Form 6-K CaesarStone Sdot-Yam For: Sep 09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of September 2015

Commission File Number: 001-35464

Caesarstone Sdot-Yam Ltd.

(Translation of registrant’s name into English)

Kibbutz Sdot Yam

MP Menashe

Israel 3780400

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): __

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): __

EXPLANATORY NOTE

On September 9, 2015, Caesarstone Sdot-Yam Ltd. released a report titled “Caesarstone’s Response to Spruce Point.” A copy of the report is attached hereto as Exhibit 99.1.

The information on this Form 6-K, including the exhibit attached hereto, shall not be deemed ‘filed’ for purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934.

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

CAESARSTONE SDOT-YAM LTD.

|

|||

|

Date: September 9, 2015

|

By: |

/s/ Michal Baumwald Oron

|

|

|

Name: Michal Baumwald Oron

|

|||

|

|

Title: VP Business Development & General Counsel

|

||

3

EXHIBIT INDEX

|

Exhibit

|

Description

|

|

99.1

|

Report dated September 9, 2015, titled “Caesarstone’s Response to Spruce Point”.

|

4

Exhibit 99.1

1

September 9, 2015

Caesarstone’s Response to Spruce Point

2

Written and oral statements made in and in connection with the following presentation that reflect management’s views about the Company’s future performance,

financial position, business strategy and plans and objectives for future operations constitute “forward-looking statements” under the Private Securities Litigation Reform

Act of 1995.

financial position, business strategy and plans and objectives for future operations constitute “forward-looking statements” under the Private Securities Litigation Reform

Act of 1995.

These statements, which contain words such as "believe,” “expect,” “anticipate,” “intend,” “estimate,” “forecast,” “project,” “will,” “may,” “should”, “plan”, “seek” and

similar expressions or references to future periods, reflect the beliefs and expectations of the Company and are subject to risks and uncertainties, including those described

under “Risk factors” in the Company’s annual report on Form 20-F for the year ended December 31, 2014 and other documents filed with the U.S. Securities and Exchange

Commission (the “SEC”), that may cause actual results to differ materially from the results discussed in our forward-looking statements. This presentation should be read in

conjunction with our annual report on Form 20-F for the year ended December 31, 2014 and our other documents filed with the SEC. These risks and uncertainties include,

among other factors, the strength of the home renovation and construction sectors; economic conditions within any of our key existing markets; actions by our

competitors; changes in raw material prices; unpredictability of seasonal fluctuations in revenues; the outcome of silicosis claims; the outcome of the claim by our former

quartz processor; fluctuations in currency exchange rates; delays in manufacturing if our suppliers are unable to supply raw materials; and other factors discussed under the

heading “Risk Factors” in the annual report on Form 20-F and other documents filed with the U.S. Securities and Exchange Commission. These and other factors could

adversely affect the outcome and financial effects of the plans and events described herein.

similar expressions or references to future periods, reflect the beliefs and expectations of the Company and are subject to risks and uncertainties, including those described

under “Risk factors” in the Company’s annual report on Form 20-F for the year ended December 31, 2014 and other documents filed with the U.S. Securities and Exchange

Commission (the “SEC”), that may cause actual results to differ materially from the results discussed in our forward-looking statements. This presentation should be read in

conjunction with our annual report on Form 20-F for the year ended December 31, 2014 and our other documents filed with the SEC. These risks and uncertainties include,

among other factors, the strength of the home renovation and construction sectors; economic conditions within any of our key existing markets; actions by our

competitors; changes in raw material prices; unpredictability of seasonal fluctuations in revenues; the outcome of silicosis claims; the outcome of the claim by our former

quartz processor; fluctuations in currency exchange rates; delays in manufacturing if our suppliers are unable to supply raw materials; and other factors discussed under the

heading “Risk Factors” in the annual report on Form 20-F and other documents filed with the U.S. Securities and Exchange Commission. These and other factors could

adversely affect the outcome and financial effects of the plans and events described herein.

These forward-looking statements are made only as of the date hereof, and neither the Company nor any of its respective agents, employees or advisors intend, undertake

or have any duty or obligation to supplement, amend, update or revise any of the forward-looking statements contained in this presentation, whether as a result of new

information, future events or otherwise.

or have any duty or obligation to supplement, amend, update or revise any of the forward-looking statements contained in this presentation, whether as a result of new

information, future events or otherwise.

This presentation includes certain non-GAAP measures, which should all be considered in addition to, and not as a substitute for, comparable GAAP measures. A

reconciliation of GAAP net income to adjusted net income is provided below. The Company provides these non-GAAP financial measures because it believes that they

present a better measure of the Company’s core business and management uses the non-GAAP measures internally to evaluate the Company’s ongoing performance.

Accordingly, the Company believes that they are useful to investors in enhancing an understanding of the Company’s operating performance. However, these measures

should not be considered as substitutes for GAAP measures and may be inconsistent with similar measures presented by other companies.

reconciliation of GAAP net income to adjusted net income is provided below. The Company provides these non-GAAP financial measures because it believes that they

present a better measure of the Company’s core business and management uses the non-GAAP measures internally to evaluate the Company’s ongoing performance.

Accordingly, the Company believes that they are useful to investors in enhancing an understanding of the Company’s operating performance. However, these measures

should not be considered as substitutes for GAAP measures and may be inconsistent with similar measures presented by other companies.

Disclaimer

3

Executive Summary

§ This presentation is a direct response to the Spruce Point report

published on August 19, 2015, which is a misleading and otherwise

factually inaccurate description of Caesarstone

published on August 19, 2015, which is a misleading and otherwise

factually inaccurate description of Caesarstone

§ This presentation generally relies upon Caesarstone’s prior statements

and disclosures and other publicly available data to reiterate:

and disclosures and other publicly available data to reiterate:

§ Caesarstone’s global leadership in the quartz surface market

§ Caesarstone’s innovation in product development

§ The quality of Caesarstone’s products and the strength of its brand

§ The integrity of Caesarstone’s financial statements and reports

§ Caesarstone’s strengthening position in its markets

4

Caesarstone

Global Leader in the Quartz Surface Market

5

§ Pioneered the quartz surfaces 28 years ago and has led the category since then

§ Strong premium brand known for high quality, innovation, inspiring design and excellent service

§ 12% global market share as of December 2014¹

§ Distribution network across more than 50 countries

§ Diversified revenue with approximately 60% of H1’15 revenue from North America

¹Based on market size data, Freedonia report, Feb. 2015

Company Overview

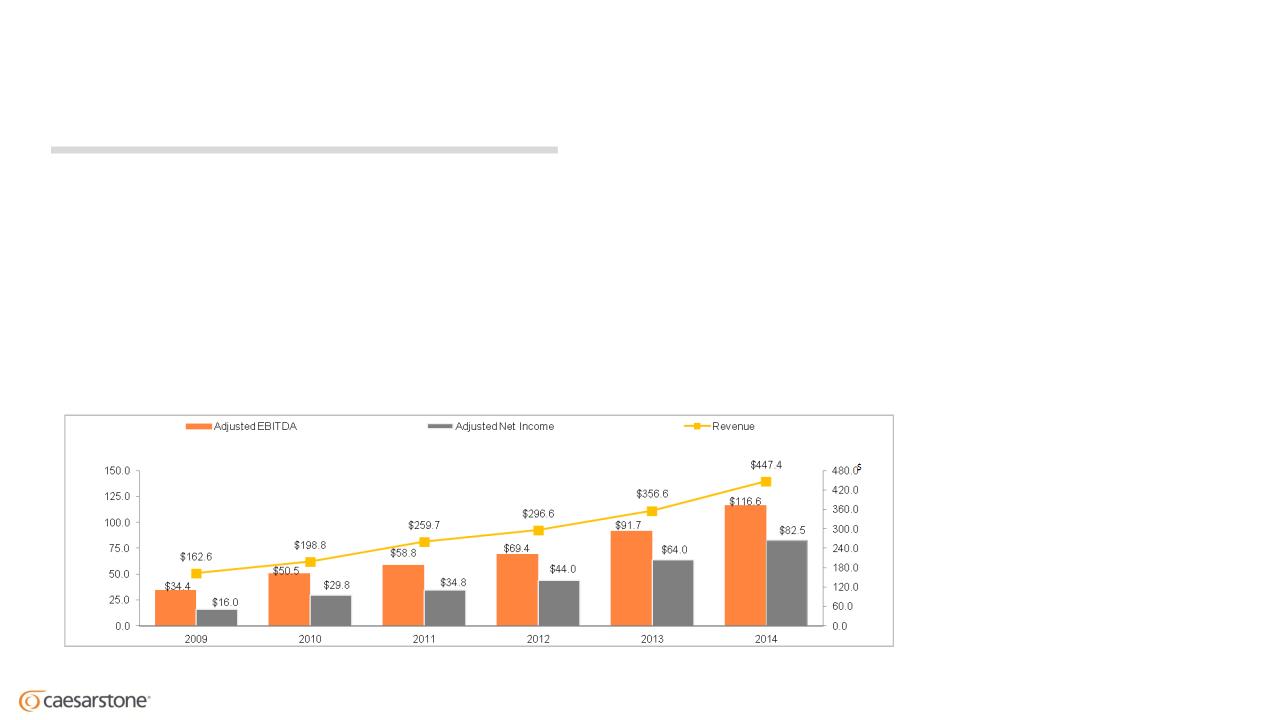

Best in Class - Strong Performance Through the Cycle ($mm)

6

2014 Quartz Share of Countertop Market by Region (by volume)

§ 2014 market penetration - 10% by sales²

§ Fastest growing surfaces category (’99 - ’14)

§ Grew at 15.7% CAGR

§ From 2% penetration in 1999

§ Capturing high % market share in key markets

Quartz Market Opportunity — Quartz is the

Fastest Growing Category in an $81bn¹ Market

Fastest Growing Category in an $81bn¹ Market

$81B Global Countertop Market Material Segmentation (2014 sales)

¹ Freedonia report, Feb. 2015; Sales to end-consumers in 2014 based on average installed price, which includes installation and other related costs;

the Company estimates that 40-50% of the total sales represents sales by manufacturers

² Based on market size data, Freedonia report, Feb. 2015

7

The U.S. Remains a Significant Opportunity

1 Source: Freedonia report February 2015; Company estimates

Calculation applies 1% increase in quartz penetration (by volume) based on 2014 total market volume and 2014 quartz prices as provided by Freedonia February 2015 report

2 HousingEconomics.com - Feb’15

3 Home Improvement Research Institute, March 2015

1,001k

2014

2016E

1,400k

U.S. New Housing Starts2

U.S. Home Improvement Product Sales3

Caesarstone U.S. Revenue Performance ($mm)

U.S. Market Penetration (by volume)

1% increase in

penetration ≈ $350mm1

penetration ≈ $350mm1

21%

9%

42%

50%

186

23%

YoY organic growth

8

Successful Innovative Products

9

Statuario Nuvo 5111

10

Vanilla Noir 5100

11

Bianco Drift 6131

12

Tommy Hilfiger chose Caesarstone

for his countertop and flooring

(Published in Architectural Digest)

Designer Trace Lehnhoff chose

Caesarstone Pure White for Neil Patrick

Harris’ new kitchen (Published in

Architectural Digest)

Caesarstone Pure White for Neil Patrick

Harris’ new kitchen (Published in

Architectural Digest)

A Leading Brand

Ty Pennington, Television Host

“You walk into a home and you

see the kitchen has Caesarstone in

it? It changes the way you look at

the value of that house.”

see the kitchen has Caesarstone in

it? It changes the way you look at

the value of that house.”

13

Caesarstone was ranked #63 in FORTUNE’s

Fastest-Growing Companies list for 2015

Fastest-Growing Companies list for 2015

Fast Growing Company

(Published 2015)

14

Spruce Point Capital Management published on August 19, 2015 a so-called “Investment Research Report”

while identifying itself as having a short position in Caesarstone’s shares and stating that it therefore stands

to realize significant gains if the price of Caesarstone’s shares declines.

while identifying itself as having a short position in Caesarstone’s shares and stating that it therefore stands

to realize significant gains if the price of Caesarstone’s shares declines.

Spruce Point’s report misrepresents Caesarstone’s business. The report is disturbing because of the nature

and extent of its misstatements, omissions and errors.

and extent of its misstatements, omissions and errors.

In our view, the report should not be relied upon by shareholders and potential investors in Caesarstone.

Spruce Point’s report, again, is false and misleading. As we stated after the publication of the Spruce Point

report, we stand by all of our previous public statements, regulatory filings and presentations. This includes

those statements that Spruce Point’s report seeks to call into question.

report, we stand by all of our previous public statements, regulatory filings and presentations. This includes

those statements that Spruce Point’s report seeks to call into question.

Spruce Point Report

15

Spruce Point misrepresents Caesarstone’s business, and stands to profit from any negative view

created in the minds of investors relying on its misrepresentations and its “short agenda”.

created in the minds of investors relying on its misrepresentations and its “short agenda”.

Spruce Point’s claims refer to the following:

- Caesarstone’s products and brand

- Caesarstone’s financials and reports

- Market trends and Caesarstone’s premium position

We will refer in this presentation to the principal misrepresentations in the Spruce Point report and

explain how Spruce Point has misled shareholders and potential investors.

explain how Spruce Point has misled shareholders and potential investors.

We believe given the nature and extent of the misstatements, omissions and errors in the Spruce Point

report that they may be intentional and we reserve our rights to take appropriate legal action.

report that they may be intentional and we reserve our rights to take appropriate legal action.

Spruce Point Report

16

Caesarstone Products and Brand

17

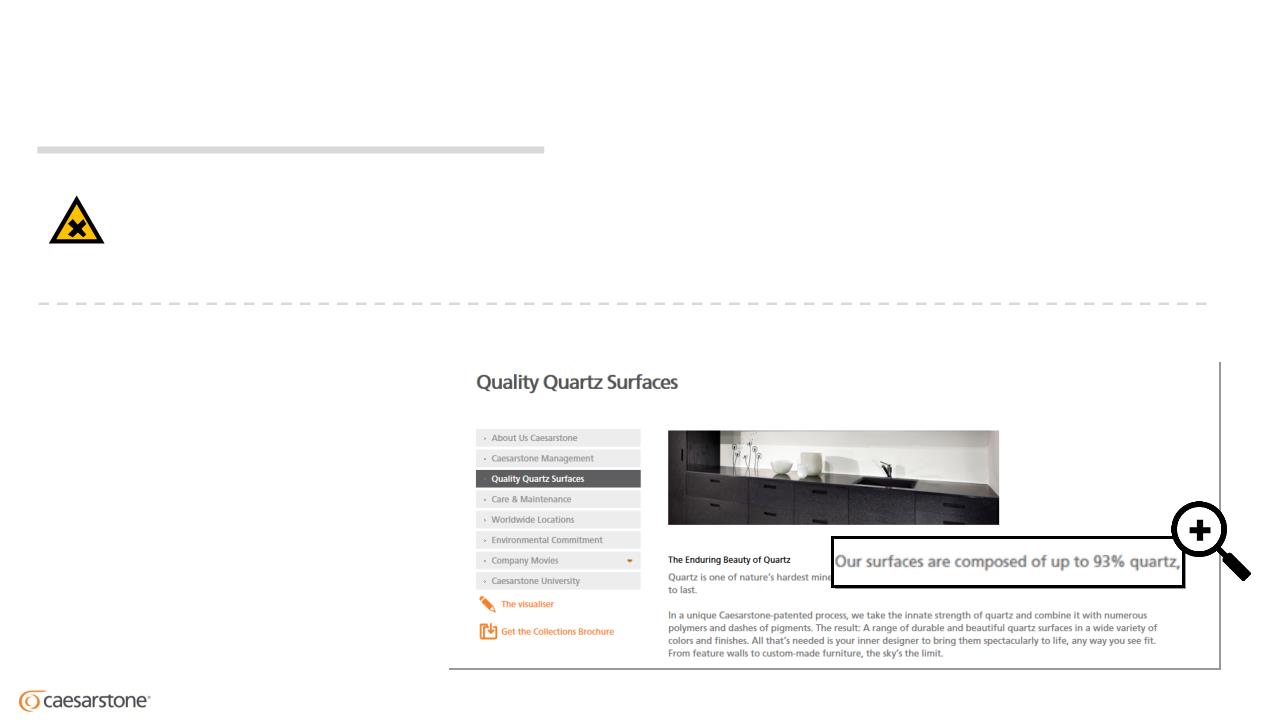

§ Caesarstone states very clearly

that its products contain “up to”

93% quartz - see, for example, the

company’s web site

that its products contain “up to”

93% quartz - see, for example, the

company’s web site

§ According to the Company’s

annual report on Form 20-F for

2014, Caesarstone’s products

contain “approximately 90%”

quartz.

annual report on Form 20-F for

2014, Caesarstone’s products

contain “approximately 90%”

quartz.

Spruce Point’s misrepresentation:

Caesarstone advertises that its products

contain 93% quartz, but they may contain

less quartz

contain 93% quartz, but they may contain

less quartz

FACT:

Caesarstone states clearly that its products

contain up to 93% quartz

contain up to 93% quartz

From Caesarstone’s web site

Stated Quartz Content

!

18

§ The percentage of quartz in a quartz surface differs slightly between different models, as a result of the

different size of the quartz grains used

different size of the quartz grains used

§ Delicate designed colors that have smaller quartz grains contain more binder material

§ Spruce Point misleadingly chose to compare Caesarstone models with delicate designs to competitors’

models with bigger quartz grains

models with bigger quartz grains

§ Product quality is achieved by the optimal combination of all ingredients. Quartz percentage alone is not the

relevant parameter for determining the product quality

relevant parameter for determining the product quality

§ We are proud of, and known for our high quality premium products

FACT:

Caesarstone’s products contain optimal quartz

content compared to competitors’ products;

content compared to competitors’ products;

Product quality relative to competing products

cannot be simply measured by quartz content

cannot be simply measured by quartz content

Quartz Content Comparison

!

Spruce Point’s misrepresentation :

Caesarstone’s products contain less quartz

than competitors’ products

than competitors’ products

19

Spruce Point’s misrepresentation:

Cautionary reviews amplify concerns about

product quality

product quality

FACT:

Very high level of consumer satisfaction with

Caesarstone products’ quality

Caesarstone products’ quality

Quality — Consumer Satisfaction

!

§ Caesarstone faces less than 0.5% warranty claims out of sold

products annually

products annually

§ A lifetime warranty is granted in the U.S. for all products

§ Warranty complaints are submitted to our customer service

department, and are handled to the full satisfaction of the

customer

department, and are handled to the full satisfaction of the

customer

§ A few individual complaints that appear on the internet and were

selectively picked by Spruce Point are not indicative of our

customer service level

selectively picked by Spruce Point are not indicative of our

customer service level

§ Spruce Point selectively quoted a few complaints about

Caesarstone from Countertop Investigator. But Countertop

Investigator’s review on Caesarstone makes clear the opposite:

Caesarstone from Countertop Investigator. But Countertop

Investigator’s review on Caesarstone makes clear the opposite:

§ Customers are extremely happy with Caesarstone countertops

§ Caesarstone’s service level is excellent

From countertop investigator web site

20

Spruce Point’s misrepresentation:

Since 1987 the company has introduced three

additional product collections. Caesarstone

has introduced only a few new collections in

the past few years

additional product collections. Caesarstone

has introduced only a few new collections in

the past few years

FACT:

Since 2012 Caesarstone has successfully

launched 20 new colors in the U.S. market.

Caesarstone continues to expand its

differentiated product offerings worldwide

launched 20 new colors in the U.S. market.

Caesarstone continues to expand its

differentiated product offerings worldwide

Innovation Pace

!

Clamshell

Dreamy Marfil

Emperadoro

London Grey

Organic White

Piatra Grey

Wild Rice

Red shimmer

Alpine Mist

Bianco Drift

Calacatta Nuvo

Coastal Grey

Frosty Carrina

Ocean foam

sleek concrete

Vanilla Noir

Woodlands

fresh concrete

raw concrte

Buttermilk

21

Caesarstone Financials and Reports

22

Spruce Point’s misrepresentation:

Quartz prices increased by 20% as opposed

to 4% represented by the Company

to 4% represented by the Company

FACT:

Our cost of quartz increased by approximately

4% from 2013 to 2014 as stated in our Form

4% from 2013 to 2014 as stated in our Form

20-F for 2014

Quartz Prices Increase

!

Spruce Point presented two letters entered into between Caesarstone and Mikroman, one of its Turkish suppliers,

stating that quartz prices increased 20%. But Spruce Point fails to mention that:

stating that quartz prices increased 20%. But Spruce Point fails to mention that:

A.One of the letters, dated February 6, 2012, sets forth the prices for the year 2012 and the other letter, dated

December 19, 2013, sets forth the prices for the year 2014. That means that the 20% increase of Mikroman prices

reflects changes over two years and not one year, as stated by Spruce Point; and

December 19, 2013, sets forth the prices for the year 2014. That means that the 20% increase of Mikroman prices

reflects changes over two years and not one year, as stated by Spruce Point; and

B.Four Turkish quartzite suppliers supplied approximately 67% of our total quartz consumption in 2014, and

Mikroman was only one of them. The overall quartz price mix has increased by approximately 4%, as we stated.

Mikroman was only one of them. The overall quartz price mix has increased by approximately 4%, as we stated.

23

Spruce Point’s misrepresentation:

In light of the rising Quartz prices, it is possible

that Caesarstone is mitigating price increases

by including less quartz

that Caesarstone is mitigating price increases

by including less quartz

FACT:

As stated in our 20-F, polyester is significantly more

expensive than quartz. The company’s cost incentive

will thus always be to maximize quartz content and

minimize polyester

expensive than quartz. The company’s cost incentive

will thus always be to maximize quartz content and

minimize polyester

Quartz Content and Cost Saving

!

§ Resin (polyester) is the key ingredient in our products in addition to quartz. As resin is much more expensive than

quartz, the company’s cost incentive will always be to maximize quartz content and minimize resin content.

quartz, the company’s cost incentive will always be to maximize quartz content and minimize resin content.

§ As stated in our Form 20-F for 2014, despite the fact that our products contain ~90% quartz, the cost of quartz

was only 31% of our total raw material costs in 2014 while polyester was 43% of such costs.

was only 31% of our total raw material costs in 2014 while polyester was 43% of such costs.

24

Spruce Point’s misrepresentation:

Caesarstone’s reported gross margin is in

question because of the gross margins of

Australia and Singapore subsidiaries

question because of the gross margins of

Australia and Singapore subsidiaries

FACT:

Subsidiary-level gross margins reflect transfer pricing

adjustments and are not relevant to the consolidated

result

adjustments and are not relevant to the consolidated

result

and Singaporean Subsidiaries

!

§ Caesarstone distribution subsidiaries’ margins reflect transfer prices between the parent company and

the distribution subsidiaries - which do not impact the Company’s consolidated results (except tax

expense)

the distribution subsidiaries - which do not impact the Company’s consolidated results (except tax

expense)

§ Those transfer prices are based on transfer pricing studies

§ In no way do those transfer prices impact the consolidated results of the company (except its net income

due to the impact on tax expenses)

due to the impact on tax expenses)

Gross Margins of the Australian

25

Spruce Point’s misrepresentation:

Significant margin erosion appears to be

masked by FX benefits; a pro-forma analysis

for Q2 2015 prepared by Spruce Point suggests

that real margins would be 3.7% - 5% lower

than reported, without FX impact

masked by FX benefits; a pro-forma analysis

for Q2 2015 prepared by Spruce Point suggests

that real margins would be 3.7% - 5% lower

than reported, without FX impact

FACT:

Q2’15 gross margin was impacted negatively by

approximately 200 basis points compared to Q2’14 as

stated in our Q2’15 earnings call

approximately 200 basis points compared to Q2’14 as

stated in our Q2’15 earnings call

Impact of Foreign Exchange Rates

!

§ Spruce Point pro-forma analysis is misleading and erroneous:

§ Spruce Point inserted incorrect numbers for our Q2'14 (COGS, Gross Profit and Gross Margin are wrong)

§ In analyzing revenue on a constant currency basis, Spruce Point failed to give effect to the Australian dollar

devaluation, which is the most sensitive currency for us and which devalued significantly year over year

devaluation, which is the most sensitive currency for us and which devalued significantly year over year

§ Spruce Point did not give nearly enough effect to the euro on revenue on a constant currency basis

§ As a result, Spruce Point’s pro-forma revenue is $8.2M too low and misrepresents the impact of different

currencies on the company’s results

currencies on the company’s results

§ For COGS Spruce Point gave an exaggerated effect to a weakened NIS, whereas NIS represents much less than

50% of company’s COGS (Raw Material, which is ~50% of COGS, is almost all in U.S. dollars and euros)

50% of company’s COGS (Raw Material, which is ~50% of COGS, is almost all in U.S. dollars and euros)

26

Spruce Point’s misrepresentation :

Caesarstone’s Cash Flow not reconciling with

Balance Sheet changes

Balance Sheet changes

FACT:

Cash Flow and Balance Sheet changes are aligned

subject to standard accounting rule requirements

subject to standard accounting rule requirements

Cash Flow vs. Balance Sheet

!

§ All year over year changes reflected in our BS are fully aligned with our CF, with respect to all years referred to by

Spruce Point. Spruce Point’s claim otherwise is false

Spruce Point. Spruce Point’s claim otherwise is false

§ In accordance with applicable accounting standards, the BS and CF structure and items’ classifications are different.

For example, the $8,806K increase in Account Payables in 2014 as appears in the BS, is included in the CF, divided

into 2 different lines: $1,811K account payables related to non-Fixed Asset and $6,992K related to Fixed Assets AP

(all numbers are rounded to the closest number)

For example, the $8,806K increase in Account Payables in 2014 as appears in the BS, is included in the CF, divided

into 2 different lines: $1,811K account payables related to non-Fixed Asset and $6,992K related to Fixed Assets AP

(all numbers are rounded to the closest number)

§ Spruce Point used wrong numbers in the table included in slide 28 to their report, and thus created a

misrepresentation with respect to changes to Inventories and Trade Receivables in 2014; all such changes are

reflected appropriately in Caesarstone’s CF

misrepresentation with respect to changes to Inventories and Trade Receivables in 2014; all such changes are

reflected appropriately in Caesarstone’s CF

§ Our reports are made in accordance with the applicable accounting standards

27

Spruce Point’s misrepresentation:

PCAOB 2013 inspection reports show significant

deficiencies

deficiencies

FACT:

PCAOB reports referred to by Spruce Point are not

related to Caesarstone, and Spruce Point had no

reason to assume otherwise

related to Caesarstone, and Spruce Point had no

reason to assume otherwise

!

PCAOB Comments

§ Spruce Point wrongly suggests that Caesarstone’s financials are of low integrity, suggesting that this is evidenced by

PCAOB inspections published in 2013 and 2010

PCAOB inspections published in 2013 and 2010

§ PCAOB comments on E&Y audits presented by Spruce Point refer to other companies and have nothing to do with

Caesarstone’s Financial Statements:

Caesarstone’s Financial Statements:

§ PCAOB inspection of the audit of Caesarstone financials was conducted for the first time in 2014 on our 2012

financials

financials

§ The 2013 PCAOB report quoted by Spruce Point refers to an inspection conducted in 2012 in relation to the

financial statements of 2011

financial statements of 2011

§ The 2010 report refers to an inspection conducted in 2006 in relation to the financial statements of 2004.

Caesarstone was not even public company in these years

Caesarstone was not even public company in these years

§ Searching PCAOB’s inspection results in Israel for the largest auditors (including E&Y which is considered as one

of the “Big Four”) shows that E&Y’s comment rate was the lowest

of the “Big Four”) shows that E&Y’s comment rate was the lowest

28

Spruce Point’s misrepresentation:

§ Unusual significant spread between CSTE’s DSO and

DPO - “The spread of 30 at year end 2014 was the

widest in the past 4 years ... CSTE is trying to stretch

out its payable … to generate temporary cash flow

from operations and may be having trouble collecting

from its customers”

DPO - “The spread of 30 at year end 2014 was the

widest in the past 4 years ... CSTE is trying to stretch

out its payable … to generate temporary cash flow

from operations and may be having trouble collecting

from its customers”

FACT:

Spruce Point drew a misleading graph with two

separate bars and scales for DSO and DPO, thereby

creating the wrong impression of an increasing gap

between DSO and DPO in 2014 vs. all previous years.

separate bars and scales for DSO and DPO, thereby

creating the wrong impression of an increasing gap

between DSO and DPO in 2014 vs. all previous years.

!

Gap Between Payables and Receivables Days

§ In 2011 and 2012, the gaps between DSO and DPO were approximately 22 and 23 days respectively, and

in 2013 and 2014, approximately 30 and 31 days, respectively

in 2013 and 2014, approximately 30 and 31 days, respectively

§ The gap between DSO and DPO increased to 30 days since moving to direct distribution in the U.S. and

Canada and with increasing capital expenditures in 2013 and 2014, which carry longer payment terms

Canada and with increasing capital expenditures in 2013 and 2014, which carry longer payment terms

§ See graphs which speak for themselves on the next slide

29

Gap Between Payables and Receivables Days (cnt’d)

Spruce Point chart with misleading scales

Chart with single scale

30

Market Trends and Caesarstone Premium Position

31

81% of fabricators said they expected sales

revenue to increase in 2015

revenue to increase in 2015

65% of fabricators watched their

business grow during 2014

business grow during 2014

§ Spruce Point selectively mentioned certain findings in

the Stone World 2015 Fabricator Survey, stating that

37% of the fabricators identified margin as their

challenge

the Stone World 2015 Fabricator Survey, stating that

37% of the fabricators identified margin as their

challenge

§ What is new about that? Usually one of the

common business challenges is maintaining

margins

common business challenges is maintaining

margins

§ Spruce Point failed to mention that the same report

found that in 2014 and 2015 65% and 81% of the

fabricators, respectively, were optimistic about their

business growth and expected the stone market to

grow

found that in 2014 and 2015 65% and 81% of the

fabricators, respectively, were optimistic about their

business growth and expected the stone market to

grow

1

2

Spruce Point’s misrepresentation:

Stone fabricators are worried about margin

contraction

contraction

!

Fabricators’ Business Insights

FACT:

A minority of fabricators (naturally) see margins

as a challenge and the majority are reporting

growth in their business at the same time and

expecting the stone market to grow

as a challenge and the majority are reporting

growth in their business at the same time and

expecting the stone market to grow

32

§ R&D expenses grew at 31% year over year in 2014 while revenue grew 25%

§ In 2012 we realigned functions between our R&D department and our operations department. This change

improved our innovation related efficiency, although part of the expense and headcount that was classified

as R&D expense has been shifted to COGS

improved our innovation related efficiency, although part of the expense and headcount that was classified

as R&D expense has been shifted to COGS

Spruce Point’s misrepresentation:

Caesarstone portrays itself as a premium

product but its R&D margins and headcount

are shrinking

product but its R&D margins and headcount

are shrinking

!

R&D Expenses

FACT:

We have a strong and high performing R&D

team, responsible for our continuing

successful offering of innovative products.

R&D expenses and headcount grew in line

with our business growth

team, responsible for our continuing

successful offering of innovative products.

R&D expenses and headcount grew in line

with our business growth

33

§ We grew our M&S to build strong direct distribution operation in the U.S. and Canada by 112% and 38% in

2011 and 2012, respectively - well above revenue growth

2011 and 2012, respectively - well above revenue growth

§ In the last 2 years we were able to leverage a lower percentage of M&S expenses while increasing revenues

by approximately 28% on a constant currency basis

by approximately 28% on a constant currency basis

§ We believe we invest appropriately to grow our business, while capturing the benefit of scale

Spruce Point’s misrepresentation:

Caesarstone Marketing and Sales margins have fallen

sharply

sharply

§ If Caesarstone doesn’t spend more - sales growth

will decline

will decline

§ If Caesarstone spends more on marketing - EBITDA

margins will be lower

margins will be lower

!

M&S Expenses

FACT:

We have strong marketing and sales

resources, as reflected in our strong brand

and top line growth

resources, as reflected in our strong brand

and top line growth

34

§ Since 2014 we added production lines to answer growing global demand for our products (line 5 in Israel and line 6 in

the U.S.; line 7 in the U.S. is expected to be operational in Q4’15)

the U.S.; line 7 in the U.S. is expected to be operational in Q4’15)

§ Adding manufacturing capacity in the U.S. is aimed at even better serving our main market, a key growth engine

§ The U.S. market presents a strong opportunity for us and cannot be described as "saturated“:

§ Quartz penetration is increasing at a quicker rate replacing natural stone and other materials¹

§ Quartz penetration was 5% in 2010, 6% in 2012 and 8% in 2014; yet it is well below Canada (18%) or Australia

(39%)

(39%)

§ The housing market is trending up and the forecast is that this trend will continue²

§ Caesarstone has been demonstrating double digit growth in this market quarter after quarter

§ See next slide addressing the U.S. opportunity

Manufacturing Expansion in the U.S.

Spruce Point’s misrepresentation:

Caesarstone is expanding its manufacturing into

a rapidly saturated market

a rapidly saturated market

!

FACT:

We believe the quartz revolution is gaining

momentum in the U.S. market and there is much

potential for growth. We have added additional

capacity in the U.S. to address growing demand

momentum in the U.S. market and there is much

potential for growth. We have added additional

capacity in the U.S. to address growing demand

¹Source: Freedonia February 2015; Company estimates

2 HousingEconomics.com - Feb’15; Home Improvement Research Institute, March 2015

35

§ There is no basis for any claim regarding the objectivity or integrity of Freedonia group, which has been

researching and analyzing the global and U.S. countertop industries since 2002, publishing more than 20 multi-

client countertop studies

researching and analyzing the global and U.S. countertop industries since 2002, publishing more than 20 multi-

client countertop studies

§ The data source utilized by Spruce Point is applied incorrectly to determine market share without any degree of

precision - page 46 of the Spruce Point report shows quantity of bills of lading without indicating how many

containers each of them represents

precision - page 46 of the Spruce Point report shows quantity of bills of lading without indicating how many

containers each of them represents

§ If we had used the import data presented by Spruce Point, Caesarstone’s implied market share giving effect to

North America suppliers would have been over 25% - which is above the market share derived by Freedonia

North America suppliers would have been over 25% - which is above the market share derived by Freedonia

Caesarstone’s Market Share in the U.S. Market

Spruce Point’s misrepresentation:

Caesarstone is using Freedonia paid-for

research to provide market data, therefore the

data can’t be considered as unbiased; Import

data call into question Caesarstone market

share gains in the U.S.

research to provide market data, therefore the

data can’t be considered as unbiased; Import

data call into question Caesarstone market

share gains in the U.S.

!

FACT:

Import data presented by Spruce Point is

misleading and not indicative as to actual

market share, nor does it show lower market

share for Caesarstone

misleading and not indicative as to actual

market share, nor does it show lower market

share for Caesarstone

36

Thank you

37

(1) Consists of our portion of the results of operations of Caesarstone USA prior to its acquisition by us in May 2011.

(2) Consists of charges to cost of goods sold for the difference between the higher carrying cost of the inventory of two of the Company's subsidiaries- Caesarstone USA's inventory at the time of its acquisition and inventory that was

purchased from its distributor and Caesarstone Australia Pty Limited's inventory that was purchased from its distributor, and the standard cost of the Company's inventory-which adversely impacts the Company's gross margins

until such inventory is sold. The majority of the inventory acquired from Caesarstone USA was sold in 2011, and the majority of the inventory acquired from the Australian distributor was sold in 2012.

purchased from its distributor and Caesarstone Australia Pty Limited's inventory that was purchased from its distributor, and the standard cost of the Company's inventory-which adversely impacts the Company's gross margins

until such inventory is sold. The majority of the inventory acquired from Caesarstone USA was sold in 2011, and the majority of the inventory acquired from the Australian distributor was sold in 2012.

(3) In 2013, share-based compensation consists of expenses related to the stock options granted to employees of the Company. In 2014, share-based compensation consists primarily of expenses related to the stock options granted to

employees of the Company, as well as expenses related to share-based rights granted during the period.

employees of the Company, as well as expenses related to share-based rights granted during the period.

(4) Relates to a change in estimate for the value of inventory following the implementation of the Company's new ERP system in April 2013.

(5) In 2013, consists of direct expenses related to a follow-on offering that closed in April 2013, including a bonus paid by the Company' former shareholder, Tene, to certain of its employees that under US GAAP the Company is

required to expense against paid-in capital. In 2014, consists of direct expenses related to a follow-on offering that closed in June 2014.

required to expense against paid-in capital. In 2014, consists of direct expenses related to a follow-on offering that closed in June 2014.

(6) Consists of the payment of $1.72 million to certain employees of the Company and $0.25 million to the Company's Chairman for their contribution to the completion of the Company's initial public offering, or IPO.

(7) Relates to the change in fair value of the contingent consideration that was part of the consideration transferred in connection with the acquisition of Caesarstone USA.

(8) In 2011, litigation gain consists of a mediation award in the Company's favor pursuant to two trademark infringement cases brought by Caesarstone Australia Pty Limited. In 2012, litigation gain resulted from a settlement

agreement with the former chief excecutive officer of Caesarstone Australia Pty Limited related to litigation that had been commenced in 2010. Pursuant to the settlement, he transferred to the Company the ownership of all his

shares in Caesarstone Australia Pty Limited received in connection with his employment. The Company did not make any payments in connection with such transfer or other payments to the former chief executive officer. As a

result of the settlement, the Company reversed the liability provision in connection with the litigation and the adjustment is presented net of the related litigation expenses incurred in connection with the settlement.

agreement with the former chief excecutive officer of Caesarstone Australia Pty Limited related to litigation that had been commenced in 2010. Pursuant to the settlement, he transferred to the Company the ownership of all his

shares in Caesarstone Australia Pty Limited received in connection with his employment. The Company did not make any payments in connection with such transfer or other payments to the former chief executive officer. As a

result of the settlement, the Company reversed the liability provision in connection with the litigation and the adjustment is presented net of the related litigation expenses incurred in connection with the settlement.

(9) Relates to our writing down to zero the cost of inventory provided to Microgil, our former third-party quartz processor in Israel, in 2011 in the amount of $1.8 million and our writing down to zero our $1.1 million loan to Microgil, in

each case, in connection with a dispute.

each case, in connection with a dispute.

(10) Relates to an adjustment of provision for taxable employee fringe benefits as a result of a settlement with the Israel Tax Authority and with the National Insurance Intitute of Israel.

(11) Relates to a refund of Israeli value added tax (VAT) associated with a bad debt from 2007

38

(1) Consists of charges to cost of goods sold for the difference between the higher carrying cost of the inventory of two of the Company's subsidiaries- Caesarstone USA's inventory at the time of its acquisition and inventory that was

purchased from its distributor and Caesarstone Australia Pty Limited's inventory that was purchased from its distributor, and the standard cost of the Company's inventory-which adversely impacts the Company's gross margins until

such inventory is sold. The majority of the inventory acquired from Caesarstone USA was sold in 2011, and the majority of the inventory acquired from the Australian distributor was sold in 2012.

purchased from its distributor and Caesarstone Australia Pty Limited's inventory that was purchased from its distributor, and the standard cost of the Company's inventory-which adversely impacts the Company's gross margins until

such inventory is sold. The majority of the inventory acquired from Caesarstone USA was sold in 2011, and the majority of the inventory acquired from the Australian distributor was sold in 2012.

(2) In 2013, share-based compensation consists of expenses related to the stock options granted to employees of the Company. In 2014, share-based compensation consists primarily of expenses related to the stock options granted to

employees of the Company, as well as expenses related to share-based rights granted during the period.

employees of the Company, as well as expenses related to share-based rights granted during the period.

(3) Consists of the payment of $1.72 million to certain employees of the Company and $0.25 million to the Company's Chairman for their contribution to the completion of the Company's IPO.

(4) Relates to the change in fair value of the contingent consideration that was part of the consideration transferred in connection with the acquisition of Caesarstone USA.

(5) Relates to a change in estimate for the value of inventory following the implementation of the Company's new ERP system in April 2013.

(6) In 2013, consists of direct expenses related to a follow on-offering that closed in April 2013, including a bonus paid by the Company' former shareholder, Tene, to certain of its employees that under US GAAP the Company is required to

expense against paid-in capital. In 2014, consists of direct expenses related to a follow on offering that closed in June 2014.

expense against paid-in capital. In 2014, consists of direct expenses related to a follow on offering that closed in June 2014.

(7) In 2011, litigation gain consists of a mediation award in the Company's favor pursuant to two trademark infringement cases brought by Caesarstone Australia Pty Limited. In 2012, litigation gain resulted from a settlement agreement

with the former chief excecutive officer of Caesarstone Australia Pty Limited related to litigation that had been commenced in 2010. Pursuant to the settlement, he transferred to the Company the ownership of all his shares in

Caesarstone Australia Pty Limited received in connection with his employment. The Company did not make any payments in connection with such transfer or other payments to the former chief executive officer. As a result of the

settlement, the Company reversed the liability provision in connection with the litigation and the adjustment is presented net of the related litigation expenses incurred in connection with the settlement.

with the former chief excecutive officer of Caesarstone Australia Pty Limited related to litigation that had been commenced in 2010. Pursuant to the settlement, he transferred to the Company the ownership of all his shares in

Caesarstone Australia Pty Limited received in connection with his employment. The Company did not make any payments in connection with such transfer or other payments to the former chief executive officer. As a result of the

settlement, the Company reversed the liability provision in connection with the litigation and the adjustment is presented net of the related litigation expenses incurred in connection with the settlement.

(8) Relates to our writing down to zero the cost of inventory provided to Microgil, our former third-party quartz processor in Israel, in 2011 in the amount of $1.8 million and our writing down to zero our $1.1 million loan to Microgil, in each

case, in connection with a dispute.

case, in connection with a dispute.

(9) Relates to an adjustment of provision for taxable employee fringe benefits as a result of a settlement with the Israel Tax Authority and with the National Insurance Intitute of Israel.

(10) Relates to a refund of Israeli value added tax (VAT) associated with a bad debt from 2007

(11) Tax adjustment as a result of tax settlement with the Israeli tax authorities.

(12) The tax adjustments for the three and Twelve months ended December 31, 2014 and 2013 were based on the effective tax rate (excluding adjustments to the tax line item) for these periods, respectively.

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Caesarstone Announces Date for First Quarter 2024 Results

- Vinhomes, Vietnam largest property developer, unveils a series of new entertainment and shopping destinations

- Man Group PLC : Form 8.3 - Tyman plc

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share