Form 497K WELLS FARGO FUNDS TRUST

Summary Prospectus

December 6, 2016

Wells Fargo Real Return Fund

Class/Ticker: Class A - IPBAX; Class C - IPBCX

|

Link to Prospectus |

Link to SAI |

Before you invest, you may want to review the Fund's prospectus, which contains more information about the Fund and its risks. You can find the Fund's prospectus and other information about the Fund online at wellsfargofunds.com/reports. You can also get information at no cost by calling 1-800-222-8222, or by sending an email request to [email protected]. The current prospectus ("Prospectus") and statement of additional information ("SAI"), dated October 1, 2016, as supplemented from time to time, are incorporated by reference into this summary prospectus. The Fund's SAI may be obtained, free of charge, in the same manner as the Prospectus.

Investment Objective

The Fund seeks returns that exceed the rate of inflation over the long-term.

Fees and Expenses

These tables are intended to help you understand the various costs and expenses you will pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in the aggregate in specified classes of certain Wells Fargo Funds. More information about these and other discounts is available from your financial professional and in "Share Class Features" and "Reductions and Waivers of Sales Charges" on pages 22 and 23 of the Prospectus and "Additional Purchase and Redemption Information" on page 55 of the Statement of Additional Information.

|

Shareholder Fees (fees paid directly from your investment) |

|

|

|

|

Class A |

Class C |

|

Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

4.50% |

None |

|

Maximum deferred sales charge (load) (as a percentage of offering price) |

None1 |

1.00% |

| 1. |

Investments of $1 million or more are not subject to a front-end sales charge but generally will be subject to a deferred sales charge of 1.00% if redeemed within 18 months from the date of purchase. |

|

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)1 |

||

|

|

Class A |

Class C |

|

Management Fees2 |

0.45% |

0.45% |

|

Distribution (12b-1) Fees |

0.00% |

0.75% |

|

Other Expenses3 |

0.74% |

0.74% |

|

Total Annual Fund Operating Expenses |

1.19% |

1.94% |

|

Fee Waivers |

(0.34)% |

(0.34)% |

|

Total Annual Fund Operating Expenses After Fee Waiver4 |

0.85% |

1.60% |

| 1. |

Expenses have been adjusted as necessary from amounts incurred during the Fund's most recent fiscal year to reflect current fees and expenses. |

| 2. |

Includes the fees charged by the Manager for providing advisory services to the master portfolio in which the Fund invests substantially all of its assets. |

| 3. |

Includes other expenses allocated from the master portfolio in which the Fund invests. |

| 4. |

The Manager has contractually committed through September 30, 2017, to waive fees and/or reimburse expenses to the extent necessary to cap the Fund's Total Annual Fund Operating Expenses After Fee Waiver at the amount shown above. Brokerage commissions, stamp duty fees, interest, taxes, acquired money market fund fees and expenses (if any), and extraordinary expenses are excluded from the cap. All other acquired fund fees from the underlying master portfolio(s) are included in the cap. After this time, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees. |

Example of Expenses

The example below is intended to help you compare the costs of investing in the Fund with the costs of investing in other mutual funds. The example assumes a $10,000 initial investment, 5% annual total return, and that fees and expenses remain the same as in the tables above. To the extent that the Manager is waiving fees or reimbursing expenses, the example assumes that such waiver or reimbursement will only be in place through the date noted above. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

|

Assuming Redemption at End of Period |

|

Assuming No Redemption |

||

|

After: |

Class A |

Class C |

|

|

Class C |

|

1 Year |

$533 |

$263 |

$163 |

||

|

3 Years |

$779 |

$576 |

$576 |

||

|

5 Years |

$1,044 |

$1,016 |

$1,016 |

||

|

10 Years |

$1,799 |

$2,237 |

$2,237 |

||

Portfolio Turnover

The Fund pays transaction costs, such as commissions,when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund's performance. During the most recent fiscal year, the Fund's portfolio turnover rate was 29% of the average value of its portfolio.

Principal Investment Strategies

Under normal circumstances, we invest:

-

at least 80% of the Fund's total assets in debt securities;

-

at least 65% of the Fund's total assets in inflation-indexed debt securities;

-

up to 20% of the Fund's total assets in below investment-grade debt securities;

-

up to 15% of the Fund's total assets in debt securities of foreign-issuers, including issuers from emerging markets; and

-

up to 20% of the Fund's total assets in equity securities, including common and preferred stock, of domestic and foreign issuers, including issuers from emerging markets.

The Fund is a gateway fund that invests substantially all of its assets in the Real Return Portfolio, a master portfolio with a substantially identical investment objective and substantially similar investment strategies. We may invest in additional master portfolios, in other Wells Fargo Funds, or directly in a portfolio of securities.

We utilize an active allocation strategy to diversify the portfolio across various investments, assets and sectors, in an attempt to generate a real return (a return in excess of the rate of inflation) over an economic cycle, consistent with an appropriate level of risk. We allocate investments to various broad asset classes based on our assessment of changing economic, global market, industry, and issuer conditions. We use a "top-down" analysis of macroeconomic trends combined with a "bottom-up" fundamental analysis of market sectors, industries, and issuers to seek to take advantage of varying sector reactions to the economic environment. In implementing the active allocation strategy, we evaluate relative risk and relative values across asset classes, countries, sectors, and issuers.

We invest principally in debt securities, seeking to exceed the rate of inflation over a full market cycle. These securities may have fixed, floating or variable rates and may include debt securities of both domestic and foreign issuers, including issuers from emerging markets. We invest primarily in inflation-indexed debt securities issued or guaranteed by governments, their agencies or instrumentalities, as well as corporate issuers. We may also invest in a variety of other debt securities, including corporate, mortgage- and asset-backed securities, bank loans and government obligations. We treat the returns from inflation-indexed debt securities as including interest paid on the principal amount of the security, adjustments made to the principal amount based on an official inflation measure and changes in market value.

We invest in investment-grade debt securities by generally purchasing securities that we believe have strong relative value based on an analysis of a security's characteristics (such as its principal value, coupon rate, credit quality, maturity, duration and yield) in light of the current market environment. We may also invest in below investment-grade debt securities, often called "high yield securities" or "junk bonds". We start our investment process with a focus on bottom-up fundamental credit analysis to generate investment ideas, to understand the potential risks, and to select individual securities that may potentially add value from income and/or capital appreciation. Our credit research may include an assessment of an issuer's general financial condition, its competitive positioning and management strength, as well as industry characteristics and other factors. We may sell a debt security due to changes in credit characteristics or our outlook, as well as changes in portfolio strategy or cash flow needs or to replace a debt security with another security that presents what we believe to be a better value or risk/reward profile. We do not manage the Fund's portfolio to a specific maturity or duration.

We may invest in equity securities, including common and preferred stocks, of domestic and foreign issuers, including emerging market issuers and American Depositary Receipts (ADRs). We seek out investments that we believe have strong financial attributes and offer compelling valuation opportunities. We may invest in equity securities of companies of any size. These investments will generally be within sectors of the market that we believe to be inflation-sensitive.

We may invest in derivatives, such as futures and swaps that have economic or financial characteristics that are similar to inflation-indexed or other debt securities. We may also use futures contracts to manage or adjust duration and yield curve exposure, as well as to manage risk or to enhance return.

We may enter into currency-related transactions through derivative instruments, including currency and cross currency forwards. The use of derivative currency transactions is intended to allow the Fund to manage, hedge or reduce a foreign currency-specific risk exposure of a portfolio security or its denominated currency or to obtain net long exposure to selected currencies for the purpose of generating income or additional returns.

Principal Investment Risks

An investment in the Fund may lose money, is not a deposit of Wells Fargo Bank, N.A. or its affiliates, is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency, and is primarily subject to the risks briefly summarized below.

Credit Risk. The issuer or guarantor of a debt security may be unable or perceived to be unable to pay interest or repay principal when they become due, which could cause the value of an investment to decline and a Fund to lose money.

Derivatives Risk. The use of derivatives, such as futures, options and swap agreements, can lead to losses, including those magnified by leverage, particularly when derivatives are used to enhance return rather than mitigate risk. Certain derivative instruments may be difficult to sell when the portfolio manager believes it would be appropriate to do so, or the other party to a derivative contract may be unwilling or unable to fulfill its contractual obligations.

Emerging Markets Risk. Emerging market securities typically present even greater exposure to the risks described under "Foreign Investment Risk" and may be particularly sensitive to global economic conditions. Emerging market securities are also typically less liquid than securities of developed countries and could be difficult to sell, particularly during a market downturn.

Foreign Currency Contracts Risk. A Fund that enters into forwards or other foreign currency contracts, which are a type of derivative, is subject to the risk that the portfolio manager may be incorrect in his or her judgment of future exchange rate changes.

Foreign Investment Risk. Foreign investments may be subject to lower liquidity, greater price volatility and risks related to adverse political, regulatory, market or economic developments. Foreign investments may involve exposure to changes in foreign currency exchange rates and may be subject to higher withholding and other taxes.

Futures Contracts Risk. A Fund that uses futures contracts, which are a type of derivative, is subject to the risk of loss caused by unanticipated market movements. In addition, there may at times be an imperfect correlation between the movement in the prices of futures contracts and the value of their underlying instruments or indexes and there may at times not be a liquid secondary market for certain futures contracts.

High Yield Securities Risk. High yield securities and unrated securities of similar credit quality (commonly known as "junk bonds") have a much greater risk of default or of not returning principal and their values tend to be more volatile than higher-rated securities with similar maturities.

Inflation-Indexed Debt Securities Risk. The principal value of an inflation-indexed debt security is periodically adjusted according to the rate of inflation and, as a result, the value of a Fund's yield and return will be affected by changes in the rate of inflation.

Interest Rate Risk. When interest rates rise, the value of debt securities tends to fall. When interest rates decline, interest that a Fund is able to earn on its investments in debt securities may also decline, but the value of those securities may increase.

Loan Risk. Loans may be unrated, less liquid and more difficult to value than traditional debt securities. The highly leveraged capital structure of the borrowers in such transactions may make such loans especially vulnerable to adverse changes in financial, economic or market conditions. A Fund may be unable to sell loans at a desired time or price. The Fund may also not be able to control amendments, waivers or the exercise of any remedies that a lender would have under a direct loan and may assume liability as a lender.

Management Risk. Investment decisions, techniques, analyses or models implemented by a Fund's manager or sub-adviser in seeking to achieve the Fund's investment objective may not produce the returns expected, may cause the Fund's shares to lose value or may cause the Fund to underperform other funds with similar investment objectives.

Market Risk. The values of, and/or the income generated by, securities held by a Fund may decline due to general market conditions or other factors, including those directly involving the issuers of such securities. Security markets are volatile and may decline significantly in response to adverse issuer, regulatory, political, or economic developments. Different sectors of the market and different security types may react differently to such developments.

Mortgage- and Asset-Backed Securities Risk. Mortgage- and asset-backed securities may decline in value and become less liquid when defaults on the underlying mortgages or assets occur and may exhibit additional volatility in periods of rising interest rates. Rising interest rates tend to extend the duration of these securities, making them more sensitive to changes in interest rates than instruments with fixed payment schedules. When interest rates decline or are low, the prepayment of mortgages or assets underlying such securities can reduce a Fund's returns.

Smaller Company Securities Risk. Securities of companies with smaller market capitalizations tend to be more volatile and less liquid than those of larger companies.

Swaps Risk. Depending on their structure, swap agreements and options to enter into swap agreements ("swaptions"), both of which are types of derivatives, may increase or decrease a Fund's exposure to long- or short-term interest rates, foreign currency values, mortgage-backed securities, corporate borrowing rates, or credit events or other reference points such as security prices or inflation rates.

U.S. Government Obligations Risk. U.S. Government obligations may be adversely impacted by changes in interest rates, and securities issued or guaranteed by U.S. Government agencies or government-sponsored entities may not be backed by the full faith and credit of the U.S. Government.

Performance

The following information provides some indication of the risks of investing in the Fund by showing changes in the Fund's performance from year to year. The Fund's average annual total returns are compared to the performance of one or more indices. Past performance before and after taxes is no guarantee of future results. Current month-end performance is available on the Fund's website at wellsfargofunds.com.

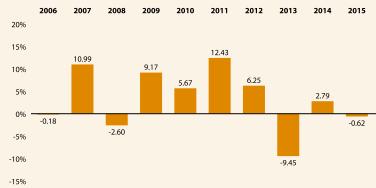

Calendar Year Total Returns for Class A as of 12/31 each year

(Returns do not reflect sales charges and would be lower if they did)

Highest Quarter: 1st Quarter 2008 +5.19% Lowest Quarter: 2nd Quarter 2013 -7.50% Year-to-date total return as of 6/30/2016 is +7.93%

|

Average Annual Total Returns for the periods ended 12/31/2015 (returns reflect applicable sales charges) |

||||

|

|

Inception Date of Share Class |

1 Year |

5 Year |

10 Year |

|

Class A (before taxes) |

2/28/2003 |

-5.09% |

1.09% |

2.77% |

|

Class A (after taxes on distributions) |

2/28/2003 |

-5.69% |

-0.06% |

1.61% |

|

Class A (after taxes on distributions and the sale of Fund Shares) |

2/28/2003 |

-2.62% |

0.67% |

1.84% |

|

Class C (before taxes) |

2/28/2003 |

-2.43% |

1.26% |

2.50% |

|

Barclays U.S. TIPS Index (reflects no deduction for fees, expenses, or taxes) |

-1.44% |

2.55% |

3.93% |

|

|

Consumer Price Index (reflects no deduction for fees, expenses, or taxes) |

0.73% |

1.53% |

1.86% |

|

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state, local or foreign taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown, and after-tax returns shown are not relevant to tax-exempt investors or investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) Plans or Individual Retirement Accounts. After-tax returns are shown only for the Class A shares. After-tax returns for the Class C shares will vary.

Fund Management

|

Manager |

Sub-Adviser |

Portfolio Manager, Title/Managed Since |

|

Wells Fargo Funds Management, LLC |

Wells Capital Management Incorporated |

Kandarp R. Acharya, CFA, FRM, Portfolio Manager / 2014 |

Purchase and Sale of Fund Shares

In general, you can buy or sell shares of the Fund online or by mail, phone or wire on any day the New York Stock Exchange is open for regular trading. You also may buy and sell shares through a financial professional.

|

Buying Fund Shares |

To Place Orders or Redeem Shares |

|

Minimum Initial Investment |

Mail: Wells Fargo Funds |

Tax Information

Any distributions you receive from the Fund may be taxable as ordinary income or capital gains, except when your investment is in an IRA, 401(k) or other tax advantaged investment plan. However, subsequent withdrawals from such a tax advantaged investment plan may be subject to federal income tax. You should consult your tax adviser about your specific tax situation.

Payments to Intermediaries

If you purchase a Fund through an intermediary, the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the intermediary and your financial professional to recommend the Fund over another investment. Consult your financial professional or visit your intermediary's website for more information.

|

Link to Prospectus |

Link to SAI |

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Wells Fargo Upgrades Neurocrine Bio. (NBIX) to Overweight 'as the Company is Knocking on the Doors of the Large-Cap Club'

- Wells Fargo Upgrades Datadog (DDOG) to Overweight

- Chipotle Mexican Grill (CMG) PT Raised to $3,300 at Wells Fargo

Create E-mail Alert Related Categories

SEC FilingsRelated Entities

Wells FargoSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share