Form FWP Digital Brands Group, Filed by: Digital Brands Group, Inc.

Issuer Free Writing Prospectus Filed Pursuant to Rule 433 Registration Number: 333 - 264347 May 2022

Free Writing Prospectus Issuer Free Writing Prospectus Issued Pursuant to Rule 433 of the Securities Act of 1933 , as amended (the "Securities Act") : Digital Brands Group, Inc . (the "Company") has filed a registration statement on Form S - 1 (File No . 333 - 264347 ), including a prospectus, as amended and supplemented (the "Registration Statement"), with the U . S . Securities and Exchange Commission (the "SEC") for the Company's public offering of its shares of common stock, par value $ 0 . 0001 per share, to which this free writing prospectus relates . This free writing prospectus should be read together with the prospectus included in the Registration Statement, the filing which can be accessed at the following link : https : //sec . report/Document/ 0001104659 - 22 - 046664 Before you invest, you should read the prospectus in the Registration Statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering . You might get these documents for free by visiting EDGAR on the SEC website at www . sec . gov . Alternatively, the Company, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling 212 - 687 - 5650 or info@alexandercapitallp . com , or on the Company's website https : //ir . digitalbrandsgroup . co/sec - filings/all - sec - filings Forward - looking Statements Certain statements included in this free writing prospectus are "forward - looking statements" within the meaning of the federal securities laws . Forward - looking statements are made based on our expectations and beliefs concerning future events impacting DBG and therefore involve several risks and uncertainties . You can identify these statements by the fact that they use words such as "will," "anticipate," "estimate," "expect," "should," and "may" and other words and terms of similar meaning or use of future dates, however, the absence of these words or similar expressions does not mean that a statement is not forward - looking . All statements regarding DBG's plans, objectives, projections and expectations relating to DBG's operations or financial performance, and assumptions related thereto are forward - looking statements . We caution that forward - looking statements are not guarantees and that actual results could differ materially from those expressed or implied in the forward - looking statements . DBG undertakes no obligation to publicly update or revise any forward - looking statements, whether as a result of new information, future events or otherwise, except as required by law . Potential risks and uncertainties that could cause the actual results of operations or financial condition of DBG to differ materially from those expressed or implied by forward - looking statements include, but are not limited to : risks arising from the widespread outbreak of an illness or any other communicable disease, or any other public health crisis, including the coronavirus (COVID - 19 ) global pandemic ; the level of consumer demand for apparel and accessories ; disruption to DBGs distribution system ; the financial strength of DBG's customers ; fluctuations in the price, availability and quality of raw materials and contracted products ; disruption and volatility in the global capital and credit markets ; DBG's response to changing fashion trends, evolving consumer preferences and changing patterns of consumer behavior ; intense competition from online retailers ; manufacturing and product innovation ; increasing pressure on margins ; DBG's ability to implement its business strategy ; DBG's ability to grow its wholesale and direct - to - consumer businesses ; retail industry changes and challenges ; DBG's and its vendors' ability to maintain the strength and security of information technology systems ; the risk that DBG's facilities and systems and those of our third - party service providers may be vulnerable to and unable to anticipate or detect data security breaches and data or financial loss ; DBG's ability to properly collect, use, manage and secure consumer and employee data ; stability of DBG's manufacturing facilities and foreign suppliers ; continued use by DBG's suppliers of ethical business practices ; DBG's ability to accurately forecast demand for products ; continuity of members of DBG's management ; DBG's ability to protect trademarks and other intellectual property rights ; possible goodwill and other asset impairment ; DBG's ability to execute and integrate acquisitions ; changes in tax laws and liabilities ; legal, regulatory, political and economic risks ; adverse or unexpected weather conditions ; DBG's indebtedness and its ability to obtain financing on favorable terms, if needed, could prevent DBG from fulfilling its financial obligations ; and climate change and increased focus on sustainability issues . More information on potential factors that could affect DBG's financial results is included from time to time in DBG's public reports filed with the SEC, including DBG's Annual Report on Form 10 - K, and Quarterly Reports on Form 10 - Q, and Forms 8 - K filed or furnished with the SEC . 2 Safe Harbor / Forward - Looking

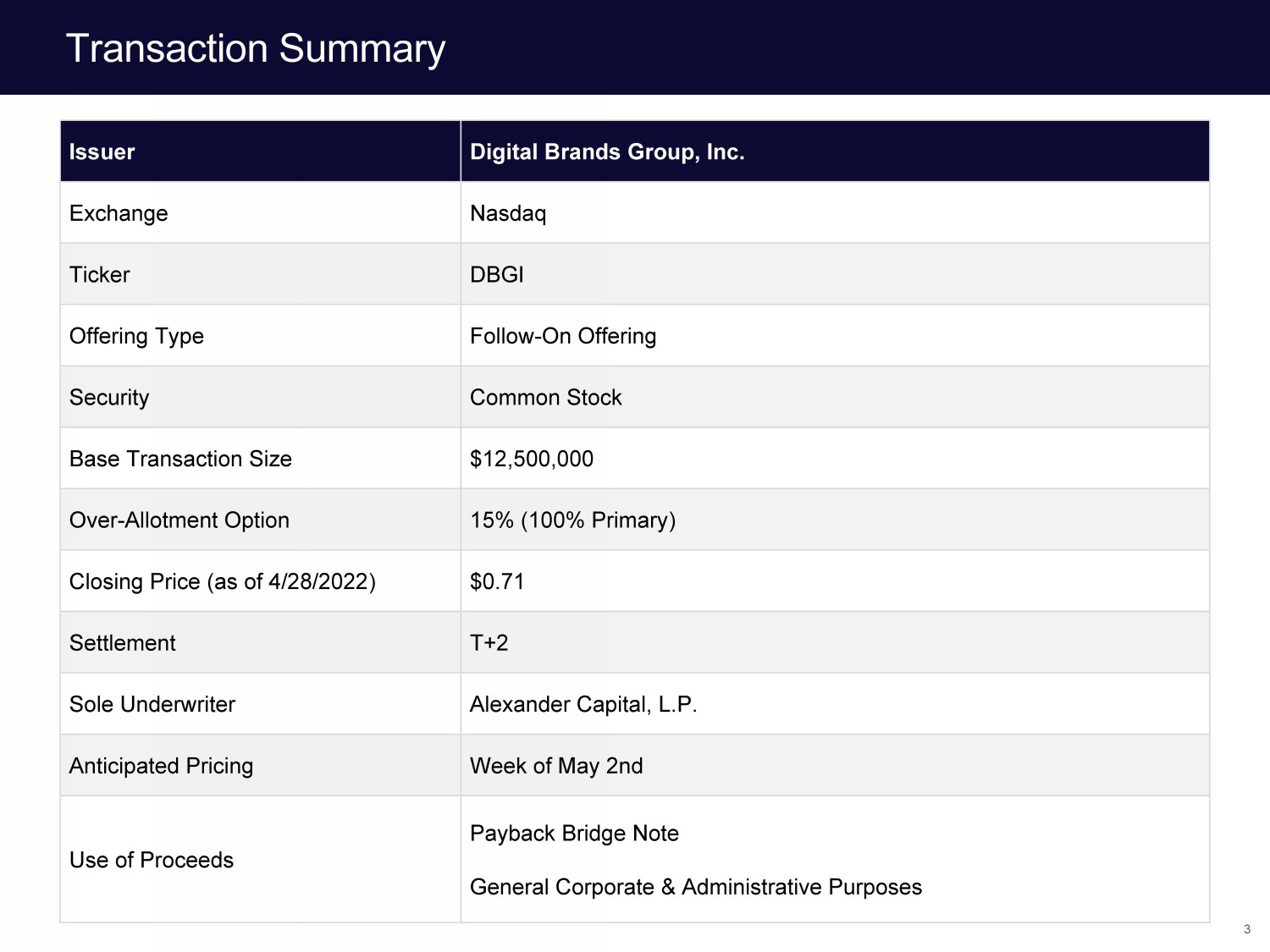

3 Transaction Summary Issuer Digital Brands Group, Inc . Exchange Nasdaq Ticker DBGI Offering Type Follow - On Offering Security Common Stock Base Transaction Size $ 12 , 500 , 000 Over - Allotment Option 15 % ( 100 % Primary) Closing Price (as of 4 / 28 / 2022 ) $ 0 . 71 Settlement T+ 2 Sole Underwriter Alexander Capital, L . P . Anticipated Pricing Week of May 2 nd Use of Proceeds Payback Bridge Note General Corporate & Administrative Purposes

Digital Brands Group has changed the traditional nature of the corporate holding company for direct to consumer and wholesale apparel brands by focusing on a customer’s "closet share" and leveraging their data and personalized customer cohorts to create targeted content. We believe this allows the company to successfully drive LTV while exponentially increasing new customer growth. Furthermore, Digital Brands Group strives to drive margin expansion through a shared services model and by owning the entire margin stack, which allows the company to control pricing, promotions and profitability. This creates a scalable flywheel driven by personalized and targeted customer experiences, which we believe fuels loyalty, LTV and virality that leverages operating costs with the goal of increasing cash flow. 4 x Reshaping Traditional Retail

5 We believe that traditional department and specialty stores are no longer able to leverage their dominate power to determine brand product assortments, price points and promotional activity as they no longer maintain exclusivity on the customer relationship. We believe that the customer transactions have transitioned to the internet as digital distribution continues to capture greater wallet - share, crushing traditional operating margins and forcing unprecedented store closures. However, we believe digitally native brands are not a stand - alone business because they are not scalable, profitable and therefore unsustainable. Digital is a channel not a business model. We believe the digital - only model fails because it struggles to acquire customers at a fair price and grow market share while achieving profitability as shopping, returns, marketing and hiring expenses outstrip repeat customer revenue. x CURRENT RETAIL ISSUES Our Belief is that Traditional Retail is Broken Read the article here. Read the article here. & Digital - Only Brands Can Not Scale to Sustainability

Moder nizing the Holding Company Model by Owning Multiple Brands Our growth model focuses on driving significant revenue growth over a lower shared cost base, creating margin expansion, resulting in exponential cash flow. 6 PORTFOLIO OF BRANDS CLOSET SHARE CUSTOMER DATA CUSTOMIZED CONTENT OWNING THE MARGIN STACK CASH FLOW CONTROL COST SYNERGIES MARGIN EXPANSION = = = = 1 2 3 4 HOW WE WIN

Very seldom does one wear the same brand from head to toe. By owning multiple brands across complementary categories, the customer is provided head to toe looks and personalized styles. This results in the customer buying and wearing multiple brands, across product categories instead of wearing a singular brand’s products in one category. Digital Brands Group refers to this as “Closet Share,” which results in best of class KPIs, margins and sustainable revenue growth. By owning the customer data, Digital Brands Group is able to capture an individual’s shopping behavior and style preferences. This results in the ability to cross merchandise styles for every customer using all the brands in the portfolio to create personalized looks for each customer. Digital Brands Group refers to this as "Customized Content" for each customer. This content is highly targeted, and as they aggregate more data, it exponentially increases the customers in their audience build, whereby customer cohorts become increasingly targeted and customized. 7 PORTFOLIO OF BRANDS CLOSET SHARE CUSTOMER DATA CUSTOMIZED CONTENT = = Moder nizing the Holding Company Model HOW WE WIN Driving Significant Revenue Growth

Capitalizing on the Changing Retail Landscape Our growth model focuses on our f ormula for Sustainable Success: Acquire in Physical, Retain in Digital Traditional B&M For single - brand physical stores, we believe this is not a scalable solution. Many of t hese stores are unprofitable and require balance sheet obligations. For single - brands that rely on department stores to generate their revenue, we believe the gross margins continuously diminishes due to significant mark - downs and returns demanded by the department stores. Traditional DTC We believe this is not a scalable solution since customers acquired online have a low loyalty rate, and also have very high return rates. We believe t his means the brands spend significant CAC dollars on a low retention customer with high returns. We believe t his results in low margins and significant cap ex. New Formula: Acquire Physical/Retain Digital It is not about being an omni channel brand, it is about where you acquire and retain the customer. By using wholesale channels for acquisition, our brands have low CAC, solid gross margins and significant distribution and reach since this is a limited revenue channel. The customer can see, feel and fit the product, which we believe lowers returns when they acquire online. By using digital channels for retention, our brands create personalized content using all our brands to show different looks that are created using their shopping data. Our brands have high gross margins, low CAC, high retention due to personalized communications, and control over the frequency and content of the customer communications. PURCHASE $$$ PRE - PURCHASE POST - PURCHASE BRICK & MORTAR PURCHASE PRE - PURCHASE $$$ POST - PURCHASE DTC OMNI - CHANNEL PURCHASE $ PRE - PURCHASE $ POST - PURCHASE $ POST - COVID We believe the wholesale and DTC strategies above force brands to heavy up all their marketing spend in one area of the custo mer 's path to purchase. Our formula is designed to allow you to spread those same dollars over each area, which we believe creates lower CAC and return rates and higher gross margins and retention rates. 8 HOW WE WIN PRE - COVID PRE - COVID

9 Moder nizing the Holding Company Model Jane Jacket 400% increase in units sold Merchandised with a DSTLD denim skirt Claudine Pant 71% increase in units sold Merchandised with DSTLD leather hoodie Case study: Cross - Merchandising Our Portfolio Brands Drives Results DSTLD separates merchandised with Bailey 44 product on bailey44.com increased sales of the Bailey’s collection 9 HOW WE WIN

10 Moder nizing the Holding Company Model DSTLD Denim Skirt 500% increase in units sold DSTLD Leather Hoodie 600% increase in units sold Case study: Cross Merchandising Increases Portfolio Results & Significantly Decreases CAC Costs DSTLD products featured for sale on bailey44.com increased DSTLD sales and there was no CAC to acquire the customer 10 HOW WE WIN

Moder nizing the Holding Company Model Our Marketing Team Applied Our Best Practices to Bailey's Acquisition New Photography, Styling and Customer Communications Created an Immediate Lift in Product Sales Addie Polka Dot Sweater 225% Increase in Units Sold Weldon Belted Jacket From 0 units to 22 units in 3 weeks Dishdasha Dress 176% Increase in Units Sold Lizzie Crop Pant 200% Increase in Units Sold Kendra Bodysuit 140% Increase in Units Sold Elize Cami 120% Increase in Units Sold Mini Marguerite Top 400% Increase in Units Sold 11 HOW WE WIN

By owning the supply chain and margin stack, the group controls the retail price points, the promotional activities, and the gross/operating margins. This results in (1) lower price points for the customer, which increases sell - through and revenues, and (2) higher gross/operating margins as they control the retail price points, promotions and margin structure, with the goal of increasing cash flow. Digital Brands Group refers to this as "Cash Flow Control," providing them the power to set their own retail price points, margin structure, and promotional activities resulting in higher margins, sustainable cash flow and operating leverage. By owning multiple brands, Digital Brands Group leverages fixed and variable costs across multiple revenue streams through shared services. This results in marketing, back office, and fulfillment efficiencies across multiple brands while allowing them to hire experienced leaders at the portfolio level, sharing their expertise across the entire company. Digital Brands Group refers to this as "Margin Expansion," providing each brand with lower operating expenses and the portfolio company with significantly higher operating margins and cash flow. Moreover, this allows for the creation of “Best in Class” management bench strength. 12 OWNING THE MARGIN STACK CASH FLOW CONTROL COST SYNERGIES MARGIN EXPANSION = = Moder nizing the Holding Company Model HOW WE WIN Lower cost base creates increased cash flow

Driven by Wall Street Ready Management Team Hil Davis CHIEF EXECUTIVE OFFICER Reid Yeoman CHIEF FINANCIAL OFFICER Hil came to Digital Brands Group in March 2018 with a substantial background in e - commerce and luxury apparel. In 2007, he founded J. Hilburn, a made - t - measure men’s apparel brand that he built from an idea into a $55 million company in just six years, funded by venture capital firms and TAL. Previously, he founded the e - commerce beauty and charitable venture, Beautykind , where he served as CEO, CFO, and Chairman. Prior to working in e - commerce, Hil was an equity research analyst covering consumer and luxury pubco .’s at Thomas Weisel Partners, SunTrust, and Citadel Investment Group. He was also Head of Investor Relations at Brinker International, a $2,9 billion market capitalization restaurant company that owns Chili’s. Reid is a finance professional with a core FP&A background at major multi - national Fortune 500 companies — including Nike & Qualcomm. He has a proven track record of driving growth and expanding profitability with retail. Most recently, Reid served as CFO/COO at Hurley — a standalone global brand within the Nike portfolio — where he managed the full P&L/Balance Sheet, reporting directly to Nike and oversaw the brand’s logistics and operations. Reid is a native Californian and holds an MBA from UCLA’s Anderson School of Management, and a BA from UC Santa Barbara. Laura Dowling CHIEF MARKETING OFFICER Laura is a change agent who pioneers cutting - edge strategies and challenges the status quo by shifting the paradigm in marketing plans and execution. Laura recently joined from Coach, a Tapestry brand, where her innovative audience - driven investments resulted in substantial incremental annual results within the digital, social, and CRM channels. Prior to Coach, Ms. Dowling held strategic positions at Harry Winston and Ralph Lauren, where she created and launched first - to - market campaigns that catalyzed revenue growth and recognition for those brands. Jon Patrick MENS DESIGN DIRECTOR JP joined in December 2019 with an extensive background In apparel design, merchandising, VM presentation, retail development, and commerce which began at Ralph Lauren where he was then recruited by Hart Schaffner Marx to lead design and merchandising to develop and grow a captured brand strategy — pairing licensed brands with exclusive retail partners. Then moved into Womenswear with Lilly Pulitzer, where he spearheaded store design, retail development, and established corporate standards for company stores and franchises to scale successfully. He most recently worked with the founders of UNTUCKit to transition the brand from an Ecommerce retailer to a click & mortar kingpin, operation over 70+ stores for them. 13 DBG VISION

EXECUTIVE BOARD MEMBER Jameeka Green Aaron is the Chief Information Security Officer at Auth0, she is responsible for the holistic security and compliance of Auth0’s platform, products, and corporate environment. Auth0 provides a platform to authenticate, authorize, and secure access for applications, devices, and users. Prior to her current role Jameeka was the Chief Information Officer Westcoast Operations at United Legwear and Apparel. Her 20+ years of experience include serving as the Director of North American Technology and Director of Secure Code and Identity and Access Management at Nike, and as Chief of Staff to the CIO of Lockheed Martin Space Systems Company. She is also a 9 - year veteran of the United States Navy. Jameeka’s dedication to service has extended beyond her military career; She is committed to advancing women and people of color in Science, Technology, Engineering, and Mathematics (STEM) fields she is an alumni of the U.S. State Department’s TechWomen program and the National Urban League of Young Professionals. She currently sits on the board of the California Women Veterans Leadership Council, is an advisor for U.C. Riverside Design Thinking Program, and is a member of Alpha Kappa Alpha Sorority, Inc. Born in Stockton, California, she holds a bachelor’s degree in Information Technology from the University of Massachusetts, Lowell. She is an ISC (2) Certified Information Systems Security Professional (CISSP Executive Management Team DBG VISION Jameeka Green Aaron EXECUTIVE BOARD MEMBER A seasoned finance and strategy executive, Lucy Doan brings expertise working with some of the world’s best - known brands. Since 2018, Lucy serves as advisor to CEOs and founders of high - growth DTC, ecommerce and retail brands, in apparel and consumer products. In this capacity, she provides strategic guidance to successfully scale businesses while driving profitability, with focus on operational excellence and capital resource planning. In 2019, she became a board member of Grunt Style, a patriotic apparel brand. Prior, Lucy spent 20 years in senior executive roles at Guitar Center, Herbalife International, Drapers & Damons , and Fox Television, where she built high performance teams to drive execution of business plans and growth strategies. Lucy Doan EXECUTIVE BOARD MEMBER Mark T. Lynn has been a director of our company since inception and served as our Co - Chief Executive Officer from September 2013 to the October 2018. Prior to joining us, until September 2011 he was Co - Founder of WINC, a direct - to - consumer e - commerce company which was then the fastest growing winery in the world, backed by Bessemer Venture Partners. Prior to Club W, Mr. Lynn co - founded a digital payments company that was sold in 2011. He holds a digital marketing certificate from Harvard Business School’s Executive Education Program. Mark T. Lynn EXECUTIVE BOARD MEMBER Trevor Pettennude is a seasoned financial services executive. In 2013, Mr. Pettennude became the CEO of 360 Mortgage Group, where he oversees a team of 70 people generating over $1 billion of annual loan volume. He is also the founder and principal of Banctek Solutions, a global merchant service company which was launched in 2009 and which processes over $300 million of volume annually. Trevor Pettennude 14

Current Portfolio of Brands 15

16 16 • Focused on classic design, superior quality, and essential product selection in order to deliver the perfect core wardrobe. • Inspired by a sophisticated, modern and sleek style utilizing an edited color palette. • Creative and urban, city dwellers within the coveted age demographic of 25 – 35. The Purpose

17 • Offers premium suiting and sportswear at an exceptional value. Constructed from luxury fabrics and designed in multiple fits, to create a more custom - tailored look as all men are built differently. • Partnering with the best mills and factories in Italy and Europe, the collection is driven by luxury, performance, fit and quality. • A dedicated customer target base of men ages 18 – 45 looking to invest in quality suiting and sportswear at more accessible prices. 17 The Purpose

18 18 • A contemporary womenswear brand that combines beautiful, luxe fabrics with on - trend designs specializing in the “date night” category. • Majority of distribution through specialty and select wholesale partners such as Nordstrom and Bloomingdales. • The most well - known brand and widest distribution that will be leveraged across other brands. The Purpose

19 19 • Tastemaker stylish “made - to - measure” suiting and sportswear that relays a one - of - a - kind confidence. • Ability to provide full - closet customization, including shirts, jackets, pants, shorts, polos, and more that are all made - to - measure. • Ready - to - wear is an expanding category for the brand and our goal is that it will increase the addressable market. The Purpose

20 20 • West Coast inspired style with an elevated basic assortment seamlessly blending both the luxe and casual aesthetic rooted in sustainability and quality. • Each of the Women’s separates emphasizes elegance and comfort which allows for sophisticated pairings that compliment any look versus being a singular focal point. • Easy product category to cross - promote across all the brands or produce co - branded capsule collections with the other portfolio brands. The Purpose

Summary Financial Results 21 $3,034,216 $5,239,437 $7,785,859 $1,407,711 $559,682 $2,895,659 $0 $2,000,000 $4,000,000 $6,000,000 $8,000,000 Net Revenue Gross Profit 2020 2021 2019

Key Investment Considerations 22 Complimentary Brand Portfolio Leverage E - Commerce Expertise as a a Digitally Native - First Retailer Extensive Industry Expertise and Relationships Focus on Organic Market Share Growth and Profit Margin Expansion

Christopher Carlin Alexander Capital, LP [email protected] 646.787.8890 May 2022

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Digital Brands Group Reports Fourth Quarter and Fiscal Year 2023 Financial Results

- Business Update from Lior Tal, CEO at Cyngn Inc.

- Patelco Credit Union selects the Empower LOS to streamline and bolster home loan and home-equity origination

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share