 $117 $119 2011 2012 2013 YTD 2014 R o o m n ig h t per L a s V egas p a s s e n g e r L a s V egas A D R Las Vegas ADR vs Allegiant hotel demand Las Vegas ADR (lhs) Room night / Las Vegas passenger (inverse - rhs) ADR average daily rate lhs left hand side of chart rhs right hand side of chart

�

Q&A Maury Gallagher Chairman & CEO

�

n 2015 Scheduled ASMs +9 to 13% n 2015 CASM ex fuel (4) to 0% n 2015 CAPEX $175mm to $185mm 2015 Guidance 76

�

GAAP reconciliation EBITDA calculations 77 $mm 2013 2012 2011 Net Income 92.3 78.6 49.4 +Provision for Income Taxes 54.9 46.2 30.1 +Other Expenses 8.5 7.8 5.9 +Depreciation and Amortization 69.3 57.5 42.0 =EBITDA 225.0 190.1 127.4

�

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Midday movers: Meta, IBM, Caterpillar fall; Chipotle rises

- Travel + Leisure Co. and Allegiant Announce Multi-Year Marketing Agreement

- Oracle (ORCL) Introduces New AI Capabilities to Help Organizations Boost Sales

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share