Form DEF 14A DARDEN RESTAURANTS INC For: Sep 22

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

|

Filed by the Registrant ☒ |

Filed by a Party other than the Registrant ☐ | |||||||||

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

DARDEN RESTAURANTS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which the transaction applies: |

| (2) | Aggregate number of securities to which the transaction applies: |

| (3) | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials. |

| (6) |

|

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Table of Contents

| 2021 | Darden Restaurants, Inc. Annual Meeting of Shareholders and Proxy Statement | |

| Wednesday, September 22, 2021 10:00 a.m., Eastern Time | ||

| Our Brands | ||||

Table of Contents

August 9, 2021

Dear Shareholders:

Table of Contents

Notice of 2021 Annual

Meeting of Shareholders

To be held on September 22, 2021

| Annual Meeting of Shareholders | ||||

| Date and Time: Wednesday, September 22, 2021 |

Place: Online, via the internet at

|

Record Date: Wednesday, July 28, 2021 | ||

| Items of Business

|

How to Vote

| |||||||

| Item 1. To elect a full Board of eight directors from the named director nominees to serve until the next annual meeting of shareholders and until their successors are elected and qualified;

Item 2. To obtain advisory approval of the Company’s executive compensation;

Item 3. To ratify the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending May 29, 2022;

Item 4. To approve the amendment of the Company’s Employee Stock Purchase Plan;

Item 5. To vote on a shareholder proposal described in the accompanying Proxy Statement if properly presented at the meeting; and

Item 6. To transact such other business, if any, as may properly come before the meeting and any adjournment.

Important Notice Regarding the Availability of Proxy Materials for the Shareholders Meeting to be held on September 22, 2021: The accompanying Proxy Statement and our 2021 Annual Report on Form 10-K are available at www.darden.com. In addition, you may access these materials at www.proxyvote.com. On August 9, 2021, we mailed a Notice of Internet Availability of Proxy Materials to certain shareholders, containing instructions for voting online and for requesting a paper copy of the Proxy Statement and 2021 Annual Report on Form 10-K. |

by going to the website shown on your proxy card or Notice of Availability of Proxy Materials and following the instructions for Internet voting set forth on such proxy card or Notice

|

by completing, signing, dating and returning the proxy card | ||||||

|

by telephone at the number shown on your proxy card and following the instructions on such proxy card (If you reside in the United States or Canada) |

Shareholders of record and beneficial owners will be able to vote their shares electronically during the Annual Meeting. However, even if you plan to participate in the Annual Meeting online, we recommend that you vote by proxy so that your votes will be counted if you later decide not to participate in the Annual Meeting.

| |||||||

| Who Can Vote | ||||||||

| You can vote during the Annual Meeting and any adjournment if you were a holder of record of our common stock at the close of business on July 28, 2021.

| ||||||||

| Date of Mailing | ||||||||

| This Notice of the Annual Meeting of Shareholders and the Proxy Statement are first being distributed or otherwise furnished to shareholders on or about August 9, 2021. | ||||||||

| By Order of the Board of Directors

| ||||||||

| Matthew R. Broad Senior Vice President, General Counsel, Chief Compliance Officer and Corporate Secretary |

DARDEN RESTAURANTS, INC. 1000 Darden Center Drive Orlando, Florida 32837 | |||||||

Table of Contents

Table of Contents

|

Proxy Statement for Annual Meeting of Shareholders to be held on September 22, 2021

|

The Board of Directors (the Board) of Darden Restaurants, Inc. (Darden, the Company, we, us or our) is soliciting your proxy for use at the Annual Meeting of Shareholders to be held on September 22, 2021. This Proxy Statement summarizes information concerning the matters to be presented at the meeting and related information that will help you make an informed vote at the meeting. This Proxy Statement and the proxy card are first being distributed or otherwise furnished to shareholders on or about August 9, 2021. Capitalized terms used in this Proxy Statement that are not otherwise defined are defined in Appendix B to this document.

This summary highlights certain information discussed in more detail in this Proxy Statement.

2021 Annual Meeting of Shareholders

| Date & Time: |

Wednesday, September 22, 2021, 10:00 a.m., E.T. | |

| Location: |

Online, via the internet at www.virtualshareholdermeeting.com/DRI2021 | |

Matters Presented for Vote at the Meeting

The matters to be voted upon at this meeting, along with the Board’s recommendation, are set forth below.

| Proposals |

Required Approval |

Board Recommendation |

Page Reference | |||||

| Proposal 1. Election of Eight Directors from the Following Nominees: - M. Shân Atkins - James P. Fogarty - Cynthia T. Jamison - Eugene I. Lee, Jr. - Nana Mensah - William S. Simon - Charles M. Sonsteby - Timothy J. Wilmott |

Majority of |

✓ | For Each Nominee | p. 20 | ||||

| Proposal 2. Advisory Approval of the Company’s Executive Compensation |

Majority of |

✓ | For | p. 26 | ||||

| Proposal 3. Ratification of Appointment of the Company’s Independent Registered Public Accounting Firm for the Fiscal Year Ending May 29, 2022 |

Majority of |

✓ | For | p. 27 | ||||

| Proposal 4. Approval of Amended Employee Stock Purchase Plan |

Majority of |

✓ | For | p. 28 | ||||

| Proposal 5. Shareholder Proposal Requesting that the Company Adopt Certain Policies Regarding Retention of Shares by Company Executives |

Majority of |

× | Against | p. 34 | ||||

2021 Proxy Statement 1

Table of Contents

Darden Restaurants, Inc. (“Darden”, “the Company,” “we,” “our” or “us”) is a full-service restaurant company, and as of May 30, 2021, we owned and operated 1,834 restaurants through subsidiaries in the United States and Canada under the Olive Garden®, LongHorn Steakhouse®, Cheddar’s Scratch Kitchen®, Yard House®, The Capital Grille®, Seasons 52®, Bahama Breeze® and Eddie V’s Prime Seafood® trademarks.

Strategy Summary

Although throughout fiscal 2021 we continued to adapt our business model to address the impacts of the COVID-19 pandemic on the United States as a whole, and the casual dining industry in particular, our operating philosophy remained focused on strengthening the core operational fundamentals of the business by providing an outstanding guest experience rooted in culinary innovation, attentive service, engaging atmosphere, and integrated marketing. Darden enables each brand to reach its full potential by leveraging our scale, insights, and experience in a way that protects uniqueness and competitive advantages.

We manage our business organized around one core mission and one driving philosophy that keeps us focused on actions that will help us to be financially successful through great people consistently delivering outstanding food, drinks and service in an inviting atmosphere, making every guest loyal.

A full-service restaurant company with …

| 1 Mission |

Be financially successful through great people consistently delivering outstanding food, drinks and service in an inviting atmosphere making every guest loyal.

| |||||||||||||

| 4 Competitive Advantages |

Significant Scale |

● | Extensive Data & Insights |

● | Rigorous Strategic Planning |

● | Results- Oriented Culture | |||||||

| 1 Driving Philosophy |

Back-To-Basics | |||||||||||||

| Culinary Innovation & Execution | ● | Attentive Service |

● | Engaging Atmosphere |

● | Integrated Marketing | ||||||||

| 8 Iconic Brands |

|

|||||||||||||

2 Darden Restaurants, Inc.

Table of Contents

Fiscal 2021 Was Dramatically Impacted by the COVID-19 Pandemic

For much of fiscal 2021, the COVID-19 pandemic resulted in a significant reduction in guest traffic at our restaurants due to changes in consumer behavior as public health officials encouraged social distancing and required personal protective equipment and state and local governments mandated restrictions including suspension of dine-in operations, reduced restaurant seating capacity, table spacing requirements, bar closures and additional physical barriers. Beginning in late March 2020, we operated with all of our dining rooms closed and served our guests in a To Go only or To Go and delivery format. In late April 2020, state and local governments began to allow us to open dining rooms at limited capacities, along with other operating restrictions. As a result, we began fiscal 2021 with significant limitations on our operations, which over the course of the fiscal year varied widely from time to time, state to state and city to city. During November 2020, rising case rates resulted in certain jurisdictions implementing restrictions that again reduced dining room capacity or mandated the re-closure of dining rooms. Once COVID-19 vaccines were approved and moved into wider distribution in the United States in early 2021, public health conditions improved and almost all of the COVID-19 restrictions on businesses have eased. As of July 30, 2021, all of our restaurants were able to open their dining rooms and few capacity restrictions or other COVID-19 restrictions remained in place in the United States. However, it is possible additional future outbreaks could require us to again reduce our capacity or limit or suspend our in-restaurant dining operations.

As our dining rooms have returned to full or close-to-full capacity, we are focused on continuing to provide a safe environment for our team members and guests, and maintaining many of the operating efficiencies established during fiscal 2021. As we navigated through the pandemic, the steps we took demonstrated our focus on our mission: “Be financially successful through great people consistently delivering outstanding food, drinks and service in an inviting atmosphere making every guest loyal.”

2021 Proxy Statement 3

Table of Contents

|

Key Highlights

|

||||

|

We invested in our great people, our team members, in many ways including introducing a new minimum wage rate, offering permanent paid sick leave, providing emergency pay programs, offering paid time off to get the COVID-19 vaccine and paying one-time bonuses to hourly team members.

We implemented safety protocols in our restaurants to create a safe, welcoming environment for team members and guests.

We worked to streamline our menus and improve our processes to remove complexity from our restaurant operations and consistently deliver great food.

We invested in technology enhancements to improve the off-premise and in-restaurant guest experience, including mobile apps, internet ordering capabilities and tabletop ordering and payment options.

We served our communities with a focus on fighting hunger in fiscal 2021: we donated $2.5 million to Feeding America through the Darden Foundation, including providing five mobile food trucks to local food banks with exceptionally high need, and contributed 5.6 million pounds of food through our Harvest program – amounting to 4.7 million meals.

* Adjusted EPS is a non-GAAP number. Reconciliation of Reported to Adjusted EPS can be found in Appendix C to this Proxy Statement. |

We ended fiscal 2021 with the following key financial results: | |||

|

| ||||

4 Darden Restaurants, Inc.

Table of Contents

|

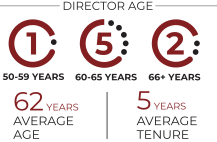

Director Highlights

| ||||

|

|

|

| ||

| 8 Nominees | ||||

Each of our eight director nominees is committed to our core values (integrity and fairness, respect and caring, inclusion and diversity, always learning – always teaching, being “of service,” teamwork and excellence.) We seek directors who have an inquisitive and objective perspective, practical wisdom, mature judgment and a wide range of experience in the business world. The Company strives to maintain a Board that reflects gender, ethnic, racial and other diversity and also fosters diversity of thought. In 2021, we amended our Director Nomination Protocols to commit that the initial candidate pool for any vacancy on the Board, including any pool developed by a search firm, will include candidates with diversity of gender, race and/or ethnicity.

Our Director Nominees

|

|

|

|

Committee Memberships | |||||||||

| Nominee and Primary Occupation |

Age | Director Since |

A | C | F | N | ||||||

| MARGARET SHÂN ATKINS Retired Co-Founder and Managing Director, |

64 | 2014 | ¡ | ¡ | ||||||||

|

JAMES P. FOGARTY CEO, FULLBEAUTY Brands, Inc.

|

53 | 2014 | ● | ¡ | ||||||||

|

CYNTHIA T. JAMISON Retired CFO of AquaSpy, Inc.

|

61 | 2014 | ● | ¡ | ¡ | |||||||

| EUGENE I. LEE, JR. Chairman and CEO, |

60 | 2015 | ||||||||||

| NANA MENSAH Chairman and Chief Executive Officer, |

69 | 2016 | ¡ | ● | ||||||||

|

WILLIAM S. SIMON Senior Advisor to KKR & Co.

|

61 | 2014 | ¡ | ● | ||||||||

| CHARLES M. SONSTEBY Retired Vice Chairman, |

67 | 2014 | ||||||||||

| TIMOTHY J. WILMOTT retired Chief Executive Officer, |

63 | 2018 | ¡ | ¡ | ||||||||

A = Audit C = Compensation F = Finance N = Nominating and Governance ● = Chair ¡ = Member

2021 Proxy Statement 5

Table of Contents

Corporate Governance Highlights

Our Board seeks to maintain the highest standards of corporate governance and ethical business conduct, including the following highlights:

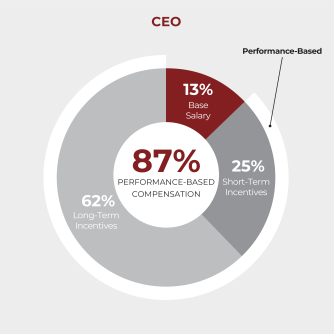

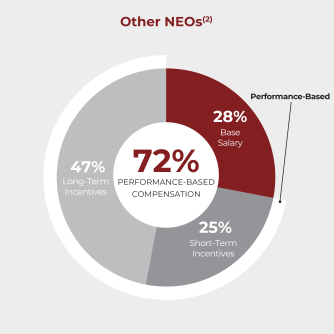

Executive Compensation Highlights

Our fiscal 2021 compensation programs were designed to create a strong alignment between pay and performance for our executives. Highlights of our executive compensation programs include:

We have included a detailed Executive Summary in the “Compensation Discussion and Analysis” section of this Proxy Statement.

We are committed to protecting our planet for future generations and sourcing food with care.

Darden’s current key Sustainability areas of focus are:

|

Protecting our Planet | With more than 1,800 restaurant locations, we view conservation efforts at our restaurants as the first line of action in managing climate risks and resource volatility. | ||

To that end, we track and report to our management and the Board on the following metrics annually:

| Ø | Taking Action on Climate Risks - Greenhouse gas (GHG) emissions (Scope 1 & 2) |

| Ø | Energy – Average Usage per Restaurant |

| Ø | Water – Average Usage per Restaurant |

| Ø | Waste – Recycling Rate |

We are committed to providing disclosure to our shareholders on these and other sustainability metrics. We disclose all of these metrics on our corporate website, www.darden.com, and we include the GHG emissions in our annual report on Form 10-K.

6 Darden Restaurants, Inc.

Table of Contents

|

Our Climate Commitments

|

Climate change is a significant global challenge. As a business, we must prepare for both the risks and opportunities of a changing climate.

Given our size, and the fact that we own and operate our restaurants, we know that we can do more to make an impact. That is why we are working to take action. During calendar year 2021, we are working with external experts to conduct a full Environmental Impact Assessment of our entire value chain, and we plan to share key findings on our website, www.darden.com. In the meantime, we are committed to managing risks and making improvements in our impacts on the climate through the additional commitments.

To help us manage risk, we commit to:

| • | Measuring and reporting our Scope 3 GHG emissions by the end of fiscal 2022. This is in addition to Scope 1 & 2, which we already report publicly on our website, www.darden.com, and in our annual report on Form 10-K. |

| • | Aligning our climate approach to the Task Force on Climate-related Financial Disclosures (TCFD) by creating a framework that covers Governance, Strategy, Risk Management, and Metrics & Targets. |

To help us tackle the climate impacts of our business, we commit to:

| • | Creating a strategy to address Scope 1 & 2 GHG emissions with the goal of achieving 100% renewable energy for our restaurants by 2030. |

| • | Developing, and publicly reporting, a Science-Based target for both direct operations (Scope 1&2) and broader value chain impacts (Scope 3). |

|

Sourcing Food with Care | We lead in food safety and quality while also caring for farm animals and holding our suppliers to our Food Principles. We know that where our ingredients come from and how they are grown are integral elements in the recipe for preparing great food for our guests. Darden’s Food Principles are our foundation for sourcing food for our guests sustainably. | ||

We continually engage with our suppliers regarding our Food Principles and commitments to our Guests, and have reviewed these important values with them. As we make progress in these areas, we will continue to share updates. New restaurant brands that join our portfolio are fully integrated into our Food Principles commitments within five years from acquisition.

| • | Antibiotics: Darden requires its suppliers to comply with FDA guidelines that recommend that antibiotics that are important in human medicine no longer be used with farm animals for growth purposes, and shared-class antibiotics (i.e., those used by both humans and animals) only be used to treat, prevent and control disease in farm animals under the supervision of a veterinarian. We will continue to monitor compliance that all of our land-based protein supply meets these guidelines. |

| • | In addition, Darden is committed to purchasing chicken raised without the use of medically important antibiotics by 2023 and will continue to work with suppliers on monitoring responsible antibiotic usage. |

| • | Animal Welfare: Our goal is that Darden’s suppliers will contribute to measurable, continuous improvements in animal welfare outcomes by 2025 as outlined in our Animal Welfare policy. |

| • | Pork: Darden is committed to work with pork suppliers to limit the use of gestation crates for housing pregnant sows, with a goal to source only gestation-crate free pork by 2025. The majority of our suppliers today have made a commitment to housing improvements. |

2021 Proxy Statement 7

Table of Contents

| • | Poultry: In partnership with our poultry suppliers, we will continue to seek improvements that result in healthy biological function, expression of natural behavior and humane processing. In addition, Darden is committed to purchasing chicken raised without the use of medically important antibiotics by 2023 and will continue to work with suppliers on monitoring responsible antibiotic usage. |

| • | Eggs: 100% of all egg products purchased by Darden are sourced from cage-free housing systems. |

| • | Nutritional Transparency: As the needs of our guests evolve, we are committed to transparency in our recipes, ingredients and nutritional information – so our guests can make informed dining decisions and ensure that their dietary restrictions and preferences are accommodated. |

We are committed to disclosing progress on these commitments to our shareholders, and plan to report our progress on our website.

In 2019, we established an Animal Welfare Council, which unites a cross-functional group of academics and thought leaders in the care of animals in food supply chains. This group is responsible for continued efforts to improve animal welfare outcomes and most recently, mapped out a framework and process for working with chicken suppliers on key welfare areas, including medically important antibiotic usage.

Additional measures we take to ensure best practices in our food sourcing include:

| Ø | We require third-party audits to ensure that our Animal Welfare Policy is upheld by farms producing our animal products. |

| Ø | We manage our suppliers by: |

| • | Conducting rigorous evaluations to verify food safety procedures and product quality. |

| • | Holding all partners accountable to our Supplier Code of Conduct. |

| • | Assigning our Total Quality team and third-party partners to perform ongoing audits every year to ensure food safety and product quality. |

| Ø | Restaurant leaders are thoroughly trained on our robust food safety and restaurant cleanliness practices and conduct in-depth walk-throughs twice each day. |

| Ø | We use a third-party partner to conduct quarterly inspections at every restaurant to validate our strict food safety protocols. |

Inclusion and Diversity Highlights

|

|

At Darden, everyone is welcome to a seat at our table. | |

Our History Shapes Our Commitment

When our founder Bill Darden opened his first restaurant in 1938, he employed anyone willing to work hard, work smart and grow with the company – without regard to race, gender or background.

Ensuring an inclusive and diverse workplace is at the very heart of Darden and our brands. We are strengthened by a diversity of cultures, perspectives, attitudes and ideas. We honor each other’s heritage and uniqueness. We prioritize our inclusion and diversity efforts not just because it is the right thing to do – but because it makes us better. It leads to innovation of thought, fuels our growth as a company and creates great places to work for our team members. Our strategy to uphold our

8 Darden Restaurants, Inc.

Table of Contents

founder’s legacy is rooted in advancing workplace diversity, creating an inclusive environment and building on our commitment.

The Board reviews and evaluates human capital metrics, strategic objectives and other initiatives with respect to the Company’s workforce. We have added detailed human capital metrics to our annual report on Form 10-K and to our corporate website. We have also added our EEO-1 data to our corporate website disclosure. Some key inclusion and diversity highlights are set forth below.

| Our Team (as of year-end fiscal 2020 unless otherwise indicated) | ||||

|

|

| ||

Our strategy to uphold our founder’s legacy is rooted in advancing workplace diversity, creating an inclusive environment and building on our commitment. We report details about these strategic initiatives on our corporate website.

| Advance Workplace Diversity | Create an Inclusive Environment | Build on Our Commitment | ||||||

| ✓ Increase our pipeline of diverse leaders

✓ Ensure all levels of our team reflect the diversity of our talent in our industry and communities

✓ Expand inclusive hiring and development best practices across all our brands |

✓ Expand inclusion and diversity awareness and training to all team member populations

✓ Equip all leaders with the tools and resources to foster an inclusive environment for team members and guests

✓ Utilize Employee Resource Groups to engage, retain and advance our team

|

✓ Make a positive impact in the communities we serve

✓ Continue to invest in diverse suppliers | ||||||

2021 Proxy Statement 9

Table of Contents

Corporate Governance and Board Administration

Our Board is Committed to the Highest Standards of Corporate Governance and Ethical Business Conduct

Corporate governance guidelines, policies and practices are the foundation for the effective and ethical governance of all public companies. Our Board is committed to the highest standards of corporate governance and ethical business conduct, providing accurate information with transparency and complying fully with the laws and regulations applicable to our business. The Company’s corporate governance structure is designed to ensure that the Company’s policies and practices are aligned with shareholder interests and corporate governance best practices. Executive management supports the Board’s commitment to be transparent through shareholder outreach efforts. We offer our shareholders an opportunity to engage in dialogue with us about aspects of our corporate governance and discuss any areas of concern. Our corporate governance practices are governed by our Articles of Incorporation, Bylaws, Corporate Governance Guidelines, Board committee charters, Shareholder Communication Procedures, Codes of Business Conduct and Ethics and Insider Trading Policy. You can access these documents at www.darden.com under Investors — Governance to learn more about the framework for our corporate governance practices. Copies are also available in print, free of charge, to any shareholder upon written request addressed to our Corporate Secretary.

Corporate Governance Guidelines

The Board has adopted Corporate Governance Guidelines that specifically address the Company’s key governance practices and policies. The Nominating and Governance Committee of the Board oversees governance issues and recommends changes to the Company’s governance guidelines, policies and practices as appropriate. Our Corporate Governance Guidelines cover many important topics, including:

| • | Director responsibilities; |

| • | Director qualification standards; |

| • | Director independence; |

| • | Director access to senior management and independent advisors; |

| • | Director compensation; |

| • | Director orientation and continuing education; |

| • | Codes of Business Conduct and Ethics; |

| • | Risk oversight; |

| • | Related party transactions; |

| • | Approval of CEO and senior management succession plans; |

| • | Annual compensation review of CEO and executive officers; |

| • | Human capital management; |

| • | An annual evaluation in executive session of the CEO by the independent directors, led by the Chairman of the Compensation Committee; and |

10 Darden Restaurants, Inc.

Table of Contents

| • | An annual performance evaluation of the Board and each of the Board committees, and an even more in-depth performance evaluation of the Board led by an outside consultant no less often than every two years. |

The Corporate Governance Guidelines also include policies on certain specific subjects, including those that:

| • | Require meetings at least four times annually of the independent directors in executive session without our CEO or other members of management present; |

| • | Require a letter of resignation from directors upon a significant change in their personal circumstances, including a change in or termination of their principal job responsibilities; |

| • | Limit the number of other boards that directors may serve on; |

| • | Provide that no member of the Audit Committee may serve on the audit committee of more than three public companies, including the Company; and |

| • | Provide a mandatory retirement age for directors. |

Our Corporate Governance Guidelines require that at least two-thirds of the Board be independent directors, as defined under the rules (the NYSE Rules) of the New York Stock Exchange (NYSE). The NYSE Rules and Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the Exchange Act), include the additional requirements that members of the Audit Committee may not accept directly or indirectly any consulting, advisory or other compensatory fee from the Company other than their director compensation and may not be affiliated with the Company or its subsidiaries. The NYSE Rules and Rule 10C-1 under the Exchange Act provide that when determining the independence of members of the Compensation Committee, the Board must consider all factors specifically relevant to determining whether a director has a relationship to the Company which is material to the director’s ability to be independent from management in connection with Compensation Committee duties, including, but not limited to, consideration of the sources of compensation of Compensation Committee members, including any consulting, advisory or other compensatory fees paid by the Company, and whether any Compensation Committee member is affiliated with the Company or any of its subsidiaries or affiliates. Compliance by Audit Committee members and Compensation Committee members with these requirements is separately assessed by the Board.

The Board has reviewed, considered and discussed each current director’s relationships, both direct and indirect, with the Company in order to determine whether such director meets the independence requirements of the applicable sections of the NYSE Rules (there are no nominees for election as directors at the Annual Meeting who are not current directors). The Board has affirmatively determined that, other than Mr. Lee, who is employed by the Company, seven of the eight nominees (Mses. Atkins and Jamison and Messrs. Fogarty, Mensah, Simon, Sonsteby and Wilmott) have no direct or indirect material relationship with us (other than their service as directors) and qualify as independent under the NYSE Rules. The Board has also affirmatively determined that each member of the Audit Committee and the Compensation Committee meets the applicable requirements of the NYSE Rules and the Exchange Act.

In making independence determinations, the Board considers that in the ordinary course of business, transactions may occur between the Company, including its subsidiaries, and entities with which some of our directors are or have been affiliated. The Board has concluded that any such transactions were immaterial in fiscal 2021.

2021 Proxy Statement 11

Table of Contents

The Company’s Corporate Governance Guidelines include a policy pertaining to related party transactions in which Interested Transactions with a Related Party, as those terms are defined below, are prohibited without prior approval of the Board. The Board will review the material facts of the proposed transaction and will either approve or disapprove of the transaction. In making its determination, the Board considers whether the Interested Transaction is consistent with the best interests of the Company and its shareholders and whether the Interested Transaction is on terms no less favorable than terms generally available to an unaffiliated third party under the same or similar circumstances, as well as the extent of the Related Party’s interest in the transaction. A director may not participate in any discussion or approval of an Interested Transaction for which he or she is a Related Party, except to provide all material information as requested. Only those directors that meet the requirements for designation as a “qualified director” under the Florida Business Corporation Act will participate in the approval of an Interested Transaction. If an Interested Transaction will be ongoing, the Board may establish guidelines for the Company’s management to follow in its dealings with the Related Party.

An “Interested Transaction” as defined in the policy is any transaction, arrangement or relationship (or series of similar transactions, arrangements or relationships) in which (i) the amount involved exceeds $120,000 in any fiscal year, (ii) the Company is a participant, and (iii) any Related Party has or will have a direct or indirect interest (other than solely as a result of being a director or a less than 10 percent beneficial owner of another entity), but does not include any salary or compensation paid by the Company to a director or for the employment of an executive officer that is required to be reported in the Company’s proxy statement (or that would have been so reported if the executive officer was a “named executive officer” as that term is defined in the rules of the Securities and Exchange Commission).

A “Related Party” as defined in the policy is any (i) person who is or was since the beginning of the last fiscal year an executive officer, director or nominee for election as a director of the Company, (ii) beneficial owner of more than five percent of the Company’s common stock, or (iii) immediate family member of any of the foregoing.

An “immediate family member” as defined in the policy is any child, stepchild, parent, stepparent, spouse, sibling, mother-in-law, father-in-law, son-in-law, daughter-in-law, brother-in-law, or sister-in-law of the person in question and any person (other than a tenant or employee) sharing the household of the person in question.

There are no Interested Transactions or related party transactions or relationships required to be reported in this Proxy Statement under Item 404 of the SEC’s Regulation S-K.

Director Election Governance Practices

We do not have a “classified board” or other system where directors’ terms are staggered; instead, our full Board is elected annually. The Company’s Bylaws provide that in an uncontested election, each director will be elected by a majority of the votes cast; provided that, if the election is contested, the directors will be elected by a plurality of the votes cast. In an uncontested election, if a nominee for director who is a director at the time of election does not receive the vote of at least the majority of the votes cast at any meeting for the election of directors at which a quorum is present, the director will promptly tender his or her resignation to the Board and remain a director until the Board appoints an individual to fill the office held by such director.

The Nominating and Governance Committee will recommend to the Board whether to accept or reject the tendered resignation or whether other action should be taken. The Board is required to act

12 Darden Restaurants, Inc.

Table of Contents

on the tendered resignation, taking into account the Nominating and Governance Committee’s recommendation, and publicly disclose (by a press release, a filing with the SEC or other broadly disseminated means of communication) its decision and the rationale within 90 days from the date of certification of the election results. If a director’s resignation is not accepted by the Board, such director will continue to serve until his or her successor is duly elected, or his or her earlier resignation or removal. If a director’s resignation is accepted by the Board, then the Board, in its sole discretion, may fill the vacancy or decrease the size of the Board. To be eligible to be a nominee for election or reelection as a director of the Company, a person must deliver to our Corporate Secretary a written agreement that he or she will abide by these requirements.

Under our Bylaws, the Board will consist of not less than three nor more than fifteen members as determined from time to time by resolution of the Board. Currently, the Board consists of eight members, all of whom have agreed to stand for reelection at the 2021 Annual Meeting.

The Company’s Corporate Governance Guidelines provide that the positions of Chairman of the Board and CEO may, in the judgment of the Board, be combined, and if the Chairman position is held by the CEO or another non-independent director, then the independent directors will choose a Lead Independent Director from among the independent directors. The Board believes that whether to have the same person serve in the roles of Chairman and CEO should be decided by the Board, from time to time, in its business judgment after considering the relevant factors, including the specific needs of the business and the best interests of the shareholders. In December, 2020, the Board voted to combine the roles of Chairman and CEO and elected Eugene I. Lee, Jr. to the combined role effective January 4, 2021. Charles M. Sonsteby, who had served as Chairman since April 2016, was elected to serve as Lead Independent Director as of that date. As Lead Independent Director, Mr. Sonsteby, along with the other independent non-employee directors, brings experience, oversight and expertise from outside the Company and industry, while our Chairman and CEO, Mr. Lee, brings Company and industry-specific experience and expertise. The Board also believes that the combination of the roles of Chairman and CEO allows Mr. Lee to leverage his decades of restaurant operating experience and drive execution of the Company’s long-term strategy.

The Company’s Corporate Governance Guidelines provide that the Chairman will preside at meetings of the Board, except that the Lead Independent Director will preside at the Board’s executive sessions of independent directors. The Lead Independent Director approves Board meeting agendas, including approving meeting schedules to assure that there is sufficient time for discussion of all agenda items, and other information sent to the Board, advises the committee chairs with respect to agendas and information needs relating to committee meetings, serves as liaison between the Chairman and the independent directors, has the authority to call meetings of the independent directors as he or she deems appropriate and is available for consultation and direct communications if requested by major shareholders. The Chairman and the Lead Independent Director perform other duties as the Board may from time to time delegate to assist the Board in fulfilling its responsibilities. The independent directors may meet without management present at any other times as determined by the Lead Independent Director.

The Board is actively engaged and involved in talent management. The Board reviews the Company’s people strategy in support of its business strategy at least annually. This includes a detailed discussion of the Company’s leadership bench and succession plans with a focus on key positions at the senior leadership level. Annually, the CEO provides the Board with an assessment of senior executives and

2021 Proxy Statement 13

Table of Contents

their potential to succeed him, and an assessment of persons considered successors to senior executives. The Nominating and Governance Committee also recommends policies regarding succession in the event of an emergency impacting the CEO or the planned retirement of the CEO. Strong potential leaders are given exposure and visibility to Board members through formal presentations and informal events. More broadly, the Board reviews and evaluates human capital metrics, strategic objectives and other initiatives with respect to the overall workforce, including diversity, recruiting and development programs.

To foster our value of always learning – always teaching, the Corporate Governance Guidelines encourage director education. Upon initial election to the Board of Directors, the Company’s management conducts an orientation program of materials and briefing sessions to educate new directors about the Company’s business and other topics to assist them in carrying out their duties. Directors may also attend a variety of external continuing education programs of their own selection at the Company’s expense. In addition, the Board receives regular updates from management and external experts regarding new developments in corporate governance, legal developments or other appropriate topics from time to time.

14 Darden Restaurants, Inc.

Table of Contents

Board Role in Oversight of Risk Management

|

Full Board The ultimate responsibility for risk oversight rests with the Board. The Board assesses major risks facing the Company and reviews options for their mitigation. Each Committee of the Board reviews the policies and practices developed and implemented by management to assess and manage risks relevant to the Committee’s responsibilities, and reports to the Board about its discussions.

|

|

Audit Committee |

Compensation Committee |

Finance Committee |

Nominating and Governance Committee | |||||||||||||||||||

|

oversees the Company’s financial reporting processes and internal controls, including the process for assessing risk of fraudulent financial reporting and significant financial risk exposures, and the steps management has taken to monitor and report those exposures. In addition to its other duties, the Audit Committee oversees the Company’s policies and procedures regarding compliance with applicable laws and regulations and the Company’s Codes of Business Conduct and Ethics. The Audit Committee also oversees the Company’s enterprise risk management (ERM) process and the comprehensive assessment of key financial, operational and regulatory risks identified by management, including cybersecurity and data protection risks. The Audit Committee discusses ERM with the full Board, which is ultimately responsible for oversight of this process. |

(i) provides oversight of the risks associated with the Compensation Committee responsibilities in its charter; (ii) reviews the Company’s incentive and other compensation arrangements to confirm that compensation does not encourage unnecessary or excessive risk taking and reviews and discusses, at least annually, the relationship between risk management policies and practices, corporate strategy and executive compensation; and (iii) discusses with the Company’s management the results of its review and any disclosures required by Item 402(s) of Regulation S-K relating to the Company’s compensation risk management. |

oversees the Company’s major financial risk exposures and management’s monitoring, mitigation activities and policies in connection with financial risk, including: capital structure; investment portfolio, including employee benefit plan investments; financing arrangements, credit and liquidity; proposed major transactions, such as mergers, acquisitions, reorganizations and divestitures; share repurchase programs; hedging or use of derivatives; commodity risk management; cash investment; liquidity management; short-term borrowing programs; interest rate risk; foreign exchange risk; off balance sheet arrangements, if any; proposed material financially-related amendments to the Company’s indentures, bank borrowings and other instruments; and reputational risk to the extent such risk arises from the topics under discussion. The Finance Committee also reviews for adequacy the insurance coverage on the Company’s assets.

|

oversees risks related to the Company’s corporate governance; director succession planning; political and charitable contributions; insider trading; environmental and social responsibility; and reputational risk to the extent such risk arises from the topics under discussion. | |||||||||||||||||||

2021 Proxy Statement 15

Table of Contents

Compliance and Ethics Office and Codes of Business Conduct and Ethics

Our Compliance and Ethics Office (Compliance Office), with the support of our management and Board, aims to ensure that all of our employees, business partners, franchisees and suppliers adhere to high ethical business standards, and is under the direction of our Senior Vice President, General Counsel, Chief Compliance Officer and Corporate Secretary. At the core of the Compliance Office is our Code of Conduct that applies to all Company employees (Employee Code of Conduct). We also have a Code of Ethics for CEO and Senior Financial Officers (CEO and Senior Financial Officer Code of Ethics) that highlights specific responsibilities of our CEO and senior financial officers, and a Code of Business Conduct and Ethics for Members of the Board of Directors (the Board Code of Conduct, and together with the Employee Code of Conduct and the CEO and Senior Financial Officer Code of Ethics, our Codes of Business Conduct and Ethics). A major objective of the Compliance Office is to educate and raise awareness of our Employee Code of Conduct, applicable regulations, and related policies. Our Codes of Business Conduct and Ethics are posted on our website at www.darden.com under Investors — Governance. We require all of our officers, director-level employees, and certain other employees to complete an annual training course and certification regarding compliance with the Employee Code of Conduct and other Company policies. Any amendment to, or waiver of, the Codes of Business Conduct and Ethics as they relate to a member of the Board of Directors, the CEO, the Chief Financial Officer, any senior financial officer or any executive officer listed in the “Stock Ownership of Management” section of this Proxy Statement will be disclosed promptly by posting such amendment or waiver on our website at www.darden.com under Investors — Governance.

We promote ethical behavior by encouraging our employees to talk to supervisors or other personnel when in doubt about the best course of action in a particular situation. To encourage employees to raise questions and report possible violations of laws or our Codes of Business Conduct and Ethics, we will not allow retaliation for reports made in good faith. We also provide a confidential hotline to allow employees to confidentially, anonymously report concerns regarding questionable accounting behavior. We are also committed to promoting compliance and ethical behavior by the third parties with whom we conduct business, and have implemented Codes of Business Conduct that are acknowledged by our international franchisees and certain suppliers.

16 Darden Restaurants, Inc.

Table of Contents

Executive Officers of the Registrant

Our executive officers as of the date of this Proxy Statement are listed below.

| Eugene I. Lee, Jr., age 60

|

Our Chairman of the Board and Chief Executive Officer since January 2021, after serving as the Company’s President and CEO since 2015. Prior to that, Mr. Lee served as President and Interim CEO since October 2014, and as President and COO of the Company from September 2013 to October 2014. He served as President, Specialty Restaurant Group from our acquisition of RARE in 2007 to 2013. Prior to the acquisition, he served as RARE’s President and COO from 2001 to 2007. From 1999 until 2001, he served as RARE’s Executive Vice President and COO. | |

| Matthew R. Broad, age 61

|

Our Senior Vice President, General Counsel, Chief Compliance Officer and Corporate Secretary since 2015. Prior to joining Darden, he served as Executive Vice President, General Counsel and Chief Compliance Officer for OfficeMax, Incorporated from 2004 to 2013. Prior to that, he was Associate General Counsel with Boise Cascade Corporation from 1989 to 2004. | |

| Todd A. Burrowes, age 58

|

Our President, LongHorn Steakhouse since 2015. He rejoined the Company after serving as President, Ruby Tuesday Concept and Chief Operations Officer of Ruby Tuesday, Inc. from 2013 to 2015. Prior to that, he served as Executive Vice President of Operations for LongHorn Steakhouse from 2008 until 2013. He joined the Company in 2002 as Regional Manager of LongHorn Steakhouse before being promoted to Director of Management Training. In 2004, he was promoted to Regional Vice President of Operations for LongHorn Steakhouse. | |

| Ricardo Cardenas, age 53

|

Our President and Chief Operating Officer since January 2021. Prior to that, Mr. Cardenas served as Senior Vice President, Chief Financial Officer since 2016. He was Senior Vice President, Chief Strategy Officer of the Company from 2015 to 2016, prior to which he served as Senior Vice President, Finance, Strategy and Technology from 2014 to 2015. He was Executive Vice President of Operations for LongHorn Steakhouse from 2013 to 2014 and Senior Vice President of Operations for LongHorn Steakhouse’s Philadelphia Division from 2012 to 2013. He served as Senior Vice President of Finance for Red Lobster, which the Company previously owned, from 2010 to 2012. Mr. Cardenas originally joined the Company in 1984 as an hourly employee and served in various positions of increasing responsibility, including Vice President of Finance for Olive Garden, prior to the positions described above. | |

2021 Proxy Statement 17

Table of Contents

| Susan M. Connelly,

|

Our Senior Vice President, Chief Communications and Public Affairs Officer since 2019. She served as Senior Vice President, Communications and Corporate Affairs from 2015 to 2019. She joined the Company in 2007 as Director, State and Local Government Relations and was promoted to Vice President, Government Relations in 2014. | |

| Daniel J. Kiernan,

|

Our President, Olive Garden since 2018, prior to which he was our Executive Vice President of Operations for Olive Garden since 2011. He began his career with Olive Garden in 1992 as a Manager in Training and has held a series of roles of increasing responsibility with Olive Garden, serving as a General Manager from 1993 to 1994, as Director of Operations from 1994 to 2002, as Senior Vice President of the Chicago Division from 2002 to 2008 and as Senior Vice President, Operations Excellence from 2008 to 2011. | |

| Sarah H. King, age 51

|

Our Senior Vice President, Chief People and Diversity Officer since May 2021, prior to which she served as Senior Vice President, Chief Human Resources Officer since 2017. Prior to joining Darden, Sarah spent 19 years with Wyndham Worldwide Corporation in various human resources leadership positions worldwide. Most recently, from 2010 through 2017, she served as Executive Vice President, Human Resources for Wyndham Vacation Ownership. | |

| John W. Madonna,

|

Our Senior Vice President, Corporate Controller since 2016, prior to which he served as our Senior Vice President, Accounting since 2015. Prior to that, he was a Director in Corporate Reporting from 2010 through 2013 when he was promoted to Senior Director, Corporate Reporting and then to Vice President of Corporate Reporting in 2014. He joined the Company in 2005 as Manager, Corporate Reporting. He joined the LongHorn Steakhouse team in 2009 as Manager, Financial Planning & Analysis. | |

| M. John Martin,

|

Our President, Specialty Restaurant Group since August 2020. Prior to that appointment, he served as President of Seasons 52 since 2018, President of Eddie V’s since 2014 and President of The Capital Grille since 2004. He joined The Capital Grille in 1990 and held several positions of increasing responsibility before being promoted to Vice President of Operations in 2001. | |

18 Darden Restaurants, Inc.

Table of Contents

| Douglas J. Milanes,

|

Our Senior Vice President, Chief Supply Chain Officer since 2015, prior to which he served as Senior Vice President, Purchasing since 2013. Prior to joining Darden, Doug served as Vice President, Global Procurement and Operations for Pfizer Inc. from 2008 to 2012 and as Chief Financial Officer for Pfizer’s Capsugel Division from 2005 to 2008. | |

| Richard L. Renninger,

|

Our Senior Vice President, Chief Development Officer since 2016. Prior to joining Darden, he was Chief Development Officer for First Watch Restaurants, Inc., from 2012 to 2016. Prior to that, he served as Executive Vice President & Chief Development Officer for OSI Restaurant Partners (now Bloomin’ Brands, Inc.) from 2008 to 2012 and their Senior Vice President of Real Estate and Development from 2005 to 2008. Prior to joining OSI, he served as Vice President of Real Estate for RARE from 2002 to 2005. | |

| Rajesh Vennam,

|

Our Senior Vice President, Chief Financial Officer and Treasurer since January 2021. Prior to that, he served as Senior Vice President, Corporate Finance and Treasurer of the Company since September 2020. He served as Senior Vice President, Finance and Analytics from May 2016 through September 2020. From November 2014 through May 2016, Mr. Vennam served as Vice President, Financial Planning and Analysis and Investor Relations for The Fresh Market, Inc., a specialty grocery retailer which during the period of Mr. Vennam’s service was publicly traded on the NASDAQ exchange. From 2013 to 2014, Mr. Vennam served in a variety of roles at Red Lobster, ultimately serving as Senior Vice President of Financial Planning & Analysis and Treasury of Red Lobster Hospitality, LLC, the entity to which the Company sold its Red Lobster restaurants in 2014. From 2010 through 2013, Mr. Vennam served as Director of Financial Planning & Analysis for LongHorn Steakhouse. Mr. Vennam joined the Company in 2003 and served in a variety of positions of increasing responsibility, including as a Manager of Treasury prior to the positions described above. | |

2021 Proxy Statement 19

Table of Contents

|

|

Election of Eight Directors from the Named Director Nominees

Our Board of Directors currently has eight members, and each director stands for election every year. The Nominating and Governance Committee believes that an eight member Board of Directors is currently appropriate for Darden. In keeping with good governance practices, the Board will continue to seek a diversity of talent and experience to draw upon and to ensure its ability to appropriately staff committees of the Board. The Board also will continue to self-evaluate and to consider various matters as to its size. As appropriate, the Board may determine to increase or decrease its size, including in order to accommodate the availability of an outstanding candidate.

The following eight director nominees are standing for election at this 2021 Annual Meeting of Shareholders to hold office until the 2022 Annual Meeting of Shareholders or until their successors are elected and qualified. All were nominated at the recommendation of our Nominating and Governance Committee and all have previously served on the Board. Each of the director nominees has consented to being named in this Proxy Statement and to serve as a director if elected. If a director nominee is not able to serve, proxies may be voted for a substitute nominated by the Board. However, we do not expect this to occur.

|

✓

|

Your Board recommends that you vote FOR each of the nominees to the Board.

|

20 Darden Restaurants, Inc.

Table of Contents

Board Nominees

The following information is as of the date of this Proxy Statement. Included is information provided by each nominee, such as his or her age, all positions currently held, principal occupation and business experience for the past five years, and the names of other publicly-held companies of which he or she currently serves as a director or has served as a director during the past five years. In addition to the specific information presented below regarding the experience, qualifications, attributes and skills that led our Board to the conclusion that the nominee should serve as a director, we also believe that each of our director nominees has a reputation for integrity, honesty and adherence to high ethical standards. Darden’s mission is to be financially successful through great people consistently delivering outstanding food, drinks and service in an inviting atmosphere making every guest loyal. This mission is supported by our core values of integrity and fairness, respect and caring, inclusion and diversity, always learning – always teaching, being “of service,” teamwork and excellence. As noted in our Corporate Governance Guidelines, our directors should reflect these core values, possess the highest personal and professional ethics, and be committed to representing the long-term interests of our shareholders. They must also have an inquisitive and objective perspective, practical wisdom and mature judgment.

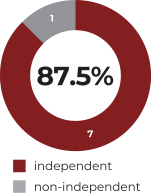

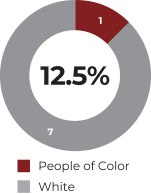

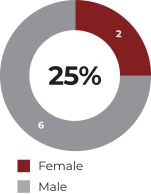

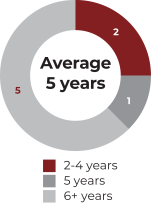

Board Summary

8 Nominees

| Independence | Racial/Ethnic Diversity | Gender Diversity | Tenure | |||

|

|

|

| |||

2021 Proxy Statement 21

Table of Contents

Biographies

|

|

|

|

MARGARET SHÂN ATKINS

Ms. Atkins is a retired consumer and retail executive. She was most recently Co-Founder and Managing Director of Chetrum Capital LLC, a private investment firm, a position she held from 2001 through 2017. Prior to founding Chetrum, she spent most of her executive career in the consumer/retail sector, including various positions with Sears, Roebuck & Co., a major North American retailer where she was promoted to Executive Vice President in 1999, and fourteen years with Bain & Company, an international management consultancy, where she was a leader in the global consumer and retail practice. She began her career as a public accountant at what is now PricewaterhouseCoopers LLP, a major accounting firm, and holds designations as a Chartered Professional Accountant and Chartered Accountant (Ontario) and as a Certified Public Accountant (Illinois).

Current Public Directorships:

• SpartanNash Company, a national grocery wholesaler/retailer and distributor of food products to the worldwide U.S. military commissary system, since 2003 • Aurora Cannabis, Inc., one of the world’s largest and leading cannabis companies, since 2019

Prior Public Board Service Within the Past Five Years:

• SunOpta, Inc., a North American manufacturer of natural and organic food products, from 2014 to 2019 • LSC Communications, Inc., a leading provider of long and short-run printing services to the book, catalog and magazine publishing industries, from 2016 to 2021

Qualifications:

The Nominating and Governance Committee concluded that Ms. Atkins is qualified and should serve, in part, because of her retail industry, operations, strategic planning and financial expertise, and public-company director experience. | |||||||

|

Age 64 |

Tenure 6 |

|||||||||

|

Independent Director Director since 2014 |

||||||||||

|

Darden Committees: • Audit • Nominating and Governance

|

||||||||||

|

JAMES P. FOGARTY

Mr. Fogarty has been the CEO at FULLBEAUTY Brands, Inc., a privately-held branded multi-channel retailer focused on fashion apparel and home goods for plus-sized women and men, since June 2019. Previously, he was the CEO and a director of Orchard Brands, a multi-channel marketer of apparel and home products, from 2011 until its sale in 2015, at which time he became a Senior Advisor to Bluestem Group Inc., the acquirer of Orchard Brands, through 2015. Prior to that, Mr. Fogarty was a private investor from 2010 to 2011. From 2009 until 2010, Mr. Fogarty was President, CEO and director of Charming Shoppes, Inc., a multi-brand, specialty apparel retailer. Other prior executive positions held by Mr. Fogarty include Managing Director of Alvarez & Marsal, an independent global professional services firm, from 1994 until 2009, President and COO of Lehman Brothers Holdings (subsequent to its Chapter 11 bankruptcy filing) from 2008 until 2009, President and CEO of American Italian Pasta Company, the largest producer of dry pasta in North America, from 2005 through 2008, CFO of Levi Strauss & Co., a brand-name apparel company, from 2003 until 2005, and from 2001 through 2003, he served as Senior Vice President and CFO and for a period as a director of The Warnaco Group, a global apparel maker.

Current Public Directorships:

None

Prior Public Board Service Within the Past Five Years:

• Assertio Therapeutics, Inc. (formerly known as Depomed Inc.), a specialty pharmaceutical company, Chairman of the Board from 2016 to 2020 through its merger with Zyla Life Sciences

Qualifications:

The Nominating and Governance Committee concluded that Mr. Fogarty is qualified and should serve, in part, because of his operational and turnaround experience, and his significant executive officer and director experience at a variety of public and private companies. | |||||||||

|

Age 53 |

Tenure 6 |

|||||||||

|

Independent Director Director since 2014 |

||||||||||

|

Darden Committees: • Compensation (Chairperson) • Finance

|

||||||||||

22 Darden Restaurants, Inc.

Table of Contents

|

|

|

|

CYNTHIA T. JAMISON

Ms. Jamison is a retired turnaround CFO. She most recently served as CFO of AquaSpy, Inc. from 2010 to 2013. Prior to AquaSpy she held six other CFO and/or COO roles in both public and private companies as a Partner with Tatum, LLC, an executive services firm focusing exclusively on providing interim CFO Services to public and private equity companies. She also led the CFO Practice at Tatum for four years where she had responsibility for over 300 CFO Partners and sat on the firm’s Operating Committee. Prior to joining Tatum, she served as CFO of Chart House Enterprises, a publicly traded restaurant company, from 1998-1999 and previously held various executive positions at Allied Domecq Retailing USA, Kraft General Foods, and Arthur Andersen. She holds the designation of Certified Public Accountant (Illinois); in addition, she is an NACD Fellow and a frequent faculty member at NACD Master Classes.

Current Public Directorships:

• Tractor Supply Company (Non-Executive Chairman), an operator of retail farm and ranch stores, director since 2002 • The ODP Corporation, parent of Office Depot, Inc., a global supplier of office products and services, since 2013 • Big Lots, Inc., a discount retailer, since 2015

Prior Public Board Service Within the Past Five Years:

None

Qualifications:

The Nominating and Governance Committee concluded that Ms. Jamison is qualified and should serve, in part, because of her status as a financial expert and experienced audit committee member and chair, as well as her senior management, leadership, financial and strategic planning, corporate governance and public company executive compensation experience. | |||||||

|

Age 61 |

Tenure 6 |

|||||||||

|

Independent Director Director since 2014 |

||||||||||

|

Darden Committees: • Audit (Chairperson) • Compensation • Finance

|

||||||||||

|

EUGENE I. LEE, JR.

Mr. Lee was named Chairman and Chief Executive Officer in January 2021 after serving as the Company’s President and CEO since 2015. Prior to that, Mr. Lee served as President and Interim CEO since October 2014, and as President and COO of the Company from September 2013 to October 2014. He served as President, Specialty Restaurant Group from our acquisition of RARE from 2007 to 2013. Prior to the acquisition, he served as RARE’s President and COO from 2001 to 2007. From 1999 until 2001, he served as RARE’s Executive Vice President and COO.

Current Public Directorships:

• Advance Auto Parts, Inc. (independent Chair of the Board), a leading automotive aftermarket parts provider in North America, director since 2015

Prior Public Board Service Within the Past Five Years:

None

Qualifications:

The Nominating and Governance Committee concluded that Mr. Lee is qualified and should serve, in part, because of his extensive senior management and leadership experience with our Company. | |||||||||

|

Age 60 |

Tenure 5 |

|||||||||

|

Chairman and

Chief Director since 2015 |

||||||||||

|

Darden Committees: None

|

||||||||||

2021 Proxy Statement 23

Table of Contents

|

|

|

|

NANA MENSAH

Mr. Mensah has been the Chairman and Chief Executive Officer of ‘XPORTS, Inc., a privately held company that exports food packaging and food processing equipment to distributors and wholesalers outside of the United States, since 2005, and previously served as Chief Executive Officer during 2003 and from 2000 through 2002. He has extensive experience as a restaurant operations executive including serving as the Chief Operating Officer of Church’s Chicken, a division of AFC Enterprises, Inc. and one of the world’s largest quick-service restaurant chains, from 2003 to 2004, and as President and Chief Operating Officer of Long John Silver’s Restaurants, Inc., the world’s largest chain of seafood quick-service restaurants, from 1997 until it was sold in 1999. Additionally, Mr. Mensah has served as President, U.S. Tax Services of H&R Block Inc., a tax, mortgage and financial services company, from January 2003 until March 2003.

Current Public Directorships:

None

Prior Public Board Service Within the Past Five Years:

• Reynolds American, Inc., the parent company of R.J. Reynolds Tobacco Company, the second-largest U.S. tobacco company, and of other companies that manufacture or sell tobacco, smokeless tobacco, nicotine replacement therapy and digital vapor products, from 2004 to 2017

Qualifications:

The Nominating and Governance Committee concluded that Mr. Mensah is qualified and should serve, in part, because of his extensive experience in the restaurant industry, including operating, turnaround, international and mergers and acquisitions and his experience as a public company director.

| |||||||

| Age 69 |

Tenure 4 |

|||||||||

|

Independent Director Director since 2016 |

||||||||||

|

Darden Committees: • Compensation • Finance (Chairperson)

|

||||||||||

|

WILLIAM S. SIMON

Mr. Simon has been Senior Advisor to KKR & Co., an investment firm, since 2014, and President of WSS Venture Holdings, LLC, a consulting and investment company, since 2014. Mr. Simon is the former Executive Vice President of Wal-Mart Stores, Inc., a global retailer, and former President and CEO of Walmart U.S., the largest division of Wal-Mart Stores, Inc., which consists of retail department stores, from 2010 to 2014. Mr. Simon also served as Executive Vice President and COO of Walmart U.S. from 2007 to 2010 and Executive Vice President of Professional Services and New Business Development from 2006 to 2007. Prior to joining Walmart, Mr. Simon held senior executive positions at Brinker International, Inc., a casual dining restaurant company, Diageo North America, Inc., a multinational alcoholic beverages company, and Cadbury Schweppes plc, a multinational confectionery company. Mr. Simon also served as Secretary of the Florida Department of Management Services and served 25 years in the U.S. Navy and Naval Reserves.

Current Public Directorships:

• Equity Distribution Acquisition Corp., a special purpose acquisition company, director since 2020 • HanesBrands Inc., a global manufacturer of apparel, director since 2021

Prior Public Board Service Within the Past Five Years:

• Agrium, Inc., an agricultural products manufacturer and retailer (now Nutrien, Ltd.), from 2016 to 2017 • Anixter International, Inc., a global distributor of communication and security products, electrical wire and cable, from 2019 to 2020 • Chico’s FAS, Inc., an apparel retailer, from 2016 to 2021 • GameStop Corp., a global video game retailer, from 2020 to 2021 • Academy Sports and Outdoors, Inc., a premier sports, outdoor and lifestyle retailer, from 2020 to 2021

Qualifications:

The Nominating and Governance Committee concluded that Mr. Simon is qualified and should serve, in part, because of his senior level executive experience in large, complex, retailing and global brand management companies and his extensive experience in retail operations, food service and restaurants, as well as consumer packaged goods.

| |||||||||

| Age 61 |

Tenure 6 |

|||||||||

|

Independent Director Director since 2014; previously served from 2012 until 2014 and rejoined in October 2014 |

||||||||||

|

Darden Committees: • Audit • Nominating and

|

||||||||||

24 Darden Restaurants, Inc.

Table of Contents

|

|

|

|

CHARLES M. SONSTEBY

Mr. Sonsteby is the retired Vice Chairman of The Michaels Companies, Inc., the largest arts and crafts specialty retailer in North America and parent company of Michaels Stores, Inc., a role he held from June 2016 until his retirement in October 2017. He had served as CFO and Chief Administrative Officer of that company and its predecessor from 2010 to 2016. Prior to that, Mr. Sonsteby served as the CFO and Executive Vice President of Brinker International, Inc., a casual dining restaurant company, from 2001 to 2010. He joined Brinker in 1990 as Director of the Tax, Treasury and Risk Management departments and thereafter served in various capacities, including as Senior Vice President of Finance from 1997 to 2001 and as Vice President and Treasurer from 1994 to 1997.

Current Public Directorships:

• Valvoline, Inc., a producer and distributor of industrial and automotive lubricants and automotive chemicals, since 2016

Prior Public Board Service Within the Past Five Years:

None

Qualifications:

The Nominating and Governance Committee concluded that Mr. Sonsteby is qualified and should serve, in part, because of his restaurant operations and executive leadership experience with several major brands, and his experience as a public company director. | |||||||

|

Age 67 |

Tenure 6 |

|||||||||

|

Lead Independent Director Director since 2014 |

||||||||||

|

Darden Committees: None

|

||||||||||

|

TIMOTHY J. WILMOTT

Mr. Wilmott is the retired Chief Executive Officer of Penn National Gaming, Inc., an operator or owner of gaming and racing facilities and video gaming terminal operations with a focus on slot machine entertainment, a role he held from 2013 until his retirement in December 2019. Prior to that, Mr. Wilmott served as President and Chief Operating Officer from 2008 to 2013. Prior to joining Penn National Gaming, Mr. Wilmott served as Chief Operating Officer of Harrah’s Entertainment, Inc. (now Caesars Entertainment, Inc.) from 2003 through 2007 and Division President, Eastern Division from 1997 to 2003. Prior to that, Mr. Wilmott held various management positions at Harrah’s properties from 1988 through 1997.

Current Public Directorships:

None

Prior Public Board Service Within the Past Five Years:

• Penn National Gaming, Inc., from 2014 to 2019

Qualifications:

The Nominating and Governance Committee concluded that Mr. Wilmott is qualified and should serve, in part, because of his entertainment business operations and executive leadership experience, and his experience as a public company director. | |||||||||

|

Age 63 |

Tenure 2 |

|||||||||

|

Independent Director Director since 2018 |

||||||||||

|

Darden Committees: • Compensation • Nominating and Governance

|

||||||||||

2021 Proxy Statement 25

Table of Contents

Advisory Approval of the Company’s Executive Compensation

In accordance with SEC rules, the Board asks shareholders for advisory approval of the Company’s executive compensation on an annual basis. Accordingly, we are asking our shareholders to provide an advisory, nonbinding vote to approve the compensation awarded to our NEOs, as we have described it in the “Compensation Discussion and Analysis” and “Executive Compensation” sections of this Proxy Statement.

As described in detail in the “Compensation Discussion and Analysis” section, the Compensation Committee oversees the executive compensation program and compensation awarded, adopting changes to the program and awarding compensation as appropriate to reflect Darden’s circumstances and to promote the main objectives of the program. These objectives include: to help us attract, motivate, reward and retain superior leaders who are capable of creating sustained value for our shareholders, and to promote a performance-based culture that is intended to align the interests of our executives with those of our shareholders.

We are asking our shareholders to indicate their support for our NEO compensation. We believe that the information we have provided in this Proxy Statement demonstrates that our executive compensation program was designed appropriately and is working to ensure that management’s interests are aligned with our shareholders’ interests to support long-term value creation.

You may vote for or against the following resolution, or you may abstain. This vote is not intended to address any specific item of compensation, but rather the overall compensation of our NEOs and the philosophy, policies and procedures described in this Proxy Statement.

Resolved, that the compensation awarded to Darden’s NEOs for fiscal 2021, as disclosed in this Proxy Statement pursuant to SEC rules, including the Compensation Discussion and Analysis, compensation tables and related narrative discussion, is hereby APPROVED.

While this vote is advisory and not binding on our Company, the Board and the Compensation Committee expect to consider the outcome of the vote, along with other relevant factors, when considering future executive compensation decisions.

|

✓

|

Your Board recommends that you vote FOR approval of the foregoing resolution.

|

26 Darden Restaurants, Inc.

Table of Contents

Ratification of Appointment of Independent Registered Public Accounting Firm

The Audit Committee of the Board is responsible for the appointment, compensation, retention and oversight of the independent registered public accounting firm. The Audit Committee has appointed KPMG LLP (KPMG) as our independent registered public accounting firm for the fiscal year ending May 29, 2022. KPMG has served as our independent registered public accounting firm continuously since 1996.

The Audit Committee annually reviews KPMG’s qualifications, performance, independence and fees in making its decision whether to engage KPMG. The focus of the process is to select and retain the most qualified firm to perform the annual audit. During the review and selection process, the Audit Committee considers a number of factors, including:

| • | Recent and historical KPMG audit performance; |

| • | The relevant experience, expertise and capabilities of KPMG and our specific audit engagement team in relation to the nature and complexity of our business; |

| • | A review of KPMG’s independence and internal quality controls; |

| • | Any legal or regulatory proceedings that raise concerns about KPMG’s qualifications or ability to continue to serve as our independent auditor, including reports, findings and recommendations of the Public Company Accounting Oversight Board (PCAOB); |

| • | The appropriateness of KPMG’s fees for audit and non-audit services; and |

| • | The length of time that KPMG has served as our independent auditor, the benefits of maintaining a long-term relationship and controls and policies for ensuring that KPMG remains independent. |

In order to assure continuing auditor independence, in conjunction with the assessment above and the mandated rotation of the audit firm’s lead engagement partner, the Audit Committee and its chairperson are involved when the selection of a new lead engagement partner is required. In addition, the Audit Committee is responsible for the audit fee negotiations with KPMG.

Based on its annual review, the Audit Committee and the Board believe that the continued retention of KPMG to serve as the Company’s independent registered public accounting firm is in the best interests of the Company and its shareholders.

Shareholder approval of this appointment is not required, but the Board is submitting the selection of KPMG for ratification in order to obtain the views of our shareholders. If the appointment is not ratified, the Audit Committee will reconsider its selection. Even if the appointment is ratified, the Audit Committee, which is solely responsible for appointing and terminating our independent registered public accounting firm, may in its discretion, direct the appointment of a different independent registered public accounting firm at any time during the year if it determines that such a change would be in the best interests of the Company and its shareholders. Representatives of KPMG are expected to be in attendance online at the Annual Meeting and will be given an opportunity to make a statement and to respond to appropriate questions by shareholders.

|

✓ |

Your Board recommends that you vote FOR ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending May 29, 2022.

|

2021 Proxy Statement 27

Table of Contents

Approval of Amended Employee Stock Purchase Plan