Form S-4/A Royalty Pharma plc

Table of Contents

As filed with the Securities and Exchange Commission on July 1, 2021

Registration No. 333-257188

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Royalty Pharma plc*

(Exact Name of Registrant as Specified in Its Articles of Association)

| England and Wales | 2834 | 98-1535773 | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

110 East 59th Street

New York, New York 10022

(212) 883-0200

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Pablo Legorreta

Chief Executive Officer

110 East 59th Street

New York, New York 10022

(212) 883-0200

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

Copy to:

Richard D. Truesdell, Jr., Esq.

Davis Polk & Wardwell LLP

450 Lexington Avenue

New York, New York 10017

(212) 450-4000

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer;” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check One)

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ | Smaller reporting company | ☐ | |||

| Emerging growth company | ☐ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) ☐

Exchange Act Rule 14d-l(d) (Cross-Border Third-Party Tender Offer) ☐

| * | A subsidiary of Royalty Pharma plc is also a registrant and is identified on the following page |

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title Of Each Class Of Securities To Be Registered |

Amount To Be Registered |

Proposed Maximum Offering Price Per Unit(1) |

Proposed Maximum Aggregate Offering Price(2) |

Amount Of Registration Fee(3) | ||||

| 0.750% Senior Notes due 2023 |

$1,000,000,000 | 100% | $1,000,000,000 | $109,100 | ||||

| 1.200% Senior Notes due 2025 |

$1,000,000,000 | 100% | $1,000,000,000 | $109,100 | ||||

| 1.750% Senior Notes due 2027 |

$1,000,000,000 | 100% | $1,000,000,000 | $109,100 | ||||

| 2.200% Senior Notes due 2030 |

$1,000,000,000 | 100% | $1,000,000,000 | $109,100 | ||||

| 3.300% Senior Notes due 2040 |

$1,000,000,000 | 100% | $1,000,000,000 | $109,100 | ||||

| 3.550% Senior Notes due 2050 |

$1,000,000,000 | 100% | $1,000,000,000 | $109,100 | ||||

| Guarantees of 0.750% Senior Notes due 2023 |

(4) | (4) | (4) | (4) | ||||

| Guarantees of 1.200% Senior Notes due 2025 |

(4) | (4) | (4) | (4) | ||||

| Guarantees of 1.750% Senior Notes due 2027 |

(4) | (4) | (4) | (4) | ||||

| Guarantees of 2.200% Senior Notes due 2030 |

(4) | (4) | (4) | (4) | ||||

| Guarantees of 3.300% Senior Notes due 2040 |

(4) | (4) | (4) | (4) | ||||

| Guarantees of 3.550% Senior Notes due 2050 |

(4) | (4) | (4) | (4) | ||||

| Total |

$6,000,000,000 | $6,000,000,000 | $654,600 | |||||

|

| ||||||||

|

| ||||||||

| (1) | Represents the aggregate principal amount of each series of notes to be offered in the exchange offers to which the registration statement relates. |

| (2) | Represents the maximum aggregate offering price of all notes to be offered in the exchange offers to which the registration statement relates. |

| (3) | Estimated solely for the purpose of determining the amount of the registration fee in accordance with Rule 457 under the Securities Act of 1933, as amended. The Registrant previously paid this filing fee upon the filing of the Form S-4 on June 17, 2021. |

| (4) | No separate consideration will be received for the Guarantees of 0.750% Senior Notes due 2023, the Guarantees of 1.200% Senior Notes due 2025, the Guarantees of 1.750% Senior Notes due 2027, the Guarantees of 2.200% Senior Notes due 2030, the Guarantees of 3.300% Senior Notes due 2040 or the Guarantees of 3.550% Senior Notes due 2050 being registered hereby. As a result, in accordance with Rule 457(n) under the Securities Act, no registration fee is payable with respect to any of the guarantees. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

ADDITIONAL REGISTRANT

| Name |

State or Other Jurisdiction of Incorporation or Organization |

Primary Standard Industrial Classification Code Number |

I.R.S. Employer Identification Number | |||

| Royalty Pharma Holdings Ltd.* |

England and Wales | 2834 | 98-1526515 |

| * | The address, including zip code, and telephone number, including area code, of the Registrant’s principal executive offices is 110 East 59th Street, New York, New York 10022, Tel. (212) 883-0200. |

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JULY 1, 2021

PRELIMINARY PROSPECTUS

Royalty Pharma plc

Offers to Exchange

New 0.750% Notes due 2023 for 0.750% Notes due 2023,

New 1.200% Notes due 2025 for 1.200% Notes due 2025,

New 1.750% Notes due 2027 for 1.750% Notes due 2027,

New 2.200% Notes due 2030 for 2.200% Notes due 2030,

New 3.300% Notes due 2040 for 3.300% Notes due 2040 and

New 3.550% Notes due 2050 for 3.550% Notes due 2050

We are offering to exchange: (i) up to $1,000,000,000 of our new registered 0.750% Senior Notes due 2023 (the “New 2023 Notes”) for up to $1,000,000,000 of our existing unregistered 0.750% Senior Notes due 2023 (the “Old 2023 Notes”); (ii) up to $1,000,000,000 of our new registered 1.200% Senior Notes due 2025 (the “New 2025 Notes”) for up to $1,000,000,000 of our existing unregistered 1.200% Senior Notes due 2025 (the “Old 2025 Notes”); (iii) up to $1,000,000,000 of our new registered 1.750% Senior Notes due 2027 (the “New 2027 Notes”) for up to $1,000,000,000 of our existing unregistered 1.750% Senior Notes due 2027 (the “Old 2027 Notes”); (iv) up to $1,000,000,000 of our new registered 2.200% Senior Notes due 2030 (the “New 2030 Notes”) for up to $1,000,000,000 of our existing unregistered 2.200% Senior Notes due 2030 (the “Old 2030 Notes”); (v) up to $1,000,000,000 of our new registered 3.300% Senior Notes due 2040 (the “New 2040 Notes”) for up to $1,000,000,000 of our existing unregistered 3.300% Senior Notes due 2040 (the “Old 2040 Notes”); and (vi) up to $1,000,000,000 of our new registered 3.550% Senior Notes due 2050 (the “New 2050 Notes” and, collectively with the New 2023 Notes, the New 2025 Notes, the New 2027 Notes the New 2030 Notes and the New 2040 Notes, the “new notes”) for up to $1,000,000,000 of our existing unregistered 3.550% Senior Notes due 2050 (the “Old 2050 Notes” and, collectively with Old 2023 Notes, the Old 2025 Notes, the Old 2027 Notes the Old 2030 Notes and the Old 2040 Notes, the “old notes”). The terms of each series of the new notes are identical in all material respects to the terms of the applicable series of old notes, except that the new notes have been registered under the Securities Act of 1933, as amended (the “Securities Act”), and the transfer restrictions and registration rights relating to the old notes do not apply to the new notes. The new notes of each series will represent the same debt as the old notes of such series and we will issue the new notes under the same indenture.

To exchange your old notes for new notes:

| • | you are required to make the representations described on page 134 to us; and |

| • | you should read the section called “The Exchange Offers” starting on page 131 for further information on how to exchange your old notes for new notes. |

The exchange offers will expire at 5:00 P.M. New York City time on , 2021 unless it is extended.

See “Risk Factors” beginning on page 10 of this prospectus for a discussion of risk factors that should be considered by you prior to tendering your old notes in the exchange offers.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities to be issued in the exchange offers or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

, 2021

Table of Contents

| PAGE | ||||

| i | ||||

| ii | ||||

| iii | ||||

| iii | ||||

| iii | ||||

| 1 | ||||

| 10 | ||||

| 43 | ||||

| 44 | ||||

| 45 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

46 | |||

| 95 | ||||

| 113 | ||||

| 131 | ||||

| 140 | ||||

| 140 | ||||

| 141 | ||||

| 143 | ||||

| 144 | ||||

| 145 | ||||

| F-1 | ||||

| F-1 | ||||

We have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses we have prepared. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may provide you. This prospectus does not constitute an offer to sell or a solicitation of any offer to buy any security other than the registered securities to which it relates, nor does it constitute an offer to sell or a solicitation of an offer to buy any securities in any jurisdiction to any person to whom it is unlawful to make such an offer or solicitation in such jurisdiction. The information contained in this prospectus is accurate as of the date on the cover. Our business, financial condition, results of operations and prospects may have changed since then. To the extent required by applicable law, we will update this prospectus during the offering period to reflect material changes to the disclosures contained herein.

We are “incorporating by reference” information filed with the SEC into this prospectus, which means that we are disclosing important information to you by referring you to those documents. Information that is incorporated by reference is an important part of this prospectus. We incorporate by reference into this prospectus the documents listed below and any future filings made with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) prior to the termination of the esxchange offers, and such documents form an integral part of this prospectus:

| • | our Annual Report on Form 10-K for the fiscal year ended December 31, 2020 (the “Annual Report”), filed with the SEC on February 24, 2021 (including the information specifically incorporated by reference therein from our Definitive Proxy Statement on Schedule 14A, filed with the SEC on April 29, 2021); |

| • | our Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2021 (the “Quarterly Report”), filed with the SEC on May 11, 2021; and |

i

Table of Contents

| • | our Current Reports on Form 8-K filed with the SEC on February 3, 2021, June 2, 2021 and June 25, 2021. |

Unless specifically stated to the contrary, none of the information that we disclose under Items 2.02 or 7.01 of any Current Report on Form 8-K that we may from time to time furnish to the SEC or any other document or information deemed to have been furnished and not filed with the SEC will be incorporated by reference into, or otherwise included in, this prospectus.

Any statement contained in this prospectus or in a document (or part thereof) incorporated or considered to be incorporated by reference in this prospectus shall be considered to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus or in any other subsequently filed document (or part thereof) that is or is considered to be incorporated by reference in this prospectus modifies or supersedes that statement. The modifying or superseding statement need not state that it has modified or superseded a prior statement or include any other information set forth in the document that it modifies or supersedes. Any statement so modified or superseded shall not be considered, except as so modified or superseded, to constitute any part of this prospectus.

You may request copies of each of the documents incorporated by reference into this prospectus (other than an exhibit to a filing unless that exhibit is specifically incorporated by reference into that filing) at no cost by writing or telephoning the office of Investor Relations, Royalty Pharma plc, 110 East 59th Street, New York, NY 10022, (212) 883-0200.

Except in “Description of the Notes” and “The Exchange Offers” and where the context otherwise requires, in this prospectus, the terms “Royalty Pharma,” “Royalty Pharma Investments,” “RPI,” the “Company,” “we,” “us,” the “Issuer” and “our” refer to Royalty Pharma plc, an English public limited company incorporated under the laws of England and Wales, and its subsidiaries on a consolidated basis. The “Manager” refers to RP Management, LLC, a Delaware limited liability company, our external advisor which provides us with all advisory and day-to-day management services.

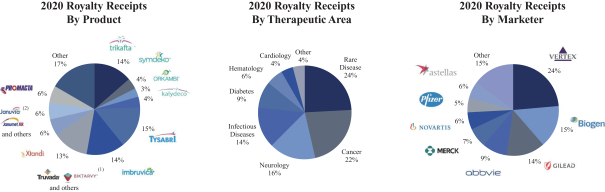

Unless the context otherwise requires, “our royalties,” “our product portfolio” and “our interests in products” refer to our contractual interests in revenue streams from the sale of biopharmaceutical products. When we refer to the “royalty receipts” generated by our portfolio, we are referring to the summation of the following line items from our Statement of Cash Flows prepared in accordance with U.S. Generally Accepted Accounting Principles (“GAAP”): Cash collections from financial royalty assets, Cash collections from intangible royalty assets, Other royalty cash collections, Distributions from non-consolidated affiliates, and Proceeds from available for sale debt securities. When we discuss our acquisition of royalties, this includes various structures, including third-party royalties and similar payment streams such as earn-outs that are tied to sales of biopharmaceutical products, synthetic or hybrid royalties, research and development (“R&D”) funding and acquisitions of companies that own significant royalties and similar payment streams, as described further in “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Uses of Capital.” Acquisitions of royalties can be accounted for in several ways, typically as a financial asset or an intangible asset. Within the financial asset classification, we acquire royalties on both approved products and development-stage product candidates. Beyond financial assets and intangible assets, we may also acquire royalties through an equity investment where our underlying investee is partnering with biopharmaceutical companies to jointly develop a product for which marketing and commercialization is or will be the responsibility of such biopharmaceutical company partner. Alternatively, we may acquire other contractual rights to royalty streams classified as financial instruments, such as acquisitions of earnout payments representing an indirect interest in sales of a pharmaceutical product. Our historical investment in Biogen’s Tecfidera, classified as available for sale debt securities, was one such example. Finally, royalties can arise through our research and development funding arrangements, whereby royalty revenue is generated through royalties or milestones we are entitled to on products coming out of our research and development collaboration arrangements.

ii

Table of Contents

Unless otherwise indicated, all references in this prospectus to monetary amounts are to U.S. dollars. Certain monetary amounts, percentages and other figures included elsewhere in this prospectus have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables or charts may not be the arithmetic aggregation of the figures that precede them, and figures expressed as percentages in the text may not total 100% or, as applicable, when aggregated may not be the arithmetic aggregation of the percentages that precede them.

This prospectus includes industry and market data that we obtained from periodic industry publications, third-party studies and surveys, filings of public companies in our industry and internal company data. These sources include government and industry sources. Industry publications and surveys generally state that the information contained therein has been obtained from sources believed to be reliable. Although we believe the industry and market data to be reliable as of the date of this prospectus, this information could prove to be inaccurate. Industry and market data could be wrong because of the method by which sources obtained their data and because information cannot always be verified with complete certainty due to the limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties. In addition, we do not know all of the assumptions regarding general economic conditions or growth that were used in preparing the forecasts from the sources relied upon or cited herein. We cannot guarantee the accuracy or completeness of such information contained in this prospectus.

This prospectus contains trademarks, service marks and trade names of third parties or their products, which are the property of their respective owners. Our use or display of third parties’ trademarks, service marks, trade names or products in this prospectus is not intended to, and should not be read to, imply a relationship with or endorsement or sponsorship of us. Solely for convenience, the trademarks, service marks and trade names referred to in this prospectus may appear without the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks, service marks and trade names.

In this prospectus, we have included financial measures that are compiled in accordance with U.S. Generally Accepted Accounting Principles (“GAAP”) as well as certain non-GAAP financial measures. These non-GAAP financial measures include Adjusted Cash Receipts, Adjusted EBITDA and Adjusted Cash Flow, which are each presented as supplemental measures to our GAAP financial performance.

These non-GAAP financial measures exclude the impact of certain items and therefore have not been calculated in accordance with GAAP. In each case, because our operating performance is a function of our liquidity, the non-GAAP measures used by management are presented and defined as supplemental liquidity measures. We caution readers that amounts presented in accordance with our definitions of Adjusted Cash Receipts, Adjusted EBITDA and Adjusted Cash Flow may not be the same as similar measures used by other companies. Not all companies and sell-side equity research analysts calculate the non-GAAP measures we use in the same manner. We compensate for these limitations by using non-GAAP financial measures as supplements to GAAP financial measures and by presenting the reconciliations of the non-GAAP financial measures to their most comparable GAAP financial measures, in each case being Net cash provided by operating activities.

iii

Table of Contents

We believe that Adjusted Cash Receipts and Adjusted Cash Flow provide meaningful information about our operating performance because our business is heavily reliant on our ability to generate consistent cash flows and these measures reflect the core cash collections and cash charges comprising our operating results. Management strongly believes that our significant operating cash flow is one of the attributes that attracts potential investors to our business.

In addition, we believe that Adjusted Cash Receipts and Adjusted Cash Flow help identify underlying trends in our business and permit investors to more fully understand how management assesses the performance of the Company, including planning and forecasting for future periods. Adjusted Cash Receipts and Adjusted Cash Flow are used by management as key liquidity measures in the evaluation of the Company’s ability to generate cash from operations. Both measures are indications of the strength of the Company and the performance of our business. Management uses Adjusted Cash Receipts and Adjusted Cash Flow when considering available cash, including for decision-making purposes related to funding of acquisitions, voluntary debt repayments, dividends and other discretionary investments. Further, these non-GAAP financial measures help management, the audit committee, and investors evaluate the Company’s ability to generate liquidity from operating activities.

Management believes that Adjusted EBITDA is an important non-GAAP measure in analyzing our liquidity and is a key component of certain material covenants under our senior unsecured revolving credit facility with Bank of America, N.A., as administrative agent, and certain other parties (the “Revolving Credit Facility”). Noncompliance with the interest coverage ratio and leverage ratio covenants under the Revolving Credit Facility could result in our lenders terminating their commitments to lend and requiring us to immediately repay all amounts borrowed. If we cannot satisfy these financial covenants, we would be prohibited under our Revolving Credit Facility from engaging in certain activities, such as incurring additional indebtedness, paying dividends, making certain payments, and acquiring and disposing of assets. Consequently, Adjusted EBITDA is critical to the assessment of our liquidity.

Management uses Adjusted Cash Flow to evaluate its ability to generate cash, to evaluate the performance of the business and to evaluate the Company’s performance as compared to its peer group. Management also uses Adjusted Cash Flow to compare its performance against non-GAAP adjusted net income measures used by many companies in the biopharmaceutical industry, even though each company may customize its own calculation and therefore one company’s metric may not be directly comparable to another’s. We believe that non-GAAP financial measures, including Adjusted Cash Flow, are frequently used by securities analysts, investors, and other interested parties to evaluate companies in our industry.

The non-GAAP financial measures used in this prospectus have limitations as analytical tools, and you should not consider them in isolation or as a substitute for the analysis of our results as reported under GAAP.

iv

Table of Contents

This summary highlights information contained elsewhere in this prospectus. This summary may not contain all of the information that may be important to you. You should read this entire prospectus before making a decision to exchange your old notes for new notes, including the section entitled “Risk Factors” beginning on page 10 of this prospectus.

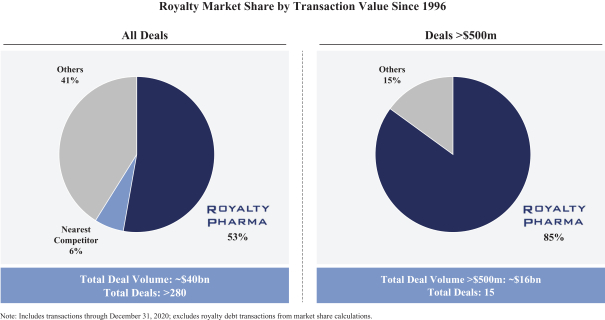

Overview

We are the largest buyer of biopharmaceutical royalties and a leading funder of innovation across the biopharmaceutical industry. Since our founding in 1996, we have been pioneers in the royalty market, collaborating with innovators from academic institutions, research hospitals and not-for-profits through small and mid-cap biotechnology companies to leading global pharmaceutical companies. We have assembled a portfolio of royalties which entitles us to payments based directly on the top-line sales of many of the industry’s leading therapies, which includes royalties on more than 45 commercial products, including AbbVie and J&J’s Imbruvica, Astellas and Pfizer’s Xtandi, Biogen’s Tysabri, Gilead’s Trodelvy, Merck’s Januvia, Novartis’ Promacta, Vertex’s Kalydeco, Orkambi, Symdeko and Trikafta, and five development-stage product candidates. We fund innovation in the biopharmaceutical industry both directly and indirectly—directly when we partner with companies to co-fund late-stage clinical trials and new product launches in exchange for future royalties, and indirectly when we acquire existing royalties from the original innovators.

Our capital-efficient business model enables us to benefit from many of the most attractive characteristics of the biopharmaceutical industry, including long product life cycles, significant barriers to entry and non-cyclical revenues, but with substantially reduced exposure to many common industry challenges such as early stage development risk, therapeutic area constraints, high research and development costs, and high fixed manufacturing and marketing costs. We have a highly flexible approach that is agnostic to both therapeutic area and treatment modality, allowing us to acquire royalties on the most attractive therapies across the biopharmaceutical industry.

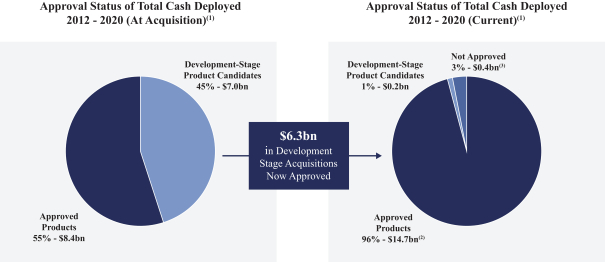

The success of our business has been the result of a focused strategy of actively identifying and tracking the development and commercialization of key new therapies, allowing us to move quickly to make acquisitions when opportunities arise. We acquire royalties on approved products, often in the early stages of their commercial launches, and development-stage product candidates with strong proof of concept data, mitigating development risk and expanding our opportunity set. From 1996 through 2020, we have deployed more than $20 billion of cash to acquire biopharmaceutical royalties, representing approximately 50% of all royalty transactions during this period. From 2012, when we began acquiring royalties on development-stage product candidates, through 2020, we have deployed more than $15 billion of cash to acquire biopharmaceutical royalties, representing approximately 60% of all royalty transactions during this period.

In 2020, we generated cash from operating activities of $2.03 billion, Adjusted Cash Receipts (as defined in “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Non-GAAP Financial Results”) of $1.80 billion and Adjusted Cash Flow (as defined in “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Non-GAAP Financial Results”) of $1.48 billion. We deployed $2.3 billion of cash in 2020 for royalties and related assets.

1

Table of Contents

The Exchange Offers

| The Exchange Offers |

We are offering to exchange (i) our New 2023 Notes which have been registered under the Securities Act for a like principal amount of our outstanding unregistered Old 2023 Notes, (ii) our New 2025 Notes which have been registered under the Securities Act for a like principal amount of our outstanding unregistered Old 2025 Notes, (iii) our New 2027 Notes which have been registered under the Securities Act for a like principal amount of our outstanding unregistered Old 2027 Notes, (iv) our New 2030 Notes which have been registered under the Securities Act for a like principal amount of our outstanding unregistered Old 2030 Notes, (v) our New 2040 Notes which have been registered under the Securities Act for a like principal amount of our outstanding unregistered Old 2040 Notes and (vi) our New 2050 Notes which have been registered under the Securities Act for a like principal amount of our outstanding unregistered Old 2050 Notes. We are offering to issue the new notes to satisfy our obligations contained in the registration rights agreement entered into when the old notes were sold in transactions permitted by Rule 144A and Regulation S under the Securities Act and therefore not registered with the SEC. For procedures for tendering, see “The Exchange Offers.” |

| Tenders, Expiration Date, Withdrawal |

The exchange offers will expire at 5:00 P.M. New York City time on , 2021 unless it is extended. If you decide to exchange a series of old notes for an applicable series of new notes, you must acknowledge that you are not engaging in, and do not intend to engage in, a distribution of the new notes. If you decide to tender your old notes in the exchange offers, you may withdraw them at any time prior to , 2021. If we decide for any reason not to accept any old notes for exchange, your old notes will be returned to you without expense to you promptly after the exchange offers expire. You may only exchange old notes in denominations of $2,000 and integral multiples of $1,000 in excess thereof. |

| U.S. Federal Income Tax Consequences |

Your exchange of old notes for new notes in the exchange offers will not result in any income, gain or loss to you for U.S. federal income tax purposes. See “Certain U.S. Federal Tax Consequences.” |

| Use of Proceeds |

We will not receive any proceeds from the issuance of the new notes in the exchange offers. |

| Exchange Agent |

Wilmington Trust, National Association is the exchange agent for the exchange offers. |

| Failure to Tender Your Old Notes |

If you fail to tender your old notes in the exchange offers, you will not have any further rights under the registration rights agreement, including any right to require us to register your old notes or to pay you additional interest or liquidated damages. All untendered old notes will continue to be subject to the restrictions on transfer set forth in the old notes and in the indenture. In general, the old notes |

2

Table of Contents

| may not be offered or sold, unless registered under the Securities Act, except pursuant to an exemption from, or in a transaction not subject to, the Securities Act and applicable state securities laws. We do not currently anticipate that we will register such untendered old notes under the Securities Act and, following these exchange offers, will be under no obligation to do so. |

You will be able to resell the new notes without registering them with the SEC if you meet the requirements described below.

| • | Based on interpretations by the SEC’s staff in no-action letters issued to third parties, we believe that new notes issued in exchange for the old notes in the exchange offers may be offered for resale, resold or otherwise transferred by you without registering the new notes under the Securities Act or delivering a prospectus, unless you are a broker-dealer receiving securities for your own account, so long as: |

| • | you acquire the new notes in the ordinary course of your business; |

| • | you do not have any arrangement or understanding with any person to participate in the distribution of the new notes; and |

| • | you are not one of our “affiliates,” which is defined in Rule 405 of the Securities Act. |

If you are an affiliate of the Company, or you are engaged in, intend to engage in or have any arrangement or understanding with respect to, the distribution of new notes acquired in the exchange offers, you (1) should not rely on our interpretations of the position of the SEC’s staff and (2) must comply with the registration and prospectus delivery requirements of the Securities Act in connection with any resale transaction.

If you are a broker-dealer and receive new notes for your own account in the exchange offers and/or in exchange for old notes that were acquired for your own account as a result of market-making or other trading activities:

| • | you must represent that you do not have any arrangement or understanding with us or any of our affiliates to distribute the new notes; |

| • | you must acknowledge that you will deliver a prospectus in connection with any resale of the new notes you receive from us in the exchange offer; and |

| • | you may use this prospectus, as it may be amended or supplemented from time to time, in connection with the resale of new notes received in exchange for old notes acquired by you as a result of market-making or other trading activities. |

For a period of 180 days after the expiration of the exchange offers, we will make this prospectus available to any broker-dealer for use in connection with any resale described above.

3

Table of Contents

Summary Description of the Notes

The terms of the new notes of each series and the old notes of such series are identical in all material respects, except that the new notes have been registered under the Securities Act, and the transfer restrictions and registration rights relating to the old notes do not apply to the new notes. The new notes of each series will represent the same debt as the old notes of such series and will be governed by the same indenture under which the old notes were issued.

| Issuer |

Royalty Pharma plc |

| Notes Offered |

$1,000,000,000 aggregate principal amount of 2023 notes |

| $1,000,000,000 aggregate principal amount of 2025 notes |

| $1,000,000,000 aggregate principal amount of 2027 notes |

| $1,000,000,000 aggregate principal amount of 2030 notes |

| $1,000,000,000 aggregate principal amount of 2040 notes |

| $1,000,000,000 aggregate principal amount of 2050 notes |

| The New 2023 Notes, New 2025 Notes, New 2027 Notes, New 2030 Notes, New 2040 Notes and New 2050 Notes will each be treated as a separate series of notes and, as such, will vote and act, and may be redeemed, separately. |

| Maturity Date |

September 2, 2023 for the New 2023 Notes |

| September 2, 2025 for the New 2025 Notes |

| September 2, 2027 for the New 2027 Notes |

| September 2, 2030 for the New 2030 Notes |

| September 2, 2040 for the New 2040 Notes |

| September 2, 2050 for the New 2050 Notes |

| Interest Rate |

0.750% per annum for the New 2023 Notes |

| 1.200% per annum for the New 2025 Notes |

| 1.750% per annum for the New 2027 Notes |

| 2.200% per annum for the New 2030 Notes |

| 3.300% per annum for the New 2040 Notes |

| 3.550% per annum for the New 2050 Notes |

| Interest Payment Dates |

Interest on the new notes will be payable on March 2 and September 2 of each year, commencing on September 2, 2021. Interest will accrue from March 2, 2021. |

| Guarantors |

Royalty Pharma Holdings Ltd. (“RP Holdings”) and any guarantor added after the issue date of the new notes, if any, as provided under “Description of the Notes—Guarantors” (collectively, the “Guarantors”). |

4

Table of Contents

| Guarantees |

The Guarantors will fully and unconditionally guarantee the payment of principal, premium, if any, and interest on the new notes on a joint and several basis. |

| Ranking |

The new notes and the guarantees will be our and the Guarantors’ senior unsecured obligations and will, respectively: |

| • | rank equally in right of payment with all of our and the Guarantors’ existing and future unsubordinated obligations, including the new notes and old notes; |

| • | rank senior in right of payment to all of our and the Guarantors’ future subordinated indebtedness; |

| • | be effectively subordinated to all of our and the Guarantors’ existing and future secured indebtedness to the extent of the value of the assets securing such secured indebtedness; and |

| • | be structurally subordinated to all existing or future liabilities of our non-guarantor subsidiaries. |

| Optional Redemption |

We may redeem the new notes of any series in whole or in part at any time or from time to time, as follows: (1) prior to the applicable Par Call Date (as set forth below) or, with respect to the New 2023 Notes, the maturity date of such notes, at a redemption price equal to the greater of 100% of the principal amount to be redeemed and a “make-whole” redemption price, in either case, plus accrued and unpaid interest, if any, up to, but excluding, the redemption date. On or after the applicable Par Call Date, the new notes of any series (other than the New 2023 Notes) will be redeemable, in whole or in part at any time or from time to time, at our option at a redemption price equal to 100% of the principal amount to be redeemed plus accrued and unpaid interest thereon up to, but excluding, the redemption date. For more detailed information on the calculation of the redemption prices, see “Description of the Notes—Optional redemption of the notes.” |

| Par Call Date |

New 2025 Notes: August 2, 2025 |

| New 2027 Notes: July 2, 2027 |

| New 2030 Notes: June 2, 2030 |

| New 2040 Notes: March 2, 2040 |

| New 2050 Notes: March 2, 2050 |

| Change of Control Triggering Event |

Upon the occurrence of a “change of control triggering event” with respect to the new notes, unless we have exercised our option to redeem the new notes by notifying the holders to that effect, we will be required to offer to repurchase such notes at a price in cash equal to 101% of the aggregate principal amount of the new notes repurchased, plus accrued and unpaid interest and Additional Amounts (as defined below), if any, on the new notes repurchased up to, but not including, the date of repurchase. See “Description of the Notes—Offer to Repurchase Upon a Change of Control Triggering Event.” |

5

Table of Contents

| Optional Tax Redemption |

In the event of various tax law changes and other limited circumstances that require us to pay additional amounts as described under “Description of the Notes—Redemption—Optional Tax Redemption”, we may redeem in whole, but not in part, any series of the new notes prior to maturity at a redemption price equal to 100% of their principal amount plus accrued interest thereon to but excluding the date of redemption. |

| Payment of Additional Amounts |

For more information on additional amounts and the situations in which we may be required to pay additional amounts, see “Description of the Notes —Payment of additional amounts” in this prospectus. |

| Certain Covenants |

The new notes will be issued under an indenture between us, the Guarantors and Wilmington Trust, National Association as trustee. The indenture relating to the new notes limits, among other things, our and the Guarantors’ ability to: |

| • | merge, consolidate or sell, transfer or convey all or substantially all of their assets; |

| • | incur liens; and |

| • | enter into certain sale leaseback transactions. |

| These covenants are subject to a number of important limitations and exceptions, which are described under “Description of the Notes—Certain covenants.” |

| Book-entry Settlement and Clearance |

Each series of new notes will be issued in book-entry form and will be represented by permanent global certificates deposited with, or on behalf of, DTC and registered in the name of a nominee of DTC, whose physical receipt will be held for safekeeping by the Trustee. Beneficial interests in any of the new notes will be shown on, and transfers will be effected only through, records maintained by DTC or its nominee, and any such interest may not be exchanged for certificated securities, except in limited circumstances. See “Book-entry settlement and clearance.” |

| Form and Denomination |

The new notes of each series will be issued in registered form in minimum denominations of $2,000 and integral multiples of $1,000 in excess thereof. |

| Further Issuances |

We may from time to time create and issue additional new notes having the same terms as the outstanding notes of a series being issued in this offering, so that such additional notes will be consolidated and form a single series with the outstanding new notes of the series, provided that if the additional new notes are not fungible with the notes offered hereby for U.S. federal income tax purposes, the additional notes will have a separate CUSIP or other identifying number. See “Description of the Notes—General.” |

6

Table of Contents

| Listing of the Notes |

We plan to list the new notes on the Official List of the International Stock Exchange located in Jersey, but this listing is not a condition to the consummation of the exchange offers. |

| Absence of Public Market for the Notes |

While we plan to list the new notes on the Official List of the International Stock Exchange, consummation of the exchange offer is not conditioned on this listing. Accordingly, we cannot assure you that any active trading markets for the new notes will exist following this offering or be maintained. |

| Risk Factors |

You should carefully consider all of the information contained in this prospectus before deciding to tender your old notes in the exchange offers. In particular, we urge you to carefully consider the information set forth under “Risk Factors” herein for a discussion of risks and uncertainties relating to us, our business and the new notes offered hereby. |

| Trustee |

Wilmington Trust, National Association |

| Governing Law |

The indenture is, and the new notes and guarantees will be, governed by the laws of the State of New York. |

7

Table of Contents

Summary of Risk Factors

Before you decide to participate in the exchange offers, you should carefully consider all the information in this prospectus, including matters set forth under the heading “Risk Factors.” These risks and uncertainties include:

Risks Relating to the Exchange Offer

| • | transfer restrictions on the old notes that will remain in force; |

| • | state securities law restrictions on the resale of the new notes; |

Risks Relating to the Notes and Our Other Indebtedness

| • | the impact of indebtedness on our cash flow; |

| • | our dependence on our subsidiaries to repay our indebtedness; |

| • | structural subordination of the new notes; |

| • | subordination of our new notes to any senior secured indebtedness; |

| • | limited covenants in the indenture for the new notes; |

Risks Relating to Our Business

| • | sales risks of biopharmaceutical products on which we receive royalties; |

| • | the growth of the royalty market; |

| • | the ability of the Manager to identify suitable assets for us to acquire; |

| • | uncertainties related to the acquisition of interests in development-stage biopharmaceutical product candidates and our strategy to add development-stage product candidates to our product portfolio; |

| • | potential strategic acquisitions of biopharmaceutical companies; |

| • | our use of leverage in connection with our capital deployment; |

| • | our reliance on the Manager for all services we require; |

| • | our reliance on key members of the Manager’s senior advisory team; |

| • | our ability to successfully execute our royalty acquisition strategy; |

| • | our ability to leverage our competitive strengths; |

| • | actual and potential conflicts of interest with the Manager and its affiliates; |

| • | interest rate and foreign exchange fluctuations; |

| • | the assumptions underlying our business model; |

| • | our reliance on a limited number of products; |

| • | the ability of the Manager or its affiliates to attract and retain highly talented professionals; |

| • | the competitive nature of the biopharmaceutical industry; |

8

Table of Contents

Risks Relating to Our Organization and Structure

| • | our organizational structure, including our status as a holding company; |

Risks Relating to Taxation

| • | the complex provisions of tax law; and |

General Risk Factors

| • | the impact of COVID-19 on our operations. |

9

Table of Contents

If any of the following risks occur, our business, results of operations or financial condition could be materially adversely affected. You should also read the section captioned “Special Note Regarding Forward-Looking Statements” for a discussion of what types of statements are forward-looking as well as the significance of such statements in the context of this prospectus.

Risks Relating to the Exchange Offer

If you choose not to exchange your old notes in the exchange offers, the transfer restrictions currently applicable to your old notes will remain in force and the market price of your old notes could decline.

If you do not exchange your old notes for new notes in the exchange offers, then you will continue to be subject to the transfer restrictions on the old notes as set forth in the offering memorandum distributed in connection with the private offering of the old notes. In general, the old notes may not be offered or sold unless they are registered or exempt from registration under the Securities Act and applicable state securities laws. Except as required by the registration rights agreement entered into in connection with the private offering of the old notes, we do not intend to register resales of the old notes under the Securities Act. The tender of old notes under the exchange offers will reduce the principal amount of the old notes outstanding, which may have an adverse effect upon, and increase the volatility of, the market price of the old notes due to reduction in liquidity.

You must follow the exchange offer procedures carefully in order to receive the new notes.

If you do not follow the procedures described in this prospectus, you will not receive any new notes. If you want to tender your old notes in exchange for new notes, you will need to contact a DTC participant to complete the book-entry transfer procedures described under “The Exchange Offers,” prior to the expiration date, and you should allow sufficient time to ensure timely completion of these procedures to ensure delivery. No one is under any obligation to give you notification of defects or irregularities with respect to tenders of old notes for exchange. For additional information, see the section captioned “The Exchange Offers” in this prospectus.

There are state securities law restrictions on the resale of the new notes.

In order to comply with the securities laws of certain jurisdictions, the new notes may not be offered or resold by any holder, unless they have been registered or qualified for sale in such jurisdictions or an exemption from registration or qualification is available and the requirements of such exemption have been satisfied. We currently do not intend to register or qualify the resale of the new notes in any such jurisdictions. However, generally an exemption is available for sales to registered broker-dealers and certain institutional buyers. Other exemptions under applicable state securities laws also may be available.

Risks Relating to the Notes and Our Other Indebtedness

Our indebtedness may limit the amount of cash flow available to invest in the ongoing needs of our business, which could prevent us from generating the future cash flow needed to fulfill our obligations under the new notes.

As of March 31, 2021, we had total long-term debt outstanding of $5.8 billion. In addition, we have up to $1.5 billion of available revolving commitments under our Revolving Credit Facility, the availability of which is subject to compliance with the covenants therein.

Subject to the limits that will be contained in our Revolving Credit Facility and the indenture governing the new notes, we may be able to incur substantial additional debt from time to time to finance working capital, capital expenditures, investments or acquisitions, or for other purposes. If we do so, the risks related to our level

10

Table of Contents

of indebtedness could intensify. Specifically, a high level of indebtedness could have important consequences to the holders of the new notes due to the adverse ways in which it affects us, including the following:

| • | requires us to dedicate a substantial portion of our cash flow from operations to payments on our indebtedness, reducing the availability of our cash flow to fund working capital, capital expenditures, dividend payments, development activity, acquisitions and other general corporate purposes; |

| • | increases our vulnerability to adverse general economic or industry conditions; |

| • | limits our flexibility in planning for, or reacting to, changes in our business or the industries in which we operate; |

| • | makes us more vulnerable to increases in interest rates, as borrowings under our Revolving Credit Facility will be at variable rates; |

| • | limits our ability to obtain additional financing in the future for working capital or other purposes, such as raising the funds necessary to repurchase all notes tendered to us upon the occurrence of specified changes of control in our ownership; |

| • | limits management’s discretion in operating our business; |

| • | limits our flexibility in planning for, or reacting to, changes in our business, the industry in which we operate or the general economy; and |

| • | places us at a competitive disadvantage compared to our competitors that have less indebtedness. |

Our Revolving Credit Facility requires us to comply with certain financial covenants, including a minimum consolidated interest coverage ratio and a maximum consolidated leverage ratio. Our ability to comply with these ratios may be affected by events beyond our control. A breach of any of these covenants or our inability to comply with the required financial covenants could result in a default under our Revolving Credit Facility. In the event of any default under our Revolving Credit Facility, the lenders under our Revolving Credit Facility could elect to terminate borrowing commitments and declare all outstanding borrowings, together with accrued and unpaid interest and other fees, to be due and payable. In the event the lenders or noteholders accelerate the repayment of our indebtedness, we and our subsidiaries may not have sufficient assets to repay that indebtedness.

If we are unable to comply with the restrictions and covenants in our Revolving Credit Facility or the indenture for the new notes, there could be a default under the terms of these debt agreements. Our ability to comply with these restrictions and covenants, including meeting financial ratios and tests, may be affected by events beyond our control including prevailing economic, financial and industry conditions. As a result, there can be no assurance that we will be able to comply with these restrictions and covenants or meet such financial ratios and tests, and any such default under our debt agreements could have a material adverse effect on our business by, among other things, limiting our ability to take advantage of financing, mergers, acquisitions or other corporate opportunities.

Our debt agreements also contain cross-default or cross-acceleration provisions, pursuant to which a default is deemed to have occurred under such agreement if a default or acceleration occurs under another debt agreement. For example, the indenture for the new notes contains cross-default provisions relating to nonpayment by us or any of our subsidiaries in connection with debt aggregating a certain amount (subject to certain cure periods). If any of the above events should occur, we and our subsidiaries may not have sufficient assets to repay in full all of our outstanding indebtedness. Additionally, we may not be able to amend our debt agreements or obtain needed waivers on satisfactory terms.

We and our subsidiaries may be able to incur substantial additional indebtedness. This could further exacerbate the risks described above.

We and our subsidiaries may be able to incur additional indebtedness in the future in the ordinary course of business. Although our Revolving Credit Facility contains restrictions on the incurrence of additional subsidiary

11

Table of Contents

indebtedness and the incurrence of certain liens by us, these restrictions are subject to a number of qualifications and exceptions, and the indebtedness and liens incurred in compliance with these restrictions could be substantial. As of March 31, 2021, we had $5.8 billion of total indebtedness outstanding and up to $1.5 billion of available revolving commitments thereunder, subject to compliance with the covenants therein. Our Revolving Credit Facility provides for an uncommitted incremental facility that allows us to increase aggregate commitments by an additional $750 million, subject to obtaining incremental commitments from lenders and satisfying customary closing conditions.

In addition, to the extent other new debt is added to our and our subsidiaries’ current debt levels, the substantial leverage risks described above would increase.

To service our indebtedness and meet our other ongoing liquidity needs, we will require a significant amount of cash. Our ability to generate cash depends on many factors beyond our control. If we cannot generate the required cash, we may not be able to make the required payments under the new notes.

As of March 31, 2021, we had total long-term debt outstanding of $5.8 billion. In addition, we have up to $1.5 billion of available revolving commitments under our Revolving Credit Facility. Except for RP Holdings, our subsidiaries that do not guarantee the new notes will have no obligation, contingent or otherwise, to pay amounts due under the Notes or to make any funds available to pay those amounts, whether by dividend, distribution, loan or other payment. We cannot assure you that our business will generate sufficient cash flow from operations to enable us to pay our indebtedness or to fund our other liquidity needs.

Absent sufficient cash flow and the ability to refinance, we could also be forced to sell assets to make up for any shortfall in our payment obligations. However, the terms of our Revolving Credit Facility and the indenture for the new notes limits our and our subsidiaries’ ability to sell assets and also restrict the use of proceeds from such a sale. Accordingly, we may not be able to sell assets quickly enough or for sufficient amounts to enable us to meet our obligations on our indebtedness.

Repayment of our indebtedness, including the new notes, is dependent on cash flow generated by our subsidiaries.

We conduct our operations through our subsidiaries and are dependent on the generation of cash flow by our subsidiaries and their ability to make such cash available to us, by dividend, debt repayment, repatriation or otherwise. Our subsidiaries do not have any obligation to pay amounts due on the new notes or to make funds available for that purpose. Our subsidiaries may not be able to, or be permitted to, make distributions to enable us to make payments in respect of our indebtedness, including the new notes. Each of our subsidiaries is a distinct legal entity and, under certain circumstances, legal and contractual restrictions may limit our ability to obtain cash from our subsidiaries. In the event that we do not receive distributions from our subsidiaries, we may be unable to make required principal and interest payments on our indebtedness, including the new notes.

The new notes will be structurally subordinated to all obligations of our existing and future subsidiaries that are not and do not become guarantors of the new notes.

Except for the Guarantors, our subsidiaries that do not guarantee the new notes will have no obligation, contingent or otherwise, to pay amounts due under the new notes or to make any funds available to pay those amounts, whether by dividend, distribution, loan or other payment. The new notes and guarantees will be structurally subordinated to all indebtedness and other obligations of any non-guarantor subsidiary such that in the event of insolvency, liquidation, reorganization, dissolution or other winding up of such non-guarantor subsidiary, all of such subsidiary’s creditors (including trade creditors) would be entitled to payment in full out of such subsidiary’s assets before we would be entitled to any payment.

12

Table of Contents

In addition, the indenture governing the new notes will permit our non-guarantor subsidiaries to incur additional indebtedness and will not contain any limitation on the amount of other liabilities, such as trade payables, that may be incurred by such subsidiaries.

If any note guarantee is released, no holder of the new notes will have a claim as a creditor against that subsidiary, and the indebtedness and other liabilities, including trade payables and preferred stock, if any, whether secured or unsecured, of that subsidiary will be effectively senior to the claim of any holders of the new notes.

The new notes and the guarantees will not be secured by our assets nor those of our subsidiaries, and the lenders under any senior secured indebtedness will be entitled to remedies available to a secured lender, which gives them priority over the noteholders to collect amounts due to them.

Following the consummation of the exchange offers, the new notes and the related guarantees will not be secured by any of our or our subsidiaries’ assets and therefore will be effectively subordinated to the claims of any secured debt holders to the extent of the value of the assets securing such secured debt. If we become insolvent or are liquidated, or if payment under any senior secured indebtedness is accelerated, the lenders under such then-existing senior secured indebtedness will be entitled to exercise the remedies available to a secured lender under applicable law (in addition to any remedies that may be available under documents pertaining to any such senior secured indebtedness). The effect of the new notes’ subordination to our and the Guarantors’ secured debt is that upon a default in payment on or the acceleration of any of our or the Guarantors’ secured indebtedness, or in the event of our bankruptcy, insolvency, liquidation, dissolution or reorganization, the proceeds from the sale of assets securing such secured indebtedness will be available to repay obligations on the new notes only after all obligations under such then-existing senior secured indebtedness have been paid in full. As a result, the noteholders may receive less, ratably, than the holders of secured debt in the event of our or the Guarantors’ bankruptcy, insolvency, liquidation, dissolution or reorganization. In addition, we and/or the Guarantors may incur senior secured indebtedness, the holders of which will be entitled to the remedies available to a secured lender.

Our variable rate indebtedness bears interest primarily based on LIBOR, which may be subject to regulatory guidance and/or reform and could cause our debt service obligations to increase significantly.

Any borrowings under our Revolving Credit Facility will be subject to variable rates of interest, primarily based on London Interbank Offered Rate (“LIBOR”), and expose us to interest rate risk. LIBOR tends to fluctuate based on general economic conditions, general interest rates, Federal Reserve rates and the supply of and demand for credit in the London interbank market. Increases in the interest rate generally, and particularly when coupled with any significant variable rate indebtedness, could materially adversely impact our interest expenses. If interest rates were to increase, our debt service obligations on the variable rate indebtedness would increase even though the amount borrowed remained the same, and our net income and cash flows, including cash available for servicing our indebtedness, will correspondingly decrease. Assuming our Revolving Credit Facility is fully drawn, each quarter point change in interest rates would result in an approximately $3.75 million change in annual interest expense on our indebtedness under our Revolving Credit Facility. To the extent we borrow under our Revolving Credit Facility, we will not be required to enter into interest rate swaps to hedge such indebtedness. If we decide not to enter into hedges on such indebtedness, our interest expense on such indebtedness will fluctuate based on LIBOR or other variable interest rates. Consequently, we may have difficulties servicing such unhedged indebtedness and funding our other fixed costs, and our available cash flow for general corporate requirements may be materially adversely affected. In the future, we may enter into interest rate swaps that involve the exchange of floating for fixed rate interest payments in order to reduce interest rate volatility. However, we may not maintain interest rate swaps with respect to all of our variable rate indebtedness, and any swaps we enter into may not fully mitigate our interest rate risk.

In 2017, the U.K. Financial Conduct Authority (the “FCA”), which regulates London LIBOR, announced that the FCA will no longer persuade or compel banks to submit rates for the calculation of the LIBOR

13

Table of Contents

benchmark after 2021. This announcement indicates that the continuation of LIBOR on the current basis cannot be guaranteed after 2021, and there is a substantial risk that LIBOR will be discontinued or modified by the end of 2021, and although alternative reference rates have been proposed, it is unknown whether they will attain market acceptance as replacements of LIBOR. At this time, it is not possible to predict the effect that these developments, any discontinuance, modification or other reforms to LIBOR or any other reference rate, or the establishment of alternative reference rates may have on LIBOR, other benchmarks or floating rate debt instruments, including borrowings under the Revolving Credit Facility. The use of alternative reference rates or other reforms could cause the interest rate calculated for such borrowings to increase or otherwise fail to correlate over time with the interest rates and/or payments that would have been made on our obligations if LIBOR was available in its current form, or have other adverse effects on us. To address the transition away from LIBOR, our Revolving Credit Facility will provide for a process to amend our Revolving Credit Facility to substitute LIBOR with a replacement rate under certain circumstances. However, there is no guarantee that any such amendment for a replacement rate would become effective, and in the event that such amendment does not become effective, we may be required to pay a rate of interest higher than expected on the amount owed under our Revolving Credit Facility.

We may not be able to repurchase the new notes upon a change of control triggering event.

Upon the occurrence of a change of control triggering event (as defined in “Description of the Notes”), each holder of notes will have the right to require us to repurchase all or any part of such holder’s notes at a price equal to 101% of their principal amount, plus accrued and unpaid interest, if any, up to, but not including, the date of repurchase. If we experience a change of control triggering event, we cannot assure you that we would have sufficient financial resources available to satisfy its obligations to repurchase the new notes. Our failure to repurchase the new notes as required under the indenture governing the new notes would result in a default under the indenture, which could result in defaults under agreements governing any of our other indebtedness, including the acceleration of the payment of any borrowings thereunder, and have material adverse consequences for us and the holders of the new notes. In addition, the change of control provisions in the indenture may not protect you from certain important corporate events, such as a leveraged recapitalization (which would increase the level of our indebtedness), reorganization, restructuring, merger or other similar transaction. Such a transaction may not involve a change in voting power or beneficial ownership or, even if it does, may not involve a change that constitutes a “Change of Control” as defined in the indenture that would trigger our obligation to repurchase the new notes. If an event occurs that does not constitute a “Change of Control” as defined in the indenture, we will not be required to make an offer to repurchase the new notes and you may be required to continue to hold your notes despite the event. See “Description of the Notes—Offer to repurchase upon a change of control triggering event.”

Redemption may adversely affect your return on the new notes.

We have the right to redeem some or all of the new notes prior to maturity, as described under “Description of the Notes—Optional Redemption of the Notes.” We may redeem the new notes at times when prevailing interest rates may be relatively low. Accordingly, you may not be able to reinvest the redemption proceeds in a comparable security at an effective interest rate as high as that of the new notes.

The limited covenants in the indenture for the new notes and the terms of the new notes do not provide protection against some types of important corporate events and may not protect your investment.

The indenture for the new notes will not:

| • | require us to maintain any financial ratios or specific levels of net worth, revenues, income, cash flow or liquidity and, accordingly, and will not protect holders of the new notes in the event that we experience significant adverse changes in its financial condition or results of operations; |

| • | limit our ability to incur indebtedness that is equal in right of payment to the new notes; |

| • | restrict our ability to repurchase or prepay its respective securities; or |

14

Table of Contents

| • | restrict our ability to sell assets, make investments or to repurchase or pay dividends or make other payments in respect of its ordinary shares or other securities ranking junior to the new notes. |

Furthermore, the indenture governing the new notes will contain only limited protections in the event of a change in control. We could engage in many types of transactions, such as certain acquisitions, refinancings or recapitalizations that could substantially affect our capital structure and the value of the new notes.

Neither we nor any of our subsidiaries has any property that has been determined to be a principal property under the indenture.

The indenture governing the new notes includes a covenant that, among other things, limits our and certain of our subsidiaries’ ability to incur, issue, permit to exist, assume or guarantee any indebtedness for borrowed money if such indebtedness (in the case of an incurrence, issuance or assumption or issuance thereof by us or such subsidiaries) or any such guarantee (in the case of a guarantee by us or any of such subsidiaries) is or becomes secured by a lien on any of our or any such subsidiaries’ principal properties or certain other limited assets. However, as of the date of this prospectus, neither we nor any of our subsidiaries has any property that constitutes a principal property under the indenture.

Federal and state fraudulent transfer or conveyance laws may permit a court to void the new notes and/or the guarantees, and if that occurs, you may not receive any payments on the new notes.

Federal and state fraudulent transfer and conveyance statutes may apply to the issuance of the new notes and the incurrence of the guarantees. Under federal bankruptcy law and comparable provisions of state fraudulent transfer or conveyance laws, which may vary from state to state or jurisdiction to jurisdiction, the new notes or the guarantees could be voided as a fraudulent transfer or conveyance if we or any of the Guarantors, as applicable, (a) issued the new notes or incurred the guarantees with the intent of hindering, delaying or defrauding creditors or (b) received less than reasonably equivalent value or fair consideration in return for either issuing the new notes or incurring the guarantees and, in the case of (b) only, one of the following is also true at the time thereof:

| • | we or any of the Guarantors, as applicable, were insolvent or rendered insolvent by reason of the issuance of the new notes or the incurrence of the guarantees; |

| • | the issuance of the new notes or the incurrence of the guarantees left us or any of the Guarantors, as applicable, with an unreasonably small amount of capital or assets to carry on the business as engaged in or contemplated; |

| • | we or any of the Guarantors intended to, or believed that we or such Guarantor would, incur debts beyond our or such Guarantor’s ability to pay as they mature; or |

| • | we or any of the Guarantors were a defendant in an action for money damages, or had a judgment for money damages docketed against us or the Guarantors if, in either case, the judgment is unsatisfied after final judgment. |

As a general matter, value is given for a transfer or an obligation if, in exchange for the transfer or obligation, property is transferred or a valid antecedent debt is secured or satisfied. A court would likely find that a guarantor did not receive reasonably equivalent value or fair consideration for its guarantee to the extent that the guarantor did not obtain a reasonably equivalent benefit directly or indirectly from the issuance of the new notes. Thus, if a guarantee were legally challenged, it could be subject to the claim that, since such guarantee was incurred for our benefit, and only indirectly for the benefit of the guarantor, the obligations of the applicable guarantor were incurred for less than reasonably equivalent value or fair consideration.

The measures of insolvency for purposes of the fraudulent transfer laws vary depending upon the law being applied in any particular proceeding, such that we cannot be certain as to the standards a court would use to

15

Table of Contents

determine whether or not we or the Guarantors were insolvent at the relevant time or, regardless of the standard that a court uses, that a court would not determine, regardless of whether or not we or a guarantor were insolvent on the date the new notes or guarantee were issued, that payments to the holders of the new notes or guarantees constituted preferences, fraudulent transfers or conveyances on other grounds, or whether the new notes or the guarantees would be subordinated to our or any of the Guarantors’ other debt. In general, however, a court would deem an entity insolvent if:

| • | the sum of its debts, including contingent and unliquidated liabilities, was greater than the fair value of all of its assets; |

| • | the present fair saleable value of its assets was less than the amount that would be required to pay its probable liability on its existing debts, including contingent liabilities, as they become absolute and mature; or |

| • | it could not pay its debts as they became due. |

If a court were to find that the issuance of the new notes or the incurrence of a guarantee was a fraudulent transfer or conveyance, the court could void the payment obligations under the new notes or that guarantee, could subordinate the new notes or that guarantee to presently existing and future indebtedness of ours or of the related guarantor or could require the holders of the new notes to repay any amounts received with respect to that guarantee. In the event of a finding that a fraudulent transfer or conveyance occurred, you may not receive any repayment on the new notes. Further, the avoidance of the new notes could result in an event of default with respect to our and our subsidiaries’ other debt that could result in acceleration of such debt.

In addition, any payment by us pursuant to the new notes or by a guarantor under a guarantee made at a time we or such guarantor were found to be insolvent could be voided and required to be returned to us or such guarantor or to a fund for the benefit of our or such guarantor’s creditors if such payment is made to an insider within a one-year period prior to a bankruptcy filing or within 90 days thereof for any non-insider party and such payment would give such insider or non-insider party more than such party would have received in a distribution in a hypothetical Chapter 7 case under the U.S. Bankruptcy Code.

Finally, as a court of equity, the bankruptcy court may subordinate the claims in respect of the new notes to other claims against us under the principle of equitable subordination if the court determines that (1) the holder of notes engaged in some type of inequitable conduct, (2) the inequitable conduct resulted in injury to our other creditors or conferred an unfair advantage upon the holders of notes and (3) equitable subordination is not inconsistent with the provisions of the bankruptcy code.

Should we default on our debt securities your right to receive payments on such debt securities may be adversely affected by UK insolvency laws.

We are incorporated under the laws of England and Wales. Accordingly, insolvency proceedings with respect to us are likely to proceed primarily under, and to be governed primarily by, UK insolvency law. The procedural and substantive provisions of such insolvency laws are, in certain cases, more favorable to secured creditors than comparable provisions of US law. These provisions afford debtors and unsecured creditors only limited protection from the claims of secured creditors and it may not be possible for us or other unsecured creditors to prevent or delay the secured creditors from enforcing their security to repay the debts due to them under the terms that such security was granted.

There may not be active trading markets for the new notes.

While the new notes will be listed on the Official List of the International Stock Exchange, such listing may not be maintained. In such case, we will use all reasonable efforts to obtain and maintain the listing of the new notes on another “recognized stock exchange” (within the meaning of Section 1005 of the Income Tax Act 2007) although there can be no assurance that we will be able to do so.

16

Table of Contents

Notwithstanding anything herein to the contrary, we may cease to make or maintain a listing (whether on the Official List of the International Stock Exchange or on another recognized stock exchange) if such listing is not required to benefit from an exemption on withholding tax on interest payments on the new notes or to otherwise prevent tax from being withheld from interest payments on the new notes.

Accordingly, there can be no assurance that active trading markets for the new notes will ever exist after this offering or will be maintained. If trading markets do not exist or are not maintained, you may find it difficult or impossible to resell notes. Future trading prices of the new notes will depend on many factors, including prevailing interest rates, our financial condition and results of operations, the then-current ratings assigned to the new notes and the markets for similar securities.

Any trading markets that develop would be affected by many factors independent of and in addition to the foregoing, including:

| • | the time remaining to the maturity of each series of notes; |

| • | the outstanding amount of each series of notes; |

| • | the terms related to optional redemption of each series of notes; and |

| • | the level, direction and volatility of market interest rates generally. |

Even if active trading markets for the new notes do exist after the exchange offer, there is no guarantee that they will continue. Further, there can be no assurance as to the liquidity of any market that may exist for the new notes, your ability to sell the new notes or the price at which you will be able to sell the new notes.

Any downgrade in our credit ratings could limit our ability to obtain future financing, increase our borrowing costs and adversely affect the trading prices for, or liquidity of, the new notes.