Form 497K WILLIAM BLAIR FUNDS

Summary Prospectus May 1, 2016

Income Fund

| Class N WBRRX | Class I BIFIX |

Before you invest, you may want to review the Fund’s prospectus, which contains more information about the Fund and its risks. You can find the Fund’s prospectus, statement of additional information and other information about the Fund online at williamblairfunds.com/prospectus. You can also get this information at no cost by calling +1 800 742 7272 or by sending an e-mail request to [email protected]. The Fund’s prospectus and statement of additional information, each dated May 1, 2016, as supplemented, are incorporated by reference into this Summary Prospectus.

INVESTMENT OBJECTIVE: The William Blair Income Fund seeks a high level of current income with relative stability of principal.

FEES AND EXPENSES: This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund.

Shareholder Fees (fees paid directly from your investment):

| Class N | Class I | |||||||

| Maximum Sales Charge (Load) Imposed on Purchases |

None | None | ||||||

| Redemption Fee |

None | None | ||||||

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment):

| Class N | Class I | |||||||

| Management Fee |

0.37% | 0.37% | ||||||

| Distribution (Rule 12b-1) Fee |

0.15% | None | ||||||

| Other Expenses |

0.29% | 0.18% | ||||||

|

|

|

|

|

|||||

| Total Annual Fund Operating Expenses |

0.81% | 0.55% | ||||||

Example: This example is intended to help you compare the cost of investing in shares of the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||

| Class N | $83 | $259 | $450 | $1,002 | ||||||||||||

| Class I | 56 | 176 | 307 | 689 | ||||||||||||

1

Portfolio Turnover: The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 21% of the average value of its portfolio.

PRINCIPAL INVESTMENT STRATEGIES: As a matter of fundamental policy, under normal market conditions, the Fund invests at least 90% of its total assets in the following: (a) U.S. dollar-denominated corporate debt securities (domestic or foreign) with long-term ratings of “A –” or better, or an equivalent rating, by at least one of the following three nationally recognized statistical rating organizations: Fitch Ratings, Moody’s Investors Service, Inc. and Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. (“Rating Organizations”); (b) obligations of or guaranteed by the U.S. Government, its agencies or instrumentalities; (c) collateralized obligations, which are debt securities issued by a corporation, trust or custodian, or by a U.S. Government agency or instrumentality, that are collateralized (i.e., secured as to payment of interest and/or principal) by a portfolio or pool of assets, such as mortgages, mortgage-backed securities, debit balances on credit card accounts or U.S. Government securities (the Fund may invest in collateralized obligations that are not guaranteed by a U.S. Government agency or instrumentality only if the collateralized obligations are rated “A –” or better, or an equivalent rating, by one of the Rating Organizations); and (d) commercial paper obligations rated within the highest grade by one of the Rating Organizations. The Fund may also invest in Rule 144A securities.

The Adviser seeks to outperform the Barclays Intermediate Government/Credit Bond Index through an actively managed diversified portfolio of debt securities. The Adviser’s investment philosophy emphasizes shifts in the Fund’s portfolio among various sectors of the debt market, subject to the Fund’s credit quality constraints for its portfolio. The Adviser also actively manages the Fund based upon the average duration and yield to maturity of the Fund’s portfolio and the Adviser’s perceived trends in interest rates.

The anticipated dollar-weighted average maturity of the Fund is three to seven years. The anticipated weighted average modified duration for the Fund is two to five years, with a maximum duration on any instrument of nine years. The Fund will not continue to hold a security whose duration has moved above nine years. The duration of an instrument is different from the maturity of an instrument in that duration measures the average period remaining until the discounted value of the amounts due (principal and interest) under the instrument are to be paid, rather than the instrument’s stated final maturity. In addition, a portfolio duration of five years means that if interest rates increased by one percent, the value of the portfolio would decrease by approximately five percent. Modified duration adjusts duration to take into account the yield to maturity and the number of coupons received each year. For purposes of calculating duration, instruments allowing prepayment will be assigned a prepayment schedule by the Adviser based upon industry experience.

Up to 10% of the Fund’s total assets may be invested in securities that at the time of purchase are debt securities that are rated lower than “A –” but at least “BBB –” (or its equivalent) by at least one of the Rating Organizations by which such securities are rated, so long as the Fund does not invest more than 3% of its total net assets in securities of any single issuer whose securities are rated “BBB –”. Securities that are downgraded below “BBB –” (or its equivalent) after purchase may continue to be held in the Fund. Although considered to be investment grade, debt securities rated “BBB” may have speculative characteristics, and changes in economic conditions or other circumstances are more likely to lead to a weakened capacity to make principal and interest payments than is the case for higher grade bonds. Debt securities rated below “BBB –” (or its equivalent) are commonly referred to as “high-yield” or “junk” bonds and are considered speculative with respect to the issuer’s capacity to pay interest and repay principal and are susceptible to default or decline in market value due to adverse economic and business developments. The market values for high-yield securities tend to be very volatile, and these securities are often less liquid than investment grade debt securities.

2

PRINCIPAL RISKS: The Fund is subject to credit risk. The Fund’s net asset value and total return may be adversely affected by the inability of the issuers of the Fund’s securities to make interest payments or payment at maturity. The Fund’s investments in obligations issued or guaranteed by U.S. Government agencies or instrumentalities may not be backed by the full faith and credit of the United States and may differ in the degree of support provided by the U.S. Government. The Fund is also subject to interest rate risk. The value of income producing securities will generally decrease when interest rates rise, which means the Fund’s net asset value and total returns will likewise decrease in a rising interest rate environment. As of the date of this Prospectus, interest rates continue to be near historic lows. However, it is likely there will be less governmental intervention in the near future to maintain low interest rates. The negative impact on fixed income securities from the resulting rate increases for that and other reasons could be swift and significant and negatively impact the Fund’s net asset value. Investments with longer maturities or durations, which typically provide higher yields than securities with shorter maturities or durations, may subject the Fund to increased price changes resulting from interest rate changes. A rising interest rate environment may also result in periods of increased redemptions from fixed income funds and increased supply in the market due to selling activity to meet redemptions. If the Fund has to liquidate portfolio securities to meet redemptions in such an environment, it may have to do so at disadvantageous times and prices, which could negatively impact the Fund’s net asset value. It may not be possible to sell or otherwise dispose of illiquid securities both at the price and within a time period deemed desirable by the Fund. Rule 144A securities are not registered for resale in the general securities market and may be classified as illiquid. The Fund’s investments in collateralized mortgage obligations are subject to prepayment and extension risk. Prepayment of high interest rate mortgage-backed securities during times of declining interest rates will tend to lower the return of the Fund and may even result in losses to the Fund if the prepaid securities were acquired at a premium. Slower prepayments during periods of rising interest rates may increase the duration of the Fund’s mortgage-backed securities and asset-backed securities and reduce their value. The Fund is also subject to income risk, which is the risk that the income received by the Fund may decrease as a result of a decline in interest rates. Foreign investments often involve additional risks, including political instability, differences in financial reporting standards and less stringent regulation of securities markets. These risks may be magnified in emerging markets countries because the securities of emerging market companies may be subject to greater volatility and less liquidity than companies in more developed markets. In certain circumstances, portfolio securities may be valued using techniques other than market quotations, including using fair value pricing. Thus, the Fund’s returns will vary, and you could lose money by investing in the Fund. Of course, for all mutual funds there is the risk that individual securities may not perform as expected or a strategy used by the Adviser may fail to produce its intended result. The Fund is not intended to be a complete investment program.

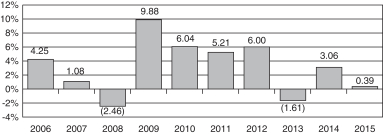

FUND PERFORMANCE HISTORY: The information below provides some indication of the risks of investing in the Fund by showing changes in the Fund’s performance from year to year and by showing how the Fund’s average annual returns for the years indicated compare with those of a broad measure of market performance. The Fund’s past performance (before and after taxes) does not necessarily indicate how it will perform in the future. For more recent performance information, go to www.williamblairfunds.com or call 1-800-635-2886.

Annual Total Returns. The bar chart below provides an illustration of how the Fund’s performance has varied in each of the last ten calendar years for Class N shares.

|

Highest Quarterly Return 4.59% (2Q09) |

Lowest Quarterly Return (3.90)% (3Q08) |

3

Average Annual Total Returns (For the periods ended December 31, 2015). The table shows returns on a before-tax and after-tax basis for Class N shares and on a before-tax basis for Class I shares. After-tax returns for Class I shares will vary. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. In some instances, the “Return After Taxes on Distributions and Sale of Fund Shares” may be greater than the “Return Before Taxes” because the investor is assumed to be able to use the capital loss on the sale of Fund shares to offset other taxable capital gains. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts.

| 1 Year | 5 Years | 10 Years | ||||||||||

| Class N Shares |

||||||||||||

| Return Before Taxes |

0.39% | 2.57% | 3.12% | |||||||||

| Return After Taxes on Distributions |

(0.84)% | 1.26% | 1.59% | |||||||||

| Return After Taxes on Distributions and Sale of Fund Shares |

0.22% | 1.44% | 1.81% | |||||||||

| Class I Shares |

||||||||||||

| Return Before Taxes |

0.63% | 2.80% | 3.32% | |||||||||

| Barclays Intermediate Government/Credit Bond Index (reflects no deduction for fees, expenses or taxes) |

1.07% | 2.58% | 4.04% | |||||||||

For current yield information see:

https://www.williamblairfunds.com/funds_and_performance/share_class_n/total_returns.fs

MANAGEMENT:

Investment Adviser. William Blair Investment Management, LLC is the investment adviser of the Fund.

Portfolio Manager(s). Christopher T. Vincent, a Partner of the Adviser, manages the Fund. Mr. Vincent has managed or co-managed the Fund since 2002.

PURCHASE AND SALE OF FUND SHARES:

Class N Share Purchase. The minimum initial investment for a regular account or Individual Retirement Account is $2,500. The minimum subsequent investment is $1,000. Certain exceptions to the minimum initial and subsequent investment amounts may apply. See “Your Account—Class N Shares” for additional information on eligibility requirements applicable to purchasing Class N shares.

Class I Share Purchase. The minimum initial investment for a regular account or an Individual Retirement Account is $500,000 (or any lesser amount if, in William Blair’s opinion, the investor has adequate intent and availability of funds to reach a future level of investment of $500,000). There is no minimum for subsequent purchases. The Distributor reserves the right to offer Class I shares without regard to the minimum purchase amount requirements to qualified or non-qualified employee benefit plans when an unaffiliated third party provides administrative and/or other support services to the plan. Certain exceptions to the minimum initial investment amount may apply. Class I shares are only available to certain investors. See “Your Account—Class I Shares” for additional information on the eligibility requirements applicable to purchasing Class I shares.

Sale. Shares of the Fund are redeemable on any day the New York Stock Exchange is open for business by mail, wire or telephone, depending on the elections you make in the account application.

4

TAX INFORMATION: The Fund intends to make distributions that may be taxed as ordinary income or capital gains, unless you are investing through a tax-advantaged investment plan. If you are investing through a tax-advantaged investment plan, you may be subject to taxes after exiting the tax-advantaged investment plan.

PAYMENTS TO BROKER-DEALERS AND OTHER FINANCIAL INTERMEDIARIES: If you purchase shares of the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

5

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- William Blair Starts First Advantage (FA) at Outperform, 'Best-in-Class Background Screener'

- Aterian Sets Date for First Quarter 2024 Earnings Announcement & Investor Conference Call

- William Blair on Sage Therapeutics (SAGE): 'we have difficulty envisioning what additional data could be generated to support a resubmission'

Create E-mail Alert Related Categories

SEC FilingsRelated Entities

William BlairSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share