Form 8-K 1ST SOURCE CORP For: May 04

UNITED STATES | ||

SECURITIES AND EXCHANGE COMMISSION | ||

Washington, D.C. 20549 | ||

FORM 8-K | ||

CURRENT REPORT | ||

PURSUANT TO SECTION 13 OR 15(d) OF | ||

THE SECURITIES EXCHANGE ACT OF 1934 | ||

Date of Report (Date of earliest event reported): May 4, 2016 | ||

| ||

1st Source Corporation | ||

(Exact name of registrant as specified in its charter) | ||

Indiana | 0-6233 | 35-1068133 |

(State or other jurisdiction of incorporation) | (Commission File No.) | (I.R.S. Employer Identification No.) |

100 North Michigan Street, South Bend, Indiana 46601 | ||

(Address of principal executive offices) (Zip Code) | ||

574-235-2000 | ||

(Registrant's telephone number, including area code) | ||

Not Applicable | ||

(Former name or former address, if changed since last report) | ||

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | ||

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||

ITEM 7.01 Regulation FD Disclosure.

The executive officers of 1st Source Corporation intend to use the material filed herewith, in whole or in part, in one or more meetings with investors and analysts. A copy of the investor presentation is attached hereto as Exhibit 99.1.

1st Source Corporation does not intend for this Item 7.01 or Exhibit 99.1 to be treated as "filed" for purposes of the Securities Exchange Act of 1934, as amended, or incorporated into its filings under the Securities Act of 1933, as amended.

ITEM 9.01 Financial Statements and Exhibits.

The following exhibit shall not be deemed as "filed" for purposes of the Securities Exchange Act of 1934, as amended.

(d) Exhibit:

99.1 1st Source Corporation Investor Presentation

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

1st SOURCE CORPORATION | ||

(Registrant) | ||

Date: May 4, 2016 | /s/ CHRISTOPHER J. MURPHY III | |

Christopher J. Murphy III | ||

Chairman of the Board and CEO | ||

Date: May 4, 2016 | /s/ ANDREA G. SHORT | |

Andrea G. Short | ||

Treasurer and Chief Financial Officer | ||

Principal Accounting Officer | ||

INVESTOR PRESENTATION Symbol: SRCE www.1stsource.com

FORWARD-LOOKING STATEMENT DISCLOSURE PAGE 2 Except for historical information, the matters discussed may include “forward-looking statements.” Generally, words such as “believe,” “possible,” “expect,” “intend,” “estimate,” “anticipate,” “project,” “will,” “contemplate,” “seek,” “plan,” “assume,” “targeted,” “continue,” “remain,” “should,” “indicate,” “would,” “may” indicate forward-looking statements. Those statements are subject to material risks and uncertainties. 1st Source cautions readers not to place undue reliance on any forward-looking statements, which speak only as of the date made. 1st Source may make other written or oral forward-looking statements from time to time. The audience is advised that various important factors could cause 1st Source’s actual results or circumstances for future periods to differ materially from those anticipated or projected in such forward-looking statements. Such factors, among others, include changes in laws, regulations or accounting principles generally accepted in the United States; 1st Source’s competitive position within its markets served; increasing consolidation within the banking industry; unforeseen changes in interest rates; unforeseen downturns in the local, regional or national economies or in the industries in which 1st Source has credit concentrations; and other risks discussed in 1st Source’s filings with the Securities and Exchange Commission, including its Annual Report on Form 10-K, which filings are available from the SEC. 1st Source undertakes no obligation to publicly update or revise any forward-looking statements. Non-GAAP Financial Measures In addition to the results presented in accordance with generally accepted accounting principles in the United States of America, this presentation contains certain non-GAAP financial measures. 1st Source Corporation believes that providing non-GAAP financial measures provides investors with information useful to understanding our financial performance.

MISSION AND VISION Mission To help our clients achieve security, build wealth and realize their dreams by offering straight talk, sound advice and keeping their best interests in mind for the long-term. Vision ■ Offer our clients the highest-quality service ■ Support a proud family of colleagues who personify the 1st Source spirit of partnership ■ Be the financial institution of choice in each market we serve ■ Remain independent and nurture pride of ownership among all 1st Source colleagues ■ Achieve long-term, superior financial results PAGE 3

CORPORATE OVERVIEW $5.2 billion Community Bank with International Reach headquartered in South Bend, Indiana Community Banking: ■ Locations throughout Northern Indiana and Southwestern Michigan ■ Personal and business banking, payment services, lending, mortgage, and leasing ■ Investment management, trust and estate planning, and retirement planning services ■ Business and consumer insurance sales Specialty Finance: ■ National and international footprint ■ Construction machinery ■ Corporate and personal aircraft ■ Auto rental and leasing, shuttle buses, charter buses, and funeral cars ■ Truck rental and leasing PAGE 4

BUSINESS MIX (LOANS AND LEASES) Personal Community Banking 29% Business Community Banking 71% Specialty Finance 49% 51% As of March 31, 2016 PAGE 5

EXPERIENCED AND PROVEN TEAM Executive Team ■ 6 executives with an average 37 years each of banking experience and 24 years with 1st Source Business Banking Officers ■ 38 business banking officers with an average 20 years each of lending experience and 11 years with 1st Source Specialty Finance Group Officers ■ 26 specialty finance group officers with an average 27 years each of lending experience and 12 years with 1st Source PAGE 6

MARKET AREA Specialty Finance Loans: $2.0 billion Community Bank Loans: $2.1 billion As of March 31, 2016 PAGE 7

COMMUNITY BANKING ■ 80 Banking Centers ■ 100 Twenty-four hour ATMs ■ 10 1st Source Insurance offices ■ 8 Trust & Wealth Management locations with approximately $3.9 billion of assets under management In person Online Over the phone Mobile PAGE 8

COMMUNITY BANKING MARKET AREA 17 – County Market Market Households 794,417 Client Households 100,978 Penetration 12.7% Businesses (approx) 74,600 Business Clients 14,761 Penetration 19.8% As of December 31, 2015 Higher Education Steel Production Regional Medical Hub Medical Devices Agriculture Distribution Hub Recreational Vehicle Manufacturing PAGE 9

PAGE ELEVEN PERFORMANCE – CLIENT ■ #1 deposit share in our 15 contiguous county market ■ #1 SBA Lender in every county where located ■ #2 SBA Lender in State of Indiana ■ Best Branch Service in the Midwest – MSR Group ■ Indiana SBA Community Lender Award – 2013 - 2015 ■ Best Bank for Business – Northwest Indiana Business Quarterly ■ Best Company to Work For – Northwest Indiana Business Quarterly ■ Best Bank for Customer Service – Northwest Indiana Business Quarterly ■ One of the Highest Customer Advocacy Scores among banks in Midwest – APECS, 2015 PAGE 10

SPECIALTY FINANCE GROUP SERVICES Aircraft Financing — $784MM Aircraft financing primarily for new and used general aviation aircraft (including helicopters) for private and corporate users, some for aircraft distributors and dealers, air charter operators, air cargo carriers, and other aircraft operators Auto and Light Truck Division — $428MM Auto/light truck financing for automobile rental and leasing companies, light truck rental and leasing companies, and special purpose vehicle users: shuttle buses, charter buses, funeral cars, etc. Construction Equipment Financing — $468MM Construction equipment financing for infrastructure projects (i.e., asphalt and concrete plants, bulldozers, excavators, cranes, and loaders, etc.) Medium and Heavy Duty Truck Division — $273MM The medium and heavy duty truck division finances highway tractors and trailers and delivery trucks for the commercial trucking industry and trash and recycling equipment for municipalities and private businesses as well as equipment for landfills As of March 31, 2016 PAGE 11

FINANCIAL REVIEW PAGE 12

ATTRACTIVE CORE DEPOSIT FRANCHISE 3555 3574 3701 3778 3961 4153 0.87 0.61 0.45 0.30 0.29 0.37 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% 1.40% 1.60% 1.80% 0 500 1000 1500 2000 2500 3000 3500 4000 4500 5000 2011 2012 2013 2014 2015 2016 Deposits Effective Rate on Deposits (%) Total Average Deposits ($MM) Average Deposits By Type (YTD 3/31/16) PAGE 13 YTD

DEPOSIT MARKET SHARE – 15 COUNTY CONTIGUOUS MARKET* $1,000,000 $1,500,000 $2,000,000 $2,500,000 $3,000,000 $3,500,000 $4,000,000 $4,500,000 June 09 June 10 June 11 June 12 June 13 June 14 June 15 1st Source Chase Lake City Bank Wells Fargo Fifth Third PNC *Includes Allen, Elkhart, Fulton, Huntington, Kosciusko, LaPorte, Marshall, Porter, Pulaski, St. Joseph, Starke, Wells, and Whitley counties in the State of Indiana, and Berrien and Cass counties in the State of Michigan. 2015 13.66% 9.59% 8.67% 8.04% 5.22% 5.21% Data as of June 2015 – FDIC (via SNL Financial) Leading Market Share in Community Banking Markets ($000) PAGE 14

DIVERSIFIED & GROWING LOAN PORTFOLIO 3079 3209 3434 3640 3837 4008 5.33 5.02 4.69 4.42 4.39 4.29 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 7.00% 8.00% 9.00% 10.00% 0 500 1000 1500 2000 2500 3000 3500 4000 4500 5000 2011 2012 2013 2014 2015 2016 YTD Loans & Leases Yield on Loans & Leases (%) Total Average Loans & Leases ($MM) Average Loans By Type (3/31/16) PAGE 15

STRONG CREDIT QUALITY PAGE 16 2.64% 2.50% 2.35% 2.31% 2.21% 2.21% 2011 2012 2013 2014 2015 2016 % of Net Loans and Leases Loan & Lease Loss Reserve Nonperforming Assets Net Charge-Offs / (Recoveries) Stable Reserves 2.28% 1.25% 1.29% 1.13% 0.50% 0.51% 2011 2012 2013 2014 2015 2016 Improving Credit Quality 0.27% 0.13% 0.02% 0.06% (0.02%) (0.02%) 2011 2012 2013 2014 2015 2016 Limited Losses YTD YTD YTD

150.9 153.8 158.6 162.2 168.2 39.9 41.8 3.69 3.69 3.67 3.59 3.60 3.58 3.45 0.00% 1.40% 2.80% 4.20% 5.60% 7.00% $0 $40 $80 $120 $160 $200 2011 2012 2013 2014 2015 2015 YTD 2016 YTD Net Interest Income ($MM) Net Interest Margin (%) ($MM) NET INTEREST MARGIN (FTE) PAGE 17

DIVERSE SOURCES OF NONINTEREST INCOME Noninterest Income Composition YTD 12/31/15 = $65.0M* YTD 3/31/16 = $16.5M* PAGE 18 28% of Total Revenue* 29% of Total Revenue* * Note: Equipment rental income is shown net of leased equipment depreciation.

OPERATING EXPENSES PAGE 19 133.7 136.3 136.3 136.1 140.8 34.0 35.6 64.4 63.3 62.4 60.6 60.9 62.1 62.3 0.0% 25.0% 50.0% 75.0% 100.0% $0.0 $30.0 $60.0 $90.0 $120.0 $150.0 $180.0 2011 2012 2013 2014 2015 2015 YTD 2016 YTD Noninterest Expense ($MM)* Efficiency (%) ($MM) * Note: Noninterest expense is shown net of leased equipment depreciation.

48.20 49.63 54.96 58.07 57.49 13.51 13.82 1.78 1.83 2.03 2.17 2.17 0.51 0.53 $0.00 $0.50 $1.00 $1.50 $2.00 $2.50 $3.00 $3.50 $4.00 $0 $10 $20 $30 $40 $50 $60 $70 2011 2012 2013 2014 2015 2015 YTD 2016 YTD Net Income EPCS (Diluted) ($MM) NET INCOME & EARNINGS PER SHARE* * Note: EPS adjusted for 10% stock dividend declared July 22, 2015 and issued on August 14, 2015. PAGE 20

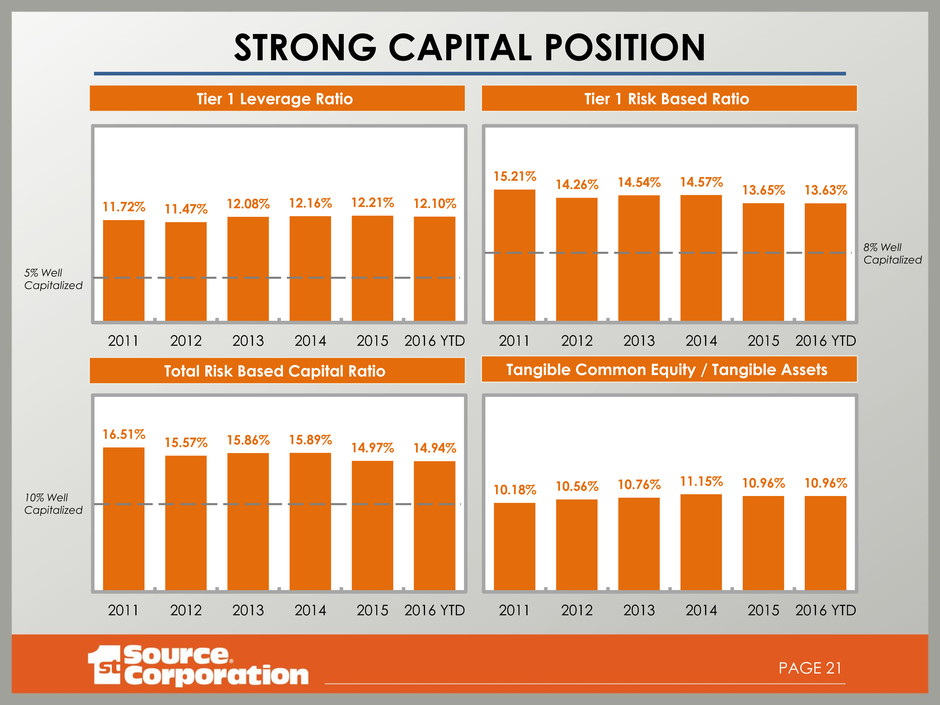

16.51% 15.57% 15.86% 15.89% 14.97% 14.94% 2011 2012 2013 2014 2015 2016 YTD 15.21% 14.26% 14.54% 14.57% 13.65% 13.63% 2011 2012 2013 2014 2015 2016 YTD 11.72% 11.47% 12.08% 12.16% 12.21% 12.10% 2011 2012 2013 2014 2015 2016 YTD STRONG CAPITAL POSITION PAGE 21 Total Risk Based Capital Ratio Tier 1 Leverage Ratio Tier 1 Risk Based Ratio Tangible Common Equity / Tangible Assets 10% Well Capitalized 5% Well Capitalized 8% Well Capitalized 10.18% 10.56% 10.76% 11.15% 10.96% 10.96% 2011 2012 2013 2014 2015 2016 YTD

$14.15 $14.95 $16.38 $17.67 $18.65 $20.16 $21.49 $21.87 $10.00 $13.50 $17.00 $20.50 $24.00 $27.50 2009 2010 2011 2012 2013 2014 2015 2016 YTD TANGIBLE BOOK VALUE PER COMMON SHARE* Consistent Growth * Note: Adjusted for 10% stock dividend declared July 22, 2015 and issued on August 14, 2015. PAGE 22

0.482 0.509 0.527 0.536 0.555 0.582 0.600 0.618 0.645 0.671 0.360 $0.000 $0.100 $0.200 $0.300 $0.400 $0.500 $0.600 $0.700 $0.800 $0.900 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 YTD COMMON DIVIDENDS PER SHARE* 28 YEARS OF CONSECUTIVE DIVIDEND GROWTH * Note: Adjusted for 10% stock dividend declared July 22, 2015 and issued on August 14, 2015. PAGE 23

DELIVERING RETURNS TO SHAREHOLDERS * As of April 15, 2016 PAGE 24

PERFORMANCE – FINANCIAL ■ #27 of 130 banks – Bank Performance Scorecard by Bank Director Magazine ■ Top 15th Percentile of Community Banks – Seifried & Brew ■ 5 Star “Superior” Rating – Bauer Financial ■ 28 years of consecutive dividend growth PAGE 25

INVESTMENT CONSIDERATIONS ■ Consistent and superior financial performance with a focus on long-term earnings per share and tangible book value growth ■ Experienced and proven team with significant investment in bank ■ Diversification of product mix and geography with asset generation capability ■ Leading market share in community banking markets ■ Stable credit quality, strongly reserved ■ Strong capital position and 28 consecutive years of dividend growth ■ Balance Sheet is asset sensitive – positioned for rising rates over time PAGE 26

CONTACT INFORMATION Christopher J. Murphy III Chairman of the Board and CEO (574) 235-2711 [email protected] Andrea G. Short CFO and Treasurer (574) 235-2348 [email protected] PAGE 27

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- 1st Source Corp (SRCE) Raises Quarterly Dividend 6.3% to $0.34; 2.7% Yield

- INVESTIGATION ALERT: The Schall Law Firm Announces it is Investigating Claims Against FiscalNote Holdings, Inc. and Encourages Investors to Contact the Firm

- GLOBAL CORD ALERT: Bragar Eagel & Squire, P.C. Announces that a Class Action Lawsuit Has Been Filed Against Global Cord Blood Corporation and Encourages Investors to Contact the Firm

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share