Form DEF 14A Poshmark, Inc. For: Jun 14

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

Poshmark, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Table of Contents

Table of Contents

POSHMARK, INC.

NOTICE OF 2022 ANNUAL MEETING OF STOCKHOLDERS & PROXY STATEMENT

Date: Tuesday, June 14, 2022

Time: 10:00 a.m. Pacific Time

Location: Live webcast via www.proxydocs.com/POSH

We are pleased to invite you to attend the 2022 Annual Meeting of Stockholders (the “Annual Meeting”) of Poshmark, Inc. (“Poshmark” or the “Company”). The meeting will be held for the following purposes:

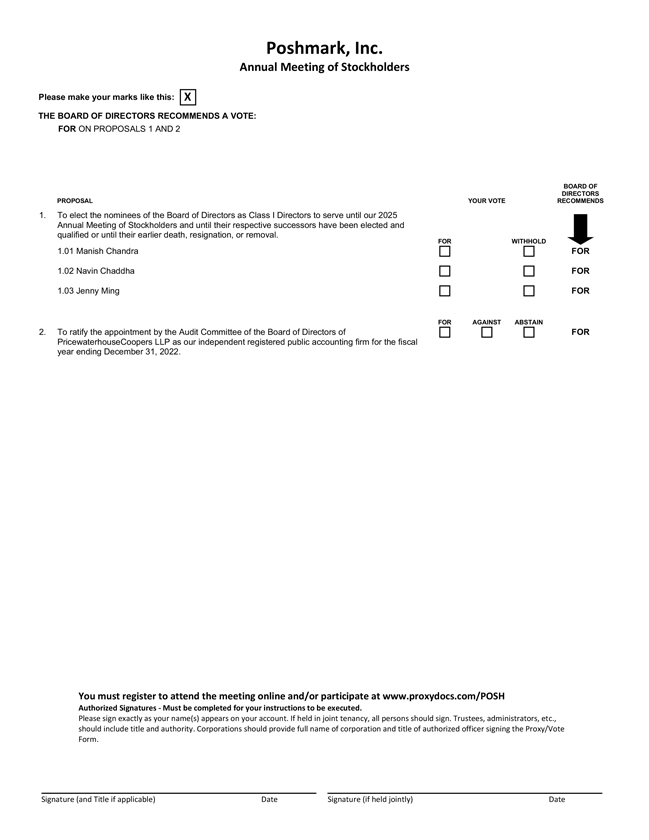

| 1. | To elect Manish Chandra, Navin Chaddha, and Jenny Ming as Class I Directors to serve until our 2025 Annual Meeting of Stockholders and until their respective successors have been elected and qualified or until their earlier death, resignation, or removal. |

| 2. | To ratify the appointment by the audit committee of the board of directors of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022. |

These items of business are more fully described in the Proxy Statement accompanying this Notice.

We will also transact such other business as may properly come before the Annual Meeting or any continuation, postponement, or adjournment of the Annual Meeting.

This year’s Annual Meeting will be held virtually through a live webcast. You will be able to attend the Annual Meeting, submit questions, and vote during the live webcast by visiting www.proxydocs.com/POSH and registering to attend the Annual Meeting by entering the Control Number included in your notice of internet availability of proxy materials, proxy card, or the voting instruction form that you received. Please refer to the additional logistical details and recommendations in the accompanying Proxy Statement. You may login beginning at 9:45 a.m. Pacific Time on June 14, 2022.

The record date for the Annual Meeting is April 18, 2022. Only stockholders of record at the close of business on that date are entitled to notice of, and to vote at, the Annual Meeting and any adjournment or postponement thereof.

Whether or not you plan to attend the Annual Meeting, we encourage you to vote and submit your proxy through the internet or by telephone or request and submit your proxy card as soon as possible, so that your shares may be represented at the Annual Meeting.

Thank you for your ongoing support of and continued interest in Poshmark.

/s/ Evan Ferl

Evan Ferl

General Counsel and Corporate Secretary

April 29, 2022

Important Notice Regarding the Availability of Proxy Materials for the 2022 Annual Meeting of Stockholders to be Held on June 14, 2022: The proxy statement and the annual report to stockholders will be available at www.proxydocs.com/POSH on or about April 29, 2022.

Table of Contents

Table of Contents

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND PROXY STATEMENT

Why did I receive a notice regarding the availability of proxy materials on the internet?

Pursuant to rules adopted by the SEC, we have elected to provide access to our proxy materials, including this Proxy Statement, over the internet. Accordingly, we have sent you a notice of internet availability of proxy materials (the “Notice”) because the Company’s board of directors is soliciting your proxy to vote at the Annual Meeting, including at any adjournments or postponements of the meeting.

This Proxy Statement contains information to be voted on at the Annual Meeting and certain other information required by the SEC. We intend to mail the Notice on or about April 29, 2022, to all stockholders of record entitled to vote at the Annual Meeting. On or about that date, all stockholders will be able to access our proxy materials at www.proxydocs.com/POSH or request printed copies by following the instructions found in the Notice.

How do I attend the Annual Meeting?

We will be hosting the Annual Meeting via live webcast only. Any stockholder of record can attend the meeting live by registering online at www.proxydocs.com/POSH. The webcast will start at 10:00 a.m. Pacific Time on June 14, 2022. Stockholders may vote and submit questions while attending the meeting online. The webcast login will open 15 minutes before the start of the meeting. In order to enter the meeting, you will need the control number, which is included in the Notice or on your proxy card if you are a stockholder of record, or included with your voting instruction card and voting instructions received from your broker, bank, or other agent if you hold your shares of common stock in a “street name.” A confirmation email with additional instructions on how to attend and participate online will be sent to you after you register at www.proxydocs.com/POSH. We encourage you to access the meeting prior to the start time. If you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please call the technical support number that will be posted in the confirmation email you received after registering for the virtual stockholder meeting.

Why is the Annual Meeting being held virtually?

Due to the ongoing COVID-19 pandemic, we believe that a virtual meeting is appropriate to support the health and well-being of our employees and stockholders, and enables us to comply with current federal, state, and local guidance and regulations. Conducting the annual meeting virtually also offers the opportunity for all stockholders to participate without the added cost, time, or planning involved in attending in-person stockholder meetings.

We will use software that verifies the identity of each participating stockholder and ensures during the question-and-answer portion of the meeting that they are granted the same rights they would have at an in-person meeting. In this way, stockholder rights are not negatively affected.

What will I be voting on?

There are two matters scheduled for a vote at the Annual Meeting:

| 1. | Elect Manish Chandra, Navin Chaddha, and Jenny Ming as Class I Directors to serve until our 2025 Annual Meeting of Stockholders and until their respective successors have been elected and qualified or until their earlier death, resignation, or removal; and |

| 2. | Ratify the appointment by the audit committee of the board of directors of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022. |

How does the Board of Directors recommend that I vote on these matters?

The Board recommends that you vote “FOR” the election of each director nominee and “FOR” the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm.

1

Table of Contents

Who can vote at the Annual Meeting?

Only stockholders of record at the close of business on April 18, 2022 will be entitled to vote at the Annual Meeting. On this record date, there were 53,536,700 shares of Class A common stock and 24,573,667 shares of Class B common stock outstanding and entitled to vote. Our Class A common stock has one vote per share and our Class B common stock has ten votes per share.

Stockholder of Record: Shares Registered in Your Name. If on April 18, 2022, your shares were registered directly in your name with Poshmark’s transfer agent, American Stock Transfer & Trust Company, LLC, then you are a stockholder of record. As a stockholder of record, you may vote online at the meeting or vote by proxy. Whether or not you plan to attend the meeting, we urge you to vote by proxy online as instructed on the Notice, vote by proxy over the telephone or vote by proxy using a proxy card that you may request or that we may elect to deliver at a later time.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank. If on April 18, 2022, your shares were held not in your name, but in an account at a brokerage firm, bank, or other similar organization, then you are the beneficial owner of shares held in “street name” and the Notice is being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker, bank, or other agent regarding how to vote the shares in your account. You are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote your shares online or submit questions at the meeting unless you request and obtain a valid proxy from your broker, bank, or other agent.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of Class A common stock and ten votes for each share of Class B common stock you owned as of April 18, 2022. The Class A common stock and Class B common stock will vote together as a single class on all proposals described in this Proxy Statement.

How do I cast my vote?

Stockholder of Record. If you are a stockholder of record, there are four ways to vote:

| 1. | by internet at www.proxypush.com/POSH by following the instructions provided the proxy card or the Notice. |

| 2. | by toll-free telephone at 855-635-6595; |

| 3. | by completing and mailing your proxy card (if you received printed proxy materials); or |

| 4. | by voting during the virtual Annual Meeting through www.proxydocs.com/POSH. To be admitted to the Annual Meeting and vote your shares, you must register by the meeting start time and provide the control number as described in the Notice or proxy card. After completion of your registration by the registration deadline, further instructions, including a unique link to access the Annual Meeting, will be emailed to you. |

Beneficial Owner. If you are a beneficial owner of shares registered in the name of your broker, bank, or other agent, you should have received voting instructions from that organization rather than from Poshmark. Simply follow the voting instructions from that organization to ensure that your vote is counted. To vote in person at the Annual Meeting, you must obtain a valid proxy from your broker, bank, or other agent.

If I am a stockholder of record and I do not vote, or if I return a proxy card or otherwise vote without giving specific voting instructions, what happens?

Stockholder of Record. If you are a stockholder of record and do not vote online, by telephone, or by completing a proxy card in advance of the Annual Meeting, or online at the Annual Meeting, your shares will not be voted. If

2

Table of Contents

you return a signed and dated proxy card or otherwise vote without marking voting selections, your shares will be voted, as applicable, “FOR” the election of each director nominee and “FOR” the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm. If any other matter is properly presented at the meeting, your proxyholder (one of the individuals named on your proxy card) will vote your shares using his or her best judgment.

Beneficial Owner. If you are a beneficial owner of shares held in street name and you do not instruct your broker, bank, or other agent how to vote your shares, that agent may still be able to vote your shares in its discretion. Brokers, banks, and other securities intermediaries may use their discretion to vote your “uninstructed” shares with respect to matters considered to be “routine,” but not with respect to “non-routine” matters. In this regard, Proposal 1 is considered to be “non-routine,” meaning that your broker may not vote your shares on those proposals in the absence of your voting instructions. However, Proposal 2 is considered to be “routine,” meaning that if you do not return voting instructions to your broker by its deadline, your broker may vote your shares in its discretion on Proposal 2.

How do I change or revoke my proxy?

Stockholder of Record. If you are a stockholder of record, you can change your vote or revoke your proxy any time before or at the Annual Meeting by:

| 1. | entering a new vote by internet or by telephone; |

| 2. | returning a later-dated proxy card (which automatically revokes the earlier proxy card); |

| 3. | notifying our Corporate Secretary in writing at 203 Redwood Shores Parkway, 8th Floor, Redwood City, CA 94065; or |

| 4. | attending and voting at the Annual Meeting (although attendance at the Annual Meeting will not, by itself, revoke a proxy) at www.proxydocs.com/POSH. |

Beneficial Owner. If you are a beneficial owner, please contact your broker, bank, or other agent for instructions on how to revoke your proxy.

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting under our amended and restated bylaws and Delaware law. A quorum will be present if stockholders holding at least a majority of the voting power of the outstanding shares entitled to vote are present at the meeting online or represented by proxy. Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank, or other nominee) or if you vote online at the meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, either the chairperson of the meeting or the holders of a majority of the voting power of the shares present at the meeting online or represented by proxy may adjourn the meeting to another date.

Who is paying for the proxy solicitation?

We will bear the cost of soliciting proxies. In addition to these proxy materials, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies.

When will the results of the vote be announced?

The preliminary voting results will be announced at the Annual Meeting. The final voting results will be published in a current report on Form 8-K filed with the SEC within four business days of the Annual Meeting.

3

Table of Contents

How do I submit a stockholder proposal or director nomination for next year’s annual meeting?

To be considered for inclusion in the proxy materials for next year’s annual meeting of stockholders (the “2023 Annual Meeting”), your proposal must be submitted in writing by December 30, 2022, to our Corporate Secretary at 203 Redwood Shores Parkway, 8th Floor, Redwood City, CA 94065, and must comply with all applicable requirements of Rule 14a-8 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Pursuant to our amended and restated bylaws, if you wish to submit a proposal (including a director nomination) at the 2023 Annual Meeting that is not to be included in next year’s proxy materials, you must do so no later than January 29, 2023, nor earlier than December 30, 2022, to our Corporate Secretary at 203 Redwood Shores Parkway, 8th Floor, Redwood City, CA 94065; provided, however, that if our 2023 Annual Meeting is held before May 15, 2023 or after August 13, 2023, then the deadline is (a) no earlier than the close of business on the 120th day prior to the date of the 2023 Annual Meeting and (b) not later than the close of business on the later of (i) the 90th day prior to the 2023 Annual Meeting or (ii) the tenth day following the day on which public announcement of the date of such meeting is first made. You are also advised to review our amended and restated bylaws, which contain additional requirements about advance notice of stockholder proposals and director nominations.

I share an address with another stockholder, and we received only one paper copy of the proxy materials. How may I obtain an additional copy of the proxy materials?

We have adopted a procedure called “householding,” which the SEC has approved. Under this procedure, we deliver a single copy of the Notice and, if applicable, our proxy materials to multiple stockholders who share the same address, unless we have received contrary instructions from one or more of such stockholders. This procedure reduces our printing costs, mailing costs and fees. Stockholders who participate in householding will continue to be able to access and receive separate proxy cards. Upon written request, we will deliver promptly a separate copy of the Notice and, if applicable, our proxy materials to any stockholder at a shared address to which we delivered a single copy of any of these materials. To receive a separate copy, or, if a stockholder is receiving multiple copies, to request that we only send a single copy of the Notice and, if applicable, our proxy materials, such stockholder may contact us at [email protected] or by mail at:

Poshmark, Inc.

203 Redwood Shores Parkway, 8th Floor

Redwood City, California 94065

Attention: Corporate Secretary

Street name stockholders may contact their broker, bank, or other nominee to request information about householding.

4

Table of Contents

PROPOSAL NO. 1: ELECTION OF DIRECTORS

The Company’s board of directors currently has seven members. In accordance with our amended and restated certificate of incorporation, our board of directors is divided into three staggered classes of directors. At the Annual Meeting, three Class I directors are standing for election, each for a three-year term.

The board of directors has nominated Manish Chandra, Navin Chaddha, and Jenny Ming for election as Class I directors at the Annual Meeting.

Each director is elected by a plurality of the votes of the holders of shares present virtually or represented by proxy and entitled to vote on the election of directors. The three director nominees receiving the highest number of “FOR” votes will be elected. If elected at the Annual Meeting, the nominees will serve until our 2025 Annual Meeting of Stockholders and until each such director’s respective successor is duly elected and qualified or until each such director’s earlier death, resignation, or removal.

For information about the nominees and each director whose term is continuing after the Annual Meeting, please see “Information Regarding Director Nominees and Current Directors.”

The nominees have agreed to serve as director, if elected. The Company has no reason to believe that any of the nominees will be unable or unwilling to serve as director. If, however, a nominee is unavailable for election, your proxy authorizes us to vote for a replacement nominee if the board of directors names one.

5

Table of Contents

Information Regarding Director Nominees and Current Directors

| Name |

Age | Director Since | Independent | Committee Membership | ||||||||||

| Class I Directors – Nominees for Election at the 2022 Annual Meeting | ||||||||||||||

| Manish Chandra* |

54 | 2011 | No | – | ||||||||||

| Navin Chaddha** |

51 | 2011 | Yes | Compensation Committee Nominating and Corporate Governance Committee*** Mergers and Acquisitions Committee | ||||||||||

| Jenny Ming |

66 | 2019 | Yes | Audit Committee | ||||||||||

| Class II Directors – Terms to Expire at the 2023 Annual Meeting | ||||||||||||||

| Ebony Beckwith(1) |

45 | 2021 | Yes | Audit Committee Nominating and Corporate Governance Committee | ||||||||||

| Jeff Epstein |

65 | 2018 | Yes | Audit Committee*** Mergers and Acquisitions Committee*** | ||||||||||

| Hans Tung |

51 | 2016 | Yes | Compensation Committee*** Nominating and Corporate Governance Committee Mergers and Acquisitions Committee | ||||||||||

| Class III Directors – Terms to Expire at the 2024 Annual Meeting | ||||||||||||||

| Serena J. Williams(2) |

40 | 2019 | Yes | Compensation Committee | ||||||||||

| * | Chairman of the board of directors |

| ** | Lead independent director |

| *** | Committee chair |

| (1) | Ebony Beckwith was appointed to our board of directors on August 6, 2021 and was appointed to the audit committee and nominating and corporate governance committee on March 28, 2022. |

| (2) | On April 21, 2022, Serena J. Williams provided notice of her decision to resign from the board of directors effective as of such date, but will remain on the board of directors until a replacement has been appointed. |

Class I Director Nominees

Manish Chandra. Mr. Chandra co-founded our Company and has served as our President, Chief Executive Officer and member of our board of directors since February 2011. Prior to co-founding Poshmark, Mr. Chandra co-founded Kaboodle, an online shopping website where he served as the Chief Executive Officer from February 2005 to August 2010, and which was acquired by Hearst Communications in August 2007. From August 2010 to February 2011, Mr. Chandra developed the foundation of what ultimately became Poshmark. Mr. Chandra holds an M.B.A. in Marketing and Finance from Haas Business School at the University of California, Berkeley, an M.S. in Computer Science from the University of Texas at Austin, and a B.Tech from the Indian Institute of Technology, Kanpur.

We believe that Mr. Chandra is qualified to serve as a member of our board of directors based on the perspective and experience he brings as our President, Chief Executive Officer, and co-founder.

Navin Chaddha. Mr. Chaddha has served on our board of directors since February 2011. Mr. Chaddha is a Managing Director and leads Mayfield, a venture capital firm, where he has worked since 2006. Over his venture

6

Table of Contents

capital career, Mr. Chaddha has invested in over 50 companies, of which over 30 have been acquired or had IPOs, resulting in his being named as a Top Five investor on the 2020 Forbes Midas list of Top Tech investors. Early in his career, Mr. Chaddha co-founded three companies, including VXtreme, which was acquired by Microsoft to become Windows Media. Mr. Chaddha holds an M.S. in Electrical Engineering from Stanford University and a B.Tech in Electrical Engineering from the Indian Institute of Technology, Delhi, from which he received the distinguished alumni award.

We believe that Mr. Chaddha is qualified to serve as a member of our board of directors due to his broad investment experience in the technology industry, his executive and board experience at various technology companies, as well as his extensive experience as an entrepreneur and venture capital investor.

Jenny Ming. Ms. Ming has served as a member of our board of directors since June 2019. From October 2009 to February 2019, Ms. Ming served as President and Chief Executive Officer of Charlotte Russe, a fast-fashion specialty retailer of apparel and accessories catering to young women. In February 2019, Charlotte Russe filed a voluntary petition under Chapter 11 of the U.S. Bankruptcy Code. From March 1999 to October 2006, Ms. Ming served as President of Old Navy, a $7 billion brand in The Gap, Inc.’s portfolio, where she oversaw all aspects of Old Navy and its 900 retail clothing stores in the United States and Canada. Ms. Ming joined The Gap, Inc. in 1986, serving in various executive capacities at its San Francisco headquarters, and in 1994, she was a member of the executive team that launched Old Navy. Ms. Ming has served on the board of directors of Affirm since February 2021 and Levi Strauss & Co. since 2014. Ms. Ming holds a B.A. in Fashion Merchandising/Marketing from San Jose State University.

We believe that Ms. Ming is qualified to serve as a member of the board of directors due to her extensive operational and retail leadership experience in the apparel industry.

Recommendation of Our Board of Directors

The board of directors unanimously recommends a vote “FOR” the election of the Class I Director nominees.

7

Table of Contents

Continuing Members of the Board of Directors

Class II Directors (Terms to expire at the 2023 Annual Meeting)

Ebony Beckwith. Ms. Beckwith has served as a member of our board of directors since August 2021. Since November 2021, Ms. Beckwith has served as Chief Business Officer of Salesforce and Chief of Staff to Marc Benioff, Chair and Co-CEO of Salesforce. In this role, Ms. Beckwith is responsible for aligning the company, operationalizing Salesforce’s core values, and leading all strategic projects, relationships, and initiatives of the Office of the Co-CEO. Additionally, Ms. Beckwith has served as CEO of the Salesforce Foundation and Chief Philanthropy Officer of Salesforce since 2016, overseeing Salesforce’s global philanthropic strategy. Ms. Beckwith extends her leadership through her service on non-profit organizations, including as a board member of the Warriors Community Foundation and as an advisory board member for PagerDuty.org. Ms. Beckwith holds a bachelor’s degree in Computer Information Systems and an honorary doctorate of Humane Letters from Golden Gate University.

We believe that Ms. Beckwith is qualified to serve as a member of our board of directors due to her broad experience in technology, operations, and philanthropy.

Jeff Epstein. Mr. Epstein has served as a member of our board of directors since April 2018. Since November 2011, Mr. Epstein has served as an Executive in Resident and then as Operating Partner of Bessemer Ventures Partners, a venture capital firm. From June 2019 to June 2021, Mr. Epstein served as Co-Chief Executive Officer and Chief Financial Officer of Apex Technology Holdings. Since September 2014, Mr. Epstein has also been a Lecturer in the Department of Management Science and Engineering at Stanford University. Mr. Epstein has served as a member of the board of directors of Couchbase since June 2015, Twilio since July 2017, Okta since May 2021, and AvePoint since July 2021. Mr. Epstein has also served as a member of the board of directors of Booking Holdings from April 2003 to June 2019, Global Eagle Entertainment from January 2013 to June 2018, and Shutterstock from April 2012 to June 2021. From September 2008 to April 2011, Mr. Epstein served as Executive Vice President and Chief Financial Officer of Oracle. Mr. Epstein holds an M.B.A. from Stanford University Graduate School of Business and a B.A. in Economics and Political Science from Yale University.

We believe that Mr. Epstein is qualified to serve as a member of our board of directors due to his executive and board experience and broad investment experience in the technology industry.

Hans Tung. Mr. Tung has served on our board of directors since March 2016. Mr. Tung is a Managing Partner at GGV Capital, a venture capital firm, where he has worked since October 2013. Prior to joining GGV, Mr. Tung was a Managing Partner at Qiming Venture Partners, a venture capital firm. Mr. Tung began his venture capital career with Bessemer Venture Partners, a venture capital firm, and was a former entrepreneur himself and a former technology banker at Merrill Lynch in New York and Hong Kong. Mr. Tung currently serves as an independent director of ContextLogic Inc. Mr. Tung has served on the board of directors of private companies including Shelfbot, Bowery Farming, StockX, Rupeek, musical.ly (which is now TikTok), and Xiaomi. Mr. Tung holds a B.S. in Industrial Engineering from Stanford University.

We believe that Mr. Tung is qualified to serve as a member of our board of directors due to his broad investment experience in the technology industry and his background advising companies in the technology industry.

Class III Directors (Terms to expire at the 2024 Annual Meeting)

Serena J. Williams. Ms. Williams has served as a member of our board of directors since January 2019. Ms. Williams began her career as a professional tennis player in 1995 and has won 23 career Grand Slam singles titles. Ms. Williams is also an activist, marketer, brand builder, and a dedicated philanthropist. In 2008, Ms. Williams established the Serena Williams Fund, where she focused on creating equity in education. To that

8

Table of Contents

end, Ms. Williams partnered with other corporations and organizations to build schools in Kenya and Jamaica as well as donate classroom resources and provide college scholarships. In 2016, Ms. Williams joined forces with her sister Venus to establish The Williams Sisters Fund to support joint philanthropic projects, beginning with the Yetunde Price Resource Center in Compton, California, which ensures individuals affected by violence and trauma have access to the resources they need to help them heal physically, emotionally, and spiritually. In 2017, Ms. Williams launched her own venture capital firm, Serena Ventures, which focuses on investing in companies that embrace diverse leadership, individual empowerment, creativity, and opportunity, and launched her own brand, SERENA, which celebrates body positivity and female empowerment. Additionally, Ms. Williams has served as a Goodwill Ambassador with UNICEF since 2011. Ms. Williams has served as a member of the board of directors of Momentive Global Inc. (formerly SVMK Inc.) since May 2017 and Velo3D, Inc. (formerly Jaws Spitfire Acquisition Corporation) since December 2020.

We believe that Ms. Williams is qualified to serve as a member of the board of directors due to her experience and perspective as an entrepreneur and developer of her global personal brand.

9

Table of Contents

Information Regarding the Board of Directors and Corporate Governance

Board of Directors

Our business and affairs are managed under the direction of our board of directors. Our board of directors consists of seven directors, six of whom qualify as “independent” under the listing standards of Nasdaq. The number of directors will be fixed by our board of directors, subject to the terms of our amended and restated certificate of incorporation and amended and restated bylaws.

Classified Board

Our amended and restated certificate of incorporation provides that our board of directors will be divided into three classes with staggered three-year terms. Only one class of directors will be elected at each annual meeting of stockholders. Our current directors are divided among the three classes as follows:

| • | the Class I directors will be Messrs. Chandra and Chaddha and Ms. Ming, and their terms will expire at the annual meeting of stockholders to be held in 2022; |

| • | the Class II directors will be Messrs. Epstein and Tung and Ms. Beckwith, and their terms will expire at the annual meeting of stockholders to be held in 2023; and |

| • | the Class III directors will be Ms. Williams, and their term will expire at the annual meeting of stockholders to be held in 2024. On April 21, 2022, Ms. Williams provided notice of her decision to resign from the board of directors effective as of such date, but will remain on the board of directors until a replacement has been appointed. |

Upon expiration of the term of a class of directors, directors for that class will be elected for three-year terms at the annual meeting of stockholders in the year in which that term expires. As a result, only one class of directors will be elected at each annual meeting of our stockholders, with the other classes continuing for the remainder of their respective three-year terms. Each director’s term continues until the election and qualification of his or her successor, or his or her earlier death, resignation, or removal.

So long as our board of directors is classified, only our board of directors may fill vacancies on our board. Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the total number of directors. The classification of our board of directors may have the effect of delaying or preventing changes in our control or management.

Director Independence

Our board of directors has undertaken a review of the independence of each director. Based on information provided by each director concerning his or her background, employment, and affiliations, including family relationships, our board of directors has determined that Messrs. Chaddha, Epstein, and Tung and Mss. Beckwith, Ming, and Williams do not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of these directors is “independent” as that term is defined under the applicable rules and regulations of the SEC and the listing standards of Nasdaq. In making these determinations, our board of directors considered the current and prior relationships that each non-employee director has with our company and all other facts and circumstances our board of directors deemed relevant in determining their independence, including the beneficial ownership of our capital stock by each non-employee director, and the transactions involving them described in “Certain Relationships and Related Transactions.”

10

Table of Contents

Director Diversity

We place great emphasis on board of directors’ diversity and actively consider diversity in the recruitment and nomination of directors. We believe that the current composition of our board of directors reflects the success of those efforts. A summary of our board of directors composition is below.

| Board Diversity Matrix (As of April 29, 2022) | ||||||||

| Total Number of Directors |

7 | |||||||

| Female | Male | Non-Binary | Did Not Disclose Gender |

|||||||||

| Part I: Gender Identity |

||||||||||||

| Directors |

3 | 4 | — | — | ||||||||

| Part II: Demographic Background |

| |||||||||||

| African American or Black |

2 | — | — | — | ||||||||

| Alaskan Native or Native American |

— | — | — | — | ||||||||

| Asian |

1 | 3 | — | — | ||||||||

| Hispanic or Latinx |

— | — | — | — | ||||||||

| Native Hawaiian or Pacific Islander |

— | — | — | — | ||||||||

| White |

— | 1 | — | — | ||||||||

| Two or More Races or Ethnicities |

— | — | — | — | ||||||||

| LGBTQ+ |

— | |||||||||||

| Did Not Disclose Demographic Background |

— | |||||||||||

Board Meetings

Our board of directors held nine meetings in 2021. Each director attended greater than 75% of all board of directors and applicable committee meetings that were held during his or her period of service as a director, with the exception of Ms. Williams. Under our corporate governance guidelines, directors are expected to spend the time needed and meet as frequently as our board deems necessary or appropriate to discharge their responsibilities. Directors are also expected to make efforts to attend our annual meeting of stockholders, all meetings of our board and all meetings of the committees on which they serve.

Committees of the Board of Directors

Our Board has established an audit committee, a compensation committee, a nominating and corporate governance committee, and a mergers and acquisitions committee. The composition and responsibilities of each of the committees of our board of directors is described below. The charter of each committee is available on our investor relations website at https://investors.poshmark.com/governance/governance-documents. Members will serve on these committees until their resignation or until as otherwise determined by our board of directors.

Audit Committee

Our audit committee consists of Mr. Epstein and Mses. Beckwith and Ming, with Mr. Epstein serving as Chairman. Ms. Beckwith was appointed to our audit committee on March 28, 2022 to fill the vacancy created by the resignation of John Marren, who served as a member of our audit committee until March 25, 2022. Each member of our audit committee meets the requirements for independence under the listing standards of Nasdaq and SEC rules and regulations. Each member of our audit committee also meets the financial literacy and sophistication requirements of the listing standards of Nasdaq. In addition, our board of directors has determined that Mr. Epstein is an audit committee financial expert within the meaning of Item 407(d) of Regulation S-K under the Securities Act. Our audit committee’s responsibilities include, among other things:

| • | selecting a qualified firm to serve as the independent registered public accounting firm to audit our financial statements; |

11

Table of Contents

| • | helping to ensure the independence and performance of the independent registered public accounting firm; |

| • | discussing the scope and results of the audit with the independent registered public accounting firm, and review, with management and the independent registered public accounting firm, our interim and year-end results of operations; |

| • | developing procedures for employees to submit concerns anonymously about questionable accounting or audit matters; |

| • | reviewing our policies on risk assessment and risk management; |

| • | reviewing related party transactions; and |

| • | approving or, as required, pre-approving, all audit and all permissible non-audit services, other than de minimis non-audit services, to be performed by the independent registered public accounting firm. |

Our audit committee operates under a written charter that satisfies the applicable rules of the SEC and the listing standards of Nasdaq. In fiscal 2021, our audit committee held eight meetings.

Compensation Committee

Our compensation committee consists of Messrs. Chaddha and Tung and Ms. Williams, with Mr. Tung serving as Chairman. Each member of our compensation committee meets the requirements for independence under the listing standards of Nasdaq and SEC rules and regulations. Each member of our compensation committee is also a non-employee director, as defined pursuant to Rule 16b-3 promulgated under the Exchange Act, or Rule 16b-3. Our compensation committee’s responsibilities include, among other things:

| • | reviewing, approving, and determining, or making recommendations to our board of directors regarding, the compensation of our executive officers; |

| • | administering our equity compensation plans; |

| • | reviewing and approving, or making recommendations to our board of directors, regarding incentive compensation and equity compensation plans; and |

| • | establishing and reviewing general policies relating to compensation and benefits of our employees. |

Pursuant to its written charter, the compensation committee has the authority to engage the services of outside advisors to assist it in the performance of its responsibilities. In 2021, the compensation committee engaged Compensia, Inc. (“Compensia”), a national compensation consulting firm, to provide information, analysis, and advice relating to our executive compensation program, including compensation market data. Compensia reports to the compensation committee and does not provide any additional services to management. From time to time, the compensation committee may direct its advisors to work with our human resources department to support it in matters relating to the fulfillment of its responsibilities. Our compensation committee has assessed the independence of Compensia pursuant to the applicable Nasdaq listing standards and SEC rules and concluded that Compensia is independent and that Compensia’s work for the compensation committee does not raise any conflict of interest.

Our compensation committee operates under a written charter that satisfies the applicable rules of the SEC and the listing standards of Nasdaq. In fiscal 2021, our compensation committee held four meetings.

Nominating and Corporate Governance Committee

Our nominating and corporate governance committee consists of Messrs. Chaddha and Tung and Ms. Beckwith, with Mr. Chaddha serving as Chairman. Ms. Beckwith was appointed to our nominating and

12

Table of Contents

corporate governance committee on March 28, 2022 to fill the vacancy created by the resignation of John Marren, who served as a member of our nominating and corporate governance committee until March 25, 2022. Each member of our nominating and corporate governance committee meets the requirements for independence under the listing standards of Nasdaq and SEC rules and regulations. Our nominating and corporate governance committee’s responsibilities include, among other things:

| • | identifying, evaluating and selecting, or making recommendations to our board of directors regarding nominees for election to our board of directors and its committees; |

| • | evaluating the performance of our board of directors and of individual directors; |

| • | considering and making recommendations to our board of directors regarding the composition of our board of directors and its committees; |

| • | reviewing developments in corporate governance practices; |

| • | evaluating the adequacy of our corporate governance practices and reporting; and |

| • | developing and making recommendations to our board of directors regarding corporate governance guidelines and matters. |

The nominating and corporate governance committee operates under a written charter that satisfies the applicable listing requirements and rules of Nasdaq. In fiscal 2021, our nominating and corporate governance committee held three meetings.

Mergers and Acquisitions Committee

Our mergers and acquisitions committee consists of Messrs. Chaddha, Tung, and Epstein, with Mr. Epstein serving as Chairman. Our mergers and acquisitions committee’s responsibilities include, among other things:

| • | reviewing, assessing, and approving certain acquisitions, investments, mergers, divestitures, and similar strategic transactions; |

| • | retaining outside legal, financial, and other advisors as it deems necessary in the performance of its duties; and |

| • | appointing and overseeing any outside advisors, including approval of fees and other terms and conditions of adviser’s retention. |

In fiscal 2021, our mergers and acquisitions committee held one meeting.

Identifying and Evaluating Director Nominees

Our board has delegated to our nominating and corporate governance committee the responsibility of identifying suitable candidates for nomination to our board (including candidates to fill any vacancies that may occur) and assessing their qualifications in light of the policies and principles in our corporate governance guidelines and the committee’s charter. Our nominating and corporate governance committee may gather information about the candidates through interviews, detailed questionnaires, comprehensive background checks, or any other means that the committee deems to be appropriate in the evaluation process. Our nominating and corporate governance committee then meets as a group to discuss and evaluate the qualities and skills of each candidate, both on an individual basis and taking into account the overall composition and needs of our board. Based on the results of the evaluation process, our nominating and corporate governance committee recommends candidates for our board’s approval as director nominees for election to our board.

Minimum Qualifications

Our nominating and corporate governance committee uses a variety of methods for identifying and evaluating director nominees and will consider all facts and circumstances that it deems appropriate or advisable.

13

Table of Contents

In its identification and evaluation of director candidates, our nominating and corporate governance committee will consider the current size and composition of our board, as well as the needs of our board and the respective committees of our board. Some of the qualifications that our nominating and corporate governance committee consider include, without limitation, issues of character, ethics, integrity, judgment, independence, diversity, skills, education, expertise, business acumen, length of service, understanding of our business and industry, and other commitments. Although our board does not maintain a specific policy with respect to board diversity, our board believes that our board should be a diverse body, and our nominating and corporate governance committee considers a broad range of backgrounds and experiences.

Nominees must also have proven achievement and competence in their field, the ability to exercise sound business judgment, an objective perspective, the ability to offer advice and support to our management team, and the ability to make significant contributions to our success. Nominees must also have skills that are complementary to those of our existing board, the highest ethics, a commitment to the long-term interests of our stockholders, and an understanding of the fiduciary responsibilities that are required of a director. Nominees must have sufficient time available in the judgment of our nominating and corporate governance committee to effectively perform all board and committee responsibilities. Members of our board are expected to prepare for, attend and participate in all meetings of our board and applicable committee meetings. Other than the foregoing, there are no stated minimum criteria for director nominees, although our nominating and corporate governance committee may also consider such other factors as it may deem, from time to time, are in our and our stockholders’ best interests. After completing its review and evaluation of director candidates, our nominating and corporate governance committee recommends to our full board the director nominees for selection.

Stockholder Recommendations

Eligible stockholders may submit recommendations for director candidates to our nominating and corporate governance committee by sending the individual’s name and qualifications to our Corporate Secretary at Poshmark, Inc., 203 Redwood Shores Parkway, 8th Floor, Redwood City, CA 94065, who will forward all recommendations to our nominating and corporate governance committee. Any such recommendations should include the information required by our bylaws. Our nominating and corporate governance committee will evaluate any candidates properly recommended by stockholders against the same criteria and pursuant to the same policies and procedures applicable to the evaluation of candidates proposed by directors or members of our management team.

Compensation Committee Interlocks and Insider Participation

Our compensation committee consists of Messrs. Chaddha and Tung and Ms. Williams, with Mr. Tung serving as Chairman. None of the members of our compensation committee is or has been an officer or employee of our company. None of our executive officers currently serves, or in the past year has served, as a member of the board of directors or compensation committee (or other board committee performing equivalent functions) of any entity that has one or more of its executive officers serving on our board of directors or compensation committee. See “Certain Relationships and Related Transactions” for information about related party transactions involving members of our compensation committee or their affiliates.

Code of Business Conduct and Ethics

Our board of directors has adopted a code of business conduct and ethics that applies to all of our employees, officers, and directors. Our code of business conduct and ethics is available on our investor relations website at https://investors.poshmark.com/governance/governance-documents. We intend to disclose any amendments to our code of business conduct and ethics, or waivers of its requirements, on our website or in filings under the Exchange Act.

14

Table of Contents

Anti-Hedging and Pledging Policy

Our insider trading policy prohibits all of our directors, officers, and employees from (i) trading derivative securities of the Company or any derivative securities that provide the economic equivalent of ownership of any of the Company’s securities or an opportunity, direct or indirect, to profit from any change in the value of the Company’s securities or engage in any other hedging transaction with respect to the Company’s securities, at any time, (ii) using the Company’s securities as collateral in a margin account and (iii) pledging the Company’s securities as collateral for a loan (or modifying an existing pledge).

Stockholder and Interested Party Communications

Stockholders or interested parties who wish to communicate with our board of directors or one or more individual members of our board of directors may do so by sending written communications to our Corporate Secretary at Poshmark, Inc., 203 Redwood Shores Parkway, 8th Floor, Redwood City, CA 94065.

Our Corporate Secretary, in consultation with appropriate members of our board, as necessary, will review all incoming communications and, if appropriate, will forward such communications to the appropriate member or members of our board, or if none is specified, to the Chairman of our board of directors. The Corporate Secretary will generally not forward communications if they are deemed inappropriate, consist of individual grievances or other interests that are personal to the party submitting the communication and could not reasonably be construed to be of concern to securityholders or other constituencies of the Company, solicitations, advertisements, surveys, “junk” mail, or mass mailings.

15

Table of Contents

2021 Director Compensation Table

The following table discloses compensation received by our non-employee directors during year ended December 31, 2021, or fiscal year 2021. Other than as set forth in the table below, we did not pay any compensation or make any equity awards to our non-employee directors during fiscal year 2021. During fiscal year 2021, Manish Chandra, our Chief Executive Officer, was a member of our board of directors, as well as an employee, and received no additional compensation for his services as a director. See “Executive Compensation–2021 Summary Compensation Table” for more information about Mr. Chandra’s compensation for our fiscal year 2021.

| Name |

Fees Earned or Paid in Cash ($) |

Stock Awards ($)(2)(3) |

Option Awards ($)(2)(4) |

Total ($) | ||||||||||||

| Ebony Beckwith |

15,000 | (1) | 150,024 | 150,002 | 315,026 | |||||||||||

| Navin Chaddha |

59,000 | 87,486 | 87,506 | 233,992 | ||||||||||||

| Jeff Epstein |

50,000 | 87,486 | 87,506 | 224,992 | ||||||||||||

| John Marren(5) |

44,000 | 87,486 | 87,506 | 218,992 | ||||||||||||

| Jenny Ming |

40,000 | 87,486 | 87,506 | 214,992 | ||||||||||||

| Hans Tung |

46,000 | 87,486 | 87,506 | 220,992 | ||||||||||||

| Serena J. Williams |

36,000 | 87,486 | 87,506 | 210,992 | ||||||||||||

| (1) | Ms. Beckwith joined our board of directors in August 2021. This amount represents a pro-rated amount of the annual retainer paid to Ms. Beckwith in fiscal year 2021. |

| (2) | The aggregate number of restricted stock units, or RSUs, and stock options held by each director listed in the table above as of December 31, 2021 was as follows. Ms. Beckwith has elected to defer settlement of all of her RSU awards into deferred stock units. |

| Director |

RSUs | Stock Options | ||||||

| Ebony Beckwith |

3,687 | 8,739 | ||||||

| Navin Chaddha |

2,083 | 4,472 | ||||||

| Jeff Epstein |

2,083 | 4,472 | ||||||

| John Marren |

2,083 | 4,472 | ||||||

| Jenny Ming |

2,083 | 4,472 | ||||||

| Hans Tung |

2,083 | 4,472 | ||||||

| Serena J. Williams |

2,083 | 4,472 | ||||||

| (3) | The amount reported represents the aggregate grant date fair value of the RSUs awarded, calculated in accordance with FASB ASC Topic 718. Such grant date fair value does not take into account any estimated forfeitures related to service vesting conditions. The assumptions used in calculating the grant date fair value of the RSUs reported in this column are set forth in the Notes to our Consolidated Financial Statements included in our 2021 Annual Report on Form 10-K. The amounts reported in this column reflect the accounting cost for these RSUs and do not correspond to the actual economic value that may be received upon any sale of the underlying shares of Class A common stock. |

| (4) | The amounts reported represent the aggregate grant date fair value of the stock options awarded, calculated in accordance with FASB ASC Topic 718. Such grant date fair value does not take into account any estimated forfeitures related to service vesting conditions. The assumptions used in calculating the grant date fair value of the stock options reported in this column are set forth in the Notes to our Consolidated Financial Statements included in our 10-K. The amounts reported in this column reflect the accounting cost for these stock options and do not correspond to actual economic value that may be received upon exercise of the stock options. |

| (5) | Mr. Marren resigned from our board of directors on March 25, 2022. |

16

Table of Contents

Non-Employee Director Compensation Program

Prior to our initial public offering in January 2021, we did not have a formal policy to compensate our non-employee directors. In connection with our initial public offering, we adopted a formal policy, our Non-Employee Director Compensation Policy, pursuant to which our non-employee directors are eligible to receive the following cash retainers and equity awards:

| Annual Retainer for Board Membership |

||||

| Annual service on the board of directors |

$ | 30,000 | ||

| Annual service as lead independent director |

$ | 15,000 | ||

| Additional Annual Retainer for Committee Membership |

||||

| Annual service as member of the audit committee (other than chair) |

$ | 10,000 | ||

| Annual service as chair of the audit committee |

$ | 20,000 | ||

| Annual service as member of the compensation committee (other than chair) |

$ | 6,000 | ||

| Annual service as chair of the compensation committee |

$ | 12,000 | ||

| Annual service as member of the nominating and corporate governance committee (other than chair) |

$ | 4,000 | ||

| Annual service as chair of the nominating and corporate governance committee |

$ | 8,000 |

Our Non-Employee Director Compensation Policy also provided, for each non-employee director on our board at the time of our initial public offering, for an equity award for our Class A common stock (the “IPO Grant”) having a fair market value of $175,000, of which 50% were RSUs and 50% were stock options. In addition, our policy provides that, upon initial election to our board of directors, each non-employee director will be granted an equity award having a fair market value of $350,000, or Initial Grant, of which 50% will be RSUs and 50% will be stock options. Furthermore, on the date of each of our annual meetings of stockholders following the completion of our initial public offering, each non-employee director who will continue as a non-employee director following such meeting will be granted an annual equity award having a fair market value of $175,000, or Annual Grant, of which 50% will be RSUs and 50% will be stock options. The IPO Grant and the Annual Grant will vest in full on the earlier of (i) the first anniversary of the grant date or (ii) our next annual meeting of stockholders, subject to continued service as a director through the applicable vesting date. The Initial Grant will vest in equal installments on the first, second, and third anniversary of the grant date, subject to continued service as a director through the applicable vesting date. Such awards are subject to full accelerated vesting upon the sale of the Company.

Non-employee directors will be given the opportunity to defer all or a portion of any RSUs granted under our policy into deferred stock units pursuant to the terms and conditions of our Non-Employee Director Compensation Policy, our 2021 Stock Option and Incentive Plan, and our Non-Employee Directors’ Deferred Compensation Program.

Employee directors will receive no additional compensation for their service as directors.

We will reimburse all reasonable out-of-pocket expenses incurred by non-employee directors for their attendance at meetings of our board of directors or any committee thereof.

17

Table of Contents

PROPOSAL NO. 2: RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Our board of directors is asking our stockholders to ratify the appointment by the audit committee of PricewaterhouseCoopers LLP (“PWC”) as the independent public accounting firm to conduct the audit of our financial statements for the fiscal year ending December 31, 2022. Stockholder ratification of such appointment is not required by our amended and restated bylaws or any other applicable legal requirement. However, our board of directors is submitting the appointment of PWC to our stockholders for ratification as a matter of good corporate governance.

This proposal is decided by a majority of the votes cast. This proposal will be approved if the number of votes cast “FOR” the proposal exceeds the number of votes cast “AGAINST” the proposal.

In the event our stockholders fail to ratify the appointment, the audit committee will reconsider whether or not to continue to retain PWC for the fiscal year ending December 31, 2022. Even if the appointment is ratified, the audit committee in its discretion may direct the appointment of a different independent registered public accounting firm at any time during the year if the audit committee believes that such a change should be made.

PWC has audited our financial statements since 2018. A representative of PWC is expected to be present at the Annual Meeting and will have the opportunity to make a statement if he or she desires to do so and is expected to be available to respond to appropriate stockholder questions.

Principal Accounting Fees and Services

The following table presents fees for professional audit services rendered by PWC, our independent registered public accounting firm, for the years ended December 31, 2020 and 2021.

| Year Ended December 31, |

||||||||

| 2020 | 2021 | |||||||

| (in thousands) | ||||||||

| Audit fees(1) |

$ | 3,131 | $ | 2,083 | ||||

| Audit-related fees(2) |

— | 110 | ||||||

| Tax fees(3) |

70 | 40 | ||||||

| All other fees(4) |

1 | 3 | ||||||

|

|

|

|

|

|||||

| Total |

$ | 3,202 | $ | 2,236 | ||||

|

|

|

|

|

|||||

| (1) | The audit fees consist of fees for the audit of our annual financial statements, and the review of our unaudited consolidated interim financial statements. The fees for fiscal year 2020 included $1.6 million of services provided in connection with the registration statement for the initial public offering of our common stock, which was completed in January 2021. |

| (2) | The audit-related fees consist of fees for assurance and related services that are reasonably related to the performance of the audit or review of our financial statements. The fees for fiscal year 2021 were related to services provided in connection with our acquisition of Suede One, Inc. in October 2021. |

| (3) | The tax fees consist of fees for professional services for tax compliance, tax advice, and tax planning. |

| (4) | These amounts consist of the aggregate fees for other services performed or provided by PwC not included in the categories above, including fees for a subscription to online accounting reference material. |

According to policies adopted by the audit committee and ratified by our board of directors, to ensure compliance

with the SEC’s rules regarding auditor independence, all audit and non-audit services to be provided by our independent registered public accounting firm must be pre-approved by the audit committee.

18

Table of Contents

The audit committee approved all services provided by PWC during the years ended December 31, 2021 and

2020. The audit committee has considered the nature and amount of the fees billed by PWC and believes that the

provision of the services for activities unrelated to the audit is compatible with maintaining PWC’s independence.

In considering the nature of the services provided by our independent registered public accounting firm, the audit

committee determined that such services are compatible with the provision of independent audit services. The

audit committee discussed these services with our independent registered public accounting firm and our

management to determine that they are permitted under the rules and regulations concerning auditor

independence.

Recommendation of Our Board of Directors

Our board of directors unanimously recommends that our stockholders vote “FOR” the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022.

19

Table of Contents

The audit committee oversees our independent registered public accounting firm and assists our board of directors in fulfilling its oversight responsibilities on matters relating to the integrity of our financial statements, our compliance with legal and regulatory requirements, and the independent registered public accounting firm’s qualifications and independence by meeting regularly with the independent registered public accounting firm and financial management personnel. Management is responsible for the preparation, presentation, and integrity of our financial statements. In fulfilling its oversight responsibilities, the audit committee:

| • | reviewed and discussed our financial statements as of and for the fiscal year ended December 31, 2021 with management and PWC; |

| • | discussed with PWC the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board and the SEC; |

| • | received the written disclosures and the letter from PWC required by the applicable requirements of the Public Company Accounting Oversight Board; and |

| • | discussed the independence of PWC with that firm. |

Based on the audit committee’s review and discussions noted above, the audit committee recommended to our board of directors, and our board of directors approved, that the audited financial statements be included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2021 for filing with the SEC. The audit committee also appointed PWC as our independent registered public accounting firm for fiscal year ending December 31, 2022.

Submitted by the audit committee of our board of directors:

Jeff Epstein (Chair)

Ebony Beckwith

Jenny Ming

20

Table of Contents

The following provides information regarding our executive officers as of December 31, 2021, and two former executive officers who no longer served as executive officers as of December 31, 2021:

| Name |

Age | Position | ||||

| Manish Chandra |

54 | Co-Founder, President, Chief Executive Officer, and Chairman of the Board | ||||

| Rodrigo Brumana |

47 | Chief Financial Officer | ||||

| John McDonald |

57 | Chief Operating Officer | ||||

| Anan Kashyap |

44 | Former Chief Financial Officer | ||||

| Kapil Agrawal |

40 | Former Interim Chief Financial Officer | ||||

Manish Chandra. Mr. Chandra co-founded our Company and has served as our President, Chief Executive Officer and member of our board of directors since February 2011. Prior to co-founding Poshmark, Mr. Chandra co-founded Kaboodle, an online shopping website where he served as the Chief Executive Officer from February 2005 to August 2010, and which was acquired by Hearst Communications in August 2007. From August 2010 to February 2011, Mr. Chandra developed the foundation of what ultimately became Poshmark. Mr. Chandra holds an M.B.A. in Marketing and Finance from Haas Business School at the University of California, Berkeley, an M.S. in Computer Science from the University of Texas at Austin, and a B.Tech from the Indian Institute of Technology, Kanpur.

Rodrigo Brumana. Mr. Brumana has served as our Chief Financial Officer since December 2021. Prior to joining Poshmark, Mr. Brumana served as Chief Financial Officer of Amazon Private Brands from June 2020 to November 2021, where he managed a team of finance, business intelligence and analytics professionals located across the Americas, Asia, and Europe. From September 2018 to March 2020, Mr. Brumana served as Chief Financial Officer of OfferUp, a leading mobile marketplace for online and local transactions. From September 2015 to August 2018, Mr. Brumana served as Senior Director of Finance at eBay, where he oversaw FP&A, business performance, monetization and marketing analytics for eBay Americas. Mr. Brumana holds an M.B.A. from the University of California, Berkeley and a Bachelor of Science in Civil Engineering from Universidade Federal de Uberlândia, Brazil.

John McDonald. Mr. McDonald has served as our Chief Operating Officer since September 2018. Mr. McDonald served as our Vice President of Business Operations from November 2013 to September 2018. From October 2009 to November 2013, Mr. McDonald served as Vice President of Sales and Support and then as General Manager at Ning, a platform to create a social media network later acquired by Glam Media in December 2011. Mr. McDonald holds an M.B.A. from Harvard Business School and a B.S. in Chemical Engineering from the University of California, Berkeley.

Anan Kashyap. Mr. Kashyap served as our Chief Financial Officer from July 2016 to August 2021. From January 2014 to July 2016, Mr. Kashyap served as Vice President of Strategic Finance, Investor Relations, and Corporate Development at GrubHub, an online and mobile food-ordering company. From May 2012 to August 2013, Mr. Kashyap served as Vice President of Finance at KAYAK, a global travel search engine acquired by Priceline. From July 2007 to May 2012, Mr. Kashyap served as a Vice President in the investment banking group at Deutsche Bank, an international investment bank and financial services company. Mr. Kashyap holds an M.B.A. from the UCLA Anderson School of Management and a B.A. in Business Economics from University of California, Los Angeles.

Kapil Agrawal. Mr. Agrawal served as our Interim Chief Financial Officer from August 2021 to December 2021. Mr. Agrawal served as our Vice President of Finance from October 2016 to August 2021. Prior to joining the Company, Mr. Agrawal served as Global Head of Pricing Strategy & Operations at Uber Technologies, Inc. from April 2015 until October 2016. Mr. Agrawal holds an M.B.A. from the University of Virginia Darden School of Business and a Bachelor of Technology in Mechanical Engineering from the Indian Institute of Technology Bombay.

21

Table of Contents

As an “emerging growth company,” we have opted to comply with the executive compensation disclosure rules applicable to “smaller reporting companies,” as such term is defined in the rules promulgated under the Securities Act. This section provides an overview of the compensation awarded to, earned by, or paid to each individual who served as our principal executive officer during our fiscal year 2021, our next two most highly compensated executive officers in respect of their service to our company for fiscal year 2021, and up to two additional individuals who would have been included under the prior prong but for the fact that they were no longer serving as executive officers at the end of the fiscal year. We refer to these individuals as our named executive officers. Our named executive officers for fiscal year 2021 were:

| • | Manish Chandra, our Chief Executive Officer; |

| • | Rodrigo Brumana, our Chief Financial Officer; |

| • | John McDonald, our Chief Operating Officer; |

| • | Anan Kashyap, our former Chief Financial Officer; and |

| • | Kapil Agrawal, our former Interim Chief Financial Officer. |

Our executive compensation program is based on a pay for performance philosophy. Compensation for our executive officers is composed primarily of the following main components: base salary, bonus, and equity incentives. Our executive officers, like all full-time employees, are eligible to participate in our health and welfare benefits and 401(k) plans. We intend to continue to evaluate our compensation philosophy and compensation plans and arrangements as circumstances require.

2021 Summary Compensation Table

The following table provides information regarding the total compensation, for services rendered in all capacities, that was earned by our named executive officers during our fiscal year 2021 and, if applicable, fiscal year ended December 31, 2020, or fiscal year 2020.

| Name and Principal Position |

Year | Salary ($) |

Stock Awards ($)(1) |

Option Awards ($)(2) |

Non-Equity Incentive Plan Compensation ($)(3) |

All Other Compensation ($) |

Total ($) |

|||||||||||||||||||||

| Manish Chandra |

2021 | 425,000 | — | — | 311,100 | — | 736,100 | |||||||||||||||||||||

| Chief Executive Officer |

2020 | 405,000 | 2,056,271 | 1,996,451 | 300,220 | — | 4,757,942 | |||||||||||||||||||||

| Rodrigo Brumana(4) |

2021 | 38,917 | — | — | — | — | 38,917 | |||||||||||||||||||||

| Chief Financial Officer |

||||||||||||||||||||||||||||

| John McDonald |

2021 | 390,000 | 2,118,279 | — | 214,110 | — | 2,722,389 | |||||||||||||||||||||

| Chief Operating Officer |

2020 | 370,000 | 3,084,407 | — | 206,622 | — | 3,661,029 | |||||||||||||||||||||

| Anan Kashyap(5) |

2021 | 270,111 | 2,118,279 | — | — | 120,249 | (6) | 2,508,639 | ||||||||||||||||||||

| Former Chief Financial Officer |

2020 | 370,000 | 3,804,096 | — | 206,622 | — | 4,380,718 | |||||||||||||||||||||

| Kapil Agrawal(7) |

2021 | 345,807 | (8) | 1,283,837 | — | 87,840 | — | 1,717,484 | ||||||||||||||||||||

| Former Interim Chief Financial Officer |

||||||||||||||||||||||||||||

| (1) | The amount reported represents the aggregate grant date fair value of the restricted stock units awarded to the named executive officers in fiscal years 2021 and 2020, calculated in accordance with FASB ASC Topic 718. Such grant date fair value does not take into account any estimated forfeitures related to service vesting conditions. The assumptions used in calculating the grant date fair value of the RSUs reported in this column are set forth in the Notes to our Consolidated Financial Statements included in our 2021 Annual Report on Form 10-K. The amounts reported in this column reflect the accounting cost for these RSUs and do not correspond to the actual economic value that may be received by the named executive officers upon any sale of the underlying shares of Class A common stock or Class B common stock, as the case may be. |

| (2) | The amounts reported represent the aggregate grant date fair value of the stock options awarded to the named executive officer in fiscal year 2020, calculated in accordance with FASB ASC Topic 718. Such grant date fair value does not take into account any estimated |

22

Table of Contents

| forfeitures related to service vesting conditions. The assumptions used in calculating the grant date fair value of the stock options reported in this column are set forth in the Notes to our Consolidated Financial Statements included in our 2021 Annual Report on Form 10-K. The amounts reported in this column reflect the accounting cost for these stock options and do not correspond to actual economic value that may be received by the named executive officers upon exercise of the stock options. |

| (3) | The amounts reported reflect bonuses paid under our 2021 Executive Compensation Plan and 2020 Executive Compensation Plan to our named executive officers based upon achievement of certain company and individual performance metrics. Our 2021 Executive Compensation Plan is described more fully in the Narrative to 2021 Summary Compensation Table below. |

| (4) | Mr. Brumana has served as our Chief Financial Officer since December 1, 2021. |

| (5) | Mr. Kashyap served as our Chief Financial Officer until August 13, 2021. |

| (6) | In connection with Mr. Kashyap’s termination of employment, we agreed to accelerate vesting of 3,296 RSUs and 1,666 stock options. The value of such vesting acceleration is $120,249, which is calculated by reference to the fair market value of our stock price on the date the acceleration became effective times the number of award shares accelerated, less any applicable exercise price. |

| (7) | Mr. Agrawal served as our Interim Chief Financial Officer from August 13, 2021 to December 1, 2021. Mr. Agrawal was not a named executive officer in 2020. |

| (8) | The amount reported includes Mr. Agrawal’s base salary and compensation for accrued paid time off. |

Narrative to 2021 Summary Compensation Table

Base Salaries

We use base salaries to recognize the experience, skills, knowledge, and responsibilities required of all our employees, including our named executive officers. Base salaries are reviewed annually, typically in connection with our annual performance review process, and adjusted from time to time to realign salaries with market levels after taking into account individual responsibilities, performance and experience. For fiscal year 2021, the annual base salaries for each of Messrs. Chandra, Brumana, McDonald, Kashyap, and Agrawal were $425,000, $467,000, $390,000, $390,000, and $320,000, respectively.

Annual Bonuses

From time to time, our board of directors may approve annual bonuses for our named executive officers based on individual performance, company performance, or as otherwise determined to be appropriate. For fiscal year 2021, each of Messrs. Chandra, McDonald, Kashyap and Agrawal participated in our Senior Executive Cash Incentive Bonus Plan, which provides a bonus based upon company performance against pre-established performance goals and individual performance. Each of Messrs. Chandra, McDonald, Kashyap, and Agrawal had a target bonus equal to 80%, 60%, 60%, and 30% of their respective annual base salary. Our fiscal year 2021 performance goals were weighted equally between a Gross Merchandise Value performance metric and an adjusted EBITDA performance metric. Gross Merchandise Value is defined as the total dollar value of transactions on our platform in a given period, prior to returns and cancellations, and excluding shipping and sales taxes. Mr. Kashyap was no longer eligible to receive bonuses under the Senior Executive Cash Incentive Bonus Plan after he departed the company in August 2021. In addition, pursuant to his offer letter as described below, Mr. Brumana was not eligible for a bonus for fiscal year 2021 under the Senior Executive Cash Incentive Bonus Plan, but he will be eligible for a bonus with a target amount equal to 50% of his annual base salary for the 2022 fiscal year.

Equity Compensation

Although we do not have a formal policy with respect to the grant of equity incentive awards to our executive officers, we believe that equity grants provide our executives with a strong link to our long-term performance, create an ownership culture, and help to align the interests of our executives and our stockholders. In addition, we believe that equity grants with a time-based vesting feature promote executive retention because this feature incentivizes our executive officers to remain in our employment during the vesting period. Accordingly, our board of directors periodically reviews the equity incentive compensation of our named executive officers and from time to time may grant equity incentive awards to them pursuant to our 2021 Stock Option and Incentive Plan.

23

Table of Contents

Executive Employment Arrangements

Offer Letters in Place During the Year Ended December 31, 2021 for Named Executive Officers

Manish Chandra

On February 10, 2011, we entered into an offer letter with Mr. Chandra for the position of Chief Executive Officer. The offer letter provided for Mr. Chandra’s at-will employment and set forth his annual base salary and his eligibility to participate in our benefit plans generally. Mr. Chandra is subject to our standard employment, confidential information, and invention assignment agreement.

Rodrigo Brumana