Form 8-K SentinelOne, Inc. For: Jun 01

Exhibit 99.1

SentinelOne Announces First Quarter Fiscal Year 2023 Financial Results

Revenue increased 109% year-over-year

ARR up 110% year-over-year

MOUNTAIN VIEW, Calif. - June 1, 2022 - SentinelOne, Inc. (NYSE: S) today announced financial results for the first quarter of fiscal year 2023 ended April 30, 2022.

“Our Q1 results demonstrate the combination of a robust demand environment for our leading cybersecurity platform and impressive execution across the board. We once again sustained triple-digit growth with significant margin expansion, added a record number of new customers, and exited the quarter with an extremely strong pipeline,” said Tomer Weingarten, CEO of SentinelOne. “We’re raising our revenue guidance to nearly triple-digit growth again this fiscal year, which now includes our acquisition of Attivo Networks.”

“Our platform unit economics and highly efficient business model uniquely position us to pair hyper growth with meaningful margin expansion and our first quarter results clearly demonstrate this success,” said Dave Bernhardt, CFO of SentinelOne. “I’m most proud of our record gross margins, which expanded double digits year-over-year. This really showcases the strong combination of our expanding product portfolio, data-enabled efficiencies, and operational excellence across SentinelOne.”

Letter to Shareholders

We have also published a letter to shareholders on the Investor Relations section of our website at investors.sentinelone.com. The letter provides further discussion of our results for the first quarter of fiscal year 2023 as well as our full fiscal year 2023 financial outlook.

First Quarter Fiscal 2023 Highlights

(All metrics are compared to the first quarter of fiscal year 2022 unless otherwise noted)

•Total revenue increased 109% to $78.3 million, compared to $37.4 million.

•Annualized recurring revenue (ARR) increased 110% to $339.0 million as of April 30, 2022.

•Total customer count grew over 55% to over 7,450 customers as of April 30, 2022. Customers with ARR over $100K grew 113% to 591 as of April 30, 2022. Dollar-based net revenue retention rate was a record 131%.

•Gross margin: GAAP gross margin was 65%, compared to 51%. Non-GAAP gross margin was 68%, compared to 53%.

•Operating margin: GAAP operating margin was (115)%, compared to (165)%. Non-GAAP operating margin was (73)%, compared to (127)%.

•Cash, cash equivalents and short-term investments were $1.6 billion as of April 30, 2022.

Financial Outlook

We are providing the following guidance for the second quarter of fiscal year 2023, ending July 31, 2022, and for our full fiscal year 2023, ending January 31, 2023, which now includes the expected results of the Attivo Networks, Inc. acquisition completed on May 3, 2022:

Q2 FY23 Guidance | Full FY2023 Guidance | |||||||||||||

| Revenue | $95-96 million | $403-407 million | ||||||||||||

| Non-GAAP gross margin | 68-69% | 69-70% | ||||||||||||

| Non-GAAP operating margin | (75)-(73)% | (60)-(55)% | ||||||||||||

These statements are forward-looking and actual results may differ materially as a result of many factors. Refer to the Forward-looking statements safe harbor below for information on the factors that could cause our actual results to differ materially from these forward-looking statements.

Guidance for non-GAAP financial measures excludes stock-based compensation, employer payroll tax on employee stock transactions, and amortization expense of acquired intangible assets. We have not provided the most directly comparable GAAP measures because certain items are out of our control or cannot be reasonably predicted. Accordingly, a reconciliation of non-GAAP gross margin and non-GAAP operating margin is not available without unreasonable effort.

Webcast information

We will host a live audio webcast for analysts and investors to discuss our earnings results for the first quarter of fiscal year 2023 and outlook for the second quarter of fiscal year 2023 and our full fiscal year 2023 today, June 1, 2022, at 2:00 p.m. Pacific time (5:00 p.m. Eastern time). The live webcast and a recording of the event will be available on the Investor Relations section of our website at investors.sentinelone.com.

We have used, and intend to continue to use, the Investor Relations section of our website at investors.sentinelone.com as a means of disclosing material nonpublic information and for complying with our disclosure obligations under Regulation FD.

Forward-looking statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which statements involve risks and uncertainties, including statements regarding our future growth, and future financial and operating performance, including our financial outlook for the second quarter of fiscal year 2023 and our full fiscal year 2023, including non-GAAP gross profit and non-GAAP operating margin, our impact of the acquisition of Attivo Networks, Inc. (“Attivo”) on our business and financial results; statements regarding total addressable market, business strategy, acquisitions and strategic investments, the COVID-19 pandemic, our reputation and performance in the market, general market trends, and our objectives are forward-looking statements. The words “believe,” “may,” “will,” “potentially,” “estimate,” “continue,” “anticipate,” “intend,” “could,” “would,” “project,” “target,” “plan,” “expect,” or the negative of these terms and similar expressions are intended to identify forward-looking statements. However, not all forward-looking statements contain these identifying words.

There are a significant number of factors that could cause our actual results to differ materially from statements made in this press release, including: our limited operating history; our history of losses; intense competition in the market we compete in; fluctuations in our operating results; network or security incidents against us; our ability to successfully integrate acquisitions and strategic investments; defects, errors or vulnerabilities in our platform; risks associated with managing our rapid growth; the continuing impact of the COVID-19 pandemic on our and our

customers’ business; our ability to attract new and retain existing customers, or renew and expand our relationships with them; the ability of our platform to effectively interoperate within our customers IT infrastructure; disruptions or other business interruptions that affect the availability of our platform; the failure to timely develop and achieve market acceptance of new products and subscriptions as well as existing products, subscriptions and support offerings; rapidly evolving technological developments in the market for security products and subscription and support offerings; length of sales cycles; risks of securities class action litigation; general market, political, economic, and business conditions, including those related to the continuing impact of COVID-19 and geopolitical uncertainty. .

Additional risks and uncertainties that could affect our financial results are included under the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” set forth in our filings and reports with the Securities and Exchange Commission (“SEC”), including our most recently filed Annual Report on Form 10-K, dated April 7, 2022, subsequent Quarterly Reports on Form 10-Q and other filings and reports that we may file from time to time with the SEC, copies of which are available on our website at investors.sentinelone.com and on the SEC’s website at www.sec.gov.

You should not rely on these forward-looking statements, as actual outcomes and results may differ materially from those contemplated by these forward-looking statements as a result of such risks and uncertainties. All forward-looking statements in this press release are based on information available to us as of the date hereof, and we do not assume any obligation to update the forward-looking statements provided to reflect events that occur or circumstances that exist after the date of this press release or to reflect new information or the occurrence of unexpected events, except as required by law. We may not actually achieve the plans, intentions, or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements.

Non-GAAP Financial Measures

In addition to our results determined in accordance with GAAP, we believe the following non-GAAP measures are useful in evaluating our operating performance. We use the following non-GAAP financial information to evaluate our ongoing operations and for internal planning and forecasting purposes. We believe that non-GAAP financial information, when taken collectively, with the financial information presented in accordance with GAAP, may be helpful to investors because it provides consistency and comparability with past financial performance. However, non-GAAP financial information is presented for supplemental informational purposes only, has limitations as an analytical tool, and should not be considered in isolation or as a substitute for financial information presented in accordance with GAAP.

Other companies, including companies in our industry, may calculate similarly titled non-GAAP measures differently or may use other measures to evaluate their performance, all of which could reduce the usefulness of our non-GAAP financial measures as tools for comparison. In addition, the utility of free cash flow as a measure of our liquidity is limited as it does not represent the total increase or decrease in our cash balance for a given period.

Reconciliations between non-GAAP financial measures to the most directly comparable financial measure stated in accordance with GAAP are contained below. Investors are encouraged to review the related GAAP financial measures and the reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measures and not rely on any single financial measure to evaluate our business.

As presented in the “Reconciliation of GAAP to Non-GAAP Financial Information” table below, each of the non-GAAP financial measures excludes one or more of the following items:

Stock-based compensation expense

Stock-based compensation expense is a non-cash expense that varies in amount from period to period and is dependent on market forces that are often beyond our control. As a result, management excludes this item from our internal operating forecasts and models. Management believes that non-GAAP measures adjusted for stock-based compensation expense provide investors with a basis to measure our core performance against the performance of other companies without the variability created by stock-based compensation as a result of the variety of equity awards used by other companies and the varying methodologies and assumptions used.

Employer payroll tax on employee stock transactions

Employer payroll tax expense related to employee stock transactions are tied to the vesting or exercise of underlying equity awards and the price of our common stock at the time of vesting, which varies in amount from period to period and is dependent on market forces that are often beyond our control. As a result, management excludes this item from our internal operating forecasts and models. Management believes that non-GAAP measures adjusted for employer payroll taxes on employee stock transactions provide investors with a basis to measure our core performance against the performance of other companies without the variability created by employer payroll taxes on employee stock transactions as a result of the stock price at the time of employee exercise.

Amortization of acquired intangible assets

Amortization of acquired intangible assets expense are tied to the intangible assets that were acquired in conjunction with acquisitions, which results in non‑cash expenses that may not otherwise have been incurred. Management excludes the expense associated with intangible assets from non-GAAP measures to allow for a more accurate assessment of our ongoing operations and provides investors with a better comparison of period-over-period operating results.

Non-GAAP Cost of Revenue, Non-GAAP Gross Profit, Non-GAAP Gross Margin, Non-GAAP Loss from Operations, Non-GAAP Operating Margin, Non-GAAP Net Loss and Non-GAAP Net Loss Per Share

We define these non-GAAP financial measures as their respective GAAP measures, excluding the expenses referenced above. We use these non-GAAP financial measures as part of our overall assessment of our performance, including the preparation of our annual operating budget and quarterly forecasts, to evaluate the effectiveness of our business strategies, and to communicate with our board of directors concerning our financial performance.

Free Cash Flow

We define free cash flow as cash used in operating activities less purchases of property and equipment and capitalized internal-use software costs. We believe free cash flow is a useful indicator of liquidity that provides our management, board of directors, and investors with information about our future ability to generate or use cash to enhance the strength of our balance sheet and further invest in our business and pursue potential strategic initiatives.

Key Business Metrics

We monitor the following key metrics to help us evaluate our business, identify trends affecting our business, formulate business plans, and make strategic decisions.

Annualized Recurring Revenue

We believe that ARR is a key operating metric to measure our business because it is driven by our ability to acquire new subscription customers and to maintain and expand our relationship with existing subscription customers. ARR represents the annualized revenue run rate of our subscription contracts at the end of a reporting period, assuming contracts are renewed on their existing terms for customers that are under subscription contracts with us.

Customers with ARR of $100,000 or More

We believe that our ability to increase the number of customers with ARR of $100,000 or more is an indicator of our market penetration and strategic demand for our platform. We define a customer as an entity that has an active subscription for access to our platform. We count MSPs, MSSPs, MDRs, and OEMs, who may purchase our products on behalf of multiple companies, as a single customer. We do not count our reseller or distributor channel partners as customers.

Dollar-Based Net Retention Rate

We believe that our ability to retain and expand our revenue generated from our existing customers is an indicator of the long-term value of our customer relationships and our potential future business opportunities. Dollar-based net retention rate measures the percentage change in our ARR derived from our customer base at a point in time. To calculate these metrics, we first determine Prior Period ARR, which is ARR from the population of our customers as of 12 months prior to the end of a particular reporting period. We calculate Net Retention ARR as the total ARR at the end of a particular reporting period from the set of customers that is used to determine Prior Period ARR. Net Retention ARR includes any expansion, and is net of contraction and attrition associated with that set of customers. NRR is the quotient obtained by dividing Net Retention ARR by Prior Period ARR.

Source String: SentinelOne

Category: Investors

Contact

Investor relations:

Doug Clark

E: investors@sentinelone.com

Press:

Jake Schuster

fama PR for SentinelOne

P: 617-986-5000

E: S1@famapr.com

SENTINELONE, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands)

(unaudited)

April 30, | January 31, | ||||||||||

2022 | 2022 | ||||||||||

Assets | |||||||||||

Current assets: | |||||||||||

| Cash and cash equivalents | $ | 766,101 | $ | 1,669,304 | |||||||

Short-term investments | 851,418 | 374 | |||||||||

Accounts receivable, net | 86,871 | 101,491 | |||||||||

Deferred contract acquisition costs, current | 26,261 | 27,546 | |||||||||

Prepaid expenses and other current assets | 24,849 | 18,939 | |||||||||

Total current assets | 1,755,500 | 1,817,654 | |||||||||

Property and equipment, net | 29,083 | 24,918 | |||||||||

Operating lease right-of-use assets | 25,731 | 23,884 | |||||||||

Deferred contract acquisition costs, non-current | 43,679 | 41,022 | |||||||||

Intangible assets, net | 15,130 | 15,807 | |||||||||

Goodwill | 108,193 | 108,193 | |||||||||

| Other assets | 11,132 | 10,703 | |||||||||

Total assets | $ | 1,988,448 | $ | 2,042,181 | |||||||

| Liabilities and Stockholders’ Equity | |||||||||||

Current liabilities: | |||||||||||

Accounts payable | $ | 13,925 | $ | 9,944 | |||||||

Accrued liabilities | 23,820 | 22,657 | |||||||||

Accrued payroll and benefits | 39,654 | 61,150 | |||||||||

Operating lease liabilities, current | 2,925 | 4,613 | |||||||||

Deferred revenue, current | 196,385 | 182,957 | |||||||||

Total current liabilities | 276,709 | 281,321 | |||||||||

Deferred revenue, non-current | 79,259 | 79,062 | |||||||||

Operating lease liabilities, non-current | 27,199 | 24,467 | |||||||||

Other liabilities | 8,039 | 6,543 | |||||||||

Total liabilities | 391,206 | 391,393 | |||||||||

Stockholders’ equity: | |||||||||||

Preferred stock | — | — | |||||||||

Class A common stock | 19 | 16 | |||||||||

Class B common stock | 8 | 11 | |||||||||

Additional paid-in capital | 2,309,505 | 2,271,980 | |||||||||

Accumulated other comprehensive income (loss) | (783) | 454 | |||||||||

Accumulated deficit | (711,507) | (621,673) | |||||||||

Total stockholders’ equity | 1,597,242 | 1,650,788 | |||||||||

| Total liabilities and stockholders’ equity | $ | 1,988,448 | $ | 2,042,181 | |||||||

SENTINELONE, INC. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (in thousands, except share and per share data) (unaudited) | ||

| Three Months Ended April 30, | |||||||||||

| 2022 | 2021 | ||||||||||

| Revenue | $ | 78,255 | $ | 37,395 | |||||||

Cost of revenue(1) | 27,139 | 18,283 | |||||||||

| Gross profit | 51,116 | 19,112 | |||||||||

| Operating expenses: | |||||||||||

Research and development(1) | 45,881 | 27,820 | |||||||||

Sales and marketing(1) | 60,641 | 36,180 | |||||||||

General and administrative(1) | 34,890 | 16,724 | |||||||||

| Total operating expenses | 141,412 | 80,724 | |||||||||

| Loss from operations | (90,296) | (61,612) | |||||||||

| Interest income | 1,087 | 23 | |||||||||

| Interest expense | (5) | (303) | |||||||||

| Other income (expense), net | (291) | (593) | |||||||||

| Loss before provision for income taxes | (89,505) | (62,485) | |||||||||

| Provision for income taxes | 329 | 149 | |||||||||

| Net loss | $ | (89,834) | $ | (62,634) | |||||||

Net loss per share attributable to Class A and Class B common stockholders, basic and diluted | $ | (0.33) | $ | (1.37) | |||||||

Weighted-average shares used in computing net loss per share attributable to Class A and Class B common stockholders, basic and diluted | 269,594,565 | 45,725,703 | |||||||||

(1) Includes stock-based compensation expense as follows: | |||||||||||

| Cost of revenue | $ | 1,848 | $ | 383 | |||||||

| Research and development | 10,463 | 7,139 | |||||||||

| Sales and marketing | 7,096 | 2,047 | |||||||||

| General and administrative | 12,223 | 3,868 | |||||||||

| Total stock-based compensation expense | $ | 31,630 | $ | 13,437 | |||||||

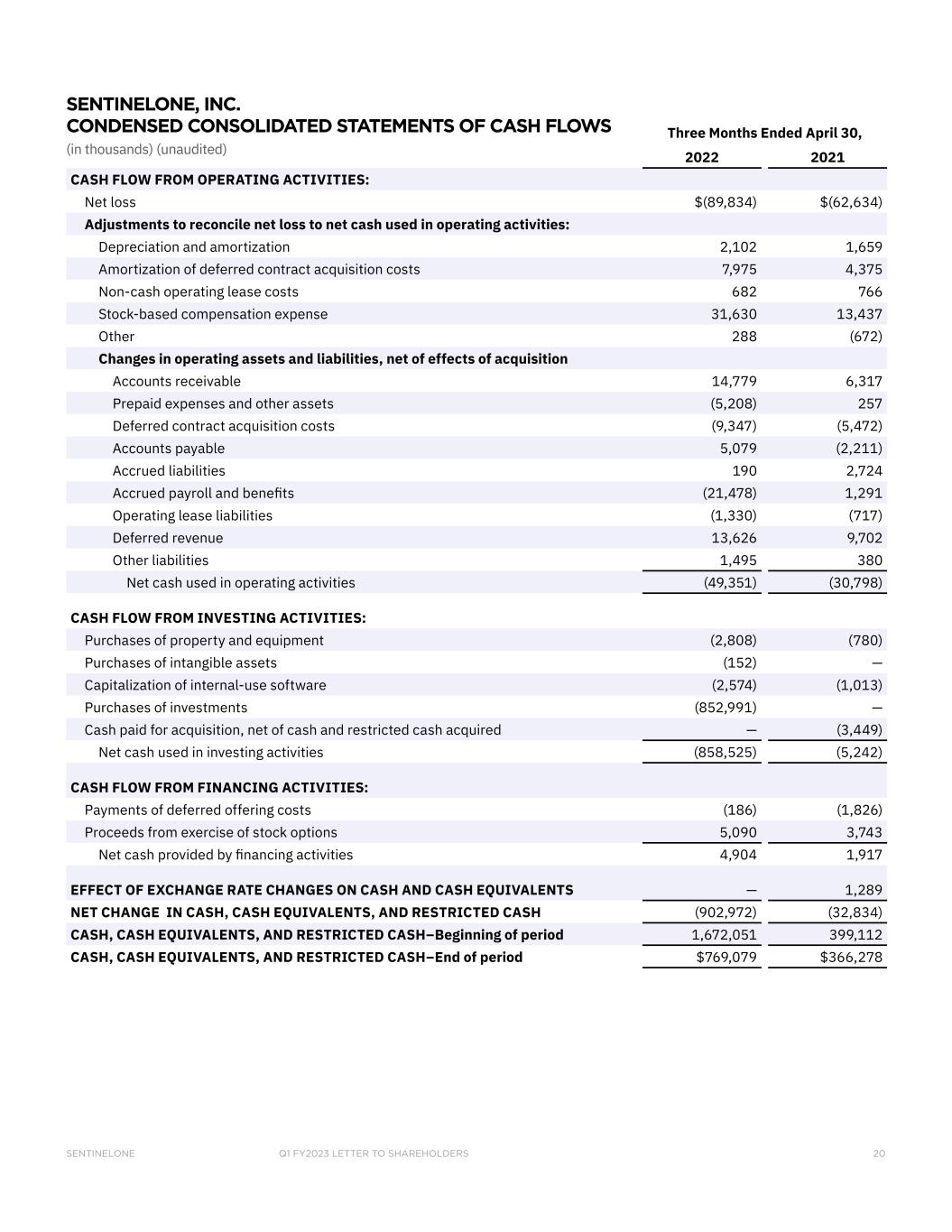

SENTINELONE, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

Three Months Ended April 30, | |||||||||||

2022 | 2021 | ||||||||||

CASH FLOW FROM OPERATING ACTIVITIES: | |||||||||||

| Net loss | $ | (89,834) | $ | (62,634) | |||||||

Adjustments to reconcile net loss to net cash used in operating activities: | |||||||||||

Depreciation and amortization | 2,102 | 1,659 | |||||||||

Amortization of deferred contract acquisition costs | 7,975 | 4,375 | |||||||||

Non-cash operating lease costs | 682 | 766 | |||||||||

Stock-based compensation expense | 31,630 | 13,437 | |||||||||

Other | 288 | (672) | |||||||||

| Changes in operating assets and liabilities, net of effects of acquisition | |||||||||||

| Accounts receivable | 14,779 | 6,317 | |||||||||

Prepaid expenses and other assets | (5,208) | 257 | |||||||||

Deferred contract acquisition costs | (9,347) | (5,472) | |||||||||

| Accounts payable | 5,079 | (2,211) | |||||||||

| Accrued liabilities | 190 | 2,724 | |||||||||

Accrued payroll and benefits | (21,478) | 1,291 | |||||||||

| Operating lease liabilities | (1,330) | (717) | |||||||||

Deferred revenue | 13,626 | 9,702 | |||||||||

| Other liabilities | 1,495 | 380 | |||||||||

Net cash used in operating activities | (49,351) | (30,798) | |||||||||

CASH FLOW FROM INVESTING ACTIVITIES: | |||||||||||

| Purchases of property and equipment | (2,808) | (780) | |||||||||

Purchases of intangible assets | (152) | — | |||||||||

Capitalization of internal-use software | (2,574) | (1,013) | |||||||||

Purchases of investments | (852,991) | — | |||||||||

Cash paid for acquisition, net of cash and restricted cash acquired | — | (3,449) | |||||||||

Net cash used in investing activities | (858,525) | (5,242) | |||||||||

CASH FLOW FROM FINANCING ACTIVITIES: | |||||||||||

| Payments of deferred offering costs | (186) | (1,826) | |||||||||

Proceeds from exercise of stock options | 5,090 | 3,743 | |||||||||

Net cash provided by financing activities | 4,904 | 1,917 | |||||||||

EFFECT OF EXCHANGE RATE CHANGES ON CASH AND CASH EQUIVALENTS | — | 1,289 | |||||||||

NET CHANGE IN CASH, CASH EQUIVALENTS, AND RESTRICTED CASH | (902,972) | (32,834) | |||||||||

CASH, CASH EQUIVALENTS, AND RESTRICTED CASH–Beginning of period | 1,672,051 | 399,112 | |||||||||

CASH, CASH EQUIVALENTS, AND RESTRICTED CASH–End of period | $ | 769,079 | $ | 366,278 | |||||||

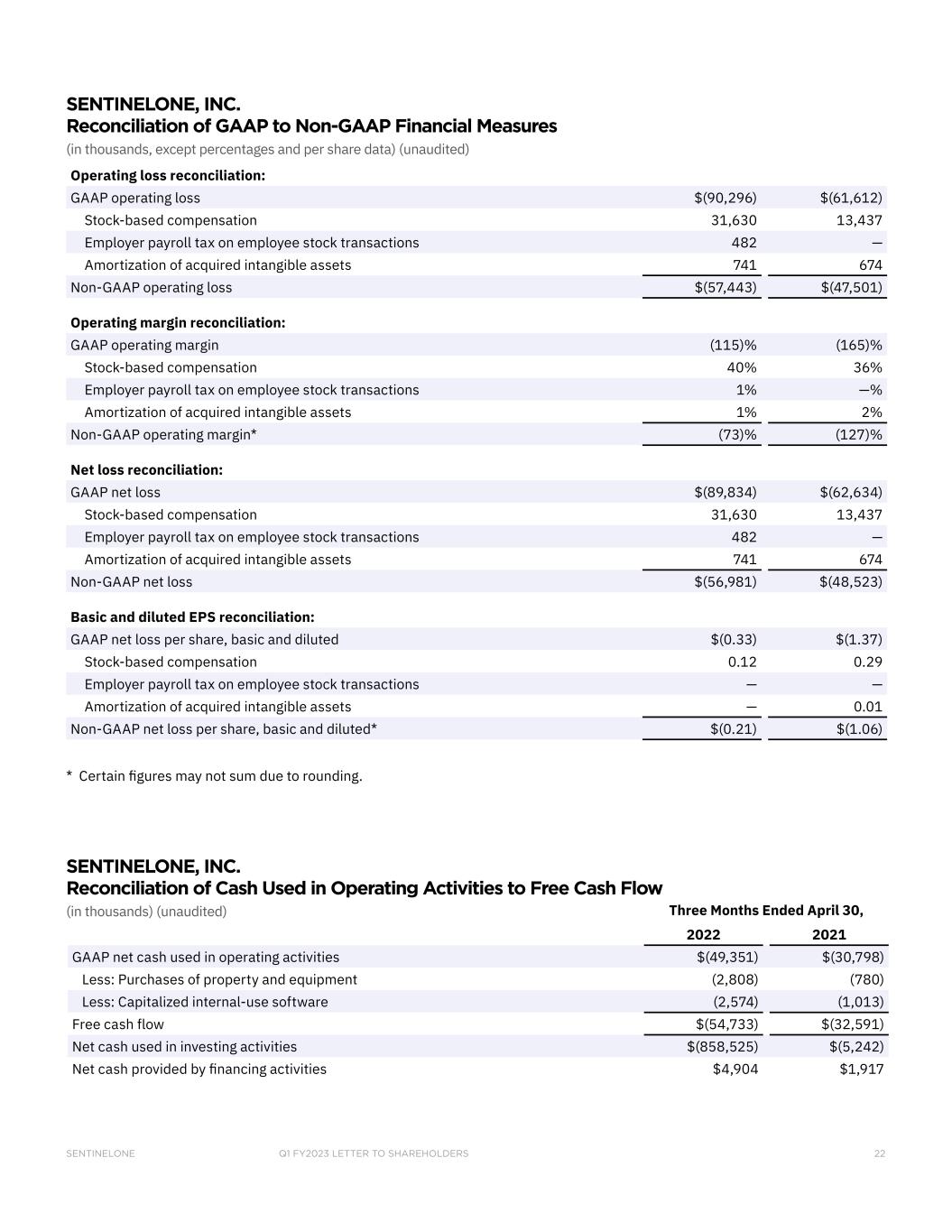

SENTINELONE, INC.

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL INFORMATION

(in thousands, except percentages and per share data)

(unaudited)

| Three Months Ended April 30, | |||||||||||

| 2022 | 2021 | ||||||||||

| Cost of revenue reconciliation: | |||||||||||

| GAAP cost of revenue | $ | 27,139 | $ | 18,283 | |||||||

| Stock-based compensation expense | (1,848) | (383) | |||||||||

| Employer payroll tax on employee stock transactions | (1) | — | |||||||||

| Amortization of acquired intangible assets | (540) | (491) | |||||||||

| Non-GAAP cost of revenue | $ | 24,750 | $ | 17,409 | |||||||

| Gross profit reconciliation: | |||||||||||

| GAAP gross profit | $ | 51,116 | $ | 19,112 | |||||||

| Stock-based compensation expense | 1,848 | 383 | |||||||||

| Employer payroll tax on employee stock transactions | 1 | — | |||||||||

| Amortization of acquired intangible assets | 540 | 491 | |||||||||

| Non-GAAP gross profit | $ | 53,505 | $ | 19,986 | |||||||

| Gross margin reconciliation: | |||||||||||

| GAAP gross margin | 65 | % | 51 | % | |||||||

| Stock-based compensation expense | 2 | % | 1 | % | |||||||

| Employer payroll tax on employee stock transactions | — | % | — | % | |||||||

| Amortization of acquired intangible assets | 1 | % | 1 | % | |||||||

| Non-GAAP gross margin* | 68 | % | 53 | % | |||||||

| Research and development expense reconciliation: | |||||||||||

| GAAP research and development expense | $ | 45,881 | $ | 27,820 | |||||||

| Stock-based compensation expense | (10,463) | (7,139) | |||||||||

| Employer payroll tax on employee stock transactions | (38) | — | |||||||||

| Non-GAAP research and development expense | $ | 35,380 | $ | 20,681 | |||||||

| Sales and marketing expense reconciliation: | |||||||||||

| GAAP sales and marketing expense | $ | 60,641 | $ | 36,180 | |||||||

| Stock-based compensation expense | (7,096) | (2,047) | |||||||||

| Employer payroll tax on employee stock transactions | (153) | — | |||||||||

| Amortization of acquired intangible assets | (183) | (166) | |||||||||

| Non-GAAP sales and marketing expense | $ | 53,209 | $ | 33,967 | |||||||

| General and administrative expense reconciliation: | |||||||||||

| GAAP general and administrative expense | $ | 34,890 | $ | 16,724 | |||||||

| Stock-based compensation expense | (12,223) | (3,868) | |||||||||

| Employer payroll tax on employee stock transactions | (290) | — | |||||||||

| Amortization of acquired intangible assets | (18) | (17) | |||||||||

| Non-GAAP general and administrative expense | $ | 22,359 | $ | 12,839 | |||||||

SENTINELONE, INC.

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL INFORMATION (CONTINUED)

(in thousands, except percentages and per share data)

(unaudited)

| Operating loss reconciliation: | |||||||||||

| GAAP operating loss | $ | (90,296) | $ | (61,612) | |||||||

| Stock-based compensation | 31,630 | 13,437 | |||||||||

| Employer payroll tax on employee stock transactions | 482 | — | |||||||||

| Amortization of acquired intangible assets | 741 | 674 | |||||||||

| Non-GAAP operating loss | $ | (57,443) | $ | (47,501) | |||||||

| Operating margin reconciliation: | |||||||||||

| GAAP operating margin | (115) | % | (165) | % | |||||||

| Stock-based compensation | 40 | % | 36 | % | |||||||

| Employer payroll tax on employee stock transactions | 1 | % | — | % | |||||||

| Amortization of acquired intangible assets | 1 | % | 2 | % | |||||||

| Non-GAAP operating margin* | (73) | % | (127) | % | |||||||

| Net loss reconciliation: | |||||||||||

| GAAP net loss | $ | (89,834) | $ | (62,634) | |||||||

| Stock-based compensation | 31,630 | 13,437 | |||||||||

| Employer payroll tax on employee stock transactions | 482 | — | |||||||||

| Amortization of acquired intangible assets | 741 | 674 | |||||||||

| Non-GAAP net loss | $ | (56,981) | $ | (48,523) | |||||||

| Basic and diluted EPS reconciliation: | |||||||||||

| GAAP net loss per share, basic and diluted | $ | (0.33) | $ | (1.37) | |||||||

| Stock-based compensation | 0.12 | 0.29 | |||||||||

| Employer payroll tax on employee stock transactions | — | — | |||||||||

| Amortization of acquired intangible assets | — | 0.01 | |||||||||

| Non-GAAP net loss per share, basic and diluted* | $ | (0.21) | $ | (1.06) | |||||||

* Certain figures may not sum due to rounding.

SENTINELONE, INC.

SELECTED CASH FLOW INFORMATION

(in thousands)

(unaudited)

Reconciliation of cash used in operating activities to free cash flow

| Three Months Ended April 30, | |||||||||||

| 2022 | 2021 | ||||||||||

| GAAP net cash used in operating activities | $ | (49,351) | $ | (30,798) | |||||||

| Less: Purchases of property and equipment | (2,808) | (780) | |||||||||

| Less: Capitalized internal-use software | (2,574) | (1,013) | |||||||||

| Free cash flow | $ | (54,733) | $ | (32,591) | |||||||

| Net cash used in investing activities | $ | (858,525) | $ | (5,242) | |||||||

| Net cash provided by financing activities | $ | 4,904 | $ | 1,917 | |||||||

Se nt in el O ne Q 1 F Y 20 23 Q1 FY2023 Letter to Shareholders June 1, 2022

Q1 FY2023 LETTER TO SHAREHOLDERSSENTINELONE 1 To Our Shareholders Our first quarter results demonstrate the combination of a robust demand environment for our leading cybersecurity platform and impressive execution across the board. We once again sustained triple-digit revenue and ARR growth with significant margin expansion, added a record number of new customers1, and delivered a record NRR. This was our fifth consecutive quarter of triple-digit growth. We closed the acquisition of Attivo Networks at the beginning of our second quarter, springboarding SentinelOne into a leadership position in Identity security. Our Singularity XDR platform is stronger than ever, covering the essential enterprise attack surfaces – Endpoint, Cloud, and Identity security. Cybersecurity is a top IT spending priority and we haven’t seen that change because of macro conditions. Secular trends are driving demand for cybersecurity, including digital transformation, expanding attack surface, and data proliferation. We are focused on capturing mindshare and market share given the significant opportunity in front of us. This is the recipe for our long-term success. We continue to achieve significant margin expansion stemming from our platform-based land-and-expand strategy and operational efficiencies. We are making steady progress towards our long-term targets. We exited the first quarter with double-digit year-over-year improvement in both gross and operating margins. In the latest MITRE ATT&CK® evaluation, the benchmark EDR technical assessment, SentinelOne outperformed the competition. Out of the 30 vendors evaluated, we achieved 100% prevention, 100% detection, the highest analytic coverage (108/109) with zero detection delays, demonstrating the platform’s ability to autonomously combat the most sophisticated threat actors. Our Singularity XDR platform delivers automation, industry-leading efficacy, and ease of use – each serving as persistent competitive differentiators. Robust Demand Environment Cyber security is a top priority for enterprise IT spending – a must-buy for the modern enterprise. The persistence of geopolitical tensions and potential for cyberwarfare is a concern shared by all of us. Risks and consequences of not being protected by a leading security solution are just too high. We’re encouraged by the broad-based demand across geographies, products, and customers. We delivered healthy growth across all geographies, including in EMEA – a testament to the resilience and durability of cybersecurity during all economic conditions. From a product perspective, endpoint remains the engine that fuels our business. In addition, we’re seeing significant growth from our module capabilities. In particular, our Cloud Workload Protection solution continues to reach new heights and was our fastest growing module. Enterprises are rapidly shifting workloads to the cloud, and this shift is creating a greenfield market opportunity. Customers are choosing Singularity Cloud in con- junction with endpoints and on a stand alone basis. The scale of cloud footprints and early deal sizes indicate a much larger future potential. 1 Adjusted for the acquisition of Scalyr in Q1 FY22 01

Q1 FY2023 LETTER TO SHAREHOLDERSSENTINELONE 2 We added a record number of new customers in the quarter. Our competitive position is strong, driven by high win rates against both legacy and next-gen vendors. In fact, our win rates improved among larger opportunities. We ex- tended our success in state and local government into the federal arena by securing a major federal agency in partner- ship with CISA, our largest federal deal to date. We continue to secure large enterprises from around the world across all verticals, from major North American telecom operators to iconic media brands and multinational conglomerates. These wins demonstrate the global adoption of Singularity XDR and continue to elevate our position in the market. Our go-to-market flywheel of sales, marketing, and channel partner network is generating strong demand for our business. We exited the first quarter with our largest ever pipeline. Sustained Growth and Platform Unit Economics Driving Margin Improvement Our platform unit economics and business model enable us to grow efficiently. We’re delivering significant growth and margin expansion at the same time. We continue to progress towards our long-term financial targets. And that’s evident once again in our Q1 results, reflecting an increasing customer footprint, expanding product portfolio, data-enabled efficiencies, and operational excellence across SentinelOne. It’s the right strategy to invest for growth to optimize long-term yields. Increasing Customer Base and Footprint: We’re rapidly increasing our market share in two ways – adding new customers and expanding our footprint within our installed base. We continue to maintain strong gross retention rates, and our dollar based net retention rate remains above our long-term target of 120%. Expanding Product Portfolio: We’ve expanded our Singularity XDR platform to cover more attack surfaces than ever, including endpoint, cloud, identity, and an increasing number of emerging capabilities. With the expanding breadth and depth of our Singularity platform, we can efficiently sell more capabilities to our growing base of enterprise customers. Our total addressable market is vast – growing to over $50 billion, significantly larger than just a year ago. Data-enabled Efficiencies: Our data-focused platform approach yields favorable unit economics and creates a virtuous cycle that continues to enhance our growth and margin profile. We’re able to collect data once and reuse it for multiple security applications. Customers are adopting more of the Singularity platform every quarter to solve their enterprise needs, with notable growth from our Cloud, Data Retention, and Ranger modules. At the same time, our increasing scale and data optimization is improving our cost efficiency. As an example, over the past year, our footprint expansion has far outpaced our cloud hosting costs. Operational Efficiencies: Our partner-supported go-to-market and global footprint are delivering operating leverage in our business. Our magic number is above 1X. As we’ve grown in scale and headcount over the past two years, we’ve significantly enhanced our onboarding processes and accelerated sales productivity. To compound this, our channel and alliance partnerships expand our reach in a highly scalable manner. For example, in Q1, our channel helped create a record amount of deal registrations, which directly leads to pipeline opportunities and low-touch customer conver- sions. Finally, we’re increasing our global R&D footprint, attracting high-end talent across multiple continents in a cost efficient manner.

Q1 FY2023 LETTER TO SHAREHOLDERSSENTINELONE 3 Q1 FY2023 Highlights • Annualized Recurring Revenue (ARR) grew 110% year-over-year to $339 million at the end of our fiscal first quarter. Revenue in the quarter grew 109% year-over-year to $78 million. • We added a record number of customers in our first fiscal quarter, about 750 customers sequentially. Total customer count grew by more than 55% year-over-year to over 7,450 at quarter-end. Customers with ARR over $100K grew 113% year-over-year to 591. Dollar- based net revenue retention rate was a record 131%. • Fiscal first quarter GAAP gross margin was 65%, up 14 percentage points year-over-year. Non-GAAP gross margin was 68%, up 15 percentage points year-over-year. • Fiscal first quarter GAAP operating margin was (115)%, up 50 percentage points year-over- year. Non-GAAP operating margin was (73)%, up 54 percentage points year-over-year. Result – Sustained Growth with Significant Margin Expansion: All of the above factors are enabling us to deliver growth and significant margin expansion while investing in the business. Paired with five consecutive quarters of triple-digit growth, our GAAP and non-GAAP gross margin expanded 14 and 15 percentage points year-over-year, respectively. Our operating margins also improved dramatically, with GAAP and non-GAAP operating margins expand- ing 50 and 54 percentage points year-over-year, respectively. Our business has never been stronger and the market opportunity has never been larger. Investing for long term success is the optimal strategy, and it’s leading us closer to our long-term targets.

Q1 FY2023 LETTER TO SHAREHOLDERSSENTINELONE 4 At SentinelLabs, we’re leading the way with our thought leadership and novel research. Our researchers publish sophisticated research and uncover modern threats and vulnerabilities, helping enterprises across the world stay one step ahead of cyber threats. Governments and enterprises around the world – and even many of our peers – are learning and benefiting from these discoveries. We continue to publish original research on geopolitical and nation- state cybersecurity affairs. On the day of Russia’s invasion of the Ukraine, SentinelLabs researchers reported a new cyberattack and named the malware ‘HermeticWiper.’ Russia deployed this wiper that targets Windows devices rendering them inoperable, demonstrating cybersecurity’s impact in modern- day warfare. SentinelLabs also discovered and named ‘AcidRain,’ a destructive form of malware which impacted critical infrastructure in Germany. Based on our findings, the European Union, the United Kingdom, and the U.S. govern- ment formally blamed the Russian government for the AcidRain hack. Pub- lication of this discovery educated technology professionals, investors, and prospective customers around the world. While geopolitical tensions remain at the center stage of cyber awareness, enterprises should remain vigilant when it comes to software deployed within their organization. It is common practice to find and patch vulnerabilities, but what if the deployed security solution itself is the cause of an enterprise-wide vulnerability? In March, we discovered a number of critical severity flaws in Microsoft Azure’s Defender for IoT products, affecting cloud and on-premise customers. Unauthenticated attackers could remotely compromise devices protected by Microsoft Azure Defender for IoT by abusing vulnerabilities in Azure’s Password Recovery mechanism. In May, we announced the inaugural LABScon Security Research Conference to be held in September 2022. LABScon is dedicated to advancing cybersecurity research for the benefit of collective digital defense and unites world-class cybersecurity researchers in showcasing groundbreaking discoveries. The battle never ends, and thought leadership and collaboration are key.

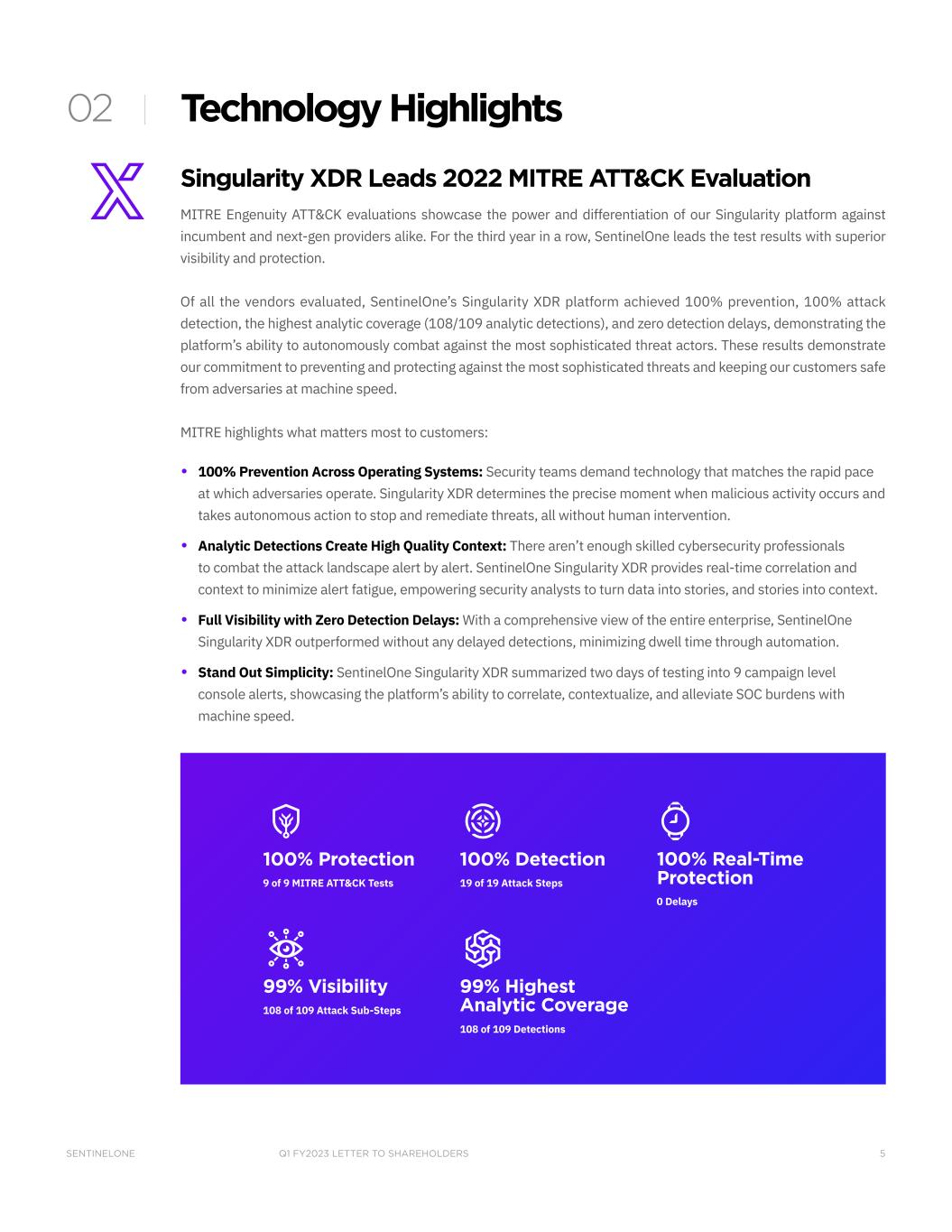

Q1 FY2023 LETTER TO SHAREHOLDERSSENTINELONE 5 Technology Highlights Singularity XDR Leads 2022 MITRE ATT&CK Evaluation MITRE Engenuity ATT&CK evaluations showcase the power and differentiation of our Singularity platform against incumbent and next-gen providers alike. For the third year in a row, SentinelOne leads the test results with superior visibility and protection. Of all the vendors evaluated, SentinelOne’s Singularity XDR platform achieved 100% prevention, 100% attack detection, the highest analytic coverage (108/109 analytic detections), and zero detection delays, demonstrating the platform’s ability to autonomously combat against the most sophisticated threat actors. These results demonstrate our commitment to preventing and protecting against the most sophisticated threats and keeping our customers safe from adversaries at machine speed. MITRE highlights what matters most to customers: • 100% Prevention Across Operating Systems: Security teams demand technology that matches the rapid pace at which adversaries operate. Singularity XDR determines the precise moment when malicious activity occurs and takes autonomous action to stop and remediate threats, all without human intervention. • Analytic Detections Create High Quality Context: There aren’t enough skilled cybersecurity professionals to combat the attack landscape alert by alert. SentinelOne Singularity XDR provides real-time correlation and context to minimize alert fatigue, empowering security analysts to turn data into stories, and stories into context. • Full Visibility with Zero Detection Delays: With a comprehensive view of the entire enterprise, SentinelOne Singularity XDR outperformed without any delayed detections, minimizing dwell time through automation. • Stand Out Simplicity: SentinelOne Singularity XDR summarized two days of testing into 9 campaign level console alerts, showcasing the platform’s ability to correlate, contextualize, and alleviate SOC burdens with machine speed. 100% Protection 9 of 9 MITRE ATT&CK Tests 100% Detection 19 of 19 Attack Steps 99% Visibility 108 of 109 Attack Sub-Steps 99% Highest Analytic Coverage 108 of 109 Detections 100% Real-Time Protection 0 Delays 02

Q1 FY2023 LETTER TO SHAREHOLDERSSENTINELONE 6 Added Leading Identity Technology to Singularity XDR Platform Protection at both the device and user level is a necessity of the XDR era. Identity is the new attack surface forming an organizational perimeter, which must be kept malware-free and accessible by the right users. Unsanctioned or compromised access has serious ramifications. Devices, networks, and data assets are just a click away with creden- tial and Active Directory access. In early May, we closed our acquisition of Attivo Networks bringing a unified identity security, identity infrastructure assessment, and cyber identity deception to Singularity XDR customers. SentinelOne delivers comprehensive identity security as part of Singularity XDR for autonomous protection including: • Singularity Identity detects real-time identity attacks across the enterprise that target Active Directory and Azure AD. • Singularity Ranger Active Directory Assessor uncovers vulnerabilities in Active Directory (AD) and Azure AD with a cloud-delivered, continuous identity assessment solution. • Singularity Hologram lures network and insider threat actors into engaging and revealing themselves with network-based threat deception. SentinelOne and Attivo Networks are more powerful together. With our existing Singularity Ranger technology, which delivers network visibility and attack surface reduction, our customers can now experience complete Active Directory vulnerability discovery, protection, and remediation both at the asset and Active Directory level. Ranger AD reduces the attack surface for our customers and outpaces the rest of the security industry in delivering revolutionary Attack Surface Management. Ranger AD delivers prescriptive, actionable insight to reduce Active Directory and Azure AD attack surfaces quickly and efficiently, allowing enterprises to stay secure and ahead of potential threats. In addition to a natural fit within our platform, Attivo complements our network of strategic service providers extremely well, specifically Incident Responders.

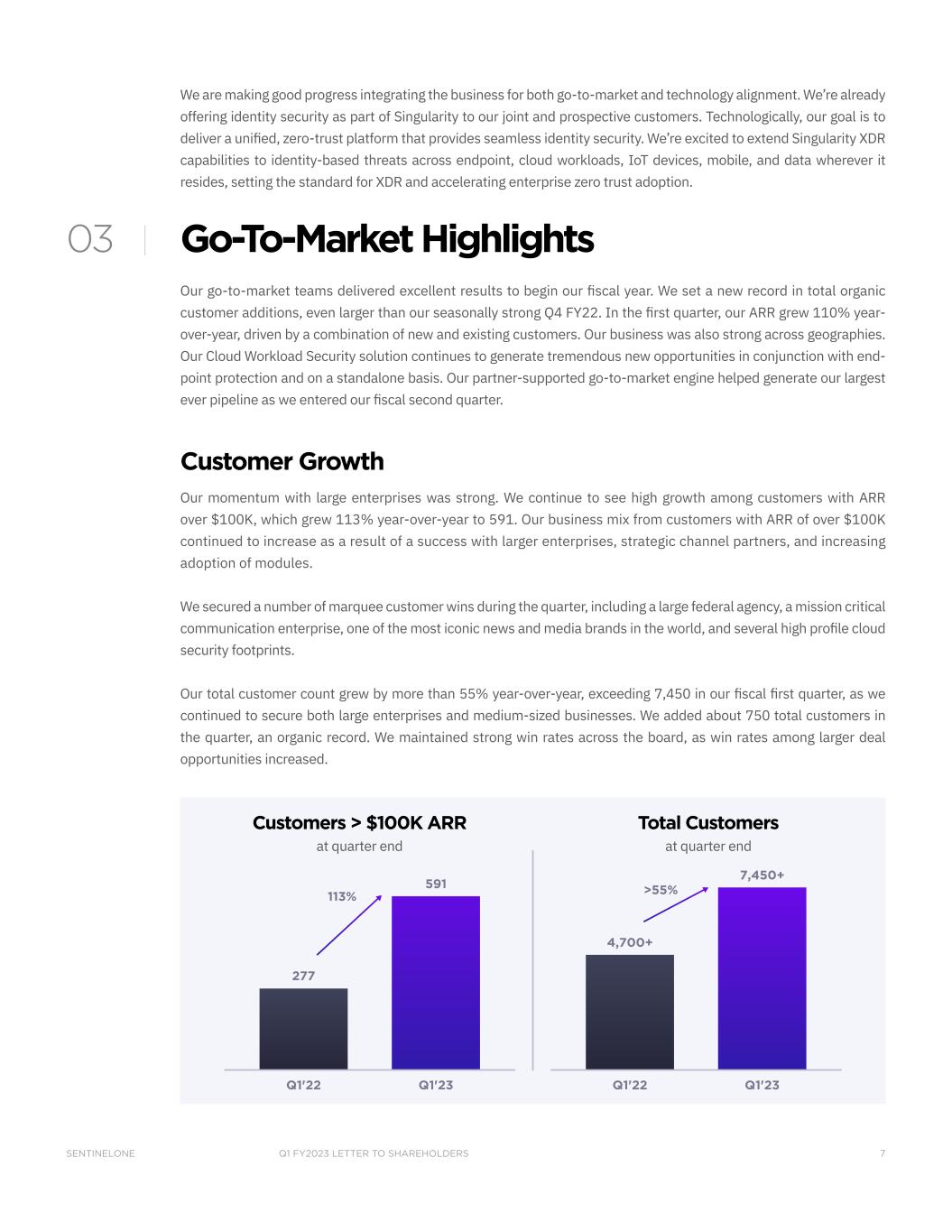

Q1 FY2023 LETTER TO SHAREHOLDERSSENTINELONE 7 We are making good progress integrating the business for both go-to-market and technology alignment. We’re already offering identity security as part of Singularity to our joint and prospective customers. Technologically, our goal is to deliver a unified, zero-trust platform that provides seamless identity security. We’re excited to extend Singularity XDR capabilities to identity-based threats across endpoint, cloud workloads, IoT devices, mobile, and data wherever it resides, setting the standard for XDR and accelerating enterprise zero trust adoption. Go-To-Market Highlights Our go-to-market teams delivered excellent results to begin our fiscal year. We set a new record in total organic customer additions, even larger than our seasonally strong Q4 FY22. In the first quarter, our ARR grew 110% year- over-year, driven by a combination of new and existing customers. Our business was also strong across geographies. Our Cloud Workload Security solution continues to generate tremendous new opportunities in conjunction with end- point protection and on a standalone basis. Our partner-supported go-to-market engine helped generate our largest ever pipeline as we entered our fiscal second quarter. Customer Growth Our momentum with large enterprises was strong. We continue to see high growth among customers with ARR over $100K, which grew 113% year-over-year to 591. Our business mix from customers with ARR of over $100K continued to increase as a result of a success with larger enterprises, strategic channel partners, and increasing adoption of modules. We secured a number of marquee customer wins during the quarter, including a large federal agency, a mission critical communication enterprise, one of the most iconic news and media brands in the world, and several high profile cloud security footprints. Our total customer count grew by more than 55% year-over-year, exceeding 7,450 in our fiscal first quarter, as we continued to secure both large enterprises and medium-sized businesses. We added about 750 total customers in the quarter, an organic record. We maintained strong win rates across the board, as win rates among larger deal opportunities increased. 277 591 Q1'22 Q1'23 113% 4,700+ 7,450+ Q1'22 Q1'23 >55% Customers > $100K ARR at quarter end Total Customers at quarter end 03

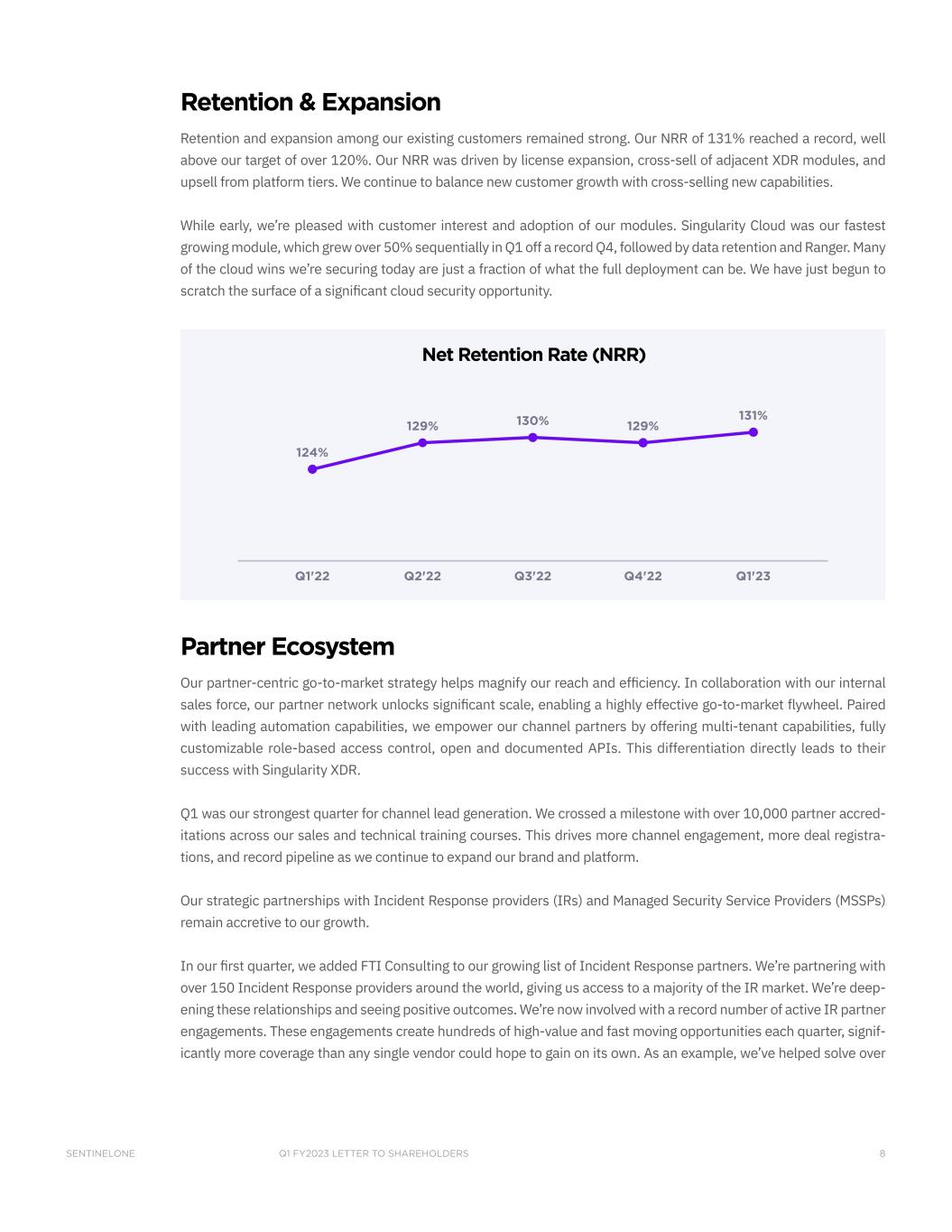

Q1 FY2023 LETTER TO SHAREHOLDERSSENTINELONE 8 Retention & Expansion Retention and expansion among our existing customers remained strong. Our NRR of 131% reached a record, well above our target of over 120%. Our NRR was driven by license expansion, cross-sell of adjacent XDR modules, and upsell from platform tiers. We continue to balance new customer growth with cross-selling new capabilities. While early, we’re pleased with customer interest and adoption of our modules. Singularity Cloud was our fastest growing module, which grew over 50% sequentially in Q1 off a record Q4, followed by data retention and Ranger. Many of the cloud wins we’re securing today are just a fraction of what the full deployment can be. We have just begun to scratch the surface of a significant cloud security opportunity. Q1'22 Q2'22 Q3'22 Q4'22 124% 129% 129%130% 131% Q1'23 Net Retention Rate (NRR) Partner Ecosystem Our partner-centric go-to-market strategy helps magnify our reach and efficiency. In collaboration with our internal sales force, our partner network unlocks significant scale, enabling a highly effective go-to-market flywheel. Paired with leading automation capabilities, we empower our channel partners by offering multi-tenant capabilities, fully customizable role-based access control, open and documented APIs. This differentiation directly leads to their success with Singularity XDR. Q1 was our strongest quarter for channel lead generation. We crossed a milestone with over 10,000 partner accred- itations across our sales and technical training courses. This drives more channel engagement, more deal registra- tions, and record pipeline as we continue to expand our brand and platform. Our strategic partnerships with Incident Response providers (IRs) and Managed Security Service Providers (MSSPs) remain accretive to our growth. In our first quarter, we added FTI Consulting to our growing list of Incident Response partners. We’re partnering with over 150 Incident Response providers around the world, giving us access to a majority of the IR market. We’re deep- ening these relationships and seeing positive outcomes. We’re now involved with a record number of active IR partner engagements. These engagements create hundreds of high-value and fast moving opportunities each quarter, signif- icantly more coverage than any single vendor could hope to gain on its own. As an example, we’ve helped solve over

Q1 FY2023 LETTER TO SHAREHOLDERSSENTINELONE 9 2,000 enterprise ransomware breaches with Arete, one of our longstanding IR relationships. Our technology is aptly suited for incident response because it can be instantly deployed and autonomously remediates an attack across the enterprise post-breach. Finally, our growing partnerships with MSSPs give us large and expanding enterprise and mid-market coverage. We are beginning to unlock platform expansion opportunities within our MSSP network. We’re now enabling our MSSP partners to deploy more of our XDR modules, like Ranger, Vigilance, RSO, among others. This creates expansion opportunities for us and our partners. Q1 FY2023 Financials Our strong growth trajectory continued in the fiscal first quarter. Year-over-year ARR growth was 110% and reached $339 million at the end of Q1. Our triple-digit growth was driven by strong demand from new and existing customers as well as large and mid-sized enterprises seeking to modernize and automate their cybersecurity technology. Our GAAP and non-GAAP gross and operating margin significantly improved year-over-year, driven by higher revenue, increased scale, and operational efficiencies. Annualized Recurring Revenue (ARR) & Revenue Fiscal first quarter marked our fifth consecutive quarter of hypergrowth. Our ARR grew 110% year-over-year to $339 million at the end of our fiscal first quarter. Our net new ARR of $47 million was exceptionally strong on a seasonal basis. The strength was broad-based across new customer adds, existing customer renewals, and upsells. Total revenue grew 109% year-over-year to $78 million in our fiscal first quarter. International revenue represented 33% of total revenue, reflecting growth of 129% year-over-year. Our global go-to-market expansion and growing brand awareness contributed to strong growth across all major international geographies, particularly in EMEA. $198 $237 $292 $339 116% 127% 131% 123% $37 $46 $56 $66 108% 121% 128% 120% $78 Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 110% $161 109% Annualized Recurring Revenue $ million, year over year growth Revenue $ million, year over year growth 04

Q1 FY2023 LETTER TO SHAREHOLDERSSENTINELONE 10 Gross Profit & Margin Gross profit was $51 million, or 65% of revenue, compared to 51% of revenue a year ago. Non-GAAP gross profit was $54 million, or 68% of revenue, compared to 53% of revenue a year ago. This significant year-over-year increase in GAAP and non-GAAP gross margin was driven by increasing scale, increasing platform adoption, and improved efficiencies. 63% 66% GAAP Non-GAAP 51% 59% 64% 53% 62% 67% Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 65% 68% Gross Margin % of revenue, GAAP & Non-GAAP Operating Expenses Our total operating expenses were $141 million, including $30 million of stock-based compensation expense (SBC), employer payroll tax on employee stock transactions, and amortization of acquired intangible assets. Our total operating expenses increased 75% year-over-year largely due to an increase in headcount and SBC. Our non-GAAP operating expenses were $111 million, representing 142% of revenue compared to $67 million or 180% of revenue a year ago. Our non-GAAP operating expenses grew 64% year-over-year. The growth was driven by an increase in headcount as we continue to invest in the long-term scale and growth of our business. Research and development expenses were $46 million, up 65% year-over-year. On a non-GAAP basis, research and development expenses increased 71% year-over-year to $35 million and represented 45% of revenue, compared to 55% a year ago. The year-over-year increase was largely due to a higher headcount. Sales and marketing expenses were $61 million, up 68% year-over-year. On a non-GAAP basis, sales and marketing expenses increased 57% year-over-year to $53 million and represented 68% of revenue, compared to 91% a year ago. The year-over-year increase was largely due to a higher headcount. General and administrative expenses were $35 million, up 109% year-over-year. On a non-GAAP basis, general and administrative expenses grew 74% year-over-year to $22 million and represented 29% of revenue, compared to 34% a year ago. The year-over-year increase was largely due to a higher headcount.

Q1 FY2023 LETTER TO SHAREHOLDERSSENTINELONE 11 GAAP NON-GAAP Q1'22 Q1'23 55% 45% 91% 68% 34% 29% Q1'22 Q1'23 74% 59% 97% 77% 45% 45% R&D S&M G&A Operating Expenses % of revenue, GAAP & Non-GAAP Operating & Net Income (Loss) GAAP operating margin was (115)%, compared to (165)% a year ago. Non-GAAP operating margin was (73)% com- pared to (127)% a year ago. The improvement in operating margin was a result of revenue growth outpacing the increase in our expenses. GAAP net loss was $90 million, compared to $63 million a year ago. The larger loss reflects the increase in SBC and in- crease in headcount. Non-GAAP net loss was $57 million compared to $49 million a year ago. The larger loss reflects an increase in headcount and public company operating costs. $(62) $(90) Q1'22 Q1'23 EBIT EBIT Margin % $(48) $(57) Q1'22 Q1'23 GAAP NON-GAAP (127)% (73)% (115)% (165)% Operating Income (Loss) & Margin $ million and % of revenue, GAAP & Non-GAAP

Q1 FY2023 LETTER TO SHAREHOLDERSSENTINELONE 12 Balance Sheet and Cash Flows We ended the quarter with approximately $1.6 billion in cash, cash equivalents, and short-term investments. Our strong balance sheet provides flexibility and support to drive sustainable growth. We closed the acquisition of Attivo Networks on May 3, 2022 for $352 million in cash and approximately 6 million shares of common stock. Net cash used in operating activities for the three months ended April 30, 2022, was $(49) million, compared to $(31) million a year ago. Free cash flow was $(55) million in our fiscal first quarter, compared to $(33) million a year ago. Guidance We are providing the following guidance for the second quarter of fiscal year 2023, ending July 31, 2022, and for our full fiscal year 2023, ending January 31, 2023, which now includes the expected results of the Attivo Networks, Inc. acquisition completed on May 3, 2022: Q2 FY23 Full-Year FY23 Revenue $95-96 million $403-407 million Non-GAAP gross margin 68-69% 69-70% Non-GAAP operating margin (75)-(73)% (60)-(55)% In the second fiscal quarter, we expect revenue between $95-96 million, reflecting growth of 107-110% year-over- year. For the full fiscal year 2023, we expect revenue of $403-407 million, reflecting growth of between 97-99% year- over-year. We expect structural tailwinds to persist, combined with benefits from product expansion, improved brand awareness, and scaling our go-to-market. We expect our second fiscal quarter non-GAAP gross margin to be between 68-69%. For the full fiscal year 2023, we expect non-GAAP gross margin to be between 69-70%. Both of these reflect year-over-year gross margin expansion. We expect to continue benefiting from increasing scale, better data processing efficiencies, and module expansion. Finally, we expect a non-GAAP operating margin of (75)-(73)% for our first fiscal quarter and (60)-(55)% for the full fiscal year 2023. Both of these represent meaningful year-over-year improvement, reflecting the increasing scale and efficiency of our business. In fiscal year 2023, we expect to continue investing for growth while making steady progress towards our long-term profitability target. The above statements are based on current targets as of the date of this letter, and we undertake no obligation to update after such date. These statements are forward-looking, and actual results may differ materially as a result of many factors. Refer to the Forward-Looking Statements safe harbor below for information on the factors that could cause our action results to differ materially from these forward-looking statements. Guidance for non-GAAP financial measures excludes stock-based compensation expense, employer payroll tax on employee stock transactions, and amortization expense of acquired intangible assets. We have not provided the forward-looking most directly comparable GAAP measures because certain items are out of our control or cannot be reasonably predicted. Accordingly, a reconciliation for non-GAAP gross margin and non-GAAP operating margin is 05

Q1 FY2023 LETTER TO SHAREHOLDERSSENTINELONE 13 not available without unreasonable effort. However, it is important to note that material changes to reconciling items could have a significant effect on future GAAP results. We have provided a reconciliation of other GAAP to non-GAAP metrics in tables at the end of this letter. Closing We will host a conference call at 2:00pm Pacific time/5:00pm Eastern time today to discuss further details of our fiscal first quarter results. A live webcast and replay will be available on SentinelOne’s Investor Relations website at investors.sentinelone.com. Thank you for taking the time to read our shareholder letter, and we look forward to your questions on our call this afternoon. Sincerely, Tomer Weingarten Nicholas Warner Dave Bernhardt President and CEO President, Security CFO 06

Q1 FY2023 LETTER TO SHAREHOLDERSSENTINELONE 14 Forward-Looking Statements This letter and the live webcast which will be held at 2:00 pm, EST on June 1, 2022, contain “forward-looking state- ments” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Secu- rities Exchange Act of 1934, as amended, which statements involve risks and uncertainties, including statements regarding our future growth, and future financial and operating performance, including our financial outlook for the second quarter of fiscal 2023 and full-year fiscal 2023, including non-GAAP gross profit and non-GAAP operating margin, our impact of the acquisition of Attivo Networks, Inc. (“Attivo”) on our business and financial results; state- ments regarding total addressable market, business strategy, acquisitions, and strategic investments, the COVID-19 pandemic, our reputation and performance in the market, general market trends, and our objectives are forward-look- ing statements. These forward-looking statements are made as of the date they were first issued and were based on current expectations, estimates, forecasts, and projections as well as the beliefs and assumptions of management. The words “believe,” “may,” “will,” “potentially,” “estimate,” “continue,” “anticipate,” “intend,” “could,” “would,” “pro- ject,” “target,” “plan,” “expect,” or the negative of these terms and similar expressions are intended to identify for- ward-looking statements. However, not all forward-looking statements contain these identifying words. There are a significant number of factors that could cause our actual results to differ materially from statements made in this letter and live webcast, including: our limited operating history; our history of losses; intense competition in the market we compete in; fluctuations in our operating results; network or security incidents against us; our ability to successfully integrate any acquisitions and strategic investments, including the integration of Attivo; defects, errors or vulnerabilities in our platform; risks associated with managing our rapid growth; the continuing impact of the COVID-19 pandemic on our and our customers’ business; our ability to attract new and retain existing customers, or renew and expand our relationships with them; the ability of our platform to effectively interoperate within our customers’ IT infrastructure; disruptions or other business interruptions that affect the availability of our platform; the failure to timely develop and achieve market acceptance of new products, and subscriptions as well as existing products, subscriptions and support offerings; rapidly evolving technological developments in the market for security products and subscription and support offerings; length of sales cycles; risks of securities class action litigation; general market, political, economic, and business conditions, including those related to the continuing impact of COVID-19 and the effects of the recent conflict in Ukraine. Additional risks and uncertainties that could affect our financial results are included under the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” set in our filings and reports with the SEC, including our Annual Report on Form 10-K for our 2022 fiscal year, our most recently filed Quar- terly Report on Form 10-Q,, and other filings and reports that we may file from time to time with the SEC, copies of which are available on our website at investors.sentinelone.com and on the SEC’s website at www.sec.gov. You should not rely on these forward-looking statements, as actual outcomes and results may differ materially from those contemplated by these forward-looking statements as a result of such risks and uncertainties. All forward-look- ing statements in this letter and the live webcast are based on information and estimates available to us at the time of this letter, and we do not assume any obligation to update the forward-looking statements provided to reflect events that occur or circumstances that exist after the date of this letter and live webcast or to reflect new information or the occurrence of unexpected events, except as required by law. We may not actually achieve the plans, intentions, or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our for- ward-looking statements.

Q1 FY2023 LETTER TO SHAREHOLDERSSENTINELONE 15 Non-GAAP Financial Measures In addition to our results determined in accordance with GAAP, we believe the following non-GAAP measures are useful in evaluating our operating performance. We use the following non-GAAP financial information to evaluate our ongoing operations and for internal planning and forecasting purposes. Non-GAAP financial information excludes stock-based compensation expense, employer payroll tax expense related to employee stock transactions and amor- tization of acquired intangible assets. We believe that non-GAAP financial information, when taken collectively, with the financial information presented in accordance with GAAP, may be helpful to investors because it provides con- sistency and comparability with past financial performance. However, non-GAAP financial information is presented for supplemental informational purposes only, has limitations as an analytical tool, and should not be considered in isolation or as a substitute for financial information presented in accordance with GAAP. Other companies, including companies in our industry, may calculate similarly titled non-GAAP measures differently or may use other measures to evaluate their performance, all of which could reduce the usefulness of our non-GAAP financial measures as tools for comparison. In addition, the utility of free cash flow as a measure of our liquidity is limited as it does not represent the total increase or decrease in our cash balance for a given period. Reconciliations between non-GAAP financial measures to the most directly comparable financial measure stated in accordance with GAAP are contained at the end of the earnings press release following the accompanying financial data. Investors are encouraged to review the related GAAP financial measures and the reconciliation of these non- GAAP financial measures to their most directly comparable GAAP financial measures and not rely on any single finan- cial measure to evaluate our business. Non-GAAP Gross Profit and Non-GAAP Gross Margin We define non-GAAP gross profit and non-GAAP gross margin as GAAP gross profit and GAAP gross margin, respec- tively, excluding stock-based compensation expense, employer payroll tax on employee stock transactions, and amortization of acquired intangible assets. We believe non-GAAP gross profit and non-GAAP gross margin provide our management and investors consistency and comparability with our past financial performance and facilitate peri- od-to-period comparisons of operations, as these measures eliminate the effects of certain variables unrelated to our overall operating performance. Non-GAAP Loss from Operations and Non-GAAP Operating Margin We define non-GAAP loss from operations and non-GAAP operating margin as GAAP loss from operations and GAAP operating margin, respectively, excluding stock-based compensation expense, employer payroll tax on employee stock transactions, and amortization of acquired intangible assets. We believe non-GAAP loss from operations and non-GAAP operating margin provide our management and investors consistency and comparability with our past financial performance and facilitate period-to-period comparisons of operations, as these metrics generally eliminate the effects of certain variables unrelated to our overall operating performance. Non-GAAP Net Loss and Non-GAAP Net Loss per Share, Basic and Diluted We define non-GAAP net loss as GAAP net loss excluding stock-based compensation expense, employer payroll tax on employee stock transactions, and amortization of acquired intangible assets. We define non-GAAP net loss per share, basic and diluted, as non-GAAP net loss divided by the weighted-average common shares outstanding. Since we have reported net losses for all periods presented, we have excluded all potentially dilutive securities from the calculation of net loss per share as their effect is anti-dilutive and accordingly, basic and diluted net loss per share is

Q1 FY2023 LETTER TO SHAREHOLDERSSENTINELONE 16 the same for all periods presented. We believe that excluding these items from non-GAAP net loss and non-GAAP net loss per share, diluted, provides management and investors with greater visibility into the underlying performance of our core business operating results. Free Cash Flow Free cash flow is a non-GAAP financial measure that we define as net cash provided by (used in) operating activities less cash used for purchases of property and equipment and capitalized internal-use software. We believe that free cash flow is a useful indicator of liquidity that provides information to management and investors, even if negative, as it provides useful information about the amount of cash generated (or consumed) by our operating activities that is available (or not available) to be used for other strategic initiatives. For example, if free cash flow is negative, we may need to access cash reserves or other sources of capital to invest in strategic initiatives. While we believe that free cash flow is useful in evaluating our business, free cash flow is a non-GAAP financial measure that has limitations as an analytical tool, and free cash flow should not be considered as an alternative to, or substitute for, net cash provided by (used in) operating activities in accordance with GAAP. The utility of free cash flow as a measure of our liquidity is limited as it does not represent the total increase or decrease in our cash balance for any given period and does not re- flect our future contractual commitments. In addition, other companies, including companies in our industry, may cal- culate free cash flow differently or not at all, which reduces the usefulness of free cash flow as a tool for comparison. Expenses Excluded from Non-GAAP Measures Stock-based compensation expense Stock-based compensation expense is a non-cash expense that varies in amount from period to period and is de- pendent on market forces that are often beyond our control. As a result, management excludes this item from our internal operating forecasts and models. Management believes that non-GAAP measures adjusted for stock-based compensation expense provide investors with a basis to measure our core performance against the performance of other companies without the variability created by stock-based compensation as a result of the variety of equity awards used by other companies and the varying methodologies and assumptions used. Employer payroll tax on employee stock transactions Employer payroll tax expenses related to employee stock transactions are tied to the vesting or exercise of underlying equity awards and the price of our common stock at the time of vesting, which varies in amount from period to period and is dependent on market forces that are often beyond our control. As a result, management excludes this item from our internal operating forecasts and models. Management believes that non-GAAP measures adjusted for employer payroll taxes on employee stock transactions provide investors with a basis to measure our core performance against the performance of other companies without the variability created by employer payroll taxes on employee stock transactions as a result of the stock price at the time of employee exercise. Amortization of acquired intangible assets We amortize intangible assets that we acquire in conjunction with acquisitions, which results in non-cash expenses that may not otherwise have been incurred. We believe excluding the expense associated with intangible assets from non-GAAP measures allows for a more accurate assessment of its ongoing operations and provides investors with a better comparison of period-over-period operating results. Key Business Metrics We monitor the following key metrics to help us evaluate our business, identify trends affecting our business, formu- late business plans and make strategic decisions.

Q1 FY2023 LETTER TO SHAREHOLDERSSENTINELONE 17 Annualized Recurring Revenue (ARR) We believe that ARR is a key operating metric to measure our business because it is driven by our ability to acquire new subscription customers and to maintain and expand our relationship with existing subscription customers. ARR represents the annualized revenue run rate of our subscription contracts at the end of a reporting period, assuming contracts are renewed on their existing terms for customers that are under subscription contracts with us. ARR is not a forecast of future revenue, which can be impacted by contract start and end dates and renewal rates. Customers with ARR of $100,000 or More We believe that our ability to increase the number of customers with ARR of $100,000 or more is an indicator of our market penetration and strategic demand for our platform. We define a customer as an entity that has an active subscription for access to our platform. We count Managed Service Providers (MSPs), Managed Security Service Providers (MSSPs), Managed Detection & Response firms (MDRs), and Original Equipment Manufacturers (OEMs), who may purchase our products on behalf of multiple companies, as a single customer. We do not count our reseller or distributor channel partners as customers. Dollar-Based Net Retention Rate (NRR) We believe that our ability to retain and expand the revenue generated from our existing customers is an indicator of the long-term value of our customer relationships and our potential future business opportunities. Dollar-based net retention rate measures the percentage change in our ARR derived from our customer base at a point in time. To calculate these metrics, we first determine Prior Period ARR, which is ARR from the population of our customers as of 12 months prior to the end of a particular reporting period. We calculate Net Retention ARR as the total ARR at the end of a particular reporting period from the set of customers that are used to determine Prior Period ARR. Net Retention ARR includes any expansion and is net of contraction and attrition associated with that set of customers. NRR is the quotient obtained by dividing Net Retention ARR by Prior Period ARR. Definitions Customers: We define a customer as an entity that has an active subscription for access to our platform. We count MSPs, MSSPs, MDRs, and OEMs, who may purchase our product on behalf of multiple companies, as a single customer. We do not count our reseller or distributor channel partners as customers.

Q1 FY2023 LETTER TO SHAREHOLDERSSENTINELONE 18 April 30, January 31, 2022 2022 Assets Current assets: Cash and cash equivalents $766,101 $1,669,304 Short-term investments 851,418 374 Accounts receivable, net 86,871 101,491 Deferred contract acquisition costs, current 26,261 27,546 Prepaid expenses and other current assets 24,849 18,939 Total current assets 1,755,500 1,817,654 Property and equipment, net 29,083 24,918 Operating lease right-of-use assets 25,731 23,884 Deferred contract acquisition costs, non-current 43,679 41,022 Intangible assets, net 15,130 15,807 Goodwill 108,193 108,193 Other assets 11,132 10,703 Total assets $1,988,448 $2,042,181 Liabilities and Stockholders’ Equity Current liabilities: Accounts payable $13,925 $9,944 Accrued liabilities 23,820 22,657 Accrued payroll and benefits 39,654 61,150 Operating lease liabilities, current 2,925 4,613 Deferred revenue, current 196,385 182,957 Total current liabilities 276,709 281,321 Deferred revenue, non-current 79,259 79,062 Operating lease liabilities, non-current 27,199 24,467 Other liabilities 8,039 6,543 Total liabilities 391,206 391,393 Stockholders’equity: Preferred stock — — Class A common stock 19 16 Class B common stock 8 11 Additional paid-in capital 2,309,505 2,271,980 Accumulated other comprehensive income (loss) (783) 454 Accumulated deficit (711,507) (621,673) Total stockholders’ equity 1,597,242 1,650,788 Total liabilities and stockholders’ equity $1,988,448 $2,042,181 SENTINELONE, INC. CONDENSED CONSOLIDATED BALANCE SHEETS (in thousands) (unaudited)

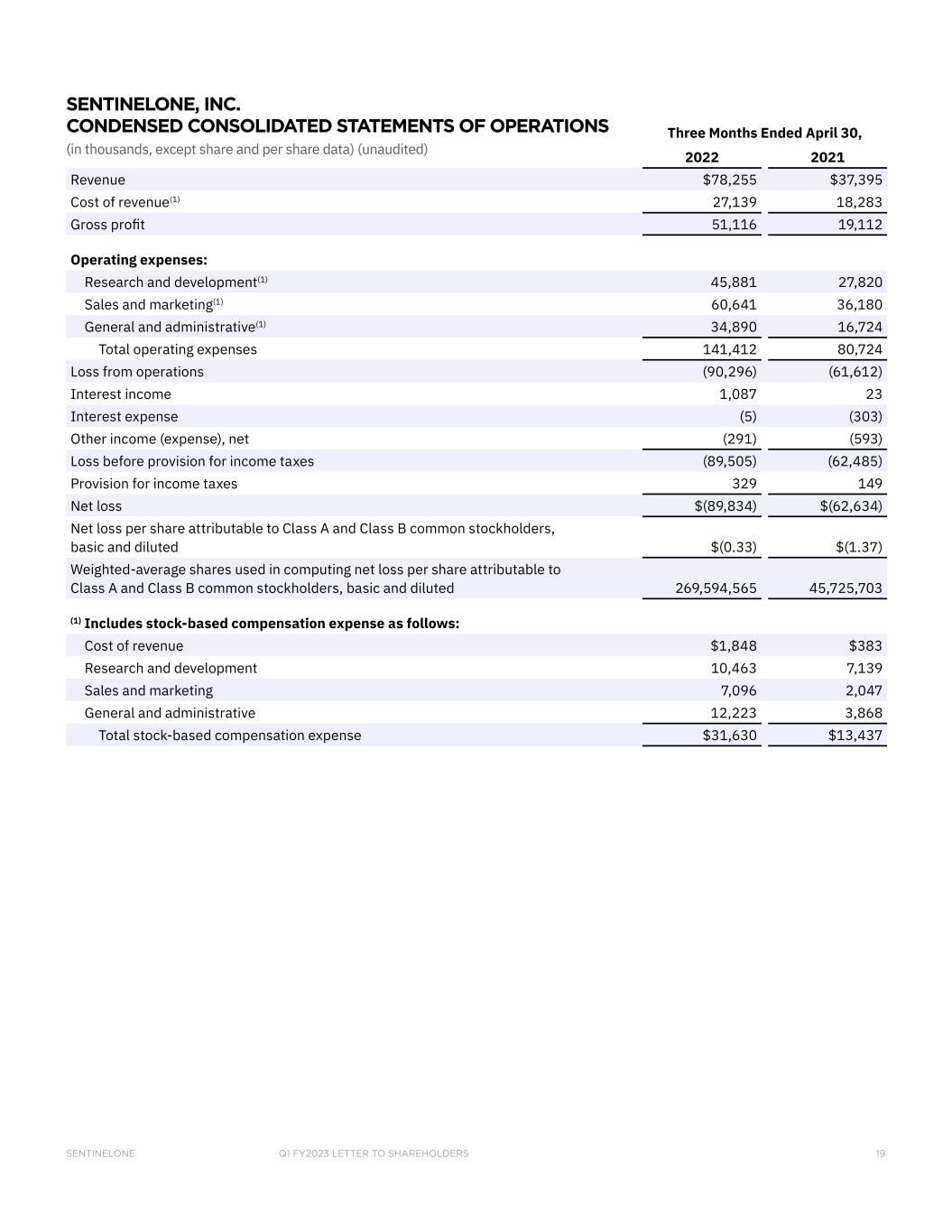

Q1 FY2023 LETTER TO SHAREHOLDERSSENTINELONE 19 Three Months Ended April 30, 2022 2021 Revenue $78,255 $37,395 Cost of revenue(1) 27,139 18,283 Gross profit 51,116 19,112 Operating expenses: Research and development(1) 45,881 27,820 Sales and marketing(1) 60,641 36,180 General and administrative(1) 34,890 16,724 Total operating expenses 141,412 80,724 Loss from operations (90,296) (61,612) Interest income 1,087 23 Interest expense (5) (303) Other income (expense), net (291) (593) Loss before provision for income taxes (89,505) (62,485) Provision for income taxes 329 149 Net loss $(89,834) $(62,634) Net loss per share attributable to Class A and Class B common stockholders, basic and diluted $(0.33) $(1.37) Weighted-average shares used in computing net loss per share attributable to Class A and Class B common stockholders, basic and diluted 269,594,565 45,725,703 (1) Includes stock-based compensation expense as follows: Cost of revenue $1,848 $383 Research and development 10,463 7,139 Sales and marketing 7,096 2,047 General and administrative 12,223 3,868 Total stock-based compensation expense $31,630 $13,437 SENTINELONE, INC. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (in thousands, except share and per share data) (unaudited)

Q1 FY2023 LETTER TO SHAREHOLDERSSENTINELONE 20 Three Months Ended April 30, 2022 2021 CASH FLOW FROM OPERATING ACTIVITIES: Net loss $(89,834) $(62,634) Adjustments to reconcile net loss to net cash used in operating activities: Depreciation and amortization 2,102 1,659 Amortization of deferred contract acquisition costs 7,975 4,375 Non-cash operating lease costs 682 766 Stock-based compensation expense 31,630 13,437 Other 288 (672) Changes in operating assets and liabilities, net of effects of acquisition Accounts receivable 14,779 6,317 Prepaid expenses and other assets (5,208) 257 Deferred contract acquisition costs (9,347) (5,472) Accounts payable 5,079 (2,211) Accrued liabilities 190 2,724 Accrued payroll and benefits (21,478) 1,291 Operating lease liabilities (1,330) (717) Deferred revenue 13,626 9,702 Other liabilities 1,495 380 Net cash used in operating activities (49,351) (30,798) CASH FLOW FROM INVESTING ACTIVITIES: Purchases of property and equipment (2,808) (780) Purchases of intangible assets (152) — Capitalization of internal-use software (2,574) (1,013) Purchases of investments (852,991) — Cash paid for acquisition, net of cash and restricted cash acquired — (3,449) Net cash used in investing activities (858,525) (5,242) CASH FLOW FROM FINANCING ACTIVITIES: Payments of deferred offering costs (186) (1,826) Proceeds from exercise of stock options 5,090 3,743 Net cash provided by financing activities 4,904 1,917 EFFECT OF EXCHANGE RATE CHANGES ON CASH AND CASH EQUIVALENTS — 1,289 NET CHANGE IN CASH, CASH EQUIVALENTS, AND RESTRICTED CASH (902,972) (32,834) CASH, CASH EQUIVALENTS, AND RESTRICTED CASH–Beginning of period 1,672,051 399,112 CASH, CASH EQUIVALENTS, AND RESTRICTED CASH–End of period $769,079 $366,278 SENTINELONE, INC. CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (in thousands) (unaudited)

Q1 FY2023 LETTER TO SHAREHOLDERSSENTINELONE 21 Three Months Ended April 30, 2022 2021 Cost of revenue reconciliation: GAAP cost of revenue $27,139 $18,283 Stock-based compensation expense (1,848) (383) Employer payroll tax on employee stock transactions (1) — Amortization of acquired intangible assets (540) (491) Non-GAAP cost of revenue $24,750 $17,409 Gross profit reconciliation: GAAP gross profit $51,116 $19,112 Stock-based compensation expense 1,848 383 Employer payroll tax on employee stock transactions 1 — Amortization of acquired intangible assets 540 491 Non-GAAP gross profit $53,505 $19,986 Gross margin reconciliation: GAAP gross margin 65% 51% Stock-based compensation expense 2% 1% Employer payroll tax on employee stock transactions —% —% Amortization of acquired intangible assets 1% 1% Non-GAAP gross margin* 68% 53% Research and development expense reconciliation: GAAP research and development expense $45,881 $27,820 Stock-based compensation expense (10,463) (7,139) Employer payroll tax on employee stock transactions (38) — Non-GAAP research and development expense $35,380 $20,681 Sales and marketing expense reconciliation: GAAP sales and marketing expense $60,641 $36,180 Stock-based compensation expense (7,096) (2,047) Employer payroll tax on employee stock transactions (153) — Amortization of acquired intangible assets (183) (166) Non-GAAP sales and marketing expense $53,209 $33,967 General and administrative expense reconciliation: GAAP general and administrative expense $34,890 $16,724 Stock-based compensation expense (12,223) (3,868) Employer payroll tax on employee stock transactions (290) — Amortization of acquired intangible assets (18) (17) Non-GAAP general and administrative expense $22,359 $12,839 SENTINELONE, INC. Reconciliation of GAAP to Non-GAAP Financial Measures (in thousands, except percentages and per share data) (unaudited)