Form 497K WILLIAM BLAIR FUNDS

Summary Prospectus May 1, 2016

Emerging Markets Leaders Fund

| Class N WELNX | Class I WBELX | Institutional Class WELIX |

Before you invest, you may want to review the Fund’s prospectus, which contains more information about the Fund and its risks. You can find the Fund’s prospectus, statement of additional information and other information about the Fund online at williamblairfunds.com/prospectus. You can also get this information at no cost by calling +1 800 742 7272 or by sending an e-mail request to [email protected]. The Fund’s prospectus and statement of additional information, each dated May 1, 2016, as supplemented, are incorporated by reference into this Summary Prospectus.

INVESTMENT OBJECTIVE: The William Blair Emerging Markets Leaders Fund seeks long-term capital appreciation.

FEES AND EXPENSES: This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund.

Shareholder Fees (fees paid directly from your investment):

| Class N | Class I | Institutional Class |

||||||||||

| Maximum Sales Charge (Load) Imposed on Purchases |

None | None | None | |||||||||

| Redemption Fee |

None | None | None | |||||||||

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment):

| Class N | Class I | Institutional Class |

||||||||||

| Management Fee |

1.10% | 1.10% | 1.10% | |||||||||

| Distribution (Rule 12b-1) Fee |

0.25% | None | None | |||||||||

| Other Expenses (includes a shareholder administration fee for Class N and Class I shares) |

0.54% | 0.44% | 0.25% | |||||||||

|

|

|

|

|

|

|

|||||||

| Total Annual Fund Operating Expenses |

1.89% | 1.54% | 1.35% | |||||||||

| Fee Waiver and/or Expense Reimbursement* |

0.24% | 0.14% | 0.10% | |||||||||

|

|

|

|

|

|

|

|||||||

| Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement |

1.65% | 1.40% | 1.25% | |||||||||

| * | The Adviser has entered into a contractual agreement with the Fund to waive fees and/or reimburse expenses in order to limit the Fund’s operating expenses (excluding interest, taxes, brokerage |

1

| commissions, acquired fund fees and expenses, other investment-related costs and extraordinary expenses, such as litigation and other expenses not incurred in the ordinary course of the Fund’s business) to 1.65%, 1.40% and 1.25% of average daily net assets for Class N, Class I and Institutional Class shares, respectively, until April 30, 2017. The Adviser may not terminate this arrangement prior to April 30, 2017 unless the management agreement is terminated. |

Example: This example is intended to help you compare the cost of investing in shares of the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and the Fund’s operating expenses remain the same. The figures reflect the expense limitation for the first year. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||

| Class N | $168 | $571 | $999 | $2,192 | ||||

| Class I | 143 | 473 | 826 | 1,823 | ||||

| Institutional Class | 127 | 418 | 730 | 1,615 |

Portfolio Turnover: The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 110% of the average value of its portfolio.

PRINCIPAL INVESTMENT STRATEGIES: Under normal market conditions, the Fund invests at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in emerging markets securities. The Fund invests primarily in a diversified portfolio of equity securities, including common stocks and other forms of equity investments (e.g., securities convertible into common stocks), issued by emerging market companies of all sizes, that the Adviser believes have above-average growth, profitability and quality characteristics. Under normal market conditions, the Fund typically holds a limited number of securities (i.e., 50-80 securities). The Adviser seeks investment opportunities in companies at different stages of development, ranging from large, well-established companies to smaller companies at earlier stages of development, that are leaders in their country, industry or globally in terms of products, services or execution. Emerging market companies, for purposes of the Fund, are companies organized under the laws of an emerging market country or that have securities traded principally on an exchange or over-the-counter in an emerging market country. Currently, emerging markets include every country in the world except the United States, Canada, Japan, Australia, New Zealand, Hong Kong, Singapore and most Western European countries. The Fund’s investments are normally allocated among at least six different countries and no more than 50% of the Fund’s equity holdings may be invested in securities of issuers in one country at any given time.

In choosing investments, the Adviser performs fundamental company analysis and focuses on stock selection. The Adviser generally seeks equity securities, including common stocks, of emerging market companies that historically have had superior growth, profitability and quality relative to local markets and relative to companies within the same industry worldwide, and that are expected to continue such performance. Such companies generally will exhibit superior business fundamentals, including leadership in their field, quality products or services, distinctive marketing and distribution, pricing flexibility and revenue from products or services consumed on a steady, recurring basis. These business characteristics should be accompanied by management that is shareholder return-oriented and that uses conservative accounting policies. Companies with above-average returns on equity, strong balance sheets and consistent, above-average earnings growth at reasonable valuation levels will be the primary focus. Stock selection will take into account both local and global comparisons.

2

The Adviser will vary the Fund’s sector and geographic diversification based upon the Adviser’s ongoing evaluation of economic, market and political trends throughout the world. In making decisions regarding country allocation, the Adviser will consider such factors as the conditions and growth potential of various economies and securities markets, currency exchange rates, technological developments in the various countries and other pertinent financial, social, national and political factors.

PRINCIPAL RISKS: The Fund’s returns will vary, and you could lose money by investing in the Fund. Because the Fund invests most of its assets in equity securities of emerging market companies, the primary risk is that the value of the equity securities it holds might decrease in response to the activities of those companies or market and economic conditions. In addition, there is the risk that individual securities may not perform as expected or a strategy used by the Adviser may fail to produce its intended result. Because the Fund may focus its investments in a limited number of securities, its performance may be more volatile than a fund that invests in a greater number of securities. Different investment styles (e.g., growth vs. value, quality bias, market capitalization focus) tend to shift in and out of favor depending on market conditions and investor sentiment, and at times when the investment style used by the Adviser for the Fund is out of favor, the Fund may underperform other equity funds that use different investment styles. Foreign investments often involve additional risks, including political instability, differences in financial reporting standards and less stringent regulation of securities markets. These risks may be magnified in emerging market countries because the securities of emerging market companies may be subject to greater volatility and less liquidity than companies in more developed markets. Because the securities held by the Fund usually will be denominated in currencies other than the U.S. dollar, changes in foreign currency exchange rates may adversely affect the value of the Fund’s investments. The currencies of emerging market countries may experience a devaluation relative to the U.S. dollar, and continued devaluations may adversely affect the value of the Fund’s assets denominated in such currencies. Many emerging market countries have experienced substantial rates of inflation for many years, and continued inflation may adversely affect the economies and securities markets of such countries. The Fund is expected to incur operating expenses that are higher than those of mutual funds investing exclusively in U.S. equity securities due to the higher custodial fees associated with foreign securities investments. In addition, the Fund may invest in the securities of smaller companies, which may be more volatile and less liquid than securities of large companies. Smaller companies may be traded in low volumes. This can increase volatility and increase the risk that the Fund will not be able to sell the security on short notice at a reasonable price. To the extent the Fund invests a significant portion of its assets in one country or geographic region, the Fund will be more vulnerable to the risks of adverse economic or political forces in that country or geographic region. To the extent that the Fund focuses its investments in particular industries, asset classes or sectors of the economy, any market changes affecting companies in those industries, asset classes or sectors may impact the Fund’s performance. Separate accounts managed by the Adviser may invest in the Fund and, therefore, the Adviser at times may have discretionary authority over a significant portion of the assets invested in the Fund. In such instances, the Adviser’s decision to make changes to or rebalance its clients’ allocations in the separate accounts may substantially impact the Fund’s performance. The Fund is not intended to be a complete investment program. The Fund is designed for long-term investors.

The Fund involves a high level of risk and may not be appropriate for everyone. You should only consider it for the aggressive portion of your portfolio.

FUND PERFORMANCE HISTORY: The information below provides some indication of the risks of investing in the Fund by showing changes in the Fund’s performance from year to year and by showing how the Fund’s average annual returns for the years indicated compare with that of a broad measure of market performance. The Fund’s past performance (before and after taxes) does not necessarily indicate how it will perform in the future. For more recent performance information, go to www.williamblairfunds.com or call 1-800-635-2886.

3

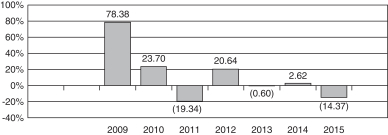

Annual Total Returns. The bar chart below provides an illustration of how the Fund’s performance has varied in each of the calendar years since the Fund started for Class I shares.

|

Highest Quarterly 33.74% (2Q09) |

Lowest Quarterly (20.59)% (3Q11) |

Average Annual Total Returns (For the periods ended December 31, 2015). The table shows returns on a before-tax and after-tax basis for Class I shares and on a before-tax basis for Institutional Class shares and Class N shares. After-tax returns for Institutional Class shares and Class N shares will vary. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. In some instances, the “Return After Taxes on Distributions and Sale of Fund Shares” may be greater than the “Return Before Taxes” because the investor is assumed to be able to use the capital loss on the sale of Fund shares to offset other taxable capital gains. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts.

| 1 Year | 5 Years | Life of the Fund (since March 26, 2008) |

||||||||||

| Class I Shares |

||||||||||||

| Return Before Taxes |

(14.37)% | (3.20)% | (1.37)% | |||||||||

| Return After Taxes on Distributions |

(14.46)% | (3.63)% | (1.70)% | |||||||||

| Return After Taxes on Distributions and Sale of Fund Shares |

(8.06)% | (2.26)% | (0.93)% | |||||||||

| Institutional Class Shares |

||||||||||||

| Return Before Taxes |

(14.24)% | (3.07)% | (1.23)% | |||||||||

| MSCI Emerging Markets Index (net) (reflects no deduction for fees, expenses or taxes) |

(14.92)% | (4.81)% | (1.81)% | |||||||||

| 1 Year | 5 Years | Since Share Class Inception (May 3, 2010) |

||||||||||

| Class N Shares |

||||||||||||

| Return Before Taxes |

(14.56)% | (3.45)% | (0.11)% | |||||||||

| MSCI Emerging Markets Index (net) (reflects no deduction for fees, expenses or taxes) |

(14.92)% | (4.81)% | (1.71)% | |||||||||

4

MANAGEMENT:

Investment Adviser. William Blair Investment Management, LLC is the investment adviser of the Fund.

Portfolio Manager(s). Todd M. McClone, a Partner of the Adviser, and Jeffrey A. Urbina, a Partner of the Adviser, co-manage the Fund. Mr. McClone has co-managed the Fund since its inception in 2008. Mr. Urbina has co-managed the Fund since its inception in 2008.

PURCHASE AND SALE OF FUND SHARES:

Class N Share Purchase. The minimum initial investment for a regular account or Individual Retirement Account is $2,500. The minimum subsequent investment is $1,000. Certain exceptions to the minimum initial and subsequent investment amounts may apply. See “Your Account—Class N Shares” for additional information on eligibility requirements applicable to purchasing Class N shares.

Class I Share Purchase. The minimum initial investment for a regular account or an Individual Retirement Account is $500,000 (or any lesser amount if, in William Blair’s opinion, the investor has adequate intent and availability of funds to reach a future level of investment of $500,000). There is no minimum for subsequent purchases. The Distributor reserves the right to offer Class I shares without regard to the minimum purchase amount requirements to qualified or non-qualified employee benefit plans when an unaffiliated third party provides administrative and/or other support services to the plan. Certain exceptions to the minimum initial investment amount may apply. Class I shares are only available to certain investors. See “Your Account—Class I Shares” for additional information on the eligibility requirements applicable to purchasing Class I shares.

Institutional Class Share Purchase. The minimum initial investment is $5 million. There is no minimum for subsequent purchases. The Distributor reserves the right to offer Institutional Class shares without regard to the minimum purchase amount requirements to qualified or non-qualified employee benefit plans when an unaffiliated third party provides administrative and/or other support services to the plan. Certain exceptions to the minimum initial investment amount may apply. Institutional Class shares are only available to certain investors. See “Your Account—Institutional Class Shares” for additional information on eligibility requirements applicable to purchasing Institutional Class shares.

Sale. Shares of the Fund are redeemable on any day the New York Stock Exchange is open for business by mail, wire or telephone, depending on the elections you make in the account application.

TAX INFORMATION: The Fund intends to make distributions that may be taxed as ordinary income or capital gains, unless you are investing through a tax-advantaged investment plan. If you are investing through a tax-advantaged investment plan, you may be subject to taxes after exiting the tax-advantaged investment plan.

PAYMENTS TO BROKER-DEALERS AND OTHER FINANCIAL INTERMEDIARIES: If you purchase shares of the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

5

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Falcon Oil & Gas Ltd - Full Year Results

- Nexstim Plc Business Update Q1 2024

- APi Group Corporation (APG) Prices 11M Share Offering at $37.50/sh

Create E-mail Alert Related Categories

SEC FilingsRelated Entities

William BlairSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share