Form 497K AMERICAN FUNDS INSURANCE

|

American Funds Insurance Series® Managed Risk International Fund Summary prospectus May 1, 2016 |

| Before you invest, you may want to review the fund’s prospectus and statement of additional information, which contain more information about the fund and its risks. You can find the fund’s prospectus, statement of additional information and other information about the fund online at americanfunds.com/afis. You can also get this information at no cost by calling (800) 421-9900, ext. 65413 or by sending an email request to [email protected]. The current prospectus and statement of additional information, dated May 1, 2016, are incorporated by reference into this summary prospectus. |

Investment objective

The fund’s investment objective is to provide you with long-term growth of capital while seeking to manage volatility and provide downside protection.

Fees and expenses of the fund

This table describes the fees and expenses that you may pay if you buy and hold an interest in Class P1 shares of the fund. It does not reflect insurance contract fees and expenses. If insurance contract fees and expenses were reflected, expenses shown would be higher.

Annual fund operating expenses (expenses that you pay each year as a percentage of the value of your investment) |

Class P1 |

| Management fees | 0.15% |

| Distribution fees | None |

| Other expenses1 | 0.41 |

| Acquired (underlying) fund fees and expenses | 0.50 |

| Total annual fund operating expenses | 1.06 |

| Fee waiver and/or expense reimbursement2 | 0.17 |

| Total annual fund operating expenses after fee waiver and/or expense reimbursement | 0.89 |

1 Based on estimated amounts for the current fiscal year.

2 The investment adviser is currently waiving a portion of its management fee equal to .05% of the fund’s net assets. In addition, the investment adviser is currently reimbursing a portion of the other expenses. This waiver and reimbursement will be in effect through at least May 1, 2017, unless modified or terminated by the fund’s board. The adviser may elect at its discretion to extend, modify or terminate the reimbursement at that time. The waiver may only be modified or terminated with the approval of the fund’s board.

Example This example is intended to help you compare the cost of investing in Class P1 shares of the fund with the cost of investing in other mutual funds.

The example assumes that you invest $10,000 in the fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the fund’s operating expenses remain the same. The example does not reflect insurance contract expenses. If insurance contract expenses were reflected, expenses shown would be higher. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 year | 3 years | 5 years | 10 years | |

| Class P1 | $91 | $320 | $568 | $1,278 |

Portfolio turnover The fund pays transaction costs, such as commissions, when it buys and sells securities and other instruments (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs. These costs, which are not reflected in annual fund operating expenses or in the example, affect the fund’s investment results. During the most recent fiscal year, the fund’s portfolio turnover rate was 15% of the average value of its portfolio.

1 American Funds Insurance Series – Managed Risk International Fund / Summary prospectus

Principal investment strategies

The fund pursues its investment objective by investing in shares of an underlying fund, the American Funds Insurance Series International FundSM, while seeking to manage portfolio volatility and provide downside protection primarily through the use of exchange-traded futures contracts.

The investment objective of the underlying fund is to provide investors with long-term growth of capital. The underlying fund invests primarily in common stocks of companies domiciled outside the United States, including companies domiciled in developing countries, that the investment adviser believes have the potential for growth.

The fund employs a risk-management overlay referred to in this prospectus as the managed risk strategy. The managed risk strategy consists of using hedge instruments — primarily short positions in exchange-traded futures contracts — to attempt to stabilize the volatility of the fund around a target volatility level and reduce the downside exposure of the fund during periods of significant market declines. The fund employs a subadviser to select individual futures contracts on equity indexes of U.S. markets and markets outside the United States that the subadviser believes are correlated to the underlying fund’s equity exposure. These instruments are selected based on the subadviser’s analysis of the relation of various equity indexes to the underlying fund’s portfolio. In addition, the subadviser will monitor liquidity levels of relevant futures contracts and transparency provided by exchanges as the counterparties in hedging transactions. The target volatility level will be set from time to time by the investment adviser and the subadviser and may be adjusted if deemed advisable in the judgment of the investment adviser and the subadviser. The subadviser may also seek to hedge the fund’s currency risk related to its exposure to equity index futures denominated in currencies other than the U.S. dollar.

A futures contract on an index is an agreement pursuant to which two parties agree to take or make delivery of an amount of cash linked to the value of the index at the close of the last trading day of the contract. A futures contract is considered a derivative because it derives its value from the price of the underlying index. A short position in an index futures contract gains in value when the underlying index declines and loses value when the underlying index rises.

The subadviser will regularly adjust the level of exchange-traded futures contracts to seek to manage the overall net risk level of the fund. In situations of extreme market volatility, the subadviser will tend to use exchange-traded equity index futures more heavily, as the exchange-traded futures could significantly reduce the fund’s net economic exposure to equity securities. Even in periods of low volatility in the equity markets, however, the subadviser will continue to use the hedging techniques (although, presumably, to a lesser degree) to seek to preserve gains after favorable market conditions and reduce losses in adverse market conditions.

The fund is nondiversified, which allows it to invest a greater percentage of its assets in any one issuer than would otherwise be the case. However, through the underlying fund, the fund owns a diversified mix of securities.

American Funds Insurance Series – Managed Risk International Fund / Summary prospectus 2

Principal risks

This section describes the principal risks associated with the fund’s principal investment strategies. You may lose money by investing in the fund. The likelihood of loss may be greater if you invest for a shorter period of time. Investors in the fund should have a long-term perspective and be able to tolerate potentially sharp declines in value. Investors in the fund should also understand that the fund’s objective of protecting against downside losses may result in the fund not realizing the full gains of the underlying fund. In addition, the managed risk strategy may not effectively protect the fund from all market declines.

Fund structure — The fund invests in an underlying fund and incurs expenses related to the underlying fund. In addition, investors in the fund will incur fees to pay for certain expenses related to the operations of the fund. An investor holding the underlying fund directly would incur lower overall expenses but would not receive the benefit of the managed risk strategy.

Underlying fund risks — Because the fund’s investments consist of an underlying fund, the fund’s risks are directly related to the risks of the underlying fund. For this reason, it is important to understand the risks associated with investing both in the fund and the underlying fund.

Investing in futures contracts — In addition to the risks generally associated with investing in derivative instruments, futures contracts are subject to the creditworthiness of the clearing organizations, exchanges and futures commission merchants with which the fund transacts. Additionally, although futures require only a small initial investment in the form of a deposit of initial margin, the amount of a potential loss on a futures contract could greatly exceed the initial amount invested. While futures contracts are generally liquid instruments, under certain market conditions, futures may be deemed to be illiquid. For example, the fund may be temporarily prohibited from closing out its position in a futures contract if intraday price change limits or limits on trading volume imposed by the applicable futures exchange are triggered. If the fund is unable to close out a position on a futures contract, the fund would remain subject to the risk of adverse price movements until the fund is able to close out the futures position. The ability of the fund to successfully utilize futures contracts may depend in part upon the ability of the fund’s investment adviser or subadviser to accurately forecast interest rates and other economic factors and to assess and predict the impact of such economic factors on the futures in which the fund invests. If the investment adviser or subadviser incorrectly forecasts economic developments or incorrectly predicts the impact of such developments on the futures in which it invests, the fund could be exposed to the risk of loss.

Hedging — There may be imperfect or even negative correlation between the prices of the futures contracts and the prices of the underlying securities. For example, futures contracts may not provide an effective hedge because changes in futures contract prices may not track those of the underlying securities or indexes they are intended to hedge. In addition, there are significant differences between the securities and futures markets that could result in an imperfect correlation between the markets, causing a given hedge not to achieve its objectives. The degree of imperfection of correlation depends on circumstances such as variations in speculative market demand for futures, including technical influences in futures trading, and differences between the financial instruments being hedged and the instruments underlying the standard contracts available for trading. A decision as to whether, when and how to hedge involves the exercise of skill and judgment, and even a well-conceived hedge may be unsuccessful to some degree because of market behavior or unexpected interest rate trends. In addition, the fund’s investment in exchange-traded futures and their resulting costs could limit the fund’s gains in rising markets relative to those of the underlying fund, or to those of unhedged funds in general.

Short positions — Losses from short positions in futures contracts occur when the underlying index increases in value. As the underlying index increases in value, the holder of the short position in the corresponding futures contract is required to pay the difference in value of the futures contract resulting from the increase in the index on a daily basis. Losses from a short position in an index futures contract could potentially be very large if the value of the underlying index rises dramatically in a short period of time.

Market conditions — The prices of, and the income generated by, the securities held by the underlying fund may decline – sometimes rapidly or unpredictably – due to various factors, including events or conditions affecting the general economy or particular industries; overall market changes; local, regional or global political, social or economic instability; governmental or governmental agency responses to economic conditions; and currency exchange rate, interest rate and commodity price fluctuations.

Issuer risks — The prices of, and the income generated by, securities held by the underlying fund may decline in response to various factors directly related to the issuers of such securities, including reduced demand for an issuer’s goods or services, poor management performance and strategic initiatives such as mergers, acquisitions or dispositions and the market response to any such initiatives.

Investing in growth-oriented stocks — Growth-oriented common stocks and other equity-type securities (such as preferred stocks, convertible preferred stocks and convertible bonds) may involve larger price swings and greater potential for loss than other types of investments. These risks may be even greater in the case of smaller capitalization stocks.

3 American Funds Insurance Series – Managed Risk International Fund / Summary prospectus

Investing outside the United States — Securities of issuers domiciled outside the United States, or with significant operations or revenues outside the United States, may lose value because of adverse political, social, economic or market developments (including social instability, regional conflicts, terrorism and war) in the countries or regions in which the issuers operate or generate revenue. These securities may also lose value due to changes in foreign currency exchange rates against the U.S. dollar and/or currencies of other countries. Issuers of these securities may be more susceptible to actions of foreign governments, such as the imposition of price controls or punitive taxes, that could adversely impact revenues. Securities markets in certain countries may be more volatile and/or less liquid than those in the United States. Investments outside the United States may also be subject to different accounting practices and different regulatory, legal and reporting standards and practices, and may be more difficult to value, than those in the United States. In addition, the value of investments outside the United States may be reduced by foreign taxes, including foreign withholding taxes on interest and dividends. Further, there may be increased risks of delayed settlement of securities purchased or sold by the underlying fund. The risks of investing outside the United States may be heightened in connection with investments in emerging markets.

Investing in emerging markets — Investing in emerging markets may involve risks in addition to and greater than those generally associated with investing in the securities markets of developed countries. For instance, developing countries may have less developed legal and accounting systems than those in developed countries. The governments of these countries may be less stable and more likely to impose capital controls, nationalize a company or industry, place restrictions on foreign ownership and on withdrawing sale proceeds of securities from the country, and/or impose punitive taxes that could adversely affect the prices of securities. In addition, the economies of these countries may be dependent on relatively few industries that are more susceptible to local and global changes. Securities markets in these countries can also be relatively small and have substantially lower trading volumes. As a result, securities issued in these countries may be more volatile and less liquid, and may be more difficult to value, than securities issued in countries with more developed economies and/or markets. Less certainty with respect to security valuations may lead to additional challenges and risks in calculating the underlying fund’s net asset value. Additionally, there may be increased settlement risks for transactions in local securities.

Nondiversification risk — As a nondiversified fund, the fund has the ability to invest a larger percentage of its assets in the securities of a smaller number of issuers than a diversified fund. Therefore, poor performance by a single large holding could adversely impact the fund’s investment results more than if the fund were invested in a larger number of issuers.

Management — The investment adviser to the fund and to the underlying fund actively manages the underlying fund’s investments. Consequently, the underlying fund is subject to the risk that the methods and analyses employed by the investment adviser in this process may not produce the desired results. In addition, the fund is subject to the risk that the methods employed by the subadviser in implementing the managed risk strategy may not produce the desired results. The occurrence of either or both of these events could cause the fund to lose value or its investment results to lag relevant benchmarks or other funds with similar objectives.

Your investment in the fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency, entity or person. You should consider how this fund fits into your overall investment program.

Investment results

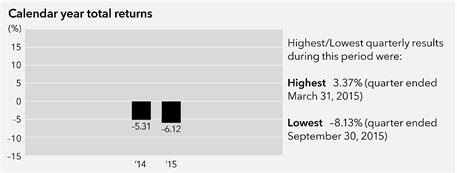

The following bar chart shows how the investment results of the Class P1 shares of the fund have varied from year to year, and the following table shows how the fund’s average annual total returns for various periods compare with different broad measures of market results. This information provides some indication of the risks of investing in the fund. The Lipper International Funds Index includes mutual funds that disclose investment objectives and/or strategies reasonably comparable to those of the fund. Past investment results (before and after taxes) are not predictive of future investment results. Figures shown reflect fees and expenses associated with an investment in the fund, but do not reflect insurance contract fees and expenses. If insurance contract fees and expenses were included, results would have been lower. Updated information on the fund’s investment results can be obtained by visiting americanfunds.com/afis.

American Funds Insurance Series – Managed Risk International Fund / Summary prospectus 4

Average annual total returns For the periods ended December 31, 2015: |

1 year | Lifetime |

| Fund (inception date – 5/1/13) | –6.12% | –1.15% |

| MSCI All Country World ex USA Index (reflects no deduction for sales charges, account fees, expenses or U.S. federal income taxes) | –5.66 | –0.75 |

| Lipper International Funds Index (reflects no deduction for sales charges, account fees or U.S. federal income taxes) | –1.34 | 2.50 |

Additionally, because no funds, private accounts or commodity pools that are managed by the fund’s investment adviser have investment objectives, policies and strategies substantially similar to those of the fund, information regarding investment results of any such other funds, accounts or pools is not provided herein.

Management

Investment adviser Capital Research and Management CompanySM

Subadviser Milliman Financial Risk Management LLC

Portfolio managers The individuals primarily responsible for the management of the fund are:

| Portfolio

manager/ Series title (if applicable) |

Portfolio

manager experience in this fund |

Primary

title with investment adviser |

| Alan

N. Berro President |

3 years | Partner – Capital World Investors |

| James R. Mulally | 3 years | Partner – Capital Fixed Income Investors |

Subadviser portfolio manager The individual primarily responsible for the management of the fund’s managed risk strategy is:

| Portfolio manager | Portfolio

manager experience in this fund |

Primary title with subadviser |

| Adam Schenck | 3 years | Director

– Portfolio Management Group, Milliman Financial Risk Management LLC |

Portfolio managers of the underlying fund The individuals primarily responsible for the portfolio management of the underlying fund are:

| Portfolio

manager/ Series title (if applicable) |

Portfolio manager experience in the underlying fund | Primary

title with investment adviser |

| Sung

Lee Vice President |

10 years | Partner – Capital Research Global Investors |

| L. Alfonso Barroso | 7 years | Partner – Capital Research Global Investors |

| Jesper Lyckeus | 9 years | Partner – Capital Research Global Investors |

| Christopher Thomsen | 10 years | Partner – Capital Research Global Investors |

Tax information

See your variable insurance contract prospectus for information regarding the federal income tax treatment of your variable insurance contract and related distributions.

Payments to broker-dealers and other financial intermediaries

If you purchase shares of the fund through a broker-dealer or other financial intermediary (such as an insurance company), the fund and the fund’s distributor or its affiliates may pay the intermediary for the sale of fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your individual financial advisor to recommend the fund over another investment. Ask your individual financial advisor or visit your financial intermediary’s website for more information. The fund is not sold directly to the general public but instead is offered as an underlying investment option for variable insurance contracts. In addition to payments described above, the fund and its related companies may make payments to the sponsoring insurance company (or its affiliates) for distribution and/or other services. These payments may be a factor that the insurance company considers in including the fund as an underlying investment option in the variable insurance contract. The prospectus (or other offering document) for your variable insurance contract may contain additional information about these payments.

| INP1IPX-086-0516P Printed in USA CGD/AFD/8024 | Investment Company File No. 811-03857 |

|

American Funds Insurance Series® Managed Risk International Fund Summary prospectus May 1, 2016 |

| Before you invest, you may want to review the fund’s prospectus and statement of additional information, which contain more information about the fund and its risks. You can find the fund’s prospectus, statement of additional information and other information about the fund online at americanfunds.com/afis. You can also get this information at no cost by calling (800) 421-9900, ext. 65413 or by sending an email request to [email protected]. The current prospectus and statement of additional information, dated May 1, 2016, are incorporated by reference into this summary prospectus. |

Investment objective

The fund’s investment objective is to provide you with long-term growth of capital while seeking to manage volatility and provide downside protection.

Fees and expenses of the fund

This table describes the fees and expenses that you may pay if you buy and hold an interest in Class P2 shares of the fund. It does not reflect insurance contract fees and expenses. If insurance contract fees and expenses were reflected, expenses shown would be higher.

Annual fund operating expenses (expenses that you pay each year as a percentage of the value of your investment) |

Class P2 |

| Management fees | 0.15% |

| Distribution fees | 0.25 |

| Other expenses | 0.40 |

| Acquired (underlying) fund fees and expenses | 0.50 |

| Total annual fund operating expenses | 1.30 |

| Fee waiver and/or expense reimbursement* | 0.17 |

| Total annual fund operating expenses after fee waiver and/or expense reimbursement | 1.13 |

* The investment adviser is currently waiving a portion of its management fee equal to .05% of the fund’s net assets. In addition, the investment adviser is currently reimbursing a portion of the other expenses. This waiver and reimbursement will be in effect through at least May 1, 2017, unless modified or terminated by the fund’s board. The adviser may elect at its discretion to extend, modify or terminate the reimbursement at that time. The waiver may only be modified or terminated with the approval of the fund’s board.

Example This example is intended to help you compare the cost of investing in Class P2 shares of the fund with the cost of investing in other mutual funds.

The example assumes that you invest $10,000 in the fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the fund’s operating expenses remain the same. The example does not reflect insurance contract expenses. If insurance contract expenses were reflected, expenses shown would be higher. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 year | 3 years | 5 years | 10 years | |

| Class P2 | $115 | $395 | $696 | $1,553 |

Portfolio turnover The fund pays transaction costs, such as commissions, when it buys and sells securities and other instruments (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs. These costs, which are not reflected in annual fund operating expenses or in the example, affect the fund’s investment results. During the most recent fiscal year, the fund’s portfolio turnover rate was 15% of the average value of its portfolio.

1 American Funds Insurance Series – Managed Risk International Fund / Summary prospectus

Principal investment strategies

The fund pursues its investment objective by investing in shares of an underlying fund, the American Funds Insurance Series International FundSM, while seeking to manage portfolio volatility and provide downside protection primarily through the use of exchange-traded futures contracts.

The investment objective of the underlying fund is to provide investors with long-term growth of capital. The underlying fund invests primarily in common stocks of companies domiciled outside the United States, including companies domiciled in developing countries, that the investment adviser believes have the potential for growth.

The fund employs a risk-management overlay referred to in this prospectus as the managed risk strategy. The managed risk strategy consists of using hedge instruments — primarily short positions in exchange-traded futures contracts — to attempt to stabilize the volatility of the fund around a target volatility level and reduce the downside exposure of the fund during periods of significant market declines. The fund employs a subadviser to select individual futures contracts on equity indexes of U.S. markets and markets outside the United States that the subadviser believes are correlated to the underlying fund’s equity exposure. These instruments are selected based on the subadviser’s analysis of the relation of various equity indexes to the underlying fund’s portfolio. In addition, the subadviser will monitor liquidity levels of relevant futures contracts and transparency provided by exchanges as the counterparties in hedging transactions. The target volatility level will be set from time to time by the investment adviser and the subadviser and may be adjusted if deemed advisable in the judgment of the investment adviser and the subadviser. The subadviser may also seek to hedge the fund’s currency risk related to its exposure to equity index futures denominated in currencies other than the U.S. dollar.

A futures contract on an index is an agreement pursuant to which two parties agree to take or make delivery of an amount of cash linked to the value of the index at the close of the last trading day of the contract. A futures contract is considered a derivative because it derives its value from the price of the underlying index. A short position in an index futures contract gains in value when the underlying index declines and loses value when the underlying index rises.

The subadviser will regularly adjust the level of exchange-traded futures contracts to seek to manage the overall net risk level of the fund. In situations of extreme market volatility, the subadviser will tend to use exchange-traded equity index futures more heavily, as the exchange-traded futures could significantly reduce the fund’s net economic exposure to equity securities. Even in periods of low volatility in the equity markets, however, the subadviser will continue to use the hedging techniques (although, presumably, to a lesser degree) to seek to preserve gains after favorable market conditions and reduce losses in adverse market conditions.

The fund is nondiversified, which allows it to invest a greater percentage of its assets in any one issuer than would otherwise be the case. However, through the underlying fund, the fund owns a diversified mix of securities.

American Funds Insurance Series – Managed Risk International Fund / Summary prospectus 2

Principal risks

This section describes the principal risks associated with the fund’s principal investment strategies. You may lose money by investing in the fund. The likelihood of loss may be greater if you invest for a shorter period of time. Investors in the fund should have a long-term perspective and be able to tolerate potentially sharp declines in value. Investors in the fund should also understand that the fund’s objective of protecting against downside losses may result in the fund not realizing the full gains of the underlying fund. In addition, the managed risk strategy may not effectively protect the fund from all market declines.

Fund structure — The fund invests in an underlying fund and incurs expenses related to the underlying fund. In addition, investors in the fund will incur fees to pay for certain expenses related to the operations of the fund. An investor holding the underlying fund directly would incur lower overall expenses but would not receive the benefit of the managed risk strategy.

Underlying fund risks — Because the fund’s investments consist of an underlying fund, the fund’s risks are directly related to the risks of the underlying fund. For this reason, it is important to understand the risks associated with investing both in the fund and the underlying fund.

Investing in futures contracts — In addition to the risks generally associated with investing in derivative instruments, futures contracts are subject to the creditworthiness of the clearing organizations, exchanges and futures commission merchants with which the fund transacts. Additionally, although futures require only a small initial investment in the form of a deposit of initial margin, the amount of a potential loss on a futures contract could greatly exceed the initial amount invested. While futures contracts are generally liquid instruments, under certain market conditions, futures may be deemed to be illiquid. For example, the fund may be temporarily prohibited from closing out its position in a futures contract if intraday price change limits or limits on trading volume imposed by the applicable futures exchange are triggered. If the fund is unable to close out a position on a futures contract, the fund would remain subject to the risk of adverse price movements until the fund is able to close out the futures position. The ability of the fund to successfully utilize futures contracts may depend in part upon the ability of the fund’s investment adviser or subadviser to accurately forecast interest rates and other economic factors and to assess and predict the impact of such economic factors on the futures in which the fund invests. If the investment adviser or subadviser incorrectly forecasts economic developments or incorrectly predicts the impact of such developments on the futures in which it invests, the fund could be exposed to the risk of loss.

Hedging — There may be imperfect or even negative correlation between the prices of the futures contracts and the prices of the underlying securities. For example, futures contracts may not provide an effective hedge because changes in futures contract prices may not track those of the underlying securities or indexes they are intended to hedge. In addition, there are significant differences between the securities and futures markets that could result in an imperfect correlation between the markets, causing a given hedge not to achieve its objectives. The degree of imperfection of correlation depends on circumstances such as variations in speculative market demand for futures, including technical influences in futures trading, and differences between the financial instruments being hedged and the instruments underlying the standard contracts available for trading. A decision as to whether, when and how to hedge involves the exercise of skill and judgment, and even a well-conceived hedge may be unsuccessful to some degree because of market behavior or unexpected interest rate trends. In addition, the fund’s investment in exchange-traded futures and their resulting costs could limit the fund’s gains in rising markets relative to those of the underlying fund, or to those of unhedged funds in general.

Short positions — Losses from short positions in futures contracts occur when the underlying index increases in value. As the underlying index increases in value, the holder of the short position in the corresponding futures contract is required to pay the difference in value of the futures contract resulting from the increase in the index on a daily basis. Losses from a short position in an index futures contract could potentially be very large if the value of the underlying index rises dramatically in a short period of time.

Market conditions — The prices of, and the income generated by, the securities held by the underlying fund may decline – sometimes rapidly or unpredictably – due to various factors, including events or conditions affecting the general economy or particular industries; overall market changes; local, regional or global political, social or economic instability; governmental or governmental agency responses to economic conditions; and currency exchange rate, interest rate and commodity price fluctuations.

Issuer risks — The prices of, and the income generated by, securities held by the underlying fund may decline in response to various factors directly related to the issuers of such securities, including reduced demand for an issuer’s goods or services, poor management performance and strategic initiatives such as mergers, acquisitions or dispositions and the market response to any such initiatives.

Investing in growth-oriented stocks — Growth-oriented common stocks and other equity-type securities (such as preferred stocks, convertible preferred stocks and convertible bonds) may involve larger price swings and greater potential for loss than other types of investments. These risks may be even greater in the case of smaller capitalization stocks.

3 American Funds Insurance Series – Managed Risk International Fund / Summary prospectus

Investing outside the United States — Securities of issuers domiciled outside the United States, or with significant operations or revenues outside the United States, may lose value because of adverse political, social, economic or market developments (including social instability, regional conflicts, terrorism and war) in the countries or regions in which the issuers operate or generate revenue. These securities may also lose value due to changes in foreign currency exchange rates against the U.S. dollar and/or currencies of other countries. Issuers of these securities may be more susceptible to actions of foreign governments, such as the imposition of price controls or punitive taxes, that could adversely impact revenues. Securities markets in certain countries may be more volatile and/or less liquid than those in the United States. Investments outside the United States may also be subject to different accounting practices and different regulatory, legal and reporting standards and practices, and may be more difficult to value, than those in the United States. In addition, the value of investments outside the United States may be reduced by foreign taxes, including foreign withholding taxes on interest and dividends. Further, there may be increased risks of delayed settlement of securities purchased or sold by the underlying fund. The risks of investing outside the United States may be heightened in connection with investments in emerging markets.

Investing in emerging markets — Investing in emerging markets may involve risks in addition to and greater than those generally associated with investing in the securities markets of developed countries. For instance, developing countries may have less developed legal and accounting systems than those in developed countries. The governments of these countries may be less stable and more likely to impose capital controls, nationalize a company or industry, place restrictions on foreign ownership and on withdrawing sale proceeds of securities from the country, and/or impose punitive taxes that could adversely affect the prices of securities. In addition, the economies of these countries may be dependent on relatively few industries that are more susceptible to local and global changes. Securities markets in these countries can also be relatively small and have substantially lower trading volumes. As a result, securities issued in these countries may be more volatile and less liquid, and may be more difficult to value, than securities issued in countries with more developed economies and/or markets. Less certainty with respect to security valuations may lead to additional challenges and risks in calculating the underlying fund’s net asset value. Additionally, there may be increased settlement risks for transactions in local securities.

Nondiversification risk — As a nondiversified fund, the fund has the ability to invest a larger percentage of its assets in the securities of a smaller number of issuers than a diversified fund. Therefore, poor performance by a single large holding could adversely impact the fund’s investment results more than if the fund were invested in a larger number of issuers.

Management — The investment adviser to the fund and to the underlying fund actively manages the underlying fund’s investments. Consequently, the underlying fund is subject to the risk that the methods and analyses employed by the investment adviser in this process may not produce the desired results. In addition, the fund is subject to the risk that the methods employed by the subadviser in implementing the managed risk strategy may not produce the desired results. The occurrence of either or both of these events could cause the fund to lose value or its investment results to lag relevant benchmarks or other funds with similar objectives.

Your investment in the fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency, entity or person. You should consider how this fund fits into your overall investment program.

Investment results

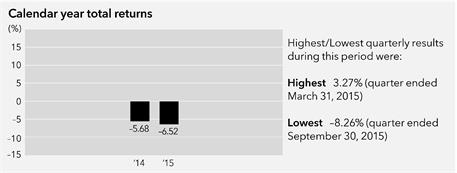

The following bar chart shows how the investment results of the Class P2 shares of the fund have varied from year to year, and the following table shows how the fund’s average annual total returns for various periods compare with different broad measures of market results. This information provides some indication of the risks of investing in the fund. The Lipper International Funds Index includes mutual funds that disclose investment objectives and/or strategies reasonably comparable to those of the fund. Past investment results (before and after taxes) are not predictive of future investment results. Figures shown reflect fees and expenses associated with an investment in the fund, but do not reflect insurance contract fees and expenses. If insurance contract fees and expenses were included, results would have been lower. Updated information on the fund’s investment results can be obtained by visiting americanfunds.com/afis.

American Funds Insurance Series – Managed Risk International Fund / Summary prospectus 4

Average annual total returns For the periods ended December 31, 2015: |

1 year | Lifetime |

| Fund (inception date – 5/1/13) | –6.52% | –1.48% |

| MSCI All Country World ex USA Index (reflects no deduction for sales charges, account fees, expenses or U.S. federal income taxes) | –5.66 | –0.75 |

| Lipper International Funds Index (reflects no deduction for sales charges, account fees or U.S. federal income taxes) | –1.34 | 2.50 |

Additionally, because no funds, private accounts or commodity pools that are managed by the fund’s investment adviser have investment objectives, policies and strategies substantially similar to those of the fund, information regarding investment results of any such other funds, accounts or pools is not provided herein.

Management

Investment adviser Capital Research and Management CompanySM

Subadviser Milliman Financial Risk Management LLC

Portfolio managers The individuals primarily responsible for the management of the fund are:

| Portfolio

manager/ Series title (if applicable) |

Portfolio

manager experience in this fund |

Primary

title with investment adviser |

| Alan

N. Berro President |

3 years | Partner – Capital World Investors |

| James R. Mulally | 3 years | Partner – Capital Fixed Income Investors |

Subadviser portfolio manager The individual primarily responsible for the management of the fund’s managed risk strategy is:

| Portfolio manager | Portfolio

manager experience in this fund |

Primary title with subadviser |

| Adam Schenck | 3 years | Director

– Portfolio Management Group, Milliman Financial Risk Management LLC |

Portfolio managers of the underlying fund The individuals primarily responsible for the portfolio management of the underlying fund are:

| Portfolio

manager/ Series title (if applicable) |

Portfolio manager experience in the underlying fund | Primary

title with investment adviser |

| Sung

Lee Vice President |

10 years | Partner – Capital Research Global Investors |

| L. Alfonso Barroso | 7 years | Partner – Capital Research Global Investors |

| Jesper Lyckeus | 9 years | Partner – Capital Research Global Investors |

| Christopher Thomsen | 10 years | Partner – Capital Research Global Investors |

Tax information

See your variable insurance contract prospectus for information regarding the federal income tax treatment of your variable insurance contract and related distributions.

Payments to broker-dealers and other financial intermediaries

If you purchase shares of the fund through a broker-dealer or other financial intermediary (such as an insurance company), the fund and the fund’s distributor or its affiliates may pay the intermediary for the sale of fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your individual financial advisor to recommend the fund over another investment. Ask your individual financial advisor or visit your financial intermediary’s website for more information. The fund is not sold directly to the general public but instead is offered as an underlying investment option for variable insurance contracts. In addition to payments described above, the fund and its related companies may make payments to the sponsoring insurance company (or its affiliates) for distribution and/or other services. These payments may be a factor that the insurance company considers in including the fund as an underlying investment option in the variable insurance contract. The prospectus (or other offering document) for your variable insurance contract may contain additional information about these payments.

| INP2IPX-086-0516P Printed in USA CGD/AFD/8024 | Investment Company File No. 811-03857 |

Create E-mail Alert Related Categories

SEC FilingsRelated Entities

The Capital Group CompaniesSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share