Form 10-Q MEDIVATION, INC. For: Mar 31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-Q

(Mark One)

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2015

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

COMMISSION FILE NUMBER: 001-32836

MEDIVATION, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 13-3863260 | |

| (State or other jurisdiction of incorporation or organization) |

(IRS Employer identification No.) |

525 Market Street, 36th floor

San Francisco, California 94105

(Address of principal executive offices) (Zip Code)

(415) 543-3470

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | x | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of May 1, 2015, 78,694,031 shares of the registrant’s Common Stock, $0.01 par value per share, were outstanding.

2

| ITEM 1. | FINANCIAL STATEMENTS |

CONSOLIDATED BALANCE SHEETS

(in thousands, except share and per share data)

(unaudited)

| March 31, 2015 |

December 31, 2014 |

|||||||

| ASSETS |

||||||||

| Current assets: |

||||||||

| Cash and cash equivalents |

$ | 568,636 | $ | 502,677 | ||||

| Receivable from collaboration partner |

126,613 | 184,737 | ||||||

| Deferred income tax assets |

20,035 | 21,987 | ||||||

| Prepaid expenses and other current assets |

12,821 | 12,264 | ||||||

| Restricted cash |

930 | 203 | ||||||

|

|

|

|

|

|||||

| Total current assets |

729,035 | 721,868 | ||||||

| Property and equipment, net |

42,031 | 41,161 | ||||||

| Intangible assets |

101,000 | 101,000 | ||||||

| Deferred income tax assets, non-current |

18,531 | 15,176 | ||||||

| Restricted cash, net of current |

12,409 | 11,562 | ||||||

| Goodwill |

10,000 | 10,000 | ||||||

| Other non-current assets |

11,845 | 10,852 | ||||||

|

|

|

|

|

|||||

| Total assets |

$ | 924,851 | $ | 911,619 | ||||

|

|

|

|

|

|||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

||||||||

| Current liabilities: |

||||||||

| Accounts payable, accrued expenses and other current liabilities |

$ | 91,965 | $ | 106,132 | ||||

| Contingent consideration |

10,000 | 10,000 | ||||||

| Deferred revenue |

1,411 | 2,822 | ||||||

| Current portion of build-to-suit lease obligation |

469 | 698 | ||||||

|

|

|

|

|

|||||

| Total current liabilities |

103,845 | 119,652 | ||||||

| Convertible Notes, net of unamortized discount of $32,993 and $36,598 at March 31, 2015 and December 31, 2014, respectively |

225,007 | 222,140 | ||||||

| Contingent consideration |

100,000 | 96,000 | ||||||

| Build-to-suit lease obligation, excluding current portion |

19,240 | 18,711 | ||||||

| Other non-current liabilities |

5,705 | 5,817 | ||||||

|

|

|

|

|

|||||

| Total liabilities |

453,797 | 462,320 | ||||||

| Commitments and contingencies (Note 13) |

||||||||

| Stockholders’ equity: |

||||||||

| Preferred stock, $0.01 par value per share; 1,000,000 shares authorized; no shares issued and outstanding |

— | — | ||||||

| Common stock, $0.01 par value per share; 170,000,000 shares authorized; 78,621,483 and 78,117,227 shares issued and outstanding at March 31, 2015 and December 31, 2014, respectively |

786 | 781 | ||||||

| Additional paid-in capital |

531,095 | 506,227 | ||||||

| Accumulated deficit |

(60,827 | ) | (57,709 | ) | ||||

|

|

|

|

|

|||||

| Total stockholders’ equity |

471,054 | 449,299 | ||||||

|

|

|

|

|

|||||

| Total liabilities and stockholders’ equity |

$ | 924,851 | $ | 911,619 | ||||

|

|

|

|

|

|||||

The accompanying notes are an integral part of these unaudited consolidated financial statements.

3

CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share data)

(unaudited)

| Three Months Ended March 31, |

||||||||

| 2015 | 2014 | |||||||

| Collaboration revenue |

$ | 129,188 | $ | 87,189 | ||||

| Operating expenses: |

||||||||

| Research and development expenses |

44,676 | 45,919 | ||||||

| Selling, general and administrative expenses |

83,939 | 49,735 | ||||||

|

|

|

|

|

|||||

| Total operating expenses |

128,615 | 95,654 | ||||||

|

|

|

|

|

|||||

| Income (loss) from operations |

573 | (8,465 | ) | |||||

| Other income (expense), net: |

||||||||

| Interest expense |

(5,608 | ) | (5,230 | ) | ||||

| Interest income |

11 | 9 | ||||||

| Other income (expense), net |

126 | (38 | ) | |||||

|

|

|

|

|

|||||

| Total other income (expense), net |

(5,471 | ) | (5,259 | ) | ||||

|

|

|

|

|

|||||

| Loss before income tax benefit |

(4,898 | ) | (13,724 | ) | ||||

| Income tax benefit |

1,780 | 59 | ||||||

|

|

|

|

|

|||||

| Net loss |

$ | (3,118 | ) | $ | (13,665 | ) | ||

|

|

|

|

|

|||||

| Basic and diluted net loss per common share |

$ | (0.04 | ) | $ | (0.18 | ) | ||

|

|

|

|

|

|||||

| Weighted average common shares used in the calculation of basic and diluted net loss per common share |

78,318 | 76,245 | ||||||

|

|

|

|

|

|||||

The accompanying notes are an integral part of these unaudited consolidated financial statements.

4

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

| Three Months Ended March 31, |

||||||||

| 2015 | 2014 | |||||||

| Cash flows from operating activities: |

||||||||

| Net loss |

$ | (3,118 | ) | $ | (13,665 | ) | ||

| Adjustments for non-cash operating items: |

||||||||

| Stock-based compensation |

13,372 | 9,661 | ||||||

| Change in fair value of contingent purchase consideration |

4,000 | — | ||||||

| Amortization of debt discount and debt issuance costs |

3,910 | 3,532 | ||||||

| Depreciation on property and equipment |

1,531 | 1,064 | ||||||

| Amortization of deferred revenue |

(1,411 | ) | (4,233 | ) | ||||

| Change in deferred income taxes |

(1,402 | ) | — | |||||

| Asset impairment and other charges |

73 | — | ||||||

| Changes in operating assets and liabilities: |

||||||||

| Receivable from collaboration partner |

58,124 | 13,959 | ||||||

| Prepaid expenses and other current assets |

(520 | ) | 3,121 | |||||

| Other non-current assets |

(1,335 | ) | (4,806 | ) | ||||

| Accounts payable, accrued expenses and other current liabilities |

(17,587 | ) | (2,687 | ) | ||||

| Interest payable |

1,698 | 1,698 | ||||||

| Other non-current liabilities |

(113 | ) | (255 | ) | ||||

|

|

|

|

|

|||||

| Net cash provided by operating activities |

57,222 | 7,389 | ||||||

|

|

|

|

|

|||||

| Cash flows from investing activities: |

||||||||

| Change in restricted cash |

(1,574 | ) | (2,073 | ) | ||||

| Purchases of property and equipment |

(956 | ) | (1,645 | ) | ||||

|

|

|

|

|

|||||

| Net cash used in investing activities |

(2,530 | ) | (3,718 | ) | ||||

|

|

|

|

|

|||||

| Cash flows from financing activities: |

||||||||

| Proceeds from issuance of common stock under equity incentive and stock purchase plans |

11,502 | 9,010 | ||||||

| Reduction of build-to-suit lease obligation |

(227 | ) | — | |||||

| Repayment of Convertible Notes |

(8 | ) | — | |||||

|

|

|

|

|

|||||

| Net cash provided by financing activities |

11,267 | 9,010 | ||||||

|

|

|

|

|

|||||

| Net increase in cash and cash equivalents |

65,959 | 12,681 | ||||||

| Cash and cash equivalents at beginning of period |

502,677 | 228,788 | ||||||

|

|

|

|

|

|||||

| Cash and cash equivalents at end of period |

$ | 568,636 | $ | 241,469 | ||||

|

|

|

|

|

|||||

| Supplemental disclosures of cash flow information: |

||||||||

| Non-cash investing activities: |

||||||||

| Interest capitalized during construction period for build-to-suit lease transactions |

$ | 527 | — | |||||

| Property and equipment expenditures incurred but not yet paid |

$ | 918 | $ | 385 | ||||

The accompanying notes are an integral part of these unaudited consolidated financial statements.

5

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2015

(unaudited)

NOTE 1. DESCRIPTION OF BUSINESS

Medivation, Inc. (the “Company” or “Medivation”) is a biopharmaceutical company focused on the development and commercialization of medically innovative therapies to treat serious diseases for which there are limited treatment options. Through the Company’s collaboration with Astellas Pharma, Inc. or Astellas, it has one commercial product, XTANDI® (enzalutamide) capsules, or XTANDI. XTANDI has received marketing approval in the United States, Europe, and numerous other countries worldwide for the treatment of patients with metastatic castration-resistant prostate cancer, or mCRPC, and in Japan for the treatment of patients with castration-resistant prostate cancer, or CRPC. Since its launch in the United States in September 2012, and subsequent launch in additional countries, XTANDI’s worldwide net sales (as reported by Astellas) were approximately $1.9 billion through March 31, 2015. The Company and Astellas are also conducting investigational studies of enzalutamide in prostate cancer and in advanced breast cancer. Under the Company’s collaboration agreement with Astellas, it shares with Astellas equally all profits (losses) related to U.S. net sales of XTANDI. The Company also receives royalties ranging from the low teens to the low twenties on ex-U.S. XTANDI net sales and certain milestone payments upon the achievement of defined development and sales events.

The Company seeks to become a global fully-integrated biopharmaceutical company through the continued commercialization of XTANDI, the acquisition or in-license and development and commercialization of other product opportunities, and through the advancement of its own proprietary research and development programs. The Company expects that its future growth may come from both internal research efforts and third party business development activities. In the fourth quarter of 2014, the Company licensed exclusive worldwide rights to pidilizumab (which is referred to as MDV9300), an immune modulatory, anti-Programmed Death-1 (PD-1) monoclonal antibody for all potential indications from CureTech, Ltd., or CureTech. Under the license agreement, the Company is responsible for all development, regulatory, manufacturing, and commercialization activities for MDV9300. The Company currently anticipates that it may initiate a Phase 3 clinical trial evaluating MDV9300 in one or more hematologic malignancies as early as in 2015. The Company is also considering evaluating MDV9300 in other indications, including but not limited to in combination with enzalutamide in breast and prostate cancer. In addition, the Company’s internal research and discovery efforts are focused, among other areas, in oncology and neurology.

The Company has incurred cumulative net losses of $60.8 million from inception through March 31, 2015, and may incur substantial costs in the foreseeable future as it continues to finance the commercialization of XTANDI in the U.S. market, clinical and preclinical studies of enzalutamide, MDV9300 and its early-stage programs, potential business development activities, and its corporate overhead costs. The Company has funded its operations primarily through public offerings of its common stock, the issuance of 2.625% convertible senior notes due April 1, 2017, or the Convertible Notes, from upfront, milestone, and cost-sharing payments under collaboration agreements, and subsequent to September 13, 2012, from collaboration revenue related to XTANDI net sales. As of March 31, 2015, the Company may earn up to $245.0 million of remaining sales milestones under the Astellas Collaboration Agreement.

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

(a) Basis of Presentation and Principles of Consolidation

The accompanying unaudited consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States, or U.S. GAAP, for interim financial information and with the instructions to Form 10-Q and Rule 10-01 of Regulation S-X. Accordingly, they do not include all of the information and footnotes required by U.S. GAAP for complete financial statements. The unaudited consolidated financial statements have been prepared on the same basis as the annual audited consolidated financial statements. In the opinion of management, all adjustments, consisting of normal recurring adjustments necessary for the fair statement of the Company’s financial condition, results of operations and cash flows for the periods presented, have been included. The results of operations of any interim period are not necessarily indicative of the results of operations for the full year or any other interim period.

The unaudited consolidated financial statements and related disclosures have been prepared with the presumption that users of the interim unaudited consolidated financial statements have read or have access to the audited consolidated financial statements for the preceding year. Accordingly, these unaudited consolidated financial statements should be read in conjunction with the audited consolidated financial statements and notes thereto for the fiscal year ended December 31, 2014, included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2014, or the Annual Report, filed with the U.S. Securities and Exchange Commission, or SEC, on February 25, 2015. The consolidated balance sheet at December 31, 2014 has been derived from the audited consolidated financial statements at that date.

6

The unaudited consolidated financial statements include the accounts of the Company and its subsidiaries. All intercompany transactions and balances have been eliminated in consolidation. The Company operates in one business segment.

All tabular disclosures of dollar and share amounts are presented in thousands unless otherwise indicated. All per share amounts are presented at their actual amounts. The number of shares issuable under the Amended and Restated 2004 Equity Incentive Award Plan, or the Medivation Equity Incentive Plan, and the Medivation, Inc. 2013 Employee Stock Purchase Plan, or ESPP, disclosed in Note 10, “Stockholders’ Equity,” are presented at their actual amounts unless otherwise indicated. Amounts presented herein may not calculate or sum precisely due to rounding.

(b) Use of Estimates

The preparation of unaudited consolidated financial statements in accordance with U.S. GAAP requires that management make estimates and assumptions in certain circumstances that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Management bases its estimates on historical experience and on assumptions believed to be reasonable under the circumstances. Although management believes that these estimates are reasonable, actual future results could differ materially from those estimates. In addition, had different estimates and assumptions been used, the consolidated financial statements could have differed materially from what is presented.

Significant estimates and assumptions used by management principally relate to revenue recognition, including reliance on third party information, estimating the performance periods of the Company’s deliverables under collaboration agreements, and estimating the various deductions from gross sales to calculate net sales of XTANDI. Additionally, significant estimates and assumptions used by management include those related to contingent purchase consideration, intangible assets, goodwill, the Convertible Notes, determining whether the Company is the primary beneficiary of any variable interest entities, leases, taxes, research and development and other accruals, and share-based compensation.

(c) Significant Accounting Policies

Reference is made to Note 2, “Summary of Significant Accounting Policies,” included in the notes to the Company’s audited consolidated financial statements included in its Annual Report. As of the date of the filing of this Quarterly Report on Form 10-Q, or Quarterly Report, there were no significant changes to the significant accounting policies described in the Company’s Annual Report.

(d) New Accounting Pronouncements

In April 2015, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2015-03, “Interest – Imputation of Interest (Subtopic 835-30): Simplifying the Presentation of Debt Issuance Costs,” which requires that debt issuance costs related to a recognized debt liability be presented on the balance sheet as a direct deduction from the carrying amount of the debt liability, consistent with debt discounts. The ASU requires retrospective adoption and is effective for reporting periods beginning after December 15, 2015. Early adoption is permitted. The Company is currently assessing the impact the adoption of the ASU will have on its consolidated financial statements and related disclosures.

In February 2015, the FASB issued ASU 2015-02, “Consolidation (Topic 820): Amendments to the Consolidation Analysis.” The amended guidance provides a revised consolidation model for all reporting entities to use in evaluating whether they should consolidate certain legal entities. All legal entities will be subject to reevaluation under this revised consolidation model. The revised consolidation model, among other things, (i) modifies the evaluation of whether limited partnerships and similar legal entities are voting interest entities, (ii) eliminates the presumption that a general partner should consolidate a limited partnership, and (iii) modifies the consolidation analysis of reporting entities that are involved with voting interest entities through fee arrangements and related party relationships. The amended guidance is effective for fiscal years beginning after December 15, 2015, including interim periods within that reporting period. The Company is currently evaluating the effect, if any, that the amended guidance will have on its consolidated financial statements and related disclosures.

In May 2014, the FASB issued ASU 2014-09, “Revenue from Contracts with Customers” (Topic 606), a comprehensive new revenue recognition standard that will supersede the existing revenue recognition guidance. The new accounting guidance creates a framework by which an entity will allocate the transaction price to separate performance obligations and recognize revenue when (or as) each performance obligation is satisfied. Under the new standard, entities will be required to use judgment and make estimates, including identifying performance obligations in a contract, estimating the amount of variable consideration to include in the transaction price, allocating the transaction price to each separate performance obligation and determining when an entity satisfies its performance obligations. The standard allows for either “full retrospective” adoption, meaning that the standard is applied to all of the periods presented with a cumulative catch-up as of the earliest period presented, or “modified retrospective” adoption, meaning the

7

standard is applied only to the most current period presented in the financial statements with a cumulative catch-up as of the current period. On April 1, 2015, the FASB proposed deferring the effective date by one year to December 15, 2017 for annual reporting periods beginning after that date. The FASB also proposed permitting early adoption of the standard, but not before the original effective date of December 15, 2016. The Company has not yet selected a transition method and is currently evaluating the effect that the updated standard will have on its consolidated financial statements and related disclosures.

NOTE 3. COLLABORATION AGREEMENT

(a) Collaboration Agreement with Astellas

In October 2009, the Company entered into a collaboration agreement with Astellas, or the Astellas Collaboration Agreement, pursuant to which it is collaborating with Astellas to develop and commercialize XTANDI globally. Under the agreement, decision making and economic participation differs between the U.S. market and the ex-U.S. market. In the United States, decisions are generally made by consensus, pre-tax profits and losses are shared equally, and, subject to certain exceptions, development and commercialization costs (including cost of goods sold and the royalty on net sales payable to The Regents of the University of California (“UCLA” or “the Regents”) under the Company’s license agreement with UCLA) are also shared equally. The primary exceptions to equal cost sharing in the U.S. market are that each party is responsible for its own commercial full-time equivalent, or FTE, costs, and that development costs supporting marketing approvals in both the United States and either Europe or Japan are borne one-third by the Company and two-thirds by Astellas. The Company and Astellas are co-promoting XTANDI in the U.S. market, with each company providing half of the sales and medical affairs effort in support of the product. Both the Company and Astellas are entitled to receive a fee for each qualifying detail made by its respective sales representatives. Outside the United States, decisions are generally made by Astellas and all development and commercialization costs (including cost of goods sold and the royalty on net sales payable to UCLA) are borne by Astellas. Astellas retains all ex-U.S. profits and losses, and pays the Company a tiered royalty ranging from the low teens to the low twenties on the aggregate net sales of XTANDI outside the United States, or ex-U.S. XTANDI net sales. Astellas has sole responsibility for promoting XTANDI outside the United States and for recording all XTANDI net sales both inside and outside the United States. Both the Company and Astellas have agreed not to commercialize certain other products having a similar mechanism of action (as defined by the Astellas Collaboration Agreement) as XTANDI for the treatment of prostate cancer for a specified time period, subject to certain exceptions.

Under the Astellas Collaboration Agreement, Astellas paid the Company a non-refundable, upfront cash payment of $110.0 million in the fourth quarter of 2009. The Company is also eligible to receive up to $335.0 million in development milestone payments and up to $320.0 million in sales milestone payments. As of March 31, 2015, the Company has earned all of the $335.0 million in development milestone payments and $75.0 million of the sales milestone payments under the Astellas Collaboration Agreement. The Company expects that any of the remaining $245.0 million in sales milestone payments that the Company may earn in future periods will be recognized as revenue in their entirety in the period in which the underlying milestone event is achieved. The triggering events for the sales milestone payments are as follows:

| Annual Global Net Sales in a Calendar Year |

Milestone Payment(1) | |||

| $400 million |

(2 | ) | ||

| $800 million |

(3 | ) | ||

| $1.2 billion |

$ | 70 million | ||

| $1.6 billion |

$ | 175 million | ||

| (1) | Each milestone shall only be paid once during the term of the Astellas Collaboration Agreement. |

| (2) | This milestone totaling $25.0 million was earned and recognized as collaboration revenue during the fourth quarter of 2013 and payment was received in the first quarter of 2014. |

| (3) | This milestone totaling $50.0 million was earned and recognized as collaboration revenue during the fourth quarter of 2014 and is included in receivable from collaboration partner on the consolidated balance sheet at December 31, 2014. Payment was received during the first quarter of 2015. |

The Company and Astellas are each permitted to terminate the Astellas Collaboration Agreement for an uncured material breach by the other party or for the insolvency of the other party. Astellas has a right to terminate the Astellas Collaboration Agreement unilaterally by advance written notice to the Company. Following any termination of the Astellas Collaboration Agreement in its entirety, all rights to develop and commercialize XTANDI will revert to the Company, and Astellas will grant a license to the Company to enable it to continue such development and commercialization. In addition, except in the case of a termination by Astellas for the Company’s material breach, Astellas will supply XTANDI to the Company during a specified transition period.

Unless terminated earlier by the Company or Astellas pursuant to the terms thereof, the Astellas Collaboration Agreement will remain in effect: (a) in the United States, until such time as Astellas notifies the Company that Astellas has permanently stopped selling products covered by the Astellas Collaboration Agreement in the United States; and (b) in each other country of the world, on a

8

country-by-country basis, until such time as (i) products covered by the Astellas Collaboration Agreement cease to be protected by patents or regulatory exclusivity in such country and (ii) commercial sales of generic equivalent products have commenced in such country.

(b) Collaboration Revenue

Collaboration revenue consists of three components: (a) collaboration revenue related to U.S. XTANDI net sales; (b) collaboration revenue related to ex-U.S. XTANDI net sales; and (c) collaboration revenue related to upfront and milestone payments.

Collaboration revenue was as follows:

| Three Months Ended March 31, |

||||||||

| 2015 | 2014 | |||||||

| Collaboration revenue: |

||||||||

| Related to U.S. XTANDI net sales |

$ | 112,010 | $ | 62,225 | ||||

| Related to ex-U.S. XTANDI net sales |

15,767 | 5,731 | ||||||

| Related to upfront and milestone payments |

1,411 | 19,233 | ||||||

|

|

|

|

|

|||||

| Total |

$ | 129,188 | $ | 87,189 | ||||

|

|

|

|

|

|||||

The Company is required to pay UCLA ten percent of all Sublicensing Income, as defined in its license agreement with UCLA. The Company is currently involved in litigation with UCLA regarding certain terms of the license agreement and other matters, which are discussed in Note 13, “Commitments and Contingencies.”

Collaboration Revenue Related to U.S. XTANDI Net Sales

Under the Astellas Collaboration Agreement, Astellas records all U.S. XTANDI net sales. The Company and Astellas share equally all pre-tax profits and losses from U.S. XTANDI net sales. Subject to certain exceptions, the Company and Astellas also share equally all XTANDI development and commercialization costs attributable to the U.S. market, including cost of goods sold and the royalty on net sales payable to UCLA under the Company’s license agreement with UCLA. The primary exceptions to 50/50 cost sharing are that each party is responsible for its own commercial FTE costs and that development costs supporting marketing approvals in both the United States and either Europe or Japan are borne one-third by the Company and two-thirds by Astellas. The Company recognizes collaboration revenue related to U.S. XTANDI net sales in the period in which such sales occur. Collaboration revenue related to U.S. XTANDI net sales consists of the Company’s share of pre-tax profits and losses from U.S. XTANDI net sales, plus reimbursement of the Company’s share of reimbursable U.S. development and commercialization costs. The Company’s collaboration revenue related to U.S. XTANDI net sales in any given period is equal to 50% of U.S. XTANDI net sales as reported by Astellas for the applicable period.

Collaboration revenue related to U.S. XTANDI net sales was as follows:

| Three Months Ended March 31, |

||||||||

| 2015 | 2014 | |||||||

| U.S. XTANDI net sales (as reported by Astellas) |

$ | 224,020 | $ | 124,451 | ||||

| Shared U.S. development and commercialization costs |

(110,313 | ) | (77,707 | ) | ||||

|

|

|

|

|

|||||

| Pre-tax U.S. profit |

$ | 113,707 | $ | 46,744 | ||||

|

|

|

|

|

|||||

| Medivation’s share of pre-tax U.S. profit |

$ | 56,853 | $ | 23,372 | ||||

| Reimbursement of Medivation’s share of shared U.S. costs |

55,157 | 38,853 | ||||||

|

|

|

|

|

|||||

| Collaboration revenue related to U.S. XTANDI net sales |

$ | 112,010 | $ | 62,225 | ||||

|

|

|

|

|

|||||

Collaboration Revenue Related to Ex-U.S. XTANDI Net Sales

Under the Astellas Collaboration Agreement, Astellas records all ex-U.S. XTANDI net sales. Astellas is responsible for all development and commercialization costs for XTANDI outside the United States, including cost of goods sold and the royalty on net

9

sales payable to UCLA under the Company’s license agreement with UCLA, and pays the Company a tiered royalty ranging from the low teens to the low twenties on net ex-U.S. XTANDI net sales. The Company recognizes collaboration revenue related to ex-U.S. XTANDI net sales in the period in which such sales occur. Collaboration revenue related to ex-U.S. XTANDI net sales consists of royalties from Astellas on those sales.

Collaboration revenue related to ex-U.S. XTANDI net sales was $15.8 million and $5.7 million for the three months ended March 31, 2015 and 2014, respectively.

Collaboration Revenue Related to Upfront and Milestone Payments

Collaboration revenue related to upfront and milestone payments from Astellas was as follows:

| Three Months Ended March 31, |

||||||||

| 2015 | 2014 | |||||||

| Development milestones earned |

$ | — | $ | 15,000 | ||||

| Amortization of deferred upfront and development milestones |

1,411 | 4,233 | ||||||

|

|

|

|

|

|||||

| Total |

$ | 1,411 | $ | 19,233 | ||||

|

|

|

|

|

|||||

Deferred revenue under the Astellas Collaboration Agreement was $1.4 million and $2.8 million at March 31, 2015, and December 31, 2014, respectively.

(c) Cost-Sharing Payments

Under the Astellas Collaboration Agreement, the Company and Astellas share certain development and commercialization costs (including cost of goods sold and the royalty on net sales payable to UCLA under the Company’s license agreement with UCLA) in the United States. For the three months ended March 31, 2015 and 2014, development cost sharing payments from Astellas were $13.8 million and $15.9 million, respectively, and were recorded as reductions in research and development, or R&D, expenses. For the three months ended March 31, 2015 and 2014, commercialization cost-sharing payments to Astellas were $20.1 million and $7.6 million, respectively, and were recorded as increases in selling, general, and administrative, or SG&A, expenses.

NOTE 4. GOODWILL AND INTANGIBLE ASSETS

In the fourth quarter of 2014, the Company entered into a License Agreement with CureTech, pursuant to which it licensed exclusive worldwide rights to CureTech’s late-stage clinical molecule, MDV9300. The Company concluded that the in-license transaction is an acquisition of a business in accordance with Accounting Standards Codification, or ASC, 805-10, “Business Combinations.” The transaction resulted in identifiable intangible assets of $101.0 million consisting entirely of in-process research and development, or IPR&D, and goodwill of $10.0 million. The Company accounts for IPR&D as indefinite-lived intangible assets until regulatory approval or discontinuation at which time the Company evaluates impairment, converts the carrying value into a definite-lived intangible asset and determines the economic life for amortization purposes. The Company assesses the impairment of intangible assets and goodwill on an annual basis or more frequently whenever events or changes in circumstances may indicate that the carrying value might not be recoverable. There were no changes to the carrying value of goodwill or indefinite-lived intangible assets during the three months ended March 31, 2015.

NOTE 5. NET INCOME (LOSS) PER COMMON SHARE

The computation of basic net income (loss) per common share is based on the weighted-average number of common shares outstanding during each period. The computation of diluted net income (loss) per common share is based on the weighted-average number of common shares outstanding during the period plus, when their effect is dilutive, incremental shares consisting of shares subject to stock options, restricted stock units, stock appreciation rights, ESPP shares, warrants, and shares issuable upon conversion of convertible debt.

In periods where the Company reports a net loss, all common stock equivalents are deemed anti-dilutive such that basic net loss per common share and diluted net loss per common share are equal. The Convertible Notes can be settled in common stock, cash, or a combination thereof, at the Company’s election. During periods of net income, the Company’s intent and ability to settle the Convertible Notes in cash could impact the computation of diluted net income per common share.

10

Approximately 11.4 million and 12.6 million potentially dilutive common shares have been excluded from the diluted net loss per common share computations for the three months ended March 31, 2015 and 2014, respectively, because such securities have an anti-dilutive effect on net loss per common share due to the Company’s net loss in each of these periods.

NOTE 6. CONVERTIBLE SENIOR NOTES DUE 2017

On March 19, 2012, the Company issued $258.8 million aggregate principal amount of the Convertible Notes. The Company pays interest semi-annually in arrears on April 1 and October 1 of each year. The Convertible Notes mature on April 1, 2017, unless earlier converted, redeemed or repurchased in accordance with their terms. The Convertible Notes are general senior unsecured obligations and rank (1) senior in right of payment to any of the Company’s future indebtedness that is expressly subordinated in right of payment to the Convertible Notes, (2) equal in right of payment to any of the Company’s future indebtedness and other liabilities of the Company that are not so subordinated, (3) junior in right of payment to any of the Company’s secured indebtedness to the extent of the value of the assets securing such indebtedness and (4) structurally junior to all future indebtedness incurred by the Company’s subsidiaries and their other liabilities (including trade payables).

Prior to April 6, 2015, the Convertible Notes were not redeemable. On or after April 6, 2015, the Company may elect to redeem for cash all or a part of the Convertible Notes if the closing sale price of its common stock for 20 or more trading days in a period of 30 consecutive trading days ending on the trading day preceding the date it provides notice of the redemption exceeds 130% of the conversion price in effect on each such trading day, subject to certain conditions. The redemption price will equal 100% of the principal amount of the Convertible Notes to be redeemed plus accrued and unpaid interest, if any, to, but excluding the redemption date. If a fundamental change (as defined in the Indenture) occurs prior to the maturity date, holders may require the Company to purchase for cash all or any portion of the Convertible Notes at a purchase price equal to 100% of the principal amount of the Convertible Notes to be purchased plus accrued and unpaid interest, if any, to, but excluding, the fundamental change purchase date.

Holders may convert their Convertible Notes prior to the close of business on the business day immediately preceding January 1, 2017 only upon the occurrence of the following circumstances: (1) during any calendar quarter commencing after the calendar quarter ending on June 30, 2012, if the closing sale price of the Company’s common stock, for at least 20 trading days (whether or not consecutive) in the period of 30 consecutive trading days ending on the last trading day of the calendar quarter immediately preceding the calendar quarter in which the conversion occurs, is more than 130% of the conversion price of the Convertible Notes in effect on each applicable trading day; (2) during the five consecutive trading-day period following any five consecutive trading-day period in which the trading price for the Convertible Notes for each such trading day was less than 98% of the closing sale price of the Company’s common stock on such date multiplied by the then-current conversion rate; (3) upon the occurrence of specified corporate events; or (4) if the Company calls any Convertible Notes for redemption, at any time until the close of business on the second business day preceding the redemption date. On or after January 1, 2017 until the close of business on the second business day immediately preceding the stated maturity date, holders may surrender their Convertible Notes for conversion at any time, regardless of the foregoing circumstances.

At March 31, 2015, the Convertible Notes met a requirement of convertibility because the Company’s common stock price was in excess of the stated conversion premium for at least 20 trading days in the period of 30 consecutive trading days ending on March 31, 2015. The Convertible Notes remain convertible through June 30, 2015. Convertibility of the Convertible Notes based on the trading price of the Company’s common stock is assessed on a calendar-quarter basis. Upon a conversion of the Convertible Notes, the Company is required to pay or deliver, as the case may be, cash, shares of the Company’s common stock, or a combination of both, at the Company’s election. As of March 31, 2015, the conversion rate was 19.5172 shares of common stock per $1,000 principal amount of the Convertible Notes, equivalent to a conversion price of approximately $51.24 per share of common stock. The conversion rate is subject to adjustment in certain events, such as distribution of dividends and stock splits. In addition, upon a Make-Whole Adjustment Event (as defined in the Indenture), the Company will, under certain circumstances, increase the applicable conversion rate for a holder that elects to convert its Convertible Notes in connection with such Make-Whole Adjustment Event.

During the first quarter of 2015, the Company received notification that $0.7 million principal amount of Convertible Notes were surrendered for conversion. The Company settled the principal and conversion premium for approximately $1.9 million in cash during the second quarter of 2015. At March 31, 2015, the $0.7 million principal amount was included in current liabilities on the consolidated balance sheet.

During the second quarter of 2015 (through May 5, 2015), the Company received notification that $90.3 million principal amount of Convertible Notes were surrendered for conversion, and settlement is anticipated to occur during the second quarter of 2015. The Company has elected to settle these conversion obligations through a combination of cash and shares of its common stock. The total payment will be based on the average of the volume-weighted-average prices of the Company’s common stock during the 20 trading-day cash settlement averaging periods specified in the Indenture governing the notes. The Company estimates the cash payment will be approximately $90.3 million for Convertible Notes surrendered through May 5, 2015.

11

Interest expense on the Convertible Notes consisted of the following:

| Three Months Ended March 31, |

||||||||

| 2015 | 2014 | |||||||

| Coupon interest expense |

$ | 1,698 | $ | 1,698 | ||||

| Non-cash amortization of debt discount |

3,605 | 3,257 | ||||||

| Non-cash amortization of debt issuance costs |

305 | 275 | ||||||

|

|

|

|

|

|||||

| Total |

$ | 5,608 | $ | 5,230 | ||||

|

|

|

|

|

|||||

NOTE 7. BUILD-TO-SUIT LEASE OBLIGATION

In the fourth quarter of 2013, the Company entered into a property lease for approximately 52,000 square feet of space located in San Francisco, California. The lease agreement expires in July 2024, and the Company has an option to extend the lease term for up to an additional five years.

The Company is deemed, for accounting purposes only, to be the owner of the entire project including the building shell, even though it is not the legal owner. In connection with the Company’s accounting for this transaction, the Company capitalized $14.5 million as a build-to-suit property within property and equipment, net, and recognized a corresponding build-to-suit lease obligation for the same amount. The Company has also recognized, as an additional build-to-suit lease obligation, structural tenant improvements totaling $3.6 million for amounts paid by the landlord and $2.0 million for capitalized interest during the construction period.

A portion of the monthly lease payment is allocated to land rent and recorded as an operating lease expense and the non-interest portion of the amortized lease payments to the landlord related to the rent of the building is applied to reduce the build-to-suit lease obligation. At March 31, 2015, $0.5 million of the build-to-suit lease obligation representing the expected reduction in the liability over the next twelve months was classified as a current liability and the remaining $19.2 million was classified as a non-current liability on the consolidated balance sheet. Expected reductions (increases) in the build-to-suit lease obligation at March 31, 2015 were as follows:

| Years Ending December 31, |

Build-To-Suit Lease Obligation |

|||

| Remainder of 2015 |

$ | 473 | ||

| 2016 |

(1 | ) | ||

| 2017 |

77 | |||

| 2018 |

162 | |||

| 2019 |

254 | |||

| 2020 and thereafter |

18,744 | |||

|

|

|

|||

| Total |

$ | 19,709 | ||

|

|

|

|||

The amounts included in the table above represent the reductions (increases) in the build-to-suit lease obligation on the Company’s consolidated balance sheet in each of the periods presented. The amount in the terminal period includes the amount to derecognize the build-to-suit lease obligation at the end of the lease term. The expected reductions (increases) in the build-to-suit lease obligation presented in the table above are impacted by the timing of the completion of the construction project. Actual expected lease payments under the build-to-suit lease obligation are included in Note 13, “Commitments and Contingencies.”

12

NOTE 8. PROPERTY AND EQUIPMENT, NET

Property and equipment, net, consisted of the following:

| March 31, 2015 |

December 31, 2014 |

|||||||

| Build-to-suit property |

$ | 20,071 | $ | 19,544 | ||||

| Leasehold improvements |

15,002 | 15,051 | ||||||

| Computer equipment and software |

9,976 | 9,499 | ||||||

| Furniture and fixtures |

4,667 | 4,667 | ||||||

| Construction in progress |

2,806 | 1,360 | ||||||

| Laboratory equipment |

735 | 735 | ||||||

|

|

|

|

|

|||||

| 53,257 | 50,856 | |||||||

| Less: Accumulated depreciation |

(11,226 | ) | (9,695 | ) | ||||

|

|

|

|

|

|||||

| Total |

$ | 42,031 | $ | 41,161 | ||||

|

|

|

|

|

|||||

NOTE 9. ACCOUNTS PAYABLE, ACCRUED EXPENSES AND OTHER CURRENT LIABILITIES

Accounts payable, accrued expenses and other current liabilities consisted of the following:

| March 31, 2015 |

December 31, 2014 |

|||||||

| Clinical and preclinical |

$ | 32,381 | $ | 31,069 | ||||

| Royalties payable |

13,554 | 13,582 | ||||||

| Accrued professional services and other current liabilities |

12,567 | 8,909 | ||||||

| Accounts payable |

12,212 | 10,492 | ||||||

| Payroll and payroll-related |

11,166 | 33,272 | ||||||

| Other payable to licensor |

5,949 | 5,000 | ||||||

| Interest payable |

3,396 | 1,698 | ||||||

| Current portion of long-term debt |

738 | 4 | ||||||

| Taxes payable |

2 | 2,106 | ||||||

|

|

|

|

|

|||||

| Total |

$ | 91,965 | $ | 106,132 | ||||

|

|

|

|

|

|||||

Accounts payable represents short-term liabilities for which the Company has received and processed a vendor invoice prior to the end of the reporting period. Accrued expenses and other current liabilities represent, among other things, compensation and related benefits to employees, royalties due to licensors of technologies, cash interest payable related to the Company’s Convertible Notes, estimated amounts due to third party vendors for services rendered prior to the end of the reporting period, invoices received from third party vendors that have not yet been processed, taxes payable, current portion of long-term debt, and other accrued items.

NOTE 10. STOCKHOLDERS’ EQUITY

(a) Stock Purchase Rights

All shares of the Company’s common stock, if issued prior to the termination by the Company of its rights agreement, dated as of December 4, 2006, include stock purchase rights. The rights are exercisable only if a person or group acquires twenty percent or more of the Company’s common stock or announces a tender or exchange offer which would result in ownership of twenty percent or more of the Company’s common stock. Following the acquisition of twenty percent or more of the Company’s common stock, the holders of the rights, other than the acquiring person or group, may purchase Medivation common stock at half of its fair market value. In the event of a merger or other acquisition of the Company, the holders of the rights, other than the acquiring person or group, may purchase shares of the acquiring entity at half of their fair market value. The rights were not exercisable at March 31, 2015.

(b) Medivation Equity Incentive Plan

The Medivation Equity Incentive Plan provides for the issuance of options and other stock-based awards, including restricted stock units, performance share awards and stock appreciation rights. The vesting of all outstanding awards under the Medivation Equity Incentive Plan will accelerate, and all such share awards will become immediately exercisable, upon a “change of control” of Medivation, as defined in the Medivation Equity Incentive Plan. At March 31, 2015, there were 21,150,000 shares of common stock authorized for issuance under the Medivation Equity Incentive Plan, of which approximately 2.0 million shares of common stock were available for issuance under the Medivation Equity Incentive Plan.

13

Stock Options

The following table summarizes stock option activity for the three months ended March 31, 2015:

| Number of Options |

Weighted Average Exercise Price |

Weighted Average Remaining Contractual Term (in years) |

Aggregate Intrinsic Value (1) |

|||||||||||||

| Outstanding at December 31, 2014 |

5,067,957 | $ | 33.52 | |||||||||||||

| Granted |

507,916 | $ | 114.56 | |||||||||||||

| Exercised |

(374,281 | ) | $ | 23.07 | ||||||||||||

| Forfeited |

(18,502 | ) | $ | 78.60 | ||||||||||||

|

|

|

|||||||||||||||

| Outstanding at March 31, 2015 |

5,183,090 | $ | 42.06 | 6.56 | $ | 451.0 | ||||||||||

|

|

|

|||||||||||||||

| Vested and exercisable at March 31, 2015 |

3,323,776 | $ | 22.56 | 5.33 | $ | 354.0 | ||||||||||

|

|

|

|||||||||||||||

| (1) | The aggregate intrinsic value is calculated as the pre-tax difference between the weighted average exercise price of the underlying awards and the closing price per share of $129.07 of the Company’s common stock on March 31, 2015. The calculation excludes any awards with an exercise price higher than the closing price of the Company’s common stock on March 31, 2015. The amounts are presented in millions. |

The weighted-average grant-date fair value per share of options granted during the three months ended March 31, 2015 was $51.07.

Restricted Stock Units

The following table summarizes restricted stock unit activity for the three months ended March 31, 2015:

| Number of Shares |

Weighted- Average Grant-Date Fair Value |

|||||||

| Unvested at December 31, 2014 |

483,580 | $ | 76.20 | |||||

| Granted |

194,171 | $ | 110.36 | |||||

| Vested |

(74,370 | ) | $ | 81.28 | ||||

| Forfeited |

(7,932 | ) | $ | 87.36 | ||||

|

|

|

|||||||

| Unvested at March 31, 2015 |

595,449 | $ | 86.56 | |||||

|

|

|

|||||||

Stock Appreciation Rights

The following table summarizes stock appreciation rights activity for the three months ended March 31, 2015:

| Number of Rights |

Weighted Average Exercise Price |

Weighted Average Remaining Contractual Term (in years) |

Aggregate Intrinsic Value (1) |

|||||||||||||

| Outstanding at December 31, 2014 |

688,228 | $ | 24.05 | |||||||||||||

| Granted |

— | — | ||||||||||||||

| Exercised |

(26,912 | ) | $ | 23.20 | ||||||||||||

| Forfeited |

— | — | ||||||||||||||

|

|

|

|||||||||||||||

| Outstanding at March 31, 2015 |

661,316 | $ | 24.08 | 6.72 | $ | 69.4 | ||||||||||

|

|

|

|||||||||||||||

| Vested and exercisable at March 31, 2015 |

520,222 | $ | 24.11 | 6.71 | $ | 54.6 | ||||||||||

|

|

|

|||||||||||||||

14

| (1) | The aggregate intrinsic value is calculated as the pre-tax difference between the weighted average exercise price of the underlying awards and the closing price per share of $129.07 of the Company’s common stock on March 31, 2015. The calculation excludes any awards with an exercise price higher than the closing price of the Company’s common stock on March 31, 2015. The amounts are presented in millions. |

(c) ESPP

The ESPP permits eligible employees to purchase shares of the Company’s common stock through payroll deductions at the lower of 85% of the fair market value of the common stock at the beginning or end of a purchase period. Eligible employee contributions are limited on an annual basis to $25,000 in accordance with Section 423 of the Internal Revenue Code. As of March 31, 2015, a total of 3,000,000 shares of the Company’s common stock were authorized for issuance under the ESPP, and 123,680 shares have been issued.

(d) Stock-Based Compensation

The Company estimates the fair value of stock options, stock appreciation rights, and ESPP shares using the Black-Scholes valuation model. The Black-Scholes assumptions used to estimate the fair value of stock options granted were as follows:

| Three Months Ended March 31, |

||||||||

| 2015 | 2014 | |||||||

| Risk-free interest rate |

1.56%-1.61 | % | 1.57-1.65 | % | ||||

| Estimated term (in years) |

4.98 | 5.23 | ||||||

| Estimated volatility |

50 | % | 64 | % | ||||

| Estimated dividend yield |

— | — | ||||||

No ESPP offering periods commenced during the three months ended March 31, 2015 and 2014, respectively.

Stock-based compensation expense was as follows:

| Three Months Ended March 31, |

||||||||

| 2015 | 2014 | |||||||

| Stock-based compensation expense recognized as: |

||||||||

| R&D expenses |

$ | 5,811 | $ | 4,122 | ||||

| SG&A expenses |

7,561 | 5,539 | ||||||

|

|

|

|

|

|||||

| Total |

$ | 13,372 | $ | 9,661 | ||||

|

|

|

|

|

|||||

Unrecognized stock-based compensation expense totaled $104.3 million at March 31, 2015 and is expected to be recognized over a weighted-average period of 2.7 years.

NOTE 11. INCOME TAXES

The Company calculates its quarterly income tax provision in accordance with the guidance provided by ASC 740-270, “Interim Income Tax Accounting,” whereby the Company forecasts its estimated annual effective tax rate and then applies that rate to its year-to-date pre-tax book income (loss). Income tax benefit for the three months ended March 31, 2015 was $1.8 million. The provision for income taxes was higher than the tax computed at the U.S. federal statutory rate due primarily to state income taxes and non-deductible stock-based compensation. Income tax benefit for the three months ended March 31, 2014 was not significant.

The effective tax rate was 36.3% for the three months ended March 31, 2015.The effective tax rate for the three months ended March 31, 2014 was not significant. The increase in the effective tax rate for the three months ended March 31, 2015 as compared to the prior year period was due to the release of a portion of the valuation allowance during the fourth quarter of 2014.

15

The Company records a valuation allowance to reduce deferred tax assets to reflect the net amount that is more likely than not to be realized. Based upon the weight of available evidence at December 31, 2014, the Company determined that it was more likely than not that a portion of its deferred tax assets would be realizable and consequently released the valuation allowance against Federal and certain state net deferred tax assets and recorded a discrete tax benefit of $33.4 million during the fourth quarter of 2014. The decision to reverse a portion of the valuation allowance was made after management considered all available evidence, both positive and negative, including but not limited to the historical operating results, income or loss in recent periods, cumulative income in recent years, forecasted earnings, forecasted future taxable income, and significant risk and uncertainty related to forecasts. The release of the valuation allowance resulted in the recognition of certain deferred net tax assets and a decrease to income tax expense.

The future effective tax rate is subject to volatility and may be materially impacted by various internal and external factors. These factors may include, but are not limited to, the amount of income tax benefits and charges from: interpretations of existing tax laws; changes in tax laws and rates; future levels of research and development expenditures; changes in the mix of earnings in countries with differing statutory tax rates in which the Company may conduct business; changes in the valuation of deferred tax assets and liabilities; state income taxes; the tax impact of stock-based compensation; accounting for uncertain tax positions; closure of statute of limitations or settlement of tax audits; changes in estimates of prior years’ items; tax costs for acquisition-related items; changes in accounting standards; non-deductible officers’ compensation; limitations on the utilization of net operating losses and tax credits due to changes in ownership; and overall levels of income before taxes.

NOTE 12. FAIR VALUE DISCLOSURES

The following table presents the Company’s financial assets and liabilities that are measured at fair value on a recurring basis:

| Fair value measurements using: | ||||||||||||||||

| Fair Value | Level 1 | Level 2 | Level 3 | |||||||||||||

| March 31, 2015: |

||||||||||||||||

| Cash equivalents: |

||||||||||||||||

| Money market funds |

$ | 189,036 | $ | 189,036 | — | — | ||||||||||

| Current liabilities: |

||||||||||||||||

| Contingent consideration |

$ | 10,000 | — | — | $ | 10,000 | ||||||||||

| Long-term liabilities |

||||||||||||||||

| Contingent consideration |

$ | 100,000 | — | — | $ | 100,000 | ||||||||||

| December 31, 2014: |

||||||||||||||||

| Cash equivalents: |

||||||||||||||||

| Money market funds |

$ | 189,031 | $ | 189,031 | — | — | ||||||||||

| Current liabilities: |

||||||||||||||||

| Contingent consideration |

$ | 10,000 | — | — | $ | 10,000 | ||||||||||

| Long-term liabilities |

||||||||||||||||

| Contingent consideration |

$ | 96,000 | — | — | $ | 96,000 | ||||||||||

16

In connection with the CureTech license transaction, the Company recorded contingent consideration liabilities pertaining to amounts potentially payable to CureTech. The fair value of contingent consideration was estimated utilizing a model with key assumptions that included estimated revenues or completion of certain development and sales milestone targets during the earn-out period, volatility, and estimated discount rates corresponding to the periods of expected payments. The estimated fair value of the contingent consideration liability is measured at each reporting period based on significant inputs not observable in the market. The Company assesses these estimates on an ongoing basis as additional data impacting the assumptions is obtained. Changes in the estimated fair value of contingent consideration are reflected as non-cash adjustments to operating expenses in the consolidated statements of operations. During the three months ended March 31, 2015, the Company recorded a non-cash fair value adjustment of $1.0 million and $3.0 million in the statement of operations to increase R&D expenses and SG&A expenses, respectively.

Contingent consideration may change significantly as development progresses and additional data is obtained that will affect the Company’s assumptions regarding probabilities of successful achievement of related milestones used to estimate the fair value of the liability and the timing in which they are expected to be achieved. Considerable judgment is required to interpret the market data used to develop the assumptions. The estimates of fair value may not be indicative of amounts that could be realized in a current market exchange. Accordingly, the use of different market assumptions and/or different valuation techniques could result in materially different fair value estimates.

The $4.0 million increase in the fair value of the contingent consideration liability during the three months ended March 31, 2015 is primarily due to the time value of money. The aggregate remaining, undiscounted amount of contingent consideration that the Company could potentially be required to pay to CureTech under the License Agreement is included in the table below:

| Potential sales milestones |

$ | 245,000 | ||

| Potential development and regulatory milestones |

$ | 85,000 | ||

| Potential payment upon completion of Manufacturing Technology Transfer |

$ | 5,000 | ||

| Potential future tiered royalties on annual worldwide net sales |

5% to 11 | % |

There were no transfers between Level 1 and Level 2 financial instruments during the three months ended March 31, 2015 and 2014. The following table includes a roll-forward of the fair value of Level 3 financial instruments:

| Three Months Ended March 31, |

||||||||

| 2015 | 2014 | |||||||

| Long-Term Liabilities (Contingent Consideration): |

||||||||

| Balance at beginning of period |

$ | 96,000 | $ | — | ||||

| Amounts acquired or issued |

— | — | ||||||

| Net change in fair value |

4,000 | — | ||||||

| Settlements |

— | — | ||||||

| Transfers in and/or out of Level 3 |

— | — | ||||||

|

|

|

|

|

|||||

| Balance at end of period |

$ | 100,000 | $ | — | ||||

|

|

|

|

|

|||||

The following table presents the total balance of the Company’s other financial instruments that are not measured at fair value on a recurring basis:

| Fair value measurements using: | ||||||||||||||||

| Total Balance | Level 1 | Level 2 | Level 3 | |||||||||||||

| March 31, 2015: |

||||||||||||||||

| Assets: |

||||||||||||||||

| Bank deposits (included in “Cash and cash equivalents”) |

$ | 379,600 | $ | 379,600 | — | — | ||||||||||

| Liabilities: |

||||||||||||||||

| Convertible Notes |

$ | 472,974 | — | $ | 472,974 | — | ||||||||||

| December 31, 2014: |

||||||||||||||||

| Assets: |

||||||||||||||||

| Bank deposits (included in “Cash and cash equivalents”) |

$ | 313,646 | $ | 313,646 | — | — | ||||||||||

| Liabilities: |

||||||||||||||||

| Convertible Notes |

$ | 359,219 | — | $ | 359,219 | — | ||||||||||

17

Due to their short-term maturities, the Company believes that the fair value of its bank deposits, receivable from collaboration partner, accounts payable and accrued expenses and other current liabilities approximate their carrying value.

The estimated fair value of the Company’s Convertible Notes, including the equity component, was $654.1 million and $496.8 million at March 31, 2015 and December 31, 2014, respectively, and was determined using recent trading prices of the Convertible Notes. The fair value of the Convertible Notes included in the table above represents only the long-term liability component of the Convertible Notes, because the equity component is included in stockholders’ equity on the consolidated balance sheets. For the purposes of the table above, the fair value of the Convertible Notes was bifurcated between the debt and equity components in a ratio similar to the principal amounts of the Convertible Notes at issuance.

NOTE 13. COMMITMENTS AND CONTINGENCIES

(a) Lease Obligations

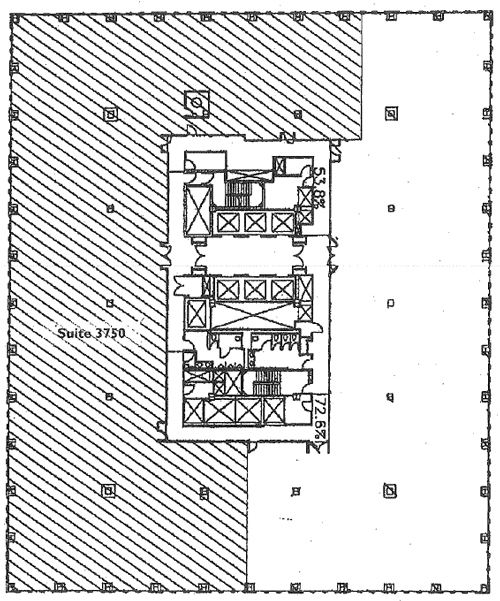

In the first quarter of 2015, the Company entered into the Sixth Amendment to its corporate headquarters lease agreement in San Francisco, California, pursuant to which it leased approximately 16,000 additional square feet of office space. The Company is entitled to approximately $0.3 million of tenant improvement allowances pursuant to the Sixth Amendment. In connection with the execution of the Sixth Amendment, the Company delivered to the lessor a letter of credit collateralized by restricted cash totaling $1.6 million. In total, at March 31, 2015, the Company leased approximately 143,000 square feet of office space pursuant to the lease agreement, as amended, which expires in June 2019. Lease commitments pursuant to the Sixth Amendment are approximately $6.1 million over the term of the lease.

Future operating lease obligations as of March 31, 2015 are as follows:

| Years Ending December 31, |

Operating Leases |

|||

| Remainder of 2015 |

$ | 6,552 | ||

| 2016 |

9,345 | |||

| 2017 |

9,544 | |||

| 2018 |

9,746 | |||

| 2019 |

5,065 | |||

| 2020 and thereafter |

— | |||

|

|

|

|||

| Total minimum lease payments |

$ | 40,252 | ||

|

|

|

|||

The Company is considered the “accounting owner” for a build-to-suit property and has recorded a build-to-suit lease obligation on its consolidated balance sheets. Additional information regarding the build-to-suit lease obligation is included in Note 7, “Build-To-Suit Lease Obligation.”

Expected future lease payments under the build-to-suit lease as of March 31, 2015 are as follows:

| Years Ending December 31, |

Expected Cash Payments Under Build- To-Suit Lease Obligation |

|||

| Remainder of 2015 |

$ | 1,852 | ||

| 2016 |

2,538 | |||

| 2017 |

2,614 | |||

| 2018 |

2,692 | |||

| 2019 |

2,773 | |||

| 2020 and thereafter |

14,162 | |||

|

|

|

|||

| Total minimum lease payments |

$ | 26,631 | ||

|

|

|

|||

(b) Restricted Cash

The Company had outstanding letters of credit collateralized by restricted cash totaling $13.3 million and $11.8 million at March 31, 2015 and December 31, 2014, respectively, to secure various operating leases. At March 31, 2015, $0.9 million and $12.4 million of restricted cash associated with these letters of credit were classified as current and long-term assets, respectively, on the consolidated balance sheets. At December 31, 2014, $0.2 million and $11.6 million of restricted cash associated with these letters of credit were classified as current and long-term assets, respectively, on the consolidated balance sheets.

18

(c) License Agreement with UCLA

Under an August 2005 license agreement with UCLA, the Company’s subsidiary Medivation Prostate Therapeutics, Inc., or MPT, holds an exclusive worldwide license under several UCLA patents and patent applications covering XTANDI and related compounds. Under the Astellas Collaboration Agreement, the Company granted Astellas a sublicense under the patent rights licensed to it by UCLA.

The Company is required to pay UCLA (a) an annual maintenance fee, (b) $2.8 million in aggregate milestone payments upon achievement of certain development and regulatory milestone events with respect to XTANDI (all of which has been paid as of March 31, 2015), (c) ten percent of all Sublicensing Income, as defined in the agreement, which the Company earns under the Astellas Collaboration Agreement, and (d) a four percent royalty on global net sales of XTANDI, as defined. Under the terms of the Astellas Collaboration Agreement, the Company shares this royalty obligation equally with Astellas with respect to sales in the United States, and Astellas is responsible for this entire royalty obligation with respect to sales outside of the United States. The Company is currently involved in litigation with UCLA, which is discussed in the section titled “Litigation” below.

UCLA may terminate the agreement if the Company does not meet a general obligation to diligently proceed with the development, manufacturing and sale of licensed products, or if it commits any other uncured material breach of the agreement. The Company may terminate the agreement at any time upon advance written notice to UCLA. If neither party terminates the agreement early, the agreement will continue in force until the expiration of the last-to-expire patent on a country-by-country basis.

(d) Clinical Manufacturing Agreements

Manufacturing Services and Supply Agreements

Contemporaneous with the execution of the License Agreement with CureTech, the Company entered into a Manufacturing Services and Supply Agreement, or MSA, with CureTech pursuant to which CureTech will provide clinical trial supply of MDV9300 over a three year period. In accordance with the terms of the MSA, the Company paid CureTech an upfront fee of $3.0 million during the fourth quarter of 2014. The Company is required to pay CureTech a one-time milestone payment of $5.0 million upon the completion of the Manufacturing Technology Transfer, as defined. In accordance with the terms of the MSA, the Company is also responsible for providing Manufacturing Funding totaling up to $19.3 million for clinical trial materials of MDV9300 over the three-year term of the MSA, of which $3.5 million was paid during the first quarter of 2015. The Manufacturing Funding is contingent upon the successful achievement of the requirements set forth in the Manufacturing Plan, and any such amounts may be reduced or eliminated by the Company under the terms of the MSA.

Development and Manufacturing Services Agreement

During the fourth quarter of 2014, the Company entered into a Development and Manufacturing Services Agreement with a third party clinical manufacturing organization. The term of the agreement is for the longer of (i) a period of five (5) years or (ii) through the completion of the Services, as defined. Under the current statement of work under this agreement, the Company intends to transfer the current manufacturing process of MDV9300 from CureTech to this third party, further scale up and production of Phase 3 clinical trial material of MDV9300 from this entity’s manufacturing facility. The estimated total consideration under the current statement of work is approximately $14.8 million, of which $0.7 million was paid during the first quarter of 2015.

(e) Research and License Agreement

In March 2014, the Company entered into a Research and License Agreement with a third party. Under the terms of the agreement, the Company paid a $12.0 million license and research agreement fee which was recorded in R&D expense in the consolidated statement of operations for the three months ended March 31, 2014. The Company could also be required to pay potential future development and sales milestone payments, subject to the achievement of defined clinical and commercial events, and royalties based on sales. Such future milestone and royalty payments are contingent upon future events that may or may not materialize.

(f) Litigation

The Company is party to legal proceedings, investigations, and claims in the ordinary course of its business, including the matters described below. The Company records accruals for outstanding legal matters when it believes that it is both probable that a liability has been incurred and the amount of such liability can be reasonably estimated. The Company evaluates, on a quarterly basis, developments in significant legal matters that could affect the amount of any accrual and developments that would make a loss contingency both probable and reasonably estimable. To the extent new information is obtained and the Company’s views on the probable outcomes of claims, suits, assessments, investigations or legal proceedings change, changes in the Company’s accrued liabilities would be recorded in the period in which such determination is made. In addition, in accordance with the relevant authoritative guidance, for matters for which the likelihood of material loss is at least reasonably possible, the Company provides disclosure of the possible loss or range of loss; however, if a reasonable estimate cannot be made, the Company will provide disclosure to that effect. Gain contingencies, if any, are recorded as a reduction of expense when they are realized.

19

In May 2011, the Company filed a lawsuit in San Francisco Superior Court against the Regents of the University of California, and one of its professors, alleging breach of contract and fraud claims, among others. The Company’s allegations in this lawsuit include that it has exclusive commercial rights to an investigational drug known as ARN-509, which is currently being developed by Aragon Pharmaceuticals, or Aragon. In August 2013, Johnson & Johnson and Aragon completed a transaction in which Johnson & Johnson acquired all ARN-509 assets owned by Aragon. ARN-509 is an investigational drug currently in development to treat the non-metastatic CRPC population. ARN-509 is a close structural analog of XTANDI, was developed contemporaneously with XTANDI in the same academic laboratories in which XTANDI was developed, and was purportedly licensed by the Regents to Aragon, a company co-founded by the heads of the academic laboratories in which XTANDI was developed. On February 9, 2012, the Company filed a Second Amended Complaint, adding as additional defendants a former Regents professor and Aragon. The Company seeks remedies including a declaration that it is the proper licensee of ARN-509, contractual remedies conferring to it exclusive patent license rights regarding ARN-509, and other equitable and monetary relief. On August 7, 2012, the Regents filed a cross-complaint against the Company seeking declaratory relief which, if granted, would require the Company to share with the Regents ten percent of any sales milestone payments it may receive under the Astellas Collaboration Agreement because such milestones constitute Sublicensing Income under the license agreement with UCLA. Under the Astellas Collaboration Agreement, the Company is eligible to receive up to $320.0 million in sales milestone payments. As of March 31, 2015, the Company has earned $75.0 million in sales milestones under the Astellas Collaboration Agreement The Company has paid UCLA $7.5 million, representing 10% of the sales milestone amounts earned from Astellas. On September 18, 2012, the trial court approved a settlement agreement dismissing the former Regents professor who was added to the case on February 9, 2012. On December 20, 2012, and January 25, 2013, the Court granted summary judgment motions filed by defendants Regents and Aragon, resulting in dismissal of all claims against Regents and Aragon, but denied such motions filed by the remaining Regents professor. On April 15, 2013, the Company filed a Notice of Appeal seeking appeal of the judgment in favor of Aragon, which is now wholly-owned by Johnson & Johnson, and the briefing of that matter has been concluded. The bench trial of the Regent’s cross-complaint against the Company was conducted in July 2013, and on January 15, 2014, the Court entered a judgment in the cross-complaint in favor of Regents, which the Company appealed on February 13, 2014 along with the December 2012 summary judgment order in favor of Regents. The jury trial of the Company’s breach of contract and fraud claims against the remaining Regents professor was conducted in October and November 2013. On November 15, 2013, the jury rendered a verdict in the case, finding in favor of Medivation on the breach of contract claim, and in favor of the Regents professor on the fraud claims. On November 22, 2013, the Court entered judgment for the prevailing party Medivation on the contract claim, and entering judgment in favor of the Regents professor on the fraud claims. The Company’s notice of appeal of the judgment on the fraud claims was filed on February 13, 2014. On October 17, 2014, the briefing in Medivation’s appeal of the summary judgment order and cross-complaint order in favor of Regents, as well as its appeal of the judgment on the fraud claims against the Regents professor commenced. On October 24, 2014, the court of appeals issued an order consolidating all of these appeals for hearing and consideration purposes, so the appeals will be heard and considered together once the briefing is completed.

On April 11, 2014, UCLA filed a complaint against the Company in which UCLA alleges that Medivation and MPT have failed to pay UCLA ten percent of “Operating Profits” Medivation has received (and will continue to receive) from Astellas, as a result of the Astellas Collaboration Agreement, and that Medivation has breached its fiduciary duties to UCLA, as minority shareholder of MPT. On July 16, 2014, UCLA dismissed without prejudice its claim that Medivation breached its fiduciary duties to UCLA, as a minority shareholder of MPT. On March 23, 2015, based upon an application by both the Company and UCLA, the court ordered the case be designated as complex and assigned to a single judge in the complex division of San Francisco Superior Court. The Company denies UCLA’s allegations and intends to vigorously defend the litigation.