Form 6-K MEXICAN ECONOMIC DEVELOP For: Mar 04

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

Date of Report: March 4, 2016

FOMENTO ECONÓMICO MEXICANO, S.A.B. DE C.V.

(Exact name of Registrant as specified in its charter)

Mexican Economic Development, Inc.

(Translation of Registrant’s name into English)

United Mexican States

(Jurisdiction of incorporation or organization)

General Anaya No. 601 Pte.

Colonia Bella Vista

Monterrey, Nuevo León 64410

México

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ¨ No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-

Contents

In connection with a proposed private placement of debt securities, Fomento Económico Mexicano, S.A.B. de C.V. (“FEMSA”) anticipates disclosing certain information that has not been previously publicly reported. This private placement is expected to be made under Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”), and, to the extent any private placement of securities follows, the securities will be sold only outside the United States to persons other than U.S. persons in reliance on Regulation S under the Securities Act. No assurance can be made that any private placement of securities will be completed. FEMSA has elected to provide this information in this report on Form 6-K in the attached Exhibit 99.1 for informational purposes only.

This report does not constitute an offer to sell or a solicitation of an offer to buy any security and shall not constitute an offer to sell or a solicitation of an offer to buy any security in any jurisdiction where such an offer to sell or solicitation of an offer to buy would be unlawful.

| Exhibit No. |

Description | |

| 99.1. | Certain information with respect to FEMSA. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| FOMENTO ECONÓMICO MEXICANO, S.A.B. DE C.V. | ||||

| By: | /s/ Miguel Eduardo Padilla Silva | |||

| Miguel Eduardo Padilla Silva | ||||

| Chief Financial and Corporate Officer | ||||

Date: March 4, 2016

EXHIBIT INDEX

| Exhibit No. |

Description | |

| 99.1 | Certain information with respect to FEMSA. |

EXHIBIT 99.1

SUMMARY

Overview

We are a Mexican company headquartered in Monterrey, Mexico, leader in the non-alcoholic beverage, beer and retail industries. Additionally, through a strategic businesses unit, we provide logistics, point-of-sale, refrigeration and plastic packaging solutions to our other business units and third parties.

We conduct our operations through the following principal holding companies:

| • | Coca-Cola FEMSA, S.A.B. de C.V. (“Coca-Cola FEMSA”), which produces, distributes and sells beverages and is the largest franchise bottler of Coca-Cola products in the world; |

| • | FEMSA Comercio, S.A. de C.V. (“FEMSA Comercio”), comprising a Retail Division operating various small-format chain stores, including OXXO, the largest and fastest-growing chain in Latin America, and a Fuel Division operating the OXXO GAS chain of retail service stations for fuels, motor oils and other car care products. As of December 31, 2015, the Fuel Division is treated as a separate business segment; and |

| • | CB Equity LLP (“CB Equity”), which holds our equity investment in Heineken, one of the world’s leading brewers, with operations in over 70 countries. |

Coca-Cola FEMSA

Coca-Cola FEMSA is the largest franchise bottler of Coca-Cola trademark beverages in the world. It operates in territories in the following countries:

| • | Mexico – a substantial portion of central Mexico, the southeast and northeast of Mexico (including the Gulf region). |

| • | Central America – Guatemala (Guatemala City and surrounding areas), Nicaragua (nationwide), Costa Rica (nationwide) and Panama (nationwide). |

| • | Colombia – most of the country. |

| • | Venezuela – nationwide. |

| • | Brazil – a major part of the states of Sao Paulo and Minas Gerais, the states of Parana and Mato Grosso do Sul and part of the states of Rio de Janeiro and Goias. |

| • | Argentina – Buenos Aires and surrounding areas. |

| • | Philippines – nationwide (through a joint venture with The Coca-Cola Company). |

Coca-Cola FEMSA was incorporated on October 30, 1991, as a stock corporation with variable capital (sociedad anónima de capital variable) under the laws of Mexico. On December 5, 2006, as required by amendments to the Mexican Securities Market Law, Coca-Cola FEMSA became a publicly traded stock corporation with variable capital (sociedad anónima bursátil de capital variable).

FEMSA Comercio

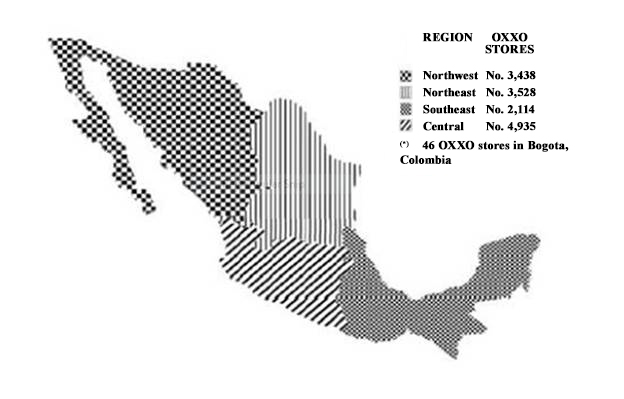

FEMSA Comercio, through its Retail Division, operates the largest chain of small-format stores in Mexico, measured in terms of number of stores as of December 31, 2015, mainly under the trade name “OXXO.” As of December 31, 2015, FEMSA Comercio – Retail Division operated 14,061 OXXO stores, of which 14,015 were located throughout Mexico and the remaining 46 stores were located in Bogota, Colombia.

FEMSA Comercio – Retail Division was established by FEMSA in 1978 with the opening of two OXXO stores in Monterrey, Nuevo Leon, one store in Mexico City and another store in Guadalajara, Jalisco. The motivating factor behind FEMSA’s entrance into the retail industry was to enhance beer sales through company-owned retail outlets as well as to gather information on customer preferences. In 2015, a typical OXXO store carried 2,954 different stock keeping units (SKUs) in 31 main product categories.

In recent years, FEMSA Comercio – Retail Division has represented an effective distribution channel for our beverage products, as well as a rapidly growing point of contact with our consumers. Based on the belief that location plays a major role in the long-term success of a retail operation such as a small-format store, as well as a role in our ability to accelerate and streamline the new-store development process, FEMSA Comercio – Retail Division has focused on a strategy of rapid, profitable growth. FEMSA Comercio – Retail Division opened 1,208, 1,132 and 1,120 net new OXXO stores in 2015, 2014 and 2013, respectively. The accelerated expansion in the number of OXXO stores and the inorganic expansion in the drugstore markets in Mexico and Chile yielded total revenue growth of 21.2% to reach Ps. 132,891 million in 2015. OXXO same-store sales increased an average of 6.9%, driven by an increased average customer ticket and an increase in same-store traffic. FEMSA Comercio performed approximately 3.7 billion transactions in 2015 compared to 3.4 billion transactions in 2014.

FEMSA Comercio – Fuel Division operates retail service stations for fuels, motor oils and other car care products. As of December 31, 2015, FEMSA Comercio – Fuel Division operates 307 service stations, concentrated mainly in the northern part of the country with a presence in 14 different states throughout Mexico.

Since 1995, FEMSA Comercio has provided services and operated retail service stations for fuels, motor oils and other car care products through agreements with third parties that own PEMEX franchises, using the trade name “OXXO GAS.” Over time, this brand has become synonymous with quality service among our customers, and revenues per gas pump have consistently grown.

Historically, Mexican legislation precluded FEMSA Comercio from participating in the retail of gasoline, and therefore from owning PEMEX franchises, due to FEMSA’s foreign institutional investor base. In March 2015, following changes to the legal framework and considering the potential expansion and synergies arising from this business as part of Mexico’s energy reform, FEMSA Comercio began to acquire PEMEX’s service station franchises and to obtain permits from PEMEX to operate each of the franchises.

Equity Investment in the Heineken Group

As of December 31, 2015, we owned a non-controlling interest in the Heineken Group, one of the world’s leading brewers. As of December 31, 2015, our 20.0% economic interest in the Heineken Group comprised 43,018,320 shares of Heineken Holding N.V. and 72,182,203 shares of Heineken N.V. For 2015, we recognized equity income of Ps. 5,879 million regarding our 20.0% economic interest in the Heineken Group; see Note 10 to our audited consolidated financial statements.

As described above, FEMSA Comercio – Retail Division has a distribution agreement with subsidiaries of Cuauhtémoc Holding, S.A. de C.V. (“Cuauhtémoc Moctezuma”), now part of the Heineken Group, pursuant to which OXXO stores in Mexico only carry beer brands produced and distributed by Cuauhtémoc Moctezuma. OXXO stores will continue to benefit from the existing relationship under which Cuauhtémoc Moctezuma will continue to be the exclusive supplier of beer to OXXO until June 2020. As of April 30, 2010, Coca-Cola FEMSA has agreed with Cervejarias Kaiser (also now part of the Heineken Group) to continue to distribute and sell the Kaiser beer portfolio in Coca-Cola FEMSA’s Brazilian territories for a 20-year term beginning in 2003, consistent with the arrangement already in place. In addition, our logistic services subsidiary provides certain services to Cuauhtémoc Moctezuma and its subsidiaries.

2

Other Business

Our other business consists of the following smaller operations that support our core operations:

| • | Our logistics services subsidiary provides a broad range of logistics and vehicle maintenance services to Coca-Cola FEMSA, FEMSA Comercio and third-party clients in the beverages, consumer products and retail industries. It has operations in Mexico, Brazil, Colombia, Panama, Costa Rica, Nicaragua and Peru. |

| • | Our refrigeration business produces vertical and horizontal commercial refrigerators for the soft drink, beer and food industries, with an annual capacity of 546,934 units at December 31, 2015. In 2015, this business sold 429,464 refrigeration units, 31.1% of which were sold to Coca-Cola FEMSA, and the remainder of which were sold to third parties. |

The following table presents an overview of our operations by reportable segment and by geographic area:

Operations by Segment—Overview

Year Ended December 31, 2015 and % of growth (decrease) vs. previous year

| Coca-Cola FEMSA | FEMSA Comercio – Retail Division |

FEMSA Comercio – Fuel Division(4) |

CB Equity(1) | |||||||||||||||||||||||||||||

| (in millions of Mexican pesos, except for employees and percentages) | ||||||||||||||||||||||||||||||||

| Total revenues |

P | s. 152,360 | 3 | % | P | s. 132,891 | 21 | % | Ps. | 18,510 | NA | Ps. | — | — | ||||||||||||||||||

| Gross Profit |

72,030 | 5 | % | 47,291 | 20 | % | 1,420 | NA | — | — | ||||||||||||||||||||||

| Share of the profit (loss) of associates and joint ventures accounted for using the equity method, net of taxes |

155 | 224 | %(2) | (10 | ) | (127 | %)(3) | — | NA | 5,879 | 12 | % | ||||||||||||||||||||

| Total assets |

210,249 | (1 | %) | 67,211 | 54 | % | 3,230 | NA | 95,502 | 11 | % | |||||||||||||||||||||

| Employees |

83,712 | 0.4 | % | 133,748 | 21 | % | 4,551 | NA | — | — | ||||||||||||||||||||||

| (1) | CB Equity holds our Heineken N.V. and Heineken Holding N.V. shares. |

| (2) | Reflects the percentage increase between the gain of Ps. 155 million recorded in 2015 and the loss of Ps. 125 million recorded in 2014. |

| (3) | Reflects the percentage decrease between the loss of Ps. 10 million recorded in 2015 and the gain of Ps. 37 million recorded in 2014. |

| (4) | The operations that compose our FEMSA Comercio – Fuel Division were acquired and have been treated as a separate business segment since 2015. As such, no results of operations are available for this segment for periods prior to 2015. |

Total Revenues Summary by Segment and Other Financial Information (1)

| Year Ended December 31, | ||||||||||||

| 2015 | 2014 | 2013 | ||||||||||

| (in millions of Mexican pesos) | ||||||||||||

| Coca-Cola FEMSA |

Ps. | 152,360 | Ps. | 147,298 | Ps. | 156,011 | ||||||

| FEMSA Comercio – Retail Division |

132,891 | 109,624 | 97,572 | |||||||||

| FEMSA Comercio – Fuel Division |

18,510 | — | — | |||||||||

| Other |

22,774 | 20,069 | 17,254 | |||||||||

| Consolidated total revenues |

311,589 | 263,449 | 258,097 | |||||||||

| Total long-term debt |

85,969 | 82,935 | 72,921 | |||||||||

| Net debt(2) |

Ps. | 62,468 | Ps. | 48,991 | Ps. | 49,489 | ||||||

| (1) | The sum of the financial data for each of our segments differs from our consolidated financial information due to intercompany transactions, which are eliminated in consolidation, and certain assets and activities of FEMSA. |

| (2) | Represents the current and non-current portion of bank loans and notes payable in an amount of Ps. 91,864 million, net of cash and cash equivalents in an amount of Ps. 29,396 million. |

3

Total Revenues Summary by Geographic Area(1)

| Year Ended December 31, | ||||||||||||

| 2015 | 2014 | 2013 | ||||||||||

| (in millions of Mexican pesos) | ||||||||||||

| Mexico and Central America(2) |

Ps. 228,563 | Ps. 186,736 | Ps. 171,726 | |||||||||

| South America(3) |

74,928 | 69,172 | 55,157 | |||||||||

| Venezuela |

8,904 | 8,835 | 31,601 | |||||||||

| Consolidated total revenues |

Ps. 311,589 | Ps. 263,449 | Ps. 258,097 | |||||||||

| (1) | The sum of the financial data for each geographic area differs from our consolidated financial information due to intercompany transactions, which are eliminated in consolidation. |

| (2) | Central America includes Guatemala, Nicaragua, Costa Rica and Panama. Domestic (Mexico-only) revenues were Ps. 218,809 million, Ps. 178,125 million and Ps. 163,351 million for the years ended December 31, 2015, 2014 and 2013, respectively. |

| (3) | South America includes Brazil, Colombia, Argentina and Chile. South America revenues include revenues from our operations in Brazil of Ps. 39,749 million, Ps. 45,799 million and Ps. 31,138 million; revenues from our operations in Colombia of Ps. 14,283 million, Ps. 14,207 million and Ps. 13,354 million; revenues from our operations in Argentina of Ps. 14,004 million, Ps. 9,714 million and Ps. 10,729 million, for the years ended December 31, 2015, 2014 and 2013, respectively, and revenues from our operations in Chile of Ps. 7,586 million for the year ended December 31, 2015. |

Business Strategy

We understand the importance of connecting with our end consumers by interpreting their needs, and ultimately delivering the right products to them for the right occasions and the optimal value proposition. We strive to achieve this by developing brand value, expanding our significant distribution capabilities and improving the efficiency of our operations while aiming to reach our full potential. We continue to improve our information gathering and processing systems in order to better know and understand what our consumers want and need, and we are improving our production and distribution by more efficiently leveraging our asset base.

Our objective is to create economic, social and environmental value for our stakeholders—including our employees, our consumers, our shareholders and the enterprises and institutions within our society—now and into the future.

We believe that the competencies that our businesses have developed can be replicated in other geographic regions. This underlying principle guided our consolidation and growth efforts, which led to our current continental footprint. We have presence in Mexico, Central and South America and the Philippines including some of the most populous metropolitan areas in Latin America—which has provided us with opportunities to create value through both an improved ability to execute our strategies in complex markets and the use of superior marketing tools. We have also increased our capabilities to operate and succeed in other geographic regions by improving management skills in order to obtain a precise understanding of local consumer needs. Going forward, we intend to use those capabilities to continue our international expansion of both Coca-Cola FEMSA and FEMSA Comercio, expanding both our geographic footprint and our presence in the non-alcoholic beverage industry and small box retail formats, as well as taking advantage of potential opportunities across markets to leverage our skill set and key competencies. One such opportunity is our recent entry into the retail service stations for fuels, motor oils and other car care products business in Mexico, through FEMSA Comercio – Fuel Division, where we are applying our retail and operational capabilities to develop an attractive value proposition for consumers, while creating synergies with our OXXO stores.

4

RISK FACTORS

Risks Related to Our Company

Coca-Cola FEMSA

Coca-Cola FEMSA’s business depends on its relationship with The Coca-Cola Company, and changes in this relationship may adversely affect its business, financial condition, results of operations and prospects.

Substantially all of Coca-Cola FEMSA’s sales are derived from sales of Coca-Cola trademark beverages. Coca-Cola FEMSA produces, markets, sells and distributes Coca-Cola trademark beverages through standard bottler agreements in the territories where it operates. Coca-Cola FEMSA is required to purchase concentrate for all Coca-Cola trademark beverages from companies designated by The Coca-Cola Company, which price may be unilaterally determined from time to time by The Coca-Cola Company, in all such territories. Coca-Cola FEMSA is also required to purchase sweeteners and other raw materials only from companies authorized by The Coca-Cola Company. See “Information on the Company—Coca-Cola FEMSA—Coca-Cola FEMSA’s Territories.” Pursuant to Coca-Cola FEMSA’s bottler agreements and as a shareholder, The Coca-Cola Company has the right to participate in the process for making certain decisions related to Coca-Cola FEMSA’s business.

In addition, under Coca-Cola FEMSA’s bottler agreements, it is prohibited from bottling or distributing any other beverages without The Coca-Cola Company’s authorization or consent, and may not transfer control of the bottler rights of any of its territories without prior consent from The Coca-Cola Company.

The Coca-Cola Company also makes significant contributions to Coca-Cola FEMSA’s marketing expenses, although it is not required to contribute a particular amount. Accordingly, The Coca-Cola Company may discontinue or reduce such contributions at any time.

Coca-Cola FEMSA depends on The Coca-Cola Company to continue with its bottler agreements. Coca-Cola FEMSA’s bottler agreements are automatically renewable for ten-year terms, subject to the right of either party to give prior notice that it does not wish to renew the applicable agreement. In addition, these agreements generally may be terminated in the case of material breach. Termination of any such bottler agreement would prevent Coca-Cola FEMSA from selling Coca-Cola trademark beverages in the affected territory. The foregoing and any other adverse changes in the relationship with The Coca-Cola Company would have an adverse effect on Coca-Cola FEMSA’s business, financial condition, results of operations and prospects.

The Coca-Cola Company has substantial influence on the conduct of Coca-Cola FEMSA’s business, which may result in Coca-Cola FEMSA taking actions contrary to the interests of its shareholders other than The Coca-Cola Company, or its creditors.

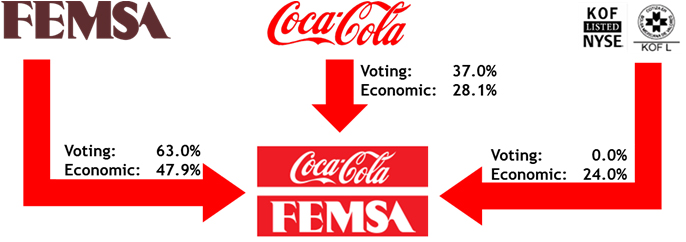

The Coca-Cola Company has substantial influence on the conduct of Coca-Cola FEMSA’s business. As of March 4, 2016, The Coca-Cola Company indirectly owned 28.1% of Coca-Cola FEMSA’s outstanding capital stock, representing 37.0% of Coca-Cola FEMSA’s shares with full voting rights. The Coca-Cola Company is entitled to appoint five of Coca-Cola FEMSA’s maximum of 21 directors and the vote of at least two of them is required to approve certain actions by Coca-Cola FEMSA’s board of directors. As of March 4, 2016, we indirectly owned 47.9% of Coca-Cola FEMSA’s outstanding capital stock, representing 63.0% of Coca-Cola FEMSA’s capital stock with full voting rights. We are entitled to appoint 13 of Coca-Cola FEMSA’s maximum of 21 directors and all of its executive officers. We and The Coca-Cola Company together, or only we in certain circumstances, have the power to determine the outcome of all actions requiring the approval of Coca-Cola FEMSA’s board of directors, and we and The Coca-Cola Company together, or only we in certain circumstances, have the power to determine the outcome of all actions requiring the approval of Coca-Cola FEMSA’s shareholders. The interests of The Coca-Cola Company may be different from the interests of Coca-Cola FEMSA’s other shareholders or its creditors, which may result in Coca-Cola FEMSA taking actions contrary to the interests of such other shareholders or its creditors.

5

Changes in consumer preferences and public concern about health related issues could reduce demand for some of Coca-Cola FEMSA’s products.

The non-alcoholic beverage industry is evolving mainly as a result of changes in consumer preferences and regulatory actions. There have been different plans and actions adopted in recent years by governmental authorities in some of the countries where Coca-Cola FEMSA operates including an increase in taxes or the imposition of new taxes on the sale of beverages containing certain sweeteners and other regulatory measures, such as restrictions on advertising for some of Coca-Cola FEMSA’s products. Moreover, researchers, health advocates and dietary guidelines are encouraging consumers to reduce their consumption of certain types of beverages sweetened with sugar and High Fructose Corn Syrup, or “HFCS.” In addition, concerns over the environmental impact of plastic may reduce the consumption of Coca-Cola FEMSA’s products sold in plastic bottles or result in additional taxes that would adversely affect consumer demand. Increasing public concern about these issues, new or increased taxes, other regulatory measures or any failure of Coca-Cola FEMSA to meet consumers’ preferences could reduce demand for some of Coca-Cola FEMSA’s products which would adversely affect its business, financial condition, results of operations and prospects.

Reputation of Coca-Cola trademarks and trademark infringement could adversely affect Coca-Cola FEMSA’s business.

Substantially all of Coca-Cola FEMSA’s sales are derived from sales of Coca-Cola trademark beverages owned by The Coca-Cola Company. Maintenance of the reputation and intellectual property rights of these trademarks is essential to Coca-Cola FEMSA’s ability to attract and retain retailers and consumers and is essential for its success. Failure to maintain the reputation of Coca-Cola trademarks and/or to effectively protect its trademarks could have a material adverse effect on Coca-Cola FEMSA’s business, financial condition, results of operations, and prospects.

Competition could adversely affect Coca-Cola FEMSA’s business, financial condition, results of operations and prospects.

The beverage industry in the territories where Coca-Cola FEMSA operates is highly competitive. Coca-Cola FEMSA faces competition from other bottlers of sparkling beverages, such as Pepsi trademark products and other bottlers and distributors of local beverage brands, and from producers of low-cost beverages or “B brands.” Coca-Cola FEMSA also competes in beverage categories other than sparkling beverages, such as water, juice-based beverages, teas, sport drinks and value-added dairy products. Coca-Cola FEMSA expects that it will continue to face strong competition in its beverage categories in all of its territories and anticipates that existing or new competitors may broaden their product lines and extend their geographic scope.

Although competitive conditions are different in each of its territories, Coca-Cola FEMSA competes principally in terms of price, packaging, effective promotional activities, access to retail outlets and sufficient shelf space, customer service, product innovation and product alternatives and the ability to identify and satisfy consumer preferences. See “Information on the Company—Coca-Cola FEMSA—Competition.” Lower pricing and activities by competitors and changes in consumer preferences may have an adverse effect on Coca-Cola FEMSA’s business, financial condition, results of operations and prospects.

Water shortages or any failure to maintain existing concessions could adversely affect Coca-Cola FEMSA’s business, financial condition, results of operations and prospects.

Water is an essential component of all of Coca-Cola FEMSA’s products. Coca-Cola FEMSA obtains water from various sources in its territories, including springs, wells, rivers and municipal and state water companies pursuant to either concessions granted by governments in its various territories (including governments at the federal, state or municipal level) or pursuant to contracts.

Coca-Cola FEMSA obtains the vast majority of the water used in its production from municipal utility companies and pursuant to concessions to use wells, which are generally granted based on studies of the existing and projected groundwater supply. Coca-Cola FEMSA’s existing water concessions or contracts to obtain water may be

6

terminated by governmental authorities under certain circumstances and their renewal depends on several factors, including having paid fees in full, having complied with applicable obligations and receiving approval for renewal from local and/or federal water authorities. See “Information on the Company—Regulatory Matters—Water Supply.” In some of its other territories, Coca-Cola FEMSA’s existing water supply may not be sufficient to meet its future production needs, and the available water supply may be adversely affected by shortages or changes in governmental regulations and environmental changes.

Water supply in the Sao Paulo region in Brazil has been reduced in recent years by low rainfall, which has affected the main water reservoir that serves the greater Sao Paulo area (Cantareira). Although Coca-Cola FEMSA’s Jundiai plant does not obtain water from this water reservoir, water shortages or changes in governmental regulations aimed at rationalizing water in such region could affect Coca-Cola FEMSA’s water supply in its Jundiai plant.

We cannot assure you that water will be available in sufficient quantities to meet Coca-Cola FEMSA’s future production needs or will prove sufficient to meet its water supply needs. Continued water scarcity in the regions where Coca-Cola FEMSA operates may adversely affect its business, financial condition, results of operations and prospects.

Increases in the prices of raw materials would increase Coca-Cola FEMSA’s cost of goods sold and may adversely affect its business, financial condition, results of operations and prospects.

In addition to water, Coca-Cola FEMSA’s most significant raw materials are (i) concentrate, which is acquired from affiliates of The Coca-Cola Company, (ii) sweeteners and (iii) packaging materials.

Prices for Coca-Cola trademark beverages concentrate are determined by The Coca-Cola Company as a percentage of the weighted average retail price in local currency, net of applicable taxes. The Coca-Cola Company has the right to unilaterally change concentrate prices or change the manner in which such prices are calculated. In the past, The Coca-Cola Company has increased concentrate prices for Coca-Cola trademark beverages in some of the countries where Coca-Cola FEMSA operates. Coca-Cola FEMSA may not be successful in negotiating or implementing measures to mitigate the negative effect this may have in the pricing of its products or its results.

The prices for other Coca-Cola FEMSA’s raw materials are driven by market prices and local availability, the imposition of import duties and restrictions and fluctuations in exchange rates. Coca-Cola FEMSA is also required to meet all of its supply needs (including sweeteners and packaging materials) from suppliers approved by The Coca-Cola Company, which may limit the number of suppliers available to it. Coca-Cola FEMSA’s sales prices are denominated in the local currency in each country where it operates, while the prices of certain materials, including those used in the bottling of its products, mainly resin, preforms to make plastic bottles, finished plastic bottles, aluminum cans, HFCS and certain sweeteners, are paid in, or determined with reference to, the U.S. dollar, and therefore may increase if the U.S. dollar appreciates against the applicable local currency. We cannot anticipate whether the U.S. dollar will appreciate or depreciate with respect to such local currencies in the future. See “Information on the Company—Coca-Cola FEMSA—Raw Materials.”

Coca-Cola FEMSA’s most significant packaging raw material costs arise from the purchase of resin and plastic preforms to make plastic bottles and from the purchase of finished plastic bottles, the prices of which are related to crude oil prices and global resin supply. The average prices that Coca-Cola FEMSA paid for resin and plastic preforms in U.S. dollars in 2015, as compared to 2014 decreased in all Coca-Cola FEMSA’s territories; however, given that high currency volatility has affected and continues to affect most of Coca-Cola FEMSA’s territories, the average prices for resin and plastic preforms in local currencies were higher in 2015 in Mexico, Colombia, Venezuela and Brazil. In 2015, average sweetener prices were lower in Guatemala, and were higher in the rest of Coca-Cola FEMSA’s territories, in each case as compared to 2014. From 2010 through 2015, international sugar prices were volatile due to various factors, including shifting demand, availability and climate issues affecting production and distribution. In all of the countries where Coca-Cola FEMSA operates, other than Brazil, sugar prices are subject to local regulations and other barriers to market entry that cause Coca-Cola FEMSA to purchase sugar above international market prices. See “Information on the Company— Coca-Cola FEMSA —Raw Materials.” We cannot assure you that Coca-Cola FEMSA’s raw material prices will not further increase in the future. Increases in the prices of raw materials would increase Coca-Cola FEMSA’s cost of goods sold and adversely affect its business, financial condition, results of operations and prospects.

7

Taxes could adversely affect Coca-Cola FEMSA’s business, financial condition, results of operations and prospects.

The countries where Coca-Cola FEMSA operates may adopt new tax laws or modify existing tax laws to increase taxes applicable to Coca-Cola FEMSA’s business or products. Coca-Cola FEMSA’s products are subject to certain taxes in many of the countries where it operates, which impose taxes on sparkling beverages. See “Information on the Company—Regulatory Matters—Taxation of Beverages.” The imposition of new taxes, increases in existing taxes or changes in the interpretation of tax laws and regulation by tax authorities may have a material adverse effect on Coca-Cola FEMSA’s business, financial condition, prospects and results of operations.

Tax legislation in some of the countries where Coca-Cola FEMSA operates has recently been subject to major changes. See “Information on the Company—Regulatory Matters—Mexican Tax Reform” and “Information on the Company—Regulatory Matters—Other Recent Tax Reforms.” We cannot assure you that these reforms or other reforms adopted by governments in the countries where Coca-Cola FEMSA operates will not have a material adverse effect on its business, financial condition, results of operations and prospects.

Regulatory developments may adversely affect Coca-Cola FEMSA’s business, financial condition, results of operations and prospects.

Coca-Cola FEMSA is subject to several laws and regulations in each of the territories where it operates. The principal areas in which Coca-Cola FEMSA is subject to laws and regulations are water, environment, labor, taxation, health and antitrust. Laws and regulations can also affect Coca-Cola FEMSA’s ability to set prices for its products. See “Information on the Company—Regulatory Matters.” Changes in existing laws and regulations, the adoption of new laws or regulations or a stricter interpretation or enforcement thereof in the countries where Coca-Cola FEMSA operates may increase its operating and compliance costs or impose restrictions on its operations which, in turn, may adversely affect Coca-Cola FEMSA’s financial condition, business, prospects and results of operations. In particular, environmental standards are becoming more stringent in several of the countries where Coca-Cola FEMSA operates. There is no assurance that Coca-Cola FEMSA will be able to comply with changes in environmental laws and regulations within the timelines established by the relevant regulatory authorities. See “Information on the Company—Regulatory Matters—Environmental Matters.”

Voluntary price restraints or statutory price controls have been imposed historically in several of the countries where Coca-Cola FEMSA operates. Currently, there are no price controls on Coca-Cola FEMSA’s products in any of the territories where it has operations, except for those in Argentina, where authorities directly supervise five of Coca-Cola FEMSA’s products sold through supermarkets as a measure to control inflation, and Venezuela, where price controls have been imposed on certain of Coca-Cola FEMSA’s products, including bottled water, and a limit has been imposed on profits earned on the sale of goods, including Coca-Cola FEMSA’s products, in an effort to seek price stability of, and equal access to, goods and services. If Coca-Cola FEMSA exceeds such limit on profits, it may be forced to reduce the prices of its products in Venezuela, which would in turn adversely affect its business, financial condition, prospects, and results of operations. In addition, consumer protection laws in Venezuela are subject to continuing review and changes, and any such changes may have an adverse impact on Coca-Cola FEMSA. We cannot assure you that existing or future laws and regulations in the countries where Coca-Cola FEMSA operates relating to goods and services (in particular, laws and regulations imposing statutory price controls) will not affect Coca-Cola FEMSA’s products or that Coca-Cola FEMSA will not need to implement voluntary price restraints, which could have a negative effect on its business, financial condition, prospects and results of operations. See “Information on the Company—Regulatory Matters—Price Controls.”

Unfavorable results of legal proceedings could have an adverse effect on Coca-Cola FEMSA’s business, financial condition, results of operations and prospects.

Coca-Cola FEMSA’s operations have from time to time been and may continue to be subject to investigations and proceedings by antitrust authorities, and litigation relating to alleged anticompetitive practices. Coca-Cola FEMSA also has been subject to investigations and proceedings on tax, consumer protection, environmental and labor matters. We cannot assure you that these investigations and proceedings will not have an adverse effect on Coca-Cola FEMSA’s business, results of operations, prospects and financial condition.

8

Weather conditions may adversely affect Coca-Cola FEMSA’s business, financial condition, results of operations and prospects.

Lower temperatures, higher rainfall and other adverse weather conditions such as typhoons and hurricanes may negatively impact consumer patterns, which may result in reduced sales of Coca-Cola FEMSA’s beverage offerings. Additionally, such adverse weather conditions may affect plant installed capacity, road infrastructure and points of sale in the territories where Coca-Cola FEMSA operates and limit Coca-Cola FEMSA’s ability to produce, sell and distribute its products, thus affecting its business, financial condition, results of operations and prospects.

Coca-Cola FEMSA may not be able to successfully integrate its acquisitions and achieve the expected operational efficiencies and/or synergies.

Coca-Cola FEMSA has and may continue to acquire bottling operations and other businesses. Key elements to achieving the benefits and expected synergies of Coca-Cola FEMSA’s acquisitions and/or mergers are the integration of acquired or merged businesses’ operations into its own in a timely and effective manner and the retention of qualified and experienced key personnel. Coca-Cola FEMSA may incur unforeseen liabilities in connection with acquiring, taking control of, or managing bottling operations and other businesses and may encounter difficulties and unforeseen or additional costs in restructuring and integrating them into its operating structure. We cannot assure you that these efforts will be successful or completed as expected by Coca-Cola FEMSA, and Coca-Cola FEMSA’s business, financial condition, results of operations and prospects could be adversely affected if it is unable to do so.

Political and social events in the countries where Coca-Cola FEMSA operates and changes in governmental policies may have an adverse effect on Coca-Cola FEMSA’s business, financial condition, results of operations and prospects.

In recent years, some of the governments in the countries where Coca-Cola FEMSA operates have implemented and may continue to implement significant changes in laws, public policy and/or regulations that could affect the political and social conditions in these countries. Any such changes may have an adverse effect on Coca-Cola FEMSA’s business, results of operations, prospects and financial condition. We cannot assure you that political or social developments in any of the countries where Coca-Cola FEMSA operates, such as the election of new administrations, political disagreements, civil disturbances and the rise in violence and perception of violence, over which Coca-Cola FEMSA has no control, will not have a corresponding adverse effect on the local or global markets or on Coca-Cola FEMSA’s business, financial condition, results of operations and prospects.

FEMSA Comercio

Competition from other retailers in Mexico could adversely affect FEMSA Comercio – Retail Division’s business, financial condition, results of operations and prospects.

The Mexican retail sector is highly competitive. FEMSA participates in the retail sector primarily through FEMSA Comercio – Retail Division. FEMSA Comercio – Retail Division’s OXXO stores face competition from small-format stores like 7-Eleven, Extra, Super City, Círculo K stores and other numerous chains of retailers across Mexico, from other regional small-format retailers to small informal neighborhood stores. In particular, small informal neighborhood stores can sometimes avoid regulatory oversight and taxation, enabling them to sell certain products at prices below average market prices. In addition, these small informal neighborhood stores could improve their technological capabilities so as to enable credit card transactions and electronic payment of utility bills, which would diminish one of FEMSA Comercio – Retail Division’s competitive advantages. FEMSA Comercio – Retail Division may face additional competition from new market participants. Increased competition may limit the number of new store locations available and require FEMSA Comercio – Retail Division to modify its product offering or pricing structure. As a consequence, FEMSA Comercio – Retail Division’s business, financial condition, results of operations and prospects may be adversely affected by competition in the future.

9

Sales of OXXO small-format stores may be adversely affected by changes in economic conditions in Mexico.

Small-format stores often sell certain products at a premium. The small-format store market is thus highly sensitive to economic conditions, since an economic slowdown is often accompanied by a decline in consumer purchasing power, which in turn results in a decline in the overall consumption of FEMSA Comercio – Retail Division’s main product categories. During periods of economic slowdown, OXXO stores may experience a decline in traffic per store and average ticket per customer, which may result in a decline in FEMSA Comercio – Retail Division’s overall performance.

Regulatory changes may adversely affect FEMSA Comercio – Retail Division’s business.

In Mexico, FEMSA Comercio – Retail Division is subject to regulation in areas such as labor, taxation, zoning, operations and related local permits and health and safety regulations. Changes in existing laws and regulations, the adoption of new laws or regulations, or a stricter interpretation or enforcement thereof in the countries where FEMSA Comercio – Retail Division operates may increase its operating and compliance costs or impose restrictions on its operations which, in turn, may adversely affect FEMSA Comercio – Retail Division’s business, financial condition, results of operations and prospects. In addition, changes in current laws and regulations may negatively impact customer traffic, revenues, operational costs and commercial practices, which may have an adverse effect on FEMSA Comercio – Retail Division’s business, financial condition, results of operations and prospects.

FEMSA Comercio – Retail Division may not be able to maintain its historic growth rate.

FEMSA Comercio – Retail Division increased the number of OXXO stores at a compound annual growth rate of 10.1% from 2011 to 2015. The growth in the number of OXXO stores has driven growth in total revenue and results at FEMSA Comercio – Retail Division over the same period. As the overall number of stores increases, growth in the number of OXXO stores is likely to slow. In addition, as small-format store penetration in Mexico grows, the number of viable new store locations may decrease, and new store locations may be less favorable in terms of same-store sales, average ticket and store traffic. As a result, FEMSA Comercio – Retail Division’s future results and financial condition may not be consistent with prior periods and may be characterized by lower growth rates in terms of total revenue and results of operations. In Colombia, OXXO stores may not be able to maintain historic growth rates similar to those in Mexico. We cannot assure you that FEMSA Comercio – Retail Division’s future retail stores will generate revenues and cash flow comparable with those generated by its existing retail stores.

FEMSA Comercio – Retail Division’s business depends heavily on information technology and a failure, interruption, or breach of its IT systems could adversely affect it.

FEMSA Comercio – Retail Division’s business relies heavily on advanced information technology (which we refer to as IT) systems to effectively manage its data, communications, connectivity, and other business processes. FEMSA Comercio – Retail Division invests aggressively in IT to maximize its value generation potential. Given the rapid speed at which such division adds new services and products to its commercial offerings, the development of IT systems, hardware and software needs to keep pace with the growth of the business. If these systems become obsolete or if planning for future IT investments is inadequate, FEMSA Comercio – Retail Division’s business could be adversely affected.

Although FEMSA Comercio – Retail Division constantly improves its IT systems and protects them with advanced security measures, they may still be subject to defects, interruptions, or security breaches such as viruses or data theft. Such a defect, interruption, or breach could adversely affect FEMSA Comercio – Retail Division’s business, financial condition, results of operations and prospects.

10

FEMSA Comercio – Retail Division’s business may be adversely affected by an increase in the price of electricity.

The performance of FEMSA Comercio – Retail Division’s stores would be adversely affected by increases in the price of utilities on which the stores depend, such as electricity. In recent years the price of electricity in Mexico has remained stable, and particularly the price was reduced last year although, it could potentially increase as a result of inflation, shortages, interruptions in supply, or other reasons, and such an increase could adversely affect FEMSA Comercio – Retail Division’s business, financial condition, results of operations and prospects.

FEMSA Comercio – Retail Division’s expansion strategy and entry into new markets and retail formats may lead to decreased profit margins.

FEMSA Comercio – Retail Division has recently entered into new markets through the acquisition of other small-format retail businesses such as drugstores and pharmacies. FEMSA Comercio – Retail Division continued with this strategy in 2015 and may continue with it in the future. These new businesses are currently less profitable than OXXO, and might therefore marginally dilute FEMSA Comercio – Retail Division’s margins in the short to medium term.

Taxes could adversely affect FEMSA Comercio’s business.

The imposition of new taxes or increases in existing taxes, or changes in the interpretation of tax laws and regulations by tax authorities, may have a material adverse effect on FEMSA Comercio’s business, financial condition, results of operations and prospects.

Energy regulatory changes may adversely affect FEMSA Comercio – Fuel Division’s business.

FEMSA Comercio – Fuel Division sells mainly gasoline and diesel through owned or leased retail service stations. Currently, the prices of these products are regulated in Mexico by the Comisión Reguladora de Energía (Energy Regulatory Commission), a government agency. Changes in how these prices may be determined or controlled may adversely affect FEMSA Comercio – Fuel Division’s business, financial condition, results of operations and prospects. In the future and in accordance with what is envisioned by the current regulations in Mexico, prices will follow the dynamics of the international fuel market, which may also adversely affect FEMSA Comercio – Fuel Division’s business, financial condition, results of operations and prospects.

Uncertainty in Mexican legislation and regulation of the energy sector could affect FEMSA Comercio – Fuel Division’s business.

Mexican legislation and regulation of the energy sector in general, and of fuel distribution in particular, is in transition or has not been fully implemented (through secondary legislation and rules) given the recent passing of energy reforms. The authorities have certain discretion to implement the energy reform and, in the future, new rules, additional requirements or steps or interpretations could adversely affect FEMSA Comercio – Fuel Division’s business, financial condition, results of operations and prospects.

FEMSA Comercio – Fuel Division’s business could be affected by new safety regulations enforced by government, global environmental regulations and new energy technologies.

Federal, state and municipal laws and regulations for the installation of new service stations are becoming or may become more stringent; compliance with these laws and regulations is often difficult and costly. Global trends to reduce the consumption of fossil fuels through incentives and taxes could push sales of these fuels at service stations to slow or decrease in the future, and automotive technologies, including efficiency gains in traditional fuel vehicles and increased popularity of alternative fuel vehicles, such as electric and liquefied petroleum gas (LPG) vehicles, have caused a significant reduction in fuel consumption. Other new technologies could further reduce the sale of traditional fuels; all of which could adversely affect FEMSA Comercio – Fuel Division’s results or financial position.

11

Competition from new players in Mexico could adversely affect FEMSA Comercio – Fuel Division’s business.

The opening of the Mexican fuel distribution market is expected to alter the competitive dynamics of the industry. The Mexican fuel distribution market is expected to enter into a consolidation process as large companies and international competitors enter the market or gain market share at the expense of small, independently owned and operated service stations. Consolidation may occur rapidly and materially alter the market dynamics in Mexico which may affect our ability to take advantage of existing opportunities. Such changes could adversely affect FEMSA Comercio – Fuel Division’s business, financial condition, results of operations and prospects. We cannot assure you that any further market consolidation will not be detrimental to FEMSA Comercio – Fuel Division’s market position or competitiveness or will not materially and adversely affect its business, financial condition, results of operations and prospects.

Risks Related to Mexico and the Other Countries Where We Operate

Adverse economic conditions in Mexico may adversely affect our financial position and results.

We are a Mexican corporation, and our Mexican operations are our single most important geographic territory. For the year ended December 31, 2015, 70% of our consolidated total revenues were attributable to Mexico. During 2012, 2013 and 2014 the Mexican gross domestic product, or “GDP,” increased by approximately 4.0%, 1.4% and 2.1%, respectively, and in 2015 it increased by approximately 2.5% on an annualized basis compared to 2014, due to stronger performance in the services and primary sectors, which were partially offset by lower volumes and cheaper prices in the oil and gas industries. We cannot assure you that such conditions will not have a material adverse effect on our business, financial condition, results of operations and prospects going forward. The Mexican economy continues to be heavily influenced by the U.S. economy, and therefore, deterioration in economic conditions in, or delays in recovery of, the U.S. economy may hinder any recovery in Mexico. In the past, Mexico has experienced both prolonged periods of weak economic conditions and deteriorations in economic conditions that have had a negative impact on our results.

Our business may be significantly affected by the general condition of the Mexican economy, or by the rate of inflation in Mexico, interest rates in Mexico and exchange rates for, or exchange controls affecting, the Mexican peso. Decreases in the growth rate of the Mexican economy, periods of negative growth and/or increases in inflation or interest rates may result in lower demand for our products, lower real pricing of our products or a shift to lower margin products. Because a large percentage of our costs and expenses are fixed, we may not be able to reduce costs and expenses upon the occurrence of any of these events, and our profit margins may suffer as a result.

In addition, an increase in interest rates in Mexico would increase the cost of our debt and would cause an adverse effect on our financial position and results. Mexican peso-denominated debt (including currency hedges) constituted 39% of our total debt as of December 31, 2015.

Depreciation of the Mexican peso and of our other local currencies relative to the U.S. dollar could adversely affect our financial position and results.

Depreciation of the Mexican peso and of our other local currencies relative to the U.S. dollar increases the cost of a portion of the raw materials we acquire, the price of which is paid in or determined with reference to U.S. dollars, and of our debt obligations denominated in U.S. dollars, and thereby negatively affects our financial position and results. A severe devaluation or depreciation of the Mexican peso may result in disruption of the international foreign exchange markets and may limit our ability to transfer or to convert Mexican pesos into U.S. dollars and other currencies for the purpose of making timely payments of interest and principal on our U.S. dollar-denominated debt or obligations in other currencies. The Mexican peso is a free-floating currency and as such, it experiences exchange rate fluctuations relative to the U.S. dollar over time. During 2014, 2013 and 2012, the Mexican peso experienced fluctuations relative to the U.S. dollar consisting of 7.1% of recovery, 1.0% of depreciation and 12.6% of depreciation respectively, compared to the years of 2013, 2012 and 2011. During 2015, the Mexican peso depreciated relative to the U.S. dollar by approximately 16.6% compared to 2014. Through February 26, 2015, the Mexican peso has depreciated 5.8% since December 31, 2015.

12

While the Mexican government does not currently restrict, and since 1982 has not restricted, the right or ability of Mexican or foreign persons or entities to convert Mexican pesos into U.S. dollars or to transfer other currencies out of Mexico, the Mexican government could impose restrictive exchange rate policies in the future, as it has done in the past. Currency fluctuations may have an adverse effect on our financial position, results and cash flows in future periods.

When the financial markets are volatile, as they have been in recent periods, our results may be substantially affected by variations in exchange rates and commodity prices, and to a lesser degree, interest rates. These effects include foreign exchange gain and loss on assets and liabilities denominated in U.S. dollars, fair value gain and loss on derivative financial instruments, commodities prices and changes in interest income and interest expense. These effects can be much more volatile than our operating performance and our operating cash flows.

13

INFORMATION ON THE COMPANY

Overview

We are a Mexican company headquartered in Monterrey, Mexico, and our origin dates back to 1890. Our company was incorporated on May 30, 1936 and has a duration of 99 years. The duration can be extended indefinitely by resolution of our shareholders. Our legal name is Fomento Económico Mexicano, S.A.B. de C.V., and in commercial and business contexts we frequently refer to ourselves as FEMSA. Our principal executive offices are located at General Anaya No. 601 Pte., Colonia Bella Vista, Monterrey, Nuevo León 64410, Mexico. Our telephone number at this location is (+52-81) 8328-6000. Our website is www.femsa.com. We are organized as a sociedad anónima bursátil de capital variable under the laws of Mexico.

We conduct our operations through the following principal holding companies:

| • | Coca-Cola FEMSA, which produces, distributes and sells beverages, and is the largest franchise bottler of Coca-Cola products in the world; |

| • | FEMSA Comercio, comprising a Retail Division operating various small-format chain stores, including OXXO, the largest and fastest-growing chain in Latin America, and a Fuel Division operating the OXXO GAS chain of retail service stations for fuels, motor oils and other car care products. As of December 31, 2015, the Fuel Division is treated as a separate business segment; and |

| • | CB Equity, which holds our equity investment in Heineken, one of the world’s leading brewers, with operations in over 70 countries. |

Corporate Background

FEMSA traces its origins to the establishment of Mexico’s first brewery, Cervecería Cuauhtémoc, S.A., which we refer to as Cuauhtémoc Moctezuma, which was founded in 1890 by four Monterrey businessmen: Francisco G. Sada, José A. Muguerza, Isaac Garza and José M. Schneider. Descendants of certain of the founders of Cuauhtémoc Moctezuma are participants of the voting trust that controls the management of our company.

The strategic integration of our company dates back to 1936 when our packaging operations were established to supply crown caps to the brewery. During this period, these operations were part of what was known as the Monterrey Group, which also included interests in banking and steel businesses and other packaging operations.

In 1974, the Monterrey Group was split between two branches of the descendants of the founding families of Cuauhtémoc Moctezuma. The steel and other packaging operations formed the basis for the creation of Corporación Siderúrgica, S.A. (now Alfa, S.A.B. de C.V.), controlled by the Garza Sada family, and the beverage and banking operations were consolidated under the Valores Industriales, S.A. de C.V. (the corporate predecessor of FEMSA) corporate umbrella controlled by the Garza Lagüera family. FEMSA’s shares were first listed on what is now the Bolsa Mexicana de Valores, S.A.B. de C.V. (which we refer to as the Mexican Stock Exchange) on September 19, 1978. Between the decades of 1970 and 1980, FEMSA diversified its operations through acquisitions in the soft drinks and mineral water industries, the establishment of the first stores under the trade name “OXXO” and other investments in the hotel, construction, auto parts, food and fishing industries, which were considered non-core businesses and were subsequently divested.

In the 1990s, we began a series of strategic transactions to strengthen the competitive positions of our operating subsidiaries. These transactions included the sale of a 30% strategic interest in Coca-Cola FEMSA to a wholly-owned subsidiary of The Coca-Cola Company and a subsequent public offering of Coca-Cola FEMSA shares, both of which occurred in 1993. Coca-Cola FEMSA listed its L shares on the Mexican Stock Exchange and, in the form of American Depositary Shares, or ADSs, on the New York Stock Exchange, or NYSE.

14

In 1998, we completed a reorganization that changed our capital structure by converting our outstanding capital stock at the time of the reorganization into BD Units and B Units, and united the shareholders of FEMSA and the former shareholders of Grupo Industrial Emprex, S.A. de C.V. (which we refer to as Emprex) at the same corporate level through an exchange offer that was consummated on May 11, 1998. As part of the reorganization, FEMSA listed ADSs on the NYSE representing BD Units, and listed the BD Units and its B Units on the Mexican Stock Exchange.

In May 2003, our subsidiary Coca-Cola FEMSA expanded its operations throughout Latin America by acquiring 100% of Panamerican Beverages, Inc. (which we refer to as Panamco), then the largest soft drink bottler in Latin America in terms of sales volume in 2002. Through its acquisition of Panamco, Coca-Cola FEMSA began producing and distributing Coca-Cola trademark beverages in additional territories in Mexico, Central America, Colombia, Venezuela and Brazil, along with bottled water, beer and other beverages in some of these territories.

In January 2010, FEMSA announced that its board of directors unanimously approved a definitive agreement under which FEMSA would exchange its brewery business (Cuauhtémoc Moctezuma) for a 20% economic interest in Heineken N.V. and Heineken Holding N.V. (which, together with their respective subsidiaries, we refer to as Heineken or the Heineken Group), one of the world’s leading brewers. In April 2010, FEMSA announced the closing of the transaction, after Heineken N.V., Heineken Holding N.V. and FEMSA approved the transaction. Under the terms of the agreement, FEMSA received 43,018,320 shares of Heineken Holding N.V. and 43,009,699 shares of Heineken N.V., with an additional 29,172,504 shares of Heineken N.V. (which shares we refer to as the Allotted Shares) delivered pursuant to an allotted share delivery instrument, or the ASDI. Heineken also assumed US$ 2.1 billion of indebtedness, including Cuauhtémoc Moctezuma’s unfunded pension obligations. The Allotted Shares were delivered to FEMSA in several installments during 2010 and 2011, with the final installment delivered on October 5, 2011. As of December 31, 2015, FEMSA’s interest in Heineken N.V. represented 12.53% of Heineken N.V.’s outstanding capital and 14.94% of Heineken Holding N.V.’s outstanding capital, resulting in our 20% economic interest in the Heineken Group.

On January 25, 2013, as part of Coca- Cola FEMSA’s efforts to expand its geographic reach, it acquired a 51.0% non-controlling majority stake in CCFPI from The Coca-Cola Company. Coca- Cola FEMSA has an option to acquire the remaining 49.0% stake in CCFPI at any time during the seven years following the closing date. Coca-Cola FEMSA also has a put option to sell its ownership in CCFPI to The Coca-Cola Company commencing on the fifth anniversary of the closing date and ending on the sixth anniversary of the closing date. Coca- Cola FEMSA currently manages the day-to-day operations of the business; however, pursuant to its shareholders’ agreement with The Coca-Cola Company (a) during a four- year period ending January 25, 2017, all decisions must be approved jointly with The Coca-Cola Company, (b) following this four-year period, all decisions related to the annual normal operations plan and any other ordinary matters will be approved only by Coca- Cola FEMSA, (c) The Coca-Cola Company has the right to appoint (and may remove) CCFPI’s chief financial officer, and (d) Coca- Cola FEMSA has the right to appoint (and may remove) the chief executive officer and all other officers of CCFPI. Coca-Cola FEMSA currently records its investment in CCFPI and its operating results using the equity method.

In May 2013, Coca-Cola FEMSA closed its merger with Grupo Yoli, S.A. de C.V. or Grupo Yoli, a Mexican bottler operating mainly in the state of Guerrero as well as in parts of the state of Oaxaca.

On May 2, 2013, FEMSA Comercio through one of its subsidiaries, Cadena Comercial de Farmacias, S.A.P.I. de C.V. (which we refer to as CCF), closed the acquisition of Farmacias YZA, a leading drugstore operator in Southeast Mexico, headquartered in Merida, Yucatan. The founding shareholders of Farmacias YZA hold a 25% stake in CCF. In a separate transaction, on May 13, 2013, CCF acquired Farmacias FM Moderna, a leading drugstore operator in the western state of Sinaloa.

In August 2013, Coca-Cola FEMSA closed its acquisition of Companhia Fluminense de Refrigerantes (which we refer to as Companhia Fluminense), a franchise that operates in parts of the states of Sao Paulo, Minas Gerais and Rio de Janeiro in Brazil.

In October 2013, Coca-Cola FEMSA closed its acquisition of Spaipa S.A. Indústria Brasileira de Bebidas or Spaipa, a Brazilian bottler with operations in the state of Parana and in parts of the state of Sao Paulo. For more information on Coca-Cola FEMSA’s corporate history, see “Information on the Company – Coca-Cola FEMSA – Corporate History.”

15

In December 2013, FEMSA Comercio, through one of its subsidiaries, purchased the operating assets and trademarks of Doña Tota, a leading quick-service restaurant operator in Mexico. The founding shareholders of Doña Tota hold a 20% stake in the FEMSA Comercio subsidiary that now operates the Doña Tota business.

Since 1995, FEMSA Comercio has provided services and operated retail service stations for fuels, motor oils and other car care products through agreements with third parties that own Petróleos Mexicanos (“PEMEX”) franchises. In March 2015, following changes to the legal framework and considering the potential expansion and synergies arising from this business as part of Mexico’s energy reform, FEMSA Comercio began to acquire PEMEX’s service station franchises and to obtain permits from PEMEX to operate each of the franchises.

In June 2015, CCF acquired 100% of Farmacias Farmacon, a regional pharmacy chain consisting at that time of more than 200 stores in the northwestern Mexican states of Sinaloa, Sonora, Baja California and Baja California Sur.

In September 2015, FEMSA Comercio acquired 60% of Grupo Socofar (which we refer to as Socofar), a leading South American drugstore operator based in Santiago, Chile. Socofar operated at that time, directly and through franchises, more than 600 drugstores and 150 beauty stores throughout Chile and over 150 drugstores throughout Colombia. FEMSA Comercio has the right to appoint the majority of the members of Socofar’s board of directors and exercises day-to-day operating control over Socofar. The former controlling shareholders have the right to appoint two members of the board of directors of Socofar. FEMSA Comercio has the right to appoint the majority of the members of Socofar’s board of directors and exercises day to day operating control over Socofar. The former controlling shareholders have the right to appoint two members of the board of directors of Socofar. In connection with the acquisition of 60% of Socofar, FEMSA Comercio entered into option transactions regarding the remaining 40% non-controlling interest not held by FEMSA Comercio. The former controlling shareholders of Socofar may be able to put some or all of that interest to FEMSA Comercio beginning (i) 42-months after the initial acquisition, upon the occurrence of certain events, and (ii) 60 months after the initial acquisition, in any event. FEMSA Comercio can call the remaining 40% non-controlling interest beginning on the seventh anniversary of the initial acquisition date. Both of these options would be exercisable at the then fair value of the interest and shall remain indefinitely. As such, at the initial acquisition date and at December 31, 2015, their fair value is not significant.

16

Ownership Structure

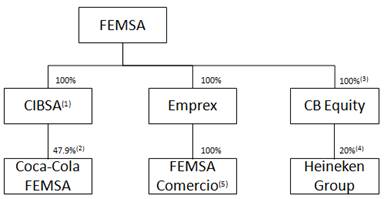

We conduct our business through our principal sub-holding companies as shown in the following diagram and table:

Principal Sub-holding Companies—Ownership Structure

As of March 4, 2016

| (1) | Compañía Internacional de Bebidas, S.A. de C.V., which we refer to as CIBSA. |

| (2) | Percentage of issued and outstanding capital stock owned by CIBSA (representing 63.0% of Coca-Cola FEMSA’s capital stock with full voting rights). See “Information on the Company—Coca-Cola FEMSA—Capital Stock.” |

| (3) | Ownership in CB Equity held through various FEMSA subsidiaries. |

| (4) | Combined economic interest in Heineken N.V. and Heineken Holding N.V. |

| (5) | Includes 100% ownership of FEMSA Comercio – Retail Division and 99.96% ownership of FEMSA Comercio – Fuel Division. |

The following table presents an overview of our operations by reportable segment and by geographic area:

Operations by Segment—Overview

Year Ended December 31, 2015 and % of growth (decrease) vs. previous year

| Coca-Cola FEMSA | FEMSA Comercio – Retail Division |

FEMSA Comercio – Fuel Division(4) |

CB Equity(1) | |||||||||||||||||||||||||||||

| (in millions of Mexican pesos, except for employees and percentages) | ||||||||||||||||||||||||||||||||

| Total revenues |

Ps. | 152,360 | 3 | % | Ps. | 132,891 | 21 | % | Ps. | 18,510 | NA | Ps. | — | — | ||||||||||||||||||

| Gross Profit |

72,030 | 5 | % | 47,291 | 20 | % | 1,420 | NA | — | — | ||||||||||||||||||||||

| Share of the profit (loss) of associates and joint ventures accounted for using the equity method, net of taxes |

155 | 224 | %(2) | (10 | ) | (127 | %)(3) | — | NA | 5,879 | 12 | % | ||||||||||||||||||||

| Total assets |

210,249 | (1 | %) | 67,211 | 54 | % | 3,230 | NA | 95,502 | 11 | % | |||||||||||||||||||||

| Employees |

83,712 | 0.4 | % | 133,748 | 21 | % | 4,551 | NA | — | — | ||||||||||||||||||||||

| (1) | CB Equity holds our Heineken N.V. and Heineken Holding N.V. shares. |

| (2) | Reflects the percentage increase between the gain of Ps. 155 million recorded in 2015 and the loss of Ps. 125 million recorded in 2014. |

| (3) | Reflects the percentage decrease between the loss of Ps. 10 million recorded in 2015 and the gain of Ps. 37 million recorded in 2014. |

| (4) | The operations that compose our FEMSA Comercio – Fuel Division were acquired and have been treated as a separate business segment since 2015. As such, no results of operations are available for this segment for periods prior to 2015. |

17

Total Revenues Summary by Segment(1)

| Year Ended December 31, | ||||||||||||

| 2015 | 2014 | 2013 | ||||||||||

| (in millions of Mexican pesos) | ||||||||||||

| Coca-Cola FEMSA |

Ps.152,360 | Ps.147,298 | Ps.156,011 | |||||||||

| FEMSA Comercio – Retail Division |

132,891 | 109,624 | 97,572 | |||||||||

| FEMSA Comercio – Fuel Division |

18,510 | — | — | |||||||||

| Other |

22,774 | 20,069 | 17,254 | |||||||||

| Consolidated total revenues |

Ps. 311,589 | Ps. 263,449 | Ps. 258,097 | |||||||||

| (1) | The sum of the financial data for each of our segments differs from our consolidated financial information due to intercompany transactions, which are eliminated in consolidation, and certain assets and activities of FEMSA. |

Total Revenues Summary by Geographic Area(1)

| Year Ended December 31, | ||||||||||||

| 2015 | 2014 | 2013 | ||||||||||

| (in millions of Mexican pesos) | ||||||||||||

| Mexico and Central America(2) |

Ps. 228,563 | Ps. 186,736 | Ps. 171,726 | |||||||||

| South America(3) |

74,928 | 69,172 | 55,157 | |||||||||

| Venezuela |

8,904 | 8,835 | 31,601 | |||||||||

| Consolidated total revenues |

Ps. 311,589 | Ps. 263,449 | Ps. 258,097 | |||||||||

| (1) | The sum of the financial data for each geographic area differs from our consolidated financial information due to intercompany transactions, which are eliminated in consolidation. |

| (2) | Central America includes Guatemala, Nicaragua, Costa Rica and Panama. Domestic (Mexico-only) revenues were Ps. 218,809 million, Ps. 178,125 million and Ps. 163,351 million for the years ended December 31, 2015, 2014 and 2013, respectively. |

| (3) | South America includes Brazil, Colombia, Argentina and Chile. South America revenues include revenues from our operations in Brazil of Ps. 39,749 million, Ps. 45,799 million and Ps. 31,138 million; revenues from our operations in Colombia of Ps. 14,283 million, Ps. 14,207 million and Ps. 13,354 million; revenues from our operations in Argentina of Ps. 14,004 million, Ps. 9,714 million and Ps. 10,729 million, for the years ended December 31, 2015, 2014 and 2013, respectively, and revenues from our operations in Chile of Ps. 7,586 million for the year ended December 31, 2015. |

Significant Subsidiaries

The following table sets forth our significant subsidiaries as of December 31, 2015:

| Name of Company |

Jurisdiction of Establishment |

Percentage Owned |

||||

| CIBSA: |

Mexico | 100.0 | % | |||

| Coca-Cola FEMSA |

Mexico | 47.9 | %(1) | |||

| Emprex: |

Mexico | 100.0 | % | |||

| FEMSA Comercio(2) |

Mexico | 100.0 | % | |||

| CB Equity(3) |

United Kingdom | 100.0 | % | |||

| (1) | Percentage of capital stock. FEMSA, through CIBSA, owns 63.0% of the shares of Coca-Cola FEMSA with full voting rights. |

| (2) | Includes FEMSA Comercio – Retail Division and FEMSA Comercio – Fuel Division. |

| (3) | Ownership in CB Equity held through various FEMSA subsidiaries. CB Equity holds our Heineken N.V and Heineken Holding N.V. shares. |

Business Strategy

We understand the importance of connecting with our end consumers by interpreting their needs, and ultimately delivering the right products to them for the right occasions and the optimal value proposition. We strive to achieve this by developing brand value, expanding our significant distribution capabilities and improving the

18

efficiency of our operations while aiming to reach our full potential. We continue to improve our information gathering and processing systems in order to better know and understand what our consumers want and need, and we are improving our production and distribution by more efficiently leveraging our asset base.

Our objective is to create economic, social and environmental value for our stakeholders—including our employees, our consumers, our shareholders and the enterprises and institutions within our society—now and into the future.

We believe that the competencies that our businesses have developed can be replicated in other geographic regions. This underlying principle guided our consolidation and growth efforts, which led to our current continental footprint. We have presence in Mexico, Central and South America and the Philippines including some of the most populous metropolitan areas in Latin America—which has provided us with opportunities to create value through both an improved ability to execute our strategies in complex markets and the use of superior marketing tools. We have also increased our capabilities to operate and succeed in other geographic regions by improving management skills in order to obtain a precise understanding of local consumer needs. Going forward, we intend to use those capabilities to continue our international expansion of both Coca-Cola FEMSA and FEMSA Comercio, expanding both our geographic footprint and our presence in the non-alcoholic beverage industry and small box retail formats, as well as taking advantage of potential opportunities across markets to leverage our skill set and key competencies. One such opportunity is our recent entry into the retail service station business in Mexico, through FEMSA Comercio – Fuel Division, where we are applying our retail and operational capabilities to develop an attractive value proposition for consumers, while creating synergies with our OXXO stores.

Coca-Cola FEMSA

Overview

Coca-Cola FEMSA is the largest franchise bottler of Coca-Cola trademark beverages in the world. It operates in territories in the following countries:

| • | Mexico—a substantial portion of central Mexico, the southeast and northeast of Mexico (including the Gulf region). |

| • | Central America—Guatemala (Guatemala City and surrounding areas), Nicaragua (nationwide), Costa Rica (nationwide) and Panama (nationwide). |

| • | Colombia—most of the country. |

| • | Venezuela—nationwide. |

| • | Brazil—a major part of the states of Sao Paulo and Minas Gerais, the states of Parana and Mato Grosso do Sul and part of the states of Rio de Janeiro and Goias. |

| • | Argentina—Buenos Aires and surrounding areas. |

| • | Philippines—nationwide (through a joint venture with The Coca-Cola Company). |

Coca-Cola FEMSA was incorporated on October 30, 1991 as a stock corporation with variable capital (sociedad anónima de capital variable) under the laws of Mexico for a term of 99 years. On December 5, 2006, as required by amendments to the Mexican Securities Market Law, Coca-Cola FEMSA became a publicly traded stock corporation with variable capital (sociedad anónima bursátil de capital variable). Coca-Cola FEMSA’s legal name is Coca-Cola FEMSA, S.A.B. de C.V. Coca-Cola FEMSA’s principal executive offices are located at Calle Mario Pani No. 100, Colonia Santa Fe Cuajimalpa, Delegación Cuajimalpa de Morelos, 05348, Mexico City, Mexico. Coca-Cola FEMSA’s telephone number at this location is (52-55) 1519-5000. Coca-Cola FEMSA’s website is www.coca-colafemsa.com.

19

The following is an overview of Coca-Cola FEMSA’s operations by consolidated reporting segment in 2015.

Operations by Consolidated Reporting Segment—Overview

Year Ended December 31, 2015

| Revenues | Gross Profit | |||||||||||||||

| (in millions of Mexican pesos, except for percentages) | ||||||||||||||||

| Mexico and Central America(1) |

|

Ps. 78,709 |

|

51.7 | % | Ps. 40,130 | 55.7 | % | ||||||||

| South America(2) (excluding Venezuela) |

64,752 | 42.5 | % | 27,532 | 38.2 | % | ||||||||||

| Venezuela |

8,899 | 5.8 | % | 4,368 | 6.1 | % | ||||||||||

| Consolidated |

Ps. 152,360 | 100 | % | Ps. 72,030 | 100 | % | ||||||||||

| (1) | Includes Mexico, Guatemala, Nicaragua, Costa Rica and Panama. |

| (2) | Includes Colombia, Brazil and Argentina. |

Corporate History

Coca-Cola FEMSA commenced operations in 1979, when one of our subsidiaries acquired certain sparkling beverage bottlers in Mexico City and surrounding areas. In 1991, we transferred our ownership in the bottlers to FEMSA Refrescos, S.A. de C.V., the corporate predecessor to Coca-Cola FEMSA.

In June 1993, a subsidiary of The Coca-Cola Company subscribed for 30% of Coca-Cola FEMSA’s capital stock in the form of Series D shares. In September 1993, we sold Series L shares that represented 19.0% of Coca-Cola FEMSA’s capital stock to the public, and Coca-Cola FEMSA listed these shares on the Mexican Stock Exchange and, in the form of ADSs, on the NYSE.

In a series of transactions since 1994, Coca-Cola FEMSA has acquired new territories, brands and other businesses which today comprise Coca-Cola FEMSA’s business. In May 2003, Coca-Cola FEMSA acquired Panamco and began producing and distributing Coca-Cola trademark beverages in additional territories in the central and gulf regions of Mexico and in Central America (Guatemala, Nicaragua, Costa Rica and Panama), Colombia, Venezuela and Brazil, along with bottled water, beer and other beverages in some of these territories.

In November 2006, we acquired 148,000,000 of Coca-Cola FEMSA’s Series D shares from certain subsidiaries of The Coca-Cola Company, which increased our ownership of Coca-Cola FEMSA to 53.7%.