Form 40-F PLATINUM GROUP METALS For: Aug 31

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________

FORM 40-F

[ ] Registration statement pursuant to Section 12 of the Securities Exchange Act of 1934

or

[X] Annual report pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934

For the fiscal year ended August 31, 2016

Commission File Number 001-33562

_______________________

Platinum Group Metals Ltd.

(Exact name of registrant as specified in its charter)

| British Columbia | 1099 | Not Applicable |

| (Province or Other Jurisdiction of | (Primary Standard Industrial Classification | (I.R.S. Employer |

| Incorporation or Organization) | Code Number) | Identification No.) |

Bentall Tower 5

Suite 788 - 550 Burrard Street

Vancouver, BC

Canada V6C 2B5

(604) 899-5450

(Address and telephone number of registrant’s principal executive

offices)

_______________________

DL Services Inc.

Columbia Center, 701 Fifth

Avenue, Suite 6100

Seattle, WA 98104-7043

(206) 903-8800

(Name, address (including zip code) and telephone number (including

area code) of agent for service in the United States)

_______________________

Securities to be registered pursuant to Section 12(b) of the Act:

| Title of Each Class: | Name of Each Exchange On Which Registered: |

| Common Shares, no par value | NYSE MKT |

Securities registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

For annual reports, indicate by check mark the information filed with this form:

| [X] Annual Information Form | [X] Audited Annual Financial Statements |

As of August 31, 2016, the Registrant had outstanding 88,857,028 common shares without par value.

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. [X] Yes [ ] No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). [ ] Yes [ ] No

DOCUMENTS INCORPORATED BY REFERENCE

The annual information form (“AIF”) of Platinum Group Metals Ltd. (the “Registrant” or the “Company”) for the fiscal year ended August 31, 2016 is incorporated herein by reference.

The audited consolidated financial statements of the Company as of and for the years ended August 31, 2016 and August 31, 2015, including the report of the auditors with respect thereto, are incorporated herein by reference (the “Financial Statements”).

The Company’s management’s discussion and analysis (“MD&A”) for the year ended August 31, 2016 is incorporated herein by reference.

EXPLANATORY NOTE

The Company is a Canadian issuer eligible to file its annual report pursuant to Section 13 of the Exchange Act on Form 40-F. The Company is a “foreign private issuer” as defined in Rule 3b-4 under the Exchange Act. Accordingly, the Company’s equity securities are exempt from Sections 14(a), 14(b), 14(c), 14(f) and 16 of the Exchange Act pursuant to Rule 3a12-3.

The Company is permitted, under a multi-jurisdictional disclosure system adopted by the United States, to prepare this annual report on Form 40-F in accordance with Canadian disclosure requirements, which are different from those of the United States.

FORWARD LOOKING STATEMENTS

This report contains forward-looking statements concerning anticipated developments in the operations of the Company in future periods, planned exploration and development activities, the adequacy of the Company’s financial resources and other events or conditions that may occur in the future. Forward-looking statements are frequently, but not always, identified by words such as “expects,” “anticipates,” “believes,” “intends,” “estimates,” “potential,” “possible” and similar expressions, or statements that events, conditions or results “will,” “may,” “could” or “should” occur or be achieved. Information concerning the interpretation of drill results and mineral resource or reserve estimates also may be deemed to be forward-looking statements, as such information constitutes a prediction of what mineralization might be found to be present if and when a project is actually developed. Forward-looking statements are statements about the future and are inherently uncertain, and actual achievements of the Company or other future events or conditions may differ materially from those reflected in the forward-looking statements due to a variety of risks, uncertainties and other factors, including, without limitation, those described in the AIF incorporated by reference in this report.

The Company’s forward-looking statements are based on the beliefs, expectations and opinions of management on the date the statements are made and the Company assumes no obligation to update such forward-looking statements in the future. For the reasons set forth above, investors should not place undue reliance on forward-looking statements.

The Company prepares its financial statements in accordance with International Financial Reporting Standards, as issued by the International Financial Accounting Boards, and they may be subject to Canadian auditing and auditor independence standards. Accordingly, the Financial Statements of the Company incorporated by reference in this report may not be comparable to financial statements of United States companies.

DISCLOSURE CONTROLS AND PROCEDURES

The information provided under the heading “Disclosure Controls and Internal Control Over Financial Reporting” contained in the Company’s MD&A is incorporated by reference herein.

MANAGEMENT’S REPORT ON INTERNAL CONTROL OVER FINANCIAL REPORTING

The information provided under the heading “Disclosure Controls and Internal Control Over Financial Reporting” contained in the Company’s MD&A is incorporated by reference herein.

ATTESTATION REPORT OF THE REGISTERED ACCOUNTING FIRM

The information provided under the heading “Disclosure Controls and Internal Control Over Financial Reporting – Exemption from Section 404(b) of the Sarbanes-Oxley Act” contained in the Company’s MD&A is incorporated by reference herein.

CHANGES IN INTERNAL CONTROL OVER FINANCIAL REPORTING

The information provided under the heading “Disclosure Controls and Internal Control Over Financial Reporting – Changes in Internal Controls over Financial Reporting” contained in the Company’s MD&A is incorporated by reference herein.

NOTICES PURSUANT TO REGULATION BTR

The Company did not send any notices required by Rule 104 of Regulation BTR during the year ended August 31, 2016 concerning any equity security subject to a blackout period under Rule 101 of Regulation BTR.

AUDIT COMMITTEE FINANCIAL EXPERT

The information provided under the heading “Audit Committee – Audit Committee Composition and Background” contained in the Company’s AIF is incorporated by reference herein.

CODE OF ETHICS

The information provided under the heading “Directors and Officers – Code of Ethics” contained in the Company’s AIF is incorporated by reference herein.

PRINCIPAL ACCOUNTANT FEES AND SERVICES

The information provided under the headings “Audit Committee – External Auditor Service Fees (By Category)” and “Audit Committee – Pre-Approval Policies and Procedures” contained in the Company’s AIF is incorporated by reference herein.

OFF-BALANCE SHEET ARRANGEMENTS

The information provided “Discussion of Operations and Financial Condition – Off-Balance Sheet Arrangements” contained in the Company’s MD&A is incorporated by reference herein.

TABULAR DISCLOSURE OF CONTRACTUAL OBLIGATIONS

The following table discloses as of August 31, 2016 the Company’s known contractual obligations.

| (payments by period in thousands of United States dollars) | |||||||||||||||

| Contractual Obligations | Total | Less than 1 year | 1 – 3 years | 3 – 5 years | More than 5 years | ||||||||||

| Long-Term Debt Obligations | $ | 102,650 | 33,377 | 44,866 | 24,407 | - | |||||||||

| Operating Lease Obligations | $ | 1,866 | 362 | 1,504 | - | - | |||||||||

| Purchase Obligations | $ | 16,124 | 16,124 | - | - | - | |||||||||

| Total | $ | 120,640 | 49,863 | 46,370 | 24,407 | - | |||||||||

For additional information related to the Company’s contractual obligations and commitments, including certain acquisition payments and break fees, see Note 12, “Contingencies and Commitments”, to the Financial Statements and the information set forth under the heading “Discussion of Operations and Financial Condition – Liquidity and Capital Resources” contained in the MD&A, each incorporated by reference herein.

IDENTIFICATION OF THE AUDIT COMMITTEE

The information provided under the heading “Audit Committee – Audit Committee Composition and Background” contained in the Company’s AIF is incorporated by reference herein. The Company has a separately-designated standing audit committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended.

MINE SAFETY DISCLOSURE

The Company was not the operator, and did not have a subsidiary that was an operator, of a coal or other mine, as defined in Section 3 of the Federal Mine Safety and Health Act of 1977, in the United States during the year ended August 31, 2016.

NYSE MKT CORPORATE GOVERNANCE

The Company’s common shares are listed for trading on the NYSE MKT LLC (“NYSE MKT”). Section 110 of the NYSE MKT Company Guide permits the NYSE MKT to consider the laws, customs and practices of foreign issuers in relaxing certain NYSE MKT listing criteria, and to grant exemptions from NYSE MKT listing criteria based on these considerations. A company seeking relief under these provisions is required to provide written certification from independent local counsel that the non-complying practice is not prohibited by home country law. A description of the significant ways in which the Company’s governance practices differ from those followed by domestic companies pursuant to NYSE MKT standards is provided on the Company’s website at platinumgroupmetals.net.

UNDERTAKINGS

The Company undertakes to make available, in person or by telephone, representatives to respond to inquiries made by the Commission staff, and to furnish promptly, when requested to do so by the Commission staff, information relating to: the securities registered pursuant to Form 40-F; the securities in relation to which the obligation to file an annual report on Form 40-F arises; or to transactions in said securities.

CONSENT TO SERVICE OF PROCESS

The Company has previously filed with the Commission a written consent to service of process and power of attorney on Form F-X. Any change to the name or address of the Company’s agent for service shall be communicated promptly to the Commission by amendment to the Form F-X referencing the file number of the Company.

SIGNATURES

Pursuant to the requirements of the Exchange Act, the Registrant certifies that it meets all of the requirements for filing on Form 40-F and has duly caused this annual report to be signed on its behalf by the undersigned, thereunto duly authorized.

| PLATINUM GROUP METALS LTD. | |

| /s/ R. Michael Jones | |

| R. Michael Jones | |

| President, Chief Executive Officer and Director |

Date: November 29, 2016

EXHIBIT INDEX

The following documents are being filed with the Commission as exhibits to this annual report on Form 40-F.

|

| ANNUAL INFORMATION FORM OF PLATINUM GROUP METALS LTD. |

| FOR YEAR ENDED: AUGUST 31, 2016 |

| Annual Information Form – November 29, 2016 |

TABLE OF CONTENTS

Platinum Group Metals Ltd.

2016 Annual Information Form

| ITEM 2 | PRELIMINARY NOTES |

Date of Information

All information in this Annual Information Form (“AIF”) of Platinum Group Metals Ltd. (“Platinum Group” or the “Company”) is as of August 31, 2016 unless otherwise indicated.

List of Abbreviations and Glossary of Mining Terms

Schedule “A” attached hereto is a list of abbreviations and glossary of mining terms used in this AIF.

Financial Information

Reference is made in this AIF to the consolidated audited financial statements of the Company for the year ended August 31, 2016 (the “Financial Statements”), a copy of which may be obtained online at www.sedar.com.

All financial information in this AIF is prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board.

Cautionary Note Regarding Forward-Looking Statements

This AIF and the documents incorporated by reference herein contain “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and “forward-looking information” within the meaning of applicable Canadian securities legislation (collectively, “Forward-Looking Statements”). All statements, other than statements of historical fact, that address activities, events or developments that the Company believes, expects or anticipates will, may, could or might occur in the future are Forward-Looking Statements. The words “expect”, “anticipate”, “estimate”, “may”, “could”, “might”, “will”, “would”, “should”, “intend”, “believe”, “target”, “budget”, “plan”, “strategy”, “goals”, “objectives”, “projection” or the negative of any of these words and similar expressions are intended to identify Forward-Looking Statements, although these words may not be present in all Forward-Looking Statements. Forward-Looking Statements included or incorporated by reference in this AIF include, without limitation, statements with respect to:

| • | production estimates and assumptions, including production rate, grade per tonne and smelter recovery; |

| • | production timing; |

| • | capital raising activities, compliance with terms of indebtedness and the adequacy of capital; |

| • | revenue, cash flow and cost estimates and assumptions; |

| • | statements with respect to future events or future performance; |

| • | anticipated exploration, development, construction, production, permitting and other activities on the Company’s properties; |

| • | the adequacy of capital, financing needs and the availability of and potential for receiving further commitments; |

| • | project economics; |

| • | future metal prices and exchange rates; |

| • | mineral reserve and mineral resource estimates; and |

| • | potential changes in the ownership structures of the Company’s projects. |

- 2 –

Platinum Group Metals Ltd.

2016 Annual Information Form

Forward-Looking Statements reflect the current expectations or beliefs of the Company based on information currently available to the Company. Forward-Looking Statements in respect of capital costs, operating costs, production rate, grade per tonne and concentrator and smelter recovery are based upon the estimates in the technical reports referred to in this AIF and in the documents incorporated by reference herein and ongoing cost estimation work, and the Forward-Looking Statements in respect of metal prices and exchange rates are based upon the three year trailing average prices and the assumptions contained in such technical reports and ongoing estimates.

Forward-Looking Statements are subject to a number of risks and uncertainties that may cause the actual events or results to differ materially from those discussed in the Forward-Looking Statements, and even if events or results discussed in the Forward-Looking Statements are realized or substantially realized, there can be no assurance that they will have the expected consequences to, or effects on, the Company. Factors that could cause actual results or events to differ materially from current expectations include, among other things:

| • |

uncertainty of production, development plans and cost estimates for the Maseve platinum and palladium mine (“Maseve Mine”), formerly known as Project 1 (“Project 1”), and Project 3 (“Project 3”) of what was formerly the Western Bushveld Joint Venture (the “WBJV”); |

| • |

additional financing requirements; |

| • |

the Company’s history of losses; |

| • |

the inability of the Company to generate sufficient cash flow to make payment on its indebtedness under the Sprott Facility (defined below) and the LMM Facility (defined below) and the restrictions imposed by such indebtedness; |

| • |

the Sprott Facility and the LMM Facility are secured and the Company has pledged its shares of Platinum Group Metals (RSA) Proprietary Limited (“PTM RSA”) to the Sprott Lenders (defined below) and LMM (defined below, and together with the Sprott Lenders, the “Lenders”) under the Project 1 Working Capital Facilities (defined below), which potentially could result in the loss of the Company’s interest in Project 1 (defined below), Project 3 (defined below), the Waterberg Project (defined below) and in PTM RSA in the event of a default under either the Sprott Facility or the LMM Facility; |

| • |

the Company’s negative cash flow; |

| • |

the Company’s ability to continue as a going concern; |

| • |

delays in the production ramp-up of Project 1, which could result in a default under the LMM Facility or the Sprott Facility; |

| • |

there can be no assurance that underground development and production ramp-up at Project 1 will meet its production ramp-up timeline or that production at Project 1 will meet the Company’s expectations; |

| • |

delays in, or inability to achieve, planned commercial production; |

| • |

completion of a Definitive Feasibility Study (“DFS”) for the Waterberg Project, which is subject to resource upgrade and economic analysis requirements; |

| • |

discrepancies between actual and estimated mineral reserves and mineral resources, between actual and estimated development and operating costs, between actual and estimated metallurgical recoveries and between estimated and actual production; |

| • |

fluctuations in the relative values of the U.S. Dollar, the Rand and the Canadian Dollar; |

| • |

volatility in metals prices; |

- 3 –

Platinum Group Metals Ltd.

2016 Annual Information Form

| • |

the failure of the Company or its joint venture partners to fund their pro rata share of funding obligations for Project 1 or the Waterberg Project; |

| • |

the inability of the Company to find an additional and suitable joint venture partner for Project 1 and Project 3 within such time frame as may be determined by the South African Department of Mineral Resources (”DMR”); |

| • |

any disputes or disagreements with the Company’s joint venture partners; |

| • |

other than at Project 1 and the Waterberg Project, the lack of known mineral reserves on the Company’s properties; |

| • |

the ability of the Company to retain its key management employees and skilled and experienced personnel; |

| • |

contractor performance and delivery of services, changes in contractors or their scope of work or any disputes with contractors; |

| • |

conflicts of interest; |

| • |

any designation of the Company as a “passive foreign investment company” and potential adverse U.S. federal income tax consequences for U.S. shareholders; |

| • |

litigation or other legal or administrative proceedings brought against the Company; |

| • |

actual or alleged breaches of governance processes or instances of fraud, bribery or corruption; |

| • |

exploration, development and mining risks and the inherently dangerous nature of the mining industry, including environmental hazards, industrial accidents, unusual or unexpected formations, safety stoppages (whether voluntary or regulatory), pressures, mine collapses, cave ins or flooding and the risk of inadequate insurance or inability to obtain insurance to cover these risks and other risks and uncertainties; |

| • |

property and mineral title risks including defective title to mineral claims or property; |

| • |

changes in national and local government legislation, taxation, controls, regulations and political or economic developments in Canada, South Africa or other countries in which the Company does or may carry out business in the future; |

| • |

equipment shortages and the ability of the Company to acquire the necessary access rights and infrastructure for its mineral properties; |

| • |

environmental regulations and the ability to obtain and maintain necessary permits, including environmental authorizations and water use licences; |

| • |

extreme competition in the mineral exploration industry; |

| • |

delays in obtaining, or a failure to obtain, permits necessary for current or future operations or failures to comply with the terms of such permits; |

| • |

the failure to maintain or increase equity participation by historically disadvantaged South Africans in the Company’s prospecting and mining operations and to otherwise comply with the Amended Broad Based Socio Economic Empowerment Charter for the South African Mining Industry (the "Mining Charter"); |

| • |

certain potential adverse Canadian tax consequences for foreign-controlled Canadian companies that acquire common shares of the Company; |

- 4 –

Platinum Group Metals Ltd.

2016 Annual Information Form

| • |

risks of doing business in South Africa, including but not limited to, labour, economic and political instability and potential changes to and failures to comply with legislation; and |

| • | the other risks disclosed under the heading “Risk Factors” in this AIF. |

These factors should be considered carefully, and investors should not place undue reliance on the Company’s Forward-Looking Statements. In addition, although the Company has attempted to identify important factors that could cause actual actions or results to differ materially from those described in Forward-Looking Statements, there may be other factors that cause actions or results not to be as anticipated, estimated or intended.

The mineral resource and mineral reserve figures referred to in this AIF and the documents incorporated herein by reference are estimates and no assurances can be given that the indicated levels of platinum ("Pt"), palladium ("Pd"), rhodium ("Rh") and gold ("Au") will be produced. Such estimates are expressions of judgment based on knowledge, mining experience, analysis of drilling results and industry practices. Valid estimates made at a given time may significantly change when new information becomes available. By their nature, mineral resource and mineral reserve estimates are imprecise and depend, to a certain extent, upon statistical inferences which may ultimately prove unreliable. Any inaccuracy or future reduction in such estimates could have a material adverse impact on the Company.

Any Forward-Looking Statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any Forward-Looking Statement, whether as a result of new information, future events or results or otherwise.

Reserve and Mineral Resource Disclosure

Due to the uncertainty that may be attached to inferred mineral resource estimates, it cannot be assumed that all or any part of an inferred mineral resource estimate will be upgraded to an indicated or measured mineral resource estimate as a result of continued exploration. Confidence in an inferred mineral resource estimate is insufficient to allow meaningful application of the technical and economic parameters to enable an evaluation of economic viability sufficient for public disclosure, except in certain limited circumstances set out in National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). Inferred mineral resource estimates are excluded from estimates forming the basis of a feasibility study.

Mineral resources that are not mineral reserves do not have demonstrated economic viability.

Cautionary Note to U.S. Investors

Estimates of mineralization and other technical information included or incorporated by reference herein have been prepared in accordance with NI 43-101. The definitions of proven and probable reserves used in NI 43-101 differ from the definitions in SEC Industry Guide 7 of the U.S. Securities and Exchange Commission (the “SEC”). Under SEC Industry Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority. As a result, the reserves reported by the Company in accordance with NI 43-101 may not qualify as “reserves” under SEC standards. In addition, the terms “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” are defined in and required to be disclosed by NI 43-101; however, these terms are not defined terms under SEC Industry Guide 7 and normally are not permitted to be used in reports and registration statements filed with the SEC. Mineral resources that are not mineral reserves do not have demonstrated economic viability. Investors are cautioned not to assume that any part or all of the mineral deposits in these categories will ever be converted into reserves. “Inferred mineral resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian securities laws, estimates of inferred mineral resources may not form the basis of feasibility or prefeasibility studies, except in rare cases. See “Reserve and Mineral Resource Disclosure”. Additionally, disclosure of “contained ounces” in a resource is permitted disclosure under Canadian securities laws; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in place tonnage and grade without reference to unit measurements. Accordingly, information contained in this AIF and the documents incorporated by reference herein containing descriptions of the Company’s mineral deposits may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements of United States federal securities laws and the rules and regulations thereunder.

- 5 –

Platinum Group Metals Ltd.

2016 Annual Information Form

Currency Presentation and Exchange Rate Information

On September 1, 2015, the Company changed its presentation currency from the Canadian Dollar to the U.S. Dollar. The change in presentation currency is to better reflect the Company’s business activities and to improve investors’ ability to compare the Company’s financials results with other publicly traded businesses in the mining industry. In making this change to the U.S. Dollar presentation currency, the Company followed the guidance in IAS 21 ‘The Effects of Changes in Foreign Exchange Rates’ and has applied the change retrospectively as if the new presentation currency had always been the Company’s presentation currency. Unless stated otherwise or the context otherwise requires, all references to dollar amounts in this AIF are references to U.S. Dollars. All references to “U.S. Dollars” or to “US$” are to United States Dollars. All references to “R” or to “Rand” are to South African Rand. All references to “CDN$” are to Canadian Dollars.

The following table sets forth the rate of exchange for the U.S. Dollar expressed in Canadian Dollars in effect at the end of each of the indicated periods, the average of the exchange rates in effect on the last day of each month during each of the periods indicated, and the high and low exchange rates during each of the periods indicated based on the noon rate of exchange as reported by the Bank of Canada for the conversion of U.S. Dollars into Canadian Dollars.

| U.S. Dollar to Canadian Dollars | Year Ended August 31 | ||

| 2016 | 2015 | 2014 | |

| Rate at end of period | CDN$1.3124 | CDN$1.3223 | CDN$1.0858 |

| Average rate for period | CDN$1.3265 | CDN$1.2102 | CDN$1.0776 |

| High for period | CDN$1.4589 | CDN$1.3303 | CDN$1.1251 |

| Low for period | CDN$1.2544 | CDN$1.0863 | CDN$1.0237 |

The noon rate of exchange on November 29, 2016 as reported by the Bank of Canada for the conversion of U.S. Dollars into Canadian Dollars was $1.00 equals CDN$1.3435.

The following table sets forth the rate of exchange for the South African Rand expressed in Canadian Dollars in effect at the end of each of the indicated periods, the average of the exchange rates in effect on the last day of each month during each of the periods indicated, and the high and low exchange rates during each of the periods indicated based on the noon rate of exchange as reported by the Bank of Canada for the conversion of South African Rand into Canadian Dollars.

| South

African Rand to Canadian Dollars |

Year Ended August 31 | ||

| 2016 | 2015 | 2014 | |

| Rate at end of period | CDN$0.0893 | CDN$0.0998 | CDN$0.1019 |

| Average rate for period | CDN$0.0902 | CDN$0.1026 | CDN$0.1026 |

| High for period | CDN$0.0993 | CDN$0.1102 | CDN$0.1067 |

| Low for period | CDN$0.0821 | CDN$0.0986 | CDN$0.0984 |

The noon rate of exchange on November 29, 2016 as reported by the Bank of Canada for the conversion of South African Rand into Canadian Dollars was R1 equals CDN$0.09670.

Terms used and not defined in this AIF that are defined in National Instrument 51-102 - Continuous Disclosure Obligations (“NI 51-102”) shall bear that definition. Other definitions are set out in National Instrument 14-101 - Definitions.

- 6 –

Platinum Group Metals Ltd.

2016 Annual Information Form

Notice Regarding Non-GAAP Measures

This AIF may include certain terms or performance measures commonly used in the mining industry that are not defined under IFRS as issued by the International Accounting Standards Board, which is incorporated in the Handbook of the Canadian Institute of Chartered Accountants. We believe that, in addition to conventional measures prepared in accordance with IFRS, certain investors use this information to evaluate our performance. The data presented is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. These non-GAAP measures should be read in conjunction with our financial statements.

Share Consolidation

On January 26, 2016, the Company announced that effective January 28, 2016 its common shares would be consolidated on the basis of one new share for ten old shares (1:10). All information in this AIF regarding the issued and outstanding common shares, options and weighted average number and per share information has been retrospectively restated to reflect the ten to one consolidation.

| ITEM 3 | CORPORATE STRUCTURE |

The Company was amalgamated on February 18, 2002 under the Business Corporations Act (British Columbia) (“BCBCA”) pursuant to an order of the Supreme Court of British Columbia approving an amalgamation between Platinum Group Metals Ltd. and New Millennium Metals Corporation. On January 25, 2005, the Company was transitioned under the BCBCA.

On February 22, 2005, the Company’s shareholders passed a special resolution to: (a) amend the authorized share capital from 1,000,000,000 common shares without par value to an unlimited number of common shares without par value; (b) remove the Pre-existing Company Provisions; and (c) adopt new articles. On February 27, 2014, the shareholders passed an ordinary resolution approving the advance notice policy of the Company and an alteration to the Company’s Articles to include provisions requiring advance notice of director nominees from shareholders, as described in the Company’s information circular for its annual meeting of shareholders held on February 27, 2014.

The Company’s head office is located at:

788 – 550 Burrard Street

Vancouver, British Columbia

Canada, V6C 2B5

The Company’s registered office is located at:

Gowling WLG (Canada) LLP

2300 -

550 Burrard Street

Vancouver, British Columbia

Canada, V6C 2B5

The Company is a platinum-focused exploration and development company conducting work primarily on mineral properties it has staked or acquired by way of option agreements or applications in the Republic of South Africa and in Canada.

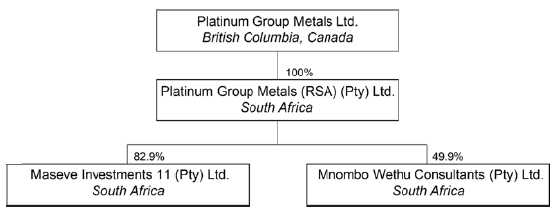

Platinum Group Metals Ltd. and its Principal Subsidiaries

The Company’s material subsidiaries are one wholly-owned company, one majority-owned company and a 49.9% holding in a third company, all of which are incorporated under the company laws of the Republic of South Africa.

- 7 –

Platinum Group Metals Ltd.

2016 Annual Information Form

The Company conducts its South African exploration and development work through its wholly-owned direct subsidiary, PTM RSA. PTM RSA holds the Company’s interests in the Project 1 (also known as the Maseve Mine) and Project 3 platinum mines of what was formerly the Western Bushveld Joint Venture through its 82.9% holdings in Maseve Investments 11 Proprietary Limited (“Maseve”). We esizwe Platinum Ltd. (“Wesizwe”), through its subsidiary Africa Wide Mineral Prospecting and Exploration Proprietary Limited (“Africa Wide”) has a 17.1% ownership interest in Maseve. See “Mineral Property Interests – Projects 1 and 3 of the Western Bushveld Complex” below.

On August 20, 2014, an arbitrator ruled that Africa Wide’s shareholding in Maseve would be reduced to 21.2766% as a result of a failure to fund its US$21.8 million share of a unanimously approved Maseve cash call by the Maseve board of directors. This was the first cash call ever presented to Africa Wide for their share of Maseve development costs. On March 3, 2014, Africa Wide informed the Company that it would not be funding its US$21.52 million share of a second unanimously approved cash call. As a result, Africa Wide’s ownership of Maseve has been further diluted to approximately 17.1% based on the dilution formula in the Maseve Shareholders Agreement among PTM RSA, Africa Wide e and Maseve (the “Maseve Shareholders Agreement”), as confirmed by the arbitrator. Likewise, the Company’s ownership in Maseve has increased to approximately 82.9% . See “Africa Wide Dilution” below for more information.

The Company also owns 49.9% of Mnombo Wethu Consultantts (Pty) Limited (“Mnombo”), a black economic empowerment (“BEE”) company, which holds a 26% participating interest in both the Waterberg joint venture project (the “Waterberg JV Project”) and the Waterberg extension project (the “Waterberg Extension Project” and together with the Waterberg JV Project, the “Waterberg Project”).

The Company previously held 100% of the shares of Platinu um Group Metals (Barbados) Ltd., a company incorporated under the laws of Barbados originally set up to hold and manage potential PGM opportunities. Platinum Group Metals (Barbados) Ltd. was voluntarily wound up and officially deregistered in accordance with the provisions of the Companies Act of Barbados effective July 15, 2016.

PTM RSA previously held 100% of the shares of Wesplats Holding (Proprietary) Limited, a holding company incorporated under the laws of South Africa and originally set up to acquire surface rights. Wesplats Holding (Proprietary) Limited was voluntarily wound up and officially deregistered by the Companies and Intellectual Property Commission (“CIPC”) of South Africa on September 16, 2015.

The Company previously held a 37% interest in Wildebeest Platinum (Pty) Limited, a company set up to hold prospecting rights. Wildebeest was voluntarily wound up and officially deregistered by the CIPC on June 30, 2015.

| ITEM 4 | GENERAL DEVELOPMENT OF THE BUSINESS |

Since its formation in 2002, the Company has been engaged in the acquisition, exploration and development of platinum and palladium properties. The Company currently holds interests in platinum properties in the Western and Northern Limbs of the Bushveld Complex in South Africa and in Canada. The Company’s business is conducted primarily in South Africa, and to a lesser extent, in Ontario, the Northwest Territories and Newfoundland and Labrador in Canada.

- 8 –

Platinum Group Metals Ltd.

2016 Annual Information Form

At present the Company is focused on the ramp-up of production at Project 1.

The Company is also advancing the exploration and assessment of the Waterberg Project. A pre-feasibility study for the Waterberg Project was published on October 19, 2016. Work in preparation for a planned Definitive Feasibility Study (“DFS”) is now underway, targeting a large, thick PGM resource with the objective to model a large-scale, fully-mechanized mine. A substantial portion of the Waterberg Project’s prospecting area remains unexplored.

Recent Developments

On November 1, 2016 the Company announced the closing of a public offering of common shares (the “November 2016 Offering”). Pursuant to the November 2016 Offering, the Company issued 22,230,000 common shares at a price of US$1.80 per share, for aggregate gross proceeds of approximately US$40 million. BMO Capital Markets and RBC Dominion Securities Inc. acted as the underwriters and agreed to buy the shares on a bought deal basis. The net proceeds of the November 2016 Offering will be used for (i) underground development and production ramp-up of the Project 1 Maseve Platinum Mine, (ii) working capital during start-up, (iii) repayment of all or a portion of the US$5.0 million Second Advance (defined below) received by the Company under the Amended and Restated Sprott Facility (defined below), and (iv) general corporate purposes. The November 2016 Offering was made pursuant to an effective shelf registration statement previously filed on October 14, 2016 with the SEC and a corresponding Canadian base shelf prospectus filed with the securities regulatory authority in each of the provinces of Canada, except Quebec. In relation to the offering, a prospectus supplement to the base shelf prospectus was filed on October 25, 2016 with the SEC and with the securities regulatory authority in each of the provinces of Canada, except Quebec.

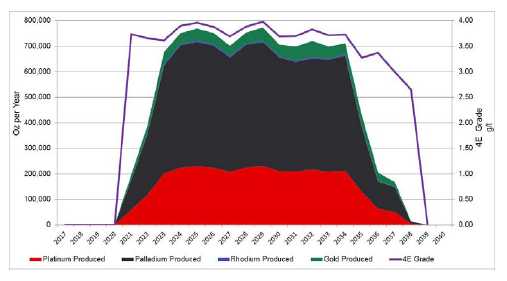

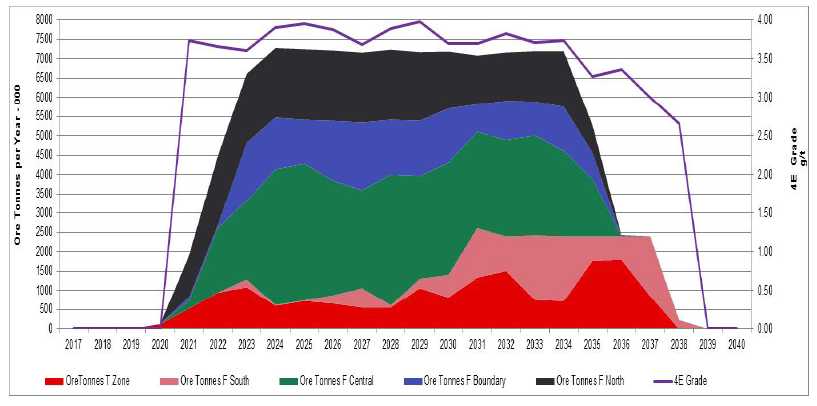

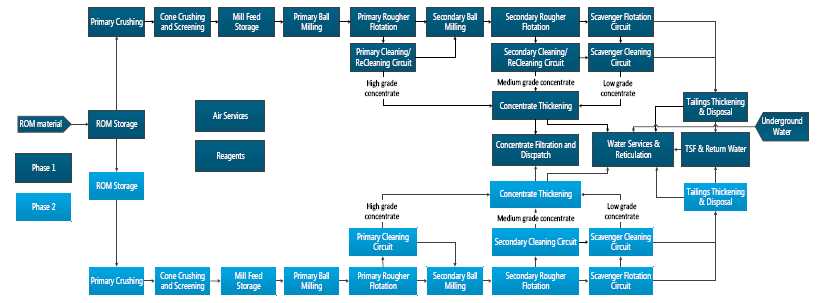

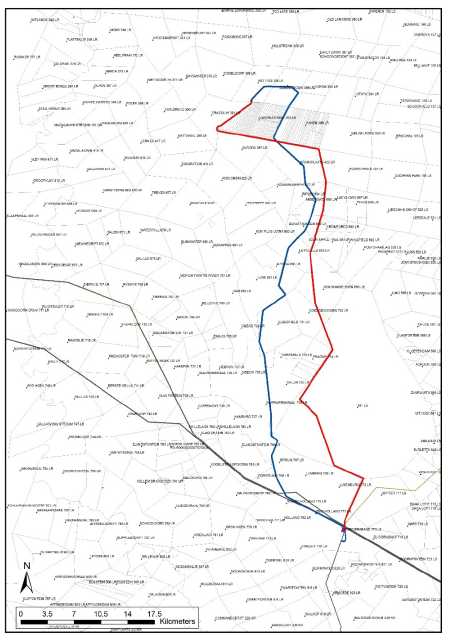

On October 19, 2016 the Company announced positive results from an independent pre-feasibility study on the Waterberg Project (“WPFS”) contained in a technical report dated October 19, 2016 and filed on SEDAR titled “Independent Technical Report on the Waterberg Project Including Mineral Resource Update and Pre-Feasibility Study” (the “WPFS Technical Report”). Platinum Group is to hold a 58.62% effective interest in the Waterberg Project (including through its minority interest in Mnombo) with the Japan, Oil, Gas and Metals National Corporation (“JOGMEC”) holding a 28.35% interest. Empowerment partner Mnombo holds the balance of the joint venture. Highlights of the WPFS include (i) validation of the 2014 Waterberg Preliminary Economic Assessment (“PEA”) results for a large scale, shallow, decline accessible, mechanized platinum, palladium, rhodium and gold (“4E”) mine, (ii) annual steady state production rate of 744,000 4E ounces in concentrate, (iii) a 3.5 year construction period, (iv) on site life-of-mine average cash cost of US$248 per 4E ounce including byproduct credits and exclusive of smelter discounts, (v) after-tax net present value (“NPV”) of US$320 million, at an 8% discount rate, using three-year trailing average metal prices, (vi) after-tax NPV of US$507 million, at an 8% discount rate, using investment bank consensus average metal prices, (vii) estimated capital to full production of approximately US$1.06 billion including US$67 million in contingencies. Peak project funding estimated at US$914 million, (viii) After-tax Internal Rate of Return (“IRR”) of 13.5% using three-year trailing average price deck, (ix) after-tax IRR of 16.3% at investment bank consensus average metal prices, (x) probable reserves of 12.3 million 4E ounces (2.5 g/t 4E cut-off), (xi) indicated resources updated to 24.9 million 4E ounces (2.5 g/t 4E cut-off) and deposit remains open on strike to the north and below a 1,250 meter arbitrary depth cutoff. See details at “Summary of Mineral Reserves and Mineral Resource Estimates” below. The Company plans to continue drilling the deposit and to advance the project to completion of feasibility study and a construction decision. The Company also plans to file a mining right application, with joint venture approval, based substantially on the results of the WPFS.

On October 12, 2016 the Company announced that Sprott Resource Lending Partnership (“Sprott”), among other lenders (the lenders from time to time, the “Sprott Lenders”) had provided a US $5.0 million second advance (the “Second Advance”) to the Company. The original US$40.0 million credit facility agreement with the Sprott Lenders dated February 13, 2015, as subsequently amended on November 19, 2015, May 3, 2016 and September 19, 2016 (the "Sprott Facility"), pursuant to which US$40 million was advanced to the Company on November 20, 2015, was amended and restated effective October 11, 2016 to reflect the Second Advance and an increase to US$45.0 million (the “Amended and Restated Sprott Facility”). Interest will accrue and become payable to Sprott monthly on any outstanding principal related to the Second Advance at a rate of LIBOR plus 8.5%, the same rate as for the original Sprott Facility. Other terms, conditions and covenants related to the Amended and Restated Sprott Facility are substantially the same as for the original Sprott Facility. See more below in this section.

- 9 –

Platinum Group Metals Ltd.

2016 Annual Information Form

Under the terms of the Amended and Restated Sprott Facility, Sprott had a right to elect for earlier repayment of the Second Advance the from the proceeds of an equity or debt financing by the Company prior to December 31, 2017. On November 2, 2016 Sprott elected for early repayment of US$2.5 million of the Second Advance from the proceeds of the November 2016 Offering, which the Company has repaid. The remaining US$2.5 million principal balance of the Second Advance is to be repaid in six equal, monthly installments commencing on July 31, 2017; provided, that if the Company or any of its subsidiaries closes one or more equity or debt financing (excluding intercompany financings) on or before December 31, 2017, Sprott may elect to require the proceeds of such financing, net of reasonable financing costs, be paid to the Sprott Lenders in repayment of the remaining outstanding amount of the Second Advance. In consideration of the Second Advance, as a fee, the Company issued 113,963 common shares of the Company at a price of CDN$3.2428 per share, less a ten percent discount.

On September 19, 2016 the Company announced that Sprott and Liberty Metals and Mining Holdings, LLC, a subsidiary of Boston-based Liberty Mutual Insurance ("LMM"), had agreed to amend certain terms to the Sprott Facility and the November 2, 2015 US$40 million credit facility agreement with LMM (the "LMM Facility", and together with the Amended and Restated Sprott Facility, the “Project 1 Working Capital Facilities”). Sprott agreed to defer 12 planned monthly repayments of the original US$40 million Sprott Facility from commencing on January 31, 2017 to commencing on January 31, 2018. LMM agreed to defer 9 planned quarterly repayments of its original US$40 million LMM Facility plus capitalized interest from commencing December 31, 2018 until June 30, 2019. LMM also agreed to defer the quarterly payment of interest due to LMM from commencing December 31, 2016 until December 31, 2017. During the additional twelve-month period interest will continue to be accrued monthly and capitalized to principal. Sprott and LMM both agreed to reset agreed monthly production covenants so that month one of production will be October, 2016. In consideration of the amendments, the Company issued 801,314 common shares of the Company as directed by the Sprott Lenders and 801,314 in common shares of the Company to LMM. The shares were priced at CDN$3.66 per share, less a ten percent discount.

On September 19, 2016 the Company also reported that primary development at the Maseve Mine had accessed mining Block 11, hosting some of the best grade thickness ore at the Maseve Mine. Block 11 is an important part of the next several years of scheduled mining. Block 11 is a large, well-drilled and stable mining block estimated to host more than 545,000 4E Merensky Reef ounces (3,066,512 tonnes at 5.53 grams per tonne 4E Indicated). Production at the Maseve Mine is behind schedule due to challenges related to the ramp up of stoping tonnes. Difficulties and delays were caused in part by poor contractor performance and incomplete underground infrastructure, causing bottlenecks in the movement of waste and ore out of the mine. Completion of the first underground silo top, the addition of a belt loader at this silo and future top and bottom completions at silos two and three are expected to improve production into 2017. Feed to the plant since commissioning has been substantially comprised of low grade development stockpiles and a combination of mined stoping tonnes and development tonnes from primary headings where Merensky Reef is present. Looking forward, Merensky tonnes mined are scheduled to increase as key mining blocks are accessed, developed and stoped. A conveyor from underground has been commissioned that feeds directly to the overland conveyor and into the primary crusher and mill. A final conveyor leg directly to Block 11 is being engineered and planned for construction, which is expected to improve the future ability to move good grade tonnes out of the mine and directly into the mill.

Three-Year History

The following is a summary of the Company’s noteworthy developments over the last three fiscal years.

Fiscal 2014 Developments

Third Independent Mineral Resource Estimate for Waterberg – On September 3, 2013, the Company announced an updated independent inferred mineral resource estimate for the Waterberg JV Project.

Africa Wide Dilution - On October 18, 2013, Africa Wide informed the Company that it would not be funding its approximate US$21.8 million share of a project budget and cash call for Project 1 that had been unanimously approved by the Maseve board of directors. As a result of Africa Wide’s failure to fund its share of the initial cash call, the Company entered into arbitration proceedings with Africa Wide to determine the extent of the dilution of Africa Wide’s ownership in Maseve (the “Africa Wide Dilution”), and therefore Project 1 and Project 3, in accordance with the terms of the Maseve Shareholders Agreement. The Company also delayed certain expenditures on Project 1 from October 2013 to January 2014 so that the Company could raise additional equity financing. On August 20, 2014, an arbitrator determined that Africa Wide’s shareholding in Maseve would be reduced to 21.2766% . As a result of Africa Wide’s decision not to fund its US$21.52 million share of a second cash call delivered in February 2014, Africa Wide’s ownership in Maseve was further diluted to approximately 17.1% based on the dilution formula in the Maseve Shareholders Agreement, as confirmed by the arbitration. Likewise, the Company’s ownership in Maseve has therefore increased to approximately 82.9% . The Company expects that it will be required to fund 100% of Maseve’s cash requirements and since 2014 has loaned Maseve such required amounts.

- 10 –

Platinum Group Metals Ltd.

2016 Annual Information Form

Project 1 New Lender Mandate – On November 11, 2013, the Company entered into a new mandate letter with three commercial banking groups to arrange for up to a US$195 million project finance loan to develop the Maseve Mine. The new mandate was to build on work and due diligence conducted up until October 18, 2013 under an earlier mandate. The proposed revised facility agreement would not rely on Wesizwe or Africa Wide to provide any covenants, guarantees or consents. See "Termination of Project 1 New Lender Mandate” in “Fiscal 2015 Developments” below.

CDN$175 Million Public Offering – On December 31, 2013, the Company closed a previously announced public offering of common shares. The Company issued 148.5 million common shares at a price of CDN$1.18 per share, for aggregate gross proceeds of CDN$175.23 million. BMO Capital Markets and GMP Securities L.P. led a team of underwriters which included CIBC World Markets Inc., RBC Dominion Securities Inc., Barclays Capital Canada Inc., PI Financial Corp., Raymond James Ltd. and Dundee Securities Ltd. which had agreed to buy the shares on a bought deal basis. The Company intended to use the net proceeds of the offering to partially fund Phase 2 development at the Maseve Mine, to fund the Company’s portion of ongoing exploration and engineering work on the Waterberg JV Project, to fund the Company’s portion of ongoing exploration work on the Waterberg Extension Project and for general working capital purposes. The common shares were offered by way of a short form prospectus filed in all provinces of Canada, except for Quebec, and in the United States by way of a registration statement filed with the SEC.

Waterberg PEA – On February 14, 2014, the Company announced positive results from an independent Preliminary Economic Assessment on the Waterberg JV Project. The project was advanced to the pre-feasibility stage. As disclosed in the Company’s press release dated October 21, 2014, the Preliminary Economic Assessment is outdated and no longer valid. Accordingly, the Preliminary Economic Assessment should not be relied upon.

Fourth Independent Mineral Resource Estimate for Waterberg – On June 11, 2014, the Company announced an increase in the estimated inferred mineral resource at the Waterberg JV Project and adjacent Waterberg Extension Project.

Fiscal 2015 Developments

Termination of Project 1 New Lender Mandate - On November 3, 2014, the Company announced the termination of the mandate for a US$195 million term loan facility previously entered into with a syndicate of lenders and announced on November 11, 2013.

Sprott US$40 Million Senior Secured Loan Facility - On December 9, 2014, the Company announced that the Company had entered into a term sheet with Sprott for the Sprott Facility in the amount of US$40 million at an interest rate of LIBOR plus 8.50%, compounded and payable monthly. Later, on February 16, 2015, the Company entered into a credit facility agreement (the “Sprott Credit Agreement”) regarding the Sprott Facility. The Company used the proceeds of the Sprott Facility for the development and operation of the Maseve Mine and for general working capital purposes.

The Company made or will be obligated to make certain payments to Sprott, including (a) a bonus payment made concurrently with execution and delivery of the Sprott Credit Agreement in the amount of US$1,500,000, being 3.75% of the principal amount of the Sprott Facility, payable in 2,830,188 common shares of the Company issued on February 16, 2015 at a deemed price per share equal to US$0.53 per common share of the Company; (b) a draw down payment to Sprott of US$800,000, being equal to 2% of the amount being drawn down under the Sprott Facility, payable in 3,485,839 common shares issued on November 20, 2015 at a deemed price equal to US$0.23 per common share of the Company; (c) a structuring fee comprised of a cash payment in the amount of US$100,000, paid concurrently with the execution and delivery of the term sheet for the Sprott Facility; and (d) a standby fee payable monthly until December 31, 2015 in cash equal to 4% per annum of the un-advanced principal amount of the Facility.

- 11 –

Platinum Group Metals Ltd.

2016 Annual Information Form

US$113.8 Million Public Offering – On December 31, 2014, the Company announced the closing of a previously announced public offering of common shares. The Company issued 214.8 million common shares at a price of US$0.53 per share, for aggregate gross proceeds of US$113.844 million. The common shares issued include 7.2 million common shares issued pursuant to the exercise of an over-allotment option. BMO Capital Markets and GMP Securities L.P. acted as the underwriters and agreed to buy the offered shares on a bought deal basis. The net proceeds of the offering were intended to fund Phase 2 development at the Maseve Mine. The shares were offered by way of a short form prospectus filed in all provinces of Canada, except for Quebec, and were offered in the United States pursuant to a registration statement filed under the Canada/U.S. multi-jurisdictional disclosure system.

Waterberg Unitization – On May 26, 2015, the Company announced that JOGMEC had committed to fund the next US$20 million of joint venture funding at Waterberg. In conjunction with JOGMEC’s firm funding commitment, the Company, JOGMEC and empowerment partner Mnombo agreed to consolidate the Waterberg JV Project and the Waterberg Extension Project into one unitized project area, which is referred to as the Waterberg Project. The resulting new ownership interests in the Waterberg Project on unitization be as follows:

| • | Platinum Group: | 45.65% (1) | |

| • | JOGMEC: | 28.35% | |

| • | Mnombo: | 26.00% |

| (1) |

Platinum Group indirectly owns an additional 12.97% interest in the Waterberg Project through its 49.9% interest in Mnombo, for a total 58.62% interest in the Waterberg Project. |

Platinum Group will increase its direct and indirect effective interest in the old Waterberg JV Project area from 49.98% currently to 58.62% . Platinum Group will decrease its effective interest in the old Waterberg Extension Project from 87% to 58.62% . JOGMEC will decrease its interest in the old Waterberg Joint Venture from 37% to 28.35% and increase its interest in the old Waterberg Extension Project from zero to 28.35% . See further details below.

Project 1 Mineral Resources and Reserves Update – On July 15, 2015, the Company announced that mineral resources and mineral reserves for Project 1 had been updated to account for the planned increased use of mechanized mining methods where the deposit is estimated to be thicker and accessible from nearby completed underground development. The updated mineral reserves were calculated using current three-year trailing metal prices and current cost estimates to July 2015, updated detailed surface and underground drilling results and a revised mine plan. See details at “Summary of Mineral Reserves and Mineral Resource Estimates” below.

Fifth Independent Mineral Resource Estimate for Waterberg – On July 22, 2015 the Company reported an updated independent platinum, palladium and gold (collectively referred to as “3E”) resource estimate for the Waterberg Project, effective July 20, 2015.

Fiscal 2016 Developments

US$40 Million Sprott Facility – On November 20, 2015, the Company drew down US$40 million working capital facility pursuant to the Sprott Credit Agreement. The Company issued 348,584 common shares to Sprott in connection with its draw down of the Sprott Facility at a deemed price of CDN$3.045 per share. The Sprott facility bears interest at 8.5% over US Libor. Sprott, in first lien position, agreed to amend its original terms and enter into an inter-creditor agreement to allow for the second lien position for the LMM Facility.

The Sprott Facility was later amended and restated in May and October, 2016. See details above under “Recent Developments” and below under “Fiscal 2016 Developments”.

- 12 –

Platinum Group Metals Ltd.

2016 Annual Information Form

US$40 Million LMM Facility – On November 20, 2015, the Company also drew down US$40 million from the LMM Facility pursuant to a credit agreement (the “LMM Credit Agreement”) entered into on November 2, 2015 with its largest shareholder, LMM. Pursuant to the terms of the LMM Credit Agreement, the Company issued 348,584 common shares to LMM with its draw down of the LMM Facility at a deemed price of CDN$3.045 per share. The LMM facility bears interest at 9.5% over US Libor. Pursuant to the LMM Credit Agreement the Company entered into a life of mine Production Payment Agreement (“PPA”) with LMM. Under the PPA, the Company agreed to pay to LMM a production payment of 1.5% of net proceeds received on concentrate sales or other minerals from the Maseve Mine (the “Production Payment”).

Events of default under the Sprott Facility are also treated as events of default under the LMM Facility, and vice versa. Under the LMM Facility, the Company has provided a subordinated pledge of 100% of the shares of PTM RSA. The LMM Facility is subordinated to the Sprott Facility and scheduled to be repaid after Sprott. An event of default under the PPA triggers the payment of a termination fee based on a net present value of the Production Payments to be made under the PPA at a 5% discount rate. An event of default under the Sprott Facility or the LMM Facility is also treated as an event of default under the PPA. The Company holds the right to terminate the PPA upon payment of the termination fee.

The PPA is secured with the second lien position of the LMM Facility until it is repaid. The PPA will be acknowledged in any subsequent debt arrangement of the Company. The Company has a right to refinance the Sprott Facility or the LMM Facility, subject to certain rights granted to LMM under the PPA.

The LMM Facility was later amended and restated in May, 2016. See details below under “Fiscal 2016 Developments”.

Maseve Mine Commissioning - On February 9, 2016 the Company reported that operations at the Maseve Mine had successfully completed a 72-hour run test during hot commissioning of its concentrator facility. The mine produced its first concentrate for delivery to the Anglo Platinum Waterval smelter 40 km to the south of the mine. Since commissioning, operations have continued with further underground development and production ramp-up.

Sixth Independent Mineral Resource Estimate for Waterberg – On April 19, 2016 the Company reported an updated independent 3E resource estimate for the Waterberg Project, effective April 18, 2016. LMM Facility and Sprott Facility Amended – On May 5, 2016 the Company announced that the US$40 million LMM Facility and the US$40 million Sprott Facility were each amended effective May 3, 2016. Under the amendments, the provision whereby Maseve must reach and maintain on a three-month rolling average at least 60% of planned production for a three-month period was extended and the provision whereby Maseve must reach and maintain on a three-month rolling average at least 70% of planned production was also extended. In consideration of the amendments the Company issued 131,654 common shares of the Company to Sprott and 131,654 common shares of the Company to LMM priced at CDN$4.18 per share, , less a seven and one-half percent discount.

US$33.0 Million Public Offering – On May 26, 2016 the Company announced the closing of a previously announced public offering of common shares. The Company issued 11,000,000 shares at a price of US$3.00 per share, for aggregate gross proceeds of US$33,000,000. BMO Capital Markets, RBC Dominion Securities Inc. and Macquarie Capital Markets Canada Ltd. acted as the underwriters and agreed to buy the offered shares on a bought deal basis. The net proceeds of the offering were used for underground development and the ramp-up of production at the Maseve Mine. The shares were offered by way of a short form prospectus filed in all provinces of Canada, except for Quebec, and were offered in the United States pursuant to a registration statement filed under the Canada/U.S. multi-jurisdictional disclosure system.

Significant Acquisitions

The Company has not made any significant acquisitions during its most recently completed financial year for which disclosure is required under Part 8 of NI 51-102.

- 13 –

Platinum Group Metals Ltd.

2016 Annual Information Form

| ITEM 5 | DESCRIPTION OF THE COMPANY’S BUSINESS |

General

The Company is a platinum-focused exploration, development and operating company conducting work primarily on mineral properties it has staked or acquired by way of option agreements or applications in the Republic of South Africa and in Canada.

Currently, the Company considers the Maseve Mine and the Waterberg Project to be material mineral properties. The Company also holds interests in various early-stage exploration projects located in Canada and in South Africa, including Project 3, which is located adjacent to and to the north of the Maseve Mine. The Company continues to evaluate exploration opportunities both on currently owned properties and on new prospects.

Principal Products

Our principal product once production commences at the Maseve Mine will be a PGM bearing concentrate. The concentrate will contain certain amounts of eight elements payable to the Company’s account comprised of platinum, palladium, rhodium, gold, ruthenium, iridium, copper and nickel. All of the PGM bearing concentrate produced at the Maseve Mine is to be delivered and sold to Anglo American Platinum Limited (”Amplats”) in accordance with the terms of a life-of-mine off-take agreement for the Maseve Mine with Rustenburg Platinum Mines Limited ("RPM"). The off-take agreement followed a competitive tender process and the exercise of a right of first refusal by RPM. The concentrate from the Maseve Mine is planned for delivery to the RPM Waterval smelter, approximately 40 km away by truck.

Specialized Skill and Knowledge

Various aspects of our business require specialized skills and knowledge, including the areas of geology, engineering, operations, drilling, metallurgy, permitting, logistical planning and implementation of exploration programs as well as legal compliance, finance and accounting. We face competition for qualified personnel with these specialized skills and knowledge, which may increase our costs of operations or result in delays.

Due to the requirement for specialized skills and knowledge, the Company has contracted the services of an experienced and professional human resources company, to provide site and office human resources, organization design and planning services to Maseve. The contracted human resources company specializes in the mining industry, and their team of professional engineers, psychologists and human resources practitioners has an intimate understanding of organization design & development, including knowledge of the applied legislation, mining techniques and associated labour practices. They have also assisted the Company in completing a “Local Skills Assessment” in six communities to help identify candidates for leadership and staff positions as per Maseve’s Social and Labour Plan (the “Maseve Social and Labour Plan”) and human resources development obligations. Community members have been hired and more are currently undergoing medical examinations, training and induction.

Social or Environmental Policies

Corporate Social Responsibility

Being a responsible corporate citizen means protecting the natural environment associated with our business activities, providing a safe workplace for our employees and contractors, and investing in infrastructure, economic development, and health and education in the communities where we operate so that we can enhance the lives of those who work and live there beyond the life of such operations. We take a long-term view of our corporate responsibility, which is reflected in the policies that guide our business decisions, and in our corporate culture that fosters safe and ethical behaviour across all levels of Platinum Group. Our goal is to ensure that our engagement with our stakeholders, including our workforce, industry partners, and the communities where we operate, is continued, mutually beneficial and transparent. By building such relationships and conducting ourselves in this manner, we can address specific concerns of our stakeholders and work cooperatively and effectively towards achieving this goal.

- 14 –

Platinum Group Metals Ltd.

2016 Annual Information Form

Social and Labour Plans

The Maseve Social and Labour Plan was compiled pursuant to DMR guidelines for social and labour plans and submitted in accordance with section 46 of the MPRDA (defined below). The objective of a social and labour plan is to align the Company’s social and labour principles with the related requirements established under the Mining Charter. These requirements for Maseve include promoting employment, advancement of the social and economic welfare of all South Africans, contributing toward the transformation of the mining industry and contributing towards the socio-economic development of the communities proximal to the Maseve Mine. Contractors are required to comply with the Maseve Social and Labour Plan and policies, including commitment to employment equity and BEE, proof of competence in terms of regulations, commitment to undertake training programs, compliance with all Maseve policies relating to recruitment, training, health and safety, etc. In terms of human resources training, the Maseve Social and Labour Plan establishes objectives for adult-based education training, learnerships and development of skills required by mining industry, portable skills training for transition into industries other than mining, education bursaries and internships. The Maseve Social and Labour Plan also establishes local economic development objectives for projects such as community centre refurbishment, high school refurbishment, water and reticulation projects, housing development, establishment of recreational parks and various other localized programmes for small scale industry, agriculture, entrepreneurship and health and education.

The Company is in process to develop a social and labour plan for the Waterberg Project (the “Waterberg Social and Labour plan”).

Labour in South Africa

The gold and platinum mining industries in South Africa witnessed significant labour unrest in recent years and demands for higher wages by certain labour groups. Both legal and illegal or “unprotected” strikes have occurred at several mines since the beginning of August 2012. In June 2014, the Association of Mineworkers and Construction Union accepted a negotiated wage settlement to end a five month long strike affecting a significant proportion of the platinum industry. To date, the Company has seen no adverse labour action on its site at the Maseve Mine.

The primary union at the Maseve Mine representing the workers of Maseve’s primary underground mining contractor, JIC Mining Services (“JIC”), is the National Union of Mineworkers (“NUM”). The Company maintains an active dialogue with JIC, NUM and its own employees. JIC recently agreed to terms with NUM for a labour contract at the Maseve Mine for a two-year period ending September 2017. In the future, should higher salaries and wages occur across the industry, the Company will likely be required to comply with higher pay bands, and the resulting increase in the cost of labour. See “Risk Factors”.

Environmental Compliance

The Company’s current and future exploration and development activities, as well as future mining and processing operations, if warranted, are subject to various federal, state, provincial and local laws and regulations in the countries in which the Company conducts its activities. These laws and regulations govern the protection of the environment, prospecting, development, production, taxes, labour standards, occupational health, mine safety, hazardous substances and other matters. Company management expects to be able to comply with those laws and does not believe that compliance will have a material adverse effect on the Company’s competitive position. The Company intends to obtain and maintain all licences and permits required by all applicable regulatory agencies in connection with its mining operations and exploration activities. The Company intends to maintain standards of compliance consistent with contemporary industry practice.

Competitive Conditions

The global PGM mining industry has historically been characterised by long-term rising demand from global automotive and fabrication sectors on the one hand and constrained supply sources on the other. South Africa’s PGM mining sector has been the largest and fastest growing sector in the South African mining industry until recently, representing approximately 80% of global supply. Since mid-2012 global economic uncertainty, recycling and slow growth have created a weak market for PGMs. Lower market prices for PGMs combined with labour unrest has caused stoppages and closures of some higher cost platinum mines and shafts in South Africa. Almost all of the South African platinum supply comes from the geographic constraints of the Western, Northern and Eastern Limbs of the Bushveld Complex, resulting in a high degree of competition for mineral rights and projects. South Africa’s PGM mining sector remains beholden to economic developments in the global automotive industry, which currently accounts for approximately 41% of the total global demand for platinum. A prolonged downturn in global automobile and light truck sales, resulting in depressed platinum prices, often results in declining production as unprofitable mines are shut down. Alternatively, strong automobile and light truck sales combined with strong fabrication demand for platinum, most often results in a more robust industry, creating competition for resources, including funding, labour, technical experts, power, water, materials and equipment. The South African industry is dominated by three or four producers, who also control smelting and refining facilities. As a result, there is general competition for access to these facilities on a contract basis. As the Company moves towards production on the Maseve Mine, it will become exposed to many of the risks of competition described herein. See “Risk Factors”.

- 15 –

Platinum Group Metals Ltd.

2016 Annual Information Form

Employees and Contractors

The Company’s current complement of managers, staff and consultants in Canada consists of approximately 9 individuals and the Company’s complement of managers, staff, consultants, security and casual workers in South Africa consists of approximately 311 individuals, inclusive of approximately 18 individuals active at the Waterberg Project.

The Waterberg Project is operated by the Company utilizing its own staff and personnel as described above. Contract drilling, geotechnical and support services are utilized as required.

Maseve is operated by the Company on an “owner managed-contractor” basis. The Company has hired full time local mining specialists in South Africa as part of an operational readiness plan while the Company drives to ramp up production at the Maseve Mine. The Company’s management team has taken over many duties and responsibilities previously assigned to contractors, resulting in improved planning and execution capabilities at Maseve. The safety record at the Maseve Mine has been maintained at levels better than industry average levels through a focus on safety. The Maseve management team has frequent interaction and dialogue with the inspectorate branch of the DMR and follows their guidance carefully.

As at October 31, 2016, the total labour force at the Maseve Mine totalled approximately 2,145 people. The Company had 116 permanent and temporary employees and directly managed 1,012 contractor employees assigned to engineering (343 employees), security (101 employees), mining sub-contractors (427 employees) and support services (141 employees). Underground mining contractor JIC had approximately 834 people, including mining sub-contractors, assigned to working on both the north and south mine areas at the Maseve Mine. As the Maseve Mine ramps up production, Company management is working to streamline and refine contractor engagement for underground mining and development at the Maseve Mine to improve operational efficiencies and rates of production.

In December 2012, DRA Mineral Projects (Pty) Ltd. (“DRA”) was formally engaged as the EPCM contractor for commencement of surface infrastructure, including mill and flotation circuit construction. At October 31, 2016 DRA and all its subcontractors had demobilised from site post the completion of the EPCM works.

During December 2015, Tailing Technology (Pty) Limited (“TTL”) was engaged to provide concentrator management, operating and maintenance services for the Maseve mill. TTL personnel were inducted to site and completed training and the establishment of operating procedures and protocols in December 2015 and January 2016. During February 2016 TTL commissioned the Maseve Mine mill with assistance of the DRA commissioning team. At October 31, 2016 TTL had approximately 114 employees on site plus approximately 69 sub-contractor personnel.

The Company has worked closely for several years with local communities and a human resource specialist company to create a database of local persons interested in work at Maseve, including their skill and experience details. The Company has set a target of 30% local employment for the mine, including persons under the employ of contractors. As at October 31, 2016, approximately 13% of the onsite Maseve workforce was comprised of local persons from surrounding communities. Management will, as production build up and increased labour requirement allow, address the shortfall in this target.

- 16 –

Platinum Group Metals Ltd.

2016 Annual Information Form

Foreign Operations

The Company conducts the majority of its business in South Africa. South Africa has a large and well-developed mining industry, particularly in the area where the Maseve Mine is located. This, among other factors, means the infrastructure in the area is well-established, with well-maintained roads and highways as well as electricity distribution networks, water supply and telephone and communication systems. Electrical generating capacity has been strained by demand in recent years in South Africa, but additional capacity is currently underway. Additional water infrastructure will also be required. See “Risk Factors”.

There is also access to materials and skilled labour in the region due to the existence of many platinum and chrome mines in the immediate vicinity. Smelter complexes and refining facilities are also located in the area. South Africa has an established government, police force and judiciary as well as financial, health care and social institutions, although such institutions underwent significant change following the fall of apartheid and free elections in 1994, and are continuing to be developed. The system of mineral tenure was overhauled by new legislation in 2002, which came into force in 2004. Since 1994, South Africa has been considered an emerging democracy. See “Risk Factors”.

5.1 - Mineral Property Interests

Under IFRS, the Company defers all acquisition, exploration and development costs related to mineral properties. The recoverability of these amounts is dependent upon the existence of economically recoverable mineral reserves, the ability of the Company to obtain the necessary financing to complete the development of the property, and any future profitable production; or alternatively upon the Company’s ability to dispose of its interests on an advantageous basis.

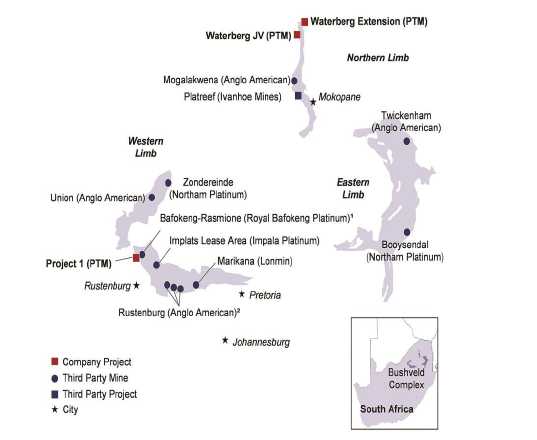

The Company’s key development project and exploration targets are located in the Bushveld Complex in South Africa. The Bushveld Complex is comprised of a series of distinct layers or reefs, three of which contain the majority of the economic concentrations of platinum group metals (together, “PGMs”, and the subset of 4E PGMs consisting of platinum, palladium, rhodium and gold, or the subset of 3E PGMs consisting of platinum, palladium and gold) within the Bushveld Complex: (i) the Merensky Reef (“Merensky” or “MR”), which occurs around the Western Limb of the Bushveld Complex, (ii) the Upper Group 2 Layer or Reef (“UG2”), which occurs around the Eastern Limb of the Bushveld Complex and (iii) the Platreef (“Platreef”), found within the Northern Limb. These reefs exhibit extensive geological continuity and predictability and have an established history of economic PGM production. The Merensky, UG2 and Platreef have been producing PGMs since the 1920s, 1970s and 1990s, respectively.

- 17 –

Platinum Group Metals Ltd.

2016 Annual Information Form

Overview of the Bushveld Complex

(Map not drawn to scale)

Notes:

| 1 |

Anglo American Platinum Limited owns a 33% stake. | |

| 2 |

Comprised of Bathopele, Siphumelele and Thembelani mines. |

Projects 1 and 3 of the Western Bushveld Complex

The Maseve Mine and Project 3 are located adjacent to each other on the Western Limb of the Bushveld Complex, 110 km west northwest of Pretoria and 120 km from Johannesburg. The approximately 47 km2 of mining rights comprising the Maseve Mine and Project 3 are owned by project operating company Maseve, of which the Company owns an 82.9% interest and Wesizwe, through its subsidiary Africa Wide, owns 17.1% .