Form 8-K CVR PARTNERS, LP For: Dec 01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

___________________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

___________________________________

Date of Report (Date of earliest event reported): December 1, 2016

CVR PARTNERS, LP

(Exact name of registrant as specified in its charter)

Delaware (State or other jurisdiction of incorporation) | 001-35120 (Commission File Number) | 56-2677689 (I.R.S. Employer Identification Number) |

2277 Plaza Drive, Suite 500 Sugar Land, Texas 77479 (Address of principal executive offices, including zip code) | ||

Registrant’s telephone number, including area code: (281) 207-3200

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 7.01. Regulation FD Disclosure.

On December 1, 2016, CVR Partners, LP, or the “Partnership,” posted an investor presentation to its website at www.cvrpartners.com under the tab “Investor Relations”. The information included in the presentation provides an overview of the Partnership’s strategy and performance and includes, among other things, information concerning the fertilizer market. The presentation is intended to be made available to unitholders, analysts and investors, including investor groups participating in forums such as sponsored investor conferences, during the fourth quarter of 2016. The presentation is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

In accordance with General Instruction B.2 of Form 8-K, the information in this Current Report on Form 8-K and Exhibit 99.1 attached hereto are being furnished pursuant to Item 7.01 of Form 8-K and will not, except to the extent required by applicable law or regulation, be deemed filed by the Partnership for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section, nor will any of such information or exhibits be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except as expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

The following exhibit is being “furnished” as part of this Current Report on Form 8-K:

99.1 Slides from management presentation.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: December 1, 2016

CVR Partners, LP | |

By: CVR GP, LLC, its general partner | |

By: | /s/ Susan M. Ball |

Susan M. Ball | |

Chief Financial Officer and Treasurer | |

Graphics file located here:

O:\IBD_Regional_Documents_Repository_AM_Groups\Pres

Tech Graphics\Custom templates\C49E\CVR Rentech

Note:

Cover slide is a jpg requested by the banker.

0

0

0

Dark 1

255

255

255

Light 1

102

162

188

Dark 2

123

113

160

Light 2

0

56

104

Accent 1

120

152

179

Accent 2

178

194

209

Accent 3

107

113

118

Accent 4

218

219

221

Accent 5

123

124

65

Accent 6

37

91

137

Hyperlink

102

136

164

Followed

Hyperlink

CVR Partners, LP

Investor Presentation

December 2016

0

0

0

Dark 1

255

255

255

Light 1

102

162

188

Dark 2

123

113

160

Light 2

0

56

104

Accent 1

120

152

179

Accent 2

178

194

209

Accent 3

107

113

118

Accent 4

218

219

221

Accent 5

123

124

65

Accent 6

37

91

137

Hyperlink

102

136

164

Followed

Hyperlink

1

Safe Harbor Statement

The following presentation contains forward-looking statements based on management’s current expectations and

beliefs, as well as a number of assumptions concerning future events. The assumptions and estimates underlying

forward-looking statements are inherently uncertain and, although considered reasonable as of the date of

preparation by the management team of our general partner, are subject to a wide variety of significant business,

economic, and competitive risks and uncertainties that could cause actual results to differ materially from those

contained in the prospective information. Accordingly, there can be no assurance that we will achieve the future

results we expect or that actual results will not differ materially from expectations.

You are cautioned not to put undue reliance on such forward-looking statements (including forecasts and

projections regarding our future performance) because actual results may vary materially from those expressed or

implied as a result of various factors, including, but not limited to those set forth under “Risk Factors” in CVR

Partners, LP’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and any other filings CVR Partners,

LP makes with the Securities and Exchange Commission.

CVR Partners, LP assumes no obligation to, and expressly disclaims any obligation to, update or revise any

forward-looking statements, whether as a result of new information, future events or otherwise, except as required

by law.

Non-GAAP Financial Measures

Certain financial information included herein, including EBITDA, Adjusted EBITDA, Pro Forma Adjusted EBITDA

and Free Cash Flow are not presentations made in accordance with U.S. GAAP, and use of such terms varies

from others in the same industry. Non-GAAP financial measures should not be considered as alternatives to

income from continuing operations, income from operations or any other performance measures derived in

accordance with U.S. GAAP as measures of operating performance or cash flows as measures of liquidity. Non-

GAAP financial measures have important limitations as analytical tools, and you should not consider them in

isolation or as substitutes for results as reported under U.S. GAAP. This presentation includes a reconciliation of

certain non-GAAP financial measures to the most directly comparable financial measures calculated in

accordance with U.S. GAAP.

Safe Harbor Statement and Non-GAAP Financial

Measures

0

0

0

Dark 1

255

255

255

Light 1

102

162

188

Dark 2

123

113

160

Light 2

0

56

104

Accent 1

120

152

179

Accent 2

178

194

209

Accent 3

107

113

118

Accent 4

218

219

221

Accent 5

123

124

65

Accent 6

37

91

137

Hyperlink

102

136

164

Followed

Hyperlink

2

CVR Partners, LP (NYSE: UAN) is a leading North American producer and

distributor of nitrogen fertilizer products

− Delivered ~1.5MM tons of nitrogen products in 2015 (pro forma for East Dubuque acquisition)(1)

− Structured as a publicly-traded master limited partnership (variable distributions)

• General Partner does not receive Incentive Distribution Rights (IDRs)

‒ Pro Forma Adjusted LTM EBITDA of $151 million(2)(3)

Attractive long-term industry fundamentals

Acquisition of Rentech Nitrogen Partners(1)

− Creates a strong business enterprise with two plants and a diversified earnings base

‒ Provides enhanced flexibility and reduced operating risk

‒ Expands position into additional attractive markets – from Southern Plains to Mid Corn Belt

‒ Increases scale, profitability and free cash flow profile

Experienced management team

Opportunities for growth

Key Investment Highlights

(1) On April 1, 2016, CVR Partners acquired Rentech Nitrogen Partners, L.P. (previously NYSE:RNF), whereby CVR Partners acquired the nitrogen fertilizer manufacturing facility located in East Dubuque,

Illinois (the East Dubuque Facility). The transaction excluded RNF’s facility in Pasadena, Texas (was divested prior to closing on the acquisition of RNF). As such, the results of the Pasadena facility are

excluded for all periods presented.

(2) Pro Forma Adjusted LTM EBITDA for the period ended September 30, 2016 based on reported, unaudited pro forma adjusted values to reflect the acquisition of RNF. See page 24 for reconciliation of Net

Income to Adjusted EBITDA.

(3) Excludes full year of anticipated $12mm in synergies.

TBU for final structure

0

0

0

Dark 1

255

255

255

Light 1

102

162

188

Dark 2

123

113

160

Light 2

0

56

104

Accent 1

120

152

179

Accent 2

178

194

209

Accent 3

107

113

118

Accent 4

218

219

221

Accent 5

123

124

65

Accent 6

37

91

137

Hyperlink

102

136

164

Followed

Hyperlink

3

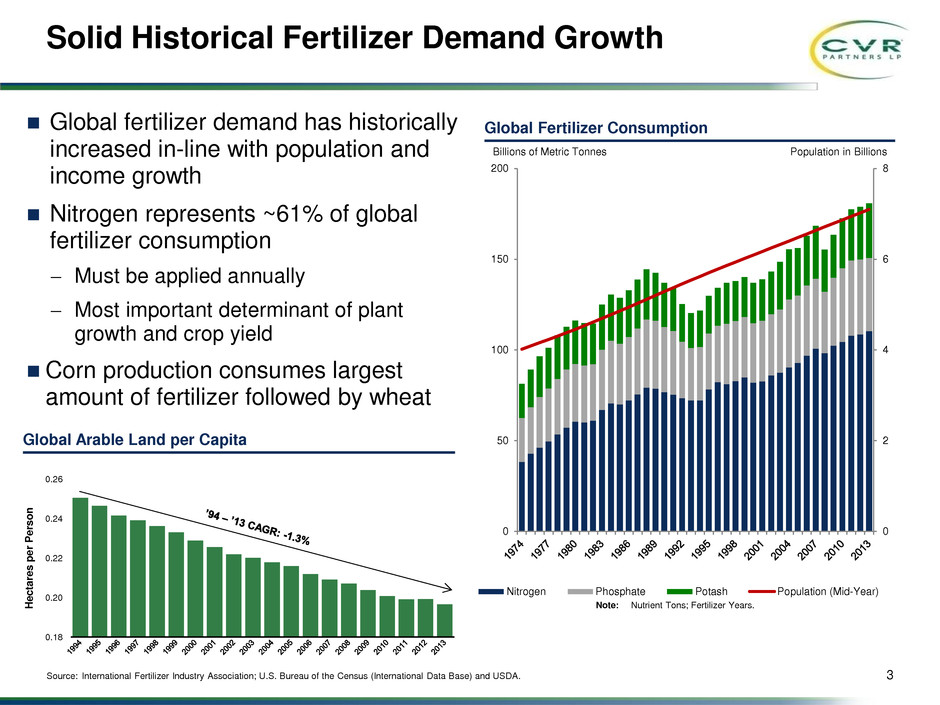

Solid Historical Fertilizer Demand Growth

0

2

4

6

8

0

50

100

150

200

Nitrogen Phosphate Potash Population (Mid-Year)

Billions of Metric Tonnes Population in Billions

Source: International Fertilizer Industry Association; U.S. Bureau of the Census (International Data Base) and USDA.

Global fertilizer demand has historically

increased in-line with population and

income growth

Nitrogen represents ~61% of global

fertilizer consumption

− Must be applied annually

− Most important determinant of plant

growth and crop yield

Corn production consumes largest

amount of fertilizer followed by wheat

Global Fertilizer Consumption

Note: Nutrient Tons; Fertilizer Years.

Global Arable Land per Capita

0.18

0.20

0.22

0.24

0.26

H

e

c

ta

re

s

pe

r

P

e

rs

o

n

0

0

0

Dark 1

255

255

255

Light 1

102

162

188

Dark 2

123

113

160

Light 2

0

56

104

Accent 1

120

152

179

Accent 2

178

194

209

Accent 3

107

113

118

Accent 4

218

219

221

Accent 5

123

124

65

Accent 6

37

91

137

Hyperlink

102

136

164

Followed

Hyperlink

4

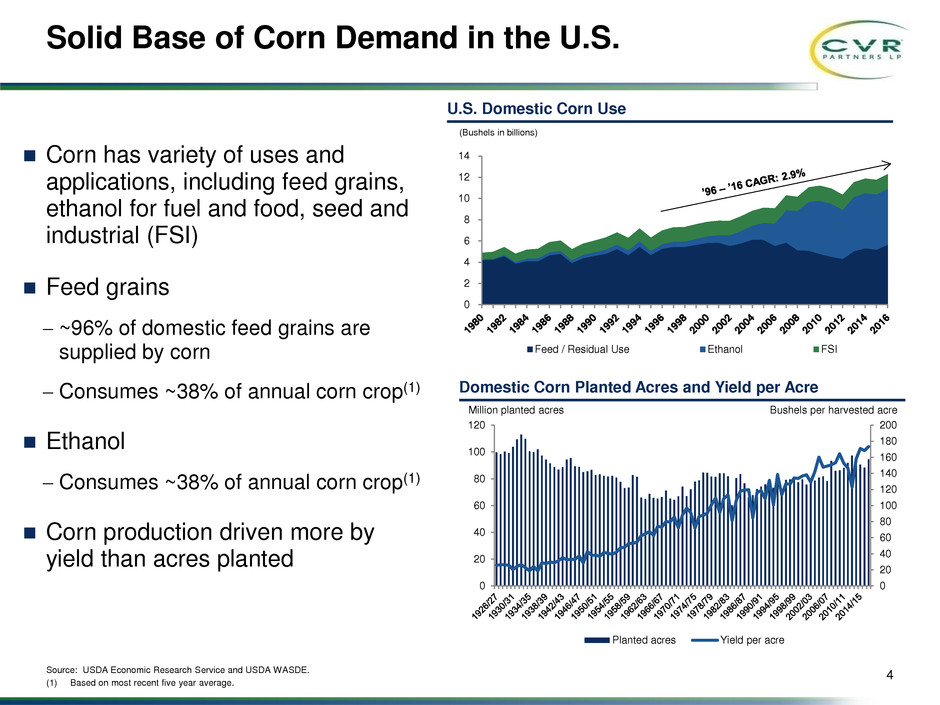

Solid Base of Corn Demand in the U.S.

Source: USDA Economic Research Service and USDA WASDE.

(1) Based on most recent five year average.

Corn has variety of uses and

applications, including feed grains,

ethanol for fuel and food, seed and

industrial (FSI)

Feed grains

− ~96% of domestic feed grains are

supplied by corn

− Consumes ~38% of annual corn crop(1)

Ethanol

− Consumes ~38% of annual corn crop(1)

Corn production driven more by

yield than acres planted

Domestic Corn Planted Acres and Yield per Acre

0

20

40

60

80

100

120

140

160

180

200

0

20

40

60

80

100

120

Planted acres Yield per acre

Million planted acres Bushels per harvested acre

U.S. Domestic Corn Use

0

2

4

6

8

10

12

14

Feed / Residual Use Ethanol FSI

(Bushels in billions)

0

0

0

Dark 1

255

255

255

Light 1

102

162

188

Dark 2

123

113

160

Light 2

0

56

104

Accent 1

120

152

179

Accent 2

178

194

209

Accent 3

107

113

118

Accent 4

218

219

221

Accent 5

123

124

65

Accent 6

37

91

137

Hyperlink

102

136

164

Followed

Hyperlink

80

90

100

110

120

130

M

il

li

o

n

T

onne

s

5

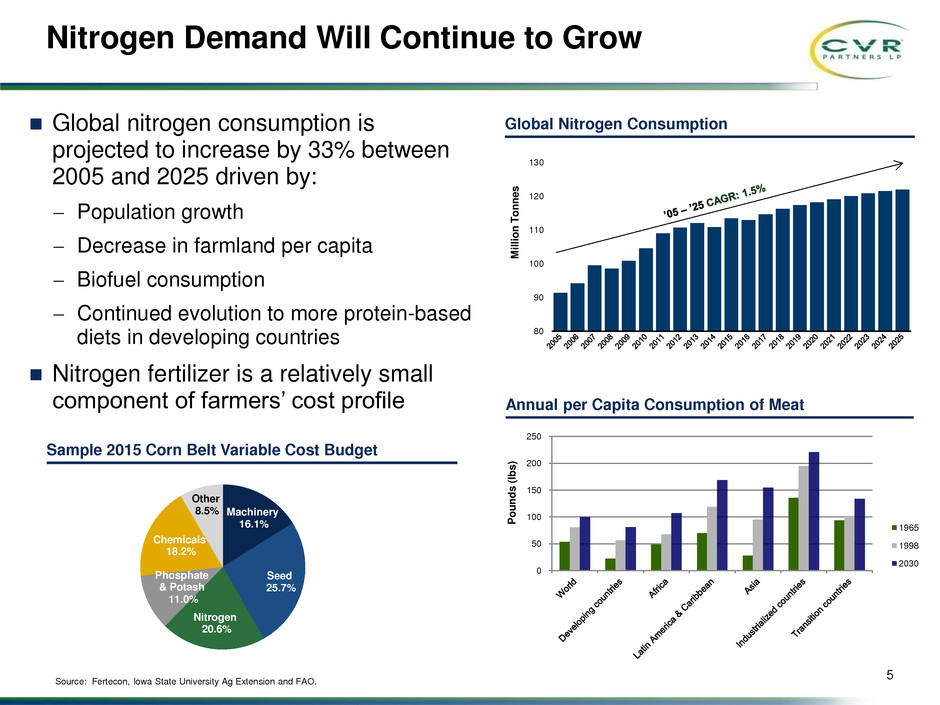

Nitrogen Demand Will Continue to Grow

Global nitrogen consumption is

projected to increase by 33% between

2005 and 2025 driven by:

− Population growth

− Decrease in farmland per capita

− Biofuel consumption

− Continued evolution to more protein-based

diets in developing countries

Nitrogen fertilizer is a relatively small

component of farmers’ cost profile

Global Nitrogen Consumption

Source: Fertecon, Iowa State University Ag Extension and FAO.

Annual per Capita Consumption of Meat

P

oun

d

s

(

lbs

)

0

50

100

150

200

250

1965

1998

2030

Sample 2015 Corn Belt Variable Cost Budget

Machinery

16.1%

Seed

25.7%

Nitrogen

20.6%

Phosphate

& Potash

11.0%

Chemicals

18.2%

Other

8.5%

0

0

0

Dark 1

255

255

255

Light 1

102

162

188

Dark 2

123

113

160

Light 2

0

56

104

Accent 1

120

152

179

Accent 2

178

194

209

Accent 3

107

113

118

Accent 4

218

219

221

Accent 5

123

124

65

Accent 6

37

91

137

Hyperlink

102

136

164

Followed

Hyperlink

6

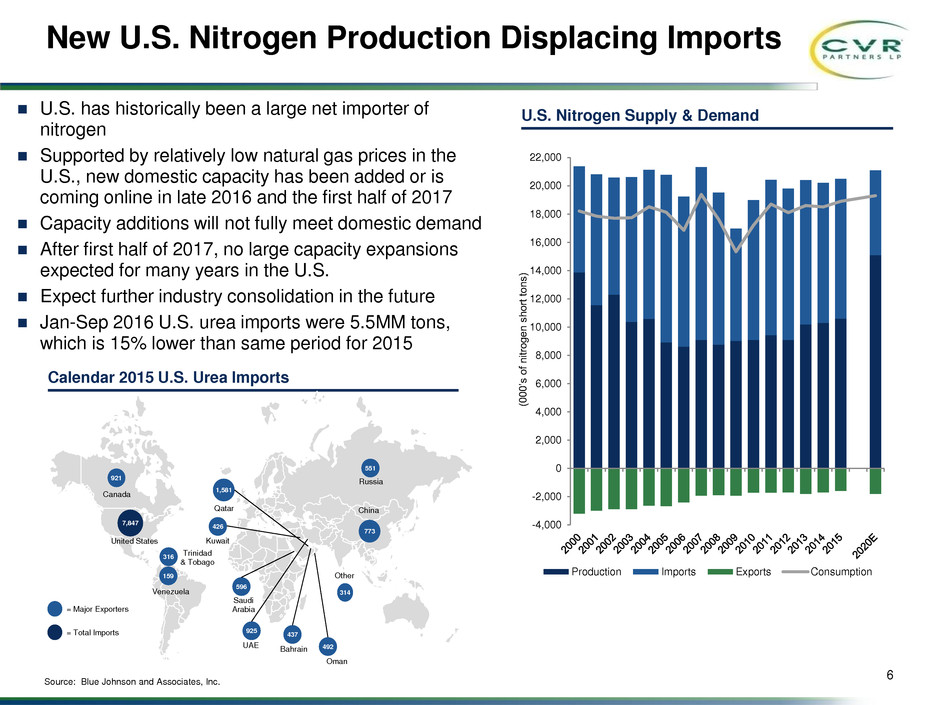

New U.S. Nitrogen Production Displacing Imports

-4,000

-2,000

0

2,000

4,000

6,000

8,000

10,000

12,000

14,000

16,000

18,000

20,000

22,000

Production Imports Exports Consumption

U.S. has historically been a large net importer of

nitrogen

Supported by relatively low natural gas prices in the

U.S., new domestic capacity has been added or is

coming online in late 2016 and the first half of 2017

Capacity additions will not fully meet domestic demand

After first half of 2017, no large capacity expansions

expected for many years in the U.S.

Expect further industry consolidation in the future

Jan-Sep 2016 U.S. urea imports were 5.5MM tons,

which is 15% lower than same period for 2015

U.S. Nitrogen Supply & Demand

(0

0

0

’s

o

f

n

it

ro

g

e

n

s

h

o

rt

t

o

n

s

)

Calendar 2015 U.S. Urea Imports

921

7,847

316

159

Canada

United States

Trinidad

& Tobago

Venezuela

551

Russia

773

China

596

492

437

925

UAE

Bahrain

Oman

Saudi

Arabia

1,581

Qatar

426

Kuwait

= Major Exporters

= Total Imports

Source: Blue Johnson and Associates, Inc.

314

Other

0

0

0

Dark 1

255

255

255

Light 1

102

162

188

Dark 2

123

113

160

Light 2

0

56

104

Accent 1

120

152

179

Accent 2

178

194

209

Accent 3

107

113

118

Accent 4

218

219

221

Accent 5

123

124

65

Accent 6

37

91

137

Hyperlink

102

136

164

Followed

Hyperlink

Summer

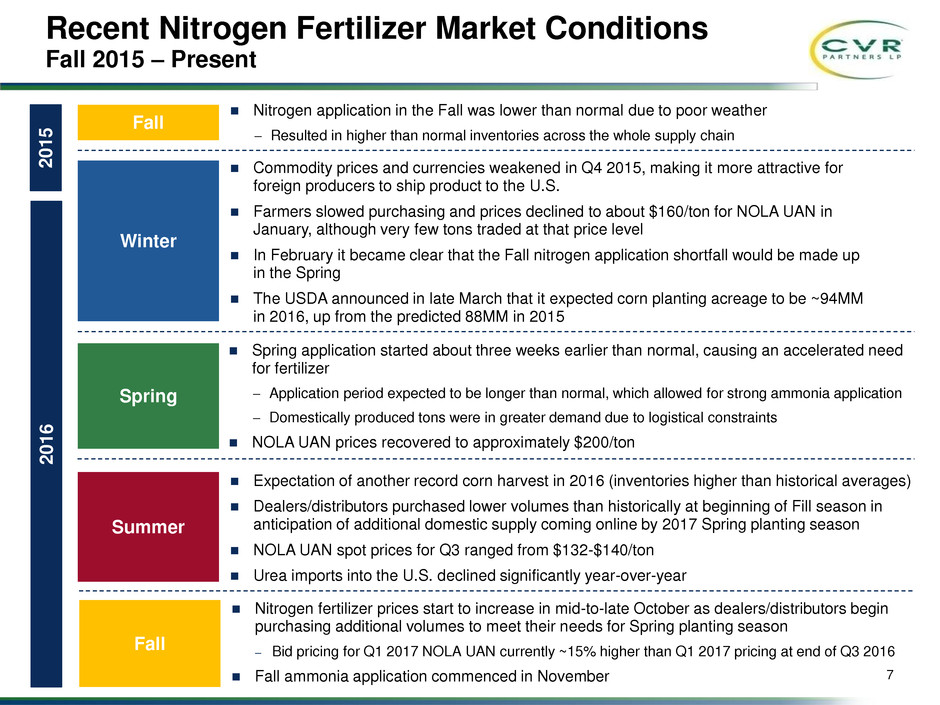

Recent Nitrogen Fertilizer Market Conditions

Fall 2015 – Present

Expectation of another record corn harvest in 2016 (inventories higher than historical averages)

Dealers/distributors purchased lower volumes than historically at beginning of Fill season in

anticipation of additional domestic supply coming online by 2017 Spring planting season

NOLA UAN spot prices for Q3 ranged from $132-$140/ton

Urea imports into the U.S. declined significantly year-over-year

Nitrogen application in the Fall was lower than normal due to poor weather

− Resulted in higher than normal inventories across the whole supply chain

Commodity prices and currencies weakened in Q4 2015, making it more attractive for

foreign producers to ship product to the U.S.

Farmers slowed purchasing and prices declined to about $160/ton for NOLA UAN in

January, although very few tons traded at that price level

In February it became clear that the Fall nitrogen application shortfall would be made up

in the Spring

The USDA announced in late March that it expected corn planting acreage to be ~94MM

in 2016, up from the predicted 88MM in 2015

Spring application started about three weeks earlier than normal, causing an accelerated need

for fertilizer

− Application period expected to be longer than normal, which allowed for strong ammonia application

− Domestically produced tons were in greater demand due to logistical constraints

NOLA UAN prices recovered to approximately $200/ton

2

0

1

6

Fall

Winter

Spring

2

0

1

5

7

Nitrogen fertilizer prices start to increase in mid-to-late October as dealers/distributors begin

purchasing additional volumes to meet their needs for Spring planting season

– Bid pricing for Q1 2017 NOLA UAN currently ~15% higher than Q1 2017 pricing at end of Q3 2016

Fall ammonia application commenced in November

Fall

0

0

0

Dark 1

255

255

255

Light 1

102

162

188

Dark 2

123

113

160

Light 2

0

56

104

Accent 1

120

152

179

Accent 2

178

194

209

Accent 3

107

113

118

Accent 4

218

219

221

Accent 5

123

124

65

Accent 6

37

91

137

Hyperlink

102

136

164

Followed

Hyperlink

8

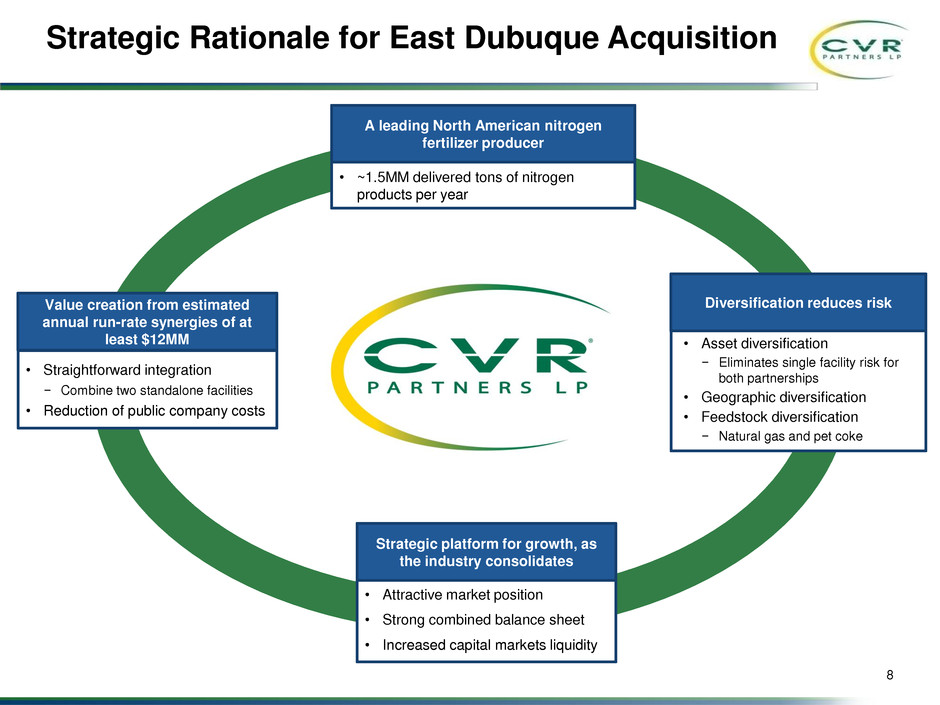

Strategic Rationale for East Dubuque Acquisition

A leading North American nitrogen

fertilizer producer

• ~1.5MM delivered tons of nitrogen

products per year

Diversification reduces risk

• Asset diversification

− Eliminates single facility risk for

both partnerships

• Geographic diversification

• Feedstock diversification

− Natural gas and pet coke

Value creation from estimated

annual run-rate synergies of at

least $12MM

• Straightforward integration

− Combine two standalone facilities

• Reduction of public company costs

Strategic platform for growth, as

the industry consolidates

• Attractive market position

• Strong combined balance sheet

• Increased capital markets liquidity

0

0

0

Dark 1

255

255

255

Light 1

102

162

188

Dark 2

123

113

160

Light 2

0

56

104

Accent 1

120

152

179

Accent 2

178

194

209

Accent 3

107

113

118

Accent 4

218

219

221

Accent 5

123

124

65

Accent 6

37

91

137

Hyperlink

102

136

164

Followed

Hyperlink

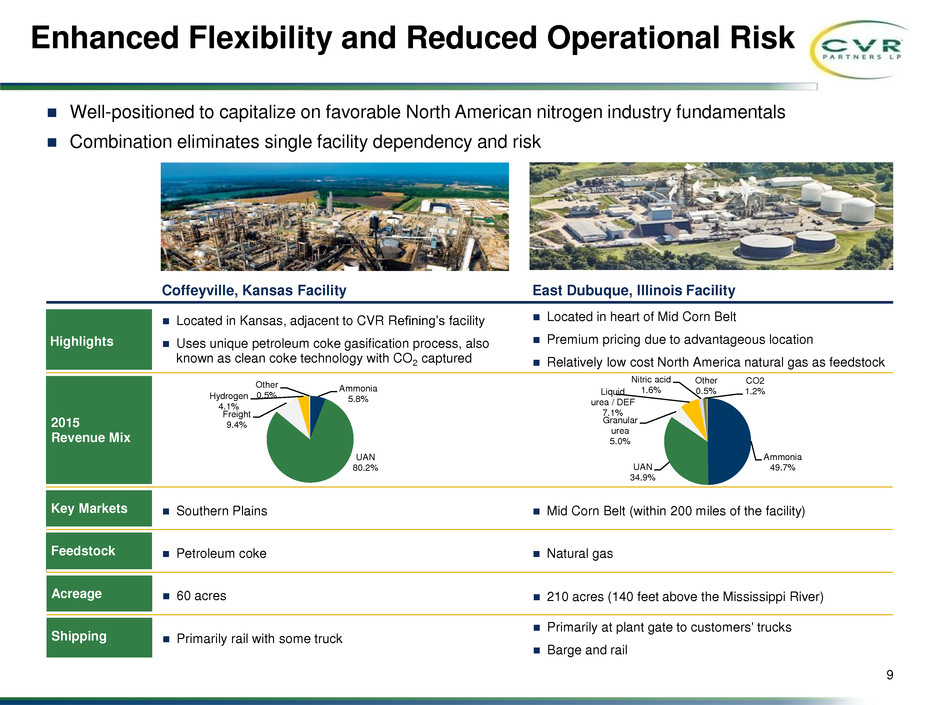

Well-positioned to capitalize on favorable North American nitrogen industry fundamentals

Combination eliminates single facility dependency and risk

9

Enhanced Flexibility and Reduced Operational Risk

Highlights

Located in Kansas, adjacent to CVR Refining’s facility

Uses unique petroleum coke gasification process, also

known as clean coke technology with CO2 captured

Located in heart of Mid Corn Belt

Premium pricing due to advantageous location

Relatively low cost North America natural gas as feedstock

2015

Revenue Mix

Key Markets Southern Plains Mid Corn Belt (within 200 miles of the facility)

Feedstock Petroleum coke Natural gas

Coffeyville, Kansas Facility East Dubuque, Illinois Facility

Acreage 60 acres 210 acres (140 feet above the Mississippi River)

Shipping Primarily rail with some truck

Primarily at plant gate to customers' trucks

Barge and rail

Ammonia

5.8%

UAN

80.2%

Freight

9.4%

Hydrogen

4.1%

Other

0.5%

Ammonia

49.7% UAN

34.9%

Granular

urea

5.0%

Liquid

urea / DEF

7.1%

Nitric acid

1.6%

CO2

1.2%

Other

0.5%

0

0

0

Dark 1

255

255

255

Light 1

102

162

188

Dark 2

123

113

160

Light 2

0

56

104

Accent 1

120

152

179

Accent 2

178

194

209

Accent 3

107

113

118

Accent 4

218

219

221

Accent 5

123

124

65

Accent 6

37

91

137

Hyperlink

102

136

164

Followed

Hyperlink

East Dubuque Facility Market Area

Company-Owned Nitrogen Fertilizer Facilities

Company-Partnered Nitrogen Fertilizer Facility

Coffeyville Facility, Kansas

Strategic location in the Southern Plains

Located on Union Pacific mainline

Transportation cost advantage to Southern Plains vs. U.S. Gulf Coast

East Dubuque Facility, Illinois

Entire market within a 200-mile radius

In the center of the Mid Corn Belt – the largest nitrogen market and top

corn producing region

Transportation cost savings compared to product shipped into region

Combined

Storage at facilities allow for better timing of product pick-up / application

by customers versus competitors located outside of the region

Region relies on imports from other parts of the U.S. to meet demand

Strong market for ammonia and UAN

10

Attractive Market Position

Attractive Location for Nitrogen Fertilizer Plants

Large geographic footprint

serving the Southern

Plains and Mid Corn Belt

markets

Product prices higher due

to advantaged cost of

freight

Competitive advantage

due to storage capabilities

at the facilities and offsite

locations

Mid-2016 addition of

marketing agreement with

Pryor, OK, for the facility’s

UAN production

Coffeyville, KS

Pryor, OK

East Dubuque, IL

0

0

0

Dark 1

255

255

255

Light 1

102

162

188

Dark 2

123

113

160

Light 2

0

56

104

Accent 1

120

152

179

Accent 2

178

194

209

Accent 3

107

113

118

Accent 4

218

219

221

Accent 5

123

124

65

Accent 6

37

91

137

Hyperlink

102

136

164

Followed

Hyperlink

11

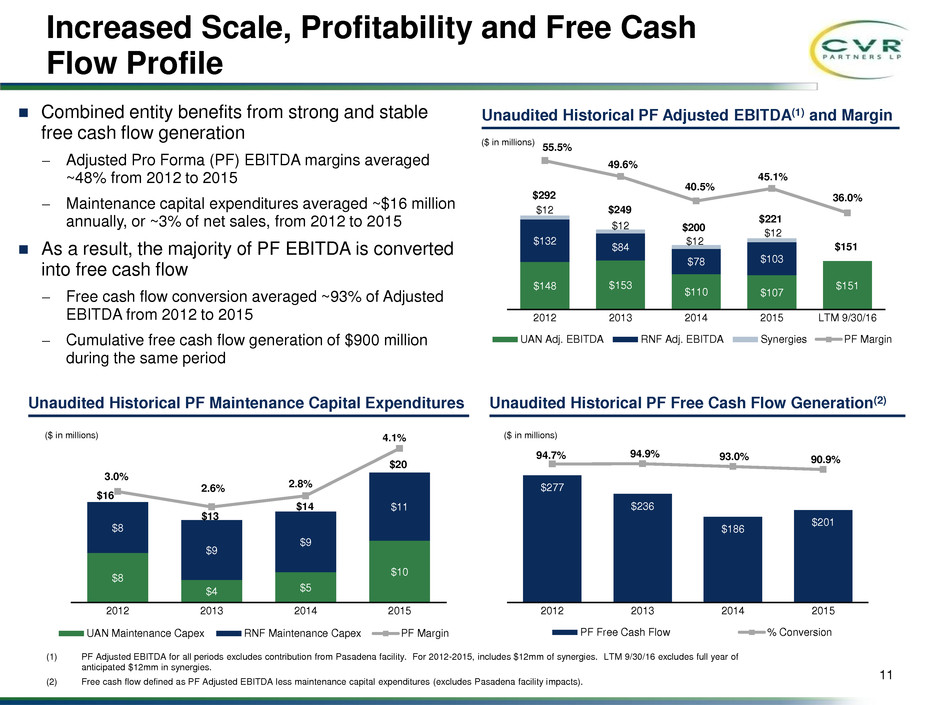

Combined entity benefits from strong and stable

free cash flow generation

− Adjusted Pro Forma (PF) EBITDA margins averaged

~48% from 2012 to 2015

− Maintenance capital expenditures averaged ~$16 million

annually, or ~3% of net sales, from 2012 to 2015

As a result, the majority of PF EBITDA is converted

into free cash flow

− Free cash flow conversion averaged ~93% of Adjusted

EBITDA from 2012 to 2015

− Cumulative free cash flow generation of $900 million

during the same period

Unaudited Historical PF Adjusted EBITDA(1) and Margin

Unaudited Historical PF Free Cash Flow Generation(2)

$148 $153

$110 $107

$151

$132

$84

$78 $103

$12

$12

$12

$12

55.5%

49.6%

40.5%

45.1%

36.0%

0.0%

10.0%

20.0%

30.0%

40.0%

50.0%

60.0%

$0

$100

$200

$300

$400

$500

2012 2013 2014 2015 LTM 9/30/16

UAN Adj. EBITDA RNF Adj. EBITDA Synergies PF Margin

($ in millions)

$292

$249

$200

$221

$277

$236

$186

$201

94.7% 94.9% 93.0% 90.9%

0.0%

25.0%

50.0%

75.0%

100.0%

$0

$50

$100

$150

$200

$250

$300

$350

2012 2013 2014 2015

PF Free Cash Flow % Conversion

($ in millions)

Unaudited Historical PF Maintenance Capital Expenditures

$8

$4 $5

$10

$8

$9

$9

$11

3.0%

2.6% 2.8%

4.1%

0.0%

1.0%

2.0%

3.0%

4.0%

$0

2012 2013 2014 2015

UAN Maintenance Capex RNF Maintenance Capex PF Margin

($ in millions)

$16

$13

$14

$20

(1) PF Adjusted EBITDA for all periods excludes contribution from Pasadena facility. For 2012-2015, includes $12mm of synergies. LTM 9/30/16 excludes full year of

anticipated $12mm in synergies.

(2) Free cash flow defined as PF Adjusted EBITDA less maintenance capital expenditures (excludes Pasadena facility impacts).

Increased Scale, Profitability and Free Cash

Flow Profile

$151

0

0

0

Dark 1

255

255

255

Light 1

102

162

188

Dark 2

123

113

160

Light 2

0

56

104

Accent 1

120

152

179

Accent 2

178

194

209

Accent 3

107

113

118

Accent 4

218

219

221

Accent 5

123

124

65

Accent 6

37

91

137

Hyperlink

102

136

164

Followed

Hyperlink

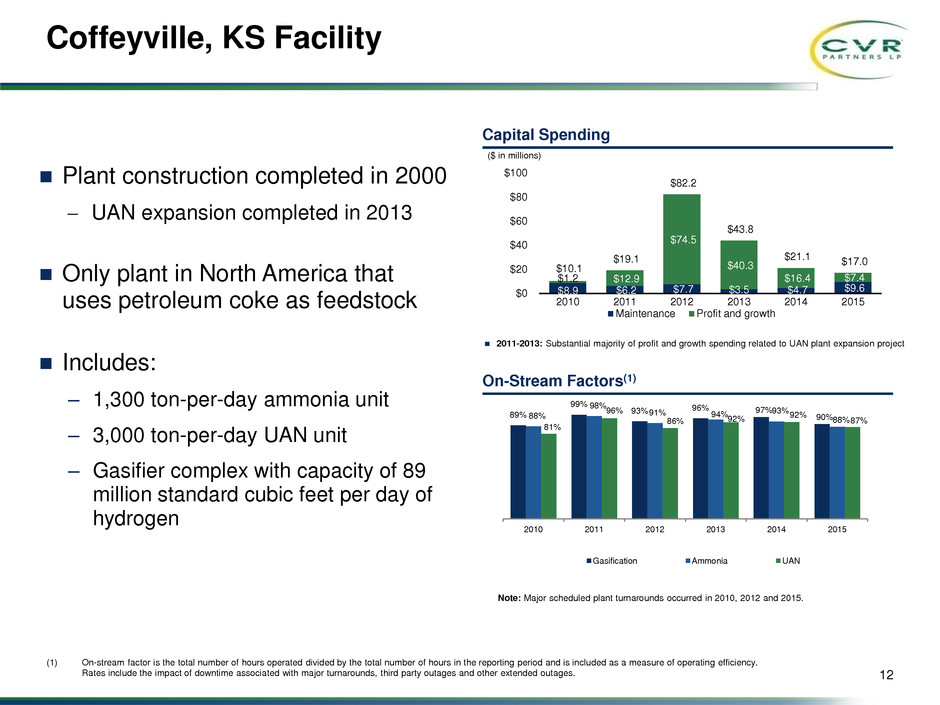

Plant construction completed in 2000

− UAN expansion completed in 2013

Only plant in North America that

uses petroleum coke as feedstock

Includes:

‒ 1,300 ton-per-day ammonia unit

‒ 3,000 ton-per-day UAN unit

‒ Gasifier complex with capacity of 89

million standard cubic feet per day of

hydrogen

12

Coffeyville, KS Facility

Capital Spending

On-Stream Factors(1)

89%

99%

93% 96% 97%

90%88%

98%

91% 94% 93%

88%

81%

96%

86% 92%

92%

87%

2010 2011 2012 2013 2014 2015

Gasification Ammonia UAN

(1) On-stream factor is the total number of hours operated divided by the total number of hours in the reporting period and is included as a measure of operating efficiency.

Rates include the impact of downtime associated with major turnarounds, third party outages and other extended outages.

$8.9 $6.2 $7.7 $3.5 $4.7 $9.6

$1.2 $12.9

$74.5

$40.3

$16.4 $7.4

$10.1

$19.1

$82.2

$43.8

$21.1 $17.0

$0

$20

$40

$60

$80

$100

2010 2011 2012 2013 2014 2015

Maintenance Profit and growth

($ in millions)

2011-2013: Substantial majority of profit and growth spending related to UAN plant expansion project

Note: Major scheduled plant turnarounds occurred in 2010, 2012 and 2015.

0

0

0

Dark 1

255

255

255

Light 1

102

162

188

Dark 2

123

113

160

Light 2

0

56

104

Accent 1

120

152

179

Accent 2

178

194

209

Accent 3

107

113

118

Accent 4

218

219

221

Accent 5

123

124

65

Accent 6

37

91

137

Hyperlink

102

136

164

Followed

Hyperlink

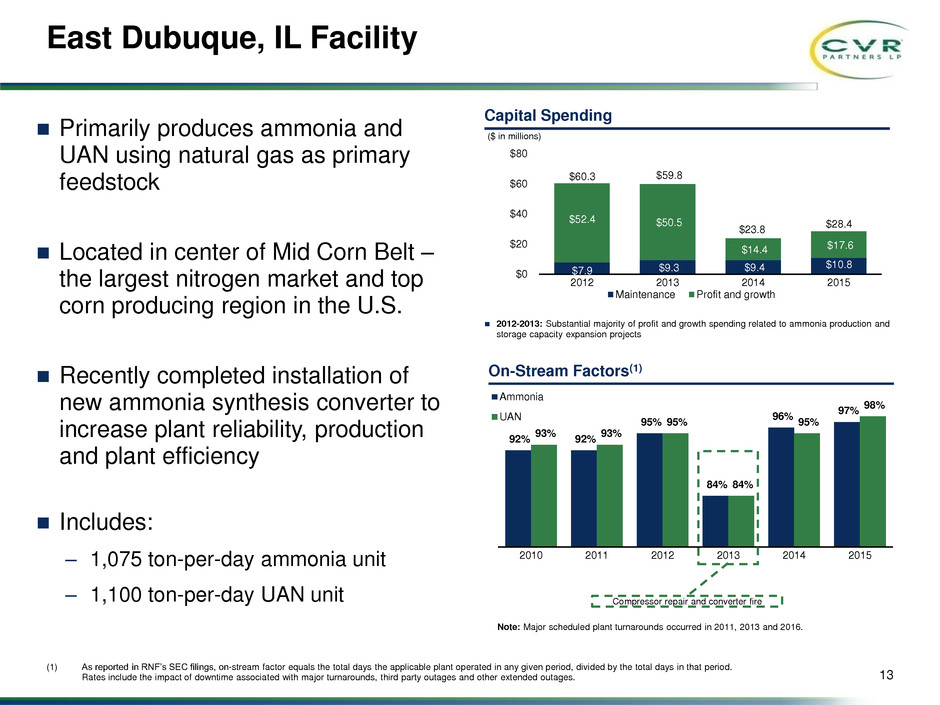

92% 92%

95%

84%

96%

97%

93% 93%

95%

84%

95%

98%

2010 2011 2012 2013 2014 2015

Ammonia

UAN

Primarily produces ammonia and

UAN using natural gas as primary

feedstock

Located in center of Mid Corn Belt –

the largest nitrogen market and top

corn producing region in the U.S.

Recently completed installation of

new ammonia synthesis converter to

increase plant reliability, production

and plant efficiency

Includes:

‒ 1,075 ton-per-day ammonia unit

‒ 1,100 ton-per-day UAN unit

13

East Dubuque, IL Facility

Capital Spending

On-Stream Factors(1)

(1) As reported in RNF’s SEC filings, on-stream factor equals the total days the applicable plant operated in any given period, divided by the total days in that period.

Rates include the impact of downtime associated with major turnarounds, third party outages and other extended outages.

Compressor repair and converter fire

$7.9 $9.3 $9.4

$10.8

$52.4 $50.5

$14.4 $17.6

$60.3 $59.8

$23.8

$28.4

$0

$20

$40

$60

$80

2012 2013 2014 2015

Maintenance Profit and growth

($ in millions)

2012-2013: Substantial majority of profit and growth spending related to ammonia production and

storage capacity expansion projects

Note: Major scheduled plant turnarounds occurred in 2011, 2013 and 2016.

0

0

0

Dark 1

255

255

255

Light 1

102

162

188

Dark 2

123

113

160

Light 2

0

56

104

Accent 1

120

152

179

Accent 2

178

194

209

Accent 3

107

113

118

Accent 4

218

219

221

Accent 5

123

124

65

Accent 6

37

91

137

Hyperlink

102

136

164

Followed

Hyperlink

14

Experienced Management Team

John (Jack) J. Lipinski: Executive Chairman – Over 40 years

Mark A. Pytosh: CEO & President – 30 years

Susan M. Ball: CFO & Treasurer – 32 years

William (Bill) White: EVP Marketing & Operations – 40 years

Neal E. Barkley: VP Operations – 35 years

Matthias (Matt) O. Green: VP Marketing – 32 years

John R. Walter: SVP, General Counsel & Secretary – 14 years

0

0

0

Dark 1

255

255

255

Light 1

102

162

188

Dark 2

123

113

160

Light 2

0

56

104

Accent 1

120

152

179

Accent 2

178

194

209

Accent 3

107

113

118

Accent 4

218

219

221

Accent 5

123

124

65

Accent 6

37

91

137

Hyperlink

102

136

164

Followed

Hyperlink

15

Solid Financial Profile

Cash and Cash Equivalents 65.3$

Working Capital 78.2$

Total Assets 1,326.9$

Total Debt 649.2$ (1)

Total Partners' Capital 639.5$

Net Sales 417.9$

EBITDA 145.6$ (2)(3)

Adjusted EBITDA 150.5$ (2)(3)

Net Income 11.8$ (2)

EPU - Diluted 0.10$ (2)

Weighted Average Diluted Units Outstanding 113.3

Total Debt to Pro Forma Adjus ed EBITDA 4.3 x

Net Debt to Pro Forma Adjusted EBITDA 3.9 x (4)

Total Debt to Capital 50%

Net Debt to Capital 45% (4)

Unaudited Selected Credit M trics

Unaudited Selected Balance Sheet Data

As of September 30, 2016

(in millions)

Unaudited Pro Forma Selected Income Statement Data

For the Twelve Months Ended September 30, 2016

(in millions, except per unit data)

(1) Gross debt not net of unamortized debt issuance costs or unamortized discount.

(2) Excludes full year of anticipated $12mm in synergies.

(3) See page 24 for reconciliation of Net Income to EBITDA and Adjusted EBITDA.

(4) Net Debt defined as Total Debt less Cash and Cash Equivalents.

0

0

0

Dark 1

255

255

255

Light 1

102

162

188

Dark 2

123

113

160

Light 2

0

56

104

Accent 1

120

152

179

Accent 2

178

194

209

Accent 3

107

113

118

Accent 4

218

219

221

Accent 5

123

124

65

Accent 6

37

91

137

Hyperlink

102

136

164

Followed

Hyperlink

16

CVR Partners’ 2016 Q3 and YTD Results

Three Months Ended

September 30,

Nine Months Ended

September 30,

2016 2015 2016 2015

UAN Product Price Per Ton at Gate(1) $154 $227 $187 $256

Ammonia Product Price Per Ton at Gate(1) $345 $478 $385 $529

Net Sales $78.5 $49.3 $271.4 $223.2

Net Income (Loss) ($13.4) ($13.5) ($12.4) $43.3

EBITDA(2) $18.8 ($4.3) $61.7 $69.7

Adjusted EBITDA(2) $17.4 $3.8 $74.4 $78.3

Available Cash for Distribution(2) $0.4 ($3.0) $50.8 $58.0

Distribution Declared Per Unit(3) $0.00 $0.00 $0.44 $0.84

Common Units Outstanding(3) 113.3 73.1 113.3 73.1

In millions, except product price at gate per ton and per unit data

Note: The results of our East Dubuque Facility are included for the post acquisition period beginning April 1, 2016.

(1) Product pricing at g te represents net sales less fr ight rev nue divided by product sales volumes in tons and is shown in order to provide

a pricing measure that is comparabl across the fertilizer industry.

(2) See pa e 25 for reconciliation of Net In ome (Loss) to EBITDA, Adjusted EBITDA and Available Cash for Distribution.

(3) 2016 Q3 and YTD 2016 distribution declared per unit is based on post-merger 113.3MM common unts utstanding.

0

0

0

Dark 1

255

255

255

Light 1

102

162

188

Dark 2

123

113

160

Light 2

0

56

104

Accent 1

120

152

179

Accent 2

178

194

209

Accent 3

107

113

118

Accent 4

218

219

221

Accent 5

123

124

65

Accent 6

37

91

137

Hyperlink

102

136

164

Followed

Hyperlink

17

Key Investment Highlights

Leading North American producer and distributor of nitrogen fertilizer

products

Attractive long-term industry fundamentals

Benefitting from recent acquisition of Rentech Nitrogen Partners, L.P.

Experienced management team

Opportunities for growth

0

0

0

Dark 1

255

255

255

Light 1

102

162

188

Dark 2

123

113

160

Light 2

0

56

104

Accent 1

120

152

179

Accent 2

178

194

209

Accent 3

107

113

118

Accent 4

218

219

221

Accent 5

123

124

65

Accent 6

37

91

137

Hyperlink

102

136

164

Followed

Hyperlink

Appendix

0

0

0

Dark 1

255

255

255

Light 1

102

162

188

Dark 2

123

113

160

Light 2

0

56

104

Accent 1

120

152

179

Accent 2

178

194

209

Accent 3

107

113

118

Accent 4

218

219

221

Accent 5

123

124

65

Accent 6

37

91

137

Hyperlink

102

136

164

Followed

Hyperlink

19

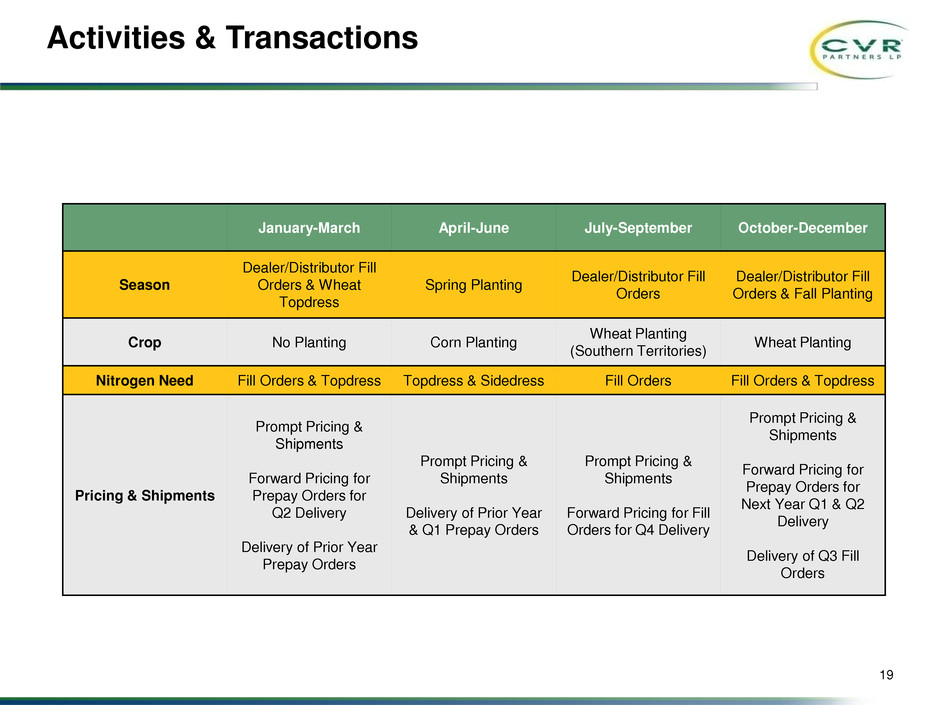

Activities & Transactions

January-March April-June July-September October-December

Season

Dealer/Distributor Fill

Orders & Wheat

Topdress

Spring Planting

Dealer/Distributor Fill

Orders

Dealer/Distributor Fill

Orders & Fall Planting

Crop No Planting Corn Planting

Wheat Planting

(Southern Territories)

Wheat Planting

Nitrogen Need Fill Orders & Topdress Topdress & Sidedress Fill Orders Fill Orders & Topdress

Pricing & Shipments

Prompt Pricing &

Shipments

Forward Pricing for

Prepay Orders for

Q2 Delivery

Delivery of Prior Year

Prepay Orders

Prompt Pricing &

Shipments

Delivery of Prior Year

& Q1 Prepay Orders

Prompt Pricing &

Shipments

Forward Pricing for Fill

Orders for Q4 Delivery

Prompt Pricing &

Shipments

Forward Pricing for

Prepay Orders for

Next Year Q1 & Q2

Delivery

Delivery of Q3 Fill

Orders

0

0

0

Dark 1

255

255

255

Light 1

102

162

188

Dark 2

123

113

160

Light 2

0

56

104

Accent 1

120

152

179

Accent 2

178

194

209

Accent 3

107

113

118

Accent 4

218

219

221

Accent 5

123

124

65

Accent 6

37

91

137

Hyperlink

102

136

164

Followed

Hyperlink

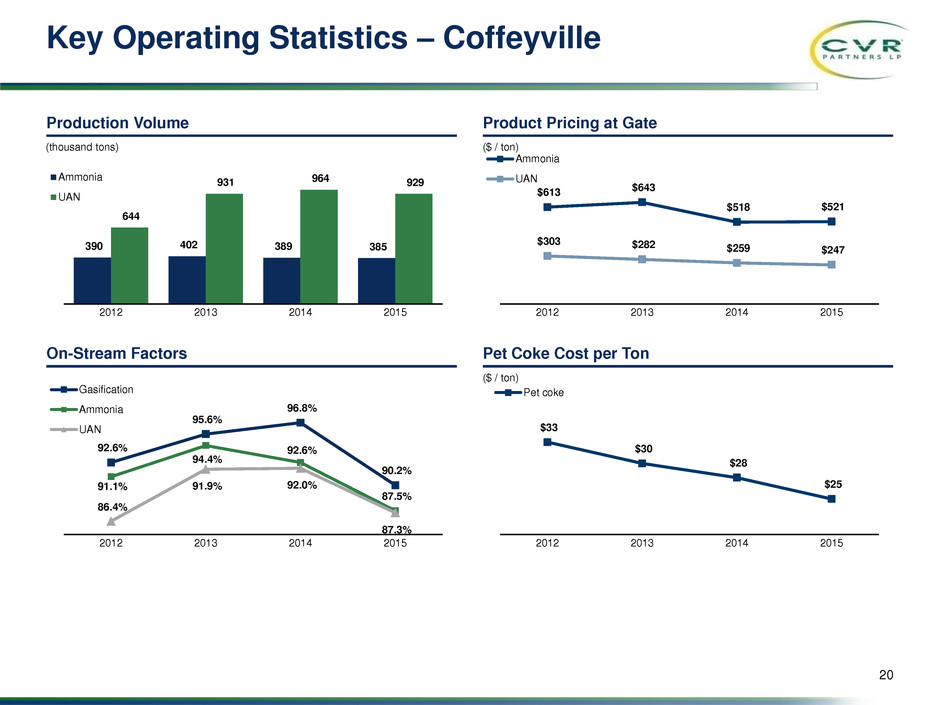

$33

$30

$28

$25

2012 2013 2014 2015

Pet coke

92.6%

95.6%

96.8%

90.2%

91.1%

94.4%

92.6%

87.5%

86.4%

91.9% 92.0%

87.3%

2012 2013 2014 2015

Gasification

Ammonia

UAN

$613 $643

$518 $521

$303 $282 $259 $247

2012 2013 2014 2015

Ammonia

UAN

20

On-Stream Factors Pet Coke Cost per Ton

Product Pricing at Gate Production Volume

Key Operating Statistics – Coffeyville

390 402 389 385

644

931 964 929

2012 2013 2014 2015

Ammonia

UAN

(thousand tons) ($ / ton)

($ / ton)

0

0

0

Dark 1

255

255

255

Light 1

102

162

188

Dark 2

123

113

160

Light 2

0

56

104

Accent 1

120

152

179

Accent 2

178

194

209

Accent 3

107

113

118

Accent 4

218

219

221

Accent 5

123

124

65

Accent 6

37

91

137

Hyperlink

102

136

164

Followed

Hyperlink

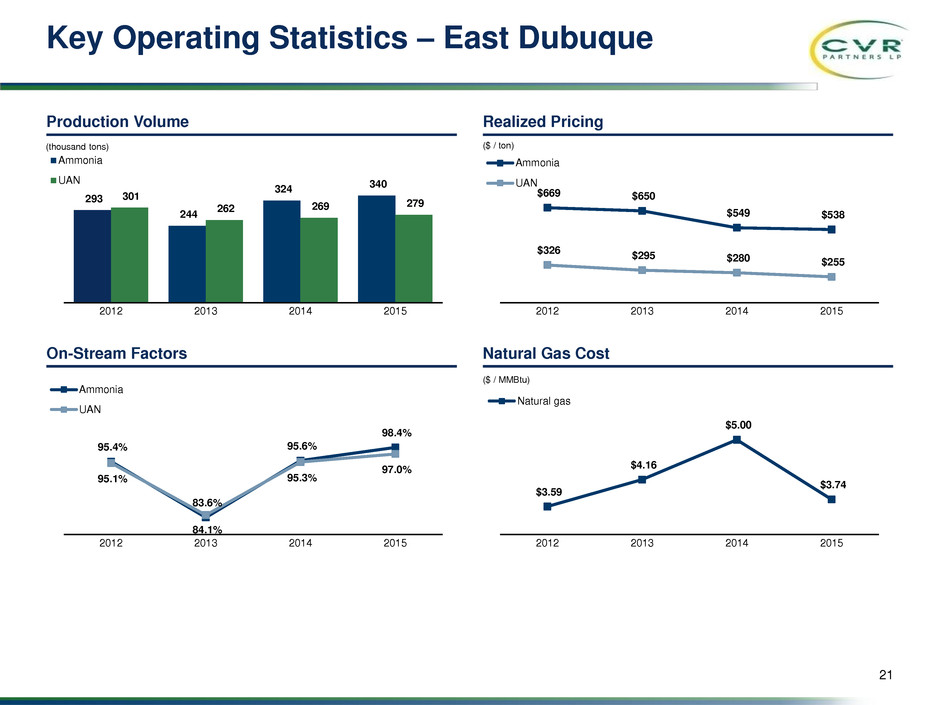

$3.59

$4.16

$5.00

$3.74

2012 2013 2014 2015

Natural gas

$669 $650

$549 $538

$326

$295 $280 $255

2012 2013 2014 2015

Ammonia

UAN

21

On-Stream Factors Natural Gas Cost

Realized Pricing Production Volume

Key Operating Statistics – East Dubuque

293

244

324 340

301

262 269

279

2012 2013 2014 2015

Ammonia

UAN

(thousand tons) ($ / ton)

($ / MMBtu)

95.4%

83.6%

95.6%

98.4%

95.1%

84.1%

95.3%

97.0%

2012 2013 2014 2015

Ammonia

UAN

0

0

0

Dark 1

255

255

255

Light 1

102

162

188

Dark 2

123

113

160

Light 2

0

56

104

Accent 1

120

152

179

Accent 2

178

194

209

Accent 3

107

113

118

Accent 4

218

219

221

Accent 5

123

124

65

Accent 6

37

91

137

Hyperlink

102

136

164

Followed

Hyperlink

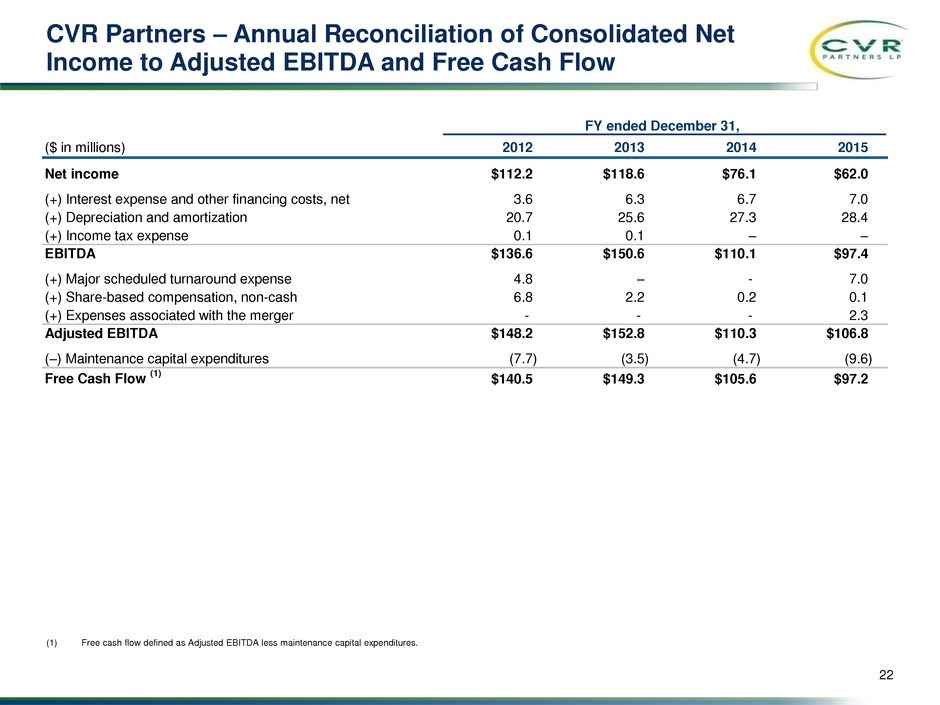

22

CVR Partners – Annual Reconciliation of Consolidated Net

Income to Adjusted EBITDA and Free Cash Flow

(1) Free cash flow defined as Adjusted EBITDA less maintenance capital expenditures.

FY ended December 31,

($ in millions) 2012 2013 2014 2015

Net income $112.2 $118.6 $76.1 $62.0

(+) Interest expense and other financing costs, net 3.6 6.3 6.7 7.0

(+) Depreciation and amortization 20.7 25.6 27.3 28.4

(+) Income tax expense 0.1 0.1 – –

EBITDA $136.6 $150.6 $110.1 $97.4

(+) Major scheduled turnaround expense 4.8 – - 7.0

(+) Share-based compensation, non-cash 6.8 2.2 0.2 0.1

(+) Expenses associated with the merger - - - 2.3

Adjusted EBITDA $148.2 $152.8 $110.3 $106.8

(–) Maintenance capital expenditures (7.7) (3.5) (4.7) (9.6)

Free Cash Flow

(1)

$140.5 $149.3 $105.6 $97.2

0

0

0

Dark 1

255

255

255

Light 1

102

162

188

Dark 2

123

113

160

Light 2

0

56

104

Accent 1

120

152

179

Accent 2

178

194

209

Accent 3

107

113

118

Accent 4

218

219

221

Accent 5

123

124

65

Accent 6

37

91

137

Hyperlink

102

136

164

Followed

Hyperlink

23

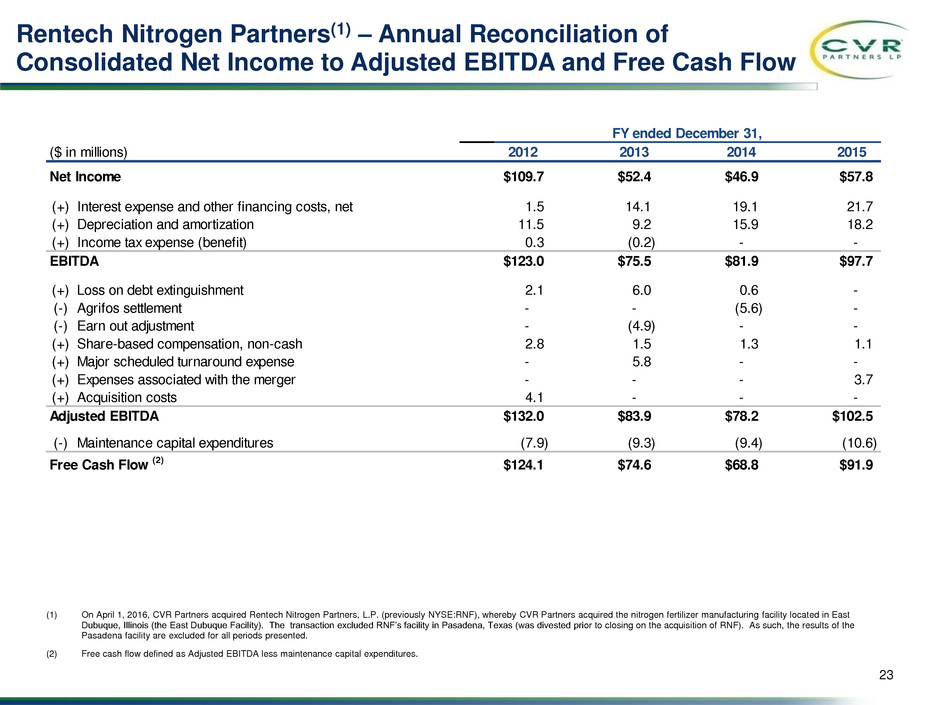

Rentech Nitrogen Partners(1) – Annual Reconciliation of

Consolidated Net Income to Adjusted EBITDA and Free Cash Flow

(1) On April 1, 2016, CVR Partners acquired Rentech Nitrogen Partners, L.P. (previously NYSE:RNF), whereby CVR Partners acquired the nitrogen fertilizer manufacturing facility located in East

Dubuque, Illinois (the East Dubuque Facility). The transaction excluded RNF’s facility in Pasadena, Texas (was divested prior to closing on the acquisition of RNF). As such, the results of the

Pasadena facility are excluded for all periods presented.

(2) Free cash flow defined as Adjusted EBITDA less maintenance capital expenditures.

($ in millions) 2012 2013 2014 2015

Net Income 109.7$ 52.4$ 46.9$ $57.8

(+) Interest expense and other financing costs, net 1.5 14.1 19.1 21.7

(+) Depreciation and amortization 11.5 9.2 15.9 18.2

(+) Income tax expense (benefit) 0.3 (0.2) - -

EBITDA 123.0$ 75.5$ 81.9$ $97.7

(+) Loss on debt extinguishment 2.1 6.0 0.6 -

(-) Agrifos settlement - - (5.6) -

(-) Earn out adjustment - (4.9) - -

(+) Sh re-based compensation, non-cash 2.8 1.5 1.3 1.1

(+) Major scheduled turnaround expense - 5.8 - -

(+) Expenses associated with the merger - - - 3.7

(+) Acquisition costs 4.1 - - -

Adjusted EBITDA 132.0$ 83.9$ 78.2$ $102.5

(-) Maintenance capital expenditures (7.9) (9.3) (9.4) (10.6)

Free Cash Flow (2) 124.1$ 74.6$ 68.8$ $91.9

FY ended December 31,

0

0

0

Dark 1

255

255

255

Light 1

102

162

188

Dark 2

123

113

160

Light 2

0

56

104

Accent 1

120

152

179

Accent 2

178

194

209

Accent 3

107

113

118

Accent 4

218

219

221

Accent 5

123

124

65

Accent 6

37

91

137

Hyperlink

102

136

164

Followed

Hyperlink

24

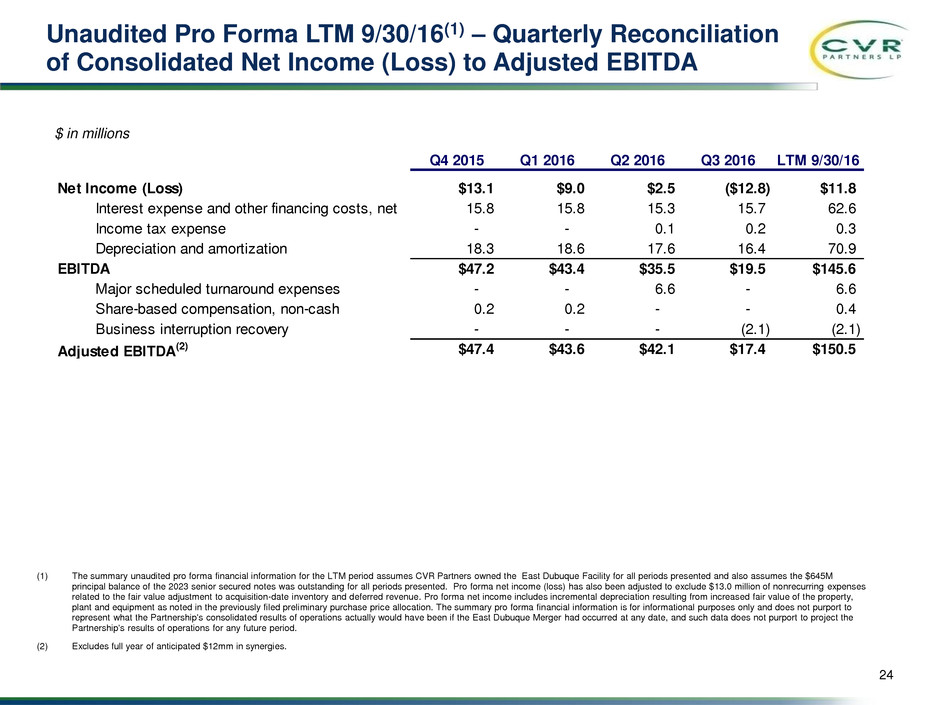

Unaudited Pro Forma LTM 9/30/16(1) – Quarterly Reconciliation

of Consolidated Net Income (Loss) to Adjusted EBITDA

(1) The summary unaudited pro forma financial information for the LTM period assumes CVR Partners owned the East Dubuque Facility for all periods presented and also assumes the $645M

principal balance of the 2023 senior secured notes was outstanding for all periods presented. Pro forma net income (loss) has also been adjusted to exclude $13.0 million of nonrecurring expenses

related to the fair value adjustment to acquisition-date inventory and deferred revenue. Pro forma net income includes incremental depreciation resulting from increased fair value of the property,

plant and equipment as noted in the previously filed preliminary purchase price allocation. The summary pro forma financial information is for informational purposes only and does not purport to

represent what the Partnership's consolidated results of operations actually would have been if the East Dubuque Merger had occurred at any date, and such data does not purport to project the

Partnership's results of operations for any future period.

(2) Excludes full year of anticipated $12mm in synergies.

$ in millions

Q4 2015 Q1 2016 Q2 2016 Q3 2016 LTM 9/30/16

Net Income (Loss) $13.1 $9.0 $2.5 ($12.8) $11.8

Interest expense and other financing costs, net 15.8 15.8 15.3 15.7 62.6

Income tax expense - - 0.1 0.2 0.3

Depreciation and amortization 18.3 18.6 17.6 16.4 70.9

EBITDA $47.2 $43.4 $35.5 $19.5 $145.6

Major scheduled turnaround expenses - - 6.6 - 6.6

Share-based compensation, on-cash 0.2 0.2 - - 0.4

Business interruption recovery - - - (2.1) (2.1)

Adjusted EBITDA(2) $47.4 $43.6 $42.1 $17.4 $150.5

0

0

0

Dark 1

255

255

255

Light 1

102

162

188

Dark 2

123

113

160

Light 2

0

56

104

Accent 1

120

152

179

Accent 2

178

194

209

Accent 3

107

113

118

Accent 4

218

219

221

Accent 5

123

124

65

Accent 6

37

91

137

Hyperlink

102

136

164

Followed

Hyperlink

25

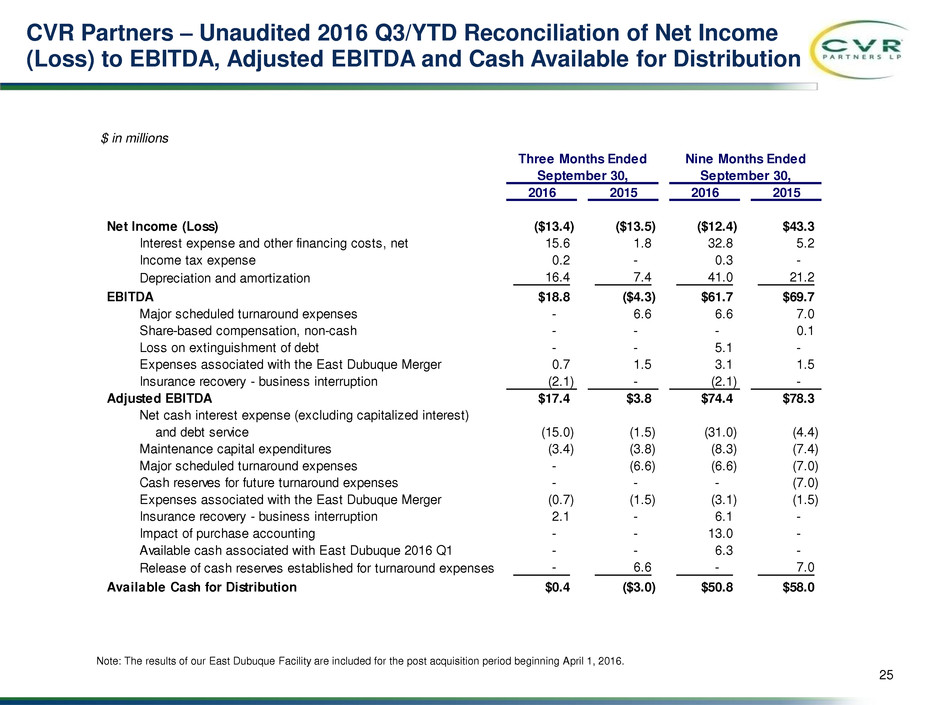

CVR Partners – Unaudited 2016 Q3/YTD Reconciliation of Net Income

(Loss) to EBITDA, Adjusted EBITDA and Cash Available for Distribution

$ in millions

Note: The results of our East Dubuque Facility are included for the post acquisition period beginning April 1, 2016.

Three Months Ended Nine Months Ended

September 30, September 30,

2016 2015 2016 2015

Net Income (Loss) ($13.4) ($13.5) ($12.4) $43.3

Interest expense and other financing costs, net 15.6 1.8 32.8 5.2

Income tax expense 0.2 - 0.3 -

Depreciation and amortization 16.4 7.4 41.0 21.2

EBITDA $18.8 ($4.3) $61.7 $69.7

Major scheduled turnaround expenses - 6.6 6.6 7.0

Share-based compensation, non-cash - - - 0.1

Loss on extinguishment of debt - - 5.1 -

Expenses associated with the East Dubuque Merger 0.7 1.5 3.1 1.5

Insurance recovery - business interruption (2.1) - (2.1) -

Adjusted EBITDA $17.4 $3.8 $74.4 $78.3

Net cash interest expense (excluding capitalized interest)

and debt service (15.0) (1.5) (31.0) (4.4)

Maintenance capital expenditures (3.4) (3.8) (8.3) (7.4)

Major scheduled turnaround expenses - (6.6) (6.6) (7.0)

Cash reserves for future turnaround expenses - - - (7.0)

Expenses associated with the East Dubuque Merger (0.7) (1.5) (3.1) (1.5)

Insurance recovery - business interruption 2.1 - 6.1 -

Impact of purchase accounting - - 13.0 -

Available cash associated with East Dubuque 2016 Q1 - - 6.3 -

Release of cash reserves established for turnaround expenses - 6.6 - 7.0

Available Cash for Distribution $0.4 ($3.0) $50.8 $58.0

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- ROSEN, LEADING INVESTOR COUNSEL, Encourages Equinix, Inc. Investors to Inquire About Securities Class Action Investigation – EQIX

- ADTRAN Holdings, Inc. to Meet with Investors at the German Spring Conference 2024 – Equity Forum on May 13-15, 2023

- 8PG Heats Up for DABBECUE Following Successful Inaugural Event

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share