Form 497 LAZARD RETIREMENT SERIES

Lazard Retirement Series Prospectus

April 29, 2016

Equity

Lazard Retirement US Strategic Equity Portfolio

Lazard Retirement US Small-Mid Cap Equity Portfolio

Lazard Retirement International Equity Portfolio

Emerging Markets

Lazard Retirement Emerging Markets Equity Portfolio

Asset Allocation

Lazard Retirement Global Dynamic Multi Asset Portfolio

Service Shares and Investor Shares

The Securities and Exchange Commission has not approved or disapproved the shares described in this Prospectus or determined whether this Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Lazard Retirement Series Table of Contents

|

|

|

|

|

2 |

Carefully review this important section for |

|||

2 |

information on the Portfolios’ investment |

|||

6 |

objectives, fees and past performance and a |

|||

10 |

summary of the Portfolios’ principal investment |

|||

14 |

strategies and risks. |

|||

18 |

|

|

||

24 |

|

|

||

25 |

Review this section for additional information |

|||

35 |

Review this section for details on the people |

|||

35 |

and organizations who oversee the Portfolios. |

|||

35 |

|

|

||

36 |

|

|

||

37 |

|

|

||

37 |

|

|

||

37 |

|

|

||

38 |

Review this section for details on how shares |

|||

38 |

are valued, how to purchase and sell shares |

|||

38 |

and payments of dividends and distributions. |

|||

39 |

|

|

||

40 |

|

|

||

40 |

|

|

||

40 |

|

|

||

41 |

Review this section for recent financial information. |

|||

46 |

|

|

||

|

Where to learn more about the Portfolios. |

Prospectus1 |

Lazard Retirement Series Summary Section

Lazard Retirement US Strategic Equity Portfolio

Investment Objective

The Portfolio seeks long-term capital appreciation.

Fees and Expenses

This table describes the fees and expenses that you may pay if you buy and hold shares of the Portfolio, a series of Lazard Retirement Series, Inc. (the “Fund”), but does not reflect the fees or charges imposed by the separate accounts of certain insurance companies (the “Participating Insurance Companies”) under variable annuity contracts (“VA contracts”) or variable life insurance policies (“VLI policies” and, together with VA contracts, the “Policies” and each, a “Policy”). If such fees and charges were reflected, the figures in the table would be higher.

|

|

|

|

|

|||||

|

Service |

Investor |

|||||||

|

|||||||||

Annual Portfolio Operating Expenses (expenses that you pay each year as a percentage |

|

|

|

|

|||||

|

|||||||||

Management Fees |

.70% |

|

|

.70% |

|||||

|

|||||||||

Distribution and Service (12b-1) Fees |

.25% |

|

|

None |

|||||

|

|||||||||

Other Expenses |

1.36% |

|

|

1.36% |

* |

|

|||

|

|||||||||

Total Annual Portfolio Operating Expenses |

2.31% |

|

|

2.06% |

|||||

|

|||||||||

Fee Waiver and Expense Reimbursement** |

1.31% |

|

|

1.31% |

|||||

|

|||||||||

Total Annual Portfolio Operating Expenses After Fee Waiver and Expense Reimbursement** |

1.00% |

|

|

.75% |

|||||

|

|||||||||

* |

“Other Expenses” are based on estimated amounts for the current fiscal year, using “Other Expenses” for Service Shares from the last fiscal year. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

** |

Reflects a contractual agreement by Lazard Asset Management LLC (the “Investment Manager”) to waive its fee and, if necessary, reimburse the Portfolio until May 1, 2017, to the extent Total Annual Portfolio Operating Expenses exceed 1.00% and .75% of the average daily net assets of the Portfolio’s Service Shares and Investor Shares, respectively, exclusive of taxes, brokerage, interest on borrowings, fees and expenses of “Acquired Funds” and extraordinary expenses. This agreement can only be amended by agreement of the Fund, upon approval by the Fund’s Board of Directors (the “Board”), and the Investment Manager to lower the net amount shown and will terminate automatically in the event of termination of the Investment Management Agreement between the Investment Manager and the Fund, on behalf of the Portfolio. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Example

This Example is intended to help you compare the cost of investing in the Portfolio with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in the Portfolio for the time periods indicated and then hold or redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Portfolio’s operating expenses remain the same, giving effect to the fee waiver and expense reimbursement arrangement in year one only. The Example does not reflect fees and expenses imposed by the Participating Insurance Companies under the Policies; if they were reflected, the figures in the Example would be higher. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

1 Year |

3 Years |

5 Years |

10 Years |

||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|

Service Shares |

|

|

$ |

|

102 |

|

|

$ |

|

595 |

|

|

$ |

|

1,116 |

|

|

$ |

|

2,544 |

||||||||

|

||||||||||||||||||||||||||||

|

Investor Shares |

|

|

$ |

|

77 |

|

|

$ |

|

519 |

|

|

$ |

|

987 |

|

|

$ |

|

2,285 |

||||||||

|

||||||||||||||||||||||||||||

Portfolio Turnover

The Portfolio pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs. These costs, which are not reflected in annual portfolio operating expenses or in the Example, affect the Portfolio’s performance. During the most recent fiscal year, the Portfolio’s portfolio turnover rate was 86% of the average value of its portfolio.

2Prospectus |

Principal Investment Strategies

The Portfolio invests primarily in equity securities, principally common stocks, of US companies that the Investment Manager believes have strong and/or improving financial productivity and are undervalued based on their earnings, cash flow or asset values. Although the Portfolio generally focuses on large cap companies, the market capitalizations of issuers in which the Portfolio invests may vary with market conditions and the Portfolio also may invest in mid cap and small cap companies.

Under normal circumstances, the Portfolio invests at least 80% of its assets in equity securities of US companies. The Portfolio may invest up to 20% of its assets in securities of non-US companies.

Principal Investment Risks

The value of your investment in the Portfolio will fluctuate, which means you could lose money.

Market Risk. Market risks, including political, regulatory, market and economic developments, and developments that impact specific economic sectors, industries or segments of the market, can affect the value of the Portfolio’s investments. In addition, turbulence in financial markets and reduced liquidity in equity, credit and/or fixed income markets may negatively affect many issuers, which could adversely affect the Portfolio.

Issuer Risk. The value of a security may decline for a number of reasons which directly relate to the issuer, such as management performance, financial leverage and reduced demand for the issuer’s goods or services, as well as the historical and prospective earnings of the issuer and the value of its assets or factors unrelated to the issuer’s value, such as investor perception.

Value Investing Risk. The Portfolio invests in stocks believed by the Investment Manager to be undervalued, but that may not realize their perceived value for extended periods of time or may never realize their perceived value. The stocks in which the Portfolio invests may respond differently to market and other developments than other types of stocks.

Large Cap Companies Risk. Investments in large cap companies may underperform other segments of the market when such other segments are in favor or because such companies may be less responsive to competitive challenges and opportunities and may be unable to attain high growth rates during periods of economic expansion.

Small and Mid Cap Companies Risk. Small and mid cap companies carry additional risks because their earnings tend to be less predictable, their share prices more volatile and their securities less liquid than larger, more established companies. The shares of small and mid cap companies tend to trade less frequently than those of larger companies, which can have an adverse effect on the pricing of these securities and on the ability to sell these securities when the Investment Manager deems it appropriate.

Non-US Securities Risk. The Portfolio’s performance will be influenced by political, social and economic factors affecting the non-US countries and companies in which the Portfolio invests. Non-US securities carry special risks, such as less developed or less efficient trading markets, political instability, a lack of company information, differing auditing and legal standards, and, potentially, less liquidity. In addition, investments denominated in currencies other than US dollars may experience a decline in value, in US dollar terms, due solely to fluctuations in currency exchange rates. Emerging market countries can generally have economic structures that are less diverse and mature, and political systems that are less stable, than those of developed countries.

Prospectus3 |

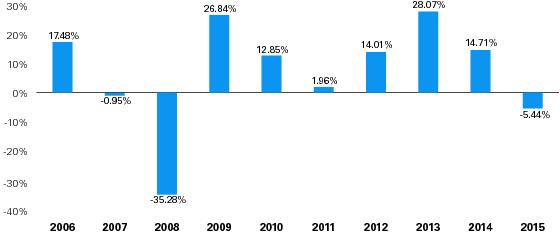

Performance Bar Chart and Table

Year-by-Year Total Returns for Service Shares

As of 12/31

The accompanying bar chart and table provide some indication of the risks of investing in Lazard Retirement US Strategic Equity Portfolio by showing the Portfolio’s year-by-year performance and its average annual performance compared to that of a broad measure of market performance. The bar chart shows how the performance of the Portfolio’s Service Shares has varied from year to year over the past 10 calendar years. Performance information does not reflect the fees or charges imposed by the Participating Insurance Companies under the Policies, and such fees will have the effect of reducing performance. Updated performance information is available at www.LazardNet.com or by calling (800) 823-6300. The Portfolio’s past performance is not necessarily an indication of how the Portfolio will perform in the future.

As a new share Class, past performance information is not available for Investor Shares as of the date of this Prospectus. Investor Shares would have had annual returns substantially similar to those of Service Shares because the shares are invested in the same portfolio of securities, and the annual returns would differ only to the extent of the different expense ratios of the Classes.

|

|

|

|

Best Quarter: |

Average Annual Total Returns

(for the periods ended December 31, 2015)

|

|

|

|

|

|

|

|

|

|

|

|

|

Inception |

1 Year |

5 Years |

10 Years |

Life of |

|||||

|

||||||||||

|

Service Shares |

3/18/98 |

-5.44% |

10.06% |

5.70% |

4.83% |

|||||

|

||||||||||

S&P 500 Index |

|

|

1.38% |

12.57% |

7.31% |

5.56% |

||||

|

||||||||||

4Prospectus |

Management

Investment Manager

Lazard Asset Management LLC

Portfolio Managers/Analysts

Christopher H. Blake, portfolio manager/analyst on various of the Investment Manager’s US Equity teams, has been with the Portfolio since May 2007.

Martin Flood, portfolio manager/analyst on various of the Investment Manager’s US Equity teams and the Global Equity Select and Fundamental Long/Short teams, has been with the Portfolio since May 2011.

Andrew D. Lacey, portfolio manager/analyst on various of the Investment Manager’s US Equity and Global Equity teams, has been with the Portfolio since May 2003.

Ronald Temple, portfolio manager/analyst on various of the Investment Manager’s US Equity and Global Equity teams, has been with the Portfolio since February 2009.

Additional Information

For important information about the purchase and sale of Portfolio shares, tax information and financial intermediary compensation, please turn to “Additional Information about the Portfolios” on page 24.

Prospectus5 |

Lazard Retirement Series Summary Section

Lazard Retirement US Small-Mid Cap Equity Portfolio

Investment Objective

The Portfolio seeks long-term capital appreciation.

Fees and Expenses

This table describes the fees and expenses that you may pay if you buy and hold shares of the Portfolio, but does not reflect the fees or charges imposed by the separate accounts of the Participating Insurance Companies under the Policies. If such fees and charges were reflected, the figures in the table would be higher.

|

|

|

|

|

|||||

|

Service |

Investor |

|||||||

|

|||||||||

Annual Portfolio Operating Expenses (expenses that you pay each year as a percentage |

|

|

|

|

|||||

|

|||||||||

Management Fees |

.75% |

|

|

.75% |

|||||

|

|||||||||

Distribution and Service (12b-1) Fees |

.25% |

|

|

None |

|||||

|

|||||||||

Other Expenses |

.35% |

|

|

.35% |

* |

|

|||

|

|||||||||

Total Annual Portfolio Operating Expenses |

1.35% |

|

|

1.10% |

|||||

|

|||||||||

Fee Waiver and Expense Reimbursement** |

.10% |

|

|

.10% |

|||||

|

|||||||||

Total Annual Portfolio Operating Expenses After Fee Waiver and Expense Reimbursement** |

1.25% |

|

|

1.00% |

|||||

|

|||||||||

* |

“Other Expenses” are based on estimated amounts for the current fiscal year, using “Other Expenses” for Service Shares from the last fiscal year. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

** |

Reflects a contractual agreement by the Investment Manager to waive its fee and, if necessary, reimburse the Portfolio until May 1, 2017, to the extent Total Annual Portfolio Operating Expenses exceed 1.25% and 1.00% of the average daily net assets of the Portfolio’s Service Shares and Investor Shares, respectively, exclusive of taxes, brokerage, interest on borrowings, fees and expenses of “Acquired Funds” and extraordinary expenses. This agreement can only be amended by agreement of the Fund, upon approval by the Board, and the Investment Manager to lower the net amount shown and will terminate automatically in the event of termination of the Investment Management Agreement between the Investment Manager and the Fund, on behalf of the Portfolio. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Example

This Example is intended to help you compare the cost of investing in the Portfolio with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in the Portfolio for the time periods indicated and then hold or redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Portfolio’s operating expenses remain the same, giving effect to the fee waiver and expense reimbursement arrangement in year one only. The Example does not reflect fees and expenses imposed by the Participating Insurance Companies under the Policies; if they were reflected, the figures in the Example would be higher. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

1 Year |

3 Years |

5 Years |

10 Years |

||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|

Service Shares |

|

|

$ |

|

127 |

|

|

$ |

|

418 |

|

|

$ |

|

730 |

|

|

$ |

|

1,615 |

||||||||

|

||||||||||||||||||||||||||||

|

Investor Shares |

|

|

$ |

|

102 |

|

|

$ |

|

340 |

|

|

$ |

|

597 |

|

|

$ |

|

1,331 |

||||||||

|

||||||||||||||||||||||||||||

Portfolio Turnover

The Portfolio pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs. These costs, which are not reflected in annual portfolio operating expenses or in the Example, affect the Portfolio’s performance. During the most recent fiscal year, the Portfolio’s portfolio turnover rate was 89% of the average value of its portfolio.

6Prospectus |

Principal Investment Strategies

The Portfolio invests primarily in equity securities, principally common stocks, of small to mid cap US companies. The Investment Manager considers “small-mid cap companies” to be those companies that, at the time of initial purchase by the Portfolio, have market capitalizations within the range of companies included in the Russell 2500® Index (ranging from approximately $10.9 million to $14.9 billion as of April 5, 2016).

Under normal circumstances, the Portfolio invests at least 80% of its assets in equity securities of small-mid cap US companies. The Investment Manager focuses on relative value in seeking to construct a diversified portfolio of investments for the Portfolio that maintains sector and industry balance, using investment opportunities identified through bottom-up fundamental research conducted by the Investment Manager’s small cap, mid cap and global research analysts.

The Portfolio may invest up to 20% of its assets in the securities of larger or smaller US or non-US companies.

Principal Investment Risks

The value of your investment in the Portfolio will fluctuate, which means you could lose money.

Market Risk. Market risks, including political, regulatory, market and economic developments, and developments that impact specific economic sectors, industries or segments of the market, can affect the value of the Portfolio’s investments. In addition, turbulence in financial markets and reduced liquidity in equity, credit and/or fixed income markets may negatively affect many issuers, which could adversely affect the Portfolio.

Issuer Risk. The value of a security may decline for a number of reasons which directly relate to the issuer, such as management performance, financial leverage and reduced demand for the issuer’s goods or services, as well as the historical and prospective earnings of the issuer and the value of its assets or factors unrelated to the issuer’s value, such as investor perception.

Small and Mid Cap Companies Risk. Small and mid cap companies carry additional risks because their earnings tend to be less predictable, their share prices more volatile and their securities less liquid than larger, more established companies. The shares of small and mid cap companies tend to trade less frequently than those of larger companies, which can have an adverse effect on the pricing of these securities and on the ability to sell these securities when the Investment Manager deems it appropriate.

Value Investing Risk. The Portfolio invests in stocks believed by the Investment Manager to be undervalued, but that may not realize their perceived value for extended periods of time or may never realize their perceived value. The stocks in which the Portfolio invests may respond differently to market and other developments than other types of stocks.

Non-US Securities Risk. The Portfolio’s performance will be influenced by political, social and economic factors affecting the non-US countries and companies in which the Portfolio invests. Non-US securities carry special risks, such as less developed or less efficient trading markets, political instability, a lack of company information, differing auditing and legal standards, and, potentially, less liquidity. In addition, investments denominated in currencies other than US dollars may experience a decline in value, in US dollar terms, due solely to fluctuations in currency exchange rates. Emerging market countries can generally have economic structures that are less diverse and mature, and political systems that are less stable, than those of developed countries.

Prospectus7 |

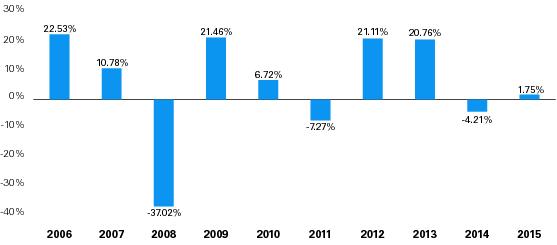

Performance Bar Chart and Table

Year-by-Year Total Returns for Service Shares

As of 12/31

The accompanying bar chart and table provide some indication of the risks of investing in Lazard Retirement US Small-Mid Cap Equity Portfolio by showing the Portfolio’s year-by-year performance and its average annual performance compared to that of a broad measure of market performance. The bar chart shows how the performance of the Portfolio’s Service Shares has varied from year to year over the past 10 calendar years. Performance information does not reflect the fees or charges imposed by the Participating Insurance Companies under the Policies, and such fees will have the effect of reducing performance. Updated performance information is available at www.LazardNet.com or by calling (800) 823-6300. The Portfolio’s past performance is not necessarily an indication of how the Portfolio will perform in the future.

As a new share Class, past performance information is not available for Investor Shares as of the date of this Prospectus. Investor Shares would have had annual returns substantially similar to those of Service Shares because the shares are invested in the same portfolio of securities, and the annual returns would differ only to the extent of the different expense ratios of the Classes.

|

|

|

|

Best Quarter: |

Average Annual Total Returns

(for the periods ended December 31, 2015)

The Russell 2000/2500 Linked Index shown in the table is an unmanaged index created by the Investment Manager, which links the performance of the Russell 2000® Index for all periods through May 31, 2009 (when the Portfolio’s investment focus was changed from small cap companies to small-mid cap companies) and the Russell 2500 Index for all periods thereafter.

|

|

|

|

|

|

|

|

|

|

|

|

|

Inception |

1 Year |

5 Years |

10 Years |

Life of |

|||||

|

||||||||||

|

Service Shares |

11/4/97 |

-2.38% |

8.00% |

6.62% |

7.46% |

|||||

|

||||||||||

Russell 2500 Index |

|

|

-2.90% |

10.32% |

7.56% |

8.19% |

||||

|

||||||||||

Russell 2000/2500 Linked Index |

|

|

-2.90% |

10.32% |

7.50% |

7.10% |

||||

|

||||||||||

8Prospectus |

Management

Investment Manager

Lazard Asset Management LLC

Portfolio Managers/Analysts

Daniel Breslin, portfolio manager/analyst on the Investment Manager’s US Small-Mid Cap Equity team, has been with the Portfolio since May 2007.

Michael DeBernardis, portfolio manager/analyst on the Investment Manager’s US Small-Mid Cap Equity and Global Small Cap Equity teams, has been with the Portfolio since October 2010.

Martin Flood, portfolio manager/analyst on various of the Investment Manager’s US Equity teams and the Global Equity Select and Fundamental Long/Short teams, has been with the Portfolio since 2014.

Additional Information

For important information about the purchase and sale of Portfolio shares, tax information and financial intermediary compensation, please turn to “Additional Information about the Portfolios” on page 24.

Prospectus9 |

Lazard Retirement Series Summary Section

Lazard Retirement International Equity Portfolio

Investment Objective

The Portfolio seeks long-term capital appreciation.

Fees and Expenses

This table describes the fees and expenses that you may pay if you buy and hold shares of the Portfolio, but does not reflect the fees or charges imposed by the separate accounts of the Participating Insurance Companies under the Policies. If such fees and charges were reflected, the figures in the table would be higher.

|

|

|

|

|

|||||

|

Service |

Investor |

|||||||

|

|||||||||

Annual Portfolio Operating Expenses (expenses that you pay each year as a percentage |

|

|

|

|

|||||

|

|||||||||

Management Fees |

.75% |

|

|

.75% |

|||||

|

|||||||||

Distribution and Service (12b-1) Fees |

.25% |

|

|

None |

|||||

|

|||||||||

Other Expenses |

.11% |

|

|

.11% |

* |

|

|||

|

|||||||||

Total Annual Portfolio Operating Expenses |

1.11% |

|

|

.86% |

|||||

|

|||||||||

Fee Waiver and Expense Reimbursement** |

.01% |

|

|

.01% |

|||||

|

|||||||||

Total Annual Portfolio Operating Expenses After Fee Waiver and Expense Reimbursement** |

1.10% |

|

|

.85% |

|||||

|

|||||||||

* |

“Other Expenses” are based on estimated amounts for the current fiscal year, using “Other Expenses” for Service Shares from the last fiscal year. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

** |

Reflects a contractual agreement by the Investment Manager to waive its fee and, if necessary, reimburse the Portfolio until May 1, 2017, to the extent Total Annual Portfolio Operating Expenses exceed 1.10% and .85% of the average daily net assets of the Portfolio’s Service Shares and Investor Shares, respectively, exclusive of taxes, brokerage, interest on borrowings, fees and expenses of “Acquired Funds” and extraordinary expenses. This agreement can only be amended by agreement of the Fund, upon approval by the Board, and the Investment Manager to lower the net amount shown and will terminate automatically in the event of termination of the Investment Management Agreement between the Investment Manager and the Fund, on behalf of the Portfolio. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Example

This Example is intended to help you compare the cost of investing in the Portfolio with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in the Portfolio for the time periods indicated and then hold or redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Portfolio’s operating expenses remain the same, giving effect to the fee waiver and expense reimbursement arrangement in year one only. The Example does not reflect fees and expenses imposed by the Participating Insurance Companies under the Policies; if they were reflected, the figures in the Example would be higher. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

1 Year |

3 Years |

5 Years |

10 Years |

||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|

Service Shares |

|

|

$ |

|

112 |

|

|

$ |

|

352 |

|

|

$ |

|

611 |

|

|

$ |

|

1,351 |

||||||||

|

||||||||||||||||||||||||||||

|

Investor Shares |

|

|

$ |

|

87 |

|

|

$ |

|

273 |

|

|

$ |

|

476 |

|

|

$ |

|

1,060 |

||||||||

|

||||||||||||||||||||||||||||

Portfolio Turnover

The Portfolio pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs. These costs, which are not reflected in annual portfolio operating expenses or in the Example, affect the Portfolio’s performance. During the most recent fiscal year, the Portfolio’s portfolio turnover rate was 37% of the average value of its portfolio.

10Prospectus |

Principal Investment Strategies

The Portfolio invests primarily in equity securities, principally common stocks, of relatively large non-US companies with market capitalizations in the range of companies included in the MSCI® Europe, Australasia and Far East (“EAFE®”) Index (ranging from approximately $1.7 billion to $235.6 billion as of April 5, 2016) that the Investment Manager believes are undervalued based on their earnings, cash flow or asset values.

In choosing stocks for the Portfolio, the Investment Manager looks for established companies in economically developed countries and may invest up to 15% of the Portfolio’s assets in securities of companies whose principal business activities are located in emerging market countries. Under normal circumstances, the Portfolio invests at least 80% of its assets in equity securities.

Principal Investment Risks

The value of your investment in the Portfolio will fluctuate, which means you could lose money.

Market Risk. Market risks, including political, regulatory, market and economic developments, and developments that impact specific economic sectors, industries or segments of the market, can affect the value of the Portfolio’s investments. In addition, turbulence in financial markets and reduced liquidity in equity, credit and/or fixed income markets may negatively affect many issuers, which could adversely affect the Portfolio.

Issuer Risk. The value of a security may decline for a number of reasons which directly relate to the issuer, such as management performance, financial leverage and reduced demand for the issuer’s goods or services, as well as the historical and prospective earnings of the issuer and the value of its assets or factors unrelated to the issuer’s value, such as investor perception.

Non-US Securities Risk. The Portfolio’s performance will be influenced by political, social and economic factors affecting the non-US countries and companies in which the Portfolio invests. Non-US securities carry special risks, such as less developed or less efficient trading markets, political instability, a lack of company information, differing auditing and legal standards, and, potentially, less liquidity.

Emerging Market Risk. Emerging market countries can generally have economic structures that are less diverse and mature, and political systems that are less stable, than those of developed countries. The economies of countries with emerging markets may be based predominantly on only a few industries, may be highly vulnerable to changes in local or global trade conditions, and may suffer from extreme debt burdens or volatile inflation rates. The securities markets of emerging market countries have historically been extremely volatile. These market conditions may continue or worsen. Significant devaluation of emerging market currencies against the US dollar may occur subsequent to acquisition of investments denominated in emerging market currencies.

Foreign Currency Risk. Investments denominated in currencies other than US dollars may experience a decline in value, in US dollar terms, due solely to fluctuations in currency exchange rates. The Portfolio’s investments could be adversely affected by delays in, or a refusal to grant, repatriation of funds or conversion of emerging market currencies. The Investment Manager does not intend to actively hedge the Portfolio’s foreign currency exposure.

Value Investing Risk. The Portfolio invests in stocks believed by the Investment Manager to be undervalued, but that may not realize their perceived value for extended periods of time or may never realize their perceived value. The stocks in which the Portfolio invests may respond differently to market and other developments than other types of stocks.

Large Cap Companies Risk. Investments in large cap companies may underperform other segments of the market when such other segments are in favor or because such companies may be less responsive to competitive challenges and opportunities and may be unable to attain high growth rates during periods of economic expansion.

Small and Mid Cap Companies Risk. Small and mid cap companies carry additional risks because their earnings tend to be less predictable, their share prices more volatile and their securities less liquid than larger, more established companies. The shares of small and mid cap companies tend to trade less frequently than those of larger companies, which can have an adverse effect on the pricing of these securities and on the ability to sell these securities when the Investment Manager deems it appropriate.

Prospectus11 |

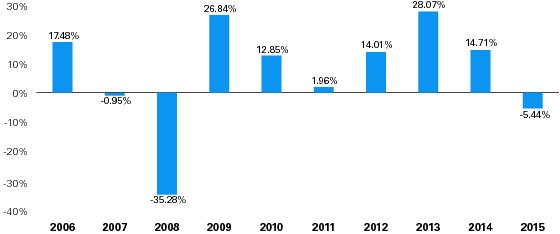

Performance Bar Chart and Table

Year-by-Year Total Returns for Service Shares

As of 12/31

The accompanying bar chart and table provide some indication of the risks of investing in Lazard Retirement International Equity Portfolio by showing the Portfolio’s year-by-year performance and its average annual performance compared to that of a broad measure of market performance. The bar chart shows how the performance of the Portfolio’s Service Shares has varied from year to year over the past 10 calendar years. Performance information does not reflect the fees or charges imposed by the Participating Insurance Companies under the Policies, and such fees will have the effect of reducing performance. Updated performance information is available at www.LazardNet.com or by calling (800) 823-6300. The Portfolio’s past performance is not necessarily an indication of how the Portfolio will perform in the future.

As a new share Class, past performance information is not available for Investor Shares as of the date of this Prospectus. Investor Shares would have had annual returns substantially similar to those of Service Shares because the shares are invested in the same portfolio of securities, and the annual returns would differ only to the extent of the different expense ratios of the Classes.

|

|

|

|

Best Quarter: |

Average Annual Total Returns

(for the periods ended December 31, 2015)

|

|

|

|

|

|

|

|

|

|

|

|

|

Inception |

1 Year |

5 Years |

10 Years |

Life of |

|||||

|

||||||||||

|

Service Shares |

9/1/98 |

1.75% |

5.74% |

3.89% |

4.08% |

|||||

|

||||||||||

MSCI EAFE Index |

|

|

-0.81% |

3.60% |

3.03% |

4.50% |

||||

|

||||||||||

12Prospectus |

Management

Investment Manager

Lazard Asset Management LLC

Portfolio Managers/Analysts

Michael G. Fry, portfolio manager/analyst on various of the Investment Manager’s Global Equity and International Equity teams, has been with the Portfolio since November 2005.

Michael A. Bennett, portfolio manager/analyst on various of the Investment Manager’s International Equity teams, has been with the Portfolio since May 2003.

Kevin J. Matthews, portfolio manager/analyst on various of the Investment Manager’s International Equity teams, has been with the Portfolio since May 2013.

Michael Powers, portfolio manager/analyst on various of the Investment Manager’s Global Equity and International Equity teams, has been with the Portfolio since May 2003.

John R. Reinsberg, portfolio manager/analyst on the Investment Manager’s Global Equity and International Equity teams, has been with the Portfolio since September 1998.

Additional Information

For important information about the purchase and sale of Portfolio shares, tax information and financial intermediary compensation, please turn to “Additional Information about the Portfolios” on page 24.

Prospectus13 |

Lazard Retirement Series Summary Section

This Portfolio is closed to investment by new insurance companies. See page 38 for more information.

Lazard Retirement Emerging Markets Equity Portfolio

Investment Objective

The Portfolio seeks long-term capital appreciation.

Fees and Expenses

This table describes the fees and expenses that you may pay if you buy and hold shares of the Portfolio, but does not reflect the fees or charges imposed by the separate accounts of the Participating Insurance Companies under the Policies. If such fees and charges were reflected, the figures in the table would be higher.

|

|

|

|

|

|||||

|

Service |

Investor |

|||||||

|

|||||||||

Annual Portfolio Operating Expenses (expenses that you pay each year as a percentage |

|

|

|

|

|||||

|

|||||||||

Management Fees |

1.00% |

|

|

1.00% |

|||||

|

|||||||||

Distribution and Service (12b-1) Fees |

.25% |

|

|

None |

|||||

|

|||||||||

Other Expenses |

.14% |

|

|

.15% |

|||||

|

|||||||||

Total Annual Portfolio Operating Expenses |

1.39% |

|

|

1.15% |

|||||

|

|||||||||

Example

This Example is intended to help you compare the cost of investing in the Portfolio with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in the Portfolio for the time periods indicated and then hold or redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Portfolio’s operating expenses remain the same. The Example does not reflect fees and expenses imposed by the Participating Insurance Companies under the Policies; if they were reflected, the figures in the Example would be higher. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

1 Year |

3 Years |

5 Years |

10 Years |

||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|

Service Shares |

|

|

$ |

|

142 |

|

|

$ |

|

440 |

|

|

$ |

|

761 |

|

|

$ |

|

1,669 |

||||||||

|

||||||||||||||||||||||||||||

|

Investor Shares |

|

|

$ |

|

117 |

|

|

$ |

|

365 |

|

|

$ |

|

633 |

|

|

$ |

|

1,398 |

||||||||

|

||||||||||||||||||||||||||||

Portfolio Turnover

The Portfolio pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs. These costs, which are not reflected in annual portfolio operating expenses or in the Example, affect the Portfolio’s performance. During the most recent fiscal year, the Portfolio’s portfolio turnover rate was 9% of the average value of its portfolio.

14Prospectus |

Principal Investment Strategies

The Portfolio invests primarily in equity securities, principally common stocks, of non-US companies whose principal activities are located in emerging market countries and that the Investment Manager believes are undervalued based on their earnings, cash flow or asset values.

Emerging market countries include all countries represented by the MSCI Emerging Markets® Index, which currently includes: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Peru, Philippines, Poland, Qatar, Russia, South Africa, Taiwan, Thailand, Turkey and United Arab Emirates.

Under normal circumstances, the Portfolio invests at least 80% of its assets in equity securities of companies whose principal business activities are located in emerging market countries.

Principal Investment Risks

The value of your investment in the Portfolio will fluctuate, which means you could lose money.

Market Risk. Market risks, including political, regulatory, market and economic developments, and developments that impact specific economic sectors, industries or segments of the market, can affect the value of the Portfolio’s investments. In addition, turbulence in financial markets and reduced liquidity in equity, credit and/or fixed income markets may negatively affect many issuers, which could adversely affect the Portfolio.

Issuer Risk. The value of a security may decline for a number of reasons which directly relate to the issuer, such as management performance, financial leverage and reduced demand for the issuer’s goods or services, as well as the historical and prospective earnings of the issuer and the value of its assets or factors unrelated to the issuer’s value, such as investor perception.

Non-US Securities Risk. The Portfolio’s performance will be influenced by political, social and economic factors affecting the non-US countries and companies in which the Portfolio invests. Non-US securities carry special risks, such as less developed or less efficient trading markets, political instability, a lack of company information, differing auditing and legal standards, and, potentially, less liquidity.

Emerging Market Risk. Emerging market countries can generally have economic structures that are less diverse and mature, and political systems that are less stable, than those of developed countries. The economies of countries with emerging markets may be based predominantly on only a few industries, may be highly vulnerable to changes in local or global trade conditions, and may suffer from extreme debt burdens or volatile inflation rates. The securities markets of emerging market countries have historically been extremely volatile. These market conditions may continue or worsen. Significant devaluation of emerging market currencies against the US dollar may occur subsequent to acquisition of investments denominated in emerging market currencies.

Foreign Currency Risk. Investments denominated in currencies other than US dollars may experience a decline in value, in US dollar terms, due solely to fluctuations in currency exchange rates. The Portfolio’s investments could be adversely affected by delays in, or a refusal to grant, repatriation of funds or conversion of emerging market currencies. The Investment Manager does not intend to actively hedge the Portfolio’s foreign currency exposure.

Small and Mid Cap Companies Risk. Small and mid cap companies carry additional risks because their earnings tend to be less predictable, their share prices more volatile and their securities less liquid than larger, more established companies. The shares of small and mid cap companies tend to trade less frequently than those of larger companies, which can have an adverse effect on the pricing of these securities and on the ability to sell these securities when the Investment Manager deems it appropriate.

Large Cap Companies Risk. Investments in large cap companies may underperform other segments of the market when such other segments are in favor or because such companies may be less responsive to competitive challenges and opportunities and may be unable to attain high growth rates during periods of economic expansion.

Prospectus15 |

Value Investing Risk. The Portfolio invests in stocks believed by the Investment Manager to be undervalued, but that may not realize their perceived value for extended periods of time or may never realize their perceived value. The stocks in which the Portfolio invests may respond differently to market and other developments than other types of stocks.

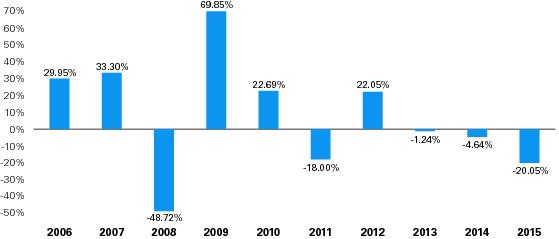

Performance Bar Chart and Table

Year-by-Year Total Returns for Service Shares

As of 12/31

The accompanying bar chart and table provide some indication of the risks of investing in Lazard Retirement Emerging Markets Equity Portfolio by showing the Portfolio’s year-by-year performance and its average annual performance compared to that of a broad measure of market performance. The bar chart shows how the performance of the Portfolio’s Service Shares has varied from year to year over the past 10 calendar years. Performance information does not reflect the fees or charges imposed by the Participating Insurance Companies under the Policies, and such fees will have the effect of reducing performance. Updated performance information is available at www.LazardNet.com or by calling (800) 823-6300. The Portfolio’s past performance is not necessarily an indication of how the Portfolio will perform in the future.

|

|

|

|

Best Quarter: |

Average Annual Total Returns

(for the periods ended December 31, 2015)

|

|

|

|

|

|

|

|

|

|

|

|

|

Inception |

1 Year |

5 Years |

10 Years |

Life of |

|||||

|

||||||||||

|

Service Shares |

11/4/97 |

-20.05% |

-5.50% |

3.38% |

6.14% |

|||||

|

||||||||||

|

Investor Shares |

5/1/06 |

-19.90% |

-5.28% |

N/A |

2.03% |

|||||

|

||||||||||

MSCI Emerging Markets Index |

|

|

-14.92% |

-4.81% |

3.61% |

5.75% |

||||

|

||||||||||

16Prospectus |

Management

Investment Manager

Lazard Asset Management LLC

Portfolio Managers/Analysts

James M. Donald, portfolio manager/analyst on the Investment Manager’s Emerging Markets Equity team, has been with the Portfolio since November 2001.

Rohit Chopra, portfolio manager/analyst on the Investment Manager’s Emerging Markets Equity team, has been with the Portfolio since May 2007.

Monika Shrestha, portfolio manager/analyst on the Investment Manager’s Emerging Markets Equity team, has been with the Portfolio since December 2014.

John R. Reinsberg, portfolio manager/analyst on the Investment Manager’s Global Equity and International Equity teams, has been with the Portfolio since November 1997.

Additional Information

For important information about the purchase and sale of Portfolio shares, tax information and financial intermediary compensation, please turn to “Additional Information about the Portfolios” on page 24.

Prospectus17 |

Lazard Retirement Series Summary Section

Lazard Retirement Global Dynamic Multi Asset Portfolio

Investment Objective

The Portfolio seeks total return.

Fees and Expenses

This table describes the fees and expenses that you may pay if you buy and hold shares of the Portfolio, but does not reflect the fees or charges imposed by the separate accounts of the Participating Insurance Companies under the Policies. If such fees and charges were reflected, the figures in the table would be higher.

|

|

|

|

|

|||||

|

Service |

Investor |

|||||||

|

|||||||||

Annual Portfolio Operating Expenses (expenses that you pay each year as a percentage |

|

|

|

|

|||||

|

|||||||||

Management Fees |

.85% |

|

|

.85% |

|||||

|

|||||||||

Distribution and Service (12b-1) Fees |

.25% |

|

|

None |

|||||

|

|||||||||

Other Expenses |

.21% |

|

|

.21% |

* |

|

|||

|

|||||||||

Total Annual Portfolio Operating Expenses |

1.31% |

|

|

1.06% |

|||||

|

|||||||||

Fee Waiver and Expense Reimbursement** |

.26% |

|

|

.16% |

|||||

|

|||||||||

Total Annual Portfolio Operating Expenses After Fee Waiver and Expense Reimbursement** |

1.05% |

|

|

.90% |

|||||

|

|||||||||

* |

“Other Expenses” are based on estimated amounts for the current fiscal year, using “Other Expenses” for Service Shares from the last fiscal year. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

** |

Reflects a contractual agreement by the Investment Manager to waive its fee and, if necessary, reimburse the Portfolio until May 1, 2017, to the extent Total Annual Portfolio Operating Expenses exceed 1.05% and .90% of the average daily net assets of the Portfolio’s Service Shares and Investor Shares, respectively, exclusive of taxes, brokerage, interest on borrowings, fees and expenses of “Acquired Funds” and extraordinary expenses. This agreement can only be amended by agreement of the Fund, upon approval by the Board, and the Investment Manager to lower the net amount shown and will terminate automatically in the event of termination of the Investment Management Agreement between the Investment Manager and the Fund, on behalf of the Portfolio. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Example

This Example is intended to help you compare the cost of investing in the Portfolio with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in the Portfolio for the time periods indicated and then hold or redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Portfolio’s operating expenses remain the same, giving effect to the fee waiver and expense reimbursement arrangement in year one only. The Example does not reflect fees and expenses imposed by the Participating Insurance Companies under the Policies; if they were reflected, the figures in the Example would be higher. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

1 Year |

3 Years |

5 Years |

10 Years |

||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|

Service Shares |

|

|

$ |

|

107 |

|

|

$ |

|

390 |

|

|

$ |

|

693 |

|

|

$ |

|

1,556 |

||||||||

|

||||||||||||||||||||||||||||

|

Investor Shares |

|

|

$ |

|

92 |

|

|

$ |

|

321 |

|

|

$ |

|

569 |

|

|

$ |

|

1,280 |

||||||||

|

||||||||||||||||||||||||||||

Portfolio Turnover

The Portfolio pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs. These costs, which are not reflected in annual portfolio operating expenses or in the Example, affect the Portfolio’s performance. During the most recent fiscal year, the Portfolio’s portfolio turnover rate was 114% of the average value of its portfolio.

18Prospectus |

Principal Investment Strategies

The Investment Manager allocates the Portfolio’s assets among various US and non-US equity and fixed-income strategies managed by the Investment Manager in proportions consistent with the Investment Manager’s evaluation of various economic and other factors designed to estimate probabilities, including volatility. The Investment Manager makes allocation decisions among the strategies based on quantitative and qualitative analysis using a number of different tools, including proprietary software models and input from the Investment Manager’s research analysts. At any given time the Portfolio’s assets may not be allocated to all strategies.

A principal component of the Investment Manager’s investment process for the Portfolio is volatility management. The Investment Manager generally will seek to achieve, over a full market cycle, a level of volatility in the Portfolio’s performance of approximately 10%. Volatility, a risk measurement, measures the magnitude of up and down fluctuations in the value of a financial instrument or index over time.

As a consequence of allocating its assets among various of the Investment Manager’s investment strategies, the Portfolio may:

• |

invest in US and non-US equity and debt securities (including those of companies with business activities located in emerging market countries and securities issued by governments of such countries), depositary receipts and shares, currencies and related instruments, and structured notes |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

• |

invest in exchange-traded open-end management investment companies (“ETFs”) and similar products, which generally pursue a passive index-based strategy |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

• |

invest in securities of companies of any size or market capitalization |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

• |

invest in debt securities of any maturity or duration |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

• |

invest in securities of any particular quality or investment grade and, as a result, the Portfolio may invest significantly in securities rated below investment grade (e.g., lower than Baa by Moody’s Investors Service, Inc. (“Moody’s”) or lower than BBB by Standard & Poor’s Ratings Group (“S&P”)) (“junk bonds”) or securities that are unrated |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

• |

enter into swap agreements (including credit default swap agreements) and forward contracts, and may purchase and write put and covered call options, on securities, indexes and currencies, for hedging purposes (although it is not required to do so) or to seek to increase returns |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Under normal market conditions, the Portfolio invests significantly (at least 40%—unless market conditions are not deemed favorable by the Investment Manager, in which case the Portfolio would invest at least 30%) in issuers organized or located outside the US or doing a substantial amount of business outside the US, securities denominated in a foreign currency or foreign currency forward contracts.

Principal Investment Risks

The value of your investment in the Portfolio will fluctuate, which means you could lose money.

Allocation Risk. The Portfolio’s ability to achieve its investment objective depends in part on the Investment Manager’s skill in determining the Portfolio’s allocation among investment strategies. The Investment Manager’s evaluations and assumptions underlying its allocation decisions may differ from actual market conditions.

Market Risk. Market risks, including political, regulatory, market and economic developments, and developments that impact specific economic sectors, industries or segments of the market, can affect the value of the Portfolio’s investments. In addition, turbulence in financial markets and reduced liquidity in equity, credit and/or fixed income markets may negatively affect many issuers, which could adversely affect the Portfolio.

Issuer Risk. The value of a security may decline for a number of reasons which directly relate to the issuer, such as management performance, financial

Prospectus19 |

leverage and reduced demand for the issuer’s goods or services, as well as the historical and prospective earnings of the issuer and the value of its assets or factors unrelated to the issuer’s value, such as investor perception.

Volatility Management Risk. While the Investment Manager generally will seek to achieve, over a full market cycle, the level of volatility in the Portfolio’s performance as described above, there can be no guarantee that this will be achieved; actual or realized volatility for any particular period may be materially higher or lower depending on market conditions. In addition, the Investment Manager’s efforts to manage the Portfolio’s volatility can be expected, in a period of generally positive equity market returns, to reduce the Portfolio’s performance below what could be achieved without seeking to manage volatility and, thus, the Portfolio would generally be expected to underperform market indices that do not seek to achieve a specified level of volatility.

Value Investing and Growth Investing Risks. The Portfolio may invest a portion of its assets in stocks believed by the Investment Manager to be undervalued, but that may not realize their perceived value for extended periods of time or may never realize their perceived value. The Portfolio also may invest a portion of its assets in stocks believed by the Investment Manager to have the potential for growth, but that may not realize such perceived potential for extended periods of time or may never realize such perceived growth potential. Such stocks may be more volatile than other stocks because they can be more sensitive to investor perceptions of the issuing company’s growth potential. The stocks in which the Portfolio invests may respond differently to market and other developments than other types of stocks.

Quantitative Model Risk. The success of the Portfolio depends upon effectiveness of the Investment Manager’s quantitative model. A quantitative model, such as the risk and other models used by the Investment Manager requires adherence to a systematic, disciplined process. The Investment Manager’s ability to monitor and, if necessary, adjust its quantitative model could be adversely affected by various factors, including incorrect or outdated market and other data inputs. Factors that affect a security’s value can change over time, and these changes may not be reflected in the quantitative model. In addition, the factors used in quantitative analysis and the weight placed on those factors may not be predictive of a security’s value.

Non-US Securities Risk. The Portfolio’s performance will be influenced by political, social and economic factors affecting the non-US countries and companies in which the Portfolio invests. Non-US securities carry special risks, such as less developed or less efficient trading markets, political instability, a lack of company information, differing auditing and legal standards, and, potentially, less liquidity.

Emerging Market Risk. Emerging market countries can generally have economic structures that are less diverse and mature, and political systems that are less stable, than those of developed countries. The economies of countries with emerging markets may be based predominantly on only a few industries, may be highly vulnerable to changes in local or global trade conditions, and may suffer from extreme debt burdens or volatile inflation rates. The securities markets of emerging market countries have historically been extremely volatile. These market conditions may continue or worsen. Significant devaluation of emerging market currencies against the US dollar may occur subsequent to acquisition of investments denominated in emerging market currencies.

Foreign Currency Risk. Investments denominated in currencies other than US dollars may experience a decline in value, in US dollar terms, due solely to fluctuations in currency exchange rates. The Portfolio’s investments could be adversely affected by delays in, or a refusal to grant, repatriation of funds or conversion of emerging market currencies. The Investment Manager does not intend to actively hedge the Portfolio’s foreign currency exposure.

Fixed-Income and Debt Securities Risk. The market value of a debt security may decline due to general market conditions that are not specifically related to a particular company, such as real or perceived adverse economic conditions, changes in the outlook for corporate earnings, changes in interest

20Prospectus |

or currency rates or adverse investor sentiment generally. The debt securities market can be susceptible to increases in volatility and decreases in liquidity. Liquidity can decline unpredictably in response to overall economic conditions or credit tightening.

Prices of bonds and other debt securities tend to move inversely with changes in interest rates. Interest rate risk is usually greater for fixed-income securities with longer maturities or durations. A rise in interest rates (or the expectation of a rise in interest rates) may result in periods of volatility, decreased liquidity and increased redemptions, and, as a result, the Portfolio may have to liquidate portfolio securities at disadvantageous prices. Risks associated with rising interest rates are heightened given that interest rates in the US and other countries are at or near historic lows.

The Portfolio’s investments in lower-rated, higher-yielding securities (“junk bonds”) are subject to greater credit risk than its higher rated investments. Credit risk is the risk that the issuer will not make interest or principal payments, or will not make payments on a timely basis. Non-investment grade securities tend to be more volatile, less liquid and are considered speculative. If there is a decline, or perceived decline, in the credit quality of a debt security (or any guarantor of payment on such security), the security’s value could fall, potentially lowering the Portfolio’s share price. The prices of non-investment grade securities, unlike investment grade debt securities, may fluctuate unpredictably and not necessarily inversely with changes in interest rates. The market for these securities may be less liquid and therefore these securities may be harder to value or sell at an acceptable price, especially during times of market volatility or decline.

Some debt securities may give the issuer the option to call, or redeem, the securities before their maturity, and, during a time of declining interest rates, the Portfolio may have to reinvest the proceeds in an investment offering a lower yield (and the Portfolio may not fully benefit from any increase in the value of its portfolio holdings as a result of declining interest rates).

Structured notes are privately negotiated debt instruments where the principal and/or interest is determined by reference to a specified asset, market or rate, or the differential performance of two assets or markets. Structured notes can have risks of both debt securities and derivative transactions.

ETF Risk. Any investments in ETFs are subject to the risks of the investments of the ETFs, as well as to the general risks of investing in ETFs. Portfolio shares will bear not only the Portfolio’s management fees and operating expenses, but also their proportional share of the management fees and operating expenses of any ETFs in which the Portfolio invests. Shares of ETFs in which the Portfolio invests may trade at prices that vary from their net asset values (“NAVs”), sometimes significantly. The shares of ETFs may trade at prices at, below or above their most recent NAV.

Small and Mid Cap Companies Risk. Small and mid cap companies carry additional risks because their earnings tend to be less predictable, their share prices more volatile and their securities less liquid than larger, more established companies. The shares of small and mid cap companies tend to trade less frequently than those of larger companies, which can have an adverse effect on the pricing of these securities and on the ability to sell these securities when the Investment Manager deems it appropriate.

Liquidity Risk. The lack of a readily available market may limit the ability of the Portfolio to sell certain securities at the time and price it would like. The size of certain securities offerings of emerging markets issuers may be relatively smaller in size than offerings in more developed markets and, in some cases, the Portfolio, by itself or together with other Portfolios or other accounts managed by the Investment Manager, may hold a position in a security that is large relative to the typical trading volume for that security; these factors can make it difficult for the Portfolio to dispose of the position at the desired time or price.

Forward Currency Contracts and Other Derivatives Risk. Forward currency contracts and other derivatives transactions, including those entered into for hedging purposes, may increase volatility or reduce returns, perhaps substantially, particularly since most derivatives have a leverage component

Prospectus21 |

that provides investment exposure in excess of the amount invested. Swap agreements, forward currency contracts, over-the-counter options on securities, indexes and currencies, structured notes and other over-the-counter derivatives transactions are subject to the risk of default by the counterparty and can be illiquid. These derivatives transactions, as well as the exchange-traded options in which the Portfolio may invest, are subject to many of the risks of, and can be highly sensitive to changes in the value of, the related security, index or currency. As such, a small investment could have a potentially large impact on the Portfolio’s performance. Derivatives transactions incur costs, either explicitly or implicitly, which reduce return. Successful use of derivatives is subject to the Investment Manager’s ability to predict correctly movements in the direction of the relevant reference asset or market. Use of derivatives transactions, even if entered into for hedging purposes, may cause the Portfolio to experience losses greater than if the Portfolio had not engaged in such transactions.

High Portfolio Turnover Risk. The Portfolio’s investment strategy may involve high portfolio turnover (such as 100% or more). A portfolio turnover rate of 100%, for example, is equivalent to the Portfolio buying and selling all of its securities once during the course of the year. A high portfolio turnover rate could result in high transaction costs.

Performance Bar Chart and Table

Year-by-Year Total Returns for Service Shares

As of 12/31

The accompanying bar chart and table provide some indication of the risks of investing in Lazard Retirement Global Dynamic Multi Asset Portfolio by showing the Portfolio’s year-by-year performance and its average annual performance compared to that of broad measures of market performance. The bar chart shows how the performance of the Portfolio’s Service Shares has varied from year to year. Performance information does not reflect the fees or charges imposed by the Participating Insurance Companies under the Policies, and such fees will have the effect of reducing performance. Updated performance information is available at www.LazardNet.com or by calling (800) 823-6300. The Portfolio’s past performance is not necessarily an indication of how the Portfolio will perform in the future.

As a new share Class, past performance information is not available for Investor Shares as of the date of this Prospectus. Investor Shares would have had annual returns substantially similar to those of Service Shares because the shares are invested in the same portfolio of securities, and the annual returns would differ only to the extent of the different expense ratios of the Classes.

|

|

|

|

Best Quarter: |

22Prospectus |

Average Annual Total Returns

(for the periods ended December 31, 2015)

The 50% MSCI World Index/50% Barclays Capital Global Aggregate Bond Index shown in the table is an unmanaged index created by the Investment Manager and is a 50/50 blend of the MSCI World Index and the Barclays Capital Global Aggregate Bond® Index.

|

|

|

|

|

|

|

|

|

Inception |

1 Year |

Since |

|||

|

||||||

|

Service Shares |

4/30/12 |

-0.44% |

7.22% |

|||

|

||||||

MSCI World Index |

|

|

-0.87% |

9.25% |

||

|

||||||

50% MSCI World Index/50% Barclays Capital Global Aggregate Bond Index |

|

|

-1.79% |

4.25% |

||

|

||||||

Management

Investment Manager

Lazard Asset Management LLC

Portfolio Managers/Analysts

Jai Jacob, portfolio manager/analyst on the Investment Manager’s Multi Asset team, has been with the Portfolio since April 2012.

Stephen Marra, portfolio manager/analyst on the Investment Manager’s Multi Asset team, has been with the Portfolio since May 2013.

Additional Information

For important information about the purchase and sale of Portfolio shares, tax information and financial intermediary compensation, please turn to “Additional Information about the Portfolios” on page 24.

Prospectus23 |

Lazard Retirement Series Additional Information about the Portfolios

Purchase and Sale of Portfolio Shares

Portfolio shares are currently offered only to Participating Insurance Companies. Portfolio shares may be sold each business day by the separate accounts of the Participating Insurance Companies.

Tax Information

Owners of the Policies offered by the separate accounts of Participating Insurance Companies should consult the prospectuses or other disclosure documents of the separate accounts regarding the federal tax consequences of investing in a Portfolio through a separate account.

Financial Intermediary Compensation

Payments to Participating Insurance Companies and Financial Intermediaries

The Portfolios and the Investment Manager and its affiliates may pay Participating Insurance Companies, or their affiliates, for the sale of Portfolio shares and related services. Participating Insurance Companies, or their affiliates, may pay broker-dealers or other financial intermediaries that sell Policies for the sale of shares of a Portfolio and related services. When received by a Participating Insurance Company, such payments may be a factor that the Participating Insurance Company considers in including a Portfolio as an investment option in its Policies. The prospectus or other disclosure document for the Policies may contain additional information about these payments. When received by a financial intermediary, such payments may create a conflict of interest by influencing the financial intermediary and salespersons to recommend a Portfolio over other mutual funds available as investment options under a Policy. Ask the salesperson or visit the financial intermediary’s website for more information.

24Prospectus |

Lazard Retirement Series Investment Strategies and Investment Risks

Overview

The Fund consists of twenty-one separate Portfolios, five of which are described in this prospectus.

Each Portfolio has its own investment objective, strategies, and risk/return and expense profile. There is no guarantee that any Portfolio will achieve its investment objective. Because you could lose money by investing in a Portfolio, be sure to read all risk disclosures carefully before investing.

Each Portfolio other than Lazard Retirement Global Dynamic Multi Asset Portfolio has adopted a policy to invest at least 80% of its assets in specified securities appropriate to its name and to provide its shareholders with at least 60 days’ prior notice of any change with respect to this policy.

The investment objective of each Portfolio may only be changed with the approval of the Portfolio’s shareholders.

Information on the recent strategies and holdings of each Portfolio can be found in the current annual/semi-annual report (see back cover).

The Portfolios are intended to be funding vehicles for VA contracts and VLI policies offered by the separate accounts of the Participating Insurance Companies. Not all Portfolios or share classes may be available through a particular Policy. Individuals may not purchase Portfolio shares directly from the Fund. The Policies are described in the separate account prospectuses, over which the Fund assumes no responsibility. The investment objective and policies of a Portfolio may be similar to other funds/portfolios managed or advised by the Investment Manager. However, the investment results of a Portfolio may be higher or lower than, and there is no guarantee that the investment results of a Portfolio will be comparable to, any other funds/portfolios managed or advised by the Investment Manager. Portfolio shares may also be offered to certain qualified pension and retirement plans and to accounts permitting accumulation of assets on a tax-deferred basis (“Eligible Plans”). Differences in tax treatment or other considerations may cause the interests of Policy owners and Eligible Plan participants investing in a Portfolio to conflict. The Board monitors each Portfolio for any material conflicts and determines what action, if any, should be taken. For information about Eligible Plan investing, call (800) 823-6300.

Investment Strategies

Lazard Retirement US Strategic Equity Portfolio

The Portfolio invests primarily in equity securities, including common stocks, preferred stocks and convertible securities, of US companies that the Investment Manager believes have strong and/or improving financial productivity and are undervalued based on their earnings, cash flow or asset values. Ordinarily, the market capitalizations of the Portfolio’s investments will be within the range of companies included in the S&P 500 Index (ranging from approximately $2.6 billion to $609.8 billion as of April 5, 2016). Although the Portfolio generally focuses on large cap companies, the market capitalizations of issuers in which the Portfolio invests may vary with market conditions and the Portfolio also may invest in mid cap and small cap companies.

Under normal circumstances, the Portfolio invests at least 80% of its assets in equity securities of US companies. The Portfolio may invest up to 20% of its assets in securities of non-US companies.

The Portfolio considers a company or issuer to be a “US company” if: (i) the company/issuer is organized under the laws of or is domiciled in the US or maintains its principal place of business in the US; (ii) the security, or security of such company/issuer, is traded principally in the US; or (iii) during the most recent fiscal year of the company/issuer, the company/issuer derived at least 50% of its revenues or profits from goods produced or sold, investments made, or services performed in the US or that has at least 50% of its assets in the US.

The Portfolio may invest in ETFs and similar products, which generally pursue a passive index-based strategy.

The Portfolio may, but is not required to, enter into futures contracts and/or swap agreements in an effort to protect the Portfolio’s investments against a

Prospectus25 |