Form 424B5 Jones Energy, Inc.

Use these links to rapidly review the document

TABLE OF CONTENTS

TABLE OF CONTENTS

Filed Pursuant to Rule 424(b)(5)

Registration No. 333-211568

The information in this prospectus supplement and the accompanying prospectus is not complete and may be changed. This prospectus supplement and the accompanying prospectus are not an offer to sell these securities and are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Preliminary Prospectus

SUBJECT TO COMPLETION, DATED AUGUST 18, 2016

PROSPECTUS SUPPLEMENT

(To prospectus dated July 26, 2016)

14,000,000 Shares

Jones Energy, Inc.

Class A Common Stock

We are offering 14,000,000 shares of our Class A common stock.

Our Class A common stock is listed on the New York Stock Exchange under the symbol "JONE." On August 17, 2016, the last reported trading price of our Class A common stock as reported on the New York Stock Exchange was $3.58 per share.

Concurrently with this offering, we are making a public offering, which we refer to as the Concurrent Preferred Offering, of 1,000,000 shares of % Series A Perpetual Convertible Preferred Stock, par value $0.001 per share (or up to 150,000 shares if the underwriters in that offering exercise their over-allotment option in full) at an issue price of $50 per share, pursuant to a separate prospectus supplement. We cannot assure you that the Concurrent Preferred Offering will be completed or, if completed, on what terms it will be completed. The offering of shares of our Class A common stock pursuant to this prospectus supplement and the accompanying prospectus is not contingent upon the closing of the Concurrent Preferred Offering, and the Concurrent Preferred Offering is not contingent upon the closing of the offering of shares of our Class A common stock hereunder.

Entities affiliated with one of our material beneficial owners, JVL Advisors, L.L.C., have expressed an interest in purchasing an aggregate of approximately 50% of the Class A common stock offered in this offering at the initial price offered to the public. Because this indication is not a binding agreement or commitment to purchase, this entity may elect not to purchase any shares in this offering, or the underwriters may elect not to sell any shares in this offering to this entity. In the event that this entity confirms its interest, we will request that the underwriters consider selling to it such percentage of the common stock offered in this offering.

If such percentage is so allocated, we expect affiliates of JVL Advisors, L.L.C. to own slightly in excess of 17% of our outstanding Class A common stock and Class B common stock following this offering.

Investing in shares of our Class A common stock involves risks that are described in the "Risk Factors" section beginning on page S-9 of this prospectus supplement and page 3 of the accompanying base prospectus.

| |

Per share | Total | |||||

|---|---|---|---|---|---|---|---|

Public Offering Price |

$ | $ | |||||

Underwriting Discount |

$ | $ | |||||

Proceeds, before expenses, to us |

$ | $ | |||||

We have granted the underwriters an option for a period of 30 days from the date of this prospectus supplement to purchase up to 2,100,000 shares of Class A common stock on the same terms and conditions as set forth above.

None of the Securities and Exchange Commission, any state securities commission, or any other regulatory body has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying base prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The shares of Class A common stock will be ready for delivery on or about , 2016.

Joint Book-Running Managers

Credit Suisse |

J.P. Morgan | |||

|

||||

GMP Securities |

Johnson Rice & Company L.L.C. |

|||

The date of this prospectus supplement is , 2016

Prospectus Supplement

S-i

INFORMATION IN THIS PROSPECTUS SUPPLEMENT AND

THE ACCOMPANYING PROSPECTUS

This document is in two parts. The first part is this prospectus supplement, which describes the specific terms of this offering of Class A common stock. The second part is the accompanying base prospectus, which gives more general information, some of which may not apply to this offering of Class A common stock. Generally, when we refer only to the "prospectus," we are referring to both this prospectus supplement and the accompanying base prospectus combined. If the information relating to the offering varies between this prospectus supplement and the accompanying base prospectus, you should rely on the information in this prospectus supplement.

Any statement made in this prospectus supplement or in a document incorporated or deemed to be incorporated by reference into this prospectus supplement will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus supplement or in any other subsequently filed document that is also incorporated by reference into this prospectus modifies or supersedes that statement. Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this prospectus. Please read "Information Incorporated by Reference" on page S-31 of this prospectus supplement.

You should rely only on the information contained in or incorporated by reference into this prospectus supplement, the accompanying base prospectus and any free writing prospectus prepared by or on behalf of us relating to this offering of Class A common stock. Neither we nor the underwriters have authorized anyone to provide you with additional or different information. If anyone provides you with additional, different or inconsistent information, you should not rely on it. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where an offer or sale is not permitted. You should not assume that the information contained in this prospectus supplement, the accompanying base prospectus or any free writing prospectus is accurate as of any date other than the dates shown in such documents or that any information we have incorporated by reference herein is accurate as of any date other than the date of the document incorporated by reference. Our business, financial condition, results of operations and prospects may have changed since such dates.

None of Jones Energy, Inc., the underwriters or any of their respective representatives is making any representation to you regarding the legality of an investment in our Class A common stock by you under applicable laws. You should consult with your own advisors as to legal, tax, business, financial and related aspects of an investment in our Class A common stock.

Market and industry data and forecasts used in this prospectus supplement and the documents incorporated by reference herein have been obtained from independent industry sources as well as from research reports prepared for other purposes. Although we believe these third-party sources to be reliable, we have not independently verified the data obtained from these sources and we cannot assure you of the accuracy or completeness of the data. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and uncertainties as the other forward-looking statements in this prospectus supplement.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

The information in this prospectus supplement, the accompanying prospectus, and the documents we incorporate by reference herein or therein contain "forward-looking statements." All statements, other than statements of historical fact included in this prospectus, regarding our strategy, future operations, financial position, estimated revenues and losses, projected costs, prospects, plans and objectives of management are forward-looking statements. When used in this prospectus, the words "could," "should," "will," "may," "believe," "anticipate," "intend," "estimate," "expect," "project" and

S-ii

similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on our current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. When considering forward-looking statements, you should keep in mind the many factors that may cause results to differ including those described under "Risk Factors" in this prospectus supplement and the accompanying prospectus and in our most recent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and other filings we make with the Securities and Exchange Commission (the "SEC") incorporated by reference herein and elsewhere in this prospectus supplement and the accompanying prospectus. These forward-looking statements are based on management's current belief, based on currently available information, as to the outcome and timing of future events, actions and developments including:

- •

- business strategy;

- •

- estimated current and future net reserves and the present value thereof;

- •

- drilling and completion of wells including our identified drilling locations;

- •

- cash flows and liquidity;

- •

- financial strategy, budget, projections and operating results;

- •

- future prices and change in prices for oil, natural gas and natural gas liquids;

- •

- customers' elections to reject ethane and include it as part of the natural gas stream;

- •

- timing and amount of future production of oil and natural gas;

- •

- availability and cost of drilling, completion and production equipment;

- •

- availability and cost of oilfield labor;

- •

- the amount, nature and timing of capital expenditures, including future development costs;

- •

- ability to fund our capital expenditure budgets;

- •

- availability and terms of capital;

- •

- development results from our identified drilling locations;

- •

- ability to generate returns and pursue opportunities;

- •

- marketing of oil, natural gas and NGLs;

- •

- property acquisitions and dispositions, including the Pending Acquisitions (as described below), and realizing the expected benefits

or effects of completed acquisitions and dispositions;

- •

- our ability to consummate the Pending STACK/SCOOP Acquisition (as defined below) and our anticipated financing transactions in

connection therewith;

- •

- our ability to close the Pending Anadarko Acquisition (as defined below);

- •

- our expectations regarding borrowing base redeterminations;

- •

- the availability, cost and terms of, and competition for mineral leases and other permits and rights-of-way and our ability to

maintain mineral leases;

- •

- costs of developing our properties and conducting other operations;

- •

- general economic conditions, including the levels of supply and demand for oil, natural gas and NGLs, and the commodity price

environment;

- •

- competitive conditions in our industry;

S-iii

- •

- effectiveness and extent of our risk management activities;

- •

- estimates of future potential impairments;

- •

- environmental and endangered species regulations and liabilities;

- •

- counterparty credit risk;

- •

- the extent and effect of any hedging activities engaged in by us;

- •

- the impact of, and changes in, governmental regulation of the oil and natural gas industry, including tax laws and regulations,

environmental, health and safety laws and regulations, and laws and regulations with respect to derivatives and hedging activities;

- •

- developments in oil-producing and natural gas-producing countries;

- •

- uncertainty regarding our future operating results;

- •

- weather, including its impact on oil and natural gas demand and weather-related delays on operations;

- •

- technology; and

- •

- plans, objectives, expectations and intentions contained in this prospectus supplement that are not historical.

We caution you that these forward-looking statements are subject to all of the risks and uncertainties, most of which are difficult to predict and many of which are beyond our control, incident to the exploration for and development and production of oil and natural gas. These risks include, but are not limited to, commodity price levels and volatility, inflation, the cost of oil field equipment and services, lack of availability of drilling, completion and production equipment and services, environmental risks, drilling and other operating risks, regulatory changes, the uncertainty inherent in estimating oil and natural gas reserves and in projecting future rates of production, cash flow and access to capital, the timing of development expenditures, and the other risks described under "Risk Factors" in this prospectus supplement, the accompanying prospectus and in the documents incorporated herein and therein by reference.

Reserve engineering is a process of estimating underground accumulations of oil and natural gas that cannot be measured in an exact way. The accuracy of any reserve estimate depends on the quality of available data, the interpretation of such data and price and cost assumptions made by reservoir engineers. In addition, the results of drilling, testing and production activities may justify revisions of estimates that were made previously. If significant, such revisions would change the schedule of any further production and development drilling. Accordingly, reserve estimates may differ significantly from the quantities of oil and natural gas that are ultimately recovered.

Should one or more of the risks or uncertainties described in this prospectus supplement or the accompanying prospectus occur, or should underlying assumptions prove incorrect, our actual results and plans could differ materially from those expressed in any forward-looking statements.

All forward-looking statements, expressed or implied, included in this prospectus supplement and the accompanying prospectus are expressly qualified in their entirety by this cautionary statement. This cautionary statement should also be considered in connection with any subsequent written or oral forward-looking statements that we or persons acting on our behalf may issue.

Except as otherwise required by applicable law, we disclaim any duty to update any forward-looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this prospectus supplement.

S-iv

This summary highlights information contained elsewhere in or incorporated by reference into this prospectus supplement and the accompanying base prospectus. Because this is a summary, it may not contain all of the information that may be important to you and to your investment decision. The following summary is qualified in its entirety by the more detailed information and financial statements and notes thereto included elsewhere in this prospectus supplement, the accompanying base prospectus and the documents incorporated herein by reference and other documents to which we refer. You should read "Risk Factors" beginning on page S-9 of this prospectus supplement and on page 3 of the accompanying base prospectus for more information about important risks that you should consider carefully before buying our Class A common stock. Except as otherwise indicated, all information contained in this prospectus supplement assumes that the underwriters do not exercise their option to purchase additional Class A common stock.

Unless indicated otherwise in this prospectus supplement or the context requires otherwise, all references to "Jones Energy," the "Company," "our company," "we," "our" and "us" refer to Jones Energy, Inc. and its subsidiaries, including Jones Energy Holdings, LLC ("JEH LLC"). As the sole managing member of JEH LLC, Jones Energy, Inc. is responsible for all operational, management and administrative decisions relating to JEH LLC's business and consolidates the financial results of JEH LLC and its subsidiaries. References to "Metalmark Capital" are to MCP (C) II Jones Intermediate LLC, MCP II Co-Investment Jones Intermediate LLC, MCP II Jones Intermediate LLC, MCP II (TE) AIF Jones Intermediate LLC, MCP II (Cayman) AIF Jones Intermediate LLC and MCP II Executive Fund Jones Intermediate LLC, collectively. Jones Energy, Inc. is a holding company whose sole material asset is an equity interest in Jones Energy Holdings, LLC. The estimates of our proved reserves included in this prospectus supplement or incorporated by reference as of December 31, 2013, 2014 and 2015 are based on reserve reports prepared for Jones Energy by Cawley, Gillespie & Associates, Inc., independent petroleum engineers ("Cawley Gillespie").

We are an independent oil and gas company engaged in the exploration, development, production and acquisition of oil and natural gas properties in the mid-continent United States, spanning areas of Texas and Oklahoma. Our Chairman and CEO, Jonny Jones, founded our predecessor company in 1988 in continuation of his family's long history in the oil and gas business, which dates back to the 1920's. We have grown rapidly by leveraging our focus on low cost drilling and completion methods and our horizontal drilling expertise to develop our inventory and execute several strategic acquisitions. We have accumulated extensive knowledge and experience in developing the Anadarko and Arkoma basins, having concentrated our operations in the Anadarko basin for over 25 years and applied our knowledge to the Arkoma basin since 2011. We have drilled 836 total wells as operator, including 660 horizontal wells, since our formation and delivered compelling rates of return over various commodity price cycles. Our operations are focused on horizontal drilling and completions within two distinct basins in the Texas Panhandle and Oklahoma:

- •

- the Western Anadarko Basin—targeting the liquids rich Cleveland, Granite Wash, Tonkawa and Marmaton formations;

- •

- the Arkoma Basin—targeting the Woodford shale formation; and

- •

- assuming the Pending STACK/SCOOP Acquisition is completed, the STACK/SCOOP play in the Eastern Anadarko Basin—targeting the Sycamore and Woodford shale formations.

We seek to optimize returns through a disciplined emphasis on controlling costs and promoting operational efficiencies, and we are recognized as one of the lowest cost drilling and completion operators in the Cleveland and Woodford shale formations.

S-1

As of December 31, 2015, our total estimated proved reserves were 101.7 MMBoe, of which 58% were classified as proved developed reserves. Approximately 25% of our total estimated proved reserves as of December 31, 2015 consisted of oil, 32% consisted of NGLs, and 43% consisted of natural gas. As of December 31, 2015, our properties included 1,016 gross producing wells. For the three years ended December 31, 2015, we drilled 294 wells, substantially all of which we drilled as operator. The following table presents summary reserve, acreage and production data for each of our operating areas:

| |

As of December 31, 2015 | Year Ended December 31, 2015 |

|||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Estimated Net Proved Reserves |

Acreage | Average Daily Net Production |

||||||||||||||||

| |

MMBoe | % Oil and NGLs |

Gross Acreage |

Net Acreage |

MBoe/d | % Oil and NGLs |

|||||||||||||

Cleveland |

80.6 | 63 | % | 181,353 | 117,700 | 18.4 | 64 | % | |||||||||||

Woodford |

16.3 | 32 | % | 12,383 | 4,418 | 3.6 | 31 | % | |||||||||||

Other |

4.8 | 43 | % | 34,488 | 15,259 | 3.1 | 40 | % | |||||||||||

| | | | | | | | | | | | | | | | | | | | |

All properties |

101.7 | 57 | % | 228,224 | 137,377 | 25.1 | 57 | % | |||||||||||

The following table presents summary well and drilling location data for each of our key formations as of December 31, 2015:

| |

Producing Wells |

Identified Drilling Locations(1) |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Gross | Net | Gross | Net | |||||||||

Cleveland |

573 | 410 | 711 | 455 | |||||||||

Woodford |

152 | 59 | 277 | 45 | |||||||||

Other |

291 | 81 | 1,115 | 473 | |||||||||

| | | | | | | | | | | | | | |

All properties |

1,016 | 550 | 2,103 | 973 | |||||||||

- (1)

- Our total identified drilling locations include 412 gross locations associated with proved undeveloped reserves as of December 31, 2015. We have estimated our drilling locations based on well spacing assumptions for the areas in which we operate and other criteria. See "Business—Development of Proved Undeveloped Reserves" and "Business—Drilling Locations" in our Annual Report on Form 10-K for the year ended December 31, 2015 for more information regarding our proved undeveloped reserves and the processes and criteria through which these drilling locations were identified.

Our 2015 capital expenditures totaled $200.1 million (excluding the impact of asset retirement costs), of which $173.2 million was utilized to drill and complete operated wells. In our Annual Report on Form 10-K for the year ended December 31, 2015, we provided an overview of our 2016 capital expenditures budget, which was initially set at $25 million with the majority dedicated to capital well workovers and field optimization activities. On May 4, 2016 the Company announced a revised 2016 capital expenditures program of $100 million. The Company resumed drilling with one rig in the Cleveland in April 2016, followed by the addition of a second and third rig in June 2016. On August 3, 2016, the Company announced a further revised 2016 capital expenditures program, lowering full year 2016 guidance (excluding acquisitions) by 10% to $90 million, primarily due to better than expected execution on the Company's Cleveland drilling program and maintenance projects coming in below budget. The Company expects to fund its revised 2016 capital budget, excluding capital expenditures related to the Pending Acquisitions, with cash flows from operations.

S-2

Pending Acquisitions

Pending STACK/SCOOP Acquisition

On August 18, 2016, JEH LLC entered into a definitive purchase and sale agreement (the "Purchase Agreement") with SCOOP Energy Company, LLC, an Oklahoma limited liability company (the "Seller"), to acquire oil and gas properties located in the STACK/SCOOP play in the Eastern Anadarko Basin in Central Oklahoma, for a purchase price of $136.5 million, subject to customary purchase price adjustments. This transaction, which we refer to as the "Pending STACK/SCOOP Acquisition," principally consists of approximately 18,000 undeveloped net acres in Canadian, Grady and McClain Counties, Oklahoma (the "Properties"), subject to reductions for exercised preferential purchase rights and failures to obtain required consents. We intend to finance the Pending STACK/SCOOP Acquisition, subject to market conditions and other factors, with net proceeds from this offering, the Concurrent Preferred Offering (as defined below) and borrowings under our Revolver (as defined below). We expect to close the Pending STACK/SCOOP Acquisition prior to the end of the third quarter of 2016. However, the Pending STACK/SCOOP Acquisition remains subject to the completion of satisfactory title and environmental due diligence and the satisfaction of customary closing conditions. In addition, the Pending STACK/SCOOP Acquisition requires the approval of the Oklahoma probate court with jurisdiction over the assets of one of the Seller's equity owners (the "Court Approval"). There can be no assurance that we will acquire all or any portion of the acreage subject to the Purchase Agreement.

Pending Anadarko Acquisition

As previously announced, on August 3, 2016, JEH LLC entered into a definitive agreement to acquire producing and undeveloped oil and gas assets in the Western Anadarko Basin, which we refer to as the "Pending Anadarko Acquisition," for $27.1 million, subject to customary closing adjustments. The assets subject to the Pending Anadarko Acquisition include interests in up to 174 producing wells and approximately 26,000 net acres in Lipscomb and Ochiltree Counties in the Texas Panhandle, subject to reductions for exercised preferential purchase rights and failures to obtain required consents. The Company expects to fund the Pending Anadarko Acquisition with cash on hand, and anticipates the transaction will close by the end of August 2016, subject to completion of due diligence and satisfaction of customary closing conditions. We refer to the Pending Anadarko Acquisition, together with the Pending STACK/SCOOP Acquisition, as the "Pending Acquisitions."

Concurrent Offering of Shares of our Convertible Preferred Stock

Concurrently with this offering of shares of our Class A common stock, we are offering, by means of a separate prospectus supplement, 1,000,000 shares of our % Series A Perpetual Convertible Preferred Stock, par value $0.001 per share (our "convertible preferred stock") at an issue price of $50 per share, in an offering registered under the Securities Act of 1933, as amended, (the "Securities Act"), which we refer to as the Concurrent Preferred Offering. We also expect to grant a 30-day option to the underwriters in the Concurrent Preferred Offering to purchase up to an additional 150,000 shares of our convertible preferred stock, solely to cover over-allotments. The shares of convertible preferred stock will be convertible into an aggregate of up shares of our Class A common stock (or up to shares of our Class A common stock, if the underwriters in that offering exercise their over-allotment option in full), in each case subject to anti-dilution, make-whole and other adjustments, as described in the prospectus supplement related to the offering of our convertible preferred stock. We expect to receive net proceeds of approximately $ million from the Concurrent Preferred Offering, excluding any fees or expenses payable by us, and assuming no exercise by the underwriters of their over-allotment option. We cannot give any assurance that the Concurrent Preferred Offering will

S-3

be completed. We refer to this offering and Concurrent Preferred Offering as the "Securities Offerings."

This offering is not contingent upon the Concurrent Preferred Offering, and the Concurrent Preferred Offering is not contingent upon this offering. This prospectus supplement shall not be deemed an offer to sell or a solicitation to buy the convertible preferred shares.

Amendment of Senior Secured Revolving Credit Facility

On August 1, 2016, the Company entered into an amendment to our senior secured revolving credit facility (our "Revolver") to, among other things (i) require that the Company's deposit accounts and securities accounts (subject to certain exclusions) become subject to control agreements, (ii) restrict the Company from making borrowings under the Revolver if the Company has or, after giving effect to the borrowing, will have a Consolidated Cash Balance (as defined in the Revolver) in excess of $30.0 million and (iii) set the borrowing base under the Revolver at $410.0 million effective immediately, with an automatic increase to $425.0 million upon closing of the Pending Anadarko Acquisition. The borrowing base under the Revolver will not increase or decrease upon the closing of the Pending STACK/SCOOP Acquisition. Our borrowing base is scheduled for a redetermination on or about October 1, 2016, at which time we expect a reduction, resulting in a borrowing base of between $360 million and $330 million, assuming the closing of the Pending Anadarko Acquisition.

Letter Agreement and Waiver of Delaware General Corporation Law Section 203

Given that affiliates of JVL Advisors, L.L.C. (together with its affiliates and associates, "JVL") may own in excess of 15% of our outstanding voting stock as a result of JVL's indication of interest in this offering, the Company is entering into a letter agreement (the "JVL Letter Agreement") with JVL Advisors, L.L.C. in connection with the offering. The JVL Letter Agreement will approve, pursuant to Section 203 of the Delaware General Corporation Law ("Section 203"), the purchase of shares of Class A common stock in this offering by JVL if the underwriters decide to allocate shares to JVL. This approval will result in JVL not being subject to the restrictions on "business combinations" contained in Section 203. In consideration of such approval, JVL will agree that, among other things:

- •

- it will not acquire any material assets of the Company;

- •

- it will not become the owner of more than 19.9% of the Company's outstanding voting stock (other than as a result of actions taken

solely by the Company) without the prior approval of the Company's independent directors who are not affiliated with JVL; and

- •

- it will not engage in any "business combination" (as defined in the JVL Letter Agreement).

Following this offering, the Company intends to negotiate a registration rights agreement with JVL to facilitate an orderly distribution of JVL's shares of Class A common stock in the future.

Jones Energy, Inc. (NYSE: JONE) was incorporated as a Delaware corporation in March 2013. We are a holding company whose sole material asset consists of units ("JEH LLC Units") in JEH LLC. As the sole managing member of JEH LLC, we are responsible for all operational, management and administrative decisions relating to JEH LLC's business and consolidate the financial results of JEH LLC and its subsidiaries. Our principal executive offices are located at 807 Las Cimas Pkwy, Suite 350, Austin, Texas 78746, and our telephone number is (512) 328-2953.

S-4

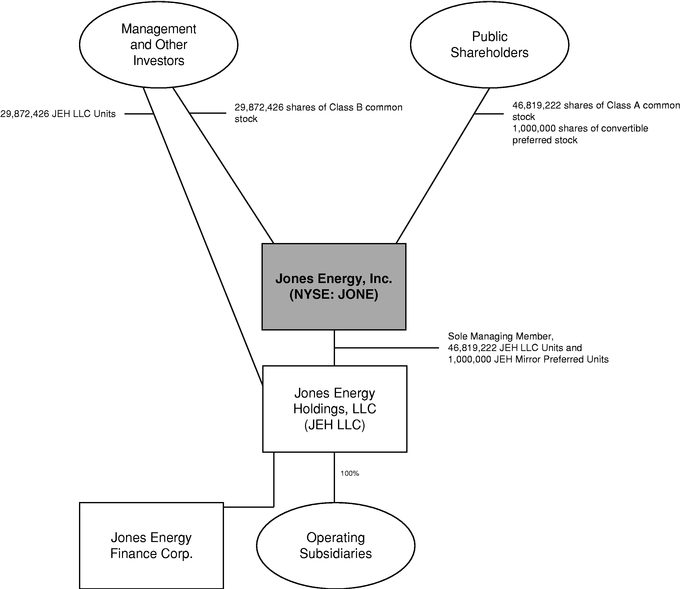

The following diagram depicts a summary of our organizational and ownership structure after giving effect to this offering and the Concurrent Preferred Offering (assuming the underwriters do not exercise their option to purchase additional shares in this offering or the Concurrent Preferred Offering).

S-5

Class A common stock offered by us |

14,000,000 shares (16,100,000 shares if the underwriters' option to purchase additional shares is exercised in full). | |

Option to purchase additional shares |

We have granted the underwriters an option for a period of 30 days from the date of this prospectus supplement to purchase up to 2,100,000 additional shares of Class A common stock. |

|

Class A common stock outstanding before this offering |

32,819,222 shares. |

|

Class A common stock outstanding after this offering |

46,819,222 shares, or 48,919,222 shares if the underwriters exercise in full their option to purchase an additional 2,100,000 shares. Excludes the up to shares of our Class A common stock issuable upon conversion of the convertible preferred stock offered in the Concurrent Preferred Offering (or shares of our Class A common stock issuable upon conversion of our convertible preferred stock if the underwriters in the Concurrent Preferred Offering exercise their over-allotment option in respect of the Concurrent Preferred Offering in full), in each case, subject to anti-dilution, make-whole and other adjustments. |

|

Class B common stock outstanding after this offering |

29,872,426 shares. Shares of our Class B common stock have voting rights, but no economic rights. When a JEH LLC Unit is exchanged for a share of Class A common stock, a share of Class B common stock held by the exchange holder will be cancelled. |

|

Voting power of Class A common stock outstanding after giving effect to this |

61.0% (or 100% if all outstanding JEH LLC Units held by the Existing Owners (as defined below) were exchanged, along with a corresponding number of shares of our Class B common stock, for newly-issued shares of Class A common stock on a one-for-one basis). |

|

Voting power of Class B |

39.0% (or 0% if all outstanding JEH LLC Units held by the Existing Owners were exchanged, along with a corresponding number of shares of our Class B common stock, for newly-issued shares of Class A common stock on a one-for-one basis). |

S-6

Use of proceeds |

We expect to receive net proceeds from this offering of approximately $ after deducting underwriting discounts and commissions and offering expenses. We intend to use the net proceeds from this offering, together with $ net proceeds of the Concurrent Preferred Offering (including the net proceeds received upon exercise of the underwriters' option in either of the Securities Offerings), to fund a portion of the $136.5 million purchase price for the Pending STACK/SCOOP Acquisition (see "—Recent Developments—Pending Acquisitions—Pending STACK/SCOOP Acquisition" above). If the Pending STACK/SCOOP Acquisition is not consummated or the purchase price is reduced because we acquire less than all of the Properties subject to the Purchase Agreement, we intend to use any remaining net proceeds for general corporate purposes, which may include leasehold interest and property acquisitions and working capital. See "Use of Proceeds" on page S-16 of this prospectus supplement. |

|

Voting rights |

Each share of our Class A common stock entitles its holder to one vote on all matters to be voted on by stockholders generally. Each share of our Class B common stock entitles its holder to one vote on all matters to be voted on by stockholders generally. Holders of our Class A common stock and Class B common stock vote together as a single class on all matters presented to our stockholders for their vote or approval, except as otherwise required by applicable law or by our amended and restated certificate of incorporation. See "Description of Capital Stock" beginning on page 15 of the accompanying base prospectus. |

|

Concurrent preferred offering |

Concurrently with this offering of shares of our Class A common stock, we are making a public offering of 1,000,000 shares of our convertible preferred stock, and we have granted the underwriters of that offering a 30-day option to purchase up to 150,000 additional shares of our convertible preferred stock to cover over-allotments. The shares of convertible preferred stock will be convertible into an aggregate of up to shares of our Class A common stock (or up to shares of our Class A common stock, if the underwriters in that offering exercise their over-allotment option in full), in each case subject to anti-dilution, make-whole and other adjustments, as described in the prospectus supplement related to the offering of our convertible preferred stock. |

|

|

We cannot assure you that the Concurrent Preferred Offering will be completed or, if completed, on what terms it will be completed. The closing of this offering is not conditioned upon the closing of the Concurrent Preferred Offering, and the closing of our offering of convertible preferred shares is not conditioned upon the closing of this offering. Please see "—Recent Developments—Concurrent Offering of Shares of our Convertible Preferred Stock" for a summary of the terms of our convertible preferred stock and a further description of the Concurrent Preferred Offering. |

S-7

Dividend policy |

Holders of Class A common stock are entitled to dividends when and if declared by our board of directors, subject to certain restrictions and preferences; however, we do not anticipate paying any cash dividends on our Class A common stock. Holders of Class B common stock are not entitled to dividends unless such dividends are in kind. In addition, our Revolver prevents us from paying cash dividends. See "Description of Capital Stock" beginning on page 15 of the accompanying base prospectus. |

|

Exchange rights of holders of JEH LLC Units |

Under the Exchange Agreement (the "Exchange Agreement") entered into by us, the Jones family entities, Metalmark Capital and certain other parties (collectively, the "Existing Owners"), holders of JEH LLC Units may exchange their JEH LLC Units (together with a corresponding number of shares of Class B common stock) for shares of Class A common stock (on a one-for-one basis, subject to customary conversion rate adjustments for stock splits, stock dividends and reclassification and other similar transactions). |

|

Risk factors |

You should read the risk factors found in the documents incorporated herein by reference, as well as the other cautionary statements throughout this prospectus supplement, to ensure you understand the risks associated with an investment in our Class A common stock. See "Risk Factors" on page S-9 of this prospectus supplement and page 3 of the accompanying base prospectus. |

|

New York Stock Exchange symbol |

JONE. |

S-8

Our business is subject to uncertainties and risks. Before you invest in our Class A common stock, you should carefully consider the risk factors on page 3 of the accompanying base prospectus and all of the other information included in, or incorporated by reference into, this prospectus, including those included in our Annual Report on Form 10-K for the year ended December 31, 2015 and in our Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. If any of these risks were to occur, our business, financial condition or results of operations could be adversely affected. In that case, the trading price of our Class A common stock could decline and you could lose all or part of your investment. Please also read "Cautionary Note Regarding Forward-Looking Statements" beginning on page S-ii of this prospectus supplement and beginning on page 30 of the accompanying base prospectus.

The Pending Acquisitions may not be completed as anticipated, and even if the Pending Acquisitions are completed, we may fail to realize the benefits anticipated as a result of the Pending Acquisitions.

The Pending STACK/SCOOP Acquisition is expected to close prior to the end of the third quarter of 2016, subject to satisfaction of title and environmental due diligence and closing conditions, many of which are beyond our control. In particular, the closing of the Pending STACK/SCOOP Acquisition is conditioned upon receipt of the consent of the Oklahoma probate court with jurisdiction over the assets of one of the Seller's equity owners. It has also been publicly reported that a representative of a group of lender creditors under a syndicated term loan to another of the Seller's equity owners has requested that the probate court permit the creditors to consent to sales of significant assets of the Seller's equity owner, although it is not clear whether such a request would include the Pending STACK/SCOOP Acquisition. There can be no assurance that such consent will be obtained or that the other closing conditions will be satisfied. An affiliate of Credit Suisse Securities (USA) LLC, an underwriter in this offering, is one of several lender creditors under the syndicated term loan described above. See "Underwriting—Other Relationships." The Pending Anadarko Acquisition is expected to close by the end of August 2016, subject to the completion of due diligence and satisfaction of closing conditions, many of which are beyond our control. However, completion of either of the Pending Acquisitions is not a condition to completion of this offering of our Class A common stock or the Concurrent Preferred Offering.

There are a number of risks and uncertainties relating to the Pending Acquisitions. For example, the Pending Acquisitions may not be completed, or may not be completed in the time frame, on the terms, or in the manner currently anticipated, as a result of a number of factors, including, among other things, the failure to satisfy one or more of the conditions to closing. There can be no assurance that such conditions will be satisfied or that the Pending Acquisitions will be consummated. If these conditions are not satisfied or waived, one or both of the Pending Acquisitions will not be consummated. We also risk losing all or a portion of our substantial cash deposits under the acquisition agreements for the Pending Acquisitions, including a deposit of approximately $20.5 million for the Pending STACK/SCOOP Acquisition and a deposit of approximately $2.7 million for the Pending Anadarko Acquisition, if we fail to close either such transaction in breach of the respective agreement. In addition, properties that are identified to have title or environmental defects may be excluded from the Pending Acquisitions, so the properties acquired may not consist of the entire group of properties that are contemplated to be acquired in the Pending Acquisitions. There is no assurance that either of the Pending Acquisitions will close on or before the scheduled time for closing, or at all, or that the properties acquired will include all the properties expected to be acquired, and the closing of this offering or the Concurrent Preferred Offering is not conditioned on the closing of either of the Pending Acquisitions. Accordingly, if you decide to purchase our Class A common stock, you should be

S-9

willing to do so whether or not we complete the Pending Acquisitions. The consummation of the Pending Acquisitions involves potential risks, including:

- •

- the failure to realize recoverable reserves;

- •

- regulatory compliance and permitting;

- •

- title issues or other unidentified or unforeseeable liabilities and costs;

- •

- the incurrence of liabilities or other compliance costs related to environmental or regulatory matters, including potential

liabilities that may be imposed without regard to fault or the legality of conduct;

- •

- the diversion of management's attention from our existing properties; and

- •

- the incurrence of significant charges, such as asset devaluation or restructuring charges.

If we consummate the Pending Acquisitions and if these risks or other unanticipated liabilities were to materialize, any desired benefits of the Pending Acquisitions may not be fully realized, if at all, and our future financial performance and results of operations could be negatively impacted. We cannot assure you that we will realize value from the Pending Acquisitions that equals or exceeds the consideration paid.

If completed, the Pending STACK/SCOOP Acquisition may not achieve its intended results and may result in us assuming unanticipated liabilities. To date, we have conducted only limited diligence regarding the assets and liabilities we would assume in the Pending STACK/SCOOP Acquisition. These risks are heightened because the Pending STACK/SCOOP Acquisition, if consummated, would involve acquisition of a material amount of undeveloped acreage relative to our current undeveloped acreage position.

We entered into the Purchase Agreement with the expectation that the Pending STACK/SCOOP Acquisition would result in various benefits and opportunities. Achieving the anticipated benefits of the Pending STACK/SCOOP Acquisition is subject to a number of risks and uncertainties. For example, under the Purchase Agreement, we have the opportunity to conduct customary environmental and title due diligence following the execution of the Purchase Agreement, but our diligence efforts to date have been limited. As a result, we may discover title defects or adverse environmental or other conditions of which we are currently unaware. Environmental, title and other problems could reduce the value of the properties to us, and, depending on the circumstances, we could have limited or no recourse to the Seller with respect to those problems. We will assume certain of the Seller's liabilities and are entitled to indemnification in connection with those liabilities in only limited circumstances and in limited amounts. We cannot assure that such potential remedies will be adequate for any liabilities we incur, and such liabilities could be significant.

The risks involved in the Pending STACK/SCOOP Acquisition are heightened due to the size and location of the acquisition. The Pending STACK/SCOOP Acquisition, if consummated, would involve our acquisition of approximately 18,000 undeveloped net acres in Canadian, Grady and McClain Counties, Oklahoma, which is a material amount of undeveloped acreage relative to our approximately 27,248 undeveloped net acres as of December 31, 2015. In addition, the Properties to be acquired in the Pending STACK/SCOOP Acquisition are located in the STACK/SCOOP play, which is an area in which we do not have previous drilling experience. As a result, the risk that our ability to efficiently and effectively develop and produce the Properties acquired in the Pending STACK/SCOOP Acquisition is heightened. If we are unable to efficiently and effectively develop and produce the Properties, the areas may not be as economic as we anticipate and we may not realize the expected benefits of the acquisition.

The anticipated future growth of our business will impose significant added responsibilities on management. The anticipated growth may place strain on our administrative and operational

S-10

infrastructure. Our senior management's attention may be diverted from the management of daily operations to the integration of the Seller's business operations and the assets acquired in the Pending STACK/SCOOP Acquisition. Our ability to manage our business and growth will require us to apply our operational, financial and management controls, reporting systems and procedures to the acquired business. We may also encounter risks, costs and expenses associated with any undisclosed or other unanticipated liabilities, and use more cash and other financial resources on integration and implementation activities than we anticipate. We may not be able to successfully integrate the Seller's operations into our existing operations, successfully manage this additional acreage or realize the expected economic benefits of the Pending STACK/SCOOP Acquisition, which may have a material adverse effect on our business, financial condition and results of operations.

The development of the properties to be acquired will be subject to all of the risks and uncertainties associated with oil and gas activities as described in the "Risk Factors" section of our Annual Report on Form 10-K for the year ended December 31, 2015.

A significant portion of the value of the Pending STACK/SCOOP Acquisition is associated with undeveloped acreage that is not held by production, will require substantial amounts of capital to develop and may not be economic.

Most of the acreage we are acquiring in the Pending STACK/SCOOP Acquisition is undeveloped and will require substantial amounts of capital to fully develop, which we may not be able to fully fund or may require significant issuances or incurrence of equity or debt which may not be available to us or may only be available at a cost that does not allow us to achieve our plans, development schedule and production schedule associated with the acreage. We may also significantly change our development plans in response to commodities pricing. As a result, our investment in these areas may not achieve the production growth or returns we anticipate or may render development opportunities uneconomic, and we could incur material write-downs of unevaluated properties.

In addition, because most of the acreage we are acquiring in the Pending STACK/SCOOP Acquisition is undeveloped, it is not held by production. Unless development or production, in accordance with the terms of the respective leases, is established, these leases will expire. If the acquired leases expire, we will lose our right to develop the Properties. Our drilling and development plans for the area are subject to change based upon various factors, many of which are beyond our control. If we are unable to establish the development or production necessary to hold our leases, we may be forced to pay extension fees to prevent those leases from expiring. If our leases expire or we are forced to pay extension fees in order to maintain them, the areas may not be as economic as we anticipate and we may not realize the expected benefits of the acquisition.

Our business requires substantial capital expenditures, and we may be unable to obtain needed capital or financing on satisfactory terms or at all.

Our exploration, exploitation, development and acquisition activities require substantial capital expenditures. Our total capital expenditures for 2015 were $200.1 million excluding the impact of asset retirement costs. On August 3, 2016, the Company announced a further revised 2016 capital expenditures program, lowering full year 2016 guidance (excluding acquisitions) by 10% to $90 million, primarily due to better than expected execution on the Company's Cleveland drilling program and maintenance projects coming in below budget. Historically, we have funded development and operating activities primarily through a combination of equity capital raised from a private equity partner and public equity offerings, through borrowings under our Revolver, through the issuance of debt securities and through internal operating cash flows. We intend to finance the majority of our capital expenditures for the remainder of 2016, including capital expenditures related to the Pending Acquisitions, with cash flows from operations and borrowings under our Revolver. Our capital expenditures have historically been greater than our cash flows from operations, and we expect our

S-11

capital expenditures for the remainder of 2016 to continue to exceed our cash flows. In addition, we expect to borrow additional amounts under our Revolver to help fund the Pending STACK/SCOOP Acquisition which will reduce the availability under our Revolver. Availability under our Revolver is expected to be further reduced when our borrowing base is redetermined on or about October 1, 2016, at which time we expect a reduction, resulting in a borrowing base of between $360 million and $330 million, assuming the closing of the Pending Anadarko Acquisition. If necessary, we may also access capital through proceeds from potential asset dispositions and the issuance of additional debt and equity securities. Our cash flow from operations and access to capital are subject to a number of variables, including:

- •

- the estimated quantities of our oil, natural gas and NGL reserves;

- •

- the amount of oil, natural gas and NGLs we produce from existing wells;

- •

- the prices at which we sell our production;

- •

- any gains or losses from our hedging activities;

- •

- the costs of developing and producing our oil, natural gas and NGL reserves;

- •

- take-away capacity;

- •

- our ability to acquire, locate and produce new reserves;

- •

- the ability and willingness of banks to lend to us; and

- •

- our ability to access the equity and debt capital markets.

If our cash flow from operations is not sufficient to fund our capital expenditure budget, we may have limited ability to obtain the additional capital necessary to conduct our operations at expected levels. Our Revolver and the indentures governing our 2022 Notes (as defined below) and 2023 Notes (as defined below) may restrict our ability to obtain new debt financing. We may not be able to obtain debt or equity financing on terms favorable to us, or at all. The failure to obtain additional financing could result in a curtailment of our operations relating to exploration and development of our prospects, which in turn could lead to a decline in our oil, natural gas and NGLs production or reserves, and in some areas a loss of properties.

In addition, our estimate of the required development capital for the Pending Acquisitions may not be sufficient for the actual development capital needs of the Pending Acquisitions. If our estimate of the targeted development capital was lower than the actual needs of the Pending Acquisitions, we could be required to fund such additional development capital needs out of other operating cash flows or borrowings under our Revolver and through the capital markets.

External financing may be required in the future to fund our growth. We may not be able to obtain additional financing, and financing under our Revolver and through the capital markets may not be available in the future. Without additional capital resources, we may be unable to pursue and consummate acquisition opportunities as they become available, and we may be forced to limit or defer our planned oil, natural gas and NGLs development program, which will adversely affect the recoverability and ultimate value of our oil, natural gas and NGLs properties, in turn negatively affecting our business, financial condition and results of operations.

The borrowing base under our Revolver is subject to redetermination and any reduction in the borrowing base may reduce our liquidity or result in our having to repay indebtedness under our Revolver earlier than anticipated.

We have experienced significant recent declines in our borrowing base under our Revolver as a result of redeterminations and we expect further significant declines. The current borrowing base under

S-12

our Revolver is $410 million. On August 16, 2016, we had availability of approximately $225 million on our Revolver. Upon the closing of the Pending Anadarko Acquisition, our borrowing base will automatically increase to $425 million. Our borrowing base is scheduled for redetermination on or about October 1, 2016, at which time we expect a reduction, resulting in a borrowing base of between $360 million and $330 million, assuming the closing of the Pending Anadarko Acquisition, due in large part to the roll off of hedge contracts and the commodity price environment. Further redeterminations occur at least semi-annually. Redeterminations are based primarily on reserve reports using lender commodity price expectations at such time. JEH LLC and the administrative agent (acting at the direction of lenders holding at least 662/3% of the outstanding loans) may each request one unscheduled borrowing base redetermination between each scheduled redetermination. In addition, the lenders may elect to redetermine the borrowing base upon the occurrence of certain defaults under our material operating agreements or upon the cancellation or termination of certain of our joint development agreements. The borrowing base may also be reduced as a result of our issuance of unsecured notes, a continued or further reduction in the price or volume of our hedging positions or our consummation of significant asset sales. If current low commodity prices continue through such redetermination events, the borrowing base under our Revolver may be reduced.

Any reduction in the borrowing base will reduce our liquidity, and, if a borrowing base reduction results in the outstanding amount of obligations under our Revolver exceeding the borrowing base, we will be required to repay the deficiency within a short period of time. If alternate sources of capital are not available, any such reductions can also adversely affect our ability to fund our drilling program and development of our undeveloped properties, including those that may be acquired in the Pending Acquisitions, which in turn can limit our ability to replace or add reserves and maintain or grow our borrowing base, and could adversely affect our business, financial condition and results of operations.

Certain federal regulatory agencies, including the Office of the Comptroller of the Currency ("OCC"), the Federal Reserve, and the Federal Deposit Insurance Corp., have recently focused on oil and gas lenders' examinations and ratings of reserve-based loans, with a view towards encouraging such lenders to reduce their exposure to potentially substandard loans to oil and gas companies. In March 2016, the OCC issued an updated "Oil and Gas Production Lending" bank examination booklet, which details potential regulatory requirements related to reserve-based lending. Whether or not these regulatory agencies are successful in implementing stricter requirements related to reserve-based lending, oil and gas lenders may respond to these discussions by taking a more conservative approach in their lending practices, which could also adversely impact future borrowing base redeterminations under our Revolver.

If the concurrent offering of our convertible preferred stock is consummated, a substantial number of shares of our Class A common stock may be issued upon its conversion, or as dividends and redemption payments in respect of the convertible preferred stock, which issuances could reduce the value of our Class A common stock.

In addition to the issuance of shares of Class A common stock upon conversion of shares of our proposed convertible preferred stock, the terms of our convertible preferred stock will permit us, subject to certain limitations, to issue shares of our Class A common stock in lieu of cash to satisfy payments of dividends and redemption prices with respect to the convertible preferred stock. The number of shares issued for such payments will be determined based on 95% of a five day average market value of such shares determined shortly before such payments, and could be substantial, especially during periods of significant declines in market prices of our Class A common stock.

The covenants applicable to our Revolver and the indentures governing our currently outstanding senior notes currently restrict, and any indentures and other financing agreements that we enter into in the future may restrict, our ability to pay cash dividends on our capital stock, including the convertible preferred stock. These limitations may cause us to be unable to pay dividends in cash on our

S-13

convertible preferred stock unless we can obtain an amendment of such provisions or refinance amounts outstanding under those agreements. In most situations, however, we are permitted under our financing agreements to pay dividends in equity interests, including common stock, as permitted by the terms of the convertible preferred stock. Accordingly, we expect that any initial dividends declared and paid in respect of the convertible preferred stock following consummation of the Concurrent Offerings will be paid in Class A common stock, unless and until we obtain an amendment of our Revolver covenants. There is no assurance that we will obtain such an amendment. Issuance of shares of Class A common stock as dividends, upon the occurrence of conversion, including following a fundamental change, or upon redemption of the convertible preferred stock, will dilute ownership of the Class A common stock and accordingly may adversely affect its market value.

Our issuance of additional shares of Class A common stock for sale in the future could reduce the market price of our Class A common stock.

Except as described herein under "Underwriting," we are not restricted from issuing additional Class A common stock, including securities that are convertible into or exchangeable for, or that represent the right to receive, Class A common stock, including any Class A common stock that may be issued upon the conversion or redemption of the convertible preferred stock being offered concurrently with this offering. In the future, we may sell additional shares of our common stock to raise capital to fund our development program, acquire oil and gas properties or interests in other companies by using a combination of cash and our common stock or just our common stock. Any of these events may dilute your ownership interest in our company and have an adverse impact on the price of our common stock. In addition, a substantial number of shares of our Class A common stock is reserved for issuance upon conversion of the convertible preferred stock. Sales of a substantial number of shares of our common stock could depress the market price of our Class A common stock and impair our ability to raise capital through the sale of additional equity securities. We cannot predict the effect that future sales of our common stock, or the perception that these sales may occur, or other equity-related securities would have on the market price of our Class A common stock.

The convertible preferred stock may adversely affect the market price of our Class A common stock for other reasons.

If the Concurrent Preferred Offering is consummated, the market price of our Class A common stock is likely to be influenced by the convertible preferred stock. For example, the market price of our Class A common stock could become more volatile and could be depressed by:

- •

- investors' anticipation of the potential resale in the market of a substantial number of additional shares of our Class A

common stock received upon conversion of the convertible preferred stock;

- •

- possible sales of our Class A common stock by investors who view the convertible preferred shares as a more attractive means of

equity participation in us than owning shares of our Class A common stock; and

- •

- hedging or arbitrage trading activity that may develop involving the convertible preferred shares and our Class A common stock.

S-14

Failure to complete the Pending Acquisitions could negatively affect our stock price as well as our business and financial results.

If the Pending Acquisitions are not completed, we will be subject to a number of risks, including but not limited to the following:

- •

- we must pay costs related to the Pending Acquisitions including, among others, legal, accounting and financial advisory fees, whether

the acquisition is completed or not;

- •

- we may experience negative reactions from the financial markets; and

- •

- we could be subject to litigation related to the failure to complete the Pending Acquisitions.

Each of these factors may adversely affect our business, financial results and stock price. This offering is not conditioned upon the consummation of the Pending Acquisitions. As a result, if the Pending Acquisitions are not consummated, holders of our common stock would be exposed to the risks described above and various other risks, including our inability to use the proceeds from this offering effectively and the additional dilution we would have incurred by issuing additional shares of our common stock in this offering.

Our level of indebtedness may reduce our financial flexibility.

As of June 30, 2016 we had $185 million outstanding under our Revolver, approximately $409 million outstanding principal amount of 2022 Notes and $150.0 million outstanding principal amount of 2023 Notes. Our level of indebtedness may have several important effects on our future operations, including, without limitation:

- •

- requiring us to dedicate a significant portion of our cash flows from operations to support the payment of debt service;

- •

- increasing our vulnerability to adverse changes in general economic and industry conditions, and putting us at a competitive

disadvantage relative to competitors that have fewer fixed obligations and greater cash flows to devote to their businesses;

- •

- limiting our ability to obtain additional financing for working capital, capital expenditures, general corporate and other purposes;

and

- •

- limiting our flexibility in operating our business and preventing us from engaging in certain transactions that might otherwise be beneficial to us.

A high level of indebtedness increases the risk that we may default on our debt obligations. Our ability to meet our debt obligations and to reduce our level of indebtedness depends on our future performance. General economic conditions, oil and natural gas prices and financial, business and other factors affect our operations and our future performance. Many of these factors are beyond our control. If oil and natural gas prices remain at their current level for an extended period of time or continue to decline, we may not be able to generate sufficient cash flows to pay the interest on our debt and future working capital, and borrowings or equity financing may not be available to pay or refinance such debt. Factors that will affect our ability to raise cash through an offering of our capital stock or a refinancing of our debt include financial market conditions, the value of our assets and our performance at the time we need capital.

S-15

We expect to receive net proceeds from this offering of approximately $ after deducting underwriting discounts and commissions and offering expenses. We intend to use the net proceeds from this offering, together with $ of net proceeds of the Concurrent Preferred Offering (including the net proceeds received upon exercise of the underwriters' option in either of the Securities Offerings), to fund a portion of the $136.5 million purchase price for the Pending STACK/SCOOP Acquisition (see "Prospectus Supplement Summary—Recent Developments—Pending Acquisitions—Pending STACK/SCOOP Acquisition"). If the Pending STACK/SCOOP Acquisition is not consummated or the purchase price is reduced because we acquire less than all of the Properties subject to the Purchase Agreement, we intend to use any remaining net proceeds for general corporate purposes, which may include leasehold interest and property acquisitions and working capital.

There is no assurance that the Concurrent Preferred Offering or the Pending STACK/SCOOP Acquisition will occur on or before a certain time, or at all. The closing of this offering is not conditioned on the consummation of the Pending STACK/SCOOP Acquisition or the Concurrent Preferred Offering. If the Pending STACK/SCOOP Acquisition does not occur, the proceeds of this offering will be used for general corporate purposes, including the payment of approximately $24.4 million to fund the Pending Anadarko Acquisition.

S-16

The following table sets forth our cash and cash equivalents and capitalization as of June 30, 2016:

- •

- on a historical basis;

- •

- as adjusted to give effect to the issuance and sale of the Class A common stock offered hereby (but not the application of the

proceeds therefrom), after deducting underwriting discounts and commissions and estimated offering expenses;

- •

- as further adjusted to give effect to the issuance and sale of the convertible preferred stock offered pursuant to the Concurrent

Preferred Offering (but not the application of the proceeds therefrom), after deductible underwriting discounts and commissions and estimated offering expenses; and

- •

- as further adjusted to give pro forma effect to the Pending Acquisitions (including the net proceeds of this offering the Concurrent Preferred Offering and borrowing approximately $ million under our Revolver).

The table below should be read in conjunction with, and is qualified in its entirety by reference to, "Use of Proceeds" and the other financial information in this offering memorandum as well as the historical consolidated financial statements and related notes included elsewhere or incorporated by reference in this offering memorandum.

| |

As of June 30, 2016 | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Historical | As Adjusted |

As Further Adjusted(2) |

Pro Forma As Further Adjusted(2)(3) |

|||||||||

| |

(in thousands) |

||||||||||||

Cash and cash equivalents |

$ | 59,298 | $ | $ | $ | ||||||||

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Long-term debt: |

|||||||||||||

Senior secured revolving credit facility(1) |

$ | 185,000 | $ | 185,000 | $ | 185,000 | $ | ||||||

6.75% Senior Notes due 2022 ("2022 Notes") |

409,148 | 409,148 | 409,148 | 409,148 | |||||||||

9.25% Senior Notes due 2023 ("2023 Notes") |

150,000 | 150,000 | 150,000 | 150,000 | |||||||||

Total long-term debt |

$ | 744,148 | $ | 744,148 | $ | 744,148 | $ | ||||||

| | | | | | | | | | | | | | |

Mezzanine equity: |

|||||||||||||

% Series A Perpetual Convertible Preferred Stock |

$ | — | $ | — | $ | $ | |||||||

| | | | | | | | | | | | | | |

Stockholders' equity: |

|||||||||||||

Class A Common Stock |

32 | ||||||||||||

Class B Common Stock |

31 | 31 | 31 | 31 | |||||||||

Treasury stock |

(358 | ) | (358 | ) | (358 | ) | (358 | ) | |||||

Additional paid-in capital |

368,306 | 415,567 | 415,567 | 415,567 | |||||||||

Retained earnings |

32,235 | 32,235 | 32,235 | 32,235 | |||||||||

Non-controlling interest |

520,172 | 520,172 | 520,172 | 520,172 | |||||||||

| | | | | | | | | | | | | | |

Total stockholders' equity |

$ | 920,418 | $ | $ | $ | ||||||||

| | | | | | | | | | | | | | |

Total equity |

$ | 920,418 | $ | $ | $ | ||||||||

| | | | | | | | | | | | | | |

Total capitalization |

$ | 1,664,566 | $ | $ | $ | ||||||||

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

- (1)

- As

of August 16, 2016, we had $185 million of outstanding borrowings under our Revolver and available borrowing capacity at such date of

$225 million.

- (2)

- There

is no assurance that the Concurrent Preferred Offering or the Pending Acquisitions will occur at all.

- (3)

- We expect to pay approximately $136.5 million to fund the closing of the Pending STACK/SCOOP Acquisition, which is expected to close in the third quarter of 2016, and approximately $27.1 million to fund the closing of the Pending Anadarko Acquisition, which is expected to close by August 31, 2016.

S-17

PRICE RANGE OF CLASS A COMMON STOCK

Our Class A common stock trades on the New York Stock Exchange (the "NYSE") under the symbol "JONE." The following table shows the intra-day high and low sales prices per share of Class A common stock, as reported by the NYSE Composite Transactions Tape.

| |

High | Low | |||||

|---|---|---|---|---|---|---|---|

2014 |

|||||||

First Quarter |

$ | 18.32 | $ | 13.05 | |||

Second Quarter |

$ | 20.57 | $ | 14.50 | |||

Third Quarter |

$ | 20.79 | $ | 17.26 | |||

Fourth Quarter |

$ | 18.82 | $ | 9.50 | |||

2015 |

|||||||

First Quarter |

$ | 12.60 | $ | 7.74 | |||

Second Quarter |

$ | 11.63 | $ | 8.39 | |||

Third Quarter |

$ | 9.15 | $ | 4.41 | |||

Fourth Quarter |

$ | 6.05 | $ | 3.20 | |||

2016 |

|||||||

First Quarter |

$ | 3.94 | $ | 1.26 | |||

Second Quarter |

$ | 4.88 | $ | 2.98 | |||

Third Quarter (through August 17, 2016) |

$ | 4.49 | $ | 3.16 | |||

On August 17, 2016, the last sales price of the Class A common stock as reported on the NYSE was $3.58 per share. As of August 17, 2016, there were approximately 26 record holders of our Class A common stock and 10 record holders of our Class B common stock.

In the past, we have not paid cash dividends on our Class A common stock, and we do not intend to pay cash dividends on our Class A common stock in the foreseeable future. We currently intend to retain earnings, if any, for the future operation and development of our business. The restrictions on our present or future ability to pay dividends are included in the provisions in the Delaware General Corporation Law and in certain restrictive provisions in our Revolver and in the indentures executed in connection with our 2022 Notes and 2023 Notes.

S-18

MATERIAL U.S. FEDERAL INCOME AND ESTATE TAX CONSIDERATIONS FOR

NON-U.S. HOLDERS

The following is a general discussion of the material U.S. federal income and, to a limited extent, estate tax consequences of the acquisition, ownership and disposition of our Class A common stock to a non-U.S. holder. Except as specifically provided below (see "—Estate tax"), for the purpose of this discussion, a non-U.S. holder is any beneficial owner of our Class A common stock that, for U.S. federal income tax purposes, is an individual, corporation, estate or trust and is not any of the following:

- •

- an individual citizen or resident of the United States;

- •

- a corporation (or other entity treated as a corporation for U.S. federal income tax purposes) created or organized in the United

States or under the laws of the United States or any state thereof or the District of Columbia;

- •

- an estate whose income is subject to U.S. federal income tax regardless of its source; or

- •

- a trust (x) whose administration is subject to the primary supervision of a U.S. court and which has one or more United States persons who have the authority to control all substantial decisions of the trust or (y) which has made a valid election to be treated as a United States person.

If a partnership (or an entity or arrangement treated as a partnership for U.S. federal income tax purposes) holds our Class A common stock, the tax treatment of a partner in the partnership will generally depend on the status of the partner and upon the activities of the partnership. Accordingly, we urge partnerships (including entities and arrangements treated as partnerships for U.S. federal income tax purposes) that hold our Class A common stock and partners in such partnerships to consult their tax advisors.

This discussion assumes that non-U.S. holders will hold our Class A common stock issued pursuant to the offering as a capital asset (generally, property held for investment). This discussion does not address all aspects of U.S. federal income and estate taxation (e.g., the Medicare tax on certain investment income and the alternative minimum tax) or any aspects of U.S. federal gift taxation or state, local or non-U.S. taxation, nor does it consider any U.S. federal income tax considerations that may be relevant to non-U.S. holders that may be subject to special treatment under U.S. federal income tax laws, including, without limitation, U.S. expatriates, insurance companies, tax-exempt or governmental organizations, dealers in securities or currency, banks or other financial institutions, qualified foreign pension funds, investors whose functional currency is other than the U.S. dollar, "controlled foreign corporations," "passive foreign investment companies," common trust funds, certain trusts, and hybrid entities, and investors that hold our Class A common stock as part of a hedge, straddle or conversion transaction. Furthermore, the following discussion is based on current provisions of the Internal Revenue Code of 1986, as amended (the "Code"), and Treasury Regulations and administrative and judicial interpretations thereof, all as in effect on the date hereof, and all of which are subject to change, possibly with retroactive effect.

We urge each prospective investor to consult a tax advisor regarding the U.S. federal, state, local and non-U.S. income and other tax consequences of acquiring, holding and disposing of shares of our Class A common stock.

Dividends

We have not made any distributions on our Class A common stock, and we do not plan to make any distributions for the foreseeable future. However, if we do make cash or other property distributions on our Class A common stock, those distributions will constitute dividends for U.S. tax

S-19

purposes to the extent paid from our current or accumulated earnings and profits, as determined under U.S. federal income tax principles. To the extent those distributions exceed our current and accumulated earnings and profits, such excess will first constitute a non-taxable return of capital to the extent of the non-U.S. holder's adjusted tax basis in its Class A common stock, and thereafter will be treated as gain from the sale of Class A common stock (see "—Gain on disposition of Class A common stock" below).

Any dividend (i.e., a distribution paid out of earnings and profits) paid to a non-U.S. holder of our Class A common stock generally will be subject to U.S. federal income tax withholding, either at a rate of 30% of the gross amount of the dividend or such lower rate as may be specified by an applicable tax treaty. To receive the benefit of a reduced treaty rate, a non-U.S. holder must provide us or our paying agent with an IRS Form W-8BEN, IRS Form W-8BEN-E, or other appropriate version of IRS Form W-8 certifying qualification for the reduced rate. If the non-U.S. holder holds the stock through a financial institution or other agent acting on the holder's behalf, the holder will be required to provide appropriate documentation to the agent. The holder's agent will then be required to provide certification to us or our paying agent, either directly or through other intermediaries. Special certification and other requirements apply to certain non-U.S. holders that are pass-through entities rather than corporations or individuals.